The following tables present our selected consolidated financial information as of the dates and for each of the periods indicated. This data is qualified in its entirety by reference to, and should be read together with, our audited year-end financial statements. The balance sheet data as of December 31, 2004 and 2005, and the income statement data for the years ended December 31, 2003, 2004 and 2005, are derived from the financial statements appearing elsewhere in this annual report. This data should also be read together with "Operating and Financial Review and Prospects."

Our financial statements have been prepared in accordance with Mexican GAAP, which differs in significant respects from U.S. GAAP. Note 17 to our financial statements appearing elsewhere in this annual report provides a description of the principal differences between Mexican GAAP and U.S. GAAP as they relate to us, and a reconciliation to U.S. GAAP of net income and other items for the years ended December 31, 2003, 2004 and 2005 and stockholders’ equity at December 31, 2003, 2004 and 2005. Any reconciliation to U.S. GAAP may reveal significant differences between our stockholders’ equity, net income and other items as reported under Mexican GAAP and U.S. GAAP. See "Risk Factors-Risk Factors Related to Mexico-Differences Between Mexican GAAP and U.S. GAAP May Have an Impact on the Presentation of Our Financial Information."

We report our investment in the Costco de Mexico Group joint venture under the proportional consolidation method of accounting by consolidating 50% of the operations of that joint venture in our financial statements.

The exchange rate used in translating Pesos into U.S. Dollars in calculating the convenience translations included in the following tables is determined by reference to the Interbank Rate, as reported by Banamex, as of December 31, 2005, which was Ps.10.627 per U.S. Dollar. The exchange rate translations contained in this annual report should not be construed as representations that the Peso amounts actually represent the U.S. Dollar amounts presented or that they could be converted into U.S. Dollars at the rate indicated.

| | Year Ended December 31, |

| | 2001 | 2002 | 2003 | 2004 | 2005 | 2005 |

| | (Millions of constant Pesos as of December 31, 2005 and millions of U.S. Dollars, except for percentages) (1) |

Income Statement Data | | | | | | |

Mexican GAAP: | | | | | | |

Net sales................................................................. | Ps. 39,495 | Ps. 36,223 | Ps. 38,004 | Ps. 38,842 | Ps. 40,309 | U.S.$ 3,793 |

Gross profit............................................................ | 7,513 | 7,105 | 7,608 | 7,862 | 8,478 | 798 |

Selling, general and administrative expenses........... | 6,286 | 6,067 | 6,080 | 6,033 | 6,200 | 583 |

Operating income................................................... | 1,228 | 1,040 | 1,527 | 1,828 | 2,278 | 214 |

Integral results of financing ................................... | 11 | (67) | (203) | 182 | (621) | 58 |

Interest expense................................................. | (307) | (260) | (356) | (300) | (432) | (41) |

Interest income (2)............................................ | 66 | 49 | 46 | 79 | 64 | 6 |

Foreign-exchange (loss) gain, net....................... | 27 | (247) | (108) | (7) | (87) | 8 |

Loss from repurchase of notes............................ | - | (9) | (44) | - | - | - |

(Loss) gain from forward agreements.................. | (48) | 56 | - | 91) | (576) | (54) |

Gain from monetary position............................. | 273 | 344 | 259 | 319 | 236 | 22 |

Other (expense) income, net (3)............................ | (21) | 5 | 67 | (19) | (520) | 49 |

Provision for income taxes and employee statutory profit sharing..................................................... | 302 | 79 | 261 | 208 | 333 | 31 |

Interest of minority stockholders in results of subsidiaries.......................................................... | (9) | (7) | (8) | (8) | (13) | (1) |

Net income............................................................ | 906 | 892 | 1,122 | 1,775 | 1,832 | 172 |

Capital stock outstanding shares at end of period .. | 1,061,000 | 1,078,000 | 1,080,000 | 1,086,000 | 1,086,000 | |

Net income per B Unit and BC Unit(4).................. | 0.85 | 0.83 | 1.04 | 1.63 | 1.69 | 0.16 |

Net income per GDS (5)......................................... | 17.0 | 16.6 | 20.80 | 31.6 | 33.8 | 3.18 |

Dividends per B Unit and BC Unit.......................... | 0.107 | 0.107 | 0.107 | 0.1115 | 0.123 | 0.01 |

Dividends per GDS (5)............................................ | 2.14 | 2.14 | 2.14 | 2.23 | 2.46 | 0.23 |

Weighted average B Units and BC Units

outstanding............................................................. | 1,061 | 1,078 | 1,080 | 1,086 | 1,086 | |

| | | | | | | |

U.S. GAAP (6) (19): | | | | | | |

Net sales................................................................ | 33,140 | 29,514 | 30,844 | 31,016 | 31,922 | 3,006 |

| Operating income .................................................. | - | - | 1,535 | 1,879 | 2,283 | 215 |

Net income............................................................ | 994 | 954 | 857 | 1,603 | 371 | 35 |

Net income per B Unit and BC Unit(4).................. | 0.94 | 0.88 | 0.79 | 1.48 | 0.34 | |

Net income per GDS (5)......................................... | 18.8 | 17.6 | 15.8 | 29.5 | 14.0 | |

| | | | | | | |

Balance Sheet Data | | | | | | |

Mexican GAAP: | | | | | | |

Cash and temporary investments............................ | 1,416 | 970 | 1,325 | 1,291 | 1,621 | 153 |

Current assets......................................................... | 7,314 | 8,350 | 9,541 | 9,909 | 8,597 | 809 |

Property, equipment and leasehold and owned building improvements, net................................ | 17,567 | 17,329 | 17,933 | 18,918 | 20,574 | 1,936 |

Total assets............................................................ | 25,297 | 26,194 | 27,965 | 29,694 | 30,325 | 2,854 |

Short-term debt...................................................... | - | 178 | - | - | 319 | 30 |

Long-term debt...................................................... | 2,053 | 1,979 | 2,285 | 2,197 | 2,216 | 209 |

Total liabilities....................................................... | 12,365 | 12,812 | 13,723 | 14,019 | 13,571 | 1,277 |

Minority interest (7).............................................. | 99 | 94 | 101 | 100 | 106 | 10 |

Majority stockholders’ equity................................. | 12,833 | 13,288 | 14,141 | 15,575 | 16,648 | 1,567 |

| | | | | | | |

U.S. GAAP (6) (19): | | | | | | |

| Current assets ....................................................... | - | - | - | 10,389 | 9,708 | 914 |

Total assets............................................................ | 24,326 | 25,353 | 26,815 | 31,265 | 32,053 | 3,016 |

| Current liabilities | - | - | - | 11,239 | 9,651 | 908 |

Total liabilities....................................................... | 11,871 | 12,382 | 13,209 | 16,299 | 16,908 | 1,591 |

Stockholders’ equity............................................... | 12,434 | 12,957 | 13,605 | 14,866 | 15,039 | 1,415 |

| | | | | | | |

| Other Data | | | | | | |

Mexican GAAP | | | | | | |

Net income............................................................ | 906 | 892 | 1,122 | 1,775 | 1,832 | 172 |

Net income as a percentage of net sales.................. | 2.3% | 2.5% | 3.0% | 4.6% | 4.5% | |

Depreciation and amortization............................... | 816 | 819 | 736 | 702 | 711 | 67 |

Capital expenditures (8)......................................... | 1,362 | 839 | 1,670 | 2,104 | 2,684 | 253 |

Total debt/capitalization (9)................................... | 0.18 | 0.18 | 0.17 | 0.14 | 0.15 | |

Working capital (10).............................................. | 181 | (22) | 374 | 471 | (457) | (43) |

| | | | | | | |

Operating Information | | | | | | |

Store Information (11): | | | | | | |

Food sales (12)....................................................... | 63.3% | 64.9% | 66.3% | 68.9% | 66.8% | |

Non-food sales (12)................................................ | 36.7% | 35.1% | 33.7% | 31.1% | 33.2% | |

Average annual sales per store (millions) (13)......... | Ps. 262 | Ps. 249 | Ps. 256 | Ps. 253 | Ps. 251 | |

Sales per retail square foot (thousands) (13)............ | Ps. 3.73 | Ps. 3.73 | Ps. 3.47 | Ps. 3.39 | Ps. 3.13 | |

Sales per operating employee (thousands) (13) (14). | Ps. 1,651 | Ps. 1,513 | Ps. 1,572 | Ps. 1,619 | Ps. 1,614 | |

Same store sales growth (15)................................... | (3.3)% | (10.3)% | 0.3% | (0.1)% | 0.5% | |

Stores: | | | | | | |

Operating at end of period............................... | 172 | 170 | 175 | 181 | 191 | |

Opened during period...................................... | 7 | 3 | 8 | 8 | 15 | |

Closed during period ....................................... | 2 | 5 | 3 | 2 | 5 | |

Remodeled during period (16).......................... | 14 | 12 | 9 | 9 | 12 | |

Total retail square feet at end of period (thousands) (17) ....................................................................... | 11,998 | 12,098 | 13,037 | 13,551 | 14,472 | |

Number of employees (at end of period) (18)......... | 31,955 | 32,993 | 33,557 | 33,763 | 35,837 | |

_________________

(1) Except operating information, percentages and ratios.

(2) Interest income includes our income from interest-bearing temporary investments

(3) Other (expense) income, net consists of amortization of negative goodwill from our acquisition of the Mexican operations of Auchan, S.A. in February 2003 and the write-off of certain fixed assets. For the year ended December 31, 2001, also includes gain on sale of marketable securities. For the years 2004 of Ps.217.9 million and year 2005 of Ps.243.9 million consisted of amortization of negative goodwill from our acquisition of the Mexican operations of Auchan S.A.

(4) Computed by dividing the net income for the year by the weighted average B Units and BC Units outstanding.

(5) Each GDS represents 20 BC units. See "Major Shareholders and Related Party Transactions - Capital Stock."

(6) For a description of the principal differences between Mexican GAAP and U.S. GAAP, see Note 17 to our financial statements.

(7) Consists of interests held by minority stockholders in our subsidiary that manufactures plastic bags and certain of our subsidiaries that own shopping centers.

(8) Capital expenditures for all periods include amounts contributed by us to the Costco de Mexico Group joint venture but exclude amounts contributed to the joint venture by Costco.

(9) Total debt/capitalization is determined by dividing the sum of short term debt and long term debt by stockholders’ equity.

(10) Working capital is current assets minus current liabilities.

(11) Except as otherwise indicated, store information relates to all of our stores, including those operated through the Costco de Mexico Group joint venture (calculated on the basis of 100% of the amounts attributable to the Costco membership warehouses). The information does not include our restaurants.

(12) Food sales include sales of basic groceries and perishables. Non-food sales include sales of general merchandise and clothing. In each case, this information is presented as a percentage of net sales of our stores. For this purpose, sales include only the net sales from the Costco de Mexico Group joint venture that are included in our operating results.

(13) In computing sales per retail square foot for a period, we divide total store sales for the full period by the aggregate retail square footage at the end of such period. Accordingly, stores that are opened for less than the full period have the effect of decreasing store sales per retail square foot, and stores that are closed prior to the end of the full period have the opposite effect. Similarly, in computing average annual sales per store, we divide total store sales for the full period by the number of stores at the end of the period, and in computing sales per operating employee, we divide total store sales for the full period by the number of operating employees at the end of the period.

(14) Takes into account all employees at our stores, including Costco membership warehouses and distribution centers but excludes administrative employees and restaurant employees.

(15) See "Operating and Financial Review and Prospects" for the calculation of same store sales.

(16) Includes conversions of stores from one format to another format.

(17) Retail square footage means the square footage of space in our stores from the cash registers (including accompanying displays) to the back of our stores (excluding any warehouse space). Space for cashiers constituted approximately 8.5% of the total selling area of our stores at December 31, 2005.

(18) Takes into account all employees at our stores, including Costco membership warehouses, restaurants and distribution centers as well as our administrative employees.

(19) For U.S. GAAP purposes, CCM has adopted to avail itself the SEC accommodation to omit reconciling differences related to the classification or display and instead provides summarized footnote disclosure of the amounts proportionally consolidated. See note 17 to the financial statements.

Dividends

Our shares are currently held in B Units and in BC Units. Each B Unit consists of four B Shares and each BC Unit consists of three B Shares and one C Share. The table below sets forth the nominal amount of dividends per B Unit and BC Unit paid in April of each year indicated. Peso amounts have been translated into U.S. Dollars at the exchange rate on each of the respective payment dates.

We paid aggregate dividends of Ps.128.8 million in 2003, Ps.129.4 million in 2004, Ps.138.0 million in 2005 and Ps.149.6 million in 2006. Our current policy is to pay annual aggregate dividends of between U.S.$12.0 million and U.S.$15.0 million.

During our annual shareholders’ meeting on April 6, 2006 our shareholders approved a dividend of Ps.0.138 for each BC Unit, in a single payment, which was made to holders of record on April 18, 2006.

In respect of | Dividend

In nominal Pesos per B and BC Unit | Dividend

In dollars per B and BC Unit |

| | |

2002 | Ps. 0.107 | U.S. 0.00980 |

2003 | Ps. 0.107 | U.S. 0.01112 |

2004 | Ps. 0.1115 | U.S. 0.01252 |

2005 | Ps. 0.123 | U.S. 0.01372 |

2006 | Ps. 0.138 | U.S. 0.01467 |

Exchange Rate Information

Mexico has had a free market for foreign exchange since November 1991 and the Mexican government allows the Peso to float freely against the U.S. Dollar. There can be no assurance that the government will maintain its current policies with regard to the Peso or that the Peso will not further depreciate or appreciate significantly in the future.

The following table sets forth, for the periods indicated, the high, low, average and period-end noon buying rate in New York City for cable transfers in Pesos published by the Federal Reserve Bank of New York, expressed in Pesos per U.S. Dollar. The rates have not been restated in constant currency units and therefore represent nominal historical figures.

| | High | Low | Average(1) | Period End |

Period | | | | |

2000................................................................................. | 10.09 | 9.18 | 9.47 | 9.62 |

2001................................................................................. | 9.97 | 8.95 | 9.33 | 9.16 |

2002................................................................................. | 10.42 | 9.00 | 9.75 | 10.42 |

2003................................................................................. | 11.41 | 10.11 | 10.80 | 11.24 |

2004................................................................................. | 11.63 | 10.80 | 11.31 | 11.15 |

2005................................................................................. | 11.41 | 10.41 | 10.94 | 10.63 |

2006: | | | | |

January................................................................ | 10.64 | 10.44 | 10.54 | 10.44 |

February.............................................................. | 10.53 | 10.43 | 10.45 | 10.45 |

March................................................................. | 10.95 | 10.46 | 10.75 | 10.90 |

April.................................................................... | 11.16 | 10.86 | 11.05 | 11.09 |

May..................................................................... | 11.30 | 10.84 | 11.09 | 11.29 |

| June.................................................................... | 11.48 | 11.24 | 11.40 | 11.34 |

July (through July 14, 2006)................................. | 11.25 | 10.98 | 11.05 | 10.98 |

______________

(1) Average of month-end rates.

The Mexican economy has suffered balance of payment deficits and shortages in foreign exchange reserves in the past. While the Mexican government has not restricted for more than ten years the ability of Mexican or foreign persons or entities to convert Pesos to U.S. Dollars, we cannot assure you that the Mexican government will not institute restrictive exchange control policies in the future. To the extent that the Mexican government institutes restrictive exchange control policies in the future, our ability to transfer or to convert Pesos into U.S. Dollars and other currencies for the purpose of making timely payments of interest and principal of indebtedness, including the notes, as well as to obtain imported goods would be adversely affected. See "-Risk Factors-Risk Factors Related to Mexico-Currency Fluctuations or the Devaluation and Depreciation of the Peso Could Limit Our Ability to Convert Pesos into U.S. Dollars or into Other Currencies, Which Could Adversely Affect Our Business, Financial Condition or Results of Operations."

On July 14, 2006, the noon buying rate was Ps. 10.98 To U.S $1.00.

Risk Factors

The following is a discussion of risks associated with our Company and an investment in our securities. Some of the risks of investing in our securities are specific to our business. Other risks are general risks associated with doing business in Mexico. The discussion below contains information about the Mexican government and the Mexican economy obtained from public sources. We have not independently verified this information. Any of the following risks, if they actually occur, could materially and adversely affect our business, financial condition, results of operations or the price of our securities.

Risk Factors Related to Our Business

We Participate in a Very Competitive Market and Increased Competition May Adversely Affect Our Business

The retail industry in Mexico is characterized by intense competition and increasing pressure on profit margins. The number and type of competitors and the degree of competition experienced by individual stores vary by location. Competition occurs principally on the basis of price and, to a lesser extent, location, selection of merchandise, quality of merchandise (in particular perishables), service, store conditions and promotions. We face strong competition from other national and international operators of supermarket and retail stores, including Walmex, Soriana, Chedraui (which acquired in 2005, 29 Carrefour stores), Gigante and other U.S. and international retailers. The Costco membership warehouses also face competition from Sam’s Club, a self-service warehouse club owned by Walmex. Additional U.S. and international retailers may enter the market in Mexico in the future either through joint ventures or directly. One of our competitors, Walmex, is affiliated with a large multinational retailer with significant financial resources. We also compete with numerous local and regional supermarkets and self-service store chains, as well as small, family-owned neighborhood stores and street markets, in each region in which we do business. In addition, several of our stores, which are located in the same shopping areas, compete with each other. The restaurant business in Mexico is also highly competitive. Restaurantes California competes with numerous regional and national fast-food restaurant chains, local restaurants and prepared food establishments and street markets. We face strong competition from various U.S. fast-food restaurant chains, including McDonalds, Burger King, Kentucky Fried Chicken, Dominos Pizza and Pizza Hut. There can be no assurance that our performance will not be adversely affected by increased competition, whether resulting from the competitors described above or others. See "Information on the Company-Business Overview."

Other leading Mexican retailers, including Walmex and Soriana, are better capitalized than we are and have greater market share than we have as measured by net sales in 2005. Walmex has a pricing strategy of "Every Day Low Prices," which in recent years has increased the pressure on our operating margins and compelled us to lower the prices of certain of our products. Recently, Walmex announced an aggressive expansion plan which involves opening an additional 81 stores across Mexico in 2006. Other competitors have also announced expansion and modernization plans. These actions by our competitors are likely to cause us to respond by adopting more aggressive pricing policies at affected store locations and by implementing our growth strategy more rapidly. As Walmex and other retailers currently in the market in Mexico expand their operations, and as other U.S. and international retailers enter the market in Mexico, competition will continue to intensify and may adversely impact our performance.

Our Growth Strategy Is Dependent Upon the Continued Improvement of the Mexican Economy and Generating Positive Cash Flow

A major component of our future growth is expected to come from adding new stores (including Costco membership warehouses) and restaurants and remodeling our existing stores and restaurants. Our ability to carry out our expansion and remodeling plans and our returns on our investment in expansion and remodeling are dependent to a significant extent on the continued improvement of Mexico’s economic performance and our ability to generate positive cash flow given the Mexican economy. The Mexican economy has suffered severe downturns in the past and may do so in the future. See "-Risk Factors Related to Mexico-Mexico Has Experienced Adverse Economic Conditions." There can be no assurance that we will be able to open or remodel the number of stores (including Costco membership warehouses) and restaurants currently intended, whether because of economic conditions, availability of funds to make capital expenditures, availability of suitable and affordable sites, the ability to attract and retain certain qualified employees or otherwise. See "Operating and Financial Review and Prospects" and "Information on the Company-Business Overview."

Implementation of Our Expansion Program Presents Additional Risks

The growth in our net sales and net income depends to a substantial degree on our expansion program. Successful execution of our expansion program is dependent upon a number of factors, including our hiring and training of qualified personnel, the level of existing and future competition in areas where new stores are to be located, the availability of additional capital, our ability to locate new store and restaurant sites on acceptable terms, our ability to execute our retail concepts successfully in new markets and favorable financial market and macroeconomic conditions in Mexico. We plan to open new stores and restaurants both in areas in which we already operate and in new areas in Mexico. We cannot assure you that our new store and restaurant openings will not result in diversion of sales from our existing operations, and we may be unable to locate sufficient properties to support our expansion plans. Zoning restrictions, permit requirements and other regulations restricting the construction of buildings of the type in which we operate our various formats may also affect our ability to open new stores and restaurants.

If we are unable to open new stores and restaurants, our financial performance could be adversely affected. In addition, if consumers in the markets into which we expand are not receptive to our retail concepts, our financial performance could be adversely affected.

Our Joint Venture With Costco Is Jointly Controlled and Is Subject to Termination in Certain Circumstances

The Costco de Mexico Group joint venture is managed, on a day-to-day basis, by officers appointed by Costco and approved by us pursuant to certain management agreements between us, Costco and the Costco de Mexico Group joint venture. The affirmative vote of a majority of the entire board of directors of the joint venture is required to approve certain significant decisions regarding the joint venture, including some revisions to the joint venture business plan, entering into significant contracts, incurring significant indebtedness not provided for in the business plan, the removal of any management personnel, the election of officers and certain transfers of ownership interests in the joint venture. Furthermore, some significant decisions also require the approval of both members of an executive committee, which consists of our chief executive officer and the chief executive officer of Costco. Accordingly, although we expect Costco membership warehouses to be an important part of our future growth, we do not have sole control over the growth and operation of the Costco membership warehouse format. In addition, the Costco de Mexico Group joint venture is subject to termination under some circumstances. See "Information on the Company-Business Overview-Retail Store Formats-Membership Warehouse Stores."

Our Operations Are Highly Concentrated in the Mexico City Metropolitan Area and in the Central Region

Although we operate nationwide, our principal properties and operations are concentrated in the two most populated areas of Mexico, the Mexico City metropolitan area and the Central Region. At December 31, 2005, our stores located in those areas accounted for approximately 72.0% of our total retail square feet and 80.3% of our net sales for the year ended December 31, 2005. Our restaurants located in those areas accounted for approximately 1.6% of our net sales from restaurant sales for the year ended December 31, 2005. Although we own stores and restaurants, and expect to develop or acquire additional stores and restaurants, outside of the Mexico City metropolitan area and the Central Region, we expect to continue to depend to a very large extent on economic conditions in those areas. Therefore, an economic downturn in those areas could have an adverse effect on our business, financial condition and results of operations. In addition, in the Mexico City metropolitan area, there is very limited availability of sites to acquire or lease for additional stores. As competition intensifies, it will become increasingly difficult to locate sufficient sites to support our expansion plans. If we are unable to locate sufficient sites, we will be unable to implement our expansion plans and our financial performance could be adversely affected.

Our Acquisition of the Mexican Operations of Auchan Is Dependent on Payment of the Purchase Price Due and Failure to Pay Will Result in Forfeiture of Auchan Properties and All Amounts Paid

In February 2003, we acquired Auchan’s operations in Mexico, consisting of five hypermarket stores located in the Central Region. We now operate these stores under the Mega format. The purchase price for this acquisition consists of six installment payments. We paid U.S.$15.0 million in 2003, U.S.$20.0 million in 2004, U.S.$25 million in 2005 and U.S.$20 million in 2006. We are required to make additional payments of U.S.$20.0 million in each of 2007 and 2008. The stock of the Mexican corporations that hold the fixed assets of these stores are presently held in an escrow. The stock will not be released from this escrow, and we will not acquire title to the stock, until the purchase price is paid in full to the sellers. If we do not pay the purchase price in full when due, we will not obtain title to the stock and will have no right to be repaid the amounts we previously paid to Auchan. In addition, there are certain restrictive covenants that limit the operations of the business until the purchase price is paid to the seller. See "Information on the Company-Business Overview-New Initiatives-Acquisition of Auchan’s Mexican Operations."

Our Markets Are Undergoing Rapid Consolidation

Over the last several years, the retail sector in Mexico has been undergoing consolidation as large retail chains have gained market share at the expense of small, independently owned and operated stores. Recently, Walmex announced an aggressive expansion plan which involves opening an additional 81 stores across Mexico in 2006. We believe that further consolidation will likely occur as competition intensifies and economies of scale become increasingly important. Future consolidation may occur rapidly and materially alter the current competitive situation in Mexico. Walmex and Soriana are larger and better capitalized than we are and as a result are likely to be better positioned than we are to take advantage of strategic acquisition and consolidation opportunities. There can be no assurance that any further market consolidation will not be detrimental to our market position or will not materially and adversely affect our business, financial condition and results of operations.

Compliance with new rules and regulations concerning corporate governance may be costly, time consuming, and difficult to achieve, which could harm our operating results and business.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and related regulations implemented by the SEC and the Public Company Accounting Oversight Board, or PCAOB, are creating uncertainty for public companies, increasing legal and financial compliance costs and making some activities more time consuming. We will be evaluating our internal control over financial reporting to allow management to report on, and our registered independent public accounting firm to attest to, our internal controls over financial reporting. We will be performing the system and process evaluation and testing (and any necessary remediation) required to comply with the management certification and auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, which we are required to comply within our annual report which we will file in 2007 for our 2006 fiscal year. As a result, we expect to incur substantial additional expenses and diversion of management’s time. While we anticipate being able to fully implement the requirements relating to internal controls and all other aspects of Section 404 by our deadline, we cannot be certain as to the timing of completion of our evaluation, testing and any remediation actions or the impact of the same on our operations since there is presently no precedent available by which to measure compliance adequacy. If we are not able to implement the requirements of Section 404 in a timely manner or with adequate compliance, we might be subject to sanctions or investigation by regulatory authorities such as the SEC or the PCAOB. Any such action could adversely affect our financial results or investors’ confidence in our company and could cause the price of our securities to fall. In addition, if we fail to develop and maintain effective controls and procedures, we may be unable to provide the financial information in a timely and reliable manner.

Risk Factors Related to Mexico

Economic and Political Developments in Mexico Could Affect Mexican Economic Policy and Our Business, Financial Condition And Results Of Operations

CCM is a Mexican corporation and all of its operations and assets are located in Mexico. As a result, our business, financial condition and results of operations may be affected by the general condition of the Mexican economy, the devaluation of the Peso as compared to the U.S. Dollar, price instability, inflation, interest rates, regulation, taxation, social instability and other political, social and economic developments in or affecting Mexico over which we have no control.

The Mexican government has exercised, and continues to exercise, significant influence over the Mexican economy. Mexican governmental actions concerning the economy and state-owned enterprises could have a significant effect on Mexican private sector entities in general, and us in particular, and on market conditions, prices and returns on Mexican securities, including our securities.

Although the Mexican economy has exhibited signs of improvement, general economic sluggishness continues. This continuing sluggishness in the Mexican economy, combined with recent political events, has slowed economic reform and progress.

Presidential and federal congress elections in Mexico were held on July 2, 2006 and Felipe Calderon, a member of the incumbent political party, was elected in a highly contested election. Controversies sourrounding the election could lead to further friction among political parties and the executive branch officers, which could potentially cause additional political and economic instability. Additionally, as a result of the election of Felipe Calderon and new representatives to congress, there could be significant changes in laws, public policies and government programs, which could have a material adverse effect on the Mexican economic and political situation which, in turn may adversely affect our business, financial condition and results of operations.

National politicians are currently focused on the 2006 election controversies and crucial reforms regarding fiscal and labor policies, gas, electricity, social security and oil have not been and may not be approved. The effects on the social and political situation in Mexico, including the 2006 presidential elections and presidential succession, could adversely affect the Mexican economy, including the stability of its currency, which in turn could have a material adverse effect on our business, financial condition and results of operations, as well as market conditions and prices for our securities.

Mexico Has Experienced Adverse Economic Conditions

Mexico has historically experienced uneven periods of economic growth. In 2001, Mexico’s gross domestic product, or GDP, decreased 0.3% primarily as a result of the downturn in the U.S. economy. Mexican GDP increased 0.9% in 2002, 1.3% in 2003, 4.4% in 2004, 3.0% in 2005 and 4.1% in the first quarter 2006. GDP growth fell short of Mexican government estimates in 2005.

If the Mexican economy should fall into a recession, our business, financial condition and results of operations may be adversely affected.

Developments in Other Emerging Market Countries or in the United States May Affect Us and the Prices for our Debt Securities

The market value of securities of Mexican companies, the economic and political situation in Mexico and our financial condition and results of operations are, to varying degrees, affected by economic and market conditions in other emerging market countries and in the United States. Although economic conditions in other emerging market countries and in the United States may differ significantly from economic conditions in Mexico, investors’ reactions to developments in any of these other countries may have an adverse effect on the market value or trading price of securities of Mexican issuers, including our debt securities, or in our business.

In particular, Argentina’s continued insolvency and default on its public debt could adversely affect Mexico, the market value of our debt securities or our business. Although a majority of the foreign holders of Argentina’s indebtedness have agreed to exchange their securities in connection with Argentina’s restructuring, holders of a substantial amount of the country’s indebtedness have refused such exchange. To the extent that the Argentine government is unsuccessful in preventing further economic decline, the crisis may also adversely affect Mexico, the price of our securities or our business.

In addition, the political and economic future of Venezuela remains uncertain. A nationwide general strike that occurred between December 2002 and January 2003 caused a significant reduction in oil production in Venezuela, and has had a material adverse effect on Venezuela’s oil-dependent economy. In February 2003, Venezuelan authorities imposed foreign exchange and price controls on specified products. Inflation continues to grow despite price controls and the political and economic environment has continued to deteriorate. Venezuela has experienced increasing social instability and massive public demonstrations against President Chavez. We cannot predict what effect, if any, the decisions of the Venezuelan government will have on the economies of other emerging market countries, including Mexico, the price of our debt securities or our business.

Brazil has also not achieved institutional and economic stability and political crises in Brazil in the past have affected the development of its economy. For example, Brazil has historically experienced extremely high rates of inflation, including rates as high as 5,000 percent a year during the late 1980s. Inflation and certain of the Brazilian government’s measures taken in the attempt to curb inflation have had significant negative effects on the Brazilian economy. The Brazilian government’s actions to control inflation and affect other policies have often involved wage and price controls, currency devaluations, capital controls, and limits on imports, among other things. Uncertainty as to future government policies may contribute to an increase in the volatility the Brazilian economy. The Brazilian economy grew 2.3% in 2005, 4.9% in 2004 and 0.5% in 2003. Due to the limited economic growth in recent years, it is not certain whether the current economic policy will prevail.

Our operations, including demand for our products or services, and the price of our debt securities, have also historically been adversely affected by increases in interest rates in the United States and elsewhere. The U.S. Federal Reserve Bank has signaled that it will continue implementing "measured" increases in interest rates in 2005. As interest rates rise, the prices of our debt securities may fall.

Military Operations in Iraq and Elsewhere Have Negatively Affected Industry and Economic Conditions Globally, and These Conditions Have Had, and May Continue to Have, a Negative Effect on Our Business

Military operations in Iraq have depressed economic activity in the United States and globally, including the Mexican economy. Since the invasion of Iraq, there have been terrorist attacks abroad, like the terrorist attacks in Madrid on March 11, 2004, as well as ongoing threats of future terrorist attacks in the United States and abroad. Although it is not possible at this time to determine the long-term effect of these terrorist threats and attacks and the consequent response by the United States, there can be no assurance that there will not be other attacks or threats in the United States or abroad that will lead to a further economic contraction in the United States or any other major markets. In the short term, however, terrorist activity against the United States and the U.S. military operations in Iraq have contributed to the uncertainty of the stability of the U.S. economy as well as global capital markets. It is not certain how long these economic conditions will continue. If terrorist attacks continue or become more prevalent or serious, if the economic conditions in the United States decline or if a global recession materializes, our business, financial condition and results of operations may be materially and adversely affected.

Currency Fluctuations or the Devaluation and Depreciation of the Peso Could Limit Our Ability to Convert Pesos into U.S. Dollars or into Other Currencies, Which Could Adversely Affect Our Business, Financial Condition or Results of Operations

A substantial portion of our indebtedness is U.S. Dollar-denominated. In addition, some of our costs, principally the costs of products from international suppliers, are U.S. Dollar and other foreign currency denominated. However, all of our revenues are Peso-denominated. As a result, decreases in the value of the Peso against the U.S. Dollar and other foreign currencies could cause us to incur foreign exchange losses, which would adversely affect our financial condition and reduce our net income.

Severe devaluation or depreciation of the Peso may also result in governmental intervention, as has resulted in Argentina, or disruption of international foreign exchange markets. This may adversely affect our ability to transfer or convert Pesos into U.S. Dollars for the purpose of making timely payments of interest and principal on our indebtedness and may adversely affect our ability to transfer or convert Pesos into U.S. Dollars and other currencies to obtain imported goods. The Mexican economy has suffered balance of payment deficits and shortages in foreign exchange reserves in the past. While the Mexican government has not restricted for more than ten years the ability of Mexican or foreign persons or entities to convert Pesos to U.S. Dollars, we cannot assure you that the Mexican government will not institute restrictive exchange control policies in the future. To the extent that the Mexican government institutes restrictive exchange control policies in the future, our ability to transfer or to convert Pesos into U.S. Dollars and other currencies for the purpose of making timely payments of interest and principal of indebtedness, including the notes, as well as to obtain imported goods would be adversely affected. Devaluation or depreciation of the Peso against the U.S. Dollar or other currencies may also adversely affect U.S. Dollar or other currency prices for our debt securities or the cost of imported goods.

High Inflation Rates in Mexico May Adversely Affect Our Results of Operations and Financial Condition

Mexico historically has experienced high levels of inflation, although the rates have been lower in recent years. The annual rate of inflation, as measured by changes in the NCPI, was 4.4% in 2001, 5.7% for 2002, 4.0% for 2003, 5.2% for 2004 and 3.3% in 2005. Mexico’s current level of inflation remains higher than the annual inflation rates of its main trading partners. High inflation rates can adversely affect our business, financial condition and results of operations in the following ways:

- inflation can adversely affect consumer purchasing power, thereby adversely affecting consumer demand for our products and services; and

- to the extent inflation exceeds our price increases, our prices and revenues will be adversely affected in "real" terms.

High Interest Rates in Mexico Could Increase Our Financing Costs

Mexico historically has had, and may continue to have, high interest rates. The interest rates on 28-day Mexican government treasury securities averaged 7.1% for 2002, 6.2% for 2003, 6.8% for 2004 and 8.0% in 2005. Accordingly, if we have to incur Peso-denominated debt in the future, it will likely be at higher interest rates. High interest rates in Mexico could increase our financing costs and thereby impair our financial condition, results of operations and cash flows.

Mexican Antitrust Laws May Limit Our Ability to Expand Through Acquisitions or Joint Ventures

Mexico’s federal antitrust laws and regulations may affect some of our activities, including our ability to introduce new products and services, to enter into new or complementary businesses or joint ventures and to complete acquisitions. In addition, the federal antitrust laws and regulations may adversely affect our ability to determine the rates we charge for our services and products. Approval of the Comisión Federal de Competencia, or Mexican Antitrust Commission, is required for us to acquire and sell significant businesses or to enter into significant joint ventures. The Mexican Antitrust Commission may not approve any proposed future acquisition or joint venture that we may pursue.

At the end of 2003, three of the main retail companies in Mexico, CCM, Gigante and Soriana, formed Sinergia de Autoservicios, S. de R.L. de C.V., or Sinergia, a limited liability company created to improve procurement for the three companies by combining their purchasing power. After an extensive process, the Mexican Antitrust Commission granted approval for the formation and operation of Sinergia but imposed certain conditions to prevent monopolistic practices. Among these conditions, Sinergia is subject to certain ongoing reporting obligations to the Mexican Antitrust Commission regarding its internal systems and procedures. Sinergia also is required to disclose to the Mexican Antitrust Commission on an ongoing basis the economic benefits being obtained by its members. There can be no assurance that there will not be any further challenge to Sinergia on antitrust grounds or otherwise. Without the benefits of Sinergia, our cost of sales may increase. These higher costs could have an adverse effect on our results of operations.

Differences Between Mexican GAAP and U.S. GAAP May Have an Impact on the Presentation of Our Financial Information

A principal objective of the securities laws of the United States, Mexico and other countries is to promote full and fair disclosure of all material corporate information. However, there may be less publicly available information about foreign issuers of securities listed in the United States than is regularly published by or about domestic issuers of listed securities. In addition, our financial statements are prepared in accordance with Mexican GAAP, which differs from U.S. GAAP and accounting procedures adapted in other countries in a number of respects. For example, most Mexican companies, including our company, must incorporate the effects of inflation directly in accounting records and in their published financial statements. Thus, financial statements and reported earnings of Mexican companies may differ from those of companies in other countries with the same financial performance. Note 17 to our financial statements provides a description of the principal differences between Mexican GAAP and U.S. GAAP as they relate to us.

Risk Factors Related to Our Principal Shareholders

Our Principal Shareholders Have Substantial Influence Over Our Management and the Interests of Our Principal Shareholders May Differ from Those of Other Shareholders

As of December 31, 2005, approximately 73.9% of our outstanding B Shares were beneficially owned, directly or indirectly, by a trust, the beneficiaries of whom are primarily members of the González Family. The B Shares are the only class of our capital stock that is entitled to elect our board of directors. As our controlling shareholder, this trust controls our business through its power to elect a majority of our board of directors and to determine the outcome of almost all actions that require shareholder approval. For example, the trust has the ability to cause us to declare dividends. The trust was established by five corporations and the beneficiaries of the trust are members of the González family. For a description of this trust, see "Major Shareholders and Related Party Transactions." In addition to their indirect ownership interest in our company, Mr. Guillermo González Nova, Mr. Jaime González Nova, Mr. Carlos González Zabalegui, Ms. Elena González Guerra, and Mr. Pablo González Guerra, who are members of the González family, are directors. Mr. Guillermo González Nova also serves as our Chairman of the Board, Mr. Jaime González Nova serves as our Vice-Chairman and Mr. Carlos González Zabalegui serves as our Vice-Chairman and Chief Executive Officer. See "Major Shareholders and Related Party Transactions."

Forward-Looking Statements

Some of the statements in this annual report constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include references to future capital expenditures and the amount and nature of these expenditures, business strategies and measures to implement these strategies, competitive strengths and the impact of competition, goals, expansion and growth of our business and operations, plans and references to our future success and expectations regarding future operating results and liquidity. Words like "believe," "anticipate," "plan," "expect," "intend," "target," "estimate," "project," "predict," "forecast," "guideline," "should" and similar expressions are intended to identify forward-looking statements, but are not the exclusive means of identifying these statements.

Forward-looking statements involve inherent risks and uncertainties. We caution you that a number of important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in these forward-looking statements. These factors, some of which are discussed under "-Risk Factors," include economic and political conditions and government policies in Mexico or elsewhere, inflation rates, exchange rates, regulatory developments, changes in our product mix and pricing strategies, difficulty in acquiring new land for development, difficulty in completing proposed store openings, customer demand, technology implementation, industry consolidation and competition. You should evaluate any statements made by us in light of these important factors. We also caution you that the foregoing list of factors is not exclusive and that other risks and uncertainties may cause actual results to differ materially from those in forward-looking statements.

Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information or future developments.

Item 4. Information on the Company

History and Development of the Company

CCM is a sociedad anónima de capital variable, or a limited liability variable stock corporation, organized under the laws of Mexico. Our principal offices are located at Av. Revolución No. 780, Módulo 2, Colonia San Juan, C.P. 03730 México, D.F. and our telephone number is (52) (55) 5270 9312.

We trace our history to 1930 when Antonino González Abascal and his son founded their first store, which primarily sold textiles, in Mexico City. The first combination supermarket/general merchandise store under the name Comercial Mexicana was opened in Mexico City in 1962, and 20 additional stores were established during the 1970’s. During the 1980’s we continued to expand through the acquisition of the chain of Sumesa stores and the opening of 51 Comercial Mexicana stores. The first Restaurante California commenced operations in 1982, and the first Bodega opened in 1989. We entered into the joint venture with Costco Wholesale Corporation in June 1991, and the first Costco membership warehouse opened in February 1992. In 1993, we introduced the Mega format, which combines features of both department stores and supermarkets. In February 2003, we acquired Auchan, S.A.’s operations in Mexico. As of March 2006, the Company inaugurated the first unit of its new format named City Market.

CCM was wholly owned by the González family until April 1991, when shares of capital stock of CCM were listed in the Mexican Stock Exchange and offered publicly in Mexico. In 1996, GDSs representing shares of capital stock of CCM were listed on the New York Stock Exchange and the GDSs and the underlying shares were offered publicly in Mexico, the United States and elsewhere outside of Mexico.

Our deed of incorporation was executed on December 9, 1988, and we were registered in the Public Registry of Commerce in Mexico City on February 21, 1989, under the number 60562. The term of our company is 99 years beginning on May 11, 1989.

Capital Expenditures

Capital expenditures reflect our strategy of growth through expansion and acquisition as well as our emphasis on self-development and ownership of real estate, and on improvements in logistics and technology. We believe that continued capital spending in technology focusing on store operations, logistics, manufacturing procurement, category management, merchandising and buying practices, should reduce merchandising costs as a percent of sales.

The following table sets forth our capital expenditures for each of the three years ended December 31, 2003, 2004, 2005 and the budgeted capital expenditures for the year ended December 31, 2006:

| | Year ended December 31,(1) |

| | 2003 | 2004 | 2005 | 2006 (2) |

| | (Millions of constant Pesos as of December 31, 2005,

except for 2006 amounts, which are in nominal Pesos) |

Real estate (3) ........................................................................... | Ps. 625.9 | Ps. 1,335.8 | Ps. 1,694.1 | Ps.2,089.6 |

Store fixtures (4) ........................................................................ | 974.0 | 697.8 | 915.6 | 913.5 |

Information systems..................................................................... | 69.7 | 70.0 | 74.0 | 79.9 |

Total .......................................................................................... | Ps. 1,669.6 | Ps. 2,103.6 | 2,683.7 | Ps. 3,083.0 |

______________

(1) Capital expenditures include, Ps.354.1 in 2003, Ps.455.0 in 2004 and Ps.515.9 in 2005 contributed by us to the Costco de Mexico Group joint venture.

(2) Represents budgeted amounts for the year ending December 31, 2006.

(3) Not including our acquisition of Auchan’s operations.

(4) Represents new units, store fixtures, remodeling and other equipment expenditures.

Capital expenditures including 2005 Auchan’s operations payment was Ps.2,969.5 million in 2005 and were funded with cash from operations. Our plans for 2006 could change depending on the economic situation in Mexico, our financial results and our ability to generate sufficient cash flow to fund such expenditures.

We expect to open 22 units in 2006 as follows: one City Market, five Bodegas, seven Megas, three Costco membership warehouses, two Sumesa and four Restaurantes California. We intend to continue remodeling units.

Capital expenditures reflect our strategy of growth through expansion and acquisition as well as our emphasis on self-development and ownership of real estate, and on improvements in logistics and technology. We believe that continued capital spending in technology, focusing on store operations, logistics, manufacturing procurement, category management, merchandising and buying practices, should reduce merchandising costs as a percent of sales. During 2006, we expect capital spending to be approximately U.S.$300 million. We intend to use primarily cash flow from operations to finance capital expenditure requirements.

We currently plan to finance all 2006 capital expenditures primarily with cash flow from operations.Although we believe that sufficient financing will be available to us, we cannot assure you that we will have sufficient cash flow from operations to make all of our planned capital expenditures when scheduled or, if necessary, that we will be able to obtain, or what the terms may be of, any bank or other financing. We are also responsible for financing 50% of new Costco membership warehouses. See "Information on the Company-Property, Plant, and Equipment" and "Key Information-Risk Factors-Risk Factors Related to Our Business-Our Growth Strategy Is Dependent Upon the Continued Improvement of the Mexican Economy and Generating Positive Cash Flow."

Business Overview

We operate one of the largest retail companies in Mexico as well as a chain of family-style restaurants under the name Restaurantes California. Our retail operations include a 50% interest in a joint venture with Costco Wholesale Corporation, or Costco, which we refer to as the Costco de Mexico Group joint venture. The Costco de Mexico Group joint venture operates a chain of warehouse clubs in Mexico.

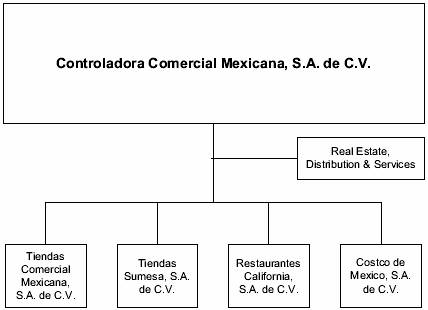

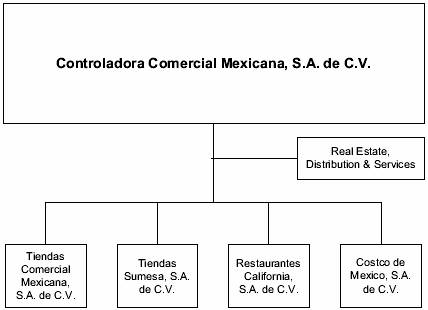

We carry out our business through five retailing store formats and one chain of family-style restaurants. These formats and restaurants are divided into three segments:

- the CM Group, which comprises our core business and includes our Comercial Mexicana and Bodega supermarkets and Mega hypermarkets;

- the Costco de Mexico Group, which consists of our 50% interest in the joint venture with Costco; and

- the Other Group, which includes our Sumesa stores and Restaurantes California.

Our stores sell a wide variety of food items, including basic groceries and perishables, as well as non-food items, including general merchandise and clothing. Food items represented 66.8% of our net sales from our stores in 2005. At December 31, 2005, we had 191 stores operating under our five retailing store formats, with a total selling area of approximately 14.5 million square feet. Our stores are concentrated primarily in the Mexico City metropolitan area and in the central Mexico region, including Guadalajara, or the Central Region.

Historically, the Mexican retail sector has been fragmented, with consumers served by a number of formats, including traditional formats like independent grocery stores and food specialists, modern formats like supermarkets, department stores and hypermarkets, as well as informal outlets like street vendors and markets. Hypermarkets are large stores that include features of both supermarkets and department stores. In recent years, the Mexican retail sector has experienced consolidation and the entry of large international retailers like Wal-Mart Stores Inc., which controls Walmex. We believe that there is considerable potential for growth as the Mexican retail sector continues its process of modernization. We believe that consumer preferences are shifting away from smaller, traditional and informal outlets toward larger, standardized supermarket and hypermarket chains. These chains offer consumers superior value through greater merchandise selection, convenience and better prices through the chains’ greater purchasing power. Additionally, we believe that the recovery of consumers’ purchasing power in Mexico and favorable demographics, which is expected to lead to increased numbers of consumers, should benefit the retail sector in the short and long terms. We believe our business strategy is designed to capitalize on this trend toward larger supermarket and hypermarket chains.

Our chain of family-style restaurants serves a wide variety of Mexican and continental cuisines for breakfast, lunch and dinner. Our restaurants emphasize high quality, homemade-style food with fast service at low prices, with an average lunch costing less than Ps.85.00, or approximately U.S.$7.61. At December 31, 2005, we had 62 restaurants located in 18 cities in Mexico, concentrated primarily in the Mexico City metropolitan area.

Our Business Strategy

The key elements of our business strategy include the following:

- Controlled growth. Our growth strategy has two principal components:

„ continued improvements in same store sales growth through enhanced merchandising techniques, attractive promotions, remodeling of our stores and expansion of selling area; and

„ new store openings in areas where we already have a significant presence and in areas with high potential but that are currently underserved by modern retail formats.

Although there are many external market variables that affect the performance of same store sales, we believe our new store formats and low prices will help reduce the impact of factors that are beyond our control. Despite increased competition in certain areas, we believe the Mexican market continues to be underserved, leaving significant room for additional store growth. During 2004 and 2005, we dedicated a great deal of time and resources in identifying attractive locations for new stores, our expansion plan for 2006 includes the opening of 18 new stores and four restaurants as well as the remodeling of ten stores across Mexico. We expect to derive the required funds primarily from internally generated cash flow. Through this expansion plan, we intend to reinforce our presence in the Mexico City metropolitan area and in the Central Region, capitalizing on our existing presence and strong reputation in those markets. We also intend to expand our operations in other regions.

- Continue with our everyday low price strategy instead of frequent promotions. We adopted a low pricing strategy in 2002 with the principal objective of attracting a more loyal customer base. We believe that our historical strategy of offering promotions and deep discounts from time to time was effective in the historical Mexican macroeconomic environment, which was characterized by high inflation. As the Mexican economy became more stable, consumers became more aware of price differences and started comparing them among different retailers. The introduction by Walmex, our principal competitor, of the "Every Day Low Prices" concept was also well received by consumers. We believe that we have been successful in communicating our competitive prices to our customers, thus increasing customer loyalty as well as our customer base in general.

- Focus on operating margins. We seek to improve our operating margins by:

„ streamlining our distribution channels through the use of our new distribution center that services our Comercial Mexicana, Mega, Bodega and Sumesa store formats; and

„ continuing to grow our Mega store format, which has higher margins than our other businesses.

Because many of our suppliers offer generic product brand names, we are able to negotiate better terms and conditions with these suppliers than those that we would be able to obtain from suppliers that, due to their popularity and the high demand for their brand of products, have stronger negotiating power. By leveraging our market presence and establishing relationships with new product suppliers, we intend to maintain our low pricing strategy while trying to improve our operating margins. Our distribution centers that service the Comercial Mexicana, Mega, Bodega and Sumesa store formats allow us to negotiate better prices with our suppliers, shorten the distance over which our goods are shipped and achieve efficiency gains in our inventory management and turnover. Of the 18 new stores we intend to open during 2006, seven are Mega formats.

- Focus on differentiation. Competition occurs principally on the basis of price and, to a lesser extent, location, selection of merchandise, quality of merchandise (in particular perishables), service, store conditions and promotions. We believe that competition based solely on low pricing will ultimately result in decreased margins and low customer loyalty. We intend to attract and retain customers by providing a more enjoyable shopping environment and improving their overall shopping experience through the use of new, modern and exclusive product offerings, innovative promotions and improved marketing techniques. For example, in 2005, we launched "Kitchenware," which was a promotion of stickers that could be exchange for cookware products at very low prices. In 2005, we launched "Spanish week," which consisted of several promotions involving groceries, cheese, wine and other Spanish products. Sales in our stores also typically increase during the "Julio Regalado" special promotion occurring each July and during the Christmas season. We have also been a market leader in introducing convenient new services for our customers, like providing them with facilities for the convenient payment of third party services and local taxes. We believe that these marketing strategies have been successful. We expect to continue launching new and innovative promotions to continue to attract customers. Additionally, we try to differentiate ourselves in our product offerings as we offer unique products that are unlikely to be found in our competitors’ selling floor. We believe that we are recognized as a high quality supplier of perishables and will continue to focus on delivering high quality perishable products.

- Increase efficiency. We intend to increase productivity and customer service through investments in information technology and the increased utilization of our new distribution center which opened in August 2003. In recent years, we have made significant investments in computer systems focused primarily on improving inventory efficiency, supply levels and controls. Innovative technologies used by our stores include point of sales systems, a unit inventory control system, data warehouse category management, fiber optic communications networks and electronic communication systems to submit purchase orders to suppliers. We believe that continued upgrading of our systems will allow us to further increase efficiency, reduce expenses and provide the necessary product and sales information to enhance merchandising decisions at each store. We continue to increase the utilization of our distribution centers which has increased our storage capacity and has improved our ability to supply our stores with a more efficient product mix by utilizing a centralized location for distribution. The Costco de Mexico Group joint venture is currently being serviced by a distribution center that is located in the Mexico City metropolitan area.

- Merchandising and market segmentation. Our merchandising and market segmentation strategy emphasizes competition on the basis of price, selection of merchandise, quality of merchandise (in particular perishables) and service. We target specific consumer segments, preferences and demographics by using distinct retail formats, which differ in store size, service level and product range. As Mexican consumer preferences have shifted toward large supermarkets and hypermarkets, we have sought to meet this demand by growing our Mega format. Net sales of the Mega format accounted for approximately 31.5% of our net sales in 2005.

- Location. In opening new stores, we select the type of retail store and offer the merchandise and service mix that we consider most appropriate for each location’s anticipated customer base. We determine a location’s anticipated customer base by analyzing a number of factors, including the current and expected future population density, income levels and competitive conditions surrounding that location. We believe that this analysis allows our new stores to provide better services to our customers and improves our stores’ success rate. From January 1, 2005 through December 31, 2005 we purchased approximately 4.3 million square feet of unimproved land using part of it for new stores and the rest for our land reserve of 7.0 million square feet. We intend to continue to explore the possibility of additional strategic land acquisitions in desirable locations. Decisions with respect to opening new Costco membership warehouses are made by the Costco de Mexico Group joint venture.

- Lower Pricing Strategy. Historically, we based our pricing strategy cyclical promotions and discounts offered from time-to-time. This strategy proved successful in a market with high inflation rates. As prices changed often, consumers did not have the opportunity to compare prices among different retailers.

As the result of the decrease in inflation we have moved away from this strategy toward a strategy of offering consistently low prices, retaining only the most popular promotions, including the "Julio Regalado," in order to attract customer traffic. The lower pricing strategy was implemented in August 2002.

When we started with the "low prices" strategy in 2002, we experienced an initial 13.1% decrease in sales and decrease in number of customers and ticket amount per customer, but by 2003 the number of customers had increased by 6.0%, in 2004 the number of customers increased by 2.1% and an increase of 2.9% in 2005.

- Sinergia. At the end of 2003, three of the main retail companies in México, Gigante, Soriana, and us formed Sinergia, a limited liability company created to improve the purchase procurement for the three companies. Through Sinergia, CCM, Gigante and Soriana negotiate as a group with some of the large common suppliers of our businesses and the businesses of Gigante and Soriana. Currently, a small portion of our total purchases are negotiated through Sinergia. By forming a negotiating group with two other large retailers, we benefit from increased purchasing power as a whole, and corresponding lower cost of goods. See "Key Information-Risk Factors-Risk Factors Related to Mexico-Mexican Antitrust Laws May Limit Our Ability to Expand Through Acquisitions or Joint Ventures."

Operations

At December 31, 2005, we had 191 stores operating under five retailing formats with a total selling area of approximately 14.5 million square feet. Although we operate nationwide, our stores are concentrated in the two most populated areas of Mexico, the Mexico City metropolitan area and the Central Region. Our stores located in those areas accounted for approximately 72.0% of our total retail floor space at December 31, 2005. At December 31, 2005, we had 62 Restaurantes California located in 18 cities in Mexico, 33 of which were located in the Mexico City metropolitan area.

The percentage breakdown of our total selling area and number of stores by geographic region at December 31, 2005, is set forth in the following table:

| | At December 31, 2005 |

| | Percentage of

Total Selling

Area | Number of

Stores |

Mexico City metropolitan area............................................................................. | 37.7 % | 86 |

Central region......................................................................................................... | 34.3 | 60 |

Northwest region................................................................................................... | 13.4 | 21 |

Northeast region.................................................................................................... | 2.4 | 3 |

Southeast region.................................................................................................... | 8.4 | 13 |

Southwest region................................................................................................... | 3.8 | 8 |

Total......................................................................................................................... | 100.0 % | 191 |

The number of restaurants by geographic region at December 31, 2005 is set forth in the following table:

| | At December 31, 2005 |

| | Number of

Restaurants |

Mexico City metropolitan area............................................................................................ | 33 |

Central region........................................................................................................................ | 20 |

Northwest region.................................................................................................................. | 2 |

Northeast region................................................................................................................... | - |

Southeast region.................................................................................................................. | 5 |

Southwest region................................................................................................................. | 2 |

Total....................................................................................................................................... | 62 |

The percentage breakdown of the contribution of our store formats (including the Costco membership warehouses) and our restaurants to total sales is set forth below for each of the three years ended December 31, 2003, 2004 and 2005.

| | Year Ended December 31, |

| | 2003 | 2004 | 2005 |

Comercial Mexicana................................... | 36.3% | 32.9% | 29.7% |

Bodega......................................................... | 14.4 | 13.7 | 13.3 |

Mega............................................................ | 26.3 | 28.8 | 31.5 |

Sumesa......................................................... | 2.3 | 2.5 | 2.8 |

Costco.......................................................... | 18.9 | 20.1 | 20.8 |

Restaurantes California............................. | 1.6 | 1.6 | 1.6 |

Miscellaneous Income............................... | 0.2 | 0.3 | 0.3 |

Total............................................................. | 100.0% | 100.0% | 100.0% |

Except for Sumesas, which offer primarily food items, stores operated by us offer a combination of food and non-food items. Management classifies our store sales into four main product lines. The percentage contribution to total sales of each of these product lines is set forth below for each of the three years ended December 31, 2003, 2004 and 2005.

| | Year Ended December 31, |

| | 2003 | 2004 | 2005 |

Perishables.................................................... | 25.6% | 27.7% | 28.7% |

Groceries....................................................... | 40.7 | 41.2 | 38.2 |

General Merchandise.................................. | 24.1 | 21.9 | 25.6 |

Clothing......................................................... | 9.5 | 9.2 | 7.5 |

Total............................................................... | 100.0% | 100.0% | 100.0% |

Our management believes that in recent years Mexican consumers have increasingly preferred stores that offer a combination of the wide variety of food items carried by conventional supermarkets as well as a variety of non-food items, like general merchandise, clothing, household items and home improvement products. In response to this change in consumer preferences, our newer stores offer expanded perishable departments, prepared foods, tortilla presses and bakery goods as well as wider selections of health, beauty and pharmaceutical products.

Retail Store Formats

We carry out our business through five retail store formats: Comercial Mexicana, Bodega, Mega, Sumesa and Costco membership warehouses (through the Costco de Mexico Group joint venture). Through these formats, we are able to target nearly all the population segments in the Mexico City metropolitan area and the other are as which we serve. In March 2006 the Company opened a new format named City Market for the high income level basically with sales mix of perishables and high quality groceries.

In opening new stores, we select the retail store format that offers the merchandise and service mix we consider most appropriate for each location’s anticipated customer base. We determine a location’s anticipated customer base by referring to a number of factors, including the current and expected future population density, income levels and competitive conditions surrounding that location. Decisions with respect to opening new Costco membership warehouses are made by the Costco de Mexico Group joint venture. From 2002 to 2005 the Company has opened 31 stores and 11 Restaurantes California.

We believe in changing the retailing format of our retail stores when appropriate, based on changing demographics and competitive characteristics of the location surrounding an established store. For example, from 2001 to 2005, nine Comercial Mexicana stores were converted into Megas, five Comercial Mexicana stores were converted into Bodegas and one Bodega was converted into a Comercial Mexicana store. In addition, since acquiring the Sumesa chain in 1981, we have converted six Sumesas into other formats. The conversion costs typically ranged from U.S.$2.1 million to U.S.$5.0 million per store, averaging approximately U.S.$3.1 million per store. Besides the convertions, the Company had closed from 2002 to 2005 ten stores and three Restaurantes Califonia due to reasons of low profitability or ending leased contracts.While we currently expect to continue using our five retailing formats, we may experiment with additional formats in the future.

Combination Supermarket/General Merchandise Stores

Comercial Mexicana. At December 31, 2005, we operated 61 Comercial Mexicana stores, including 18 in the Mexico City metropolitan area, 25 in the Central Region (including Guadalajara), eleven in the northwest region (including Tijuana), none in the northeast region, two in the southeast region and five in the southwest region. Comercial Mexicana stores are targeted at middle and upper-income customers.

Comercial Mexicana stores carry an extensive line of food items and non-food items. Food items include meats, poultry, fish, fresh fruits and vegetables, dairy products, baked goods, frozen goods, canned goods, prepared foods, delicatessen, wines and liquors and imported foods. Non-food items include men’s, women’s and children’s clothing and shoes, paper products, office supplies, books and magazines, health and beauty products, garden supplies, automotive supplies, photographic supplies, electric appliances, sporting goods, toys and gifts and numerous household items. All Comercial Mexicana stores have one or more specialty departments, like a bakery or tortilla press. All Comercial Mexicana stores have pharmacies offering prescription and non-prescription medications. A typical Comercial Mexicana store offers more than 55,000 products.

Most Comercial Mexicana stores are located in neighborhood shopping centers. Comercial Mexicana stores require large parking lots and access to roads to allow customers to drive to the stores.