- USAK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEFM14A Filing

USA Truck (USAK) DEFM14AProxy related to merger

Filed: 3 Aug 22, 4:53pm

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

| ☐ | No fee required | |||

| ☒ | Fee paid previously with preliminary materials | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

|  | |||

Alexander D. Greene | James D. Reed | |||

Chairman of the Board | President and Chief Executive Officer |

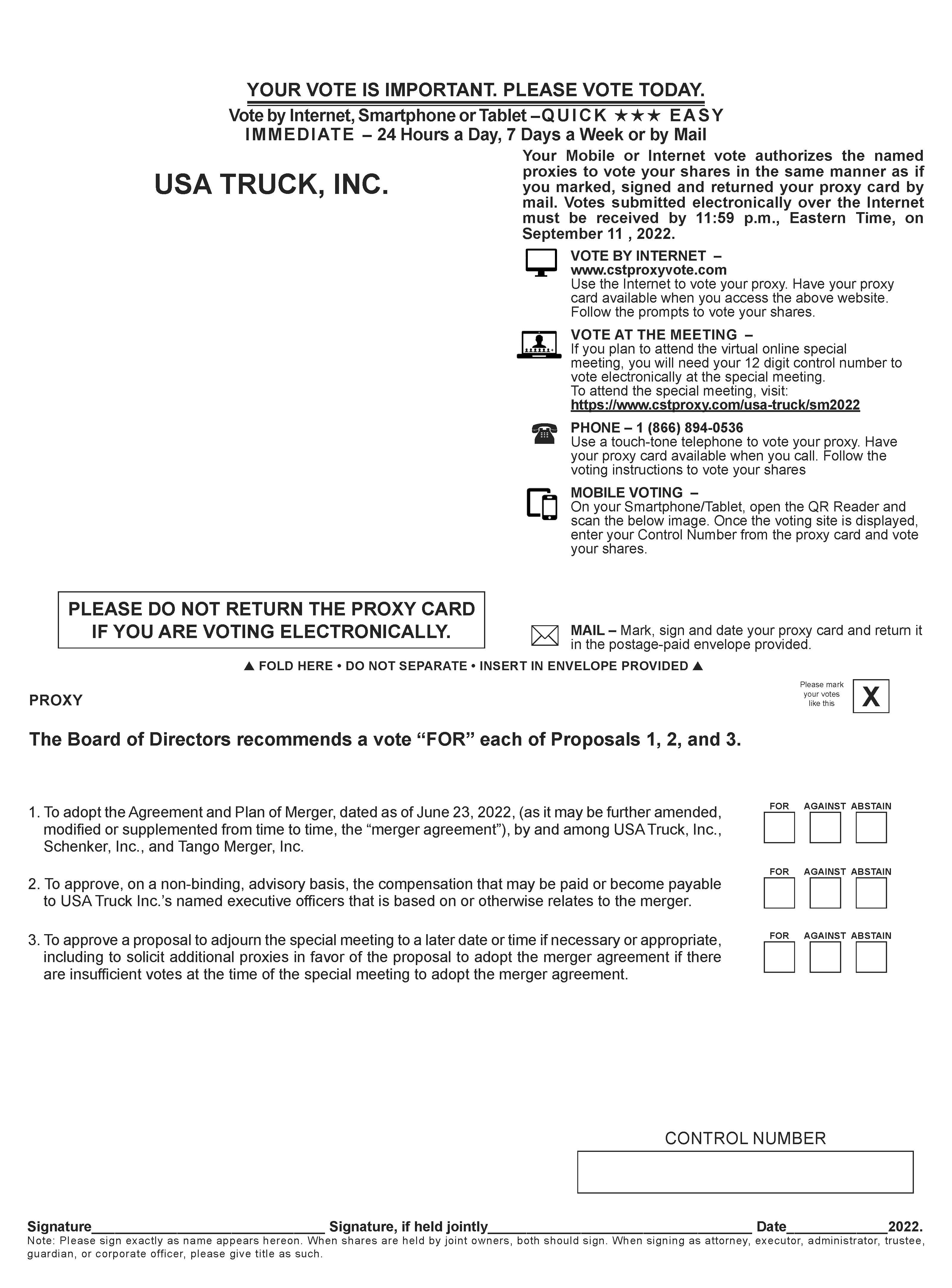

| 1. | a proposal to adopt the Agreement and Plan of Merger, dated as of June 23, 2022, (as it may be further amended, modified or supplemented from time to time, the “merger agreement”), by and among the Company, Schenker, Inc., a New York corporation (“Parent”) and Tango Merger, Inc., a Delaware corporation and wholly owned subsidiary of Parent (“Merger Sub”), pursuant to which Merger Sub will be merged with and into the Company (the “merger”), with the Company surviving as a wholly owned subsidiary of Parent; |

| 2. | a proposal to approve, by a non-binding advisory vote, the compensation that may be paid or become payable to the Company’s named executive officers that is based on or otherwise relates to the merger, as discussed in the section entitled “The Merger—Interests of Directors and Executive Officers in the Merger,” beginning on page 51; and |

| 3. | a proposal to adjourn the special meeting to a later date or time if necessary or appropriate, including to solicit additional proxies in favor of the proposal to adopt the merger agreement if there are insufficient votes at the time of the special meeting to adopt the merger agreement. |

By Order of the Board of Directors | |

| |

Charles Lane | |

Secretary |

| 1 | |

| 1 | |

| 1 | |

| 2 | |

| 2 | |

| 2 | |

| 3 | |

| 3 | |

| 3 | |

| 4 | |

| 4 | |

| 5 | |

| 5 | |

| 6 | |

| 7 | |

| 8 | |

| 10 | |

| 10 | |

| 11 | |

| 11 | |

| 12 | |

| 12 | |

| 19 | |

| 20 | |

| 20 | |

| 20 | |

| 21 | |

| 21 | |

| 21 | |

| 21 | |

| 21 | |

| 22 | |

| 22 | |

| 23 | |

| 23 | |

| 24 | |

| 25 | |

| 25 | |

| 25 | |

| 26 | |

| 26 | |

| 26 | |

| 27 | |

| THE MERGER | 27 |

| Overview | 27 |

| Background of the Merger | 28 |

| Recommendation of the Board | 36 |

| Reasons for Recommending the Adoption of the Merger Agreement | 36 |

| 40 | |

| 43 | |

| 51 | |

| 56 | |

| 56 | |

| 57 | |

| 57 | |

| 61 | |

| 62 | |

| 62 | |

| 62 | |

| 62 | |

| 63 | |

| 63 | |

| 63 | |

| 63 | |

| 65 | |

| 65 | |

| 66 | |

| 66 | |

| 66 | |

| 68 | |

| 71 | |

| 74 | |

| 74 | |

| 75 | |

| 76 | |

| Stockholder Litigation | 77 |

| Takeover Statutes | 77 |

| Other Covenants | 77 |

| 77 | |

| 78 | |

| 80 | |

| 80 | |

| 80 | |

| 81 | |

| 81 | |

| 81 | |

| 81 | |

| 85 | |

| 87 | |

| 87 | |

| 88 | |

| 89 | |

| | |

| |

This summary highlights certain information contained elsewhere in this proxy statement but may not contain all of the information that may be important to you with respect to the merger. We encourage you to carefully read this entire proxy statement and the attached annexes and the other documents to which this proxy statement refers to you for a more complete understanding of the matters being considered at the special meeting. In addition, this proxy statement incorporates by reference important business and financial information about USA Truck, Inc. You may obtain the information incorporated by reference in this proxy statement without charge by following the instructions in the section entitled “Where You Can Find More Information.” Unless the context otherwise indicates, we refer to USA Truck, Inc. as the “Company,” “we,” “us” or “our.” We have included page references in this summary to direct you to a more complete description of the topics presented below. USA Truck, Inc., a Delaware corporation (the “Company”), provides comprehensive capacity solutions to a broad and diverse customer base throughout North America. The Company’s Trucking and USAT Logistics divisions blend an extensive portfolio of asset and asset-light services, offering a balanced approach for our customers’ supply chain management, including customized truckload, dedicated contract carriage, intermodal and third-party logistics freight management services. The Company’s principal executive offices are located at 3200 Industrial Park Road, Van Buren, Arkansas 72956, and its telephone number is 479-471-2500. Schenker, Inc., is a New York corporation (“Parent”). Parent is a subsidiary of DB Schenker, a leading logistics provider. Upon completion of the merger, Parent will be the immediate parent company of the Company. Parent’s principal office is located at 1305 Executive Boulevard, Suite 200, Chesapeake, VA 23320, and its telephone number is 757-821-3400. Tango Merger, Inc., is a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”). Merger Sub was formed on June 23, 2022, expressly for the purpose of the merger and the other transactions contemplated by the merger agreement and conducts no other business. Upon completion of the merger, Merger Sub will merge with and into the Company, with the Company surviving, and Merger Sub will cease to exist. Merger Sub’s head office is located at 1305 Executive Boulevard, Suite 200, Chesapeake, VA 23320, and its telephone number is 757-821-3400. The Company, Parent and Merger Sub entered into an Agreement and Plan of Merger, dated as of June 23, 2022, (as it may be further amended, modified or supplemented from time to time, the “merger agreement”). On the terms and subject to the conditions of the merger agreement, Merger Sub will be merged with and into the Company (the “merger”), with the Company surviving the merger (the “surviving corporation”) as a wholly owned subsidiary of Parent. A copy of the merger agreement is attached as Annex A to this proxy statement. We encourage you to read the entire merger agreement carefully because it is the principal document governing the merger. At the effective time of the merger (the “effective time”), each share of the Company’s common stock, par value $0.01 per share (“Company common stock”), that is issued and outstanding immediately prior to the effective time (other than (i) shares owned by the Company or its subsidiaries, Parent or Merger Sub and (ii) shares held by stockholders who are entitled to demand and have properly demanded appraisal of such shares pursuant to, and have otherwise complied in all respects with, Section 262 of the General Corporation Law of the state of Delaware (the “DGCL”) as of immediately prior to the effective time (clauses (i) and (ii), collectively, the “excluded shares”)) will be automatically cancelled and cease to exist and each holder of such shares will be entitled to receive $31.72 per share, in cash, without interest (the “merger consideration”), subject to any applicable withholding taxes. Following the completion of the merger, the Company will cease to be a publicly traded company and will become a wholly owned subsidiary of Parent. |

The special meeting will be held virtually via live webcast on September 12, 2022, at 11:00 a.m. Eastern Time at https://www.cstproxy.com/usa-truck/sm2022 (including any postponements or adjournments thereof, the “special meeting”). You will be able to listen, vote and submit questions from any remote location that has Internet connectivity. There will be no physical location. You may participate online by logging in at https://www.cstproxy.com/usa-truck/sm2022 and entering the control number included on your proxy card, or the special instructions that accompanied your proxy materials. At the special meeting, you will be asked, among other things, to vote for the proposal to adopt the merger agreement. See the section entitled “The Special Meeting,” beginning on page 21, for additional information on the special meeting, including how to vote your shares of Company common stock. You may vote at the special meeting if you were a holder of record of shares of Company common stock as of the close of business on August 1, 2022, which is the record date for the special meeting (the “record date”). You will be entitled to one vote for each share of Company common stock that you owned on the record date. As of the record date, there were 9,033,766 shares of Company common stock issued and outstanding and entitled to vote at the special meeting (including 529,066 shares of restricted stock that are entitled to vote). The adoption of the merger agreement requires the affirmative vote of the holders of two-thirds of the issued and outstanding shares of Company common stock entitled to vote on such matter. Stockholders of record have a choice of voting (i) by proxy by completing a proxy card and mailing it in the prepaid envelope provided, (ii) by proxy through the Internet or by phone or (iii) by attending the special meeting and voting virtually. Please refer to your proxy card or the information forwarded by your bank, broker, trust or other nominee to see which options are available to you. The Internet and phone voting facilities for stockholders of record will close at 11:59 p.m. Eastern Time on the day before the special meeting. If you wish to vote by proxy and your shares are held by a bank, broker, trust or other nominee, you must follow the voting instructions provided to you by your bank, broker, trust or other nominee. Unless you give your bank, broker, trust or other nominee instructions on how to vote your shares of Company common stock, your bank, broker, trust or other nominee will not be able to vote your shares on any of the proposals. If you wish to vote virtually at the special meeting and your shares are held in the name of a bank, broker or other holder of record, you must obtain a legal proxy, executed in your favor, from the bank, broker or other holder of record authorizing you to vote at the special meeting. YOU SHOULD NOT SEND IN YOUR STOCK CERTIFICATE(S) WITH YOUR PROXY CARD. A letter of transmittal with instructions for the surrender of certificates representing shares of Company common stock will be mailed to stockholders if the merger is completed. For additional information regarding the procedure for delivering your proxy, see the sections entitled “The Special Meeting—How to Vote,” beginning on page 23, and “The Special Meeting—Solicitation of Proxies,” beginning on page 25. If you have more questions about the merger or how to submit your proxy, or if you need additional copies of this proxy statement or the enclosed proxy card or voting instructions, please contact our proxy solicitor: MacKenzie Partners, Inc. 1407 Broadway, 27th Floor New York, New York 10018 (212) 929-5500 (Call Collect) (800) 322-2885 (Toll Free) proxy@mackenziepartners.com (E-Mail Address) |

Following the completion of the merger, shares of Company common stock will no longer be traded on the NASDAQ Global Select Market (the “NASDAQ”) or any other public market. In addition, the registration of shares of Company common stock under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), will be terminated. If the proposal to adopt the merger agreement does not receive the required approval from the Company stockholders, or if the merger is not completed for any other reason, you will not receive any consideration from Parent or Merger Sub for your shares of Company common stock. Instead, the Company will remain a public company and Company common stock will continue to be (i) registered under the Exchange Act and (ii) listed and traded on the NASDAQ. In addition, upon termination of the merger agreement under certain circumstances, the Company would be obligated to pay Parent a termination fee of $10.0 million (the “Company termination fee”). For additional information, see the section entitled “The Agreement and Plan of Merger – Company Termination Fee,” beginning on page 80. Company Stock Options The merger agreement provides that, at the effective time: • each outstanding and unexercised option to purchase shares of Company common stock (whether vested or unvested and whether exercisable or unexercisable) (a “Company stock option”) will become fully vested and be cancelled; and • each holder of any such Company stock option will be entitled to receive, in consideration of and in full settlement for the cancellation of each such Company stock option, a cash payment, without interest and subject to applicable tax withholding, of an amount equal to the product of (i) the total number of shares of Company common stock underlying each such Company stock option, and (ii) the excess, if any, of the merger consideration over the exercise price per share of each such Company stock option. Restricted Stock The merger agreement provides that, at the effective time: • each outstanding share of restricted stock of the Company (whether vested or unvested) (“restricted stock”), will become fully vested and be cancelled; and • each holder of any such restricted stock will be entitled to receive, in consideration of and in full settlement for the cancellation of each such share of restricted stock, a cash payment, without interest and subject to applicable tax withholding, of an amount equal to the product of (i) the total number of shares of Company common stock underlying each such award of restricted stock and (ii) the merger consideration. Restricted Performance Stock Units The merger agreement provides that, at the effective time: • each outstanding performance stock unit with respect to shares of Company common stock (whether vested or unvested) (a “PSU”), will become fully vested and be cancelled; and • each holder of any such PSU will be entitled to receive, in consideration of and in full settlement for the cancellation of each such PSU, a cash payment, without interest and subject to applicable tax |

withholding, of an amount equal to the product of (i) the total number of shares of Company common stock underlying each such PSU and (ii) the merger consideration. See the section entitled “The Agreement and Plan of Merger—Treatment of Company Equity Awards,” beginning on page 65 for details regarding payment timing in respect of the Company’s equity awards in the merger. In considering the recommendation of the Board that you vote “FOR” the proposal to adopt the merger agreement, you should be aware that some of our directors and executive officers have interests that may be different from, or in addition to, the interests of the Company stockholders generally. A description of these interests is included in the section entitled “The Merger—Interests of Directors and Executive Officers in the Merger,” beginning on page 51. The Board was aware of these interests and considered them at the time it approved the merger agreement and made its recommendation to the Company stockholders. Such interests potentially include entitlement to: • accelerated vesting and settlement of outstanding Company equity awards at the effective time; • possible severance payments and/or benefits under preexisting change-in-control/severance agreements; and • continued indemnification and insurance coverage under the merger agreement. The respective obligations of the Company, Parent and Merger Sub to effect the merger are subject to the satisfaction or, where permitted by law, waiver at or before the closing date of the merger (the “closing date”) of the following conditions: • the approval and adoption of the merger agreement by the vote of stockholders of two-thirds of shares of the Company common stock issued and outstanding and entitled to vote on the matter; • no law or outstanding order enacted, promulgated, issued, entered, amended or enforced by any governmental entity that restrains, enjoins or otherwise prohibits the consummation of the merger; and • the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”). In addition, the respective obligations of the Company to effect the merger are subject to the satisfaction or waiver at or before the closing date of the following conditions: • the accuracy of representations and warranties of Parent and Merger Sub in the merger agreement, as of the date of the merger agreement and as of the date of the closing of the merger (except for representations and warranties that relate to a specific date or time (which need only be true and correct as of such date or time)), subject to certain materiality and “material adverse effect” qualifiers with certain exceptions for inaccuracies that do not constitute a Parent Material Adverse Effect (as defined in the merger agreement); • the performance in all material respects by Parent and Merger Sub of or with their respective covenants and agreements required to be performed by them under the merger agreement at or before the closing date, subject to certain cure rights; and • the receipt by the Company of a certificate signed on behalf of Parent by certain executive officers of Parent certifying that the conditions described in the two immediately preceding bullets have been satisfied. |

In addition, the obligations of Parent and Merger Sub to effect the merger are further subject to the satisfaction or waiver on or before the closing date of the following conditions: • the accuracy of representations and warranties of the Company in the merger agreement, as of the date of the merger agreement and as of the date of the closing of the merger (except for representations and warranties that relate to a specific date or time (which need only be true and correct as of such date or time)), subject to certain materiality and “material adverse effect” qualifiers and with certain exceptions for inaccuracies that are de minimis or do not constitute a Company Material Adverse Effect (as defined in “The Agreement and Plan of Merger—Representations and Warranties”); • the performance in all material respects by the Company of or with the covenants and agreements required to be performed by it under the merger agreement at or before the closing date, subject to certain cure rights; • since June 23, 2022, there not having occurred a Company Material Adverse Effect under clause (b) of the definition thereof; • the receipt by Parent of a certificate signed on behalf of the Company by certain executive officers of the Company stating that the conditions described in the three immediately preceding bullets have been satisfied; and • CFIUS approval (as defined in “The Merger—Regulatory Approvals Required for the Merger”) having been obtained. Finally, no party may rely on the failure of any condition set forth above to be satisfied if such failure was caused by that party’s material breach of any provision of the merger agreement. The respective obligations of the Parent, Merger Sub and the Company under the merger agreement to effect the merger are subject to the termination or expiration of any waiting period (or extension thereof) applicable to the transactions contemplated by the merger agreement under the HSR Act being terminated or having expired. Notification under the HSR Act was filed on July 8, 2022. The obligations of Parent and Merger Sub to effect the merger are further subject to CFIUS approval (as defined in “The Merger—Regulatory Approvals Required for the Merger”). Each of the parties agreed to use its reasonable best efforts to take, or cause to be taken, all actions that are necessary, proper or advisable under the merger agreement and applicable law to obtain all regulatory approvals required to consummate and make effective the merger and the other transactions contemplated by the merger agreement as promptly as practicable. There is currently no way to predict how long it will take to obtain all of the required regulatory approvals or whether such approvals will ultimately be obtained, and there may be a substantial period of time between the approval by our stockholders and the completion of the merger. In addition, each party has agreed to use reasonable best efforts to (1) cooperate reasonably with each other in connection with regulatory filings or submissions in connection with the transactions contemplated by the merger agreement or any investigation or other inquiry by a governmental entity in connection with the transactions contemplated by the merger agreement; (2) promptly inform the other parties to the merger agreement of material communications regarding the transactions contemplated by the merger agreement received from the Federal Trade Commission (“FTC”), the Antitrust Division of the Department of Justice (“Antitrust Division”), Committee on Foreign Investment in the United States (“CFIUS”), or any other similar governmental entity (foreign or domestic); (3) consult with each other prior to taking any material position with respect to the regulatory filings or submissions; (4) permit the other parties’ legal counsel to review and discuss in advance any analyses, presentations, memoranda, briefs, arguments, opinions and proposals to be submitted to any governmental entity with respect to regulatory filings; and (5) coordinate with the other parties’ legal counsel in |

preparing and exchanging such information and promptly provide the other parties’ legal counsel with copies of all filings, presentations or material submissions made by such party with any governmental entity with respect to regulatory filings. Parent will, with prior notice to and consultation of the Company, and taking the Company’s views into account in good faith, control and lead all communications and strategy on behalf of the parties relating to regulatory filings. For a description of the respective obligations of Parent, Merger Sub and the Company under the merger agreement with respect to regulatory approvals, see the sections entitled “The Merger—Regulatory Approvals Required for the Merger” beginning on page 61 and “The Agreement and Plan of Merger—Efforts to Complete the Merger,” beginning on page 74. Except as expressly permitted by the merger agreement (as described in “The Agreement and Plan of Merger —Restrictions on Solicitation of Acquisition Proposals” on page 71 of this proxy statement), until the earlier of the closing date and the termination of the merger agreement in accordance with its terms, the Company has agreed not to, and to cause its subsidiaries not to, and its subsidiaries’ respective directors, officers, and representatives not to instruct, authorize or knowingly permit any of their officers, directors or other representatives to: • solicit, initiate, propose or knowingly induce the making, submission or announcement of, or knowingly encourage, facilitate or assist, any inquiry or proposal that constitutes, or would reasonably be expected to lead to, an acquisition proposal (as defined in “The Agreement and Plan of Merger —Restrictions on Solicitation of Acquisition Proposals”); • furnish to any third party any non-public information relating to the Company or its subsidiaries or afford to any third party access to the properties, assets, books, records or other non-public information, or to any personnel, of the Company or its subsidiaries, in any such case with the intent to induce the making, submission or announcement of, or to knowingly encourage, facilitate or assist an acquisition proposal or any inquiries or the making of any proposal or offer that would reasonably be expected to lead to an acquisition proposal; • participate or engage in discussions, communications or negotiations with any third party with respect to an acquisition proposal or inquiry (other than to inform such third party that provisions of the merger agreement prohibit such discussions); • approve, endorse or recommend any proposal that constitutes or would reasonably be expected to lead to, an acquisition proposal; or • enter into any letter of intent, agreement in principle, memorandum of understanding, merger agreement, acquisition agreement or other contract with respect to, or that is intended to result in, or would reasonably be expected to lead to an acquisition transaction (as defined in “The Agreement and Plan of Merger —Restrictions on Solicitation of Acquisition Proposals”) (an “alternative acquisition agreement”). Notwithstanding the foregoing, if prior to the receipt of the Company stockholder approval (as defined below), (i) the Company has received an acquisition proposal (as defined in “The Agreement and Plan of Merger —Restrictions on Solicitation of Acquisition Proposals”) from a third party, (ii) such acquisition proposal was not the result of any material breach of the non-solicitation restrictions set forth in the merger agreement and (iii) the Board (or a committee thereof) determines in good faith (after consultation with its financial advisor and outside legal counsel) that such acquisition proposal either (A) constitutes a superior proposal (as defined in “The Agreement and Plan of Merger —Restrictions on Solicitation of Acquisition Proposals”) or would be reasonably likely to lead to a superior proposal and (B) the failure to discuss such acquisition proposal would be reasonably likely to be inconsistent with the Board’s fiduciary duties under applicable law, the Company may participate or engage in discussions or negotiations with, furnish non-public information relating to the Company and its subsidiaries, or afford access to non-public information, or to any personnel, of the Company or its subsidiaries pursuant to a confidentiality agreement, the provisions of which are not materially less favorable, in the |

aggregate, to the Company than its confidentiality agreement with Parent, to any third party or its representatives that has made or delivered to the Company such acquisition proposal. The Company must provide to Parent and its representatives any non-public information that is provided to any third party or its representatives given such access that was not previously made available to Parent prior to or substantially concurrently to the time it is provided to such third party. Subject to certain limited exceptions, until the receipt of the approval of the proposal to adopt the merger agreement by the vote of stockholders of a two-thirds of shares of the issued and outstanding Company common stock as of the record date and entitled to vote on the matter (the “Company stockholder approval”) neither our Board nor any committee thereof will: • withhold, withdraw, amend, qualify, or modify in any manner adverse to Parent or Merger Sub in any material respect, its recommendation to approve the merger; • adopt, approve, endorse, recommend or otherwise declare advisable an acquisition proposal; • fail to include the Board’s recommendation to approve the merger in this proxy statement; • within five business days of Parent’s written request, fail to make or reaffirm its recommendation to approve the merger following the date any acquisition proposal or any material modification thereto is first publicly disclosed or distributed to the Company’s stockholders; • cause or direct the Company or its subsidiaries to enter into any alternative acquisition agreement (as defined in “The Agreement and Plan of Merger —Restrictions on Solicitation of Acquisition Proposals”); or • publicly propose or agree to any of the foregoing. If the Company receives an acquisition proposal from a third party that the Board determines in good faith (after consultation with its financial advisor and outside legal counsel) constitutes a superior proposal and the failure to discuss such acquisition proposal would be reasonably likely to be inconsistent with the Board’s fiduciary duties under applicable law, the Board may, provided that the Company has not breached the non-solicitation restrictions in the merger agreement in any material respect with respect to such acquisition proposal, effect a Board recommendation change (as defined in “The Agreement and Plan of Merger —Restrictions on Solicitation of Acquisition Proposals”) with respect to such superior proposal or terminate the merger agreement to enter into an alternative acquisition agreement, subject to compliance with certain notice and other requirements set forth in the merger agreement (as described in “The Agreement and Plan of Merger —Restrictions on Solicitation of Acquisition Proposals” on page 71 of this proxy statement). In addition, the Company will not be permitted to terminate the merger agreement to accept a superior proposal in accordance with the terms and conditions of the merger agreement unless the Company pays the Company termination fee described in “The Agreement and Plan of Merger—Company Termination Fee” on page 80 of this proxy statement. Notwithstanding the foregoing, the Board may, at any time prior to the receipt of the Company stockholder approval, effect a Board recommendation change in response to an intervening event (as defined in “The Agreement and Plan of Merger —Restrictions on Solicitation of Acquisition Proposals”) if the Board determines in good faith (after consultation with its financial advisor and outside legal counsel) that the failure to do so would reasonably be expected to be inconsistent with its fiduciary duties pursuant to applicable law, subject to compliance with certain notice and other requirements set forth in the merger agreement (as described in “The Agreement and Plan of Merger —Restrictions on Solicitation of Acquisition Proposals” on page 71 of this proxy statement). The merger agreement may be terminated at any time prior to the effective time only as follows: • by mutual written consent of the Company and Parent; |

• by Parent (on behalf of itself and Merger Sub) or the Company: o if the Company stockholder meeting (as it may be adjourned) has concluded following the taking of a vote to approve the merger and the Company stockholder approval has not been obtained; o if (i) the consummation of the merger has been restrained, enjoined, prohibited or otherwise made illegal by any law or outstanding order (whether temporary, preliminary or permanent) enacted, promulgated, issued, entered, amended or enforced by any governmental entity that is final and non-appealable or (ii) as of March 23, 2023 (the “outside date”), the expiration or termination of the waiting period under the HSR Act shall not have occurred; provided that the right to terminate the merger agreement as describe in this paragraph will not be available to a party if such party’s material failure to comply with its obligations set forth in the merger agreement was the principal cause of the circumstances described in the foregoing clauses (i) or (ii); • by the Company: o if the transactions contemplated by the merger agreement have not been completed on or before the outside date; so long as the Company’s breach of the merger agreement was not the principal cause of the failure to close prior to the outside date; o at any time prior to the receipt of the Company stockholder approval, if the Board authorizes the Company to enter into a definitive agreement with respect to a superior proposal to the extent permitted by and in accordance with the merger agreement (provided that the Company pays the Company termination fee to Parent concurrently with such termination); o if Parent or Merger Sub have breached in any material respect any of their representations or warranties or Parent or Merger Sub have failed to perform in any material respect any of their covenants or other agreements contained in the merger agreement which breach or failure to perform would render certain conditions to the consummation of the merger incapable of being satisfied by the outside date, or if capable of being satisfied by the outside date, shall not have been cured by the earlier of (x) 30 days after the Company has provided written notice of such breach to Parent and (y) the third business day prior to the outside date; provided, however, that the Company may not terminate the merger agreement in this way if the Company is then in material breach of any of its obligations under the merger agreement; o if (i) all of the conditions to Parent’s obligations to complete the merger have been satisfied or waived (other than conditions that by their terms are to be satisfied at the closing of the merger, but subject to such conditions being capable of being satisfied), (ii) the Company has delivered a written notice to Parent at least three business days prior to such termination confirming that, if Parent performed its obligations, the Company is ready, willing and able to consummate the closing and (iii) Parent has failed to close within three business days after the later to occur of (x) delivery of the written notice of such failure and (y) the date when the closing is required to occur under the merger agreement; • by Parent (on behalf of itself and Merger Sub): o if the transactions contemplated by the merger agreement have not been completed on or before the outside date; so long as Parent’s breach of the merger agreement was not the principal cause of the failure to close prior to the outside date; o prior to the time at which the Company stockholder approval has been obtained, if the Company effects a Board recommendation change whether or not in compliance with the |

merger agreement or the Company enters into a merger agreement, letter of intent or other similar agreement related to an alternative acquisition proposal from a third party; or o if the Company has breached in any material respect any of its representations or warranties or the Company has failed to perform in any material respect any of its covenants or other agreements contained in the merger agreement, which breach or failure to perform would render certain conditions incapable of being satisfied by the outside date, or if capable of being satisfied by the outside date, shall not have been cured prior to the earlier of (x) 30 days after Parent provided written notice of such breach to the Company and (y) the third business day prior to the outside date; provided, however, that Parent may not terminate the merger agreement in this way if Parent is then in material breach of any of its obligations under the merger agreement. In the event that the merger agreement is terminated pursuant to the termination rights above, the merger agreement (other than certain provisions that expressly survive termination of the merger agreement) will become void and of no effect without liability or obligation on the part of any party thereto. However, no termination of the merger agreement shall relieve any party from liabilities or damages incurred or suffered as a result of a willful and material breach of any representations, warranties, covenants or other agreements set forth in the merger agreement or fraud if such willful and material breach or fraud is the principal cause of a condition to the closing of the merger to becoming incapable of satisfaction by the outside date (or if capable of being satisfied by the outside date, to not be satisfied by the outside date). Under the merger agreement, the Company must pay to Parent the Company termination fee of $10.0 million if the merger agreement is terminated under the following circumstances: • prior to the receipt of the Company stockholder approval, if the Company terminates the merger agreement to enter into a definitive agreement with respect to a superior proposal in accordance with the terms of the merger agreement; • prior to the receipt of the Company stockholder approval, Parent terminates the merger agreement because the Company has effected a Board recommendation change or the Company has entered into a merger agreement, letter of intent or other similar agreement related to an alternative acquisition proposal from a third party; or • if the following clauses (a), (b) and (c) are all satisfied: (a) either Parent or the Company terminates the merger agreement because the Company stockholder meeting has concluded following the taking of a vote to approve the merger and the Company stockholder approval has not been obtained, (b) an acquisition proposal made by a third party that is reasonably capable of consummating such acquisition proposal has been publicly disclosed after the date of the merger agreement (except that for purposes of this bullet point, all references to “25%” in the definition of “acquisition proposal” will be deemed to be references to “50%”) and (c) within 12 months of such termination the Company and its subsidiaries consummate any alternative acquisition proposal. In the event the Company fails to promptly pay the Company termination fee when due and Parent commences a suit in order to obtain such payment and such suit resulting in a judgment against the Company for payment of the Company termination fee, the Company will be required to pay, up to $2.0 million, Parent’s and its affiliates’ costs and expenses (including reasonable attorneys’ fees) in connection with such suit, together with interest on the amount of any unpaid fee, cost or expense from the date such fee, cost or expense was required to be paid to (but excluding) the payment date. Under the Delaware law, holders of record of shares of Company common stock are entitled to appraisal rights in connection with the merger, provided that such holders meet all of the conditions set forth in Section 262 of the |

DGCL. A holder of record of shares of Company common stock who properly seeks appraisal and complies with the applicable requirements under the Delaware law (the holders of such shares, “dissenting stockholders”) will forego the merger consideration and instead be entitled to receive a cash payment equal to the “fair value” of such holder’s shares of the Company common stock in connection with the merger. Fair value will be determined by the Court of Chancery of the State of Delaware (“Court of Chancery”) following an appraisal proceeding. The fair value of the Company common stock may be more than, the same as or less than the merger consideration that such holders would have received under the merger agreement. A detailed description of the appraisal rights available to holders of Company common stock and procedures required to exercise statutory appraisal rights is included in the section entitled “Appraisal Rights,” beginning on page 81. To seek appraisal, a Company stockholder of record must deliver a written demand for appraisal to the Company before the vote on the merger agreement at the Company special meeting, not vote in favor of the proposal to adopt the merger agreement, continuously hold the shares of Company common stock until the effective time, and otherwise comply with the procedures set forth in Section 262 of the DGCL. Failure to follow exactly the procedures specified under the Delaware law may result in the loss of appraisal rights. The text of the Delaware appraisal rights statute, Section 262 of the DGCL, is reproduced in its entirety as Annex C to this proxy statement. You are encouraged to read these provisions carefully and in their entirety. As of July 31, 2022, one complaint had been filed against the Company and the Company had received draft complaints related to the merger. On July 21, 2022, a purported stockholder of the Company filed a complaint in the Southern District of New York related to the merger. On July 29, 2022, the Company received two separate draft complaints related to the merger. The complaints name as defendants the Company and the members of the Board. Each of the complaints alleges violations of Sections 14(a) and 20(a) of the Exchange Act, and Rule 14a-9 promulgated thereunder. The complaints generally allege that the defendants filed a materially incomplete and misleading registration statement with the SEC. Additionally, one of the draft complaints asserts a claim for breach of fiduciary duties against the members of the Board. Each of the complaints seeks injunctive relief preventing the consummation of the merger, damages and other relief. The Company believes that the claims asserted in the complaints are without merit and intends to defend itself vigorously in any litigation related to the merger. Additional lawsuits may be filed against the Company, the Board or the Company’s officers in connection with the merger. Any lawsuits related to the merger could prevent or delay completion of the merger and result in substantial costs to the Company, including any costs associated with indemnification. Other than with respect to Company common stock received in compensatory arrangements, the material U.S. federal income tax consequences of the merger are described in “The Merger—Material U.S. Federal Income Tax Consequences of the Merger” beginning on page 57 of this proxy statement. The receipt of cash by a U.S. holder (as defined in “The Merger—Material U.S. Federal Income Tax Consequences of the Merger”) in exchange for the U.S. holder’s shares of Company common stock in the merger generally will be a taxable transaction for U.S. federal income tax purposes. A U.S. holder generally will recognize taxable gain or loss equal to the difference, if any, between the amount of cash received by the U.S. holder for such shares (determined before the deduction of any applicable withholding taxes) and the U.S. holder’s adjusted tax basis in such shares. The amount and character of such gain or loss will be determined separately for each block of shares of Company common stock (that is, shares acquired at the same cost in a single transaction) exchanged for cash in the merger. The receipt of cash by a non-U.S. holder (as defined in “The Merger—Material U.S. Federal Income Tax Consequences of the Merger”) in exchange for the non-U.S. holder’s shares of Company common stock in the merger generally will not be subject to U.S. federal income taxation unless (1) the non-U.S. holder has certain connections to the U.S. or (2) the Company is, or was during the relevant period, a U.S. real property holding corporation. Company stockholders should refer to “The Merger—Material U.S. Federal Income Tax Consequences of the Merger” beginning on page 57 of this proxy statement for a more complete description of the material U.S. federal income tax consequences of the merger and consult their own tax advisors concerning the U.S. federal |

income tax consequences to them of the merger in light of their particular circumstances, as well as any consequences arising under the U.S. federal tax laws other than those pertaining to income tax, including estate or gift tax laws, or under any state, local or non-U.S. tax law or under any applicable income tax treaty. You can find more information about the Company in the periodic reports and other information we file with the SEC. The information is available at the website maintained by the SEC at www.sec.gov. |

| Q: | Why am I receiving this proxy statement? |

| A: | On June 23, 2022, the Company entered into the merger agreement with Parent and Merger Sub providing for the acquisition of the Company by Parent for a price of $31.72 per share, in cash, without interest and subject to any applicable withholding taxes. You are receiving this proxy statement in connection with the solicitation of proxies by the Board in favor of the proposal to adopt the merger agreement and to approve the other related proposals to be voted on at the special meeting. |

| Q: | As a stockholder of the Company, what will I receive in the merger? |

A: | If the merger is completed, you will be entitled to receive $31.72, in cash, without interest and subject to any applicable withholding taxes, for each share of Company common stock you own as of immediately prior to the effective time (other than the excluded shares), unless you have properly exercised and perfected your demand for appraisal rights in accordance the Section 262 of the DGCL with respect to such shares. Strict compliance with the statutory procedures in Section 262 of the DGCL is required. Failure to timely and properly comply with such statutory requirements may result in the loss or waiver of your appraisal rights. See “The Agreement and Plan of Merger—Appraisal Rights” on page 66 of this proxy statement. |

| Q: | What will happen to my Company stock options in the merger? |

A: | At the effective time, each then-outstanding and unexercised Company stock option (whether vested or unvested and whether exercisable or unexercisable) will become fully vested and be cancelled, and each holder of any such Company stock option will be entitled to receive a cash payment, without interest and subject to applicable tax withholding, of an amount equal to the product of (i) the total number of shares of Company common stock underlying each such Company stock option and (ii) the excess, if any, of the merger consideration over the exercise price per share of each such cancelled Company stock option. For additional information regarding the treatment of outstanding Company equity awards, see the section entitled “The Agreement and Plan of Merger—Treatment of Company Equity Awards,” beginning on page 65. |

| Q: | What will happen to my restricted stock in the merger? |

A: | At the effective time, each then-outstanding share of restricted stock (whether vested or unvested), will become fully vested and be cancelled, and each holder of any such restricted stock will be entitled to receive a cash payment, without interest and subject to applicable tax withholding, of an amount equal to the product of (i) the total number of shares of Company common stock underlying each such award of restricted stock and (ii) the merger consideration. For additional information regarding the treatment of outstanding Company equity awards, see the section entitled “The Agreement and Plan of Merger—Treatment of Company Equity Awards,” beginning on page 65. |

| Q: | What will happen to my PSUs in the merger? |

A: | At the effective time, each then-outstanding PSU (whether vested or unvested), will become fully vested and be cancelled, and each holder of any such PSU will be entitled to receive a cash payment, without interest and subject to applicable tax withholding, of an amount equal to the product of (i) the total number of shares of Company common stock underlying each such PSU and (ii) the merger consideration. For additional information regarding the treatment of outstanding Company equity awards, see the section entitled “The Agreement and Plan of Merger—Treatment of Company Equity Awards,” beginning on page 65. |

| Q: | Where and when will the special meeting of stockholders be held? |

| A: | The special meeting of the Company stockholders will be held virtually via live webcast on September 12, 2022, at 11:00 a.m. Eastern Time at https://www.cstproxy.com/usa-truck/sm2022. |

| Q: | Are there any requirements if I plan to attend the special meeting? |

| A: | The special meeting will be held solely via live webcast, and there will not be a physical meeting location. Company stockholders will be able to attend the special meeting by visiting the special meeting website. If you choose to attend the special meeting and vote your shares via the special meeting website, you will need the control number included on your proxy card. |

| Q: | Who is entitled to vote at the special meeting? |

| A: | Only holders of record of Company common stock as of the close of business on August 1, 2022, the record date for the special meeting, are entitled to receive these proxy materials and to vote at the special meeting. You will be entitled to one vote on each of the proposals presented in this proxy statement for each share of Company common stock that you held on the record date. |

| Q: | What proposals will be considered at the special meeting? |

| A: | At the special meeting, you will be asked to consider and vote on: • a proposal to adopt the merger agreement, pursuant to which, subject to the satisfaction or waiver of certain specified conditions, Merger Sub will merge with and into the Company, with the Company continuing as the surviving corporation and a wholly owned subsidiary of Parent; • a proposal to approve, by a non-binding advisory vote, the compensation that may be paid or become payable to the Company’s named executive officers that is based on or otherwise relates to the merger, as discussed in the section entitled “The Merger—Interests of Directors and Executive Officers in the Merger,” beginning on page 51; and • a proposal to adjourn the special meeting to a later date or time if necessary, including to solicit additional proxies in favor of the proposal to adopt the merger agreement if there are insufficient votes at the time of the special meeting to adopt the merger agreement. |

| Q: | What vote is required to approve each of the proposals? |

A: | The proposal to adopt the merger agreement requires the affirmative vote of the stockholders of two-thirds of the issued and outstanding shares of Company common stock entitled to vote on such matter. Abstentions and failures to vote (including a failure to instruct your broker, bank or other nominee to vote shares held on your behalf) will have the same effect as a vote “AGAINST” the proposal to adopt the merger agreement. The approval of the non-binding compensation advisory proposal requires the affirmative vote of a majority of the votes cast by stockholders present virtually or represented by proxy at the special meeting entitled to vote on such matter. Although the Board intends to consider the vote resulting from this proposal, the vote is advisory only and, therefore, is not binding on the Company or Parent or any of their respective subsidiaries, and, if the merger agreement is adopted by the Company stockholders and the merger is completed, the compensation that |

is based on or otherwise relates to the merger will be payable to our named executive officers in accordance with the terms of their compensation agreements and arrangements even if this proposal is not approved. Abstentions and failures to vote will have no effect on the approval of this proposal. The approval of the proposal to adjourn the special meeting if necessary or appropriate requires the affirmative vote of a majority of the votes cast by stockholders present virtually or represented by proxy at the special meeting entitled to vote on such matter. Abstentions and failures to vote will have no effect on the approval of this proposal. In addition, even if a quorum is not present at the special meeting, the affirmative vote of holders of a majority of the shares of Company common stock present virtually or represented by proxy at the special meeting entitled to vote on such matter may adjourn the meeting to another place, date or time. In such case, abstentions will have the same effect as a vote “AGAINST” such adjournment. Failures to vote will have no effect on such adjournment. The Company may not recess or postpone the special meeting, and may not change the record date, except (a) with Parent’s consent, (b) if, as of the time for which the special meeting is originally scheduled, there are insufficient shares of Company common stock represented (either virtually or by proxy) to constitute a quorum necessary to conduct the business of the special meeting, (c) to allow reasonable additional time for the filing and mailing of any supplemental or amended disclosure which the Board has determined in good faith is necessary or advisable and for such supplemental or amended disclosure to be disseminated and reviewed by the Company’s stockholders prior to the special meeting, (d) to allow additional solicitation of votes to the extent necessary in order to obtain the Company stockholder approval at the special meeting or (e) to the extent required by applicable law. |

| Q: | How does the Board recommend that I vote on the proposals? |

A: | Upon careful consideration, the Board has unanimously determined that the transactions contemplated by the merger agreement, including the merger, are fair to and in the best interests of the Company and its stockholders, and unanimously recommends that you vote “FOR” the proposal to adopt the merger agreement, “FOR” the non-binding compensation advisory proposal and “FOR” the proposal to adjourn the special meeting if necessary or appropriate. For a discussion of the factors that the Board considered in determining to recommend the adoption of the merger agreement, see the section entitled “The Merger—Reasons for Recommending the Adoption of the Merger Agreement,” beginning on page 36. In addition, in considering the recommendation of the Board with respect to the merger agreement, you should be aware that some of our directors and executive officers have interests that may be different from, or in addition to, the interests of the Company stockholders generally. For additional information, see the section entitled “The Merger—Interests of Directors and Executive Officers in the Merger,” beginning on page 51. |

| Q: | Have any of the Company’s stockholders already agreed to approve the proposal to adopt the merger agreement? |

A: | No. Neither the Company nor any of its subsidiaries is a party to any voting trust, proxy, voting agreement, stockholders agreement, registration rights agreement or other similar agreement relating to the voting or disposition of any Company securities. There are no outstanding bonds, debentures, notes or other indebtedness of the Company having the right to vote (whether on an as-converted basis or otherwise) (or convertible into, or exchangeable for, securities having the right to vote) on any matters on which stockholders of the Company may vote. |

| Q: | Do I need to attend the special meeting? |

| A: | No. It is not necessary for you to virtually attend the special meeting via the special meeting website in order to vote your shares. You may vote by mail, through the Internet or by phone, as described in more detail below. |

| Q: | How many shares are needed to constitute a quorum? |

A: | The presence at the special meeting, virtually or by proxy, of the holders of a majority of the issued and outstanding shares of Company common stock entitled to vote constitutes a quorum for the purpose of considering the proposals. As of the record date, there were 9,033,766 shares of Company common stock issued and outstanding and entitled to vote at the special meeting (including 529,066 shares of restricted stock that are entitled to vote). If you are a Company stockholder as of the close of business on the record date and you vote by mail, through the Internet, by phone or virtually at the special meeting, you will be considered part of the quorum. If you are a “street name” holder of shares of Company common stock (i.e., you hold your shares in the name of a bank, broker, trust or other nominee), your shares will not be counted in determining the presence of a quorum, unless you provide your bank, broker, trust or other nominee with voting instructions. All shares of Company common stock held by the Company stockholders that are present virtually, or represented by proxy, and entitled to vote at the special meeting, regardless of how such shares are voted or whether such stockholders have indicated on their proxy that they are abstaining from voting, will be counted in determining the presence of a quorum. In addition, even if a quorum is not present at the special meeting, the affirmative vote of holders of a majority of the shares of Company common stock present virtually or represented by proxy at the special meeting entitled to vote on such matter may adjourn the meeting to another place, date or time. |

| Q: | Why am I being asked to consider and cast a non-binding advisory vote to approve the compensation that may be paid or become payable to the Company’s named executive officers that is based on or otherwise relates to the merger? |

A: | Section 14A of the Exchange Act requires the Company to conduct a non-binding advisory vote with respect to certain “golden parachute” compensation that may be paid or become payable to the Company’s named executive officers in connection with the merger, including the agreements and understandings with the Company pursuant to which such compensation may be paid or become payable. For additional information, see the section entitled “Proposal 2: Non-Binding Compensation Advisory Proposal,” beginning on page 26. |

| Q: | What will happen if the Company stockholders do not approve the non-binding compensation advisory proposal? |

A: | The vote to approve the non-binding compensation advisory proposal is a vote separate and apart from the vote to adopt the merger agreement. Approval of the non-binding compensation advisory proposal is not a condition to completion of the merger and is advisory in nature only, meaning that it will not be binding on the Company or Parent or any of their respective subsidiaries. Accordingly, if the merger agreement is adopted by the Company stockholders and the merger is completed, the compensation that is based on or otherwise relates to the merger will be payable to our named executive officers in accordance with the terms of their compensation agreements and arrangements even if this proposal is not approved. |

| Q: | What do I need to do now? |

| A: | After carefully reading and considering the information contained in this proxy statement and the Annexes attached to this proxy statement, please vote your shares of Company common stock in one of the ways described below as soon as possible. You will be entitled to one vote for each share of Company common stock that you owned on the record date. |

| Q: | How do I vote if I am a stockholder of record? |

| A: | You may vote by: • submitting your proxy by completing, signing and dating each proxy card you receive and returning it by mail in the enclosed prepaid envelope; • submitting your proxy through the Internet or by phone by following the voting instructions printed on each proxy card you receive; or • appearing virtually at the special meeting and voting electronically. If you are submitting your proxy through the Internet or by phone, your voting instructions must be received by 11:59 p.m. Eastern Time on the day before the special meeting. Submitting your proxy by mail, through the Internet, or by phone will not prevent you from voting virtually at the special meeting. You are encouraged to submit a proxy by mail, through the Internet, or by phone even if you plan to virtually attend the special meeting to ensure that your shares of Company common stock are represented at the special meeting. If you return your signed and dated proxy card, but do not mark the boxes showing how you wish to vote, your shares will be voted “FOR” the proposal to adopt the merger agreement, “FOR” the approval of the non-binding compensation advisory proposal and “FOR” the approval of the proposal to adjourn the special meeting if necessary or appropriate. |

| Q: | If my shares are held for me by a bank, broker, trust or other nominee, will my bank, broker, trust or other nominee vote those shares for me with respect to the proposals? |

| A: | Your bank, broker, trust or other nominee will NOT have the power to vote your shares of Company common stock at the special meeting unless you provide instructions to your bank, broker, trust or other nominee on how to vote. You should instruct your bank, broker, trust or other nominee on how to vote your shares with respect to the proposals, using the instructions provided by your bank, broker, trust or other nominee. You may be able to vote through the Internet or by phone if your bank, broker, trust or other nominee offers this option. |

| Q: | What if I fail to instruct my bank, broker, trust or other nominee how to vote? |

| A: | Your bank, broker, trust or other nominee will NOT be able to vote your shares of Company common stock unless you have properly instructed your bank, broker, trust or other nominee on how to vote. Because the proposal to adopt the merger agreement requires the affirmative vote of two-thirds of the outstanding shares of Company common stock, the failure to provide your nominee with voting instructions will have the same effect as a vote “AGAINST” the proposal to adopt the merger agreement. |

| Q: | May I change my vote after I have mailed my proxy card or submitted my proxy through the Internet or by phone? |

A: | Yes. You may revoke your proxy or change your vote at any time before it is voted at the special meeting. You may revoke your proxy by delivering a signed written notice of revocation stating that the proxy is revoked and bearing a date later than the date of the proxy to the Secretary of the Company at USA Truck, Inc., 3200 Industrial Park Road, Van Buren, Arkansas 72956. You may also revoke your proxy or change your vote by submitting another proxy through the Internet or by phone in accordance with the instructions on the enclosed proxy card. You may also submit a later-dated proxy card relating to the same shares of Company common stock. If you voted by completing, signing, dating and returning the enclosed proxy card, you should retain a copy of the voter control number found on the proxy card in the event that you later decide to revoke your proxy or change your vote through the Internet or by phone. Alternatively, your proxy may be revoked or changed by virtually attending the special meeting and voting virtually. However, simply virtually attending the |

special meeting without voting will not revoke or change your proxy. “Street name” holders of shares of Company common stock should contact their bank, broker, trust or other nominee to obtain instructions as to how to revoke or change their proxies. If you have instructed a bank, broker, trust or other nominee to vote your shares, you must follow the instructions received from your bank, broker, trust or other nominee to change your vote. All properly submitted proxies received by us before the special meeting that are not revoked or changed prior to being exercised at the special meeting will be voted at the special meeting in accordance with the instructions indicated on the proxies or, if no instructions were provided, “FOR” each of the proposals. |

| Q: | What does it mean if I receive more than one proxy card? |

A: | If you receive more than one proxy card, it means that you hold shares of Company common stock that are registered in more than one account. For example, if you own your shares in various registered forms, such as jointly with your spouse, as trustee of a trust or as custodian for a minor, you will receive, and you will need to sign and return, a separate proxy card for those shares because they are held in a different form of record ownership. Therefore, to ensure that all of your shares are voted, you will need to submit your proxies by properly completing and mailing each proxy card you receive or through the Internet or by phone by using the different voter control number(s) on each proxy card. |

| Q: | What happens if I transfer my shares of Company common stock before the special meeting? |

A: | The record date for the special meeting is earlier than the date on which the merger is expected to be completed. If you own shares of Company common stock as of the close of business on the record date but transfer your shares prior to the special meeting, you will retain your right to vote at the special meeting, but the right to receive the merger consideration will pass to the person who holds such shares as of immediately prior to the effective time. |

| Q: | May I exercise dissenters’ rights or rights of appraisal in connection with the merger? |

A: | Yes. In order to exercise your appraisal rights, you must follow the requirements set forth in Section 262 of the DGCL. Under the Delaware law, holders of record of Company common stock who do not vote in favor of adopting the merger agreement will have the right to seek appraisal of the fair value of their shares as determined by the Court of Chancery if the merger is completed. Appraisal rights will be available to these holders only if they deliver a written demand for an appraisal to the Company prior to the vote on the proposal to adopt the merger agreement at the special meeting and they comply with the procedures and requirements set forth in Section 262 of the DGCL, which are summarized in this proxy statement. The appraisal amount could be more than, the same as or less than the amount a stockholder would be entitled to receive under the terms of the merger agreement. A copy of Section 262 of the DGCL is included as Annex C to this proxy statement. For additional information, see the section entitled “Appraisal Rights,” beginning on page 81. |

| Q: | If I hold my shares in certificated form, should I send in my stock certificates now? |

A: | No. Shortly after the merger is completed, stockholders holding certificated shares of Company common stock will be sent a letter of transmittal that includes detailed written instructions on how to return such stock certificates. You must return your stock certificates in accordance with such instructions in order to receive the merger consideration. PLEASE DO NOT SEND IN YOUR STOCK CERTIFICATE(S) NOW. |

| Q: | Should I do anything with respect to my Company equity awards now? |

A: | No. There is no need for you to do anything with respect to your Company equity awards at this time. For additional information, see the section entitled “The Agreement and Plan of Merger—Treatment of Company Equity Awards,” beginning on page 65. |

| Q: | When is the merger expected to be completed? |

A: | We and Parent are working toward completing the merger as quickly as possible. We currently anticipate that the merger will be completed by the end of 2022, but it is not certain when or if the conditions to the merger will be satisfied or, to the extent permitted, waived. The merger cannot be completed until the conditions to closing are satisfied (or, to the extent permitted, waived), including the adoption of the merger agreement by the Company stockholders and the receipt of certain regulatory approvals. For additional information, see the section entitled “The Agreement and Plan of Merger— Conditions to Consummation of the Merger,” beginning on page 77. |

| Q: | What happens if the merger is not completed? |

A: | If the proposal to adopt the merger agreement is not approved by the holders of two-thirds of the issued and outstanding shares of Company common stock entitled to vote on the matter or if the merger is not completed for any other reason, you will not receive any consideration from Parent or Merger Sub for your shares of Company common stock. Instead, the Company will remain a public company, and Company common stock will continue to be (i) registered under the Exchange Act and (ii) listed and traded on the NASDAQ. We expect that our management will operate our business in a manner similar to that in which it is being operated today and that holders of shares of Company common stock will continue to be subject to the same risks and opportunities to which they are currently subject with respect to their ownership of Company common stock. Under specified circumstances, the Company may be required to pay Parent the Company termination fee upon the termination of the merger agreement, as described in “The Agreement and Plan of Merger—Company Termination Fee” on page 80 of this proxy statement. If Parent or Merger Sub breaches the merger agreement (excluding a willful breach or fraud) or fails to perform under the merger agreement, then the Company’s sole and exclusive remedies (other than specific performance to the extent permitted under the merger agreement, as described in “The Agreement and Plan of Merger—Specific Performance” on page 81 of this proxy statement) against Parent, Merger Sub or any of their affiliates or representatives for any breach of, or failure to perform under, the merger agreement or any document delivered in connection with the merger agreement or otherwise will be for the Company to terminate the merger agreement in accordance with its terms. |

| Q: | Who is soliciting my vote? |

| A: | The Board is soliciting your proxy, and the Company will bear the cost of soliciting proxies. MacKenzie Partners, Inc. has been retained to assist with the solicitation of proxies. MacKenzie Partners, Inc. will be paid approximately $25,000 and will be reimbursed for specified out-of-pocket expenses for these and other advisory services in connection with the special meeting. Solicitation initially will be made by mail. Forms of proxies and proxy materials may also be distributed through brokers, custodians and other like parties to the beneficial owners of shares of Company common stock, in which case these parties will be reimbursed for their reasonable out-of-pocket expenses. Proxies may also be solicited in person or by telephone, facsimile, electronic mail or other electronic medium by MacKenzie Partners, Inc. or, without additional compensation, by the Parent or Merger Sub and certain of the Company’s, the Parent’s and Merger Sub’s directors, officers and employees. |

| Q: | Where can I find more information about the Company? |

| A: | We file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains a website, www.sec.gov, that contains reports, proxy, prospectus and other information regarding registrants, such as the Company. You can also find additional information about us at www.usa-truck.com. The information provided on our website is not part of this proxy statement and is not incorporated by reference in this proxy statement by this or any other reference to our website in this proxy statement. For a more detailed description of the information available, see the section entitled “Where You Can Find More Information,” beginning on page 89. |

| Q: | Who can help answer my questions? |

| A: | For additional questions about the merger, assistance in submitting proxies or voting shares of Company common stock or additional copies of this proxy statement or the enclosed proxy card(s), please contact our proxy solicitor: MacKenzie Partners, Inc. 1407 Broadway, 27th Floor New York, New York 10018 (212) 929-5500 (Call Collect) (800) 322-2885 (Toll Free) proxy@mackenziepartners.com (E-Mail Address) If your shares are held for you by a bank, broker, trust or other nominee, you should also call your bank, broker, trust or other nominee for additional information. |

| • | the satisfaction of the conditions precedent to the consummation of the merger, including, without limitation, the timely receipt of stockholder and regulatory approvals (or any conditions, limitations or restrictions placed on such approvals); |

| • | uncertainties as to the timing of the merger and the possibility that the merger may not be completed; |

| • | unanticipated difficulties or expenditures relating to the merger; |

| • | the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, including, in circumstances which would require the Company to pay the Company termination fee; |

| • | legal proceedings, judgments or settlements, including those that may be instituted against the Company, the Board, the Company’s executive officers and others following the announcement of the merger; |

| • | disruptions of current plans and operations caused by the announcement and pendency of the merger; |

| • | risks related to disruption of management’s attention from the Company’s ongoing business operations due to the merger; |

| • | potential difficulties in employee retention due to the announcement and pendency of the merger; |

| • | the response of customers, suppliers, drivers and regulators to the announcement and pendency of the merger; |

| • | disruptions in the execution of plans, strategies, goals and objectives of management for future operations caused by the merger; |

| • | changes in accounting standards or tax rates, laws or regulations; |

| • | continued and sufficient access to capital; |

| • | economic, market, business or geopolitical conditions (including resulting from the COVID-19 pandemic, inflation, or the conflict in Ukraine and related sanctions) or competition, or changes in such conditions, negatively affecting the Company’s business, operations and financial performance; |

| • | the fact that receipt of the all-cash per share price will be taxable to our stockholders that are U.S. taxpayers and may be taxable to our stockholders that are taxpayers in foreign jurisdictions; |

| • | risks that the price of the Company common stock price may decline significantly if the merger is not completed; |

| • | the possibility that the Company could, following the merger, engage in operational or other changes that could result in meaningful appreciation in its value; and |

| • | the possibility that the Company could, at a later date, engage in unspecified transactions, including restructuring efforts, special dividends or the sale of some or all of the Company’s assets to one or more as yet unknown purchasers, which could conceivably produce a higher aggregate value than that available to our stockholders in the merger. |

| • | a proposal to adopt the merger agreement, pursuant to which, subject to the satisfaction or waiver of certain specified conditions, Merger Sub will merge with and into the Company, with the Company continuing as the surviving corporation and a wholly owned subsidiary of Parent; |

| • | a proposal to approve, by a non-binding advisory vote, the compensation that may be paid or become payable to the Company’s named executive officers that is based on or otherwise relates to the merger, as discussed in the section entitled “The Merger—Interests of Directors and Executive Officers in the Merger,” beginning on page 51; and |

| • | a proposal to adjourn the special meeting to a later date or time if necessary or appropriate, including to solicit additional proxies in favor of the proposal to adopt the merger agreement if there are insufficient votes at the time of the special meeting to adopt the merger agreement. |

| • | The Board carefully reviewed and considered the terms and conditions of the merger agreement, the merger and the other transactions contemplated by the merger agreement and the unanimous recommendation of the Transaction Committee. By a unanimous vote, the Board (i) approved, adopted and declared advisable the merger agreement and the merger and the consummation by the Company of the transactions contemplated by the merger agreement, including the merger, (ii) authorized and approved the execution, delivery and performance of the merger agreement and the consummation by the Company of the transactions contemplated by the merger agreement, including the merger, (iii) determined that the transactions contemplated by the merger agreement, including the merger, are fair to and in the best interests of the Company and its stockholders, (iv) directed that a proposal to adopt the merger agreement be submitted to a vote at a meeting of the Company’s stockholders and (v) recommended that the Company’s stockholders vote for the adoption of the merger agreement. Accordingly, the Board unanimously recommends you vote “FOR” the proposal to adopt the merger agreement. |

| • | The Board unanimously recommends you vote “FOR” the non-binding compensation advisory proposal. |

| • | The Board unanimously recommends you vote “FOR” the approval of the proposal to adjourn the special meeting, if necessary or appropriate, to solicit additional proxies in favor of the proposal to adopt the merger agreement if there are insufficient votes at the time of the special meeting to adopt the merger agreement. |

| • | submitting your proxy by completing, signing and dating each proxy card you receive and returning it by mail in the enclosed prepaid envelope; |

| • | submitting your proxy through the Internet or by phone by following the voting instructions printed on each proxy card you receive; or |

| • | appearing virtually at the special meeting and voting electronically. |

| • | by submitting another proxy through the Internet or by phone, in accordance with the instructions on the accompanying proxy card; |

| • | by delivering a signed written notice of revocation bearing a date later than the date of the proxy to the Company’s Secretary at 3200 Industrial Park Road, Van Buren, Arkansas 72956, stating that the proxy is revoked; |

| • | by submitting a later-dated proxy card relating to the same shares of Company common stock; or |

| • | by attending the special meeting and voting virtually (your attendance at the special meeting will not, by itself, revoke your proxy; you must vote virtually at the special meeting). |

| • | approved, adopted and declared advisable the merger agreement and the merger and the consummation by the Company of the transactions contemplated by the merger agreement, including the merger; |

| • | authorized and approved the execution, delivery and performance of the merger agreement and the consummation by the Company of the transactions contemplated by the merger agreement, including the merger; |

| • | determined that the transactions contemplated by the merger agreement, including the merger, are fair to and in the best interests of the Company and its stockholders; |

| • | directed that a proposal to adopt the merger agreement be submitted to a vote at a meeting of the Company stockholders; and |

| • | recommended that the Company stockholders vote for the adoption of the merger agreement. |

| • | Financial Terms; Certainty of Value |

| o | recent and historical market prices, volatility and trading information with respect to the Company common stock, including that the merger consideration of $31.72 per share of Company common stock as of June 23, 2022, represented a substantial premium to the Company’s recent closing and historical stock prices of: |