Investor Presentation May/June 2017 Exhibit 99.1

Forward-Looking Statement Certain statements in this report may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that include projections, predictions, expectations, or beliefs about future events or results or otherwise and are not statements of historical fact. Such statements are often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” “intend,” “will,” or words of similar meaning or other statements concerning opinions or judgment of the Company and its management about future events. Although the Company believes that its expectations with respect to forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results, performance, or achievements of the Company will not differ materially from any future results, performance, or achievements expressed or implied by such forward-looking statements. Actual future results and trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to, the effects of and changes in: general economic and bank industry conditions, the interest rate environment, legislative and regulatory requirements, competitive pressures, new products and delivery systems, inflation, changes in the stock and bond markets, accounting standards or interpretations of existing standards, mergers and acquisitions, technology, and consumer spending and savings habits. More information is available on the Company’s website, http://investors.bankatunion.com and on the Securities and Exchange Commission’s website, www.sec.gov. The information on the Company’s website is not a part of this presentation. The Company does not intend or assume any obligation to update or revise any forward-looking statements that may be made from time to time by or on behalf of the Company. 2

Company Snapshot 3 Overview Branch Map • Shares listed under “UBSH” on NASDAQ • Headquartered in Richmond, VA • 100+ years of banking history • 113 branches across more than 50 counties and 10 MSAs throughout Virginia - Only Virginia-based bank with a statewide footprint - Largest community banking organization headquartered in Virginia Financial Highlights as of 3/31/2017 Market data as of March 31, 2017 Source: SNL Financial UBSH (113) ($ Millions) Total Assets $8,669.9 Total Loans Held For Investment 6,554.1 Total Deposits 6,614.2 Shareholders' Equity 1,015.6 Market Capitalization 1,536.7 Capital Ratios Tier 1 Common Capital (CET1) 9.55% Tier 1 Leverage 9.79% Tier 1 Capital 10.77% Total Capital 13.29% Tangible Common Equity / Tangible Assets 8.36%

Diversity Supports Growth in Virginia Richmond • State Capital • Fortune 500 headquarters (6) • Finance and insurance • VCU & VCU Medical Center Fredericksburg • Defense and security contractors • Health care • Retail • Real Estate development Charlottesville • University of Virginia & Medical College • High-tech and professional businesses • Real Estate development Northern Virginia • Nation’s Capital • Defense and security contractors • Associations (lobbyists) • High tech Virginia Beach - Norfolk • Military • Shipbuilding • Fortune 500 headquarters (3) • Tourism Roanoke - Blacksburg • Virginia Tech • Health care • Retail • Fortune 500 headquarters (1) 4

Union Bank & Trust Key Statistics • 113 (-10 in 2016; -1 YTD 2017) Branches • 1,309 Full Time Equivalent • 58 Commercial Bankers • $6.55 billion Loans • $6.61 billion Deposits • 178+ thousand Consumer Households 5 Union is the only Virginia-based bank with a statewide footprint

MSA Market Share Rank Company Deposits Total Market Deposits Market Share Roanoke Deposits: $378 mm Market Tot.: $7.3 bn Mkt. Share: 5.2% Rank: #6 Branches: 8 Staunton / Harrisonburg Rank: #2 Deposits: $516 mm Market Tot.: $4.0 bn Mkt. Share: 12.9% Branches: 11 Blacksburg Rank: #2 Deposits: $614 mm Market Tot.: $3.0 bn Mkt. Share: 20.9% Branches: 9 Charlottesville Rank: #5 Deposits: $447 mm Market Tot.: $4.3 bn Mkt. Share: 9.6% Branches: 8 Richmond Rank: #5 Deposits: $1.8 bn Market Tot.: $34.5 bn Mkt. Share: 5.3% Branches: 32 Culpeper Rank: #2 Deposits: $484 mm Market Tot.: $2.9 bn Mkt. Share: 16.9% Branches: 8 Fredericksburg Rank: #1 Deposits: $886mm Market Tot.: $4.0 bn Mkt. Share: 22.4% Branches: 13 Statewide Rank: #7 Deposits: $6.1bn Market Tot.: $191bn Mkt. Share: 3.2% Branches: 113 Strong Presence Across All Major Virginia Markets Northern Neck Rank: #2 Deposits: $323mm Market Tot.: $1.6 bn Mkt. Share: 21.0% Branches: 9 Virginia Beach Rank: #14 Deposits: $157mm Market Tot.: $23.7 bn Mkt. Share: 0.7% Branches: 5 Source: SNL Financial; Deposit data as of 6/30/2016; Branch count as of 1/31/17 6

Source: SNL Financial; Deposit data as of 6/30/2016; Pro forma for recent acquisitions Largest Community Bank Headquartered in Virginia Deposit Market Share – Virginia 7 Rank Parent Company Name Number of Branches Total Deposits ($000) Total Deposit Market Share (%) 1 Wells Fargo & Co. (CA) 287 38,612,667 20.1 2 Bank of America Corp. (NC) 140 26,154,322 13.6 3 BB&T Corp. (NC) 351 22,630,570 11.8 4 SunTrust Banks Inc. (GA) 203 19,014,719 9.9 5 Capital One Financial Corp. (VA) 74 14,811,622 7.7 6 United Bankshares Inc. (WV) 83 7,089,799 3.7 7 Union Bankshares Corp. (VA) 115 6,101,710 3.2 8 TowneBank (VA) 33 5,704,362 3.0 9 Carter Bank & Trust (VA) 88 3,948,043 2.1 10 PNC Financial Services Group Inc. (PA) 100 3,479,206 1.8 Other Market Participants (122) 987 44,197,077 23.1 Market Total 2,461 191,744,097 100.0

Union Wealth Management Key Statistics • Trust, Asset Management, Private Banking, Brokerage and Financial Planning Services • Acquired Old Dominion Capital Management in May 2016 Growth • $2.4B in AUM and AUA, the majority of which is managed assets Size • $2.8 million, +$650,000 from 1Q16 Income • Organic and acquisitions Opportunity 8

1Q 2017 Financial Highlights 9 • $19.1million, +$2.2 million or +12.8%, from 1Q16 Net Income • $0.44, +6 cents, or 15.8%, from 1Q16 Earnings per share • 92 basis points, + 4 bps from 1Q16 ROA • 11.20%, +107 bps from 1Q16 ROTCE • 65.3%, -82 bps from 1Q16 Efficiency • +3.9% from 4Q16, annualized to 15.7% Loans • +3.7% from 4Q16, annualized to 14.7% Deposits

Balance Sheet Trends 10 $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 2012 2013 2014 2015 2016 1Q2017 $3,298 $3,237 $5,639 $5,964 $6,379 $6,614 Deposits ($M) $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 2012 2013 2014 2015 2016 1Q2017 $2,967 $3,039 $5,346 $5,671 $6,307 $6,554 Loans ($M) $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 $8,000,000 $9,000,000 2012 2013 2014 2015 2016 1Q2017 $4,096 $4,177 $7,359 $7,694 $8,427 $8,670 Assets ($M)

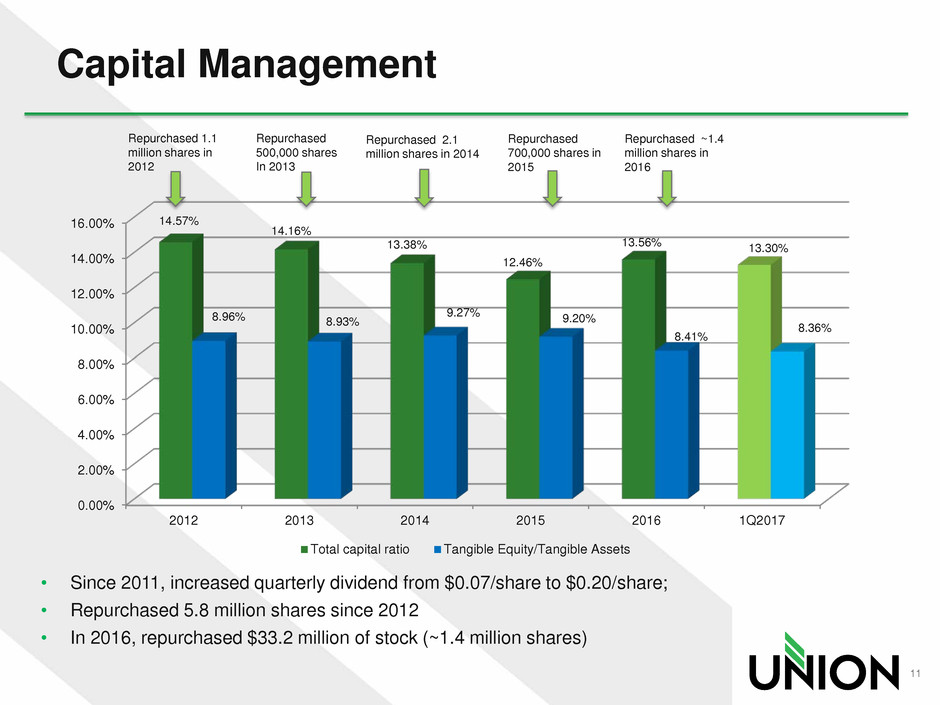

0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 2012 2013 2014 2015 2016 1Q2017 14.57% 14.16% 13.38% 12.46% 13.56% 13.30% 8.96% 8.93% 9.27% 9.20% 8.41% 8.36% Total capital ratio Tangible Equity/Tangible Assets Repurchased 1.1 million shares in 2012 Capital Management 11 • Since 2011, increased quarterly dividend from $0.07/share to $0.20/share; • Repurchased 5.8 million shares since 2012 • In 2016, repurchased $33.2 million of stock (~1.4 million shares) Repurchased 500,000 shares In 2013 Repurchased 2.1 million shares in 2014 Repurchased 700,000 shares in 2015 Repurchased ~1.4 million shares in 2016

Profitability Ratios and Income Trends * excludes after-tax acquisition expenses and acquisition accounting impact 12 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 2012* 2013* 2014* 2015* 2016* 1Q17* 0.89% 0.90% 0.91% 0.90% 0.96% 0.92% Return on Average Assets (ROA) 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 2012* 2013* 2014* 2015* 2016* 1Q17* 9.89% 10.05% 10.13% 10.00% 11.45% 11.20% ROTCE 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 2012* 2013* 2014* 2015* 2016*1Q2017* 4.24% 4.18% 3.93% 3.79% 3.72% 3.58% Net Interest Margin $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 2012 2013* 2014* 2015* 2016* 1Q2017* $35,262 $36,408 $65,888 $67,079 $77,476 $19,124 Net Income ($)

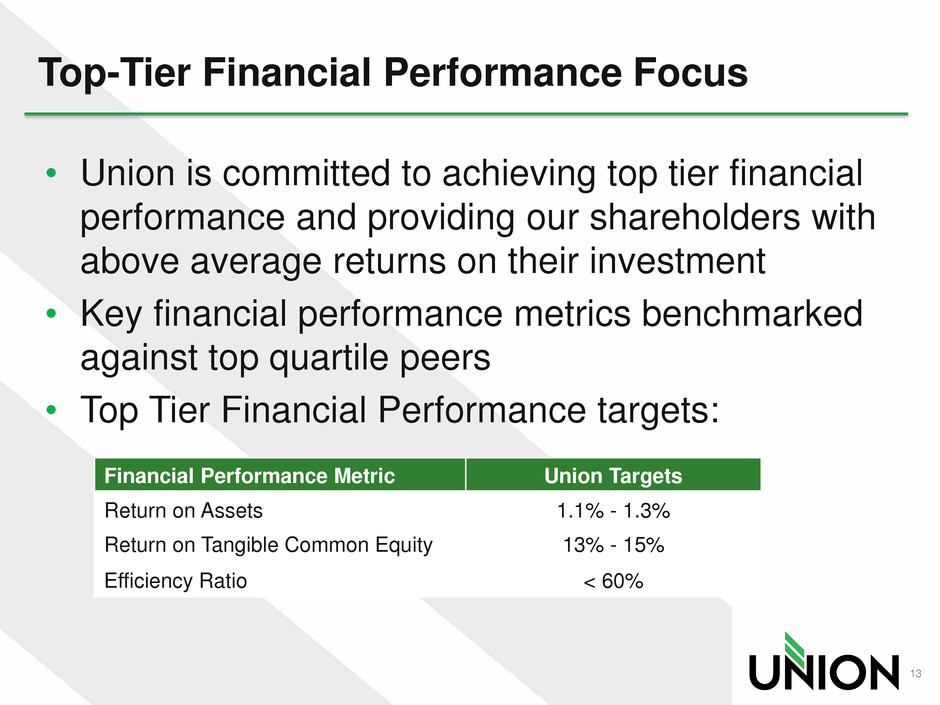

Top-Tier Financial Performance Focus • Union is committed to achieving top tier financial performance and providing our shareholders with above average returns on their investment • Key financial performance metrics benchmarked against top quartile peers • Top Tier Financial Performance targets: 13 Financial Performance Metric Union Targets Return on Assets 1.1% - 1.3% Return on Tangible Common Equity 13% - 15% Efficiency Ratio < 60%

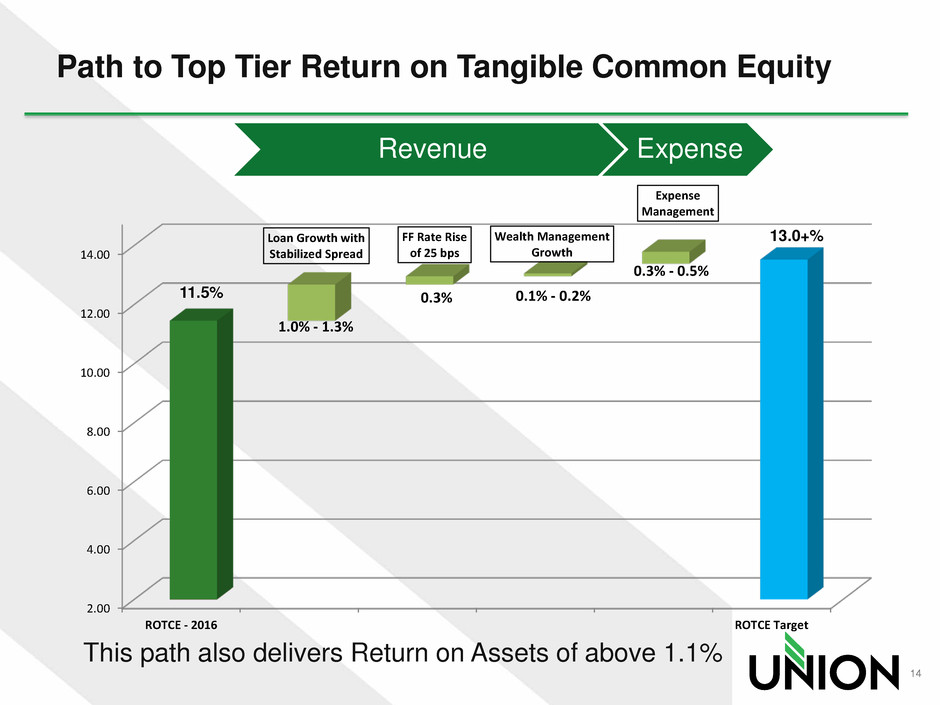

Path to Top Tier Return on Tangible Common Equity Revenue Expense This path also delivers Return on Assets of above 1.1% 14 2.00 4.00 6.00 8.00 10.00 12.00 14.00 ROTCE - 2016 ROTCE Target 11.5% 1.0% - 1.3% 0.3% 0.1% - 0.2% 0.3% - 0.5% Loan Growth with Stabilized Spread FF Rate Rise of 25 bps Wealth Management Growth Expense Management 13.0+%

2017 Outlook • Expect stable economy in Virginia footprint Economy • Low double digit Loan Growth • Stabilizing in 2Q • Modest expansion in second half of 2017 Net Interest Margin • Expect improvement in return on assets, return on tangible common equity and efficiency ratio vs. 2016 Key Financial Metrics 15

2017 Priorities 16 • Loan portfolio • Revenue streams Diversification • Pace loan growth with deposit growth • Target 95% loan to deposit ratio over time Core Funding • Drive efficiency ratio <60% • More revenue + lower cost structure Efficiency • Finalize preparations in 2017 $10 billion asset crossing

Value Proposition • Statewide branch footprint is a competitive advantage and brings a unique franchise value Scale • Balance sheet and Capital levels Strength • Organic and acquisition opportunities Growth • Committed to top-tier financial performance Opportunity • Solid dividend yield and payout ratio with earnings upside Shareholder 17

APPENDIX 18

CEO Succession Plan • John Asbury became President & CEO of Union Bank & Trust and President of Union Bankshares Corporation on October 1; CEO of Holding company on January 2, 2017 – succeeding Billy Beale. • Asbury was most recently President and CEO of First National Bank of Santa Fe, a multi-state bank located in the Southwest • Prior to that, he was Senior Executive Vice President at Regions responsible for all lines serving business and commercial customers and managed a $50 billion book of business • Senior Vice President at Bank of America – served in a variety of roles last position responsible for all Pacific Northwest Region business banking • Asbury joined the board on October 1 • Billy was Executive Vice Chairman through March 31 and was re-elected to board in May 2017 and will serve as an advisor to the CEO and Board 19

Diversified Loan Portfolio 20 Source: SNL Financial, Company documents Loan Composition at March 31, 2017 – $6.554 Billion Portfolio Characteristics Average loan size $143,000 Weighted average maturity 83 months Yield YTD (Tax Equivalent) 4.35% Composition By Type Composition By Region NOO CRE/Total Capital Ratio: 300% ADC/Total Capital: 81% Residential 1-4 Family 16% NOOCRE 30% Owner Occupied CRE 13% C&D 12% Second Mortgages 1% Equity LOC 8% C&I 9% Personal 9% Other 2% Charlottesville 16% Richmond 27% Fredericksburg 14% Northern Neck 3% Hampton Roads 8% Rappahannock 9% Northern Virginia 3% Southwest & Charlotte 11% Corporate 8%

Commercial Real Estate Portfolio 21 Source: SNL Financial, Company documents CRE Composition at March 31, 2017 - $2.856 Billion Portfolio Characteristics 10 largest loans 7.0% of CRE portfolio 10 largest loans 2.6% of total loan portfolio Weighted average maturity 61 months Weighted average coupon 3.99% Composition By Type Composition By Region Owner Occupied 31% Retail 14% Office 14% Office Warehouse 8% Hotel, Motel, B&B 7% Special Use 10% Small Mixed Use Building 4% Other 0% Multifamily 12% Charlottesville 19% Richmond 27% Fredericksburg 14% Northern Neck 1% Hampton Roads 12% Rappahannock 4% Northern Virginia 7% Southwest & Charlotte 9% Corporate 7%

Construction and Development Loans 22 Source: Company documents C&D Composition at March 31, 2017 - $770 million Portfolio Characteristics 10 largest loans 17.0% of C&D portfolio 10 largest loans 2.6% of total loan portfolio Weighted average maturity 20 months Weighted average coupon 4.21% C&D Loans/Total Capital Ratio 81.0% • 36.0% commercial construction, 23.2% residential construction and remainder of portfolio divided between raw land, land development and lots • Most C&D loans have interest reserves • Residential A&D loans must have 50% or more of the lots under contract to close • CRE construction loans must be approved with a UB&T-provided mini-perm Charlottesville 13% Richmond 41% Fredericksburg 16% Northern Neck 1% Hampton Roads 10% Rappahannock 3% Northern Virginia 4% Southwest & Charlotte 4% Corporate 8%

Core Deposit Base 23 (1) Time deposits greater than $100,000 Note: Minimal exposure to CDARS/ICS deposits Source: SNL Financial, Company documents Deposit Composition at March 31, 2017 - $6.614 Billion Deposit Base Characteristics Average cost of interest bearing deposits 41 basis points Average total cost of deposits 32 basis points Ranked 1st in deposit market share for community banks in Richmond MSA Ranked 1st in deposit market share for community banks in Charlottesville MSA Ranked 2nd in deposit market share in Blacksburg-Christiansburg-Radford MSA 50% in transactional accounts Non-interest Bearing 23% NOW 27% Money Market 23% Savings 9% Jumbo Time¹ 8% Retail Time 10%

Union Mortgage Group • 22 offices: 20 in Virginia, 1 each in Maryland and North Carolina • 101 FTEs – 39 loan officers • $100.2 million of originations 1Q17; (34% refinance) • $4,000 net income in 1Q17 • Opportunities: • Salesforce expansion in Virginia growth markets • Process improvement 24