Gilead to Acquire Pharmasset November 21, 2011 Exhibit 99.2 |

Slide 2 Safe Harbor Disclaimer Statements included in this presentation that are not historical in nature are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Gilead cautions readers that forward-looking statements are subject to certain risks and uncertainties, which could cause actual results to differ materially. These risks and uncertainties include: Gilead’s ability to consummate the acquisition of Pharmasset and advance Pharmasset’s product pipeline as planned; Gilead’s ability to successfully develop its HCV franchise; Gilead’s ability to develop an all oral antiviral regimen for HCV; and Gilead’s ability to achieve its anticipated full year 2011 financial results. Gilead directs readers to its Quarterly Report on Form 10-Q for the third quarter ended September 30, 2011 and subsequent current reports on Form 8-K. Gilead claims the protection of the Safe Harbor contained in the Private Securities Litigation Reform Act of 1995 for forward-looking statements. All forward-looking statements are based on information currently available to Gilead, and Gilead assumes no obligation to update any such forward-looking statements. This announcement is neither an offer to purchase nor a solicitation of an offer to sell shares of Pharmasset. At the time the offer is commenced, Gilead will file a Tender Offer Statement on Schedule TO with the U.S. Securities and Exchange Commission, and Pharmasset will file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the offer. Pharmasset stockholders and other investors are urged to read the tender offer materials (including an Offer to Purchase, a related Letter of Transmittal and certain other offer documents) and the Solicitation/Recommendation Statement because they will contain important information which should be read carefully before any decision is made with respect to the tender offer. The Offer to Purchase, the related Letter of Transmittal and certain other offer documents, as well as the Solicitation/Recommendation Statement, will be made available to all stockholders of Pharmasset at no expense to them. The Tender Offer Statement and the Solicitation/Recommendation Statement will be made available for free at the Commission's web site at www.sec.gov. |

Slide 3 Agenda 1. Pharmasset Acquisition Highlights 2. HCV Landscape 3. Overview of Pharmasset HCV Portfolio 4. Gilead’s Combined HCV Opportunity Page 4 8 16 22 |

Slide 4 Pharmasset Acquisition Highlights |

Slide 5 Terms of the Agreement Cash tender offer at $137 per share Transaction value of approximately $11 billion Tender offer expected to close within Q1 12 – Subject to minimum tender requirement – Hart-Scott-Rodino (antitrust) clearance – Other customary conditions |

Slide 6 Strategic Rationale Accelerates Gilead’s strategy to develop the first all-oral regimen for the treatment of HCV – PSI-7977 is the most potent, advanced nucleotide in clinical development – Phase 3 clinical studies of PSI-7977 in combination with ribavirin open to enrollment – Targeted U.S. FDA approval in 2014 Since HCV can be cured, it will be important to be first to market with an all-oral, well-tolerated regimen Opportunity for significant revenue growth and diversification in 2014 and beyond – Composition of matter patent protection for PSI-7977 into 2029 Pharmasset is a strategic fit with Gilead’s areas of operational excellence |

Slide 7 Fit with Gilead’s Areas of Operational Excellence Established expertise and commitment to liver disease Preclinical, clinical development and regulatory expertise – Developed and commercialized 5 HIV and 2 hepatitis products – Viread regulatory approvals in approximately 140 countries – Established team: Quad NDA filing in 6 weeks after last patient, last visit Expertise in process research and development, and established worldwide API and product manufacturing network – Developed 1 fixed-dose combination and 3 single-tablet regimens in HIV – Manufacture tenofovir DF at >110 metric tons per year Established commercial operations in 23 countries worldwide, with expanding presence in Asia |

Slide 8 HCV Landscape |

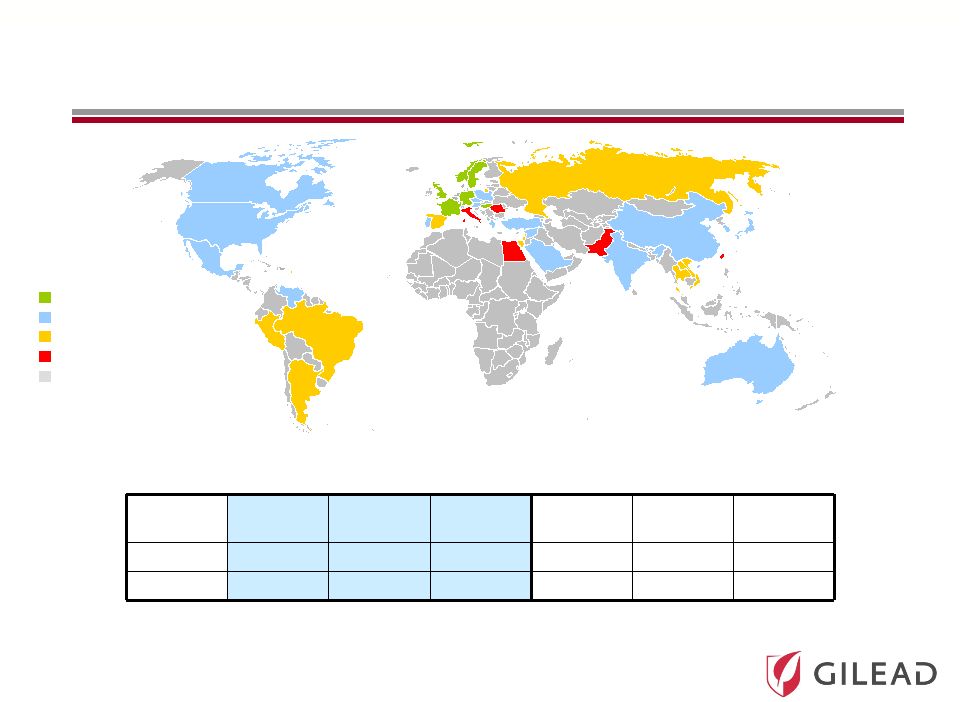

Slide 9 <1% 1-1.9% 2-2.9% >3% Not tested HCV Prevalence in Core and Emerging Markets (M) Global Prevalence of HCV is Estimated to be 160 Million Individuals (1) HCV Prevalence (% of population) Region US 2 Japan 2 Europe Other 3 Asia 3 Latin America 3 All GT 2.9 3.7 0.6 6.7 70.8 5.4 GT1 (%) 73% 63% 70% 65% 39% 68% EU-Core 5 2 Sources: 1) Lavanchy, et al. 2011. 2) Gilead Forecast (2011 prevalence estimate). 3) Cornberg, Sievert, and Kershenobich, et al 2011. Country populations from 2009 World Bank estimates |

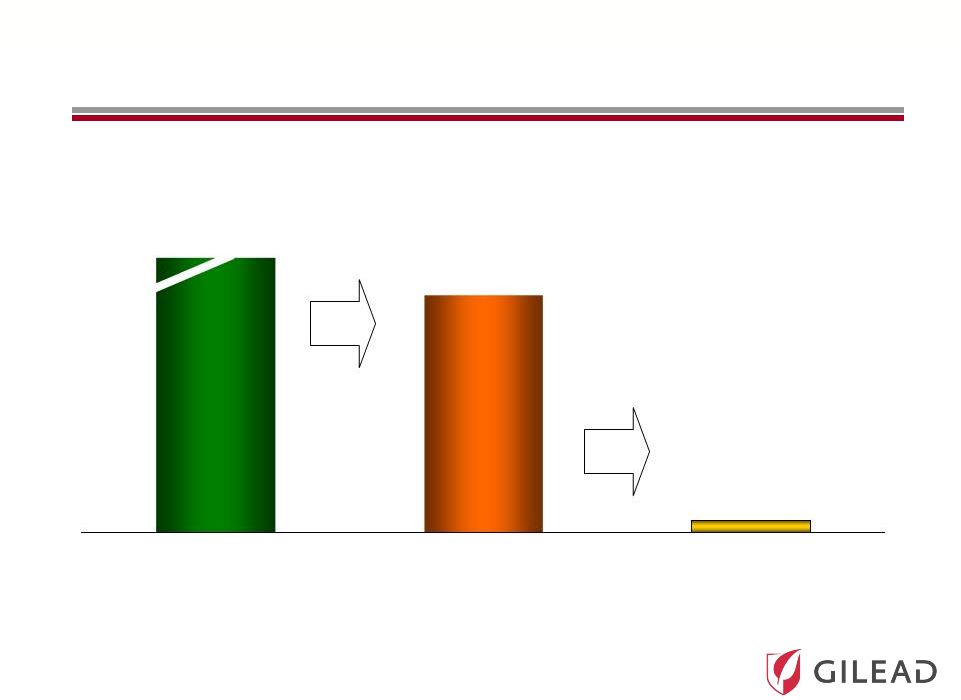

Slide 10 Over 12 Million Infected Individuals in Major Markets (1) with Fewer than 200,000 Treated per Year Treated/ Year 182 Diagnosed Prevalence 12,601 Patients in thousands 36% 4,524 1. Major markets include US, EU-5, Japan, Australia, Austria, Brazil, Denmark, Finland, Greece, Ireland, Norway, Poland, Portugal, Sweden, Switzerland, Turkey, Canada Sources: Prevalence – KantarHealth Core-5 EU epidemiology analysis (2010), NHANES (1999-2006), Armstrong (2004), Hepatology, 40(4:S1):176a, Chak (2011), Liver Intl., 8, 1090-1101, Cornberg (2011), Liver Intl., 31 (s2), 31-60, Kershenobich (2011), Liver Intl., 31 (s2), 18-29 Diagnosed – KantarHealth Core-5 EU epidemiology analysis (2010), Armstrong (2004) Hepatology, 40(4:S1):176a, Culver (2000), Transfusion 40:1176 Treated – IMS MIDAS (2004 – 2009), Synovate chart audits (2007), Roche and Schering Plough annual reports (2009) HCV: A Significant Unmet Medical Need 4% |

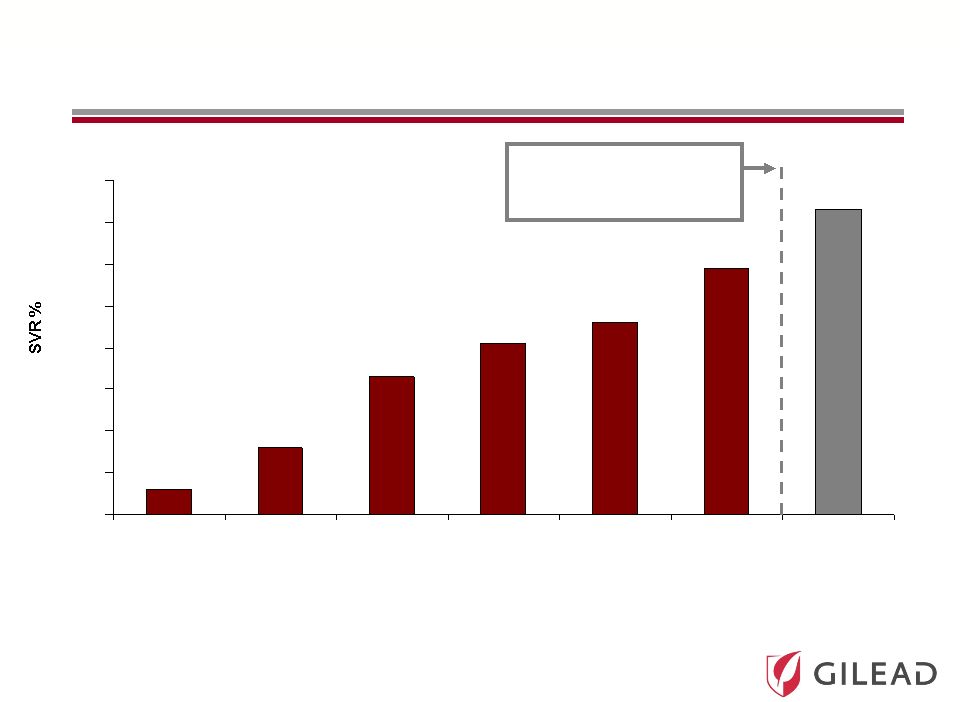

Slide 11 0 10 20 30 40 50 60 70 80 IFN 24 Wk IFN 48 Wk IFN/RBV 24 Wk IFN/RBV 48 Wk (1998) IFN/RBV 48 Wk (2001) PegIFN/RBV 48 Wk PI + PegIFN/RBV 48 Wk (2011) 6% 13-19% 31-35% 38-43% 45-47% 54-63% 66-79% IFN 24 Weeks IFN 48 Weeks IFN/RBV 24 Weeks IFN/RBV 48 Weeks 1998 IFN/RBV 48 Weeks 2001 PegIFN/RBV 48 Weeks Protease Inhibitor + PegIFN/RBV 24-48 Weeks 2011 HCV Treatment Evolution IFN = Interferon RBV = Ribavirin PegIFN = Pegylated Interferon FDA Approval of Protease Inhibitors (PIs) in May 2011 |

Slide 12 Challenges of Current PI-based Treatment Remains Additional safety issues and exacerbation of side effects (rash and anemia) – Discontinuation rates significantly increased on PIs Lower response rates in sub-populations (previous IFN/RBV non-responders, cirrhotics) Burdensome for patients and practitioners – PIs dosed 2-3 times per day, plus ribavirin and a self-administered injection – Time intensive adverse event management, complexity of response guided therapy |

Slide 13 Ultimate Goal in HCV Therapy Once a day Pan-genotype No clinical resistance No response guided therapy Short duration Safe with manageable side effects High cure rates Suitable for all populations Ideal HCV Therapy Most Likely Achieved Ideal HCV Therapy Most Likely Achieved through a Combination of Two or More Drugs through a Combination of Two or More Drugs Easier for doctors and patients Leads to increased diagnosis and treatment Potential to cure many more patients Lowers cost to healthcare system due to prevention of end-stage liver disease |

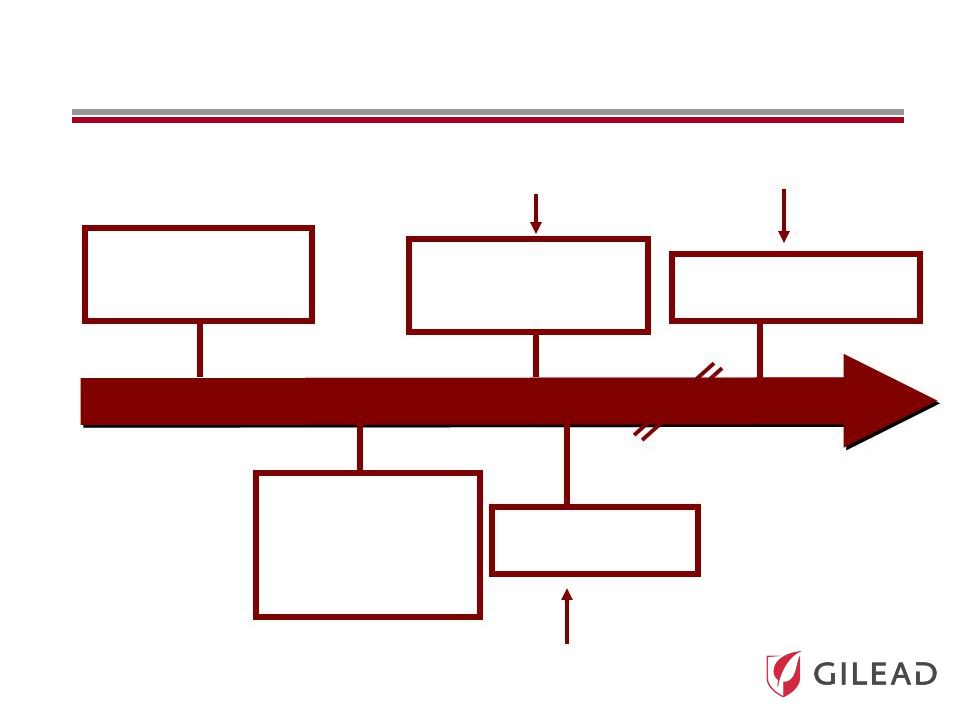

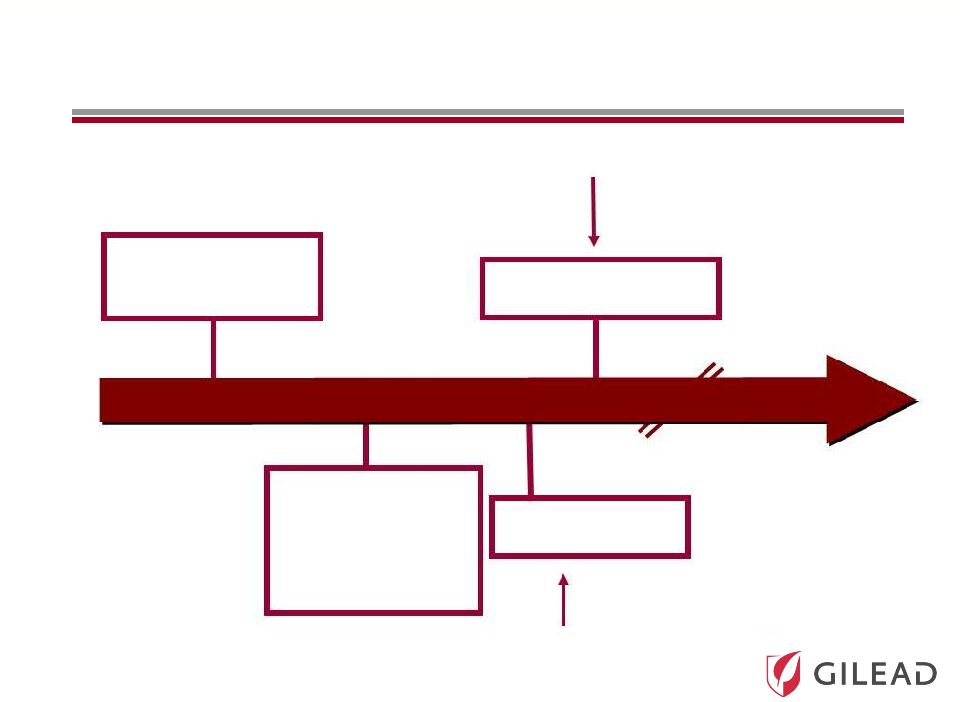

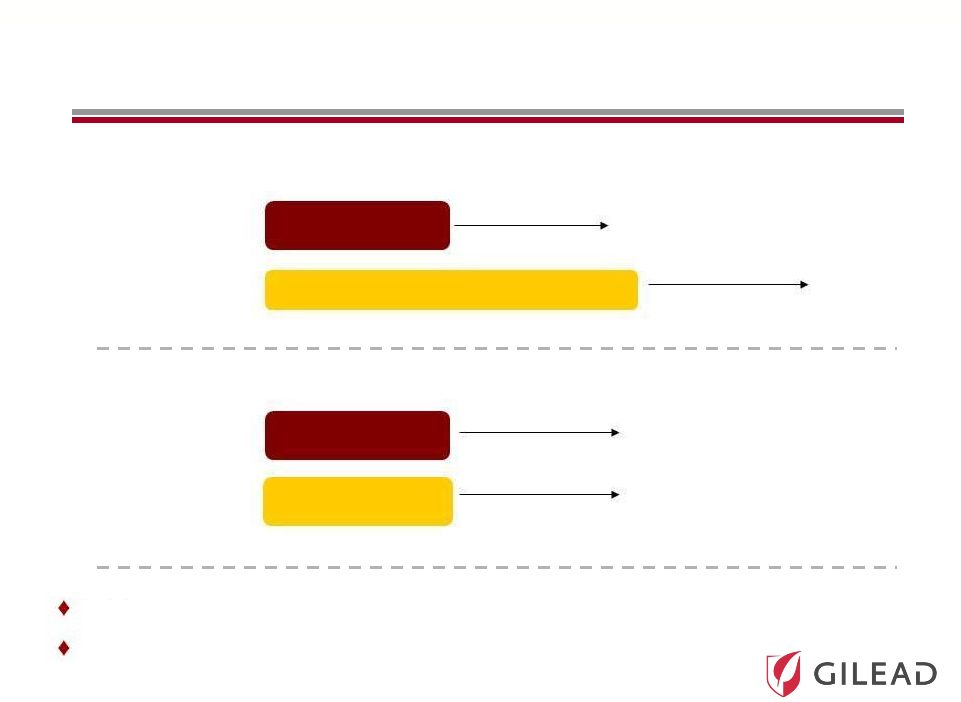

Slide 14 2010 2010 2011 2011 2020 2020 IFN Free Strategy Ultimate Goal The Evolution of HCV Therapy: 2010 Current Standard of Care (SOC): PEG + RBV Combination Oral Antivirals + Shorter Course IFN Broad Genotypic Oral Antiviral Regimen The First Antivirals + SOC to Improve Response Rates and Reduce Duration All Oral Antiviral Regimen IFN Sparing Strategy |

Slide 15 Current Standard of Care (SOC): PEG + RBV The First Antivirals + SOC to Improve Response Rates and Reduce Duration The Competitive Nature and Speed of Development Have Significantly Accelerated the Timelines Ultimate Goal All Oral Antiviral Regimen IFN Free Strategy 2010 2010 2011 2011 2020 2020 Broad Genotypic Oral Antiviral Regimen 2014 2014 |

Slide 16 Overview of Pharmasset HCV Portfolio |

Slide 17 Pharmasset’s HCV Nucleotide Portfolio PSI-7977 PSI-938 RG 7128 • 3.6 log HCV RNA with 400 mg QD over 3 days • Phase 3 in combination with ribavirin open to enrollment • Highest on treatment and SVR rates to date • Unpartnered with worldwide rights • 3.6 log HCV RNA with 300 mg QD over 3 days • Phase 2 • 14 day data, with ongoing 12 week studies • Unpartnered with worldwide rights • 0.6 log HCV RNA with 1gm BID • Phase 2b • Partnered with Roche |

Slide 18 PSI-7977: Pharmasset’s Lead Pyrimidine Nucleotide Analogue Excellent safety profile – 250 patients at 8 weeks or more – 1,500 patients by May 2014 High rates of cure in genotype 2/3 – 100% (10/10) with ribavirin – 60% (6/10) without ribavirin Studies in genotype 1 ongoing – Expecting Phase 2 SVR12 data early 2012 Multiple expanding data sets from studies in different patient populations |

Slide 19 PSI-7977: Genotype 2/3 Phase 2 Results (ELECTRON) Time (Weeks) PSI-7977 RBV 12 weeks PEG PSI-7977 RBV NO PEG PSI-7977 NO PEG NO RBV n/n (%) < LOD n/n (%) < LOD n/n (%) < LOD 2 8/11 (82%) 8/10 (80%) 8/10 (80%) 4 11/11 (100%) 10/10 (100%) 10/10 (100%) 12 11/11 (100%) 10/10 (100%) 10/10 (100%) SVR4 11/11 (100%) 10/10 (100%) 6/10 (60%) SVR12 11/11 (100%) 10/10 (100%) n/a n/a – not yet available |

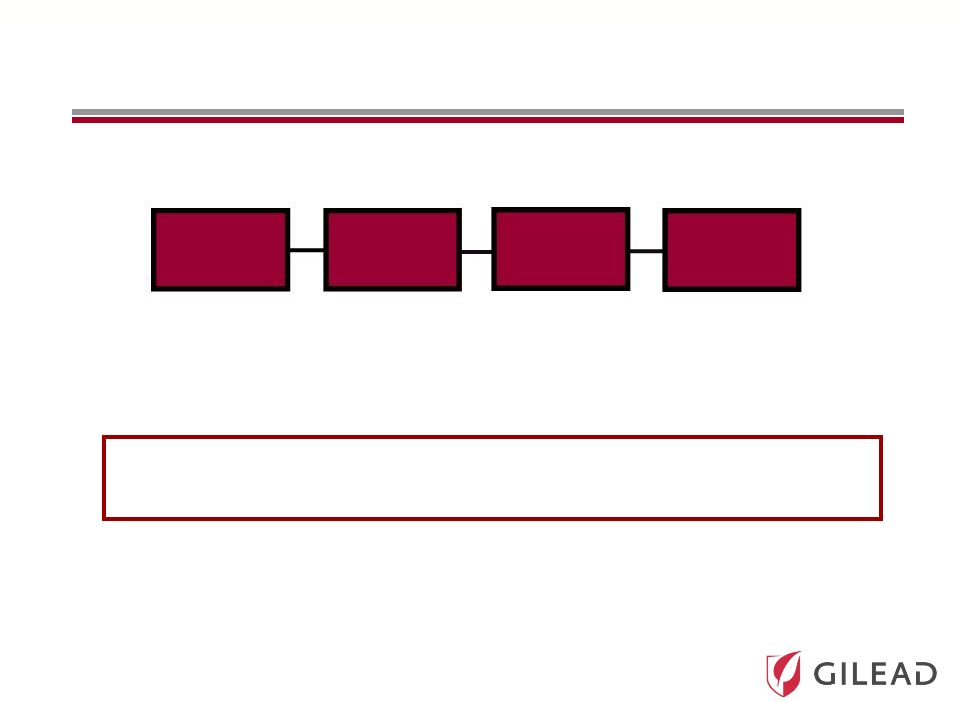

Slide 20 Pharmasset’s Phase 3 Program (Announced November 1, 2011) Genotype 2/3 (naïve) Genotype 2/3 (IFN intolerant) N=~250 N=~250 N=~150 N=~75 SVR12 SVR12 0 12 24 36 SVR12 SVR12 0 12 24 POSITRON FISSION 36 PSI-7977 400mg + RBV Peg-IFN + RBV PSI-7977 400mg + RBV PSI-7977 placebo + RBV placebo A third Phase 3 study to be initiated in genotype 1 patients in 1H 12 Targeted U.S. FDA approval in 2014 |

Slide 21 Key Remaining Questions in the Treatment of HCV Will one regimen work for all genotypes or will different regimens be required for different genotypes? How many molecules or mechanisms do you need? Can ribavirin be replaced? What is the minimum duration of therapy? Can HCV be cured with once-daily therapy? |

Slide 22 Gilead’s Combined HCV Opportunity |

Slide 23 Pharmasset and Gilead Combined HCV Efforts Position Us to Answer These Questions High barrier to resistance/pan-genotypic compounds will be an important component for any all-oral regimen – Pharmasset’s PSI-7977 is the most advanced, pan-genotypic compound with a high barrier to resistance – Ongoing efforts at Gilead to identify other pan-genotypic compounds Complementary portfolio accelerates potential for oral regimens – Includes direct acting antivirals with four different mechanisms in Phase 2/3 clinical development – Potential to pursue different combinations to then answer the question of duration of treatment and necessity of ribavirin Complementary portfolios cover a number of opportunities for once-daily regimens – Potential for co-formulation |

Slide 24 Phase PC GS 9451 (NS3 protease inhibitor)* GS 5885 (NS5A inhibitor)* GS 9620 (TLR-7 agonist)* GS 6620 (nucleotide NS5B inhibitor)** GS 9669 (non-nuc NS5B site 2 inhibitor)* Combined HCV Clinical Portfolio * Once-daily dosing I II III PSI-7977 (nucleotide NS5B inhibitor)* PSI-938 (nucleotide NS5B inhibitor)* Pharmasset Acquisition Complements and Accelerates Gilead’s HCV Portfolio GS 9256 (NS3 protease inhibitor)** Tegobuvir/GS 9190 (non-nuc NS5B inhibitor) ** No further clinical trials planned |

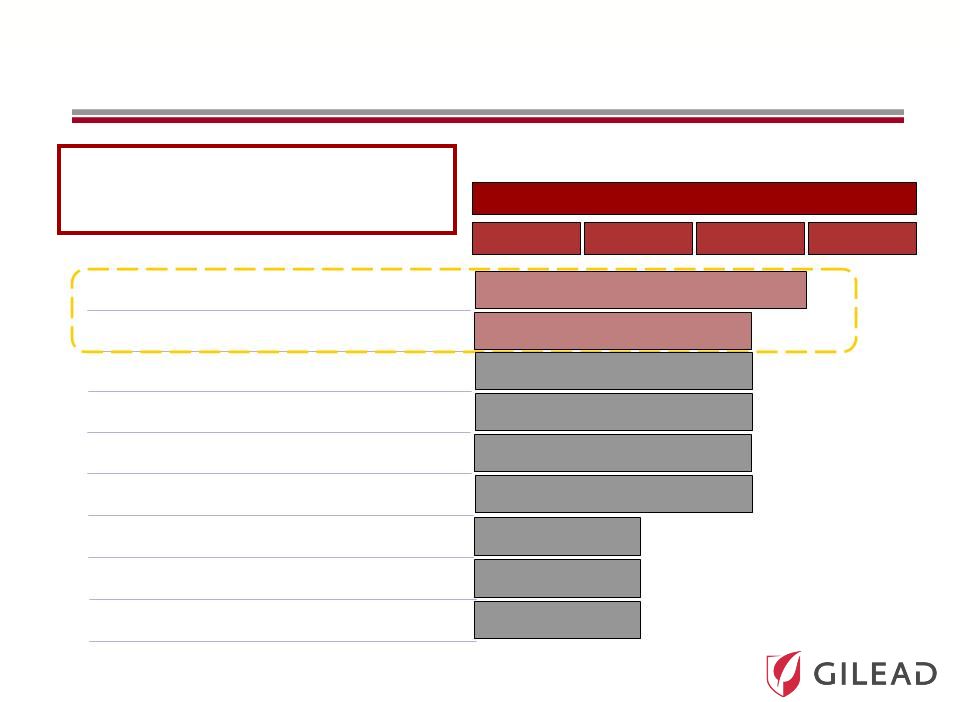

Slide 25 All-Gilead Portfolio Increases the Chance of Developing Oral Therapies across Genotypes Nuc PI NS5A Non-Nuc GS 5885 PSI-7977 PSI-938 GS 9451 GS 9190 GS 9669 Combination Therapies with High Potency May Further Combination Therapies with High Potency May Further Shorten Duration and Eliminate Ribavirin Shorten Duration and Eliminate Ribavirin |

Slide 26 2012 Key HCV Milestones Initiate and integrate Pharmasset’s Phase 3 programs – GT 2/3 programs: no change – GT 1: Phase 2 data will determine strategy Initiate clinical trial with PSI-7977 to define minimum treatment duration in GT 2/3 patients Initiate multiple enabling drug-drug interaction studies with Gilead and Pharmasset assets Explore combinations that exclude ribavirin Initiate programs in pre-transplant and HIV co-infected populations SVR data from Gilead’s all-oral Phase 2 Study 120 at EASL |

Slide 27 In Summary Accelerates Gilead’s strategy to develop the first all-oral regimen for the treatment of HCV Since HCV can be cured, it will be important to be first to market with an all-oral, well-tolerated regimen Pharmasset is a strategic fit with Gilead’s areas of operational excellence Opportunity to change revenue trajectory starting in 2014 |

Slide 28 Gilead’s Business Prospects Strong confidence in our core business – LTM HIV revenues of ~$6.4B in a total ~$13.0B market – LTM ~$1B in revenues coming from products outside HIV Anticipate major HIV product launches in 2012 – New revenue sources through partnerships to follow More Phase 2/3 programs across therapeutic areas than ever before – HIV, liver disease, oncology/inflammation/fibrosis, respiratory and cardiovascular Note: LTM = last twelve months |

Slide 29 Financial Impact of Pharmasset Acquisition Cash flows from core business will allow us to finance transaction Expect to use existing cash and $6.2 billion in incremental debt Committed to retaining investment grade credit rating – Debt/EBITDA ratio to return to 1.5x at closing + 1 year Transaction expected to be dilutive initially and significantly accretive beyond 2015 – Increased interest expense associated with transaction debt – Share repurchases to offset dilution as debt is repaid |

Slide 30 Transaction Summary Unique opportunity to dramatically change HCV disease burden worldwide Potential to extend leadership in liver disease to HCV Opportunity to parallel the commercial success in HIV Redefined potential for revenue growth in 2014 and beyond |

Gilead to Acquire Pharmasset November 21, 2011 |