As filed with the Securities and Exchange Commission on July 11, 2003

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2002

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 33-44756

Controladora Comercial Mexicana, S.A. de C.V.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

United Mexican States

(Jurisdiction of incorporation or organization)

Av. Revolución No. 780 Módulo 2

Colonia San Juan

03730 México, D.F.

México

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

Series B Shares without par value ("B Shares") | New York Stock Exchange (for listing purposes only) |

Series C Shares without par value ("C Shares") | New York Stock Exchange (for listing purposes only) |

Units, each representing three B shares and one C share | New York Stock Exchange (for listing purposes only) |

Global Depositary Shares ("GDSs"), each representing 20 Units | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

9.375% Senior Notes due 2005

The number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 31, 2002 was:

4,005,551,610 B Shares

338,448,390 C Shares

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (of for such shorter period that he registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check which financial statement item the registrant has elected to follow. Item 17 [x] Item 18 [ ]

TABLE OF CONTENTS

Page

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Item 2. Offer Statistics and Expected Timetable

Item 3. Key Information

Selected Financial Data

Dividends

Exchange Rate Information

Risk Factors

Forward-Looking Statements

Item 4. Information on the Company

History and Development of the Company

Capital Expenditures

Business Overview

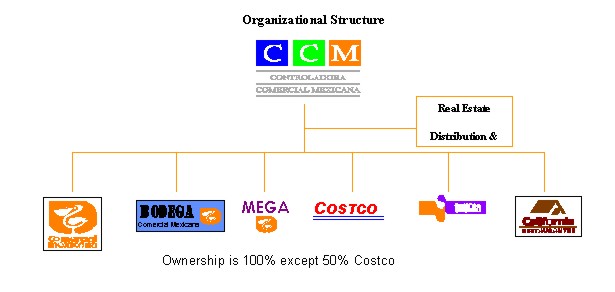

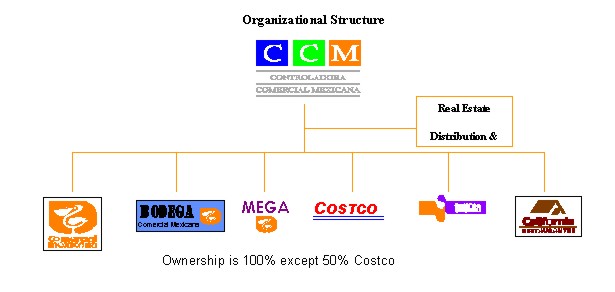

Organizational Structure

Property, Plant and Equipment

Item 5. Operating and Financial Review and Prospects

Item 6. Directors, Senior Management and Employees

Board Practices

Item 7. Major Shareholders and Related Party Transactions

Major Shareholders

Related Party Transactions

Item 8. Financial Information

Item 9. Offer and Listing Details

Item 10. Other Information

Bylaws

Material Contracts

Legal Proceedings

Exchange Controls and Restrictions on Foreign Investment

Taxation

Documents on Display

Item 11. Quantitative and Qualitative Disclosures About Market Risk

Interest Rate Risk

Foreign Exchange Rate Risk

Item 12. Description of Securities Other than Equity Securities

PART II

Item 13. Defaults, Dividend Arrearages and Delinquencies

Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds

PART III

Item 15. [Reserved]

Item 16. [Reserved]

PART IV

Item 17. Financial Statements

Item 18. Financial Statements

Item 19. Exhibits

We publish our Financial Statements in accordance with generally accepted accounting principles in Mexico, or Mexican GAAP, which differ in significant respects from generally accepted accounting principles in the United States Of America ("United States"), or U.S. GAAP, and accounting procedures adopted in other countries. The exchange rates used in preparing our Financial Statements are determined by reference as of the specified date to the interbank free market exchange rate, or the Interbank Rate, as reported by Banco Nacional de México, S.A. As of December 31, 2002, the Interbank Rate was Ps. 10.395 to U.S.$1.00. See "Item 3. Key Information Exchange Rate Information." The exchange rates used in translating Pesos into U.S. Dollars elsewhere in this annual report are determined by reference to the Interbank Rate as of December 31, 2002, unless otherwise indicated.

Unless otherwise indicated, (i) information included in this annual report is as of December 31, 2002 and (ii) references to "Ps." or "Pesos" in this annual report are to Mexican Pesos and references to "Dollars," "U.S. Dollars," "U.S. dollars," "$," or "U.S.$" are to United States dollars.

Unless otherwise indicated, (i) operating information contained in this Annual Report regarding our stores relates to all of our stores, which are the Comercial Mexicana, Mega, Bodega, Sumesa, and the Costco membership warehouses (through a joint venture, the Costco Mexico joint venture, or Costco Mexico, with Costco Wholesale Co. (formerly Price/Costco, Inc.), or Costco, of the United States), but not our restaurants, and (ii) information herein regarding same store sales, sales per operating employee and sales per retail square foot is calculated on the basis of 100% of the sales from all of our stores, including those operated through the Costco Mexico joint venture.

As used herein, the term "billion" means one thousand million.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

Selected Financial Data

The following tables present our selected financial data and that of our consolidated subsidiaries. We consolidate our proportionate interest in the results and assets and liabilities of the Costco Mexico joint venture. This data is qualified in its entirety by reference to, and should be read together with, our audited year-end financial statements, or Financial Statements. Our Financial Statements have been prepared in accordance with Mexican GAAP, which differs in significant respects from U.S. GAAP and accounting procedures adopted in other countries. Note 17 to the Financial Statements provides a description of the principal differences between Mexican GAAP and U.S. GAAP as they relate to us and provides a reconciliation to U.S. GAAP of net income for the fiscal years ended December 31, 2000, 2001 and 2002 and total stockholder's equity as of December 31, 2001 and 2002.

In calculating the convenience translations included herein, Pesos are translated into U.S. dollars at an exchange rate of Ps. 10.395 per U.S. dollar, the Representative Rate as of December 31, 2002. These translations should not be construed as a representation that such Peso amounts actually represent U.S. dollar amounts or could be converted into U.S. dollar amounts at the rates indicated.

| Year Ended December 31, |

| | 1998 | 1999 | 2000 | 2001 | 2002 | 2002 |

| (Millions of constant Pesos as of December 31, 2002 and millions of U.S. Dollars) (1) |

| Income Statement Data |

| Mexican GAAP: | | | | | | |

| Net sales | 31,770 | 32,659 | 34,883 | 34,948 | 32,053 | 3,084 |

| Gross profit | 6,209 | 6,280 | 6,666 | 6,648 | 6,287 | 605 |

| Selling and administrative | 5,042 | 5,020 | 5,443 | 5,562 | 5,368 | 516 |

| Operating income | 1,167 | 1,259 | 1,223 | 1,086 | 920 | 89 |

| Integral results of financing (2): | | | | | | |

| Interest expense | (400) | (276) | (259) | (272) | (239) | (23) |

| Interest income (3) | 208 | 93 | 58 | 59 | 43 | 4 |

| Foreign-exchange gain (loss), net | (694) | 100 | (57) | 24 | (218) | (21) |

| Loss (gain) in forward agreement | | | | (42) | 49 | 5 |

| Gain from monetary position | 1,077 | 676 | 501 | 242 | 306 | 29 |

| Other income (expense), net (4) | (221) | (166) | (158) | (19) | 5 | |

| Provisions for: | | | | | | |

| Income and asset taxes | (21) | (160) | (145) | (40) | (123) | (12) |

| Employees profit sharing | (4) | (8) | (13) | (2) | (8) | (1) |

| Deferred income tax and gain on monetary position through the initial deferred income tax effect. | | | 74 | (225) | 62 | 6 |

| Interest of minority stockholders in results of subsidiaries | (6) | (7) | (8) | (9) | (7) | (1) |

| Net income | 1,147 | 1,510 | 1,216 | 803 | 789 | 76 |

| Net income per BC Unit and B Unit (5) | 1.06 | 1.40 | 1.12 | 0.76 | 0.73 | 0.07 |

| Net income per GDS (7) | 21.30 | 27.89 | 22.51 | 15.14 | 14.64 | 1.41 |

| Dividends per BC Unit and B Unit (5) | 0.10 | 0.11 | 0.11 | 0.11 | 0.11 | 0.01 |

| Dividends per GDS (6) | 1.92 | 2.17 | 2.03 | 2.26 | 2.23 | 0.21 |

| Weighted average Units and B Units outstanding (millions)(5) | 1,077 | 1,081 | 1,080 | 1,061 | 1,078 | 104 |

| |

| U.S. GAAP (7): | | | | | | |

| Net sales | 28,439 | 28,694 | 29,913 | 29,325 | 26,116 | 2,512 |

| Net income | 1,370 | 1,553 | 1,320 | 880 | 844 | 81 |

| Net income per BC Unit and B Unit (5) | 1.27 | 1.44 | 1.22 | 0.83 | 0.78 | 0.01 |

| Net income per GDS (6) | 25.49 | 28.58 | 24.44 | 16.59 | 15.66 | 1.51 |

| |

| Balance Sheet Data |

| Mexican GAAP: | | | | | | |

| Cash and temporary investments | 1,027 | 1,181 | 1,415 | 1,253 | 859 | 83 |

| Current assets | 6,286 | 6,930 | 6,811 | 6,472 | 7,389 | 711 |

| Property, plant and equipment, net | 14,504 | 14,537 | 15,030 | 15,545 | 15,334 | 1,475 |

| Total assets | 21,088 | 21,922 | 22,341 | 22,385 | 23,181 | 2,230 |

| Short-term debt (8) | 648 | 376 | | 0 | 158 | 15 |

| Long-term debt (8) | 2,294 | 1,576 | 1,909 | 1,817 | 1,751 | 168 |

| Total liabilities | 9,414 | 8,995 | 11,440 | 10,942 | 11,338 | 1,091 |

| Minority interest | 110 | 111 | 89 | 88 | 85 | 8 |

| Majority stockholders’ equity | 11,563 | 12,815 | 10,813 | 11,355 | 11,758 | 1,131 |

| | | | | | | |

| U.S. GAAP: (7) | | | | | | |

| Total assets | 20,941 | 22,031 | 22,741 | 21,525 | 22,434 | 2,157 |

| Total liabilities | 12,278 | 12,056 | 12,128 | 10,505 | 10,957 | 1,054 |

| Stockholders’ equity | 8,664 | 9,975 | 10,613 | 11,003 | 11,466 | 1,103 |

| |

| Other Data |

| Mexican GAAP: | | | | | | |

| EBITDA (9) | | | 1,902 | 1,808 | 1,645 | 158 |

| Depreciation and amortization | 611 | 604 | 679 | 722 | 725 | 70 |

| Capital expenditures (10) | 2,232 | 1,046 | 1,383 | 1,206 | 742 | 71 |

| Interest expense | (400) | (277) | (259) | (272) | (239) | (23) |

| EBITDA/Interest expense | | | 7.34 | 6.65 | 6.88 | |

| Total debt/EBITDA | | | 1.00 | 1.01 | 1.16 | |

| Net debt/EBITDA (11) | | | 0.27 | 0.31 | 0.63 | |

| Total debt/capitalization | 0.21 | 0.14 | 0.16 | 0.16 | 0.16 | |

| Working capital (12) | (801) | (451) | (198) | 160 | (19) | (2) |

| Year Ended December 31, |

| | 1998 | 1999 | 2000 | 2001 | 2002 | 2002 |

| (Millions of constant Pesos as of December 31, 2001 and millions of U.S.Dollars) (1) |

| Operating Information |

| Store Information (13): | | | | | | |

| Food sales (14) | 64.6% | 64.0% | 63.3% | 63.3% | 64.9% | |

| Non-food sales (14) | 35.4% | 36.0% | 36.7% | 36.7% | 35.1% | |

| Average annual sales per store (millions)(15) | 228 | 228 | 234 | 232 | 220 | 21.2 |

| Sales per retail square foot (thousands)(15) | 3.35 | 3.37 | 3.40 | 3.33 | 3.09 | 0.3 |

| Sales per operating employee (thousands)(15)(16) | 1,253 | 1,311 | 1,270 | 1,473 | 1,339 | 128.8 |

| Same store sales growth (18) | 6.7% | 0.3%. | 2.6% | (3.3)% | (10.3)% | |

| |

| Stores: | | | | | | |

| Operating at end of period | 154 | 158 | 167 | 172 | 170 | |

| Opened | 5 | 5 | 16 | 7 | 3 | |

| Closed | 0 | 1 | 7 | 2 | 5 | |

| Remodeled (18) | 9 | 9 | 10 | 14 | 12 | |

| Total retail square feet at end of period (thousands)(19) | 10,330 | 10,713 | 11,552 | 11,998 | 12,098 | |

| Number of employees (at end of period) | 31,389 | 32,007 | 35,332 | 29,116 | 29,808 | |

| Number of operating employees | 27,616 | 27,581 | 30,946 | 26,828 | 27,947 | |

| | | | | | | |

| Restaurant Information: | | | | | | |

| Restaurants operating at end of period | 35 | 39 | 46 | 50 | 55 | |

| Total restaurant seats at end of period | 7,598 | 8,654 | 10,320 | 11,228 | 12,293 | |

Notes to Selected Consolidated Financial and Operating Information

| (1) | Except Unit and B Unit data and operating information, percentages and ratios. |

| (2) | Integral results of financing include interest expense, interest income, foreign-exchange loss, net, and gain from monetary position. |

| (3) | Interest income includes our income from interest-bearing temporary investments and our net gain or loss on the market value of our temporary investments. In 1998, 1999 and 2000 interest income additionally includes gains of Ps.71.2 million, Ps.1.0 million and Ps.0.3 million respectively (for 2001 there is none) from the repurchase and cancellation of Senior Notes at a discount price. |

| (4) | Includes miscellaneous income, net, revenues received from maintenance income, and negative goodwill from the acquisition of companies under common control, as well as a special item from change in amortization of preopening costs in 1997 and 1998; and in 1998, 1999, 2000 and 2001, write-offs of fixed assets not compliant with the Y2K issue. For the year ended December 31, 2001, also includes gain in permanent investment sales. |

| (5) | After giving effect to the Restructuring, including the split of each B Share into three B Shares and the subsequent distribution of one C Share or one B Share in respect of every three B Shares, as a result of which shareholders now hold Units and B Units. Amounts do not include shares held in treasury. |

| (6) | Each GDS represents 20 Units. |

| (7) | See Note 17 to the Financial Statements. |

| (8) | See Note 7 to the Financial Statements. |

| (9) | EBITDA represents operating income plus depreciation and amortization. We have included EBITDA data as a convenience because such data is used by certain investors to measure a company's ability to service debt. EBITDA is not a measure of financial performance under either Mexican GAAP or U.S. GAAP and should not be considered an alternative to net income as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. |

| (10) | Capital expenditures for all periods exclude amounts contributed by Costco to the Costco de Mexico joint. See "Item 4. Information on the Company." |

| (11) | Net debt is total debt less cash and temporary investments. |

| (12) | Working capital is current assets minus current liabilities. |

| (13) | Store information relates to all of our stores, including those operated through joint ventures (calculated on the basis of 100% of the sales from the Costco de Mexico stores). The information does not include our restaurants. |

| (14) | Food sales include sales of basic groceries and perishables. Non-food sales include sales of general merchandise and clothing. |

| (15) | In computing sales per retail square foot for a period, we divide total store sales for the full period by the aggregate retail square footage at the end of such period. Accordingly, stores that are opened for less than the full period have the effect of decreasing store sales per retail square foot, and stores that are closed prior to the end of the full period have the opposite effect. Similarly, in computing average annual sales per store, we divide total store sales for the full period by the number of stores at the end of the period, and in computing sales per operating employee, we divide total store sales for the full period by the number of operating employees at the end of the period . |

| (16) | Includes all employees at our stores other than administrative employees and employees of our restaurants. |

| (17) | Calculated by comparing sales at stores during a period against sales at the same stores during the prior period, using only those same months in each period during which the same stores were open and using constant Pesos. |

| (18) | Includes conversions of stores from one format to another format. |

| (19) | Retail square feet includes areas for cashiers, which constituted approximately 8.3% of the total selling area of our stores at December 31, 2002. |

Dividends

The table below sets forth the nominal amount of preferential dividends per Unit paid on April 14, 2000 in respect of the fiscal year ended December 31, 1999; paid in April 5, 2001 in respect of the fiscal year ended December 31, 2000; paid on April 11, 2002 in respect of the fiscal year ended December 31, 2001 and paid on April 3, 2003 in respect of the fiscal year ended December 31,2002. Peso amounts have been translated into U.S. dollars at the exchange rate on each of the respective payment dates.

During our last general stockholders meeting on April 3, 2003 our stockholders approved a dividend of Ps.0.107 for each Unit, in a single payment which was made to holders of record on April 15, 2003.

| Dividend |

| In respect of | In nominal pesos per Unit |

| 2000 | Ps.107 |

| 2001 | Ps.107 |

| 2002 | Ps.107 |

Exchange Rate Information

Exchange Rates

Mexico abolished its exchange control system on November 11, 1991. Prior to December 1994, the Mexican central bank, orBanco de México, kept the Peso-U.S. dollar exchange rate within a range prescribed by the government through intervention in the foreign exchange market. On December 21, 1994, the Mexican Government announced its decision to suspend its policy of intervention by Banco de México and to allow the Peso to float freely against the U.S. Dollar. Factors contributing to the decision included the growing size of Mexico's current account deficit, the declining level ofBanco de México's foreign exchange reserves, rising interest rates for other currencies, especially the U.S. dollar, and reduced confidence in the Mexican economy on the part of international investors due to political uncertainty. See "Item 3. Key Information Risk Factors Risk Factors Relating to Mexico" and "Item 5. Operating and Financial Review and Prospects." The peso declined sharply in December 1994 and continued to fall under conditions of high volatility in 1995. In 1996 the peso fell more slowly and was less volatile. Relative stability characterized the foreign exchange markets during the first three quarters of 1997. The fall of the Hang Seng Index of the Hong Kong Stock Exchange on October 24, 1997, marked the beginning of a period of increased volatility in the foreign exchange markets with the peso falling over 10% in just a few days. During 1998, the foreign exchange markets experienced volatility as a result of financial crises in Asia and Russia and financial turmoil in countries such as Brazil and Venezuela.

The following table sets forth, for the periods indicated, the period-end, average high and low noon buying rate as published by the Federal Reserve Bank of New York, or the Noon Buying Rate, expressed in nominal Pesos per U.S. Dollar.

| |

| Year Ended December 31, | Period End | Average (2) | High | Low |

| 1996 | 7.86 | 7.60 | 8.05 | 7.33 |

| 1997 | 8.06 | 7.90 | 8.60 | 7.50 |

| 1998 | 9.90 | 9.29 | 10.54 | 8.04 |

| 1999 | 9.50 | 9.55 | 10.60 | 9.24 |

| 2000 | 9.62 | 9.34 | 10.09 | 9.18 |

| 2001 | 9.16 | 9.34 | 9.97 | 8.95 |

| 2002 | 10.39 | 9.74 | 10.39 | 9.00 |

| Month Ended: December 2002 | 10.39 | 10.22 | 10.39 | 10.10 |

| 2003: January | 10.90 | 10.62 | 10.98 | 10.32 |

| February | 11.03 | 10.94 | 11.06 | 10.77 |

| March | 10.78 | 10.91 | 11.24 | 10.66 |

| April | 10.31 | 10.59 | 10.76 | 10.31 |

| May | 10.34 | 10.25 | 10.42 | 10.11 |

| June (through June 13, 2003) | 10.60 | 10.52 | 10.74 | 10.24 |

(1) As published by the Federal Reserve Bank of New York, since November 8, 1993.

(2) Average of end-month rates. Monthly average rates reflect the average of daily rates.

Risk Factors

The following is a discussion of risks associated with our Company and an investment in our securities. Some of the risks of investing in our securities are general risks associated with doing business in Mexico. Other risks are specific to our business. The discussion below contains information about the Mexican government and the Mexican economy obtained from official statements of the Mexican government as well as other public sources. We have not independently verified this information. Any of the following risks, if they actually occur, could materially and adversely affect our business, financial condition, results of operations or the price of our securities.

Risk Factors Relating to Developments in Mexico

Economic and Political Developments in Mexico and Elsewhere May Adversely Affect Our Business. Most of our operations and assets are located in Mexico. As a result, our business may be affected by the general condition of the Mexican economy, the devaluation of the Peso as compared to the U.S. Dollar, Mexican inflation, interest rates and political developments in Mexico and elsewhere.

Mexican Economic Conditions. We are a Mexican company with all our consolidated assets located in Mexico and all our consolidated net sales derived from Mexico. As a result, our business may be affected by the general condition of the Mexican economy, the devaluation of the Peso as compared to the U.S. Dollar, Mexican inflation, interest rates and political developments in Mexico.

The Mexican government has exercised and continues to exercise, significant influence over the Mexican economy. Mexican governmental actions concerning the economy and state-owned enterprises could have a significant impact on Mexican private sector entities, in general, an on us, in particular, and on market conditions, prices, and returns on Mexican securities, including our securities.

The level of manufacturing activity in Mexico has in the past been affected by prevailing conditions in the Mexican economy, and domestic demand (including domestic demand for the Company's products) has been and is, to a significant extent, vulnerable to economic downturns in Mexico. In addition, the Company's financial condition, liquidity (including its ability to obtain financing) and prospects have been and are expected to continue to be affected by prevailing economic conditions in Mexico, particularly downturns in the Mexican economy and changes in government policies, including public spending on infrastructure projects.

In December 1994, Mexico experienced an economic crisis characterized by exchange rate instability and significant devaluation of the peso increased inflation, high domestic interest rates, a substantial outflow of capital, negative economic growth, reduced consumer purchasing power and high unemployment. In addition, the financial crises in 1998 and early 1999 in Asia, Russia and Latin America resulted in instability in the foreign exchange markets and international financial markets. These events resulted in limited liquidity for the Mexican government and for local corporations as well as an increase in interest rates in Mexico.

The recent economic and financial crises in Argentina and recent civil and political unrest in Venezuela could produce similar results. Although the Mexican economy declined by 0.3% in 2001, the Mexican economy grew by 0.9% in 2002 and by 2.3% in the first quarter of 2003. In April 2003, Banco de Mexico decreased the official growth forecast for 2003 to 2.4% from its initial prediction of 3.0%.

Beginning in January 2001, and increasing in the fourth quarter of 2001, amid concerns of a global economic slowdown and a recession in the United States, Mexico began to experience an economic slowdown marked by a decline in GDP. In 2001, Mexico's GDP shrank by 0.3% in real terms while the inflation rate was 4.4%, interest rates on 28-day CETES averaged 11.3% and the peso appreciated 4.6% in value (in nominal terms) relative to the U.S. dollar. During 2002, as the United States and global economic slowdown continued, the Mexican real GDP growth rate was 0.9%, the inflation rate was 5.7%, interest rates on 28 day CETES averaged 11.3% and the peso devalued 13.8% (in nominal terms) relative to the U.S. dollar.

World Economy. In particular, Argentina’s insolvency and recent default on its public debt, which deepened the existing financial, economic and political crises in that country, could adversely affect Mexico, the market value of our securities or our business. The recent Argentine President, Eduardo Duhalde, took office on January 6, 2002 in the midst of significant political unrest after a series of interim presidents and administrations took office following the resignation of President Fernando de la Rúa in December 2001. On May 15, 2003, a new president, Néstor Kirchner, took office in Argentina and is expected to retain the same economy minister and continue the fiscal and monetary policies initiated by President Duhalde The recent devaluation of the Argentine peso will have a material adverse effect on Argentina and presents risks that the Argentine financial system may collapse and that substantial inflation may occur. The rapid and radical nature of changes in the Argentine social, political, economic and legal environment have continued to create significant uncertainty. To the extent that the new Argentine government is unsuccessful in preventing further economic decline via this and other measures, this crisis may adversely affect Mexico, the price of our securities or our business.

In addition, on April 12, 2002, following a week of strikes, demonstrations and riots, Venezuelan President Hugo Chávez was forced to resign from office by Venezuela’s military commanders in an attempted coup d’etat. Although Mr. Chávez was restored to power on April 14, 2002, the political and economic future of Venezuela remains uncertain. More recently, an ongoing nationwide general strike that began in December 2002 has caused a significant reduction in oil production in Venezuela, and has had a material adverse effect on Venezuela’s oil-dependent economy. In response to the general strike and in an effort to shore up the economy and control inflation, in February 2003 Venezuelan authorities imposed foreign exchange and price controls on specified products. We cannot predict what effect, if any, these events will have on the economies of other emerging market countries, Mexico, the price of our securities or our business.

The terrorist attacks on September 11, 2001 depressed economic activity in the U.S. and globally, including the Mexican economy. Since those attacks, there have been terrorist attacks in Indonesia and ongoing threats of future terrorist attacks in the United States and abroad. In response to these terrorist attacks and threats, the United States has instituted several anti-terrorism measures, most notably, the formation of the Office of Homeland Security, a formal declaration of war against terrorism and the war in Iraq. Although it is not possible at this time to determine the long-term effect of these terrorist threats and attacks and the consequent response by the United States, there can be no assurance that there will not be other attacks or threats in the United States or abroad that will lead to a further economic contraction in the United States or any other major markets. In the short term, however, terrorist activity against the United States and the consequent response by the United States has contributed to the uncertainty of the stability of the United States economy as well as global capital markets. It is not certain how long these economic conditions will continue. If terrorist attacks continue or worsen, if the weak economic conditions in the U.S. continue or worsen, or if a global recession materializes, our business, financial condition and results of operations may be materially and adversely affected.

Expansion. Changes in the general business and economic conditions in our operating regions, including the rate of inflation, population growth, and employment and job growth in the markets in which we operate may affect our ability to hire and train qualified employees to operate our stores. This would negatively affect our expected growth. Moreover, General economic changes may also affect the shopping habits of our customers, which could affect our expansion plans for the following years. We currently intend to fund substantially all of our 2003 capital expenditures primarily with cash flows from operations. Although we believe that sufficient financing will be available to us, there can be no assurance that we will have sufficient cash flow from operations to make all of our planned capital expenditures when scheduled or if necessary, that we will be able to obtain, or what the terms may be of, any bank or other financing.

Overview of the Mexican Economy in 2002

Indicators of economic activity suggest that Mexican economy registered a moderate expansion during the second half of 2002. Future development of the economy remains fragile among the different economic sectors. In particular, the rate of growth of the economic sectors closely linked to external markets has been weaker than those sectors associated with domestic sources of demand.

During 2002, Mexico’s Gross Domestic Product increased by 0.9% in real terms, as compared with 2001. The financial services, insurance and real estate sector grew by 4.4%, the electricity, gas and water sector grew by 3.8%, and the transportation, storage and communications sector grew by 2.2%, each in real terms. The construction sector grew by 1.7%, and the community, social and personal services sector grew by 1.3%, each in real terms. The mining, petroleum and gas sector decreased by 0.3%, the agriculture, livestock, fishing and forestry sector and the commerce, hotels and restaurants sector each decreased by 0.4%, and the manufacturing sector decreased by 0.6%, each in real terms. During 2002, the commercial sector (defined by ANTAD as Retailers, Department Stores and other types of stores) grew 1.5%, which was substantially lower than the 6.1% growth predicted at the beginning of 2002.

Inflation during 2002 was 5.70%, as compared to 4.40% during 2001. Inflation during January 2003 was 0.40%, 0.52 percentage points lower than in January 2002.

During 2002, interest rates on 28-day Cetes averaged 7.08% and interest rates on 91-day Cetes averaged 7.44%, as compared with average rates on 28-day and 91-day Cetes of 11.30% and 12.24%, respectively, during 2001.

Last year Mexico registered a trade deficit of US$7,996.8 million, as compared with a trade deficit of US$9,953.6 million for 2001. Merchandise exports increased by 1.4% during 2002, to US$160,682.0 million, as compared with US$158,442.9 million in 2001. During 2002, petroleum exports increased by 13.1% and non-petroleum exports increased by 0.4%, each as compared with 2001. Exports of manufactured goods, which represented 88.4% of total merchandise exports, increased by 0.4% during 2002 as compared with 2001.

Total imports were US $168,678.9 million during 2002, a 0.2% increase as compared to 2001. Imports of intermediate goods increased by 0.3%, imports of capital goods decreased by 6.7% and imports of consumer goods increased by 7.2% during 2002, each as compared with 2001.

As of December 31, 2002, the net internal debt of the Government was US$79.6 billion, as compared with U.S. $75.6 billion outstanding as of December 31, 2001. Gross external debt of the Government totaled US$78.82 billion in 2002. Outstanding gross external debt decreased by approximately US$1.52 billion. Of the total external debt as of December 31, 2002, US$76.03 billion represented long-term debt and US$2.80 billion represented short-term debt.

Mexico’s Economic Outlook for 2003

According to the General Criteria on Economic Policy, the government’s main concern in 2003 will be "to preserve the climate of stability and certainty". This will, in turn, condition its two central objectives: reactivating the economy and reducing poverty. This approach is correct because only with low inflation can economic growth and an increase in social welfare be long lasting.

The government intends to improve its financial situation through a 0.15% reduction in the economic deficit to GDP ratio and no increase in external indebtedness. Furthermore, the government has adopted the 3% inflation target proposed by Banco de México. The signs of fiscal discipline and the support to the central bank’s goal represent the best contribution to economic certainty, among other reasons, because they could reduce the perception of the "country-risk" and lower interest rates.

Currency Fluctuations or the Devaluation and Depreciation of the Peso Could Limit the Ability of Others and Us to Convert Pesos into U.S. Dollars or Other Currencies and/or Adversely Affect Our Financial Condition. Less than half of our indebtedness and some of our costs are U.S. Dollar-denominated, while our revenues are primarily Peso-denominated. As a result, decreases in the value of the Peso against the U.S. Dollar could cause us to incur foreign exchange losses, which would reduce our net income.

Severe devaluation or depreciation of the Peso may also result in governmental intervention, as has resulted in Argentina, or disruption of international foreign exchange markets. This may limit our ability to transfer or convert Pesos into U.S. Dollars and other currencies for the purpose of making timely payments of interest and principal on our indebtedness and adversely affect our ability to obtain imported goods. While the Mexican government does not currently restrict, and for many years has not restricted, the right or ability of Mexican or foreign persons or entities to convert Pesos into U.S. Dollars or to transfer other currencies outside of Mexico, the Mexican government could institute restrictive exchange control policies in the future. Devaluation or depreciation of the Peso against the U.S. Dollar may also adversely affect U.S. Dollar prices for our securities. Such fluctuations also would affect the conversion by the Depositary into U.S. dollars of any cash dividends paid in Pesos on the B Shares and the C Shares comprising the Units.

High Inflation Rates in Mexico May Decrease Consumer Demand for Our Goods While Increasing Our Costs. In recent years, Mexico has experienced high levels of inflation. The annual rate of inflation, as measured by changes in the Mexican National Consumer Price Index, or the NCPI, 9.0% for 2000, 4.4% for 2001 and 5.7% for 2002 and 1.3% for the three month period ended March 31, 2003. High inflation rates can adversely affect our business and results of operations in the following ways:

inflation can adversely affect consumer purchasing power, thereby adversely affecting consumer demand for our products;

to the extent inflation exceeds our price increases, our prices and revenues will be adversely affected in "real" terms; and

if the rate of Mexican inflation exceeds the rate of devaluation of the Peso against the U.S. Dollar, our U.S. Dollar-denominated sales will decrease in relative terms when stated in constant Pesos.

High Interest Rates in Mexico Could Increase Our Financing Costs. Mexico has, and is expected to continue to have, high real and nominal interest rates. The interest rates on 28-day Mexican government treasury securities averaged 15.2%, 11.3%, 7.08% and 8.9% for 2000, 2001, 2002 and the three month period ended March 31, 2003. Accordingly, if we need to incur Peso-denominated debt in the future, it will likely be at high interest rates.

Mexican Antitrust Laws May Limit Our Ability to Expand Through Acquisitions or Joint Ventures. Mexico's federal antitrust laws and regulations may affect some of our activities, including our ability to introduce new products and services, enter into new or complementary businesses or joint ventures and complete acquisitions. In addition, the federal antitrust laws and regulations may adversely affect our ability to determine the rates we charge for our products. Approval of the Mexican Antitrust Commission is required for us to acquire and sell significant businesses or enter into significant joint ventures. The Mexican Antitrust Commission may not approve any proposed future acquisition or joint venture that we may pursue. See "Information on the Company Business Overview."

The Protections Afforded To Minority Shareholders In Mexico Are Different From Those In The United States. In accordance with theLey del Mercado de Valores, or the Mexican Securities Market Law, as amended, we recently amended our bylaws to increase the protections afforded to our minority shareholders in an effort to try to insure that our corporate governance procedures are substantially similar to international standards. See "Other Information Mexican Securities Market Law" and " Bylaws Other Provisions." Notwithstanding these amendments, under Mexican law, the protections afforded to minority shareholders are different from those in the United States. In particular, the law concerning fiduciary duties of directors is not well developed, there is no procedure for class actions or shareholder derivative actions and there are different procedural requirements for bringing shareholder lawsuits. As a result, in practice, it may be more difficult for our minority shareholders to enforce their rights against us or our directors or principal shareholders than it would be for shareholders of an U.S. company.

Risk Factors Relating to the Company

We Participate In A Very Competitive Market And Increased Competition May Adversely Affect Our Business. The retail industry in Mexico is highly competitive. We face strong competition from other national and international operators of supermarket and retail stores, including Walmex (formerly Cifra), Carrefour and Gigante. All of the foregoing stores owned by third parties compete with our stores. The Costco membership warehouses face competition from Sam's Club, a self-service warehouse club owned by Walmex. We expect that other United States and international retailers may enter the market in Mexico in the future either through joint ventures or directly. We also compete with numerous local and regional supermarket and self-service store chains, as well as small, family-owned neighborhood stores and street markets, in each region in which we do business. In addition, certain of our stores, which are located in the same shopping areas, compete with each other. The restaurant business in Mexico is also highly competitive, and Restaurantes California compete with numerous regional and national fast-food restaurant chains, local restaurants and street merchants. There can be no assurance that our performance will not be adversely affected by increased competition, whether resulting from these or other sources. See "Item 4. Information on the Company Business Overview Competition."

Our Growth Strategy is Dependent Upon the Continued Improvement of the Mexican Economy. A major component of our future growth is expected to come from adding new stores (including Costco membership warehouses) and restaurants and remodeling existing stores. Our ability to resume our expansion and remodeling plans as provided in our current business plan and our returns on our investment in expansion and remodeling are dependent to a significant extent on the continued improvement of Mexico's economic performance. Even following the continued recovery of the Mexican economy, there can be no assurance that we will be able to open or remodel the number of stores (including Costco membership warehouses) and restaurants currently intended, whether because of economic conditions, availability of financing, availability of suitable and affordable sites, the ability to attract and retain certain qualified employees or otherwise. See "Item 5. Operating and Financial Review and Prospects" and "Item 4. Information on the Company."

Our Joint Venture With Costco Mexico is Jointly Controlled and is Subject to Termination in Certain Circumstances. The Costco Mexico joint venture is managed, on a day-to-day basis, by officers appointed by Costco and approved by us pursuant to certain management agreements between Costco and the Costco Mexico joint venture. In addition, the affirmative vote of at least two of the three directors appointed by each of Costco and us to the Costco Mexico joint venture board of directors is required to approve significant decisions regarding the joint venture, including among other things, certain revisions to the joint venture business plan, obligations or acquisitions of the estate or certain other assets not otherwise provided for in the business plan or the removal of the management personnel appointed by Costco. Furthermore, certain significant decisions also require the approval of both members of an executive committee, which consists of our chief executive officer, and that of Costco. Accordingly, although we expect Costco membership warehouses to be an important part of our future growth, we do not have sole control over the growth and operation of the Costco membership warehouse format. In addition, the Costco Mexico joint venture is subject to termination in certain circumstances. See "Item 4. Business Overview Retail Store Formats."

There Are Differences in Corporate Disclosure and Accounting Standards for Mexican Companies and this May Cause our Financial Statements to Differ in Certain Respects from U.S Issuers. A principal objective of the securities laws of the United States, Mexico and other countries is to promote full and fair disclosure of all material corporate information. However, there may be less publicly available information about foreign issuers of securities listed in the United States than is regularly published by or about domestic issuers of listed securities. In addition, we prepare our Financial Statements in accordance with Mexican GAAP, which differ from U.S. GAAP and accounting procedures adopted in other countries in a number of respects. For example, most Mexican companies, including us, must incorporate the effects of inflation directly in accounting records and in their published Financial Statements. Thus, Mexican financial statements and reported earnings may differ from those of companies in other countries in this and other respects. Note 17 to our Annual Financial Statements describes the principal differences between Mexican GAAP and U.S. GAAP as they relate to us and provides a reconciliation to U.S. GAAP of net income and total stockholders' equity.

The Seasonal Nature of Our Business Affects Our Revenue and a Significant Reduction in Third or Fourth Quarter Net Sales Could Impact Our Results of Operations. Our business reflects seasonal patterns of consumer spending, which is common in the retail industry. We typically recognize a disproportionately large percentage of our overall net sales in the third quarter in connection with the "Julio Regalado" holiday and in the fourth quarter in connection with the Christmas holiday season. Accordingly, a significant reduction in the third or fourth quarter revenue could adversely affect our business, financial condition and results of operations.

We are Controlled by Principal Shareholders. Members of the González family, are included as our Principal Shareholders and own a majority of the outstanding B Shares through B Units and Units. As a result of this majority ownership, the Principal Shareholders are able to elect a majority of the members of the Board and to determine the outcome of the voting on substantially all actions that require shareholder approval. See "Item 7. Major Shareholders and Related Party Transactions."

The Principal Shareholders have advised us that, in connection with any primary sale of equity by us in the future, they may purchase additional B Shares through B Units or Units (through the exercise of pre-emptive rights, if any, or otherwise) so that they will continue to own B Shares representing a majority of the total outstanding B Shares of CCM. The Principal Shareholders have also advised us that they may raise funds for such purchase by selling, borrowing or engaging in other types of financing transactions secured by B Units or Units which they own.

Our Principal Shareholders Have Substantial Influence Over Our Management and the Interests of Our Principal Shareholders May Differ from Those of Other Shareholders. Approximately 69.3% of our outstanding B Units, the class of capital stock that is entitled to elect a majority of our Board of Directors and the only class of capital stock entitled to vote on other general corporate matters, is beneficially owned, directly or indirectly by a trust the beneficiaries of whom are members of the González Family. As our controlling shareholder, this trust controls our business through its power to elect a majority of our Board of Directors and to determine the outcome of almost all actions that require shareholder approval. For example, the trust has the ability to cause us to declare dividends. The principal grantor and beneficiary of this trust is a corporation owned by the González family. For a description of this trust see the section entitled The Scotiabank Trust. In addition to their indirect ownership interest in our company, Mr. Carlos González Nova, Mr. Guillermo González Nova, Mr. Jaime González Nova, Mr. Carlos González Zabalegui, Ms. Elena González Guerra, and Mr. Pablo González Guerra serve as our directors. Mr. Guillermo González Nova also serves as our Chairman of the Board, and Mr. Carlos González Zabalegui serves as our Chief Executive Officer. See "Major Shareholders and Related Party Transactions -Principal Shareholders" and "Directors, Senior Management and Employees."

Forward-Looking Statements

Some written information and oral statements made or incorporated by reference from time to time by CCM, or its representatives in this annual report, other reports, filings with the Securities and Exchange Commission, press releases, conferences, or otherwise, are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements, which are subject to various risks and uncertainties, include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance, or achievement, and may contain forward-looking terminology such as "anticipate," "believe," "continue," "expect," "estimate," "project," "will," "will be," "will continue," "will likely result," "may," "plan," or words or phrases of similar meaning. Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from the forward-looking statements. The risks and uncertainties are detailed from time to time in reports filed by CCM with the SEC and include, among others, the following:

- Our ability to achieve sales and earnings-per-share goals will be affected primarily by: industry consolidation; pricing and promotional activities of existing and new competitors, including non-traditional competitors.

- Our efforts to meet our working capital reduction targets could be adversely affected by: increases in product costs; our ability to obtain sales growth from new square footage; competitive activity in the markets in which we operate; changes in our product mix; and changes in laws and regulations.

- Our ability to generate operating cash flow to the extent expected could be adversely affected if any of the factors identified above negatively impacts our operations, or if any of our underlying strategies, including those to reduce shrink and SG& A and to increase productivity, are not achieved.

- Consolidation in the retail industry is likely to continue and the effects on our business, favorable or unfavorable, cannot be foreseen.

- The retailing industry continues to experience fierce competition from other retailers, supercenters, clubs or warehouse stores, mom and pop stores and others. Our continued success is dependent upon our ability to compete in this industry and continue to reduce operating expenses, including managing salaries and corporate expenses. While we believe our opportunities for sustained, profitable growth are considerable, unanticipated actions of competitors could impact our sales and net income.

- Changes in laws and regulations, including changes in accounting standards, taxation requirements, and environmental laws may have a material impact on our financial statements.

- Changes in the general business and economic conditions in our operating regions, including the rate of inflation, population growth, and employment and job growth in the markets in which we operate may affect our ability to hire and train qualified employees to operate our stores. This would negatively affect earnings and sales growth. General economic changes may also affect the shopping habits of our customers, which could affect sales and earnings.

- Our capital expenditures could differ from our estimate if we are unsuccessful in acquiring suitable sites for new stores, if development costs vary from those budgeted, or if our logistics and technology projects are not completed in the time frame expected or on budget.

- Depreciation and amortization expenses may vary from our estimates due to the timing of new store openings.

- Interest expense will vary with changes in capital markets and the amount of debt that we have outstanding. Although we use derivative financial instruments to manage our net exposure to financial risks, we are still exposed to interest rate fluctuations and other capital market conditions.

- We cannot fully foresee the effects of the general economic downturn on CCM’s business. We have assumed economic and competitive situations will not change significantly for 2003.

- Other factors and assumptions not identified above could also cause actual results to differ materially from those set forth in the forward-looking information. Accordingly, actual events and results may vary significantly from those included in or contemplated or implied by forward-looking statements made by us or our representatives.

The risks summarized above are not exhaustive. Other sections of this annual report may include additional factors that could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for management to predict all of these risk factors, nor can it assess the impact of all of these risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors and analysts should not place undue reliance on forward-looking statements as a prediction of actual results. Accordingly, when considering forward-looking statements, you should keep in mind the factors described in "Item 3. Key Information Risk Factors" and other cautionary statements appearing in "Item 5. Operating and Financial Review and Prospects" and elsewhere in this annual report.

The predictive and forward-looking statements in this annual report may not come true and are made under the SEC's disclosure safe harbor. Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information or future developments.

Item 4. Information on the Company

History and Development of the Company

Controladora Comercial Mexicana, S.A. de C.V., or CCM or the Company, is a limited liability stock company with variable capital (sociedad anónima de capital variable) organized under the laws of Mexico. Our principal offices are located at Av. Revolución No. 780, Módulo 2 Colonia San Juan, C.P. 03730 México, D.F. and our telephone number is (52) 55 5270 9312.

We trace our history to 1944 when Antonino González Abascal and his son founded their first store in Mexico City, which sold primarily textiles. The first combination supermarket/general merchandise store under the name Comercial Mexicana was opened in Mexico City in 1962, and 20 additional stores were established during the 1970's. During the 1980's we continued to expand through the acquisition of the Sumesa chain in 1981 and with 51 Comercial Mexicana store openings. The first Restaurante California commenced operations in 1982, and the first Bodega opened in 1989. We entered into the Costco Mexico joint venture in June 1991, and the initial Costco Mexico opened in February 1992. In 1993, we introduced the Mega format to take advantage of the perceived potential of the supercenter and hypermarket formats. CCM was fully owned by the González family until April 1991, when shares of capital stock of CCM were listed in the Mexican Stock Exchange and offered publicly in Mexico. In 1996, GDSs representing shares of capital stock of CCM were listed on the New York Stock Exchange and the GDSs and the underlying shares were offered publicly in Mexico, the United States and elsewhere outside of Mexico.

Our deed of incorporation was executed on December 9, 1988 and we were registered in the Public Registry of Commerce in Mexico City on February 21, 1989, under the number 60562. The term of the Company is 99 years beginning on May 11, 1989.

Capital Expenditures

Capital expenditures reflect our strategy of growth through expansion and acquisition as well as our emphasis on self-development and ownership of real estate, and on logistics and technology improvements. Continued capital spending in technology focusing on improved store operations, logistics, manufacturing procurement, category management, merchandising and buying practices, should reduce merchandising costs as a percent of sales. For fiscal 2003, we expect capital spending to be approximately $130 million. We intend to use the combination of cash flow from operations, including reductions in working capital to finance capital expenditure requirements.

The following table sets forth our capital expenditures for each of the three years ended December 31, 2000, 2001, 2002 and the budgeted capital expenditures for 2003:

| Year ended December 31(1), |

| | 2000 | 2001 | 2002 | 2003 (2) |

| (Millions of constant Pesos as of December 31, 2002, except for 2003 amounts which are in nominal Pesos) |

| Real estate | 500.7 | 590.8 | 315.7 | 526.4 |

| Store fixture (3) | 859.8 | 593.4 | 411.3 | 685.9 |

| Information systems | 22.2 | 21.4 | 15.4 | 25.7 |

| | | | | |

| Total | Ps.1,382.7 | Ps.1,205.6 | Ps. 742.4 | Ps. 1,238.0 |

(1) Capital expenditures exclude Ps.239.9 in 2000, Ps.276.0 in 2001 and Ps. 204.0 in 2002 contributed by Costco to the Costco Mexico joint venture.

(2) Represents budgeted amounts for the year ending December 31, 2003.

(3) Represents store fixtures and other equipment expenditures.

Annually, we invest significant resources in areas such as construction, acquisition of equipment and the remodeling of stores. Since 2000, we have opened 23 stores and 17 restaurants. Additionally, 25 units have been remodeled and 12 units have been reconverted, to better serve the geographic areas where these stores are located. Similarly, we have invested significant resources in the construction of an efficient and reliable merchandise system.

The capital expenditures of Ps. 742.4 million in 2002 were funded with cash generated from operations. Our plans for 2003 are contingent primarily upon the economic situation in Mexico and our ability to generate sufficient cash flow to fund such expenditures. Depending upon these conditions, our goal is to open or commence construction on an aggregate of up to 10 stores and 6 restaurants in 2003, and to remodel 12 units.

We currently intend to fund substantially all of our 2003 capital expenditures primarily with cash flows from operations. Although we believe that sufficient financing will be available to us, there can be no assurance that we will have sufficient cash flow from operations to make all of our planned capital expenditures when scheduled or if necessary, that we will be able to obtain, or what the terms may be of, any bank or other financing. Costco is responsible for funding 50% of the cost of the new Costco membership warehouses. See "Item 4. Information on the Company Property, Plant, and Equipment" and "Item 3. Key Information Risk Factors Factors Relating to the Company Growth Strategy Dependent Upon Continued Improvement of Mexican Economy."

Business Overview

General

CCM is a holding company, which, through its subsidiaries, operates the second largest retail company in Mexico, as measured by net sales in 2002, as well as a chain of family restaurants. In addition, we own a 50% interest in the Costco Mexico joint venture with Costco of the United States, which operates a chain of warehouse clubs in Mexico. Our retail operations sell a wide variety of food items, including basic groceries and perishables, and non-food items, which include general merchandise and clothing, with food items representing 64.9% of our total sales in 2002. At December 31, 2002, we had 170 stores operating under five retailing formats (including stores operated by the Costco Mexico joint venture) with a total selling area of approximately 12.1 million square feet, concentrated primarily in the Mexico City metropolitan area and the central Mexico region, including Guadalajara, or the Central Region.

The Mexican retail sector is fragmented and consumers are served by a number of formats, including traditional formats such as independent grocery stores and food specialists, modern formats such as supermarkets, hypermarkets and department stores, as well as informal outlets such as street vendors and markets. We believe that there is considerable potential for growth as the Mexican retail sector continues its process of modernization. We believe that consumer preferences are shifting away from smaller, traditional and informal outlets toward larger, standardized supermarket and hypermarket chains, which offer consumers superior value through greater merchandise selection, convenience and better prices through the chains' greater purchasing power. Our strategy is designed to capitalize on this trend. Additionally, we believe that the recovery of consumers' purchasing power in Mexico and favorable demographics approximately half of Mexico's population is under 21 years old which will lead to increased numbers of consumers, will benefit the retail sector in the near and long terms.

Strategy

Our strategies are designed to benefit from the modernization of the retail sector, building upon our position as one of Mexico's leading chains and our strong brand franchise. To achieve this goal, we pursue four primary strategies in the Mexican retail market.

Merchandising Strategy. Our merchandising strategy emphasizes competition on the basis of product selection, quality, price and consumer service. We target specific consumer preferences and demographics by using distinct retail formats, which differ in store size, service level and product range. As Mexican consumer preferences have shifted toward large supermarkets and hypermarkets, we have met this demand by introducing our Mega format in 1993. In addition, we have sought partnerships with leading international retailers to introduce innovative formats to the Mexican market. In 1992 our Costco Mexico joint venture opened the first Costco Mexico warehouse club. Currently, we operate five retailing formats:

- Combination Supermarket/General Merchandise Stores. Through our flagship subsidiary "Comercial Mexicana," we operate combination self service supermarket/general merchandise stores under three formats: Comercial Mexicana stores (71 stores), which target middle and upper income segments; Bodega Comercial Mexicana stores (34 stores), which target lower income segments; and Mega (27 stores), super combination stores which carry the broadest line of products and complementary services in the combination store format and target a broad range of income levels.

- Supermarkets. Under the name Sumesa, we currently operate 17 neighborhood supermarkets.

- Membership Warehouse Stores. Through the Costco Mexico joint venture we operate 21 self-service membership warehouse stores, targeting businesses, professionals and upper income customers, which offer members low prices on bulk purchases.

Pricing Strategy. The Company believes that its historical strategy of promotions and deep discounts was effective in the historical Mexican macroeconomic environment, which was characterized by high inflation. As the Mexican economic landscape has become more stable, consumers have become more aware of price differences, and have started comparing them among the different retailers. The introduction of the Walmex strategy of "Every Day Low Prices" has become more attractive to consumers. The "promotion/heavy discount" strategy also attracted wholesale customers (resellers), who only shopped for discounted merchandise, and as a rule do not show any kind of customer loyalty. With the main objective attracting a more loyal customer base, the Company decided to adopt a low prices strategy in the second quarter of 2002. The Company believes that its customer base is adjusting to this change in pricing strategy, and that the Company’s operational results and its ability to forecast and plan its procurement needs are consistently improving, thereby achieving better costs, efficiencies and ultimately higher customer satisfaction. The Company is very optimistic about the final outcome of this strategy.

Operating Strategy. Our operating strategy emphasizes increased productivity and customer service through investment in information technology. From 2000 through December 31, 2002, we invested approximately U.S.$ 5.6 million in computer systems focused primarily on improving inventory efficiency, supply levels and controls. Innovative technologies used by our stores include point of sales systems (including bar code scanners), a unit inventory control system, fiber optic communications networks and an electronic communication system to submit purchase orders to suppliers. We believe that continued upgrading of our systems would allow it to further increase efficiencies, reduce expenses and provide the necessary product and sales information to enhance merchandising decisions at each store.

Growth Strategy. Our growth strategy is intended to take advantage of the fragmented nature of the Mexican retailing market and to strengthen our market penetration. Our growth strategy has two principal components: (i) continued improvements in same-store sales growth through enhanced merchandising techniques, attractive promotions, remodeling and expansion of selling area and (ii) new store openings both in areas where we already have a strong presence and in areas with high potential but which are currently undeserved by modern retail formats. From 2000 and through 2001, we invested Ps.2,588.3 million to open 8 Comercial Mexicana, 5 Mega, 3 Bodega, 12 Restaurantes California, 1 Sumesa store and 3 Costco. During this period we also remodeled 15 units, converted 4 Comercial Mexicana stores into the Mega format and 7 Comercial Mexicana into the Bodega format. In 2002, we invested Ps.742.4 to open 1 Mega, 1 Bodega Comercial Mexicana, 1 Costco membership warehouse, and 5 Restaurantes California. We also remodeled 10 units and converted 1 Comercial Mexicana into the Mega format. We intend to open 10 stores, 6 restaurants and remodel 12 units in 2003. In particular, we intend to continue the growth of the larger formats stores, such as Mega hypermarkets and Costco membership warehouses.

Since December 1994, when Mexico experienced an economic crisis, instability, increased inflation, high domestic interest rates, negative economic growth, increased unemployment, we have implemented a program to streamline operations in order to reduce operating expenses and increase cash flow while taking steps to minimize the effects of reduced purchasing power. During 2003, we expect to continue our aggressive program to reduce expenses at both our branches and at the corporate level in an effort to improve our operating margins. Economic conditions continued to improve in 2000 with gross domestic product increasing by 6.9% in 2000 as compared to 1999, but declined by 0.3% in 2001 as compared to 2000, and increased in 2002 by 0.9% compared to 2002. In 2000, 2001 the retail sector increased by 7.5%, 6.9% and decreased by 1.8% en 2002 respectively, while our total net sales increased by 6.8%, 0.2% and decreased 8.3% during the periods. In response to the improving economic conditions, we resumed our growth strategy, with capital expenditures of Ps.1.401.5 million in 2000 Ps.1,205.6 million in 2001 and Ps. 742.4 million in 2002.

At December 31, 2002, we also operated a chain of 55 family-style restaurants under the name of "Restaurantes California". Restaurantes California provide customers with homemade-style food and high quality service at affordable prices. As part of our growth strategy, we intend to open six new Restaurantes California by the end of 2003.

Location Strategy. In opening new stores, we select the type of retail store and offer the merchandise and service mix which they consider most appropriate for each location's anticipated customer base. The Company determines a location's anticipated customer base by analyzing a number of factors, including the current and expected future population density, income levels and competitive conditions surrounding that location. Decisions with respect to opening new Costco warehouses are made by the Costco Mexico joint venture.

Seasonally

Due to the seasonal nature of the retail industry, where merchandise sales and cash flows from operations are historically higher in the third and fourth quarters than any other period, a disproportionate amount of operating cash flows are generated in the previously mentioned quarters. In preparation for the Julio Regalado and the Holiday seasons, we significantly increase our merchandise inventories, which traditionally have been financed by cash flows from operations, bank lines of credit, trade credit and terms from vendors. Our profitability and cash flows are primarily dependent upon the large sales volume generated during the quarters of our fiscal year.

Sales in our stores typically increase during the "Julio Regalado" special promotion occurring each July, and during the Christmas season. In 2000, 2001 and 2002 approximately 55.1%, 50.9% and 53.6% respectively, of our sales occurred during the last six months of the year, with an average of 27.4% in 2000, 22.7% in 2001 and 27.6% in 2002 of such sales occurring in the last quarter of the year. Although we have recently instituted a year-round "Low-Price" strategy, we currently intend to continue to yearly "Julio Regalado" and Christmas Holidays promotions.

Retail Operations

At December 31, 2002, we had 170 stores operating under five retailing formats with a total selling area of approximately 12.1 million square feet. Although we operate nationwide, our stores are concentrated in the two most populated areas of Mexico, the Mexico City metropolitan area and the Central region. Our stores located in those areas account for approximately 76.6% of our total retail floor space at December 31, 2002.

The percentage breakdown of our total selling area and number of stores by geographic region at December 31, 2002, is set forth in the following table:

| | At December 31, 2002 |

| | Percentage of Total Selling Area | Number of Stores |

| Mexico City metropolitan area | 39.6% | 78 |

| Central region | 37.0 | 57 |

| Northwest region | 9.2 | 13 |

| Northeast region | 2.8 | 4 |

| Southeast region | 6.8 | 10 |

| Southwest region | 4.6 | 8 |

| Total | 100.0% | 170 |

The percentage breakdown of the contribution of our retail formats (including the Costco membership warehouses) and restaurants to total sales is set forth below for each of the three years ended December 31, 2002.

| | Year Ended December 31, |

| | 2000 | 2001 | 2002 |

| Comercial Mexicana | 51.3% | 46.5% | 40.0% |

| Bodega | 13.1 | 13.9 | 14.9 |

| Mega | 17.8 | 19.8 | 22.6 |

| Sumesa | 2.0 | 2.0 | 2.3 |

| Costco | 14.3 | 16.1 | 18.5 |

| Restaurantes California | 1.3 | 1.4 | 1.5 |

| Miscellaneous Income | 0.2 | 0.3 | 0.2 |

| Total | 100.0% | 100.0% | 100.0% |

Except for Sumesa stores, which offer primarily food items, stores operated by us offer a combination of food and non-food items. Management classifies our sales into four main product lines. The percentage contribution to total sales of each of these product lines is set forth below for each of the three years ended December 31, 2000, 2001 and 2002.

| | Year ended December 31, |

| | 2000 | 2001 | 2002 |

| Perishables | 26.0% | 25.4% | 26.1% |

| Groceries | 37.3 | 38.0 | 38.8 |

| General Merchandise | 25.2 | 25.3 | 24.7 |

| Clothing | 11.5 | 11.3 | 10.4 |

| Total | 100.0% | 100.0% | 100.0% |

Our management believes that in recent years Mexican consumers have increasingly preferred stores that offer a combination of the wide variety of food items carried by conventional supermarkets as well as a variety of non-food items, such as general merchandise, clothing, household items and home improvement products. In response to this change in consumer preferences, our newer stores offer expanded perishable departments, prepared foods, tortilla presses and bakery goods as well as wider selections of health, beauty and pharmaceutical products.

Multiple Format Strategy. We conduct retail operations through our five retailing store formats: Comercial Mexicana, Bodega, Mega, Sumesa and Costco membership warehouses (through the Costco Mexico joint venture). Through these formats, we are able to target nearly all the population segments in Mexico City and the other areas, which we serve.

In opening new stores, we select the type of retail store and offers the merchandise and service mix which we consider most appropriate for each location's anticipated customer base. We determine a location's anticipated customer base by referring to a number of factors, including the current and expected future population density, income levels and competitive conditions surrounding that location. Decisions with respect to opening new Costco warehouses are made by the Costco Mexico joint venture.

We believe, based on changing demographics and competitive characteristics of the location surrounding an established store, in changing the retailing format of our retail sites when appropriate. For example, in 2001 three Comercial Mexicana were converted into a Mega and another five were converted into Bodega and in 2002 we converted one Comercial Mexicana into a Mega and one Bodega into a Comercial Mexicana. In addition, since acquiring the Sumesa chain in 1981, we have converted six Sumesa stores into other formats. The conversion costs typically ranged from U.S.$2.1 million to U.S.$5.0 million per unit, averaging approximately U.S.$3.1 million per unit.

While we currently expect to continue using our five retailing formats, we may experiment with additional formats in the future.

Retail Store Formats

We currently operate stores in the five retail formats discussed below.

Combination Supermarket/General Merchandise Stores

Comercial Mexicana. At December 31, 2002, we operated 71 Comercial Mexicana stores, including 19 in the Mexico City metropolitan area, 30 in the central region (including Guadalajara), 9 in the Northwest region (including Tijuana), 2 in the Northeast region, 5 in the Southeast region and 6 in the Southwest region. Comercial Mexicana stores are targeted at middle and upper-income customers.

Comercial Mexicana stores carry an extensive line of food items and non-food items. Food items include meats, poultry, fish, fresh fruits and vegetables, dairy products, baked goods, frozen goods, canned goods, prepared foods, delicatessen, wines and liquors and imported foods. Non-food items include men's, women's and children's clothing and shoes, paper products, office supplies, books and magazines, health and beauty products, garden supplies, automotive supplies, photographic supplies, electric appliances, sporting goods, toys and gifts and numerous household items. All Comercial Mexicanas have one or more specialty departments, such as a bakery, tortilla press or video rental shop. Most Comercial Mexicana stores have pharmacies offering prescription and non-prescription medications. A typical Comercial Mexicana offers more than 55,000 products.

Most Comercial Mexicana stores are located in neighborhood shopping centers. Comercial Mexicana stores require large parking lots and access to roads to allow customers to drive to the stores.

Comercial Mexicana stores offer, at competitive prices, locally and nationally advertised and distributed brands of merchandise, together with certain food items, general merchandise and clothing product lines which are sold under our own private label names. Comercial Mexicana stores incorporate merchandising techniques, such as good lighting, wider-than-usual aisles and store layouts, which are designed to encourage greater spending per customer. All Comercial Mexicana stores are identified by an easily recognizable pelican logo.

Comercial Mexicana remodeling generally involves the installation of new services, lighting, decorations, freezers and refrigerators and automated check-out counters, as well as the replacement of fixtures, painting and necessary repairs and changes in the store layout which are intended to make the stores more attractive to customers. At the same time, the store systems are upgraded to improve operating efficiencies and allow the introduction of new services. In 2000, 2001 and 2002, we remodeled three Comercial Mexicana and four for both years 2001 and 2002.

Comercial Mexicana stores generally range in size from approximately 43,000 to 107,000 square feet of selling area, with an average of approximately 68,000 square feet. Comercial Mexicana stores employed 10,566 individuals at December 31, 2002.

Comercial Mexicana stores have experienced a decline in the number of customers in the last three years. The Company believes this is mainly a result of our conversion of eight Comercial Mexicanas into Bodegas or Megas in 2000 and 2001, and increased competition in the market. We have developed several strategies in response to these developments, including reorganization of the Comercial Mexicana employee structure, construction of new a distribution center servicing all store formats, including Comercial Mexicana, and the institution of a new pricing strategy of low prices instead of one-time promotionsand discounts.

Bodega. At December 31, 2002, we operated 34 Bodegas, of which 25 were located in Mexico City and its surrounding suburbs, seven were located in the Central region (including one store in Guadalajara), one was located in the Southeast region and one in the Southwest region. During 2002, we opened one Bodega in the Central Region. Bodegas target lower-income customers.

Bodegas are warehouse stores, which offer more than 30,000 products, mainly food items, pharmaceutical items and general merchandise of the type sold in Comercial Mexicana stores (but with less selection in terms of brands and sizes of items offered).

Bodegas have lower operating costs as a percentage of sales than those of Comercial Mexicana stores. Lower operating costs are obtained primarily because Bodegas use less advertising and a lower level of customer service, fewer amenities, less decoration and reduced storage costs (because items are stocked on display on the sales floor). In addition, Bodegas have fewer promotions and product introductions. Most of the Bodegas have a tortilla press, a bakery and/or other specialty department. Because their customers generally do not have cars, Bodegas are within walking distance of residential areas or accessible by public transportation. Bodegas also are identified by the same easily recognizable pelican logo as Comercial Mexicana stores.

Bodegas range in size from approximately 24,000 to 65,000 square feet of selling area, with an average of approximately 50,600 square feet. Bodegas employed 4,366 individuals at December 31, 2002.

Mega. Under the Mega format, we currently operate our largest combination stores. As of December 31, 2002, we operated 27 Megas, including 14 in Mexico City, 10 in the Central Region, 2 in the North and one in the South Region. The Mega targets a broad range of economic groups.