As filed with the U.S. Securities and Exchange Commission on November 30, 2017

Registration No. 333-221075

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

Form N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| | | | |

| | Pre-Effective Amendment No. | | ☐ |

| | Post-Effective Amendment No. 1 | | ☒ |

IVY FUNDS

(a Delaware statutory trust)

(Exact Name as Specified in Charter)

6300 Lamar Avenue, Overland Park, Kansas

(Address of Principal Executive Office)

66202-4200

(Zip Code)

Registrant’s Telephone Number, including Area Code (913) 236-2000

Philip A. Shipp

6300 Lamar Avenue

Overland Park, Kansas 66202-4200

(Name and Address of Agent for Service)

Approximate Date of Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933.

Title of Securities Being Offered: Shares of Beneficial Interest, no par value.

An indefinite amount of the Registrant’s securities has been registered under the Securities Act of 1933 pursuant to Rule 24-f2 under the Investment Company Act of 1940. In reliance upon such Rule, no filing fee is paid at this time.

It is proposed that this filing will become effective immediately upon filing pursuant to Rule 485(b) under the Securities Act of 1933, as amended.

IVY FUNDS

IVY DIVIDEND OPPORTUNITIES FUND

6300 LAMAR AVENUE

OVERLAND PARK, KANSAS 66202

Dear Shareholder:

As a shareholder of the Ivy Dividend Opportunities Fund, you are invited to vote on a proposal to reorganize your Fund into the Ivy Global Equity Income Fund. Your Fund will hold a special meeting of shareholders on February 1, 2018, at 6300 Lamar Avenue, Overland Park, Kansas 66202 at 2:00 p.m., Central Time to consider the proposed reorganization. The specific details and reasons for the proposed reorganization are contained in the enclosed combined Prospectus and Proxy Statement. Please read it carefully.

After careful consideration, the Board of Trustees of Ivy Funds unanimously approved the proposal and recommends that shareholders vote “FOR” the proposal.

This special meeting will be held at 6300 Lamar Avenue, Overland Park, Kansas. While we hope you can attend this meeting, it is very important that you vote your shares at your earliest convenience. To assist with the solicitation of proxies, we have engaged D.F. King & Co., Inc., a proxy solicitation firm. As the meeting date approaches, if you have not voted your shares you may receive a phone call from them urging you to vote your shares.

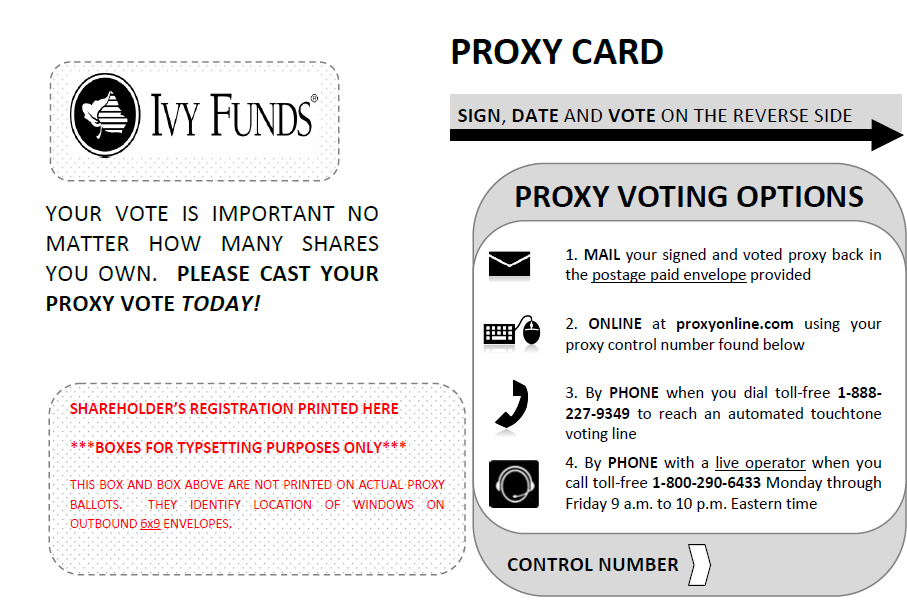

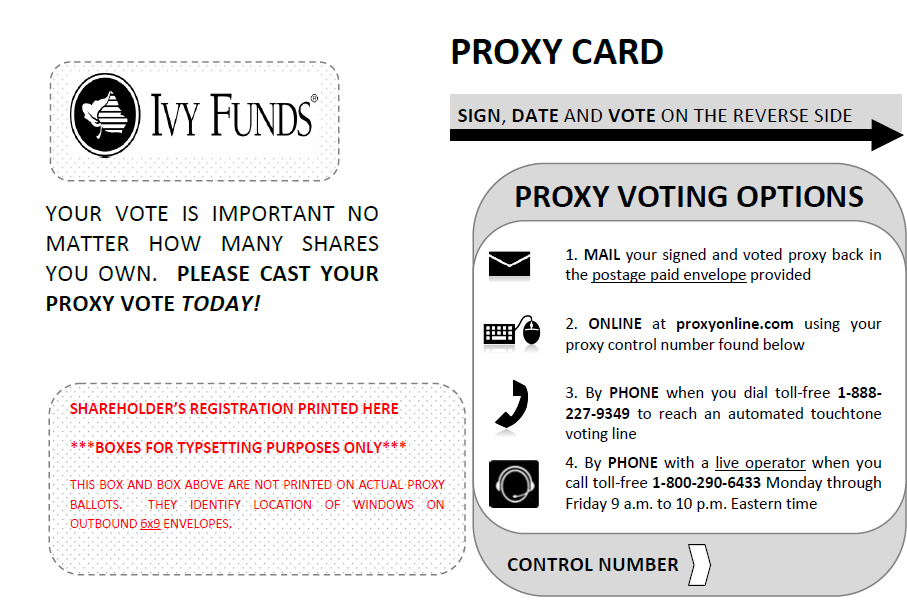

Your vote is important, regardless of the number of shares you own. It is important that we receive your vote no later than the time of the special meeting of shareholders on February 1, 2018. If you have more than one account registered in your name, you will receive a separate proxy card for each account. Please vote and return each proxy card that you receive, or take advantage of the telephonic or electronic voting procedures described in the proxy card(s). Please help your Fund avoid the expense of a follow-up mailing by voting today!

If you have any questions regarding the enclosed Combined Prospectus and Proxy Statement, please call Ivy Client Services at 1-800-777-6472 or your financial advisor.

We appreciate your participation and prompt response in these matters and thank you for your continued support.

Sincerely,

Philip J. Sanders, President

Ivy Funds

November 30, 2017

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD FEBRUARY 1, 2018

Ivy Dividend Opportunities Fund

NOTICE IS HEREBY GIVEN that a Special Meeting of the shareholders of the Ivy Dividend Opportunities Fund will be held at 2:00 p.m. Central Time on February 1, 2018, at 6300 Lamar Avenue, Overland Park, Kansas (the “Meeting”) for these purposes:

| | 1. | To approve an Agreement and Plan of Reorganization providing for the transfer of all of the assets of Ivy Dividend Opportunities Fund to, and the assumption of all of the liabilities of the Ivy Dividend Opportunities Fund by, the Ivy Global Equity Income Fund in exchange for shares of the Ivy Global Equity Income Fund and the distribution of such shares to the shareholders of the Ivy Dividend Opportunities Fund in complete liquidation of the Ivy Dividend Opportunities Fund (the “Proposal”). |

| | 2. | To consider and act upon any other matters that may properly come before the Meeting and any adjourned session of the Meeting. |

The Proposal is discussed in detail in the Combined Prospectus and Proxy Statement (the “Prospectus/Proxy Statement”) attached to this notice. Please read the Prospectus/Proxy Statement carefully for information concerning the Proposal. The person named as proxy will vote in his discretion on any other business that may properly come before the Meeting or any adjournment or postponement thereof.

Shareholders of record at the close of business on November 29, 2017 are entitled to notice of and to vote at the Meeting and any adjourned session thereof.

Each shareholder is invited to attend the Meeting in person. Whether or not you plan to be present at the Meeting, we urge you to complete, sign and date the enclosed proxy card, and return it in the accompanying postage-paid envelope as promptly as possible, or take advantage of the telephonic or electronic voting procedures described on the proxy card. If you vote by proxy and later desire to change your vote or vote in person, you may revoke your proxy at any time prior to its exercise at the Meeting.

Should the quorum necessary to transact business or the vote required to approve the Proposal not be obtained, the person named as

proxy may propose one or more adjournments of the Meeting, in accordance with applicable law, to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of the holders of a majority of the shares of the Ivy Dividend Opportunities Fund present in person or by proxy at the Meeting or an adjournment thereof. The person named as proxy will vote “FOR” any such adjournment those proxies which he is entitled to vote in favor of the Proposal and will vote “AGAINST” any such adjournment those proxies to be voted against the Proposal.

| | | | |

| | | | By order of the Board of Trustees of the Ivy Funds, |

| | |

| | | | Jennifer K. Dulski, |

| | | | Secretary |

November 30, 2017

Your vote is important, regardless of the number of shares you own. You can vote easily and quickly by phone, by mail, by internet or in person. See the enclosed proxy card for instructions. Please help your Fund avoid the expense of a follow-up mailing by voting today!

Combined Prospectus and Proxy Statement

November 30, 2017

IVY FUNDS

6300 Lamar Avenue

Overland Park, Kansas 66202

1-800-777-6472

Transfer of all of the Assets and Liabilities of the

Ivy Dividend Opportunities Fund, a series of

Ivy Funds

By and in Exchange for Shares of the

Ivy Global Equity Income Fund, a series of

Ivy Funds

TABLE OF CONTENTS

This Combined Prospectus and Proxy Statement (“Prospectus/Proxy Statement”) is being furnished to shareholders of the Ivy Dividend Opportunities Fund (the “Dividend Opportunities Fund”), a series of the Ivy Funds (the “Trust”), in connection with the solicitation of proxies by the Board of Trustees (the “Board,” and its members, the “Trustees”) of the Trust for use at a special meeting of shareholders of the Dividend Opportunities Fund and any adjournments or postponements thereof (the “Meeting”).

The Meeting is scheduled to occur at 2:00 p.m. Central Time on February 1, 2018 at the offices of the Trust, 6300 Lamar Avenue, Overland Park, Kansas. The purposes of the Meeting are as follows:

| | 1. | To approve an Agreement and Plan of Reorganization (the “Reorganization Plan”) providing for the transfer of all of the assets of the Dividend Opportunities Fund to, and the assumption of all of the liabilities of the Dividend Opportunities Fund by, the Ivy Global Equity Income Fund |

1

| | (the “Global Equity Income Fund”) in exchange for shares of the Global Equity Income Fund and the distribution of such shares to the shareholders of the Dividend Opportunities Fund in complete liquidation of the Dividend Opportunities Fund (the “Reorganization”). |

| | 2. | To consider and act upon any other matters that may properly come before the Meeting and any adjourned session of the Meeting. |

The Board, including the Trustees who are not “interested persons” (as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the Trust (the “Independent Trustees”), has approved the Reorganization Plan and the Reorganization.

Shareholders of record of the Dividend Opportunities Fund at the close of business on November 29, 2017 are entitled to notice of, and to vote at, the Meeting or any adjournments or postponements thereof. This Prospectus/Proxy Statement, the proxy card(s) and the accompanying Notice of Special Meeting of Shareholders were first mailed or given to shareholders of record of the Dividend Opportunities Fund on or about December 8, 2017. The Board requests that shareholders of the Dividend Opportunities Fund vote their shares by completing and returning the enclosed proxy card or by following one of the other methods for voting specified on the proxy card.

This Prospectus/Proxy Statement provides information that a shareholder of the Dividend Opportunities Fund should know before voting on the proposal to approve the Reorganization Plan and sets forth concisely information about the Global Equity Income Fund that a prospective investor ought to know before investing. You should read this Prospectus/Proxy Statement and it should be retained for future reference. It is both a proxy statement for the Reorganization and a prospectus for the Global Equity Income Fund. If the Reorganization of the Dividend Opportunities Fund occurs, you will become a shareholder of the Global Equity Income Fund. If the Plan is approved by the shareholders of the Dividend Opportunities Fund and the Reorganization occurs, the Dividend Opportunities Fund will transfer all of the assets and liabilities attributable to each class of its shares to the Global Equity Income Fund in exchange for shares of the same class of shares of the Global Equity Income Fund with the same aggregate net asset value (“NAV”) as the net value of the assets and liabilities transferred. After that exchange, shares of each class received by the Global Equity Income Fund will be distributed pro rata to the Fund’s shareholders of the corresponding class.

2

The Dividend Opportunities Fund and the Global Equity Income Fund (each a “Fund,” collectively, the “Funds”) are each a series of the Trust, a registered, open-end management investment company organized as a Delaware statutory trust. The investment objective of the Dividend Opportunities Fund is to seek to provide total return. The investment objective of the Global Equity Income Fund is to seek to provide total return through a combination of current income and capital appreciation. The Funds have similar principal investment strategies and principal investment risks and identical fundamental investment restrictions.

The following documents have been filed with the Securities and Exchange Commission (the “SEC”) and are incorporated into this Prospectus/Proxy Statement by reference:

| | - | The Prospectus for the funds of the Trust dated July 5, 2017, relating to the Funds (as supplemented to date) (the “Ivy Funds Prospectus”) (previously filed on EDGAR, Accession Nos. 0001193125-17-225159/228572/254219/

261969/287046/299235/346833/350562). |

| | - | The Statement of Additional Information (“SAI”) dated November 30, 2017 relating to the Reorganization. |

The following documents have been filed with the SEC and are incorporated by reference into the SAI:

| | - | The Statement of Additional Information for the funds of the Trust dated July 5, 2017, relating to the Funds (as supplemented to date) (the “Ivy Funds SAI”) (previously filed on EDGAR, Accession Nos. 0001193125-17-225159/228574/261970/299238/350562). |

| | - | The audited financial statements included in the Funds’ Annual Report to shareholders, relating to the Funds, dated March 31, 2017 (previously filed on EDGAR, Accession No. 0001193125-17-197772). |

For a free copy of any of the documents listed above, you may call 1-800-777-6472, or you may write to the attention of either Fund at:

Ivy Funds

6300 Lamar Avenue

P.O. Box 29217

Shawnee Mission, Kansas 66201-9217

3

The Trust is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act, and in accordance therewith files reports and other information with the SEC. You also may obtain many of these documents by accessing the Internet site for Ivy Funds at www.ivyinvestments.com. Text-only versions of the Ivy Funds documents can be viewed online or downloaded from the EDGAR database on the SEC’s Internet site at www.sec.gov. You can review and copy information about the Funds by visiting the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You can obtain copies, upon payment of a duplicating fee, by sending an e-mail request to publicinfo@sec.gov or by writing the SEC Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. Information on the operations of the Public Reference Room may be obtained by calling 1-202-551-8090.

The Securities and Exchange Commission has not approved or disapproved these securities or determined if this Prospectus/Proxy Statement is truthful or complete. Any representation to the contrary is a criminal offense.

Shares of each Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal.

No person has been authorized to give any information or to make any representations other than those contained in this Prospectus/Proxy Statement and, if given or made, such other information or representations must not be relied upon as having been authorized by the Trust.

4

SYNOPSIS

This Prospectus/Proxy Statement provides a brief overview of the key features and other matters typically of concern to shareholders affected by a reorganization of a mutual fund into another mutual fund. These responses are qualified in their entirety by the remainder of this Prospectus/Proxy Statement, which you should read carefully because it contains additional information and further details regarding the Reorganization. The material terms of the Reorganization are discussed in more detail in the section titled “THE PROPOSAL-Approval of the Reorganization of the Dividend Opportunities Fund into the Global Equity Income Fund-Terms of the Reorganization Plan,” and in the full text of the Reorganization Plan, which is attached as Appendix A.

What is being proposed?

Both the Dividend Opportunities Fund and the Global Equity Income Fund are series of the Trust, an open-end, registered investment company. The Board is recommending that shareholders of the Dividend Opportunities Fund approve the Reorganization Plan and the resulting Reorganization, in which the Global Equity Income Fund would acquire all of the assets and liabilities of the Dividend Opportunities Fund in exchange for shares of the Global Equity Income Fund (the “Proposal”). The Dividend Opportunities Fund, in turn, will distribute shares of the Global Equity Income Fund to shareholders of the Dividend Opportunities Fund in liquidation, and shareholders of the Dividend Opportunities Fund will become shareholders of the Global Equity Income Fund. Your shares of the Dividend Opportunities Fund will be cancelled. Pursuant to the Reorganization Plan, you will receive shares of the Global Equity Income Fund with an aggregate NAV equal to the aggregate NAV of your Dividend Opportunities Fund shares as of the business day before the closing of the Reorganization.

What is the Board’s recommendation regarding the Proposal?

At a meeting held on October 9, 2017, the Board, on behalf of the Dividend Opportunities Fund, considered the Proposal to reorganize the Dividend Opportunities Fund with and into the Global Equity Income Fund, approved the Reorganization Plan, and voted to recommend that shareholders of the Dividend Opportunities Fund vote to approve the Reorganization Plan. For the reasons summarized immediately below and discussed in more detail in the section below titled “THE PROPOSAL-Approval of the Reorganization of the Dividend Opportunities Fund into the Global Equity Income Fund- Reasons for the

5

Reorganization,” the Board, including the Independent Trustees, has determined that participation in the Reorganization is in the best interests of the Dividend Opportunities Fund. The Board also concluded that no dilution in value would result for the shareholders of the Dividend Opportunities Fund as a result of the Reorganization.

In making its recommendation, what factors did the Board consider?

The Board approved the Reorganization Plan and the Reorganization, because it offers shareholders of the Dividend Opportunities Fund the opportunity to invest in a combined larger fund (allowing the potential for more efficient operations by spreading relatively fixed costs, such as audit and legal fees, over a larger asset base). In reviewing the Reorganization, the Board also considered the following factors, among others:

| | • | | Reorganization Expenses Allocated Among the Funds. The total amount of the expenses for the Reorganization is estimated to be approximately $280,000. The expenses will be allocated between the Dividend Opportunities Fund and the Global Equity Income Fund based on net assets, with the Dividend Opportunities Fund bearing 75% of the reorganization expenses ($210,000) and the Global Equity Income Fund bearing 25% of the reorganization expenses ($70,000). This expense allocation will be made whether or not the Reorganization is consummated. The Board and Ivy Funds management believed that a partial allocation of Reorganization expenses to each Fund was appropriate because the Reorganization is expected to be beneficial to each Fund and its shareholders. |

| | • | | Same or Lower Overall Expenses. By reorganizing into the Global Equity Income Fund, former Dividend Opportunities Fund shareholders will be subject to the same or lower ongoing expenses than those imposed by the Dividend Opportunities Fund. For Class B shares of the Dividend Opportunities Fund that will be reorganizing into a share class of the Global Equity Income Fund whose expenses are higher than its corresponding share class of the Dividend Opportunities Fund, IICO, Ivy Distributors, Inc. (“IDI”), the Funds’ distributor, and/or Waddell & Reed Services Company, doing business as WI Services Company (“WISC”), the Funds’ transfer agent, have agreed to limit the operating expenses that will be charged to shareholders of such class of shares of the Global Equity Income |

6

| | Fund to be equal to any lower expense ratio of the corresponding class of the Dividend Opportunities Fund through July 31, 2020. |

After the Reorganization, shareholders of Class A shares, Class C shares, Class I shares, Class N shares, Class R shares, and Class Y shares will be subject to the same or lower annual fund operating expenses that had been experienced as shareholders of the Dividend Opportunities Fund.

In connection with the closing of the Reorganization, the Global Equity Income Fund will begin offering Class E shares effective the closing date of the proposed merger. Class E shareholders will initially have the same annual fund operating expenses that they experienced as shareholders of the Dividend Opportunities Fund.

| | | | | | | | | | | | |

| | | Total Annual Fund Operating Expenses After Fee

Waiver/Expense Reimbursement | |

| | | Dividend

Opportunities

Fund

(Target Fund) | | | Global Equity

Income Fund

(Acquiring Fund) | | | Global Equity

Income Fund

(After the

Reorganization) | |

Class A shares | | | 1.24 | % | | | 1.30 | % | | | 1.23 | % |

Class B shares | | | 2.04 | % | | | 1.95 | % | | | 1.95 | % |

Class C shares | | | 1.92 | % | | | 1.95 | % | | | 1.90 | % |

Class E shares* | | | 1.13 | % | | | N/A | | | | 1.13 | % |

Class I shares | | | 0.92 | % | | | 0.94 | % | | | 0.91 | % |

Class N shares | | | 0.77 | % | | | 0.81 | % | | | 0.75 | % |

Class R shares | | | 1.51 | % | | | 1.56 | % | | | 1.49 | % |

Class Y shares | | | 1.17 | % | | | 1.19 | % | | | 1.15 | % |

| | * | Class E shares of the Global Equity Income Fund are new and will not commence operations until the closing of the Reorganization. |

| | • | | No Shareholder Dilution. The Reorganization will occur at the NAV of each Fund and therefore will not dilute the interests of the Dividend Opportunities Fund shareholders. |

| | • | | Tax Free Reorganization. The Reorganization is expected to be tax-free for shareholders of the Dividend Opportunities Fund who choose to remain shareholders of the Global Equity Income Fund, while a liquidation or shareholder redemption would be a realization event for tax purposes. |

For a more detailed discussion of the considerations of the Board, see the section below titled “THE PROPOSAL-Approval of the

7

Reorganization of the Dividend Opportunities Fund into the Global Equity Income Fund-Reasons for the Reorganization.”

When will the shareholder Meeting and the Reorganization take place?

The Meeting has been called for February 1, 2018 to consider the approval of the Reorganization. If Dividend Opportunities Fund’s shareholders approve the Reorganization, the Reorganization is currently scheduled to take place on or around February 26, 2018. Shortly after completion of the Reorganization, affected shareholders will receive a confirmation statement reflecting their new Global Equity Income Fund account number and number of shares owned.

What happens if the Reorganization is not approved?

If the Reorganization is not approved by the Dividend Opportunities Fund’s shareholders or does not close for any reason, such shareholders will remain shareholders of the Dividend Opportunities Fund, and the Dividend Opportunities Fund will continue to operate. The Board then will consider such other actions as it deems necessary or appropriate for the Dividend Opportunities Fund.

How will shareholder voting be handled?

Shareholders who own shares of the Dividend Opportunities Fund at the close of business on November 29, 2017 (the “Record Date”) will be entitled to vote at the Meeting and will be entitled to one vote for each full share and a proportionate fractional vote for each fractional share that they hold. Approval of the Reorganization by the Dividend Opportunities Fund requires the affirmative vote of the lesser of: (i) a majority of the outstanding shares of the Dividend Opportunities Fund or (ii) 67% or more of the outstanding shares of the Dividend Opportunities Fund present at or represented by proxy at the Meeting if the holders or more than 50% of the outstanding shares of the Dividend Opportunities Fund are present or represented by proxy.

Please vote by proxy as soon as you receive this Prospectus/Proxy Statement. You may place your vote by completing, signing, and mailing the enclosed proxy card, by calling the number on the enclosed proxy card, or if eligible, via the Internet by following the on-line instructions. If you vote by any of these methods, the persons appointed as proxies will officially cast your votes at the Meeting. You may also attend the Meeting and cast your vote in person at the Meeting.

8

You can revoke you proxy or change your voting instructions at any time until the vote is taken at the Meeting. For more details about shareholder voting, see the section below titled “VOTING INFORMATION.”

What Global Equity Income Fund shares will I receive in the Reorganization?

Under the Reorganization Plan, Class A, Class B, Class C, Class E, Class I, Class N, Class R and Class Y shares of the Dividend Opportunities Fund will be reorganized into the corresponding Class A, Class B, Class C, Class E, Class I, Class N, Class R and Class Y shares of the Global Equity Income Fund. The shares of the Global Equity Income Fund you receive in exchange for your Dividend Opportunities Fund shares will have an aggregate NAV equal to the aggregate NAV of your respective Dividend Opportunities Fund shares as of the close of business on the business day before the closing of the Reorganization. You will have voting rights identical to those you currently have, but as a shareholder of the Global Equity Income Fund. The rights of the shareholders of each Fund are identical since each Fund is a series of the Trust. The purchase and exchange privileges of the Dividend Opportunities Fund are identical to those currently offered by the Global Equity Income Fund. All shareholder features that you have elected will remain available and in effect after the Reorganization unless you direct that those elections be changed.

Distributions by the Global Equity Income Fund will continue to be paid on the same schedule after the Reorganization as they are currently. Each Fund distributes net investment income quarterly in March, June, September and December. Net realized capital gains (and any gains from foreign currency transactions) ordinarily are distributed by each Fund in December.

For more information on the characteristics of the Global Equity Income Fund shares you will receive, please see the section titled “Your Account” in the Ivy Funds Prospectus that accompanies this Prospectus/Proxy Statement.

How do the Funds’ investment objectives, fundamental investment restrictions, principal investment strategies and principal investment risks compare?

The following summarizes the primary similarities and differences in the Funds’ investment objectives, fundamental investment restrictions, principal investment strategies and risks.

9

Investment Objectives:

The investment objectives of the Funds are similar. The Dividend Opportunities Fund seeks to provide total return. The Global Equity Income Fund seeks to provide total return through a combination of current income and capital appreciation.

Principal Investment Strategies:

The principal investment strategies of the Dividend Opportunities Fund and the Global Equity Income Fund are similar. The Funds both seek to achieve their investment objectives by investing primarily in large-capitalization companies. Although both Funds invest primarily in large-capitalization companies (typically companies with market capitalizations at least $10 billion at the time of acquisition), they may invest in companies of any size. However, there are certain differences between the principal investment strategies of the Funds. While both Funds seek to achieve their objective by investing primarily in large-capitalization companies, the Dividend Opportunities Fund looks for companies that often are market leaders in their industry, with established operating records that IICO believes may accelerate or grow their dividend payout ratio and that also demonstrate favorable prospects for total return. The Global Equity Income Fund invests principally in equity securities that are issued by companies of any size located largely in developed markets around the world, that IICO believes will be able to generate a reasonable level of current income for investors given current market conditions, and that demonstrate favorable prospects for total return. The Global Equity Income Fund focuses on companies that IICO believes have the ability to maintain and/or grow their dividends while providing capital appreciation over the long-term.

Under normal circumstances, both Funds invests at least 80% of its net assets in equity securities. For this purpose, such equity securities consist primarily of dividend-paying common stocks. The Global Equity Income Fund includes common stocks across the globe. In an attempt to enhance return, the Global Equity Income Fund also may invest, to a lesser extent, in companies not currently paying dividends to shareholders or companies with an unsustainably high dividend. The Global Equity Income Fund may invest in U.S. and non-U.S. issuers and, under normal circumstances, invests at least 40% (or if IICO deems it warranted by market conditions, at least 30% of its total assets) in securities of non-U.S. issuers and may invest up to 100% of its total assets in foreign securities. The Dividend Opportunities Fund typically holds a limited number of stocks (generally 40 to 60) and although the Dividend

10

Opportunities Fund invests primarily in U.S. securities, it may invest up to 25% of its total assets in foreign securities.

In selecting securities for the Dividend Opportunities Fund, IICO primarily focuses on companies that have an above-market dividend yield that is supported by what IICO believes are attractive relative and absolute valuations and tends to favor companies that IICO believes have the ability to grow their dividend at an average or above-average rate relative to the market. IICO also seeks to invest in companies that it believes have the potential for strong growth in their dividend payout due to the companies having a low initial payout ratio and a commitment to raising the payout ratio over time, or above-average earnings growth potential which also are supported by what it believes are attractive relative and absolute valuations. In selecting securities for the Global Equity Income Fund, IICO combines a top-down (assessing the market environment), approach with a bottom-up (researching individual issuers) stock selection process, and uses a combination of country analysis, sector and industry dynamics, and individual stock selection. As part of the Global Equity Income Fund’s investment process, IICO seeks to identify investment themes, then seeks to determine the most appropriate sectors and geographies to benefit from its top-down analysis and generally seeks to find what it believes are reasonably-valued, dividend-paying companies with growth prospects, a sound balance sheet and steady cash flow generation.

For additional information, see “COMPARISON OF THE FUNDS – Comparison of Principal Investment Strategies.”

Fundamental Investment Restrictions:

The fundamental investment restrictions of the Dividend Opportunities Fund and the Global Equity Income Fund are identical. For more information, see “COMPARISON OF THE FUNDS- Comparison of Fundamental Investment Restrictions.”

Principal Investment Risks:

The principal investment risks of the Dividend Opportunities Fund and the Global Equity Income Fund are similar. The Funds disclose the following principal risks in common: Company Risk, Dividend-Paying Stock Risk, Foreign Exposure Risk, Foreign Securities Risk, Large Company Risk, Management Risk and Market Risk.

In addition, the Dividend Opportunities Fund but not the Global Equity Income Fund discloses as principal investment risks Growth Stock Risk, Holdings Risk, Sector Risk and Value Stock Risk, while the

11

Global Equity Income Fund but not the Dividend Opportunities Fund discloses as principal investment risks Foreign Currency Exchange Transactions and Forward Foreign Currency Contracts Risk and Foreign Currency Risk. For additional information, see “COMPARISON OF THE FUNDS- Comparison of Principal Investment Risks.”

Will the Reorganization result in a higher investment management fee rate and higher fund expense rates?

No. The current investment management fees paid by the Dividend Opportunities Fund and the Global Equity Income Fund is equal to 0.70% of each Fund’s net assets. After the Reorganization, the fees paid by the Global Equity Income Fund will be reduced to 0.69% due to the combination of the Dividend Opportunities Fund’s and Global Equity Income Fund’s assets, which allow the Global Equity Income Fund to benefit from an investment management fee breakpoint. For Class B shares of the Dividend Opportunities Fund that will be reorganizing into a share class of the Global Equity Income Fund whose expenses are higher than its corresponding share class of the Dividend Opportunities Fund, IICO, IDI, and/or WISC, have agreed to limit the operating expenses that will be charged to shareholders of such class of shares of the Global Equity Income Fund to be equal to any lower expense ratio of the corresponding class of the Dividend Opportunities Fund through July 31, 2020.

After the Reorganization, shareholders of Class A shares, Class C shares, Class I shares, Class N shares, Class R shares, and Class Y shares will be subject to the same or lower annual fund operating expenses that had been experienced as shareholders of the Dividend Opportunities Fund.

In connection with the closing of the Reorganization, the Global Equity Income Fund will begin offering Class E shares effective the closing date of the proposed merger. Class E shareholders will initially have the same annual fund operating expenses that they experienced as shareholders of the Dividend Opportunities Fund.

Additional pro forma fee, expense, and financial information is included in the “COMPARISON OF THE FUNDS-Comparison of Shareholder Fees and Annual Fund Operating Expenses” section of this Prospectus/Proxy Statement.

What are the federal income tax consequences of the Reorganization?

The Reorganization is expected to be tax-free to you for federal income tax purposes. This means that neither shareholders nor the Dividend Opportunities Fund is expected to recognize a gain or loss as a result of the Reorganization.

12

Immediately prior to the Reorganization, the Dividend Opportunities Fund will declare and pay a distribution of substantially all net investment company taxable income, if any, and net realized capital gains (after reduction by any available capital loss carry-forwards), if any, to its shareholders. The cost basis and holding period of the Dividend Opportunities Fund shares are expected to carry over to your new shares in the Global Equity Income Fund.

Will the services provided by IICO change?

IICO currently manages both the Dividend Opportunities Fund and the Global Equity Income Fund and will continue to serve as the investment manager of the Global Equity Income Fund following the Reorganization. Christopher J. Parker, Vice President of IICO, is the portfolio manager of the Dividend Opportunities Fund. Robert E. Nightingale, Senior Vice President of IICO, is the portfolio manager of the Global Equity Income Fund. Mr. Nightingale and Mr. Parker will continue to serve as co-portfolio managers of the Global Equity Income Fund after the Reorganization. The Funds have the same principal underwriter, accounting services agent, transfer agent, custodian and independent registered public accounting firm. Upon completion of the Reorganization, the Global Equity Income Fund will continue to engage its existing service providers. In all cases, the types of services provided to the Funds under these service arrangements are the same.

Will there be any sales charge, commission or other transaction fee in connection with the Reorganization?

No. There will be no sales charge, commission or other transactional fee in connection with the Reorganization. The full and fractional value of shares of the Dividend Opportunities Fund will be exchanged for full and fractional corresponding shares of the Global Equity Income Fund having equal aggregate value, without any sales charge, sales load, commission or other transactional fee being imposed.

The shares acquired in the Reorganization may be exchanged for shares of the same class of any other fund in the Ivy Funds, and for clients of Waddell & Reed, Inc. (“Waddell & Reed”) and non-affiliated third parties that have entered into selling agreements with Waddell & Reed, in the Waddell & Reed Advisors Funds (“WRA Funds”), without the payment of an additional initial sales charge or additional contingent deferred sales charge (“CDSC”), for as long as you own your shares of the Global Equity Income Fund.

However, for Class A, Class B or Class C shares that you received in connection with the Reorganization to which a CDSC would otherwise

13

apply, the time period for the CDSC will continue to age from the date you purchased the respective shares of the Dividend Opportunities Fund. Class E, Class I, Class N, Class R and Class Y shares of the Funds are not subject to a CDSC.

Are there any significant differences between shares of the Dividend Opportunities Fund and Global Equity Income Fund?

No. The procedures for purchasing, exchanging and redeeming your shares of the Global Equity Income Fund will be the same after the Reorganization as they are currently for the Dividend Opportunities Fund. In addition, the sales charge, distribution plan and administrative services plan structures for the Funds are identical. For more information, see the section entitled “COMPARISONS OF THE FUNDS – Comparison of Share Class Characteristics, Shareholder Transactions and Services” and the section titled “Your Account” in the Ivy Funds Prospectus that accompanies this Prospectus/Proxy Statement.

Can I still add to my existing Dividend Opportunities Fund account until the Reorganization?

Yes. Dividend Opportunities Fund shareholders may continue to make additional investments until the closing, which is anticipated to be on or about February 26, 2018 (the “Closing Date”), unless the Board determines to limit future investments to ensure a smooth transition of shareholder accounts or for any other reason. In anticipation of the Reorganization, the Dividend Opportunities Fund is expected to be closed to new shareholders as of February 2, 2018.

Will I need to open an account in the Global Equity Income Fund prior to the Reorganization?

No. An account will be set up in your name and your shares of the Dividend Opportunities Fund will automatically be converted to corresponding shares of the Global Equity Income Fund. You will receive confirmation of your new account in the Global Equity Income Fund following the Reorganization.

Will my cost basis change as a result of the Reorganization?

No. Your total cost basis is not expected to change as a result of the Reorganization. However, since the number of shares you hold after the Reorganization may be different than the number of shares you held prior to the Reorganization, your average cost basis per share may change. Since the Reorganization is expected to be treated as a tax-free

14

reorganization for the Dividend Opportunities Fund, shareholders should not recognize any capital gain or loss as a direct result of the Reorganization.

Will either Fund pay fees associated with the Reorganization?

Yes. The costs of the Reorganization will be allocated between the Dividend Opportunities Fund and Global Equity Income Fund based on net assets in the following percentages (and estimated corresponding dollar amounts): Dividend Opportunities Fund 75% ($210,000), Global Equity Income Fund 25% ($70,000).

What if I want to exchange my shares into another fund of the Trust prior to the Reorganization?

You may exchange your shares into another fund of the Trust before the Closing Date (on or about February 26, 2018) in accordance with your preexisting exchange privileges. If you choose to exchange your shares of the Dividend Opportunities Fund for another fund in the Ivy Funds and, for clients of Waddell & Reed and non-affiliated third parties that have entered into selling agreements with Waddell & Reed, in the WRA Funds, your request will be treated as a normal exchange of shares and will be a taxable transaction unless your shares are held in a tax-deferred account, such as an individual retirement account. Exchanges may be subject to minimum investment requirements, sales loads. This is not an offer to sell shares of other funds of the Trust, it is for informational purposes only. Before exchanging into a fund, please read its prospectus carefully.

15

COMPARISON OF THE FUNDS

This section provides a comparison of each Fund, including but not limited to, each Fund’s shareholder fees, annual fund operating expenses, investment objective, principal investment strategies, principal investment risks, fundamental investment restrictions, and historical performance. There is no assurance that a Fund will achieve its stated objective.

Comparison of Shareholder Fees and Annual Fund Operating Expenses

Shareholder fees are fees paid directly from your investment. The shareholder fees presented below show the maximum sales charge (load) on purchases of Fund shares as a percentage of offering price, and the maximum CDSC on redemption of Fund shares as a percentage of the amount invested or their redemption value, as applicable. However, you will not have to pay any sales charge on any shares of the Global Equity Income Fund received as part of the Reorganization.

Annual fund operating expenses are paid out of a Fund’s assets and include fees for portfolio management and administrative services, including recordkeeping, accounting and other shareholder services. You do not pay these fees directly, but as the examples in the table below show, these costs are borne indirectly by all shareholders.

The annual fund operating expenses shown in the tables below represent annualized expenses for the Dividend Opportunities Fund and the Global Equity Income Fund, as well as those estimated for the Global Equity Income Fund on a pro forma basis, assuming shareholder approval of the Reorganization and consummation of the Reorganization. The Annual Fund Operating Expense tables below allow a shareholder to compare the sales charges, management fees and expense ratios of the Dividend Opportunities Fund with the Global Equity Income Fund and to analyze the estimated expenses that the Global Equity Income Fund expects to bear following the Reorganization.

The current investment management fees paid by the Dividend Opportunities Fund and the Global Equity Income Fund is equal to 0.70%. After the Reorganization, the fees paid by the Global Equity Income Fund will be reduced to 0.69% due to the combination of the Dividend Opportunities Fund’s and Global Equity Income Fund’s assets, which allow the Global Equity Income Fund to benefit from an investment management fee breakpoint. For Class B shares

16

of the Dividend Opportunities Fund that will be reorganizing into a share class of the Global Equity Income Fund whose expenses are higher than its corresponding share class of the Dividend Opportunities Fund, IICO, IDI, and/or WISC, have agreed to limit the operating expenses that will be charged to shareholders of such class of shares of the Global Equity Income Fund to be equal to any lower expense ratio of the corresponding class of the Dividend Opportunities Fund through July 31, 2020.

After the Reorganization, shareholders of Class A shares, Class C shares, Class I shares, Class N shares, Class R shares, and Class Y shares will be subject to the same or lower annual fund operating expenses that had been experienced as shareholders of the Dividend Opportunities Fund.

In connection with the closing of the Reorganization, the Global Equity Income Fund will begin offering Class E shares effective the closing date of the proposed merger. Class E shareholders will initially have the same annual fund operating expenses that they experienced as shareholders of the Dividend Opportunities Fund.

17

The Annual Fund Operating Expenses shown in the table below are based on the expenses of each fund for the twelve-month period ended March 31, 2017. Also shown are the Annual Fund Operating Expenses projected for the Global Equity Income Fund on a pro forma basis after giving effect to the proposed Reorganization, based on combined net assets as if the Reorganization had occurred on April 1, 2016 and had a year of combined operations.

Shareholder Fees

(fees paid directly from your investment)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Dividend Opportunities Fund+

(Target Fund) | | | Global Equity Income Fund

(Acquiring Fund) | | | Global Equity Income Fund after

Reorganization with the

Dividend Opportunities Fund

(pro forma combined) | |

| | | Class A

Shares | | | Class B

Shares | | | Class C

Shares | | | Class E

Shares | | | Class A

Shares | | | Class B

Shares | | | Class C

Shares | | | Class E*

Shares | | | Class A

Shares | | | Class B

Shares | | | Class C

Shares | | | Class E*

Shares | |

Maximum Sales Charge (Load) imposed on purchases (as a % of offering price) | | | 5.75 | % | | | None | | | | None | | | | 2.50 | % | | | 5.75 | % | | | None | | | | None | | | | NA | | | | 5.75 | % | | | None | | | | None | | | | 2.50 | % |

Maximum Deferred Sales Charge (Load) (as a % of lesser of amount invested or redemption value) | | | 1.00 | %1 | | | 5.00 | %1 | | | 1.00 | %1 | | | None | | | | 1.00 | %1 | | | 5.00 | %1 | | | 1.00 | %1 | | | NA | | | | 1.00 | %1 | | | 5.00 | %1 | | | 1.00 | %1 | | | None | |

Maximum Account Fee | | $ | 20 | 2 | | | None | | | $ | 20 | 2 | | $ | 20 | 2 | | $ | 20 | 2 | | | None | | | $ | 20 | 2 | | | NA | | | $ | 20 | 2 | | | None | | | $ | 20 | 2 | | $ | 20 | 2 |

| | | |

| | | Dividend Opportunities Fund+

(Target Fund) | | | Global Equity Income Fund

(Acquiring Fund) | | | Global Equity Income Fund after

Reorganization with the

Dividend Opportunities Fund

(pro forma combined) | |

| | | Class I

Shares | | | Class N

Shares | | | Class R

Shares | | | Class Y

Shares | | | Class I

Shares | | | Class N

Shares | | | Class R

Shares | | | Class Y

Shares | | | Class I

Shares | | | Class N

Shares | | | Class R

Shares | | | Class Y

Shares | |

Maximum Sales Charge (Load) imposed on purchases (as a % of offering price) | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | |

Maximum Deferred Sales Charge (Load) (as a % of lesser of amount invested or redemption value) | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | |

Maximum Account Fee | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | | | | None | |

18

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Dividend Opportunities Fund+

(Target Fund) | | | Global Equity Income Fund

(Acquiring Fund) | | | Global Equity Income Fund after

Reorganization with the

Dividend Opportunities Fund

(pro forma combined) | |

| | | Class A

Shares | | | Class B

Shares | | | Class C

Shares | �� | | Class E

Shares | | | Class A

Shares | | | Class B

Shares | | | Class C

Shares | | | Class E*

Shares | | | Class A

Shares | | | Class B

Shares | | | Class C

Shares | | | Class E*

Shares | |

Management Fee | | | 0.70 | % | | | 0.70 | % | | | 0.70 | % | | | 0.70 | % | | | 0.70 | % | | | 0.70 | % | | | 0.70 | % | | | NA | | | | 0.69 | % | | | 0.69 | % | | | 0.69 | % | | | 0.69 | % |

Distribution and Service (12b-1) Fees | | | 0.25 | % | | | 1.00 | % | | | 1.00 | % | | | 0.25 | % | | | 0.25 | % | | | 1.00 | % | | | 1.00 | % | | | NA | | | | 0.25 | % | | | 1.00 | % | | | 1.00 | % | | | 0.25 | % |

Other Expenses | | | 0.29 | % | | | 0.41 | % | | | 0.22 | % | | | 0.59 | % | | | 0.43 | % | | | 0.25 | % | | | 0.25 | % | | | NA | | | | 0.29 | % | | | 0.36 | % | | | 0.21 | % | | | 0.58 | % |

Total Annual Fund Operating Expenses | | | 1.24 | %3 | | | 2.11 | %3 | | | 1.92 | % | | | 1.54 | %3 | | | 1.38 | %4 | | | 1.95 | % | | | 1.95 | % | | | NA | | | | 1.23 | % | | | 2.05 | %5 | | | 1.90 | % | | | 1.52 | %5 |

Fee Waiver and/or Expense Reimbursement | | | 0.00 | %3 | | | 0.07 | %3 | | | None | | | | 0.41 | %3 | | | 0.08 | %4 | | | None | | | | None | | | | N/A | | | | None | | | | 0.10 | %5 | | | None | | | | 0.39 | %5 |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | | | 1.24 | %3 | | | 2.04 | %3 | | | 1.92 | % | | | 1.13 | %3 | | | 1.30 | %4 | | | 1.95 | % | | | 1.95 | % | | | NA | | | | 1.23 | % | | | 1.95 | %5 | | | 1.90 | % | | | 1.13 | %5 |

19

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Dividend Opportunities Fund+

(Target Fund) | | | Global Equity Income Fund

(Acquiring Fund) | | | Global Equity Income Fund

after Reorganization with the

Dividend

Opportunities Fund

(pro forma combined) | |

| | | Class I

Shares | | | Class N

Shares | | | Class R

Shares | | | Class Y

Shares | | | Class I

Shares | | | Class N

Shares | | | Class R

Shares | | | Class Y

Shares | | | Class I

Shares | | | Class N

Shares | | | Class R

Shares | | | Class Y

Shares | |

Management Fee | | | 0.70 | % | | | 0.70 | % | | | 0.70 | % | | | 0.70 | % | | | 0.70 | % | | | 0.70 | % | | | 0.70 | % | | | 0.70 | % | | | 0.69 | % | | | 0.69 | % | | | 0.69 | % | | | 0.69 | % |

Distribution and Service (12b-1) Fees | | | None | | | | None | | | | 0.50 | % | | | 0.25 | % | | | None | | | | None | | | | 0.50 | % | | | 0.25 | % | | | None | | | | None | | | | 0.50 | % | | | 0.25 | % |

Other Expenses | | | 0.22 | % | | | 0.07 | % | | | 0.31 | % | | | 0.22 | % | | | 0.26 | % | | | 0.11 | % | | | 0.36 | % | | | 0.26 | % | | | 0.22 | % | | | 0.06 | % | | | 0.30 | % | | | 0.21 | % |

Total Annual Fund Operating Expenses | | | 0.92 | %3 | | | 0.77 | % | | | 1.51 | % | | | 1.17 | %6 | | | 0.96 | %4 | | | 0.81 | % | | | 1.56 | % | | | 1.21 | %4,6 | | | 0.91 | % | | | 0.75 | % | | | 1.49 | % | | | 1.15 | %6 |

Fee Waiver and/or Expense Reimbursement | | | 0.00 | %3 | | | None | | | | None | | | | 0.00 | %6 | | | 0.02 | %4 | | | None | | | | None | | | | 0.02 | %4,6 | | | None | | | | None | | | | None | | | | 0.00 | %6 |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | | | 0.92 | %3 | | | 0.77 | % | | | 1.51 | % | | | 1.17 | %6 | | | 0.94 | %4,7 | | | 0.81 | % | | | 1.56 | % | | | 1.19 | %4,6 | | | 0.91 | % | | | 0.75 | % | | | 1.49 | % | | | 1.15 | %6 |

| + | On October 16, 2017, the Waddell & Reed Advisors, (“WRA”) Dividend Opportunities Fund reorganized into the Dividend Opportunities Fund. The Annual Fund Operating Expenses have been estimated based on the combined net assets of the WRA Dividend Opportunities Fund and Dividend Opportunities Fund and an assumption that the combined Fund had a year of operations as of March 31, 2017. |

| * | Class E shares of the Global Equity Income Fund are new and were created in anticipation of the Reorganization. |

| 1 | For Class A shares, a 1% CDSC is only imposed on shares that were purchased at NAV for $1 million or more that are subsequently redeemed within 12 months of purchase. For Class B shares, the CDSC declines from 5% for redemptions within the first year of purchase, to 4% for redemptions within the second year, to 3% for redemptions within the third and fourth years, to 2% for redemptions within the fifth year, to 1% for redemptions within the sixth year and to 0% for redemptions after the sixth year. For Class C shares, a 1% CDSC applies to redemptions within 12 months of purchase. |

| 2 | With limited exceptions, for Class A and Class C shares, if your Fund account balance is below $650 at the start of business on the Friday prior to the last full week of September of each year, the account will be assessed an account fee of $20. With limited exceptions, for Class E shares, the current $20 account fee accounts with a balance of less than $25,000 will be assessed annually at the close of business on the second Tuesday of December. |

| 3 | Through July 31, 2020, IICO, IDI and/or WISC, have contractually agreed to reimburse sufficient management fees, 12b-1 fees and/or shareholder servicing fees to cap the total annual ordinary fund operating expenses (which would exclude interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses, if any) for the Dividend Opportunities Fund as follows: |

20

| | Class A shares at 1.24%, Class B shares at 2.04%, Class E shares at 1.13% and Class I shares at 0.92%. Prior to that date, the expense limitation may not be terminated without consent of the Board. |

| 4 | Through July 31, 2020, IICO, IDI, and/or WISC, have contractually agreed to reimburse sufficient management fees, 12b-1 fees and/or shareholder servicing fees to cap the total annual ordinary fund operating expenses (which would exclude interest, taxes, brokerage commissions, acquired fund fees and expenses and extraordinary expenses, if any) for the Global Equity Income Fund as follows: Class A shares at 1.30%, Class I shares at 0.94% and Class Y shares at 1.19%. Prior to that date, the expense limitation may not be terminated by IICO, IDI, WISC or the Board. |

| 5 | Through July 31, 2020, IICO, IDI, and/or WISC, have contractually agreed to reimburse sufficient management fees, 12b-1 fees and/or shareholder servicing fees to cap the total annual ordinary fund operating expenses for the Global Equity Income Fund after the Reorganization for Class B shares at 1.95% and Class E shares at 1.13%. Prior to that date, the expense limitation may not be terminated by IICO, IDI, WISC or the Board. |

| 6 | Through July 31, 2020, IDI and/or WISC have contractually agreed to reimburse sufficient 12b-1 and/or shareholder servicing fees to ensure that the total annual ordinary fund operating expenses of the Class Y shares do not exceed the total annual ordinary fund operating expenses of the Class A shares, as calculated at the end of each month. Prior to that date, the expense limitation may not be terminated without consent of the Board. |

| 7 | The Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement ratio shown above does not correlate to the expense ratio shown in the Financial Highlights table contained in the March 31, 2017 Annual Report to shareholders, because it has been restated to reflect a change in the Global Equity Income Fund’s contractual class waiver. |

21

Examples

These Examples are intended to help you compare the cost of investing in the Dividend Opportunities Fund, the Global Equity Income Fund and the Global Equity Income Fund, after the Reorganization, with the cost of investing in other mutual funds. The Examples assume that you invest $10,000 in the Dividend Opportunities Fund, the Global Equity Income Fund and the Global Equity Income Fund after the Reorganization for the time periods indicated and reinvest all dividends and distributions. The Examples also assume that your investment has a 5% return each year, that the Funds’ operating expenses without waivers remain the same and that expenses were capped for the periods indicated above. The pro forma expense examples reflect the expense limitation agreement in effect through July 31, 2020. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

If shares are redeemed:

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

Class A Shares | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 694 | | | $ | 946 | | | $ | 1,217 | | | $ | 1,989 | |

Ivy Global Equity Income Fund | | $ | 700 | | | $ | 971 | | | $ | 1,269 | | | $ | 2,115 | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 693 | | | $ | 943 | | | $ | 1,212 | | | $ | 1,978 | |

Class B Shares | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 607 | | | $ | 947 | | | $ | 1,221 | | | $ | 2,208 | |

Ivy Global Equity Income Fund | | $ | 598 | | | $ | 912 | | | $ | 1,152 | | | $ | 2,125 | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 598 | | | $ | 923 | | | $ | 1,184 | | | $ | 2,152 | |

Class C Shares | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 195 | | | $ | 603 | | | $ | 1,037 | | | $ | 2,243 | |

Ivy Global Equity Income Fund | | $ | 198 | | | $ | 612 | | | $ | 1,052 | | | $ | 2,275 | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 193 | | | $ | 597 | | | $ | 1,026 | | | $ | 2,222 | |

Class E Shares* | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 382 | | | $ | 704 | | | $ | 1,091 | | | $ | 2,169 | |

Ivy Global Equity Income Fund | | | NA | | | | NA | | | | NA | | | | NA | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 382 | | | $ | 702 | | | $ | 1,084 | | | $ | 2,150 | |

22

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

Class I Shares | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 94 | | | $ | 293 | | | $ | 509 | | | $ | 1,131 | |

Ivy Global Equity Income Fund | | $ | 96 | | | $ | 303 | | | $ | 530 | | | $ | 1,184 | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 93 | | | $ | 290 | | | $ | 504 | | | $ | 1,120 | |

Class N Shares | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 79 | | | $ | 246 | | | $ | 428 | | | $ | 954 | |

Ivy Global Equity Income Fund | | $ | 83 | | | $ | 259 | | | $ | 450 | | | $ | 1,002 | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 77 | | | $ | 240 | | | $ | 417 | | | $ | 930 | |

Class R Shares | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 154 | | | $ | 477 | | | $ | 824 | | | $ | 1,802 | |

Ivy Global Equity Income Fund | | $ | 159 | | | $ | 493 | | | $ | 850 | | | $ | 1,856 | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 152 | | | $ | 471 | | | $ | 813 | | | $ | 1,779 | |

Class Y Shares | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 119 | | | $ | 372 | | | $ | 644 | | | $ | 1,420 | |

Ivy Global Equity Income Fund | | $ | 121 | | | $ | 380 | | | $ | 661 | | | $ | 1,462 | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 117 | | | $ | 365 | | | $ | 633 | | | $ | 1,398 | |

You would pay the following expenses if you did not redeem your shares:

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

Class A Shares | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 694 | | | $ | 946 | | | $ | 1,217 | | | $ | 1,989 | |

Ivy Global Equity Income Fund | | $ | 700 | | | $ | 977 | | | $ | 1,276 | | | $ | 2,121 | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 693 | | | $ | 943 | | | $ | 1,212 | | | $ | 1,978 | |

Class B Shares | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 207 | | | $ | 647 | | | $ | 1,121 | | | $ | 2,208 | |

Ivy Global Equity Income Fund | | $ | 198 | | | $ | 612 | | | $ | 1,052 | | | $ | 2,125 | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 198 | | | $ | 623 | | | $ | 1,084 | | | $ | 2,152 | |

23

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

Class C Shares | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 195 | | | $ | 603 | | | $ | 1,037 | | | $ | 2,243 | |

Ivy Global Equity Income Fund | | $ | 198 | | | $ | 612 | | | $ | 1,052 | | | $ | 2,275 | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 193 | | | $ | 597 | | | $ | 1,026 | | | $ | 2,222 | |

Class E Shares* | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 423 | | | $ | 784 | | | $ | 1,168 | | | $ | 2,239 | |

Ivy Global Equity Income Fund | | | NA | | | | NA | | | | NA | | | | NA | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 421 | | | $ | 778 | | | $ | 1,158 | | | $ | 2,217 | |

Class I Shares | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 94 | | | $ | 293 | | | $ | 509 | | | $ | 1,131 | |

Ivy Global Equity Income Fund | | $ | 96 | | | $ | 306 | | | $ | 533 | | | $ | 1,187 | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 93 | | | $ | 290 | | | $ | 504 | | | $ | 1,120 | |

Class N Shares | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 79 | | | $ | 246 | | | $ | 428 | | | $ | 954 | |

Ivy Global Equity Income Fund | | $ | 83 | | | $ | 259 | | | $ | 450 | | | $ | 1,002 | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 77 | | | $ | 240 | | | $ | 417 | | | $ | 930 | |

Class R Shares | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 154 | | | $ | 477 | | | $ | 824 | | | $ | 1,802 | |

Ivy Global Equity Income Fund | | $ | 159 | | | $ | 493 | | | $ | 850 | | | $ | 1,856 | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 152 | | | $ | 471 | | | $ | 813 | | | $ | 1,779 | |

Class Y Shares | | | | | | | | | | | | | | | | |

Ivy Dividend Opportunities Fund | | $ | 119 | | | $ | 372 | | | $ | 644 | | | $ | 1,420 | |

Ivy Global Equity Income Fund | | $ | 121 | | | $ | 382 | | | $ | 663 | | | $ | 1,464 | |

Ivy Global Equity Income Fund (pro forma, assuming consummation of the Reorganization) | | $ | 117 | | | $ | 365 | | | $ | 633 | | | $ | 1,398 | |

| * | Class E shares of the Global Equity Income Fund are new and were created in anticipation of the Reorganization. |

24

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Examples, affect the Funds’ performance. During the fiscal year ended March 31, 2017, the Dividend Opportunities Fund’s portfolio turnover rate was 54% of the average value of its portfolio and the Global Equity Income Fund’s portfolio turnover rate was 103% of the average value of its portfolio. The higher portfolio turnover rate for the Global Equity Income Fund for the fiscal year ended March 31, 2017 was attributable primarily to a change in the Global Equity Income Fund’s country and sector allocations due to political events in the United States and Europe.

Comparison of Investment Objectives

Both Funds seek to provide total return while the Global Equity Income Fund seeks to provide a total return through a combination of current income and capital appreciation.

Comparison of Principal Investment Strategies

The Dividend Opportunities Fund and the Global Equity Income Fund have similar investment objectives and similar principal investment strategies. Provided below is the principal investment strategies of the Dividend Opportunities Fund and the Global Equity Income Fund.

Dividend Opportunities Fund. The Dividend Opportunities Fund seeks to achieve its objective by investing primarily in large-capitalization companies, that often are market leaders in their industry, with established operating records that IICO believes may accelerate or grow their dividend payout ratio and that also demonstrates favorable prospects for total return. Under normal circumstances, the Fund invests at least 80% of its net assets in dividend-paying equity securities. For this purpose, such securities consist primarily of dividend-paying common stocks. Although the Fund invests primarily in securities issued by large-capitalization companies (typically, companies with capitalizations of at least $10 billion at the time of acquisition), it may invest in securities issued by companies of any size. The Fund may invest in securities of companies across the valuation spectrum, including securities issued by value and growth companies. The Fund typically holds a limited number of stocks (generally 40 to 60).

25

In selecting securities for the Dividend Opportunities Fund, IICO primarily focuses on companies that have an above-market dividend yield that is supported by what IICO believes are attractive relative and absolute valuations and tends to favor companies that IICO believes have the ability to grow their dividend at an average or above-average rate relative to the market. IICO also seeks to invest in companies that it believes have the potential for strong growth in their dividend payout due to the companies having a low initial payout ratio and a commitment to raising the payout ratio over time, or above-average earnings growth potential which also are supported by what it believes are attractive relative and absolute valuations. IICO also considers other factors, which may include: the company’s established operating history; financial condition; quality of management; competitive position; capital allocation; business characteristics; growth and profitability opportunities; return on capital; history of improving sales and profits; and stock price as compared to its estimated intrinsic value.

Although the Dividend Opportunities Fund invests primarily in U.S. securities, it may invest up to 25% of its total assets in foreign securities. Many of the companies in which the Fund may invest have diverse operations, with products or services in foreign markets. Therefore, the Fund may have indirect exposure to various foreign markets through investments in these companies, even if the Fund is not invested directly in such markets.

Generally, in determining whether to sell a security, IICO consider many factors, including: changes in economic or market factors in general or with respect to a particular industry or sector, changes in the market trends or other factors affecting an individual security, and changes in the relative market performance or its belief in the appreciation possibilities offered by individual securities. IICO also may sell a security to reduce the Funds’ holdings in that security, to take advantage of what it believes are more attractive investment opportunities or to raise cash.

Global Equity Income Fund. The Global Equity Income Fund invests principally in equity securities that are issued by companies of any size located largely in developed markets around the world, that IICO believes will be able to generate a reasonable level of current income for investors given current market conditions, and that demonstrate favorable prospects for total return. The Global Equity Income Fund focuses on companies that IICO believes have the ability to maintain and/or grow their dividends while providing capital appreciation over the long-term.

26

Under normal circumstances, the Global Equity Income Fund invests at least 80% of its net assets in equity securities. For this purpose, such equity securities consist primarily of dividend-paying common stocks across the globe. In an attempt to enhance return, the Fund also may invest, to a lesser extent, in companies not currently paying dividends to shareholders or companies with an unsustainably high dividend. The Global Equity Income Fund may invest in U.S. and non-U.S. issuers and may invest up to 100% of its total assets in foreign securities. Although the Global Equity Income Fund invests primarily in large-capitalization companies (typically companies with market capitalizations of at least $10 billion at the time of acquisition), it may invest in companies of any size.

Under normal circumstances, the Global Equity Income Fund invests at least 40% (or, if IICO deems it warranted by market conditions, at least 30%) of its total assets in securities of non-U.S. issuers.

In selecting securities for the Global Equity Income Fund, IICO combines a top-down (assessing the market environment) approach with a bottom-up (researching individual issuers) stock selection process, and uses a combination of country analysis, sector and industry dynamics, and individual stock selection.

As part of its investment process, IICO seeks to identify investment themes, then seeks to determine the most appropriate sectors and geographies to benefit from its top-down analysis and generally seeks to find what it believes are reasonably-valued, dividend-paying companies with growth prospects, a sound balance sheet and steady cash flow generation. IICO also considers several other factors, which typically include a company’s history of fundamentals; management proficiency; competitive environment; and relative valuation.

Many of the companies in which the Global Equity Income Fund may invest have diverse operations, with products or services in foreign markets. Therefore, the Global Equity Income Fund may have indirect exposure to various additional foreign markets through investments in these companies, even if the Fund is not invested directly in such markets.

The Global Equity Income Fund may use forward foreign currency contracts to manage the Fund’s exposure to various foreign currencies and the U.S. dollar.

Generally, in determining whether to sell a security, IICO uses the same type of analysis that it uses in buying securities of that type. For example, IICO may sell a security if it believes the security no longer

27

offers attractive current income prospects or significant growth potential, if it believes the management of the company has weakened, and/or there exists political or economic instability in the issuer’s country. IICO also may sell a security to reduce the Global Equity Income Fund’s holding in that security, to take advantage of what it believes are more attractive investment opportunities or to raise cash.

Comparison of Fundamental Investment Restrictions

Fundamental investment restrictions cannot be changed without shareholder approval of the affected Fund. The Dividend Opportunities Fund and the Global Equity Income Fund have the same fundamental investment restrictions regarding borrowing money, acting as underwriter, making loans, purchasing or selling real estate or commodities, issuing series securities, and concentrating in an industry.

For more information concerning the Funds’ investment policies and restrictions, see the Ivy Funds Prospectus and Ivy Funds SAI.

Comparison of Principal Investment Risks

Like all investments, an investment in each Fund involves risk. All of the principal investment risks applicable to the Funds are described below. As previously noted, the Funds have similar investment objectives and similar principal investment strategies. An investment in the Global Equity Income Fund involves similar risks as an investment in the Dividend Opportunities Fund, as noted below. The fact that a particular risk is not identified does not mean that a Fund, as part of its overall investment strategy, does not invest or is precluded from investing in securities that give rise to that risk. As with any mutual fund, the value of a Fund’s shares will change, and you could lose money on your investment. A variety of factors can affect the investment performance of a Fund and prevent it from achieving its objective.

The Funds have the following principal investment risks in common:

| | | | | | |

| Company Risk | | Dividend-Paying Stock Risk | | Foreign Exposure Risk | | Foreign Securities Risk |

| | | |

| Large Company Risk | | Management Risk | | Market Risk | | |

28

The following principal investment risks differ between the Funds:

| | |

| Dividend Opportunities Fund | | Global Equity Income Fund |

| |

| Growth Stock Risk | | Foreign Currency Exchange Transactions and Forward Foreign Currency Contracts Risk |

| |

| Holdings Risk | | Foreign Currency Risk |

| |

| Sector Risk | | |

| |

| Value Stock Risk | | |

Descriptions of the principal investment risks common to both Funds:

Company Risk – A company may be more volatile or perform worse than the overall market due to specific factors, such as adverse changes to its business or investor perceptions about the company.

Dividend-Paying Stock Risk – Dividend-paying stocks may fall out of favor with investors and underperform non-dividend paying stocks and the market as a whole over any period of time. In addition, there is no guarantee that the companies in which a Fund invests will declare dividends in the future or that dividends, if declared, will remain at current levels or increase over time. The amount of any dividend a company may pay may fluctuate significantly. In addition, the value of dividend-paying common stocks can decline when interest rates rise as other investments become more attractive to investors. This risk may be greater due to the current period of historically low interest rates.

Foreign Exposure Risk – The securities of many companies may have significant exposure to foreign markets as a result of the company’s operations, products or services in those foreign markets. As a result, a company’s domicile and/or the markets in which the company’s securities trade may not be fully reflective of its sources of revenue. Such securities would be subject to some of the same risks as an investment in foreign securities, including the risk that political and economic events unique to a country or region will adversely affect those markets in which the company’s products or services are sold.

Foreign Securities Risk – Investing in foreign securities involves a number of economic, financial, legal and political considerations that are not associated with the U.S. markets and that could affect a Fund’s performance unfavorably, depending upon the prevailing conditions at any given time. Among these potential risks are: greater price volatility; comparatively weak supervision and regulation of securities exchanges,

29

brokers and issuers; higher brokerage costs; social, political or economic instability; fluctuations in foreign currency exchange rates and related conversion costs or currency redenomination; nationalization or expropriation of assets; adverse foreign tax consequences; different and/or less stringent financial reporting standards; and settlement, custodial or other operational delays. World markets, or those in a particular region, all may react in similar fashion to important economic or political developments. In addition, key information about the issuer, the markets or the local government or economy may be unavailable, incomplete or inaccurate. Securities of issuers traded on exchanges may be suspended, either by the issuers themselves, by an exchange or by governmental authorities. In the event that a Fund holds material positions in such suspended securities, a Fund’s ability to liquidate its positions or provide liquidity to investors may be compromised and a Fund could incur significant losses.

Large Company Risk – Large-capitalization companies may go in and out of favor based on market and economic conditions. Large-capitalization companies may be unable to respond quickly to new competitive challenges, such as changes in technology, and also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion. Although the securities of larger companies may be less volatile than those of companies with smaller market capitalizations, returns on investments in securities of large-capitalization companies could trail the returns on investments in securities of smaller companies.

Management Risk – Fund performance is primarily dependent on IICO’s skill in evaluating and managing a Fund’s portfolio. There can be no guarantee that its decisions will produce the desired results, and a Fund may not perform as well as other similar mutual funds.

Market Risk – Markets can be volatile, and a Fund’s holdings can decline in response to adverse issuer, political, regulatory, market or economic developments or conditions that may cause a broad market decline. Different parts of the market, including different sectors and different types of securities, can react differently to these developments. Since the financial crisis that started in 2008, the U.S. and many foreign economies continue to experience its after-effects, which have resulted, and may continue to result, in volatility in the financial markets, both U.S. and foreign. Global economies and financial markets are becoming increasingly interconnected, which increases the possibilities that conditions in one country or region may adversely affect issuers in another country or region, which in turn may adversely affect securities

30