Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

[GRAPHIC]

Safe Harbor Statement

[GRAPHIC]

This presentation contains forward-looking information. The actual results of the future events described in such forward-looking statements could differ materially from those stated in such forward-looking statements. Among the factors that could cause actual results to differ materially are: general economic conditions, competition, acts of terrorism or acts of war, government regulation, changes in foreign currency valuations in relation to the United States Dollar and possible future litigation. Additional information concerning these and a number of other factors that could cause actual results to differ materially from the information that will be discussed is readily available in our report on Form 10-K for the fiscal year ended January 1, 2005, our Form 10-Q reports and our Form 8-K dated September 14, 2004, all filed with the Securities and Exchange Commission. Accordingly, you should consider these facts in evaluating the information and are cautioned not to place undue reliance on the forward-looking statements contained herein. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

November 1, 2005

[LOGO]

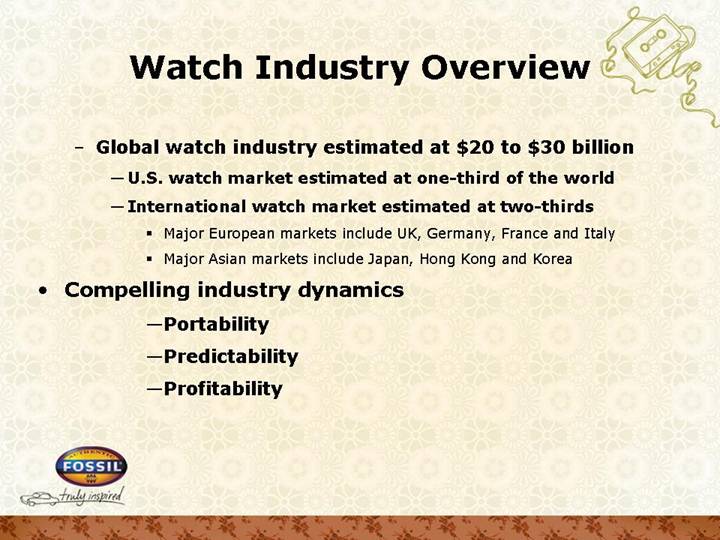

Watch Industry Overview

• Global watch industry estimated at $20 to $30 billion

• U.S. watch market estimated at one-third of the world

• International watch market estimated at two-thirds

• Major European markets include UK, Germany, France and Italy

• Major Asian markets include Japan, Hong Kong and Korea

• Compelling industry dynamics

• Portability

• Predictability

• Profitability

Investment Highlights

• Global leader in retail watch market | [LOGO] |

|

• Portfolio of global brands that maximizes growth potential |

|

• Proven track record for attracting and expanding brands |

|

• Vast infrastructure that provides for future growth in watches and related categories |

|

• Strong cash flow |

Company Overview

• Global leader in fashion watch category | [LOGO] |

• $960 million in 2004 revenue |

|

• Competitive advantages |

• Design |

• Sourcing |

• Distribution |

|

• Portfolio approach maximizes growth potential |

[LOGO]

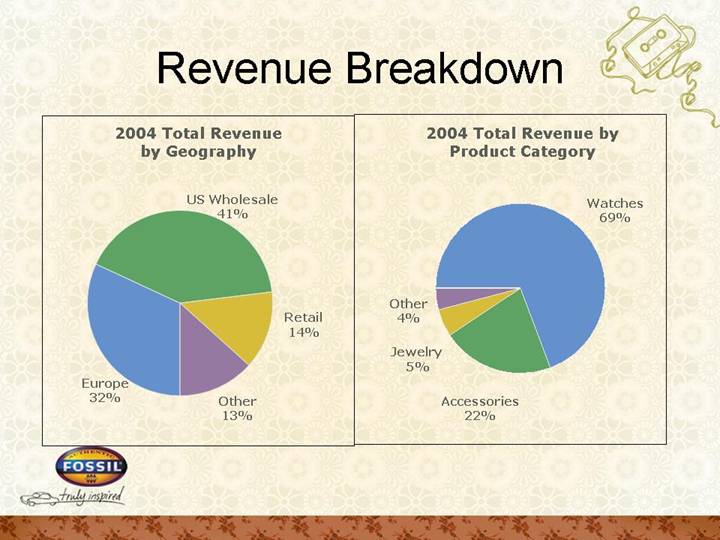

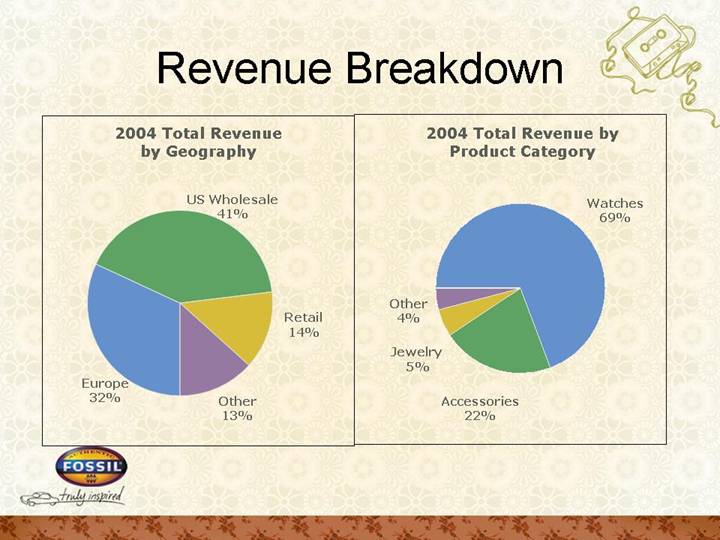

Revenue Breakdown

2004 Total Revenue by Geography | | 2004 Total Revenue by Product Category |

| | |

[CHART] | | [CHART] |

Sales Channels

• Department stores and specialty retail stores in over 90 countries worldwide

• Network of approximately 52 independent distributors – potential acquisition targets

• Company-owned and independently-owned FOSSIL retail stores and shop-in-shops in certain international markets

Jewelry

New business initiative with solid growth prospects

Advantages

• Strong margins

• Similar distribution to watches

• Global expansion

Key initiatives

• Leverage strength of Fossil in Germany by expanding into additional markets

• Expand infrastructure to support additional brand opportunities

Accessories

Creating scale through product extension

Advantages

• A top performer in department and mid-tier stores

• Superior design

Key initiatives

• Leverage design capabilities by introducing additional brands and categories

• Longer term, develop category outside the U.S.

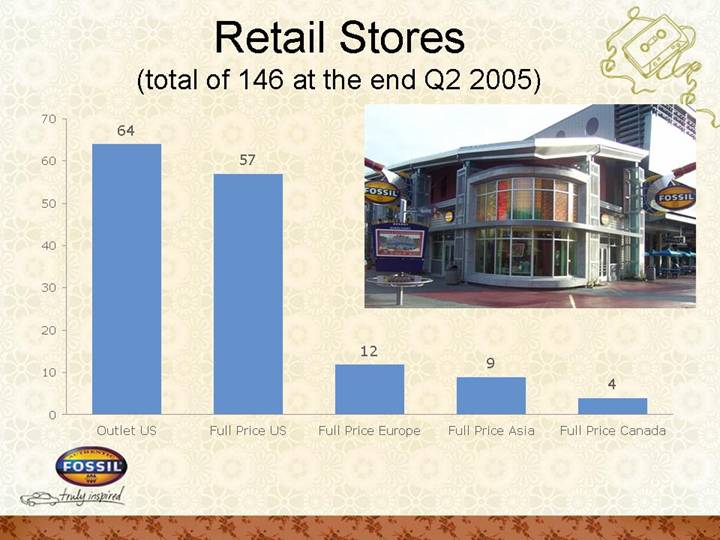

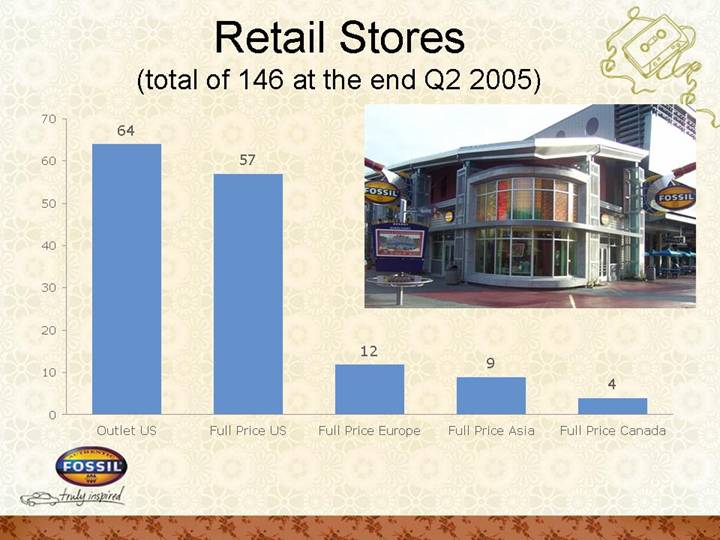

Retail Stores

(total of 146 at the end Q2 2005)

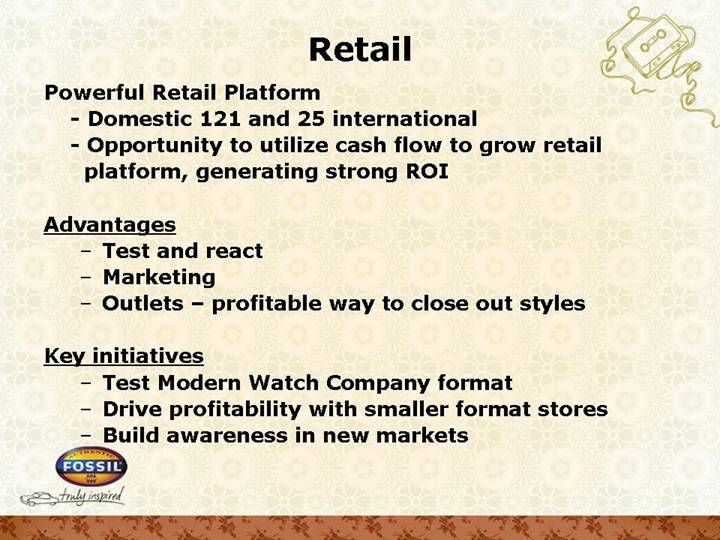

Retail

Powerful Retail Platform

• Domestic 121 and 25 international

• Opportunity to utilize cash flow to grow retail platform, generating strong ROI

Advantages

• Test and react

• Marketing

• Outlets – profitable way to close out styles

Key initiatives

• Test Modern Watch Company format

• Drive profitability with smaller format stores

• Build awareness in new markets

Key Sales Growth Initiatives

• Fashion watches worldwide | [GRAPHIC] |

|

• Jewelry |

|

• Swiss watches |

|

• Accessories |

|

• Retail stores |

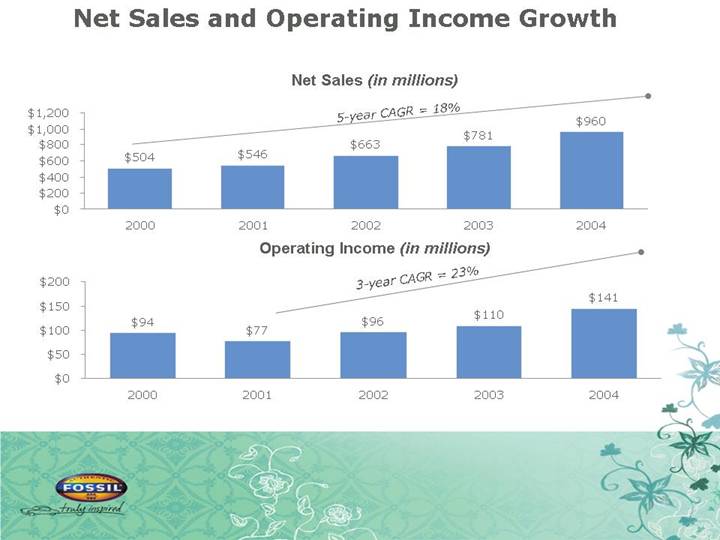

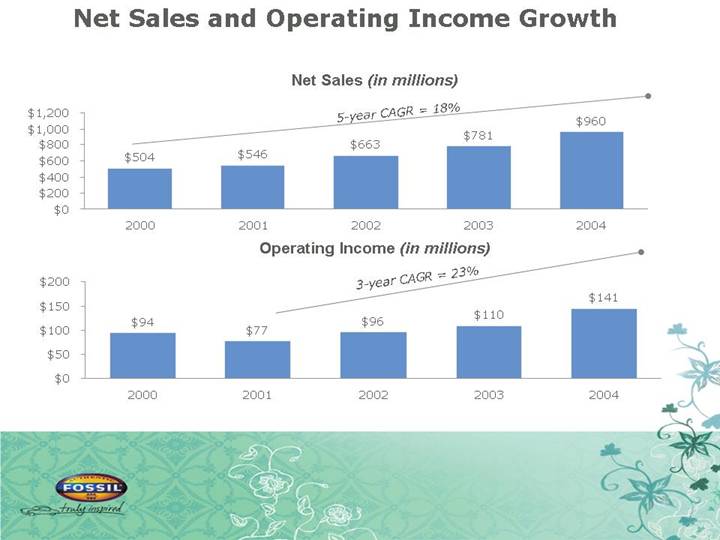

Net Sales and Operating Income Growth

Net Sales (in millions)

[CHART]

Operating Income (in millions)

[CHART]

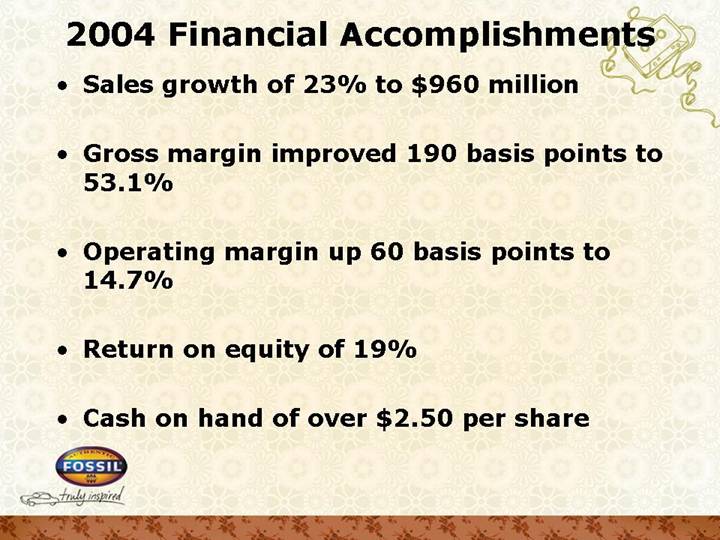

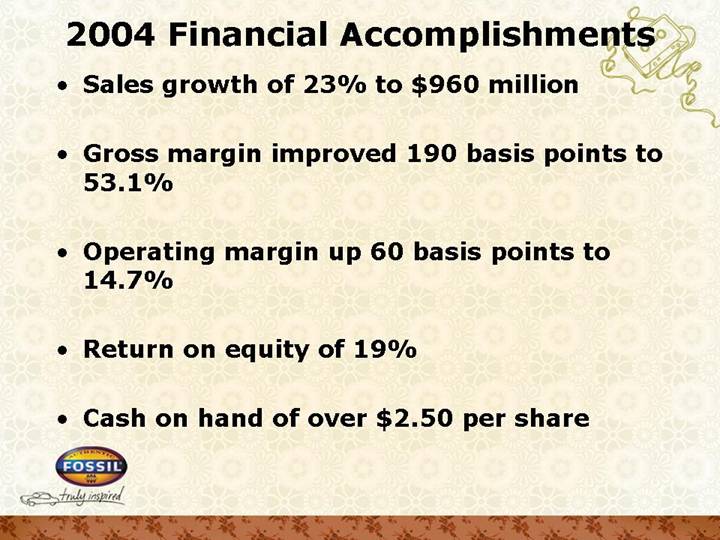

2004 Financial Accomplishments

• Sales growth of 23% to $960 million

• Gross margin improved 190 basis points to 53.1%

• Operating margin up 60 basis points to 14.7%

• Return on equity of 19%

• Cash on hand of over $2.50 per share

Margin Expansion Strategy

• Leverage infrastructure investments • Dallas distribution • Consolidation of European distribution • SAP implementations • New initiative costs (jewelry & Swiss watches) | | [GRAPHIC] |

| |

• Increasing international and retail store sales | |

| |

• Increase new initiative sales • Jewelry • Swiss watches • Mass market watches | |

Long-Term Drivers of Earnings Growth

Revenue Growth | |

| | 15 - 20% | | • Organic 10% to 13% |

| | | |

| | | • New business 5% to 7% |

| | | | | | |

Operating Income Growth | |

| | 20 – 25% | | • Exceeds revenue growth due to gross margin improvement |

| | | | | | |

| | | | | | • Operating leverage on SG&A structure |

Investment Highlights

• Global leader in $20 to $30 billion retail watch market

• Portfolio of global brands that maximizes growth

• Proven track record for attracting and expanding brands

• Vast infrastructure that provides for future growth in watches and related categories

• Strong cash flow

[GRAPHIC]

Thanks for

Stopping By!