USA Truck

Forward-Looking Statement

This information and statements made at the Stephens Inc. Fall Investment Conference

may contain forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of

1934, as amended. These statements generally may be identified by their use of terms

or phrases such as “expects,” “estimates,” “anticipates,” “projects,” “believes,”

“plans,” “intends,” “may,” “will,” “should,” “could,” “potential,” “continue,”

“future,” and terms or phrases of similar substance. Forward-looking statements are

based upon the current beliefs and expectations of our management and are inherently

subject to risks and uncertainties, some of which cannot be predicted or quantified,

which could cause future events and actual results to differ materially from those set

forth in, contemplated by, or underlying the forward-looking statements. Accordingly,

actual results may differ from those set forth in the forward-looking

statements. Readers should review and consider the factors that may affect future

results and other disclosures by the Company in its reports, Annual Report on Form

10-K, and other filings with the Securities and Exchange Commission. We disclaim

any obligation to update or revise any forward-looking statements to reflect actual

results or changes in the factors affecting the forward-looking information. In light of

these risks and uncertainties, the forward-looking events and circumstances discussed

at the Stephens Inc. Fall Investment Conference might not occur.

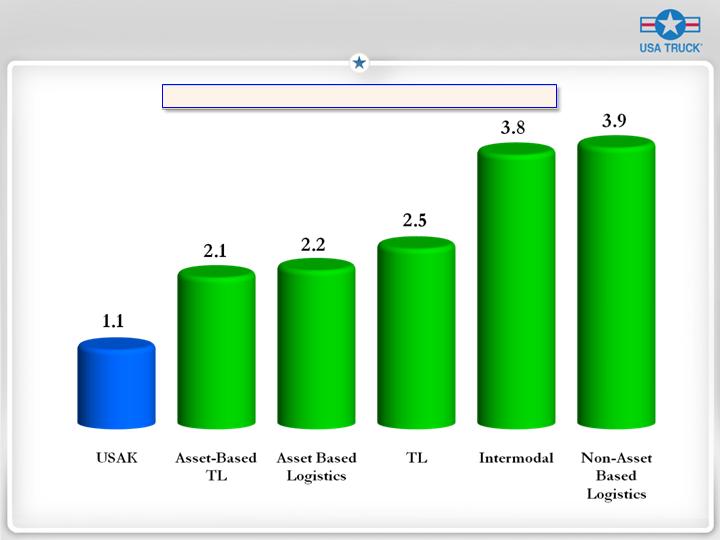

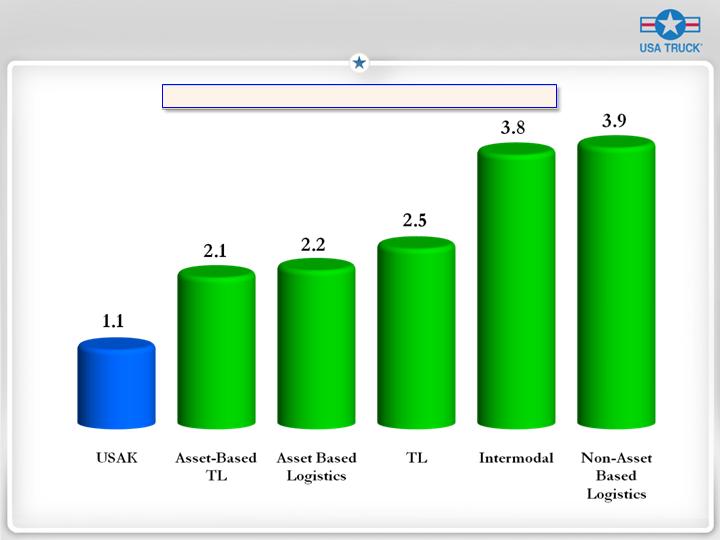

Our Stock is Under-Valued

As of November 10, 2008

Price to Book Multiples

Market Rejected Growth Strategy

USAK is the 2nd fastest growing name in TL Group*over past 10 years

(14.3% revenue CAGR), but…….

7th out of 9: EBITDA Growth CAGR

8th out of 9: Average ROCE and ROIC

2nd Largest Spread: Revenue CAGR and EBITDA CAGR (850 BPS)

2nd Largest Spread: Revenue CAGR and Net Income CAGR (500 BPS)

Largest Spread: Revenue CAGR and ROCE (930 BPS)

Largest Spread: Revenue CAGR and ROIC (950 BPS)

USAK has the 8th ranked 10-year Stock Price CAGR (1.0%)

*CLDN, CVTI, HTLD, JBHT, KNX, MRTN, PTSI, USAK and WERN

Source: SEC Documents and Stephens Inc.

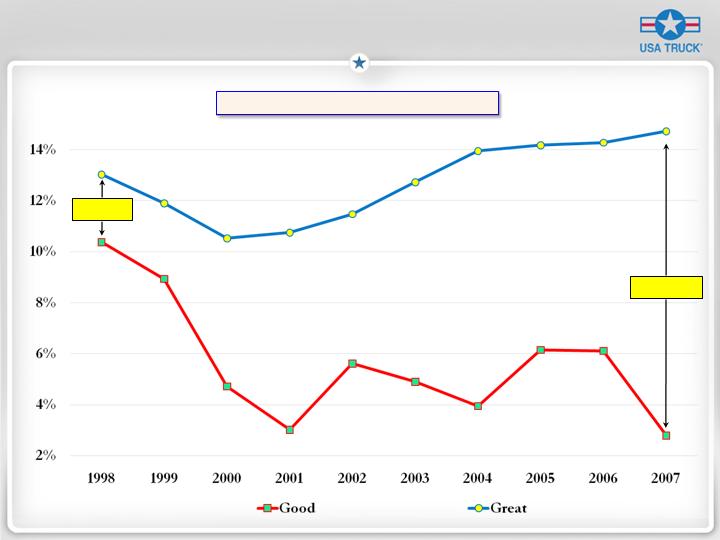

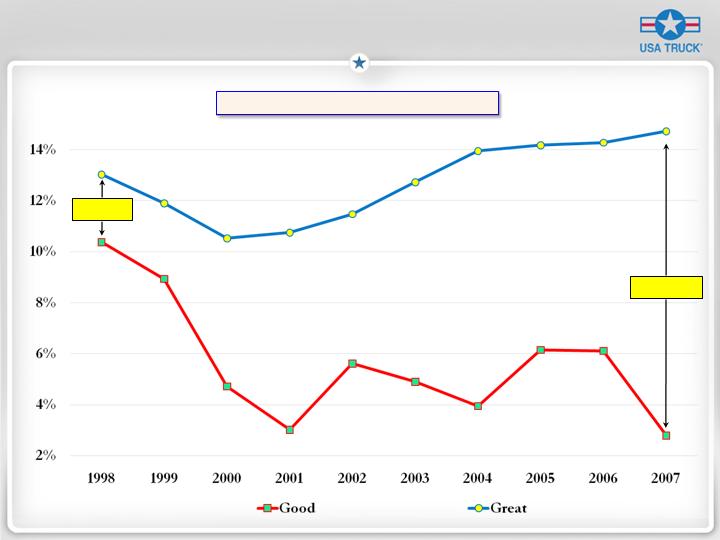

ROC Drives Stock!

Copeland’s Value Mountain

Revenue Growth vs. Stock Price: Low Correlation + 27%

Operating Ratio vs. Stock Price: Lowest Correlation - 2%

EBIT Growth vs. Stock Price: High Correlation + 74%

ROCE vs. Stock Price: Highest Correlation + 79%

Stock Performance Drivers

Lane’s Value Mountain

*SEC Documents and Stephens Inc.

Applied to T&L Industry

Confirms Copeland’s Theory

Divergent Business Models

1,190 BPS

270 BPS

Operating Margin Comparison

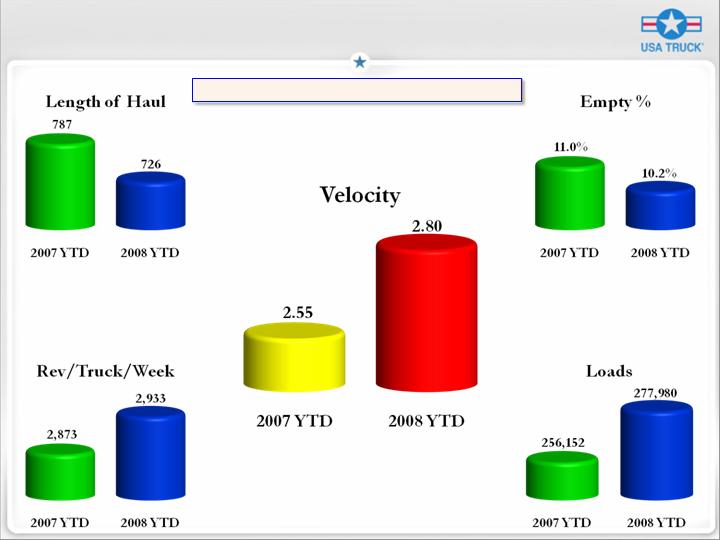

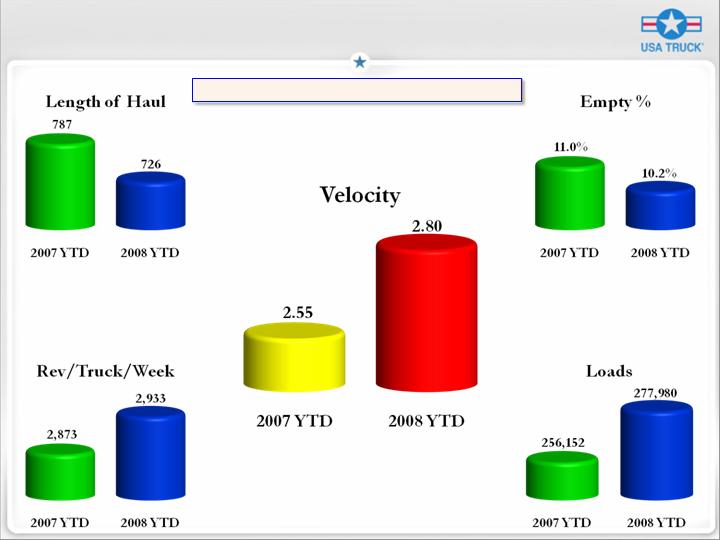

2007 Average LOH = 829

2007 Average LOH = 550

Strong Core

Strong Core

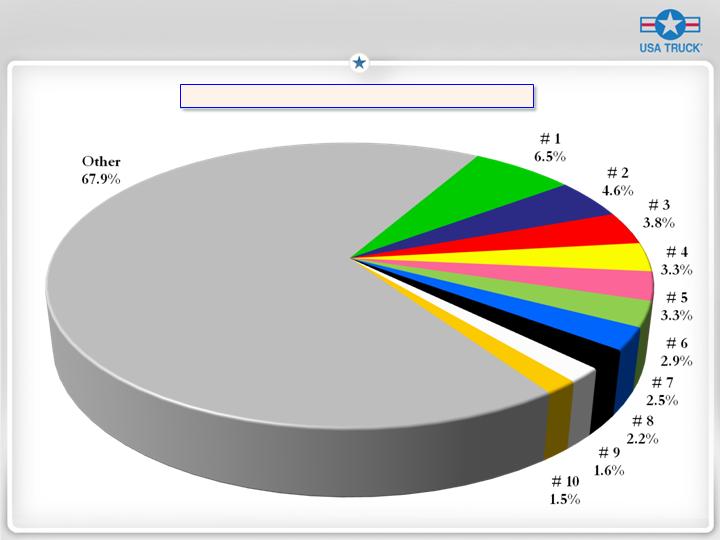

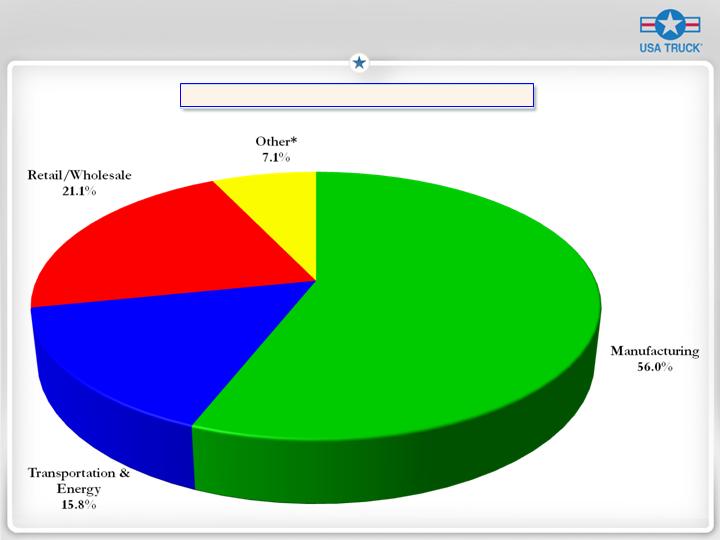

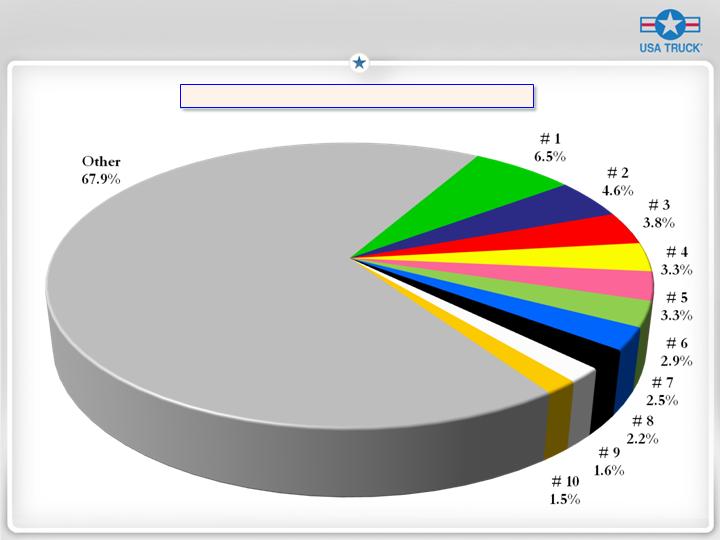

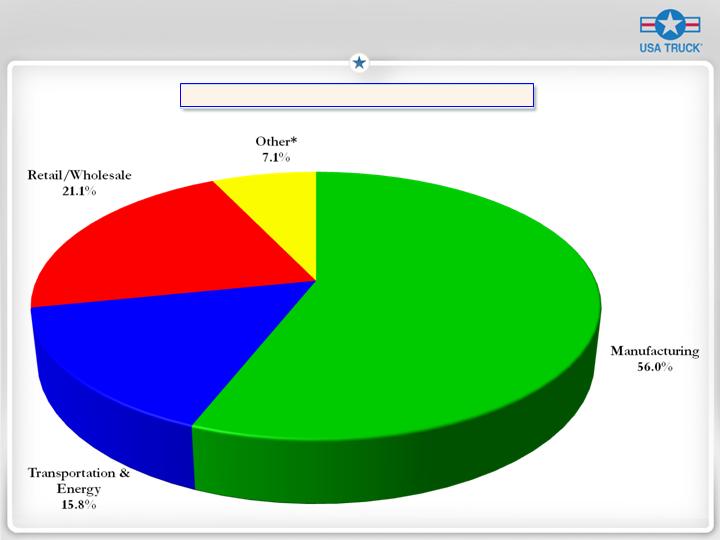

Deep, Diverse Customer Base

Strong Core

Industries Serviced

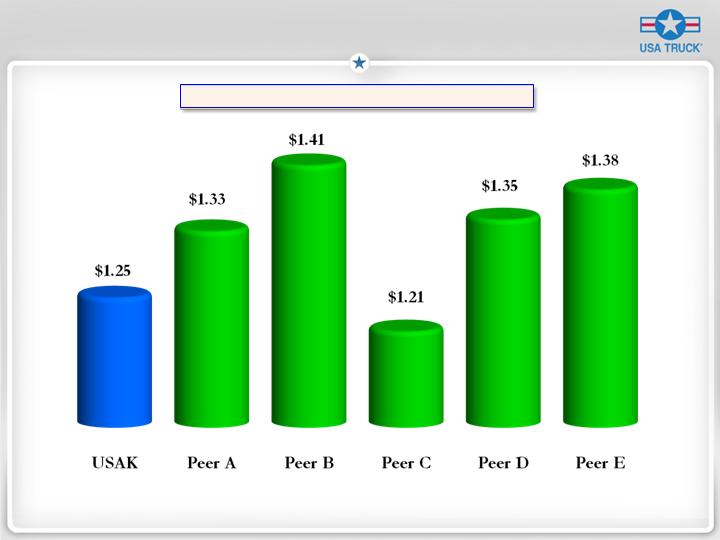

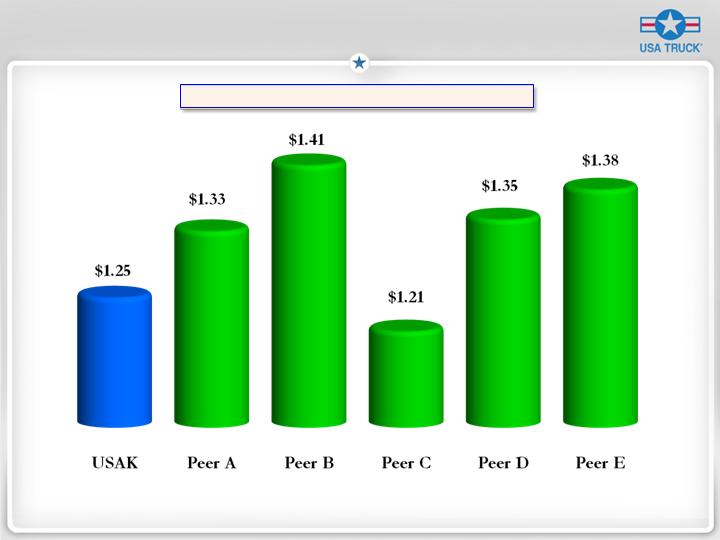

Best-In-Class Cost Structure

Operating Cost per Mile*

* Asset-based operations only for quarter ended September 30,

2008 Source: SEC Documents and USA Truck, Inc.

A New Business Strategy

A Fresh Operating Strategy

Preserve the Core:

Customer base

Cost discipline

Service culture

Trucking Segment:

Restrict capacity growth

Build profitable freight flows

Reduce length of haul

Increase use of asset-light owner operators (120/5%)

Strategic Capacity Solutions (SCS) Segment:

Aggressive growth in asset-light Brokerage & Intermodal

Compliment our Trucking Operations

Flexible capacity for customers

Strong return on capital

The VEVA*Plan

August 2007

December 2013

December 2010

PHASE II – Earnings Growth

* We call our strategic plan Vision for Economic Value-Added, or VEVA

1.0 x Book Value

2 % ROC

98% O.R.

3.0 x Book Value

10% ROC

89% O.R.

4.0 x Book Value

≥ 10% ROC

≥ 10% EBIT CAGR

< 89% O.R.

The Results We’ll Need

Consistent Earnings

Earn our Cost of Capital

Positioned for Long-Term Growth

How We'll Do It

Culture (Mission, Core Values)

Project Velocity

War on Accidents

Limit Capacity/Yield Management

Cost Management

Expand Owner Operator Fleet

Improve Brokerage Model

Launch Intermodal Model

Project Tech

Project People

The Results We’ll Need

Sustained Earnings Growth > 10%

Positive Economic Value Added

How We’ll Do It

Intermodal Growth

Brokerage Growth

Niche Dedicated Launch

General Freight Acquisitions

Productivity Gains

Share Repurchases/Dividends

PHASE I – Margin Expansion

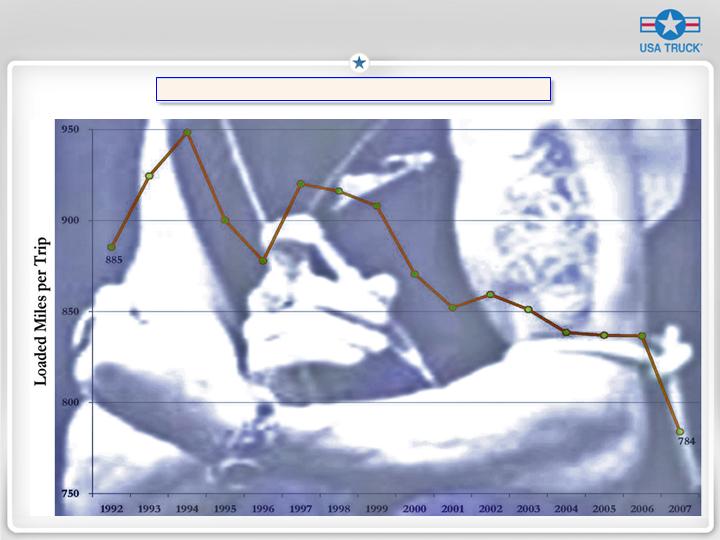

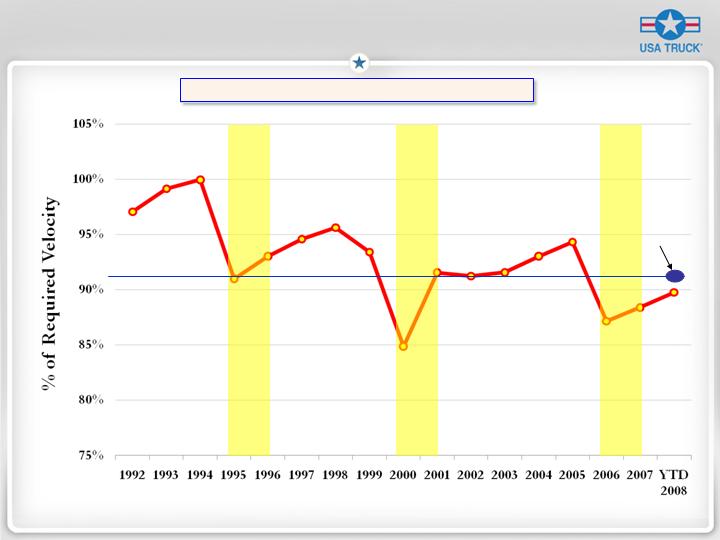

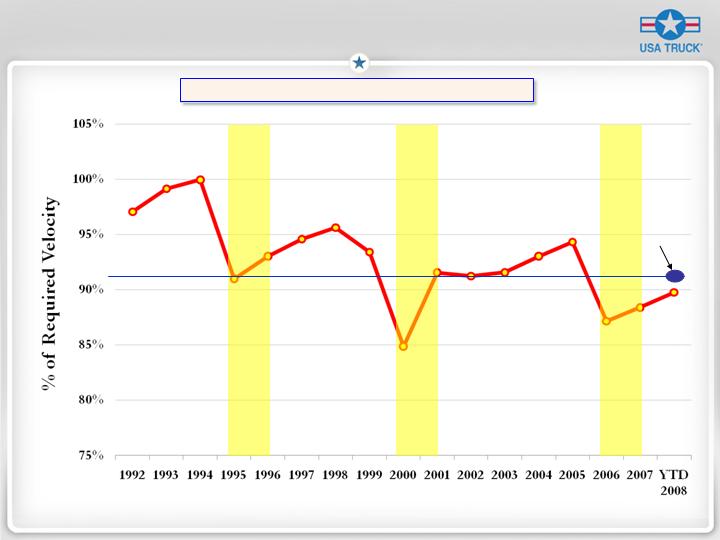

Project Velocity

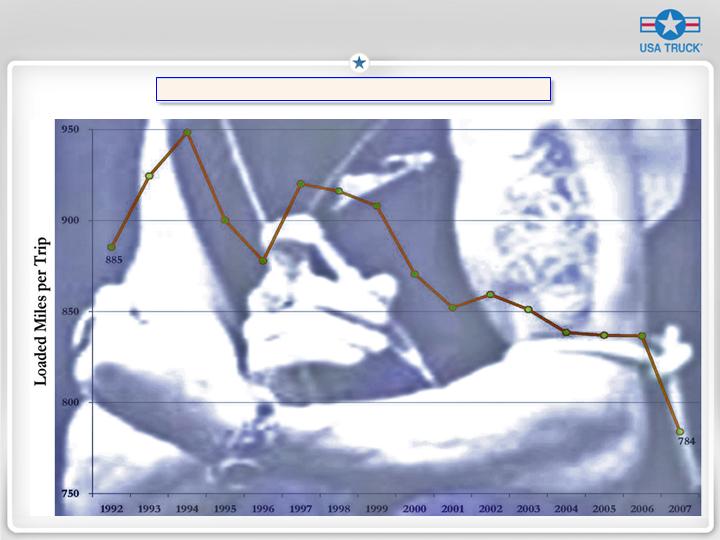

Our Mileage Addiction

Velocity Effect

Nine Months Ended September 30

Project Velocity

Performance History

March 22 to

September 30

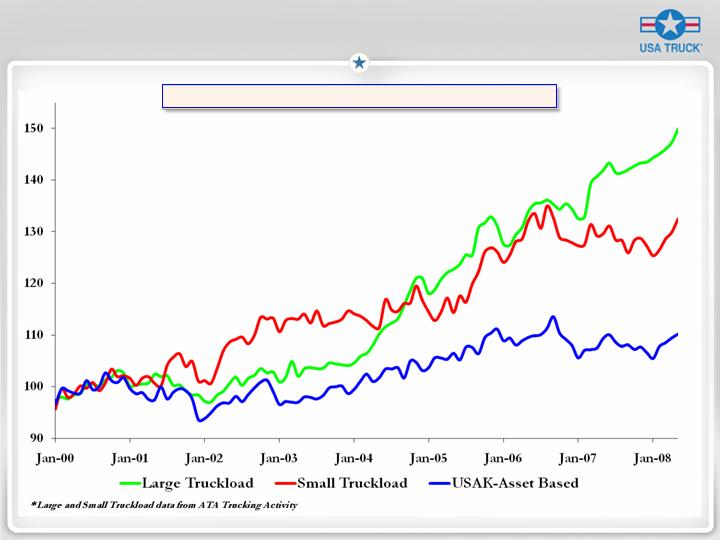

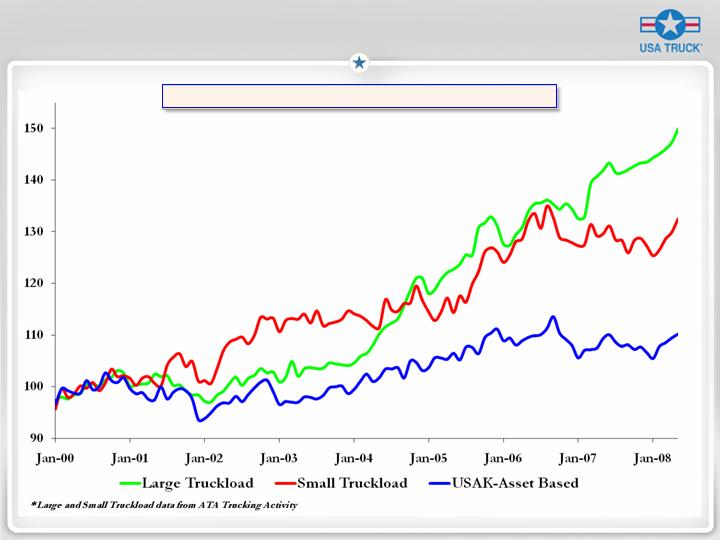

Yield Management

Base Revenue per Paid Mile (2000 = 100)

4.7%

CAGR

1.1%

CAGR

The War on Accidents

Insurance & Claims

Strategic Capacity Solutions

Freight Brokerage Growth*

Intermodal Growth*

*Base Revenue (excludes fuel surcharge) in Thousands

Project Tech

Software Application

Hardware Platform

Developer

Year Installed

Age

Accounts Payable

Mainframe

3rdParty

Accounting

Mainframe

3rdParty

Risk Management

Mainframe

Custom

Operations

Mainframe

Custom

Accounts Receivable

Mainframe

Custom

Maintenance

Mainframe

Custom

Website

Mainframe

Custom

Driver Recruiting

Mainframe

Custom

Lane Analysis

Server

3rdParty

Business Intelligence

Server

3rdParty

Customer Relationship Mgmt

Server

3rdParty

Aging Technology Infrastructure

October 2008

First Quarter 2009

Fourth Quarter 2008

Third Quarter 2009

Third Quarter 2009

January 2008

October 2008

January 2008

1985 23

1995 13

1999 9

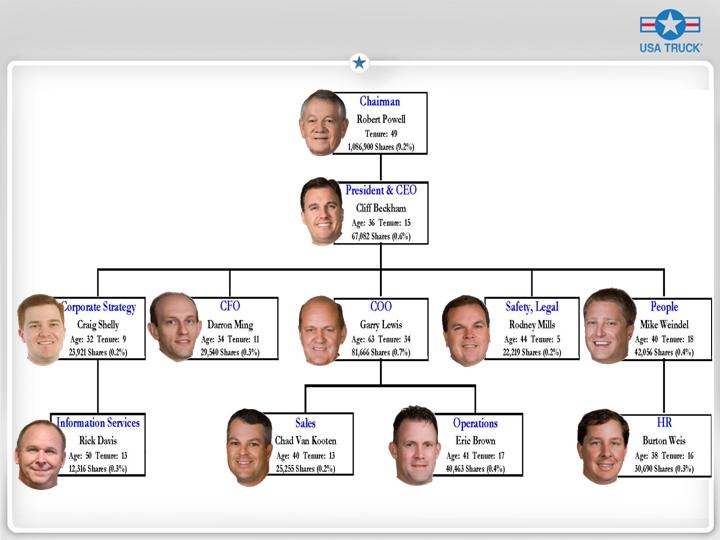

Project People

USAK – 1/1/2008 3.2 : 1

Peer Average – 2007 3.8 : 1

Best-in-Class – 2007 6.0 : 1

USAK – 9/30/08 3.5 : 1

Driver to Non-Driver Ratio

Education Level

Fort Smith MSA

National Average

Less than High School

27%

20%

Bachelor’s degree or higher

13%

24%

Why Invest In USA Truck?

We have a solid core of

service, cost discipline

and a diverse customer

portfolio.

Our stock is trading at

a deep discount to our

industry peers.

We have a vision and a

plan to create

shareholder value.

USA Truck