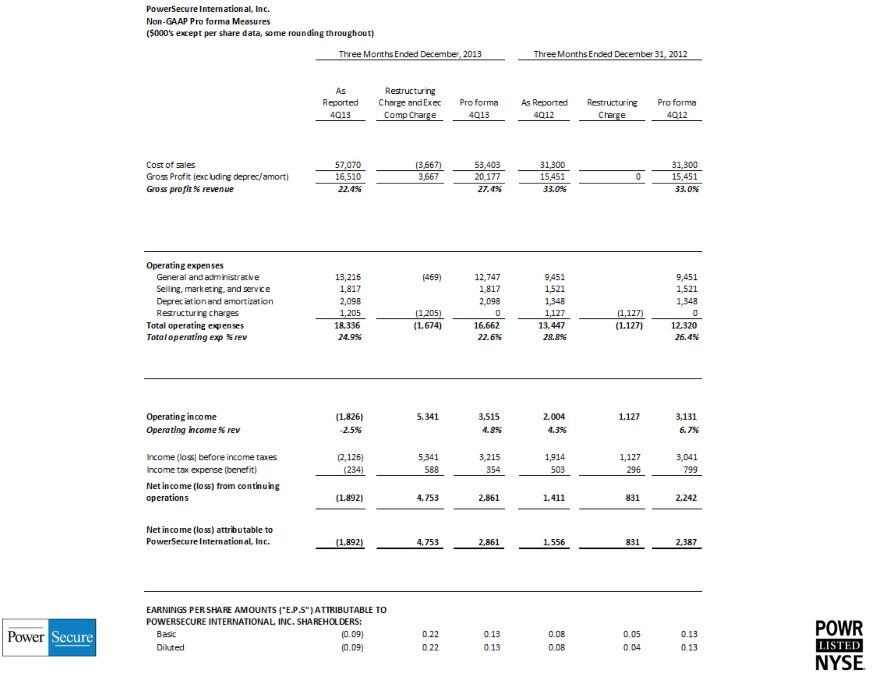

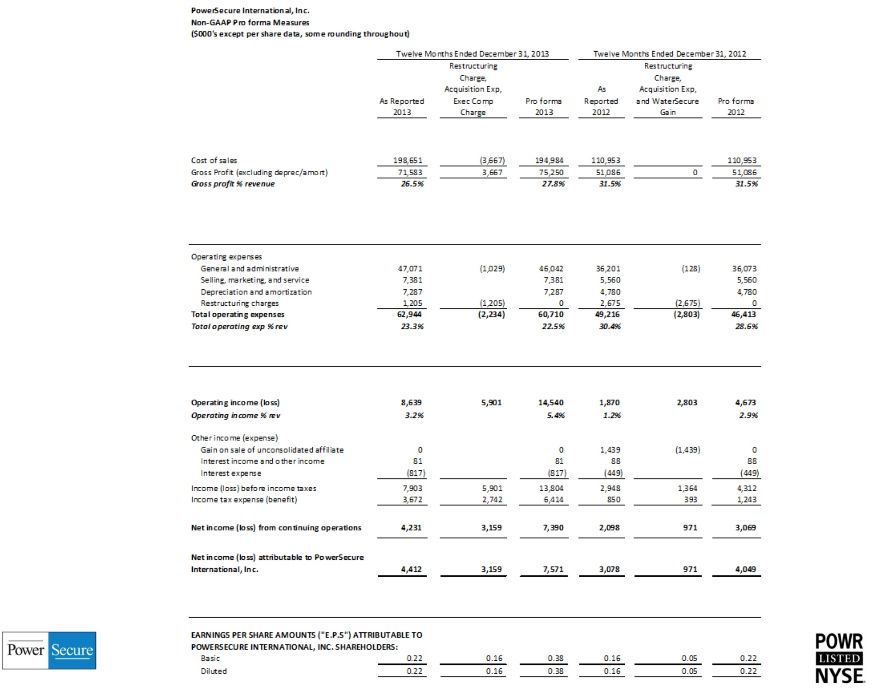

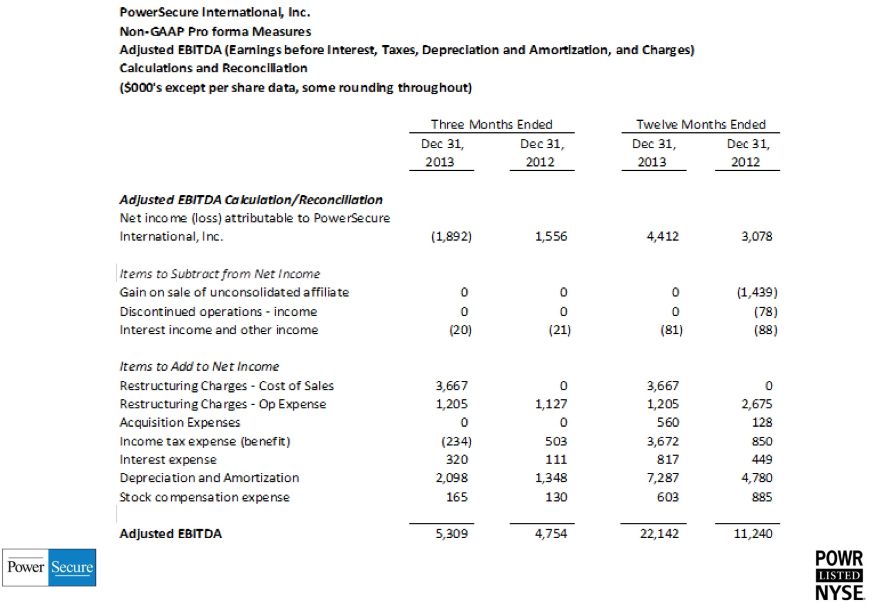

Non-GAAP Financial Measures 24 | © 2014 PowerSecure. All rights reserved. References to our fourth quarter and full year 2012 and 2013 Adjusted EBITDA, which we define as our earnings before interest, taxes, depreciation and amortization, as discussed and shown in this release, constitutes a non-GAAP “pro forma” financial measure. We believe that Adjusted EBITDA, as a non-GAAP pro forma financial measure, provides meaningful information to investors in terms of enhancing their understanding of our operating performance and results, as it allows investors to more easily compare our financial performance on a consistent basis compared to the prior year periods. This non-GAAP financial measure also corresponds with the way we expect investment analysts to evaluate and compare our results. Any non-GAAP pro forma financial measures should be considered only as supplements to, and not as substitutes for or in isolation from, or superior to, our other measures of financial information prepared in accordance with GAAP, such as net income attributable to PowerSecure International, Inc. We define and calculate Adjusted EBITDA as net income attributable to PowerSecure International, Inc., minus: 1) the gain on the sale of our unconsolidated affiliate, 2) discontinued operations and 3) interest income and other income, plus: 4) restructuring charges, 5) acquisition expenses, 6) income tax expense (or minus an income tax benefit), 7) interest expense, 8) depreciation and amortization and 9) stock compensation expense. We disclose Adjusted EBITDA because we believe it is a useful metric by which to compare the performance of our business from period to period. We understand that measures similar to Adjusted EBITDA are broadly used by analysts, rating agencies, investors and financial institutions in assessing our performance. Accordingly, we believe that the presentation of Adjusted EBITDA provides useful information to investors. The table below provides a reconciliation of Adjusted EBITDA to net income attributable to PowerSecure International, Inc., the most directly comparable GAAP financial measure. |