A Perfect Fit

Dean Scarborough

President & CEO

Rob van der Merwe

Chairman, President & CEO

Investor Presentation

March 23, 2007

1

1

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995,

including statements about Avery Dennison's anticipated acquisition of Paxar and statements about projected future financial and operating results. These

statements are based on current expectations and beliefs and are subject to a number of risks, uncertainties and assumptions that could cause actual results to

differ materially from those described in the forward-looking statements. All statements other than statements of historical fact are statements that could be

deemed forward-looking statements.

Risks, Uncertainties and Assumptions – Avery Dennison

Risks, uncertainties, and assumptions pertaining to Avery Dennison include, but are not limited to, the impact of economic conditions on underlying demand for the

Company’s products; the impact of competitors’ actions, including expansion in key markets, product offerings and pricing; the degree to which higher raw material

and energy-related costs can be passed on to customers through selling price increases (and previously implemented selling price increases can be sustained),

without a significant loss of volume; potential adverse developments in legal proceedings and/or investigations, including those regarding competitive activities, and

including possible fines, penalties, judgments or settlements; the ability of Avery Dennison to achieve and sustain targeted cost reductions; credit risks; ability to

obtain adequate financing arrangements; changes in governmental regulations; foreign currency exchange rates and other risks associated with foreign operations;

impact of war, terror, natural disasters and epidemiological events on the economy and Avery Dennison’s customers and suppliers; successful integration of

acquisitions; financial condition and inventory strategies of customers; changes in customer order patterns; loss of significant contract(s) or customer(s); timely

development and market acceptance of new products; fluctuations in demand affecting sales to customers; and other matters referred to in Avery Dennison’s SEC

filings.

Risks, Uncertainties and Assumptions - Paxar

Risks, uncertainties and assumptions pertaining to Paxar include, but are not limited to, the ability of Paxar to achieve and sustain targeted cost reductions, for

example, those related to its global apparel realignment plan and other restructuring/reorganization initiatives; changes in foreign currency exchange rates; political

or economic instability in Paxar’s major markets; the impact of competitive products and pricing; fluctuations in cost and availability of petroleum-based raw

materials; fluctuations in retail and apparel industry demand affecting sales to customers; and other matters referred to in Paxar’s SEC filings.

Risks, Uncertainties and Assumptions - The Transaction

Forward looking statements pertaining to Avery Dennison’s acquisition and integration of Paxar include statements relating to or of expected synergies, cost

savings, accretion, timing, industry size, execution of integration plans and management and organizational structure. Risks, uncertainties and assumptions

pertaining to the transaction include the possibility that the market for and development of certain products and services may not proceed as expected; that the

Paxar acquisition does not close or that the companies may be required to modify aspects of the transaction to achieve regulatory approval; that prior to the closing

of the proposed acquisition, the businesses of the companies suffer due to uncertainty or diversion of management attention; that the parties are unable to

successfully execute their integration strategies, or achieve planned synergies and cost reductions, in the time and at the cost anticipated or at all; acquisition of

unknown liabilities; effects of increased leverage; and other matters that are referred to in the parties’ SEC filings.

For a more detailed discussion of these and other factors, see “Risk Factors” and “Management’s Discussion and Analysis of Results of Operations and Financial

Condition” in Avery Dennison’s and Paxar’s reports on Form 10-K both of which were filed on February 28, 2007 with the SEC.

Forward-looking statements included in this presentation are made only as of the date of this presentation, and the companies undertake no obligation to update

the forward-looking statements to reflect subsequent events or circumstances except as may be required by law.

Use of Non-GAAP Financial Measures

This presentation contains certain non-GAAP measures as defined by SEC rules. As required by these rules, we have provided a reconciliation of non-GAAP

measures to the most directly comparable GAAP measures, included in the Appendix section of this presentation.

2

2

Transaction Overview

$30.50 per Paxar share, a 27% premium to closing price on 3/22/07

$1.34 billion Enterprise Value, including $5 million of debt (net of cash)

14.2x adjusted 2006 EBITDA* before cost synergies

6.9 - 7.3x adjusted 2006 EBITDA* after cost synergies

Substantial value creation through $90 - $100M of annualized cost

synergies

EPS-accretive (excluding integration-related charges) in 12 months

following close

EVA-positive (exceeds cost of capital) for the third year following

close; turns EVA-positive by the end of the second year excluding

integration-related charges

Principal conditions to closing:

Paxar shareholder approval

Regulatory clearances

* 2006 Adjusted EBITDA excludes gain on lawsuit settlement and integration/restructuring and other

costs – see Appendix for detail

3

Market Overview

Global retail information and brand identification market estimated to

represent over $15 billion in annual revenue, including:

All varieties of tags and labels, branded packaging, and printers for

exterior and interior labeling

Tags and labels for softgoods (e.g., linens) and footwear

Applications outside of apparel and softgoods (e.g., jewelry, toys,

sporting goods, office products, etc.)… we serve customers in virtually

all of these categories today

Rapidly expanding opportunities for domestic consumption in emerging

economies (e.g., China, India, etc.)

This large, growing market remains highly fragmented and

competitive

Combined market share for Avery Dennison/Paxar is less than 10%

Opportunity for growth through speed, quality, and global service

4

Products, Solutions, and Services

Variable Data Labels and Tags

Brand Promotion and

Merchandising Tags

Woven and Printed Fabric

Labels

Brand Protection and Security

Products

In-Plant Printers, Accessories

and Supplies

Bar Code and RFID Printers

Handheld Labelers; Labels

and Tag Fasteners

Information Management

Software and Systems

5

Our products support

top US/EU retailers

and brands…

… but > 20,000 factories

actually purchase our

products

Customers

6

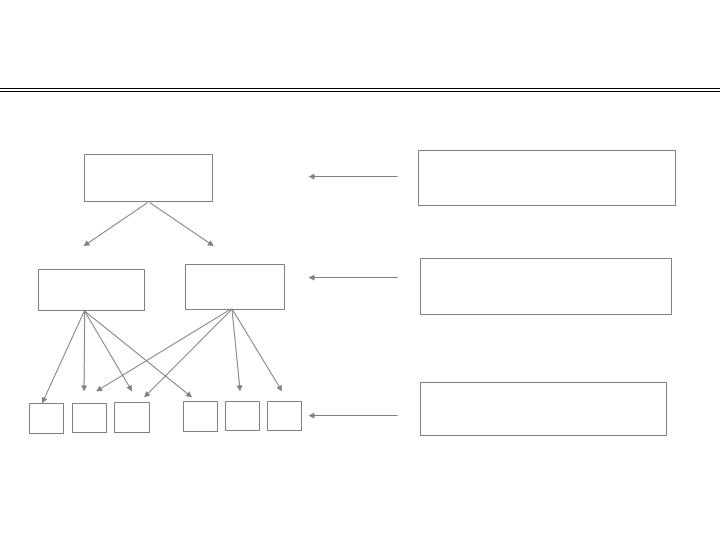

TIER 1

Retailers / Brand Owners

TIER 2

Buying Offices / Agents / Importers

TIER 3

Vendors / Factories / Contractors

Multi-Tier Supply Chain

7

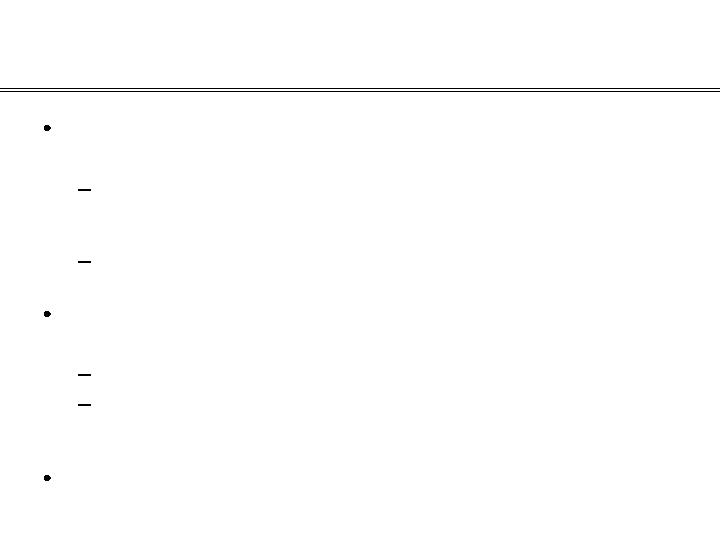

Retailer

Buying Office/

Agent

Domestic

Importer

Retailer Controlled

Outsourced

Contractors

Contractors

A

B

C

D

E

F

Front-end creative design services

Real-time electronic communication

In-country production support

local representation

price, quality, speed of delivery

advanced information management

systems linking trading partners

graphic design services and

product/program development

Tier 1

Tier 2

Tier 3

Each Tier Has Different Priorities

8

Key Success Factors

Speed and responsiveness

Quality and global consistency

“Close to the needle”

New products and services

9

Strategic Rationale:

(1) Enhances Revenue Growth Potential

Expands capabilities with above-average growth

opportunity

Increases our presence in the expanding retail information and

brand identification market, more than doubling revenues to over

$1.5 billion

Creates a leader in $15 billion-plus, highly fragmented global

market

Allows us to compete more effectively in complex, global

supply chain

Broadens range of product and service capabilities

Better able to meet customer demands for product innovation

and improved quality and speed of service, particularly at the

factory level

Facilitates expansion into new product and geographic

segments

10

Strategic Rationale:

(1) Enhances Revenue Growth Potential (cont’d)

Combines complementary strengths

Improves access to European retailers and brand owners

Relative geographic strength at factory level is highly

complementary – Avery Dennison strong in Asia; Paxar strong in

Europe/Middle East/Africa and Latin America

Enhances our product offering in interior labels and hardware

solutions (bar code, printing and labeling systems)

Accelerates expansion into key Asian geographies, particularly

in south Asia, where Paxar has a strong foothold

Strengthens capabilities in rapidly growing apparel item-level

RFID segment

11

Strategic Rationale:

(2) Estimated $90 To $100M of Annualized Cost Synergies

Similar infrastructure – areas of overlap include SG&A

(e.g., corporate overhead, back office support) and

production

High degree of visibility on sources of synergy – expect

to achieve substantially all of the targeted savings within

24 months following close of transaction

Proven track record of successfully integrating

international acquisitions and achieving substantial cost

synergies

Restructuring and asset impairment costs expected to

total $100 to $125 million

IT integration and other IT investments expected to total

at least $50 million

12

Combining Complementary Strengths Will Better

Serve Customer Needs

Broader product line and improved service capabilities –

implement “best of breed” to benefit both manufacturers

and the retailers/brand owners they supply

Faster delivery times on new brand designs and products

Quicker access to information to shorten lead times in apparel

supply chain

New marking and branding solutions to enable customers to

better differentiate their products

Improved efficiency in product development and

delivery improved customer value

Expand customer base – beyond apparel, beyond

US/EU imports

13

Financial Summary

Key factors underlying financial targets:

$90 to $100 mil. in annualized cost synergies realized within 24 months following

close of transaction

Estimated $70 to $80 mil. of incremental annual interest expense during first 36

months following close

Estimated $15 mil. incremental annual expense related to amortization of intangibles

(included in EPS projections)

Modestly negative impact on Company’s tax rate

Anticipated EPS Impact:

Modest EPS dilution (less than $.05) in Year 1, before transaction and integration-

related costs; turning accretive by end of first year

Accretive in Year 2, before integration-related costs

$0.60 to $0.70 EPS accretion in Year 3

Anticipated EVA / Cash Return Impact:

EVA-positive (exceeds cost of capital) for the third year following close; turns EVA-

positive by the end of the second year excluding integration-related charges

Free cash flow return on investment* > 10%

Financing:

Transaction to be financed with debt; structure determined prior to close

JPMorgan has committed $1.35 billion in acquisition financing and will also arrange

long-term financing

Company is committed to retaining a strong investment grade credit rating, and

returning financial ratios to pre-transaction levels

* [2006 Adjusted EBITDA – see Appendix for detail – plus cost synergies less capital/software investments] divided by

[Enterprise Value at time of purchase plus integration-related cash costs]

14

14

Sources of Value Creation

Good premium paid to Paxar shareholders

Good value creation for Avery Dennison

shareholders:

Enhances top-line growth potential

Substantial cost synergies

High degree of visibility to potential savings

Proven track record with acquisition integration on global

scale… high degree of confidence in ability to quickly achieve

the savings

15

APPENDIX

16

2006 Adjusted Paxar EBITDA

17