Exhibit (a)(5)(viii)

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION.

If you are in any doubt as to the action you should take, you are recommended immediately to seek your own financial advice from an appropriately authorised independent financial adviser. If you have any questions about this document (other than on the financial or tax aspects), you should contact Liz MacKay at Merant Share Services, The Lawn, 22-30 Old Bath Road, Newbury, Berkshire RG14 1QN or by email to Liz.MacKay@Merant.com or by telephone to:

(44) (0) 1635 277703 or by fax to (44) (0) 1635 277730. (“Liz MacKay”)

MERANT plc

(incorporated in England and Wales with registered number 1709998)

Abbey View

Everard Close

St. Albans, Hertfordshire, AL12PS

United Kingdom

31 March 2004

To holders of Options (“Optionholders”) under the 1996 Merant Share Option Plan and the Merant 1998 Share Option Plan (together the “Plans”) resident in Australia, Canada or Japan

Dear Optionholder

1 Introduction

On 3 March 2004, the Board of Merant PLC (“Merant”) announced that it and the board of SERENA Software, Inc (“SERENA”) had reached agreement on the terms of a recommended cash and share offer (the “Offer”) for the entire issued and to be issued share capital of Merant.

The Offer is not being made into Australia, Canada or Japan. As a result, you cannot accept the Offer from Canada, Australia or Japan. You should consult an appropriately authorized independent financial adviser to determine what to do with your Merant Shares as a result of the Offer not being extended to you.

I am writing to you to explain the impact which the Offer has on the options granted to you under the Plans(the “Options”).

2 Terms of the Offer

In summary, the Offer has been made outside Australia, Canada and Japan on the following basis:

for every 1 Merant Share � 60; 136.5 pence in cash and 0.04966 of

a new SERENA share

(For your information, under the Offer SERENA is offering a mix and match election under which Merant securityholders who validly accept the Offer from outside Australia, Canada or Japan may request to vary the proportions in which they receive SERENA shares and cash in respect of their Merant Shares. The maximum number of SERENA shares to be issued in the Offer and the maximum amount of cash to be paid under the Offer will not be varied as a result of the mix

1

and match election. Accordingly, a Merant securityholder’s mix and match election will be satisfied only to the extent that other Merant securityholders make opposite elections.)

The Offer valued each Merant Share at 195 pence based on an exchange rate of US$1.8488 : £1.00, which is calculated at the average of the US dollar / pound sterling exchange rate derived from the noon buying rate in New York City for cable transfers in pounds sterling as certified for customs purposes by the Federal Reserve Bank of New York for the five trading days ended 3 March 2004 and the price per SERENA share of US$21.78, which is calculated as the average of the closing prices of one SERENA Share as reported on Nasdaq for the twenty United States trading days ended 1 March 2004.

3 Effect of the Offer on your Options

Your Options are either already exercisable or will become fully or partially exercisable if the Offer succeeds (ie it has become or been declared unconditional in all respects), so that SERENA obtains control of Merant. For further details please see section 3 of Appendix 1.

Under the Rules of the Plans, if the Offer succeeds, SERENA may assume your Options or substitute equivalent options over SERENA Shares for your Options over Merant Shares (a “Rollover”). SERENA has agreed to do this, although its formal proposal will not be made to Optionholders until after the Offer succeeds and then only if that proposal can be made without the issue of a prospectus or other disclosure document being required under your local securities laws.

Generally the Rollover is an alternative to exercising your Options, but, if you have an Option which is only partly exercisable, even following the change of control, then you can exercise only the exercisable part of your options and the remainder will automatically be subject to the Rollover. Rollover is the only practical choice if your Option’s exercise price exceeds the Offer price (i.e. the Option is ‘underwater’).

If the Offer succeeds, then SERENA will send you its formal Rollover Proposal. The terms of the proposal are described in Appendix 1.

The proposals which will be put to you are set out in detail in Appendix 1 to this letter. You should consult your tax adviser as to the tax consequences to you of the Rollover Proposal or any exercise of your Option(s).

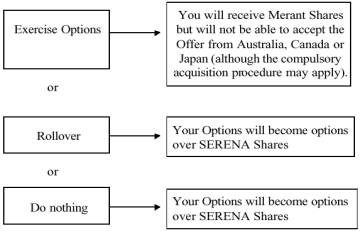

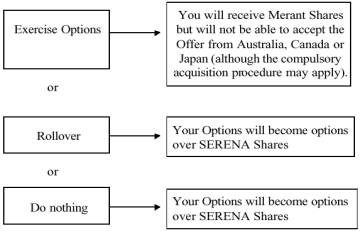

4 Your choices

In summary, the choices available to you are:

(a) to accept the Rollover Proposal, if and when it is made, under which your Option(s) over Merant Shares would be converted into an option over SERENA Shares; or

(b) to exercise your Option(s), to the extent they are or become exercisable as a result of the Offer. If you exercise your Option(s), you will not be able to accept the Offer with respect to those Merant Shares if at that time you are in Canada, Australia or Japan. However, they may be

2

acquired by SERENA under the compulsory acquisition procedure in the Companies Act 1985 of England and Wales if SERENA secures sufficient Merant Shares under the Offer outside Australia, Canada and Japan. You should consult an appropriately authorized independent financial adviser to determine what to do with your Merant Shares as a result of the Offer not being extended to you; or

(c) to take no further action (in which case your Option(s) will be Rolled over, if the Offer succeeds)

and the consequences, assuming the Offer succeeds, are as follows:

Note that SERENA’s ability to offer you replacement options under the Rollover Proposal is subject to local securities laws. In particular, that proposal cannot be made in Australia unless and until SERENA is able to comply with the requirements of class order relief granted by the Australian Securities and Investments Commission in relation to employee share schemes. In any other case, we understand that SERENA will exercise any compulsory acquisition rights it may have under the Companies Act 1985 of England and Wales to acquire any shares acquired by you upon exercise of your Options, to the extent permitted by applicable securities law. That acquisition would be made on the same terms as apply to other shareholders accepting the Offer (including, where the law permits, a limited reintroduction of the mix and match election solely among holders of Merant securities subject to the compulsory acquisition).

5 General

The decision as to which course of action to take is a matter for you alone.

Before you make a decision, you should read this document carefully and take independent professional advice if you are in any doubt as to what action to take. You should also carefully read the public filings of SERENA and Merant before making any decisions.

SERENA files annual, quarterly and current reports, proxy statements and other

3

information with the United States Securities and Exchange Commission (the “SEC”). Merant files annual and current reports with the SEC and pursuant to the Companies Act of England and Wales. You may read and copy any reports, statements or other information that SERENA and Merant file at the SEC’s public reference room at 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information regarding the public reference room. SERENA’s and Merant’s public filings also are available to the public from commercial document retrieval services and at the Internet website maintained by the SEC at http://www.sec.gov.

If you have any queries (other than on financial or tax aspects) please contact Liz MacKay.

If you want to exercise your Options now (to the extent they may already be exercisable) you should use the usual form of exercise. If you want a usual form of exercise please contact Liz MacKay.

In the event of a conflict between this letter and the rules of the Plans or any relevant legislation, the rules or the legislation will prevail.

Yours faithfully

J. Michael Gullard

Chairman

4

APPENDIX 1

1. Introduction

The purpose of this Appendix is to set out the choices you have in relation to your Options and the action you could take now, if you wish.

Before taking any action with regard to your Options, you should read this Appendix and the letter from the Chairman of Merant.

Nothing in the letter from the Chairman of Merant or in this Appendix shall constitute an offer of options by SERENA and the information given in this Appendix is indicative only of the terms on which it is understood that SERENA will make its proposal, if permitted by local securities laws, once the Offer has been successful.

2. Rollover Proposal

After the Offer succeeds, SERENA will, subject to local securities laws, offer to convert your existing option(s) over Merant Shares into option(s) over SERENA Shares on the following basis:

For every Merant Share under option | | 0.16553 of a new SERENA Shares under the new option | |

and so on in proportion for any other number of Merant Shares under option. Fractional entitlements will be disregarded.

As the SERENA Shares are quoted in United States dollars, the new exercise price will be converted into dollars using the exchange rate used in the mix and match arrangements (US$1.8488 : £1.00). So that means you can find the new exercise price by multiplying the old exercise price by 11.1689. The following table shows the new exercise prices per share under the rolled over option(s):

Old Exercise Price per

Merant Share | | New Exercise Price per

SERENA Share | |

| | | |

£1.06 | | $ | 11.8391 | |

£1.08 | | $ | 12.0624 | |

£1.32 | | $ | 14.7430 | |

£1.37 | | $ | 15.3013 | |

£1.52 | | $ | 16.9767 | |

The terms of the Rollover Proposal (i.e. the basis on which the number of SERENA Shares and the exercise price per SERENA Share are calculated) are to be designed to reflect the terms of the Offer. The aggregate exercise price payable on exercise of the rolled over option(s) will (so far as practicable) be the same as the aggregate amount payable on exercise of your existing option(s) on the basis of an exchange rate of US$1.8488 : £1.00 and a price per SERENA Share of US $21.78.

The rolled over option(s) will be governed by the rules of the relevant Merant Plan. The rolled over option(s) will be exercisable and cease to be exercisable in the same circumstances as your existing option(s). You should note that your rolled over option(s) may not be exercised early

5

again except in accordance with the provisions of the relevant Merant Plan. You should also bear in mind that the value of your rolled over option(s) will be subject to movements in the price of SERENA Shares.

3. Exercise of Options granted under the Plans

Your Options are either already exercisable or will become fully or partially exercisable, if the Offer succeeds. You should check the terms of your Options to see whether they are already exercisable and/or whether they become exercisable on a change of control (and if so to what extent). If you are in any doubt on any of these questions, please contact Liz MacKay.

For those of you who hold standard Options which are currently exercisable only in part, the date of grant and the date when control passes to SERENA will be key dates. At this stage we do not know when control will pass and so Liz MacKay may not be able to say precisely the extent to which your Option will be exercisable on a change of control. However, the principle is that:

• You may exercise the Option to the extent that it has vested in accordance with the normal vesting schedule plus 25% of the Merant Shares subject to the original option.

• If the Option would, under its normal vesting schedule, have been exercisable in full within one year after the change of control then it can be exercised in full if and when the Offer succeeds.

Any part of the Option which is not exercisable on this basis continues in force and vests rateably over the remainder of the original vesting period.

If you exercise your Options (in whole or in part), you will acquire Merant Shares. You cannot accept the Offer from Australia, Canada or Japan. However, if SERENA receives valid acceptances in respect of over 90 per cent. of the Merant Shares, SERENA intends to exercise its right to acquire the balance under the compulsory acquisition procedure in the Companies Act 1985 of England and Wales. The compulsory acquisition process will apply to your Merant Shares.

Procedure for exercise

You can exercise your currently available (vested) Options now. If you wish to do this you should complete the usual forms of exercise. These forms are available from the company intranet or from Liz MacKay. Be aware, however, that under current market conditions, a sale in the market of the Merant Shares you acquire cannot be guaranteed and Merant Share Services will work on a first come first served basis whenever market liquidity constrains the sale of Merant Shares.

Following the effective exercise of your Options, you will receive Merant Shares. You can keep your Merant Shares or sell your Merant Shares while they continue to be listed on the London Stock Exchange. You should consult an appropriately authorized independent financial adviser to determine what to do with your Merant Shares as a result of the Offer not being extended to you. However, you should be aware that if the Offer succeeds, and SERENA receives valid acceptances in respect of over 90 per cent. of the Merant Shares, SERENA intends to acquire the balance under the compulsory acquisition procedure in the Companies Act 1985. SERENA has also stated that it is intended that Merant will be de-listed, if the Offer succeeds. If you are in any doubt as to whether your Options are currently exercisable (or the extent to which they are exercisable) please contact Liz MacKay.

6

4. Do nothing

If you do nothing and the Offer succeeds, and if SERENA is able to offer replacement SERENA options to you without the issue of a prospectus or other disclosure document being required, your Options will be rolled over in accordance with the Rollover Proposal. In any other case, we understand that SERENA will exercise any compulsory acquisition rights it may have under the Companies Act 1985 of England and Wales to acquire any shares acquired by you upon exercise of your Options, to the extent permitted by applicable securities law. That acquisition would be made on the same terms as apply to other shareholders accepting the Offer (including, where the law permits, a limited reintroduction of the mix and match election solely among holders of Merant securities subject to the compulsory acquisition).

7