Charting Our Path to Growth and Long-Term Profitability October 2014

Certain statements on the slides which follow may be forward-looking statements about Christopher & Banks Corporation (the “Company”). Such forward-looking statements involve risks and uncertainties which may cause actual results to differ. These forward-looking statements may be identified by such terms as “will”, “expect”, “believe”, “anticipate”, “outlook”, “target”, “plan”, “initiatives”, “estimated”, “strategy” and similar terms. You are directed to the cautionary statements regarding risks or uncertainties described in the Company’s filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and other SEC filings made since the date of that 10-K report. Participants are cautioned not to place undue reliance on such forward-looking statements, which reflect management’s views only as of October 7, 2014. The Company undertakes no obligation to update or revise the forward-looking statements. 2 Safe Harbor

Our Vision & Mission Vision To be her trusted brand by delivering style and value every day Mission To provide women of all sizes with apparel and accessories with style and versatility that reflects who she is, lasting quality and the affordable value she expects, delivered with the personalized attention she deserves 3

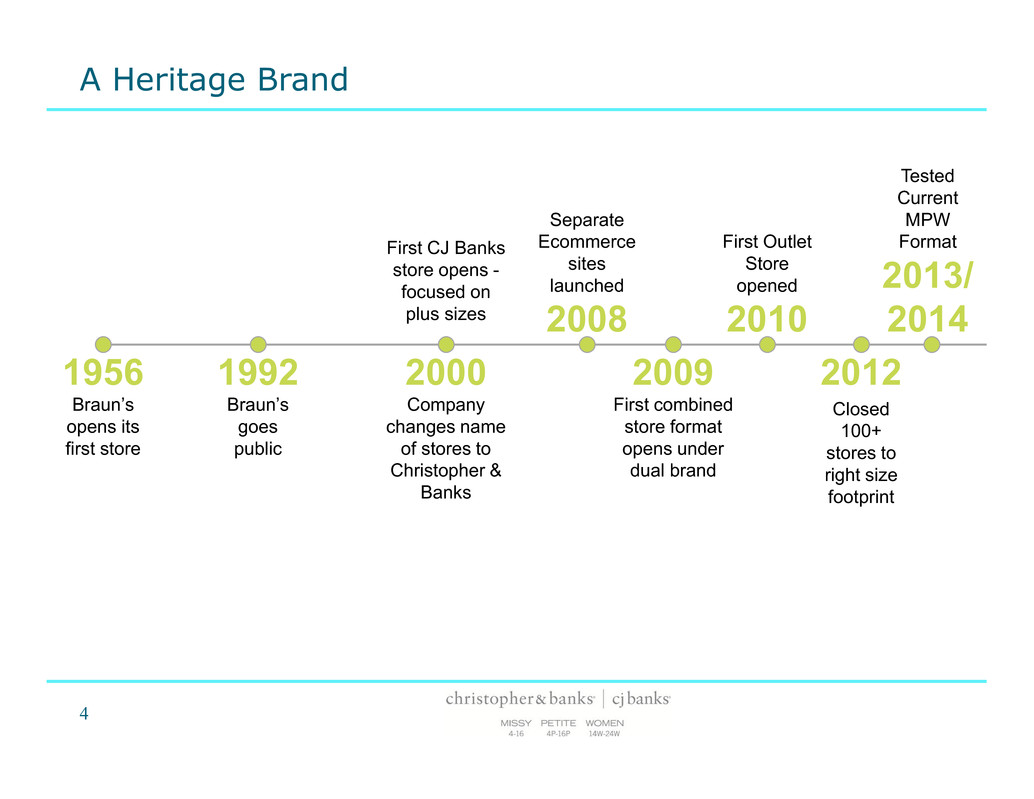

A Heritage Brand 1956 Braun’s opens its first store 1992 Braun’s goes public 2000 Company changes name of stores to Christopher & Banks First CJ Banks store opens - focused on plus sizes Separate Ecommerce sites launched 2008 2009 First combined store format opens under dual brand First Outlet Store opened 2010 2012 Closed 100+ stores to right size footprint Tested Current MPW Format 2013/ 2014 4

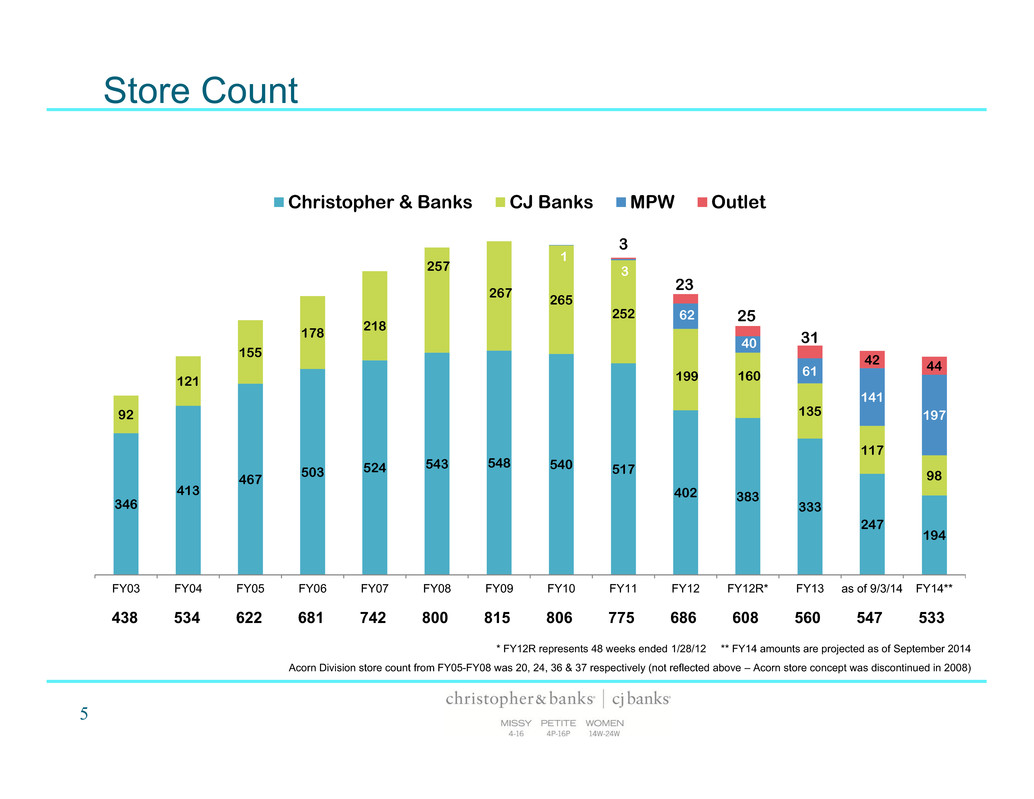

Store Count * FY12R represents 48 weeks ended 1/28/12 ** FY14 amounts are projected as of September 2014 Acorn Division store count from FY05-FY08 was 20, 24, 36 & 37 respectively (not reflected above – Acorn store concept was discontinued in 2008) 346 413 467 503 524 543 548 540 517 402 383 333 247 194 92 121 155 178 218 257 267 265 252 199 160 135 117 98 1 3 62 40 61 141 197 3 23 25 31 42 44 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY12R* FY13 as of 9/3/14 FY14** Christopher & Banks CJ Banks MPW Outlet 438 534 622 681 742 800 815 806 775 686 608 560 547 533 5

Christopher & Banks 2000 | Braun’s changes names to Christopher & Banks 2009 | Peak store count at 548 stores 9/3/14 | 247 stores Projected (end of fiscal year) | 194 stores C.J. Banks 2000 | First CJ Banks store opens – catering to plus size 2009 | Peak store count at 267 stores 9/3/14 | 117 stores Projected (end of fiscal year) | 98 stores 6

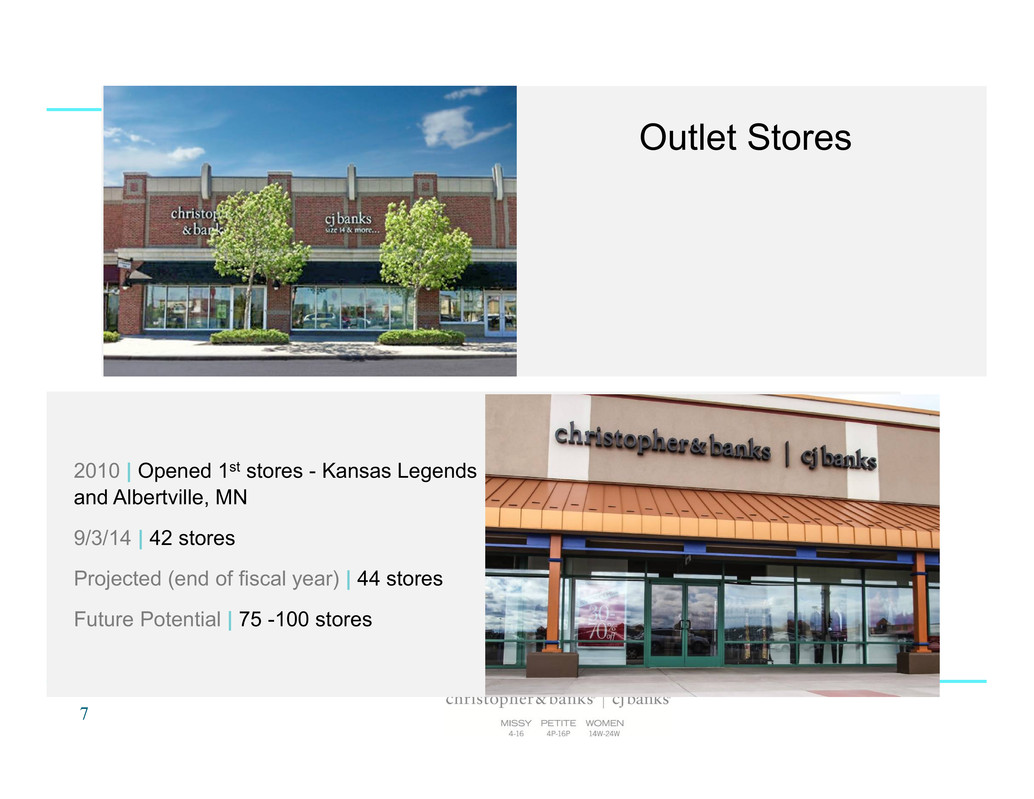

2010 | Opened 1st stores - Kansas Legends and Albertville, MN 9/3/14 | 42 stores Projected (end of fiscal year) | 44 stores Future Potential | 75 -100 stores Outlet Stores 7

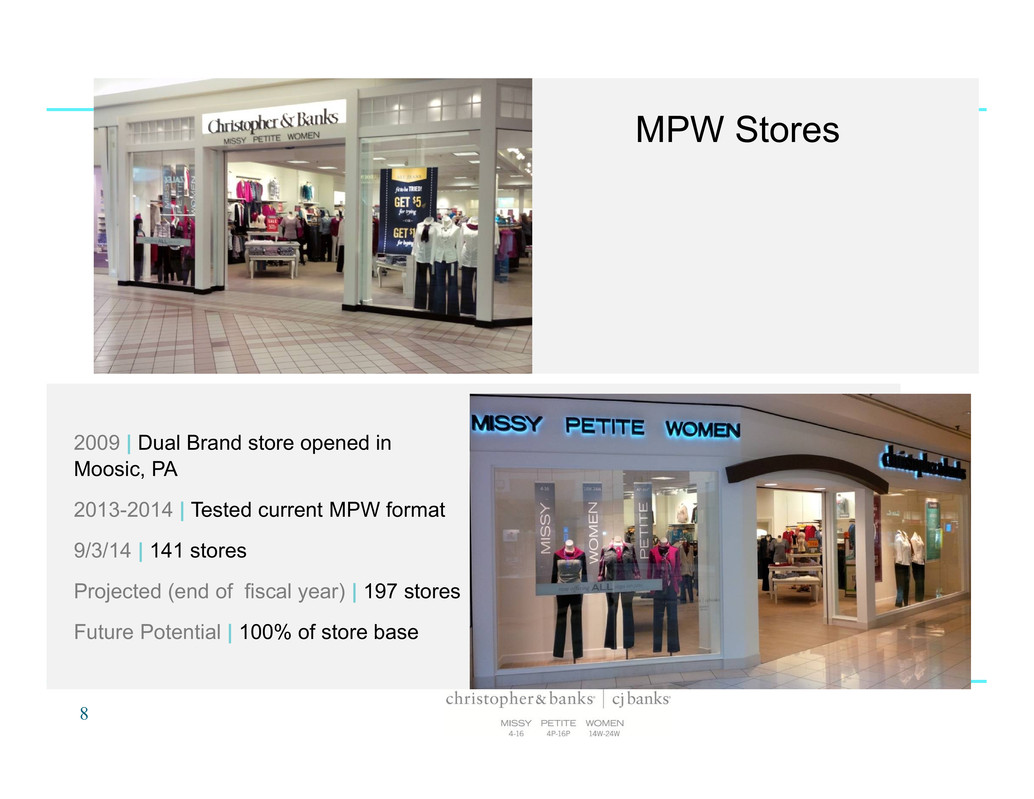

2009 | Dual Brand store opened in Moosic, PA 2013-2014 | Tested current MPW format 9/3/14 | 141 stores Projected (end of fiscal year) | 197 stores Future Potential | 100% of store base MPW Stores 8

Target women 45-60 years Avg. household income $70k-$75k More than 50% higher than US avg. 70% work outside of the home Two-thirds married Purchases 3.4 times annually Self-reports that she visits more frequently Spends $157 annually On average, $46 per purchase 9 Our Core Customer

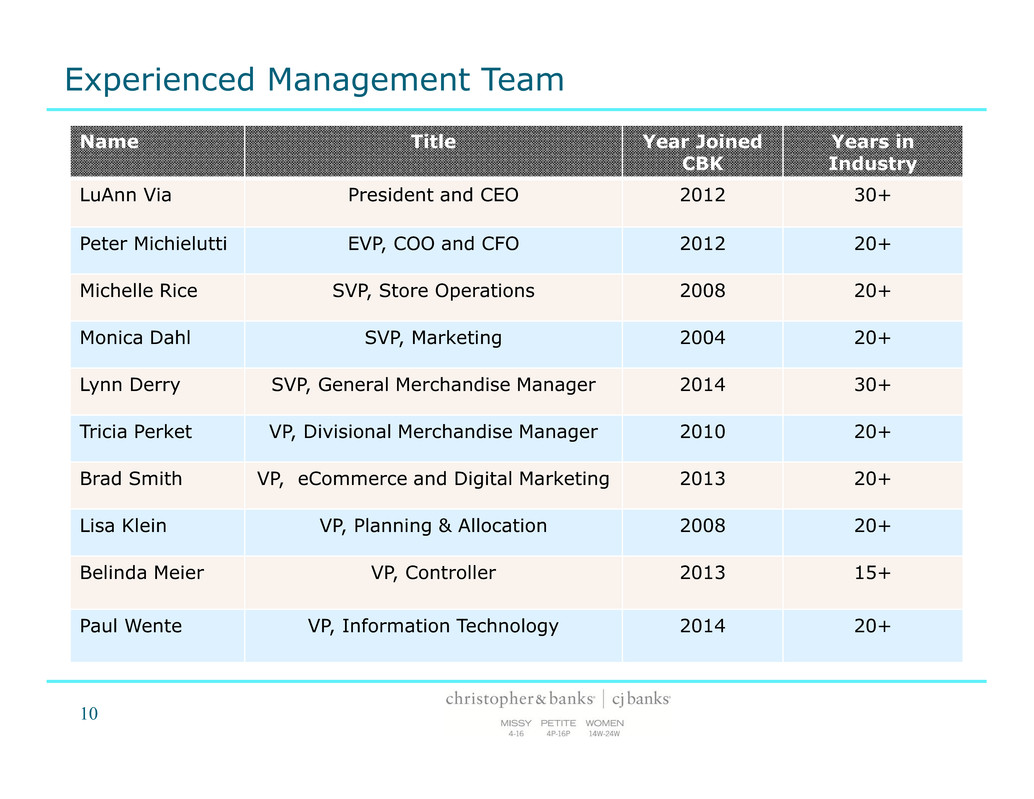

Name Title Year Joined CBK Years in Industry LuAnn Via President and CEO 2012 30+ Peter Michielutti EVP, COO and CFO 2012 20+ Michelle Rice SVP, Store Operations 2008 20+ Monica Dahl SVP, Marketing 2004 20+ Lynn Derry SVP, General Merchandise Manager 2014 30+ Tricia Perket VP, Divisional Merchandise Manager 2010 20+ Brad Smith VP, eCommerce and Digital Marketing 2013 20+ Lisa Klein VP, Planning & Allocation 2008 20+ Belinda Meier VP, Controller 2013 15+ Paul Wente VP, Information Technology 2014 20+ 10 Experienced Management Team

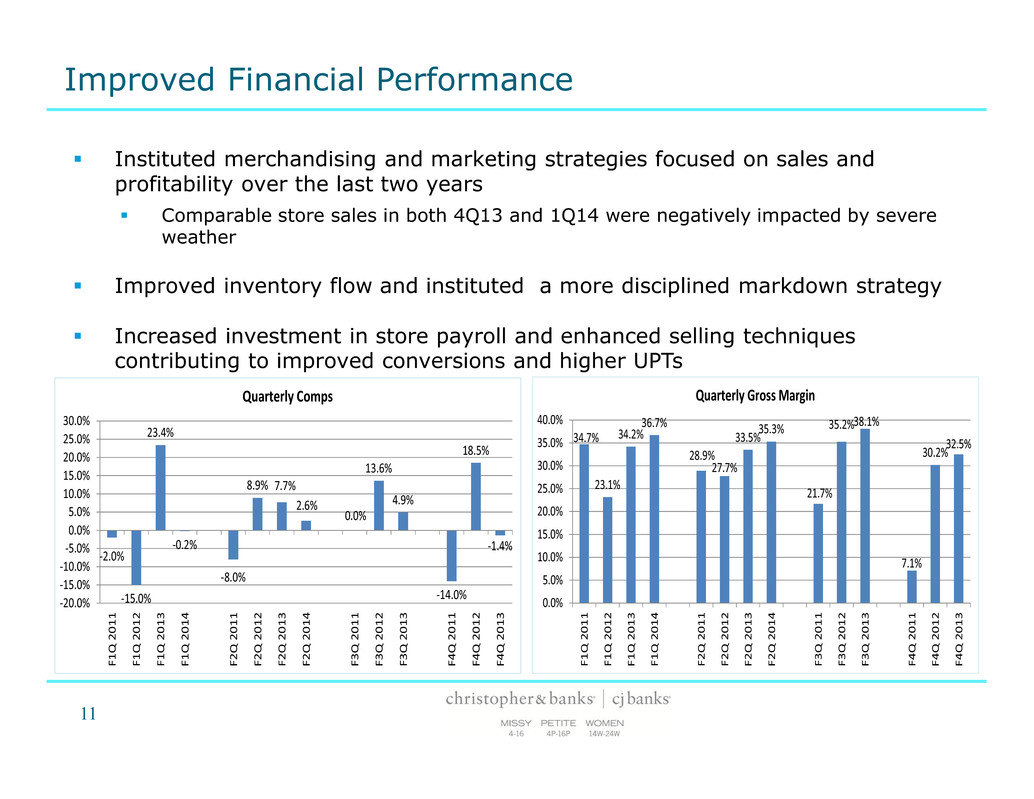

11 Improved Financial Performance Instituted merchandising and marketing strategies focused on sales and profitability over the last two years Comparable store sales in both 4Q13 and 1Q14 were negatively impacted by severe weather Improved inventory flow and instituted a more disciplined markdown strategy Increased investment in store payroll and enhanced selling techniques contributing to improved conversions and higher UPTs -2.0% -15.0% 23.4% -0.2% -8.0% 8.9% 7.7% 2.6% 0.0% 13.6% 4.9% -14.0% 18.5% -1.4% -20.0% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% F 1 Q 2 0 1 1 F 1 Q 2 0 1 2 F 1 Q 2 0 1 3 F 1 Q 2 0 1 4 F 2 Q 2 0 1 1 F 2 Q 2 0 1 2 F 2 Q 2 0 1 3 F 2 Q 2 0 1 4 F 3 Q 2 0 1 1 F 3 Q 2 0 1 2 F 3 Q 2 0 1 3 F 4 Q 2 0 1 1 F 4 Q 2 0 1 2 F 4 Q 2 0 1 3 Quarterly Comps 34.7% 23.1% 34.2% 36.7% 28.9% 27.7% 33.5% 35.3% 21.7% 35.2%38.1% 7.1% 30.2% 32.5% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% F 1 Q 2 0 1 1 F 1 Q 2 0 1 2 F 1 Q 2 0 1 3 F 1 Q 2 0 1 4 F 2 Q 2 0 1 1 F 2 Q 2 0 1 2 F 2 Q 2 0 1 3 F 2 Q 2 0 1 4 F 3 Q 2 0 1 1 F 3 Q 2 0 1 2 F 3 Q 2 0 1 3 F 4 Q 2 0 1 1 F 4 Q 2 0 1 2 F 4 Q 2 0 1 3 Quarterly Gross Margin

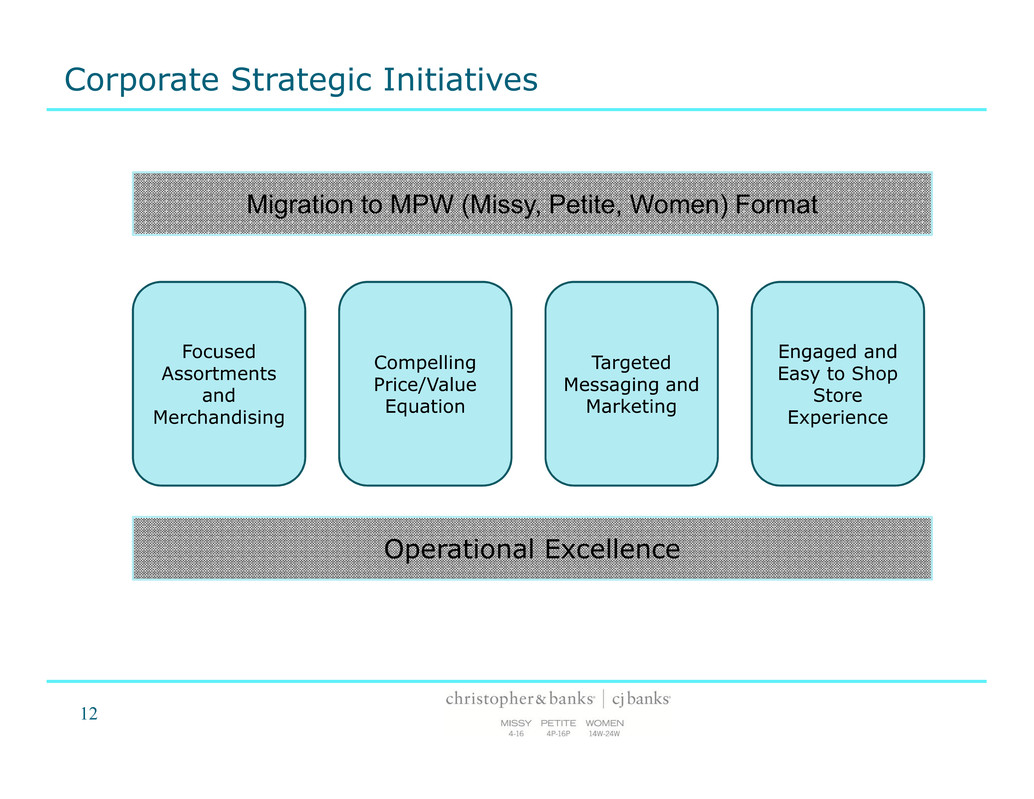

Migration to MPW (Missy, Petite, Women) Format Focused Assortments and Merchandising Compelling Price/Value Equation Targeted Messaging and Marketing Engaged and Easy to Shop Store Experience Operational Excellence 12 Corporate Strategic Initiatives

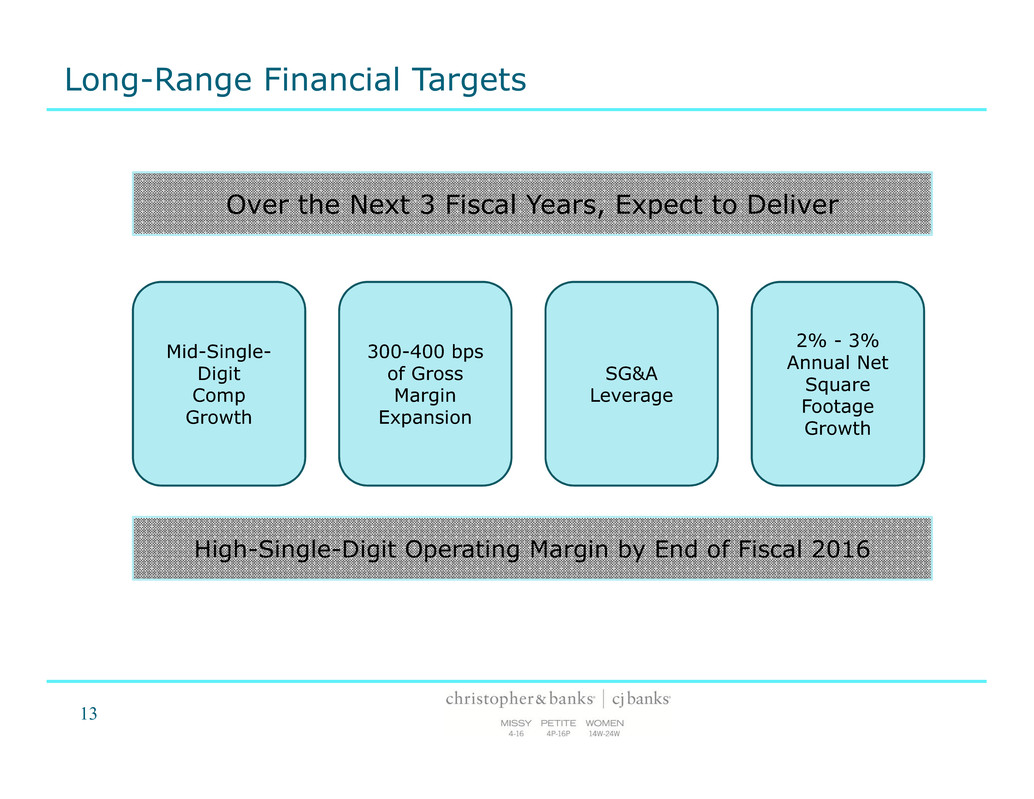

Over the Next 3 Fiscal Years, Expect to Deliver Mid-Single- Digit Comp Growth 300-400 bps of Gross Margin Expansion SG&A Leverage 2% - 3% Annual Net Square Footage Growth High-Single-Digit Operating Margin by End of Fiscal 2016 13 Long-Range Financial Targets

14 Consistently deliver a balanced, compelling and versatile fashion assortment Offer fashion-right, age-appropriate options Continue to maximize sales and margin with year round core basic programs and appropriate depth of key styles Increase wear-to-work options including jackets, blouses, essential cardigans and year round pants Provide easy, complete outfitting with complementing accessories Focused Merchandise Assortments

Expand core programs of Everyday Denim and Layer Your Look knit tees Introduce new fit solutions and easy care fabrics Signature slimming pants Wrinkle-resistant shirts Expand weekend wear Expand soft knit dressing 15 Focused Merchandise Assortments

16 Offer a price/value proposition that resonates with customers Provide attractive opening price points in all categories Drive key sales and margin at compelling price points Plan promotional buys to maximize margin Continue to offer a well-balanced good / better / best product mix Consistently deliver on quality Compelling Price/Value Equation

17 Leverage Customer Relationship Management (CRM) Programs Friendship Loyalty Program at approximately 4.2 million in total and 2.2 million Active customers generating 97% of our 12-month sales as of end of 2QFY14 Increased analytics around customer segments Investing in qualitative & quantitative research Continue to expand Private Label Credit Card Program (launched in April 2012) Ended 2QFY14 with nearly 685,000 card holders Cardholders represent 24% of active customers Over 31% of overall sales for 2QFY14 were made on the card VIP cardholder events and in-store payments 56% of customers who make a payment in store also make a same day purchase Targeted Messaging and Marketing

18 Invest in marketing programs that increase customer growth and loyalty while driving measurable returns Continue investment in direct mail Increase investments in social media and select PR Support new store formats with enhanced grand opening events Refine promotional strategy Targeted and pre-planned category promotions versus all-store promotions Store signage and messaging, balancing product features & promotions to drive traffic Targeted Messaging and Marketing

Enhanced Omni-Channel Experience NOW there is a major shift from Multi-channel to Omni-channel Moving from selling via any channel to providing a seamless, consistent experience across ALL customer touch points – store, web, social, mobile, catalog, email and digital • Adds complexity of integration of all business aspects and requires a single view of the customer Increase our use of digital media to extend the reach of our brands and acquire a new customer Leverage growth in paid search Expand use of targeted, data-driven display advertising Grow multi-channel customer base 19

Refreshed “Selling with Care” program Refining selling techniques through additional videos and tools Reinforce clientelling as key to selling culture Increased selling hours at select stores Upgraded Talent Aligning store personnel capabilities with real estate strategy Enhanced on-boarding program Enhanced Visual Merchandising Increased outfitting displays Create consistency from store to store by maintaining brand standards Greater use of mannequins, tables and visual props for increased flexibility and visual appeal Maintain Strong Personal Relationships with Our Customer In-store seasonal Fashion Events Maximize grassroots opportunities i.e. women’s conventions, leadership conferences and women’s clubs 20 Engaged and Easy-to-Shop In-Store Experience

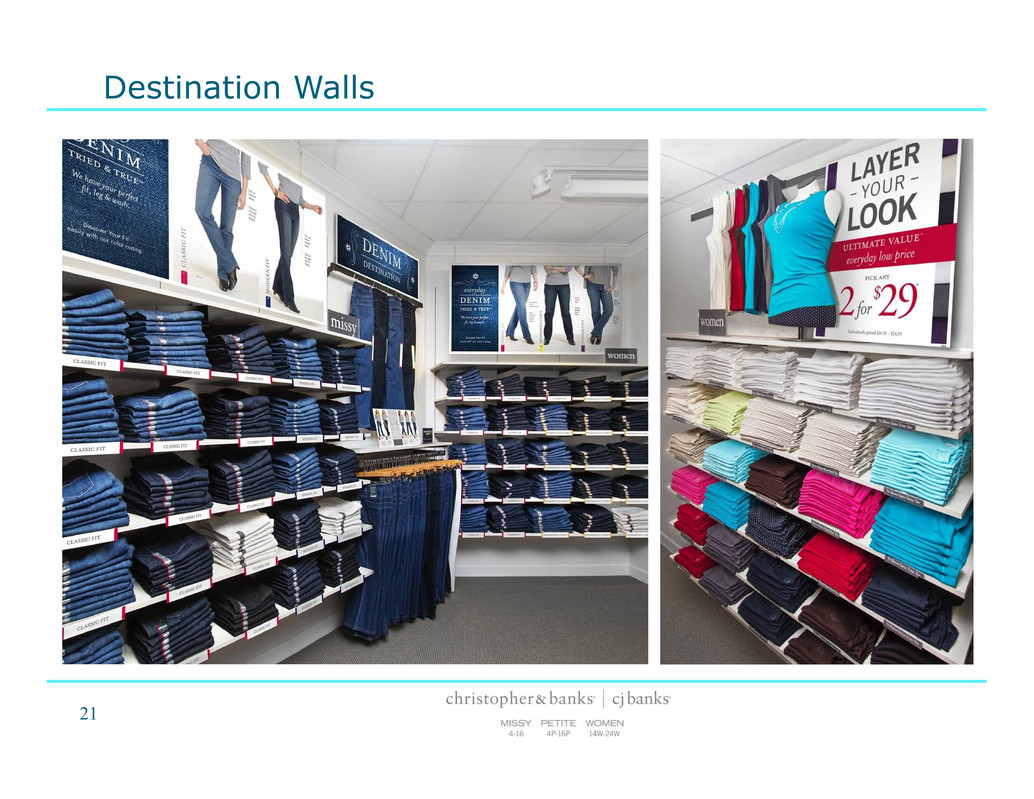

Destination Walls 21

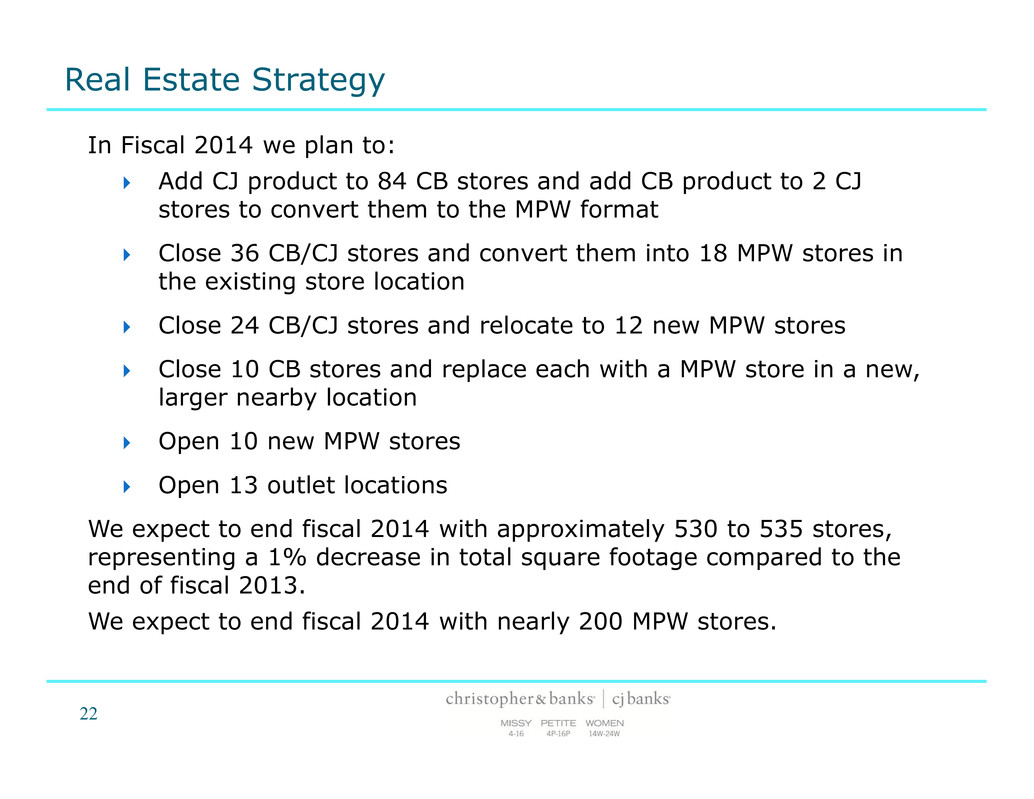

22 In Fiscal 2014 we plan to: Add CJ product to 84 CB stores and add CB product to 2 CJ stores to convert them to the MPW format Close 36 CB/CJ stores and convert them into 18 MPW stores in the existing store location Close 24 CB/CJ stores and relocate to 12 new MPW stores Close 10 CB stores and replace each with a MPW store in a new, larger nearby location Open 10 new MPW stores Open 13 outlet locations We expect to end fiscal 2014 with approximately 530 to 535 stores, representing a 1% decrease in total square footage compared to the end of fiscal 2013. We expect to end fiscal 2014 with nearly 200 MPW stores. Real Estate Strategy

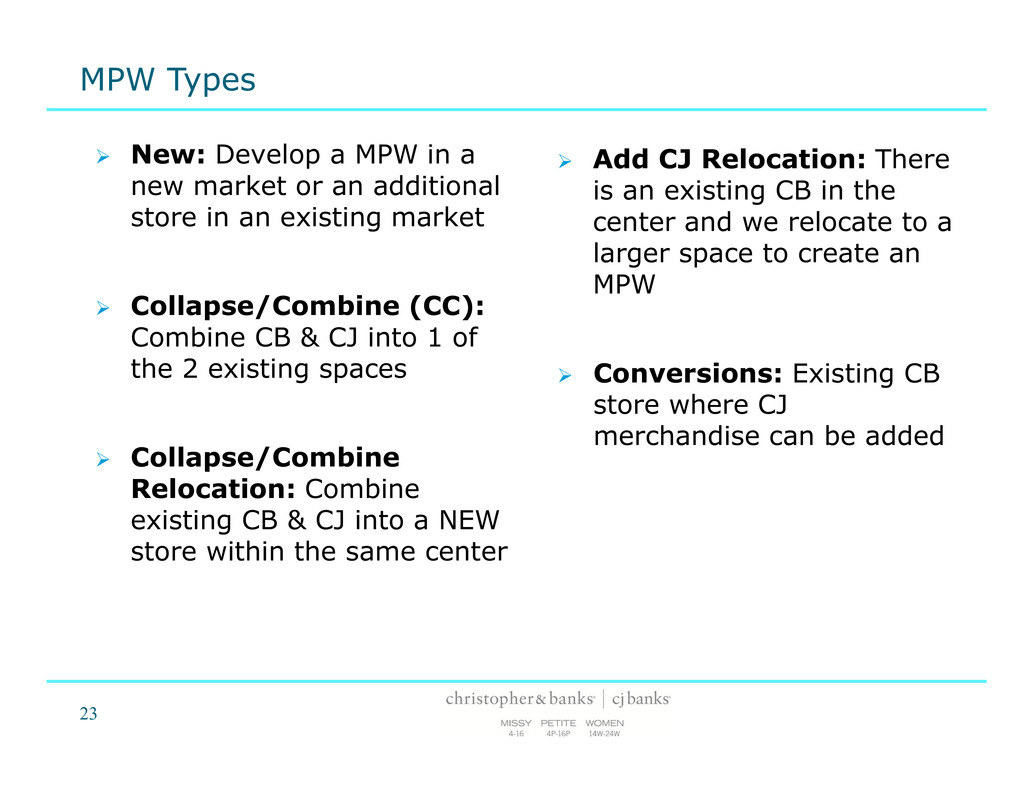

MPW Types New: Develop a MPW in a new market or an additional store in an existing market Collapse/Combine (CC): Combine CB & CJ into 1 of the 2 existing spaces Collapse/Combine Relocation: Combine existing CB & CJ into a NEW store within the same center Add CJ Relocation: There is an existing CB in the center and we relocate to a larger space to create an MPW Conversions: Existing CB store where CJ merchandise can be added 23

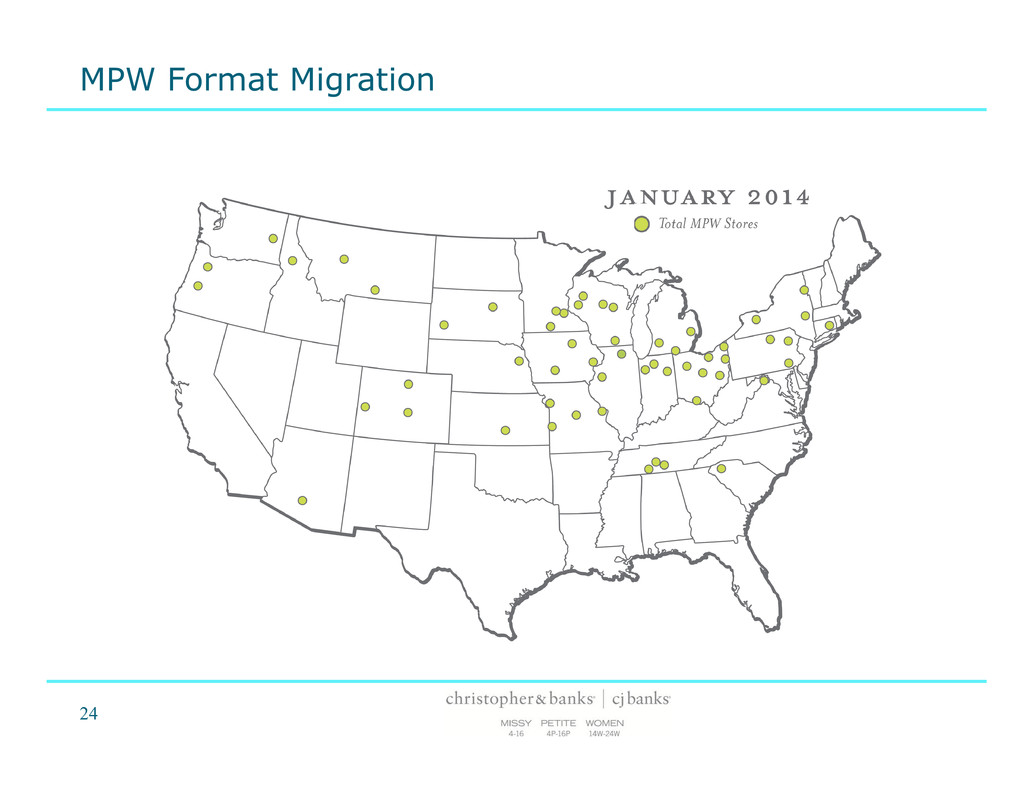

MPW Format Migration 24

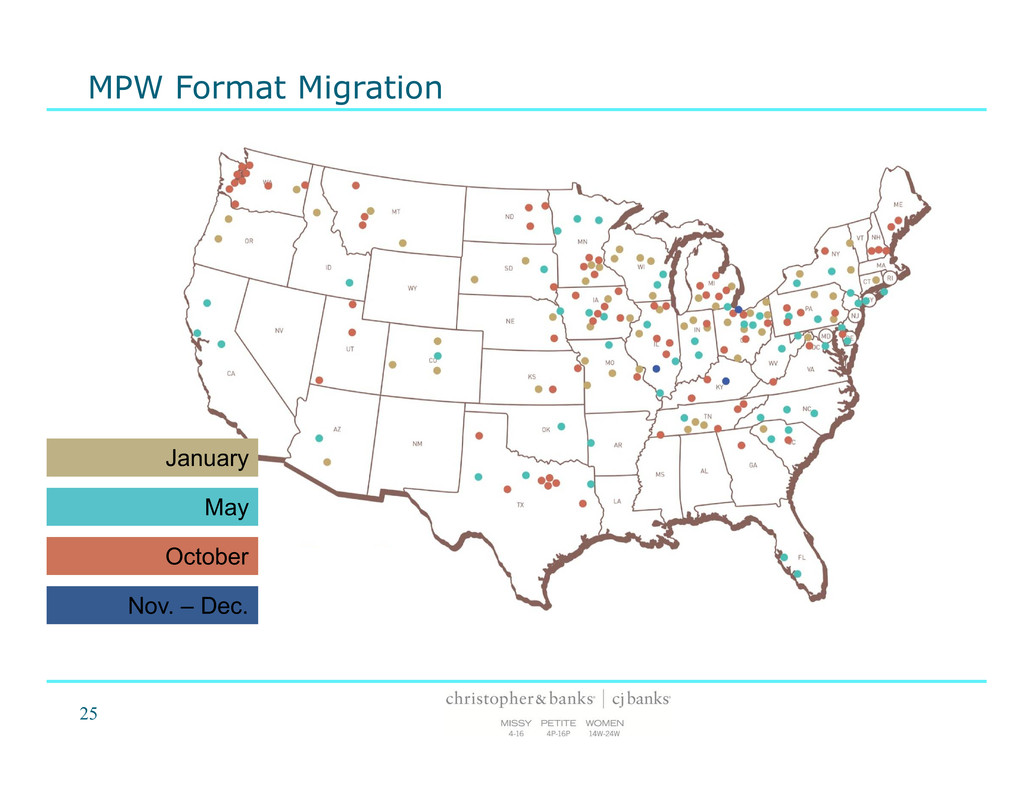

MPW Format Migration January May 25 October Nov. – Dec.

26 Unique customer niche largely underserved by others Achieve historical sales productivity and gross margin levels generating operating income of 8-10% Drive increases in sales per square foot thru new product introductions, customer acquisition, MPW migration and outlet store growth Control two largest expense drivers: occupancy and store payroll Leverage SG&A expenses Manage inventory to improve turnover, reduce markdowns and increase gross margin Invest cash wisely for greatest return to shareholders Investment Highlights

27 Mall of America – 1993

Mall of America – 2014 28

29 Mall of America – 2014

Financial Highlights 30

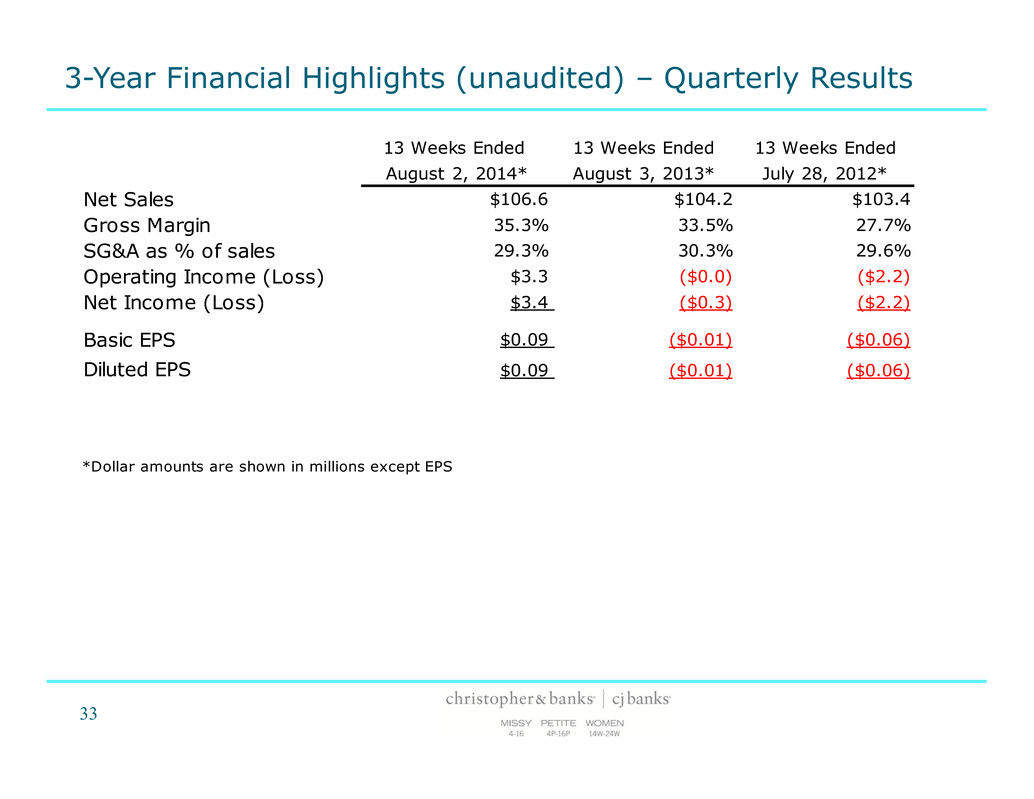

Total comparable sales for 2Q2014 were up 2.6% Improved conversion rates, higher units per transaction, and an increase in the AUR led to a 9.8% increase in average dollar sale Gross margin for fiscal 2Q2014 was 35.3% compared to 33.5% for 2Q2013 Merchandise margin rate improved 143 bps Lower markdowns Improved IMU Occupancy leverage Substantial year-over-year growth in both operating income and earnings per share Operating income increased by $3.3M in the second quarter compared to 2Q2013 EPS of $0.09 in 2Q2014 vs. a loss of ($0.01) in the comparable quarter for the prior year Improved Financial Performance 31

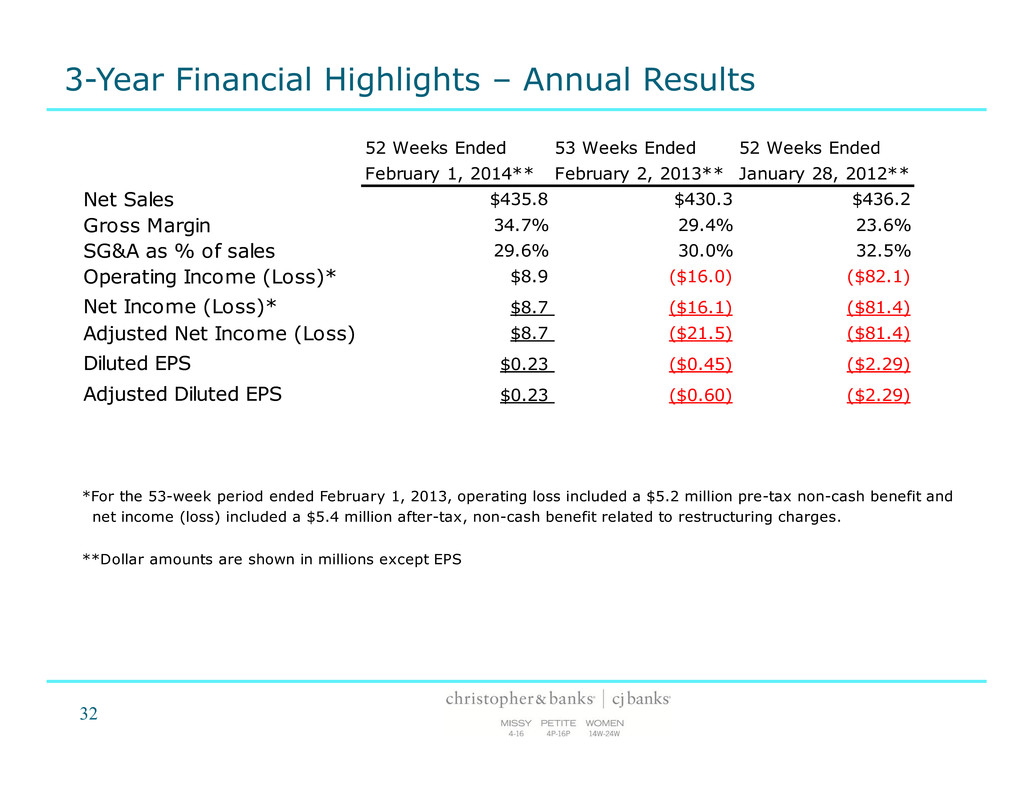

52 Weeks Ended 53 Weeks Ended 52 Weeks Ended February 1, 2014** February 2, 2013** January 28, 2012** Net Sales $435.8 $430.3 $436.2 Gross Margin 34.7% 29.4% 23.6% SG&A as % of sales 29.6% 30.0% 32.5% Operating Income (Loss)* $8.9 ($16.0) ($82.1) Net Income (Loss)* $8.7 ($16.1) ($81.4) Adjusted Net Income (Loss) $8.7 ($21.5) ($81.4) Diluted EPS $0.23 ($0.45) ($2.29) Adjusted Diluted EPS $0.23 ($0.60) ($2.29) *For the 53-week period ended February 1, 2013, operating loss included a $5.2 million pre-tax non-cash benefit and net income (loss) included a $5.4 million after-tax, non-cash benefit related to restructuring charges. **Dollar amounts are shown in millions except EPS 3-Year Financial Highlights – Annual Results 32

13 Weeks Ended 13 Weeks Ended 13 Weeks Ended August 2, 2014* August 3, 2013* July 28, 2012* Net Sales $106.6 $104.2 $103.4 Gross Margin 35.3% 33.5% 27.7% SG&A as % of sales 29.3% 30.3% 29.6% Operating Income (Loss) $3.3 ($0.0) ($2.2) Net Income (Loss) $3.4 ($0.3) ($2.2) Basic EPS $0.09 ($0.01) ($0.06) Diluted EPS $0.09 ($0.01) ($0.06) *Dollar amounts are shown in millions except EPS 3-Year Financial Highlights (unaudited) – Quarterly Results 33

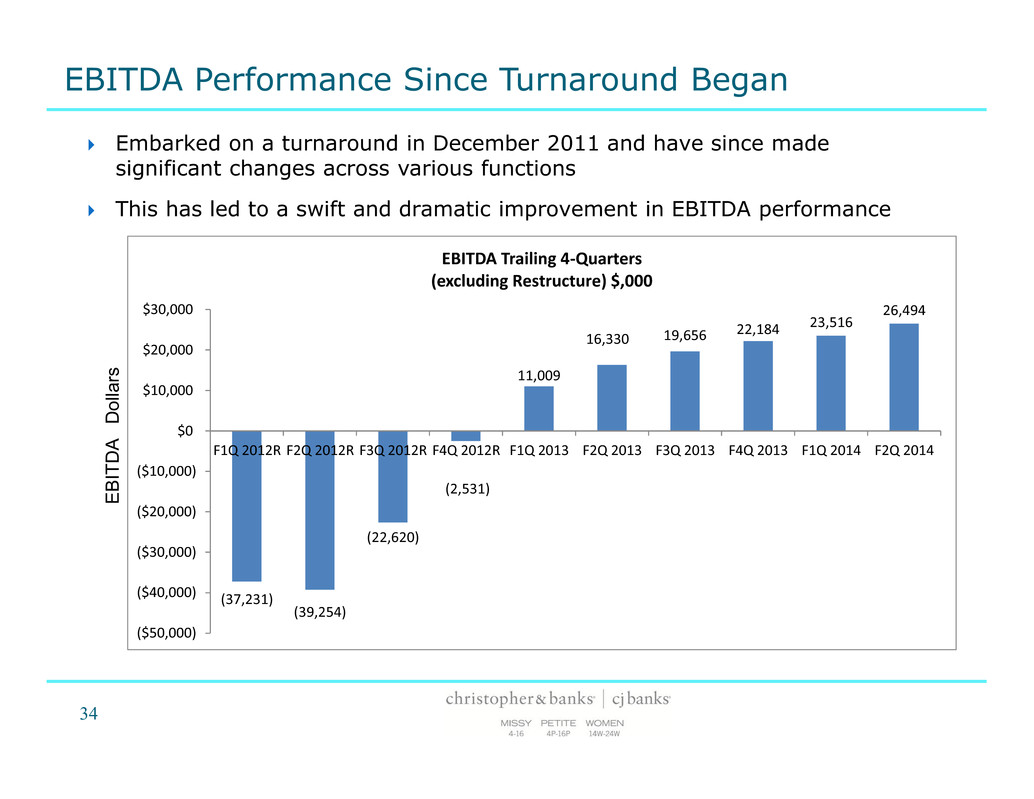

EBITDA Performance Since Turnaround Began Embarked on a turnaround in December 2011 and have since made significant changes across various functions This has led to a swift and dramatic improvement in EBITDA performance 34 E B IT D A D o ll a rs (37,231) (39,254) (22,620) (2,531) 11,009 16,330 19,656 22,184 23,516 26,494 ($50,000) ($40,000) ($30,000) ($20,000) ($10,000) $0 $10,000 $20,000 $30,000 F1Q 2012R F2Q 2012R F3Q 2012R F4Q 2012R F1Q 2013 F2Q 2013 F3Q 2013 F4Q 2013 F1Q 2014 F2Q 2014 EBITDA Trailing 4-Quarters (excluding Restructure) $,000

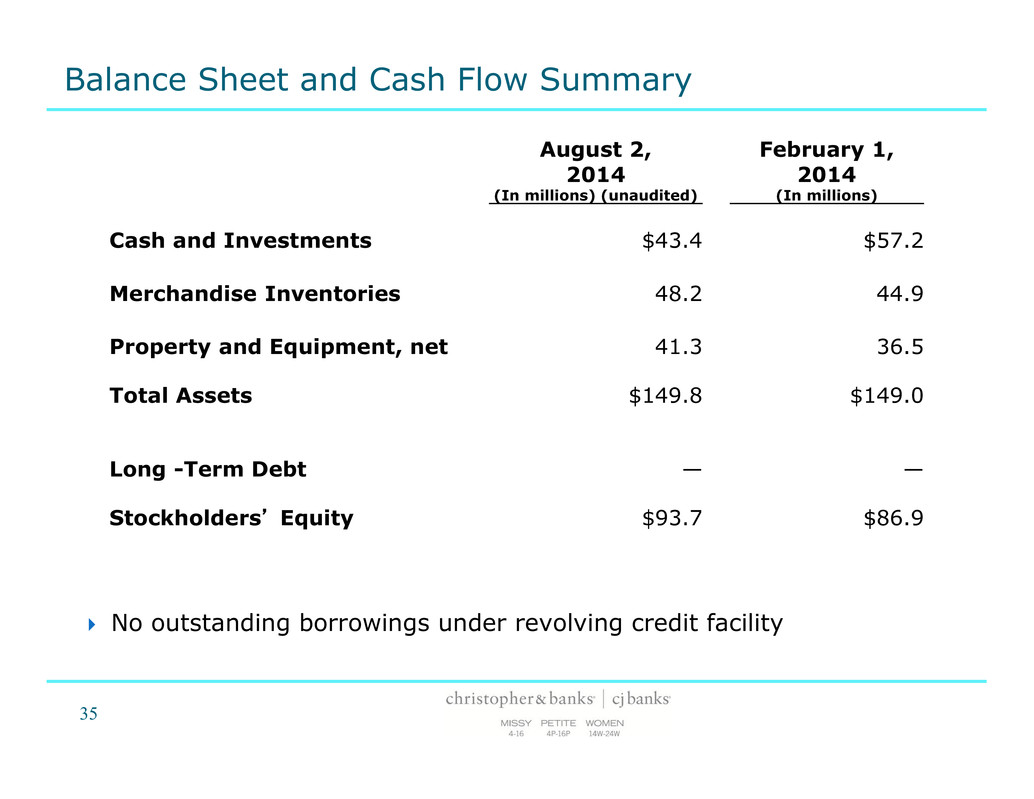

August 2, 2014 (In millions) (unaudited) February 1, 2014 (In millions) Cash and Investments $43.4 $57.2 Merchandise Inventories 48.2 44.9 Property and Equipment, net 41.3 36.5 Total Assets $149.8 $149.0 Long -Term Debt — — Stockholders’ Equity $93.7 $86.9 Balance Sheet and Cash Flow Summary No outstanding borrowings under revolving credit facility 35

Q3 Guidance Update For the third quarter of fiscal 2014 the Company expects: Total net sales of between $114 and $118 million, compared to $118.1 million in last year’s third quarter. Gross margin improvement of approximately 75 to 100 bps, as compared to the comparable prior year period. SG&A dollars to be between approximately $33.5 million and $34.0 million, compared to $33.2 million of SG&A expense reported in the third quarter last year. Inventory to remain higher than the levels from the comparable prior year period on a dollars-per-square-foot basis, the result of planned higher levels of core inventory, but at a level lower than at the end of the second quarter. 36

FY 2014 Guidance Update For the full year of fiscal 2014, the Company: Expects capital expenditures to be approximately $22 million to $23 million. Expects to recognize a nominal amount of tax expense, as the Company’s tax provisions will continue to be affected by the valuation allowance on our deferred tax assets in fiscal 2014; the potential exists that the valuation allowance may be reversed later this fiscal year. Plans for average store count to be down 8% and related average square footage for the year to be down 6% as compared to fiscal 2013. Expects to end the fiscal year with a decrease of 1% in total square footage as compared to the end of fiscal 2013. 37

38