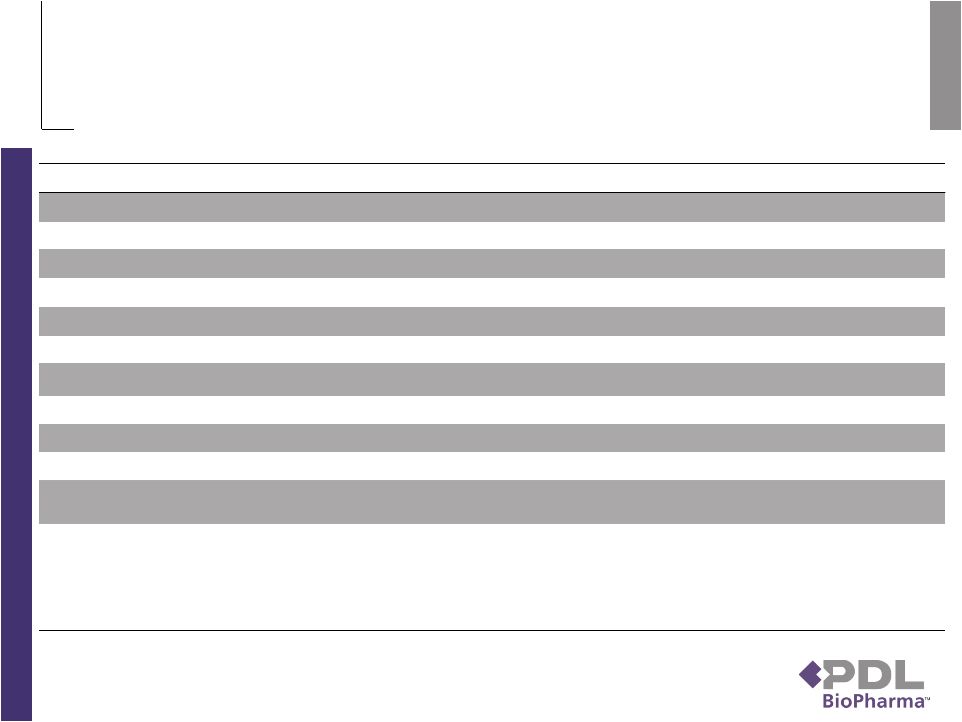

Securitization Terms Issuer……………………..... QHP Royalty Sub LLC, Delaware limited liability company, initially 100% owned by PDL Security…………………….. 60% of the Genentech royalties in Avastin, Herceptin, Xolair, Lucentis and future licensed products Principal Amount………… $300 million Coupon …………………….. 10.25% per annum Loan Type………………….. Amortizing in relation to 60% of Genentech royalties Loan-to-Value……………… 41.2% Expected Closing Date…… Monday, November 2 Payment Dates…………….. March 15, June 15, September 15, and December 15 beginning on March 15, 2010 Expected Average Life…… 1.9 years based on sales, manufacturing and FX waterfall assumptions Expected Final Maturity….. December 15, 2012 (3.1 years) based on sales, manufacturing and FX waterfall assumptions Legal Maturity……………… March 15, 2015 (coincides with expected duration of royalty payments) Non-Recourse……………... The obligation to pay debt service is an obligation solely of QHP and is without recourse to any other entity, except to the extent of the pledge of the equity in QHP by PDL Redemption………………… The Notes have an optional redemption feature which allows QHP to redeem the Notes at any time with payment of a premium. The premium is calculated by the following formula: the greater of (x) the outstanding principal balance of the Notes being redeemed and (y) the present value, discounted at the applicable Treasury Rate plus 2.0%, of such principal payment amounts and interest (assuming the principal balances are amortized at the times and in the amounts set forth in Schedule B to the Indenture) plus, in each case, the accrued and unpaid interest to the redemption date on the Notes that are being redeemed. 5 |