SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the registrant x Filed by a party other than the registrant ¨

Check the appropriate box:

| ¨ | Preliminary proxy statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive proxy statement |

| ¨ | Definitive additional materials |

| ¨ | Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12 |

VALASSIS COMMUNICATIONS, INC.

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, schedule or registration statement no.: |

VALASSIS COMMUNICATIONS, INC.

19975 VICTOR PARKWAY

LIVONIA, MI 48152

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

AND PROXY STATEMENT

TO BE HELD MAY 15, 2007

It is my pleasure to invite you to this year’s annual meeting of stockholders of Valassis Communications, Inc., which will be held at Valassis Corporate Headquarters, 19975 Victor Parkway, Livonia, Michigan 48152 on the 15th day of May, 2007, at 9:00 a.m. (Eastern Daylight Time). The purpose of the annual meeting is to:

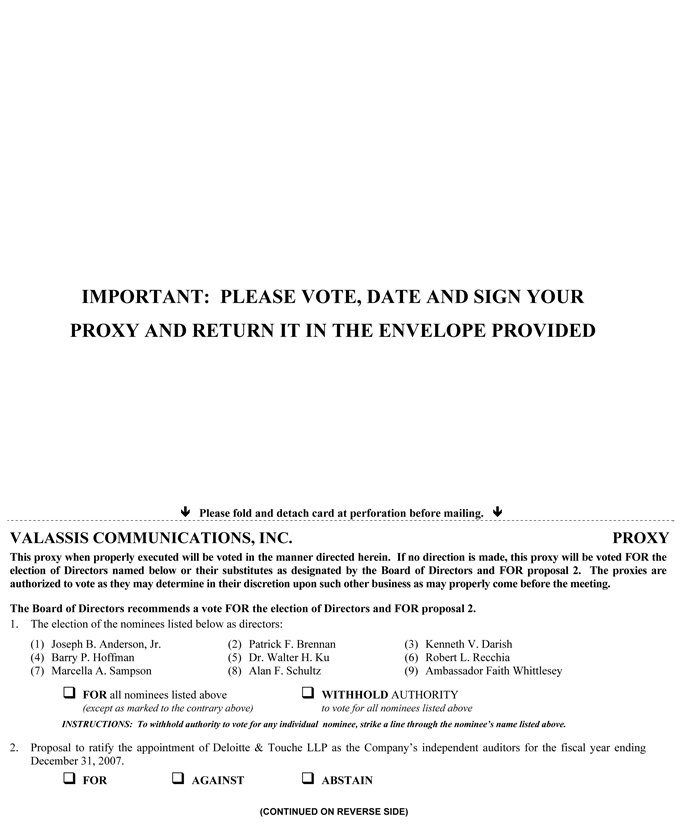

| | (1) | elect nine directors to our Board of Directors to hold office until our next annual meeting of stockholders or until their respective successors are duly elected and qualified; |

| | (2) | ratify the selection of Deloitte & Touche LLP as our independent auditors for the fiscal year ending December 31, 2007; and |

| | (3) | consider any other appropriate matters as may properly come before the annual meeting or any adjournment or adjournments thereof. |

Our Board of Directors has fixed the close of business on March 20, 2007 as the record date for the determination of the stockholders entitled to notice of and to vote at the annual meeting. Each share of our common stock is entitled to one vote on all matters presented at the annual meeting.

ALL HOLDERS OF OUR COMMON STOCK (WHETHER THEY EXPECT TO ATTEND THE ANNUAL MEETING OR NOT) ARE REQUESTED TO COMPLETE, SIGN, DATE AND RETURN PROMPTLY THE PROXY CARD ENCLOSED WITH THIS NOTICE OR VOTE BY TELEPHONE OR ON THE INTERNET ACCORDING TO THE INSTRUCTIONS ON THE PROXY CARD.

|

| By Order of the Board of Directors, |

|

| |

BARRY P. HOFFMAN Secretary |

April 9, 2007

TABLE OF CONTENTS

i

Table of Contents (cont.)

ii

VALASSIS COMMUNICATIONS, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 15, 2007

INTRODUCTION

This proxy statement is being furnished to stockholders of record of Valassis Communications, Inc. (“Valassis,” the “Company,” “we,” “us” or “our”) as of March 20, 2007, in connection with the solicitation by our Board of Directors of proxies for the 2007 annual meeting of stockholders to be held at Valassis Corporate Headquarters, 19975 Victor Parkway, Livonia, Michigan 48152 on May 15, 2007 at 9:00 a.m. (Eastern Daylight Time), or at any and all adjournments thereof, for the purposes stated in the notice of annual meeting. The approximate date of mailing of this proxy statement and the enclosed form of proxy is April 9, 2007.

QUESTIONS AND ANSWERS

ABOUT THE ANNUAL MEETING AND VOTING

What is the purpose of the annual meeting?

At our annual meeting, stockholders will act upon the matters outlined in the notice of annual meeting on the cover page of this proxy statement, including the election of directors and the ratification of our independent auditors.

Who is entitled to vote at the meeting?

Only stockholders of record at the close of business on March 20, 2007 are entitled to receive notice of and to participate in the annual meeting. If you were a shareholder of record on that date, you will be entitled to vote all of the shares that you held on that date at the meeting, or at any postponements or adjournments of the meeting.

What are the voting rights of the holders of our common stock?

Each share of our common stock, par value $.01 per share, outstanding on March 20, 2007 will be entitled to one vote on each matter considered at the annual meeting.

Who can attend the annual meeting?

All stockholders of our common stock as of March 20, 2007, or their duly appointed proxies, may attend the annual meeting, and each may be accompanied by one guest. Registration will begin at 8:00 a.m., and seating will begin at 8:30 a.m. If you attend, please note that you may be asked to present valid picture identification, such as a driver’s license or passport.

Please also note that if you hold your shares in “street name” (that is, through a broker or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of March 20, 2007 and check in at the registration desk at the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of our common stock, issued and outstanding as of March 20, 2007, will constitute a quorum. As of March 20, 2007, we had 47,878,238 shares of our common stock outstanding. Therefore, the presence of the holders of our common stock representing at least 23,939,120 votes will be required to establish a quorum.

Proxies received but indicating abstentions and broker non-votes will be included in the calculation of the number of votes considered to be present at the annual meeting.

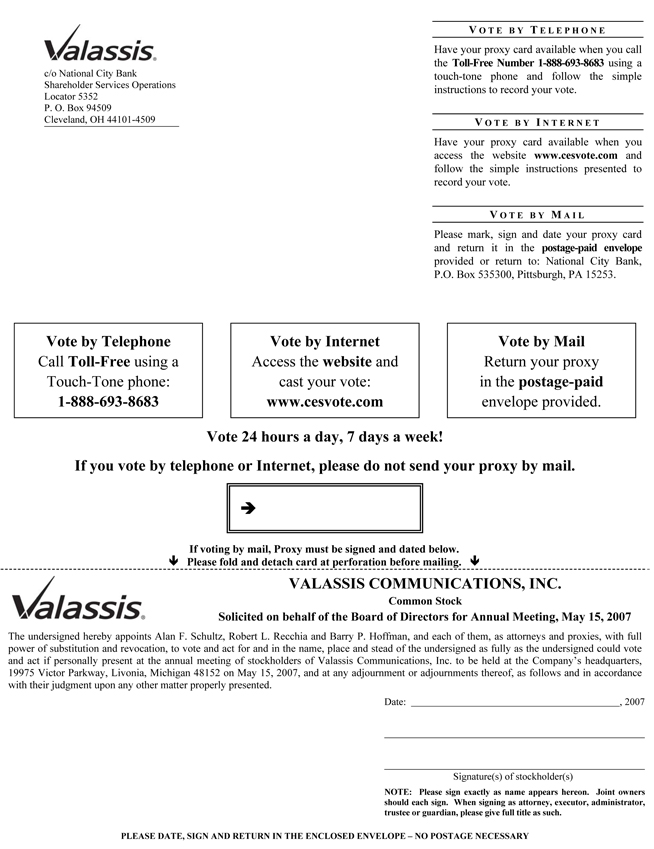

How do I vote?

By Mail

Be sure to complete, sign and date the proxy card and return it to us in the prepaid envelope. If you are a shareholder and you return your signed proxy card but do not indicate your voting preferences, the persons named in the proxy card will vote the shares represented by that proxy as recommended by the Board of Directors.

1

By Telephone or on the Internet

Our telephone and Internet voting procedures for stockholders are designed to authenticate your identity, to allow you to give your voting instructions and to confirm that those instructions have been properly recorded.

You can vote by calling the toll-free telephone number on your proxy card. Please have your proxy card in hand when you call.

The Web site for Internet voting is www.cesvote.com. Please have your proxy card handy when you go online. As with telephone voting, you can confirm that your instructions have been properly recorded.

Telephone and Internet voting facilities for stockholders will be available 24 hours a day, 7 days a week. If you vote by telephone or on the Internet, you do not have to return your proxy card.

In Person at the Annual Meeting

All stockholders may vote in person at the annual meeting. You may also be represented by another person at the annual meeting by executing a proper proxy designating that person. “Street name” stockholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares.

Our Board of Directors has appointed National City Bank, our transfer agent and registrar, to serve as our Inspector of Election and tabulate and certify the votes at the annual meeting.

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy, you may revoke or change your vote at any time before the proxy is exercised by filing with our Corporate Secretary either a notice of revocation or a duly executed proxy bearing a later date or by voting another proxy by telephone or on the Internet at a later date. The powers of the proxy holders will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

What are our Board of Directors’ recommendations?

Unless you give other instructions on your proxy card, or by telephone or on the Internet, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of our Board of Directors. Our Board of Directors’ recommendation is set forth together with the description of each item in this proxy statement. In summary, our Board of Directors recommends a vote:

| | • | | for election of the nominated slate of directors (see Item 1); and |

| | • | | for ratification of the appointment of Deloitte & Touche LLP as our independent auditors for fiscal year ending December 31, 2007 (see Item 2). |

With respect to any other matter that properly comes before the annual meeting, the proxy holders will vote as recommended by our Board of Directors or, if no recommendation is given, in their own discretion.

What vote is required to approve each item?

Election of Directors. The affirmative vote of a plurality of the votes cast at the meeting is required for the election of directors. This means that the director nominee with the most votes for a particular slot is elected for that slot. A properly executed proxy indicating “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum.

Other items. For each other item, the affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote on the item will be required for approval. A properly executed proxy indicating “ABSTAIN” with respect to any such matter will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Therefore, if you do not give your broker or nominee specific instructions, your shares may not be voted on those matters and will not be counted in

2

determining the number of shares necessary for approval. These “broker non-votes” will not be counted as part of the total number of votes cast on such proposals. Therefore, a “broker non-vote” will have no effect in determining whether any given proposal has been approved by the stockholders. Shares represented by such “broker non-votes” will, however, be counted in determining whether there is a quorum.

DIRECTORS AND EXECUTIVE OFFICERS

Our Board of Directors presently is comprised of nine directors. All nine directors elected at the 2007 annual meeting will serve until our next annual meeting or until their respective successors are duly elected and qualified.

ELECTION OF DIRECTORS (PROPOSAL 1)

Set forth below is certain information with respect to each of our nominees for the office of director and each of our other executive officers.

Shares represented by proxies returned duly executed will be voted, unless otherwise specified, in favor of the following nine nominees: Joseph B. Anderson, Jr., Patrick F. Brennan, Kenneth V. Darish, Barry P. Hoffman, Dr. Walter H. Ku, Robert L. Recchia, Marcella A. Sampson, Alan F. Schultz and Ambassador Faith Whittlesey. Each nominee for director has consented to serve on our Board of Directors and will be elected by a plurality of the votes cast at the annual meeting. If any (or all) such persons should be unavailable or unable to serve, the persons named in the enclosed proxy will vote the shares covered thereby for any substitute nominee (or nominees) as our Board of Directors may select. Stockholders may withhold authority to vote for any nominee by indicating “WITHHOLD AUTHORITY” on the proxy and by entering the name of such nominee in the space provided for such purpose on the proxy or specifying the name of such nominee by telephone.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL OF THE NOMINEES NAMED IN THIS PROXY STATEMENT.

Directors

Joseph B. Anderson, Jr., 64, has served as our director since July 2006. Mr. Anderson serves as the Chairman and Chief Executive Officer of TAG Holdings, LLC, the parent company of a diverse range of businesses in the United States, Korea and China, including the manufacture of automotive parts, plumbing products and assembly and supply chain management services. Prior to joining TAG Holdings, Mr. Anderson was the Chairman and Chief Executive Officer of Chivas Industries, LLC, a manufacturer of products for the automotive industry, from 1994 until 2002. Mr. Anderson began his business career with General Motors in 1979 and in 1990 was appointed as General Director of a GM business. Mr. Anderson currently serves on the boards of Rite Aid Corporation, Quaker Chemical Corporation, ArvinMeritor, Inc. and Sierra Pacific Resources. Mr. Anderson’s professional and civic affiliations include chairman of the Original Equipment Suppliers Association, director of the Society of Automotive Engineers Foundation and executive committee member of the National Association of Black Automotive Suppliers. Mr. Anderson also serves on the board of trustees of Kettering University.

Patrick F. Brennan, 75, has served as our director since August 1998. After serving for 33 years in the paper industry, he retired in December 1996 as the President and Chief Executive Officer of Consolidated Papers, Inc. (“CPI”), where under his leadership CPI was one of the nation’s leading paper companies. Until November 2001, Mr. Brennan served as a member of the Board of Directors of Northland Cranberries, Inc., a juice manufacturing company.

Kenneth V. Darish, 48, has served as our director since June 2001. Since September 2001, he has been the Director of Business Operations of BBDO Detroit, a subsidiary of Omnicom providing operational consulting services to the Creative Director. Since February 2005, he has also served as the Chief Financial Officer of BBDO Windsor, Ontario. From September 1984 until July 2001, Mr. Darish served as the Chief Financial Officer and Senior Vice President of FCB Advertising-Detroit, a subsidiary of Interpublic Group of Companies. Mr. Darish is a certified public accountant.

Barry P. Hoffman, 65, has served as our Executive Vice President, General Counsel and Secretary since July 1991 and has served as our director since January 2002. Mr. Hoffman has been with us since 1982. He is recognized in the field of promotion law.

Dr. Walter H. Ku,Ph.D., 71, has served as our director since February 2003. Dr. Ku is an internationally known scientist in the field of electronic systems and systems controls. He is professor of electrical and computer engineering at the University of California, San Diego, and is the founding director of the National Science Foundation Industry/University Cooperative Research Center on Ultra High-Speed Integrated Circuits and Systems. His extensive consulting activities and

3

internationally recognized expertise have assisted businesses with developing high-level international relationships and opportunities. He was a full professor at Cornell University and the first occupant of the Naval Electronic Systems Command Research Chair Professorship at the Naval Post-Graduate School. Dr. Ku also consults and teaches in China and Taiwan.

Robert L. Recchia, 50, has been our Executive Vice President, Chief Financial Officer, Treasurer and our director since October 1991. Mr. Recchia has been with us since 1982. Mr. Recchia is a certified public accountant with audit experience with Deloitte & Touche LLP.

Marcella A. Sampson, 76, has served as our director since August 1998. She retired in 1999 from Central State University in Wilberforce, Ohio. During her 35 years of service to Central State, she served as Dean of Students and directed the Central State University Career Services Center since 1975. She has received awards and honors for her work in the field of education and is a recognized expert in college student placement, particularly experiential opportunities.

Alan F. Schultz, 48, has served as our director since December 1995. He is Chairman of our Board of Directors, President and Chief Executive Officer. Mr. Schultz was elected Chief Executive Officer and President in June 1998 and appointed Chairman of the Board of Directors in December 1998. He served as our Executive Vice President and Chief Operating Officer from 1996 through 1998 and served as our Executive Vice President of Sales and Marketing from 1992 through 1996. Mr. Schultz has held positions as our Director of Insert Operations and Vice President of the Central Sales Division beginning in 1984. Mr. Schultz is a certified public accountant with audit experience with Deloitte & Touche LLP and currently serves on the Board of Directors for both the Advertising Council, Inc., “Ad Council,” and R.H. Donnelley Corporation. Mr. Schultz also currently serves on the Board of Directors for the American Advertising Federation as Treasurer.

Ambassador Faith Whittlesey, 68, has served as our director since January 1992. Ambassador Whittlesey has had a long career in law, diplomacy and government at local, state, and national levels. She has served as Chairman of the Board of the American Swiss Foundation, headquartered in New York, since 1989 and is also President of Maybrook Associates since 1998. She served two tours of duty as U.S. Ambassador to Switzerland from 1981 to 1983 and from 1985 to 1988. From 1983 to 1985, Ambassador Whittlesey was a member of the senior White House staff. Ambassador Whittlesey is also a member of the Board of the Institute of World Politics in Washington, DC, a graduate school of statecraft and national security affairs, where she served as Chairman for six years. Ambassador Whittlesey served as a member of the Board of Directors and the Compensation Committee of the Sunbeam Corporation from November 1996 until December 2002.

Additional Executive Officers

In addition to our executive officers who are listed as being directors, we (including our subsidiaries) have the following executive officers:

Richard Herpich, 54, has served as Executive Vice President of U.S. Sales since December 2003. From June 1998 through November 2003, he served as our Executive Vice President of Manufacturer Services. He served as National Sales Manager from January 1996 through June 1998, Vice President, Midwest Sales Division from June 1994 through December 1995 and Account Manager from 1978 through June 1994.

William F. Hogg,Jr., 60, has served as our Executive Vice President of Manufacturing and Client Services since October 2001 and has been with us for over 25 years. Currently he is leading the integration process in connection with the acquisition of ADVO, Inc., or ADVO, our new wholly-owned subsidiary. He served as Vice President of our Durham Printing Division from June 1983 to September 2001.

Brian Husselbee, 55, has been the President and Chief Executive Officer of NCH Marketing Services, Inc. (“NCH”) since July 1997, and was General Manager of NCH, from January 1997 to July 1997. We acquired NCH in February 2003. Mr. Husselbee served as a director from August 1998 until February 2003, the time that the NCH acquisition was consummated.

Robert A. Mason, 49, has served as President of ADVO since the consummation of the ADVO acquisition on March 2, 2007. Previously, he served as our Senior Vice President, Retail and Services. Mr. Mason has assumed general management and profit and loss responsibilities while focusing on sales and marketing efforts. He also provides strategic direction for ADVO, working closely with leaders across both companies. Prior to his recent role with us, Mr. Mason was a successful Account Executive and Director of Sales for us, and has been recognized as Sales Person of the Year and Team Player of the Year. Before joining us in 1995, he held a variety of positions within the newspaper and printing industries.

4

OUR CORPORATE GOVERNANCE PRINCIPLES

Our Board of Directors has general oversight responsibilities for our business, property and affairs pursuant to the General Corporation Law of the State of Delaware and our by-laws. In exercising its fiduciary duties, our Board of Directors represents and acts on behalf of our stockholders. Although the Board of Directors does not have responsibility for the day-to-day management of our company, members of the Board of Directors stay informed about our business through discussions with Alan F. Schultz, our President and Chief Executive Officer, and with key members of our management, by reviewing materials provided to them and by participating in meetings of our Board of Directors and its committees. Our Board of Directors provides guidance to management through periodic meetings, site visits and other interactions. Additional details concerning the role and structure of our Board of Directors are in our Corporate Governance Guidelines, which can be found in the “Investor/Corporate Governance” section of our Web site atwww.valassis.com.

Policies and Procedures

We have a Code of Business Conduct and Ethics for our directors, officers and employees as well as Corporate Governance Guidelines to ensure that our business is conducted in a consistently legal and ethical manner. In addition, our Board of Directors recently adopted a Policy on Related Person Transactions, which sets forth policies and procedures governing the review, and when required pursuant to the policy, the approval or ratification of related person transactions by our Corporate Governance/Nominating Committee. We have spent a considerable amount of time and effort reviewing and improving our corporate governance policies and practices. This includes comparing our current policies and practices to policies and practices suggested by various groups or authorities active in corporate governance and practices of other public companies. Based upon this review, we periodically adopt certain changes that our Board of Directors believes are the best corporate governance policies and practices for us. We also adopt changes, as appropriate, to comply with the Sarbanes-Oxley Act of 2002 and any rule changes made by the SEC and the New York Stock Exchange. We believe that our current policies and procedures form the foundation for an open relationship among colleagues that contributes to good business conduct as well as the high integrity level of our employees.

Determination of Director Independence

Under the rules of the New York Stock Exchange, our Board of Directors is required to affirmatively determine the independence of each director based on the absence of any material relationship between us and the director. These determinations are required to be disclosed in this proxy statement. Our Board of Directors has established guidelines to assist it in making these determinations. These guidelines, which are attached to this proxy statement asExhibit A, include all elements of the Corporate Governance Rules of the New York Stock Exchange on this subject. For relationships between us and a director not covered by the guidelines, the determination of independence is made by the other members of our Board of Directors who are independent. Members of the Audit, Compensation/Stock Option and Corporate Governance/Nominating Committees must meet all applicable independence tests of the New York Stock Exchange, Securities and Exchange Commission and the Internal Revenue Service. During our fiscal year ended December 31, 2006, Messrs. Anderson, Brennan, Darish and Goldstein and Dr. Ku and Ms. Sampson and Ambassador Whittlesey, during the time that each served as a director, served as our independent directors. Based on these guidelines, our Board of Directors, at its meeting on March 13, 2007, determined that Messrs. Anderson, Brennan and Darish and Dr. Ku, Ms. Sampson and Ambassador Whittlesey are still independent.

Presiding Director

In September 2002, our Board of Directors determined that the directors who are deemed independent based on the New York Stock Exchange rules will meet in executive session at each Board of Directors meeting and that the independent director with the most seniority on our Board of Directors will preside. The independent directors are also our non-management directors and, as such, these non-management directors will meet in regularly scheduled executive sessions without management present. Ambassador Whittlesey currently serves as the presiding director at all such executive sessions.

Attendance

During the fiscal year ended December 31, 2006, our Board of Directors held 18 meetings (including regularly scheduled and special meetings). Each director attended at least 75% of the meetings held by our Board of Directors during the period in which that director served, including the meetings held by the committees on which that director served as a member. It is our Board of Directors’ policy that the directors should attend our annual meeting of stockholders absent exceptional circumstances. All of the directors nominated at the 2006 annual meeting of stockholders attended such annual meeting.

5

COMMITTEES OF THE BOARD

The standing committees of our Board of Directors include our Executive Committee, our Audit Committee, our Compensation/Stock Option Committee and our Corporate Governance/Nominating Committee.

Our Executive Committee, whose members are Alan F. Schultz, Robert L. Recchia and Ambassador Faith Whittlesey, is generally authorized to exercise the management powers of our Board of Directors; provided, however, that our Executive Committee does not have the authority to declare cash dividends, amend our certificate of incorporation, adopt an agreement of merger or consolidation, recommend the disposition of all or substantially all of our assets or recommend our dissolution. Our Executive Committee did not meet during the fiscal year ended December 31, 2006.

Our current Audit Committee’s members are Patrick F. Brennan, Ambassador Faith Whittlesey, Kenneth V. Darish and Joseph B. Anderson, who became a committee member in December 2006. Our Audit Committee recommends the selection of our independent auditors, discusses and reviews the scope and the fees of the prospective annual audit and reviews the results of each audit with the independent auditors. Our Audit Committee also reviews compliance with our existing major accounting and financial policies, reviews the adequacy of our financial organization and reviews management’s procedures and policies relevant to the adequacy of our internal accounting controls and compliance with federal and state laws relating to accounting practices. We have appointed an internal auditor that reports directly to our Audit Committee. Our Audit Committee held four meetings during the fiscal year ended December 31, 2006. Our Board of Directors has determined that Kenneth V. Darish meets the New York Stock Exchange standard of having accounting or related financial management expertise and the SEC’s definition of an “audit committee financial expert.” Each of the other members of our Audit Committee has financial management experience or is financially literate. Our Board of Directors has determined that each committee member meets the additional independence requirements for members of an audit committee in the New York Stock Exchange Corporate Governance Rules. Our Board of Directors has adopted a written charter for this committee setting out the functions that this committee is to perform, which can be found on our Web site atwww.valassis.com.

Our Compensation/Stock Option Committee’s members are Ambassador Faith Whittlesey, Patrick F. Brennan and Marcella A. Sampson. Our Compensation/Stock Option Committee administers our 2002 Long-Term Incentive Plan, our Broad-Based Incentive Plan, our Amended and Restated Senior Executives Annual Bonus Plan, our 2005 Executive Restricted Stock Plan, our 2005 Employee and Director Restricted Stock Award Plan, our Employee Stock Purchase Plan and our Supplemental Benefit Plan, as amended. Our Compensation/Stock Option Committee also reviews and approves the annual salary, bonus and other benefits, direct or indirect, of the members of our senior management. The Committee’s primary procedures for establishing and overseeing executive compensation can be found in the Compensation Discussion and Analysis section under “Compensation-Setting Process.” During the year ended December 31, 2006, partially as a result of our acquisition of ADVO and the combination of ADVO’s large employee base with our employees, the Compensation/Stock Option Committee retained Towers Perrin Human Resources Services, a human resources consulting firm, to review its compensation program and recommend appropriate changes. Towers Perrin was tasked with comparing the compensation for each of the 120 positions at our company with the compensation for similar persons in similar positions in the general industry. Following Tower Perrin’s initial presentation of its finding, the Compensation/Stock Option Committee asked Towers Perrin to refine its findings and recommendations. Our Compensation/Stock Option Committee intends to use Tower Perrins’ findings and analysis to assist it in negotiating the terms of our executive officers’ contracts when they come up for renewal. The use of an independent consultant provides additional assurance that our executive compensation programs are reasonable and consistent with our objectives and industry standards. Our Compensation/Stock Option Committee is comprised of non-employee directors as such term is defined under Rule 16b-3 of the Securities Exchange Act of 1934, as amended, or the Exchange Act. During the fiscal year ended December 31, 2006, our Compensation/Stock Option Committee met five times. Our Board of Directors has adopted a written charter for this committee setting out the functions that this committee is to perform, which can be found on our Web site atwww.valassis.com.

Our Corporate Governance/Nominating Committee’s members are Marcella A. Sampson, Kenneth V. Darish and Dr. Walter H. Ku. Our Corporate Governance/Nominating Committee (i) assists our Board of Directors by identifying individuals qualified to become Board members and recommends to our Board of Directors the director nominees for the next annual meeting of stockholders, (ii) recommends to our Board of Directors the corporate governance guidelines applicable to us and (iii) takes a leadership role in shaping our corporate governance. Our Corporate Governance/Nominating Committee held two meetings during the fiscal year ended December 31, 2006. Our Board of Directors has adopted a written charter for this committee setting out the functions that this committee is to perform, which can be found on our Web site atwww.valassis.com.

Our Corporate Governance/Nominating Committee evaluates the current members of our Board of Directors at the time they are considered for nomination. Our Corporate Governance/Nominating Committee also considers whether any new

6

members should be added to our Board of Directors. In the past, candidates for independent director have been found through recommendations from members of our Board of Directors and other employees at our company. The Corporate Governance/Nominating Committee may also seek help from an executive search firm to assist in the selection process.

Our Corporate Governance/Nominating Committee has not established any specific minimum qualifications for a director but has adopted a set of criteria, which is attached to this proxy statement asExhibit B, describing the qualities and characteristics that are sought for our Board of Directors as a whole. Our Corporate Governance/Nominating Committee does not give these criteria any particular weight and they are not equally applicable to all nominees. Our Corporate Governance/Nominating Committee may also from time to time identify particular characteristics to look for in a candidate in order to balance the skills and characteristics of our Board of Directors. Our Corporate Governance/Nominating Committee may modify these criteria from time to time and adopt special criteria to attract exceptional candidates to meet our specific needs.

Our Corporate Governance/Nominating Committee will consider recommendations from stockholders of potential candidates for nomination as director. Recommendations should be made in writing, including the candidate’s written consent to be nominated and to serve, and sufficient background information on the candidates to enable our Corporate Governance/Nominating Committee to properly assess the candidate’s qualifications. Recommendations should be addressed to our Corporate Secretary at our principal office and must be received no later than October 1, 2007 in order to be considered for the next annual meeting. The process for evaluating potential candidates recommended by stockholders and derived from other sources is substantially the same.

COMPENSATION/STOCK OPTION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During the fiscal year ended December 31, 2006, Ambassador Faith Whittlesey, Patrick F. Brennan and Marcella A. Sampson served on the Compensation/Stock Option Committee. None of our Compensation/Stock Option Committee members (i) have ever been an officer or employee of our company, (ii) is or was a participant in a “related person” transaction in fiscal year 2006 (see the section entitled “Certain Relationships and Related Transactions” for a description of our Policy on Related Person Transactions) and (iii) is an executive officer of another entity, at which one of our executive officers serves on the board of directors.

7

INDEPENDENT DIRECTOR COMPENSATION

The table below summarizes the compensation paid by us to non-employee directors for the fiscal year ended December 31, 2006.

| | | | | | | | |

Name | | Fees

Earned

or Paid

in Cash

($) | | Stock

Awards

($)(1) | | Option

Awards

($)(2) | | Total

($) |

Patrick F. Brennan | | 55,885 | | 24,001 | | 126,238 | | 206,124 |

Kenneth V. Darish | | 52,783 | | 24,001 | | 126,238 | | 203,022 |

Dr. Walter H. Ku, PhD | | 52,166 | | 24,001 | | 126,238 | | 202,405 |

Marcella A. Sampson | | 52,783 | | 24,001 | | 126,238 | | 203,022 |

Ambassador Faith Whittlesey | | 53,918 | | 24,001 | | 126,238 | | 204,157 |

Joseph B. Anderson, Jr. | | 22,353 | | 12,006 | | 8,500 | | 42,859 |

Seth Goldstein(3) | | 13,055 | | 11,995 | | 131,888 | | 156,938 |

(1) | This column represents the dollar amount recognized for financial statement reporting purposes with respect to the 2006 fiscal year for the fair value of restricted stock granted in 2006 as well as prior fiscal years, in accordance with SFAS 123R. Pursuant to SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. For additional information, refer to Note 8 of our financial statements in our Annual Report on Form 10-K/A for the year ended December 31, 2006, as filed with the SEC. These amounts reflect our accounting expense for these awards, and do not correspond to the actual value that will be realized by the directors. |

(2) | This column represents the dollar amount recognized for financial statement reporting purposes with respect to the 2006 fiscal year for the fair value of stock options granted in 2006 as well as prior fiscal years, in accordance with SFAS 123R. Pursuant to SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. The stock options reflected in this column (in the form of dollar amounts) were granted on one or more of the following dates: April 1, 2005, October 1, 2005, April 1, 2006 and October 1, 2006 and had grant date fair values estimated using the Black-Scholes option-pricing method in accordance with SFAS 123R of $12.95, $15.76, $11.32 and $6.80, respectively. For additional information on the valuation assumptions with respect to the 2006 grants, refer to Note 8 of our financial statements in our Annual Report on Form 10-K/A for the year ended December 31, 2006, as filed with the SEC. These amounts reflect the company’s accounting expense for these awards, and do not correspond to the actual value that will be realized by the directors. The following directors have outstanding options as of December 31, 2006: Mr. Anderson (5,000), Mr. Brennan (44,000), Mr. Darish (39,000), Dr. Ku (30,000), Ms. Sampson (44,000) and Ambassador Whittlesey (66,000). |

(3) | Mr. Goldstein served as our director from March 1999 until May 2006. |

Beginning in 2007, our independent directors, or non-employee directors, are entitled to receive the following fees in connection with their participation on our Board of Directors and related Board committees: (i) an annual independent director retainer fee of $48,000 (an increase of $6,588 from 2006), which is comprised of $24,000 in cash (an increase of $6,626 from 2006) plus an annual grant of restricted stock, pursuant to our 2005 Employee and Director Restricted Stock Award Plan, having an aggregate fair market value equal to $24,000 granted on a pro-rated quarterly basis; and (ii) $2,570 (an increase of $87 from 2006) per board meeting attended in person, $1,284 (an increase of $43 from 2006) per board meeting attended by telephone, $1,284 (an increase of $43 from 2006) per committee meeting attended in person and $642 (an increase of $22 from 2006) per committee meeting attended by telephone. The committee attendance fees are payable only if the committee meeting is not scheduled in conjunction with (just before or after) a Board of Directors meeting and telephonic meeting fees are paid on a pro-rated basis if an independent director does not participate via telephone for the entire meeting.

In addition, our independent directors are eligible to receive non-qualified options to purchase an aggregate of 10,000 shares of our common stock annually pursuant to our 2002 Long-Term Incentive Plan (or such other plan applicable to our independent directors in effect from time to time). These options are granted in two semi-annual installments consisting of 5,000 stock options on April 1 and October 1 of each year, and have a strike price equal to the fair market value (as defined in our applicable stock option plan) of our common stock on the date of grant and become fully vested one year from the date of grant, with the same terms and conditions as our standard non-qualified stock option agreement for independent directors.

8

Upon a change of control (as defined in our applicable stock option plan) all shares with respect to which any option granted prior to the change of control shall become fully exercisable. In addition, if any payment provided to our independent directors on account of such acceleration of exercisability of such options upon a change of control would be subject to the excise tax imposed by Section 4999 of the Internal Revenue Code of 1986 or any successor provision, our independent directors will be entitled to a gross-up payment.

Directors who are also our employees or employees of any of our affiliates do not receive any compensation for their services as a director. Accordingly, Messrs. Hoffman, Recchia and Schultz are not compensated as such for their services as directors.

9

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

COMPENSATION PHILOSOPHY

Our compensation philosophy is to develop and implement policies that will encourage and reward outstanding financial performance, seek to increase our profitability, and thereby increase stockholder value. Accordingly, a high proportion of executive compensation is tied in some manner to both short-term and long-term corporate performance. Maintaining competitive compensation levels in order to attract, retain and reward executives who bring valuable experience and skills to us is also an important consideration. Our executive compensation programs are designed to attract, hire and retain talented individuals and motivate them to achieve our business objectives and performance targets, including increasing long-term stockholder value. Most of our compensation elements simultaneously fulfill one or more of our performance, alignment and retention objectives.

COMPENSATION-SETTING PROCESS

Our management plays a significant role in the compensation-setting process. The most significant aspects of management’s role are:

| | • | | evaluating executive performance; |

| | • | | establishing business performance targets and objectives; and |

| | • | | recommending salary levels and equity awards. |

Working with management, our Compensation/Stock Option Committee of our Board of Directors then develops and implements compensation plans for our senior management. It conducts an annual review of our goals and objectives as related to the form and amount of executive compensation.

As is the case for all of our employees at a level of Vice President or above, each of our executive officers named in the Summary Compensation Table for Fiscal Year 2006 (whom we refer to as our named executive officers) is currently employed pursuant to a multi-year employment agreement. These multi-year employment agreements retain the services of the executives for an extended period and bind former executives to non-competition and non-solicitation obligations. Each of our named executive officers has been employed by us for over 20 years. The employment agreements with such named executive officers were first entered into immediately prior to our initial public offering consummated in 1992.

The minimum compensation to which each named executive officer is entitled is specified in their respective employment agreements. Accordingly, the Compensation/Stock Option Committee’s primary opportunity to modify fixed terms of executive compensation to reflect policy changes is at the time the agreement is up for renewal.

The length of time employment agreements are extended into the future is a result of a variety of factors, including the staggering of expiration dates of other executive employment agreements, the roles and responsibilities of the executive and a risk assessment of the executive being hired by one of our competitors.

In establishing and administering the variable elements in the compensation of our named executive officers, our Compensation/Stock Option Committee tries to recognize individual contributions, as well as overall business results. Compensation levels are also determined based upon the executive’s responsibilities, the efficiency and effectiveness with which he or she marshals resources and oversees the matters under his or her supervision, the degree to which he or she has contributed to the accomplishments of major tasks that advance our goals, including sales growth, earnings and acquisitions, and our current competitive environment, employee retention and morale. Our financial performance is a key factor that affects the overall level of compensation for our named executive officers.

During 2006, partially as a result of our then-pending acquisition of ADVO, Inc. and the combination of ADVO’s large employee base with the employees of Valassis, our Compensation/Stock Option Committee retained Towers Perrin Human Resources Services to review its compensation program and recommend appropriate changes. Since many of the businesses with which we compete for executive talent are substantially larger and have greater financial resources than we do, Towers Perrin compared the compensation for each of the 120 positions at our combined company with the compensation for similar persons in similar positions in the general industry, rather than limiting the comparison to our specific product competitors.Towers Perrin made a presentation to our Compensation/Stock Option Committee of its preliminary findings and

10

recommendations at a meeting held on September 18, 2006. Following that meeting, our Compensation/Stock Option Committee hired Towers Perrin to refine its findings and recommendations and consult directly with the Committee. Our Compensation/Stock Option Committee intends to use the findings and analysis of Towers Perrin to assist it in negotiating the executive officer’s employment agreements that come up for renewal.

COMPENSATION ELEMENTS

Our cash and equity compensation structure for named executive officers includes the following elements:

| | • | | stock options and restricted stock awards; |

| | • | | retirement and other benefits; and |

| | • | | modest perquisites and personal benefits. |

Cash Compensation

The annual cash compensation of our named executive officers consists of annual salary and cash bonuses. The cash compensation of each named executive officer (other than the Chief Executive Officer) may be increased based on an annual review of such officer’s performance by the Chief Executive Officer and his recommendations to our Compensation/Stock Option Committee. The cash compensation of the Chief Executive Officer may also be increased based on an annual review of his performance by the Compensation/Stock Option Committee.

(1) Salary

Base salary is the guaranteed element of an executive’s annual cash compensation. The salary of our named executive officers is governed by their employment agreements. During the years ended December 31, 2005 and 2006, our Compensation/Stock Option Committee did not increase named executive officer salaries given our financial performance.

(2) Incentive Bonuses

We have established and structured our annual cash bonus program to align executive goals with our earnings growth objectives for the current year. Under the employment agreements with our named executive officers, each is entitled to an incentive bonus of up to 100% of base salary if certain performance goals set by our Compensation/Stock Option Committee, or, in the case of Messrs. Herpich and Hogg, our Compensation/Stock Option Committee and Chief Executive Officer, are met. This reflects our objective of ensuring that a substantial amount of each named executive officer’s compensation is tied to the achievement of specific performance goals.

Pursuant to the named executive officer employment agreements, the 2006 incentive bonuses were paid two times during the year and were contingent upon our meeting semi-annual earnings per share, or EPS, targets that were set by our Compensation/Stock Option Committee in December 2005 for the six-month periods ending June 30, 2006 and December 31, 2006. Typically, our Compensation/Stock Option Committee sets the semi-annual EPS targets at the mid-point of the range of the EPS guidance that we intend to give to our stockholders in our earnings release. No bonus attributable to EPS performance targets is payable to any named executive officer unless actual EPS exceeds 70% of the EPS target for the period. In determining whether the performance targets have been achieved, the Compensation/Stock Option Committee adjusts for certain items described below under “Adjustments for Certain Items.” The Compensation/Stock Option Committee considered the expected decline in EPS for 2006 as compared to 2005 and, as a result, decided to limit for 2006 the annual amount of the bonus opportunity that each named executive officer could earn to 80% (or 40% with respect to each semi-annual bonus opportunity) of the executive’s annual base salary even in the event that the performance targets were obtained. The threshold and target award opportunities for the semi-annual cash incentive bonuses for 2006 are reported in the Grants of Plan-Based Awards in 2006 Fiscal Year table below. After the conclusion of the relevant six-month performance period, the Compensation/Stock Option Committee reviewed our applicable 2006 financial results and the resulting actual payments for 2006 (some of which were paid in 2007) are reported in the Summary Compensation Table for Fiscal Year 2006 in the column entitled “Non-Equity Incentive Compensation.” The actual semi-annual incentive bonuses paid to Messrs. Schultz, Hoffman and Recchia for 2006 represent the proportionate amounts of their respective target potential bonus opportunities (i.e., 40% of annual base salary) that correlate to the percentage of the EPS target (between 70% and 100%) achieved for the applicable six-month period during fiscal 2006. The actual semi-annual incentive bonuses

11

paid to Messrs. Herpich and Hogg represent the sum of (i) the proportionate amounts of their respective target potential bonus opportunities (i.e., 20% of annual base salary) that correlate to the percentage of the EPS target (between 70% and 100%) achieved for the applicable six-month period during fiscal 2006 and (ii) the proportionate amounts of their respective target bonus opportunities that correlate to the percentage of the individual performance targets achieved for the applicable six-month period of fiscal 2006 set by our Chief Executive Officer; provided that, in no event can the sum of the semi-annual bonuses for either Messrs. Herpich or Hogg exceed 80% of their respective annual base salary. Our Compensation/Stock Option Committee bases awards on meeting EPS targets for the following reasons:

| | • | | EPS is a meaningful measure of performance used by the marketplace to value stock. |

| | • | | We believe that a target based upon EPS emphasizes our commitment to reach and maintain a competitive rate of return on equity and achieve long-term growth in earnings, which are critical factors for assuring creation of value for our stockholders. |

| | • | | We believe that the use of EPS is an effective motivator because it is easy to track and clearly understood by employees. |

Adjustments for Certain Items

Consistent with past practice and based on criteria established at the beginning of the performance period, our Compensation/Stock Option Committee adjusted the earnings results on which 2006 bonuses and performance awards were determined to eliminate the effect of certain items. The adjustments are intended to ensure that award payments represent the underlying growth of the core business and are not artificially inflated or deflated due to such items either in the award year or the previous (comparator) year. For the 2006 awards calculation, our Compensation/Stock Option Committee adjusted EPS to eliminate costs related to the litigation with, and subsequent acquisition of, ADVO, costs related to interest rate swaps entered into in anticipation of financing the ADVO acquisition, restructuring costs and asset write-off charges.

Additionally, we believe that by providing for bonuses twice a year instead of annually, a greater sense of urgency will motivate named executive officers to meet the targets.

Equity Compensation

We believe that equity compensation fosters the long-term perspective necessary for our success and ensures that the executives properly focus on shareholder value. Non-cash compensation of named executive officers currently consists of options granted under our 2002 Long-Term Incentive Plan and restricted stock granted pursuant to our 2005 Executive Restricted Stock Plan or our 2005 Employee and Director Restricted Stock Award Plan. Until April 2006, stock options were granted to the named executive officers in accordance with the amounts, terms and conditions of their employment agreements. Similarly, the amounts of restricted stock awarded to the named executive officers is also set forth in the executive’s respective employment agreement, except for Mr. Hogg who receives discretionary amounts that are approved by our Compensation/Stock Option Committee . Because the employment agreements did not specify any amounts to be granted after April 2006 and, after factoring in our financial performance and the Committee’s general shift to lower the percentage of stock options granted, the Compensation/Stock Option Committee did not grant any additional options to the named executive officers for 2006.

As of January 1, 2007, the Compensation/Stock Option Committee granted options for fiscal 2007 in the following amounts: Mr. Schultz (45,000), Mr. Herpich (25,000), Mr. Hoffman (25,000), Mr. Hogg (25,000) and Mr. Recchia (25,000).

(1) Performance-based options

The exercise price of each stock option awarded to our named executive officers under our 2002 Long-Term Incentive Plan is the closing sales price of our common stock on the date of grant. The grant dates are determined without regard to anticipated earnings or other major announcements by us.

Until April 1, 2006, each of our named executive officers was entitled to a fixed number of stock options granted twice a year pursuant to their employment agreements. Stock options produce value for executives only if our stock price increases over the option exercise price.

Although there are no particular targets with respect to named executive officers’ holdings of stock options, in general, the higher the level of an executive officers’ responsibility, the larger this stock-based component of his compensation will be.

12

To further strengthen the commonality of interest between named executive officers and our stockholders, these performance-based stock options provide accelerated vesting in one-third increments as our common stock meets certain specified price per share targets, which are typically increases of $5.00, $10.00 and $15.00 per share over the then-current fair market value at the time of grant. Generally, if our common stock does not reach the price per share targets, these options vest after five years from the date of grant. The number of shares subject to the performance options is determined in the case of the named executive officers by their employment agreements. Our Compensation/Stock Option Committee believes that these performance-based options provide even greater motivation for our named executive officers to achieve our performance targets.

(2) Restricted stock

In order to further incentivize management during the terms of their employment agreements, our named executive officers are entitled to a fixed number of shares of restricted stock each year, which are generally granted on the first day of the subsequent year. They are entitled to earn an additional number of restricted shares if the Compensation/Stock Option Committee determines that 80% of the EPS targets have been met and an additional number of restricted shares if 115% of the EPS targets have been met. The amount of restricted stock is specified in the executive’s employment agreement and the applicable performance target is set by the Committee each year. In order to enhance the awards’ incentives for longer term focus and retention, the shares of restricted stock referred to above are subject to vesting in approximately equal portions over a three-year period, or one year, in the case of the performance-based restricted stock awards granted to the Chief Executive Officer pursuant to his employment agreement. We believe that grants of restricted stock further a sense of stock ownership by our named executive officers and give us a significant advantage in retaining and motivating key executives.

Voluntary Stock Ownership Guidelines

To align the interests of executive officers with the interest of our stockholders, we have adopted the following voluntary guidelines for executive officers to maintain a minimum number of shares in our common stock (excluding stock options):

| | |

| Chief Executive Officer of Valassis: | | 3X annual base salary |

| |

| Executive Vice Presidents of Valassis and Presidents of NCH and ADVO: | | 2X annual base salary |

| |

| Senior Vice Presidents and Vice Presidents of Valassis and ADVO: | | 1X annual base salary |

Executives have two years from a promotion to each level to be in compliance with these voluntary guidelines.

Retirement Plans

Executive officers (as well as all of our employees) also are eligible to participate in Valassis Employees’ Retirement Savings Plan and certain executive officers are eligible to participate in the Supplemental Benefit Plan, which provides for supplemental benefits to those participants for a period of 10 years commencing upon death, retirement or other termination of employment. See the section entitled “Pension Benefits” for additional information.

Perquisites and Other Personal Benefits

Named executive officers are entitled to limited perquisites and personal benefits including, among other things, all or a combination of, car allowance, tax and accounting advice and country club membership. The perquisites and personal benefits are detailed in the named executive officer’s employment agreements.

Change of Control

Our named executive officers are entitled to certain benefits upon a change of control (as defined in our applicable stock plan). These change of control benefits are designed to promote stability and continuity of senior management. Information regarding applicable payments upon a change of control for the named executive officers is provided under the heading “Potential Payments and Benefits Upon Termination.”

13

INCOME TAX AND ACCOUNTING CONSIDERATIONS

In the event total compensation for any named executive officer exceeds the $1 million threshold at which tax deductions are limited under Internal Revenue Code Section 162(m), our Compensation/Stock Option Committee intends to balance tax deductibility of executive compensation with its responsibility to retain and motivate executives with competitive compensation programs. As a result, our Compensation/Stock Option Committee may take such actions as it deems to be in the best interests of the stockholders, including: (i) provide non-deductible compensation above the $1 million threshold; (ii) require deferral of a portion of the bonus or other compensation to a time when payment may be deductible by us; and/or (iii) modify existing programs to qualify bonuses and other performance-based compensation to be exempt from the deduction limit.

As a result of Statement of Financial Accounting Standards No. 123 (revised 2004), Share Based Payment, or SFAS 123R, our Compensation/Stock Option Committee has shifted its equity compensation mix for executive officers to a greater percentage of restricted stock rather than stock options. Thus, with respect to 2006, after April 2006 when the executive officers’ employments agreements no longer required a specific amount of options to be granted, our Compensation/Stock Option Committee did not grant any options to the named executive officers during the remainder of 2006. Furthermore, during 2007, the Compensation/Stock Option Committee has decreased the number of options granted (as compared to prior years).

COMPENSATION/STOCK OPTION COMMITTEE REPORT

We, the Compensation/Stock Option Committee of the Board of Directors of Valassis Communications, Inc, have reviewed and discussed the Compensation Discussion and Analysis set forth above with the management of the Company, and, based on such review and discussion, have recommended to the Board of Directors inclusion of the Compensation Discussion and Analysis in this Proxy Statement and, through incorporation by reference from this Proxy Statement, the Company’s Annual Report on Form 10-K, as amended by Amendment No. 1 on Form 10K/A, for the year ended December 31, 2006.

COMPENSATION/STOCK OPTION COMMITTEE

Ambassador Faith Whittlesey, Chairman

Patrick F. Brennan

Marcella A. Sampson

14

SUMMARY COMPENSATION TABLE FOR FISCAL YEAR 2006

The following Summary Compensation Table sets forth the compensation of Alan F. Schultz, our Chief Executive Officer and President, Robert L. Recchia, our Executive Vice President, Chief Financial Officer and Treasurer, and our other three most highly compensated executive officers who served in such capacities on December 31, 2006.

| | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary ($) | | Stock

Awards

($)(1) | | Option

Awards

($)(2) | | Non-Equity

Incentive Plan

Compensation

($)(3) | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings ($)(4) | | All Other

Compensation

($)(5) | | Total ($) |

Alan F. Schultz Chief Executive Officer, President and Director | | 2006 | | 780,000 | | 384,525 | | 1,459,940 | | 193,050 | | 151,861 | | 54,398 | | 3,023,774 |

Robert L. Recchia Executive Vice President, Chief Financial Officer, Treasurer and Director | | 2006 | | 390,000 | | 80,246 | | 547,648 | | 96,525 | | 77,475 | | 52,875 | | 1,244,769 |

Barry P. Hoffman Executive Vice President, General Counsel, Secretary and Director | | 2006 | | 390,000 | | 80,246 | | 559,889 | | 96,525 | | 77,475 | | 27,924 | | 1,232,059 |

Richard Herpich Executive Vice President of U.S. Sales | | 2006 | | 360,000 | | 80,246 | | 460,258 | | 125,190 | | 103,729 | | 39,562 | | 1,168,985 |

William F. Hogg, Jr. Executive Vice President of Manufacturing and Client Services | | 2006 | | 290,000 | | 29,070 | | 431,844 | | 138,431 | | — | | 29,433 | | 918,778 |

(1) | This column represents the dollar amount recognized for financial statement reporting purposes with respect to the 2006 fiscal year for the fair value of shares of restricted stock granted in 2006 as well as prior fiscal years, in accordance with SFAS 123R. Pursuant to SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. For additional information, refer to Note 8 of the financial statements in the Form 10-K/A for the year ended December 31, 2006, as filed with the SEC. See the Grants of Plan-Based Awards Table for information on awards made in 2006. These amounts reflect our accounting expense for these awards, and do not correspond to the actual value that may be realized by the named executive officers. |

(2) | This column represents the dollar amount recognized for financial statement reporting purposes with respect to the 2006 fiscal year for the fair value of stock options granted to each of the named executive officers, in 2006 as well as prior fiscal years, in accordance with SFAS 123R. Pursuant to SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. For additional information on the valuation assumptions with respect to the 2006 grants, refer to Note 8 of the financial statements in the Form 10-K/A for the year ended December 31, 2006, as filed with the SEC. For information on the valuation assumptions with respect to grants made prior to 2006, refer to Note 8 of the financial statements in the Form 10-K/A for the respective year-end. These amounts reflect our accounting expense for these awards, and do not correspond to the actual value that may be realized by the named executive officers. See the Grants of Plan-Based Awards Table for information on options granted in 2006. |

(3) | This column reflects amounts earned pursuant to bonus opportunities established under the named executive officers’ employment agreements, and in the case of Mr. Schultz, in accordance with our Amended and Restated Senior Executive Bonus Plan. The EPS performance targets were set by our Compensation/Stock Option Committee as described in the Compensation Discussion and Analysis. In addition, certain performance targets for Messrs. Herpich and Hogg were set by our Chief Executive Officer. |

15

(4) | This column represents the change during 2006 in the present value of the benefits payable under the Supplemental Benefit Plan to each of the named executive officers that are participants under the plan. See the section entitled “Pension Benefits” for additional information, including the present value assumptions used in this calculation. We do not have a nonqualified deferred compensation plan. |

(5) | The compensation represented by the amounts set forth in the All Other Compensation column for the named executive officers are actual costs and are detailed in the following table. |

| | | | | | | | | | |

Name | | Common Stock Match in

Employee

Stock Purchase

Plan ($)(1) | | Contribution to

Employee

Profit Sharing

Plan ($)(2) | | Tax

Preparation

Fees ($) | | Car

Allowance

($) | | Country

Club Dues ($) |

Alan F. Schultz | | — | | 16,590 | | 21,450 | | 2,800 | | 13,558 |

Robert L. Recchia | | 21,400 | | 16,590 | | 2,915 | | 6,510 | | 5,460 |

Barry P. Hoffman | | 700 | | 16,590 | | 1,495 | | 9,139 | | — |

Richard Herpich | | 2,100 | | 16,590 | | — | | 7,314 | | 13,558 |

William F. Hogg, Jr. | | — | | 16,590 | | 3,750 | | 9,093 | | — |

(1) | This column represents matching contributions to the named executive officer’s employee stock purchase plan account. The matching contributions are equal to 25% of the executive’s contribution to the employee stock purchase plan, pursuant to which all employees are eligible to participate, and are in the form of our common stock. |

(2) | This column represents contributions we made on behalf of the named executive officers to our Employees’ Profit Sharing Plan, pursuant to which all employees participate. |

16

GRANTS OF PLAN-BASED AWARDS IN 2006 FISCAL YEAR

The following table shows the range of potential payments that could have been earned under the cash and equity incentive awards to named executive officers in 2006, as well as the time-vested and performance-based stock awards made to them for the year ended December 31, 2006.

| | | | | | | | | | | | | | | | | | | | | |

Name | | Grant

Date(1) | | Estimated Possible

Payouts Under Non-

Equity Incentive Plan

Awards | | | Estimated Future

Payouts Under Equity

Incentive Plan Awards | | | Stock

Awards:

Number

of Shares

of Stock

or Units

(#) | | | Exercise

or Base

Price of

Option

Awards

($/Sh)(2) | | Grant Date

Fair Value

of Stock

and

Options

Awards

($)(3) |

| | | Threshold

($) | | | Target

($) | | | Threshold

(#) | | | Maximum

(#) | | | | |

Alan F. Schultz | | 1/1/06 | | | | | | | | 11,250 | (4) | | 22,500 | (5) | | 11,250 | (6) | | | | 654,075 |

Alan F. Schultz | | | | 9,750 | (7) | | 312,000 | (8) | | | | | | | | | | | | | |

Alan F. Schultz | | | | 9,750 | (7) | | 312,000 | (8) | | | | | | | | | | | | | |

Alan F. Schultz | | 4/1/06 | | | | | | | | 135,000 | (9) | | | | | | | | 29.37 | | 1,528,200 |

Robert L. Recchia | | 1/1/06 | | | | | | | | 2,250 | (4) | | 4,500 | (5) | | 2,250 | (6) | | | | 130,815 |

Robert L. Recchia | | | | 4,875 | (7) | | 156,000 | (8) | | | | | | | | | | | | | |

Robert L. Recchia | | | | 4,875 | (7) | | 156,000 | (8) | | | | | | | | | | | | | |

Robert L. Recchia | | 4/1/06 | | | | | | | | 56,250 | (9) | | | | | | | | 29.37 | | 636,750 |

Barry P. Hoffman | | 1/1/06 | | | | | | | | 2,250 | (4) | | 4,500 | (5) | | 2,250 | (6) | | | | 130,815 |

Barry P. Hoffman | | | | 4,875 | (7) | | 156,000 | (8) | | | | | | | | | | | | | |

Barry P. Hoffman | | | | 4,875 | (7) | | 156,000 | (8) | | | | | | | | | | | | | |

Barry P. Hoffman | | 4/1/06 | | | | | | | | 56,250 | (9) | | | | | | | | 29.37 | | 636,750 |

Richard Herpich | | 1/1/06 | | | | | | | | 2,250 | (4) | | 4,500 | (5) | | 2,250 | (6) | | | | 130,815 |

Richard Herpich | | | | 2,250 | (10) | | 144,000 | (11) | | | | | | | | | | | | | |

Richard Herpich | | | | 2,250 | (10) | | 144,000 | (11) | | | | | | | | | | | | | |

William F. Hogg, Jr. | | 1/1/06 | | | | | | | | | | | | | | 3,000 | (6) | | | | 87,210 |

William F. Hogg, Jr. | | | | 1,813 | (10) | | 116,000 | (11) | | | | | | | | | | | | | |

William F. Hogg, Jr. | | | | 1,813 | (10) | | 116,000 | (11) | | | | | | | | | | | | | |

William F. Hogg, Jr. | | 4/1/06 | | | | | | | | 43,750 | (9) | | | | | | | | 29.37 | | 495,250 |

(1) | Each named executive officer, other than Mr. Hogg, is entitled to earn equity awards during each year of the term of his employment agreement. |

(2) | This exercise price represents the closing sales price of our common stock on the date of grant. |

(3) | This column shows the full grant date fair value of equity awards granted in 2006 computed in accordance with SFAS 123R, except that no assumptions as to forfeitures were made. A discussion of the assumptions used in calculating grant date fair value is set forth in Note 8 of the financial statements in the Form 10-K/A for the year ended December 31, 2006, as filed with the SEC. |

(4) | These amounts reflect potential payouts of restricted stock corresponding to the achievement of 80% of the EPS performance target, which shares, if granted, would vest ratably over three years (except in the case of Mr. Schultz for whom the shares would vest after one year). In 2006, the performance target was not satisfied. |

(5) | These amounts reflect potential payouts of restricted stock corresponding to the achievement of 115% of the EPS performance target, which shares, if granted, would vest ratably over three years (except in the case of Mr. Schultz for whom the shares would vest after one year). In 2006, the performance target was not satisfied. |

(6) | These restricted stock awards vest ratably over three years. |

(7) | These amounts reflect the minimum value of the potential incentive cash bonus payout if our EPS exceeded 70% of the EPS target for each applicable six-month opportunity period. The EPS target is set by the Compensation/Stock Option Committee, as more completely described in the Compensation Discussion and Analysis. |

(8) | These amounts reflect the value of the potential incentive cash bonus payout if 100% of the EPS target was satisfied for each applicable six-month opportunity period. Even though such executive’s employment agreement provides for a potential bonus opportunity of 100% of annual base salary, the Compensation/Stock Option Committee decided to limit the amount of bonus to 80% of the executive’s annual base salary as more completely described in the Compensation Discussion and Analysis. |

(9) | These options were granted pursuant to the respective employment agreements of the named executive officers and become exercisable in increments of 33.333%, 33.333% and 33.334% at such time that the closing sales price per share of our common stock is equal to or exceeds $34.37, $39.37 and $44.37, respectively. In any event, however, the options vest by April 1, 2011 and will be exercisable until April 1, 2013. See the discussion following this table. |

(10) | These amounts reflect the minimum value of the potential incentive cash bonus payout for each applicable six-month opportunity period if (i) our EPS exceeded 70% of the EPS target and (ii) the named executive officer did not achieve |

17

| | his individual performance targets set by our Chief Executive Officer. The EPS target is set by the Compensation/Stock Option Committee, as more completely described in the Compensation Discussion and Analysis. |

(11) | These amounts reflect the value of the potential incentive cash bonus payout for each applicable six-month opportunity period if (i) 100% of the EPS target was satisfied and (ii) the named executive officer achieved his individual performance targets set by our Chief Executive Officer. Even though such executive’s employment agreement provides for a potential bonus opportunity of 100% of annual base salary, the Compensation/Stock Option Committee decided to limit the amount of bonus to 80% of the executive’s annual base salary as more completely described in the Compensation Discussion and Analysis. |

Narrative to Summary Compensation Table and Grants of Plan-Based Awards Table

Employment Contracts

We have employment agreements with each of our named executive officers. The following summary of certain provisions of these employment agreements does not purport to be complete and is subject to and is qualified in its entirety by reference to the actual text of the employment agreements of the named executive officers, copies of which are exhibits to our SEC filings.

Mr. Schultz’s employment agreement expires December 31, 2008, Mr. Herpich’s employment agreement expires December 31, 2009, Mr. Recchia’s and Mr. Hoffman’s employment agreements each expires December 31, 2008 and Mr. Hogg’s employment agreement expires on March 31, 2008. Mr. Schultz’s employment agreement provides that he is entitled to an annual base salary equal to $780,000. Pursuant to their respective employment agreements, Mr. Hoffman and Mr. Recchia are each entitled to an annual base salary equal to $390,000. Mr. Herpich’s employment agreement provides that he is entitled to an annual base salary equal to $360,000. Mr. Hogg’s employment agreement provides that he is entitled to an annual base salary of $290,000. For 2006, salaries paid to our named executive officers accounted for the following percentages of their total compensation: Mr. Schultz (26%), Mr. Recchia (31%), Mr. Hoffman (32%), Mr. Herpich (31%) and Mr. Hogg (32%).

Further, the employment agreements of each of Mr. Herpich, Mr. Hoffman and Mr. Recchia provide that each of these executives is entitled to receive 2,250 shares of restricted stock for each year during the term of his respective employment agreement pursuant to our applicable restricted stock award plan and up to an additional 4,500 shares of restricted stock for each year during the term of his employment agreement if we achieve certain performance targets. Mr. Schultz’s employment agreement provides that he is entitled to receive 11,250 shares of restricted stock for each year during the term of his employment agreement and up to an additional 22,500 shares of restricted stock for each year during the term of his employment agreement pursuant to our applicable executive restricted stock award plan if we achieve certain performance targets. In addition, pursuant to the terms of the employment agreements of Mr. Schultz, Mr. Recchia and Mr. Hoffman, all of these executives may be entitled to semi-annual bonuses of up to 50% of their annual salary if we achieve certain performance targets set by our Compensation/Stock Option Committee. Messrs. Herpich’s and Hogg’s employment agreements provide that they are entitled to a semi-annual bonus of up to 25% of their annual salary if we achieve certain performance targets set by our Compensation/Stock Option Committee and a semi-annual bonus of up to 25% of their annual salary in accordance with certain performance targets (sales targets in the case of Mr. Herpich) set annually by our Chief Executive Officer. See the Compensation Discussion and Analysis for additional information regarding the vesting periods applicable to the restricted stock awards described in this paragraph, as well as the performance targets applicable to certain of such awards.

Each of the employment agreements with our named executive officers provides that such executive officers were eligible to receive non-qualified stock options to purchase a fixed number of shares of our common stock pursuant to our 2002 Long-Term Incentive Plan (or such other plan applicable to our executives in effect from time to time). The aggregate number of stock options granted pursuant to the employments agreements with Messrs. Schultz, Herpich, Hoffman, Recchia and Hogg were 1,080,000, 393,000, 450,000, 450,000 and 350,000, respectively. Such options were granted by us in eight semi-annual installments on April 1 and October 1 commencing on October 1, 2002 through April 1, 2006; provided, however, that the options that were granted to Mr. Herpich were in seven semi-annual installments ending on October 1, 2005 which corresponded with the term of his employment agreement at the time such provision was added. Each option had an exercise price equal to the fair market value of our common stock on the date of grant and becomes fully vested five years from such date of grant and exercisable for two years thereafter. Such options will earlier vest in one-third increments if and as our common stock meets certain specified price per share targets. See the table above entitled “Grants of Plan-Based Awards in 2006 Fiscal Year.”

18

Provisions of the employment agreements that relate to severance are described below in the section entitled “Potential Payments and Benefits Upon Termination.”

Non-equity Incentive Plan Compensation

The non-equity incentive plan compensation set forth in the Summary Compensation Table for Fiscal Year 2006 reflects annual cash incentive compensation under the executives’ employment agreements. Annual cash incentive compensation is earned based upon the achievement of a threshold EPS target and is payable as a percentage of salary as set forth in the executive’s employment agreement.

The threshold and target amounts set forth in the Grants of Plan-Based Awards in 2006 Fiscal Year table represent the potential amounts that could be earned if our EPS exceeded 70% or achieved 100%, respectively, of the EPS target set by the Compensation/Stock Option Committee for each applicable six-month opportunity period.

Restricted Stock