QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant /x/

|

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /x/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to §240.14a-12

|

HF FINANCIAL CORP. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| /x/ | | No fee required |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| / / | | Fee paid previously with preliminary materials. |

| / / | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

FINANCIAL CORP.

P.O. BOX 5000

SIOUX FALLS, SOUTH DAKOTA 57117-5000

PHONE (605) 333-7556 * FAX (605) 333-7621

October 15, 2001

Dear Fellow Stockholder:

On behalf of the Board of Directors of HF Financial Corp., I cordially invite you to attend the Annual Meeting of Stockholders of the Corporation to be held at 2:00 p.m., Sioux Falls, South Dakota time, on November 14, 2001, at the Best Western Ramkota Inn located at 2400 North Louise Avenue, Sioux Falls, South Dakota.

Stockholders are being asked to vote upon the election of two directors of the Corporation and to ratify the appointment of McGladrey & Pullen, LLP as auditors for the Corporation. Your Board of Directors unanimously recommends that you voteFOR each of the nominees for director andFOR the ratification of McGladrey & Pullen, LLP.

I encourage you to attend the Meeting in person. Whether or not you plan to attend, however,please read the enclosed Proxy Statement and then complete, sign and date the enclosed proxy card and return it in the accompanying postpaid return envelope as promptly as possible. This will save the Corporation additional expense in soliciting proxies and will ensure that your shares are represented at the Meeting. The Notice of Annual Meeting, this Proxy Statement and the form of proxy are first being mailed to stockholders of the Corporation on or about October 15, 2001.

Thank you for your attention to this important matter.

| | | Very truly yours, |

|

|

|

| | | CURTIS L. HAGE

Chairman, President and Chief Executive Officer |

HF FINANCIAL CORP.

225 South Main Avenue

Sioux Falls, South Dakota 57104

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on November 14, 2001

Notice is hereby given that the Annual Meeting of Stockholders (the "Meeting") of HF Financial Corp. (the "Corporation") will be held at 2:00 p.m., Sioux Falls, South Dakota time, on November 14, 2001, at the Best Western Ramkota Inn located at 2400 North Louise Avenue, Sioux Falls, South Dakota.

A proxy card and the Proxy Statement for the Meeting are enclosed along with the Corporation's Summary Annual Report and Annual Report on Form 10-K for the fiscal year ending June 30, 2001. The Meeting is for the purpose of considering and acting upon:

- 1.

- The election of two directors of the Corporation;

- 2.

- The ratification of the appointment of McGladrey & Pullen, LLP as auditors of the Corporation for the fiscal year ending June 30, 2002; and

such other matters as may properly come before the Meeting or any adjournments or postponements thereof. The Board of Directors is not aware of any other business to come before the Meeting.

Any action may be taken on any one of the foregoing proposals at the Meeting on the date specified above, or on any date or dates to which the Meeting may be adjourned or postponed. Stockholders of record at the close of business on September 28, 2001, are the stockholders entitled to vote at the Meeting and any adjournments or postponements thereof.

A complete list of stockholders entitled to vote at the Meeting is available for examination by any Stockholder for any purpose germane to the Meeting. Such stockholder list is available for a period of twenty days prior to the meeting and may be examined at any time between 9:00 A.M. and 3:00 P.M. on days which the Corporation is open for business, at the main office of the Corporation located at 225 South Main Avenue, Sioux Falls, South Dakota.

You are requested to complete, sign and date the enclosed proxy card, which is solicited on behalf of the Board of Directors, and to mail it promptly in the enclosed postpaid return envelope. The proxy will not be used if you attend and vote at the Meeting in person.

| | | By Order of the Board of Directors, |

|

|

|

| | | GENE F. UHER

Executive Vice President, Chief Operations Officer

and Secretary |

Sioux Falls, South Dakota

October 15, 2001

IMPORTANT: THE PROMPT RETURN OF PROXY CARDS WILL SAVE THE CORPORATION THE EXPENSE OF FURTHER REQUESTS FOR PROXIES TO ENSURE A QUORUM AT THE MEETING. A PRE-ADDRESSED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED WITHIN THE UNITED STATES.

PROXY STATEMENT

HF FINANCIAL CORP.

225 South Main Avenue

Sioux Falls, South Dakota 57104

ANNUAL MEETING OF STOCKHOLDERS

November 14, 2001

Introduction

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of HF Financial Corp. (the "Corporation") to be used at the Annual Meeting of Stockholders of the Corporation (the "Meeting"), to be held at the Best Western Ramkota Inn located at 2400 North Louise Avenue, Sioux Falls, South Dakota, on November 14, 2001, at 2:00 p.m., Sioux Falls, South Dakota time, and at all adjournments or postponements of the Meeting. The accompanying Notice of Meeting, proxy card and this Proxy Statement are first being mailed to stockholders on or about October 15, 2001. Certain of the information provided herein relates to Home Federal Savings Bank ("Home Federal" or the "Bank"), a wholly owned subsidiary and the primary operating entity of the Corporation.

At the Meeting, the stockholders of the Corporation are being asked to consider and vote upon the election of two nominees to the Board of Directors of the Corporation, a proposal to ratify the appointment of McGladrey & Pullen, LLP as the Corporation's independent auditors for the fiscal year ending June 30, 2002, and any other matters that may properly come before the meeting or any adjournments or postponements thereof.

The close of business on September 28, 2001, has been fixed by the Board of Directors as the record date (the "Record Date") for the determination of stockholders entitled to notice of and to vote at the Meeting and any and all adjournments thereof. Only stockholders of record at that time are entitled to notice of and to vote at the Meeting. The total number of shares of Common Stock, par value $.01 per share, of the Corporation (the "Common Stock") outstanding on the Record Date was 3,693,785, which are the only securities of the Corporation entitled to vote at the Meeting. Each stockholder is entitled to one vote on all matters to be voted on at the Meeting for each share of Common Stock held in the stockholder's name as of the Record Date.

Voting Rights and Proxy Information

All shares of Common Stock represented at the Meeting by properly executed proxies received prior to or at the Meeting, and not revoked, will be voted at the Meeting in accordance with the instructions thereon. Directors shall be elected by a plurality of the votes present in person or represented by proxy at the Meeting and entitled to vote on the election of directors. In all matters, the affirmative vote of the majority of shares present in person or represented by proxy at the Meeting and entitled to vote on the matter shall be considered the act of the stockholders. The Corporation does not know of any matters, other than as described in the Notice of Meeting, that are to come before the Meeting. If any other matters are properly presented at the Meeting for action, the persons named in the enclosed form of proxy will have the discretion to vote on such matters in accordance with their best judgment.

If no instructions are indicated, properly executed proxies will be votedFOR election of the nominees for director named herein andFOR the proposal to ratify the appointment of McGladrey & Pullen, LLP. Proxies marked as abstaining with respect to a proposal have the same effect as votes against the proposal. If an executed proxy card is returned and the shareholder has abstained from voting on any matter, the shares represented by such proxy will be considered present at the meeting for purposes of determining a quorum and for purposes of calculating the vote, but will not be considered to have been voted in favor of such matter. If an executed proxy is returned by a broker holding shares in street name which indicates that the broker does not have discretionary authority as to certain shares to vote on one or more matters, such shares will be considered present at the Meeting for purposes of determining a quorum, but will not be considered to be represented at the meeting for purposes of calculating the vote with respect to such

matter. One-third of the shares of the Corporation's Common Stock, present in person or represented by proxy, shall constitute a quorum for purposes of the Meeting.

A proxy given pursuant to this solicitation may be revoked at any time before it is voted. Proxies may be revoked by: (i) filing with the Secretary of the Corporation before the voting at the Meeting a written notice of revocation bearing a later date than the proxy; (ii) duly executing a subsequent proxy relating to the same shares and delivering it to the Secretary of the Corporation before the voting at the Meeting; or (iii) attending the Meeting and voting in person (although attendance at the Meeting will not in and of itself constitute revocation of a proxy). Any written notice revoking a proxy should be delivered to Gene F. Uher, Executive Vice President, Chief Operations Officer and Secretary, HF Financial Corp., 225 South Main Avenue, Sioux Falls, South Dakota 57104.

Voting Securities and Principal Holders Thereof

The following table sets forth certain information regarding ownership of the Common Stock as of September 17, 2001, by (i) each person known to the Corporation to own beneficially more than 5% of the Common Stock, (ii) each director of the Corporation, (iii) each officer named in the executive compensation table on page 6 of this Proxy Statement, and (iv) all directors and officers as a group. Unless otherwise indicated, each person in the table has sole voting and investment power as to the shares shown.

Beneficial Owner

| | Amount and Nature of

Beneficial Ownership

| | Percentage of

Outstanding Stock

| |

|---|

Jeffrey L. Gendell

Tontine Partners, L.P.

31 West 52nd Street, 17th Floor

New York, New York 10019(1) |

|

305,250 |

|

8.26 |

% |

John T. Vucurevich

629 Quincy Street

PO Box 170

Rapid City, SD 57709(2) | | 298,912 | | 8.09 | % |

HF Financial Corp.

Employee Stock Ownership Plan

225 South Main Avenue

Sioux Falls, South Dakota 57104(3) | | 257,530 | | 6.97 | % |

Dimensional Fund Advisors, Inc.

1299 Ocean Avenue, 11th Floor

Santa Monica, CA 90401(4) | | 220,350 | | 5.97 | % |

| Curtis L. Hage, Chairman, President and Chief Executive Officer and Director(5) | | 220,855 | | 5.80 | % |

| Gene F. Uher, Executive Vice President, Chief Operations Officer and Secretary(6) | | 36,134 | | * | |

| Brent E. Johnson, Senior Vice President, Chief Financial Officer and Treasurer(7) | | 2,616 | | * | |

| Mark S. Sivertson, Senior Vice President and Trust Officer(8) | | 16,611 | | * | |

| Michael H. Zimmerman, Senior Vice President and Senior Retail Lending Officer(9) | | 13,568 | | * | |

| Paul J. Hallem, Director | | 55,004 | | 1.49 | % |

2

| Robert L. Hanson, Director(10) | | 26,807 | | * | |

| Kevin T. Kirby, Director | | 20,216 | | * | |

| JoEllen G. Koerner, Director | | 5,366 | | * | |

| Jeffrey G. Parker, Director(11) | | 20,807 | | * | |

| Wm. G. Pederson, Director(12) | | 10,616 | | * | |

| Thomas L. Van Wyhe, Director | | 7,716 | | * | |

| Directors and executive officers as a group (19 persons)(13) | | 486,102 | | 12.49 | % |

*Indicates individual owns less than one percent of outstanding shares of Common Stock.

- (1)

- The above information regarding beneficial ownership by Mr. Jeffrey L. Gendell is as reported in a Schedule 13G dated February 14, 2001.

- (2)

- The above information regarding beneficial ownership by Mr. John T. Vucurevich is as reported in a Schedule 13D dated March 30, 1998.

- (3)

- Includes 257,530 shares allocated to the individual accounts of employees, officers and directors, which such individuals are deemed to have sole voting and no investment power. Each participant may instruct the Employee Stock Ownership Plan ("ESOP") trustee, Firstar Bank of Minnesota, N.A., as to the voting of the shares allocated to such participant's account under the ESOP.

- (4)

- The above information regarding beneficial ownership by Dimensional Fund Advisors, Inc. is as reported in a Schedule 13G dated February 2, 2001.

- (5)

- Includes 92,042 shares held directly or held by certain members of Mr. Hage's family, which shares Mr. Hage may be deemed to have sole or shared voting and/or investment power. Also includes awards of 116,532 shares subject to options granted to Mr. Hage under the Corporation's 1991 Stock Option and Incentive Plan (the "Stock Option Plan") and 12,281 shares allocated to Mr. Hage's account under the ESOP. Excludes 10,878 shares held solely by Mr. Hage's spouse in and over which he disclaims beneficial interest and voting and/or investment power.

- (6)

- Includes 13,293 shares held directly by Mr. Uher with sole voting and/or investment power. Also includes awards of 19,534 shares subject to options granted to Mr. Uher under the Stock Option Plan and 3,307 shares allocated to Mr. Uher's account under the ESOP.

- (7)

- Includes 100 shares held directly by Mr. Johnson with sole voting and/or investment power. Also includes 1,118 shares subject to options granted to Mr. Johnson under the Stock Option Plan. Also includes 1,398 shares allocated to Mr. Johnson's account under the ESOP. Mr. Johnson resigned from the Corporation effective August 10, 2001.

- (8)

- Includes 3,342 shares held directly by Mr. Sivertson with sole voting and/or investment power. Also includes 9,690 shares subject to options granted to Mr. Sivertson under the Stock Option Plan. Also includes 3,579 shares allocated to Mr. Sivertson's account under the ESOP.

- (9)

- Includes 1,800 shares held directly by Mr. Zimmerman with sole voting and/or investment power. Also includes 8,913 shares subject to options granted to Mr. Zimmerman under the Stock Option Plan. Also includes 2,855 shares allocated to Mr. Zimmerman's account under the ESOP.

- (10)

- Includes 10,191 shares subject to options granted to Mr. Hanson under the Stock Option Plan.

- (11)

- Includes 10,191 shares subject to options granted to Mr. Parker under the Stock Option Plan.

- (12)

- Includes 500 shares held by Mr. Pederson's spouse which shares he may be deemed to have shared voting and/or investment power.

- (13)

- Includes 19 executive officers and directors as a group. Includes 248,058 shares held directly or held by certain members of the named individuals' families, or held by trusts of which the named individual is a trustee or substantial beneficiary, with respect to which shares the respective directors and officers may be deemed to have sole or shared voting and investment power, as well as 199,670 shares subject to options granted under the Stock Option Plan, which are currently exercisable and 38,374 shares allocated under the ESOP.

3

PROPOSAL I—ELECTION OF DIRECTORS

The Corporation's Board of Directors currently consists of eight members. The Board is divided into three classes, one class of the directors is elected annually. Directors of the Corporation are generally elected to serve for a three-year term or until their respective successors are elected and qualified. All nominees have agreed to stand for election at the annual meeting. If, prior to the annual meeting, the Board of Directors learns that any nominee will be unable to serve by reason of death, incapacity or other unexpected occurrence, the proxies which would have otherwise been voted for such nominee will be voted for a substitute nominee, if any, elected by the Board.

Two directors have been nominated for election to the Corporation's Board of Directors at the Meeting to hold office for a term of three years and until their successors are duly elected and qualified (except in the case of earlier death, resignation or removal). The accompanying proxy card is intended to be voted for the election of nominees for directors named below, unless authority to vote for one or more nominees is withheld as specified on the proxy card. The Board of Directors unanimously recommends that stockholders vote "FOR" each of the two nominees identified below.

Information with Respect to Nominees and Continuing Directors

The principal occupation and business experience for the last five years and certain other information with respect to each nominee for election as a director and the other directors of the Corporation are set forth below. The information concerning the nominees and the continuing directors has been furnished by them to the Corporation.

Information About Nominees

ROBERT L. HANSON, age 55, a Class II Director, is Chief Executive Officer of Harold's Photo Centers located in Sioux Falls, South Dakota, a position he has held since 1980. He has served as a director of both the Corporation and the Bank since 1992.

KEVIN T. KIRBY, age 47, a Class II Director, is President of Kirby Investment Corp., Sioux Falls, South Dakota, a private investment firm. He has held this position since 1993. Mr. Kirby has been employed as the Executive Vice President and Chief Investment Officer for Western Surety Company from 1985-1993 and the President of Western Surety Life Insurance Company from 1979-1985. He has served as a director of both the Corporation and the Bank since 1997. Mr. Kirby also serves as a director for Raven Industries, Inc.

Information About Continuing Directors

CURTIS L. HAGE, age 55, a Class III Director, is Chairman, President and Chief Executive Officer of the Corporation. Mr. Hage was elected Chairman of the Board of Directors of the Corporation in September 1996 and has held the position of President and Chief Executive Officer of the Corporation since February 1991. Mr. Hage joined the Bank in 1968 and served in various capacities prior to being elected its Executive Vice President in 1986. Mr. Hage has served as a director of the Corporation since 1992 and the Bank since 1986.

PAUL J. HALLEM, age 75, a Class I Director, is currently retired. Prior to his retirement in February 1991, Mr. Hallem was President and Chief Executive Officer of Home Federal Savings Bank, a position he had held since 1986. Mr. Hallem has over 39 years of experience in the savings institution industry. He has served as a director of the Corporation since 1992 and the Bank since 1969.

JOELLEN G. KOERNER, Ph.D., age 55, a Class I Director, is Chief Clinical Officer/Vice Chair, Simulis LLC, Houston, Texas, a web-based company providing technical and industrial skills training. Prior to joining Simulis LLC, she served as President of the Global Nursing Academy, Digital mEd from 1997 through 2001. She is also the Senior Partner of JoEllen Koerner and Associates, a healthcare consultation

4

company. From 1984 through 1998, she was employed in various capacities with Sioux Valley Hospitals and Health System, Sioux Falls, South Dakota, a health care services provider. She has served as a director of both the Corporation and the Bank since 1997.

JEFFREY G. PARKER, age 54, a Class III Director, is President of Parker Transfer and Storage, Inc., Sioux Falls, South Dakota, a moving and storage company and also serves as Vice President for U.S. Communications Corporation, a Delaware corporation that builds and operates hybrid fiber optic networks for the delivery of voice, video and data services. He has held his current position with Parker Transfer and Storage, Inc. since 1969 and position with U.S. Communications Corporation since June 2000. Mr. Parker has served as a director for both the Corporation and the Bank since 1993. Mr. Parker also serves as a director on the advisory board for McLeodUSA Company, a Nasdaq company.

WM. G. PEDERSON, age 45, a Class I Director, is Chairman and Chief Executive Officer of PAM Oil, Inc., Sioux Falls, South Dakota, a wholesale distributor of automotive products. He has held his current position since 1986 and has been with PAM Oil, Inc. since 1978. He has served as a director of both the Corporation and the Bank since 1996.

THOMAS L. VAN WYHE, age 51, a Class III Director, is District Manager, Trane Company, Sioux Falls, South Dakota, an air conditioning and heating sales and service company. He has been employed in various capacities by that organization since 1973 and has held his present position with them since 1994. Mr. Van Wyhe has served as a director of both the Corporation and the Bank since 1996.

The Board of Directors of the Bank is currently comprised of the same eight members as the Board of Directors of the Corporation. Because the Corporation owns all of the issued and outstanding shares of capital stock of the Bank, the Corporation elects the directors of the Bank.

Meetings of the Board of Directors, Committees and Compensation of Directors

Meetings and Compensation of the Corporation's Board of Directors. Meetings of the Corporation's Board of Directors are generally held on a quarterly basis. The Board of Directors met eight times during fiscal 2001. During fiscal 2001, no incumbent director of the Corporation attended fewer than 75% of the aggregate of the total number of Board meetings and the total number of meetings held by the committees of the Board of Directors on which they served. In fiscal 2001, non-employee directors received an aggregate of 1,607 shares of restricted common stock pursuant to the 1996 Director Restricted Stock Plan and a $400 fee for attendance at committee meetings of which they are a member. Employee directors receive no fees for their services as a director.

Committees of the Corporation. The Board of Directors of the Corporation has standing Audit and Personnel, Compensation and Benefits Committees.

The Audit Committee recommends independent auditors to the Board, reviews the results of the auditors' services, reviews with management and the internal auditors the systems of internal control and the internal audit reports, and assures that the books and records of the Corporation are kept in accordance with applicable accounting principles and standards. The members of the Audit Committee are Directors Kirby (Chairman), Hallem, Hanson and Van Wyhe, all of whom are independent as that term is defined in the NASDAQ listing requirement. The Audit Committee held four meetings in fiscal 2001.

The Personnel, Compensation and Benefits Committee is composed of Directors Koerner (Chair), Hallem, Parker and Pederson. The Personnel, Compensation and Benefits Committee is responsible for administering the Corporation's Stock Option Plan and reviews compensation and benefit matters. The Personnel, Compensation and Benefits Committee held six meetings during fiscal 2001.

The entire Board of Directors acts as a Nominating Committee for selecting nominees for election as directors. While the Board of Directors of the Corporation will consider nominees recommended by stockholders, the Board has not actively solicited such nominations. Pursuant to the Corporation's current Bylaws, nominations by stockholders must be delivered in writing to the Secretary of the Corporation at least 30 days before the date of the Meeting.

5

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information concerning the compensation paid by Home Federal for services in all capacities rendered during the three fiscal years ended June 30, 2001, 2000 and 1999 to the Corporation's Chief Executive Officer, the Chief Operations Officer, the Chief Financial Officer, the Senior Vice President/Trust Officer and the Senior Vice President/Senior Retail Lending Officer. The Corporation's Officers do not receive any cash compensation from the Corporation for their services performed in their capacities as officers of the Corporation.

Annual Compensation

| | Long Term

Compensation

Awards

| |

| |

|---|

Name and Principal Position

| | Year

| | Salary

($)

| | Bonus

($)

| | Other Annual

Compensation

($)

| | Restricted

Stock

Award(s) ($)

| | Options/

SARs

(#)

| | All Other

Compensation ($)

| |

|---|

Curtis L. Hage,

Chairman, President and

Chief Executive Officer | | 2001

2000

1999 | | $

$

$ | 226,914

218,927

214,240 | | $

$

$ | 61,338

60,884

-0- | | $

$

$ | 2,167

899

628 | (1)

(1)

(1) | -0-

-0-

-0- | | 17,514

-0-

16,748 | | $

$

$ | 15,613

9,232

8,513 | (2)

(2)

(2) |

Gene F. Uher

Executive Vice President,

Chief Operations Officer

and Secretary | | 2001

2000

1999 | | $

$

$ | 148,000

148,000

145,600 | | $

$

$ | 38,702

41,159

-0- | | $

$

$ | 1,204

554

226 | (3)

(3)

(3) | -0-

-0-

-0- | | 11,840

-0-

11,382 | | $

$

$ | 9,676

8,495

11,307 | (4)

(4)

(4) |

Brent E. Johnson

Senior Vice President,

Chief Financial Officer and

Treasurer(5) | | 2001

2000

1999 | | $

$

$ | 112,000

104,833

58,718 | | $

$

$ | 18,648

19,195

6,000 | | $

$

$ | -0-

-0-

-0- | | -0-

-0-

-0- | | 5,591

-0-

-0- | | $

$

$ | 7,572

5,995

3,554 | (6)

(6)

(6) |

Mark S. Sivertson

Senior Vice President and

Trust Officer | | 2001

2000

1999 | | $

$

$ | 106,600

102,000

95,700 | | $

$

$ | 17,973

23,256

-0- | | $

$

$ | -0-

-0-

-0- | | -0-

-0-

-0- | | 5,440

-0-

4,420 | | $

$

$ | 7,186

5,835

4,843 | (7)

(7)

(7) |

Michael H. Zimmerman

Senior Vice President and

Senior Retail Lending

Officer | | 2001

2000

1999 | | $

$

$ | 102,700

99,050

95,700 | | $

$

$ | 17,100

18,136

-0- | | $

$

$ | -0-

-0-

-0- | | -0-

-0-

-0- | | 5,282

-0-

4,486 | | $

$

$ | 6,889

5,589

6,612 | (8)

(8)

(8) |

- (1)

- Represents preferential interest earnings on behalf of Mr. Hage related to the Deferred Compensation Plan in excess of 120% of the applicable federal long-term rate.

- (2)

- Includes $7,414 and $2,262 for 2001; $6,722 and $2,510 for 2000; and $5,786 and $2,727 for 1999, which represents the Bank's contributions to the Pension Plan and the ESOP, respectively, on behalf of Mr. Hage. Also includes $5,937 for 2001, which represents the Bank's contributions to the Excess Pension Plan on behalf of Mr. Hage.

- (3)

- Represents preferential interest earnings on behalf of Mr. Uher related to the Deferred Compensation Plan in excess of 120% of the applicable federal long-term rate.

- (4)

- Includes $7,414 and $2,262 for 2001; $6,082 and $2,413 for 2000; and $8,582 and $2,725 for 1999, which represents the Bank's contributions to the Pension Plan and ESOP, respectively, for Mr. Uher.

- (5)

- Mr. Johnson resigned from the Corporation effective August 10, 2001.

- (6)

- Includes $5,802 and $1,770 for 2001; $4,292 and $1,703 for 2000; and $2,360 and $1,194 for 1999, which represents the Bank's contributions to the Pension Plan and ESOP, respectively, on behalf of Mr. Johnson.

- (7)

- Includes $5,506 and $1,680 for 2001; $4,178 and $1,657 for 2000; and $2,872 and $1,971 for 1999, which represents the Bank's contributions to the Pension Plan and the ESOP, respectively, on behalf of Mr. Sivertson.

- (8)

- Includes $5,279 and $1,610 for 2001; $4,002 and $1,587 for 2000; and $4,688 and $1,924 for 1999, which represents the Bank's contributions to the Pension Plan and the ESOP, respectively, on behalf of Mr. Zimmerman.

6

Stock Option Grants in Last Fiscal Year

The following table provides information on stock option grants for fiscal year ended June 30, 2001, to the named executive officers.

| | Individual Grants

| |

| |

|

|---|

| | Number of

Shares

Underlying

Options Granted

(#)(1)

| | Percent of

Total Options

Granted to

Employees in

Fiscal Year(2)

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for

Option Term(3)

|

|---|

Name

| | Exercise

Price Per

Share

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Curtis L. Hage | | 17,514 | | 18.12 | % | $ | 9.375 | | 09/13/10 | | $ | 103,261 | | $ | 261,683 |

| Gene F. Uher | | 11,840 | | 12.25 | % | $ | 9.375 | | 09/13/10 | | $ | 69,807 | | $ | 176,905 |

| Brent E. Johnson(4) | | 5,591 | | 5.78 | % | $ | 9.375 | | 09/13/10 | | $ | 32,964 | | $ | 83,537 |

| Mark S. Sivertson | | 5,440 | | 5.63 | % | $ | 9.375 | | 09/13/10 | | $ | 32,074 | | $ | 81,281 |

| Michael H. Zimmerman | | 5,282 | | 5.46 | % | $ | 9.375 | | 09/13/10 | | $ | 31,142 | | $ | 78,920 |

- (1)

- Such options are subject to a five-year vesting schedule with 20% of the grants vesting each year with Hage, Uher, Johnson, Zimmerman and Sivertson beginning June 30, 2001.

- (2)

- The Corporation granted options representing 96,655 shares to employees in fiscal 2001.

- (3)

- These amounts are based on the assumed rates of appreciation as permitted by the rules of the Securities and Exchange Commission. Actual gains, if any, on stock option exercises are dependent upon the future performance of the Common Stock.

- (4)

- As previously stated, Mr. Johnson resigned from the Corporation effective August 10, 2001. As provided in Footnote 1 above, 20% of the options granted to Mr. Johnson vested on June 30, 2001. As a result of Mr. Johnson's resignation, all or any portion of such vested options must be exercised within 90 days following August 10, 2001. All unvested options are forfeited.

Stock Option Exercises in Last Fiscal Year

The following table provides information regarding the number and value of options granted to the named executive officers at June 30, 2001.

| |

| |

| |

| |

| | Value of Unexercised

In-the-Money Options/

SARs at

FY-End(1)

|

|---|

| |

| |

| | Number of Unexercised Options/SARs at FY-End (#)

|

|---|

Name

| | Shares Acquired

on Exercise (#)

| | Value

Realized ($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Curtis L. Hage | | 3,100 | | $ | 17,980 | | 116,532 | | 23,790 | | $ | 773,003 | | $ | 63,404 |

| Gene F. Uher | | N/A | | | N/A | | 19,534 | | 16,612 | | $ | 18,470 | | $ | 44,799 |

| Brent E. Johnson | | N/A | | | N/A | | 1,118(2 | ) | 4,473 | (3) | $ | 5,059 | | $ | 20,240 |

| Mark S. Sivertson | | N/A | | | N/A | | 9,690 | | 6,926 | | $ | 14,670 | | $ | 19,693 |

| Michael H. Zimmerman | | N/A | | | N/A | | 8,913 | | 6,750 | | $ | 13,081 | | $ | 19,123 |

- (1)

- Represents the aggregate market value (market price of the Common Stock less the exercise price) of the option granted based upon the closing price of $13.900 per share of the Common Stock as reported on the NASDAQ National Market System on June 30, 2001.

- (2)

- Represents the vested options of Mr. Johnson of which all or any portion may be exercised within 90 days of August 10, 2001.

- (3)

- Represents the unvested options of Mr. Johnson which are forfeited.

Employment Agreements

On April 23, 1992, the Bank entered into an employment agreement with Mr. Hage. The employment agreement, as amended to date, provides for an annual base salary as determined by the Board of Directors, which may be not less than the salary for the prior year. The employment agreement provides for annually-renewable one year terms. Mr. Hage may terminate his employment agreement upon 90 days'

7

prior written notice to the Bank. In the event there is a change in control of the Corporation or Home Federal, and Mr. Hage's employment terminates involuntarily (or, under certain circumstances, voluntarily) in connection with such change in control or within 24 months thereafter, Mr. Hage is entitled to a payment equal to the remaining salary payable under his employment agreement, plus a termination payment equal to 299% of his then-current compensation. Assuming a change in control took place as of June 30, 2001, the aggregate amount payable to Mr. Hage pursuant to this change in control provision would be approximately $861,873. The employment agreement contains other standard provisions and provides for standard benefits applicable to executive personnel. On December 20, 2000, the Board of Directors extended the term of Mr. Hage's employment agreement until April 7, 2004.

On March 3, 1997, the Bank entered into an employment agreement with Mr. Uher, and on April 8, 1998, the Bank entered into employment agreements with Messrs. Sivertson and Zimmerman. All of the employment agreements provide for, among other things, annual base salaries as determined by the Board of Directors and participation in bonus and benefit plans of the Bank in effect from time to time. Each of the employment agreements provides for an initial term of three years. On December 20, 2000, the Board of Directors extended the term of Mr. Uher's employment agreement until April 7, 2003. Mr. Uher's employment may be terminated with or without cause; however, if his termination is without cause, he is entitled to compensation and benefits through the remaining term of the agreement. Mr. Uher may terminate his employment agreement upon 90 days' prior written notice to the Bank. The employment agreements of Messrs. Sivertson and Zimmerman are for employment at will, and either the employee or the Bank may terminate the agreement with or without cause upon one month's written notice.

The Bank also entered into Change in Control Agreements with Messrs. Uher, Sivertson and Zimmerman. The agreements provide for certain payments to the employee where employment terminates involuntarily in connection with a change in control of the Corporation or the Bank, or in the event of a voluntary termination of employment due to a loss of the employee's status in connection with a change in control. In such an event, the employee is entitled to payment of the remaining salary payable under his employment agreement and the continuation of certain benefits. In addition, the employee receives a termination payment equal to 299% for Mr. Uher and Mr. Zimmerman, and 150% for Mr. Sivertson, of the employee's then-current compensation. Assuming a change in control took place as of June 30, 2001, the aggregate amount payable to Mr. Uher, Mr. Sivertson, and Mr. Zimmerman would be approximately $558,239, $186,860, and $358,202, respectively.

Pension Plan

The Corporation sponsors a defined benefit pension plan for its employees (the "Pension Plan"). An employee is eligible to participate in the Pension Plan upon the completion of one year of service and upon reaching the age of 21. That participation is retroactive to the previous July 1. A participant must complete five years of service before such participant earns a vested interest in accrued retirement benefits, at which time the participant is 100% vested. A participant will also be 100% vested if employment ends due to death or disability. The Pension Plan is funded solely through contributions made by the Corporation. It is anticipated that this obligation will be funded through the Corporation's future earnings.

The following table sets forth, as of June 30, 2001 estimated annual pension benefits for individuals at age 65 payable in the form of a life annuity under the most advantageous Pension Plan provisions for various levels of compensation and years of service. The figures in this table are based upon the

8

assumption that the individual is age 65 as of June 30, 2001 with a specified number of years of service as calculated under the Pension Plan.

| | Years of Service

|

|---|

Remuneration

| | 10

| | 20

| | 30

| | 40

|

|---|

| $ | 50,000 | | $ | 5,789 | | $ | 15,815 | | $ | 26,163 | | $ | 35,384 |

| $ | 75,000 | | $ | 9,752 | | $ | 25,764 | | $ | 42,462 | | $ | 57,226 |

| $ | 100,000 | | $ | 13,714 | | $ | 35,713 | | $ | 58,761 | | $ | 79,068 |

| $ | 125,000 | | $ | 17,677 | | $ | 45,662 | | $ | 75,060 | | $ | 100,910 |

| $ | 150,000 | | $ | 21,639 | | $ | 55,610 | | $ | 91,358 | | $ | 122,751 |

| $ | 150,000 | | $ | 23,025 | | $ | 56,803 | | $ | 91,873 | | $ | 123,238 |

| $ | 200,000 | | $ | 23,025 | | $ | 56,803 | | $ | 91,873 | | $ | 123,238 |

Compensation includes all taxable compensation paid to the participant, which includes salary, bonus, overtime and commissions. Compensation for 2001 was limited to $170,000 as stated under Section 401(a)(17) of the Internal Revenue Code.

A participant is eligible for an early retirement benefit upon the attainment of age 62, provided such participant has participated in the Pension Plan for a minimum of five years. The monthly benefit payable at early retirement is the actuarial equivalent of the participant's accrued monthly benefit at age 65. If a participant continues to work beyond age 65, the participant is entitled to the greater of: (i) such participant's benefit taking into account all service and compensation through the actual retirement date or (ii) the actuarial equivalent of the benefit that would have been payable had the participant retired on the normal retirement date. In the event of termination of employment for any reason other than death, disability or early or normal retirement, a participant is still entitled to 100% of the participant's accrued normal retirement benefit, provided that the participant is vested.

The Pension Plan was amended and restated effective July 1, 1999, to convert the benefit formula to a cash balance pension formula with a hypothetical account maintained separately for each participant, with such account credited annually for contributions and earnings. The plan was a final average pay plan before this conversion. Each participant's accrued benefit as of July 1, 1999, was converted to a beginning account balance. Each year an employer contribution equal to 6% of the participant's compensation for the plan year is allocated to that participant's account. Investment returns are credited to account balances as of the first day of each plan year for the upcoming plan year in an amount equal to the average daily rates for return for 30 year U.S. Treasury bills during the previous February. Normal retirement age is 65 with five years of service and early retirement age is 62 with five years of service.

The normal retirement benefit is a monthly annuity based on an individual's hypothetical account balance as of benefit commencement. A participant may elect, at the time of retirement, several optional forms of benefits which are the actuarial equivalent of the normal form, such as the joint and survivor benefits for married participants or an actuarially equivalent lump sum payment. A married participant must receive a joint and 50% survivor annuity unless the participant's spouse consents to a different form of benefit.

At June 30, 2001, the estimated credited years of service of Mr. Hage was 30 years. Mr. Hage had $170,000 of compensation covered under the Pension Plan during fiscal 2001; however, Mr. Hage's benefits payable under the Pension Plan upon retirement would be limited because his salary level exceeds the maximum covered compensation under the Pension Plan.

At June 30, 2001, the estimated credited years of service of Mr. Uher was 4 years. Mr. Uher had approximately $170,000 projected annual compensation under the Pension Plan during fiscal 2001; however, Mr. Uher's benefits payable under the Pension Plan upon retirement would be limited because his salary level exceeds the maximum covered compensation under the Pension Plan.

9

At June 30, 2001, the estimated years of service for Mr. Sivertson was 6 years. Mr. Sivertson had approximately $126,237 projected annual compensation under the Pension Plan during fiscal 2001.

At June 30, 2001, the estimated years of service for Mr. Zimmerman was 5 years. Mr. Zimmerman had approximately $121,045 projected annual compensation under the Pension Plan during fiscal 2001.

Report of the Board Compensation Committee Report on Executive Compensation

The Personnel, Compensation and Benefits Committee has furnished the following report on executive compensation:

Since its inception, the Personnel, Compensation and Benefits Committee of the Board of Directors has been responsible for supervising and recommending for full Board approval the compensation and benefits of the executive officers of the Bank. The Committee has reviewed, at least annually, competitive salary levels at other financial institutions and set salary ranges for executive officer positions based on a philosophy of placing the average of the range in relation to the competitive value of the position. From this reference point, the base salaries of executive officers of the Bank have been set to be commensurate with their experience, scope of duties and responsibilities and overall level of performance.

At present, the executive compensation program is comprised of salary, bonuses, incentive opportunities in the form of stock options, stock appreciation rights and restricted stock, and miscellaneous benefits typically offered to executives of similar type corporations. Along with other eligible employees, executive officers also participate in a defined benefit retirement program and an Employee Stock Ownership Plan.

The compensation and bonuses for all executive officers, including the Chief Executive Officer, have been based on the performance of the organization. Specific areas that the Personnel, Compensation and Benefits Committee has reviewed to determine the salary increases are return on assets, interest rate risk measurements, capital ratios, delinquency ratios and regulatory ratings. In addition, during fiscal year 2001, in setting the compensation for the Chief Executive Officer, the Personnel, Compensation and Benefits Committee also took into consideration peer group comparisons of compensation for chief executive officers and the contribution of the Chief Executive Officer to the overall performance of the Bank.

Annual incentive plans for executive officers and the entire staff of the Bank were developed and implemented in fiscal year 2001. Specific goals for the organization were established along with specific goals for individual departments. This program was developed to enhance shareholder value and enable the organization to attract and retain competent management and employees.

The foregoing report is furnished by Dr. Koerner (Chair) and Messrs. Hallem, Parker and Pederson.

Personnel, Compensation And Benefits Committee Interlocks and Insider Participation

As stated above, Dr. Koerner and Messrs. Hallem, Parker and Pederson, comprise the Personnel, Compensation and Benefits Committee of the Board of Directors. No member of the Personnel, Compensation and Benefits Committee of the Board of Directors was an officer, former officer, or employee of the company or any of its subsidiaries during fiscal 2001 or at any other time.

10

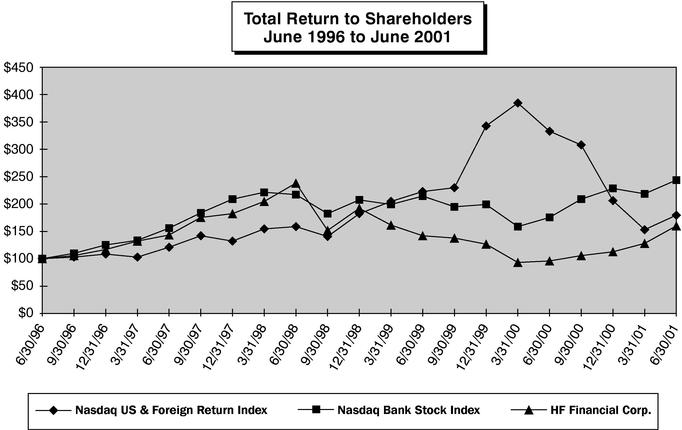

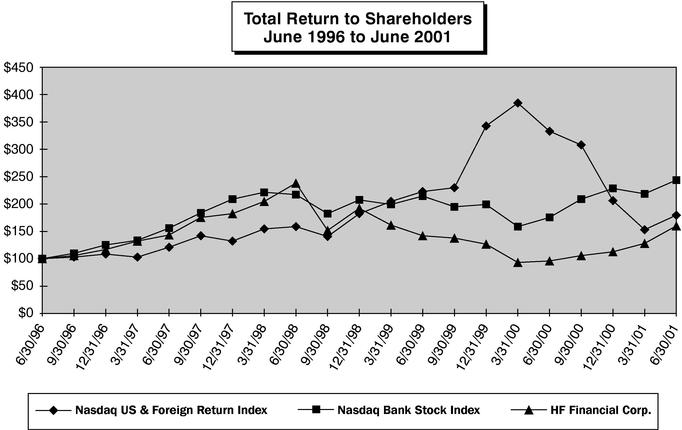

Stockholder Return Performance Presentation

The following line graph compares the cumulative total stockholder return on the Corporation's Common Stock to the cumulative total return of the NASDAQ U.S. and Foreign Total Return Index and the NASDAQ Bank Stock Index for the last five years.

Certain Transactions

The Bank, like many financial institutions, has followed a policy of granting to officers, directors and employees loans secured by the borrower's residence and consumer loans. Consumer loans to employees are originated at one percent below Home Federal's quoted interest rate. In addition, in connection with single-family mortgage loans made to non-officer employees, all in-house closing costs, expenses and points are waived. If the employee relationship ceases, the terms of the loan revert back to the terms that would have applied but for the employee-employer relationship. All loans to the Bank's officers and directors are made in the ordinary course of business and on the same terms and conditions as those of comparable transactions prevailing at the time, and do not involve more than the normal risk of collectibility or present other unfavorable features. All loans by the Bank to its directors and executive officers are subject to Office of Thrift Supervision regulations restricting loans and other transactions with affiliated persons of the Bank. Federal law requires that all such loans be made on terms and conditions comparable to those for similar transactions with non-affiliates. All loans from the Bank to its officers, directors, key employees or their affiliates are approved by the Bank's Loan Committee and ratified by the Bank's Board of Directors.

The Corporation intends that all transactions between the Corporation or the Bank and its officers, directors, holders of 10% or more of the shares of any class of its Common Stock and affiliates thereof, will contain terms no less favorable to the Corporation than could have been obtained by it in arm's-length negotiations with unaffiliated persons and will be approved by a majority of disinterested directors of the Corporation, if any.

11

The following table sets forth certain information as to loans made by Home Federal to each of its directors and executive officers whose aggregate indebtedness to Home Federal exceeded $60,000 at any time since June 30, 2000. All such loans were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with others and did not involve more than the normal risk of collectibility or present other unfavorable features.

Name and Position

| | Date of

Loan

| | Type of Loan

| | Largest Amount

Outstanding Since

July 1,

2000

| | Balance

As of

June 30,

2001

| | Interest

Rate as of

Date of

Origination

| | Market

Rate at

Origination

| |

|---|

Jeffrey G. Parker

Director | | 01/15/98

04/04/00

09/25/00 | | Commercial Revolving

Line of Credit

Commercial Revolving

Line of Credit

Mortgage Loan | | $

$

$ | 123,958

300,000

240,000 | | $

$

$ | 123,958

300,000

238,614 | | 8.000

7.500

7.750 | %

%

% | 8.000

7.500

7.750 | %

%

% |

At June 30, 2001, Home Federal had approximately $736,173 (or 1.40% of the Corporation's stockholders' equity) of loans to directors, executive officers and affiliates of such persons.

Report of the Audit Committee

The following Audit Committee Report shall not be deemed to be incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or under the Exchange Act, except to the extent the Corporation specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

The Audit Committee of the Board is responsible for providing independent, objective oversight of the Corporation's accounting functions and internal controls. The Audit Committee is composed of four directors, each of whom is independent as defined under the National Association of Securities Dealers' listing standards. The Audit Committee operates under a written charter approved by the Board. A copy of the charter is attached to this Proxy Statement as Appendix A.

Management is responsible for the Corporation's internal controls and financial reporting process. The independent accountants are responsible for performing an independent audit of the Corporation's consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and to issue a report thereon. The Audit Committee's responsibility is to monitor and oversee these processes.

In connection with these responsibilities, the Audit Committee met with management and the independent accountants to review and discuss the fiscal year ended June 30, 2001, financial statements. The Audit Committee discussed with the independent accountants the matters required by Statement on Auditing Standards No. 61 (Communication with Audit Committees). The Audit Committee also received written disclosures from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent accountants that firm's independence.

Based upon the Audit Committee's discussions with management and the independent accountants and based upon the Audit Committee's review of the representations of management and the independent accountants, the Audit Committee recommended the Board include the audited consolidated financial statements in the Corporation's Annual Report on Form 10-K for the fiscal year ended June 30, 2001, to be filed with the Securities and Exchange Commission.

Audit Fees. McGladrey & Pullen, LLP has billed a total amount of $98,000 for professional services rendered for the audit of the Corporation's various annual financial statements and related attestation

12

services as of June 30, 2001, and the reviews of the financial statements included in the Corporation's Forms 10-Q for the 2001 fiscal year.

Financial Information Systems Design and Implementation Fees. McGladrey and Pullen, LLP did not render any professional services to the Corporation for information technology advice during the fiscal year ended June 30, 2001.

All Other Fees. McGladrey & Pullen, LLP has billed a total amount of $86,000 for professional services rendered in connection with other matters requested by the Corporation during the fiscal year ended June 30, 2001.

The Audit Committee of the Board of the Corporation considers that the provision of the services referenced above to the Corporation is compatible with maintaining independence by McGladrey & Pullen, LLP.

Subject to ratification by shareholders at the Annual Meeting, the Audit Committee has recommended to the Board, and the Board has approved, the selection of the independent public accounting firm of McGladrey & Pullen, LLP to audit the Corporation's consolidated financial statements for the 2002 fiscal year. It is expected that representatives of McGladrey & Pullen, LLP will be present at the Annual Meeting, will have the opportunity to make a statement if they so desire, and will be available to respond to appropriate questions.

If the foregoing recommendation is rejected, or if McGladrey & Pullen, LLP declines to act or otherwise becomes incapable of acting, or if its appointment is otherwise discontinued, the Board will appoint other independent accountants whose appointment for any period subsequent to the 2001 Annual Meeting of Shareholders shall be subject to the ratification by the shareholders at that meeting.

The foregoing report is furnished by Messrs. Kirby (Chair), Hallem, Hanson and Van Wyhe.

PROPOSAL II—RATIFICATION OF THE APPOINTMENT OF AUDITORS

The Board of Directors has renewed the Corporation's agreement for McGladrey & Pullen, LLP to be its auditors for the fiscal year ending June 30, 2002, subject to the ratification of the appointment by the Corporation's stockholders. A representative of McGladrey & Pullen, LLP is expected to attend the Meeting to respond to appropriate questions and will have an opportunity to make a statement.

The Board of Directors unanimously recommends that stockholders vote "FOR" the ratification of the appointment of McGladrey & Pullen, LLP as the Corporation's auditors for the fiscal year ending June 30, 2002.

SECTION 16(a) BENEFECIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Corporation's directors and executive officers, and persons who own more than 10% of a registered class of the Corporation's equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Corporation. Officers, directors and greater than 10% stockholders are required by SEC regulation to furnish the Corporation with copies of all Section 16(a) forms they file. To the Corporation's knowledge, based solely on a review of the copies of such reports furnished to the Corporation and written representations that no other reports were required, during the fiscal year ended June 30, 2001, all Section 16(a) filing requirements applicable to its officers, directors and greater than 10% beneficial owners were complied with.

STOCKHOLDER PROPOSALS

In order to be eligible for inclusion in the Corporation's proxy materials for next year's Annual Meeting of Stockholders, any stockholder proposal to take action at such meeting must be received at the

13

Corporation's executive offices, 225 South Main Avenue, Sioux Falls, South Dakota 57104, no later than June 17, 2002. Any such proposals shall be subject to the requirements of the proxy rules adopted under the Securities Exchange Act of 1934. Stockholders who intend to present a proposal at next year's Annual Meeting of Stockholders without including such proposal in the Corporation's proxy statement must provide the Corporation with notice of such proposal not less than 30 days prior to the date of next year's Annual Meeting of Stockholders. The Corporation reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

ANNUAL REPORT

The Corporation's Summary Annual Report and Annual Report on Form 10-K for the fiscal year ending June 30, 2001, including financial statements, is being mailed with this proxy statement to stockholders entitled to notice of the Meeting.

OTHER MATTERS

The Board of Directors is not aware of any business to come before the Meeting other than the matters described above in this Proxy Statement. However, if any other matters should properly come before the Meeting, it is intended that holders of the proxies will act in accordance with their best judgment.

The cost of solicitation of proxies will be borne by the Corporation. The Corporation will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of Common Stock. In addition to solicitation by mail, directors and officers of the Corporation and regular employees of the Bank may solicit proxies personally or by telegraph or telephone, without additional compensation.

| | | By Order of the Board of Directors, |

|

|

|

| | | GENE F. UHER

Executive Vice President,

Chief Operations Officer and Secretary |

Sioux Falls, South Dakota

October 15, 2001

14

Appendix A

Audit Committee Charter

- I.

- Audit Committee Purpose

The Audit Committee is appointed by the Board of Directors to assist the Board in fulfilling its oversight responsibilities. The Audit Committee's primary duties and responsibilities are to:

- •

- Monitor the integrity of the Corporation's financial reporting process and systems of internal controls regarding finance, accounting and legal compliance.

- •

- Monitor the independence of performance of the Corporation's independent auditors and internal auditing department.

- •

- Provide an avenue of communication among the independent auditors, management, the internal auditing department and the Board of Directors.

The Audit Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities and it has direct access to the independent auditors as well as any anyone in the organization. The Audit Committee has the ability to retain, at the Corporation's expense, special legal, accounting or other consultants or experts it deems necessary in the performance of its duties.

- II.

- Audit Committee Composition and Meetings

Audit Committee members shall meet the requirements of the NASD Exchange. The Audit Committee shall be comprised of three or more directors as determined by the Board, each of whom shall be independent non-executive directors, free from any relationship that would interfere with the exercise of his or her independent judgment. All members of the Committee shall have a basic understanding of finance and accounting and be able to read and understand fundamental financial statements and at least one member of the Committee shall have accounting or related financial management expertise.

Audit Committee members shall be appointed by the Board on recommendation of the Nominating Committee. If an audit committee Chair is not designated or present, the members of the Committee may designate a Chair by majority vote of the Committee membership.

The Committee shall meet at least four times annually, or more frequently as circumstances dictate. The Audit Committee Chair shall prepare and/or approve an agenda in advance or each meeting. The Committee should meet privately in executive session at least annually with management, the director of the internal auditing department, the independent auditors, and as a committee to discuss any matters that the Committee or each of these groups believe should be discussed. In addition, the Committee or at least its Chair should communicate with management and the independent auditors quarterly to review the Corporation's financial statements and significant findings based upon the auditors limited review procedures.

- III.

- Audit Committee Responsibilities and Duties

Review Procedures

- •

- Review and reassess the adequacy of this Charter at least annually. Submit the charter to the Board of Directors for approval and have the document published at least every three years in accordance with SEC regulations.

- •

- Review the Corporation's annual audited financial statements prior to filing or distribution. Review should include discussion with management and independent auditors of significant issues regarding accounting principles, practices and judgments.

15

- •

- In consultation with the management, the independent auditors and the internal auditors, consider the integrity of the Corporation's financial reporting processes and controls. Discuss significant financial risk exposures and the steps management has taken to monitor, control, and report such exposures. Review significant findings prepared by the independent auditors and the internal auditing department together with management's responses.

- •

- Review with financial management and the independent auditors the corporation's quarterly financial results prior to the release of earnings and/or the corporation's quarterly financial statements prior to filing or distributions. Discuss any significant changes to the Corporation's accounting principles and any items required to be communicated by the independent auditors in accordance with SAS 61. The Chair of the Committee may represent the entire Audit Committee for purpose of this review.

Independent External Auditors

- •

- The independent external auditors are ultimately accountable to the Audit Committee and the Board of Directors. The Audit Committee shall review the independence and performance of the auditors and annually recommend to the board of Directors the appointment of the independent external auditors or approve any discharge of auditors when circumstances warrant. External auditor independence will be determined through discussion and by disclosure from the auditors regarding the auditor's independence as required by Independent Standards Board Standard #1.

- •

- Approve the fees and other significant compensation to be paid to the independent auditors.

- •

- On an annual basis, the Committee should review and discuss with the independent auditors all significant relationships they have with the Corporation that could impair the auditors' independence.

- •

- Review the independent auditors audit plan and engagement letters—discuss scope, staffing, locations, reliance upon management and internal audit and general audit approach.

- •

- Prior to releasing the fiscal year-end earnings, discuss the results of the audit with the independent auditors. Discuss certain matters required to be communicated to audit committees in accordance with AICPA SAS 61.

- •

- Consider the independent auditors' judgments about the quality and appropriateness of the Corporation's accounting principles as applied in its financial reporting. Inquire as to the independent auditors' views about whether management's choices of accounting principles appear reasonable from the perspective of income, asset and liability recognition and whether those principles are common practices or are minority practices.

Internal Audit Department and Legal Compliance

- •

- Review the budget, plan, changes in plan, activities, organizational structure and qualifications of the internal audit department as needed. The internal audit department shall be responsible to senior management, but have a direct reporting responsibility to the Board of Directors through the Committee. Changes in the senior internal audit executive shall be subject to committee approval.

- •

- Review the appointment, performance and replacement of the senior internal audit executive.

- •

- Review significant reports prepared by the internal audit department together with management's response and follow-up to these reports.

- •

- On at least an annual basis, review with the Corporation's counsel, any legal matters that could have a significant impact on the organization's financial statements, the Corporation's compliance with applicable laws and regulations and inquiries received from regulators or governmental agencies. Review all reports concerning any significant fraud or regulatory noncompliance that occurs at the

16

Compliance with Codes of Ethical Conduct

- •

- Review and monitor, as appropriate, with the independent accountants the administration of and compliance with, the Company's code of conduct and the Foreign Corrupt Practices Act.

Other Audit Committee Responsibilities

- •

- Annually prepare a report to shareholders as required by the Securities and Exchange Commission. The report should be included in the Corporation's annual proxy statement.

- •

- Perform any other activities consistent with this Charter, the Corporation's by-laws and governing law, as the Committee or the Board deems necessary or appropriate.

- •

- Maintain minutes of meetings and periodically report to the Board of Directors on significant results of the foregoing activities.

While the Committee has the responsibility and powers set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine the Company's financial statements are completed and accurate and are in accordance with generally accepted accounting principles. This is the responsibility of management and the independent accountant. Nor is it the duty of the Audit Committee to conduct investigations, to resolve disagreements, if any, between management and the independent accountant or to assume compliance with laws and regulations and the Company's code of conduct.

17

REVOCABLE PROXY CARD

HF FINANCIAL CORP.

ANNUAL MEETING OF STOCKHOLDERS

NOVEMBER 14, 2001

THIS PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints, Curtis L. Hage, Paul J. Hallem, JoEllen G. Koerner, Jeffrey G. Parker, Wm. G. Pederson and Thomas L. Van Wyhe each with the power to act alone and with full power of substitution, to act as attorneys and proxies for the undersigned to vote all shares of common stock of the Corporation which the undersigned is entitled to vote at the Annual Meeting of Stockholders (the "Meeting"), to be held on November 14, 2001, at the Best Western Ramkota Inn located at 2400 North Louise Avenue, Sioux Falls, South Dakota at 2:00 p.m., Sioux Falls, South Dakota time, and at any and all adjournments thereof, as specified on the reverse side of this proxy.

THIS PROXY WILL BE VOTED AS DIRECTED, BUT IF NO INSTRUCTIONS ARE SPECIFIED, THIS PROXY WILL BE VOTED FOR THE NOMINEES LISTED HEREON AND THE APPOINTMENT OF MCGLADREY & PULLEN, LLP. IF ANY OTHER BUSINESS IS PRESENTED AT SUCH MEETING, THIS PROXY WILL BE VOTED BY THOSE NAMED IN THIS PROXY IN THEIR BEST JUDGEMENT. AT THE PRESENT TIME, THE BOARD OF DIRECTORS KNOWS OF NO OTHER BUSINESS TO BE PRESENTED AT THE MEETING.

(Continued on reverse side)

| | | Please mark

your votes as

indicated in

this example | | /x/ |

The Board of Directors recommends a vote "FOR" the election of the nominees listed below, and the appointment of McGladrey & Pullen, LLP.

| |

| | For all nominees

| | For all nominees, except as marked below

| |

| |

| | FOR

| | AGAINST

| | ABSTAIN

|

|---|

| I. | | To elect as directors of all nominees listed. | | / / | | / / | | II. | | To ratify the appointment of McGladrey & Pullen, LLP as auditors of the Corporation for the fiscal year ending June 30, 2002. | | / / | | / / | | / / |

Instruction: To withhold your vote for any individual nominee, strike a line through the nominee's name in the list below. |

|

|

|

|

|

|

|

|

|

|

01. Robert L. Hanson 02. Kevin T. Kirby |

|

|

|

|

|

|

|

|

|

|

In their discretion, the proxies are authorized to vote on any other business that may properly come before the Meeting or any adjournment thereof.

Should the undersigned be present and elect to vote at the Meeting or at any adjournment thereof, and after notification to the Secretary of the Corporation at the Meeting of the stockholder's decision to terminate this Proxy, then the power of such attorneys and proxies shall be deemed terminated and of no further force and effect.

The undersigned acknowledges receipt from the Corporation, prior to the execution of this Proxy, Notice of the Annual Meeting, a Proxy Statement dated October 15, 2001, and the Corporation's Annual Report on Form 10-K for the fiscal year ended June 30, 2001.

Signatures(s) Date

QuickLinks

PROXY STATEMENT HF FINANCIAL CORP. 225 South Main Avenue Sioux Falls, South Dakota 57104 ANNUAL MEETING OF STOCKHOLDERS November 14, 2001PROPOSAL I—ELECTION OF DIRECTORSEXECUTIVE COMPENSATIONPROPOSAL II—RATIFICATION OF THE APPOINTMENT OF AUDITORSSECTION 16(a) BENEFECIAL OWNERSHIP REPORTING COMPLIANCESTOCKHOLDER PROPOSALSANNUAL REPORTOTHER MATTERS