As filed with the Securities and Exchange Commission on November 20, 2002

Registration No. 333-98653; No. 333-98653-01 to 333-98653-07

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PCA LLC

PCA Finance Corp.

(Exact name of Registrant as specified in its charter)

Delaware Delaware | | 7221 7221 | | 04-3688387 03-0462123 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (IRS Employer Identification No.) |

815 Matthews-Mint Hill Road

Matthews, North Carolina 28105

(704) 588-4351

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Barry J. Feld

Chairman, Chief Executive Officer and President

PCA LLC

815 Matthews-Mint Hill Road

Matthews, North Carolina 28105

(704) 588-4351

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Richard S. Borisoff, Esq.

Paul, Weiss, Rifkind, Wharton & Garrison

1285 Avenue of the Americas

New York, New York 10019-6064

(212) 373-3000

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANTS

Name

| | State or Other Jurisdiction of Incorporation or Organization

| | Primary Standard Industrial Classification Code Number

| | IRS Employer Identification Number

|

| American Studios, Inc. | | North Carolina | | 7221 | | 56-2002464 |

| PCA National LLC | | Delaware | | 7221 | | 56-0935596 |

| PCA National of Texas L.P. | | Texas | | 7221 | | 56-2198882 |

| PCA Photo Corporation of Canada, Inc. | | North Carolina | | 7221 | | 56-1691486 |

| Photo Corporation of America | | North Carolina | | 7221 | | 56-1956497 |

| PCA International, Inc. | | North Carolina | | 7221 | | 56-0888429 |

The address of each of the additional registrants is 815 Matthews-Mint Hill Road, Matthews, North Carolina 28105.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 20, 2002

PROSPECTUS

PCA LLC

PCA Finance Corp.

Exchange Offer for $165,000,000 of their

11.875% Senior Notes due 2009

We are offering to exchange all of our outstanding 11.875% Senior Notes due 2009, which were issued on June 27, 2002 and which we refer to as the initial notes, for a like aggregate principal amount of our registered 11.875% Senior Notes due 2009, which we refer to as the exchange notes. We will pay interest on the exchange notes semi-annually on February 1 and August 1 of each year, commencing on February 1, 2003. The exchange notes will mature on August 1, 2009.

The exchange notes will be fully and unconditionally guaranteed on a general unsecured basis by PCA International, Inc. and all of our domestic subsidiaries that are guarantors under our senior secured credit facility.

As of August 4, 2002, we had approximately $27.6 million of indebtedness outstanding under our senior secured credit facility, with approximately $12.3 million in revolving loan availability and approximately $10.1 million in outstanding letters of credit, and $40.0 million of indebtedness that would have been subordinated to the exchange notes. Our non-guarantor subsidiaries had approximately $2.2 million of liabilities, including trade payables and intercompany payables.

Terms of the exchange offer

| | • | | It will expire at 5:00 p.m., New York City time, on , 2002, unless we extend it, but in no event later than December 31, 2002. |

| | • | | If all the conditions to this exchange offer are satisfied, we will exchange all initial notes that are validly tendered and not withdrawn for exchange notes. |

| | • | | You may withdraw your tender of initial notes at any time before the expiration of this exchange offer. |

| | • | | The exchange notes that we will issue you in exchange for your initial notes will be substantially identical to your initial notes except that, unlike your initial notes, the exchange notes will have no transfer restrictions or registration rights. |

| | • | | The exchange notes that we will issue you in exchange for your initial notes are new securities with no established market for trading. |

Before participating in this exchange offer, please refer to the section in this prospectus entitled “Risk Factors” commencing on page 15.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of the exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for initial notes where such initial notes were acquired by such broker-dealer as a result of market making activities or other trading activities. We have agreed that, for a period of 180 days after the expiration date of this exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

The date of this prospectus is , 2002.

| | | Page

|

| | 1 |

|

| | 15 |

|

| | 24 |

|

| | 24 |

|

| | 25 |

|

| | 26 |

|

| | 30 |

|

| | 40 |

|

| | 51 |

|

| | 57 |

|

| | 59 |

|

| | 60 |

|

| | 65 |

|

| | 73 |

|

| | 114 |

|

| | 119 |

|

| | 120 |

|

| | 120 |

|

| | 120 |

|

| | 120 |

|

| | F-1 |

MARKET DATA

Market data used throughout this prospectus, including information relating to our relative position in the portrait photography industry, is based on the good faith estimates of management, which estimates are based upon their review of internal surveys, independent industry publications and other publicly available information, including the 2000 International Photo Imaging Industry Report by Photofinishing News, Inc. Although we believe that these sources are reliable, we do not guarantee the accuracy or completeness of this information, and we have not independently verified this information.

TRADEMARKS AND TRADE NAMES

We own or have rights to trademarks or trade names that we use in conjunction with the operation of our business. In addition, our name and logo are our service marks or trademarks. Each trademark, trade name or service mark by any other company appearing in this prospectus belongs to its holder. For example, Wal-Mart® is a trademark of Wal-Mart Stores, Inc.

i

The following summary highlights basic information about PCA and the exchange offer. It may not contain all the information that is important to you and should be read in conjunction with the more detailed information and financial statements, including the notes thereto, appearing elsewhere in this prospectus. Prospective investors are urged to read this prospectus in its entirety. Unless the context indicates otherwise, the terms “we,” “our,” “us” and “PCA” mean, collectively, PCA LLC and its subsidiaries and their predecessors and includes the operations of PCA International, Inc. and its subsidiaries. The term “Parent” refers to PCA International, Inc. Where we refer to U.S. operations, such term includes our operations in Puerto Rico. Our fiscal year ends on the Sunday closest to January 31, resulting in years of either 52 or 53 weeks, and our fiscal quarters are generally thirteen weeks. For example, our fiscal year 2001 ended on February 3, 2002, our first quarter of fiscal 2002 ended on May 5, 2002 and our second quarter of fiscal 2002 ended on August 4, 2002. The term “initial notes” refers to the 11.875% Senior Notes due 2009 that were issued on June 27, 2002 in a private offering. The term “exchange notes” refers to the 11.875% Senior Notes due 2009 offered with this prospectus. The term “notes” refers to the initial notes and the exchange notes, collectively.

Our Business

PCA is one of the largest providers of professional portrait photography products and services in North America based on revenue, number of customers and studio locations. We are a leader in the $1.2 billion domestic pre-school portrait photography market, with an estimated 22% share of total sales. We believe we are also the third largest company in the $6.3 billion domestic professional portrait industry. While the industry is highly competitive and fragmented, there are four portrait photography companies operating within large host retailers on a national basis: Olan Mills (Kmart), CPI Corporations (Sears), LifeTouch (JC Penney) and PCA (Wal-Mart). For the twelve months ended August 4, 2002, we served over 6.4 million customers through our retail and institutional channels and, at period end, operated 1,873 permanent portrait studios. Operating under the trade name Wal-Mart Portrait Studios, we are the sole portrait photography provider for Wal-Mart Stores, Inc., the world’s largest retailer in terms of sales. As of August 4, 2002, we operated 1,839 permanent portrait studios in Wal-Mart discount stores and supercenters in the United States, Canada and Mexico and provided traveling portrait photography services to approximately 1,100 additional Wal-Mart store locations in the United States. As of August 4, 2002, we also operated 34 permanent studios in other retail channels, such as Meijer stores and select military bases. Under the trade name PCA International, Inc., we also serve institutional channels, such as church congregations and schools, using a traveling photography format. For the twelve months ended August 4, 2002, we had sales of $281.2 million.

We believe we have one of the industry’s lowest cost portrait services due primarily to our vertically integrated and technologically advanced operations. We use an integrated digital imaging system that allows our customers to view a digital proof of each pose during the photography session and to select the desired images before any printing occurs. This proprietary system also automates and links the image selection process with the immediate sale of custom portrait packages and integrates our studios with our portrait processing and production system. This system, which includes two state-of-the-art processing facilities and a distribution center in the Charlotte, North Carolina area, is fully scaleable as we set up new portrait studio locations and expand into other channels. By integrating our portrait photography and production processes, we are able to minimize processing costs, provide prompt, automated service and grow with minimal incremental capital commitment as we leverage our existing infrastructure. As a result of our low cost structure, we can offer portrait packages at substantially lower prices than those of our competitors. Prices for our lowest priced portrait packages begin at $4.88 per package with no additional charges, compared to an estimated range of $5.95 to $9.99 for the lowest priced packages of our competitors. Furthermore, we do not charge sitting fees or handling charges, while our competitors’ packages typically require additional sitting fees or handling charges of up to $9.99.

Parent has been in operation since 1967. Until January 1997, our business consisted principally of operating portrait studios in Kmart stores. At that time, Parent acquired American Studios, Inc., which was then the

1

primary portrait photography provider to Wal-Mart stores in the United States and Mexico. As we expanded our Wal-Mart business, we began in the second quarter of 1997 to close certain of our underperforming studios in Kmart stores. In response to these closings and our expansion in Wal-Mart, Kmart initiated closure of a number of our studios. In August 1998, Parent consummated a recapitalization pursuant to which Jupiter Partners II L.P. became Parent’s controlling stockholder and thereafter hired a new senior management team. Led by Barry Feld, our Chairman, President and Chief Executive Officer, new management commenced wide-ranging initiatives to improve our cash flow and market share. After receiving a commitment from Wal-Mart to accelerate our expansion in Wal-Mart stores, we made a strategic decision to close all Kmart locations and redeploy those assets into Wal-Mart. We completed this process by the end of fiscal 2000. Revenue from our Wal-Mart business has grown at a compound annual growth rate of 16.5% from 1997 to 2001.

Industry

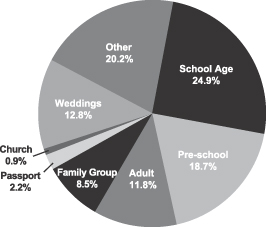

We operate in the $6.3 billion domestic professional portrait photography industry. The primary markets within the domestic professional portrait photography industry are pre-school children, school age children (including graduation portraits), adults, families/groups, weddings, passport, churches and others, such as cruise ships, conventions/events, glamour and executive portraits. From 1991 to 1999, sales in the professional portrait photography industry grew from $5.3 billion to $6.3 billion, representing a compound annual growth rate of 2.1%. Participants in the domestic professional portrait photography industry include large studio chains located in national retailers, other national free-standing portrait studio companies, national school and church photographers and a myriad of independent portrait photography providers. The industry is highly competitive and fragmented. There are only four portrait companies operating within national retail chains: CPI (Sears), Olan Mills (Kmart), Lifetouch (JCPenney and Target) and PCA (Wal-Mart). The majority of the industry is comprised of small, independent photography companies and individual photographers that use various independent processing labs. See “Business—Industry Overview” and “Business—Competition.”

Competitive Strengths

Our principal strengths include:

| | • | | A leading market position in the domestic professional portrait industry, |

| | • | | A strong, mutually beneficial relationship with Wal-Mart, |

| | • | | Low cost portrait production and attractive margins, |

| | • | | Predictable cash flows, |

| | • | | A focus on technological advancements in portrait photography, and |

| | • | | An experienced and results-oriented management team. |

However, as discussed in “Risk Factors,” we are materially dependent upon Wal-Mart, we may not be able to finance the rapid growth we may experience, we may not be able to keep pace with the evolution of technology and our business may be adversely affected if we lose our key personnel.

Business Strategy

Our business strategy is to capitalize on our strengths by implementing the following initiatives:

| | • | | Continue to deliver on strong growth prospects and maintain our strong platform for expansion in the portrait photography industry, |

| | • | | Diversify our revenue streams within the portrait photography industry, |

| | • | | Continue to drive our technological innovation and leadership, and |

| | • | | Expand sales and marketing opportunities. |

2

Equity Sponsor

Parent’s principal stockholder is Jupiter Partners II L.P. Jupiter Partners is a private investment partnership organized to invest in management buyouts, industry consolidations and growth capital opportunities. Jupiter Partners was formed in 1998 with approximately $225 million of capital available for investment. The investment manager for Jupiter Partners was formed in 1994. Jupiter Partners is approximately 50% invested in three portfolio companies. The principals of Jupiter Partners also manage a predecessor fund, which was formed in 1994. Companies that Jupiter Partners seeks to purchase typically have valuations between $100 million and $300 million, with Jupiter Partners providing equity from its own capital of between $20 million and $70 million for each investment.

Recent Transactions

PCA LLC is a newly formed company formed for the purpose of issuing the notes. PCA Finance Corp. is a wholly-owned subsidiary of PCA LLC newly formed for the sole purpose of co-issuing the notes jointly and severally with PCA LLC. On the closing date of the offering of the initial notes, the following transactions occurred:

| | • | | Parent contributed all of the equity that it owns in its subsidiaries to PCA LLC; |

| | • | | PCA LLC entered into agreements with Parent whereby Parent transferred to PCA LLC substantially all its assets and assigned to PCA LLC all contracts (or, in cases where such assignment is impracticable, all economic benefits under such contracts) to which it is a party (except for certain instruments relating to its stock option plan and other equity arrangements) and PCA LLC assumed all of the obligations thereunder; |

| | • | | PCA LLC entered into, and borrowed $26.6 million under, a new senior secured credit facility; |

| | • | | PCA LLC and PCA Finance Corp. issued $165 million of the initial notes; |

| | • | | PCA LLC issued $10 million of senior subordinated notes (the “Opco senior subordinated notes”); |

| | • | | Parent issued $30 million of senior subordinated discount notes (the “Parent senior subordinated discount notes”); |

| | • | | PCA LLC distributed to Parent the net proceeds from the offering of the notes, the borrowings under our new senior secured credit facility and the net proceeds from the sale of the Opco senior subordinated notes; and |

| | • | | Parent used the proceeds from the sale of the Parent senior subordinated discount notes, together with the funds that PCA LLC distributes to it, to repay its existing senior secured credit facility and its outstanding senior subordinated term loans. |

See “Description of Certain Indebtedness” for a description of the terms of the senior secured credit facility, the Opco senior subordinated notes and the Parent senior subordinated discount notes. See “Capitalization” for the capitalization of PCA International, Inc. and PCA LLC.

3

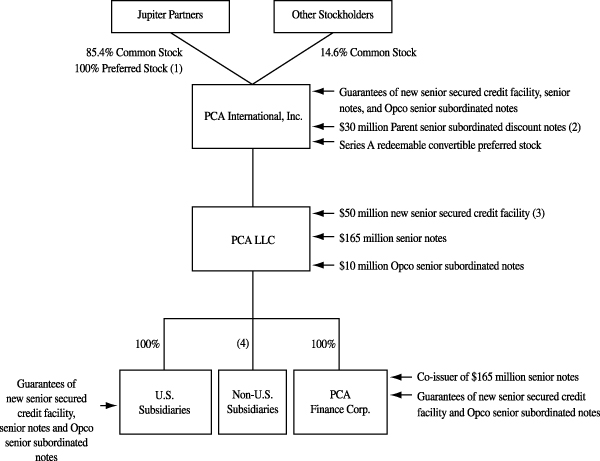

Our capital structure is as follows:

| (1) | | Based on the conversion rate of the series A redeemable convertible preferred stock held by Jupiter Partners, Jupiter Partners beneficially owns 92.0% of Parent’s common stock. See “Principal Stockholders” for a more complete discussion of the beneficial ownership of Parent’s common stock. |

| (2) | | The Parent senior subordinated discount notes are not guaranteed by any subsidiary of PCA International, Inc. |

| (3) | | As of August 4, 2002, there were $27.6 million of outstanding borrowings, $10.1 million of outstanding letters of credit and $12.3 million available to be borrowed under new senior secured credit facility. |

| (4) | | PCA LLC has four non-U.S. subsidiaries. It owns 100% of the equity of two of these subsidiaries and 99.99% of the equity of the other two subsidiaries. |

PCA LLC was organized as a Delaware limited liability company, and PCA Finance Corp. was organized as a Delaware corporation, in June 2002. The principal executive office of PCA LLC and PCA Finance Corp. is 815 Matthews-Mint Hill Road, Matthews, North Carolina 28105. Their phone number is (704) 588-4351.

4

Summary of the Exchange Offer

We are offering to exchange $165,000,000 aggregate principal amount of our exchange notes for a like aggregate principal amount of our initial notes. In order to exchange your initial notes, you must properly tender them and we must accept your tender. We will exchange all outstanding initial notes that are validly tendered and not validly withdrawn.

| Exchange Offer | We will exchange our exchange notes for a like aggregate principal amount of our initial notes. |

| Expiration Date | This exchange offer will expire at 5:00 p.m., New York City time, on , 2002, unless we decide to extend it, but in no event later than December 31, 2002. |

| Minimum Amount | The minimum dollar amount of initial notes required to be tendered in order to participate in the exchange offer is $1,000. |

| Conditions to the Exchange Offer | We will complete this exchange offer only if: |

| | • | there is no change in the laws and regulations which would impair our ability to proceed with this exchange offer, |

| | • | there is no change in the current interpretation of the staff of the Securities and Exchange Commission which permits resales of the exchange notes, |

| | • | there is no stop order issued by the Commission which would suspend the effectiveness of the registration statement which includes this prospectus or the qualification of the exchange notes under the Trust Indenture Act of 1939, |

| | • | there is no litigation or threatened litigation which would impair our ability to proceed with this exchange offer, and |

| | • | we obtain all the governmental approvals we deem necessary to complete this exchange offer. |

Please refer to the section in this prospectus entitled “The Exchange Offer—Conditions to the Exchange Offer.”

| Procedures for Tendering Initial Notes | To participate in this exchange offer, you must complete, sign and date the letter of transmittal or its facsimile and transmit it, together with your initial notes to be exchanged and all other documents required by the letter of transmittal, to The Bank of New York, as exchange agent, at its address indicated under “The Exchange Offer—Exchange Agent.” In the alternative, you can tender your initial notes by book-entry delivery following the procedures described in this prospectus. If your initial notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, you should contact that person promptly to tender your initial notes in this exchange offer. For more information on tendering your notes, please refer to the section in this prospectus entitled “The Exchange Offer—Procedures for Tendering Initial Notes.” |

5

| Special Procedures for Beneficial Owners | If you are a beneficial owner of initial notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your initial notes in the exchange offer, you should contact the registered holder promptly and instruct that person to tender on your behalf. |

| Guaranteed Delivery Procedures | If you wish to tender your initial notes and you cannot get the required documents to the exchange agent on time, you may tender your notes by using the guaranteed delivery procedures described under the section of this prospectus entitled “The Exchange Offer—Procedures for Tendering Initial Notes—Guaranteed Delivery Procedure.” |

| Withdrawal Rights | You may withdraw the tender of your initial notes at any time before 5:00 p.m., New York City time, on the expiration date of the exchange offer. To withdraw, you must send a written or facsimile transmission notice of withdrawal to the exchange agent at its address indicated under “The Exchange Offer—Exchange Agent” before 5:00 p.m., New York City time, on the expiration date of the exchange offer. |

| Acceptance of Initial Notes and Delivery of Exchange Notes | If all the conditions to the completion of this exchange offer are satisfied, we will accept any and all initial notes that are properly tendered in this exchange offer on or before 5:00 p.m., New York City time, on the expiration date. We will promptly return any initial note that we do not accept for exchange to you without expense after the expiration date. We will deliver the exchange notes to you promptly after the expiration date and acceptance of your initial notes for exchange. Please refer to the section in this prospectus entitled “The Exchange Offer—Acceptance of Initial Notes for Exchange; Delivery of Exchange Notes.” |

| Federal Income Tax Considerations Relating to the Exchange Offer | Exchanging your initial notes for exchange notes will not be a taxable event to you for United States federal income tax purposes. Please refer to the section of this prospectus entitled “Certain U.S. Federal Income Tax Considerations.” |

| Exchange Agent | The Bank of New York is serving as exchange agent in the exchange offer. |

| Fees and Expenses | We will pay all expenses related to this exchange offer. Please refer to the section of this prospectus entitled “The Exchange Offer—Fees and Expenses.” |

6

| Use of Proceeds | We will not receive any proceeds from the issuance of the exchange notes. We are making this exchange offer solely to satisfy certain of our obligations under our registration rights agreement entered into in connection with the offering of the initial notes. |

| Consequences to Holders Who Do Not Participate in the Exchange Offer | If you do not participate in this exchange offer: |

| | • | except as set forth in the next paragraph, you will not necessarily be able to require us to register your initial notes under the Securities Act, |

| | • | you will not be able to resell, offer to resell or otherwise transfer your initial notes unless they are registered under the Securities Act or unless you resell, offer to resell or otherwise transfer them under an exemption from the registration requirements of, or in a transaction not subject to, the Securities Act, and |

| | • | the trading market for your initial notes will become more limited to the extent other holders of initial notes participate in the exchange offer. |

The registration rights agreement requires us to file a registration statement for a continuous offering in accordance with Rule 415 under the Securities Act for your benefit if (1) you are prohibited by law or Securities and Exchange Commission policy from participating in the exchange offer, (2) you may not resell the exchange notes that you acquire in this exchange offer to the public without delivering a prospectus and this prospectus is not appropriate or available for such resales or (3) you are a broker-dealer and own notes acquired directly for us or our affiliate. We do not currently anticipate that we will register under the Securities Act any initial notes that remain outstanding after completion of the exchange offer. Please refer to the section of this prospectus entitled “Risk Factors—Your failure to participate in the exchange offer will have adverse consequences.”

| Resales | It may be possible for you to resell the notes issued in the exchange offer without compliance with the registration and prospectus delivery provisions of the Securities Act, subject to the conditions described in the following paragraph and under “—Obligations of Broker-Dealers” below. |

| | To tender your initial notes in this exchange offer and resell the exchange notes without compliance with the registration and prospectus delivery requirements of the Securities Act, you must make the following representations: |

| | • | you are authorized to tender the initial notes and to acquire exchange notes, and that we will acquire good and unencumbered title thereto, |

| | • | the exchange notes acquired by you are being acquired in the ordinary course of business, |

| | • | you have no arrangement or understanding with any person to participate in, a distribution of the exchange notes and is not participating in, and do not intend to participate in, the distribution of such exchange notes, |

7

| | • | you are not an "affiliate," as defined in Rule 405 under the Securities Act, of ours or, you will comply with the registration and prospectus delivery requirements of the Securities Act to the extent applicable, |

| | • | if you are not a broker-dealer, you are not engaging in, and do not intended to engage in, a distribution of exchange notes, |

| | • | if you are a broker-dealer, initial notes to be exchanged were acquired by you as a result of market-making or other trading activities and you will deliver a prospectus in connection with any resale, offer to resell or other transfer of such exchange notes. |

Please refer to the sections of this prospectus entitled “The Exchange Offer—Procedure for Tendering Initial Notes—Proper Executed and Delivery of Letters of Transmittal” and “Risk Factors—Risks Relating to the Exchange Offer—Some persons who participate in the exchange offer must deliver a prospectus in connection with resales of the exchange notes” and “Plan of Distribution.”

| Obligations of Broker-Dealers | If you are a broker-dealer (1) that receives exchange notes, you must acknowledge that you will deliver a prospectus in connection with any resales of the exchange notes, (2) who acquired the initial notes as a result of market making or other trading activities, you may use the exchange offer prospectus as supplemented or amended, in connection with resales of the exchange notes, and (3) who acquired the initial notes directly from the issuers in the initial offering and not as a result of market making and trading activities must, in the absence of an exemption, comply with the registration and prospectus delivery requirements of the Securities Act in connection with resales of the exchange notes. |

8

Summary of Terms of the Exchange Notes

| Issuers | PCA LLC and PCA Finance Corp. PCA Finance Corp. is a wholly-owned subsidiary of PCA LLC with nominal assets which conducts no operations. |

| Exchange Notes | $165,000,000 million aggregate principal amount of 11.875% Senior Notes due 2009. The forms and terms of the exchange notes are the same as the form and terms of the initial notes except that the issuance of the exchange notes is registered under the Securities Act, will not bear legends restricting their transfer and will not be entitled to registration rights under our registration rights agreement. The exchange notes will evidence the same debt as the initial notes, and both the initial notes and the exchange notes will be governed by the same indenture. |

| Maturity Date | August 1, 2009. |

| Interest Payment Dates | February 1 and August 1 of each year, commencing February 1, 2003. |

| Guarantees | PCA International, Inc. and each of the issuers’ existing and future domestic restricted subsidiaries will guarantee the issuers’ obligation to pay principal, premium, if any, and interest on the exchange notes. The obligations of each guarantor under its guarantee are joint and several and full and unconditional. See “Description of Notes—Brief Description of the Notes and the Guarantees” and “Description of Notes—Guarantees.” |

| Ranking | The exchange notes will be: |

| | • | the issuers’ general unsecured obligations; |

| | • | equal in right of payment to all of the issuers’ existing and future unsecured indebtedness and other obligations that are not, by their terms, expressly subordinated in right of payment to the exchange notes; |

| | • | senior in right of payment to all of the issuers’ existing and future indebtedness or other obligations that are, by their terms, expressly subordinated in right of payment to the exchange notes; and |

| | • | effectively junior in right of payment to all of the issuers’ secured indebtedness and other obligations to the extent of the value of the assets securing such indebtedness and other obligations. |

The exchange note guarantee of each guarantor will be:

| | • | general unsecured obligations of that guarantor; |

| | • | equal in right of payment to all existing and future unsecured indebtedness or other obligations of that guarantor that are not, by |

9

| | their terms, expressly subordinated in right of payment to the exchange note guarantee; |

| | • | senior in right of payment to all existing and future indebtedness or other obligations of that guarantor that are, by their terms, expressly subordinated in right of payment to the exchange note guarantee; and |

| | • | effectively junior in right of payment to all secured indebtedness and other obligations of that guarantor to the extent of the value of the assets securing such indebtedness and other obligations. |

As of August 4, 2002, the issuers, Parent and the subsidiary guarantors had indebtedness on Parent’s consolidated balance sheet of approximately $228.3 million, of which approximately $27.8 million was secured and of which $40.0 million was subordinated to the notes. On the same date, the issuers had $10.1 million of letters of credit under our new senior secured credit facility, which reduced the amount available for borrowings thereunder to $12.3 million.

| Mandatory Sinking Fund | None. |

| Optional Redemption | We may redeem the exchange notes, in whole or in part, at our option at any time at the greater of 101% of the principal amount of the exchange notes or a make-whole premium, plus accrued and unpaid interest to the redemption date. See “Description of Notes—Optional Redemption.” |

| Change of Control | If a change of control occurs, we may be required to make an offer to purchase the exchange notes at 101% of their face amount, plus accrued and unpaid interest. See “Description of Notes—Repurchase at the Option of Holders upon Change of Control.” |

| Covenants | The indenture governing the exchange notes will contain covenants that, among other things, will limit our ability and the ability of some of our subsidiaries to: |

| | • | pay dividends, redeem stock or make other distributions; |

| | • | enter into transactions with affiliates; |

| | • | merge or consolidate; and |

| | • | transfer and sell assets. |

These covenants are subject to a number of important qualifications and limitations. See “Description of Notes—Certain Covenants.”

10

| Use of Proceeds | We will not receive any proceeds from the issuance of the exchange notes in exchange for the outstanding initial notes. We are making this exchange solely to satisfy our obligations under the registration rights agreement entered into in connection with the offering of the initial notes. |

| Absence of a Public Market for the Exchange Notes | The exchange notes are new securities with no established market for them. We cannot assure you that a market for these exchange notes will develop or that this market will be liquid. Please refer to the section of this prospectus entitled “Risk Factors—Risks Relating to the Exchange Offer—There may be no active or liquid market for the exchange notes.” |

| Form of the Exchange Notes | The exchange notes will be represented by one or more permanent global securities in registered form deposited on behalf of The Depository Trust Company with The Bank of New York as custodian. You will not receive exchange notes in certificated form unless one of the events described in the section of this prospectus entitled “Description of Notes—Form, Denomination, Transfer, Exchange and Book-Entry Procedures—Exchanges of Book Entry Notes for Certificated Notes” occurs. Instead, beneficial interests in the exchange notes will be shown on, and transfers of these exchange notes will be effected only through, records maintained in book-entry form by The Depository Trust Company with respect to its participants. |

Risk Factors

You should carefully consider all of the information in this prospectus. In particular, for a discussion of some specific factors that you should consider in evaluating an investment in the notes, see “Risk Factors” beginning on page 15, including the risk factors with the following titles:

| | • | | We are materially dependent upon Wal-Mart, and Wal-Mart may terminate, breach or otherwise limit our license agreements, |

| | • | | We have experienced a history of net losses and deficiency of earnings to fixed charges, |

| | • | | We may not be able to finance the rapid growth we may experience, |

| | • | | If we lose our key personnel, our business will be adversely affected, |

| | • | | Our substantial indebtedness could have a material adverse affect on our business and prevent us from fulfilling our obligations under the exchange notes, |

| | • | | The agreements governing the exchange notes and our other debt impose restrictions on our business, and |

| | • | | Holders of secured debt would be paid first and would receive payment from assets used as security before you receive payments if were to become insolvent. |

11

Summary Consolidated Financial and Operating Data

(Dollars in thousands)

The summary historical consolidated financial data for and as of each of the fiscal years in the five-year period ended February 3, 2002 set forth below under the captions “Statement of Operations Data,” “Cash Flow Data,” “Other Financial Data” and “Balance Sheet Data” have been derived from, and are qualified by reference to, Parent’s audited consolidated financial statements. The summary historical consolidated financial data for and as of the twenty-six weeks ended August 4, 2002 and July 29, 2001 set forth below have been derived from, and are qualified by reference to, Parent’s unaudited consolidated financial statements for those fiscal periods. The information presented below is qualified in its entirety by, and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes of Parent included elsewhere in this prospectus. Our fiscal year ends on the Sunday closest to January 31, resulting in fiscal years of either 52 or 53 weeks, and our fiscal quarters are generally thirteen weeks. For example, our fiscal year 2001 ended on February 3, 2002, and our second fiscal quarter of 2001 and 2002 ended on July 29, 2001 and August 4, 2002, respectively.

| | | For the Fiscal Year

| | | For the Twenty-six Weeks Ended

| |

| | | 1997

| | | 1998

| | | 1999

| | | 2000

| | | 2001(1)

| | | July 29,

2001

| | | August 4,

2002 (2)

| |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales (3) | | $ | 242,899 | | | $ | 227,100 | | | $ | 236,124 | | | $ | 227,057 | | | $ | 257,869 | | | $ | 106,083 | | | $ | 129,446 | |

| Costs of sales | | | 181,966 | | | | 174,790 | | | | 186,198 | | | | 171,462 | | | | 191,124 | | | | 84,883 | | | | 99,429 | |

| Gross profit | | | 60,933 | | | | 52,310 | | | | 49,926 | | | | 55,595 | | | | 66,745 | | | | 21,200 | | | | 30,017 | |

General and administrative

expenses (4) | | | 36,160 | | | | 59,413 | | | | 34,540 | | | | 34,230 | | | | 37,450 | | | | 17,501 | | | | 20,125 | |

| Amortization of intangibles | | | 1,910 | | | | 2,025 | | | | 1,975 | | | | 1,974 | | | | 1,971 | | | | 986 | | | | 96 | |

| Income (loss) from operations | | | 22,863 | | | | (9,128 | ) | | | 13,411 | | | | 19,391 | | | | 27,324 | | | | 2,713 | | | | 9,796 | |

| Interest expense, net | | | 6,571 | | | | 15,448 | | | | 28,746 | | | | 29,107 | | | | 29,683 | | | | 14,747 | | | | 13,810 | |

| Other expense (5) | | | — | | | | — | | | | — | | | | — | | | | 15,026 | | | | 4,259 | | | | 2,061 | |

| Income tax provision (benefit) | | | 7,557 | | | | (6,936 | ) | | | 8,913 | | | | (448 | ) | | | 168 | | | | 175 | | | | 47 | |

| Income (loss) before extraordinary item and cumulative effect of accounting change | | | 8,735 | | | | (17,640 | ) | | | (24,248 | ) | | | (9,268 | ) | | | (17,553 | ) | | | (16,468 | ) | | | (6,122 | ) |

| Net income (loss) (6) | | | 8,735 | | | | (18,697 | ) | | | (24,248 | ) | | | (15,258 | ) | | | (19,281 | ) | | | (18,196 | ) | | | (10,690 | ) |

|

Cash Flow Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net cash provided by (used in) operating activities | | $ | 29,534 | | | $ | (12,405 | ) | | $ | 10,986 | | | $ | 5,163 | | | $ | 12,695 | | | $ | (3,729 | ) | | $ | 10,387 | |

| Net cash used in investing activities | | | (13,481 | ) | | | (10,412 | ) | | | (7,272 | ) | | | (9,351 | ) | | | (13,087 | ) | | | (5,546 | ) | | | (7,853 | ) |

| Net cash provided by (used in) financing activities | | | (5,296 | ) | | | 15,269 | | | | (273 | ) | | | 525 | | | | (963 | ) | | | 7,632 | | | | 38 | |

|

Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capital expenditures | | $ | 12,086 | | | $ | 11,022 | | | $ | 9,247 | | | $ | 11,591 | | | $ | 13,087 | | | $ | 5,546 | | | $ | 7,853 | |

| Depreciation and amortization | | | 15,453 | | | | 14,858 | | | | 13,455 | | | | 11,451 | | | | 11,027 | | | | 5,639 | | | | 4,773 | |

| EBITDA (7) | | | 38,316 | | | | 5,730 | | | | 26,866 | | | | 30,842 | | | | 38,351 | | | | 8,352 | | | | 14,569 | |

Ratio of earnings to fixed

charges (8) | | | 3.5 | x | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

12

| | | At the End of Fiscal Year

| | At August 4,

2002

|

| | | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| |

|

Store Data: | | | | | | | | | | | | |

| Number of permanent studios: | | | | | | | | | | | | |

| Wal-Mart | | | | | | | | | | | | |

| U.S. | | 990 | | 1,096 | | 1,254 | | 1,381 | | 1,537 | | 1,615 |

| Canada and Mexico | | 122 | | 141 | | 157 | | 171 | | 210 | | 224 |

| Kmart | | 963 | | 818 | | 566 | | — | | — | | — |

| Other | | — | | — | | — | | 10 | | 30 | | 34 |

| | |

| |

| |

| |

| |

| |

|

| Total | | 2,075 | | 2,055 | | 1,977 | | 1,562 | | 1,777 | | 1,873 |

| | |

| |

| |

| |

| |

| |

|

| | | August 4, 2002

| |

Balance Sheet Data: | | | | |

| Cash and cash equivalents | | $ | 5,444 | |

| Working capital (deficit) (9) | | | (41,397 | ) |

| Total assets | | | 135,235 | |

| Total PCA LLC consolidated debt | | | 199,894 | |

| Total Parent consolidated debt | | | 228,304 | |

| Parent Series A redeemable convertible preferred stock (10) | | | 7,976 | |

| Parent consolidated shareholders’ deficiency (11) | | | (186,914 | ) |

Notes

| (1) | | Our fiscal year 2001 consisted of 53 weeks. |

| (2) | | As restated, see Note (13) of Parent’s consolidated financial statements on page F-39. |

| (3) | | The following table sets forth our sales by channel: |

| | | For the Fiscal Year

| | For the Twenty-Six Weeks Ended

|

| | | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | July 29, 2001

| | August 4, 2002

|

| Wal-Mart | | $ | 134,141 | | $ | 150,584 | | $ | 188,267 | | $ | 215,557 | | $ | 247,404 | | $ | 102,336 | | $ | 122,232 |

| Kmart | | | 97,212 | | | 69,293 | | | 41,273 | | | 4,758 | | | — | | | — | | | — |

| Other | | | 11,546 | | | 7,223 | | | 6,584 | | | 6,742 | | | 10,465 | | | 3,747 | | | 7,214 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Total | | $ | 242,899 | | $ | 227,100 | | $ | 236,124 | | $ | 227,057 | | $ | 257,869 | | $ | 106,083 | | $ | 129,446 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| (4) | | Includes the following items: |

| | | For the Fiscal Year

| | For the Twenty-Six Weeks Ended

|

| | | 1997

| | 1998

| | 1999

| | 2000

| | 2001

| | July 29, 2001

| | August 4, 2002

|

Kmart studio closing costs net of reimbursements

from Kmart (a) | | $ | 1,153 | | $ | — | | $ | 741 | | $ | 3,233 | | $ | 839 | | $ | — | | $ | — |

| Merger-related expenses (b) | | | — | | | 25,890 | | | — | | | — | | | — | | | — | | | — |

| Management restructuring expenses (c) | | | — | | | — | | | 1,686 | | | 287 | | | 841 | | | 438 | | | 303 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Total | | $ | 1,153 | | $ | 25,890 | | $ | 2,427 | | $ | 3,520 | | $ | 1,680 | | $ | 438 | | $ | 303 |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | (a) | | Consists of expenses incurred to close our studios in Kmart stores, including severance, net of reimbursements received from Kmart for unamortized leasehold improvements in our closed studios. |

| | (b) | | In August 1998, Parent completed a recapitalization pursuant to which Jupiter Partners became Parent’s controlling stockholder. In connection with this recapitalization, we incurred merger-related charges consisting of (i) a cash charge of $18,900 for the cancellation of stock options, (ii) a non-cash charge of $2,500 for rollover of stock options and (iii) fees and expenses of $4,490 in connection with the merger. |

| | (c) | | Consists primarily of expenses for executive severance, search and relocation. |

13

| (5) | | Other expense represents the cumulative mark-to-market adjustment for the relevant fiscal period for the embedded derivative in our Series A redeemable convertible preferred stock in accordance with Statement of Financial Accounting Standards No. 133 (SFAS 133), “Accounting for Derivative Instruments and Hedging Activities,” as amended (see Note (6) below). In 1999, Parent issued to Jupiter Partners 15,000 shares of its Series A redeemable convertible preferred stock for net cash proceeds of $14.9 million. The preferred stock is convertible into Parent’s common stock at any time at the option of the holder until April 30, 2011. The preferred stock is mandatorily redeemable in cash on April 30, 2011 at the greater of (a) $1,000 per share or (b) the fair value of Parent’s common stock into which it is convertible, plus declared and unpaid dividends. See Notes (3) and (9) of Parent’s consolidated financial statements and the related notes on pages F-15 and F-21, respectively. |

| (6) | | During the fiscal year 1998, we retired $45,800 of senior debt and incurred an extraordinary loss, net of taxes of $1,057, relating to the write-off of deferred financing costs. |

| | | Effective for the fiscal year 2000, we changed our policy for recognizing revenues relating to digital photographic sales to be consistent with the Securities and Exchange Commission’s Staff Accounting Bulletin (“SAB”) No. 101, Revenue Recognition in Financial Statements. Revenues from photographic sales are recognized when the photographs are delivered to the customer. As a result of this change in accounting policy, we recorded a cumulative effect of accounting change of $(5,990) for the fiscal year 2000. Costs relating to portraits processed, or in process, are deferred when incurred and expensed when photographs are delivered and the related photographic sales revenue is recognized. Prior to the change, sales were recorded when portraits were purchased at the time of photography. All costs incurred or to be incurred related to portraits processed or to be processed but not delivered were accrued and expensed. |

| | | Effective for fiscal year 2001, we adopted SFAS 133. Parent’s Series A redeemable convertible preferred stock contains an embedded derivative under SFAS 133. As a result, Parent recorded a cumulative effect of accounting change under SFAS 133 of $(1,728) for fiscal year 2001. In addition, Parent recorded $(15,026), $(4,259) and $(2,061) in fiscal year 2001 and for the twenty-six weeks ended July 29, 2001 and August 4, 2002, respectively, of other expense as Parent marked the embedded derivative to market in accordance with SFAS 133 (see Note (5) above). |

| | | During the twenty-six weeks ended August 4, 2002, we retired $218.2 million of senior debt and senior subordinated debt, with the proceeds from the initial notes, the Opco senior subordinated notes, and the Parent senior subordinated discount notes and from our senior secured credit facility, and incurred an extraordinary loss, net of taxes and valuation allowance, relating to the write-off of deferred financing costs and accrued effective interest related to increasing rate senior debt. |

| (7) | | We define EBITDA as income (loss) before extraordinary item and cumulative effect of accounting change, plus the expense described in Note (5) above, plus interest, taxes, depreciation and amortization. EBITDA is not a measure of performance under generally accepted accounting principles and should not be used in isolation or as a substitute for net income, cash flows from operating activities or other income or cash flow statement data prepared in accordance with generally accepted accounting principles or as a measure of profitability or liquidity. EBITDA information is included because we believe that certain investors may use it as supplemental information to evaluate a company’s ability to service debt. The definition of EBITDA used in this offering circular may not be comparable to the definition of EBITDA used by other companies. |

| | | For the Fiscal Year

| | | For the Twenty-Six Weeks Ended

| |

| | | 1997

| | 1998

| | | 1999

| | | 2000

| | | 2001

| | | July 29, 2001

| | | August 4, 2002(a)

| |

EBITDA is calculated as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) before extraordinary item and cumulative effect of accounting change | | $ | 8,735 | | $ | (17,640 | ) | | $ | (24,248 | ) | | $ | (9,268 | ) | | $ | (17,553 | ) | | $ | (16,468 | ) | | $ | (6,122 | ) |

| Income tax provision (benefit) | | | 7,557 | | | (6,936 | ) | | | 8,913 | | | | (448 | ) | | | 168 | | | | 175 | | | | 47 | |

| Other expenses | | | — | | | — | | | | — | | | | — | | | | 15,026 | | | | 4,259 | | | | 2,061 | |

| Interest expense, net | | | 6,571 | | | 15,448 | | | | 28,746 | | | | 29,107 | | | | 29,683 | | | | 14,747 | | | | 13,810 | |

| Depreciation and amortization | | | 15,453 | | | 14,858 | | | | 13,455 | | | | 11,451 | | | | 11,027 | | | | 5,639 | | | | 4,773 | |

| | |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| EBITDA | | $ | 38,316 | | $ | 5,730 | | | $ | 26,866 | | | $ | 30,842 | | | $ | 38,351 | | | $ | 8,352 | | | $ | 14,569 | |

| | |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | (a) | | As restated, see Note (13) to Parent’s consolidated financial statements on page F-39. |

| (8) | | For purposes of computing this ratio, earnings consist of income from continuing operations before income taxes plus fixed charges. Fixed charges consist of net interest expense, amortization of deferred financing costs and the portion of rental expense deemed to be representative of the interest factor. For the fiscal years 1998, 1999, 2000 and 2001 and the twenty-six weeks ended July 29, 2001 and August 4, 2002, earnings were insufficient to cover fixed charges by $24,576, $15,335, $9,716, $17,385, $16,293 and $6,075, respectively. |

| (9) | | Current assets minus current liabilities. |

| (10) | In addition, as of February 3, 2002 and August 4, 2002, $24,516 and $26,577, respectively, was recorded on Parent’s balance sheet under “Other Liabilities” in respect of the fair value of the embedded derivative in Parent’s Series A redeemable convertible preferred stock. |

| (11) | $(186,914) represents an increase in shareholders’ deficiency of $(9,524) from $(177,390) at February 3, 2002. |

14

In addition to the other information in this prospectus, you should carefully consider the following factors before investing in the exchange notes. Certain statements in “Risk Factors” are forward-looking statements. See “Disclosure Regarding Forward-Looking Statements.”

Risks Related to Our Business

We are materially dependent upon Wal-Mart, and Wal-Mart may terminate, breach or otherwise limit our license agreements.

We are materially dependent upon our relationship with Wal-Mart, the continued goodwill of Wal-Mart and the integrity of the Wal-Mart brand name in the retail marketplace. Approximately 95.9% of our sales for fiscal 2001 were derived from sales in Wal-Mart stores. Our permanent Wal-Mart studios in the United States and Canada are operated pursuant to license agreements. The license agreements can be terminated or suspended by Wal-Mart for various reasons, some of which are beyond our control. Our license agreements with various Wal-Mart entities have the following expiration dates: (1) for our Mexican Wal-Mart studios, terminable at-will by either party after May 31, 2003; (2) for our U.S. Wal-Mart studios, the fifth anniversary of the opening of a Wal-Mart studio, if no renewal option is exercised; and (3) for our Canadian Wal-Mart studios, various expiration dates, ranging from April 2003 to August 2007, depending upon the date each studio commenced operations, which are more fully described in “Business—Licenses, Trademarks and Patents.”

Wal-Mart is under no definitive obligation to renew existing locations. We do not have the right to close any poorly performing locations prior to the expiration of the term of the license for such locations. Although the license agreements prohibit Wal-Mart from licensing a permanent portrait studio to any other person in the stores in which we operate, they do not make us the exclusive provider for all Wal-Mart stores. In addition, the license agreements do not prohibit Wal-Mart from selling many of the tangible goods we sell, or from developing film, in other departments within its stores. In addition, there is always the risk that Wal-Mart might breach a license agreement. The loss or breach of any license from Wal-Mart would have a material adverse effect on our business, financial condition and results of operations. An adverse change in any other aspects of our business relationship with Wal-Mart, the reduction of the number of studios operated pursuant to such arrangements or changes in Wal-Mart’s expansion plans could have a material adverse effect on our business, financial condition and results of operations. See “Business—Licenses, Trademarks and Patents—Wal-Mart Licenses.”

A prolonged economic downturn, a reduction in consumer spending or decreased customer traffic in our host stores could materially adversely affect our business.

Portrait photography services may be affected by prolonged, negative trends in the general economy. Any reduction in consumer confidence or disposable income in general may affect companies in this specialty retail service industry more significantly than companies in other industries. In addition, the portrait studios in Wal-Mart stores and Meijer stores rely largely on customer traffic generated by the host store. The host store, as part of the retail industry, may be affected by a prolonged downturn in the economy and a decrease in discretionary income of potential customers. For example, we used to provide portrait photography services in host stores operated by Kmart, which is currently in bankruptcy proceedings. During the term of our relationship with Kmart, Kmart’s financial health worsened, and negatively impacted our own performance. There is no assurance that Wal-Mart or any other host store in which we may operate will not suffer similar financial difficulties. A reduction in host store traffic would adversely affect our business, financial condition and results of operations.

We have experienced a history of net losses and deficiency of earnings to fixed charges.

For the fiscal years of 1999, 2000 and 2001, Parent has had a net loss of $24.2 million, $15.3 million and $19.3 million, respectively. For the fiscal years of 1999, 2000 and 2001, earnings were insufficient to cover fixed charges by $15.3 million, $9.7 million and $17.4 million, respectively. Although, we anticipate curing our

15

deficiency of earnings to fixed charges, we may not succeed in establishing earnings sufficient to achieve this goal. A continued net loss and/or deficiency of earnings to fixed charges may prevent us from pursuing our strategies for growth and could cause us to be unable to meet our debt obligations, capital expenditure requirements or working capital needs.

We may not be able to finance the rapid growth we may experience.

Under our United States license agreement with Wal-Mart, Wal-Mart must license us 150 net new stores in each of the next four years and use its best efforts to do so thereafter. Further, Wal-Mart has agreed to use its best efforts to build our studios into the blueprint for all new Wal-Mart stores of 100,000 square feet or larger. We anticipate opening a studio in all new Wal-Mart stores where our studios are incorporated into the blueprint. There is no assurance that we can generate sufficient capital from operations or that outside financing sources will be available to finance such rapid growth. Further, the rapid growth of portrait studios within Wal-Mart could reduce the capital available for growth outside of Wal-Mart.

If we lose our key personnel, our business may be adversely affected.

Our continued success depends, to a large extent, upon the efforts and abilities of our key employees, particularly Barry Feld, our President and Chief Executive Officer. See “Management.” Mr. Feld’s loss would result in a loss of leadership and a strong contact person with Wal-Mart. We cannot assure you of the continued employment of Mr. Feld or any other members of management. Competition for qualified management personnel is intense. The loss of the services of our key employees or the failure to retain qualified employees when needed could materially adversely affect us.

Our business may be adversely affected if we cannot manage our operations or generate sufficient cash flow or obtain sufficient capital to fund future growth.

We intend to expand rapidly as Wal-Mart opens new stores. Our future growth will require us to manage our expanding domestic and international operations and to adapt our operational, manufacturing and financial systems to respond to changes in our business environment while maintaining a competitive cost structure. The expansion of our business has placed and will continue to place significant demands on us to improve our operational, manufacturing, financial and management systems, to develop further the management skills of our managers and supervisors, and to continue to retain, train, motivate and effectively manage our employees. Our failure to manage any future growth effectively could materially adversely affect us. In addition, we have substantial fixed costs due to our two production facilities in the Charlotte, North Carolina area. These fixed costs make us vulnerable in the event of an economic downturn or other inability to generate sufficient cash flow.

We have experienced reduced sales at existing studios when we have opened new studios in close proximity to existing studios. Success of our growth strategy will depend on our ability to effectively minimize this effect. In addition, our license agreement with Wal-Mart prohibits us from opening a new non-Wal-Mart studio within a certain distance of any store where we operate a Wal-Mart portrait studio. We will need to ensure that this prohibition does not negatively impact our non-Wal-Mart expansion plans.

Additionally, our ability to maintain and increase our revenue base and to respond to shifts in customer demand and changes in industry trends will be partially dependent on our ability to generate sufficient cash flow or obtain sufficient capital for the purpose of, among other things, financing capital expenditures, infrastructure growth and acquisitions. There can be no assurances that we will be able to generate sufficient cash flow or that financing will be available on acceptable terms, or permitted to be incurred under the terms of our new senior secured credit facility and any future indebtedness, to fund our future growth. Our failure to generate sufficient cash flow or obtain sufficient financing to fund our future growth could materially adversely affect us.

16

Our fourth quarter sales and income are disproportionately high and we are vulnerable to downturns in consumer holiday spending that can adversely affect our business.

Because of the retail nature of our services and our locations in discount stores, our business is highly seasonal. The holiday season accounts for a high percentage of our sales and operating income, and our fourth fiscal quarter, early November through late January, typically produces a large percentage of annual sales and operating income. The fourth quarters in the fiscal years 2001, 2000 and 1999 have accounted for approximately 35%, 33% and 31%, respectively, of our annual sales and 78%, 89% and 99%, respectively, of our annual operating income. Our operations can be adversely affected by inclement weather, especially during the important fiscal fourth quarter.

If our competitors initiate price-cutting or changes in package configurations or introduce new technology, we may experience lower revenues or higher costs.

The professional portrait photography industry, including both permanent and traveling studios, is highly competitive. Certain of our competitors and potential competitors are more established, benefit from greater name recognition and have significantly greater capital and resources than we do. Moreover, evolving technology and business relationships may erode any proprietary barriers to entry that could keep our competitors from developing products or services similar to ours or from selling competing products or services in our markets.

The companies in the industry compete on the basis of value, price, quality, access, service, package size, technology and convenience of retail distribution channel. The major professional portrait studio companies, including CPI Corporation, Lifetouch, Inc. and Olan Mills, Inc., operate permanent studios in retail chains and independent locations. To compete successfully, we must continue to remain competitive in areas of value, price, quality, access, service, package size, technology and convenience.

The evolution of digital portrait technology has introduced additional competition from companies, such as Picture People, which operate independent locations specializing in such portrait technology. Although we have not experienced a significant decline in the discount retail distribution channel due to such technology or companies, there can be no assurance that such technology or companies specializing in such technology will not take significant business from us if we do not also invest in such technology, resulting in either lower revenues or higher cost of operation.

Furthermore, consumer products, particularly those that are value-priced, are subject to significant price competition. There can be no assurance that we will not be forced to engage in price-cutting initiatives to respond to competitive and consumer pressures. The failure of our sales volumes to grow sufficiently to improve overall revenues and income as a result of a competitive price reduction could materially adversely affect our business. See “Business—Competition.”

Parent’s principal stockholder is Jupiter Partners, whose interests may not be aligned with yours.

Over 90% of the outstanding shares of Parent’s common stock are beneficially owned by Jupiter Partners. As a result of its stock ownership, Jupiter Partners controls us and has the power to elect all of Parent’s directors, appoint new management and approve any action requiring the approval of the holders of our equity, including adopting amendments to our organizational documents, and approving mergers or sales of all or substantially all of our assets. The directors elected by Jupiter Partners will have the authority to effect decisions affecting our capital structure, including the issuance of additional capital stock, the implementation of equity repurchase programs and the declaration of dividends. Jupiter Partners’ interests may not be fully aligned with yours and this could lead to a strategy that is not in your best interests. See “Management” and “Principal Stockholders.”

We are dependent upon key suppliers.

We are dependent upon AGFA Corporation as our key supplier of photographic film, paper and processing chemistry, which are manufactured in Germany. Any disruption in the business of AGFA or in the delivery of supplies from AGFA could have a material adverse impact on our business.

17

All of our film, the collection of proceeds of sales and the delivery of portraits is dependent upon Federal Express for deliveries in the U.S. and Mexico and upon Purolator for deliveries in Canada. Any disruption in the business of Federal Express could have a material adverse impact on our business.

Our international expansion may not be successful and may expose us to additional risks that could adversely affect our business.

International operations in Canada and Mexico accounted for 7.9% of sales and 7.4% of EBITDA during fiscal 2001. We expect international sales to increase in the future as we continue to grow in Canada and Mexico and, potentially, as we launch operations in Europe. Therefore, we would be more vulnerable to risks involving the geographic distance of operations, differences in language or culture, changes in business regulations and taxation and currency fluctuations and political instability. Further, there is no proven market for portrait photography services in retail studio locations in Europe. Therefore, our in-store studio model may not perform well in Europe.

We may not be able to keep pace with the evolution of technology and develop and invest in new technologies as required to effectively compete.

The evolution of digital portrait technology, computer technology and information technology may make it difficult to support present technologies or require us to invest in new technologies. There can be no assurance that we can generate sufficient capital from operations or that outside financing sources will be available to invest in such evolving technologies. To the extent that we do invest in such technology, there is no assurance that our investment will lead to increased revenues or profits. In addition, our ability to develop digital technology, e-commerce capabilities and other new information and distribution technologies may affect our prospects.

Any disruption in our manufacturing process could have a material adverse impact on our business.

We are dependent upon the efficient operation of our portrait processing facilities to maintain our portrait quality, timeliness of delivery and low cost operation. Any disruption of the manufacturing process for any reason could have a material adverse impact on our business.

Risks Related to Our Indebtedness

Our substantial indebtedness could materially adversely affect our business and prevent us from fulfilling our obligations under the exchange notes.

The issuers have outstanding a substantial amount of debt. As of August 4, 2002, this debt consisted primarily of:

| | • | | $165.0 million of initial notes, |

| | • | | $27.6 million of borrowings under our senior secured credit facility, excluding outstanding letters of credit in the amount of $10.1 million and capital leases of $0.2 million, and |

| | • | | $10.0 million of Opco senior subordinated notes. |

In addition, at that date, we were able to borrow $12.3 million of additional available credit under our senior secured credit facility, subject to satisfaction of customary borrowing conditions.

Our substantial amount of debt, as well as the guarantees of and security interests in the assets of our subsidiaries, could have material adverse consequences for you and for us, including but not limited to:

| | • | | limiting our ability to satisfy our obligations with respect to the exchange notes; |

18

| | • | | increasing our vulnerability to general and local adverse economic and industry conditions; |

| | • | | limiting our ability to obtain additional financing; |

| | • | | requiring a substantial portion of our cash flow from operations to be used for payments on our debt; |

| | • | | reducing our ability to use our cash flow to fund our store expansion program and capital expenditures; |

| | • | | limiting our flexibility in planning for, or reacting to, changes in our business and the industry; and |

| | • | | placing us at a disadvantage compared to competitors with less debt or greater resources. |

Despite current indebtedness levels, we and our subsidiaries may be able to incur additional indebtedness, which could further increase the risks associated with our leverage.

Subject to the terms of the exchange notes and our other debt, we may be able to borrow additional debt in the future. Although all of our domestic subsidiaries will be guarantors of the exchange notes, our foreign subsidiaries will not. Thus, any debt they incur would be structurally senior to the exchange notes. In addition, we are permitted to incur a specified amount of debt that is secured. For example we are permitted to borrow additional amounts under our senior secured credit facility. If we incur additional debt, the related risks that we now face could increase.

If we fail to generate sufficient cash flow from future operations, we may have to refinance all or a portion of our indebtedness or obtain additional financing.

If we fail to generate sufficient cash flow from future operations, we may have to refinance all or a portion of our indebtedness or obtain additional financing in order to fund our new studio openings and meet our obligations with respect to the exchange notes and our other debt. We cannot assure you that we will be able to refinance any of our indebtedness or obtain additional financing, particularly because of our anticipated high levels of debt and the debt incurrence restrictions imposed by the agreements governing our debt.

The agreements governing the exchange notes and our other debt impose restrictions on our business.

The indenture governing the exchange notes contains, and the agreements governing our senior secured credit facility contains, a number of covenants imposing significant restrictions on our business. These restrictions may affect our ability to operate our business and may limit our ability to take advantage of potential business opportunities as they arise. These covenants place restrictions on our ability to, among other things:

| | • | | pay dividends, redeem or repurchase our stock or make other distributions; |

| | • | | make acquisitions or investments; |

| | • | | enter into transactions with affiliates; |

| | • | | merge or consolidate with others; |

| | • | | dispose of assets or use asset sale proceeds; |

| | • | | create liens on our assets; and |

Our senior secured credit facility also requires us to meet a number of financial ratios and tests.

19

Our ability to comply with these agreements may be affected by events beyond our control, including prevailing economic, financial and industry conditions. The breach of any of these covenants or restrictions could result in a default under the indenture governing the exchange notes or our senior secured credit facility. An event of default under our debt agreements would permit some of our lenders to declare all amounts borrowed from them to be due and payable, together with accrued and unpaid interest, and the commitments of the senior lenders to make further extensions of credit under our senior secured credit facility could be terminated. If we were unable to repay debt to our senior lenders, these lenders could proceed against the collateral securing that debt. In addition, acceleration of our other indebtedness may cause us to be unable to make interest payments on the exchange notes and repay the principal amount of the exchange notes or may cause the guarantors to be unable to make payments under the guarantees.

Risks Related to the Exchange Notes

Holders of secured debt would be paid first and would receive payments from assets used as security before you receive payments if we were to become insolvent.

The exchange notes and the guarantees will not be secured by any of our assets or the assets of our subsidiaries. The indentures governing the exchange notes will permit us to incur additional debt, including purchase money debt and other secured debt. If we were to become insolvent, holders of any current and future secured debt would be paid first and would receive payments from the assets used as security before you receive any payments. You may therefore not be fully repaid if we become insolvent.

As of August 4, 2002, the issuers and the guarantors had secured indebtedness on the issuers’ consolidated balance sheet of approximately $27.8 million and an additional $10.1 million in letters of credit under our senior secured credit facility and had availability under our senior secured credit facility for additional borrowings of up to $12.3 million.

The exchange notes will be effectively subordinated to the claims of creditors of our non-guarantor subsidiaries.

We conduct a substantial portion of our business through our subsidiaries. Our domestic subsidiaries will guarantee the exchange notes, but none of our foreign subsidiaries will guarantee such notes. Claims of creditors of our non-guarantor subsidiaries, including trade creditors, will generally have priority with respect to the assets and earnings of such subsidiaries over the claims of creditors of our company, including holders of the exchange notes. As of August 4, 2002, after eliminating intercompany activity, our subsidiaries that are not guarantors had immaterial liabilities and assets. The indenture governing the exchange notes will permit the incurrence of additional indebtedness by our non-guarantor subsidiaries in the future. See “Description of Notes—Brief Description of the Notes and the Guarantees” and “Description of Notes—Certain Covenants—Limitation on Incurrence of Additional Indebtedness.”

A court could void our subsidiaries’ guarantees of the exchange notes under fraudulent transfer laws.

Although the guarantees provide you with a direct claim against the assets of our subsidiary guarantors, under the federal bankruptcy laws and comparable provisions of state fraudulent transfer laws, a guarantee could be voided, or claims with respect to a guarantee could be subordinated to all other debts of that guarantor. In addition, a court could void (i.e., cancel) any payments by that guarantor pursuant to its guarantee and require those payments to be returned to the guarantor or to a fund for the benefit of the other creditors of the guarantor.

The court might take these actions if it found, among other things, that when the subsidiary executed its guarantee (or, in some jurisdictions, when it became obligated to make payments under its guarantee):

| | • | | the guarantor received less than reasonably equivalent value or fair consideration for the incurrence of the guarantee, and |

20

| | • | was (or was rendered) insolvent by the incurrence of the debt; |

| | • | was engaged or about to engage in a business or transaction for which its assets constituted unreasonably small capital; |

| | • | intended to incur, or believed that it would incur, obligations beyond its ability to pay as those obligations matured; or |

| | • | was a defendant in an action for money damages, or had a judgment for money damages docketed against it and, in either case, after final judgment, the judgment was unsatisfied. |

A court would likely find that a subsidiary received less than fair consideration or reasonably equivalent value for its guarantee to the extent that it did not receive direct or indirect benefit from the issuance of the exchange notes. A court could also void a guarantee if it found that the subsidiary issued its guarantee with actual intent to hinder, delay, or defraud creditors.