SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to § 240.14a-12 |

USF Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Filed by: USF Corporation

Pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: USF Corporation

Commission File No. 0-19791

On February 28, 2005, USF Corporation and Yellow Roadway Corporation participated in an investor presentation regarding their announcement of an Agreement and Plan of Merger between USF Corporation, Yellow Roadway Corporation and Yankee II LLC, a wholly owned subsidiary of Yellow Roadway. A copy of the presentation is set forth below.

Additional Information and Where to Find It

Yellow Roadway and USF will file a proxy statement/prospectus and other relevant documents concerning the proposed transaction with the Securities and Exchange Commission (SEC). Investors are urged to read the proxy statement/prospectus when it becomes available and any other relevant documents filed with the SEC because they will contain important information. You will be able to obtain the documents free of charge at the website maintained by the SEC at www.sec.gov. In addition, you may obtain documents filed with the SEC by Yellow Roadway free of charge by requesting them in writing from Yellow Roadway or by telephone at (913) 696-6100. You may obtain documents filed with the SEC by USF free of charge by requesting them in writing from USF or by telephone at (773) 824-1000.

Participants in Solicitation

Yellow Roadway and USF, and their respective directors and executive officers, may be deemed to be participants in the solicitation of proxies from the stockholders of Yellow Roadway and USF in connection with the acquisition. Information about the directors and executive officers of Yellow Roadway and their ownership of Yellow Roadway stock is set forth in the proxy statement for the Yellow Roadway 2004 Annual Meetings of Stockholders. Information about the directors and executive officers of USF and their ownership of USF stock is set forth in the proxy statement for the USF 2004 Annual Meeting of Stockholders. Investors may obtain additional information regarding the interests of such participants by reading the proxy statement/prospectus when it becomes available.

Cautionary Statement Regarding Forward-Looking Statements

The information presented in this communication may contain forward-looking contain statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words such as “expect(s)”, “feel(s)”, “believe(s)”, “will”, “may”, “could”, “anticipate(s)” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding plans, objectives and expectations with respect to future operations, products and services; and statements regarding future performance. Such statements are subject to certain risks and uncertainties, many of which are difficult to predict and generally beyond the control of Yellow Roadway and USF, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include: those discussed and identified in public filings with the SEC by Yellow Roadway and USF; the parties’ ability to consummate the proposed merger with, to achieve expected synergies and operating efficiencies in the merger within the expected time-frames or at all and to successfully integrate USF’s operations into Yellow Roadway’s operations; such integration may be more difficult, time-consuming or costly than expected; revenues following the transaction may be lower than expected; operating costs, customer loss and business disruption, including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers, may be greater than expected following the transaction; the regulatory approvals required for the transaction may not be obtained on the terms expected or on the anticipated schedule; the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the transaction and the value of the transaction consideration; changes in federal or state regulation concerning or affecting the transportation industry; inflation, inclement weather, price and availability of fuel, competitor pricing activity, expense volatility, a downturn in general or regional economic activity, changes in equity and debt markets, the state of the economy; the parties’ obligations to contribute to union-sponsored multi-employer pension plans may be higher than expected; the impact of work rules, any obligations to multi-employer health, welfare and pension plans, wage requirements, potential efforts to unionize previously non-union operations of the company and employee satisfaction, labor shortages, disruptions, stoppages or any other deterioration in the parties’ relationships with employees may impair the parties’ businesses and any future acts or threats of terrorism or war. In particular, the expectations set forth in this communication regarding accretion and achievement of annual savings and synergies are only the parties’ expectations regarding these matters. Actual results could differ materially from these expectations depending on factors such as the combined company’s cost of capital, the ability of the combined company to identify and implement cost savings, synergies and efficiencies in the time frame needed to achieve these expectations, prior contractual commitments of the combined companies and their ability to terminate these commitments or amend, renegotiate or settle the same, the combined company’s actual capital needs, the absence of any material incident of property damage or other unforeseen merger or acquisition opportunities that could affect capital needs, the costs incurred in implementing synergies and the factors that generally affect the respective businesses of Yellow Roadway and USF as further outlined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each of the companies’ respective Annual Reports on Form 10-K. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. Neither Yellow Roadway nor USF undertakes any obligation to republish revised forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Readers are also urged to carefully review and consider the various disclosures in Yellow Roadway’s and USF’s various SEC reports, including, but not limited to, each party’s Annual Report on Form 10-K for the year ended December 31, 2003 and Quarterly Reports on Form 10-Q for the reporting periods of 2004.

Opportunity Knocks Twice

February 28, 2005

Strategic Rationale

A mutually beneficial combination that delivers value to shareholders of both companies

Scale Services Synergies

Strong balance sheet

Shareholder value opportunity

Making global commerce work by connecting people, places and information

2

Scale

2005 pro forma revenue of $9.7 billion

$6 billion in combined assets

Over 70,000 employees

25,000 trucks and 90,000 trailers

Over 1,000 locations worldwide

2005 Estimated Revenue

(in billions) $9.7

$7.2

$2.5

USFC Yellow Roadway Pro Forma

Making global commerce work by connecting people, places and information

3

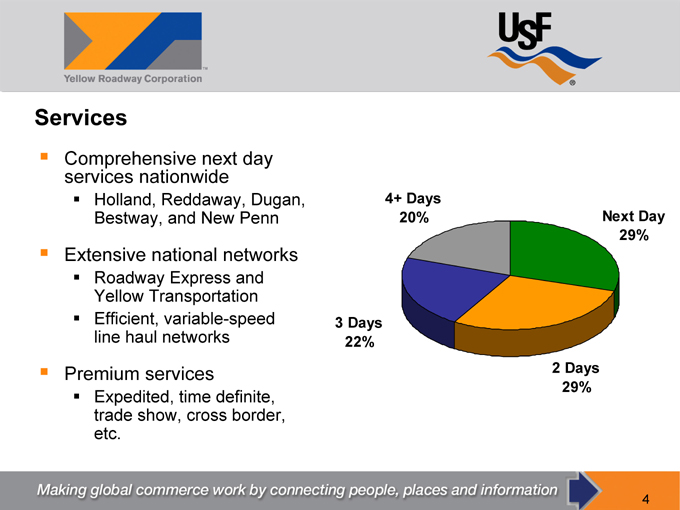

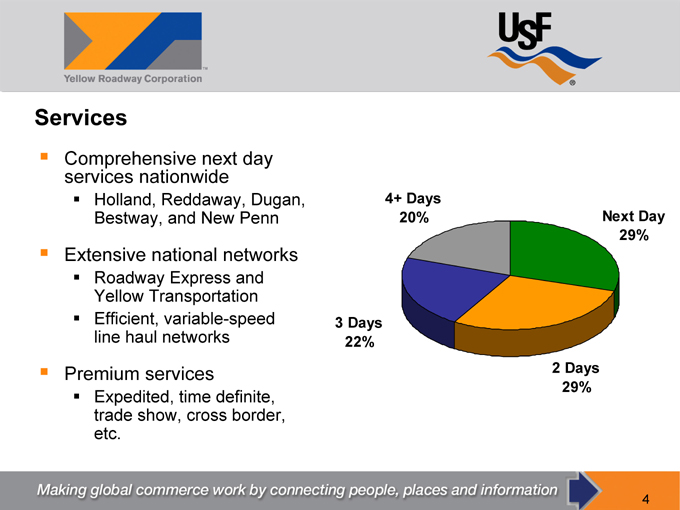

Services

Comprehensive next day services nationwide

Holland, Reddaway, Dugan, Bestway, and New Penn

Extensive national networks

Roadway Express and Yellow Transportation Efficient, variable-speed line haul networks

Premium services

Expedited, time definite, trade show, cross border, etc.

4+ Days

20% Next Day 29%

3 Days 22%

2 Days 29%

Making global commerce work by connecting people, places and information

4

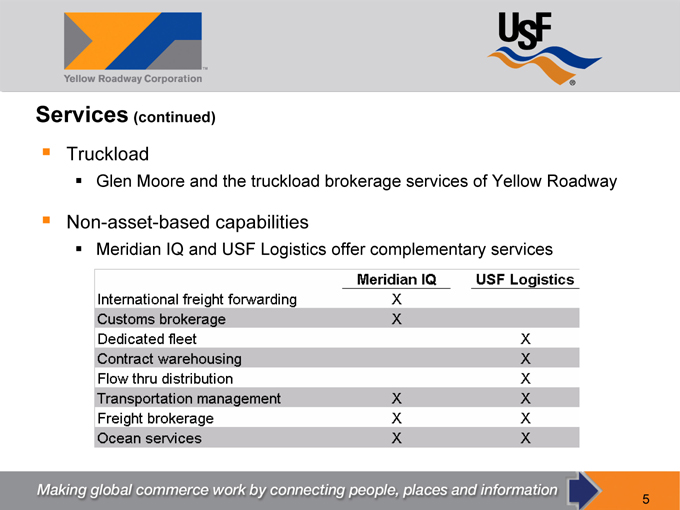

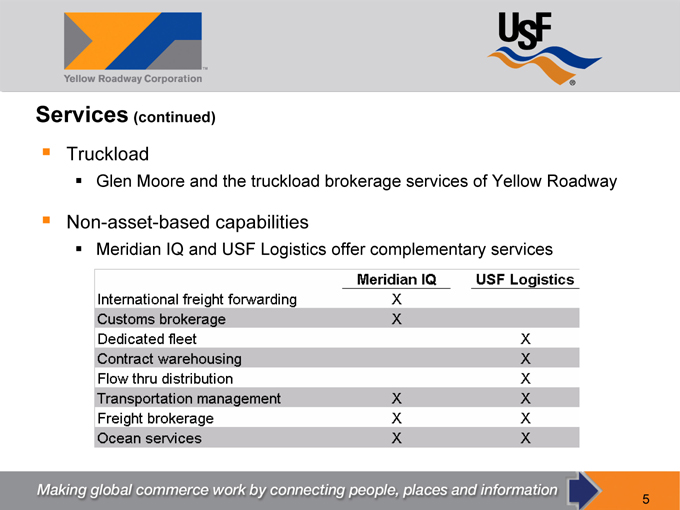

Services (continued)

Truckload

Glen Moore and the truckload brokerage services of Yellow Roadway

Non-asset-based capabilities

Meridian IQ and USF Logistics offer complementary services

Meridian IQ USF Logistics

International freight forwarding X

Customs brokerage X

Dedicated fleet X

Contract warehousing X

Flow thru distribution X

Transportation management X X

Freight brokerage X X

Ocean services X X

Making global commerce work by connecting people, places and information

5

Synergy Areas

Combination leverages the core strengths of both companies Sharing of best practices Labor – opportunity for cohesive labor strategy Technology

Develop it once, use it multiple times

Share industry leading technology

Purchasing leverage

Support functions

Making global commerce work by connecting people, places and information

6

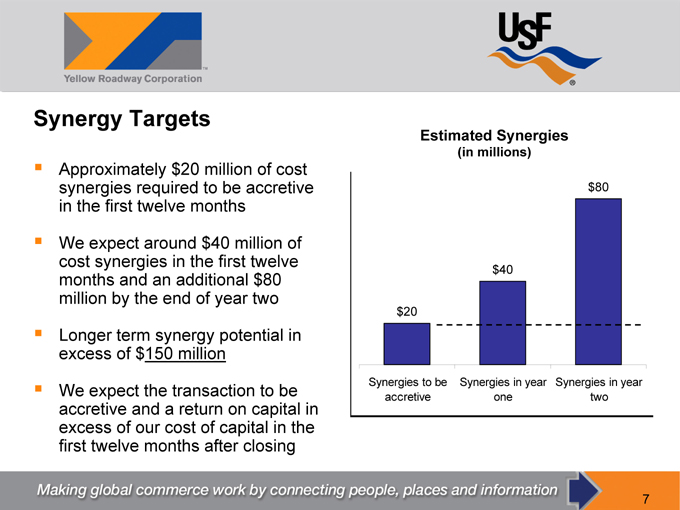

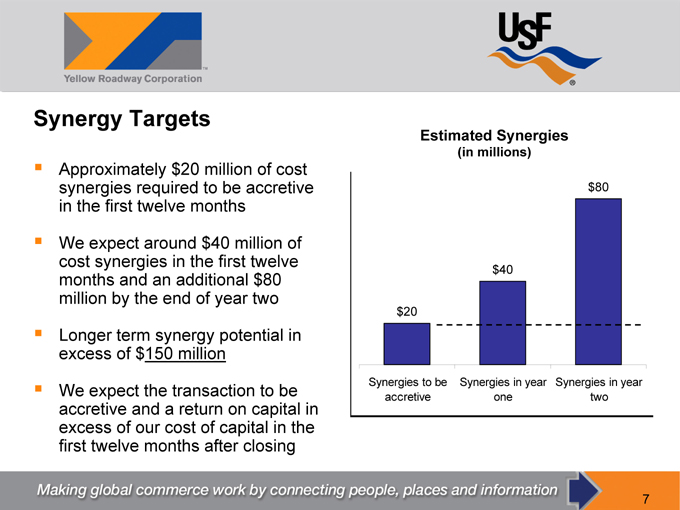

Synergy Targets

Approximately $20 million of cost synergies required to be accretive in the first twelve months

We expect around $40 million of cost synergies in the first twelve months and an additional $80 million by the end of year two

Longer term synergy potential in excess of $150 million

We expect the transaction to be accretive and a return on capital in excess of our cost of capital in the first twelve months after closing

Estimated Synergies

(in millions) $80

$40

$20

Synergies to be accretive

Synergies in year one

Synergies in year two

Making global commerce work by connecting people, places and information

7

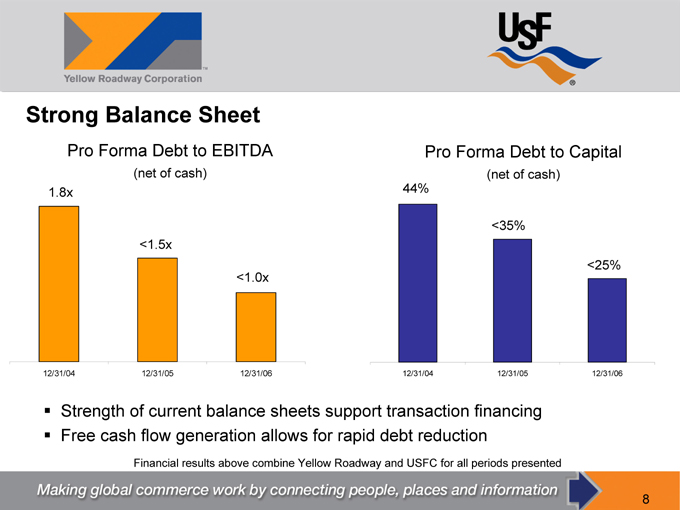

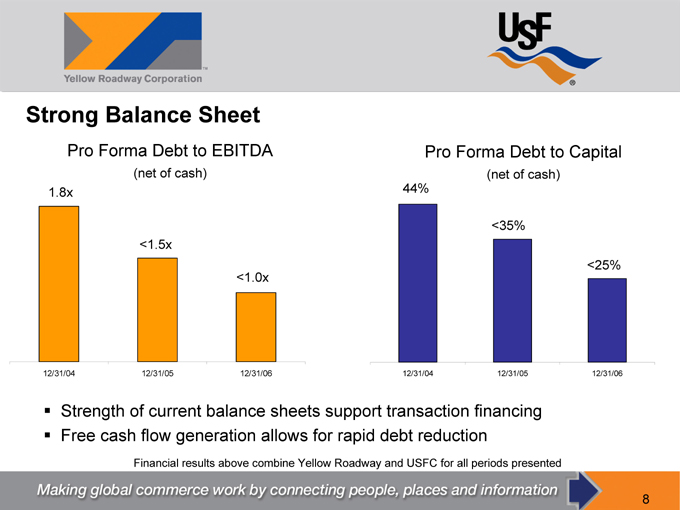

Strong Balance Sheet

Pro Forma Debt to EBITDA

(net of cash)

1.8x

<1.5x

<1.0x

12/31/04 12/31/05 12/31/06

Strength of current balance sheets support transaction financing Free cash flow generation allows for rapid debt reduction

Financial results above combine Yellow Roadway and USFC for all periods presented

Pro Forma Debt to Capital

(net of cash) 44%

<35%

<25%

12/31/04 12/31/05 12/31/06

Making global commerce work by connecting people, places and information

8

Track Record of Success

Our track record of strategic success

2002 – Secondary stock offering 2002 – Spin-off of SCST 2003 – Roadway transaction

We have created significant shareholder value over the last three years by focusing on our core business

Making global commerce work by connecting people, places and information

9

Leveraging Our Successful Strategy

Roadway Transaction USF Transaction

Maintain separate brands X X

No change to customer interface X X

Significant synergies available X X

Service overlap X

Limited customer overlap X X

Geographic overlap X X

Experienced and committed operating management X X

Making global commerce work by connecting people, places and information

10

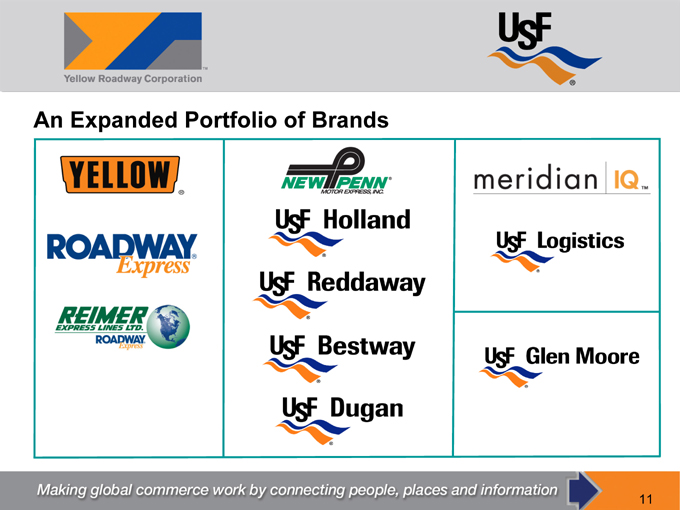

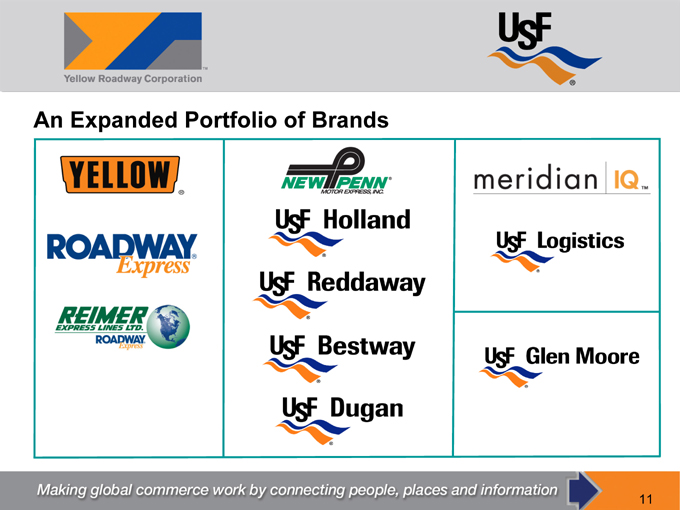

An Expanded Portfolio of Brands

Making global commerce work by connecting people, places and information

11

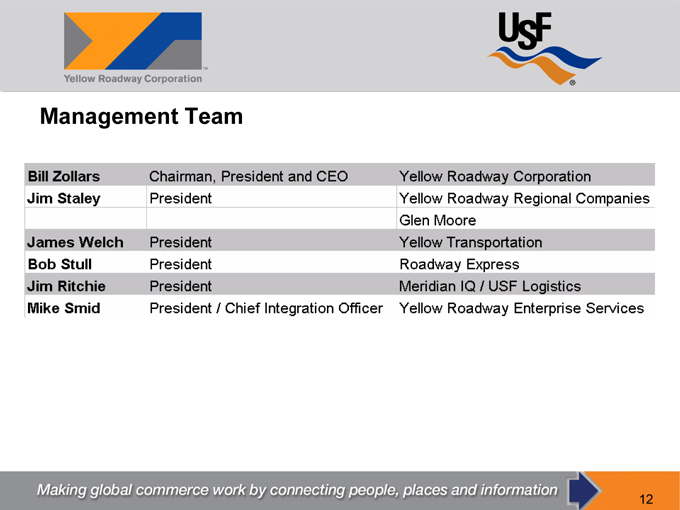

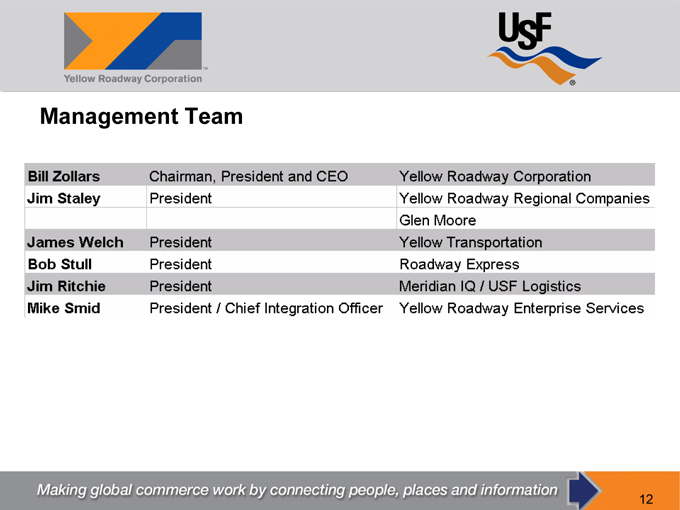

Management Team

Bill Zollars Chairman, President and CEO Yellow Roadway Corporation

Jim Staley President Yellow Roadway Regional Companies

Glen Moore

James Welch President Yellow Transportation

Bob Stull President Roadway Express

Jim Ritchie President Meridian IQ / USF Logistics

Mike Smid President / Chief Integration Officer Yellow Roadway Enterprise Services

Making global commerce work by connecting people, places and information

12

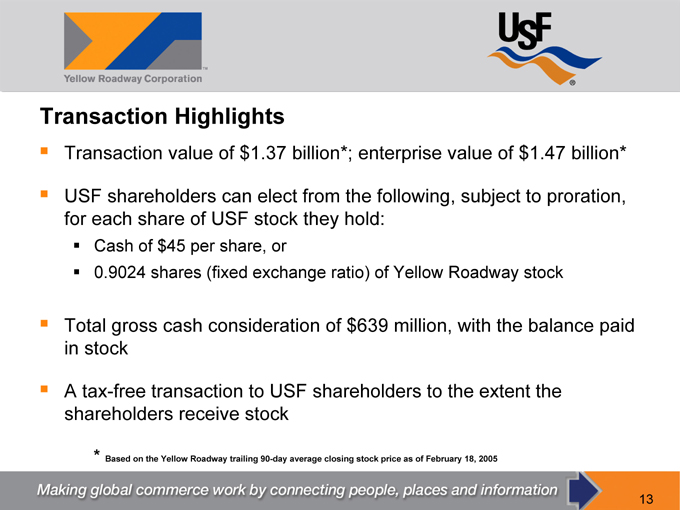

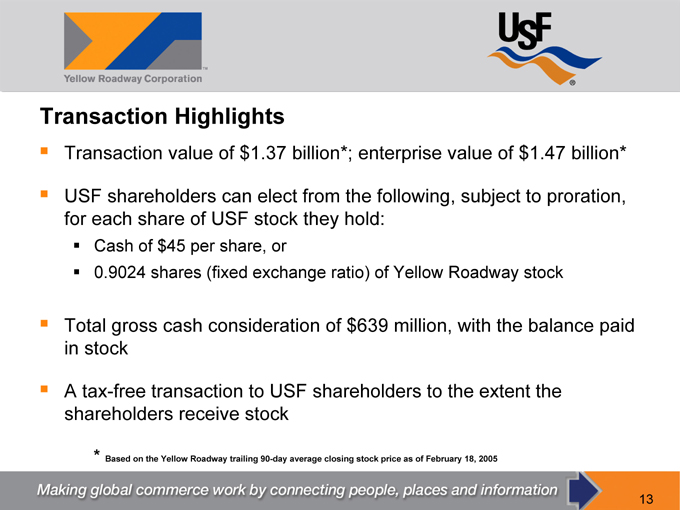

Transaction Highlights

Transaction value of $1.37 billion*; enterprise value of $1.47 billion*

USF shareholders can elect from the following, subject to proration, for each share of USF stock they hold:

Cash of $45 per share, or

0.9024 shares (fixed exchange ratio) of Yellow Roadway stock

Total gross cash consideration of $639 million, with the balance paid in stock

A tax-free transaction to USF shareholders to the extent the shareholders receive stock

* Based on the Yellow Roadway trailing 90-day average closing stock price as of February 18, 2005

Making global commerce work by connecting people, places and information

13

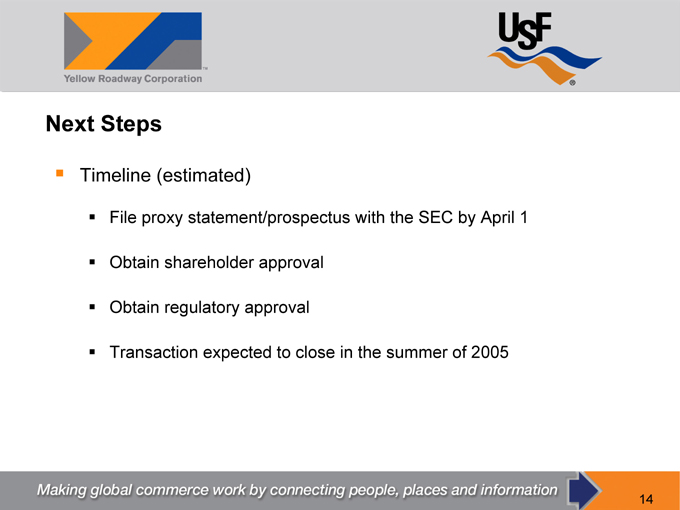

Next Steps

Timeline (estimated)

File proxy statement/prospectus with the SEC by April 1 Obtain shareholder approval Obtain regulatory approval Transaction expected to close in the summer of 2005

Making global commerce work by connecting people, places and information

14

Forward-Looking Statements

This presentation (and oral statements made regarding the subjects of this presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words such as “expect(s)”, “feel(s)”, “believe(s)”, “will”, “may”, “could”, “anticipate(s)” and similar expressions are intended to identify forward-looking statements. These statements include, but are not limited to, statements regarding plans, objectives and expectations with respect to future operations, products and services; and statements regarding future performance. Such statements are subject to certain risks and uncertainties, many of which are difficult to predict and generally beyond the control of Yellow Roadway and USF, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include: those discussed and identified in public filings with the SEC by Yellow Roadway and USF; the parties’ ability to consummate the proposed merger with, to achieve expected synergies and operating efficiencies in the merger within the expected time-frames or at all and to successfully integrate USF’s operations into Yellow Roadway’s operations; such integration may be more difficult, time-consuming or costly than expected; revenues following the transaction may be lower than expected; operating costs, customer loss and business disruption, including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers, may be greater than expected following the transaction; the regulatory approvals required for the transaction may not be obtained on the terms expected or on the anticipated schedule; the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the transaction and the value of the transaction consideration; changes in federal or state regulation concerning or affecting the transportation industry; inflation, inclement weather, price and availability of fuel, competitor pricing activity, expense volatility, a downturn in general or regional economic activity, changes in equity and debt markets, the state of the economy; the parties’ obligations to contribute to union-sponsored multi-employer pension plans may be higher than expected; the impact of work rules, any obligations to multi-employer health, welfare and pension plans, wage requirements, potential efforts to unionize previously non-union operations of the company and employee satisfaction, labor shortages, disruptions, stoppages or any other deterioration in the parties’ relationships with employees may impair the parties’ businesses and any future acts or threats of terrorism or war. In particular, the expectations set forth in this news release regarding accretion and achievement of annual savings and synergies are only the parties’ expectations regarding these matters. Actual results could differ materially from these expectations depending on factors such as the combined company’s cost of capital, the ability of the combined company to identify and implement cost savings, synergies and efficiencies in the time frame needed to achieve these expectations, prior contractual commitments of the combined companies and their ability to terminate these commitments or amend, renegotiate or settle the same, the combined company’s actual capital needs, the absence of any material incident of property damage or other unforeseen merger or acquisition opportunities that could affect capital needs, the costs incurred in implementing synergies and the factors that generally affect the respective businesses of Yellow Roadway and USF as further outlined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each of the companies’ respective Annual Reports on Form 10-K. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. Neither Yellow Roadway nor USF undertakes any obligation to republish revised forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Readers are also urged to carefully review and consider the various disclosures in Yellow Roadway’s and USF’s various SEC reports, including, but not limited to, each party’s Annual Report on Form 10-K for the year ended December 31, 2003 and Quarterly Reports on Form 10-Q for the reporting periods of 2004.

Making global commerce work by connecting people, places and information

15