Exhibit 99.2

1 April 28, 2020 First Quarter 2020 Financial Review and Analysis First Quarter 2020 Financial Review and Analysis (preliminary, unaudited) April 28, 2020 Supplemental Presentation Materials Unless otherwise indicated, comparisons are to the same period in the prior year.

2 April 28, 2020 First Quarter 2020 Financial Review and Analysis Safe Harbor Statement Certain statements contained in this document are "forward - looking statements" intended to qualify for the safe harbor from liab ility established by the Private Securities Litigation Reform Act of 1995. These forward - looking statements, and financial or other business targets, are subject to certain risks and uncertainties. We believe that the most significant risk factors that could affect our financial performance in the near - term include: (1) the impacts to our busin ess from global economic conditions, political uncertainty, and changes in governmental regulations, including as a result of the coronavirus/COVID - 19 pandemic; (2) competitor s' actions, including pricing, expansion in key markets, and product offerings; (3) the degree to which higher costs can be offset with productivity measures and/or pass ed on to customers through price increases, without a significant loss of volume; and (4) the execution and integration of acquisitions. Actual results and trends may differ materially from historical or anticipated results depending on a variety of factors, inc lud ing but are not limited to, risks and uncertainties relating to the following: the coronavirus/COVID - 19 pandemic; fluctuations in demand affecting sales to customers; worldwide and local economic and market conditions; changes in political conditions; fluctuations in foreign currency exchange rates and other risks associate d w ith foreign operations, including in emerging markets; changes in our markets due to competitive conditions, technological developments, laws and regulations, and customer pr eferences; fluctuations in the cost and availability of raw materials and energy; changes in governmental laws and regulations; the impact of competitive products an d p ricing; the financial condition and inventory strategies of customers; our ability to generate sustained productivity improvement; our ability to achieve and sus tai n targeted cost reductions; loss of significant contracts or customers; collection of receivables from customers; selling prices; business mix shift; execution and integrati on of acquisitions; product and service quality; timely development and market acceptance of new products, including sustainable or sustainably - sourced products; investment in d evelopment activities and new production facilities; amounts of future dividends and share repurchases; customer and supplier concentrations or consolidat ion s; fluctuations in interest and tax rates; changes in tax laws and regulations, and uncertainties associated with interpretations of such laws and regulations; retentio n o f tax incentives; outcome of tax audits; successful implementation of new manufacturing technologies and installation of manufacturing equipment; disruptions in infor mat ion technology systems, including cyber - attacks or other intrusions to network security; successful installation of new or upgraded information technology systems ; data security breaches; volatility of financial markets; impairment of capitalized assets, including goodwill and other intangibles; credit risks; our ability to o bta in adequate financing arrangements and maintain access to capital; the realization of deferred tax assets; fluctuations in interest rates; compliance with our debt cov enants; fluctuations in pension, insurance, and employee benefit costs; goodwill impairment; the impact of legal and regulatory proceedings, including with respect to enviro nme ntal, health and safety, anti - corruption and trade compliance; protection and infringement of intellectual property; the impact of epidemiological events on the econo my and our customers and suppliers; acts of war, terrorism, and natural disasters; and other factors. For a more detailed discussion of the more significant of these factors, see “Risk Factors” and “Management’s Discussion and Ana lysis of Results of Operations and Financial Condition” in our 2019 Form 10 - K, filed with the Securities and Exchange Commission on February 26, 2020. The forward - looking statements included in this document are made only as of the date of this document, and we undertake no obli gation to update these statements to reflect subsequent events or circumstances, other than as may be required by law.

3 April 28, 2020 First Quarter 2020 Financial Review and Analysis Use of Non - GAAP Financial Measures This presentation contains certain non - GAAP financial measures as defined by SEC rules. We report our financial results in conf ormity with accounting principles generally accepted in the United States of America, or GAAP, and also communicate with investors using certain non - GAAP financial measures. These non - GAAP financial measures are not in accorda nce with, nor are they a substitute for or superior to, the comparable GAAP financial measures. These non - GAAP financial measures are intended to supplement presentation of our financial results that are prepared in accordance with GAAP. Based upon feedback from investors and financial analysts, we believe that the supplemental non - GAAP financial measures we provide are useful to their assessment of our performance and opera ting trends, as well as liquidity. In accordance with Regulations G and S - K, reconciliations of non - GAAP financial measures to the most directly comparable GAAP financial measures, including limitations associated with these non - GAAP financial measures, are provided in the financial schedules accompanying the earnings news release for the quarter (see Attachments A - 4 through A - 8 to news release dated April 28, 2020). Our non - GAAP financial measures exclude the impact of certain events, activities or decisions. The accounting effects of these events, activities or decisions, which are included in the GAAP financial measures, may make it difficult to assess our underlying performance in a single period. By excluding the accounting effects, positive or negative , o f certain items (e.g., restructuring charges, legal settlements, certain effects of strategic transactions and related costs, losses from debt extinguishments, gains or losses from curtailment or settlement of pension obligations, gains or losses on sales of certain assets, and other items), we believe that we are providing meaningful supplemental information that facilitates an understanding of our core operating results and liquidity measures. While some o f t he items we exclude from GAAP financial measures recur, they tend to be disparate in amount, frequency, or timing. We use these non - GAAP financial measures internally to evaluate trends in our underlying performance, as well as to facilitate c omparison to the results of competitors for a single period. We use the following non - GAAP financial measures in this presentation: • Sales change ex. currency refers to the increase or decrease in net sales excluding the estimated impact of foreign currency translation, and, where ap pl icable, currency adjustment for transitional reporting of highly inflationary economies (Argentina) and reclassification of sales between segments. The estimated impact of foreign currency translation is ca lculated on a constant currency basis, with prior period results translated at current period average exchange rates to exclude the effect of currency fluctuations. • Organic sales change refers to sales change ex. currency, excluding the estimated impact of product line exits, acquisitions and divestitures, and , where applicable, the extra week in our fiscal year. We believe that sales change ex. currency and organic sales change assist investors in evaluating the sales change from the o ngo ing activities of our businesses and enhance their ability to evaluate our results from period to period. • Adjusted operating income refers to income before taxes, interest expense, other non - operating expense, and other expense, net. • Adjusted operating margin refers to adjusted operating income as a percentage of net sales. • Adjusted tax rate refers to the projected full - year GAAP tax rate, adjusted to exclude certain unusual or infrequent events that are expected to s ignificantly impact that rate, such as our U.S. pension plan termination, effects of certain discrete tax planning actions, impacts related to the enactment of the U.S. Tax Cuts and Jobs Act ("TCJA"), where app lic able, and other items. • Adjusted net income refers to income before taxes, tax - effected at the adjusted tax rate, and adjusted for tax - effected restructuring charges and o ther items. • Adjusted net income per common share, assuming dilution (adjusted EPS) refers to adjusted net income divided by weighted average number of common shares outstanding, assuming dilution. We believe that adjusted operating margin, adjusted net income, and adjusted EPS assist investors in understanding our core o per ating trends and comparing our results with those of our competitors. • Adjusted EBITDA refers to income before taxes adjusted for interest expense, other non - operating expense, equity method investment losses, depr eciation and amortization, excluding restructuring charges and other items. • Net debt to adjusted EBITDA ratio refers to total debt (including finance leases) less cash and cash equivalents, divided by adjusted EBITDA. We believe that the net debt to adjusted EBITDA ratio assists investors in assessing our leverage position. • Free cash flow refers to cash flow provided by operating activities, less payments for property, plant and equipment, software and other def er red charges, plus proceeds from sales of property, plant and equipment, plus (minus) net proceeds from insurance and sales (purchases) of investments. Free cash flow is also adjusted for the cash contri but ions related to the termination of our U.S. pension plan. We believe that free cash flow assists investors by showing the amount of cash we have available for debt reductions, dividends, share repurchases, and acquisitions . This document has been furnished (not filed) on Form 8 - K with the SEC and may be found on our website at www.investors.averydenn ison.com.

4 April 28, 2020 First Quarter 2020 Financial Review and Analysis Key Takeaways ● Q1 earnings exceeded our expectations; strong volume in essential label categories offset RBIS/IHM declines ● Safety and well - being of our employees is our top priority during global health crisis ● Early stages of this recession playing out differently than past recessions ○ Label and Packaging Materials largely serves essential categories that have experienced higher demand during pandemic ○ RBIS demand impacted by retail store and apparel manufacturing closures; expect biggest impact in Q2 ● Actively managing dynamic environment; updated our scenario plans to reflect unique aspects of the pandemic ● Despite different nature of this recession, business remains resilient ○ Free cash flow strong across wide range of scenarios… targeting $500+ mil. for 2020 and 2021 ○ Historically, business has rebounded quickly in the year following recession ○ Suspending 2020 EPS guidance in light of uncertain environment ● Strong balance sheet (net debt to adj. EBITDA ratio of 2.0); past scenario planning has ensured ample liquidity ● Strategic priorities are unchanged; ringfencing key investments in high value categories, including RFID, while driving long - term profitable growth of the base

5 April 28, 2020 First Quarter 2020 Financial Review and Analysis First Quarter Review Reported EPS of $1.60; adj. EPS (non - GAAP) of $1.66, above our expectations, reflecting lower - than - planned raw material and employee - related costs ● Reported sales declined 1.0% ○ Sales change ex - currency (non - GAAP) of 1.0% ○ Organic sales change (non - GAAP) of 0.3% ● Reported operating margin up 120 bps ○ Adjusted operating margin (non - GAAP) improved 90 bps ● Free cash flow of $(35) mil., reflecting seasonality, as well as lower cash collections related to customer shutdowns late in the quarter LGM delivered strong volume growth, reflecting March demand surge in multiple regions; posted record adj. operating margin, up 220 bps RBIS sales declined modestly, reflecting lower demand in base business, with high value categories (RFID / external embellishments) up mid - teens; adj. margin declined 380 bps IHM sales declined on reduced industrial demand, particularly automotive; adj. margin increased 90 bps

6 April 28, 2020 First Quarter 2020 Financial Review and Analysis Operations / Market Update in Light of COVID - 19 Label and Graphic Materials (LGM) 67% of 2019 sales Retail Branding and Info. Solutions (RBIS) 23% of 2019 sales Industrial and Healthcare Materials (IHM) 10% of 2019 sales ● Plants largely operational throughout crisis ● Demand surge for labels in western markets driven by food, hygiene, and pharmaceutical product labeling, as well as variable information (e.g., e - commerce labels) -- Label and Packaging Materials (LPM) March / April volumes up >10% in Europe/North America ● Peak demand created unusually large open orders; expect to work through backlogs by end of Q2 ● Demand in China declined, though improving from first two months of the year; South Asia solid for the quarter, declining late March / April due to country lockdowns ● Sharp decline in demand for durable labels and graphics solutions (~15% of LGM sales in 2019) beginning in March and continuing into April ● Government - mandated closures impacted operations in many countries; our largest hubs are open ○ Our global footprint providing significant competitive advantage during pandemic; key to meeting retailer/brand owner needs as they ramp back up (Smartrac acquisition further strengthens this advantage) ● Sharp decline in demand from apparel retailers and brands, reflecting widespread closure of malls and other retail outlets ● Enterprise - wide sales of RFID products up mid - teens in Q1. Though project pipeline continues to expand (up >20% since start of year), some trials have been delayed; decline in underlying apparel demand likely to offset other end market growth this year ● Current environment underscoring value of RFID as key technology to improve supply chains and support customer automation over the long - term ● All plants now open, some with limited production (largest China plant closed for five weeks) ● Demand in industrial categories (~60% of IHM sales in 2019) weakened through the quarter, driven largely by automotive ● Medical division (~15% of IHM sales in 2019) historically focused on advanced wound care; quickly developing new products to meet urgent short - term need for personal protective equipment (PPE)

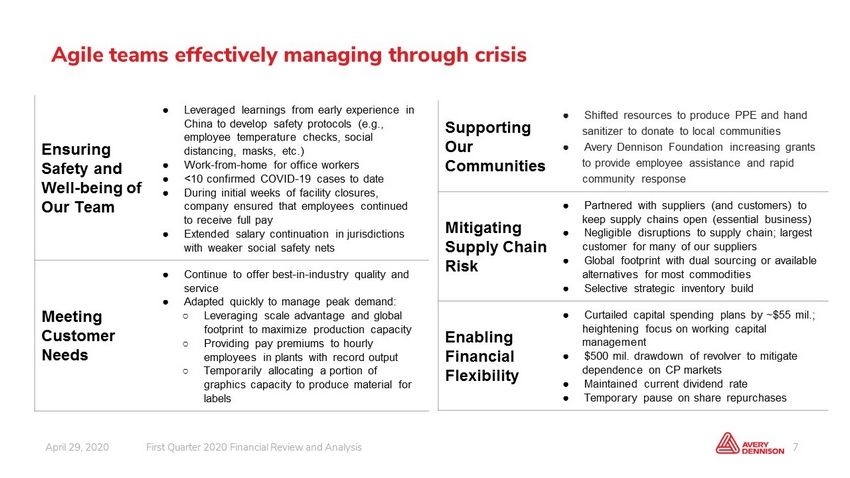

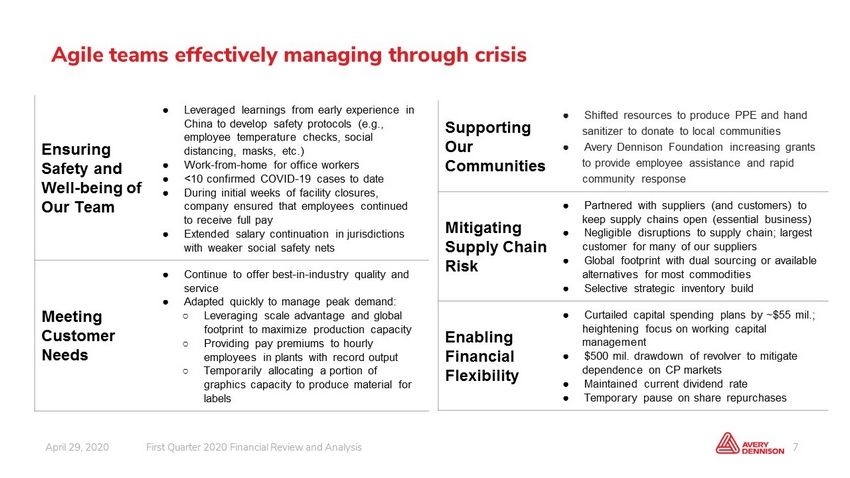

7 April 28, 2020 First Quarter 2020 Financial Review and Analysis Agile teams effectively managing through crisis Ensuring Safety and Well - being of Our Team ● Leveraged learnings from early experience in China to develop safety protocols (e.g., employee temperature checks, social distancing, masks, etc.) ● Work - from - home for office workers ● <10 confirmed COVID - 19 cases to date ● During initial weeks of facility closures, company ensured that employees continued to receive full pay ● Extended salary continuation in jurisdictions with weaker social safety nets Meeting Customer Needs ● Continue to offer best - in - industry quality and service ● Adapted quickly to manage peak demand: ○ Leveraging scale advantage and global footprint to maximize production capacity ○ Providing pay premiums to hourly employees in plants with record output ○ Repurposing graphics capacity to produce material for labels Supporting Our Communities ● Shifted resources to produce PPE and hand sanitizer to donate to local communities ● Avery Dennison Foundation increasing grants to provide employee assistance and rapid community response Mitigating Supply Chain Risk ● Partnered with suppliers (and customers) to keep supply chains open (essential business) ● Negligible disruptions to supply chain; largest customer for many of our suppliers ● Global footprint with dual sourcing or available alternatives for most commodities ● Selective strategic inventory build Enabling Financial Flexibility ● Curtailed capital spending plans by ~$55 mil.; heightening focus on working capital management ● $500 mil. drawdown of revolver to mitigate dependence on CP markets ● Maintained current dividend rate ● Temporary pause on share repurchases

8 April 28, 2020 First Quarter 2020 Financial Review and Analysis Broad exposure to diverse end markets, with ~60% tied to non - durable consumer goods, logistics & shipping, and medical products 2019 Sales by Product Category Non - durable consumer goods Retail Apparel Industrial / Durable Logistics, Shipping, & Other Variable Information Medical / Healthcare Increased demand for label materials driven by surge in spending on non - durable consumer goods, reflecting both higher consumption of packaged goods for the home, as well as inventory stocking (both pantry loading as well as inventory building along the supply chain) Increase in e - commerce benefits our businesses serving variable information needs, including RFID Significant decline in orders for Retail Apparel and Graphics, with ongoing pressure on other Industrial / Durable categories

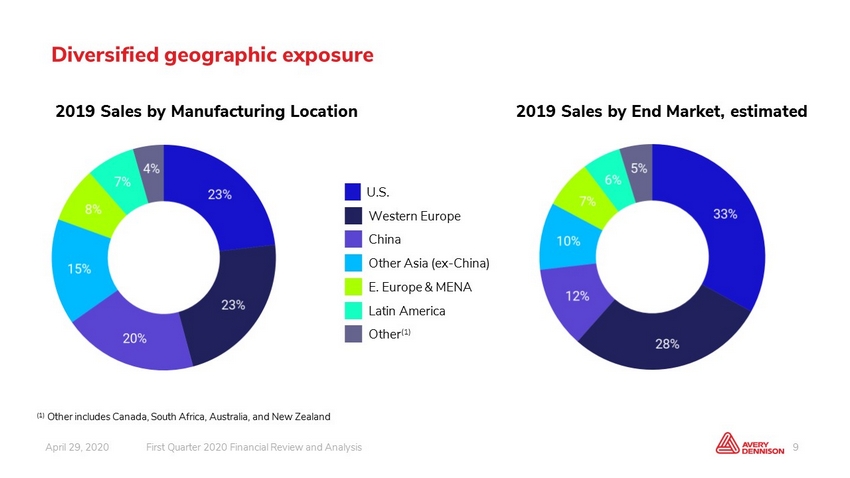

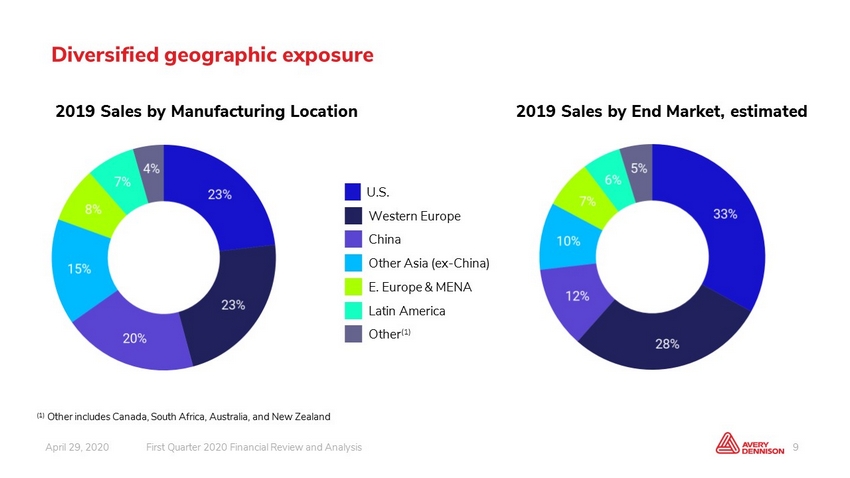

9 April 28, 2020 First Quarter 2020 Financial Review and Analysis Diversified geographic exposure 2019 Sales by Manufacturing Location 2019 Sales by End Market, estimated (1) Other includes Canada, South Africa, Australia, and New Zealand U.S. Western Europe China Other Asia (ex - China) E. Europe & MENA Latin America Other (1)

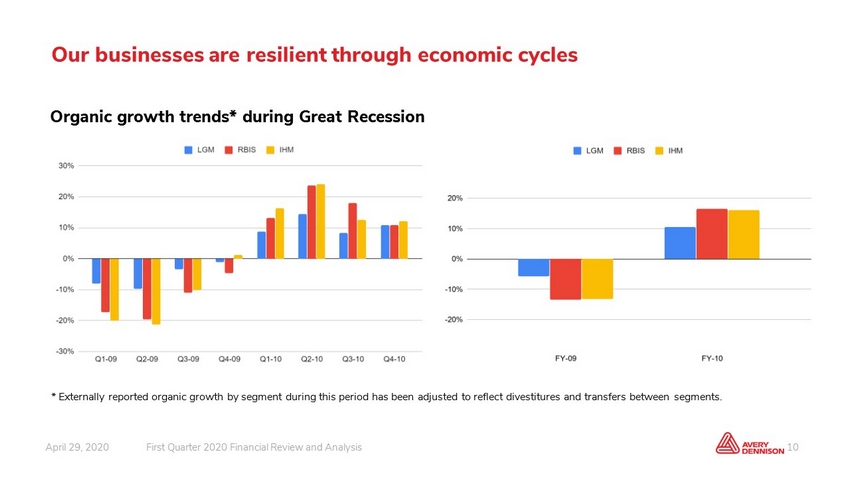

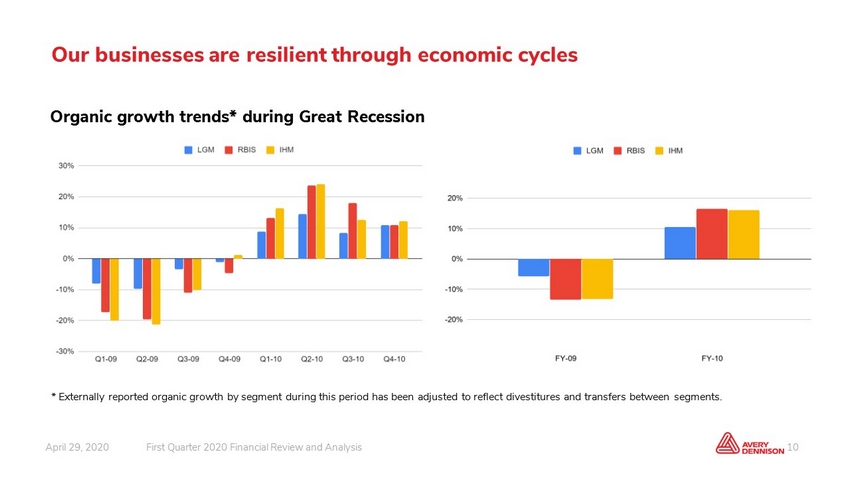

10 April 28, 2020 First Quarter 2020 Financial Review and Analysis Our businesses are resilient through economic cycles * Externally reported organic growth by segment during this period has been adjusted to reflect divestitures and transfers be twe en segments. Organic growth trends* during Great Recession

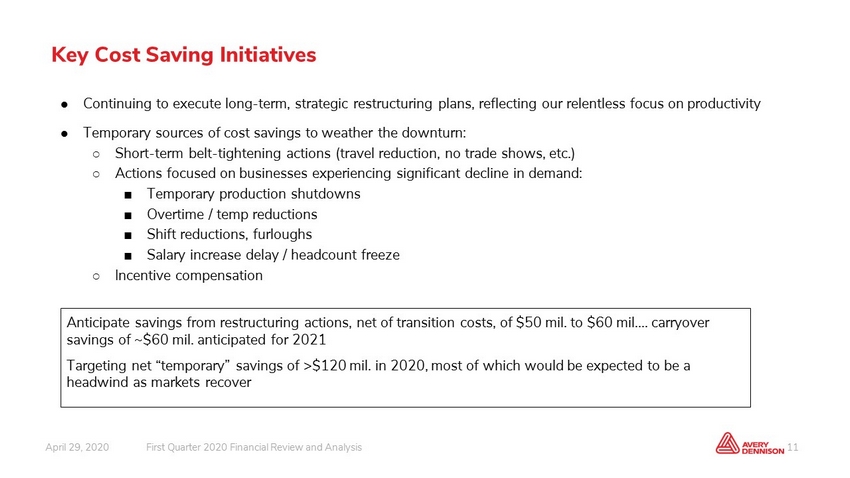

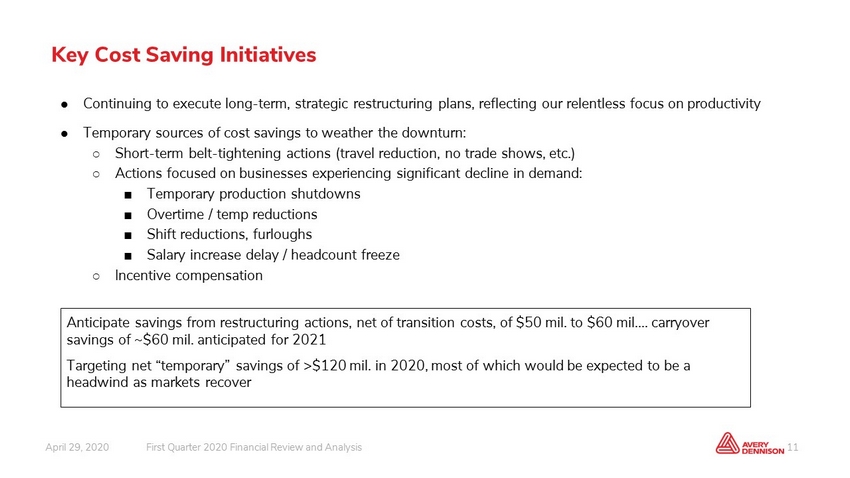

11 April 28, 2020 First Quarter 2020 Financial Review and Analysis Key Cost Saving Initiatives ● Continuing to execute long - term, strategic restructuring plans, reflecting our relentless focus on productivity ● Temporary sources of cost savings to weather the downturn: ○ Short - term belt - tightening actions (travel reduction, no trade shows, etc.) ○ Actions focused on businesses experiencing significant decline in demand: ■ Temporary production shutdowns ■ Overtime / temp reductions ■ Shift reductions, furloughs ■ Salary increase delay / headcount freeze ○ Incentive compensation Anticipate savings from restructuring actions, net of transition costs, of $50 mil. to $60 mil.... carryover savings of ~$60 mil. anticipated for 2021 Targeting net “temporary” savings of >$120 mil. in 2020, most of which would be expected to be a headwind as markets recover

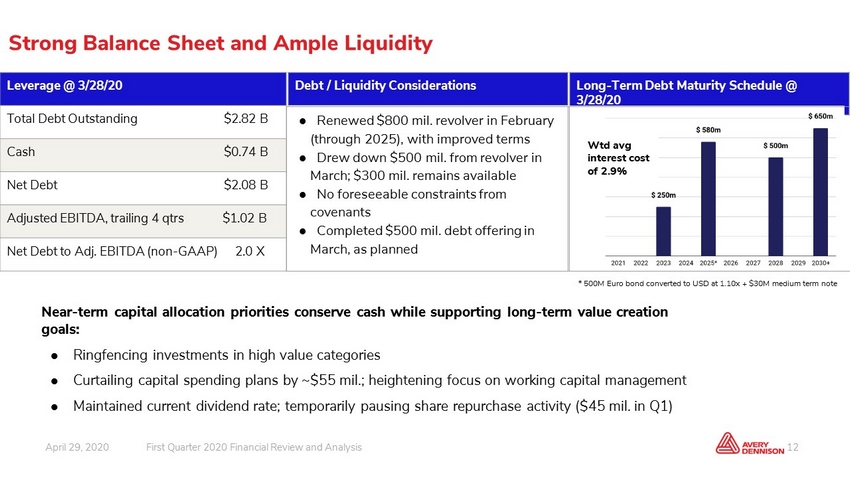

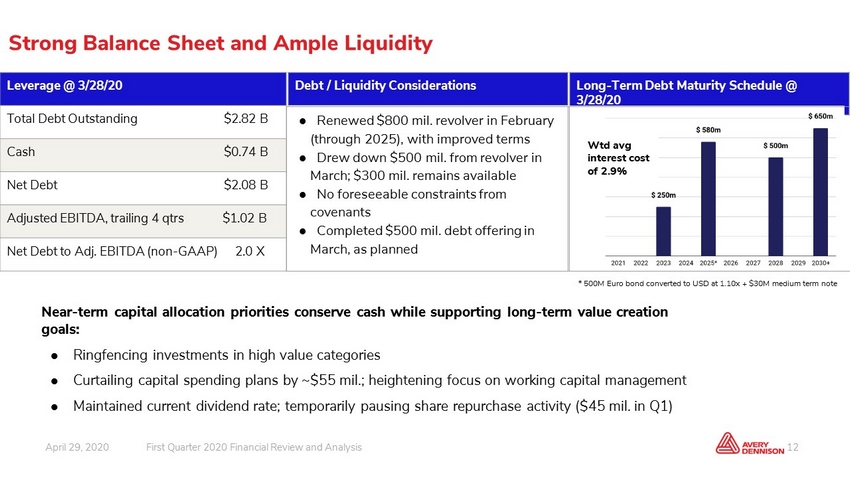

12 April 28, 2020 First Quarter 2020 Financial Review and Analysis Strong Balance Sheet and Ample Liquidity Leverage @ 3/28/20 Total Debt Outstanding $2.82 B Cash $0.74 B Net Debt $2.08 B Adjusted EBITDA, trailing 4 qtrs $1.02 B Net Debt to Adj. EBITDA (non - GAAP) 2.0 X Debt / Liquidity Considerations Long - Term Debt Maturity Schedule @ 3/28/20 ● Renewed $800 mil. revolver in February (through 2025), with improved terms ● Drew down $500 mil. from revolver in March; $300 mil. remains available ● No foreseeable constraints from covenants ● Completed $500 mil. debt offering in March, as planned Near - term capital allocation priorities conserve cash while supporting long - term value creation goals: ● Ringfencing investments in high value categories ● Curtailing capital spending plans by ~$55 mil.; heightening focus on working capital management ● Maintained current dividend rate; temporarily pausing share repurchase activity ($45 mil. in Q1) * 500M Euro bond converted to USD at 1.10x + $30M medium term note Wtd avg interest cost of 2.9%

13 April 28, 2020 First Quarter 2020 Financial Review and Analysis ● High degree of market uncertainty; suspending 2020 EPS guidance ● Prepared for range of possible macro scenarios and how they might impact each business ○ Generally expect LPM to fare relatively better than it did through ‘08 - ’09 ○ Generally expect RBIS and Graphics to experience deeper declines in demand relative to ‘08 - ’09 ● Targeting to maintain adj. EBITDA margin on lower volume ● Lower sales expected in 2020 due principally to declining volumes and currency translation ○ Expect disproportionate impact in second quarter (organic sales decline of 15% to 20% vs P/Y), with sequential improvement over balance of the year ● Free cash flow strong across wide range of scenarios ○ Targeting $500+ mil. for 2020 and 2021 Outlook

14 April 28, 2020 First Quarter 2020 Financial Review and Analysis Q1 Results Detail

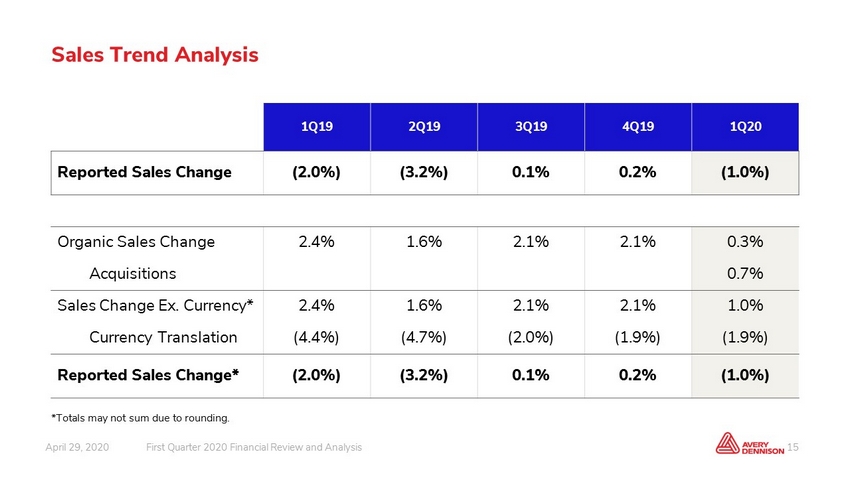

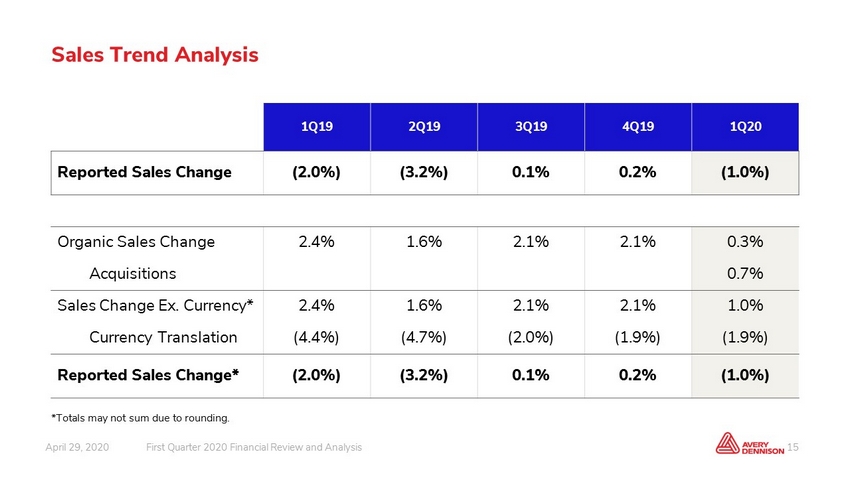

15 April 28, 2020 First Quarter 2020 Financial Review and Analysis Sales Trend Analysis 1Q19 2Q19 3Q19 4Q19 1Q20 Reported Sales Change (2.0%) (3.2%) 0.1% 0.2% (1.0%) Organic Sales Change 2.4% 1.6% 2.1% 2.1% 0.3% Acquisitions 0.7% Sales Change Ex. Currency* 2.4% 1.6% 2.1% 2.1% 1.0% Currency Translation (4.4%) (4.7%) (2.0%) (1.9%) (1.9%) Reported Sales Change* (2.0%) (3.2%) 0.1% 0.2% (1.0%) *Totals may not sum due to rounding.

16 April 28, 2020 First Quarter 2020 Financial Review and Analysis First Quarter Sales Change and Operating Margin Comparison Reported Adjusted (Non - GAAP) Operating Margin 1Q20 1Q19 1Q20 1Q19 Label and Graphic Materials 14.6% 11.8% 14.7% 12.5% Retail Branding and Information Solutions 8.0% 12.9% 8.6% 12.4% Industrial and Healthcare Materials 10.1% 8.3% 10.4% 9.5% Total Company 11.6% 10.4% 11.8% 10.9% 1Q20 Sales Change Reported Ex - Currency Organic Label and Graphic Materials 0.2% 2.5% 1.8% Retail Branding and Information Solutions (0.9%) 0.1% (1.1%) Industrial and Healthcare Materials (9.7%) (7.8%) (7.8%) Total Company (1.0%) 1.0% 0.3%

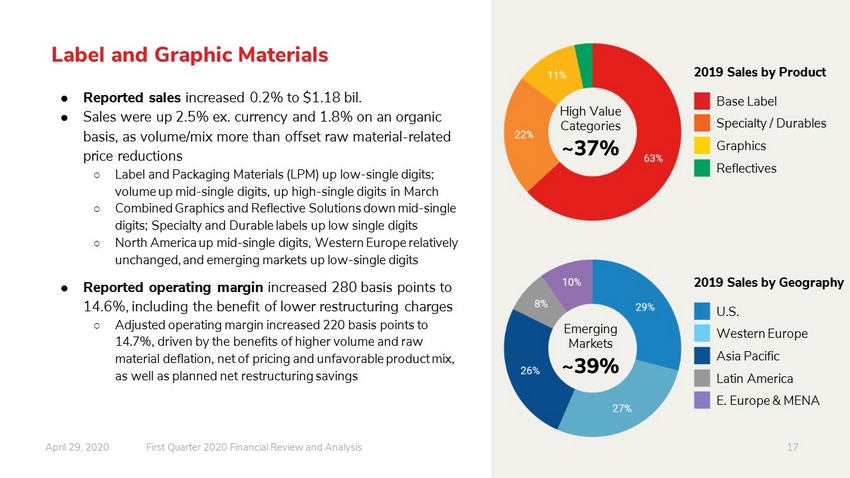

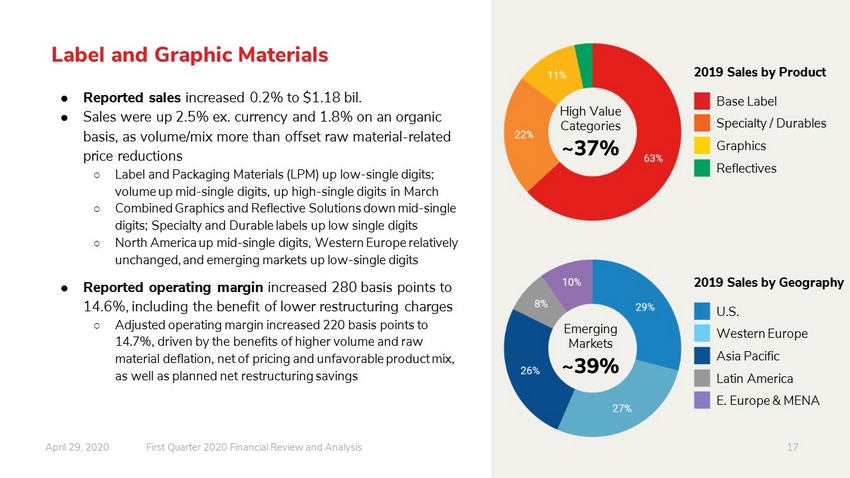

17 April 28, 2020 First Quarter 2020 Financial Review and Analysis Label and Graphic Materials ● Reported sales increased 0.2% to $1.18 bil. ● Sales were up 2.5% ex. currency and 1.8% on an organic basis, as volume/mix more than offset raw material - related price reductions ○ Label and Packaging Materials (LPM) up low - single digits; volume up mid - single digits, up high - single digits in March ○ Combined Graphics and Reflective Solutions down mid - single digits; Specialty and Durable labels up low single digits ○ North America up mid - single digits, Western Europe relatively unchanged, and emerging markets up low - single digits ● Reported operating margin increased 280 basis points to 14.6%, including the benefit of lower restructuring charges ○ Adjusted operating margin increased 220 basis points to 14.7%, driven largely by the benefit of raw material deflation, net of pricing, and the expected net benefit from restructuring actions 2019 Sales by Product Base Label Specialty / Durables Graphics Reflectives 2019 Sales by Geography U.S. Western Europe Asia Pacific Latin America E. Europe & MENA 17 High Value Categories ~37% Emerging Markets ~39%

18 April 28, 2020 First Quarter 2020 Financial Review and Analysis Retail Branding and Information Solutions ● Reported sales declined 0.9% to $395 mil. ● Sales were up 0.1% ex. currency, and down 1.1% on an organic basis ○ Base business down mid - single digits, driven by site closures and lower apparel demand late in Q1 ○ High value categories up mid - teens, with RFID solutions up low double - digits, below expectations due to lower apparel demand ○ Completed acquisition of Smartrac’s transponder business on Feb. 28; integration proceeding well ● Reported operating margin declined 490 basis points to 8.0%, including headwinds from higher restructuring charges and acquisition - related costs ○ Adjusted operating margin declined 380 basis points to 8.6%, driven largely by an increase in growth investments, both organic and acquisition - related, and higher reserves 2019 Sales by Geography (end markets, estimated) U.S. Europe Asia Pacific Others 2019 Sales by Product Apparel Tags & Labels RFID Ext. Embellishment PSD (ex. RFID) High Value Categories ~27% 18

19 April 28, 2020 First Quarter 2020 Financial Review and Analysis Industrial and Healthcare Materials ● Reported sales declined 9.7% to $148 mil. ● Sales declined 7.8% on an organic basis ○ Mid - single digit decline in industrial categories driven by automotive, which was down over 10% ○ Low - single digit decline in healthcare categories ● Reported operating margin increased 180 basis points to 10.1%, including the benefit of lower restructuring charges ○ Adjusted operating margin increased 90 basis points to 10.4% as benefit from productivity initiatives more than offset reduced fixed cost leverage 2019 Sales by Product Automotive Other Industrial Healthcare Retail 2019 Sales by Geography U.S. Europe Asia Pacific Latin America High Value Categories ~74% 19

20 April 28, 2020 First Quarter 2020 Financial Review and Analysis © 2020 Avery Dennison Corporation. All rights reserved. Avery Dennison and all other Avery Dennison brands, product names and co des are trademarks of Avery Dennison Corporation. All other brands or product names are trademarks of their respective owners. Fortune 500® is a trademark of Time, Inc. Branding and other information on any samples depicted is fictitious. Any resemblance to actual names is purely coincidental. Thank you