UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________

FORM 10-K

___________________________________________

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | | | |

| For the transition period from to |

Commission File Number: 000-19756

___________________________________________

PDL BioPharma, Inc.

(Exact name of registrant as specified in its charter)

___________________________________________

| | | | | |

| Delaware | 94-3023969 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

59 Damonte Ranch Parkway, Suite B-375

Reno, Nevada 89521

(Address of principal executive offices)

Registrant’s telephone number, including area code

(775) 832-8500

932 Southwood Boulevard

Incline Village, Nevada 89451

(Former Address)

___________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Class | Trading Symbol | Name of Exchange on which Registered |

| None | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act: None

___________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | | | | |

Large accelerated filer ¨ | | | Accelerated filer ¨ | |

Non-accelerated filer ý | | | Smaller reporting company ☒ | |

| | | Emerging growth company ☐ | |

If an emerging growth company, indicated by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨ |

Indicate by check mark whether the registrant has filed a report and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ý

The aggregate market value of shares of common stock held by non-affiliates of the registrant, based on the closing sale price of a share of common stock on June 30, 2020 (the last business day of the registrant’s most recently completed second fiscal quarter), as reported on the Nasdaq Global Select Market, was $291,544,988.

As of January 6, 2021, the registrant had outstanding 114,515,806 shares of common stock.

PDL BIOPHARMA, INC.

2020 Form 10-K Annual Report

Table of Contents

| | | | | | | | | | | |

| PART I | | | |

| | | |

| Item 1 | | | |

| Item 1A | | | |

| Item 1B | | | |

| Item 2 | | | |

| Item 3 | | | |

| Item 4 | | | |

| | | |

| PART II | | | |

| | | |

| Item 5 | | | |

| Item 6 | | | |

| Item 7 | | | |

| Item 7A | | | |

| Item 8 | | | |

| Item 9 | | | |

| Item 9A | | | |

| Item 9B | | | |

| | | |

| PART III | | | |

| | | |

| Item 10 | | | |

| Item 11 | | | |

| Item 12 | | | |

| Item 13 | | | |

| Item 14 | | | |

| | | |

| PART IV | | | |

| | | |

| Item 15 | | | |

| Item 16 | | | |

| | | |

| |

PART I

Forward-looking Statements

This Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions, including any projections of earnings, revenues or other financial items, any statements of the plans and objectives of management for future operations, including any statements concerning the timing, implementation or success of our monetization strategy/plan of complete liquidation, any statements regarding future economic conditions or performance, and any statement of assumptions underlying any of the foregoing. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases, forward-looking statements can be identified by the use of terminology such as “may,” “will,” “intends,” “plans,” “believes,” “targets,” “anticipates,” “expects,” “estimates,” “predicts,” “potential,” “continue” or “opportunity,” or the negative thereof or other comparable terminology. The forward-looking statements in this Form 10-K are only predictions. Although we believe that the expectations presented in the forward-looking statements contained herein are reasonable at the time of filing, there can be no assurance that such expectations or any of the forward-looking statements will prove to be correct. These forward-looking statements, including with regards to our plan of dissolution, are subject to inherent risks and uncertainties, including but not limited to the risk factors set forth below, and for the reasons described elsewhere in this Form 10-K. All forward-looking statements and reasons why results may differ included in this Form 10-K are made as of the date hereof. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

We own or have rights to certain trademarks, trade names, copyrights and other intellectual property used in our business, including PDL BioPharma, Inc. and the PDL logo, each of which is considered a registered trademark. All other company names, product names, trade names and trademarks included in this Form 10-K are trademarks, registered trademarks or trade names of their respective owners.

ITEM 1. BUSINESS

Overview

In this report all references to “PDL,” “we,” “us,” “our” or the “Company” mean collectively PDL BioPharma, Inc. and its subsidiaries, except where it is made clear that the term means only PDL BioPharma, Inc.

Throughout our history, our mission has been to improve the lives of patients by aiding in the successful development of innovative therapeutics and healthcare technologies. PDL BioPharma was founded in 1986 as Protein Design Labs, Inc. when it pioneered the humanization of monoclonal antibodies, enabling the discovery of a new generation of targeted treatments that have had a profound impact on patients living with different cancers as well as a variety of other debilitating diseases. In 2006, we changed our name to PDL BioPharma, Inc.

Historically, we generated a substantial portion of our revenues through the license agreements related to patents covering the humanization of antibodies, which we refer to as the Queen et al. patents. In 2012, and in anticipation of declining revenues from the Queen et al. patents, we began providing alternative sources of capital through royalty monetizations and debt facilities, and, in 2016, we began acquiring commercial-stage products and launching specialized companies dedicated to the commercialization of these products, first with our acquisition of branded prescription pharmaceutical drugs from Novartis AG, Novartis Pharma AG and Speedel Holding AG (collectively, “Novartis”) in 2016 and, in 2017, with the acquisition of LENSAR, Inc. (“LENSAR”), a medical device ophthalmology equipment manufacturing company. In 2019, we entered into a securities purchase agreement with Evofem Biosciences, Inc. (“Evofem”), pursuant to which we invested $60.0 million in a private placement of securities. These investments provided funding for Evofem’s pre-commercial activities for Phexxi®, its non-hormonal, on-demand prescription contraceptive gel for women.

Our Segments

Based on the nature of our investments entered into between 2012 through 2019 and further discussed below, our operations were structured in four segments designated as Medical Devices, Strategic Positions, Income Generating Assets, and Pharmaceutical.

Our Medical Devices segment consisted of revenue from the sale and lease of the LENSAR® Laser System, which included equipment, Patient Interface Devices (“PIDs”), procedure licenses, training, installation, warranty and maintenance agreements.

Our Strategic Positions segment consisted of an investment in Evofem (NASDAQ: EVFM). Our investment included shares of common stock and warrants to purchase additional shares of common stock.

Our Pharmaceutical segment consisted of revenue derived from branded prescription medicine products sold under the name Tekturna® and Tekturna HCT® in the United States, Rasilez® and Rasilez HCT® in the rest of the world and revenue generated from the sale of an authorized generic form of Tekturna in the United States (collectively, the “Noden Products”).

Our Income Generating Assets segment consisted of revenue derived from (i) notes and other long-term receivables, (ii) royalty rights and hybrid notes/royalty receivables, (iii) equity investments and (iv) royalties from issued patents in the United States and elsewhere covering the humanization of antibodies, which we refer to as the Queen et al. patents.

Financial information about our segments, including our revenues and net loss for the eight months ended August 31, 2020 and the years ended December 31, 2019 and 2018, and select long-lived assets as of December 31, 2020 and 2019, is included in our Consolidated Financial Statements and accompanying notes in this Form 10-K.

Liquidation and Dissolution Plan

In September 2019, we engaged financial and legal advisors and initiated a review of our strategy. This review was completed in December 2019. At such time, we disclosed that we planned to halt the execution of our growth strategy, cease making additional strategic transactions and investments and instead pursue a formal process to unlock the value of our portfolio by monetizing our assets and ultimately distributing net proceeds to stockholders (the “monetization strategy”). We further announced in December 2019 that we would explore a variety of potential transactions in connection with the monetization strategy, including a whole Company sale, divestiture of our assets, spin-offs of operating entities, merger opportunities or a combination thereof. Over the subsequent months, our board of directors (the “Board”) and management analyzed, together with our outside financial and legal advisors, how to best capture value pursuant to our monetization strategy and best return the significant intrinsic value of the assets in our portfolio to the stockholders.

In February 2020, the Board approved a plan of complete liquidation (the “Plan of Liquidation”) of our assets and passed a resolution to seek stockholder approval to dissolve our Company. At our Annual Meeting of Stockholders in August 2020, the proposal to liquidate and dissolve our Company pursuant to a plan of dissolution was approved by our stockholders. On November 5, 2020, our Board approved filing a certificate of dissolution with the Secretary of State of Delaware in January 2021 and proceeding to complete the dissolution process for our Company in accordance with the Delaware General Corporate Law. The filing of the certificate of dissolution occurred on January 4, 2021 and we closed our stock transfer books as of such date (the “Final Record Date”). After such time, we are not recording any further transfers of our common stock, except pursuant to the provisions of a deceased stockholder’s will, intestate succession, or by operation of law and we will not issue any new stock certificates, other than replacement certificates. In addition, we will not be issuing any shares of our common stock for the outstanding stock options. As a result of the closing of our transfer books, it is anticipated that distributions, if any, made in connection with the dissolution will be made pro rata to the stockholders of record as of the Final Record Date. In accordance with our dissolution plan, we completed the voluntary delisting process from the Nasdaq Stock Market exchange so that suspension of trading occurred before the market opened on December 31, 2020 and official delisting of our stock occurred on January 7, 2021. On January 8, 2021, we filed a Form 15 notifying the SEC of deregistration of our common stock under Section 12(g) of the Exchange Act and suspension of our duty to file reports under Sections 13 and 15(d) of the Exchange Act. We do not anticipate participating in Over-The-Counter (“OTC”) trading related to our stock or economic interests in our stock.

Pursuant to our monetization strategy, we explored a variety of potential transactions, including a whole Company sale, divestiture of assets, spin-offs of operating entities, merger opportunities or a combination thereof. In addition, we analyzed, and continue to analyze, optimal mechanisms for returning value to stockholders in a tax-efficient manner, including share repurchases, cash dividends and other distributions of assets. Despite the challenges of the 2019 novel coronavirus (“COVID-19”), we made significant progress in our monetization strategy during 2020, including monetizing most of our key assets and resolving a longstanding legal issue as follows:

•In May 2020, pursuant to our Plan of Liquidation we made a liquidation distribution of all of our common stock in Evofem to PDL stockholders of record as of the close of business on May 15, 2020 (the “Evofem Record Date”).

•In August 2020, we entered into a settlement agreement (the “Settlement Agreement”) with related entities of Defined Diagnostics, LLC (f/k/a Wellstat Diagnostics, LLC) (“Wellstat Diagnostics” and, together with such related entities, the “Wellstat Parties”) resolving previously reported litigation relating to loans made to Wellstat Diagnostics by us

•In August 2020, we sold three royalty interests related to third party sales of Kybella®, Zalviso®, and Coflex® to SWK Funding, LLC (“SWK”), a wholly owned subsidiary of SWK Holdings Corporation

•In September 2020, we completed the previously announced sale of our interest in Noden DAC and Noden USA

•In October 2020, pursuant to our Plan of Liquidation we completed the previously announced spin-off of LENSAR, our majority-owned medical device company, whereby we made a liquidation distribution of all of our shares of LENSAR common stock to our stockholders as of September 22, 2020 (the “LENSAR Record Date”)

•In December 2020, we entered into a Capital Provision Agreement with Epps Investments LLC (“Epps”) regarding our previously announced Settlement Agreement with the Wellstat Parties whereby we sold all remaining amounts owed to us under the Settlement Agreement for consideration received

The Settlement Agreement with the Wellstat Parties provided for the payment of $7.5 million upon the signing of the Settlement Agreement, which has been received, and either (1) $5.0 million by February 10, 2021 and $55.0 million by July 26, 2021; or (2) $67.5 million by July 26, 2021. Under the terms of the Settlement Agreement, failure by the Wellstat Parties to make payment in full by July 26, 2021, authorized us to record judgment against the Wellstat Parties for an amount of $92.5 million or such lesser amount as may be owed under the Settlement Agreement.

Pursuant to the Capital Provision Agreement with Epps we received $51.4 million on December 31, 2020 in exchange for 100% of the payments or other property or value received by PDL on or after the date of the Capital Provision Agreement pursuant to the Settlement Agreement.

The proceeds from the sale of the three royalty interests to SWK totaled $4.35 million, 90% of which was received at the closing of the transaction. The remaining 10% is currently held in escrow against certain potential contingencies and is to be released on the one-year anniversary of the closing, subject to the satisfaction of any such potential contingencies.

On July 30, 2020, we signed a definitive agreement for the sale of our interest in Noden DAC and Noden USA to CAT Capital Bidco Limited (“Stanley Capital”). In accordance with the terms of the agreement, we expect to receive consideration of up to $52.8 million. Stanley Capital made an initial cash payment to us of $12.2 million on the September 9, 2020 closing date. We are also entitled to recover $0.5 million related to value-added tax (“VAT”) for inventory purchases from Novartis. The agreement provides for an additional $33.0 million to be paid to us in twelve equal quarterly installments from January 2021 to October 2023, of which the first installment payment has been received. An additional $3.9 million will be paid in four equal quarterly installments from January 2023 to October 2023. The agreement also provides for the potential for additional contingent payments to us. We are entitled to receive $2.5 million upon Stanley Capital or any of its affiliates entering into a binding agreement for a specified transaction within one year of the closing date. We are also entitled to 50% of a license fee from a third party distributor within 10 days of receipt by Noden. Upon closing, we recorded a gain of $0.2 million. In connection with the closing of the transaction, the guaranty agreement between Novartis and us which guaranteed certain payments owed to Novartis by Noden was terminated.

We intend to pursue monetization of our remaining assets in a disciplined and cost-effective manner to maximize returns to stockholders. At the same time, we recognize that accelerating the timeline to complete our monetization process, while continuing to optimize asset value, could increase returns to stockholders due to reduced general and administrative expenses as well as provide for faster returns to stockholders. While we are cognizant that an accelerated timeline may provide greater and faster returns to our stockholders, we also recognize that the duration and extent of the public health issues related to the COVID-19 pandemic make it possible that the timing of the sale of all or substantially all of our remaining assets may require additional time to execute or for us to pursue alternatives to the sale of these assets. For example, if a suitable offer to purchase the remaining royalty assets is not received prior to completing the dissolution process, they could be placed in a liquidating trust. The available proceeds from either the ongoing collection of royalty income or from the sale of the royalty assets would ultimately be distributed to our stockholders. We will continue to assess the market for our remaining assets to determine the appropriate time to sell them or to opt for alternative paths to return their value to our stockholders.

Following is a discussion of our current and historical segments.

Medical Devices

LENSAR

LENSAR is a commercial-stage medical device company focused on designing, developing and marketing an advanced femtosecond laser system for the treatment of cataracts and the management of pre-existing or surgically induced corneal astigmatism. LENSAR’s femtosecond laser uses proprietary advanced imaging and laser technology to customize planning and treatments, allowing faster visual recovery and improved outcomes, as compared to conventional cataract surgery, a more manual procedure combined with ultrasound, referred to as phacoemulsification. LENSAR has developed the LENSAR® Laser System, which is the only femtosecond cataract laser built specifically for refractive cataract surgery. At spin-off, LENSAR had over 95 granted patents in the United States and the rest of the world and over 55 pending patent applications in the United States and the rest of the world.

As noted above, on October 1, 2020 all outstanding shares of LENSAR common stock held by us were distributed to our holders of common stock as of the LENSAR Record Date. On October 1, each of our stockholders received 0.075879 shares of LENSAR common stock for every one share of our common stock held by such holders, based on the number of outstanding shares on the LENSAR Record Date. LENSAR continues to own and operate its femtosecond laser system business following completion of the distribution. As of October 1, 2020 LENSAR became an independent, publicly traded company listed on the Nasdaq Stock Market under the symbol “LNSR”.

Strategic Positions

Evofem

We invested $60.0 million in Evofem in the second quarter of 2019, representing approximately a 27% ownership interest in the company as of March 31, 2020. The transaction was structured in two tranches. The first tranche comprised $30.0 million, which was funded on April 11, 2019. We invested an additional $30.0 million in a second tranche on June 10, 2019, alongside two existing Evofem stockholders, who each invested an additional $10.0 million. On May 21, 2020 we distributed all of our 13,333,334 shares of common stock of Evofem to our stockholders of record on the Evofem Record Date, which represented approximately 26.7% of the outstanding shares of Evofem common stock as of the close of business on May 15, 2020. As of December 31, 2020, we continued to hold the warrants to purchase up to 3,333,334 shares of Evofem common stock.

Evofem is a commercial-stage biopharmaceutical company committed to developing and commercializing innovative products to address unmet needs in women’s sexual and reproductive health. Evofem is leveraging its proprietary Multipurpose Vaginal pH Regulator (MVP-R™) platform for its first commercial product Phexxi® (L-lactic acid, citric acid and potassium bitartrate) for hormone-free birth control. On May 22, 2020 Phexxi® was approved by the U.S. Food and Drug Administration for the prevention of pregnancy in women who choose to use on demand methods for their contraceptive needs. On September 8, 2020, Phexxi® was commercially launched in the United States.

As of June 30, 2020, the Strategic Positions segment was classified as discontinued operations.

Pharmaceutical

Noden

On July 1, 2016, our subsidiary, Noden DAC, entered into an asset purchase agreement (“Noden Purchase Agreement”) whereby it purchased from Novartis the exclusive worldwide rights to manufacture, market, and sell the Noden Products and certain related assets and assumed certain related liabilities (the “Noden Transaction”). Noden DAC and Noden USA, together, and including their respective subsidiaries represented deployed capital of $191.2 million.

Tekturna (or Rasilez outside of the United States) contains aliskiren, a direct renin inhibitor, for the treatment of hypertension. While indicated as a first line treatment, it is more commonly used as a third line treatment in those patients who are intolerant of angiotensin-receptor blockers (“ARBs”) or angiotensin converting enzyme inhibitors (“ACEIs”). Studies indicate that approximately 12% of hypertension patients are ARB/ACEI intolerant. Tekturna and Rasilez are not indicated for use with ARBs and ACEIs in patients with diabetes or renal impairment and are contraindicated for use by pregnant women. In March 2019, we launched an authorized generic (“AG”) form of Tekturna, aliskiren hemifumarate 150 mg and 300 mg tablets in the United States with the same drug formulation as Tekturna. The AG is distributed by Prasco, LLC d/b/a Prasco Laboratories.

Tekturna HCT is a combination of aliskiren and hydrochlorothiazide, a diuretic, for the treatment of hypertension in patients not adequately controlled by monotherapy and as an initial therapy in patients likely to need multiple drugs to achieve their blood pressure goals. It is not indicated for use with ACEIs and ARBs in patient with diabetes or renal impairment, or for use in patients with known anuria or hypersensitivity to sulfonamide derived drugs and is contraindicated for use by pregnant women.

On September 9, 2020, we sold 100% of our interests in our wholly owned subsidiaries Noden DAC and Noden USA to Stanley Capital.

As of March 31, 2020, the Pharmaceutical segment was classified as discontinued operations.

Income Generating Assets

The income generating assets included in continuing operations consist of (i) notes and other long-term receivables, (ii) equity investments and (iii) royalties from the Queen et. al patents.

Notes and Other Long-Term Receivables

We have entered into credit agreements with borrowers across the healthcare industry, under which we made available cash loans to be used by the borrower. Obligations under these credit agreements are typically secured by a pledge of substantially all the assets of the borrower and any of its subsidiaries. As of December 31, 2020, we had one note receivable transaction outstanding, CareView, which is summarized below:

CareView

Technology

CareView is a provider of products and on-demand application services for the healthcare industry by specializing in bedside video monitoring, archiving and patient care documentation systems and patient entertainment services.

Deal Summary

In June 2015, we entered into a credit agreement with CareView, whereby we made available to CareView up to $40.0 million in loans comprised of two tranches of $20.0 million each, subject to CareView’s attainment of specified milestones and under which we have a security interest in substantially all of CareView’s assets. In October 2015, we and CareView entered into an amendment of the credit agreement to modify certain definitions related to the first and second tranche milestones and we funded the first tranche of $20.0 million, net of fees, based on CareView’s attainment of the first milestone, as amended. The second $20.0 million tranche was not funded due to CareView’s failure to meet the funding milestone and we have no further funding obligation at this time. The outstanding borrowing under the credit agreement initially bore interest at the rate of 13.5% per annum payable quarterly in arrears. Principal repayment was to commence on the ninth quarterly interest payment date and continue in equal installments until final maturity of the loan in October 2020.

In February 2018, we entered into a modification agreement with CareView (the “February 2018 Modification Agreement”) whereby we agreed, effective as of December 28, 2017, to modify the credit agreement before remedies could otherwise have become available to us under the credit agreement in relation to certain obligations of CareView that would potentially not be met, including the requirement to make principal payments. Under the February 2018 Modification Agreement, we agreed that (i) a lower liquidity covenant would be applicable and (ii) principal repayment would be delayed for a period of up to December 31, 2018. In exchange for agreeing to these modifications, among other things, the exercise price of our warrants to purchase 4.4 million shares of common stock of CareView was reduced and, subject to the occurrence of certain events, CareView agreed to grant us additional equity interests. In each of September 2018, December 2018, May 2019, September 2019 and December 2019, we entered into amendments to the February 2018 Modification Agreement with CareView whereby we agreed to deferrals of principal repayments and interest payments. In the May 2019 amendment we also increased the interest rate to 15.5% and removed the liquidity covenant under the credit agreement. In January 2020 we agreed to a further amendment of the February 2018 Modification Agreement that deferred principal repayment and interest payments until April 30, 2020, which was conditioned upon CareView raising additional financing from third parties. Pursuant to further amendments to the February 2018 Modification Agreement, the Company has agreed to defer principal and interest payments until May 31, 2021.

Royalties from Queen et al. patents

We have been issued patents in the United States and elsewhere, covering the humanization of antibodies, which we refer to as our Queen et al. patents. Our Queen et al. patents, for which final patent expiry was in December 2014, covered, among other things, humanized antibodies, methods for humanizing antibodies, polynucleotide encoding in humanized antibodies and methods of producing humanized antibodies.

We previously entered into licensing agreements under our Queen et al. patents with numerous entities that are independently developing or have developed humanized antibodies. Under our licensing agreements, we are entitled to receive a flat-rate royalty based upon our licensees’ net sales of covered antibodies, although the royalties under these agreements have substantially ended.

Solanezumab is a Lilly-licensed humanized monoclonal antibody being tested in a study of older individuals who may be at risk of memory loss and cognitive decline due to Alzheimer’s disease. Lilly has characterized the study as an assessment of whether an anti-amyloid investigational drug in older individuals who do not yet show symptoms of Alzheimer's disease cognitive impairment or dementia can slow memory loss and cognitive decline. The study will also test whether solanezumab treatment can delay the progression of Alzheimer’s disease related brain injury on imaging and other biomarkers. If solanezumab is approved and commercialized pursuant to this clinical trial or another, we would be entitled to receive a royalty based on a "know-how" license for technology provided in the design of this antibody. The 2% royalty on net sales is payable for 12.5 years after the product's first commercial sale. The above described study is currently in Phase 3 testing with an estimated study completion date expected in January of 2023.

Competition

The underlying products associated with our income generating assets compete with existing products and are vulnerable to new branded or generic entrants in the marketplace.

Human Capital

As of December 31, 2020, we had 11 full-time employees managing our intellectual property, operations and other corporate activities, as well as performing certain essential functions of a public company. All of our employees were based in the United States. None of our employees are covered by a collective bargaining agreement, and we consider our relationship with our employees to be good. As a result of the dissolution process, our human capital resources objectives include, retaining, and incentivizing our management team and other employees as we continue our monetization strategy. For example, the Compensation Committee of the Board adopted a Wind Down Retention Plan in which our executive officers and other employees were eligible to participate. Under the Wind Down Retention Plan, participants have been eligible to earn a retention benefit in consideration for their continued employment with us as we continue our monetization strategy and dissolution process.

About PDL

We were incorporated under the laws of the state of Delaware in 1986 under the name Protein Design Labs, Inc. In 2006, we changed our name to PDL BioPharma, Inc. Our business previously included a biotechnology operation that was focused on the discovery and development of novel antibodies. We spun-off the operation to our stockholders as Facet Biotech Corporation (“Facet”) in December 2008. Our principal executive offices are located at 10585 Double R Boulevard, Reno, Nevada, 89521, (775) 832-8500, and our website address is www.pdl.com. The information in or accessible through our website is not incorporated into, and is not considered part of, this filing.

Available Information

We file electronically with the SEC our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that website is www.sec.gov.

We make available free of charge on or through our website at www.pdl.com our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and proxy statements, as well as amendments to these reports and statements, as soon as practicable after we have electronically filed such material with, or furnished them to, the SEC. You may

also obtain copies of these filings free of charge by calling us at (775) 832-8500. The information in or accessible through the SEC and our website is not incorporated into, and is not considered part of, this filing.

On January 8, 2021, we filed a Form 15 notifying the SEC of deregistration of our common stock under Section 12(g) of the Exchange Act and suspension of our duty to file reports under Sections 13 and 15(d) of the Exchange Act.

ITEM 1A. RISK FACTORS

RISK FACTORS

Set forth below and elsewhere in this Annual Report on Form 10-K and in other documents we file with the Securities and Exchange Commission (SEC) are descriptions of the risks and uncertainties that could cause our actual results to differ materially from the results contemplated by forward looking statements contained in this Annual Report on Form 10-K. You should carefully consider and evaluate all of the information included in this report, including the risk factors set forth. The following is not an exhaustive discussion of all of the risks facing our company. Additional risks not presently known to us or that we currently deem immaterial may impair our wind-down.

Risks Related to Our Dissolution

There can be no assurances as to the amount of distributions, if any, to be made to our stockholders.

We filed for dissolution in January of 2021 and intend to use the dissolution process under Delaware law to liquidate our remaining assets, settle claims and, if available, make liquidating distributions of cash or other property to our stockholders. However, our dissolution and the liquidation of our remaining assets will be subject to uncertainties, and it is possible that there will be no additional liquidating distribution made to our stockholders.

We intend to rely on the “safe harbor” procedures under Sections 280 and 281(a) of the Delaware General Corporation Law (the DGCL) to, among other things, obtain an order from the Delaware Court of Chancery (the Court Order) establishing the amount and form of security for pending claims for which the Company is a party, contingent or unmatured contract claims for which the holder declined the Company’s offer of a security, and unknown claims that, based on facts known to the Company, are likely to arise or become known within five years from the filing of the Certificate of Dissolution (or such longer period of time, not to exceed ten years, as the Delaware Court of Chancery may determine), and pay or make reasonable provision for our uncontested known claims and expenses and establish reserves for other claims as required by the Court Order and the DGCL. We expect to distribute all of our remaining assets in excess of the amount to be used by us to pay claims and fund the reserves required by the Court Order and pay our operating expenses through the completion of the dissolution and winding-down process to our stockholders. The Court Order will reflect the Delaware Court of Chancery’s own determination as to the amount and form of security reasonably likely to be sufficient to provide compensation for all known, contingent and potential future claims against us. There can be no assurances that the Delaware Court of Chancery will not require us to withhold additional amounts in excess of the amounts that we believe are sufficient to satisfy our potential claims and liabilities. Accordingly, stockholders may not receive any distributions of our remaining assets, if any, for a substantial period of time.

In addition, there are numerous factors that could impact the amount of the reserves to be determined by the Court Order, and consequently the amount of cash initially available for distribution, if any, to our stockholders following the filing of the Certificate of Dissolution, including without limitation:

•whether any claim is resolved or barred pursuant to Section 280 of the DGCL;

•unanticipated costs relating to the defense, satisfaction or settlement of existing or future lawsuits or other claims threatened against us;

•whether unforeseen claims are asserted against us, in which case we would have to defend or resolve such claims and/or be required to establish additional reserves to provide for such claims;

•the amount of time it will take us to liquidate all of our remaining non-cash assets, and the amount of any costs and expenses that may be incurred in connection therewith;

•the amount of cash collected from amounts due from previous asset sales, such as our sale of Noden to Stanley Capital;

•the time to complete any tax audits for tax years impacted by amounts claimed under the CARES Act;

•the value, if any, we are able to obtain for our remaining non-cash assets in our monetization process;

•whether our royalty assets, for the next couple of years, and afterwards if retained in a liquidation trust, continue to perform as expected; and

•whether any of the expenses incurred in the winding-down process, including expenses of required personnel and other operating expenses (including legal, accounting and other professional fees) necessary to dissolve and liquidate the Company, are more or less than our estimates.

Further, the amount of any distributable proceeds and our ability to make distributions to our stockholders depend on our ability to execute our monetization strategy for our remaining non-cash assets, which is subject to significant risks and uncertainties, as further discussed in other risk factors herein.

In addition, as we wind down, we will continue to incur costs to manage the remaining business, such as salaries and other employee compensation, rental payments, insurance, and taxes, contractual obligations to current and former employees (e.g., true-up payments to holders of stock options that vested prior to the filing for dissolution) and other legal, accounting, financial advisory and consultant fees, which will reduce any amounts available for distribution to our stockholders.

As a result of these and other factors, we cannot assure you as to any amounts to be distributed to our stockholders in dissolution.

Liquidating distributions to stockholders could be substantially reduced and/or delayed due to uncertainty regarding the resolution of potential tax claims, litigation matters and other unresolved contingent liabilities of the Company.

Whether any remaining assets of the Company can be used to make liquidating distributions to stockholders would depend on whether claims for which we have set aside reserves are resolved or satisfied at amounts less than such reserves and whether a need has arisen to establish additional reserves. For example, we are subject to tax audits by the California Franchise Tax Board that have yet to be resolved, and the timing for resolution of such audits is uncertain. We cannot assure stockholders that our liabilities can be resolved for less than the amounts we have reserved, that unknown liabilities that have not been accounted for will not arise or the timing with respect to resolution of any such liabilities or claims. As a result, we may continue to hold back funds and delay additional liquidating distributions to stockholders.

We cannot predict the timing of the distributions to stockholders.

Under the DGCL, before a dissolved corporation may make any distribution to its stockholders, it must pay or make reasonable provision to pay all of its claims and obligations, including all contingent, conditional or unmatured contractual claims known to the corporation. The precise amount and timing of any distributions to our stockholders will depend on and could be delayed or diminished due to many factors, including without limitation:

•whether a claim is resolved for more than the amount of reserve established for such claim pursuant to the Court Order;

•whether we are unable to resolve claims with creditors or other third parties, or if such resolutions take longer than expected;

•whether a creditor or other third party seeks an injunction against the making of additional distributions to stockholders on the basis that the amounts to be distributed are needed to satisfy our liabilities or other obligations to the extent not previously reserved for;

•whether due to new facts and developments, new claims, as the Board reasonably determines, require additional funds to be reserved for their satisfaction; and

•whether the expenses we incur in the winding-down process, including expenses of personnel required and other expenses (including legal, accounting and other professional fees) necessary to dissolve and liquidate the Company are more than anticipated.

As a result of these and other factors, it might take significant time to resolve these matters, and as a result we are unable to predict the timing of distributions, if any, made to our stockholders.

Our dissolution pursuant to the Plan of Dissolution may be disrupted and adversely impacted by the effects of natural disasters, political crises, public health crises, and other events outside of our control.

Natural disasters, such as adverse weather, fires, earthquakes, power shortages and outages, political crises, such as terrorism, war, political instability, or other conflict, criminal activities, public health crises, such as the COVID-19 pandemic and other disease epidemics and pandemics, and other disruptions or events outside of our control could negatively affect our operations and our ability to monetize our remaining assets or realize the estimated value of our net assets in liquidation. Any of these events may cause a delay in our ability to make distributions in dissolution, and may materially impact the amount of cash or value of other non-cash assets available to distribute to our stockholders, if any.

Our stockholders may be liable to our creditors for part or all of the amount received from us in our liquidating distributions if reserves are inadequate.

In dissolution we may establish a contingency reserve designed to satisfy any additional claims and obligations that may arise. Any contingency reserve may not be adequate to cover all of our claims and obligations. Under the DGCL, if we fail to create an adequate contingency reserve for payment of our expenses, claims and obligations, each stockholder could be held liable for payment to our creditors for claims brought during this three-year period after we filed the Certificate of Dissolution with the Secretary of State, up to the lesser of (i) such stockholder’s pro rata share of amounts owed to creditors in excess of the contingency reserve and (ii) the amounts previously received by such stockholder in dissolution from us and from any liquidating

trust or trusts. Accordingly, in such event, a stockholder could be required to return part or all of the distributions previously made to such stockholder in dissolution, and a stockholder could receive nothing from us under the Plan of Dissolution. Moreover, if a stockholder has paid taxes on amounts previously received, a repayment of all or a portion of such amounts received could result in a situation in which such repayment does not result in a commensurate refund of such taxes paid. As a result, while we intend to use the protections of DGCL Sections 280 and 281(a), including having a court order approve distributions, it is important for us to retain sufficient funds through our dissolution to pay the expenses and liabilities actually owed to our creditors because if we fail to do so, each stockholder could be held liable for the repayment to creditors out of the amounts previously distributed to such stockholder from us or from any liquidating trust or trusts, up to the full amount actually received by such stockholder in our dissolution.

The directors and officers of the Company will continue to receive benefits from the Company during the dissolution.

During the dissolution, we will continue to indemnify each of our current and former directors and officers to the extent permitted under the DGCL and the Company’s certificate of incorporation, bylaws and agreements as in effect at the time of the filing of the Certificate of Dissolution.

Further stockholder approval will not be required in connection with the implementation of our Plan of Dissolution, including for the sale or disposition of any of our remaining assets.

Our Plan of Dissolution provides that we may sell our remaining assets after dissolution, as necessary to affect our Plan of Dissolution. Under our Plan of Dissolution, we will not seek and are not required to seek additional stockholder authorization of any future asset sale. As a result, the Board may authorize actions in implementing the Plan of Dissolution, including the terms and prices for the sale or disposition of our remaining assets, with which our stockholders may not agree.

Our common stock ceased to be traded at the time of our dissolution.

We closed our stock transfer books of our common stock after our dissolution became effective at approximately 4:00 p.m., Eastern time on January 4, 2021 (the “Final Record Date”). Therefore, shares of our common stock are no longer freely transferable. As a result of the closing of the stock transfer books, all liquidating distributions from a liquidating trust, if any, or from us after the Final Record Date will be made pro rata to the stockholders of record as of the Final Record Date.

We have not and do not intend to record any assignments or transfers of our common stock after the Final Record Date, other than as required by will, intestate succession or operation of law. We have been informed that after the Final Record Date some shares of our common stock have been traded under contractual obligations between the seller and purchaser of the stock, who negotiate and rely on themselves with respect to the allocation of stockholder proceeds arising from ownership of the shares. We are not facilitating or participating in the trading in our common stock or interests in proceeds from our liquidation. Accordingly, trading in our stock is highly speculative and the market for our stock is highly illiquid. As we are no longer an operating company, the only value underlying the trading price of our shares is the right to receive further distributions, if any, as part of the liquidation process. Because of the difficulty in estimating the amount and timing of the liquidating distributions and due to the other risk factors discussed herein, the economic interests derived from our common stock may be subject to significant volatility and may trade above or below the amount of any future liquidating distribution that may be made.

The loss of key personnel could adversely affect our ability to efficiently dissolve, liquidate and wind down.

We intend to rely on a few individuals in key management roles to dissolve, liquidate our remaining assets and wind-down operations. Loss of one or more of these key individuals could hamper the efficiency or effectiveness of these processes.

Our remaining licensees, borrowers and royalty-agreement counterparties may be unable to maintain regulatory approvals for their products, or to obtain regulatory approvals or favorable pricing for new products, and they may voluntarily remove products from marketing and commercial distribution. Any of such events, whether due to safety issues or other factors, could limit our revenues or return on investment. or our ability to generate expected returns from the monetization of such assets, including their sale, and reduce resulting distributions to our stockholders in dissolution.

Our licensees, borrowers and royalty-agreement counterparties are subject to stringent regulation with respect to product safety and efficacy by various international, federal, state and local authorities. Even if our licensees’, borrowers’ and royalty-agreement counterparties’ products receive regulatory approval, they will remain subject to ongoing FDA and other international regulations including, but not limited to, obligations to conduct additional clinical trials or other testing, changes to the product label, new or revised regulatory requirements for manufacturing practices, written advisements to physicians and/or a product recall or

withdrawal. Our licensees, borrowers and royalty-agreement counterparties may not maintain necessary regulatory approvals for their existing products. Moreover, the current political environment in the United States is focused on potential reductions in pricing for pharmaceutical and other healthcare products, which may negatively impact any existing or new products from which our revenues would be derived. We are unable to control the pricing strategies used by our licensees, borrowers and royalty-agreement counterparties, and if they fail to use appropriate pricing strategies, or receive negative reactions to their pricing strategies, it could negatively impact our revenues or return on investment.

In addition, communications from government officials regarding pricing for pharmaceutical and other health care products could have a negative impact on the value of the assets we intend to monetize, even if such communications do not ultimately impact our borrowers’ and royalty-agreement counterparties’ products. The occurrence of adverse events reported by any borrower or royalty-agreement counterparty may result in the revocation of regulatory approvals or decreased sales of the applicable product due to a change in physicians’ willingness to prescribe, or patients’ willingness to use the applicable product. Our borrowers and royalty-agreement counterparties could also choose to voluntarily remove licensed products from marketing and commercial distribution. Any value we may receive upon a potential transaction in furtherance of our monetization strategy in dissolution could be materially and adversely affected.

The value of our remaining income generating royalty assets may be dependent on the actions of unrelated third parties, which may negatively impact the value we are able to realize in dissolution.

In connection with our income generating assets, we are dependent, to a large extent, on third parties to enforce certain rights for our benefit. For example, Assertio (formerly Depomed), as the licensor of certain patents, retains various rights, including the contractual right to audit its licensees and to ensure those licensees are complying with the terms of the underlying license agreements. Assertio also retained full responsibility to protect and maintain the intellectual property rights underlying the licenses. While we have contractual rights to require Assertio to take action regarding certain of these rights, because Assertio’s economic interest in the license agreements is limited, it may not enforce or protect those rights as it otherwise would have had it retained the full economic interest in the payments under the license agreements.

Our royalty-agreement counterparties face significant market pressures with respect to their products, and the amount of revenues from their pharmaceutical products or medical devices, or from our income generating assets that we receive are subject to various competitive and market factors, including generic competitors, that may be outside of our control.

Our royalty-agreement counterparties face competition from other pharmaceutical companies. The introduction of new competitive products, including generics, may result in lost market share for our royalty-agreement counterparties, reduced use of their products, lower prices and/or reduced sales, any of which could reduce our royalty revenues, and have a material adverse effect on any realized value we may obtain in connection with the evaluation of potential transactions to monetize such remaining assets in dissolution.

The amounts we are able to realize from any transaction in furtherance of our monetization of our remaining assets, and the amount of cash or other assets we are able to distribute our stockholders in dissolution, will depend on many factors, including the following:

•the timing and availability of generic product competition for our royalty-agreement counterparties’ products;

•potential challenges or design-arounds to product, use or manufacturing related patents which provide exclusivity for products and assets before their expiration by generic pharmaceutical manufacturers;

•the size of the market for our royalty-agreement counterparties’ products;

•the extent and effectiveness of the sales and marketing and distribution support for our royalty-agreement counterparties’ products;

•the existence of novel or superior products to our royalty-agreement counterparties’ products;

•the availability of reduced pricing and discounts applicable to our royalty-agreement counterparties’ products;

•stocking and inventory management practices related to our royalty-agreement counterparties’ products;

•limitations on indications for which our royalty-agreement counterparties’ products can be marketed; the competitive landscape for approved products and developing therapies that compete with royalty-agreement counterparties’ products;

•the ability of patients to be able to afford our royalty-agreement counterparties’ products or obtain healthcare coverage that covers those products;

•acceptance of, and ongoing satisfaction with, our royalty-agreement counterparties’ products by the care providers, patients receiving therapy and third-party payors; or

•the unfavorable outcome (or potential thereof) of any litigation relating to our royalty-agreement counterparties’ business practices or products.

For example, in mid-2019, Bausch Health announced expected price decreases on Glumetza, a royalty-bearing product under our Assertio Royalty Agreement. These price decreases could negatively affect revenues and thus our royalties. Due to the uncertainties caused by changes in pricing by third parties that are outside our control, including as a result of generic competition, we may not be able to accurately estimate the impact on royalties on such sales paid to us for Glumetza or any other product.

We are also aware of a number of approved generic extended-release metformin products, which could further negatively affect Glumetza revenues.

Any of these factors may have a material and adverse effect on our ability to realize significant value for our remaining royalty assets and negatively affect the amount of cash or other assets we are able to distribute to our stockholders in dissolution.

Risks Related to Taxes

We may not be able to realize certain expected tax benefits.

During 2020, we engaged in certain transactions that may result in the recognition of ordinary tax losses. Such losses, through provisions of the CARES Act, could generate meaningful tax benefits to the Company as the CARES Act permits taxpayers to carry back five years any net operating losses arising in a taxable year beginning in 2018, 2019 or 2020. In connection with our monetization process, we have executed transactions that result in ordinary tax losses that could be applied to prior tax years in which PDL was a substantial tax payor. There can be no assurance that such tax benefits will be realized as expected. For example, in February 2021, a letter was sent to congressional leaders signed by 120 members of Congress that proposed retroactively repealing the net operating loss carry back provisions of the CARES Act. If these provisions were retroactively repealed, it would likely have a material adverse effect on the amount of tax benefits that may be available to us under the current provisions of the CARES Act. Any failure to obtain such expected tax benefits under the CARES Act would likely reduce the funds available for distribution to our stockholders.

U.S. Stockholders may not be able to recognize a loss for U.S. federal income tax purposes until they receive a final distribution from us.

Distributions made pursuant to the Plan of Dissolution are intended to be treated as received by a U.S. stockholder in exchange for the U.S. stockholder’s shares of our common stock. Accordingly, the amount of any such distribution allocable to a block of shares of our common stock owned by the U.S. stockholder will reduce the U.S. stockholder’s tax basis in such shares, but not below zero. Any excess amount allocable to such shares will be taxable as capital gain. Such gain generally will be taxable as long-term capital gain if the shares have been held for more than one year. Any tax basis remaining in a share of our common stock following the final liquidating distribution by the Company will be treated as a capital loss. The deductibility of capital losses is subject to limitations. U.S. stockholders should consult their tax advisors as to the particular tax consequences of our dissolution for them, including the applicability of any U.S. federal, state, local and non-U.S. tax laws.

The tax treatment of any liquidating distribution may vary from stockholder to stockholder.

We have not requested a ruling from the IRS with respect to the anticipated tax consequences of our complete dissolution and liquidation, and we will not seek an opinion of counsel with respect to the anticipated tax consequences of any liquidating distributions. If any of the anticipated tax consequences prove to be incorrect, the result could be increased taxation at the corporate or stockholder level, thus reducing the benefit to our stockholders and us from our dissolution and liquidation. Tax considerations applicable to particular stockholders may vary with and be contingent on the stockholder’s individual circumstances. Stockholders should consult with their own tax advisors for tax advice on our dissolution and liquidation’s impact on their taxes.

General Risk Factors

Failure to protect our information technology infrastructure against cyber-based attacks, network security breaches, service interruptions or data corruption could materially disrupt our operations and adversely affect our business and operating results.

We rely on our information technology systems to effectively manage all business activities and data, including accounting, financial and legal functions, asset management and business development. Our information technology systems are vulnerable to damage or interruption from earthquakes, fires, floods and other natural disasters, terrorist attacks, power losses, computer system

or data network failures, security breaches, data corruption and cyber-based attacks, including malicious software programs or other attacks, which have been attempted against us in the past. In addition, a variety of our software systems are cloud-based data management applications, hosted by third-party service providers whose security and information technology systems are subject to similar risks.

The failure to protect either our or our service providers’ information technology infrastructure could disrupt our entire operation or result in our inability to manage and monetize our remaining assets, increased overhead costs, loss or misuse of proprietary or confidential information, intellectual property or sensitive or personal information, all of which could have a material adverse effect on our business and affect the amount of cash or other assets we may be able to distribute to our stockholders in dissolution.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

We lease approximately 1,750 square feet of office space in Reno, Nevada, which serves as our corporate headquarters. The lease expires in December 2022. Previously, we leased approximately 5,900 square feet of office space in Incline Village, Nevada, which served as our corporate headquarters until December 31, 2020 when the lease was terminated.

In July 2006, we entered into two leases and a sublease for facilities in Redwood City, California, which formerly served as our corporate headquarters and cover approximately 450,000 square feet of office space. Under the amendments to the leases entered into in connection with the spin-off of Facet, Facet was added as a co-tenant under the leases. As a co-tenant, Facet is bound by all of the terms and conditions of the leases. We and Facet are jointly and severally liable for all obligations under the leases, including the payment of rental obligations. The guarantee runs through December 2021. We also entered into a Co-Tenancy Agreement with Facet in connection with the spin-off and the lease amendments under which we assigned to Facet all rights under the leases, including, but not limited to, the right to amend the leases, extend the lease terms or terminate the leases, and Facet assumed all of our obligations under the leases. Under the Co-Tenancy Agreement, we also relinquished any right or option to regain possession, use or occupancy of these facilities. Facet agreed to indemnify us for all matters associated with the leases attributable to the period after the spin-off date and we agreed to indemnify Facet for all matters associated with the leases attributable to the period before the spin-off date. In addition, in connection with the spin-off, we assigned the sublease to Facet. In April 2010, Abbott Laboratories acquired Facet and later renamed the entity AbbVie Biotherapeutics, Inc. (“AbbVie”). To date, AbbVie has satisfied all obligations under the Redwood City leases.

We believe that our existing facilities are adequate to meet our business requirements for the reasonably foreseeable future.

ITEM 3. LEGAL PROCEEDINGS

The information set forth in Note 25, Legal Proceedings, to the Consolidated Financial Statements included in Item 8, “Financial Statements and Supplementary Data” of this Annual Report is incorporated by reference herein.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

On December 8, 2020, we formally notified the Nasdaq Stock Market, Inc. of our intent to delist the Company's common stock from the Nasdaq Global Select Market ("Nasdaq"). We filed a Form 25 (Notification of Removal from Listing) with the SEC and Nasdaq relating to the voluntary delisting of our common stock on December 28, 2020 and suspended trading of our common stock prior to the opening of trading on December 31, 2020. We filed a certificate of dissolution with the Delaware Secretary of State on January 4, 2021 (the “Final Record Date”) and instructed our transfer agent to close our stock transfer books at the close of business on this date. PDL's common stock was delisted effective on January 7, 2021. On January 8, 2021, we filed a Form 15 notifying the SEC of our deregistration of our common stock under Section 12(g) of the Exchange Act and suspension of our duty to file reports under Sections 13 and 15(d) of the Exchange Act.

As of January 6, 2021, we had approximately 86 common stockholders of record. Most of our outstanding shares of common stock are held of record by one stockholder, Cede & Co., as nominee for the Depository Trust Company. Many brokers, banks and other institutions hold shares of common stock as nominees for beneficial owners that deposit these shares of common stock in participant accounts at the Depository Trust Company. The actual number of beneficial owners of our stock is likely significantly greater than the number of stockholders of record; however, we are unable to reasonably estimate the total number of beneficial owners.

Dividends

On May 5, 2020, our board of directors approved a distribution of all of the Company’s shares of common stock of Evofem Biosciences, Inc. (“Evofem”) via a special one-time dividend to PDL stockholders. The Evofem shares were distributed on May 21, 2020 to PDL shareholders of record as of the close of business on May 15, 2020 (the “Evofem Record Date”). Based on the shares of PDL common stock outstanding as of the close of business on the Evofem Record Date, PDL stockholders were entitled to receive 0.11591985 shares of Evofem common stock for each share of PDL common stock held.

On September 10, 2020, our board of directors approved a distribution of all of the Company’s shares of common stock of LENSAR via a special one-time dividend to PDL stockholders. The LENSAR shares were distributed on October 2, 2020 to PDL shareholders of record as of the close of business on September 22, 2020 (the “LENSAR Record Date”). Based on the shares of PDL common stock outstanding as of the close of business on the LENSAR Record Date, PDL stockholders were entitled to receive 0.075879 shares of LENSAR common stock for each share of PDL common stock held.

Equity Compensation Plan Information

See Part III, Item 12, “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” for information regarding securities authorized for issuance under equity compensation plans.

Recent Sales of Unregistered Securities

There were no unregistered sales of equity securities during the period covered by this report.

Issuer purchases of Equity Securities

There were no repurchases of our common stock made by us in the three months ended December 31, 2020.

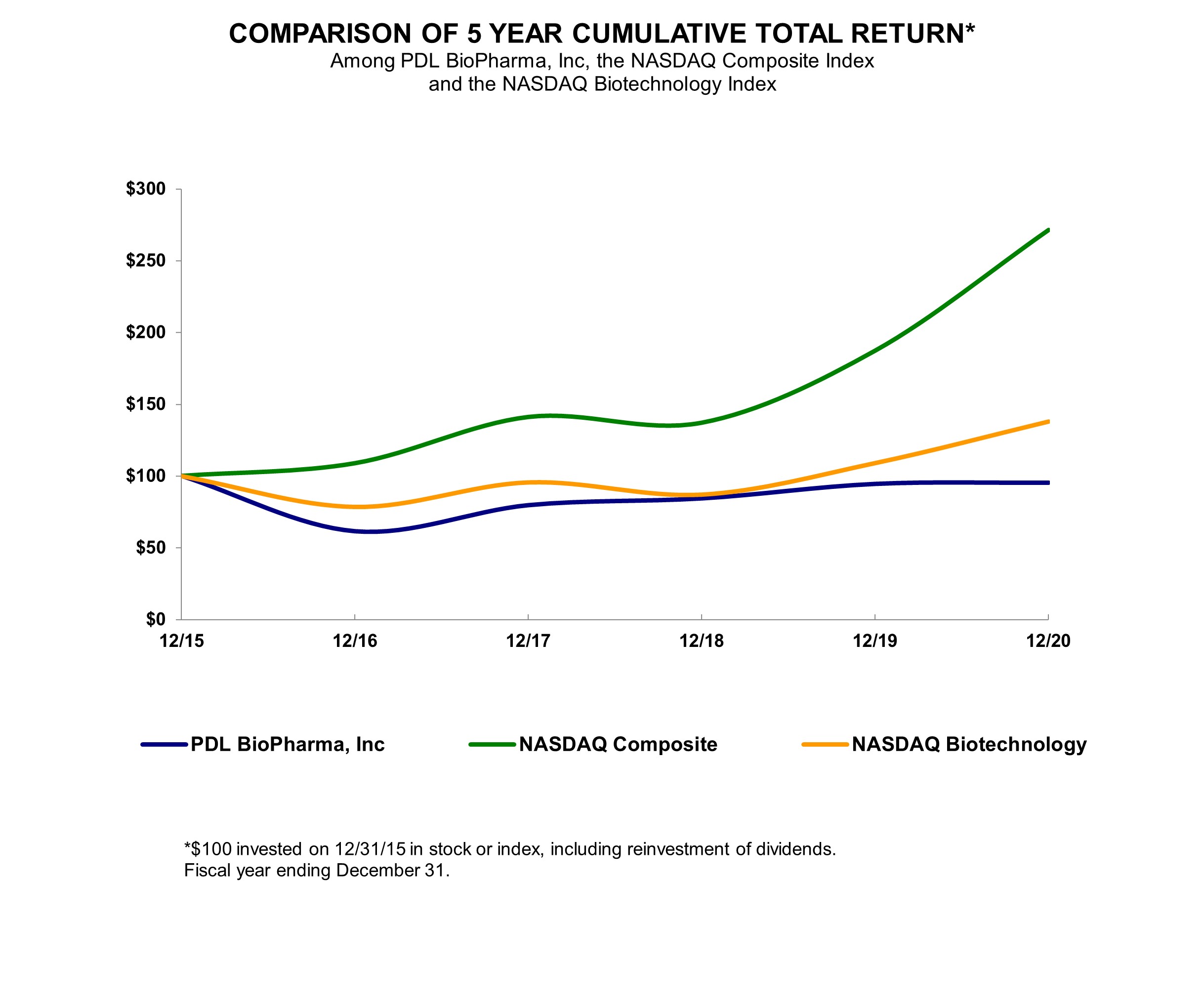

Comparison of Stockholder Returns

The line graph below compares the cumulative total stockholder return on our common stock between December 31, 2015, and December 31, 2020, with the cumulative total return of (i) the Nasdaq Biotechnology Index and (ii) the Nasdaq Composite Index over the same period. This graph assumes that $100.00 was invested on December 31, 2015, in our common stock at the closing sales price for our common stock on that date and at the closing sales price for each index on that date and that all dividends were reinvested. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns and are not intended to be a forecast.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2015 | | 12/31/2016 | | 12/31/2017 | | 12/31/2018 | | 12/31/2019 | | 12/31/2020 |

| PDL BioPharma, Inc. | $ | 100.00 | | | $ | 61.71 | | | $ | 79.76 | | | $ | 84.42 | | | $ | 94.46 | | | $ | 95.29 | |

| Nasdaq Composite Index | $ | 100.00 | | | $ | 108.87 | | | $ | 141.13 | | | $ | 137.12 | | | $ | 187.44 | | | $ | 271.64 | |

| Nasdaq Biotechnology Index | $ | 100.00 | | | $ | 78.65 | | | $ | 95.67 | | | $ | 87.19 | | | $ | 109.08 | | | $ | 137.90 | |

The information in this section shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate it by reference in such filing.

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA

Reserved.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the Consolidated Financial Statements and related Notes included elsewhere in this Form 10-K.

Overview

Throughout our history, our mission has been to improve the lives of patients by aiding in the successful development of innovative therapeutics and healthcare technologies. PDL BioPharma was founded in 1986 as Protein Design Labs, Inc. when it pioneered the humanization of monoclonal antibodies, enabling the discovery of a new generation of targeted treatments that have had a profound impact on patients living with different cancers as well as a variety of other debilitating diseases. In 2006, we changed our name to PDL BioPharma, Inc.

Historically, we generated a substantial portion of our revenues through the license agreements related to patents covering the humanization of antibodies, which we refer to as the Queen et al. patents. In 2012, and in anticipation of declining revenues from the Queen et al. patents, we began providing alternative sources of capital through royalty monetization and debt facilities, and, in 2016, we began acquiring commercial-stage products and launching specialized companies dedicated to the commercialization of these products, first with our acquisition of branded prescription pharmaceutical drugs from Novartis in 2016 and, in 2017, with the acquisition of LENSAR, a medical device ophthalmology equipment manufacturing company. In 2019, we entered into a securities purchase agreement with Evofem pursuant to which we invested $60.0 million in a private placement of securities. These investments provided funding for Evofem’s pre-commercial activities for Phexxi®, its non-hormonal, on-demand prescription contraceptive gel for women.

Based on the nature of our investments entered into between 2012 through 2019 and further discussed below, our operations were structured in four segments designated as Medical Devices, Strategic Positions, Income Generating Assets, and Pharmaceutical.

Our Medical Devices segment consisted of revenue from the sale and lease of the LENSAR® Laser System, which included equipment, PIDs, procedure licenses, training, installation, warranty and maintenance agreements.

Our Strategic Positions segment consisted of an investment in Evofem (NASDAQ: EVFM). Our investment included shares of common stock and warrants to purchase additional shares of common stock.

Our Pharmaceutical segment consisted of revenue derived from the Noden Products.

Our Income Generating Assets segment consisted of revenue derived from (i) notes and other long-term receivables, (ii) royalty rights and hybrid notes/royalty receivables, (iii) equity investments and (iv) royalties from issued patents in the United States and elsewhere covering the humanization of antibodies, which we refer to as the Queen et al. patents.

Financial information about our segments, including our revenues and net loss for the eight months ended August 31, 2020 and the years ended December 31, 2019 and 2018, and select long-lived assets as of December 31, 2020 and 2019, is included in our Consolidated Financial Statements and accompanying notes in this Form 10-K.

In September 2019, we engaged financial and legal advisors and initiated a review of our strategy. This review was completed in December 2019. At such time, we disclosed that we planned to halt the execution of our growth strategy, cease making additional strategic transactions and investments and instead pursue a formal process to unlock the value of our portfolio by monetizing our assets and ultimately distributing net proceeds to stockholders (the “monetization strategy”). Pursuant to our monetization strategy, we did not expect to enter into any additional strategic investments. We further announced in December 2019 that we would explore a variety of potential transactions in connection with the monetization strategy, including a whole Company sale, divestiture of our assets, spin-offs of operating entities, merger opportunities or a combination thereof. Over the subsequent months, our board of directors (the “Board”) and management analyzed, together with our outside financial and legal advisors, how to best capture value pursuant to our monetization strategy and best return the significant intrinsic value of the assets in our portfolio to the stockholders.

In February 2020, the Board approved a plan of complete liquidation (the “Plan of Liquidation”) of our assets and passed a resolution to seek stockholder approval to dissolve our Company. At our Annual Meeting of Stockholders in August 2020, the proposal to liquidate and dissolve our Company pursuant to a plan of dissolution was approved by our stockholders. On November 5, 2020, our Board approved filing a certificate of dissolution with the Secretary of State of Delaware in January 2021

and proceeding to complete the dissolution process for our Company in accordance with the Delaware General Corporate Law. The filing of the certificate of dissolution occurred on January 4, 2021 and we closed our stock transfer books as of such date (the “Final Record Date”). After such time, we are not recording any further transfers of our common stock, except pursuant to the provisions of a deceased stockholder’s will, intestate succession, or by operation of law and we will not issue any new stock certificates, other than replacement certificates. In addition, we will not be issuing any shares of our common stock upon exercise of outstanding stock options. As a result of the closing of our transfer books, it is anticipated that distributions, if any, made in connection with the dissolution will be made pro rata to the stockholders of record as of the Final Record Date. In accordance with our dissolution plan, we completed the voluntary delisting process from the Nasdaq Stock Market exchange so that suspension of trading occurred before the market opened on December 31, 2020 and official delisting of our stock occurred on January 7, 2021. We do not anticipate participating in any OTC trading of our stock or economic rights in our stock.

Pursuant to our monetization strategy, we explored a variety of potential transactions, including a whole Company sale, divestiture of assets, spin-offs of operating entities, merger opportunities or a combination thereof. In addition, we analyzed, and continue to analyze, optimal mechanisms for returning value to stockholders in a tax-efficient manner, including share repurchases, cash dividends and other distributions of assets. Despite the challenges of COVID-19, we made significant progress in our monetization strategy during 2020, including monetizing most of our key assets and resolving a longstanding legal issue as follows:

•In May 2020, we made a liquidation distribution of all of our common stock in Evofem to our stockholders. As of December 31, 2020, we held warrants to purchase up to 3,333,334 shares of Evofem common stock with an exercise price of $6.38

•In August 2020, we entered into a settlement agreement (the “ Settlement Agreement”) with related entities of Defined Diagnostics, LLC (f/k/a Wellstat Diagnostics, LLC) ("Wellstat Diagnostics" and, together with such related entities, the "Wellstat Parties") resolving previously reported litigation relating to loans made to Wellstat Diagnostics by us

•In August 2020, we sold three royalty interests related to third party sales of Kybella®, Zalviso®, and Coflex®

•In September 2020, we completed the previously announced sale of our interest in Noden DAC and Noden USA

•In October 2020, we completed the previously announced spin-off of LENSAR whereby we made a liquidation distribution of all of our shares of LENSAR common stock to our stockholders as of September 22, 2020

•In December 2020, we entered into a Capital Provision Agreement with Epps Investments LLC (“Epps”) regarding our previously announced Settlement Agreement with the Wellstat Parties whereby we sold all remaining amounts owed to us under the Settlement Agreement for consideration received

The Settlement Agreement with the Wellstat Parties provided for the payment of $7.5 million upon the signing of the Settlement Agreement, which has been received, and either (1) $5.0 million by February 10, 2021 and $55.0 million by July 26, 2021; or (2) $67.5 million by July 26, 2021. Under the terms of the Settlement Agreement, failure by the Wellstat Parties to make payment in full by July 26, 2021, authorized us to record judgment against the Wellstat Parties for an amount of $92.5 million or such lesser amount as may be owed under the Settlement Agreement.

The Capital Provision Agreement with Epps provided for the payment of $51.4 million, which was received on December 31, 2020, in exchange for 100% of the payments or other property or value received by PDL on or after the date of the Capital Provision Agreement pursuant to the Settlement Agreement.

The proceeds from the sale of the three royalty interests totaled $4.35 million, 90% of which was received at the closing of the transaction. The remaining 10% is currently held in escrow against certain potential contingencies and is to be released on the one-year anniversary of the closing, subject to the satisfaction of any such potential contingencies.