Searchable text section of graphics shown above

Safe Harbor Statement

This presentation contains certain statements that are not historical facts, which are “forward-looking information” within the meaning of the Private Securities Litigation Reform Act of 1955 and involve a number of risks and uncertainties. The actual results of the future events described in such forward-looking statements could differ materially from those stated in such forward-looking statements. Among the factors that could cause actual results to differ materially are: continued acceptance of the Company’s products in the marketplace; intense competition, both domestically and internationally; changes in external competitive market factors, such as introduction of new products, development of new competitors, competitive brands or competitive promotional activity or spending; changes in consumer demands for the various types of products that Fossil offers; changes in consumer tastes and fashion trends; inventory risks due to shifts in market demands; changes in foreign currency rates in relation to the United States dollar; the Company’s ability to successfully implement manufacturing, distribution and other cost efficiencies; changes in accounting rules; accuracy of forecast data; general economic conditions; acts of terrorism or acts of war; government regulation; and possible future litigation, as well as the risks and uncertainties set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 and its Form 10-Q reports filed with the Securities and Exchange Commission. Accordingly, you should consider these facts in evaluating the information and are cautioned not to place undue reliance on the forward-looking statements contained herein. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

June 6, 2006

Investment Highlights

[LOGO]

• Global watch leader

• Leading supplier to department stores for accessories

• Competitive advantages – worldwide design and distribution

• High margin businesses

• Strong cash flow

Company Overview

[LOGO]

• Fiscal 2005 revenue exceeding $1 billion

• Global watch advantages

Infrastructure

• Design

• Sourcing

• Distribution (Market ownership)

Portfolio approach maximizes growth potential & leverage

• Complimentary jewelry lines

• Expanding accessories category

• Retail store expansion

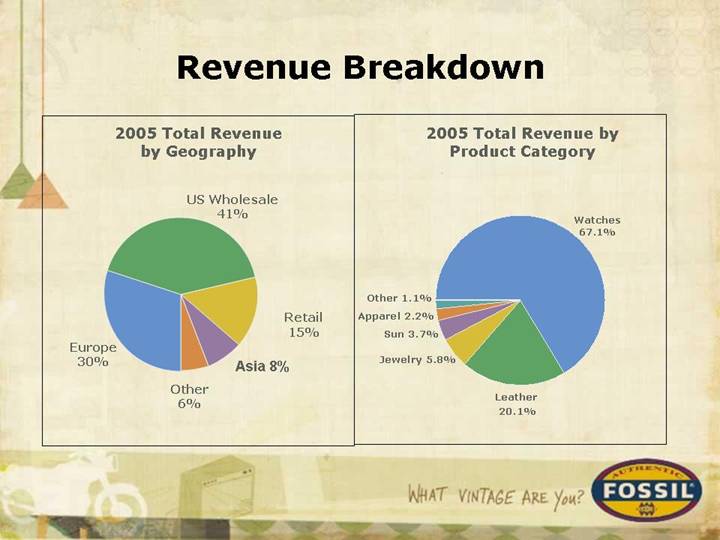

Revenue Breakdown

2005 Total Revenue | 2005 Total Revenue by |

By Geography | Product Category |

| |

[CHART] | [CHART] |

Sales Channels

• | Geographic | | More than 90 countries worldwide |

| | | |

• | Wholesale | | Luxury to mass, specialty retail, jewelry and sporting goods |

| | | |

• | Retail | | 177 company-owned stores |

| | | |

• | Direct | | Web and catalog |

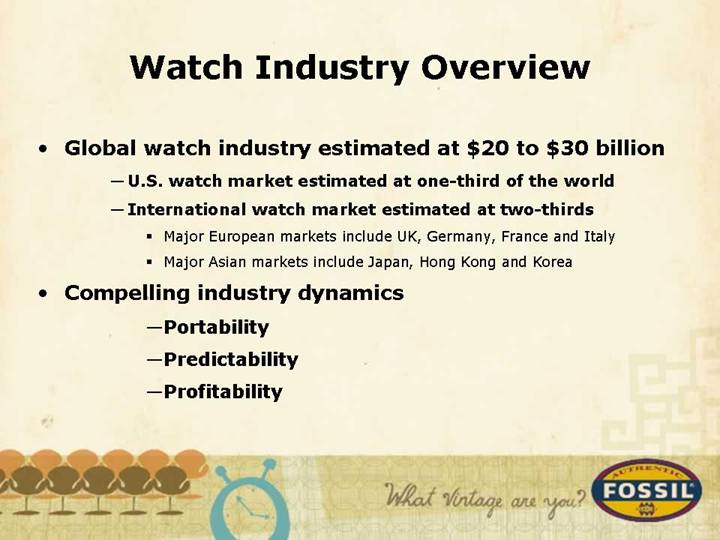

Watch Industry Overview

• Global watch industry estimated at $20 to $30 billion

• U.S. watch market estimated at one-third of the world

• International watch market estimated at two-thirds

• Major European markets include UK, Germany, France and Italy

• Major Asian markets include Japan, Hong Kong and Korea

• Compelling industry dynamics

• Portability

• Predictability

• Profitability

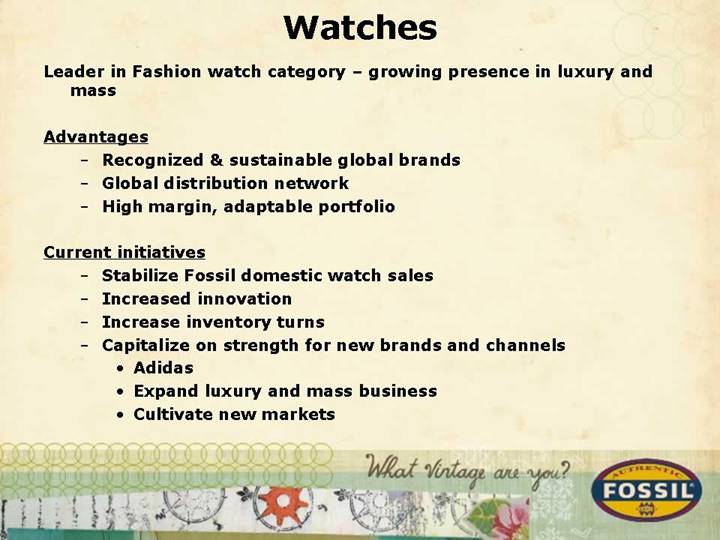

Watches

Leader in Fashion watch category – growing presence in luxury and mass

Advantages

• Recognized & sustainable global brands

• Global distribution network

• High margin, adaptable portfolio

Current initiatives

• Stabilize Fossil domestic watch sales

• Increased innovation

• Increase inventory turns

• Capitalize on strength for new brands and channels

• Adidas

• Expand luxury and mass business

• Cultivate new markets

Jewelry

New business initiative with significant growth potential

Advantages

• Scalability

• High margins

• Leverage distribution

Current initiatives

• Expand markets

• Increase penetration in existing markets

• Licensing opportunities

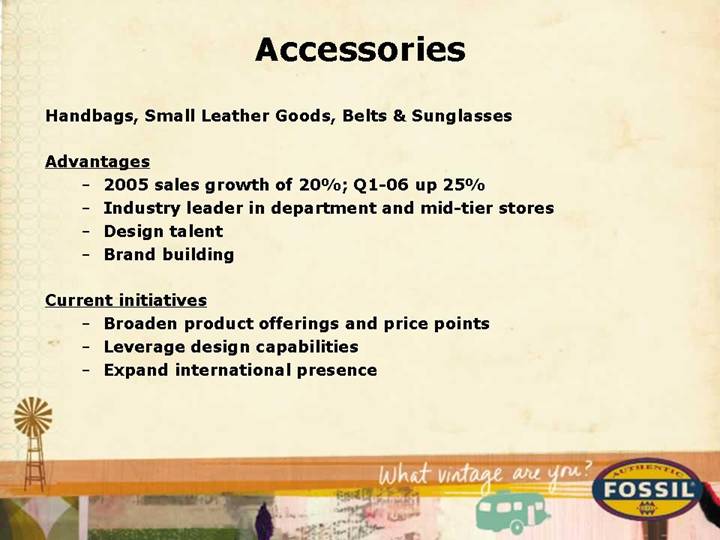

Accessories

Handbags, Small Leather Goods, Belts & Sunglasses

Advantages

• 2005 sales growth of 20%; Q1-06 up 25%

• Industry leader in department and mid-tier stores

• Design talent

• Brand building

Current initiatives

• Broaden product offerings and price points

• Leverage design capabilities

• Expand international presence

Retail

Expanding Retail Platform

• Domestic 140 and 37 international

• Opportunity to utilize cash flow generating strong ROI

Advantages

• Test and react

• Build and enforce brand image

• Direct interface with consumer

• Limits wholesale dependence

• Outlets – profitable way to close out styles

Key initiatives

• 30 to 35 new stores planned for 2006

• Grow presence internationally

• New accessories concept

• Update brand image, broaden demographic

• Expand accessories presentation

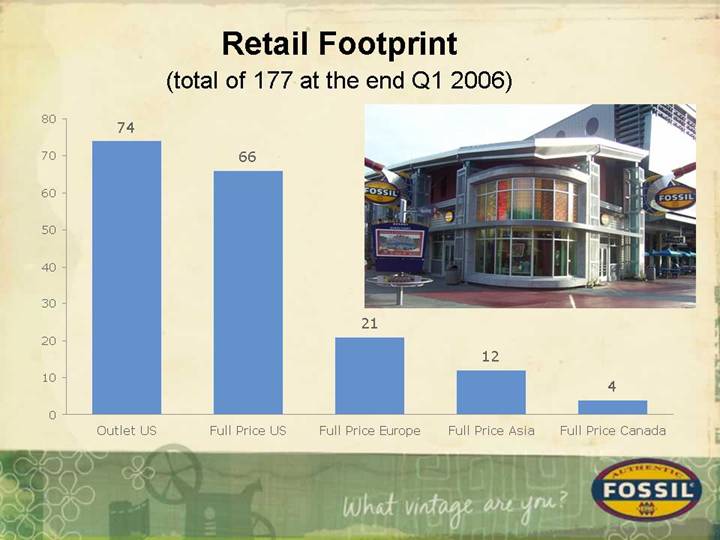

Retail Footprint

(total of 177 at the end Q1 2006)

[CHART]

[GRAPHIC]

2005 Milestones/Accomplishments

• Exceeded $1 billion in net sales

• Domestic accessories business growth of 20%

• Adidas license, Diesel jewelry license, launch of Mark Jacobs

• Initiated Fossil catalog

• $75 million expended to repurchase 3.6 million shares of common stock

• Acquisition of Scandinavia/Taiwan distribution

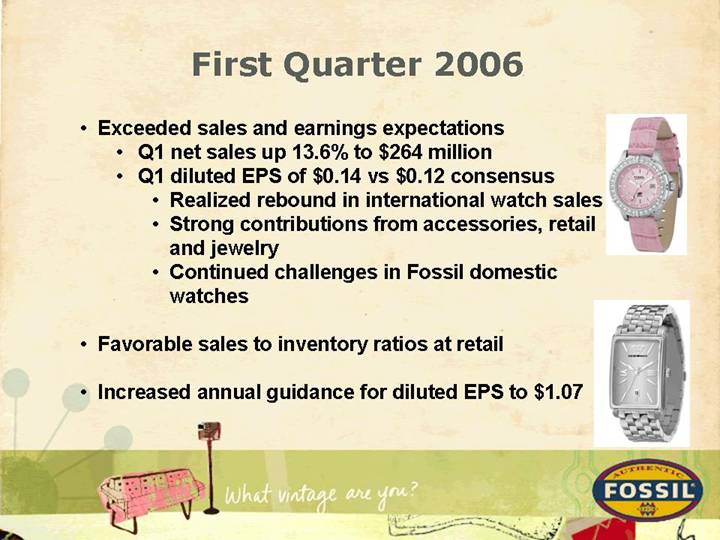

First Quarter 2006

• Exceeded sales and earnings expectations

• Q1 net sales up 13.6% to $264 million

• Q1 diluted EPS of $0.14 vs $0.12 consensus

• Realized rebound in international watch sales

• Strong contributions from accessories, retail and jewelry

• Continued challenges in Fossil domestic watches

• Favorable sales to inventory ratios at retail

• Increased annual guidance for diluted EPS to $1.07

[GRAPHIC]

Margin Expansion Initiatives

• Leverage investments

• Distribution

• SAP

• New product categories

• Increase operating leverage

• Increase international and retail store sales

• Grow revenue contributions from new product category

• Jewelry

• Swiss watches

• Mass market watches

• New licenses

[GRAPHIC]

Strategic Initiatives

• Watches worldwide

• Stabilize Fossil domestically, expand internationally

• Increase portfolio through acquisitions/licensing

• Focus on developing markets

• Accessories

• Grow market share in US

• Expand internationally

• Expand jewelry offering

• Retail stores

• US & international expansion

• Brand building

[GRAPHIC]

Investment Highlights

• Global watch leader

• Leading supplier to department stores for accessories

• Competitive advantages – worldwide design and distribution

• High margin businesses

• Strong cash flow