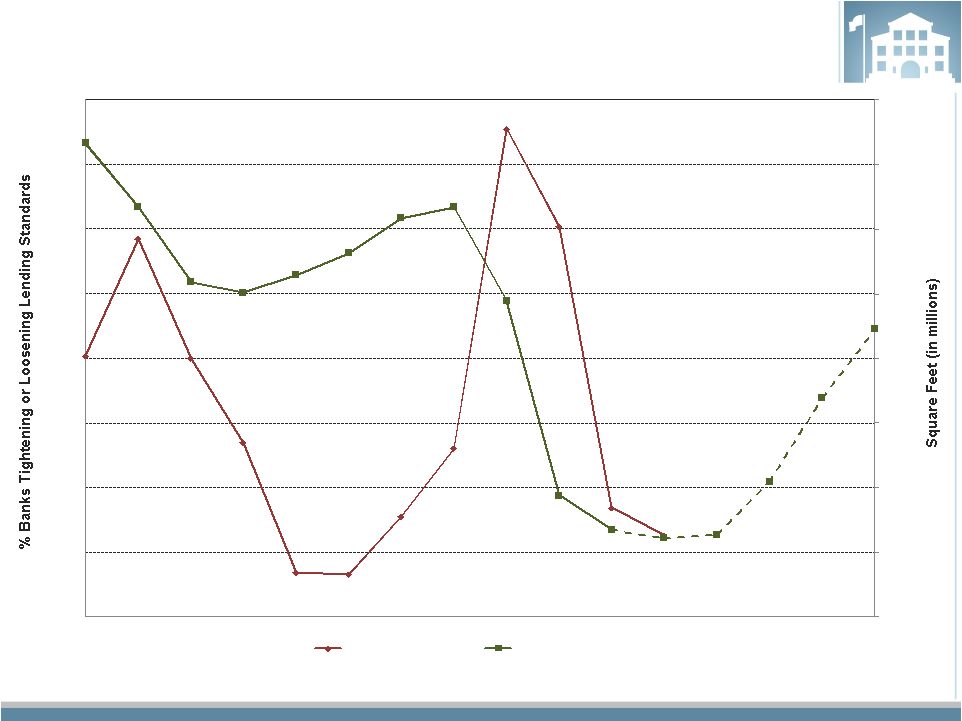

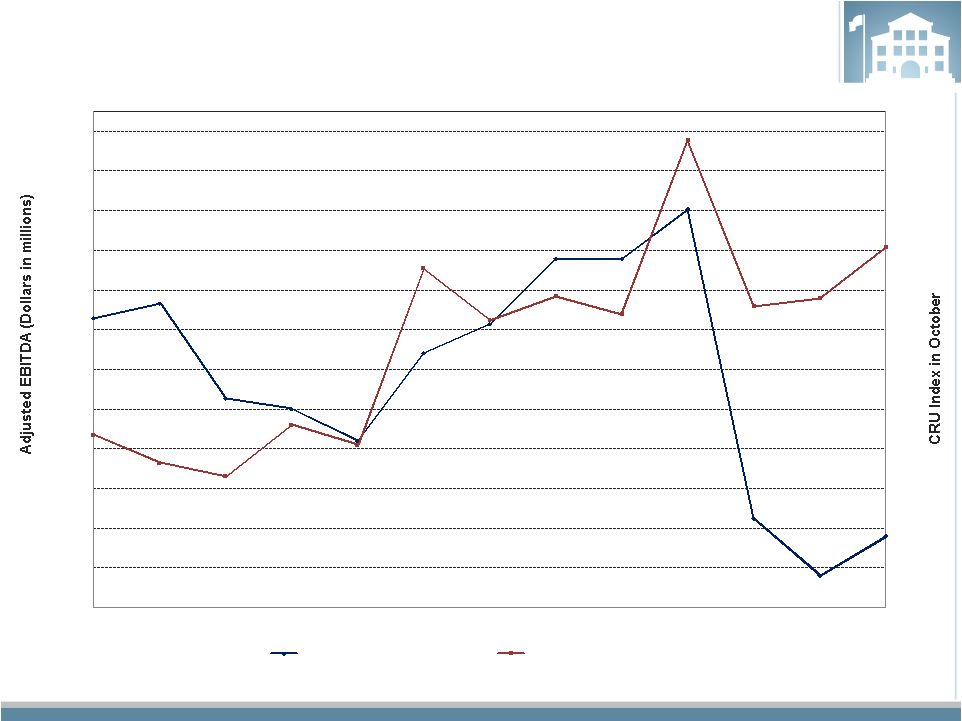

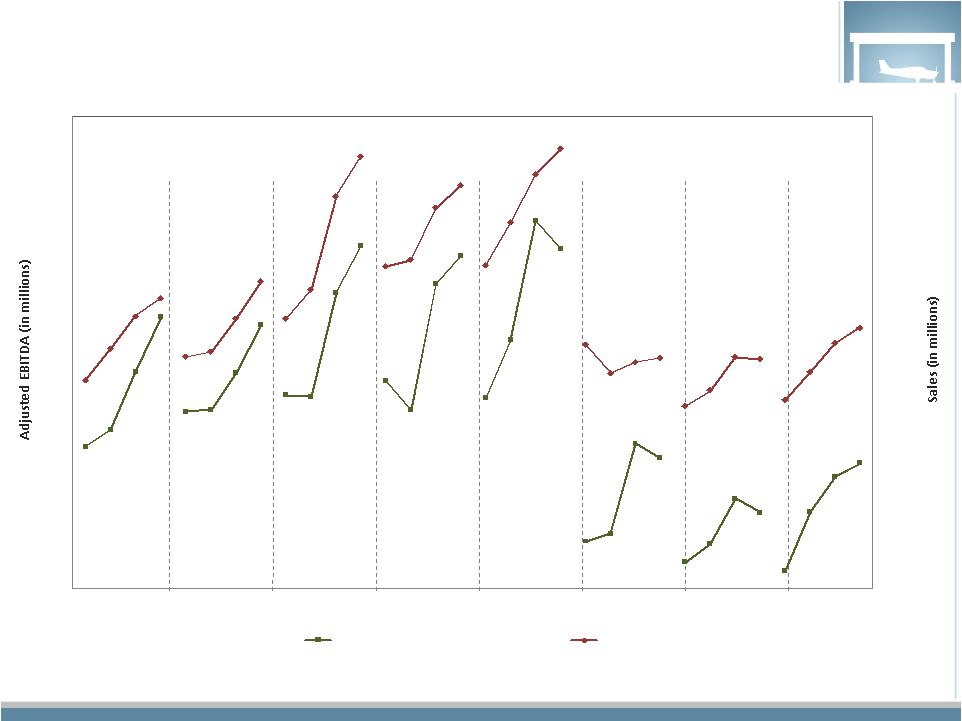

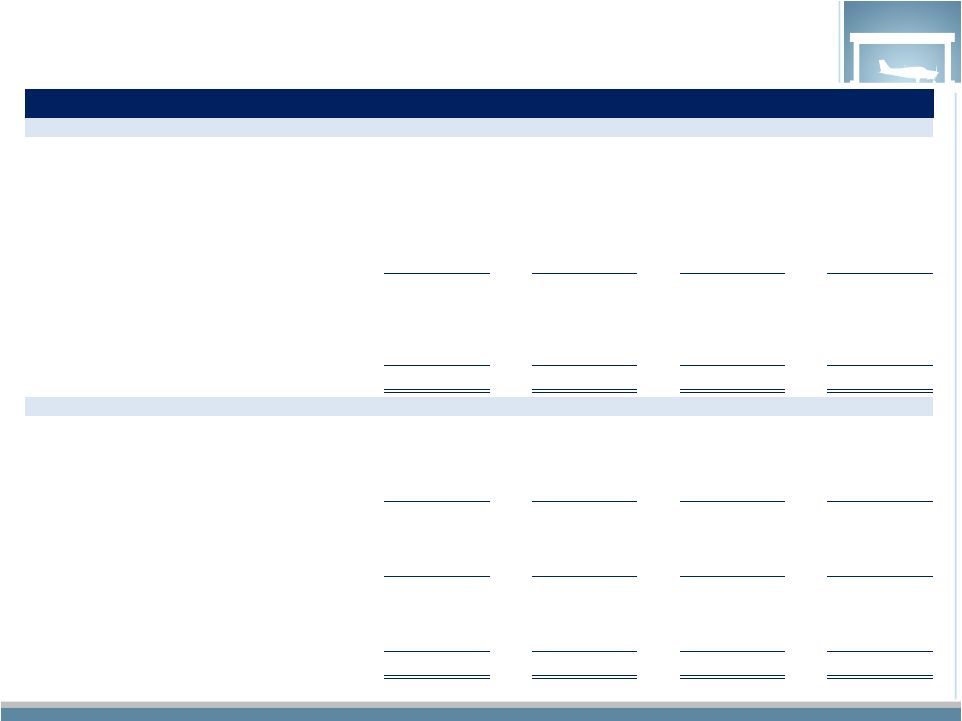

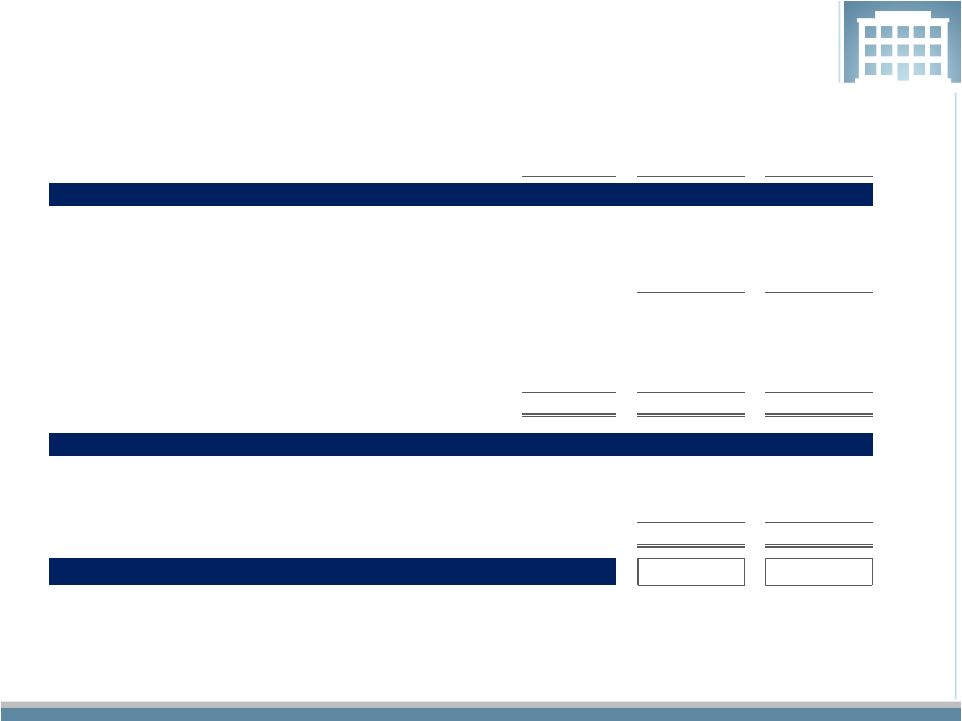

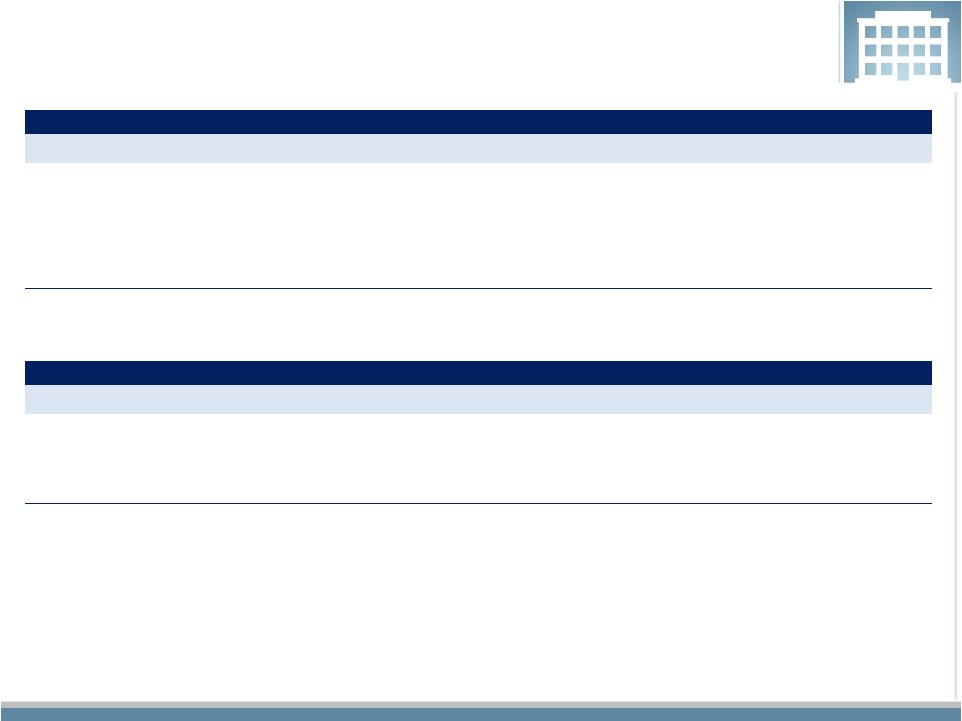

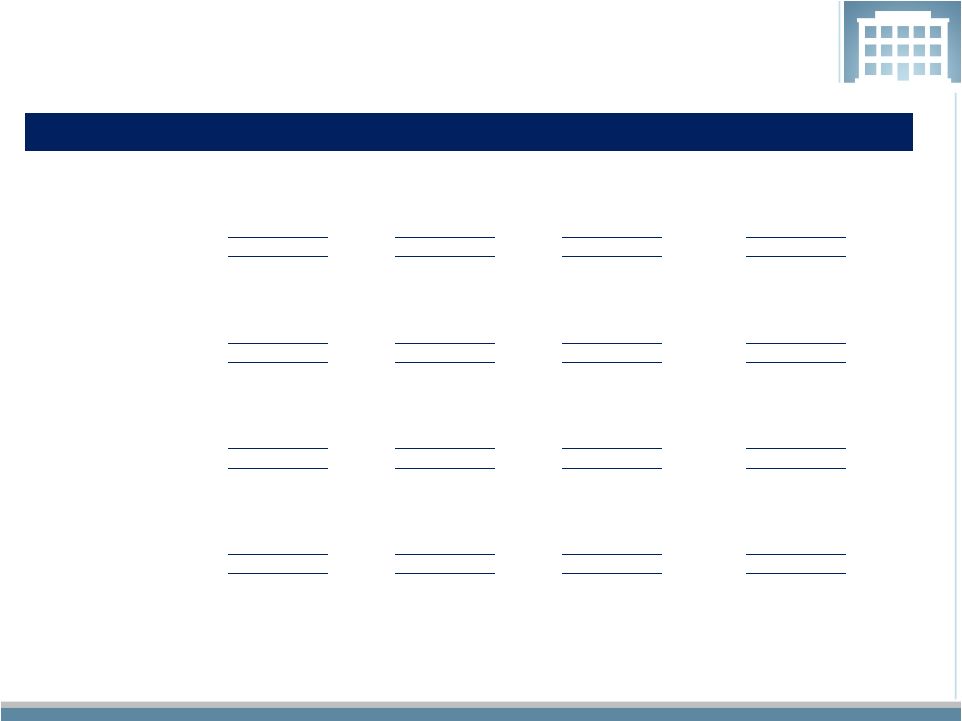

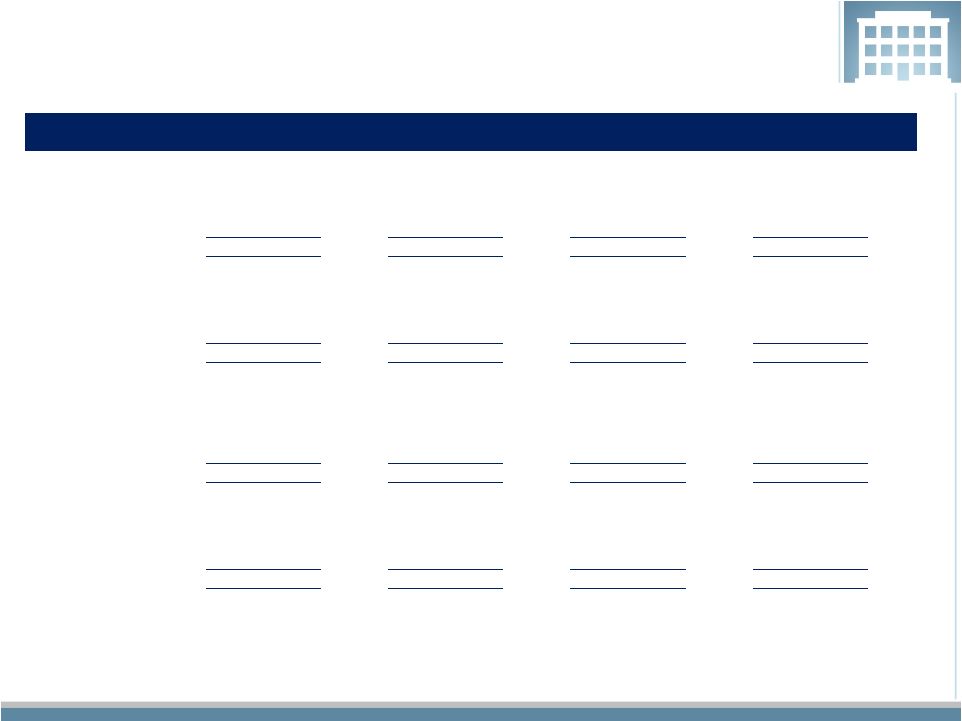

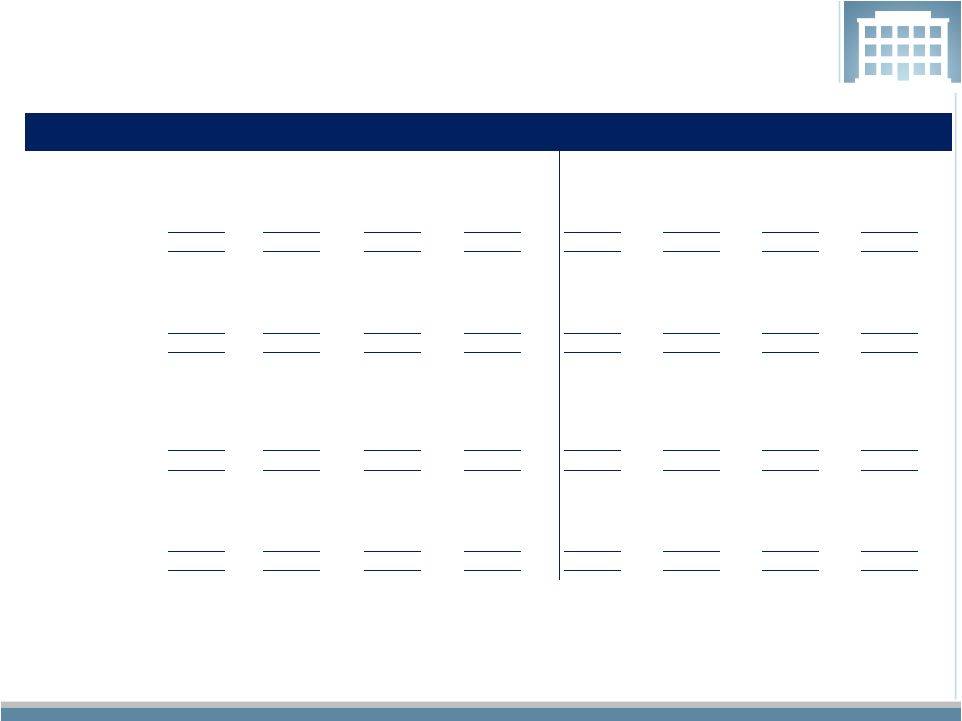

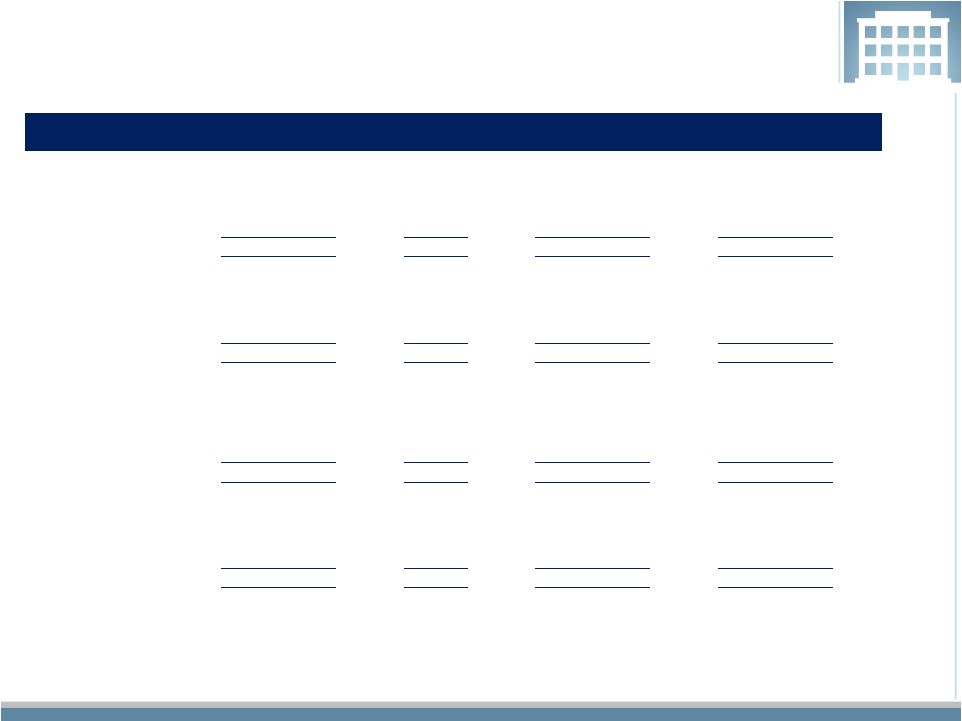

47 Reconciliation of Quarterly Adjusted EBITDA to Net Income (Loss) ($ in thousands)) Q1 a, b 2008 Q2 a, b 2008 Q3 a, b 2008 Q4 a, b 2008 Q1 a, b 2009 Q2 a, b 2009 Q3 a, b 2009 Q4 a, b 2009 Q1 a, b 2010 Q2 b 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Net Income (Loss) 6,100 13,466 30,494 23,218 (529,981) (121,571) 2,607 (101,851) (10,486) (7,656) (3,299) (5,436) (12,725) (3,229) 2,593 3,411 Income Taxes 3,823 8,537 18,554 17,092 (34,861) (16,382) 1,825 (7,495) (5,779) (5,536) (221) (1,794) (5,009) (1,786) --- 398 Interest Expense, Net 8,522 7,748 7,463 7,761 6,623 6,168 6,487 9,578 4,507 4,670 4,392 4,258 4,177 3,870 3,864 3,685 Depreciation & Amortization 9,144 8,645 8,665 8,334 8,324 8,436 7,586 7,640 7,522 7,479 7,457 7,309 7,236 7,187 7,187 6,753 Stock-Based Comp 2,871 3,442 1,563 1,628 1,372 1,177 1,241 1,045 801 1,403 1,374 1,375 1,685 1,671 1,776 1,776 Goodwill & Other Intangible Asset Impairment --- --- --- --- 517,628 104,936 --- --- --- --- --- --- --- --- --- --- Cash Restructuring Charges (Recovery) 226 640 43 150 2,479 3,796 1,213 1,564 524 829 551 1,628 --- --- (575) 283 Transaction Costs --- --- --- --- --- 629 401 107,718 174 --- --- (250) --- --- --- --- Lower of Cost or Market Adjustment, Net --- --- --- 2,739 29,378 10,608 --- --- --- --- --- --- --- --- --- --- Asset Impairments (recovery) --- --- --- 157 623 5,295 26 347 1,029 (116) (64) 221 --- --- (93) 1,214 Gain on Embedded Derivative --- --- --- --- --- --- --- --- (919) (4) (7) (7) (7) (6) (6) (6) Pre-Acquisition Contingency Adjustment --- --- --- --- --- --- --- --- --- --- --- 178 252 --- --- --- ADJUSTED EBITDA 30,686 42,478 66,782 61,079 1,585 3,092 21,386 18,546 (2,627) 1,069 10,183 7,482 (4,391) 7,707 14,746 17,514 On October 20, 2009, the Company amended and restated its Term Note facility which defines adjusted EBITDA. Adjusted EBITDA excludes non-cash charges for goodwill and other asset impairments, lower of cost or market charges and stock compensation as well as certain non-recurring charges. As such, the historical information is presented in accordance with the definition above. Concurrent with the amendment and restatement of the Term Note facility, the Company entered into an Asset-Backed Lending facility which has substantially the same definition of adjusted EBITDA except that the ABL facility caps certain non-recurring charges. The Company is disclosing adjusted EBITDA, which is a non-GAAP measure, because it is used by management and provided to investors to provide comparability of underlying operational results. Amounts have been retrospectively adjusted as a result of the adoption, effective November 2, 2009, of ASC Subtopic 470-20, “Debt with Conversion and Other Options” as well as certain additional reclassifications due to the further integration of RCC and the rationalization of our operations. a b Note: Adjusted EBITDA is defined in the Company’s credit facilities, as amended from time to time. |