Our Mission & Vision 1Q 2019 Supplemental Deck May 8, 2019 EVAL UATION These materials may not be used or relied upon for any purpose otherth an as specifically contemplated by a 1

Forward-looking Statements CertainOur statements andMission information in this presentation & may Vision constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “anticipate,” “plan,” “intend,” “foresee,” “guidance,” “potential,” “expect,” “should,” “will” “continue,” “could,” “estimate,” “forecast,” “goal,” “may,” “objective,” “predict,” “projection,” or similar expressions are intended to identify forward-looking statements (including those contained in certain visual depictions) in this presentation. These forward-looking statements reflect NCI Building Systems, Inc.’s (the “Company”) current expectations and/or beliefs concerning future events. The Company believes the information, estimates, forecasts and assumptions on which these statements are based are current, reasonable and complete. Our expectations with respect to growth and estimated financial and operating performance, including cost savings and synergies, that are contained in this presentation are forward-looking statements based on management’s best estimates as of the date of this presentation. However, the forward-looking statements in this presentation are subject to a number of risks and uncertainties that may cause the Company's actual performance to differ materially from that projected in such statements. Among the factors that could cause actual results to differ materially include, but are not limited to, risks and uncertainties relating to industry cyclicality and seasonality and adverse weather conditions; challenging economic conditions affecting the nonresidential construction industry; downturns in the residential new construction and repair and remodeling end markets, or the economy or the availability of consumer credit; volatility in the United States (“U.S.”) economy and abroad, generally, and in the credit markets; inability to successfully develop new products or improve existing products; the effects of manufacturing or assembly realignments; changes in laws or regulations; the effects of certain external domestic or international factors that we may not be able to control, including war, civil conflict, terrorism, natural disasters and public health issues; our ability to obtain financing on acceptable terms; recognition of goodwill or asset impairment charges; commodity price volatility and/or limited availability of raw materials, including steel, PVC resin and aluminum; retention and replacement of key personnel; increases in union organizing activity and work stoppages at our facilities or the facilities of our suppliers; our ability to employ, train and retain qualified personnel at a competitive cost; enforcement and obsolescence of our intellectual property rights; changes in foreign currency exchange and interest rates; costs and liabilities related to compliance with environmental laws and environmental clean-ups; changes in building codes and standards; potential product liability claims, including class action claims and warranties, relating to products we manufacture; competitive activity and pricing pressure in our industry; the credit risk of our customers; the dependence on a core group of significant customers in our Windows and Siding segments; operational problems or disruptions at any of our facilities, including natural disasters; volatility of the Company’s stock price; our ability to make strategic acquisitions accretive to earnings; our ability to fully realize expected cost savings and synergies, including those identified as a result of the Merger (as defined below); significant changes in factors and assumptions used to measure certain of Ply Gem Parent LLC’s (“Ply Gem”) defined benefit plan obligations and the effect of actual investment returns on pension assets; volatility in transportation, energy and freight prices; the adoption of climate change legislation; limitations on our net operating losses and payments under the tax receivable agreement; breaches of our information system security measures; damage to our major information management systems; necessary maintenance or replacements to our enterprise resource planning technologies; potential personal injury, property damage or product liability claims or other types of litigation; compliance with certain laws related to our international business operations; the effect of tariffs on steel imports; the cost and difficulty associated with integrating and combining the businesses of NCI and Ply Gem; potential write- downs or write-offs, restructuring and impairment or other charges required in connection with the merger of Ply Gem with and into the Company with the Company continuing in its existence as a Delaware corporation (the “Merger”); potential claims arising from the operations of our various businesses arising from periods prior to the dates they were acquired; substantial governance and other rights held by our sponsor investors; the effect on our common stock price caused by transactions engaged in by our sponsor investors, our directors or executives; our substantial indebtedness and our ability to incur substantially more indebtedness; limitations that our debt agreements place on our ability to engage in certain business and financial transactions; the effect of increased interest rates on our ability to service our debt; downgrades of our credit ratings and the results of the Company’s shareholder vote on May 23, 2019. See also the “Risk Factors” in the Company's Annual Report on Form 10-K for the fiscal year ended October 28, 2018, our Transition Report on Form 10-QT for the transition period from October 29, 2018 to December 31, 2018 and other risks described in documents subsequently filed by the Company from time to time with the Securities and Exchange Commission, which identify other important factors, though not necessarily all such factors, that could cause future outcomes to differ materially from those set forth in the forward-looking statements. The Company expressly disclaims any obligation to release publicly any updates or revisions to these forward-looking statements, whether as a result of new information, future events, or otherwise. 2

Key Business Highlights Our Mission & Vision 1 Market leading North American exterior building products company with scale 2 Comprehensive product offering with enhanced growth opportunity 3 Proven platform for industry consolidation ☻4 Value creation through ongoing cost initiatives, synergies and cross-selling 5 Expansive advantaged platform with complementary strengths 6 Strong projected earnings growth and free cash flow generation 3

Business Segments Going Forward - % of Revenues (1) (2) Our MissionCommercial & Vision Residential Insulated Engineered Metal Metal Windows Siding Metal Building Coaters Components Panels Products 17% 29% 21% 33% 59% 41% (3) Commercial Windows Siding 40% 38% 22% (1) Percentages represent the revenue % of NCI’s historical business segments for the fiscal year ended 10/28/18. (2) Percentages represent the net sales % of the historical business segments for the nine months ended 9/30/18 for Ply Gem. 4 (3) Percentages represent the LTM 1Q19 net sales of the consolidated business segments.

Key Performance Metrics Our Mission & Vision Commercial Residential (Windows and Siding) Pro Forma 1Q19 LTM PF $2.0B $3.1B $5.1B Sales Expected Medium-Term Low to mid single digit Mid single digit Low to mid single digit Sales Growth 1Q19 LTM PF $188M $350M $538M Adj. EBITDA(1) 1Q19 LTM PF $44M $50M $94M Capex 1Q19 LTM PF Unlevered Free $144M $300M $444M Cash Flow (2) Note: Above information is unaudited. 1Q19 LTM pro forma results reflect full year combined NCI, Ply Gem, Atrium, Silver Line & Environmental StoneWorks. (1) Excludes unrealized synergies from combination of NCI & Ply Gem and other recent acquisitions as well as other unrealized cost savings. Estimated run rate of remaining unrealized cost synergies & savings is ~$145M. (2) Pro forma Unlevered Free Cash Flow calculated as (PF Adj. EBITDA – PF Capex). 5

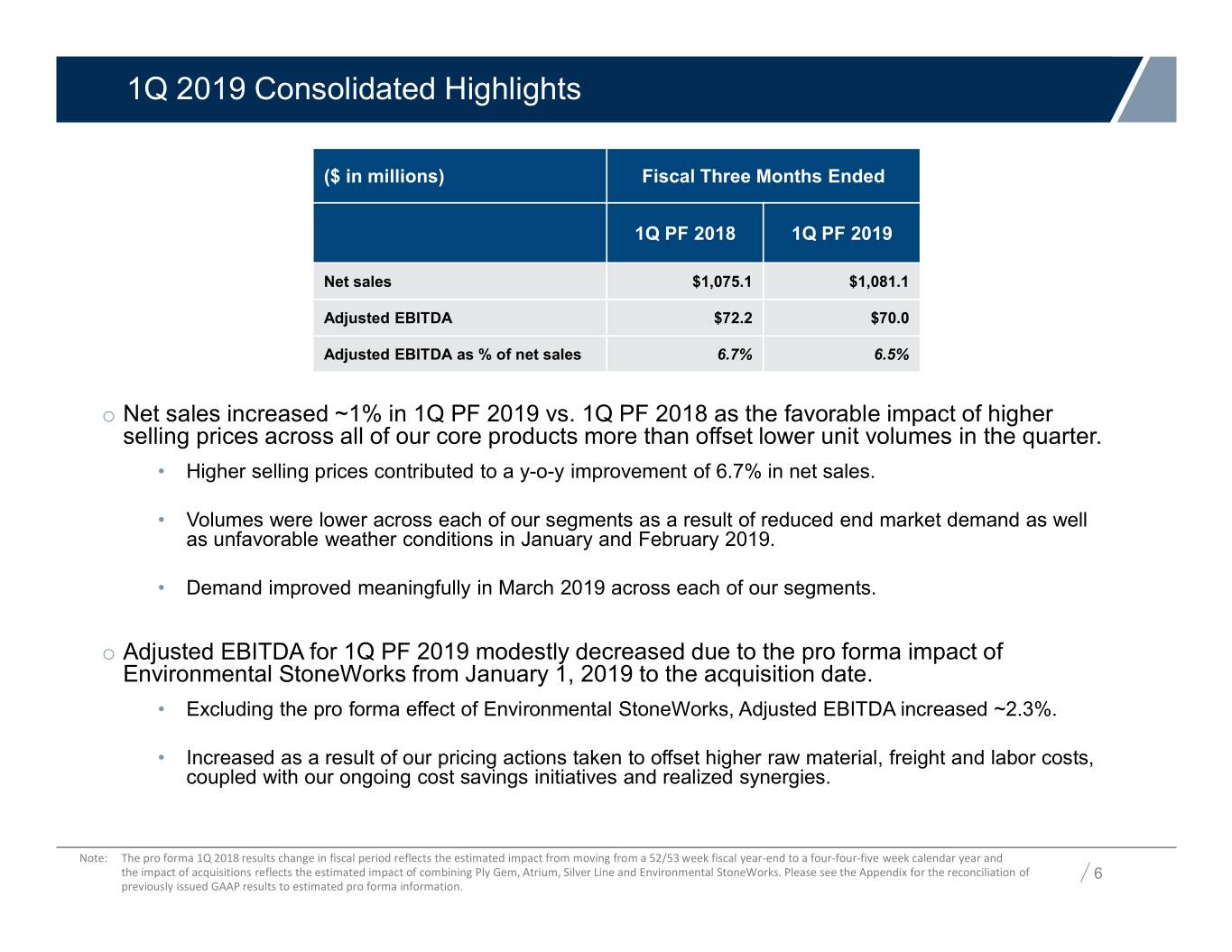

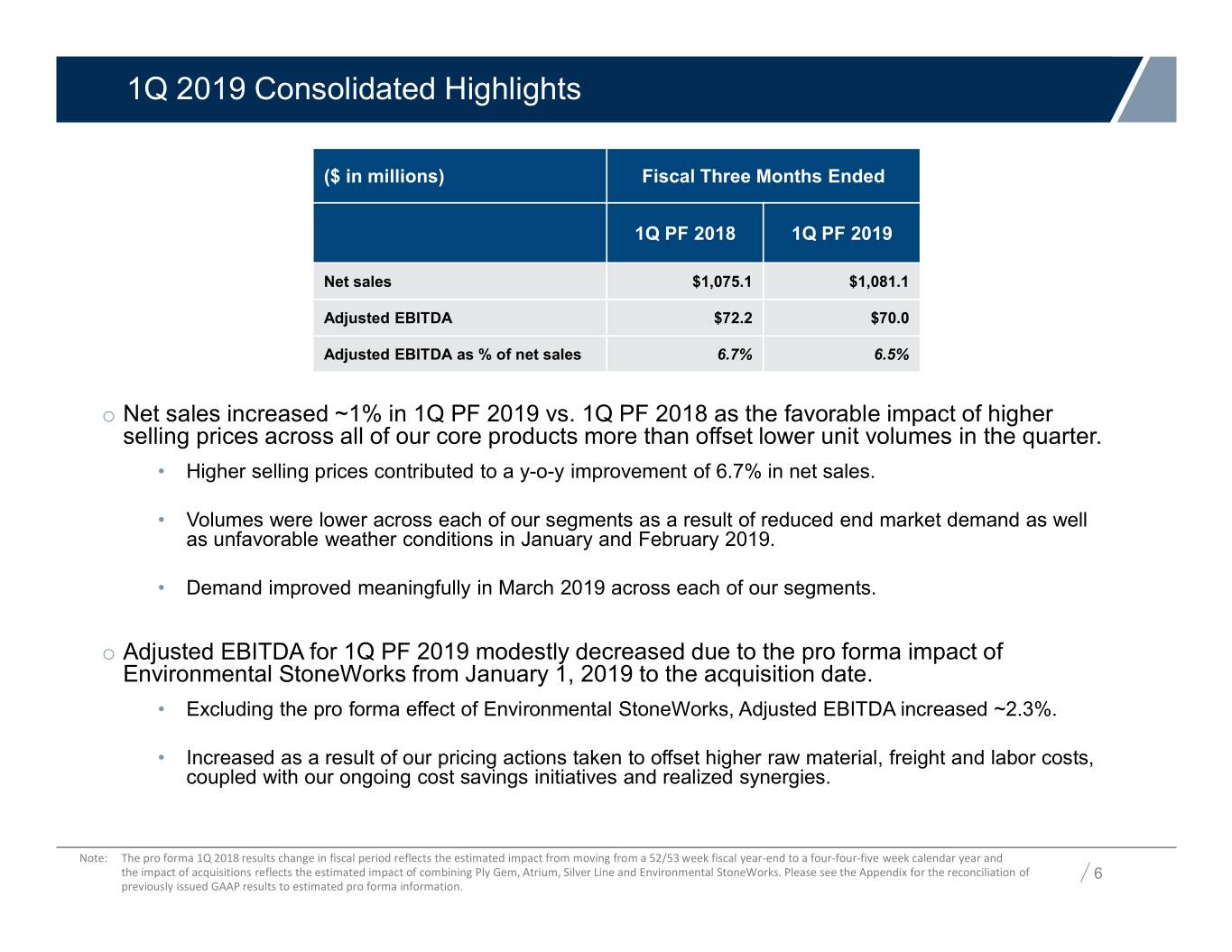

1Q 2019 Consolidated Highlights Our Mission($ in millions) & Vision Fiscal Three Months Ended 1Q PF 2018 1Q PF 2019 Net sales $1,075.1 $1,081.1 Adjusted EBITDA $72.2 $70.0 Adjusted EBITDA as % of net sales 6.7% 6.5% o Net sales increased ~1% in 1Q PF 2019 vs. 1Q PF 2018 as the favorable impact of higher selling prices across all of our core products more than offset lower unit volumes in the quarter. • Higher selling prices contributed to a y-o-y improvement of 6.7% in net sales. • Volumes were lower across each of our segments as a result of reduced end market demand as well as unfavorable weather conditions in January and February 2019. • Demand improved meaningfully in March 2019 across each of our segments. o Adjusted EBITDA for 1Q PF 2019 modestly decreased due to the pro forma impact of Environmental StoneWorks from January 1, 2019 to the acquisition date. • Excluding the pro forma effect of Environmental StoneWorks, Adjusted EBITDA increased ~2.3%. • Increased as a result of our pricing actions taken to offset higher raw material, freight and labor costs, coupled with our ongoing cost savings initiatives and realized synergies. Note: The pro forma 1Q 2018 results change in fiscal period reflects the estimated impact from moving from a 52/53 week fiscal year-end to a four-four-five week calendar year and the impact of acquisitions reflects the estimated impact of combining Ply Gem, Atrium, Silver Line and Environmental StoneWorks. Please see the Appendix for the reconciliation of 6 previously issued GAAP results to estimated pro forma information.

LTM 1Q 2019 Consolidated Pro Forma Net Sales and Adj. EBITDA Our MissionPro Forma& Vision Quarterly Net Sales Performance ($ in Millions) $5,000.0 $4,000.0 $3,000.0 $2,000.0 $1,000.0 $1,075.1 $1,368.8 $1,408.1 $1,267.6 $1,081.1 $5,125.4 $- 1Q18 2Q18 3Q18 4Q18 1Q19 LTM 1Q19 Pro Forma Quarterly Adjusted EBITDA Performance ($ in Millions) $600.0 12.7% 11.8% $500.0 10.1% 10.5% $400.0 6.7% 6.5% $300.0 $200.0 $100.0 $72.2 $173.9 $165.5 $128.6 $70.0 $537.9 $- 1Q18 2Q18 3Q18 4Q18 1Q19 LTM 1Q19 Adj EBITDA PF % of Net Sales Note: Quarterly pro forma results reflect combined NCI, Ply Gem, Atrium, Silver Line & Environmental StoneWorks. Quarterly pro forma information reflects estimated results of the Company’s change in fiscal quarters to a calendar year-end. Certain amounts in this presentation have been subject to rounding adjustments. Accordingly, amounts shown as total may not be the arithmetic aggregation of the individual amounts 7 that comprise or precede them.

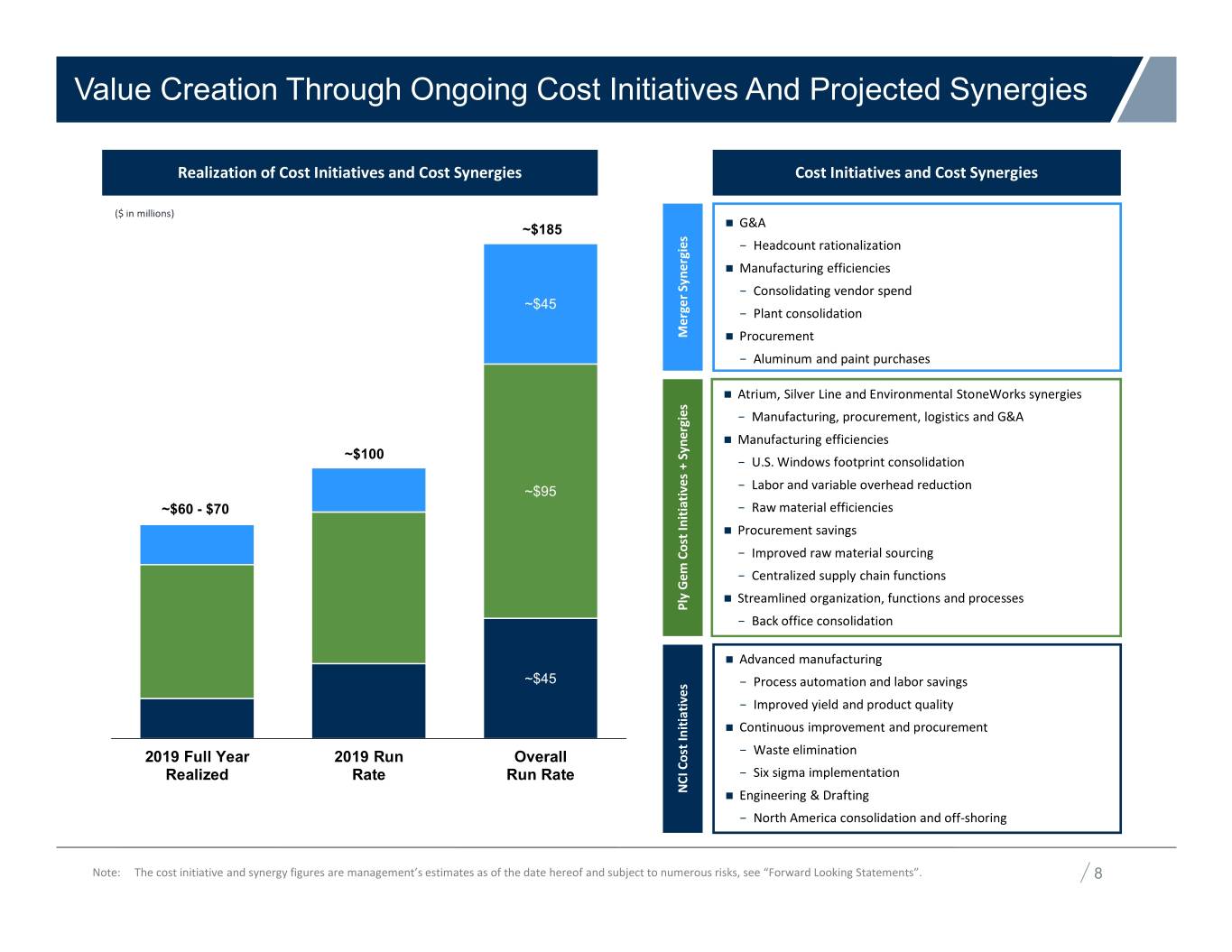

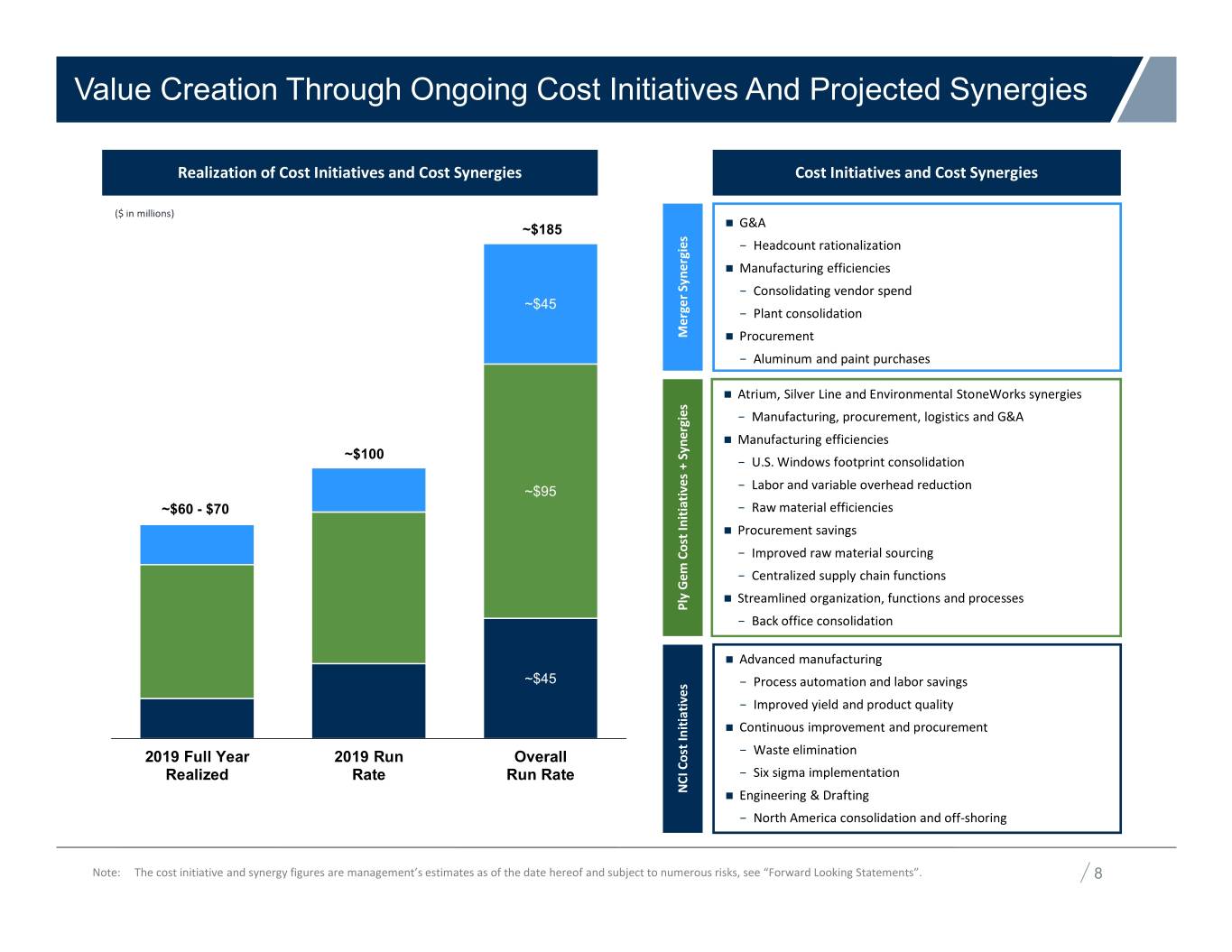

Value Creation Through Ongoing Cost Initiatives And Projected Synergies OurRealization Mission of Cost Initiatives and& Cost Vision Synergies Cost Initiatives and Cost Synergies ($ in millions) ~$185 G&A − Headcount rationalization Manufacturing efficiencies − Consolidating vendor spend ~$45 − Plant consolidation Merger Merger Synergies Procurement − Aluminum and paint purchases Atrium, Silver Line and Environmental StoneWorks synergies − Manufacturing, procurement, logistics and G&A Manufacturing efficiencies ~$100 − U.S. Windows footprint consolidation ~$95 − Labor and variable overhead reduction ~$60 - $70 − Raw material efficiencies Procurement savings − Improved raw material sourcing − Centralized supply chain functions Streamlined organization, functions and processes Ply Gem Cost Initiatives +Synergies Ply InitiativesCost Gem − Back office consolidation Advanced manufacturing ~$45 − Process automation and labor savings − Improved yield and product quality Continuous improvement and procurement 2019 Full Year 2019 Run Overall − Waste elimination Realized Rate Run Rate − Six sigma implementation NCI InitiativesCost Engineering & Drafting − North America consolidation and off-shoring Note: The cost initiative and synergy figures are management’s estimates as of the date hereof and subject to numerous risks, see “Forward Looking Statements”. 8

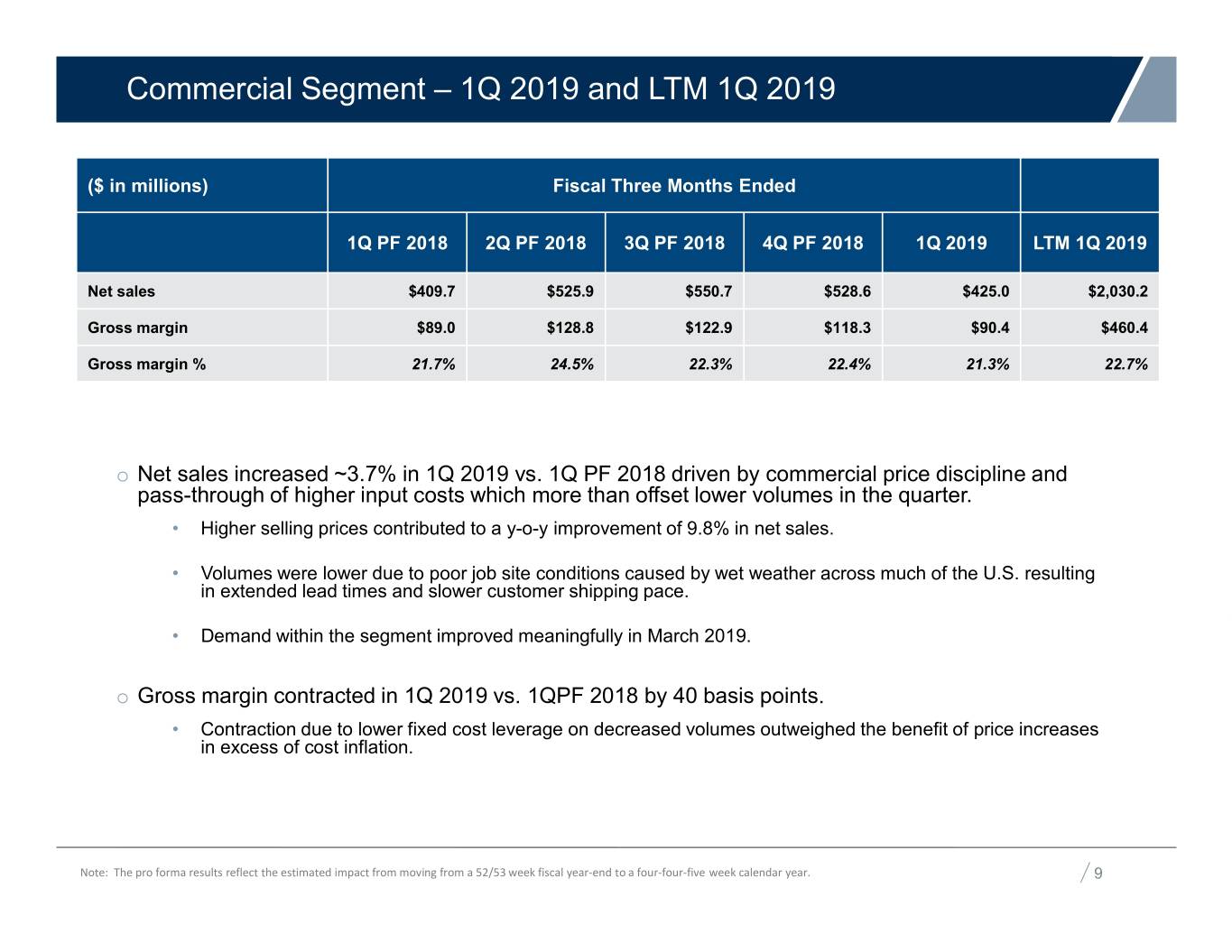

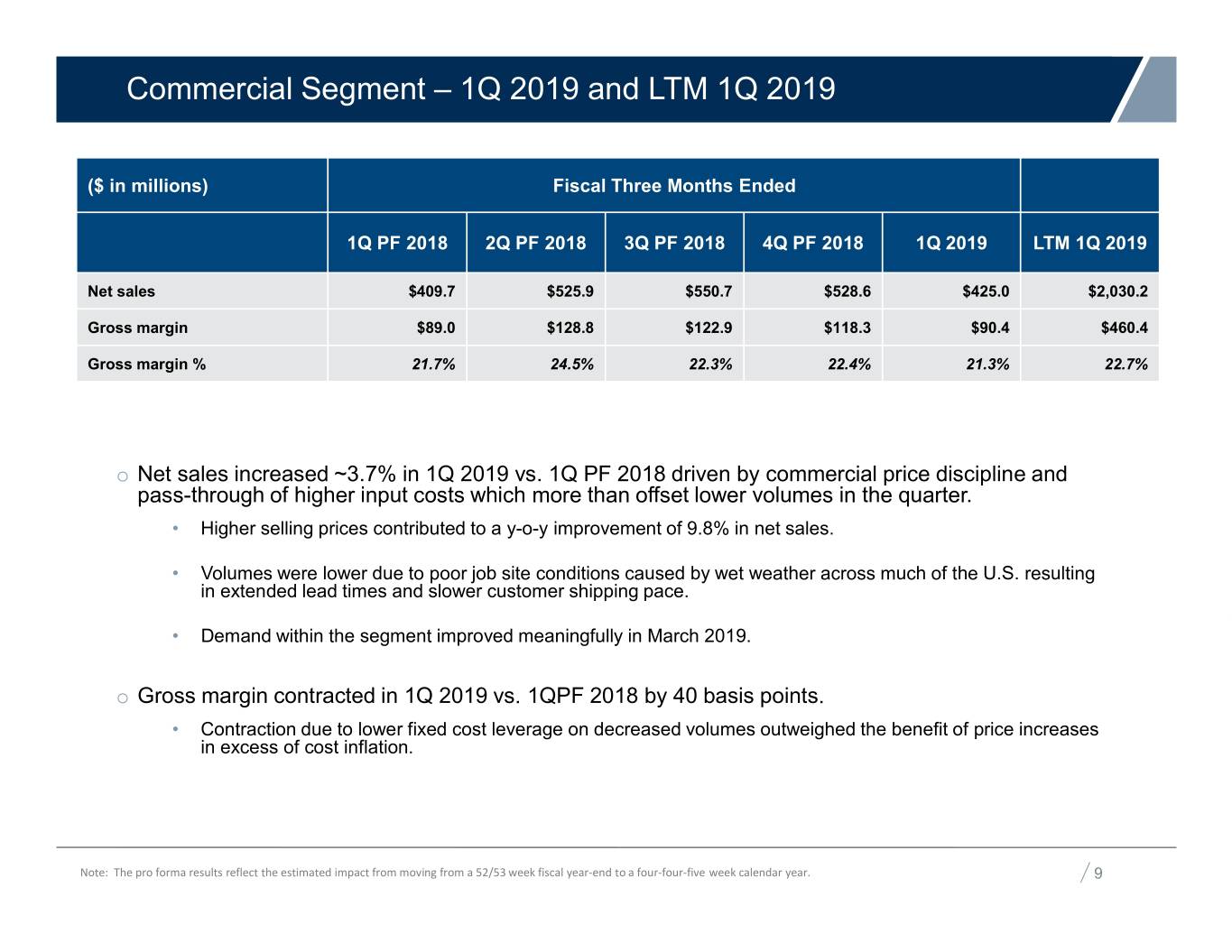

Commercial Segment – 1Q 2019 and LTM 1Q 2019 ($ Ourin millions) Mission & Vision Fiscal Three Months Ended 1Q PF 2018 2Q PF 2018 3Q PF 2018 4Q PF 2018 1Q 2019 LTM 1Q 2019 Net sales $409.7 $525.9 $550.7 $528.6 $425.0 $2,030.2 Gross margin $89.0 $128.8 $122.9 $118.3 $90.4 $460.4 Gross margin % 21.7% 24.5% 22.3% 22.4% 21.3% 22.7% o Net sales increased ~3.7% in 1Q 2019 vs. 1Q PF 2018 driven by commercial price discipline and pass-through of higher input costs which more than offset lower volumes in the quarter. • Higher selling prices contributed to a y-o-y improvement of 9.8% in net sales. • Volumes were lower due to poor job site conditions caused by wet weather across much of the U.S. resulting in extended lead times and slower customer shipping pace. • Demand within the segment improved meaningfully in March 2019. o Gross margin contracted in 1Q 2019 vs. 1QPF 2018 by 40 basis points. • Contraction due to lower fixed cost leverage on decreased volumes outweighed the benefit of price increases in excess of cost inflation. Note: The pro forma results reflect the estimated impact from moving from a 52/53 week fiscal year-end to a four-four-five week calendar year. 9

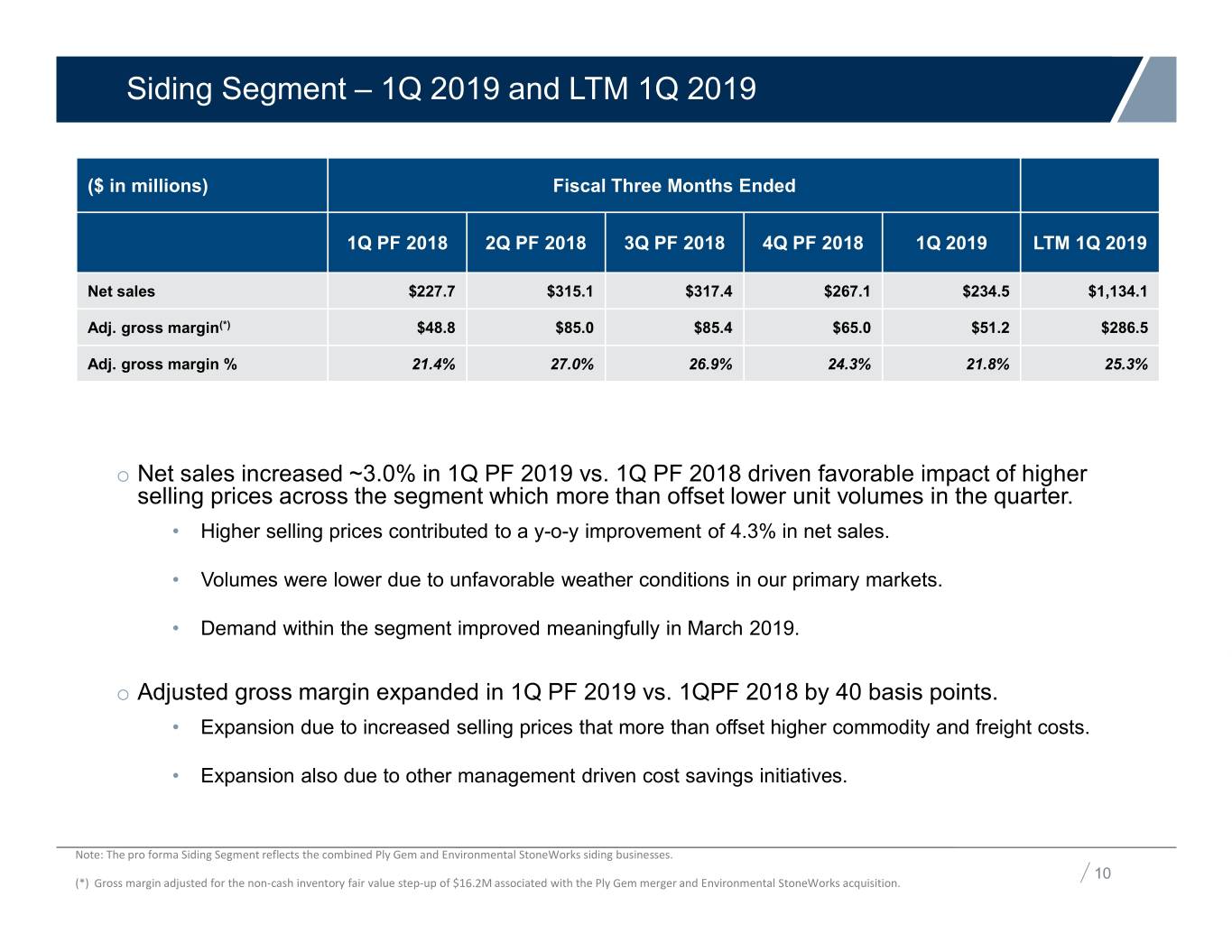

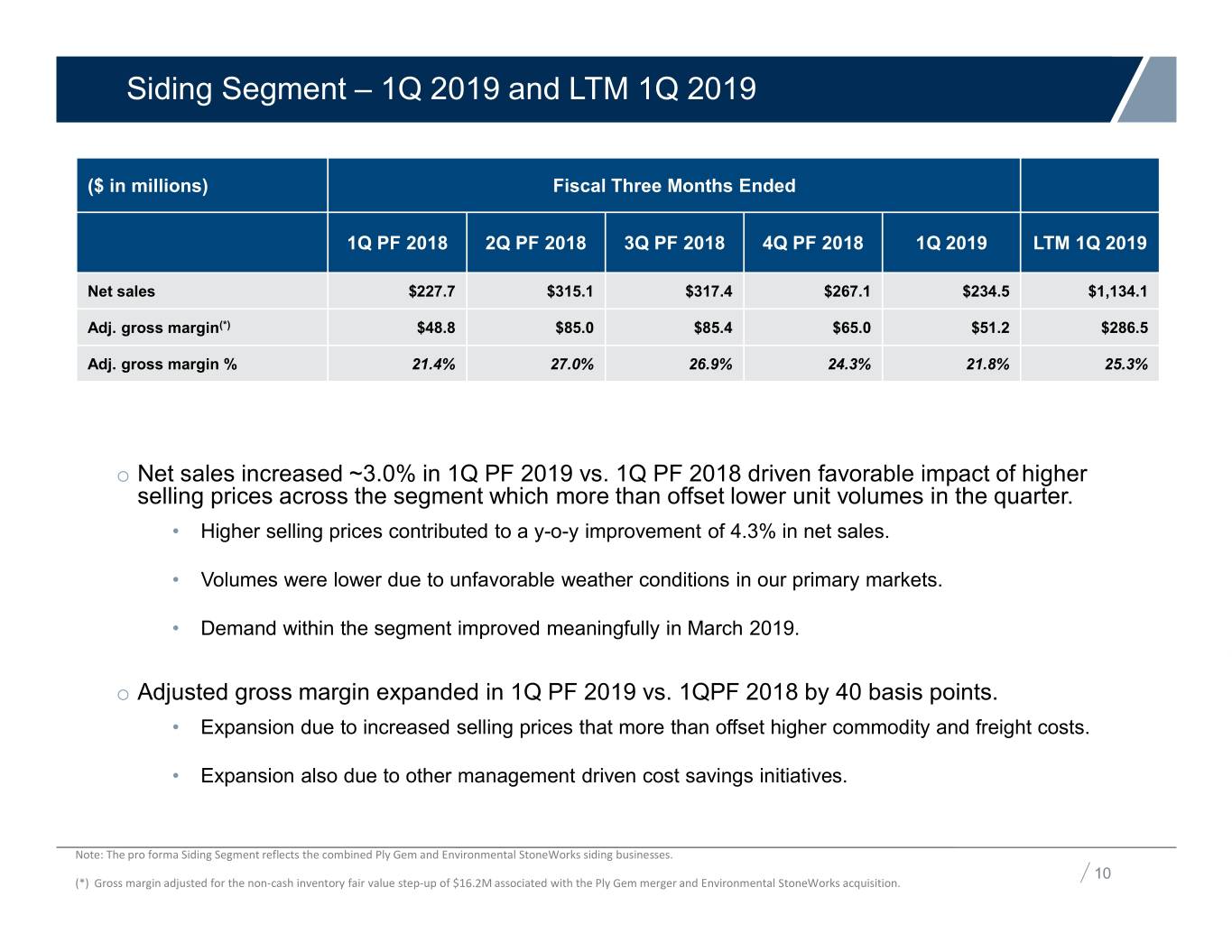

Siding Segment – 1Q 2019 and LTM 1Q 2019 ($ Ourin millions) Mission & Vision Fiscal Three Months Ended 1Q PF 2018 2Q PF 2018 3Q PF 2018 4Q PF 2018 1Q 2019 LTM 1Q 2019 Net sales $227.7 $315.1 $317.4 $267.1 $234.5 $1,134.1 Adj. gross margin(*) $48.8 $85.0 $85.4 $65.0 $51.2 $286.5 Adj. gross margin % 21.4% 27.0% 26.9% 24.3% 21.8% 25.3% o Net sales increased ~3.0% in 1Q PF 2019 vs. 1Q PF 2018 driven favorable impact of higher selling prices across the segment which more than offset lower unit volumes in the quarter. • Higher selling prices contributed to a y-o-y improvement of 4.3% in net sales. • Volumes were lower due to unfavorable weather conditions in our primary markets. • Demand within the segment improved meaningfully in March 2019. o Adjusted gross margin expanded in 1Q PF 2019 vs. 1QPF 2018 by 40 basis points. • Expansion due to increased selling prices that more than offset higher commodity and freight costs. • Expansion also due to other management driven cost savings initiatives. Note: The pro forma Siding Segment reflects the combined Ply Gem and Environmental StoneWorks siding businesses. 10 (*) Gross margin adjusted for the non-cash inventory fair value step-up of $16.2M associated with the Ply Gem merger and Environmental StoneWorks acquisition.

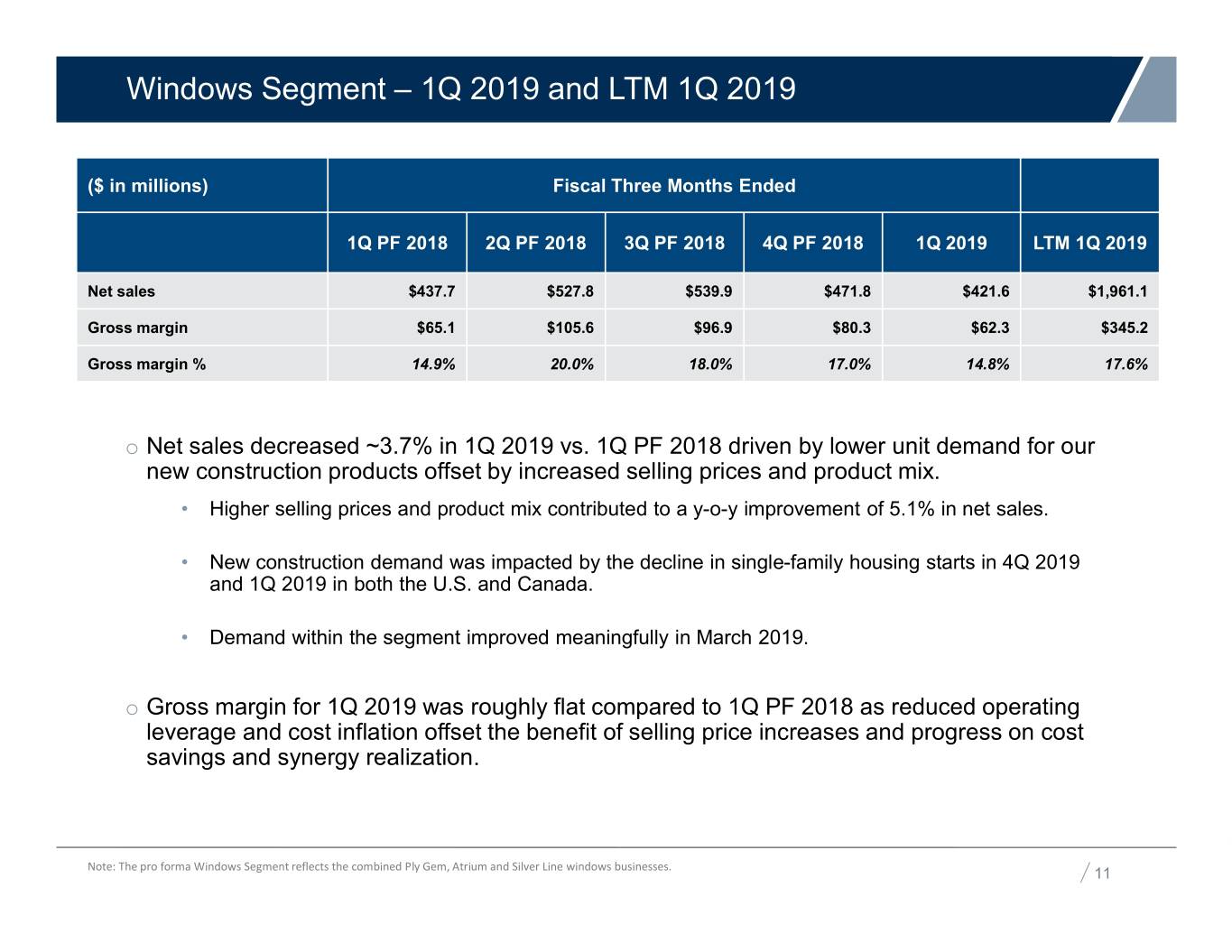

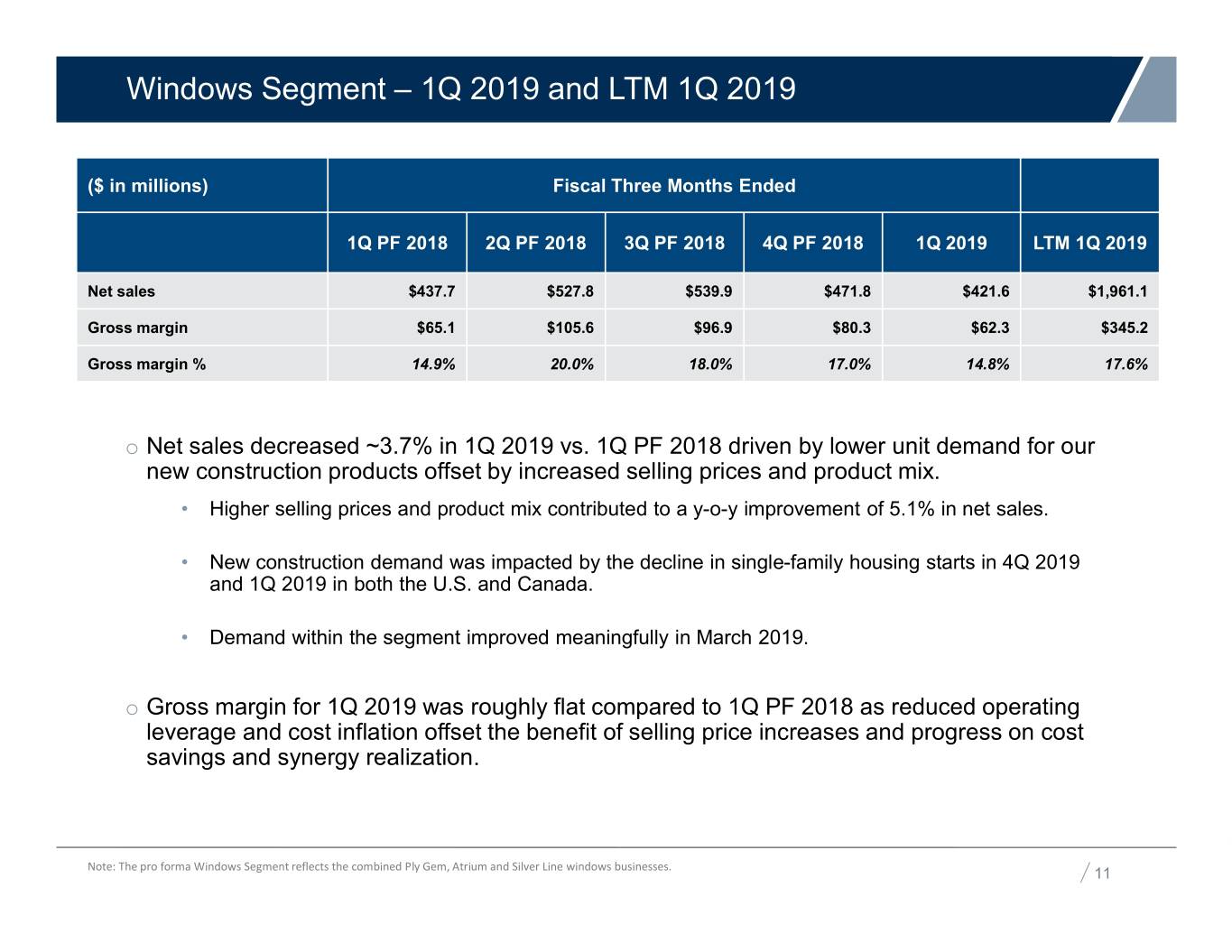

Windows Segment – 1Q 2019 and LTM 1Q 2019 ($ Ourin millions) Mission & Vision Fiscal Three Months Ended 1Q PF 2018 2Q PF 2018 3Q PF 2018 4Q PF 2018 1Q 2019 LTM 1Q 2019 Net sales $437.7 $527.8 $539.9 $471.8 $421.6 $1,961.1 Gross margin $65.1 $105.6 $96.9 $80.3 $62.3 $345.2 Gross margin % 14.9% 20.0% 18.0% 17.0% 14.8% 17.6% o Net sales decreased ~3.7% in 1Q 2019 vs. 1Q PF 2018 driven by lower unit demand for our new construction products offset by increased selling prices and product mix. • Higher selling prices and product mix contributed to a y-o-y improvement of 5.1% in net sales. • New construction demand was impacted by the decline in single-family housing starts in 4Q 2019 and 1Q 2019 in both the U.S. and Canada. • Demand within the segment improved meaningfully in March 2019. o Gross margin for 1Q 2019 was roughly flat compared to 1Q PF 2018 as reduced operating leverage and cost inflation offset the benefit of selling price increases and progress on cost savings and synergy realization. Note: The pro forma Windows Segment reflects the combined Ply Gem, Atrium and Silver Line windows businesses. 11

Our Mission & Vision Appendix

First Quarter Pro Forma Adjusted EBITDA Reconciliation Our Mission & Vision For the three months ($ in thousands) ended March 30, 2019 Operating loss, GAAP ($27,365) Restructuring and impairment 3,431 Strategic development and acquisition related costs 14,082 Non-cash charge of purchase price allocated to inventories 16,249 Customer inventory buybacks 242 Other, net 724 Adjusted operating income 7,363 Other income and expense 345 Depreciation and amortization 59,947 Share-based compensation expense 4,005 Adjusted EBITDA 71,660 Pro forma Adj. EBITDA impact for Environmental StoneWorks(1) (1,670) Pro forma Adjusted EBITDA $69,990 (1) Reflects the Adjusted EBITDA of Environment StoneWorks for the period January 1, 2019 to the acquisition date of February 20, 2019. 13

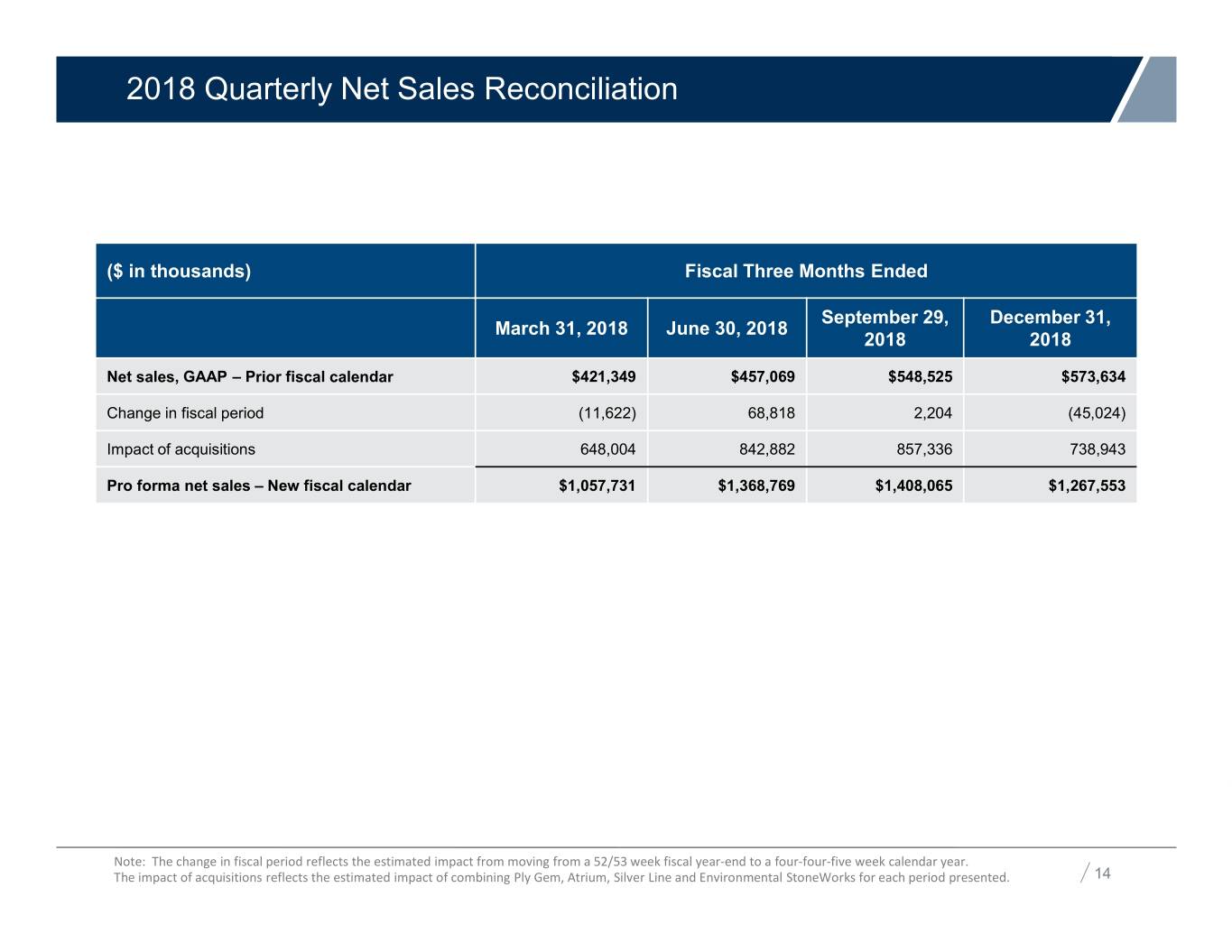

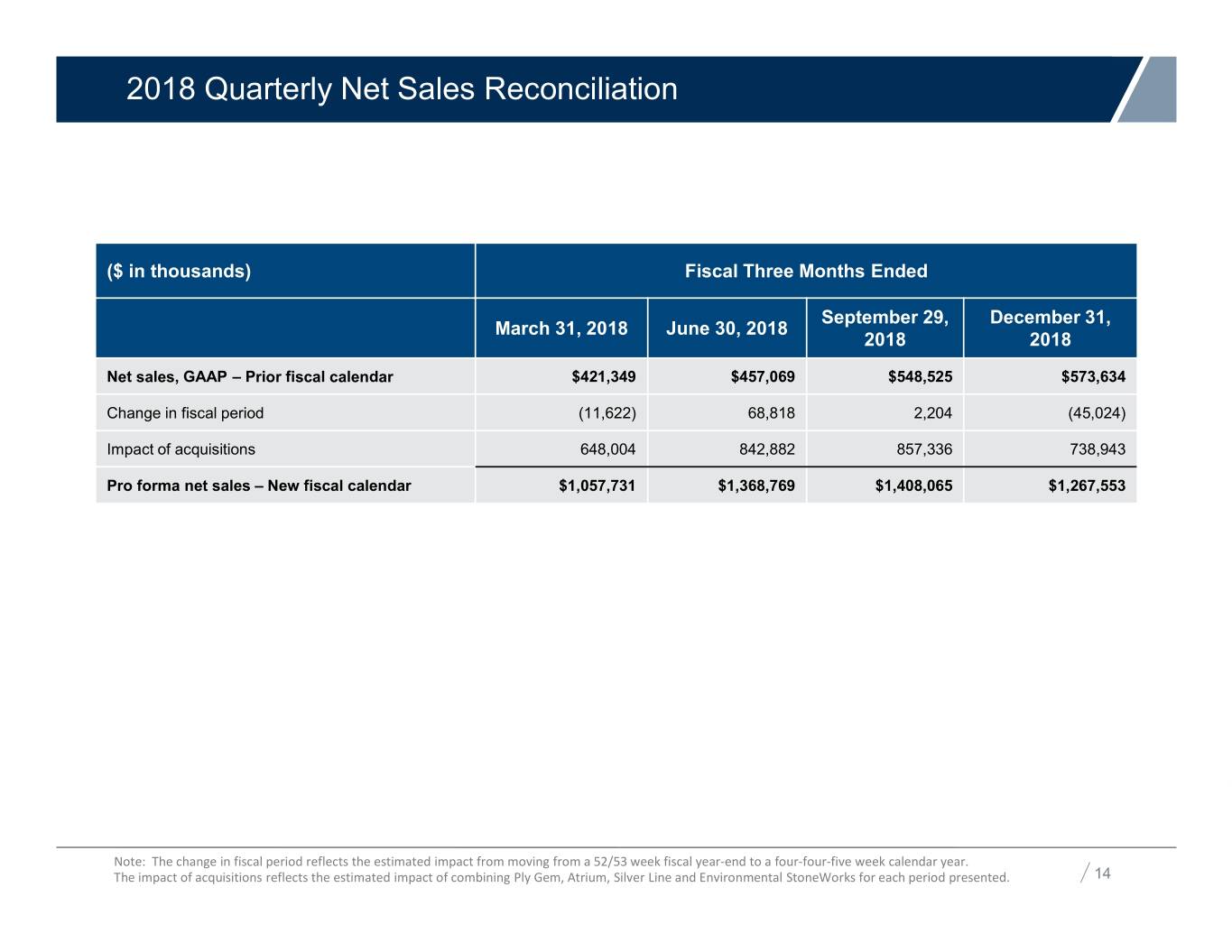

2018 Quarterly Net Sales Reconciliation Our Mission & Vision ($ in thousands) Fiscal Three Months Ended September 29, December 31, March 31, 2018 June 30, 2018 2018 2018 Net sales, GAAP – Prior fiscal calendar $421,349 $457,069 $548,525 $573,634 Change in fiscal period (11,622) 68,818 2,204 (45,024) Impact of acquisitions 648,004 842,882 857,336 738,943 Pro forma net sales – New fiscal calendar $1,057,731 $1,368,769 $1,408,065 $1,267,553 Note: The change in fiscal period reflects the estimated impact from moving from a 52/53 week fiscal year-end to a four-four-five week calendar year. The impact of acquisitions reflects the estimated impact of combining Ply Gem, Atrium, Silver Line and Environmental StoneWorks for each period presented. 14

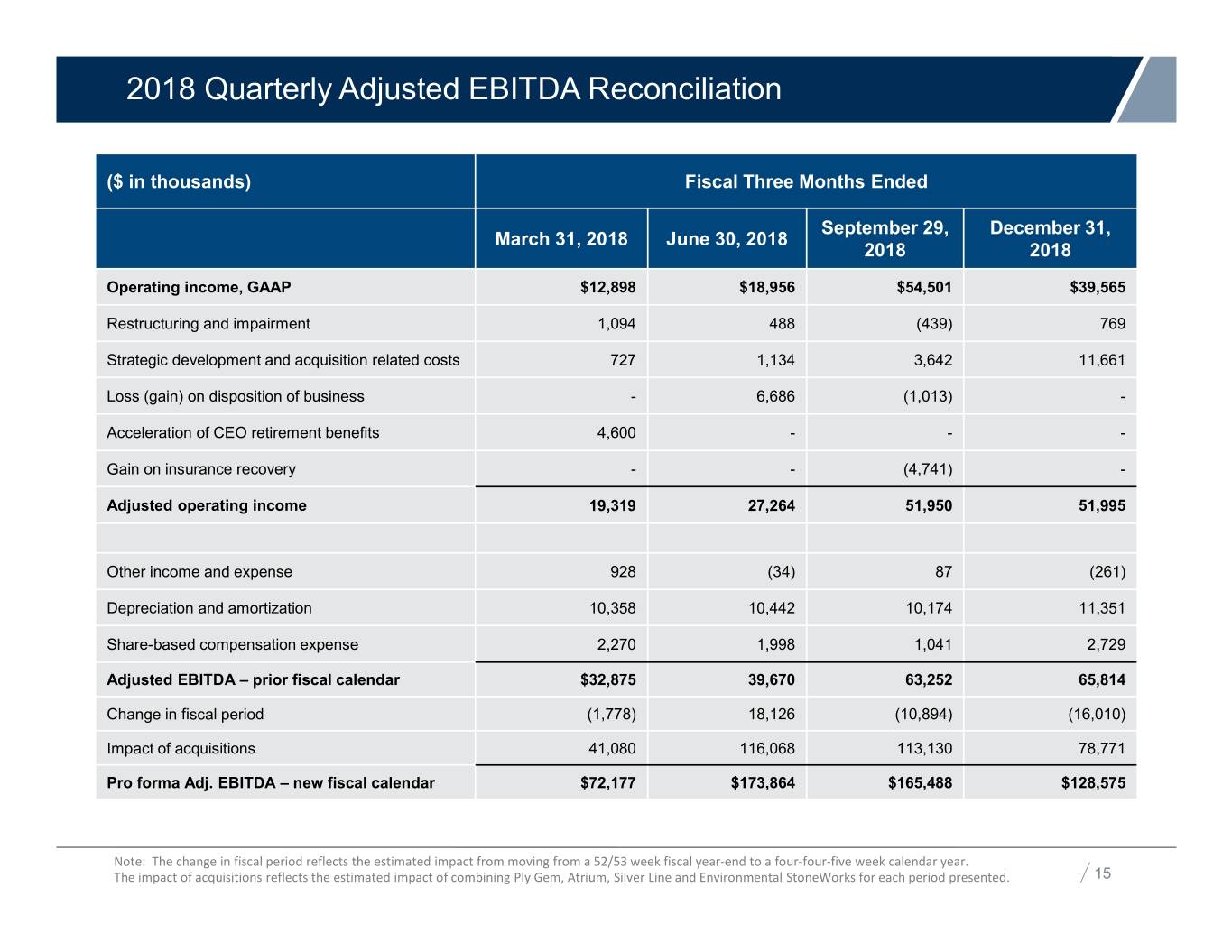

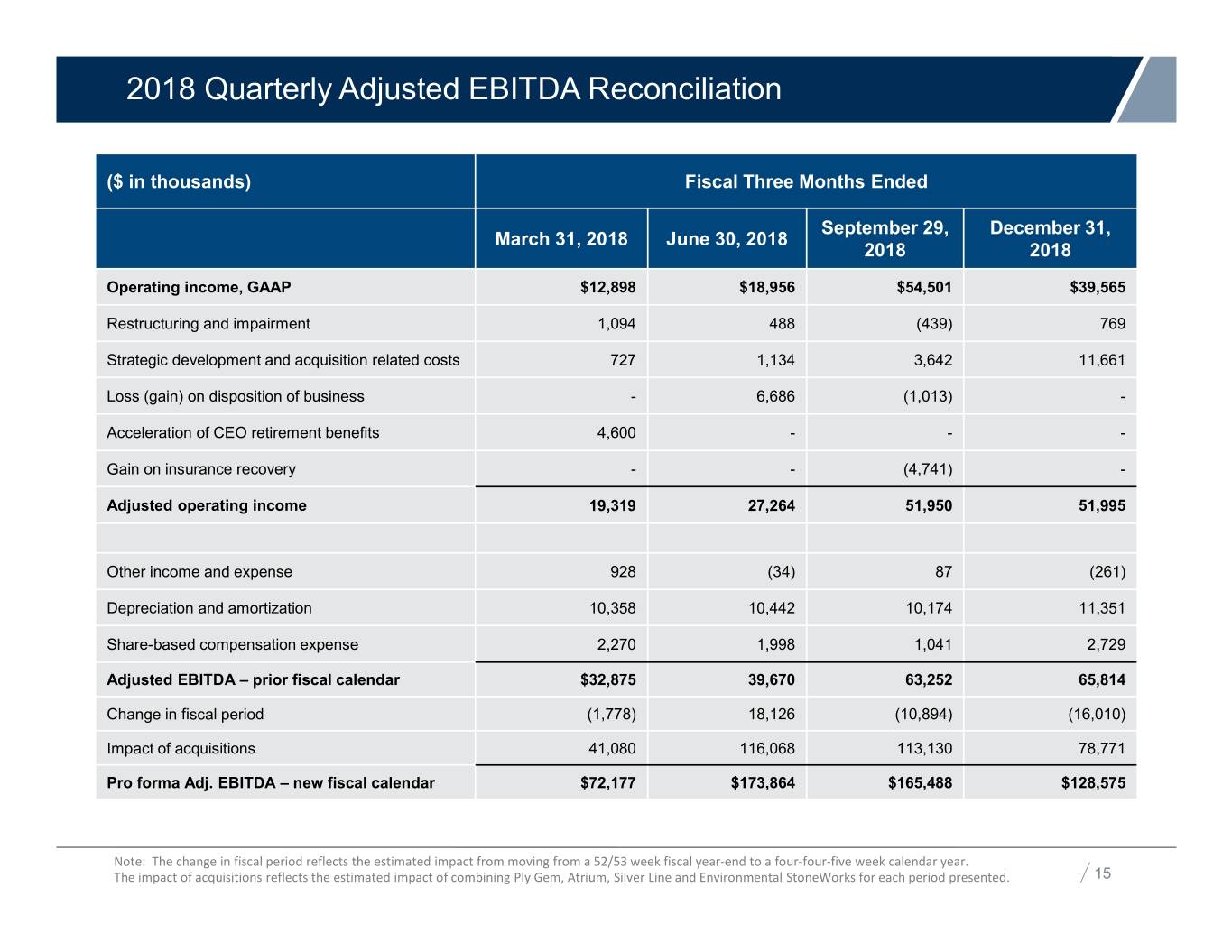

2018 Quarterly Adjusted EBITDA Reconciliation Our($ in thousands) Mission & Vision Fiscal Three Months Ended September 29, December 31, March 31, 2018 June 30, 2018 2018 2018 Operating income, GAAP $12,898 $18,956 $54,501 $39,565 Restructuring and impairment 1,094 488 (439) 769 Strategic development and acquisition related costs 727 1,134 3,642 11,661 Loss (gain) on disposition of business - 6,686 (1,013) - Acceleration of CEO retirement benefits 4,600 - - - Gain on insurance recovery - - (4,741) - Adjusted operating income 19,319 27,264 51,950 51,995 Other income and expense 928 (34) 87 (261) Depreciation and amortization 10,358 10,442 10,174 11,351 Share-based compensation expense 2,270 1,998 1,041 2,729 Adjusted EBITDA – prior fiscal calendar $32,875 39,670 63,252 65,814 Change in fiscal period (1,778) 18,126 (10,894) (16,010) Impact of acquisitions 41,080 116,068 113,130 78,771 Pro forma Adj. EBITDA – new fiscal calendar $72,177 $173,864 $165,488 $128,575 Note: The change in fiscal period reflects the estimated impact from moving from a 52/53 week fiscal year-end to a four-four-five week calendar year. The impact of acquisitions reflects the estimated impact of combining Ply Gem, Atrium, Silver Line and Environmental StoneWorks for each period presented. 15

Our Mission & Vision K. DARCEY MATTHEWS Vice President, Investor Relations E: darcey.matthews@ncigroup.com 281.897.7785 ncibuildingsystems.com