Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

BCRX similar filings

- 28 Jan 13 Other Events

- 8 Jan 13 Departure of Directors or Certain Officers

- 4 Jan 13 Departure of Directors or Certain Officers

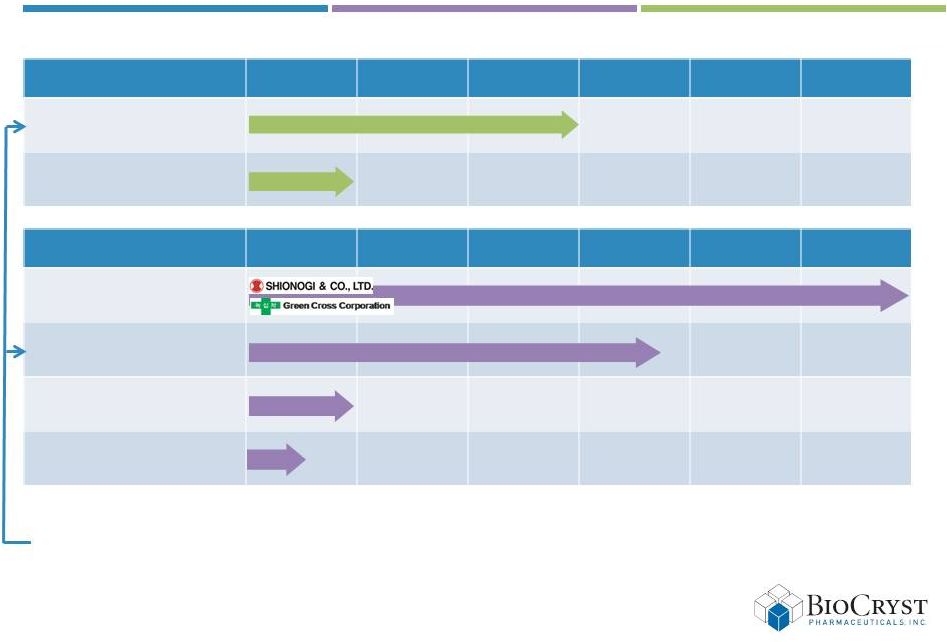

- 7 Dec 12 Biocryst Pharmaceuticals Announces Focused Corporate Strategy

- 30 Nov 12 Termination of a Material Definitive Agreement

- 27 Nov 12 Other Events

- 8 Nov 12 Biocryst Provides Corporate Update and Reports Third Quarter

Filing view

External links