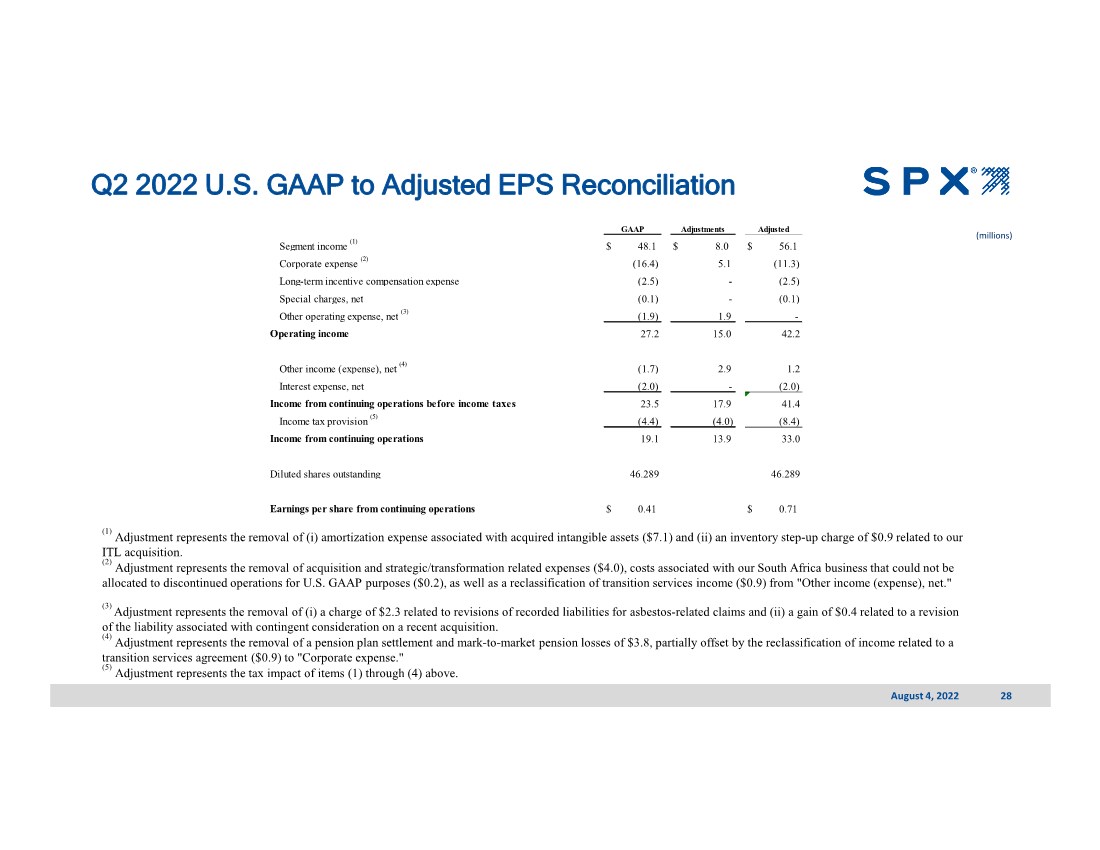

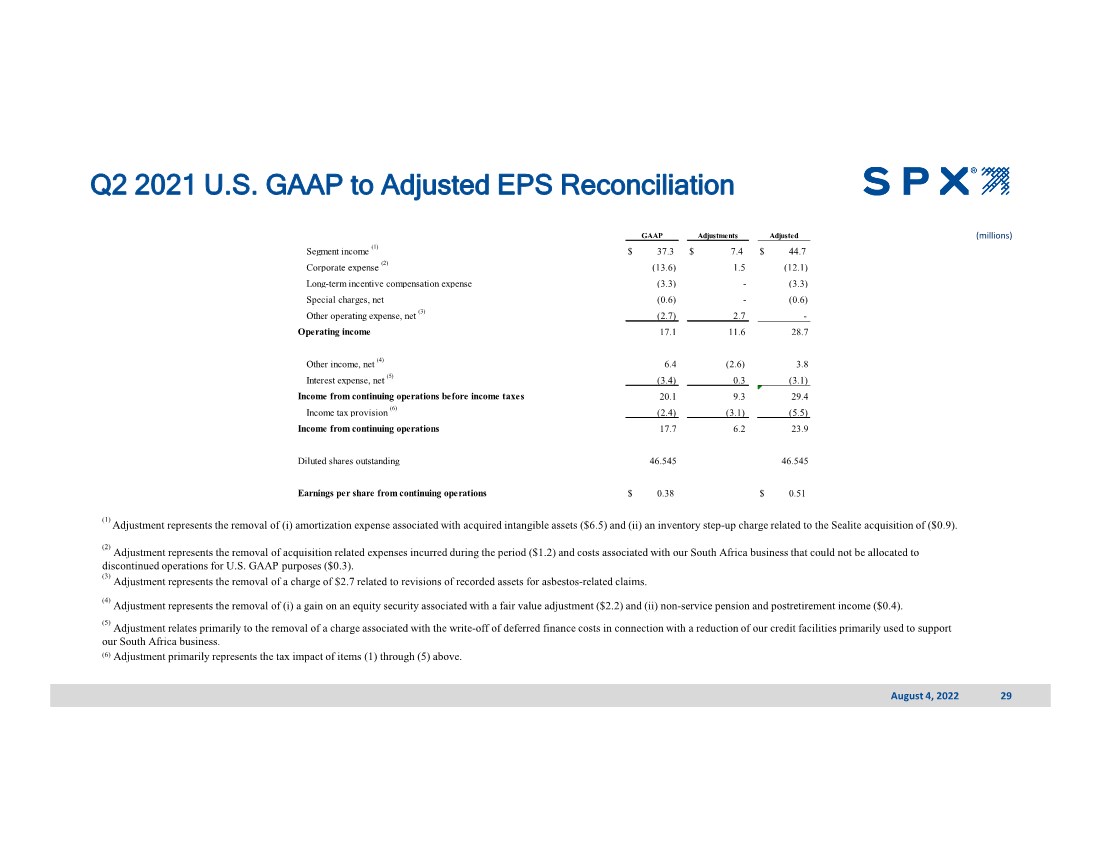

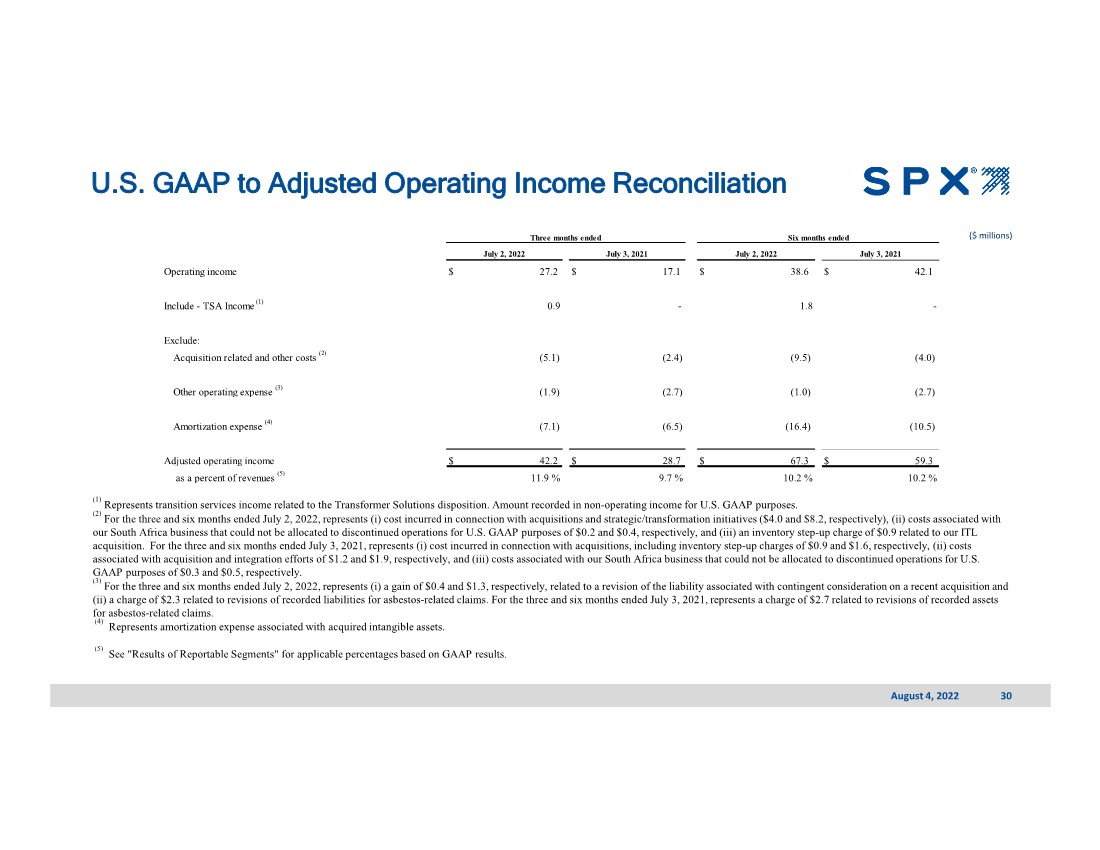

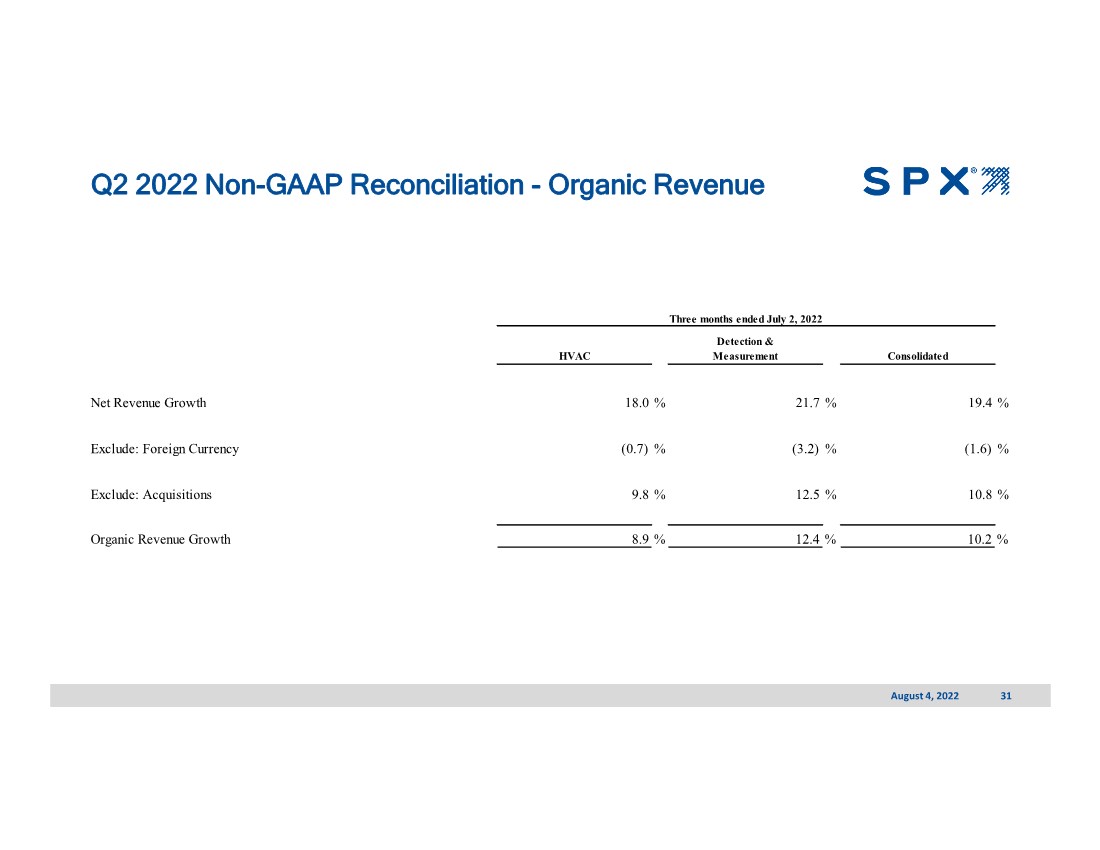

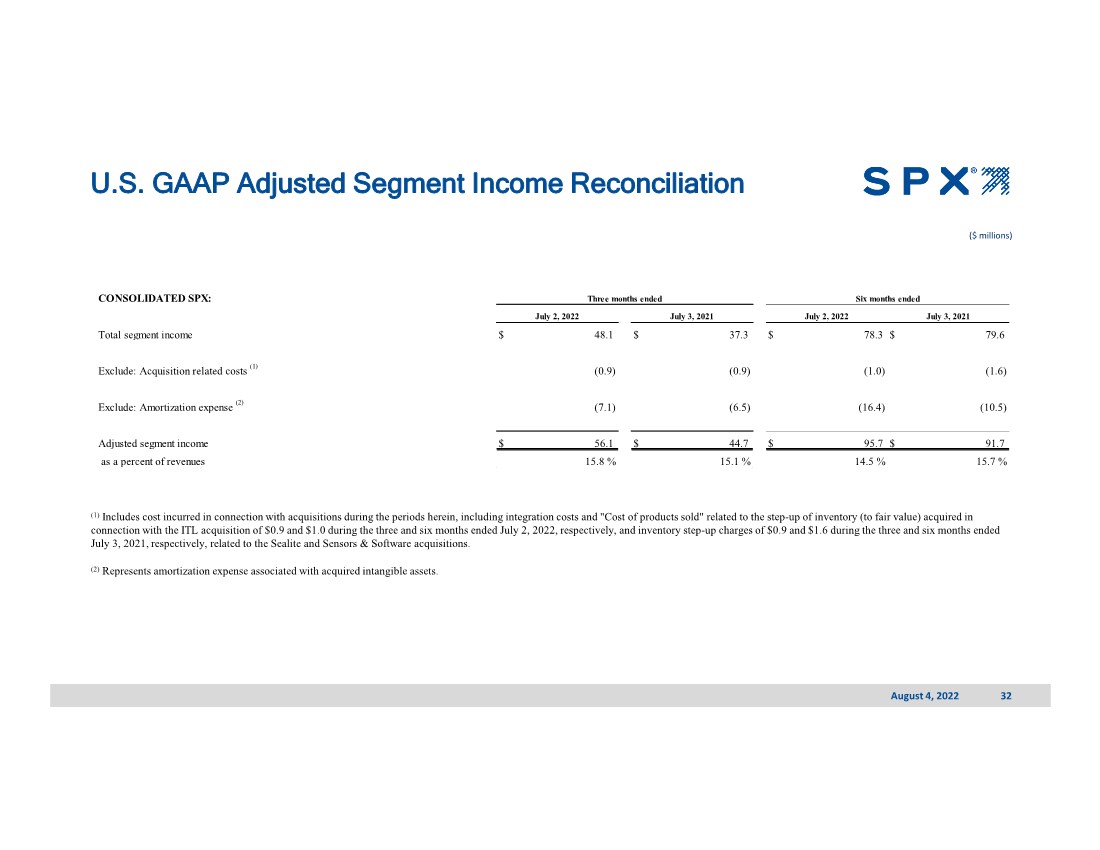

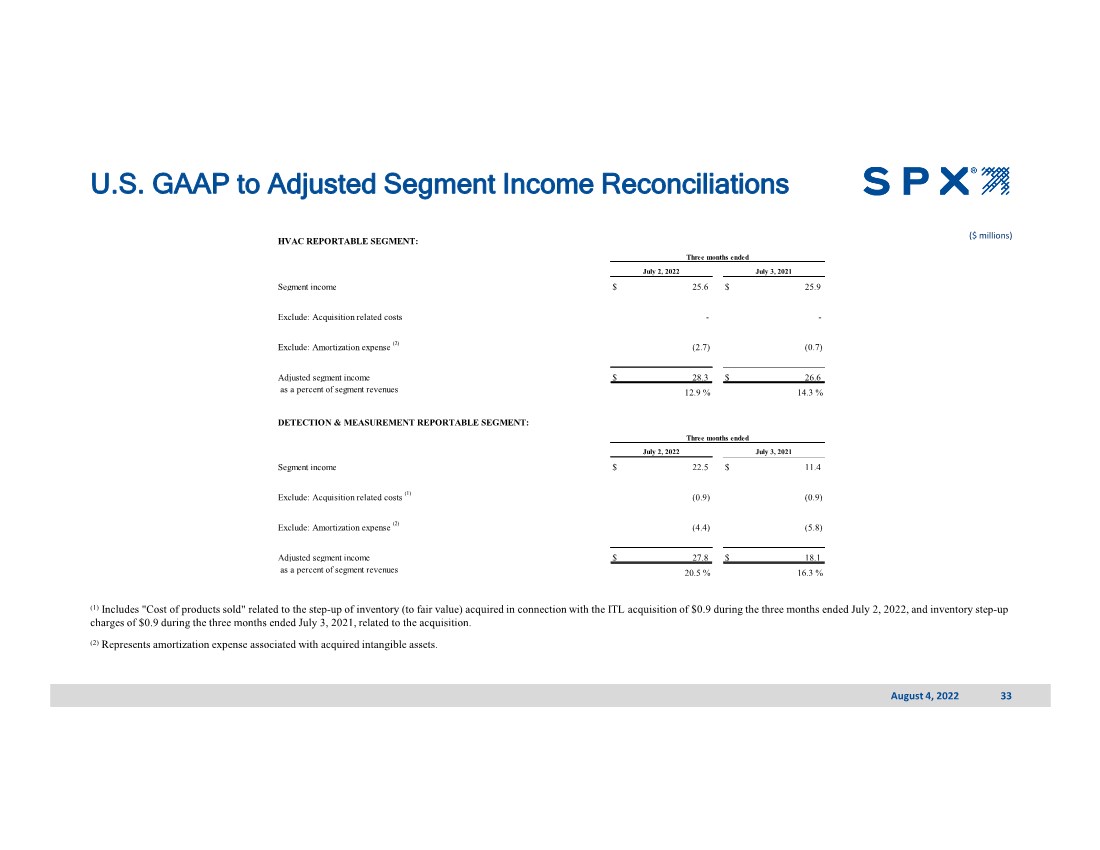

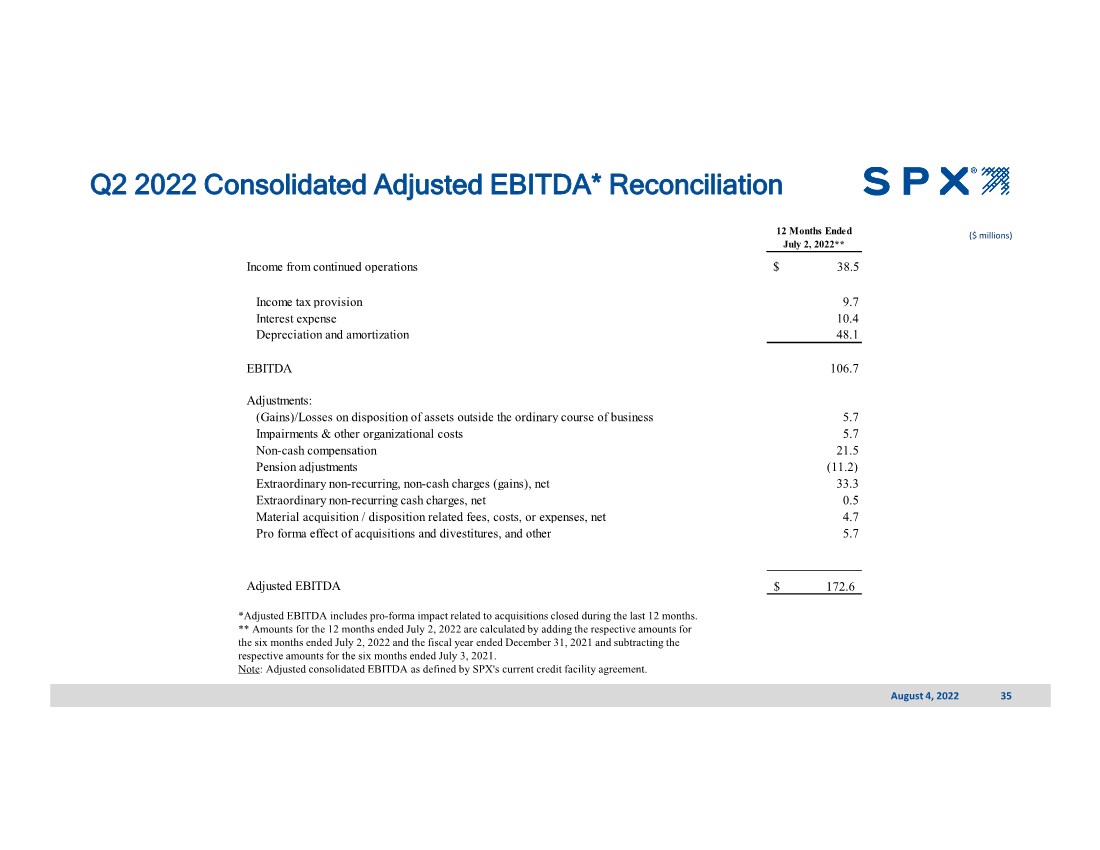

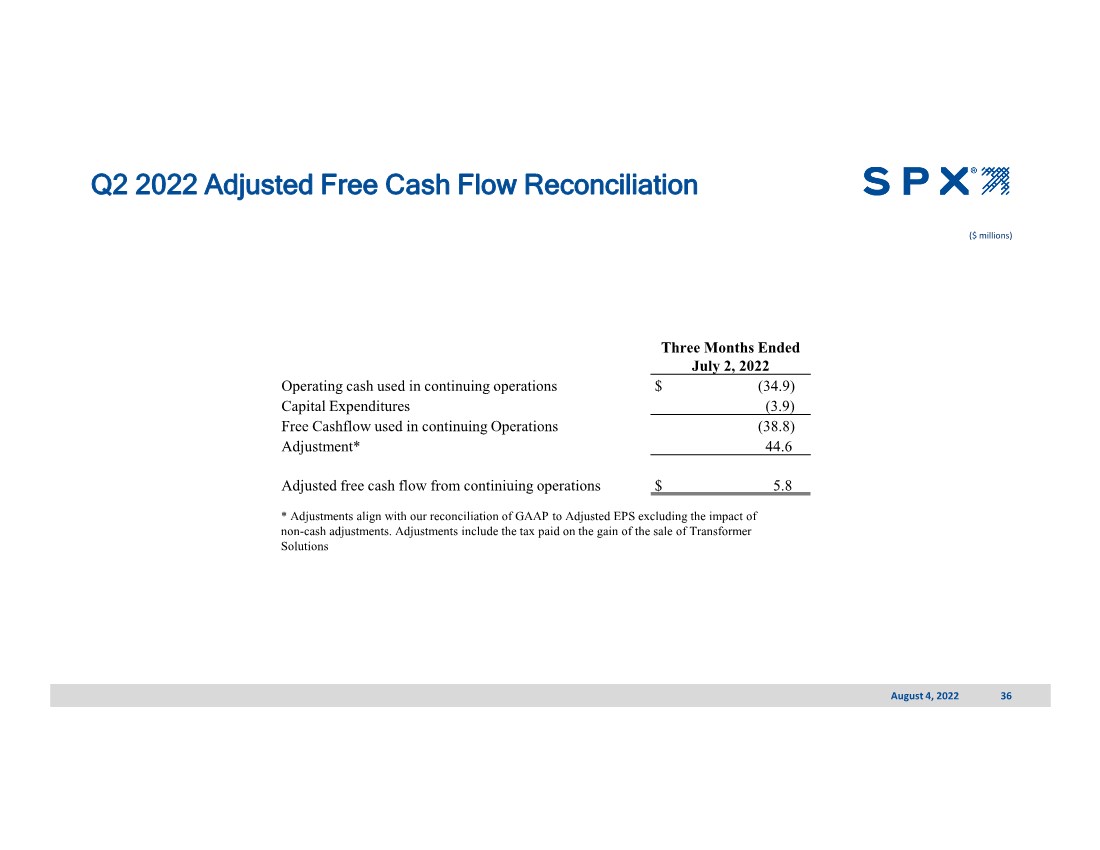

| August 4, 2022 2 Certain statements contained in this presentation that are not historical facts, including any statements as to future market conditions, results of operations, products introductions, and financial projections, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to safe harbor created thereby. These forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from future express or implied results. Although SPX believes that the expectations reflected in its forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. In addition, statements with respect to SPX’s intention to implement a reorganization of its corporate legal structure (the “Transaction”), the timing thereof and its impact on business operations and financial profile, are forward-looking statements. Forward-looking statements are based on the company’s existing operations and complement of businesses, which are subject to change. Particular risks facing SPX include risks relating to economic, business and other risks stemming from changes in the economy, including changes resulting from the impact of the COVID-19 pandemic and governmental and other actions taken in response, including labor constraints and supply-chain disruptions; the uncertainty of claims resolution with respect to the large power projects in South Africa, as well as claims with respect to asbestos, environmental and other contingent liabilities; cyclical changes and specific industry events in the company’s markets; economic impacts from continued or escalating geopolitical tensions; changes in anticipated capital investment and maintenance expenditures by customers; availability, limitations or cost increases of raw materials and/or commodities that cannot be recovered in product pricing; the impact of competition on profit margins and the company’s ability to maintain or increase market share; inadequate performance by third-party suppliers and subcontractors for outsourced products, components and services; cyber-security risks; risks with respect to the protection of intellectual property, including with respect to the company’s digitalization initiatives; the impact of overruns, inflation and the incurrence of delays with respect to long-term fixed-price contracts; defects or errors in current or planned products; domestic economic, political, legal, accounting and business developments adversely affecting the company’s business, including regulatory changes; changes in worldwide economic conditions; uncertainties with respect to the company’s ability to identify acceptable acquisition targets; uncertainties surrounding timing and successful completion of any announced acquisition or disposition transactions, including with respect to integrating acquisitions and achieving cost savings or other benefits from acquisitions; uncertainties with respect to the completion of the Transaction, which may be delayed or not completed as anticipated, as well as the extent of the expected benefits of the Transaction (if it is completed); the impact of retained liabilities of disposed businesses; potential labor disputes; and extreme weather conditions and natural and other disasters. More information regarding such risks can be found in SPX’s most recent Annual Report on Form 10-K and other SEC filings. Statements in this presentation are only as of the time made, and SPX disclaims any responsibility to update or revise such statements except as required by law. This presentation includes non-GAAP financial measures. Reconciliations of historical non-GAAP financial measures with the most comparable measures calculated and presented in accordance with GAAP are available in the appendix to this presentation. We believe that these non-GAAP measures are useful to investors in evaluating our operating performance and our management of business from period to period. |