UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED December 31, 2011 |

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

Date of event requiring this shell company report ______________.

FOR THE TRANSITION PERIOD FROM _______________ TO _________________

COMMISSION FILE NO. 001-14611

(formerly known as INTERACTIVE ENTERTAINMENT LIMITED)

(Exact name of registrant as specified in its charter)

BERMUDA

(Jurisdiction of Incorporation)

Floor Six, 65 Front Street, Hamilton HM12 Bermuda

(Address of principal executive offices)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| Title of each class | Name of each exchange on which registered |

Common Stock, Par Value $0.01per share ("Common Stock") | OTC Bulletin Board |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

The number of shares outstanding of the issuer's Common Stock, as of December 31, 2011: 7,467,288

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes: o No: x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes: o No: x

Note – checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes: x No: o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registration was required to submit and post such files).

Yes: o No: o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerate filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP o | International Financial Reporting Standards as issued by the International Accounting Standards Board | Other o |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17: x Item 18: o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes: o No: x

CREATOR CAPITAL LIMITED

ANNUAL REPORT ON FORM 20-F

TABLE OF CONTENTS

| | |

| |

| ITEM 1 - IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS | 1 |

| ITEM 2 - OFFER STATISTICS AND EXPECTED TIMETABLE | 1 |

| ITEM 3 - KEY INFORMATION | 1 |

| ITEM 4 - INFORMATION ON THE COMPANY | 3 |

| ITEM 4A – UNRESOLVED STAFF COMMENTS | 3 |

| ITEM 5 - OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 7 |

| ITEM 6 - DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 10 |

| ITEM 7 - MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 13 |

| ITEM 8 - FINANCIAL INFORMATION | 13 |

| ITEM 9 - THE OFFERING AND LISTING | 14 |

| ITEM 10 - ADDITIONAL INFORMATION | 15 |

| ITEM 11 - QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 17 |

| ITEM 12 - DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 18 |

| PART II | |

| ITEM 13 - DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 18 |

| ITEM 14 - MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 18 |

| ITEM 15 - CONTROLS AND PROCEDURES | 18 |

| ITEM 16 – AUDIT COMMITTEE, CODE OF ETHICS, ACCOUNTANT FEES | 19 |

| A. | Audit Committee Financial Expert | 19 |

| B. | Code of Ethics | 19 |

| C. | Auditor’s Fees and Services | 19 |

| D. | Exemptions from Listing Standards for Audit Committees | 19 |

| E. | Purchase of Equity Securities by the Issuer and Affiliated Purchasers | 19 |

| PART III |

| ITEM 17 - FINANCIAL STATEMENTS | 20 |

| ITEM 18 – FINANCIAL STATEMENTS | 21 |

| ITEM 19 – EXHIBITS | |

| Creator Capital Limited. December 31, 2011 20-F | Page.1 |

INTRODUCTION

Creator Capital Limited is (the “Company”) is a Bermuda company whose shares are trade on the NASD Over the Counter Bulletin Board in the United States of America. The Company provides in-flight gaming and entertainment software and services by developing, implementing and operating or licensing computerized video gaming and other entertainment software on, but not limited to, the aircraft of international commercial air carriers. Gaming software is marketed using the name Sky Games® and the entertainment software is marketed using the name Sky Play®.

In this Annual Report, the “Company”, “CCL”, “we”, and “us” refer to Creator Capital Limited (unless the context otherwise requires). In this Annual Report, unless otherwise specified, all dollar amounts are expressed in US dollars.

FORWARD LOOKING STATEMENTS

This Annual Report on Form 20-F contains forward-looking statements that include, among others, statements concerning the Company's plans to implement its software products, commence generating revenue from certain of its products, expectations as to funding its capital requirements, the impact of competition, future plans and strategies, statements which include the words "believe," "expect," and "anticipate" and other statements of expectations, beliefs, anticipated developments and other matters that are not historical facts. These statements reflect the Company's views with respect to such matters. Management cautions the reader that these forward-looking statements are subject to risks and uncertainties that could cause actual events or results to materially differ from those expressed or implied by the statements.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

No disclosure necessary.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

No disclosure necessary.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The selected financial data of the Company for the fiscal years ended December 31, 2011 and 2010 was derived from the audited consolidated financial statements of the Company included in this annual report on Form 20-F.

The selected financial data should be read in conjunction with the financial statements and other financial information included elsewhere in the Annual Report.

The following table is derived from the consolidated financial statements of the Company which have been prepared in accordance with and using accounting policies in full compliance with International Financial Reporting Standards (“IFRS”) and International Accounting Standards (“IAS”) issued by the International Accounting Standards Board (“IASB”) and interpretations of the International Financial Reporting Interpretations Committee (“IFRIC”), effective for the Company’s reporting for the years ended 31 December 2011 and 2010.

| Year Ended December 31, | | 2011 | | | 2010 | |

| | | $ | | | $ | |

| Total assets | | | 5,053 | | | | 12,879 | |

| Net assets | | | (7,504,637 | ) | | | (6,875,870 | ) |

| Share capital | | | 874,673 | | | | 874,673 | |

| | | | | | | | | |

| Revenue | | | 10,500 | | | | 32,550 | |

| Loss from operations | | | (136,295 | ) | | | (114,478 | ) |

| Net loss for the year | | | (628,767 | ) | | | (619,576 | ) |

| Basic and diluted loss per share | | | (0.01 | ) | | | (0.01 | ) |

| Weighted average number of common shares outstanding | | | 87,467,288 | | | | 87,467,288 | |

Pursuant to SEC Release No. 33-8567 “First-Time Application of International Financial Reporting Standards”, the Company is only required to include selected financial data prepared in compliance with IFRS extracted or derived from the consolidated financial statements for the years ended December 31, 2010 and 2011 (earlier periods are not required to be included).

Furthermore, pursuant to SEC Release No. 33-8879 “Acceptance from Foreign Private Issuers of Financial Statements Prepared in Accordance with International Reporting Standards Without Reconciliation to U.S. GAAP”, the Company includes selected financial data prepared in compliance with IFRS without reconciliation to U.S. GAAP

| Creator Capital Limited. December 31, 2011 20-F | Page.2 |

Dividends

No cash dividends on common shares have been declared nor are any intended to be declared. The Company is not subject to legal restrictions respecting the payment of dividends except that they may not be paid to render the Company insolvent. Dividend policy will be based on the Company's cash resources.

The outstanding Class A Preference shares accrue an annual nine percent (9.00%) dividend, calculated and accrued monthly, payable quarterly and compounded annually. At its option, the Company may redeem the Class A Preference Shares, in whole or in part, at any time, and from time to time, at a redemption price of $1,000 per share plus any accrued and unpaid dividends thereon. The Company is not required to redeem the Class A Preference Shares. In the event that the common shares to be issued to the preferred shareholder upon a preferred share conversion do not have a value of at least equal to the redemption value of the preferred shares held, the Company is obligated to issue additional common shares or repurchase all common shares and preferred shares previously issued to the holder for an amount equal to the redemption value of the preferred shares less any prior redemption proceeds.

B. Capitalization and Indebtedness

The Class A Preferred shares compose the majority of the total current liabilities. The balance of the accrued, and trade payables are the result of operations.

C. Reasons for the Offer and Use of Proceeds

During the year, the Company did not issue any equity securities.

D. Risk Factors

The Company is subject to a number of risks due to the nature of its business and the present stage of development of business. The following factors should be considered:

As of December 31, 2011 CCL has incurred a cumulative net loss of $72,062,469 (2010:$71,433,702). We anticipate generating losses for at least the next 12 months. Therefore, there is substantial doubt about our ability to continue operations in the future as a going concern as described in the Comments for US Readers on Canada. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue in existence.

Plans to deal with this uncertainty include raising additional capital or entering into a strategic arrangement with a third party. If the Company cannot continue as a viable entity, the shareholders may lose some or all of their investment in the company.

CCL’s product line of Sky Games® and Sky Play® are marketed to the world’s airlines. CCL’s future must be considered in light of the continuing financial difficulties the airline industry is experiencing globally. As a result of global financial difficulties continues, our marketing efforts may not generate additional licenses requested from airlines.

SOFTWARE

The value of CCL’s product line is in the software. The Sky Games Gambling Software remains unique in the marketplace, adaptable to the various airline in-flight entertainment systems. The Sky Play Software is utilized on older platforms still being used throughout the world. As with all software, the risks lie in it becoming obsolete overnight.

COMPETITION

There are numerous entities offering similar products to CCL’s Sky Play® PC Interactive Games product line. It is the increase in the availability of similar PC based entertainment games, and the lack of a dedicated marketing consultant that has reduced CCL’s client base.

The marketplace for the Sky Games® Interactive Gaming System, CCL’s main product line, is not well established. However the Gaming Industry as a whole internationally is constantly undergoing changes, is intensely competitive, and is subject to changes in customer attitudes, morals and preferences. New products are being developed continuously by the Gaming Industry in order to satisfy customer demands. The Sky Games® Interactive Gaming System is one of those products. Changes in International Governmental regulations and laws are in a constant state of flux, and could adversely affect the ability of the Airlines to install such a system. Changes in policies of companies or banks that handle payment processing systems or credit card transactions for gaming industry could have an adverse impact on the operation of the Sky Games® System.

RELIANCE ON EMPLOYEES

CCL relies on its management and outsourced services for the business and corporate operations. None of our executive officers have sufficient technical training or experience in marketing for the products. As such, qualified consultants will have to be hired to perform these functions. Consequently, operations, earnings and ultimate financial success could suffer irreparable harm due to management's lack of experience in this industry. As a result operations may have to be suspended or ceased which will result in the loss of your investment.

| Creator Capital Limited. December 31, 2011 20-F | Page.3 |

ABILITY TO RAISE CAPITAL

As CCL has not generated sufficient revenue to fund its operations, additional funds will be required to meet n-going obligations and in the future. As a result, additional capital will be required to effectively support the operations and to otherwise implement our overall business strategy. The inability to obtain additional capital will restrict our ability to grow and may reduce the Company’s ability to continue to conduct business operations. If additional financing cannot be obtained, development plans will likely be required to be curtailed which could cause the Company to become dormant. Any additional equity financing may involve substantial dilution to the then existing shareholders.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

Creator Capital Limited (the "Company" or "CCL"), formerly Interactive Entertainment Limited was incorporated pursuant to the laws of the Province of British Columbia on January 28, 1981 under the name Tu-Tahl Petro Inc. On May 10, 1990, the Company changed its name to Creator Capital Inc. The Company was reincorporated through the continuance of its corporate existence from the Province of British Columbia to the Yukon Territory on July 15, 1992. On January 23, 1995, the Company changed its name to Sky Games® International Ltd. ("SGI"). Effective February 22, 1995, the Company continued its corporate existence from the Yukon Territory to Bermuda as an exempted company under the Companies Act 1981 (Bermuda) (the "Bermuda Act"). In June 1997, the Company changed its name to Interactive Entertainment Limited following consummation of the amalgamation of the Company's wholly-owned subsidiary, SGI Holding Corporation Limited ("SGIH"), and SGIH's formerly 80% owned subsidiary, then known as Interactive Entertainment Limited ("Old IEL"). This was followed immediately by an amalgamation of SGI with the survivor of the first amalgamation (the "Amalgamations"). Pursuant to a Special Resolution passed by shareholders at the September 19, 2000 Annual General Meeting, the Company changed its name to Creator Capital Limited.

‘IEL (Singapore) Pte. Ltd.’ was struck off the Singapore Register of Companies, at the Company’s request, on September 23, 2000. IIL (UK) was struck off the UK Companies House Register on May 6, 2003 following an application lodged by the Company on December 10, 2002. On July 10, 2006, Sky Games® International Corporation ("SGIC") changed its name to Creator Capital (Nevada) Inc. (“CCL (US)”). As of November 11, 2011 CCL (US)’s corporate registration was not renewed.

The initial purpose of the Company was natural resource exploration and development. Beginning in January 1991 the Company concentrated its efforts on acquiring, developing and commercializing a gaming technology marketed as Sky Games®™ for in-flight use by international airline passengers and patrons in other non-traditional gaming venues. In pursuit of this purpose, the Company in 1991 acquired the principal assets of Nevada-based Sky Games® International, Inc. ("SGII"). In late 1994, the Company formed Old IEL as a joint venture with subsidiaries of Harrah's Entertainment, Inc., ("Harrah's"). This resulted in the transfer to Old IEL of the Company's in-flight gaming business and the execution of a management agreement with Harrah's with respect to Old IEL and other related relationships. Pursuant to such management agreement, Old IEL's operations were managed by a Harrah's subsidiary. The description herein of the Company's operations from December 30, 1994 through June 17, 1997 with respect to in-flight gaming activities refers to the operations of Old IEL under the management of this subsidiary of Harrah's.

B. Business Overview

1. Sky Games®

The Sky Games® Interactive Gaming System was developed to introduce gaming to international airline passengers. The system is designed to enable users to play a number of casino-type games from their seats by way of a built-in, color, interactive, in-seat monitor. The Company believed that an opportunity existed to introduce casino games on international air flights. In April of 1996, the Company announced the signing of contracts for the provision of gaming services to Singapore Airlines (“SIA”). The first flight with gaming was launched on June 1, 1998. A second aircraft was added in mid-October, 1998. Passenger participation was disappointing. On November 12, 1998, the Company announced that it had been unable to attract the additional capital necessary for continued development of its Sky Games® in-flight gaming business. The Company also announced that it had discontinued all operations associated with the Sky Games® product line. All employees were terminated as of November 13, 1998. Those former employees that subsequently had been retained on a part-time contract basis to continue operations and support the Sky Play® product, are no longer associated with CCL. Two former employees, through their corporate entity, eFlyte, had been contracted to attend to the Sky Play® business. eFlyte terminated its contract with CCL as of April 22, 2001. The technical aspect of the business is currently contracted outside the Company as necessary.

On April 30, 1997, the Company entered into a Consulting Agreement with James P Grymyr, whereby he would provide consulting services to the Company from time to time, as requested by the Company. Under the terms of this agreement, the Company issued 586,077 shares of common stock to Mr. Grymyr as consideration for all such consulting services, both past and future. During March, 2001, Mr. Grymyr informed the Company that he did not provide any consulting services to the Company. Furthermore, he indicated that the agreement was never operational. A review of the Company’s records, and conversations with previous management did not reveal any evidence to the contrary. Therefore, Mr. Grymyr offered to annul the Consulting Agreement and return the shares to the Company for cancellation. The Company accepted this offer under the terms of the Annulment Agreement dated June 20, 2001. Mr. Grymyr has completed his undertakings to the Company. The Company cancelled the 586,077 shares.

| Creator Capital Limited. December 31, 2011 20-F | Page.4 |

2. Sky Play®

On January 13, 1998, CCL completed the acquisition of all the outstanding capital stock of Inflight Interactive Limited (“IIL”) in exchange for 500,000 shares of the Company’s $.01 par value common stock (the “Common Stock”). IIL is a United Kingdom developer and provider of amusement games to the airline industry. The acquisition was accounted for using the purchase method. The games are marketed under the name Sky Play®. As at December 31, 2011, the Sky Play® games were operating on Sri Lankan Emirates Airways.

3. Investment - China Lotteries

On September 22, 2001, the Company entered into an Investment agreement with Trade Watch Consultants Limited (formerly Asset China Investments Ltd.WC”). TWC holds 70% of the outstanding shares of Beacon Hill Enterprises Ltd. Beacon Hill holds the license for and operates one of two major Soccer Betting Lottery locations in Guangzhou City, Guangdong Province, People’s Republic of China. In exchange for 1,500,000 shares of the Company’s Common Stock, and an investment of up to HK$1,500,000 (US$ 180,050.00), the Company receives 80% of the proceeds of the business profits generated from Asset China’s sports betting and lottery assets. To date, the Company has forwarded HK$900,000.00 (US$115,030.00). To date, no business profits have been generated nor distributed. No further funds will be forwarded and the shares will not be distributed until there are business profits generated and distributed.

On November 1, 2001, the Company entered into an Investment agreement with Lee John Associates (“LJA”). LJA is engaged in the business of owning the licenses for and operating several lottery locations in Guangzhou City, Guangdong Province, Peoples’ Republic of China. In exchange for 500,000 shares of the Company’s common stock, the Company shall receive 80% of the proceeds of the business profits generated from Lee John’s Lottery businesses.

As of August 2003, CCL had not yet received any funds under the agreements with TWC and LJA. Therefore, upon detailed re-evaluation and analysis all parties mutually agreed to amend the original agreements. On September 1, 2003, CCL amended these two agreements as described below:

The original agreement with TWC required a total investment of US$180,050.00 (HK$1,500,000) and the issuance of 1,500,000 CCL common shares to TWC. To date, CCL has funded US$115,000.00, but has not issued any common shares. Initially, both TWC and Beacon Hill Enterprises Ltd. ("BHE"), agreed that TWC's 70% ownership in Beacon Hill would be reduced to 49% (due to the partial completion of the original funding of US$180,050.00). The agreement was then finalized as a Licensing arrangement, whereby the $115,000 advanced was deemed to a one-time, full payment of the license fee to allow TWC to sell lottery tickets through a dedicated website www.worldwidelotteries-china.com. The 1,500,000 CCL common shares will not be issued as a part of the amended arrangement.

The original agreement with LJA required CCL to issue 500,000 CCL common shares in exchange for 80% of LJA's business profits generated from its seven sales locations within Guangdong Province, in the People's Republic of China. As of September 1, 2003, CCL had not received any funds from LJA, nor had CCL issued the 500,000 common shares. This agreement was cancelled on September 1, 2003.

As of December 31, 2003, CCL had completed the development of the website (www.worldwidelotteries-china.com), which is directed towards the international marketing and sales of the Soccer Betting Lottery. During the 3rd quarter of 2003, approval was obtained and an agreement was reached with a credit card payment processing provider. Subsequently, the provider was unable to provide the required services due to an internal issue. In the 4th quarter of 2003, agreement was reached with NEteller to provide payment processing services.

As of December 31, 2004, the Company was unable to appoint a new Chinese agent. This resulted in the lapsing of the licensing agreement. The license fee paid was written off. The online purchasing and processing software developed could be integrated into the future applications of Sky Games.

On September 19, 2003, CCL's former wholly owned subsidiary, Trade Watch Consultants Ltd. ("TWC") of the British Virgin Islands, entered into a Licensing Agreement with Action Poker Gaming Inc. ("APG"), a wholly owned subsidiary of Las Vegas From Home.com Entertainment. APG provides Gaming Software designed for the on-line gaming industry. TWC's website, www.worldwidegaming-asia.com, will feature Asian Themed games such as "Chinese Poker", "Pan" and "Big 2". A percentage of gaming revenue realized from the website is payable to Action Poker Gaming Inc. on a monthly basis.

As at the September 30, 2004 Quarter the website content and design had not been forwarded to CCL for approval. APG did not affect the steps to activate the services under the Agreement, CCL deemed the Agreement in default and withdrew.

4. Failed Acquisition of ETV Channels On Demand Inc.

| Creator Capital Limited. December 31, 2011 20-F | Page.5 |

By a share purchase agreement dated March 6, 2006 the Company was to acquire all of the outstanding common shares of ETV Channels on Demand, Inc. (“ETV”), a Panama company, in exchange for 50,000,000 common shares of the Company and one share purchase warrant entitling the holder to acquire 1,000,000 common shares of the Company at $1.00 per share from August 15, 2006 to February 15, 2008. These securities were to be issued on an earn-out basis as to one share and a proportionate amount of warrants for each $1.00 of gross revenues realized through the ETV business. The terms of the Share Purchase Agreement were not fulfilled.

On November 17, 2006, the Company deemed the Agreement null and void due to failure of the Vendor to fulfill the terms. A finder’s fee of 2,500,000 common shares to be earned-out based upon the same formula as the acquisition securities were to be issued. With the failure of the Share Purchase Agreement, the finder’s fee also became null and void.

| Creator Capital Limited. December 31, 2011 20-F | Page.6 |

5. Newmediacom

On November 30, 2006, CCL announced the execution of a Letter of Intent with Newmediacom Limited (“NMC”), of the United Kingdom, for the purpose of negotiating rights to certain services related to the provision of live, streamed, and downloadable video services to mobile devices and other video distribution and receiving technologies.

Newmediacom is one of five companies, which comprise the Phones International Group founded in 1998 by Peter Jones. The Group provides a portfolio of core business offerings combining mobile logistics, distribution and fulfillment, configuration, content products and delivery and other related services within the mobile and wireless industries. Newmediacom was acquired by the Phones International Group early in 2004. The company provides broadcast quality services and solutions that can be utilized in the mobile phone arena. As at December 31, 2006 the Letter of Intent had not yet resulted in a final Agreement. Attempts to progress beyond the Letter of Intent proved futile. CCL deemed the relationship to be at an end.

The Product

1. Sky Play®

Sky Play® PC Interactive Games offers airlines the choice of up to 19 amusement games. Unlike Nintendo-style games, which are designed to keep the player challenged and interested over long periods of time, and which generally require player skill developed over a period of time, CCL has selected and developed the Sky Play® amusement games which have very simple rules, are already well known or easy to learn, and are very simple to play. Games are licensed to airlines for a monthly license fee on a per game, per aircraft basis.

The U.S. Patent and Trademark Office granted CCL the following federal registrations:

| November 5, 2002 | “Sky Play®” Logo and name |

| July 8, 2003 | “Sky Play® International” “We Make Time Fly” and Design |

2. Sky Games®

The U.S. Patent and Trademark Office granted CCL the following federal registrations:

| April 14, 1998 | “Sky Games®” logo and the slogan "We Make Time Fly" |

| August 26, 2003 | “Sky Games® International” “We Make Time Fly” and Design |

| February 21, 2006 | “Casino Class” |

| July 4, 2006 | “Casino Class” “We Make Time Fly” and Design |

| February 24, 2006 | “Sky Casinos International” “We Make time Fly” and Design |

The Industry

According to Boeing Company's 2011-2030 Current Market Outlook (“CMO”) annualized world GDP is forecast to grow at an average of 3.3% per year over the next 20 years, an increase of 0.1%. The report noted that, the total market potential for new commercial airplanes is 33,500. Over the long term, CCL believes these forecasts represent a substantial market for In-flight Entertainment (“IFE”) systems and in-flight content over the long-term. CCL’s financial performance is dependent on the environment in which its business operates. During the second half of 2008, global economic growth slowed as the US entered a recession. As the global economic growth entered the recession it was assumed it would slow market growth over the next couple of years. However, the CMO noted recent data suggests the global economy is recovering with the emerging economies, led by China, are expanding at a moderate rate.

Boeing has observed the resilience that global airline markets have shown over time is reflected in average annual passenger traffic growth of 5.1 percent and air cargo growth of 5.6 percent over the next 20 years. This growth was founded on world economic growth of 3.3 percent and further stimulated by liberalization of market regulations in many countries. It is tempered by the high oil prices and price volatility resulting from political unrest in the Middle East.

The introduction and acceptance of portable (non embedded or installed) IFE units is growing steadily. The positive impact of these portable IFE units/systems is the trend towards lighter, less expensive IFE architecture, with the focus of such architecture being the individual seating area of each passenger. Boeing has the strengthening trend toward smaller twin-aisle airplanes in the future is driven by passengers who prefer to travel directly between their points of origin and destination.

Looking ahead, the Asia-Pacific, Latin America and the Middle East to Asia regions’ traffic are growing at the fastest rates of 7.0%, 6.7% and 7.2% respectively. Boeing’s CMO 2009 predicts that the Asia-Pacific (including within China) will become the largest internal market over the next 20 years, overtaking the market within North America. Markets in Asia-Pacific have powerful combinations of large economies, rapid economic growth, and liberalizing markets. These figures are a positive factor in CCL’s continuing strategy for initially targeting airlines in the Asia Pacific region.

Regional traffic trends are an important factor in CCL’s marketing strategies. According to the Boeing CMO annual passenger traffic will grow by 6.8 % in the Asia Pacific region; 5.1% in the Transpacific Region; 2.3% within North America; 4.0% within Europe; 6.7% within Latin America; 4.6% in Africa.

| Creator Capital Limited. December 31, 2011 20-F | Page.7 |

An observation by Sally Gethin in her March 2007 article in Aircraft Interiors International “All bets are off?” confirms CCL’s research and conclusions regarding the potential of Gaming on International airlines: She states that gaming is a numbers game: “Gambling over existing airline IFE systems could provide phenomenal returns for airlines – higher even than existing games offered on board according to research conducted by IMDC, which provides forecasting and surveys for airlines and IFE manufacturers.”

Gethin also quotes the 1995 Department of Transportation report to the US Congress that states that potential earnings of US$1 million per aircraft per annum are indeed possible.

Gethin also mentions CCL in the article under its former name; “During the 1990s, a company called IEL offered low stakes in-flight gambling to the international airline business and worked with Singapore Airlines to install the necessary software. This was short-lived due to incompatibility issues with the software and the IFE hardware, which impacted upon reliability.” Such incompatibilities no longer exist. Technology has improved to the point of offering not only much more sophisticated, embedded hardware, but also the very viable option of portable units. Such portability echoes of CCL’s initial concept of a portable gaming device, which could be issued on the aircraft in exactly the same manner as the portable IMS Pea in the Pod and the DigePlayers are issued today.

Competition

There are currently four companies supplying the in-flight interactive PC games marketplace: Creator Capital, DTI, Nintendo, and Western Outdoor Interactive. CCL is currently a distant fourth in the industry.

IMDC reports that there are three main types of interactive software packages offered by games suppliers; games; gambling software, and educational software. Not all suppliers supply in all three areas. CCL currently offers games and gambling software (which are not currently installed on any aircraft).

Market and Marketing

In the very competitive airline market, airlines are seeking a distinctive, competitive edge to attract and retain paying customers. Entertainment and service systems form a part of the airlines’ current business strategy. CCL believes that the principal benefit of its product to the airlines is the ability to enhance entertainment offerings to passengers. IFE systems are capital intensive; however, providing passenger service and comfort, especially for first and business class travelers, is a major area of competition for airlines. The target market for Sky Play® has been domestic and foreign airlines, which have committed to the purchase of, or already have installed IFE systems.

CCL's primary target market has been Asian and Pacific Rim airlines whose passengers, with certain exceptions, generally have a broad cultural acceptance of gaming. The Company also believes that the Latin American markets also hold significant potential.

CCL believes that the principal benefits of its product to the airlines will be passenger satisfaction and airline participation in a potential alternate “non-ticket” revenue stream. IFE systems are capital intensive; however, providing passenger service and comfort, especially for first and business class travelers, is a major area of competition for airlines. The Company believes that new methods of increasing revenues while providing a high level of service will be seriously considered by the airlines; however, there can be no assurance that in-flight gaming will be among the alternatives considered by airlines. Although the system is designed for gaming using currency, the system could be adapted to "pay-for-play" mode in those circumstances where gaming utilizing currency is not legal and that a system utilizing frequent flyer credits and other rewards can be integrated as part of the gaming program.

CCL expects to derive its income from a split of gaming revenues with the airline. The Company does not anticipate selling its gaming products in order to generate revenue. Airlines will receive a percentage of net revenue generated by Sky Games® on their respective flights. Passenger payouts and certain direct operating costs will be deducted from revenue and the "win" will be split on a negotiated basis. Airlines have utilized similar revenue-sharing arrangement with other product/service providers, such as in-flight communication companies (e.g. GTE Airfone). CCL would provide certain training, banking, accounting and administrative functions. The airline will provide the aircraft, the equipment, the passengers and in-flight personnel.

CCL is currently reviewing its future strategies in the airline market by researching and evaluating the process of developing several new games for the Sky Play® PC Interactive Games Catalogue, while updating some of the current games. This will enable CCL to offer current client fresh material, while affording an opportunity to re-visit previous clients and potential new clients. CCL is also currently re-evaluating and redesigning the Sky Games®® In-flight Gaming System in order to ensure its smooth integration in to the newer, more sophisticated IFE hardware platforms being developed and introduced to the Airline Industry today.

Manufacturing

As a software producer and operator, the Company has no manufacturing capability. CCL’s software is designed to interface with in-cabin hardware, including onboard computers, file servers, distribution and communication systems, manufactured by various suppliers for the airlines.

Major Customers

The Company’s Sky Play® customer is Sri Lankan Airways.

| Creator Capital Limited. December 31, 2011 20-F | Page.8 |

During the first quarter of 2002, American Airlines ceased to be a client due to budgetary restraints. Malaysia Airlines ceased to be a client as they terminated their agreement with their contracted IFE Inflight content provider who was providing them with CCL Sky Play® games. Continental Airlines also ceased to be a client at the end of the second quarter of 2002. During 2004 Air China decided to use the games provided with their new in-flight entertainment hardware. During 2005 Emirates Air also decided to use the games provide with their new in-flight entertainment hardware. During the last quarter of 2009 Japan Air Lines entered Bankruptcy. During the first quarter of 2010 they informed the Company of airplane retirements resulting in a reduced demand for Sky Play. During the last quarter of 2010 they informed the Company the last airplanes having the Sky Play games installed were retired.

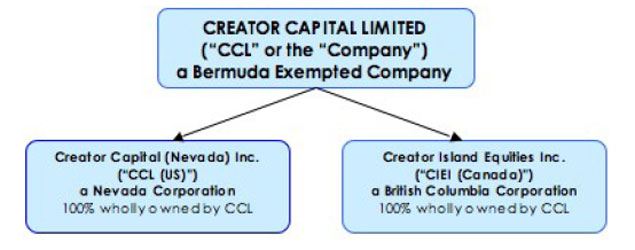

C. ORGANIZATIONAL STRUCTURE

The following chart outlines CCL’s corporate structure:

Currently, CCL’s 100% wholly owned subsidiaries, Creator Capital (Nevada), Inc. and CIEI (Canada), are inactive.

As at November 11, 2011 Creator Capital (Nevada), Inc.’s corporate registration was not renewed.

D. PROPERTY, PLANT AND EQUIPMENT

The Company’s executive office is located at Floor Six, 65 Front Street, Hamilton HM12, Bermuda.

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

Year Ended December 31, 2011 and 2010

During the year ended December 31, 2011, the Company recorded revenue of $10,500 compared to $32,550 during the year ended December 31, 2010. Subsequent to their declaration of Bankruptcy, JALAX/Japan Airlines retired their older airplanes. During the last quarter of the year ended December 31, 2010, the last of their airplanes with the Sky Play games installed were retired. They are no longer a client.

Preferred stock dividends of $601,870 for the year ended December 31, 2011 represented the 9% annual dividend on preferred shares plus the compounded portion on unpaid balance carried forward. During 2010, the Company recorded $505,098 in dividends.

General and administrative expenses for 2011 were $146,795, as compared to $147,028 for 2010. During 2011, audit fees rose, corporate administration decreased and Transfer Agent fees decreased to yield an overall decrease of $233 from 2010. For 2010, the Company conducted the 2009 and 2010 Annual General Meetings, resulting in two years worth of costs, including extra transfer agent fees. With the appointment of Meridian Fiduciary Services as the Company’s resident agent and resident offices in Bermuda, corporate administrative expenses rose. Clarifications and the refilling of the December 31, 2009 Form 20F with the SEC generated additional preparation and filing fees.

Professional fees are comprised of audit and legal fees which totaled $29,455 for 2011 compared with $23,966 for 2010. The increase in the audit fees for 2011 was offset by decrease in legal fees.

Year Ended December 31, 2010 and 2009

During the year ended December 31, 2010, the Company recorded revenue of $32,550 compared to $59,380 during the year ended December 31, 2009. Subsequent to their declaration of Bankruptcy, JALAX/Japan Airlines retired their older airplanes. During the last quarter of the year ended December 31, 2010, the last of their airplanes with the Sky Play games installed were retired. They are no longer a client.

| Creator Capital Limited. December 31, 2011 20-F | Page.9 |

Preferred stock dividends of $505,098 for the year ended December 31, 2010 represented the 9% annual dividend on preferred shares plus the compounded portion on unpaid balance carried forward. During 2009, the Company recorded $463,837 in dividends.

General and administrative expenses for 2010 were $81,062, as compared to $57,406 for 2009. During the year the Company conducted the 2009 and 2010 Annual General Meetings, resulting in two years worth of costs, including extra transfer agent fees. With the appointment of Meridian Fiduciary Services as the Company’s resident agent and resident offices in Bermuda, corporate administrative expenses rose. Clarifications and the refilling of the December 31, 2009 Form 20F with the SEC generated additional preparation and filing fees.

Professional fees are comprised of audit and legal fees which totaled $23,966 for 2010 compared with $14,160 for 2009. The drop in the audit fees for 2010 was offset by an increase in legal fees. Other corporate legal matters cost $12,846 for the year.

B. LIQUIDITY AND CAPITAL RESOURCES

As at December 31, 2011, the Company had cash on hand of $3,036, with a working capital deficit of $7,504,637 (2010 $6,875,870). Of this, $4,657,601 (2009 $4,055,731) was for dividends payable that have accrued on the preferred shares. T he Company is financing its operations through accounts payable and loans payable. The Company needs to raise additional capital. The Company is trying to raise funds through debt/equity financing. However, there is no assurance of additional funding being available.

During the year ended December 31, 2011, the Company received loan proceeds of $25,575 compared to $48,810 for the year ended December 31, 2010.

During the year ended December 31, 2011, the Company wrote off loans payable balances in the amount of $109,398 (2010: $nil) related primarily to loans payable that had remained unpaid for several years without any claims being made by these creditors against the Company. Management does not consider that these amounts are payable although there is no assurance that a formal claim will not be made against the Company for some or all of these balances in the future.

As at December 31, 2010, the Company had cash on hand of $9,786, with a working capital deficit of $6,875,870 (2009 $6,256,294). Of this, $4,055,731 (2009 $3,550,663) was for dividends payable that have accrued over several fiscal periods on the preferred shares. The Company is financing its operations through accounts payable and loans payable. The Company needs to raise additional capital. The Company is trying to raise funds through debt/equity financing. However, there is no assurance of additional funding being available.

During the year ended December 31, 2010, the Company received loan proceeds of $48,810 (Cdn$50,000) compared to $23,435 for the year ended December 31, 2009.

Critical Accounting Policies

The preparation of the Company's financial statements requires management to make estimates and assumptions regarding future events. These estimates and assumptions affect the reported amounts of certain assets and liabilities, and disclosure of contingent liabilities.

Significant areas requiring the use of management estimates include the variables used in determining stock-based compensation. These estimates are based on management's best judgment. Factors that could affect these estimates include option term and expected volatility.

Management has made significant assumptions and estimates determining the fair market value of stock-based compensation granted to employees and non-employees. These estimates have an effect on the stock-based compensation expense recognized and the contributed surplus on the Company’s balance sheet. The value of each option award is estimated on the date of grant using the Black-Scholes option-pricing model. The Black-Scholes option-pricing model requires the input of subjective assumptions, including the expected term of the option award and stock price volatility. The expected term of options granted for the purposes of the Black-Scholes calculation is the term of the award since all grants are to non-employees. These estimates involve inherent uncertainties and the application of management judgment.

Recent Accounting Pronouncements – First time adoption of IFRS

IFRS 1, ‘First-time Adoption of International Financial Reporting Standards’ sets forth guidance for the initial adoption of IFRS. The accounting policies in Note 3 have been applied in preparing the consolidated financial statements for the year ended 31 December 2011, the comparative information for the year ended 31 December 2010 and the preparation of an opening IFRS statement of financial position on 1 January 2010 (the “Transition Date”). The IFRS standards are applied retrospectively at the Transition Date, unless certain optional and mandatory exemptions under IFRS 1 apply.

Share-based payments

IFRS 1 encourages, but does not require, first-time adopters to apply IFRS 2, ‘Share-based Payment’ to equity instruments that were granted on or before 7 November 2002, or equity instruments that were granted subsequent to 7 November 2002 and vested before the Transition Date. The Company elected not to apply IFRS 2 to equity instruments that vested prior to the Transition Date.

| Creator Capital Limited. December 31, 2011 20-F | Page.10 |

Business combinations

IFRS 1 provides the option to apply IFRS 3, ‘Business Combinations’, retrospectively or prospectively from the Transition Date. The Company elected not to retrospectively apply IFRS 3 to business combinations that occurred prior to its Transition Date.

Consolidated and separate financial statements

In accordance with IFRS 1, if a company elects to apply IFRS 3 retrospectively, IAS 27, ‘Consolidated and Separate Financial Statements’ must also be applied retrospectively. As the Company elected not to apply IFRS 3 prospectively, the Company has also elected not to apply IAS 27 prospectively.

IFRS mandatory exception to retrospective application

In accordance with IFRS 1, the Company’s estimates under IFRS at the date of transition to IFRS must be consistent with estimates made for the same date under Canadian generally accepted accounting principles (“Canadian GAAP”) unless there is objective evidence that those estimates were in error. The estimates previously made by the Company under Canadian GAAP were not revised for application of IFRS.

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its consolidated financial statements.

C. RESEARCH AND DEVELOPMENT, PATENTS AND LICENSES ETC.

1. Sky Play®

The U.S. Patent and Trademark Office granted CCL the following federal registrations:

| November 5 2002 | “Sky Play®” Logo and name |

| July 8, 2003 | “Sky Play® International” “We Make Time Fly” and Design |

2. Sky Games®

The U.S. Patent and Trademark Office granted CCL the following federal registrations:

| April 14, 1998 | “Sky Games®” logo and the slogan "We Make Time Fly" |

| August 26, 2003 | “Sky Games® International” “We Make Time Fly” and Design |

| February 21, 2006 | “Casino Class” |

| July 4, 2006 | “Casino Class” “We Make Time Fly” and Design |

| February 24, 2006 | “Sky Casinos International” “We Make Time Fly” and Design |

The costs of these registrations were expensed in the period they were recorded.

D. TREND INFORMATION

The marketplace for the Company’s main product line is not well established. However, the Gaming Industry as a whole internationally is constantly undergoing changes, is intensely competitive and is subject to changes in customer attitudes, morals and preferences. New products are being developed continuously by the Gaming Industry in order to satisfy customer demands. The Sky Games® Interactive Gaming System is one of those products. Changes in International Governmental regulations and laws are in a constant state of flux, and could adversely affect the ability of the Airlines to install such a system. Changes in policies of companies or banks that handle payment processing systems or credit card transactions for gaming industry could have an adverse impact on the operation of the Sky Games® System

E. OFF-BALANCE SHEET ARRANGEMENTS

Not Applicable

F. TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

Not Applicable

| Creator Capital Limited. December 31, 2011 20-F | Page.11 |

G. SAFE HARBOUR

All financial information and statements provided have been fairly represented in accordance with International Financial Reporting Standards.

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

A. DIRECTORS AND SENIOR MANAGEMENT

Name | Position | Principal Occupation | Term of Office |

Anthony P Clements Age 66 | Director | Investment Banker | Director 1992-Present |

Deborah Fortescue-Merrin Age 56 | President & C.E.O. Director | President of CCL President of North American Medical Services Inc. | Director 1995-1997 Director 1999-Present President 1999-Present |

Anastasia Kostoff-Mann Age 64 | Vice-President Director | Founder and Chairman Corniche Group of Companies | Director 1993-1996 Director 1999-Present |

ANTHONY P. CLEMENTS has been a director of the Company since March of 1992. Mr. Clements is currently Head of Corporate Finance at ODL Securities. He began his career specializing in natural resources, having gained a B.Sc. in Economics followed by a post-graduate course in accountancy. He joined the Electricity Pension Fund in 1970 as Senior Investment Analyst before moving on in 1973 to the Post Office Pension Fund, latterly renamed Postel and now Hermes. As an Investment Manager, Tony spent several years managing Postel’s resource portfolio before moving on to manage billion dollar North American portfolio. In 1987 Mr. Clements moved over to the 'sales' side of the investment industry, becoming involved with corporate finance and North American resource issues in particular. Prior to taking up his current position with ODL Securities, Tony joined T. Hoare and Co, renamed Canaccord, in 1994.

DEBORAH FORTESCUE-MERRIN has been a director of the Company since September 10, 1999, and she was previously a director of the Company from October 1995 to October 1997. Mrs. Merrin is Vice-President of J. Perot Financial Corp., a private investment management firm located in Vancouver, British Columbia, Canada. Previous to joining J. Perot Financial, Mrs. Merrin was a securities broker for twelve years, and worked in the area of corporate finance from 1989-1992, specializing in special situations concerning medical issues. Mrs. Merrin is also the President and a Director of North American Medical Services Inc. which trades on the Toronto Venture Exchange.

ANASTASIA KOSTOFF-MANN has been a director since September 10, 1999, and she was previously a director of the Company until September 1996. Ms Mann has over 30 years experience in the hotel, sales and marketing, and travel industry. She is the founder and chairman of the Corniche Group of Companies, overseeing all aspects of travel and meeting management for corporate accounts. Ms Mann was the first female corporate sales manager for Hilton Hotels corporations based in Los Angeles, Director of Sales and Marketing at the Beverly Wilshire Hotel, Beverly Hills, California, and the first US President of Operations, Mark Allen Travel, now the entertainment division of American Express. She is a lifetime director and former President and Chairman of the International Travel & Tourism Research Association (TTRA). Ms Mann is a founding member of the California Travel & Tourism Commission, where she currently serves as Commissioner and sits on the Executive Committee. She also sits on the council of the Woodrow Wilson International Center in Washington D.C.

| Creator Capital Limited. December 31, 2011 20-F | Page.12 |

B. COMPENSATION

All of the directors of the Company are reimbursed for out-of-pocket expenses. The directors of the Company receive no other compensation.

The following table sets forth all compensation for services in all capacities to the Company for the three most recently completed fiscal years in respect of each of the individuals who served as the Chief Executive Officer during the last completed fiscal year and those individuals who were, as of December 31, 2011, the executive officers of the Company whose individual total compensation for the most recently completed financial year exceeded $100,000 (collectively, the "Named Executive Officers") including any individual who would have qualified as a Named Executive Officer but for the fact that individual was not serving as such an Officer at the end of the most recently completed financial year:

| SUMMARY COMPENSATION TABLE |

| |

| | | Annual Compensation | Long Term Compensation Awards |

Name and Principal Position | Fiscal Year Ended | Consulting fees ($) | Bonus ($) | Other Annual Compensation ($) | Restricted Stock Awards (#) | Securities Underlying Options (#) |

| | | | | | | |

Anthony Clements (Director) | 12/31/11 12/31/10 12/31/09 | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil |

| | | | | | | |

Deborah Fortescue-Merrin Chairman (Director) | 12/31/11 12/31/10 12/31/09 | $42,000* $42,000* $42,000* | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil |

| | | | | | | |

Anastasia Mann (Director) | 12/31/11 12/31/10 12/31/09 | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil | Nil Nil Nil |

*by way of related consulting entity

As at December 31, 2011 there were at total of 6,950,000 outstanding options to purchase common shares granted to the directors. These options have an exercise price of $0.25 per common share expiring on April 6, 2012. Therefore, as at the date of this document, these options have expired.

TOTAL OUTSTANDING OPTIONS GRANTED TO DIRECTORS

Name | | No of Securities Underlying Options Granted (#) | | | Exercise or Base Price ($/share) | | Expiration Date |

| | | | | | | | |

| Anthony Clements | | | 1,000,000(1) | | | $ | 0.25 | | April 6, 2012 |

| | | | | | | | | | |

| Deborah Fortescue-Merrin | | | 1,500,000(1) | | | $ | 0.25 | | April 6, 2012 |

| | | | | | | | | | |

| Anastasia Mann | | | 1,000,000(1) | | | $ | 0.25 | | April 6, 2012 |

(1) Options granted to each director of the Company under a Stock Option Agreement

C. BOARD PRACTICES

Election of Directors and Terms of Service

As of the date of this Document, The Board of Directors is currently comprised of three members, including the Chairman and CEO. Directors are elected annually by an ordinary resolution at the Annual General Meeting of Shareholders. Each director is elected for a term of one year, and may be re-elected annually for an additional one year term by the shareholders. There are no limits as to how long any individual director may serve on the Board.

Service Contracts

CCL does not currently have any service contracts or any other contracts with any of the members of the Board of Directors.

| Creator Capital Limited. December 31, 2011 20-F | Page.13 |

Audit Committee

The Audit Committee of the Board currently consists of Deborah Fortescue-Merrin and Anthony Clements. The principal functions of the Audit Committee are to make recommendations to the Board regarding; (i) its independent auditors to be nominated for election by the shareholders; (ii) to review the independence of such auditors; (iii) to approve the scope of the annual audit activities of the independent auditors; (iv) to approve the audit fee payable to the independent auditors; (v) and to review such audit results. The audit committee did not hold any meetings during the fiscal year ended December 31, 2011.

Compensation Committee

The Compensation Committee currently consists of Anastasia Kostoff-Mann, and Anthony Clements. The Compensation Committee did not hold any meetings during the fiscal year ended December 31, 2011. For information on the duties and actions of the Compensation Committee, see "Report on Compensation".

Report on Compensation

Deborah Fortescue-Merrin served as President and Chairman of CCL in the fiscal year 2011. She has not been compensated for the years ended December 31, 2009, 2010 and 2011. She was granted 1,500,000 options exercisable at $0.25 per share during 2007. These options expired April 6, 2012

D. EMPLOYEES

Currently, CCL does not employ any personnel. Corporate and business operations are handled by outsourced providers.

E. SHARE OWNERSHIP

As of December 31, 2011 based on information supplied to the Company, CCL's directors and executive officers as a group may be deemed to own beneficially (including shares purchased upon exercise of stock options and warrants, exercisable within 60 days) 3.92% of the outstanding shares of common stock. To the knowledge of the directors and officers of the Company, the following directors and officers of the Company and owners of five percent (or more) of the outstanding common stock (see Item 7 Major Shareholders and Related Party Transactions below) beneficially own the shares of common stock set forth below.

| Name | Amount and Nature of Beneficial Ownership | Percent of Class (1) |

| | | |

| Anthony P. Clements (2) | 1,000,000 – Options | 1.14% |

| | | |

| Deborah Fortescue-Merrin (3) | 1,500,000 – Options 48,500 – Direct | 1.77% |

| | | |

| Anastasia Kostoff-Mann (4) | 1,000,000 – Options | 1.14% |

| (1) | Percent of class is determined by dividing the number of shares beneficially owned by the outstanding number of shares of the Company, and increased by options outstanding (which are currently exercisable) for the respective individuals; |

| (2) | Includes, options for 1,000,000 under the April 6, 2007 Stock Option Agreement. These Options expired April 6, 2012. |

| (3) | Does not include 1,406,870 shares of Common Stock held by a charitable foundation (Missy Foundation) of which Deborah Fortescue-Merrin is a director. Includes options for 1,500,000 under the April 6, 2007 Stock Option Agreement. These Options expired April 6, 2012. |

| (4) | Includes options for 1,000,000 under the April 6, 2007 Stock Option Agreement. These Options expired April 6, 2012. |

| Creator Capital Limited. December 31, 2011 20-F | Page.14 |

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

A. MAJOR SHAREHOLDERS

As of December 31, 2011, there were 240 shareholders of record in the United States holding a total of 31,946,788 of the 87,467,288 outstanding common shares of the Company. The following persons or corporations beneficially owned directly or indirectly, or exercised control of greater than 5% of the issued and outstanding shares of the Company.

Name of Shareholders and Jurisdiction | | Number of Shares Owned | | | Percentage of Total Outstanding* | |

| | | | | | | |

CEDE & CO – United States** | | | 11,250,484 | | | | 12.86 | % |

HARRAH’S INTERACTIVE INVESTMENT COMPANY | | | 6,886,915 | | | | 7.87 | % |

Jiang Man Securities Ltd., Hong Kong | | | 4,559,958 | | | | 5.21 | % |

Pebble Mill Investments Ltd., Hong Kong | | | 4,413,560 | | | | 5.05 | % |

Galleria Ventures Inc., Grenada | | | 4,398,740 | | | | 5.03 | % |

*Based upon 87,467,288 issued and outstanding common shares of the Company as of December 31, 2009

** Depository Trust Company holds shares on behalf of the beneficial owners whose identity is not known to the Company.

To the best of the Company’s knowledge, there are no arrangements or agreements which would result in a change of control of the Company at a future date.

B. RELATED PARTY TRANSACTIONS

A company controlled by management (the owner being Rex E. Fortescue, the father of the President of the Company) provides consulting services to the Company. During the year ended December 31, 2011, the Company incurred $42,000 in said consulting fees (2010: $42,000; 2009: $42,000). During the year ended December 31, 2011, the Company incurred $1,806 in disbursements (2010: $1,967; 2009: $5,447).

A company controlled by management of the Company (the owners being Rex E. Fortescue, the father of the President of the Company, and Richard E. Fortescue, the brother of the President of the Company) provides accounting services to the Company. During the year ended December 31, 2011, the Company incurred $27,000 (2010: $26,500; 2009: $26,500) in accounting fees. Disbursements of $8,767 were charged during the year (2010: $13,009; 2009: $5,111)

Included in accounts payable and accrued liabilities at December 31, 2011 is $376,852 (2010: $304,101; 2009: $251,975) owing to directors and companies with common directors with respect to unpaid fees and expenses. These amounts are unsecured, non-interest bearing and have no specific terms for repayment.

As at December 31, 2011, the Company owes $6,541 (2010, $6,042; 2009: $5,500) to a company controlled by the President of the Company for cash advances which bear interest at 10% per annum, is unsecured, and due on January 1, 2012.

As at December 31, 2011, the Company owes $45,600 (2010: $36,626; 2009: $33,532) to a company controlled management for cash advances which bear interest at 10% per annum and is unsecured. $7,500 is due on demand, $15,000 is due on March 1, 2012, and $8,435 is due on March 15, 2012. Both have been extended for an additional year.

All of the above transactions have been in the normal course of operations and have been recorded at their exchange amounts, which are the amounts agreed upon by the transacting parties.

C. INTERESTS OF EXPERTS AND COUNSEL

Not applicable

ITEM 8. FINANCIAL INFORMATION

A. CONSOLIDATED STATEMENTS AND OTHER FINANCIAL INFORMATION

The Company’s audited consolidated financial statements for the year ended December 31, 2011 are included in Item 17 of this Annual Report.

These financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern, which assumes that the Company will be able to meet its obligations and continue its operations for its next fiscal year. Realization values may be substantially different from carrying values as shown and these financial statements do not give effect to adjustments that would be necessary to the carrying values and classification of assets and liabilities should the Company be unable to continue as a going concern. At December 31, 2011, the Company had not yet achieved profitable operations, has accumulated losses of $72,062,469 since its inception and expects to incur further losses in the development of its business, all of which casts substantial doubt about the Company’s ability to continue as a going concern. The Company will require additional financing in order to meet its ongoing levels of corporate overhead and discharge its liabilities as they come due. While the Company has been successful in securing financings in the past, there is no assurance that it will be able to do so in the future, particularly in light of current global economic conditions. Accordingly, these financial statements do not give effect to adjustments, if any, that would be necessary should the Company be unable to continue as a going concern. If the going concern assumption was not used then the adjustments required to report the Company’s assets and liabilities on a liquidation basis could be material to these financial statements

| Creator Capital Limited. December 31, 2011 20-F | Page.15 |

B. LEGAL PROCEEDINGS;

The Directors and the management of the Company do not know of any material, active or pending, legal proceedings against them; nor is the Company involved as a plaintiff in any material proceeding or pending litigation.

The Directors and the management of the Company know of no active or pending proceedings against anyone that might materially adversely affect an interest of the Company.

C. DIVIDEND POLICY

There have been no dividends paid to common stockholders since the inception of the Company on January 28, 1981. The Company currently intends to retain any earnings it may achieve for use in its business, and therefore does not anticipate paying any cash dividends in the foreseeable future. Any future determination to pay cash dividends will be made by the Board of Directors in light of the earnings, financial position, capital requirements, credit agreements and such other factors as the Board of Directors deems relevant

D. SIGNIFICANT CHANGES

On January 10, 2010 Japan Airlines applied for court protection under the Japanese Corporate Rehabilitation Law (the Japanese equivalent of the U.S. Chapter 11 Bankruptcy). The Company’s client, JALUX Inc., is the airline’s procurement business subsidiary. It provides the airline with all its in-flight supplies and the in-flight entertainment. Jalux informed the Company of Japan Airlines’ airplane retirements, resulting in a reduced demand for Sky Play. As of October 1, 2010 the last of the airplanes in which Sky Play games were installed were retired. JALUX is no longer a Sky Play client.

ITEM 9. THE OFFER AND LISTING

A. LISTING DETAILS

Since May 2007, the company’s shares have traded on both the NASDAQ OTC Bulletin Board (OTCBB) and the Pink Sheets under the symbol “CTORF”. Since August 3, 2005, the Company’s common shares have traded on the Pink Sheets under the symbol “CTORF”. Prior to August 3, 2005 and since October 16, 2000 the Company’s Common Shares have traded on the OTC Bulletin Board under the symbol “CTORF”. Prior to October 16, 2000 and since March 25, 1999, the Company’s common shares had traded on the OTC Bulletin Board under the symbol “IELSF.” From July 8, 1997 until March 24, 1999, the Company's common shares had been traded on the NASDAQ SmallCap Market under the symbol "IELSF." From March 1, 1994 until July 8, 1997, the Company's common shares traded on the NASDAQ SmallCap Market under the symbol "SKYGF." Prior to March 1, 1994, there was no trading market for the securities of the Company in the United States of America. The Company's common shares were traded on the Vancouver Stock Exchange under the symbol "CEV” until voluntarily de-listed by the Company on December 30, 1994.

On October 5, 1998, the Company was notified by NASDAQ that the Company’s shares had failed to maintain a bid price greater than or equal to $1.00 per share for the prior thirty consecutive trading days and were therefore subject to delisting. The delisting was effective on March 24, 1999.

The table below sets forth, for the periods indicated the reported high and low closing prices of the Common Stock as reported by the NASDAQ SmallCap and OTC Bulletin Board Markets.

Last six calendar months:

| Last Six Calendar Months | |

| | | High | | | Low | |

| | | | | | | |

| April 2012 | | $ | 0.01 | | | $ | 0.007 | |

| March 2012 | | $ | 0.006 | | | $ | 0.006 | |

| February 2012 | | $ | 0.01 | | | $ | 0.007 | |

| January 2012 | | $ | 0.01 | | | $ | 0.005 | |

| December 2011 | | $ | 0.0025 | | | $ | 0.003 | |

| November 2011 | | $ | 0.0025 | | | $ | 0.003 | |

| Creator Capital Limited. December 31, 2011 20-F | Page.16 |

Each fiscal quarter within the last two years:

| | | Twelve Months Ended | |

| | December 31, 2010 | | | December 31, 2011 | |

| | High | | | Low | | | High | | | Low | |

| First Quarter | | $ | 0.0050 | | | $ | 0.0005 | | | $ | 0.006 | | | $ | 0.005 | |

| Second Quarter | | $ | 0.0050 | | | $ | 0.0030 | | | $ | 0.007 | | | $ | 0.0055 | |

| Third Quarter | | $ | 0.0050 | | | $ | 0.0050 | | | $ | 0.005 | | | $ | 0.0035 | |

| Fourth Quarter | | $ | 0.0100 | | | $ | 0.0050 | | | $ | 0.0035 | | | $ | 0.0012 | |

Last five full financial years:

| Last Five Full Financial Years | |

| | | High | | | Low | |

| 2011 | | $ | 0.007 | | | $ | 0.0012 | |

| 2010 | | $ | 0.0100 | | | $ | 0.0030 | |

| 2009 | | $ | 0.0200 | | | $ | 0.0005 | |

| 2008 | | $ | 0.0420 | | | $ | 0.0010 | |

| 2007 | | $ | 0.1200 | | | $ | 0.0200 | |

ITEM 10. ADDITIONAL INFORMATION

A. SHARE CAPITAL

The Class A Preferred shares are non-voting and are convertible at any time into common shares at the option of the holder. The number of common shares will be determined by dividing $1,000 per share of Class A Preferred shares, plus any accrued and unpaid dividends thereon by a conversion price equal to 60% of the market price. Dividends on the Class A Preferred shares are cumulative and payable quarterly at an annual dividend rate of 9%. CCL, at its option, may redeem the Class A Preferred shares, in whole or in part, at any time and from time to time, at a redemption price of $1,000 per share, plus any accrued and unpaid dividends thereon. CCL is not required to redeem the Class A Preferred shares.

In 1997, CCL exchanged a promissory note in the amount of $2,737,000 for 2,737 Class A Preference shares at $1,000 per share. In 1998, CCL redeemed 500 of the Class A Preference shares at their redemption price of $1,000 per share. As of December 31, 2010, 2,237 Class A Preferred stock remained outstanding.

Dividends on the Class A Preferred shares for the years ended December 31, 2011 and 2010 were $601,870 and $505,098, respectively. They remain unpaid and are in arrears.

Under US GAAP, for financial statement presentation purposes, the balance of the preferred shares is reflected on the balance as temporary equity because the ability to issue common shares in the event of a preferred share conversion is not within the control the Company.

B. MEMORANDUM AND ARTICLES OF ASSOCIATION

This information has been reported previously. See Exhibits 3.i(a), 3.i(b), 3.ii (detailed below) – Incorporated by reference.

| 3.i(a) | Articles of Incorporation (Yukon Territory). (Incorporated by reference to Exhibit 1.1 to the Registrant's Annual Report on Form 20-F (File No. 0-22622) as filed with the SEC on October 12, 1993.) |

| 3.i(b) | Certificate of Continuance (Bermuda). (Incorporated by reference to Exhibit 1.2 to the Registrant's Annual Report on Form 20-F (File No. 0-22622) as filed with the SEC on September 16, 1996.) |

| 3.ii | By-Laws as amended. (Incorporated by reference to the same numbered exhibit to the Registrant's Annual Report on Form 10-K/A No. 2 as filed with the SEC on July 8, 1998.) |

C. MATERIAL CONTRACTS

| Creator Capital Limited. December 31, 2011 20-F | Page.17 |

Not Applicable

D. EXCHANGE CONTROLS

An exempted company is classified as non-resident in Bermuda for exchange control purposes by the Bermuda Monetary Authority ("BMA"). Accordingly, the Company may convert currency (other than Bermudian currency) held for its account to any other currency without restriction.

Persons, firms or companies regarded as residents of Bermuda for exchange control purposes require specific consent under the Exchange Control Act 1972 of Bermuda, and regulations there under, to purchase or sell shares or warrants of the Company which are regarded as foreign currency securities by the BMA. Before the Company can issue any further shares or warrants, the Company must first obtain the prior written consent of the BMA.

E. TAXATION

The following paragraphs set forth, in general terms, certain United States and Bermudian income tax considerations in connection with the ownership of common shares of the Company. The tax considerations relevant to the ownership of common shares of the Company are complex, and the tax consequences of such ownership may vary depending on the individual circumstances of the shareholder. Accordingly, each shareholder and prospective shareholder is urged to consult his own tax advisor with specific reference to the tax consequences of share ownership in his own situation. In addition, there may be relevant state, provincial or local income tax considerations which are not discussed.

United States Federal Income Tax Considerations

Passive Foreign Investment Company: Because substantially all of the Company's recent income has consisted of interest, the Company believes that it presently constitutes a passive foreign investment company (a "PFIC") within the meaning of (S) 1295 of the Internal Revenue Code of 1986, as amended. A foreign corporation is a PFIC if 75% or more of its gross income for the taxable year is from passive sources such as interest and dividends, or if the average percentage of its assets during the year that produce passive income is at least 50%.

Certain adverse tax consequences apply to U.S. persons who are shareholders of a PFIC. Specifically, U.S. shareholders of a PFIC are subject to maximum rates of tax plus an interest charge on "excess distributions," which includes gain on the sale of PFIC shares as well as certain distributions. The interest charge is based upon the value of the deemed tax deferral, and on the assumption that the excess distribution was earned pro rata over the shareholder's holding period. In addition, a U.S. shareholder who uses PFIC stock as security for a loan is treated as having disposed of the stock; a transfer of the PFIC stock may fail to qualify for non-recognition treatment that would otherwise be available; special foreign tax credit limitations will apply to a U.S. shareholder with respect to earnings of the PFIC; a U.S. shareholder will not be entitled to a basis step-up in the basis of PFIC stock at death; and the Company will continue to be treated as a PFIC throughout a U.S. shareholder's holding period, even if it no longer satisfies the income or asset tests for a PFIC described above.

The foregoing adverse tax consequences, other than the loss of the step-up in basis at death, generally will not apply if (i) the U.S. shareholder has elected to treat the PFIC as a qualified electing fund ("QEF") for each taxable year in the shareholder's holding period beginning after December 31, 1986 for which the Company was a PFIC, and (ii) the Company complies with reporting requirements to be prescribed by the IRS. In general U.S. shareholders of a QEF are taxable currently on their pro rata share of the QEF's ordinary income and net capital gain, unless they elect to defer payments of tax on amounts included in income for which no distribution has been received, subject to an interest charge on the tax deferral.

THE QEF ELECTION FOR A TAXABLE YEAR MUST BE FILED BY THE DUE DATE (PLUS EXTENSIONS) FOR FILING THE U.S. SHAREHOLDER'S INCOME TAX RETURN FOR THE YEAR. A U.S. shareholder makes the election by filing a "Shareholder Election Statement," a "PFIC Annual Information Statement" and Form 8621 with its tax return. A copy of the Shareholder Election Statement must also be filed with the IRS Center in Philadelphia.

If the Company has been a PFIC for a taxable year beginning after December 31, 1986 which includes any portion of a U.S. shareholder's holding period, the U.S. shareholder may still make a QEF election for the Company and, if so, may also elect to recognize any gain inherent in the shareholder's PFIC stock, as of at the beginning of the first year in which the Company becomes a QEF, as an excess distribution. A U.S. shareholder who makes this gain-recognition election will thereafter not be subject to the tax regime for excess distributions described above.

For so long as the Company remains a PFIC, the Company intends to comply with the reporting requirements that will be prescribed in Treasury Regulations, and to make available to its U.S. shareholders upon request a PFIC Annual Information Statement to enable them to make QEF elections.

Gain on Disposition; Distributions. Under certain limited circumstances, non-U.S. shareholders will be subject to U.S. federal income taxation at graduated rates upon gain or dividends, if any, with respect to their common shares, if such gain or income is treated as effectively connected with the conduct of the recipient's U.S. trade or business. Dividends, if any, paid to U.S. persons will be generally subject to U.S. federal ordinary income taxation, except for dividends of earnings that were previously taxed under the QEF rules discussed above. Dividends will not be eligible for the deduction for dividends received by corporations (unless such corporation owns by vote and value at least 10% of the stock of the Company, in which case a portion of such dividends may be eligible for such deduction). U.S. persons will be entitled, subject to various limitations including the so-called "basket limitations," to a credit for Canadian federal income tax withheld from such dividends.

| Creator Capital Limited. December 31, 2011 20-F | Page.18 |