As filed with the Securities and Exchange Commission on June 5, 2003.

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

TERRA CAPITAL, INC.*

(Exact name of registrant as specified in its charter)

Delaware | | 2870 | | 42-1431650 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Number) | | (I.R.S. Employer Identification No.) |

Terra Centre 600 Fourth Street, P.O. Box 6000 Sioux City, Iowa 51102 Telephone: (712) 277-1340 (Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

Mark A. Kalafut Vice President and Corporate Secretary Terra Centre 600 Fourth Street, P.O. Box 6000 Sioux City, Iowa 51102 Telephone: (712) 277-1340 (Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to: Carter W. Emerson, Esq. Gerald T. Nowak, Esq. Kirkland & Ellis 200 E. Randolph Drive Chicago, Illinois 60601 Telephone: (312) 861-2000

|

| * | | The co-registrants listed on the next page are also included in this Form S-4 Registration Statement as additional registrants. |

Approximate date of commencement of proposed sale of the securities to the public: The exchange will occur as soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered | | Amount to be Registered | | Proposed Maximum Offering Price Per Unit (1) | | Proposed Maximum Aggregate Offering Price | | Amount of Registration Fee |

|

11½% Second Priority Senior Secured Notes due 2010 | | $ | 202,000,000 | | 100% | | $ | 202,000,000 | | $16,342 (1) |

|

Guarantees on Senior Subordinated Notes (2) | | $ | 202,000,000 | | — | | | — | | (3) |

|

| (1) | | Calculated in accordance with Rule 457 under the Securities Act of 1933, as amended. |

| (2) | | All subsidiary guarantors are wholly owned subsidiaries of the registrant and have each guaranteed the Notes being registered. |

| (3) | | Pursuant to Rule 457(n), no separate fee is payable with respect to the guarantees being registered hereby |

The registrant and the co-registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant and the co-registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Co-Registrants

Exact Name of Co-Registrants*

| | Jurisdiction of Formation

| | I.R.S. Employer Identification No.

|

Beaumont Ammonia Inc. | | Delaware | | 39-1917518 |

|

Beaumont Holdings Corporation | | Delaware | | 42-1490799 |

|

BMC Holdings Inc. | | Delaware | | 73-1394219 |

|

Port Neal Corporation | | Delaware | | 42-1443999 |

|

Terra (U.K.) Holdings Inc. | | Delaware | | 39-1917519 |

|

Terra Capital Holdings, Inc. | | Delaware | | 42-1431905 |

|

Terra Industries, Inc. | | Maryland | | 52-1145429 |

|

Terra International (Oklahoma) Inc. | | Delaware | | 42-1321108 |

|

Terra International, Inc. | | Delaware | | 36-2537046 |

|

Terra Methanol Corporation | | Delaware | | 42-1431904 |

|

Terra Nitrogen Corporation | | Delaware | | 72-1159610 |

|

Terra Real Estate Corporation | | Iowa | | 42-1178622 |

| * | | The address for each of the co-registrants is c/o Terra Capital, Inc., Terra Centre, 600 Fourth Street, P.O. Box 6000 Sioux City, Iowa 51102, telephone: (712) 277-1340. The name, address, including zip code of the agent for service for each of the co-registrants is Mark A. Kalafut, Vice President and Corporate Secretary of Terra Capital, Inc., Terra Centre, 600 Fourth Street, P.O. Box 6000 Sioux City, Iowa 51102. The telephone number, including area code, of the agent for service for each of the co-registrant’s is (712) 277-1340. The primary standard industrial classification number for each of the co-registrants is 2870. |

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the SEC is effective. This prospectus is not an offer to sell nor is it an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 5, 2003

PROSPECTUS

Exchange Offer for

$202,000,000

TERRA CAPITAL, INC.

11 1/2% Second Priority Senior Secured Notes due 2010

We are offering to exchange:

up to $202,000,000 of our new 11½% Second Priority Senior Secured Notes due 2010

for

a like amount of our outstanding 11½% Second Priority Senior Secured Notes due 2010.

Material Terms of the Exchange Offer

| | ¨ | | Expires at 5:00 p.m., New York City time, on , 2003, unless extended. |

| | ¨ | | The terms of the notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the transfer restrictions and registration rights relating to the outstanding notes will not apply to the exchange notes. |

| | ¨ | | The notes will be unconditionally guaranteed by Terra Industries Inc., our parent company, and its wholly owned U.S. subsidiaries (other than Terra Capital). The notes and the subsidiary guarantees will be secured by a second priority security interest in certain domestic current assets and intellectual property of Terra Industries Inc. and its subsidiaries and certain subsidiary capital stock. They will rank equally with our and the guarantors’ existing and future unsubordinated obligations with respect to any assets that have not been pledged to any creditor. The notes and the guarantees will be effectively subordinates to the debt and other obligations of any of our subsidiaries that is not a guarantor. |

| | ¨ | | The exchange of notes will not be a taxable event for U.S. federal income tax purposes. |

| | ¨ | | Not subject to any condition other than that the exchange offer not violate applicable law or any applicable interpretation of the Staff of the SEC. |

| | ¨ | | We will not receive any proceeds from the exchange offer. |

| | ¨ | | There is no existing public market for the outstanding notes or the exchange notes. We do not intend to list the exchange notes on any securities exchange or seek approval for quotation through any automated trading system. |

For a discussion of certain factors that you should consider before participating in this exchange offer, see “Risk Factors” beginning on page 15 of this prospectus.

Neither the SEC nor any state securities commission has approved the notes to be distributed in the exchange offer, nor have any of these organizations determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

, 2003

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized any other person to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. You should assume that the information contained or incorporated by reference in this prospectus is accurate as of the date on the front cover of this prospectus or the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since then. We are not making an offer to sell the securities offered by this prospectus in any jurisdiction where the offer or sale is not permitted. See the “Where You Can Find More Information” section of this prospectus.

Until , 2003, all dealers that, buy, sell or trade the exchange notes, whether or not participating in the exchange offer, may be required to deliver a prospectus. This requirement is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments and subscriptions.

TABLE OF CONTENTS

i

PROSPECTUSSUMMARY

This summary highlights information contained elsewhere in this prospectus and may not contain all of the information important to you. We urge you to read this prospectus carefully, including the “Risk Factors” section and the consolidated financial statements and related notes. In this prospectus, unless the context requires otherwise, “Terra Industries,” the “company,” “we,” “us” and “our” each refers to Terra Industries Inc. and its subsidiaries, including Terra Capital, Inc. “Terra Capital” refers to Terra Capital, Inc., the issuer of the notes. Substantially all the consolidated assets of Terra Industries are held by Terra Capital and its subsidiaries. See “—Terra Industries Inc. Summary Capital Structure.”

The Company

We are a leading North American and U.K. producer and marketer of nitrogen products serving both agricultural and industrial end use markets. We are one of the largest North American producers of ammonia, the basic building block of nitrogen fertilizers. We upgrade a significant portion of the ammonia we produce into higher value products, which are easier for agricultural end-users to transport, store and apply to crops than ammonia. In addition, we are the largest U.S. producer of methanol. We own eight manufacturing facilities in North America and the U.K. that produce nitrogen products, two of which also produce methanol.

Our principal products are the following:

| | • | | Anhydrous ammonia, often referred to simply as ammonia, the simplest and least expensive form of nitrogen fertilizer. Ammonia is the primary feedstock used in the production of most other nitrogen fertilizers, including UAN, AN and urea. |

| | • | | Urea, which is produced by reacting ammonia and carbon dioxide. We produce both a granulated form of solid urea, generally for the fertilizer market, and urea liquor (liquid) for animal feed supplements and industrial applications. |

| | • | | Ammonium nitrate, or AN, a solid fertilizer product most commonly used by British farmers. AN is produced by combining nitric acid and ammonia into a liquid form which is then converted to a solid granular form. |

| | • | | Urea ammonium nitrate, or UAN, a liquid fertilizer produced by combining liquid urea, liquid ammonium nitrate and water. UAN, unlike ammonia, is odorless and does not require refrigeration or pressurization for transportation and storage. |

| | • | | Methanol, a liquid made primarily from natural gas. Methanol is used primarily as a feedstock in the production of other chemical products such as formaldehyde, acetic acid, methyl tertiary butyl ether, or MTBE, an oxygenate and octane enhancer currently used as an additive in reformulated gasolines, and other chemical intermediates. |

1

The locations of our North American facilities provide us with a competitive advantage in serving agricultural customers in the cornbelt and other major agricultural areas of the United States and Canada. Our U.K. facilities are able to competitively serve the entire British agricultural market. Our facilities have the following production capacities:

| | | Annual Capacity(1)

|

| | | Ammonia(2)

| | UAN(3)

| | AN(4)

| | Urea(5)

| | Methanol(6)

|

Location | | | | | | | | | | |

Beaumont, Texas(7) | | 255,000 | | — | | — | | — | | 225,000,000 |

Blytheville, Arkansas | | 420,000 | | 30,000 | | — | | 480,000 | | — |

Port Neal, Iowa | | 370,000 | | 810,000 | | — | | 60,000 | | — |

Verdigris, Oklahoma | | 1,050,000 | | 2,180,000 | | — | | — | | — |

Woodward, Oklahoma(7) | | 440,000 | | 340,000 | | — | | 25,000 | | 40,000,000 |

Courtright, Ontario | | 480,000 | | 400,000 | | — | | 175,000 | | — |

Severnside, U.K. | | 265,000 | | — | | 500,000 | | — | | — |

Billingham, U.K.(8) | | 550,000 | | — | | 500,000 | | — | | — |

| | |

| |

| |

| |

| |

|

Total | | 3,830,000 | | 3,760,000 | | 1,000,000 | | 740,000 | | 265,000,000 |

| (1) | | Annual capacity includes an allowance for planned maintenance shutdowns. |

| (2) | | Measured in gross tons of ammonia produced; net tons available for sale will vary with upgrading requirements. |

| (3) | | Measured in tons of UAN containing 28% nitrogen by weight. |

| (5) | | Urea is sold as urea liquor from our Port Neal and Woodward facilities and as granular urea from the Blytheville and Courtright facilities. Production capacities shown are for urea sold in tons. |

| (7) | | The Beaumont capacities represent the design capacity of the ammonia loop and revised capacity of the methanol plant following the loss of CO2 feedstock due to shutdown of the DuPont ammonia plant. Plant capacity for Beaumont and Woodward depends on the product mix (ammonia/methanol). |

| (8) | | The Billingham, England facility also produces merchant nitric acid; 2002 sales were 278,074 product tons. |

The principal customers for our North American nitrogen products are national agricultural retail chains, such as ConAgra and Cargill, farm cooperatives, independent dealers and industrial customers, such as DuPont. Industrial customers use our products in the manufacture of chemicals and plastics such as acrylonitrile, polyurethanes, fiber, explosives and adhesives. Our methanol customers are primarily large domestic chemical producers and we have a number of long-term methanol sales contracts with many of those customers.

Recent Industry Conditions

Nitrogen is a primary nutrient for plant growth that has no substitutes in the cultivation of high-yield crops. To be effective, nitrogen must be reapplied each year because of absorption by crops and its tendency to evaporate or run off. Consequently, demand for nitrogen fertilizer tends to be more consistent on a per acre planted basis than demand for other fertilizers such as phosphate or potash.

The principal raw material used to produce nitrogen products and methanol is natural gas. Natural gas costs in 2002 accounted for about 56% of total costs and expenses for our North American nitrogen products business, 29% of total costs and expenses for our U.K. nitrogen products business and 59% of total costs and expenses for our methanol business.

2

In February 2003, high natural gas prices caused us to cease production at our Blytheville, Arkansas and Woodward, Oklahoma facilities and reduce ammonia and methanol production rates at our other North American facilities. In March 2003, we resumed production at our Blytheville, Arkansas and Woodward, Oklahoma facilities and increased production rates at some of our other North American facilities due to natural gas price decreases and nitrogen products and methanol market improvements. At current natural gas prices, we expect to operate all of our North American plants near capacity.

Methanol prices have historically been sensitive to the overall industry supply/demand balance, the availability and price of natural gas and general economic conditions. Global methanol supply in 2002 was affected by supply outages in Venezuela, Africa and New Zealand, which increased global operating rates and strengthened prices through the resulting improved supply/demand balance. Demand for methanol as a chemical intermediate feedstock has historically been relatively unaffected by changes in methanol prices, because there are few cost-effective substitutes. However, because of the diverse range of end uses for methanol, demand has tended to move with the general level of economic activity in methanol’s major markets.

Competitive Strengths

Leading Market Positions

We have leading market positions in all of our key products. In the U.S., we are the largest producer of UAN and methanol and the second largest producer of ammonia. In the U.K., we are the largest producer of ammonia and AN. The following table shows our market positions in our principal products relative to our total revenues. The capacity positions shown are based on production capacities by product.

Product

| | % of Total 2002 Terra Revenues(1)

| | | U.S. Capacity Position

| | U.K. Capacity Position

|

Ammonia | | 22.7 | % | | 2 | | 1 |

UAN | | 29.7 | % | | 1 | | * |

AN | | 11.1 | % | | * | | 1 |

Urea | | 7.8 | % | | 4 | | * |

Methanol | | 16.3 | % | | 1 | | * |

| (1) | | Revenues from sales of carbon dioxide and nitrogen products, as well as industrial sales in the U.K., represented 12.4% of our total revenues for 2002. |

| * | | We do not compete in these markets. |

Strategically Located Plants with Access to Distribution Infrastructure

A critical competitive element in the North American agricultural market is delivered cost to customers. Our plants are located in the main agricultural areas of the United States. This provides us a significant freight cost advantage over Gulf Coast producers and imports entering through Gulf Coast ports. We also have access to an extensive distribution infrastructure that provides reliable and cost-effective delivery of products to customers.

In the United Kingdom, nearly all fertilizer is bagged and delivered directly from the manufacturers’ or importer’s sites to the farm.

3

Integrated Production of Value-Added Products

We upgrade a significant portion of the ammonia we produce into higher value products, such as UAN, AN and urea. By producing our own ammonia and upgrading it internally, we are able to operate our ammonia units at higher utilization rates throughout the year and reduce reliance on lower margin merchant ammonia sales.

Strong Plant Operating Efficiency

We believe that our Port Neal, Iowa and Courtright, Ontario facilities, together representing more than 25% of our North American capacity, are among the most efficient ammonia plants in North America in terms of natural gas consumption per ton of ammonia produced. We believe we have some of the most efficient UAN plants in North America, including three of the five lowest cost plants in terms of delivered cost to end-users. In addition, we believe we are the most efficient producer of methanol in the United States, in large part as a result of an ammonia production loop at our Beaumont, Texas facility, which produces ammonia as a by-product of the methanol production process. Our Beaumont, Texas facility is the largest methanol facility in the U.S. Our ammonia facility at Woodward, Oklahoma also uses loop technology to produce methanol, providing us with operational flexibility and helping us to optimize product mix at that site. As a high percentage of our sales are made under contract, this allows us to maintain high utilization rates and enhance the efficiency of our operations.

The focus of our U.K. operations has been to improve plant efficiency and reliability. We improved the Billingham ammonia plant’s efficiency and capacity in late 2002 by installing a hydrogen recovery unit. Efforts to improve plant reliability through more focus on key manufacturing processes are ongoing at both Billingham and Severnside.

Experienced Management Team and Employees

Our executive officers have an average of 20 years of experience in the fertilizer industry. Michael Bennett, our President and Chief Executive Officer, has been with us for 30 years. Similarly, our approximately 1,200 employees have an average of nearly 19 years of service with us. The extensive experience and stability of our employee base enables us to operate our plants efficiently with a strong safety record as compared to our peers.

Company Strategies

Enhance Competitive Position Through Continued Efficiency Improvement

We intend to continue to improve our competitive position in the worldwide nitrogen fertilizer industry by enhancing the operating and energy efficiency of our plants while rigorously controlling costs. We have upgraded and will continue to upgrade our equipment and processes through prudent investment and personnel training.

Use Natural Gas Contracts to Protect Margins

Natural gas costs in 2002 accounted for approximately 56% of total costs and expenses for our North American nitrogen products business, 29% of total costs and expenses for the U.K. nitrogen products business and 59% of total costs and expenses for the methanol business. It is our normal practice to fix or cap the price of a substantial portion of our future natural gas requirements through supply contracts, financial derivatives and

4

other instruments. These tools are used to lock in margins and protect against an adverse impact on margins due to increases in natural gas costs.

Pursue New Market Opportunities

We will aggressively pursue new market opportunities such as those presented as a result of recent environmental regulations promoting the use of ammonia to clean airborne pollutants emitted by power generating plants.We also see opportunities in pursuing the use of methanol as a fuel for fuel cells.

Maintain Leadership Position in Our Key Products

We intend to maintain our leading market positions in our key markets by focusing on being a reliable, low-cost producer of our products to our existing customers and by identifying new customers and end markets for our products.

Reduce Debt

Our primary financial strategy is to use a significant portion of our cash flow from operations to reduce debt. We have reduced debt in each of the last four years and intend to continue to do so.

5

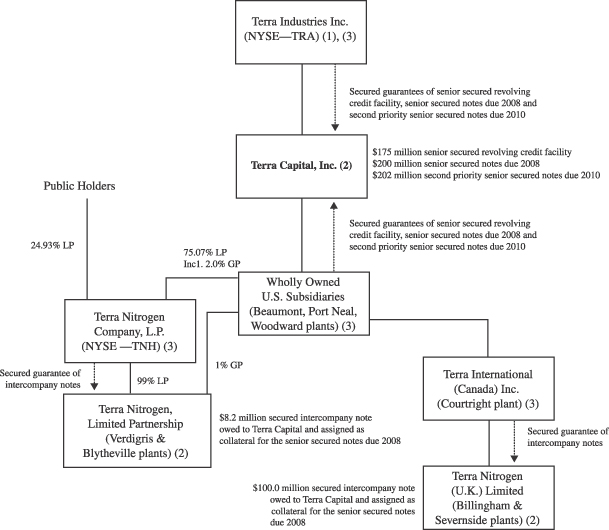

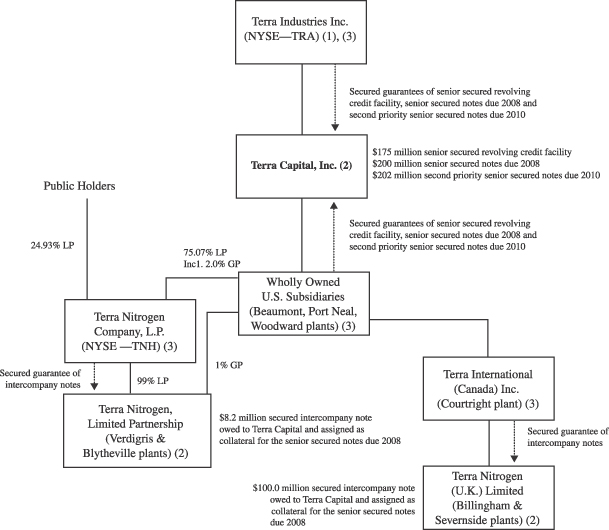

Terra Industries, Inc.

Summary Capital Structure

We own 100% of each of our subsidiaries except as indicated above.

| (1) | | Anglo American plc currently owns 48.9% of Terra Industries Inc. |

| (2) | | Borrower under the senior secured revolving credit facility. |

| (3) | | Guarantees obligations of its subsidiary under the senior secured revolving credit facility. |

6

Summary of the Exchange Offer

The Initial Offering of Outstanding Notes | | We sold the outstanding notes on May 21, 2003 to Citigroup Global Markets Inc. and Credit Suisse First Boston LLC. We collectively refer to those parties in this prospectus as the “initial purchasers.” The initial purchasers subsequently resold the outstanding notes to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended. |

|

Registration Rights Agreement

| | Simultaneously with the initial sale of the outstanding notes, we entered into a registration rights agreement for the exchange offer. In the registration rights agreement, we agreed, among other things, to use our reasonable best efforts to file a registration statement with the SEC and to complete this exchange offer within 150 days of issuing the outstanding notes. The exchange offer is intended to satisfy your rights under the registration rights agreement. After the exchange offer is complete, you will no longer be entitled to any exchange or registration rights with respect to your outstanding notes. If we do not comply with, among other things, our obligation to use our reasonable best efforts to have this exchange offer become effective within 150 days of issuing the outstanding notes, we will pay liquidated damages in cash in an amount equal to 0.25% per annum of the aggregate principal amount of outstanding notes during the first 90 days, increasing by 0.25% per annum for each subsequent 90-day period, up to a maximum of 1.00% per annum, until we are in compliance. For more details, see “The Exchange Offer.” |

|

The Exchange Offer | | We are offering to exchange the exchange notes, which have been registered under the Securities Act for your outstanding notes, which were issued on May 21, 2003 in the initial offering. In order to be exchanged, an outstanding note must be properly tendered and accepted. All outstanding notes that are validly tendered and not validly withdrawn will be exchanged. We will issue exchange notes promptly after the expiration of the exchange offer. |

|

Resales | | We believe that the exchange notes issued in the exchange offer may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act provided that: |

|

| | | • the exchange notes are being acquired in the ordinary course of your business; |

|

| | | • you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the exchange notes issued to you in the exchange offer; and |

7

| | | • you are not an affiliate of ours. |

|

| | | If any of these conditions are not satisfied and you transfer any exchange notes issued to you in the exchange offer without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from registration of your exchange notes from these requirements you may incur liability under the Securities Act. We will not assume, nor will we indemnify you against, any such liability. |

|

| | | Each broker-dealer that is issued exchange notes in the exchange offer for its own account in exchange for outstanding notes that were acquired by that broker-dealer as a result of market-marking or other trading activities, must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the exchange notes. A broker-dealer may use this prospectus for an offer to resell, resale or other retransfer of the exchange notes issued to it in the exchange offer. |

|

Record Date | | We mailed this prospectus and the related exchange offer documents to registered holders of outstanding notes on , 2003. |

|

Expiration Date | | The exchange offer will expire at 5:00 p.m., New York City time, , 2003, unless we decide to extend the expiration date. |

|

Conditions to the Exchange Offer | | The exchange offer is not subject to any condition other than that the exchange offer not violate applicable law or any applicable interpretation of the staff of the SEC. |

|

Procedures for Tendering Outstanding Notes | | We issued the outstanding notes as global securities. When the outstanding notes were issued, we deposited the global notes representing the outstanding notes with U.S. Bank National Association, as book-entry depositary. U.S. Bank National Association issued a certificateless depositary interest in each global note we deposited with it, which represents a 100% interest in the notes, to The Depositary Trust Company, known as DTC. Beneficial interests in the outstanding notes, which are held by direct or indirect participants in DTC through the certificateless depositary interest, are shown on records maintained in book-entry form by DTC. |

|

| | | You may tender your outstanding notes through book-entry transfer in accordance with DTC’s Automated Tender Offer Program, known as ATOP. To tender your outstanding notes by a means other than book-entry transfer, a letter of transmittal must be completed and signed according to the instructions contained in the letter. The letter of transmittal and any other documents required by the letter of transmittal must be delivered to the exchange agent by mail, facsimile, hand delivery or overnight carrier. In addition, you must deliver the outstanding notes to the exchange agent or comply with the procedures for guaranteed delivery. See “The Exchange Offer—Procedures for Tendering Outstanding Notes” for more information. |

8

| | | Do not send letters of transmittal and certificates representing outstanding notes to us. Send these documents only to the exchange agent. See “The Exchange Offer—Exchange Agent” for more information. |

|

Special Procedures for Beneficial Owners | | If you are the beneficial owner of book-entry interests and your name does not appear on a security position listing of DTC as the holder of the book-entry interests or if you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender the book-entry interest or outstanding notes in the exchange offer, you should contact the person in whose name your book-entry interests or outstanding notes are registered promptly and instruct that person to tender on your behalf. |

|

Withdrawal Rights | | You may withdraw the tender of your outstanding notes at any time prior to 5:00 p.m., New York City time on , 2003. |

|

Material U.S. Federal Income Tax Considerations

| | The exchange of outstanding notes will not be a taxable event for United States federal income tax purposes. You should read “Material United States Federal Income Tax Consequences” for a discussion of the significant U.S. federal income tax consequences of exchanging your outstanding notes. You should consult your own tax advisor as to the consequences of the exchange to you. |

|

Consequences of Failure to Exchange | | Outstanding notes that are not tendered will be subject to the existing transfer restrictions on such notes after the exchange offer. We will have no further obligation to register the outstanding notes. If you do not participate in the exchange offer, the liquidity of your outstanding notes could be adversely affected. |

|

Use of Proceeds | | We will not receive any proceeds from the issuance of exchange notes pursuant to the exchange offer. We will pay all of our expenses incident to the exchange offer. |

|

Exchange Agent | | U.S. Bank National Association is serving as the exchange agent in connection with the exchange offer. |

Summary of Terms of the Exchange Notes

The form and terms of the exchange notes are the same as the form and terms of the outstanding notes, except that the exchange notes will be registered under the Securities Act. As a result, the exchange notes will not bear legends restricting their transfer and will not contain the registration rights and liquidated damage provisions contained in the outstanding notes. The exchange notes represent the same debt as the outstanding notes. Both the outstanding notes and the exchange notes are governed by the same indenture. We use the term notes in this prospectus to collectively refer to the outstanding notes and the exchange notes.

|

Issuer | | Terra Capital, Inc., a Delaware corporation. |

9

|

Securities | | $202.0 million in principal amount of 11½% Second Priority Senior Secured Notes due 2010. |

|

Maturity | | June 1, 2010. |

|

Interest | | Annual rate: 11½%. Payment frequency: every six months on June 1 and December 1. First payment: December 1, 2003. |

|

Guarantees | | The notes will be guaranteed by Terra Industries and its wholly owned U.S. subsidiaries (other than Terra Capital). Terra Nitrogen, Limited Partnership, Terra Nitrogen Company, L.P. and our foreign subsidiaries will not guarantee the notes. |

|

Collateral | | The notes, the guarantees and our 2008 notes will be secured by a second priority security interest in all domestic inventory, domestic accounts receivable, intellectual property of Terra Industries and its domestic subsidiaries and certain subsidiary capital stock. |

|

Ranking | | We have outstanding $200 million aggregate principal amount of 2008 Notes secured by certain of our fixed assets and $0.5 million of indebtedness secured by other assets, each ranking effectively senior to the notes. Our revolving credit facility currently provides for revolving credit borrowings in a maximum amount of $175 million, and the indenture governing the notes permits our revolving credit facility to provide for borrowings of up to $225 million, all of which, if incurred, would be secured on a first priority basis by the collateral and would rank effectively senior with respect to certain other assets. See “Risk Factors—The value of the collateral securing the notes may not be sufficient to satisfy our obligations under the notes and the collateral securing the notes may be reduced or diluted under certain circumstances” and “—The notes will also be effectively subordinated to our obligations under our 2008 notes, the revolving credit facility and certain other secured indebtedness to the extent that these obligations are secured by collateral that does not secure the notes.” |

|

| | | If and only if all obligations under the revolving credit facility are satisfied in full, any remaining proceeds of the collateral will be available (subject to the satisfaction of obligations owing to the trustee), on a ratable basis, to satisfy obligations owing to the holders of the notes and our 2008 notes. |

|

| | | The notes and the guarantees will rank equally with existing and future unsubordinated obligations of Terra Capital and the guarantors with respect to any assets that have not been pledged to any creditor. |

|

Optional Redemption | | We may redeem some or all of the notes at any time prior to June 1, 2007, at a price equal to 100% of the principal amount, plus any accrued and unpaid interest to the date of redemption, plus a “make- |

10

|

| | | whole” premium. The “make-whole” premium will be based on a discount rate equal to the yield on a comparable U.S. Treasury Security plus 50 basis points. Thereafter, we may redeem some or all of the notes at the redemption prices set forth herein, plus accrued and unpaid interest, if any, to the redemption date. See “Description of Notes—Optional Redemption.” |

|

| | | In addition, prior to June 1, 2006, we may redeem up to 35% of the notes from the proceeds of certain equity offerings at 111.50% of the principal amount, plus accrued and unpaid interest, if any, to the date of redemption. We may make that redemption only if, after the redemption, at least 65% of the aggregate principal amount of the notes issued remain outstanding and the redemption occurs within 90 days of the date of the equity offering closing. See “Description of Notes—Optional Redemption.” |

|

Change of Control Offer | | Upon the occurrence of a change of control, you will have the right to require us to repurchase some or all of your notes at 101% of their principal amount, plus accrued and unpaid interest, if any, to the repurchase date. The occurrence of those events will impose similar repurchase requirements or may be an event of default under our senior notes due 2008 and our revolving credit facility. We may not have enough funds or the terms of other debt may prevent us from repurchasing the notes. See “Description of Notes—Change of Control.” |

|

Certain Covenants | | The indenture governing the notes will contain covenants that will limit, among other things, our ability and the ability of our restricted subsidiaries to: |

|

| | | • incur additional debt; |

|

| | | • pay dividends on common stock of Terra Industries or repurchase shares of such common stock; |

|

| | | • make investments (other than in Terra Capital or any guarantor); |

|

| | | • use assets as security in other transactions; |

|

| | | • enter into transactions with affiliates; |

|

| | | • create restrictions on our restricted subsidiaries’ abilities to pay dividends or make other payments; |

|

| | | • enter into sale and leaseback transactions; |

|

| | | • engage in other businesses; or |

|

| | | • sell all or substantially all of our assets or merge with or into other companies. |

|

| | | These covenants are subject to important exceptions and qualifications described under “Description of Notes—Certain Covenants.” |

You should refer to the section entitled “Risk Factors” for an explanation of material risks of participating in the exchange offer.

11

Summary Financial and Other Data

The following consolidated summary financial and other data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes of Terra Industries included elsewhere in this prospectus. The consolidated summary financial data as of December 31, 1998, 1999, 2000, 2001 and 2002 and for the years then ended were derived from the audited consolidated financial statements and notes thereto of Terra Industries. The consolidated summary financial data as of and for each three months ended March 31, 2002 and 2003 and for the twelve months ended March 31, 2003 were derived from the unaudited consolidated financial statements of Terra Industries, which contain all adjustments necessary, in the opinion of management, to summarize the financial position and results of operations for the periods presented. You should not regard the results of operations for the three months ended March 31, 2003 to be indicative of the results that may be expected for the full year.

| | | Year Ended December 31,

| | | Three Months Ended March 31,

| | | Twelve Months Ended March 31, 2003

| |

| | | 1998

| | | 1999(1)

| | | 2000

| | | 2001

| | | 2002

| | | 2002

| | | 2003

| | |

| | | (dollars in thousands) | |

Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Nitrogen products | | $ | 816,014 | | | $ | 745,901 | | | $ | 916,959 | | | $ | 863,512 | | | $ | 883,971 | | | $ | 184,987 | | | $ | 228,541 | | | $ | 927,525 | |

Methanol | | | 96,547 | | | | 85,178 | | | | 136,781 | | | | 169,098 | | | | 158,458 | | | | 28,303 | | | | 51,114 | | | | 181,269 | |

Other | | | (2,593 | ) | | | 2,364 | | | | 9,270 | | | | 4,700 | | | | 1,554 | | | | 270 | | | | 488 | | | | 1,772 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total revenues | | | 909,968 | | | | 833,443 | | | | 1,063,010 | | | | 1,037,310 | | | | 1,043,983 | | | | 213,560 | | | | 280,143 | | | | 1,110,566 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Costs and expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cost of sales | | | 842,255 | | | | 847,190 | | | | 975,966 | | | | 1,047,219 | | | | 1,009,970 | | | | 206,140 | | | | 284,074 | | | | 1,087,904 | |

Selling, general and administrative expense | | | 57,499 | | | | 49,295 | | | | 44,237 | | | | 37,886 | | | | 39,420 | | | | 8,788 | | | | 9,327 | | | | 39,959 | |

Product claim costs(2) | | | — | | | | — | | | | — | | | | 14,023 | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total costs and expenses | | | 899,754 | | | | 896,485 | | | | 1,020,203 | | | | 1,099,128 | | | | 1,049,390 | | | | 214,928 | | | | 293,401 | | | | 1,127,863 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Nitrogen products, net | | | 39,329 | | | | (43,909 | ) | | | 28,639 | | | | (48,476 | ) | | | (9,351 | ) | | | 666 | | | | (13,558 | ) | | | (23,575 | ) |

Methanol | | | (7,891 | ) | | | (15,210 | ) | | | 12,395 | | | | (11,739 | ) | | | 7,325 | | | | (2,523 | ) | | | 1,633 | | | | 11,481 | |

Other | | | (21,224 | ) | | | (3,923 | ) | | | 1,773 | | | | (1,603 | ) | | | (3,381 | ) | | | 489 | | | | (1,333 | ) | | | (5,203 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total income (loss) from operations | | | 10,214 | | | | (63,042 | ) | | | 42,807 | | | | (61,818 | ) | | | (5,407 | ) | | | (1,368 | ) | | | (13,258 | ) | | | (17,297 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Interest expense, net of interest income | | | 50,796 | | | | 44,715 | | | | 47,642 | | | | 50,230 | | | | 53,257 | | | | 13,248 | | | | 12,363 | | | | 52,372 | |

Minority interest | | | 27,510 | | | | 8,341 | | | | 5,379 | | | | (2,247 | ) | | | 1,510 | | | | 546 | | | | (1,718 | ) | | | (754 | ) |

Loss on early retirement of debt | | | — | | | | 15,188 | | | | — | | | | 3,042 | | | | — | | | | — | | | | — | | | | — | |

Loss from continuing operations before income taxes | | | (68,092 | ) | | | (131,286 | ) | | | (16,182 | ) | | | (112,843 | ) | | | (60,174 | ) | | | (15,162 | ) | | | (23,903 | ) | | | (68,915 | ) |

Cumulative effect of change in accounting principle | | | — | | | | — | | | | — | | | | — | | | | 205,968 | | | | 205,968 | | | | — | | | | — | |

Net loss | | | (26,249 | ) | | | (89,887 | ) | | | (10,182 | ) | | | (79,843 | ) | | | (258,325 | ) | | | (215,065 | ) | | | (14,342 | ) | | | (57,602 | ) |

|

Selected Financial Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA(3) | | | 90,800 | | | | 40,022 | | | | 157,090 | | | | 71,201 | | | | 98,939 | | | | 22,863 | | | | 16,077 | | | | 92,153 | |

Net cash flows from operating activities | | | (7,085 | ) | | | (153,860 | ) | | | 143,558 | | | | (15,846 | ) | | | 146,236 | | | | 37,081 | | | | (26,401 | ) | | | 82,754 | |

Net cash flows from investing activities | | | 44,810 | | | | 278,699 | | | | (27,910 | ) | | | (26,608 | ) | | | (56,649 | ) | | | (7,706 | ) | | | (15,972 | ) | | | (64,915 | ) |

Net cash flows from financing activities | | | (75,813 | ) | | | (256,260 | ) | | | (23,330 | ) | | | (51,713 | ) | | | (38,512 | ) | | | (34,410 | ) | | | (1,188 | ) | | | (5,290 | ) |

Depreciation and amortization(4) | | | 108,096 | | | | 111,405 | | | | 125,630 | | | | 130,772 | | | | 105,856 | | | | 24,777 | | | | 27,617 | | | | 108,696 | |

Capital expenditures | | | 55,327 | | | | 51,899 | | | | 12,219 | | | | 14,838 | | | | 25,186 | | | | 6,328 | | | | 3,578 | | | | 22,436 | |

Plant turnaround costs(5) | | | 13,791 | | | | 35,277 | | | | 21,754 | | | | 30,408 | | | | 24,260 | | | | 3,253 | | | | 12,318 | | | | 33,325 | |

Terra Capital total debt (at period end)(6) | | | 138,275 | | | | 127,706 | | | | 114,599 | | | | 236,602 | | | | 200,501 | | | | 200,372 | | | | 200,466 | | | | 200,466 | |

12

| | | Year Ended December 31,

| | Three Months Ended March 31,

| | Twelve Months Ended March 31, 2003

|

| | | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | 2002

| | 2003

| |

Selected Operating Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Cost of natural gas(7) | | $ | 2.11 | | $ | 2.27 | | $ | 3.89 | | $ | 4.38 | | $ | 3.25 | | $ | 2.38 | | $ | 6.61 | | $ | 4.31 |

Selling prices(8): | | | | | | | | | | | | | | | | | | | | | | | | |

Ammonia | | $ | 142.69 | | $ | 122.27 | | $ | 161.55 | | $ | 187.29 | | $ | 147.01 | | $ | 132.75 | | $ | 209.83 | | $ | 162.46 |

UAN | | | 65.51 | | | 61.57 | | | 79.36 | | | 97.15 | | | 72.85 | | | 66.38 | | | 85.86 | | | 76.26 |

AN | | | 133.64 | | | 113.09 | | | 117.50 | | | 126.63 | | | 118.64 | | | 121.16 | | | 125.59 | | | 119.79 |

Urea | | | 117.88 | | | 98.99 | | | 135.98 | | | 141.99 | | | 120.52 | | | 107.65 | | | 157.49 | | | 133.52 |

Methanol | | | 0.34 | | | 0.35 | | | 0.53 | | | 0.56 | | | 0.49 | | | 0.34 | | | 0.76 | | | 0.58 |

Sales volume(9): | | | | | | | | | | | | | | | | | | | | | | | | |

Ammonia | | | 1,349 | | | 1,417 | | | 1,418 | | | 1,195 | | | 1,504 | | | 341 | | | 277 | | | 1,440 |

UAN | | | 3,548 | | | 3,682 | | | 3,990 | | | 3,296 | | | 3,966 | | | 636 | | | 756 | | | 4,086 |

AN | | | 809 | | | 833 | | | 1,000 | | | 682 | | | 912 | | | 243 | | | 248 | | | 917 |

Urea | | | 631 | | | 563 | | | 474 | | | 451 | | | 633 | | | 178 | | | 152 | | | 607 |

Methanol | | | 285,958 | | | 245,821 | | | 256,812 | | | 301,596 | | | 326,796 | | | 82,651 | | | 67,506 | | | 311,651 |

| | | December 31,

| | March 31,

|

| | | 1998

| | 1999(1)

| | 2000

| | 2001

| | 2002

| | 2002

| | 2003

|

| | | (dollars in thousands) |

Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | |

Cash and short-term investments | | $ | 141,643 | | $ | 9,790 | | $ | 101,425 | | $ | 7,125 | | $ | 58,479 | | $ | 2,063 | | $ | 14,958 |

Working capital(10) | | | 262,283 | | | 152,959 | | | 199,008 | | | 136,378 | | | 85,902 | | | 118,715 | | | 58,605 |

Property, plant and equipment, net | | | 1,017,885 | | | 997,801 | | | 902,801 | | | 824,982 | | | 790,475 | | | 806,748 | | | 778,161 |

Excess of cost over net assets of acquired businesses(11) | | | 272,553 | | | 253,162 | | | 231,372 | | | 206,209 | | | — | | | — | | | — |

Total assets | | | 2,037,768 | | | 1,601,445 | | | 1,512,552 | | | 1,336,043 | | | 1,128,110 | | | 1,101,840 | | | 1,121,928 |

Total debt | | | 497,030 | | | 486,461 | | | 473,354 | | | 436,602 | | | 400,501 | | | 400,372 | | | 400,466 |

Total stockholders’ equity | | | 747,852 | | | 657,002 | | | 610,797 | | | 500,779 | | | 257,864 | | | 291,769 | | | 233,909 |

| | | Twelve Months Ended March 31, 2003

| |

| | | (dollars in thousands) | |

Pro Forma Financial Data(12): | | | | |

EBITDA(3) | | $ | 92,153 | |

Interest expense | | | 53,877 | |

Total debt (at period end) | | | 402,466 | |

Ratio of total debt (at period end) to EBITDA | | | 4.4 | x |

Ratio of EBITDA to interest expense | | | 1.7 | x |

| (1) | | On June 30, 1999, we sold our distribution business segment for $485 million. Net proceeds were used to redeem outstanding minority interests in one of our subsidiaries, fund termination of our accounts receivable securitization program and repay outstanding borrowings under our revolving credit facility. |

| (2) | | Product claim costs relate to a $14 million pretax charge in the second quarter of 2001 to reflect the estimated value of claims, plus interest and attorneys’ fees, associated with recalls of beverages containing carbon dioxide tainted with benzene. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” |

| (3) | | EBITDA is defined as net income (loss) from continuing operations before extraordinary items, excluding interest expense and income, income tax benefit or expense, depreciation and amortization. EBITDA is not a measure of performance under generally accepted accounting principles and should not be used in isolation or as a substitute for net income, cash flows from operating activities or other income or cash flow statement data prepared in accordance with generally accepted accounting principles or as a measure of profitability or liquidity. EBITDA is not necessarily a measure of our ability to fund our cash needs. We present EBITDA because management believes that it is a measure commonly used by financial |

13

| | analysts because of its usefulness in evaluating operating performance. The definition of EBITDA used in this prospectus may not be comparable to the definition of EBITDA used by other companies. The following table presents a reconciliation from our loss from continuing operations to EBITDA. |

| | | Year Ended December 31,

| | | Three Months Ended March 31,

| | | Twelve Months Ended March 31, 2003

| |

| | | 1998

| | | 1999

| | | 2000

| | | 2001

| | | 2002

| | | 2002

| | | 2003

| | |

Loss from continuing operations | | $ | (43,331 | ) | | $ | (79,363 | ) | | $ | (10,182 | ) | | $ | (79,843 | ) | | $ | (36,174 | ) | | $ | (9,097 | ) | | $ | (14,342 | ) | | $ | (41,419 | ) |

Income tax benefit | | | (24,761 | ) | | | (51,923 | ) | | | (6,000 | ) | | | (33,000 | ) | | | (24,000 | ) | | | (6,065 | ) | | | (9,561 | ) | | | (27,496 | ) |

Interest expense, net of interest income | | | 50,796 | | | | 44,715 | | | | 47,642 | | | | 50,230 | | | | 53,257 | | | | 13,248 | | | | 12,363 | | | | 52,372 | |

Loss on early retirement of debt | | | — | | | | 15,188 | | | | — | | | | 3,042 | | | | — | | | | — | | | | — | | | | — | |

Depreciation and amortization | | | 108,096 | | | | 111,405 | | | | 125,630 | | | | 130,772 | | | | 105,856 | | | | 24,777 | | | | 27,617 | | | | 108,696 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

EBITDA | | $ | 90,800 | | | $ | 40,022 | | | $ | 157,090 | | | $ | 71,201 | | | $ | 98,939 | | | $ | 22,863 | | | $ | 16,077 | | | $ | 92,153 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (4) | | Depreciation and amortization expense prior to 2002 includes amortization of excess of cost over net assets of acquired businesses which was written off in 2002. See note 11. |

| (5) | | Plant turnaround costs represent cash used for the periodic scheduled major maintenance of our continuous process production facilities performed at each plant generally every two years. We capitalize these costs and depreciate them over two years. |

| (6) | | Excludes debt owed to Terra Industries. |

| (7) | | Dollars per MMBtu for average monthly NYMEX last session closing prices for the period. |

| (8) | | Dollars per ton, except for methanol, which is in dollars per gallon. |

| (9) | | In thousands of tons, except for methanol, which is in thousands of gallons. |

| (10) | | Current assets minus current liabilities. |

| (11) | | We adopted Statement of Financial Accounting Standard No. 142, “Goodwill and Other Intangible Assets,” on January 1, 2002, which resulted in the determination that $206 million of assets classified as “Excess of cost over net assets of acquired businesses” were impaired and had no value. Consequently, these assets were written off through a charge that was reported as a change in accounting principle during the 2002 first quarter. |

| (12) | | Income statement data reflects the initial offering and the use of proceeds therefrom as if they had occurred on April 1, 2002. Balance sheet data reflects the initial offering and the use of proceeds therefrom as if they had occurred on March 31, 2003. |

14

RISK FACTORS

You should carefully consider each of the following factors and all of the other information set forth in this prospectus before deciding to participate in the exchange offer. Any of the following risks could materially adversely affect our business, financial condition or results of operations. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also materially adversely affect our business operations. In such case, we may not be able to make principal and interest payments on the notes, and you may lose all or part of your investment.

Risks Associated with the Exchange Offer

Because there is no public market for the notes, you may not be able to resell your notes.

The exchange notes will be registered under the Securities Act, but will constitute a new issue of securities with no established trading market, and there can be no assurance as to:

| | • | | the liquidity of any trading market that may develop; |

| | • | | the ability of holders to sell their exchange notes; or |

| | • | | the price at which the holders would be able to sell their exchange notes. |

If a trading market were to develop, the exchange notes might trade at higher or lower prices than their principal amount or purchase price, depending on many factors, including prevailing interest rates, the market for similar debentures and our financial performance.

We understand that the initial purchasers presently intend to make a market in the notes. However, they are not obligated to do so, and any market-making activity with respect to the notes may be discontinued at any time without notice. In addition, any market-making activity will be subject to the limits imposed by the Securities Act and the Securities Exchange Act of 1934, and may be limited during the exchange offer or the pendency of an applicable shelf registration statement. There can be no assurance that an active trading market will exist for the notes or that any trading market that does develop will be liquid.

In addition, any outstanding note holder who tenders in the exchange offer for the purpose of participating in a distribution of the exchange notes may be deemed to have received restricted securities, and if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction. For a description of these requirements, see “Exchange Offer; Registration Rights.”

Your outstanding notes will not be accepted for exchange if you fail to follow the exchange offer proceduresand, as a result, your notes will continue to be subject to existing transfer restrictions and you may not be able to sell your outstanding notes.

We will not accept your notes for exchange if you do not follow the exchange offer procedures. We will issue exchange notes as part of this exchange offer only after a timely receipt of your outstanding notes, a properly completed and duly executed letter of transmittal and all other required documents. Therefore, if you want to tender your outstanding notes, please allow sufficient time to ensure timely delivery. If we do not receive your notes, letter of transmittal and other required documents by the expiration date of the exchange offer, we will not accept your notes for exchange. We are under no duty to give notification of defects or irregularities with respect to the tenders of outstanding notes for exchange. If there are defects or irregularities with respect to your tender of notes, we will not accept your notes for exchange.

If you do not exchange your outstanding notes, your outstanding notes will continue to be subject to the existing transfer restrictions and you may not be able to sell your outstanding notes.

We did not register the outstanding notes, nor do we intend to do so following the exchange offer. Outstanding notes that are not tendered will therefore continue to be subject to the existing transfer restrictions

15

and may be transferred only in limited circumstances under the securities laws. If you do not exchange your outstanding notes, you will lose your right to have your outstanding notes registered under the federal securities laws. As a result, if you hold outstanding notes after the exchange offer, you may not be able to sell your outstanding notes.

Risks Relating to the Notes

Our substantial indebtedness could impair our financial health and prevent us from fulfilling our obligations under the notes.

We have a significant amount of debt. The following chart shows important credit statistics and is presented assuming we had completed the initial offering and the related transactions as described in “Use of Proceeds” on March 31, 2003 and applied the proceeds as described herein:

| | | Pro Forma at March 31, 2003

| |

| | | Terra Capital Consolidated

| | | Terra Industries Consolidated

| |

| | | (dollars in millions) | |

Total debt | | $ | 402.5 | | | $ | 402.5 | |

Stockholder’s/Stockholders’ equity | | | 145.9 | | | | 233.9 | |

Total debt to stockholder’s/stockholders’ equity ratio | | | 2.76 | x | | | 1.72 | x |

On a pro forma basis, Terra Capital’s and Terra Industries’ earnings for the year ended December 31, 2002 would have been insufficient to cover fixed charges by $35.6 million and $63.1 million, respectively. On a pro forma basis, Terra Capital’s and Terra Industries’ earnings for the three months ended March 31, 2003 would have been insufficient to cover fixed charges by $19.5 million and $26.6 million, respectively.

Our high level of debt and our debt service obligations could:

| | • | | make it more difficult for us to satisfy our obligations with respect to the notes; |

| | • | | reduce the amount of money available to finance our operations, capital expenditures and other activities; |

| | • | | increase our vulnerability to economic downturns and industry conditions; |

| | • | | limit our flexibility in responding to changing business and economic conditions, including increased competition and demand for new products and services; |

| | • | | place us at a disadvantage when compared to our competitors that have less debt; and |

| | • | | limit our ability to borrow additional funds. |

We may incur substantial additional debt in the future, and we may do so in order to finance future acquisitions and investments. The terms of the indenture governing the notes permit us and our subsidiaries to incur such debt. Adding more debt to our current debt levels could intensify risks related to leverage that we now face. The indenture also permits us to incur certain additional debt that may be secured by our assets to the extent such assets do not constitute collateral for the notes.

The ability of the trustee to foreclose on secured property may be limited.

Bankruptcy law could prevent the trustee from possessing and disposing of the collateral upon the occurrence of an event of default under the indenture governing the notes if a bankruptcy proceeding is commenced by or against us or the guarantors before the trustee possesses and disposes of the collateral. Under bankruptcy law, secured creditors such as the holders of the notes are prohibited from possessing their security

16

from a debtor in a bankruptcy case, or from disposing of security possessed from such debtor, without bankruptcy court approval. Moreover, bankruptcy law permits the debtor to continue to retain and to use the collateral (and the proceeds of such collateral) so long as the secured creditor is given “adequate protection.” The meaning of the term “adequate protection” may vary according to circumstances, but it is intended in general to protect the value of the secured creditor’s interest in the collateral. The court may find “adequate protection” if the debtor pays cash or grants additional security for any diminution in the value of the collateral as a result of the stay of repossession or disposition or any use of the collateral during the pendency of the bankruptcy case. In view of the lack of a precise definition of the term “adequate protection” and the broad discretionary powers of a bankruptcy court, it is impossible to predict how long payments under the notes could be delayed following commencement of a bankruptcy case, whether or when the trustee could repossess or dispose of the collateral or whether or to what extent holders of the notes would be compensated for any delay in payment or loss of value of the collateral through the requirement of “adequate protection.”

In addition, the trustee’s ability to foreclose on the collateral on your behalf may be subject to perfection issues, the consent of third parties, prior liens and practical problems associated with the realization of the trustee’s security interest in the collateral.

The value of the collateral securing the notes may not be sufficient to satisfy our obligations under the notes and the collateral securing the notes may be reduced or diluted under certain circumstances.

The collateral will secure on a first priority basis our obligations under the revolving credit facility. The revolving credit facility provides for revolving credit borrowings in a maximum amount of $175 million and the indenture permits the revolving credit facility to provide for borrowings of up to $225 million, all of which, if incurred, would be secured on a first priority basis by the collateral. At March 31, 2003, after giving effect to the initial offering and related transactions, we would have had no borrowings outstanding under our revolving credit facility and we would have been able to borrow up to an additional $117 million, subject to our borrowing base limitation. The collateral will also secure the notes and the 2008 notes, equally and ratably, on a second priority basis. The collateral may also equally and ratably secure additional notes, if issued, to the extent such indebtedness is otherwise permitted to be incurred under the indenture. Your rights to the collateral would be reduced on a dollar for dollar basis to the extent we incur additional indebtedness secured on a first priority basis by the collateral, and diluted on a pro rata basis by any increase in the indebtedness secured on a second priority basis by the collateral.

We are also permitted under the indenture to sell or dispose of collateral in the ordinary course of business or otherwise in accordance with the “Limitation on Asset Sales” covenant. The indenture does not require us to maintain any minimum amount of collateral. In the future, we could have significantly less assets constituting collateral without a corresponding reduction in the indebtedness secured by the collateral.

In the event of foreclosure on the collateral or a liquidation of our assets, the net proceeds from a sale of the collateral securing indebtedness under the notes may not be sufficient to repay the notes. This is because proceeds from a sale of the collateral would be distributed to satisfy all obligations under the revolving credit facility in full before any such proceeds are distributed on a pro rata basis in respect of the notes, the 2008 notes and, if issued, any additional notes. If the net proceeds received from the sale of the collateral (after payment of any expenses relating to the sale thereof) were insufficient to pay all amounts due with respect to the notes and all other obligations secured thereby, you would, to the extent your notes remain unpaid, have only an unsecured claim against our remaining assets.

The value of the collateral and the amount to be received upon a sale of such collateral will depend upon many factors including, among others, the condition of the collateral and the industries in which we operate, the ability to sell collateral in an orderly sale, the condition of the international, national and local economies, the availability of buyers and other similar factors. The book value of the collateral should not be relied on as a measure of realizable value for such assets. By their nature, portions of the collateral may be illiquid and may

17

have no readily ascertainable market value. In addition, a significant portion of the collateral includes assets that may only be usable, and thus retain value, as part of our existing operating businesses. Accordingly, any such sale of the collateral separate from the sale of certain operating businesses may not be feasible or of significant value. To the extent that holders of other secured indebtedness or third parties enjoy liens (including statutory liens), whether or not permitted by the indenture governing the notes, such holders or third parties may have rights and remedies with respect to the collateral securing the notes that, if exercised, could reduce the proceeds available to satisfy the obligations under the notes.

Prior to the closing of the initial offering, the trustee for the notes entered into an intercreditor agreement under which the lenders party to the revolving credit facility have the exclusive rights to dispose of, release or foreclose on or otherwise deal with the collateral securing the notes. As a result, the holders of the notes do not have the ability to make these decisions or in any way ensure that sufficient collateral is securing the obligations under the notes.

The notes will also be effectively subordinated to our obligations under our 2008 notes, the revolving credit facility and certain other secured indebtedness to the extent that these obligations are secured by collateral that does not secure the notes.

In addition to the collateral securing the notes and the guarantees, our 2008 notes are further secured by substantially all the real property, machinery and equipment of Terra Capital and the guarantors, certain limited partnership interests in Terra Nitrogen Company, L.P. owned by Terra Capital or any guarantor and certain intercompany notes secured by fixed assets. The obligations under the revolving credit facility are also secured by other assets, in addition to the collateral.

As a result, to the extent that our assets secure the 2008 notes, the revolving credit facility or other indebtedness, but do not secure the notes, the notes will be effectively subordinated to such other obligations. In the event of a bankruptcy, liquidation, reorganization or or the winding up of our business, certain of those assets described in the preceding paragraph will not be available to pay obligations under the notes unless and until payment in full of the obligations under the 2008 notes, the revolving credit facility and any other accrued indebtedness we may have. Likewise, if the lenders under the revolving credit facility or the holders of the 2008 notes or other indebtedness accelerate such obligations, then those creditors would be entitled to exercise the remedies available to secured creditors under applicable law. In addition, the revolving credit facility lenders are not required to foreclose on assets not constituting collateral before foreclosing on collateral or ever and their decisions in this regard could adversely affect any recovery of second priority lienholders in such circumstances.

Federal and state statutes allow courts, under specific circumstances, to void subsidiary guarantees of the notes.

The issuance of the subsidiary guarantees of the notes may be subject to review under U.S. federal bankruptcy law and comparable provisions of state or foreign fraudulent conveyance laws if a bankruptcy or reorganization case or lawsuit is commenced by or on behalf of a subsidiary guarantor’s unpaid creditors. Generally speaking and depending upon the specific law applicable to the situation, if a court were to find in such a bankruptcy or reorganization case or lawsuit that, at the time the subsidiary guarantor issued the guarantee of the notes:

| | • | | it issued the guarantee to delay, hinder or defraud present or future creditors; or |

| | • | | it received less than reasonably equivalent value or fair consideration for issuing the guarantee and at the time it issued the guarantee: |

—it was insolvent or rendered insolvent by reason of issuing the guarantee, or

—it was engaged, or about to engage, in a business or transaction for which its assets, after giving effect to its potential liability under the guarantee, constituted unreasonably small capital to carry on its business, or

—it intended to incur, or believed that it would incur, debts beyond its ability to pay as they mature,

18

then the court could void the obligations under the guarantee of the notes, subordinate the guarantee of the notes to that subsidiary guarantor’s other obligations or take other action detrimental to holders of the notes. If that occurs, the notes could become structurally subordinated to other obligations of the subsidiary guarantor.

The measures of insolvency for purposes of fraudulent conveyance laws vary depending upon the law of the jurisdiction that is being applied in any proceeding to determine whether a fraudulent conveyance had occurred. Generally, however, a person would be considered insolvent if, at the time it incurred the debt:

| | • | | the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or |

| | • | | it could not pay its debts as they become due. |

We cannot be certain what standard a court would use to determine whether a subsidiary guarantor was solvent at the relevant time, or, regardless of the standard that the court uses, that the issuance of the guarantee of the notes would not be voided or the guarantee of the notes would not be subordinated to a subsidiary guarantor’s other debt. If such a case were to occur, a guarantee could also be subject to the claim that, since the guarantee was incurred for our benefit, and only indirectly for the benefit of the subsidiary guarantor, the guarantee was incurred for less than fair consideration.

A significant change in ownership may not trigger an offer to purchase requirement under the change of control provisions of the indenture, and even if it did, we may not be able to effect such purchase.

Under the indenture governing the notes, a change of control is deemed to have occurred if, among other things, a person or group becomes the beneficial owner of 50% or more of the common stock of Terra Industries. Our principal stockholder, Anglo American plc, currently owns 48.9% of the common stock of Terra Industries, but has publicly announced its intention to dispose of its interest. Such disposition, even to a single person or group, would not by itself trigger the change of control provisions of the indenture.

If we do undergo a change of control as defined in the indenture, we will be required to offer to purchase the notes for a price equal to 101% of their principal amount, plus accrued interest to the purchase date. In addition, a change of control as defined in the indenture would constitute an event of default under our revolving credit facility, giving rise to a right of acceleration by the lenders thereunder. Our revolving credit facility and any future debt that we incur may also contain restrictions on repurchases in the event of a change of control or similar event. For example, under our current revolving credit facility, we are not permitted to purchase, redeem, retire or otherwise acquire for value, or set apart any money for a sinking, defeasance or other analogous fund for the purchase, redemption, retirement or other acquisition of, or make any voluntary payment or prepayment of the principal of or interest on, or any other amount owing in respect of the notes except for regularly scheduled payments of principal and interest in respect thereof required pursuant to the indenture. If a change of control were to occur, we may not have sufficient funds to repay our revolving credit facility borrowings, repurchase our 2008 notes and pay the purchase price of the notes.

The definition of change of control as defined in the indenture includes, among other things, a disposition of “all or substantially all” of our assets. The phrase “all or substantially all” has no precise established meaning under applicable law and is subject to judicial interpretation. Accordingly, in certain circumstances, there may be a degree of uncertainty in ascertaining whether a particular transaction would involve a disposition of “all or substantially all” of our assets, and therefore it may be difficult for you to determine whether a change of control has occurred.

The change of control provisions may not protect you in a transaction in which we incur a large amount of debt, including a reorganization, restructuring, merger or other similar transaction, if the transaction does not

19

involve a shift in voting power or beneficial ownership large enough to trigger a change of control as defined in the indenture governing the notes. See “Description of Notes—Change of Control.”

Risks Relating to Our Business

Our results from operations have historically been influenced by a number of factors beyond our control which have, at times, had a significant effect on our operating results. Factors that may affect our operating results include: the relative balance of supply and demand for nitrogen fertilizers, industrial nitrogen and methanol, the availability and cost of natural gas, the number of planted acres—which is affected by both worldwide demand and governmental policies, the types of crops planted, the effect of general weather patterns on the timing and duration of field work for crop planting and harvesting, the effect of environmental legislation on supply and demand for our products, the availability of financing sources to fund seasonal working capital needs, and the potential for interruption to operations due to accidents or natural disasters.

A substantial portion of our operating expense is related to the cost of natural gas, and an increase in such cost, that is either unexpected or not accompanied by increases in selling prices of our products, could result in reduced profit margins and lower production of our products.

The principal raw material used to produce nitrogen products and methanol is natural gas. Natural gas costs in 2002 comprised about 56% of total costs and expenses for our North American nitrogen products business, 29% of total costs and expenses for our U.K. nitrogen products business and 59% of total costs and expenses for our methanol business. A significant increase in the price of natural gas that is not hedged or recovered through an increase in the price of our related nitrogen and methanol products could result in reduced profit margins and lower production of our products. For example, March 2003 natural gas future prices closed at over $9.00/MMBtu in February 2003. As a result, we ceased production at our Blytheville, Arkansas and Woodward, Oklahoma facilities and reduced ammonia and methanol production rates at our other North American facilities. In March 2003, we resumed production at our Blytheville, Arkansas and Woodward, Oklahoma facilities and increased production rates at some of our other North American facilities due to natural gas price decreases and nitrogen and methanol market improvements. In addition, in early January 2001, due to unprecedented natural gas prices of nearly $10.00/MMBtu, we idled most of our North American production for most of that month. Also in response to natural gas costs, we idled our Blytheville, Arkansas and Beaumont, Texas plants and parts of our Verdigris, Oklahoma plant for the month of December 2000 and our Blytheville, Arkansas plant from June through mid-August 2000. In response to low methanol prices, we idled our Beaumont, Texas facility for two months during the first quarter of 1999.

We enter into forward pricing arrangements for some of our natural gas requirements, so long as such arrangements would not result in costs greater than expected selling prices for our finished products. Our current natural gas forward pricing policy is to fix or cap the price of between 20% and 80% of our natural gas requirements for a one-year period and up to 50% of our natural gas requirements for the subsequent two-year period through supply contracts, financial derivatives and other instruments. We notify the Board of Directors when we deviate from this policy. March 31, 2003 forward positions covered 16% of our expected 2003 natural gas requirements for the succeeding twelve months.

Declines in the prices of our products may reduce our profit margins.

Prices for nitrogen products are influenced by the global supply and demand conditions for ammonia and other nitrogen-based products. Long-term demand is affected by population growth and rising living standards that determine food consumption. Short-term demand is affected by world economic conditions and international trade decisions. Supply is affected by increasing worldwide capacity and the increasing availability of nitrogen product exports from major producing regions such as the former Soviet Union, Canada, the Middle East, Trinidad and Venezuela. A substantial amount of new ammonia capacity is expected to be added abroad in the foreseeable future. When industry oversupply occurs, as is common in commodity businesses, the price at which

20

we sell our nitrogen products typically declines, which then results in reduced profit margins and lower production of our products, including plant closures.

Fluctuations in the selling price and production cost of methanol may reduce our profit margins.