- USAK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

USA Truck (USAK) DEF 14ADefinitive proxy

Filed: 17 Apr 20, 5:08pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant |

|

Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box: |

☐ Preliminary Proxy Statement |

☐ Confidential, for use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

|

☐ Definitive Additional Materials |

☐ Soliciting Material under §240.14a‑12 |

USA TRUCK INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): |

| ||

|

| ||

☐ Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11. |

| ||

|

| ||

(1) Title of each class of securities to which transaction applies: | N/A | ||

(2) Aggregate number of securities to which transaction applies: | N/A | ||

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): | N/A | ||

(4) Proposed maximum aggregate value of transaction: | N/A | ||

(5) Total fee paid: | N/A | ||

|

|

|

|

☐ Fee paid previously with preliminary materials. |

| ||

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| ||

|

| ||

(1) Amount previously paid: | N/A | ||

(2) Form, Schedule or Registration Statement No.: | N/A | ||

(3) Filing Party: | N/A | ||

(4) Date Filed: | N/A | ||

USA TRUCK INC.

3200 Industrial Park Road

Van Buren, Arkansas 72956

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on May 21, 2020*

To the Stockholders of USA Truck Inc.:

Notice is hereby given that the Annual Meeting of Stockholders (“Annual Meeting”) of USA Truck Inc. (the “Company,” “we,” “us,” or “our”) will be held at our corporate offices at 3200 Industrial Park Road, Van Buren, Arkansas 72956, on Thursday, May 21, 2020, at 10:00 a.m., local time*, for the following purposes:

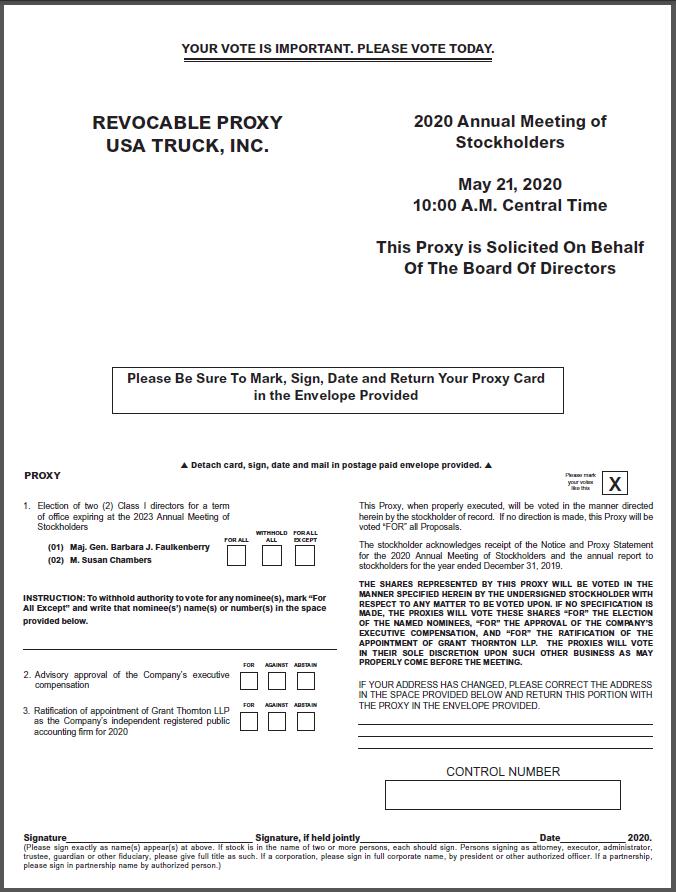

1) | Election of two (2) Class I directors for a term of office expiring at the 2023 Annual Meeting. |

2) | Advisory approval of the Company’s executive compensation. |

3) | Ratification of the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for 2020. |

Only holders of record of our Common Stock at the close of business on March 27, 2020, are entitled to notice of and to vote at the Annual Meeting and any adjournments thereof.

The Company’s Proxy Statement is submitted herewith. The Annual Report for the year ended December 31, 2019, is being mailed to stockholders contemporaneously with the mailing of this Notice and Proxy Statement. Except to the extent it is incorporated by specific reference, the enclosed copy of our 2019 Annual Report is not incorporated into this Proxy Statement and is not deemed to be a part of the proxy solicitation material.

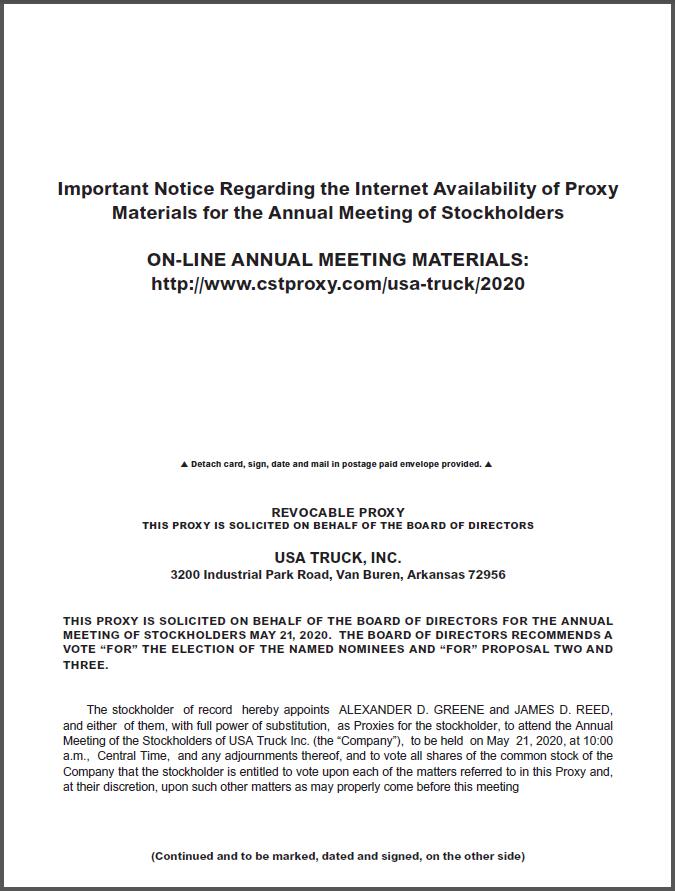

Important Notice Regarding the Availability of Proxy Materials for

the Meeting of Stockholders to Be Held on May 21, 2020

We have elected to provide access to our proxy materials both by: (i) sending you this full set of proxy materials, including a proxy card; and (ii) notifying you of the availability of our proxy materials on the Internet. This Notice of Meeting, Proxy Statement and our Annual Report to Stockholders for the fiscal year ended December 31, 2019, are available online and may be accessed at http://www.cstproxy.com/usa-truck/2020. We do not use “cookies” or other software that identifies visitors accessing these materials on this website. We encourage you to access and review all of the important information contained in the proxy materials before voting.

By order of the Board of Directors

/s/ Charles Lane

Secretary

Van Buren, Arkansas

April 17, 2020

YOUR VOTE IS IMPORTANT.

To ensure your representation at the annual meeting, you are requested to promptly date, sign and return the accompanying proxy in the enclosed envelope. Returning your proxy now will not interfere with your right to attend the annual meeting or to vote your shares personally at the annual meeting, if you wish to do so. The prompt return of your proxy may save us additional expenses of solicitation.

*The safety of our employees, customers, communities, and stockholders is our first priority. We are closely monitoring statements issued by the World Health Organization and the Centers for Disease Control and Prevention regarding the novel coronavirus disease, COVID-19. As part of our precautions, we reserve the right to reconsider the date, time, and/or means of convening the Annual Meeting, including solely by means of remote communications. If we change the date, time, and/or means of convening the Annual Meeting, we will announce our decision in advance, and details on how to participate will be posted on the Investor Relations tab of our website at http://www.usa-truck.com and filed with the SEC as additional proxy material. We encourage attendees to review guidance from public health authorities on this issue, and to check our website prior to the Annual Meeting if you plan to attend.

2

|

|

| 5 | |

| 5 | |

| 5 | |

| 5 | |

| 6 | |

| 6 | |

| 6 | |

| 7 | |

| 7 | |

| 7 | |

| 8 | |

| 8 | |

| 8 | |

| 8 | |

| 9 | |

| 9 | |

| 9 | |

| 10 | |

| 10 | |

| 11 | |

Executive Compensation Committee Interlocks and Insider Participation | 11 |

| 11 | |

| 12 | |

| 13 | |

| 14 | |

| 15 | |

| 15 | |

| 16 | |

| 17 | |

| 17 | |

| 18 | |

| 18 | |

| 18 | |

| 18 | |

| 18 | |

| 19 | |

| 20 | |

| 21 |

3

|

|

| 21 | |

| 21 | |

| 21 | |

| 25 | |

| 26 | |

President and Chief Executive Officer Compensation Structure | 26 |

| 26 | |

| 29 | |

| 30 | |

| 30 | |

2019 Equity Retention Grant | 32 |

| 32 | |

| 32 | |

| 33 | |

| 35 | |

| 35 | |

| 36 | |

2020 Management Cash Bonus Plan | 30 |

2020 EIP | 30 |

| 37 | |

| 38 | |

| 39 | |

| 40 | |

| 41 | |

| 42 | |

| 44 | |

| 44 | |

| 44 | |

| 45 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND EXECUTIVE OFFICERS | 46 |

| 47 | |

PROPOSAL TWO ADVISORY AND NON-BINDING APPROVAL OF THE COMPANY’S EXECUTIVE COMPENSATION | 47 |

| 48 | |

| 48 | |

PROPOSAL THREE RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 49 |

|

|

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS | 49 |

| 50 |

4

USA TRUCK INC.

3200 Industrial Park Road

Van Buren, Arkansas 72956

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

To be held on May 21, 2020*

This Proxy Statement is furnished in connection with the solicitation of proxies by and on behalf of the Board of Directors of USA Truck Inc., a Delaware corporation (the “Company,” “USA Truck,” “we,” “our” or “us”), for use at the Annual Meeting of the Company to be held at the time and place and for the purposes set forth in the foregoing notice. Our mailing address is 3200 Industrial Park Road, Van Buren, Arkansas 72956, and our telephone number is (479) 471‑2500.

The cost of soliciting proxies will be borne by the Company. In addition to solicitation by mail, certain of our officers and employees, who will receive no special compensation therefor, may solicit proxies in person or by telephone, telegraph, facsimile or other means. We will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of our Common Stock.

The approximate date on which this Proxy Statement and the accompanying proxy are first being mailed to stockholders is April 17, 2020.

Any stockholder executing a proxy retains the right to revoke it at any time prior to exercise at the Annual Meeting. A proxy may be revoked by delivery of written notice of revocation to Charles Lane, Secretary of the Company, by execution and delivery to the Company of a later proxy or by voting the shares in person at the Annual Meeting. If not revoked, all shares represented at the Annual Meeting by properly executed proxies will be voted as directed therein. If no direction is given, such shares will be voted for election of all nominees for director, for approval, in an advisory and non-binding vote, of the compensation of our Named Executive Officers, for the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for 2020, and at the discretion of the person(s) named as proxy(ies) therein on any other matters that may properly come before the Annual Meeting or any adjournments thereof.

OUTSTANDING STOCK AND VOTING RIGHTS

The Board of Directors has fixed the close of business on March 27, 2020, as the record date for determining the stockholders having the right to notice of, and to vote at, the Annual Meeting. As of the record date, March 27, 2020, 8,738,776 shares of Common Stock were outstanding and entitled to vote at the meeting. Each stockholder will be entitled to one vote for each share of Common Stock owned of record on the record date. The stock transfer books of the Company will not be closed. Stockholders are not entitled to cumulative voting with respect to the election of directors. The holders of a majority of the outstanding shares of Common Stock entitled to vote, present in person or represented by proxy, are necessary to constitute a quorum.

REQUIRED AFFIRMATIVE VOTE AND VOTING PROCEDURES

Our bylaws provide that the nominees who receive a plurality of the votes cast by stockholders present or represented by proxy at an Annual Meeting, and entitled to vote on the election of directors, will be elected as directors of the Company. Thus, any abstentions or broker non-votes will have no effect on the election of directors. However, at any stockholder meeting at which a director is subject to an uncontested election, any nominee for director who receives a greater number of votes “withheld” from or voted “against” his or her nomination than are voted “for” such election, excluding abstentions, shall promptly tender his or her resignation for consideration by the Nominating and Corporate Governance Committee pursuant to the Company’s majority vote policy. See “Corporate Governance – The Board of Directors and Its Committees – Additional Corporate Governance Policies” for additional information regarding our majority vote policy. Approval of any other matter submitted to stockholders each requires the affirmative vote of a majority of votes cast by stockholders entitled to vote and represented in person or by proxy at the Annual Meeting. Abstentions and broker non-votes will not be counted for purposes of determining the number of votes cast with respect to a proposed corporate action. Accordingly, abstentions and broker non-votes will have no effect on the approval of any other matter submitted to stockholders.

5

If you are a holder of record of our Common Stock, you may vote your shares either (i) over the telephone by calling a toll-free number, (ii) by using the Internet, or (iii) by mailing your proxy card. Owners who hold their shares in street name will need to obtain a voting instruction form from the institution that holds their stock and must follow the voting instructions given by that institution.

The above-mentioned telephone and Internet-voting procedures have been designed to authenticate your identity, to allow you to give instructions, and to confirm that those instructions have been recorded properly. If you choose to vote by telephone or by using the Internet, please refer to the specific instructions on the proxy card. If you wish to vote using the proxy card, complete, sign and date your proxy card and return it to us before the meeting.

PROPOSAL ONE: ELECTION OF DIRECTORS

Our Restated and Amended Certificate of Incorporation provides that there shall be eight directors, subject to increases or decreases in such number by vote of the Board of Directors in accordance with the bylaws, classified into three classes, and that members of the three classes shall be elected to staggered terms of three years each. The Board presently consists of seven persons.

The current term of office of the two Class I directors will expire at the 2020 Annual Meeting and all of those directors have been nominated for re-election at the Annual Meeting:

Class I

Term Expiring 2023

Maj. General (Ret.) Barbara J. Faulkenberry

M. Susan Chambers

Proxies may not be voted at the 2020 Annual Meeting for more than two nominees for election as directors. Each of the nominees has consented to serve if elected and, if elected, will serve until the 2023 Annual Meeting or until her successor is duly elected and qualified, or until her earlier resignation, death, or removal.

Class II and Class III directors are currently serving terms expiring in 2021 and 2022, respectively. Class II directors are James D. Reed, Thomas M. Glaser, and Gary R. Enzor. Class III directors are Robert E. Creager and Alexander D. Greene. Mr. Robert A. Peiser, formerly Chairman of the Board and a Class III director, served until his resignation in May 2019.

All duly submitted and unrevoked proxies will be voted FOR the nominees listed above, unless otherwise instructed. It is expected that the nominees will be available for election, but if for any unforeseen reason any nominee should decline or be unavailable for election, the persons designated as proxies will have full discretionary authority to vote for another person designated by the Nominating and Corporate Governance Committee.

Assuming the presence of a quorum at the Annual Meeting, the nominees who receive a plurality of the votes cast by stockholders present or represented by proxy at the Annual Meeting, and entitled to vote on the election of directors, will be elected as directors. Any director subject to an uncontested election who is elected by a plurality and receives a greater number of votes “withheld” from or voted “against” his or her election than are voted “for” such election (excluding abstentions) shall be subject to the majority vote policy described under “Corporate Governance – The Board of Directors and Its Committees – Additional Corporate Governance Policies.”

Major General (Ret.) Barbara J. Faulkenberry. General Faulkenberry, 60, has served as a director since January 2016. General Faulkenberry has chaired the Technology Committee since it was formed in May 2016, and also serves on the Nominating and Corporate Governance Committee. General Faulkenberry also serves on the board of directors, and is a member of the Audit Committee, the Nominating and Corporate Governance Committee, and the Strategic Planning and Reserves Committee, of Callon Petroleum Company since May 2018. Prior to her retirement from the military in 2014, General Faulkenberry served as the Vice Commander, 18th Air Force, Scott Air Force Base, IL, with direct oversight of 1,100 mobility aircraft and 37,000 people. Since then, General Faulkenberry has held positions as an advisor for Momentum Aerospace Group, a Trustee for the Air Force Academy’s Falcon Foundation and a board member of the International Women’s Forum Leadership Foundation. She is a NACD Board Leadership Fellow and earned the Carnegie Mellon/NACD Certificate in Cybersecurity Oversight, both of which contribute to best practices in corporate governance and cyber security. General Faulkenberry brings to the Company senior leadership experience in the areas of logistics, strategic planning, risk management, cyber defense, governmental affairs, information technology and leadership development, which we believe qualifies her to serve as a member of our Board of Directors.

6

M. Susan Chambers. Mrs. Chambers, 62, has served as a director since March 2016. Ms. Chambers has chaired the Executive Compensation Committee since November 2016. Since July 2015, Mrs. Chambers has served as principal of Chambers Consulting LLC. Mrs. Chambers served as the Chief Human Resource Officer for Walmart Inc. from 2006 to her retirement in July 2015. From May 2017 to June 2018, Ms. Chambers served as a director for publicly traded Ecoark Holdings, Inc., a company that works to modernize the post-harvest fresh food supply chain for a wide range of organizations including growers, distributors and retailers. Prior to 2006, Mrs. Chambers served in various positions at Walmart Inc. since 1999, including Vice President of Application Development – Merchandising and Supply Chain Systems and Senior Vice President of Risk Management, Retirement and Benefits. Mrs. Chambers previously served as a director of a private banking institution. We believe that Mrs. Chambers’ extensive experience in human resource, supply chain and risk management qualifies her to serve on our Board of Directors.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE TWO NOMINEES NAMED ABOVE.

James D. Reed. Mr. Reed, 47, has served as President, Chief Executive Officer (“CEO”) and a director since January 2017. From November 2016 through January 2017, Mr. Reed served as Executive Vice President and Chief Financial Officer of the Company. From June 2012 through October 2016, Mr. Reed served as Chief Financial Officer at Interstate Distributor Co., a provider of line and heavy-haul, refrigerated and intermodal transportation services throughout the continental United States and Canada, and President of two of its subsidiaries. From June 2011 through June 2012, Mr. Reed served as Senior Director, Finance at the Isilon Storage Division of EMC, a computer hardware and software company selling clustered file system hardware and software for digital content and other unstructured data to a variety of industries. He began his career with Intel Corp. in 1997. Mr. Reed holds a Bachelor of Arts in History and a Master of Business Administration from Brigham Young University. We believe Mr. Reed’s extensive management and leadership experience, his thorough knowledge of the transportation and trucking industry and his role as President and CEO of the Company, which allows the Board of Directors to interface directly with senior management, qualifies him to serve as a member of our Board of Directors.

Thomas M. Glaser. Mr. Glaser, 70, has served as a director since May 2014. Mr. Glaser has worked as an independent consultant to the truckload industry since 2010, and served as our President and CEO from July 2015 to January 2016, and our Interim Chief Operating Officer (“COO”) from April 2015 to July 2015 and January 2013 to June 2013. Mr. Glaser served as President and CEO of Arnold Transportation Services, Inc., a dry van freight services provider, from January 2008 to 2010, as well as a board member of Priority Transportation, Inc., from 2008 to 2010. Previously, Mr. Glaser held several positions at Celadon Group, Inc., from 2001 to 2007, most recently serving as President and COO. We believe Mr. Glaser’s considerable experience as a senior executive in the transportation industry qualifies him to serve as a member of our Board of Directors.

Gary R. Enzor. Mr. Enzor, 57, has served as a director since September 2014. Mr. Enzor has chaired the Nominating and Corporate Governance Committee since May 2015. He is Chairman and CEO of Quality Distribution, Inc., a chemical bulk logistics services provider. Mr. Enzor has served as Chairman of Quality Distribution, Inc., since August 2013, has served as CEO since 2007, and as President since 2005. Mr. Enzor joined Quality Distribution, Inc. in 2004 as EVP and COO. Prior to joining Quality Distribution, Mr. Enzor held executive positions with Swift Transportation Company (“Swift”), Honeywell, Dell Computer and AlliedSignal, Inc. (now Honeywell International, Inc.). We believe Mr. Enzor’s considerable experience in and thorough knowledge of the transportation and trucking industry qualifies him to serve as a member of our Board of Directors.

Robert E. Creager. Mr. Creager, 71, has served as a director since November 2012. Mr. Creager has chaired the Audit Committee since 2014, has been designated as our audit committee financial expert within the meaning of Item 407(d)(5)(ii) of Regulation S-K and meets the financial sophistication requirements set forth in Rule 5605(c)(2)(A) of The NASDAQ Stock Market’s listing standards. Mr. Creager is a certified public accountant and has 37 years of public accounting experience. Mr. Creager also serves as Chairman of the Audit Committee of Houston International Insurance Group, a property and casualty insurer, and is a director of the Texas TriCities Chapter of the NACD, as well as a governance fellow of the NACD. We believe his work with the NACD contributes to his being a valuable resource to our Board in the area of corporate governance best practices. From June 2014 until its sale in September 2016, Mr. Creager served as Chairman of the Audit Committee of Mattress Firm Holding Corp., a publicly held mattress retailer, and from April 2011 to January 2013, Mr. Creager served as Chairman of the Audit Committee of GeoMet, Inc., an independent natural gas company. His experience includes 27 years as an Assurance Partner and a former Audit Practice Leader of the Houston office of PricewaterhouseCoopers LLP. We believe Mr. Creager’s qualifications to serve on our Board of Directors include his extensive financial experience and his service on other audit committees.

7

Alexander D. Greene. Mr. Greene, 61, has served as a director since May 2014, and was appointed Chairman of the Board in May 2019. He is engaged in active service on public as well as private corporate boards. Mr. Greene currently serves as a director of Ambac Financial Group, Inc., a publicly held provider of financial guarantees and other financial services, Element Fleet Management Corp., a fleet management and services company, and GP Natural Resource Partners LLC, a diversified natural resource company, and served as Chairman of the Board of Modular Space Corporation prior to its sale in 2018. Mr. Greene served as a Managing Partner and head of U.S. Private Equity with Brookfield Asset Management, a global asset management firm, from 2005 through 2014. Prior to Brookfield, Mr. Greene was a Managing Director and co-head of Carlyle Strategic Partners, a private equity fund, and a Managing Director and investment banker at Wasserstein Perella & Co. and Whitman Heffernan Rhein & Co. Mr. Greene is a volunteer firefighter and President of the Armonk Independent Fire Company in Armonk, New York, and serves on the budget and finance advisory committee for the town of North Castle, New York. Mr. Greene brings to the Company over 35 years of experience leading private equity, corporate finance, restructuring and advisory transactions and experience serving on public and private boards, which we believe qualifies Mr. Greene to serve as a member of our Board of Directors.

There is no family relationship between any director or executive officer and any other director or executive officer of the Company. None of the corporations or organizations referenced in the director biographies above is a parent, subsidiary or other affiliate of the Company unless otherwise noted. There are no arrangements or understandings between any of the director nominees and any other person pursuant to which any of the director nominees was selected as a nominee.

The Board of Directors and its Committees

|

|

|

|

Key Features |

| ||

√ |

| Proxy access |

|

√ |

| Majority vote policy for uncontested elections |

|

√ |

| Independent Chairman of the Board |

|

√ |

| Audit Committee, Executive Compensation Committee, and Nominating and Corporate Governance Committee comprised solely of independent directors |

|

√ |

| More than two-thirds of the Board comprised of independent directors |

|

√ |

| Two of our seven directors are female |

|

√ |

| Director Overboarding Policy |

|

√ |

| Three audit committee members qualify as financial experts |

|

√ |

| Regular executive sessions of independent directors |

|

√ |

| Stock ownership guidelines for directors |

|

√ |

| Stock ownership guidelines for named executive officers |

|

√ |

| Anti-hedging and anti-pledging guidelines for senior executive officers and directors |

|

√ |

| No related party transactions |

|

√ |

| Board Retirement Policy |

|

√ |

| Change in Principal Occupation Policy for non-employee directors |

|

√ |

| At least 75% director attendance at all Board and Committee meetings |

|

√ |

| Annual enterprise risk assessment |

|

|

|

|

|

In 2019, the Board of Directors held eight meetings, and met in executive session at least quarterly. During 2019, the Board had a standing Executive Committee, Executive Compensation Committee, Audit Committee, Technology Committee, and Nominating and Corporate Governance Committee. Each current member of the Board attended at least 75% of the aggregate of all meetings of the Board and of all committees on which he or she served. We encourage the members of our Board of Directors to attend our Annual Meetings, as well as committee meetings, even if they don’t serve on that committee. All but one of the then-current directors attended the 2019 annual meeting, either by phone or in person.

8

In determining the independence of its directors, the Board relies on the standards set forth in U.S. Securities and Exchange Commission (“SEC”) regulations and The NASDAQ Stock Market’s Listing Standards, including NASDAQ Rule 5605(a)(2). To be considered independent under such standard, an outside director may not have a direct or indirect material relationship with us. A material relationship is one which impairs or inhibits, or has the potential to impair or inhibit, a director’s exercise of critical and disinterested judgment on behalf of us and our stockholders. In determining whether a material relationship exists, the Board considers, among other things, whether a director is a current or former employee of ours. Annually, our counsel reviews the Board’s approach to determining director independence and recommends changes as appropriate.

Consistent with these considerations, the Board has determined that, during 2019, all of our directors, with the exception of our President and CEO, Mr. James D. Reed, were independent directors.

Our Board of Directors oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term operational performance and enhance stockholder value. A fundamental part of risk management is not only understanding the risks we face and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for us. The involvement of the full Board of Directors in evaluating our business strategy is a key part of its assessment of management’s appetite for risk and also a determining factor of what constitutes an appropriate level of risk for us. The full Board of Directors participates in this annual assessment as we believe that risk oversight is most effective when the full knowledge, experience and skills of all directors are brought to bear on the complex subject of risk management.

In this process, risk is assessed throughout the business, focusing on the following primary areas of risk: financial risk, legal and compliance risk, technology, safety and security risk and operational and strategic risk. Within these primary areas of risk, our Board of Directors, with the input of management, has identified specific areas of risk that are pertinent to our business. Our Board of Directors receives reports and has discussions with management with respect to such areas. The Board of Directors makes assignments to certain members of management to provide reports and to answer to the Board of Directors with respect to such areas. Furthermore, our Board of Directors engages in discussions at the Board level and with management in an attempt to identify currently unknown risks.

While the full Board of Directors has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. For example, the Audit Committee reviews internal controls over financial reporting and, in connection therewith, receives a risk assessment report from our internal auditors. Additionally, in setting compensation, the Executive Compensation Committee strives to create incentives that encourage a level of risk-taking behavior consistent with our overall business strategy. The Technology Committee oversees management’s cyber security practices, as well as information technology and cyber risk. Finally, the Nominating and Corporate Governance Committee oversees enterprise risk. The Board’s role in risk oversight has not affected the leadership structure of our Board of Directors.

We separate the roles of CEO and Chairperson of the Board in recognition of the differences between the two roles. The CEO is responsible for the execution of our strategic direction and our day-to-day leadership and performance, while the Chairperson of the Board provides guidance to the CEO, participates in setting the agenda for Board meetings and presides over meetings of the Board. The Chairperson is also an independent director. Under our bylaws, we have provided for a formal office of CEO and established certain duties of the CEO that were previously reserved to the President and Chairperson of the Board.

We have no current plans to separate the CEO and President roles, and our bylaws recite that the CEO shall be the President unless a separate CEO and President shall be appointed.

9

Committees of the Board of Directors

Executive Compensation Committee

The purpose of the Executive Compensation Committee is to oversee matters pertaining to compensation of our executive officers. The Executive Compensation Committee is also responsible for administering the grants of equity and other awards to executive officers and other employees under the USA Truck Inc. 2014 Omnibus Incentive Plan, as amended (the “Incentive Plan”). Our Executive Compensation Committee’s process for making executive compensation decisions is explained in more detail in “Executive Compensation – Compensation Discussion and Analysis – Procedures for Determining Compensation.”

The charter for the Executive Compensation Committee sets forth the purpose and responsibilities of the Executive Compensation Committee in greater detail. The Executive Compensation Committee reviews and reassesses the adequacy of its charter on an annual basis and recommends changes to the Board when appropriate. A copy of the Executive Compensation Committee’s charter, as of February 27, 2020, is available at our website, http://www.usa-truck.com, under the “Corporate Governance” tab of the “Investor Relations” menu.

The Executive Compensation Committee met six times during 2019. The Executive Compensation Committee is comprised of M. Susan Chambers (Chairwoman), Alexander D. Greene, Gary R. Enzor, each of whom is an independent director. Mr. Robert A. Peiser, prior to his resignation, served on the Executive Compensation Committee as an independent director. In determining the independence of our Executive Compensation Committee members, the Board considered several relevant factors, including, but not limited to, each director’s source of compensation and affiliations. Specifically, each member of the Executive Compensation Committee (i) is independent under The NASDAQ Stock Market’s Listing Standards, including NASDAQ Rules 5605(a)(2) and 5605(d)(2)(A), (ii) meets the criteria set forth in Rule 10C‑1(b)(1) under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), (iii) did not directly or indirectly accept any consulting, advisory or other compensation fee from the Company, and (iv) as determined by our Board, is not affiliated with the Company, any Company subsidiary or any affiliate of a Company subsidiary, and does not have any other relationship or accept any compensation from the Company, which would impair each respective member’s judgment as a member of the Executive Compensation Committee.

During 2013, the Executive Compensation Committee selected an independent compensation consultant, Compensation Strategies, Inc. (“CSI”). CSI has provided analysis and recommendations that inform the Executive Compensation Committee’s decisions with respect to executive and director compensation for 2019 and 2020, including evaluating market pay data, providing analysis and input on program structure and providing updates on market trends and the regulatory environment as it relates to executive compensation. Pursuant to SEC rules and The NASDAQ Stock Market’s Listing Standards, the Executive Compensation Committee has assessed the independence of CSI, and concluded that no conflict of interest exists that would prevent CSI from independently advising the Executive Compensation Committee. In connection with this assessment, the Executive Compensation Committee considered, among others, the following factors: (i) the provision of other services to us by CSI, (ii) the amount of fees we paid to CSI as a percentage of CSI’s total revenue, (iii) CSI’s policies and procedures that are designed to prevent conflicts of interest, (iv) the absence of any business or personal relationship of CSI or the individual compensation advisors employed by CSI with any of our executive officers, (v) the absence of any business or personal relationship of the individual compensation advisors with any member of the Executive Compensation Committee, and (vi) the absence of any of our stock owned by CSI or the individual compensation advisors employed by CSI. CSI does not perform other services for us, and will not do so without the prior consent of the Executive Compensation Committee. The Executive Compensation Committee has the sole authority to approve the terms of CSI’s engagement. CSI’s role in establishing the compensation of our Named Executive Officers, to the extent material, is addressed under “Executive Compensation – Compensation Discussion and Analysis – Procedures for Determining Compensation.”

In performing its duties, the Executive Compensation Committee, as required by the applicable rules and regulations promulgated by the SEC, issues a report recommending to the Board that our Compensation Discussion and Analysis be included in this Proxy Statement. The Report of the Executive Compensation Committee for 2019 follows.

The Report of the Executive Compensation Committee shall not be deemed to be “soliciting material” or to otherwise be considered “filed” with the SEC, nor shall this report be subject to Regulation 14A or Regulation 14C (other than as indicated) or to the liabilities set forth in Section 18 of the Exchange Act. This Report of the Executive Compensation Committee also shall not be deemed to be incorporated by reference into any prior or subsequent filing with the SEC made by us under the Securities Act or the Exchange Act, notwithstanding any general statement contained in any such filings incorporated into this Proxy Statement by reference, except to the extent we incorporate such report by specific reference or treat it as soliciting material.

10

Report of the Executive Compensation Committee

The Executive Compensation Committee of the Board of Directors of USA Truck Inc. has reviewed and discussed with management the Compensation Discussion and Analysis (as required by Item 402(b) of Regulation S-K of the SEC) contained in this Proxy Statement for the Annual Meeting to be held on May 21, 2020.

Based on that review and discussion, the Executive Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement and incorporated by reference into the Company’s Annual Report on Form 10‑K for the year ended December 31, 2019.

|

|

Executive Compensation Committee: |

|

| M. Susan Chambers (Chairwoman) |

| Alexander D. Greene |

| Gary R. Enzor |

|

|

Executive Compensation Committee Interlocks and Insider Participation

The Executive Compensation Committee is comprised of M. Susan Chambers (Chairwoman), Alexander D. Greene and Gary R. Enzor. Mr. Robert A. Peiser served on the Executive Compensation Committee prior to his resignation in May 2019. All of the members who served on the Executive Compensation Committee during 2019 were independent as defined by defined by Rule 5605(a)(2) of The NASDAQ Stock Market’s Listing Standards.

No member of the Executive Compensation Committee was an officer or employee of the Company at any time during 2019 or as of the date of this Proxy Statement, nor is any member of the Executive Compensation Committee a former officer of the Company. In 2019, no member of the Executive Compensation Committee had any relationship or transaction with the Company that would require disclosure as a “related person transaction” under Item 404 of Regulation S-K in this Proxy Statement under the section entitled “Certain Transactions.”

No director serving on the Executive Compensation Committee was, at any time during or before 2019, an officer or employee of the Company or any of its subsidiaries. In addition, during 2019, none of our executive officers served as a member of the board of directors or compensation committee (or other board committees performing equivalent functions) of another entity, one of whose executive officers served on our Executive Compensation Committee or otherwise served on our Board.

See “Certain Transactions,” which describes the absence of any transactions between us and our other directors, executive officers or their affiliates, and “Executive Compensation – Compensation Discussion and Analysis –Director Compensation” for a description of compensation of the members of the Executive Compensation Committee.

The Audit Committee has primary responsibility for assisting and directing the Board in fulfilling its oversight responsibilities with respect to our auditing, accounting and financial reporting processes. The Audit Committee’s primary responsibilities include:

· | monitoring our financial reporting processes and systems of internal controls over financial reporting; |

· | monitoring the independence and performance of our independent registered public accounting firm, and managing the relationship between us and our independent registered public accounting firm; and |

· | providing an avenue of communication among the Board, the independent registered public accounting firm, our internal audit function, and our management. |

The Audit Committee has exclusive power to engage, terminate and set the compensation of our independent registered public accounting firm. The Audit Committee also evaluates and makes recommendations to the full Board with respect to all related-party transactions and other transactions representing actual or potential conflicts of interest, and reviews all such transactions at least annually. The Board has adopted a written charter for the Audit Committee, which sets forth the purpose and responsibilities of the Audit Committee in greater detail. The Audit Committee reviews and assesses the adequacy of its charter on an annual basis and recommends changes to the Board when appropriate. A copy of the Audit Committee’s charter, as of February 27, 2020, is available at our website, http://www.usa-truck.com, under the “Corporate Governance” tab of the “Investor Relations” menu.

11

The Audit Committee met nine times during 2019. Since May 2019, the Audit Committee has been comprised of Robert E. Creager (Chairman), Alexander D. Greene and Thomas M. Glaser. Between January 2019 and May 2019, the Audit Committee was comprised of Robert E. Creager (Chairman), Alexander D. Greene, and Robert A. Peiser. The Board has determined that each of Robert E. Creager, Alexander D. Greene and Thomas M. Glaser qualifies as an audit committee financial expert, as defined in Item 407(d)(5)(ii) of Regulation S-K, and meets the independence and financial sophistication requirements set forth in Rule 5605(c)(2)(A) of The NASDAQ Stock Market’s Listing Standards, and has designated Robert E. Creager as its audit committee financial expert.

All of the members who served on the Audit Committee during 2019 were independent as defined by Rule 5605(a)(2) of The NASDAQ Stock Market’s Listing Standards and meet the independence and other requirements set forth for audit committee members in Rule 5605(c)(2)(A) of those Listing Standards. See “Report of the Audit Committee.”

In performing its duties, the Audit Committee, as required by applicable rules of the SEC, issues a report recommending to the Board of Directors that our audited financial statements be included in our annual report on Form 10-K, and determines certain other matters, including the independence of our independent registered public accounting firm. The Audit Committee Report for 2019 is set forth below.

The Audit Committee Report shall not be deemed to be “soliciting material” or to otherwise be considered “filed” with the SEC, nor shall this report be subject to Regulation 14A or Regulation 14C (other than as indicated) or to the liabilities set forth in Section 18 of the Exchange Act. This Audit Committee Report also shall not be deemed to be incorporated by reference into any prior or subsequent filing with the SEC made by us under the Securities Act or the Exchange Act, notwithstanding any general statement contained in any such filings incorporating this Proxy Statement by reference, except to the extent we incorporate such report by specific reference or treat it as soliciting material.

The primary purpose of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities relating to the quality and integrity of the Company’s financial reports and financial reporting processes and systems of internal controls over financial reporting. The Audit Committee does not prepare financial statements or perform audits, and its members are not auditors or certifiers of the Company’s financial statements. Rather, the Company’s management has primary responsibility for the Company’s financial statements and the overall reporting process, including maintenance of the Company’s system of internal controls. The Audit Committee is responsible for the appointment, evaluation, compensation, retention and oversight of the work of the Company’s independent registered accounting firm, Grant Thornton LLP (“Grant Thornton”). Grant Thornton is responsible for conducting an independent audit of the Company’s financial statements and the Company’s internal controls over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board (“PCAOB”) and issuing reports thereon.

The Audit Committee recognizes the importance of maintaining the independence of the Company’s independent registered public accounting firm, both in fact and appearance. The Audit Committee evaluates the qualifications, performance, and independence of the Company’s independent registered public accounting firm and determines whether to re-engage the current firm. In doing so, the Audit Committee considers the quality and efficiency of the services provided, the auditor’s capabilities, including their technical expertise and knowledge of the Company’s operations and industry. Based on this evaluation, the Audit Committee has retained Grant Thornton as the Company’s independent registered public accounting firm for 2019. Grant Thornton has been the Company’s independent registered public accounting firm since 2006.

The Audit Committee believes that, due to Grant Thornton’s knowledge of the Company and the industry in which it operates, it is in the best interest of the Company and its stockholders to continue retention of Grant Thornton to serve as the Company’s independent registered public accounting firm. Although the Audit Committee has the sole authority to appoint the Company’s independent registered public accounting firm, the Audit Committee recommended that the Board ask the stockholders to ratify the appointment of Grant Thornton for 2020.

In performing its duties, the Audit Committee has reviewed and discussed with management and the Company’s registered independent public accounting firm the Company’s financial statements, management’s assessment of internal controls over financial reporting, and the effectiveness of internal controls over financial reporting and, in issuing this report, has relied upon the responses and information provided to the Audit Committee by management and such accounting firm. For the fiscal year ended December 31, 2019, the Audit Committee (i) reviewed and discussed with Grant Thornton the audited financial statements, including a discussion of the quality, not just the acceptability of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements, management’s assessment of internal controls over financial reporting, and the effectiveness of internal controls over financial reporting; (ii) discussed with Grant Thornton the matters required to be discussed by Auditing Standard No. 1301, Communications with Audit Committees issued by the PCAOB; (iii) received and reviewed the written disclosures and the letter from Grant Thornton required by

12

applicable requirements of the PCAOB regarding Grant Thornton’s communications with the Audit Committee concerning independence; and (iv) discussed with Grant Thornton its independence. The Audit Committee also met in periodic executive sessions with representatives of Grant Thornton, management, and the Company’s internal audit personnel during 2019.

Based on the foregoing reviews and meetings, the Audit Committee recommended to the Board, and the Board has approved, that the audited financial statements and management’s assessment of the effectiveness of internal control over financial reporting, be included in the Annual Report on Form 10‑K for the fiscal year ended December 31, 2019, for filing with the SEC.

|

|

Audit Committee: |

|

| Robert E. Creager (Chairman) |

| Alexander D. Greene |

| Thomas M. Glaser |

|

|

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for (i) recommending to the full Board corporate governance guidelines applicable to us, (ii) leading the Board in its annual review of the Board’s performance, (iii) identifying individuals qualified to become Board members consistent with criteria approved by the Nominating and Corporate Governance Committee of the Board, (iv) overseeing enterprise risk and (v) performing such other functions as are customarily performed by nominating and corporate governance committees. The members of the Nominating and Corporate Governance Committee are Gary R. Enzor (Chairman), Robert E. Creager, Barbara J. Faulkenberry and M. Susan Chambers. All of the directors who served on the Nominating and Corporate Governance Committee during 2019 were independent as defined by Rule 5605(a)(2) of The NASDAQ Stock Market’s Listing Standards. The Board has adopted a written charter for the Nominating and Corporate Governance Committee, which sets forth the purpose and responsibilities of the Nominating and Corporate Governance Committee in greater detail. The Nominating and Corporate Governance Committee reviews and reassesses the adequacy of its charter on an annual basis and recommends changes to the Board when appropriate. A copy of the Nominating and Corporate Governance Committee’s charter, as of February 27, 2020, is available at our website, http://www.usa-truck.com, under the “Corporate Governance” tab of the “Investor Relations” menu.

The Nominating and Corporate Governance Committee met four times during 2019. In order to be considered a director nominee, a person’s (including an incumbent director’s) nomination must be approved by both a majority vote of the Nominating and Corporate Governance Committee and the vote of a majority of all directors.

Whenever a determination has been made that it is necessary to nominate one or more persons, in addition to incumbent directors, the Nominating and Corporate Governance Committee will have primary authority for identifying persons who meet our required qualifications and who otherwise have the experience and abilities necessary to serve as effective members of the Board. The Nominating and Corporate Governance Committee may delegate this identification function to one or more of its members. In performing this function, the Nominating and Corporate Governance Committee may rely on such resources as it deems appropriate, including, without limitation, recommendations from our management, from our incumbent directors, from third parties or from stockholders. In addition, the Nominating and Corporate Governance Committee may, at our expense, engage the services of professional search firms or other consultants or advisers and may pay them such fees as the Nominating and Corporate Governance Committee shall determine to be reasonable and appropriate.

Each nominee should be committed to our basic beliefs as set forth in our Code of Business Conduct and Ethics and shall be an individual of integrity, intelligence and strength of character. In addition, each nominee should have, among other attributes:

· | a reputation both personal and professional, consistent with our image and reputation; |

· | relevant expertise and experience, including educational or professional backgrounds and should be able to offer advice and guidance to our management based on that expertise and experience; |

· | a working knowledge of corporate governance issues and the changing role of boards; |

· | demonstrated management and/or business skills or experience that will contribute substantially to the management of the Company; |

· | a general understanding of marketing, finance and other disciplines relevant to the success of a publicly traded company in today’s business environment; and |

· | an understanding of our business and the general trucking or transportation industry, or the willingness and ability to develop such an understanding. |

13

Finally, in identifying and selecting persons for consideration as nominees, the Nominating and Corporate Governance Committee will consider the rules and regulations of the SEC and The NASDAQ Stock Market Listing Standards (or such other stock exchange or stock market on which our securities may be listed or traded from time to time) regarding the composition of the Board and the qualifications of its members.

The Nominating and Corporate Governance Committee may take such actions as it deems appropriate to evaluate whether each person who has been recommended or proposed for approval as a nominee meets the qualifications, as described above, and set forth in the Nominating and Corporate Governance Committee charter, and otherwise has the experience and abilities necessary to be an effective member of the Board.

As set forth in detail in the Nominating and Corporate Governance Committee charter, it is generally the policy of the Nominating and Corporate Governance Committee to consider stockholder recommendations of proposed director nominees, other than through our proxy access nomination procedures, if such recommendations are timely received and otherwise comply with the requirements set forth in our bylaws and applicable SEC rules. The Nominating and Corporate Governance Committee will evaluate any stockholder recommendations pursuant to the same procedures that it follows in connection with consideration of recommendations received from any other source. Stockholders must submit such recommendations in the manner and by the dates specified for stockholder nominations in our bylaws. To be timely under our bylaws, recommendations must be received in writing at our principal executive offices, 3200 Industrial Park Road, Van Buren, Arkansas 72956, not less than 90 days nor more than 120 days prior to the anniversary date of the immediately preceding Annual Meeting. For the 2021 Annual Meeting, stockholder recommendations must be received by us no earlier than January 21, 2021 and no later than February 20, 2021. In addition, pursuant to our bylaws, any recommendation of a director submitted by a stockholder must include the following information:

· | the proposed nominee’s name, age, business address and residence address; |

· | the proposed nominee’s principal occupation or employment; |

· | a reputation both personal and professional, consistent with our image and reputation; |

· | relevant expertise and experience; |

· | the class and number of shares of our stock owned beneficially or of record by the proposed nominee and his or her affiliates and additional information concerning the nature of ownership and any risk mitigation arrangements; |

· | such other information as is required to be disclosed in solicitations of proxies with respect to nominees for election as directors pursuant to Regulation 14A under the Exchange Act; |

· | the nominating stockholder’s (and any beneficial holder’s) name and record address; |

· | the class and number of shares of our stock owned beneficially or of record by the nominating stockholder and his, her or its affiliates, and any beneficial owner and additional information concerning nature of ownership and any risk mitigation arrangements; |

· | a description of any agreements, arrangements or understandings between the nominating stockholder and the nominee pursuant to which the nomination is being made, and any material interest of the nominating stockholder in the nomination; |

· | a representation that the nominating stockholder intends to appear in person or by proxy at the annual meeting to nominate the nominee; and |

· | any other information required by Regulation 14A. |

The Technology Committee is responsible for assisting with the identification and implementation of new technology in our operating segments, as well as overseeing the technology, cyber opportunities and risks Company-wide. The Technology Committee’s responsibilities also include reviewing technology planning, strategies, trends, priorities and disaster preparedness, as well as overseeing our cyber security program and effective protection of our intellectual property.

The Board has adopted a written charter for the Technology Committee, which sets forth the purpose and responsibilities of the Technology Committee in greater detail. A copy of the Technology committee’s charter, as of February 27, 2020, is available at our website, http://usa-truck.com, under the “Corporate Governance” tab of the “Investor Relations” menu.

14

The Technology Committee met four times during 2019. The Technology Committee is comprised of Barbara J. Faulkenberry (Chairwoman), M. Susan Chambers and Thomas M. Glaser.

During 2019, the Board had a standing Executive Committee comprised of our non-employee directors. The Executive Committee did not meet in 2019.

In considering whether to recommend any candidate for inclusion in the Board’s slate of recommended director nominees, including candidates recommended by stockholders, the Nominating and Corporate Governance Committee will apply criteria, including the candidate’s integrity, business acumen, age, experience, commitment, diligence, conflicts of interest and the ability to act in the interests of all stockholders. In addition, no non-employee director nominee should serve as a director of more than four public companies, including the Company, and no director nominee who is also the CEO of the Company should serve as a director of more than one public company, excluding the Company. Please see Exhibit A to the Nominating and Corporate Governance Committee charter for additional details regarding criteria for our director nominees. A copy of the Nominating Corporate Governance Committee’s charter, as of February 27, 2020, is available at our website, http://usa-truck.com, under the “Corporate Governance” tab of the “Investor Relations” menu.

The value of diversity on the Board will continue to be considered by the Nominating and Corporate Governance Committee in the director identification and nomination process. Two of our six independent directors are female. The Nominating and Corporate Governance Committee seeks nominees with a broad diversity of experience, professions, skills, geographic representation and backgrounds. The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. We believe that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. We assess the effectiveness of our policies and practices on Board diversity in connection with assessing the effectiveness of our Board as a whole. Nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability or any other basis proscribed by law.

In order to be considered by the Board, any candidate proposed by one or more stockholders will be required to submit appropriate biographical and other information equivalent to that required of all other director candidates. The table below provides information on the qualifications, skills, characteristics, and experience of our proposed nominees and continuing directors.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| M. Susan Chambers |

| Robert E. Creager |

| Gary R. Enzor |

| Barbara J. Faulkenberry |

| Thomas M. Glaser |

| Alexander D. Greene |

| James D. Reed |

Experience |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Public Company Officer |

| √ |

| √ |

| √ |

|

|

| √ |

|

|

| √ |

Financial Reporting |

|

|

| √ |

| √ |

| √ |

| √ |

| √ |

| √ |

Industry |

|

|

| √ |

| √ |

|

|

| √ |

| √ |

| √ |

Environmental |

| √ |

| √ |

| √ |

| √ |

| √ |

| √ |

| √ |

Risk Management |

| √ |

| √ |

| √ |

| √ |

| √ |

| √ |

| √ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demographic / Background |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent |

| Yes |

| Yes |

| Yes |

| Yes |

| Yes |

| Yes |

| No |

Gender |

| Female |

| Male |

| Male |

| Female |

| Male |

| Male |

| Male |

Tenure (yrs) |

| 4 |

| 8 |

| 6 |

| 4 |

| 6 |

| 6 |

| 3 |

Age (yrs) |

| 61 |

| 71 |

| 57 |

| 60 |

| 70 |

| 61 |

| 47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The lack of a “√” for a particular item does not mean that the director does not possess that qualification, characteristic, skill or experience. We look to each director to be knowledgeable in these areas; however, the “√” indicates that the item is a specific qualification, characteristic, skill or experience that the director brings to the Board.

15

Additional Corporate Governance Policies

We are committed to sound corporate governance principles, which are essential to maintaining our integrity in the marketplace. The Board has adopted additional guidelines for membership on the Board, including:

· | Retirement Policy: no person will be appointed or stand for election as a director after his or her seventy-fifth birthday, unless waived by a majority vote of the Board. |

· | Majority Vote Policy: a director who is subject to an uncontested election at any stockholder meeting shall promptly tender his or her resignation for consideration by the Nominating and Corporate Governance Committee if such director receives a greater number of votes “withheld” from or voted “against” his or her election than are voted “for” such election, excluding abstentions. |

· | Change in Principal Occupation Policy: a non-employee director must submit his or her resignation to the Nominating and Corporate Governance Committee if such director’s principal occupation or business association changes substantially during his or her tenure as a director, so that the Nominating and Corporate Governance Committee can consider the appropriateness of continued Board membership under the circumstances. |

· | Outside Board Membership Policy: Board members must advise the Nominating and Corporate Governance Committee before accepting membership on other public boards of directors, any public audit committee or other significant committee assignment, and before establishing other significant relationships with businesses, institutions, governmental units or regulatory entities, particularly those that may result in significant time commitments, a change in the director’s relationship to the Company, or a conflict of interest. |

· | Director Overboarding: No non-employee director should serve as a director of more than four public companies, including the Company, and no director who is also the CEO of the Company should serve as a director of more than one public company, excluding the Company. |

· | Clawback Policy: In the event of a material financial restatement, with a three year look-back, or the imposition of a material financial penalty, we will require, to the fullest extent permitted by applicable law, that an employee who was subject to the reporting requirements of Section 16 of the Exchange Act forfeit or reimburse us for any incentive-based compensation (including cash- and equity-based incentive compensation) paid or granted to such employee at any time during the performance period relating to the applicable incentive-based compensation, in the sole and absolute discretion of the Board, as further provided in the Clawback Policy. |

· | Stock Ownership Policy: Our CEO, CFO and other named executive officers and non-employee directors are required to build stock ownership in the Company over time through equity grants, expressed as multiples of annual base salary or cash retainer for Board service, as applicable. |

· | Anti-Hedging and Pledging Policy: Hedging transactions in our Common Stock are prohibited (including, but not limited to, short-selling, options, puts and calls, as well as derivatives such as swaps, forwards and futures), and pledging our Common Stock as collateral for loans or purchasing our Common Stock on margin is also prohibited. |

· | Proxy Access: Eligible stockholders owning 3% or more of our Common Stock for at least three years and who otherwise meet the requirements set forth in our bylaws may have their nominees, consisting of the greater of 25% or two nominees to our Board, included in our proxy materials. Our proxy access provision allows for unlimited aggregation by stockholders to reach the 3% ownership threshold. Notice of nominations must be received not less than 120 days nor more than 150 days prior to the anniversary of the date the Company mailed its proxy for the immediately preceding annual meeting of stockholders. |

The Board has also directed that the Nominating and Corporate Governance Committee be responsible for administering and reporting to the Board no less than annually regarding compliance with the guidelines above. Please see Exhibit B to the Nominating and Corporate Governance Committee charter for additional details regarding the foregoing guidelines.

16

Other Board and Corporate Governance Matters

We are committed to conducting our business in accordance with the highest ethical standards. As part of that commitment, the Board has adopted a Code of Business Conduct and Ethics Policy (“Code of Ethics”) applicable to all directors, officers and employees, which sets forth the conduct and ethics expected of all our affiliates and employees, a copy of which is available at our website, http://www.usa-truck.com, under the “Corporate Governance” tab of the “Investor Relations” menu. In addition, any amendments to, or waivers of, any provision of the Code of Ethics that apply to our principal executive, financial and accounting officers or persons performing similar functions, will be posted at that same location on our website. The Nominating and Corporate Governance Committee is responsible for, in part, recommending to the full Board corporate governance guidelines applicable to us and leading the Board in its annual review of the Board’s performance.

We adopted a Policy Statement and Procedures for Reporting Violations and Complaints (“Whistleblower Policy”), a copy of which is available at our website, http://www.usa-truck.com, under the “Corporate Governance” tab of the “Investor Relations” menu. The Whistleblower Policy is intended to create a workplace environment that encourages open and honest communication and to hold the Company and our personnel, including senior management, accountable for adhering to our ethical standards. The Whistleblower Policy establishes procedures for any person to report violations, by us or any of our personnel, of our Code of Ethics or any laws, rules or regulations without fear of retaliation. The Whistleblower Policy also contains special procedures for submission by employees, of confidential, anonymous complaints involving our accounting practices and internal accounting controls.

We also adopted a Shareholder Communications with Directors Policy, which describes the manner in which stockholders can send communications to the Board and sets forth our policy regarding Board members’ attendance at Annual Meetings. This Policy is available at our website, http://www.usa-truck.com under the “Corporate Governance” tab of the “Investor Relations” menu.

The names and other biographical data for our current executive officers (other than Mr. Reed) are set forth below. Biographical information for Mr. Reed is set forth under the heading “Continuing Directors – Class II Directors” above.

Jason R. Bates. Mr. Bates, 42, has served as our Executive Vice President and Chief Financial Officer since May 2017. Prior to that, Mr. Bates served as Vice President of Finance, and Investor Relations Officer of Swift from December 2010 to April 2017. Mr. Bates joined Swift in 2003, and during his tenure, served in various financial leadership roles, including responsibility for financial planning and analysis, business and data analytics, strategic reporting, business intelligence, revenue and transactional services, treasury, and investor relations. Prior to his appointment as Vice President of Finance and Investor Relations Officer, he served as Swift’s Vice President and Assistant Treasurer. Prior to Swift, he served in a variety of finance and accounting leadership roles for Honeywell International. Mr. Bates completed his Bachelor of Science degree in business at Brigham Young University, and obtained his Master’s degree in business administration from Arizona State University.

Timothy W. Guin. Mr. Guin, 55, has served as our Executive Vice President and Chief Commercial Officer since April 2018. Previously, Mr. Guin served as Executive Vice President of Sales and Marketing at Swift from 2016 to 2018, and served as Vice President of Sales at Swift from 2011 to 2016. From 2006 until 2010, he served as Vice President of Business Development in charge of Mergers and Acquisitions for U.S. Xpress Enterprises, Inc., a truckload transportation services provider. Mr. Guin later became President and CEO of Arnold Transportation, a truckload transportation services provider, where he served until 2011. Mr. Guin served on the Board of Directors at Arnold Transportation from 2010 until 2011. Mr. Guin holds a Bachelor Degree in Political Science from Winthrop University.

George T. Henry. Mr. Henry, 35, has served as Senior Vice President – USAT Logistics since March of 2018. Previously, Mr. Henry served as Vice President of Logistics and Knight Dedicated at Knight Transportation, Inc., a truckload transportation services provider, from April 2013 to March 2018. Prior to joining Knight, Mr. Henry served in various 3PL and brokerage roles at Transplace, a logistics provider, from November 2005 to April 2013, where he advanced in progressively more responsible roles, culminating in his promotion to Vice President of Capacity Services. Mr. Henry has a Bachelor of Science degree in Supply Chain, Transportation and Logistics Management from the University of Wales, U.K.

Kimberly K. Littlejohn. Ms. Littlejohn, 61, has served as Vice President and Chief Technology Officer (“CTO”) since May of 2017. Ms. Littlejohn is responsible for providing communications, computing and security infrastructure that enables the Company’s internal business operations. Ms. Littlejohn previously served as director of information technology at Interstate Distributor Co. and director of Nippon Yusen Kaisha global operations application support. She has more than 30 years in the technology industry and 20 years in logistics. Ms. Littlejohn holds a Bachelor of Arts from the University of Washington.

17

All of our executive officers are appointed by the Board for such term as may be prescribed by the Board and until such person’s successor shall have been elected and shall qualify, or until such person’s death or resignation, or until such person’s removal in the manner provided under our bylaws. None of the corporations or organizations referenced in the executive biographies above is a parent, subsidiary, or other affiliate of the Company unless otherwise noted.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors, and greater than 10% stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based solely upon a review of the copies of such forms and amendments thereto, we believe that none of our officers, directors, and greater than 10% beneficial owners failed to file on a timely basis the reports required by Section 16(a), with the exception of: (i) one inadvertent late report for Mr. Guin regarding his one transaction, a forfeiture to the Company of shares to satisfy tax withholding tax obligations in connection with the vesting of restricted stock, and (ii) one inadvertent late report for Mr. Glaser regarding a purchase of stock.

Compensation Discussion and Analysis

In this section, we explain how our executive compensation programs, policies and decisions are formulated, applied and operated with respect to our Named Executive Officers (as designated below). We also discuss and analyze our executive compensation programs, including each component of compensation awarded under the programs, and the corresponding compensation amounts for each Named Executive Officer.

This section should be read in conjunction with the sections entitled “Executive Compensation – Summary Compensation Table” (and related tabular and narrative discussions) and “Corporate Governance – The Board of Directors and its Committees – Committees of the Board of Directors – Executive Compensation Committee” contained in this Proxy Statement. As noted in that section, our Executive Compensation Committee, which is comprised only of directors who satisfy applicable SEC and NASDAQ independence requirements, oversees and administers our executive compensation policies and practices.

Key Features of Our Executive Compensation Program

The following summary provides highlights of our 2019 executive compensation program:

|

|

|

|

Key Features |

| ||

√ |

| Direct link between pay and performance that aligns business strategies with value creation; |

|

√ |

| Appropriate balance between short- and long-term compensation discourages short-term risk taking at the expense of long-term results; |

|

√ |

| Double-trigger change-in-control provisions; |

|

√ |

| Clawback Policy to recoup incentive-based compensation; |

|

√ |

| Stock Ownership; |

|

√ |

| Anti-Hedging and Anti-Pledging Policy; |

|

√ |

| No tax gross-ups on equity awards; |

|

√ |

| No repricing of stock options without stockholder approval; |

|

√ |

| No payment of dividends on unvested awards; |

|

√ |

| One year minimum vesting periods; |

|

√ |

| No excessive perquisites for executives; and |

|

√ |

| Independent compensation consultant retained by the Executive Compensation Committee. |

|

|

|

|

|

Our Executive Compensation Committee is responsible for decisions regarding the compensation of our Named Executive Officers, and for ensuring that those decisions are consistent with our compensation philosophy and objectives. Our compensation policies and practices relating to the compensation of the officers listed in the table below, who are sometimes collectively referred to as the “Named Executive Officers”, are explained in more detail below. For 2019, our Named Executive Officers were:

18

|

|

|

Named Executive Officers |

| Title |

James D. Reed |

| President and Chief Executive Officer |

Jason R. Bates |

| Executive Vice President and Chief Financial Officer |

Timothy W. Guin |

| Executive Vice President and Chief Commercial Officer |

George T. Henry |

| Senior Vice President – USAT Logistics |

Kimberly K. Littlejohn |

| Vice President and Chief Technology Officer |

|

|

|

Former Executive Officers |

| Title |

Johannes "Werner" P. Hugo |

| Former Senior Vice President - Trucking Operations (1) |

|

|

|

1) | Mr. Hugo resigned from his position as Senior Vice President – Trucking Operations on March 7, 2019. |

Objective |

| How Achieved |

Align compensation with our business objectives and the interests of our stockholders and reward the achievement of corporate goals |

| All of our performance-based cash and equity compensation is dependent upon achievement of corporate or business unit goals, as described below |

|

| Caps on cash awards are built into our plan design |

|

| The equity compensation component, which has in the past consisted of restricted stock with both time-based and performance-based vesting requirements, is designed to align our management compensation with longer-term increases in stockholder value and expose the holder to the risk of downward stock prices and volatility |

|

| Balance short-term and long-term goals for performance-based compensation |

|

| Our clawback policy requires certain executive officers to forfeit or reimburse us for any performance-based compensation in the event of a material financial restatement or the imposition of material financial penalty |

Encourage and reward high levels of performance |

| Balance the mix of fixed and performance-based compensation, with the performance-based compensation encouraging high levels of performance |

|

| The Executive Compensation Committee determined that weighting the Company goals under our short-term incentive plan in 2019 to 100% for Messrs. Reed, Bates and Guin and Ms. Littlejohn, and adding a 50% business unit component for Messrs. Henry and Hugo served to align each Named Executive Officers efforts with performance results. |

Mitigate potential risk relating to short-term incentives |

| Balance the mix of fixed and performance-based compensation without overweighting annual cash incentives, which may encourage strategies and risks that may not correlate with our long-term best interests |

|

| Mitigate potential risks through caps on cash awards, which are built into our plan design |

Attract and retain executive officers who contribute to our long-term success |

| With input from our independent compensation consultant, we review publicly available data regarding all elements of compensation paid by truckload companies with similar size or operations to ensure we are competitive, as described below |

|