Notice to Investors, Prospective Investors and the Investment Community

Cautionary Information Regarding Forward-Looking Statements

Statements in this presentation regarding the proposed merger of Merge Technologies, (d.b.a. Merge eFilm) and Cedara Software Corp.

which are not historical facts, including expectations of financial results for the combined companies (e.g., projections regarding

revenue, earnings, cash flow and cost savings), are "forward-looking statements." All forward-looking statements are inherently

uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known

and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected. Investors are

cautioned not to place undue reliance on these forward-looking statements and any such forward-looking statements are qualified in

their entirety by reference to the following cautionary statements.

Important factors upon which the forward-looking statements presented in this release are premised include: (a) receipt of

regulatory and shareholder approvals without unexpected delays or conditions; (b) timely implementation and execution of merger

integration plans; (c) the ability to implement comprehensive plans for asset rationalization; (d) the successful integration of the IT

systems and elimination of duplicative overhead and IT costs without unexpected costs or delays; (e) retention of customers and critical

employees; (f) successfully leveraging Merge eFilm/Cedara’s comprehensive product offering to the combined customer base; (g)

continued growth at rates approximating recent levels for imaging information systems and other product markets; (h) no unanticipated

changes in laws, regulations, regulatory requirements or other industry standards affecting Merge eFilm/Cedara’s businesses which

require significant product redevelopment efforts, reduce the market for or value of its products or render products obsolete; (i) no

unanticipated developments relating to previously disclosed lawsuits or similar matters; (j) successful management of any impact from

slowing economic conditions or consumer spending; (k) no catastrophic events that could impact Merge eFilm/Cedara's or its major

customer's operating facilities, communication systems and technology or that has a material negative impact on current economic

conditions or levels of consumer spending; (l) no material breach of security of any Merge eFilm/Cedara's systems; and (m) successfully

managing the potential both for patent protection and patent liability in the context of rapidly developing legal framework for expansive

software patent protection. In addition, the ability of Merge eFilm/Cedara to achieve the expected revenues, accretion and synergy

savings also will be affected by the effects of competition (in particular the response to the proposed transaction in the marketplace),

the effects of general economic and other factors beyond the control of Merge eFilm/Cedara, and other risks and

uncertainties described from time to time in Merge eFilm/Cedara's public filings with United States Securities and

Exchange Commission and Canadian securities regulatory authorities.

Safe Harbor Statement

3

Safe Harbor Statement

Additional Information

Shareholders are urged to read the joint proxy statement/management information circular

regarding the proposed transaction when it becomes available, because it will contain important

information. Shareholders will be able to obtain a free copy of the joint proxy

statement/management information circular, as well as other filings containing information about

Merge eFilm and Cedara, without charge, at the Securities and Exchange Commission's internet

site (http://www.sec.gov). Copies of the joint proxy statement/management information circular

and the filings with the Securities and Exchange Commission that will be incorporated by

reference in the joint proxy statement/management information circular can also be obtained,

without charge, by directing a request to Merge eFilm's Investor Relations Department at Merge

eFilm's principal executive offices located at 1126 South 70th Street, Suite S107B, Milwaukee,

Wisconsin 53214-3151; telephone number (414) 977-4000. The respective directors and executive

officers of Merge eFilm and Cedara may be deemed to be participants in the solicitation of proxies

in respect of the proposed transaction. Information regarding Merge eFilm's directors and

executive officers is available in Merge eFilm's proxy statement for its 2004 annual meeting of

stockholders, which was filed with the Securities and Exchange Commission on April 12, 2004,

and information regarding Cedara's directors and executive officers is available in Cedara's

notice of annual meeting and proxy circular for its 2004 annual meeting, which was filed with the

Securities and Exchange Commission on September 24, 2004. Additional information regarding

the interests of potential participants in the proxy solicitation will be contained in the joint proxy

statement/management information circular to be filed with the Securities and Exchange

Commission when it becomes available.

4

Largest provider of medical imaging software to the

mid-market

Small and medium sized hospitals, imaging centers

and specialty clinics

Enhanced business growth model

Revenue diversification, lower key account risk,

financial synergies

Most comprehensive “one-stop-shop” of medical

imaging software products and services

RIS, PACS and Clinical Applications

Largest global OEM supplier of medical imaging

software

Largest OEM-supported medical imaging

software R&D lab

An Unmatched

Leader

5

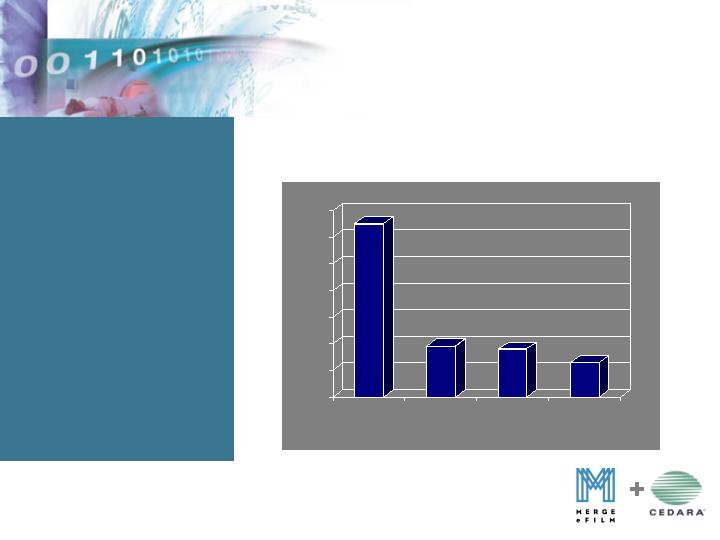

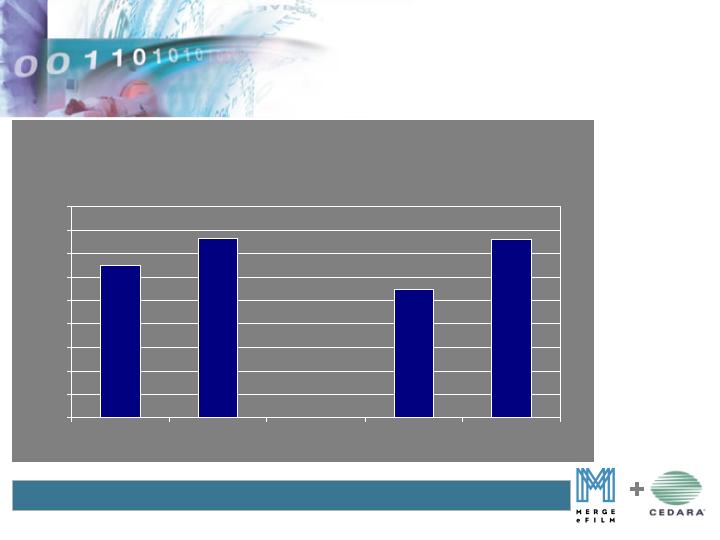

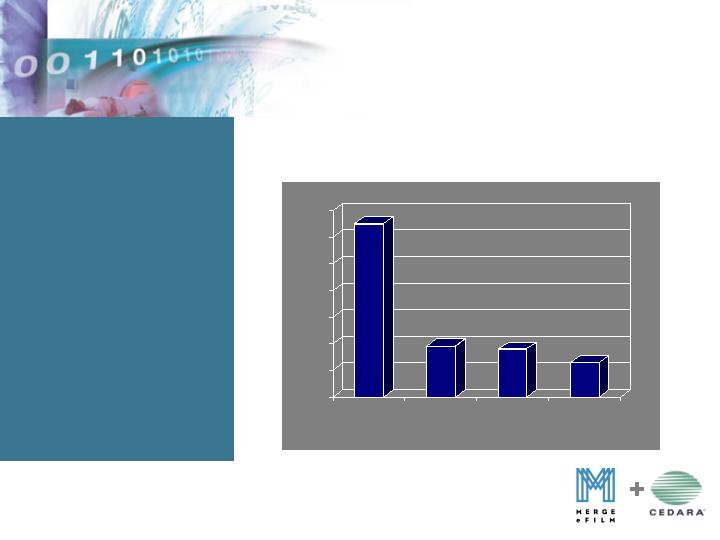

Combined Scale

and Financial Strength

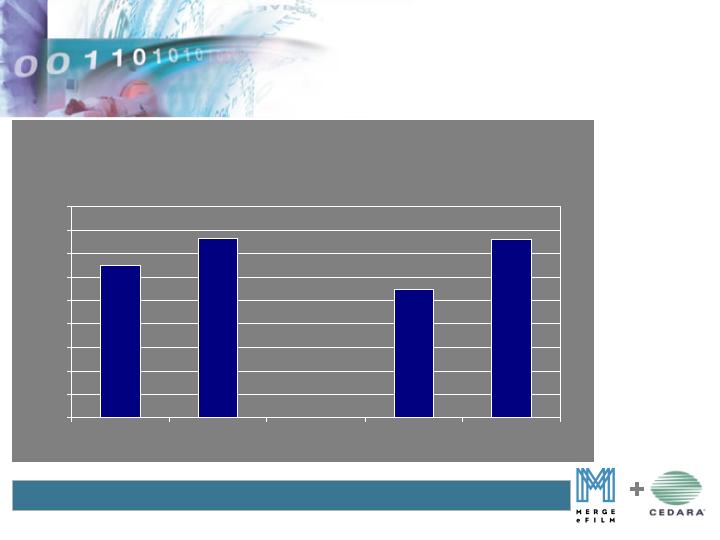

Market Capitalization of Medical Imaging

Software Companies

$0

$100

$200

$300

$400

$500

$600

$700

Merge

Cedara

AMICAS

Vital

Images

iCAD

The largest and

most profitable

company in the

medical

imaging

software sector

Approximate Market Capitalization as of 1/17/05

6

Annual revenues exceeding $100 million

EBITDA margins > 30% (pre-synergies)

Annual operating cash flow > $20 million

Immediate expense synergies > $3 million

Duplicate public company costs

Non-headcount related cost reductions

Pristine balance sheet

Total net cash balance > $20 million

33.5 million fully diluted shares

A larger and

more profitable

company that

provides clear

financial upside

for investors

based on historical results

Combined Scale

and Financial Strength

7

Merge

eFilm

Cedara

Software

Background

Company Profiles

1982

1987

Year Established

Toronto, ON

Milwaukee, WI

Headquarters

150+

100+

OEM/VAR Customers

400+

200+

End User Customers

350

200

Employees

31.8 M

13.2 M

Shares

$350 M

$250 M

Market Cap1

CDSW; CDE-TSX

MRGE

Symbol

1as of 1/17/05 (in USD)

8

Company Profiles – Summary

of Characteristics

Characteristic

Merge

Cedara

Combined

Note

International OEM Strategy

++

+++++

+++++

Market Leader

US Healthcare Market:

Image Centers

+++++

++

+++++

Market Leader

Small/Medium Hospitals

++

++++

++++

Market Leader

Specialty Clinics

++

++

++++

Market Opportunity

New Markets —

Mammo,

Cardio, Ortho, etc…

+

+

++++

Cedara’s Products + Merge

eFilm’s Direct Sales strategy

Imaging Software Innovation

++

+++++

+++++

Best in Class

Technology Synergies across

Channels

++

+++

++++

M

aterial cross

-

channel synergies

within imaging technologies

US Direct Sales, Marketing &

Distribution

++++

+++

+++++

Unmatched Direct Sales &

Professional Services Team

Revenues:

Direct Sales Growth

+++++

++

+++++

Growing 50% Annually

S

ervice Revenue Annuity

++

++++

+++++

300% Increase

International OEM

++

+++++

+++++

Market Leader

Challenges:

Sarbanes

-

Oxley

Yes

Yes

Reduced

Reduce Materiality

Key Account Risk

Some

Yes

Reduced

Reduce Risk

Revenue Diversification

Some

Some

Y

es

Reduce Quarterly Fluctuations

Competition

Yes

Yes

Reduced

Join Forces vs. Compete

Defense against “GE’s”

Limited

Limited

Strong

Increase Market Position and

Strength

9

How Will The Merger Enhance

Our Direct Sales Strategy?

10

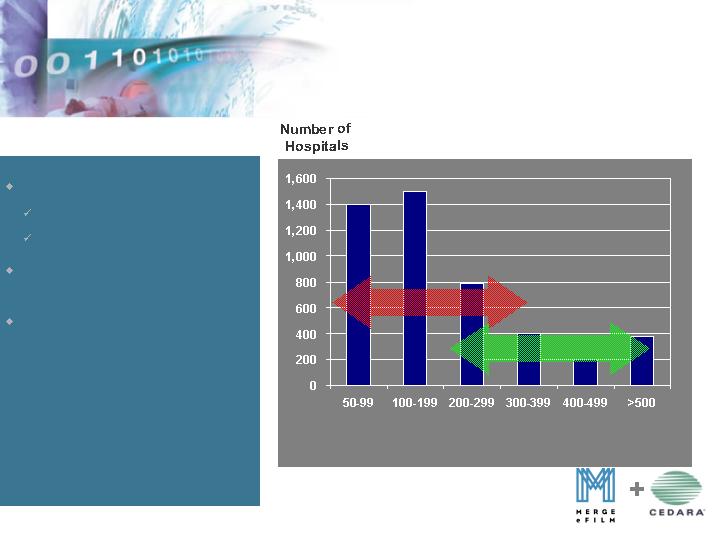

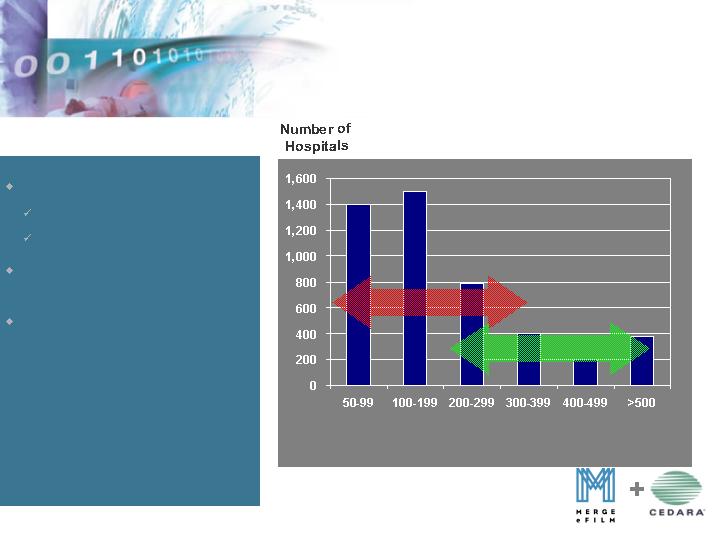

Market Opportunity

Sources: (a) American Hospital Association

2001 Hospital Statistics

(b) IMV Limited, 2002 survey

(c) Technology Marketing Group

Target Health Care Market:

Hospitals 50–399 beds 4,193(a)

Imaging Centers 3,511(b)

75% of diagnostic reads in

the market are film-based

Only 25% of this target

market has implemented

digital image processing (c)

Hospital Bed Size

Direct Sales Market

OEM Market

11

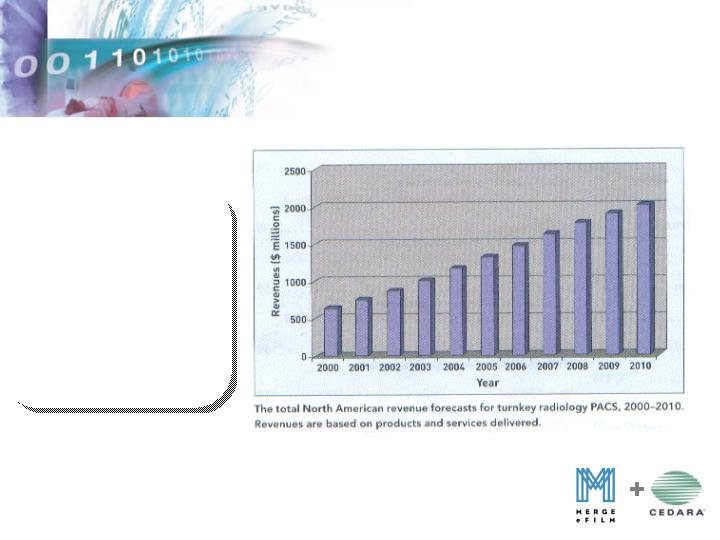

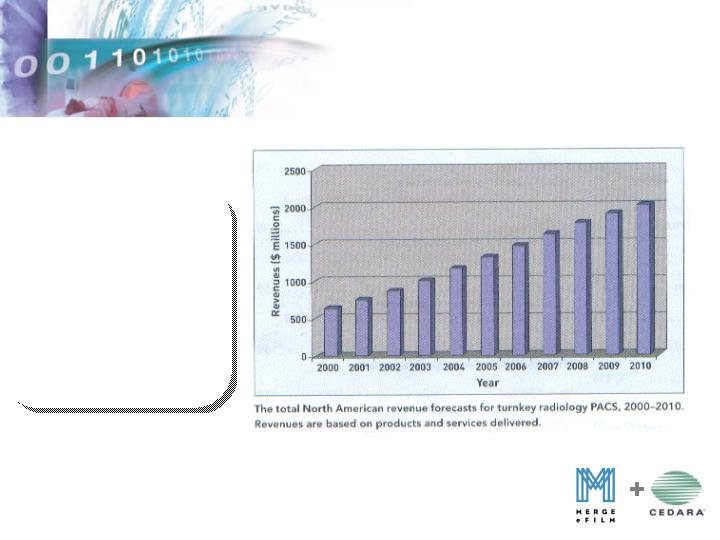

All information courtesy of Frost & Sullivan

North America is the

largest market for

turnkey PACS

(Picture Archiving and

Communications

Systems) with total

revenues reaching

approximately $1

billion in 2003.

Source: Frost & Sullivan

Market Opportunity

12

Continued pressure on cost reduction and operating

efficiency

Need for enterprise-wide, secure access to images and

information

Continuous shift to digitized health care operations - the

electronic patient record

Technological improvements make RIS/PACS financially

feasible — especially for our target market

Migration of diagnostic imaging into other specialties, driven

by technology advancement and financial gain

Technological advancements in CT, MRI and other

modalities create a need for advanced visualization, such as

3D reconstruction, 4D and advanced diagnostic services

Market Trends in

Health Care IT

and Radiology

13

One-stop-shop for comprehensive business and clinical

workflow solutions

Integrated product components

Specific product features

Roadmap depth and innovation speed

Credible vendor and brand recognition

Excellent service capability

References and word-of-mouth testimonials

In short – a safe decision and a long-term partnership with a

company that can help them be successful

The Needs of our

End User Target Market

14

A Few Companies Stand Out

But There Is No Market Leader

NO

NO

NO

NO

YES

NO

YES

RIS

YES

YES

YES

YES

YES

YES

YES

PACS

NO

BRIT Systems

NO

DR Systems

NO

Emageon

NO

Stentor

NO

Amicas

YES

Cedara / eMed

YES

Merge eFilm

CLINICAL

APPS

COMPANY

Market lacks

comprehensive

workflow

solutions

15

Market leader status of combined company:

Prospects add us to their short list prior to making PACS, RIS or

Clinical Application decision

This, in turn, should result in higher sales even at current close rates

Merge eFilm also brings to the table its Internet downloadable

radiology viewer which identifies even more prospects (the only one in

the industry)

Combined Direct Sales strength complemented by SourceOne

Partnership = comprehensive market coverage

Cedara brings to the table its major OEM customer credentials (i.e.

GE, Philips, Siemens, Toshiba, Hitachi) which greatly impresses mid-

market prospects. And improves ability to sell Merge eFilm products

globally

Market Leader Status

Benefits Direct Sales Strategy

16

How Will The Merger Enhance

Our International OEM Strategy?

17

As part of the negotiation of a major OEM product

development contract, we can offer to sell the resulting

product to our direct channel for additional fees

The ability for us to offer OEM customers access

to what will be the largest mid-market direct customer base

is a significant advantage

OEM customers would thus be able to consider us

as a revenue and cost-center issue as opposed to strictly a

cost-center issue

Takes the pressure off hard-fought pricing negotiations

because we are bringing revenue to the table

Also positions us as the innovation leader by introducing

new follow-on products and technologies to our Direct

customers

Market Leader Status

Benefits OEM Strategy

18

Cedara:

3D

Mammography

Orthopedics

Nuclear Fusion PET/CT

Cardiology

Merge eFilm: (with AccuImage acquisition)

Virtual Colonoscopy

Calcium Scoring

Lung Nodule Detection

Largest Suite of

Clinical Applications

19

January

2005

20

The Transaction

+

Key Transaction

Terms

Each Cedara shareholder will receive

0.587 Merge Common Shares or

Exchangeable Shares

17.5% premium to Cedara shareholders

based on volume weighted average price

for the 20-day period ending Jan. 14, 2005

Cedara options to be replaced by Merge

eFilm options

Vesting of options is not accelerated

The Largest

Transaction in

the Healthcare

Image

Management

Software Sector

21

Exchangeable

Shares Overview

5 Year Sunset, Traded on the TSX

Terms:

Do not count against foreign content

basket for pension funds and RRSP’s

Tax-deferred rollover treatment for

Canadian tax payers

Canadian Property:

Exchangeable into Merge Common

Shares at the option of the holder*

Exchange Rights:

* Merge common shares will be echangeable

subject to the effectiveness of an S-3

registration statement.

22

Management and

Governance

3 nominees from Cedara,

including Abe Schwartz

Board of Directors:

Abe Schwartz

Board Member, and

Business Advisor :

Rich Linden

President & CEO:

23

Financial Benefits

Accretive to Cash EPS in 2005 (exclusive of

one-time charges)

Identified Cost Synergies

Public Company Costs

Duplicative Trade Show Costs

Revenue Synergies Anticipated

Cross selling expanded product offering

Accelerate movement into clinical

specialties

There will be

significant

financial benefits

to shareholders

of both Merge

and Cedara

24

Timing

Subsequent to Shareholder

Meetings

Closing:

Early Second Quarter

Shareholder Meetings:

End of March/Early April

Shareholder Mailing:

January 18

Announcement:

25

January

2005

26

Merger Execution

+

Integration Plan

Merge eFilm and Cedara have a proven track record in integrating

acquisitions:

Timely decision making at time of Closing

Focus on expense, revenue and operational synergies

Deliver accretive earnings to shareholders

Balance near term operational performance with long-term strategy

Key Integration Plan Components:

Finalize organizational model and leadership team

Timely identification of expense synergies

Support existing customers’ technology suites

Develop roadmap for integrated product portfolio and immediate

rationalization of product overlap as appropriate

Sales, Marketing and Distribution – hit the ground running

27

January

2005

28

Financials

+

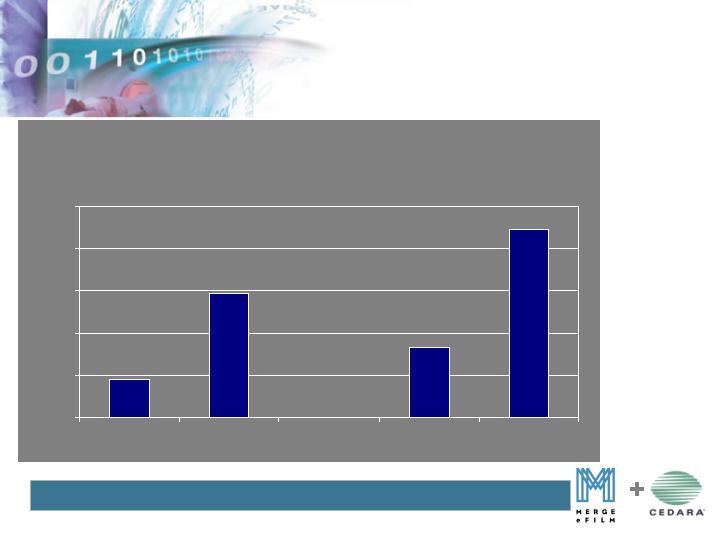

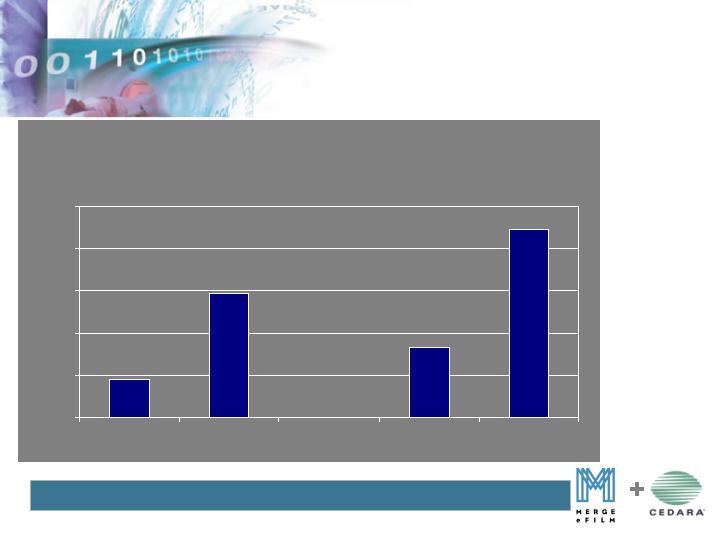

Revenue Growth

$76,148

$54,916

$76,558

$65,090

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

CY 2002

CY 2003

Nine Months

Ended 9/03

Nine Months

Ended 9/04

(USD in thousands)

Growth –17.6% – 38.7%

Pro Forma Historical Revenue

29

Operating Income

(In Millions)

$22,313

$8,238

$14,741

$4,560

0

5,000

10,000

15,000

20,000

25,000

CY 2002

CY 2003

Nine Months

Ended 9/03

Nine Months

Ended 9/04

(USD in thousands)

Growth 7.0% 19.3% 15.0% 29.3%

Pro Forma Historical EBITDA

30

31

EBITDA

$20

$67

$38

$29

($6)

$2

$13

$17

($25)

$0

$25

$50

$75

2001

2002

2003

Q3 Run

Rate

Revenues

Revenues

Rate

Q3 Run

2003

2002

2001

$75

$50

$25

$0

($25)

$14

$10

$6

$3

$16

$21

$29

$37

EBITDA

Recent Financial

Performance

Balance Sheet

Highlights

(in USD)

32

Cash

$40 M

Debt

$19 M

Deferred Revenue

$13 M

Shareholders’ Equity

$450 M

January

2005

+

Appendix

(Merge & Cedara Overviews)

34

Overview of Cedara

Medical

Device

Operating

Consoles

34

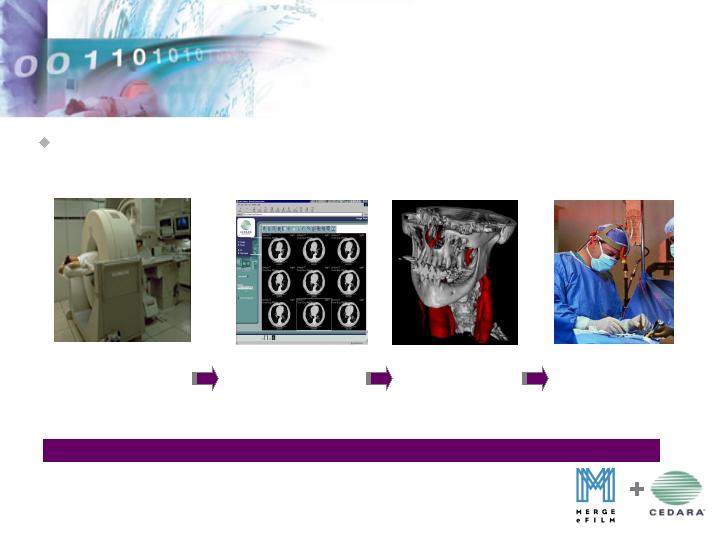

Cedara develops software for all stages of Medical

Imaging Workflow…

OEM

OEM

OEM

OEM

PACS - Picture

Archiving &

Communication

Systems

Clinical

Applications

Image

Guided

Surgery

Overview of Cedara

MR

CT

XRAY

(DR/CR/FD)

PET-CT

Nuclear

Medicine

Ultrasound

Fluoroscopy

Mammography

… Across Multiple Imaging Modalities

35

Cedara Software

and Customers

Pioneered many imaging advances

Cedara software installed on 20,000

medical imaging devices worldwide

30% of MRIs currently shipped contain

Cedara software

4,600 Picture Archiving & Communication

Systems (PACS) licenses

New technology in R&D Lab

36

Cedara

Sales Strategies

Market Presence - Direct Sales

Customers

400+ PACS customers

2600 Teleradiology solutions

Market Presence – OEM

150+

Cedara voted

“The fastest

growing company

of 2004”

by Frost & Sullivan

37

January

2005

Merge eFilm Overview

38

Merge eFilm

A global healthcare software and services

company

Focused on accelerating the productivity of

imaging centers, small- to medium-sized

hospitals and clinics

A suite of RIS/PACS products that efficiently

streamline, integrate and distribute image and

information workflow across the healthcare

enterprise.

39

Merge eFilm

Value Proposition

Facilitate transition from paper and film-based

process to fully automated and digitized flow of

diagnostic images and information across the

health care enterprise

Increase productivity

Mitigate costs

Improve quality of care

Improve services to referring physicians

Optimize financial reimbursement

Focus on

Clinical and

Business Value

That Serves

Customer

Needs

40

FUSION

RIS/PACS

FUSION

RIS

FUSION

PACS

Image/Report

Distribution

(LAN/WAN)

Archiving

Radiologist

Workflow

Technologist

Workflow

Scheduling

Registration

Image/Report

Distribution

(WEB)

Image

Visualization

Billing

Dictation

Document

Management

Merge eFilm

Overview

FUSION:

Solutions

for

Every

Workflow

Need

41

Merge eFilm

Overview

Market Presence - Direct Sale

Customers

200+ FUSION RIS, PACS and RIS/PACS

Customers, representing approximately

390 healthcare facilities

50,000+ eFilm Workstation users -

market leader in diagnostic imaging

software

500+ healthcare organizations using

Merge eFilm component and

connectivity products

Fastest

Growing

Customer

Base in the

Sector

42

Overview of Merge eFilm

eFilm Workstation

Distributed online via website

50,000+ eFilm Workstation

users world-wide

eFilm e-commerce Strategy:

Branding and market presence

Own the physician desktop

Generate add-on sale opportunities

for the FUSION RIS, PACS and

RIS/PACS Solutions

43

A Visionary Combination

January

2005

44

+

A Visionary Combination

Thank You