Filed by First Data Corporation

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-6

of the Securities Exchange Act of 1934

Commission File No: 001-31527

Subject Company: Concord EFS, Inc.

This communication is not a solicitation of a proxy from any security holder of Concord EFS, Inc. First Data Corporation has filed a proxy statement/prospectus with the Securities and Exchange Commission (SEC) concerning the planned merger of Concord EFS, Inc. with a subsidiary of First Data Corporation. WE URGE INVESTORS TO READ THE DEFINITIVE VERSION OF THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain the documents free of charge at the SEC’s website, www.sec.gov. In addition, documents filed with the SEC by First Data Corporation will be available free of charge from First Data Investor Relations, 6200 S. Quebec St., Suite 340, Greenwood Village, CO, 80111. Documents filed with the SEC by Concord EFS, Inc. will be available free of charge from Concord Investor Relations, 2525 Horizon Lake Drive, Suite 120, Memphis, TN, 38133.

First Data, its directors and executive officers and other members of its management and employees, may be deemed to be participants in the solicitation of proxies in connection with the planned merger. Information about the directors and executive officers of First Data and their ownership of First Data stock is set forth in the proxy statement for First Data’s 2003 annual meeting of stockholders. Investors may obtain additional information regarding the interests of the participants by reading the proxy statement/prospectus.

FIRST DATA CORPORATION USED THE FOLLOWING PRESENTATION AS PART OF A WEBCAST INVESTOR AND ANALYST MEETING HELD ON FEBRUARY 3, 2004:

February 3, 2004

Safe Harbor

Statements in this presentation regarding First Data Corporation’s business which are not historical facts are “forward-looking statements.” All forward-looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected. Please refer to the company’s meaningful cautionary statements contained in the appendix of this presentation and the company’s most recent earnings release for a more detailed list of risks and uncertainties.

David Banks,SVP

Investor Relations

Welcome & Opening Comments

Charlie Fote

Chairman and CEO

Key Takeaways

• Flawless execution

• Strength of enterprise

• Recurring revenue

• Long-term growth

• Right people

Ultimate Focus on Shareholder Return

Agenda

• Introductions

• 2003 Financial Review

• 2004 Strategy & Outlook

• Enterprise Payments

• Western Union

• Card Issuing, Emerging Payments, International

• Questions & Answers

Senior Management Team

Scott Betts

President

Enterprise Payments

Pam Patsley

President

First Data International

Jim Schoedinger

President

Card Issuing Services

Senior Management Team

Christina Gold

President Western Union

Bill Thomas

President of Americas Western Union

Mike Yerington

President,

Global Business Development Western Union

Senior Management Team

Kim Patmore

Chief Financial Officer

Mike Whealy

Chief Administrative Officer

Senior Management Team

Guy Battista

Chief Information Officer

Mike D’Ambrose

Human Resources

2003

Financial Review

Strong, Consistent Record of Growth

Revenue

12% CAGR $8.4 $5.9

2000 2003

Highly Visible, Recurring Revenue Streams

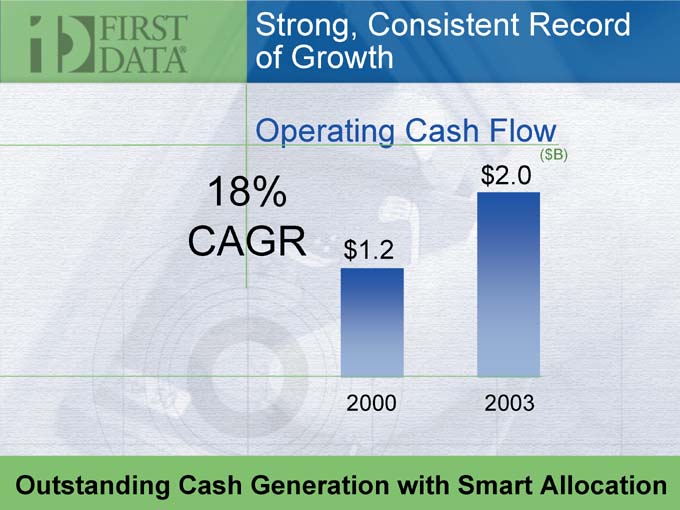

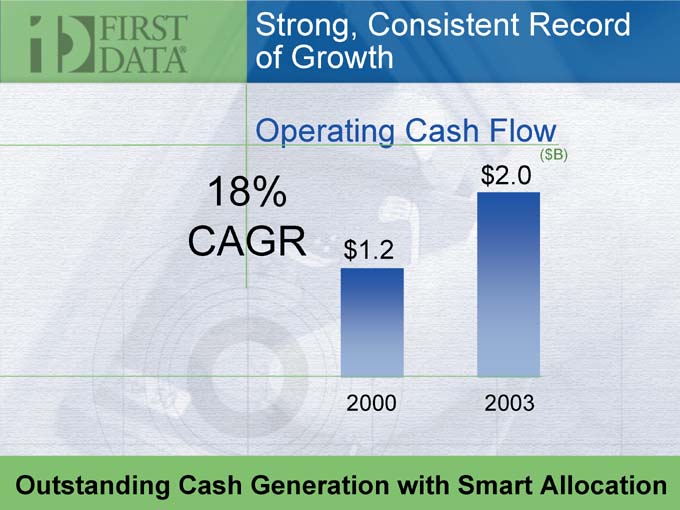

Strong, Consistent Record of Growth

Operating Cash Flow

18% CAGR

$2.0 $1.2

2000 2003

Outstanding Cash Generation with Smart Allocation

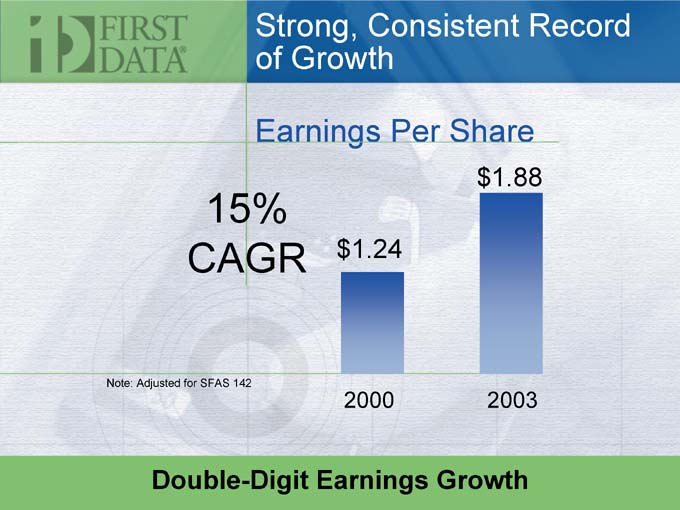

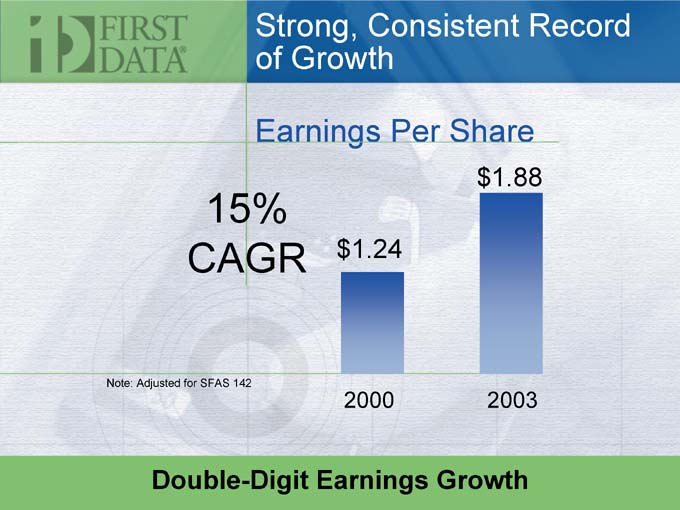

Strong, Consistent Record of Growth

Earnings Per Share

15% CAGR

Note: Adjusted for SFAS 142 $1.88 $1.24

2000 2003

Double-Digit Earnings Growth

Resulting in Outstanding Returns

December 31, 1992—2003

378%

217%

155%

196%

Shareholder Value Remains High Priority

Ended the Year with a Strong Quarter

Q4 Financial Highlights

Up 11% Revenue $2.2B Up 20% EPS $0.55 25% Margin

2003

Financial Review

Kim Patmore,

Chief Financial Officer

Strong Cash Flow Generation

Operating Cash Flow $2B

• Investments in the business

• Acquisitions

• Capital structure

Disciplined, Smart Cash Allocation

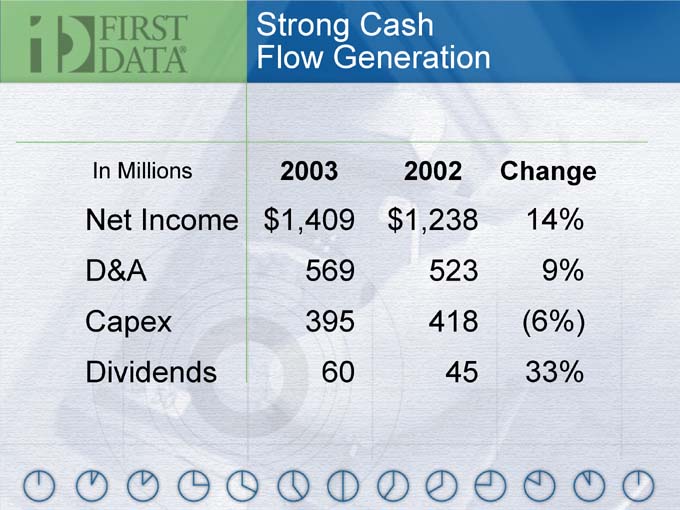

Strong Cash Flow Generation

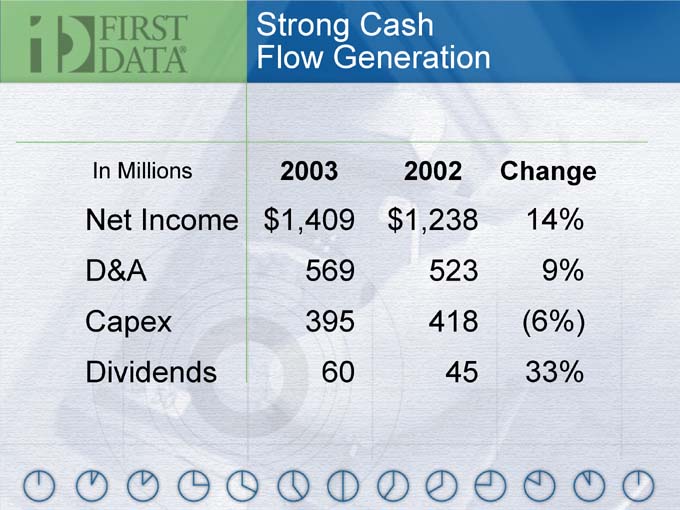

In Millions 2003 2002 Change

Net Income $ 1,409 $ 1,238 14%

D&A 569 523 9%

Capex 395 418 (6%)

Dividends 60 45 33%

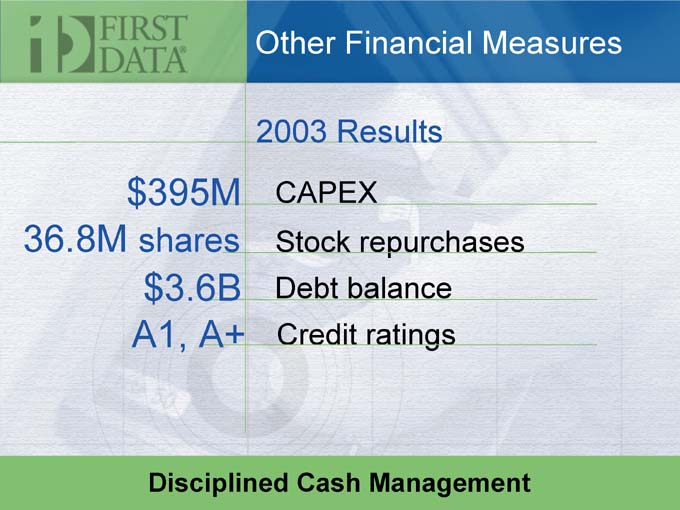

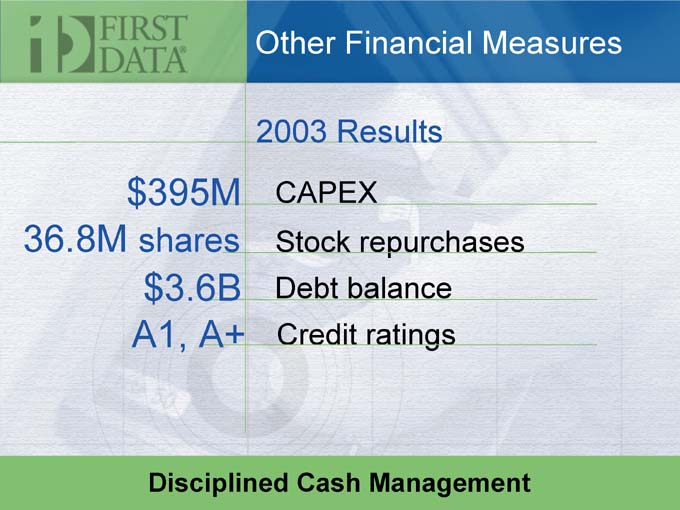

Other Financial Measures

2003 Results

$395M CAPEX

36.8M shares Stock repurchases

$3.6B Debt balance

A1, A+ Credit ratings

Disciplined Cash Management

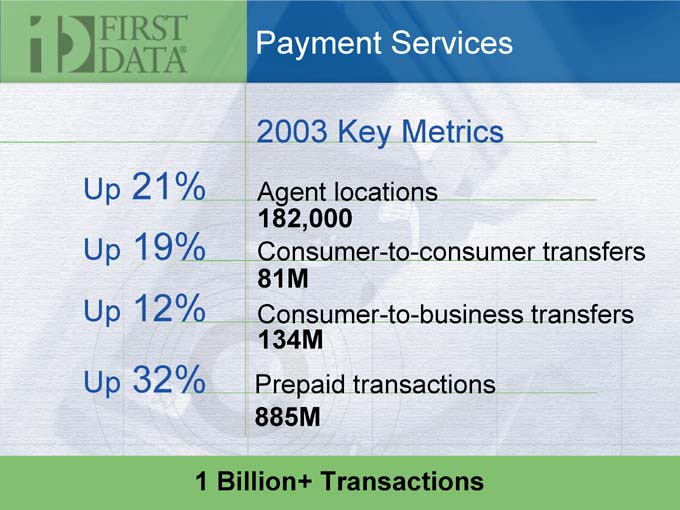

Payment Services

2003 Results

Up 15% Revenue $3.7B

Up 18% Profit $1.2B

34% Margin

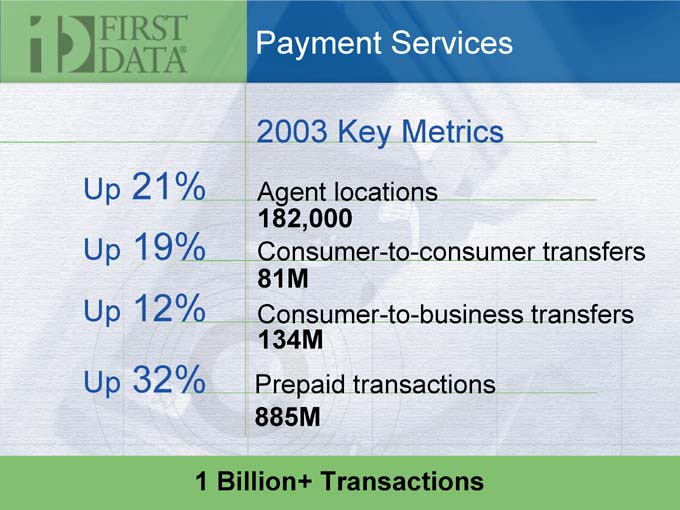

Payment Services

2003 Key Metrics

Up 21% Agent locations

182,000

Up 19% Consumer-to-consumer transfers

81M

Up 12% Consumer-to-business transfers

134M

Up 32% Prepaid transactions

885M

1 Billion+ Transactions

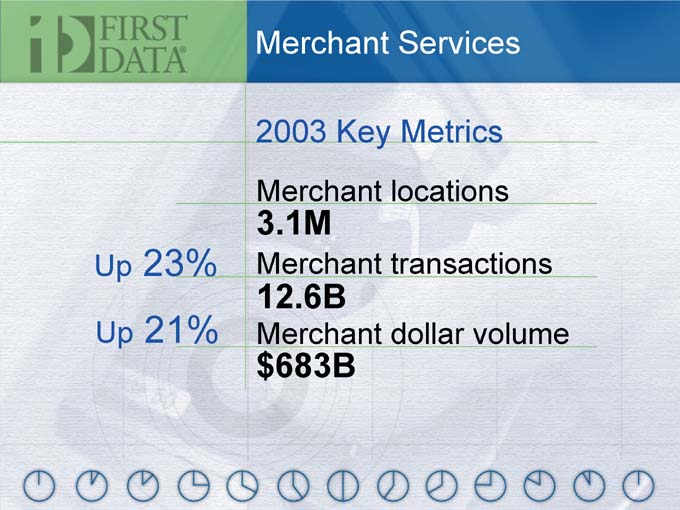

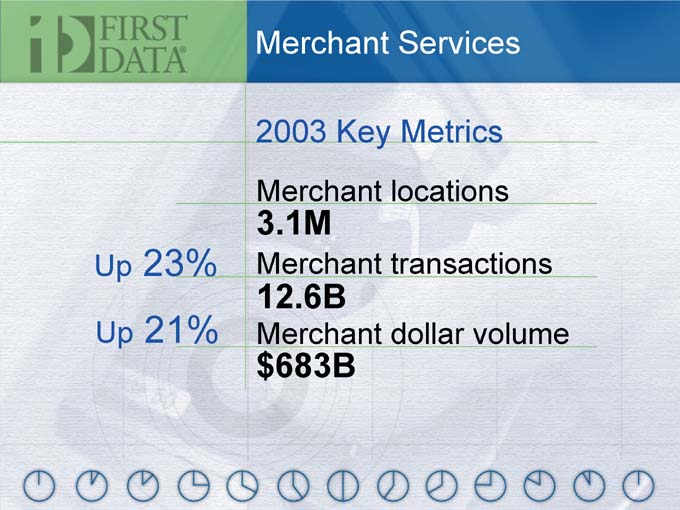

Merchant Services

2003 Results

Up 14% Revenue $3.0B Up 13% Profit $807M

27% Margin

Merchant Services

2003 Key Metrics

Merchant locations

3.1M

Up 23% Merchant transactions

12.6B

Up 21% Merchant dollar volume

$683B

Card Issuing Services

2003 Results

Up 6% Revenue $2.0B Down 18% Profit $306M

15% Margin

Up 7% Card accounts on file 348M

Charlie Fote

2004 Strategy & Outlook

Three Pillars of Success

Unity of Purpose Dedication to Performance Scope of Enterprise Capabilities

Three Pillars of Success

We are, and will be, wherever transactions occur – next door or around the world

We promote choice, voice and innovation

Unity of Purpose

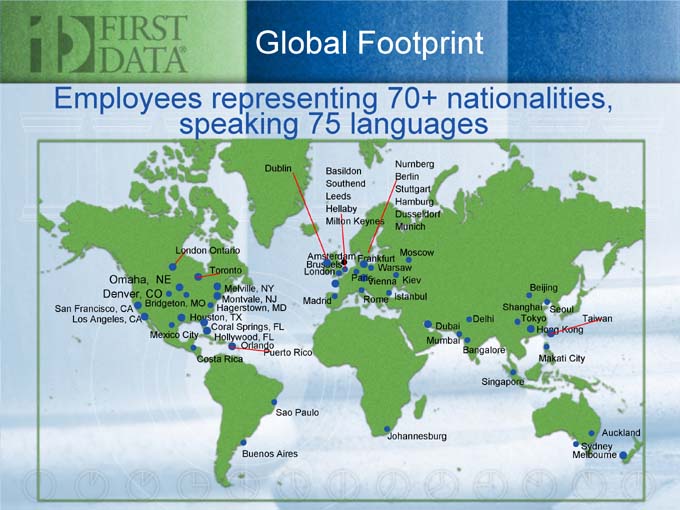

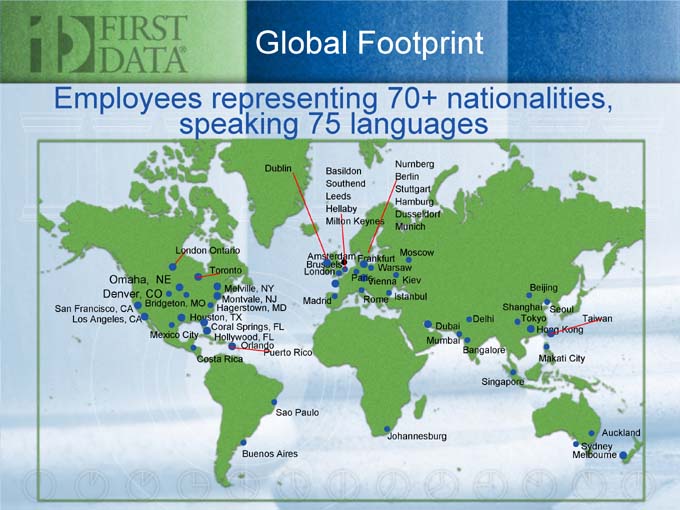

Global Footprint

Employees representing 70+ nationalities,speaking 75 languages

Western Union Agent Footprint

• Continually building super agent relationships for international growth

• We are the super agent in U.S.

Source: Celent Communications, 2002

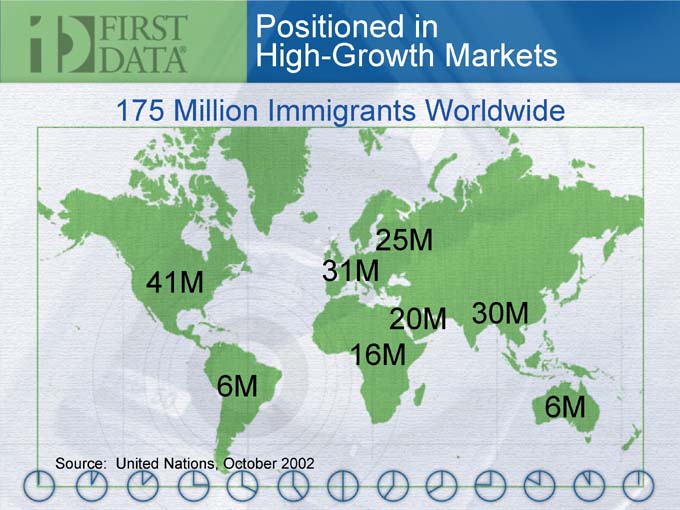

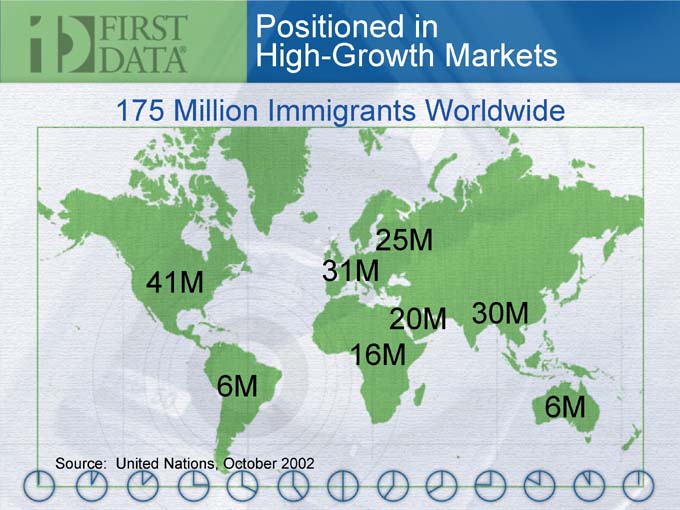

Positioned in High-Growth Markets

175 Million Immigrants Worldwide

25M

41M

6M

31M

20M

16M

30M

6M

Source: United Nations, October 2002

Payments

Market Value Chain

Touch Points in Payments Marketplace

Merchant POS presence

Card issuing

Network

Acquiring & processing

Single Source Provider of End-to-End Payment Solutions

Choice, Voice and Innovation

• Address unique client needs

• Scope & expertise

• Innovations

– Loyalty cards

– Gift cards –Electronic checkacceptance –Internet checkacceptance

Three Pillars of Success

Dedication to Performance

History of generating efficiencies – benefiting consumers, merchants and banks alike

Handling tens of billions of transactions—one transaction at a time

Historical Set Up of Efficiencies

Execution

• 6:30 a.m. Daily Call

– Customer issues

– Volume reports

• Six Sigma

•$ 1M spend requires executive committee approval

• Quarterly deep reviews of Balance Sheet

• Constant review of open position report

Broadest Product Offering

Merchant Card Money Check Acquiring Processing Transfer Guarantee

Enterprise-wide solutions

Three Pillars of Success

Scope of Enterprise Capabilities

Handling trillions of dollars per year,via 25 billion transactions, executed one at a time Aligning products, services and expertise with highest growth opportunities

Enterprise Scope

• Handled 25 billion transactions during 2003

• Western Union—14% worldwide volume*

• We moved from point A to point B $683 billion on behalf of our merchants

*Source: Celent Communications, 2002

Size in this Business is Good

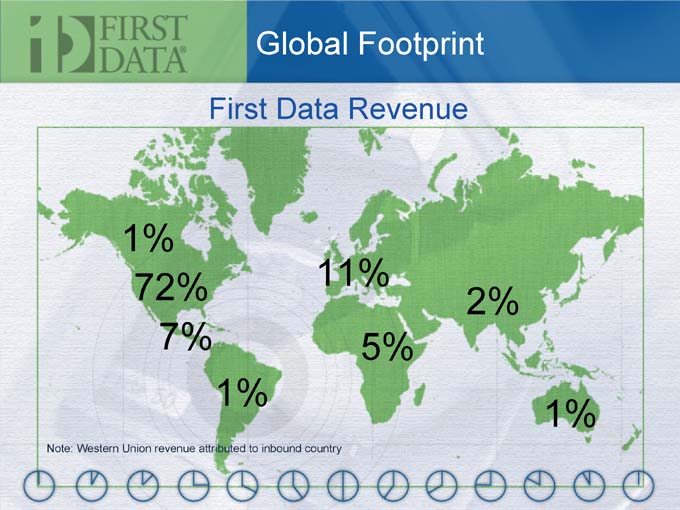

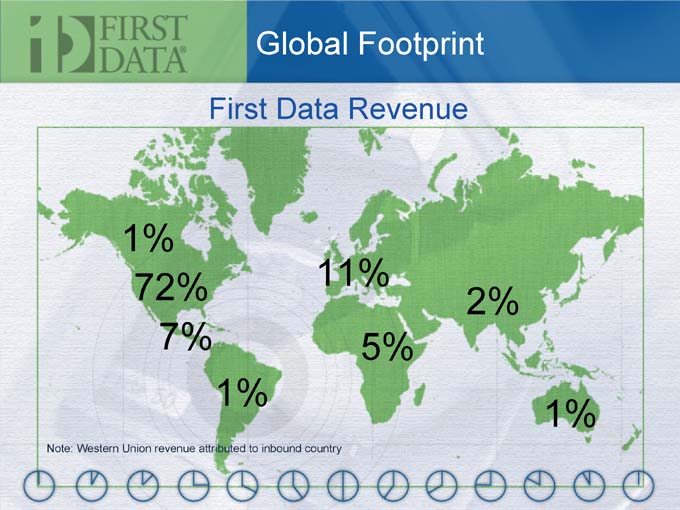

Global Footprint

First Data Revenue

1%

72%

7%

1%

11%

5%

2%

1%

Note: Western Union revenue attributed to inbound country

Partner Strategy

• Bank alliances

• Western Union agents

• Card issuers

Aligned with Growth Focused Partners

High-Growth Opportunities

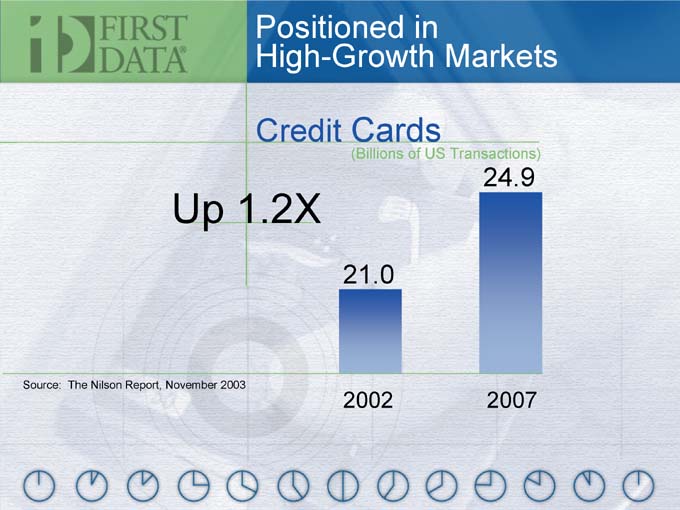

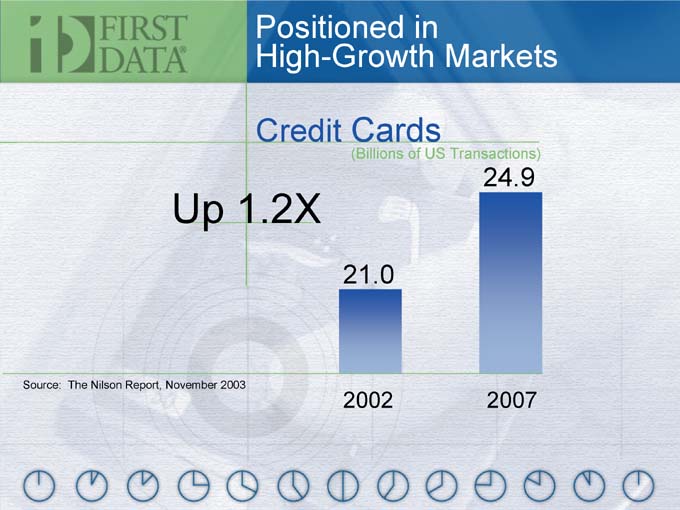

Positioned in High-Growth Markets

Credit Cards

(Billions of US Transactions)

Up 1.2X

24.9

21.0

Source: The Nilson Report, November 2003

2002

2007

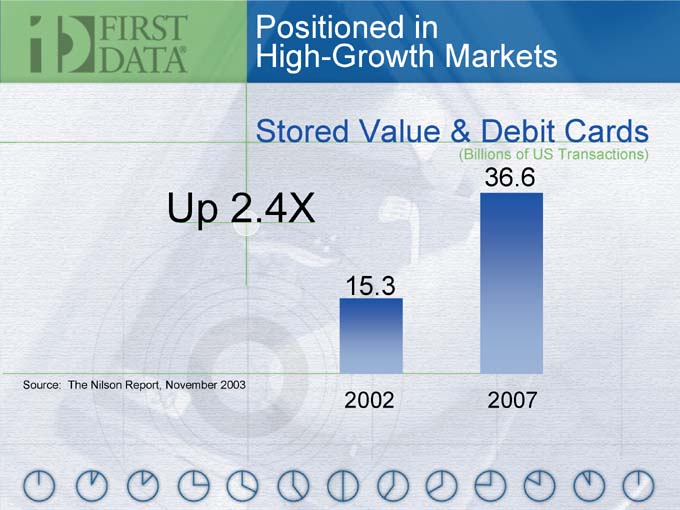

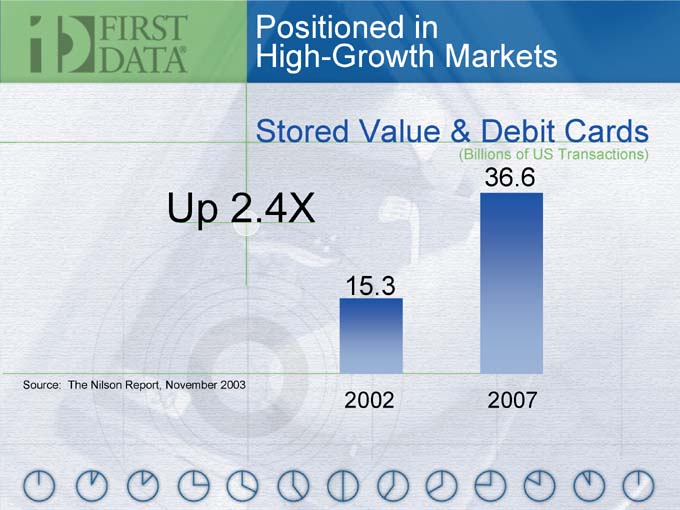

Positioned in High-Growth Markets

Stored Value & Debit Cards

(Billions of US Transactions)

Up 2.4X

36.6

15.3

2002

Source: The Nilson Report, November 2003

2007

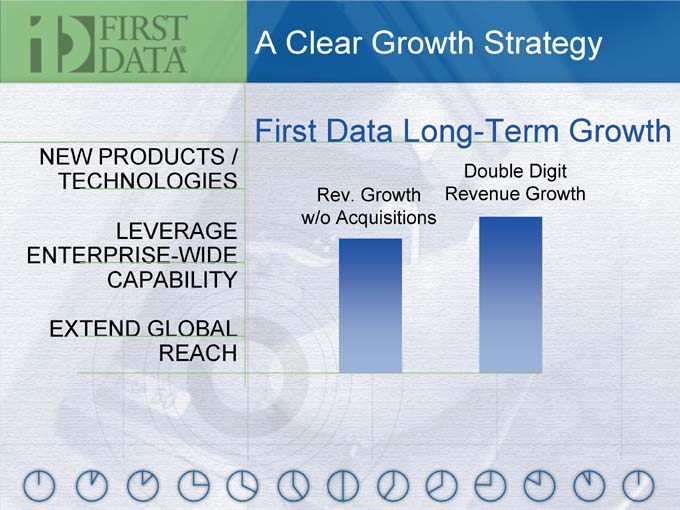

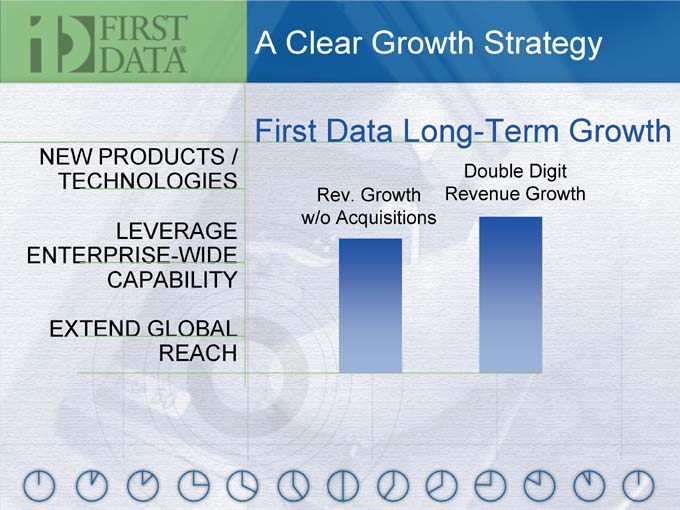

A Clear Growth Strategy

First Data Long-Term Growth

NEW PRODUCTS / TECHNOLOGIES

LEVERAGE ENTERPRISE-WIDE

CAPABILITY

EXTEND GLOBAL

REACH

Rev. Growth w/o Acquisitions

Double Digit Revenue Growth

Our International Revenue Goal in 2007

28% 33% International International

2003 2007

New Structure—Vision

First Data Market Position

• Extreme focus on scale businesses that fit into our core

• Aligning products, services and expertise to meet marketplace demands

Aligned to Meet Marketplace Demands

2004 Outlook

First Data 2004 Outlook

• Understanding 2003 EPS

• 2004 outlook

• Long-term growth objectives

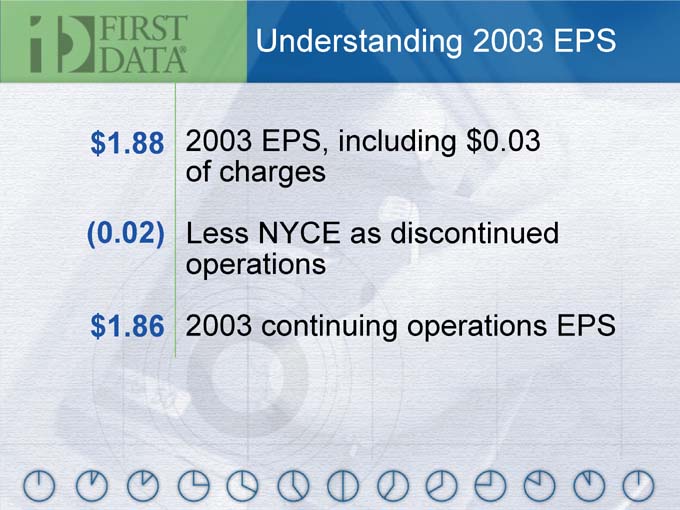

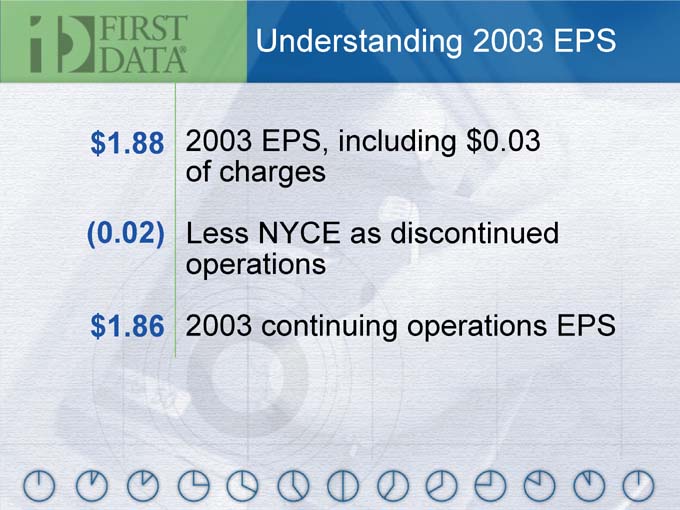

Understanding 2003 EPS $1.88 2003 EPS, including $0.03 of charges (0.02) Less NYCE as discontinued operations

$1.86 2003 continuing operations EPS

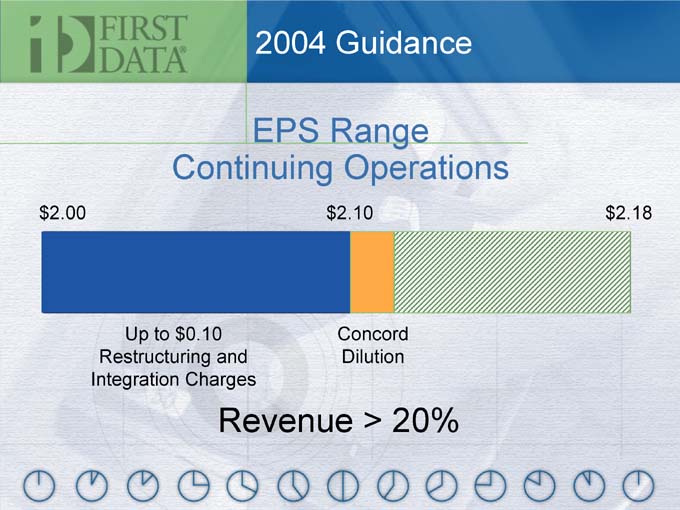

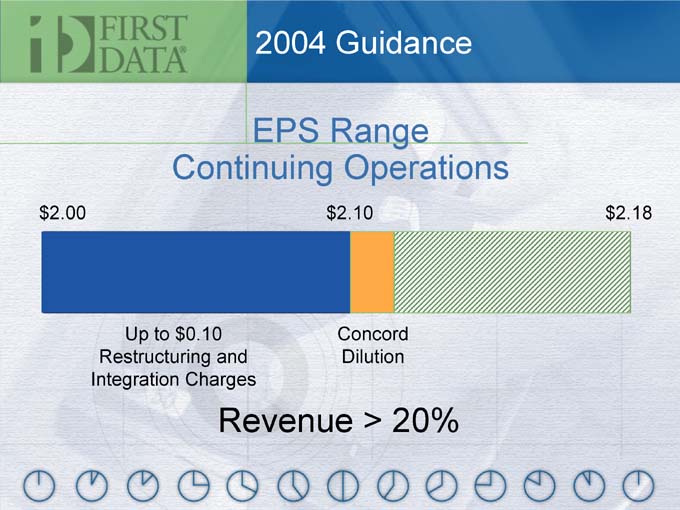

2004 Guidance

EPS Range Continuing Operations

$2.00 $2.10 $2.18

Up to $0.10 Concord Restructuring and Dilution Integration Charges

Revenue > 20%

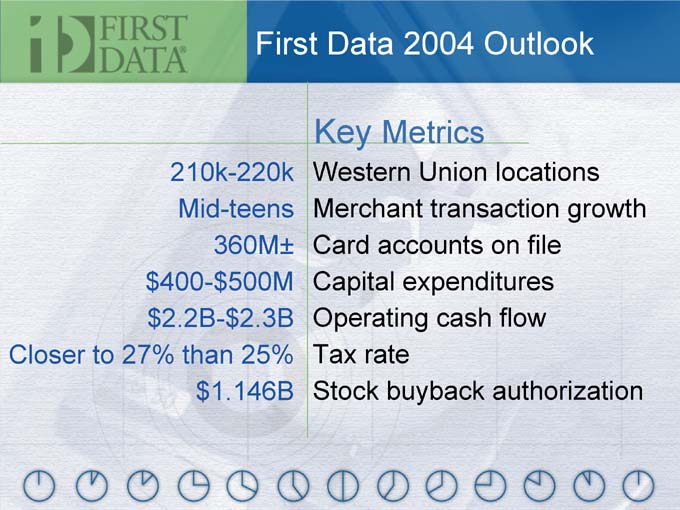

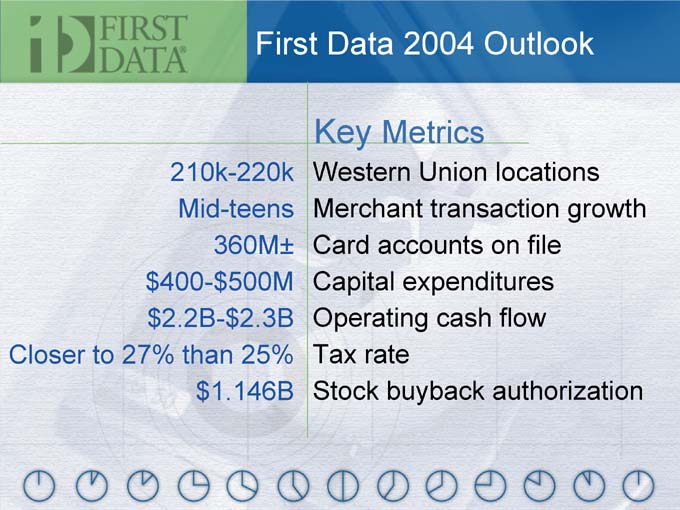

First Data 2004 Outlook

Key Metrics

210k-220k Western Union locations Mid-teens Merchant transaction growth 360M± Card accounts on file $400-$500M Capital expenditures $2.2B-$2.3B Operating cash flow

Closer to 27% than 25% Tax rate $1.146B Stock buyback authorization

Earnings Expansion

Revenue EPS

($ B) 15%

12%

CAGR $8.4 CAGR $1.88 $5.9 $1.24

2000 2003 2000 2003

Adjusted for SFAS 142

A Record of Flawless Execution

Long-Term Growth Objectives

• Revenue – double-digit Growth

• EPS 14%-17% growth

[GRAPHIC]

Scott Betts

Enterprise Payments

Winning in the Marketplace

• Creating “Enterprise Payments”

• Realizing strategic and economic benefits of Concord

• Leveraging the core merchant business

Ultimate Focus on Shareholder Return

Benefits of

Enterprise Payments

• Drive efficiencies by aggregating common operations

• Greater customer focus

• Provide broadest offerings through single source

• Align Enterprise sales teams with our largest clients

• Focus on high-growth opportunities

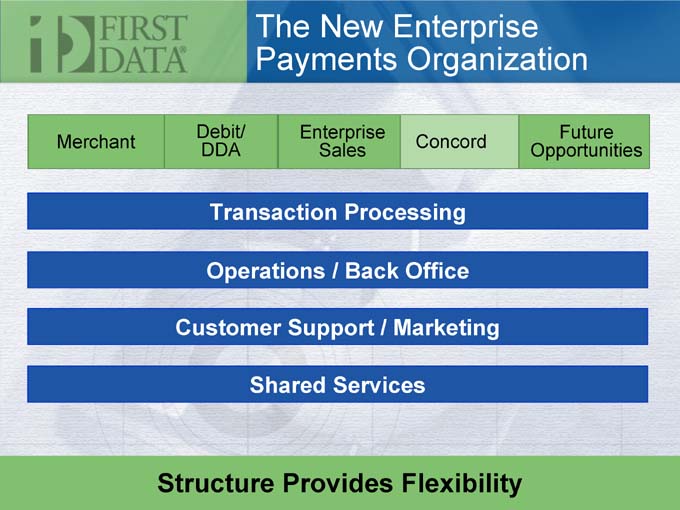

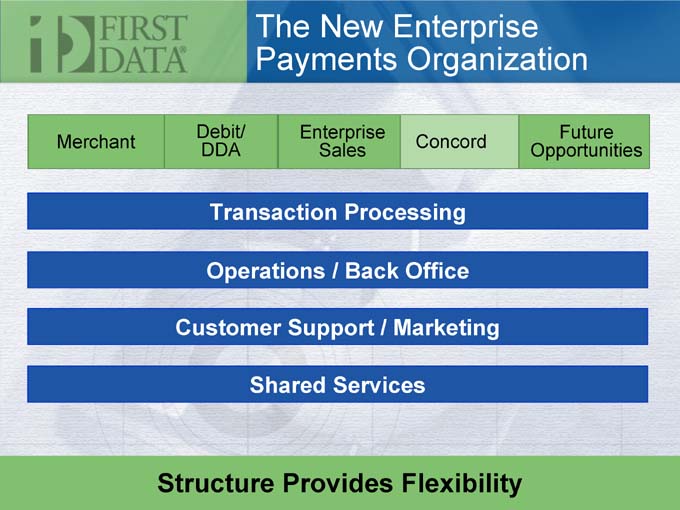

The New Enterprise Payments Organization

Debit/ Enterprise Future Merchant DDA Concord Sales Opportunities

Transaction Processing Operations / Back Office Customer Support / Marketing Shared Services

Structure Provides Flexibility

Drive Efficiencies

• Leverage scale to provide best in class services

• End-to-end solution provider

• Integrated product sets for merchants of all sizes

• Create “plug and play” capability for acquisition/new business

Best in Class

Leverage Enterprise Sales

• Focus on value-based enterprise solutions

• More integrated offerings

• Collaborate with clients to drive payment system innovation

• Expand cross-selling

• Greater expertise of our customers business needs and strategies

Addressing Industry Trends

• Margin, profitability and pricing pressures

• Consolidation and emergence of new clients

• Conflicts between players in the payment system

• Market segmentation

Strategic & Economic Benefits of Concord Merger

• Strategic alignment in new market segments and verticals

– Petroleum – Debit

– STAR (PPS, Network, ATM driving)

• Economic benefits

– Leverage new sales force with our large referral relationships

– Immediate product solutions to be leveraged

Strategic & Economic Benefits of Concord Merger (con’t.)

• Economic benefits (con’t)

– Maximize TeleCheck through PPS expanded view of DDA information lowering warranty expenses

– Debit solutions

– Terminal deployment

– Web-based payments

Branding New Opportunities When Appropriate

Concord Integration

• Synergy plans defined, resourced and ready to execute

– Over 100 individual project teams

– On track to deliver $205M

• Organization design completed at business unit level

• Consolidate platforms and data centers

Ready to Hit The Ground Running!

Acquisition Strategy Going Forward

• Continue to look for opportunities within core competencies

• Enhance speed and ease of integration

– Expertise developed on Concord project

– Enterprise Payments utilities

Core Merchant Business

• Accelerate sales engine

– Right products into right footprint

– Investment in sales force

• Tailored to channel

• Performance measures that reflect market changes

• Raise the talent bar

– Lower attrition

Focus on Sales Productivity

Core Merchant Business

• Focus on high growth business

• Some growth through acquisitions

– 2003 handcuffs are off

• Maximizing POS cross-sell opportunities

– Concord = new products + new merchants

• Grow with growth-oriented partners

TeleCheck

• Initiatives

– Sales force reorganization and expansion

– System enhancements

– Combined product offerings

• Opportunities

– Concord sales force selling TeleCheck

– Untapped verification market

– Demand for single source solutions

– Cross-sell and leverage Concord products

Why We Win

• Scale

• Breadth of product offerings

• Execution

Ultimate Focus on Shareholder Return

Hong Kong

New York

Uganda

Frankfurt

Christina Gold

Western Union

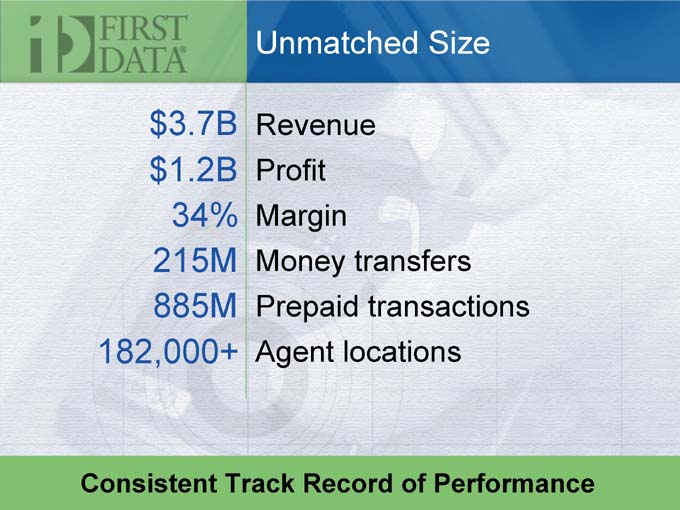

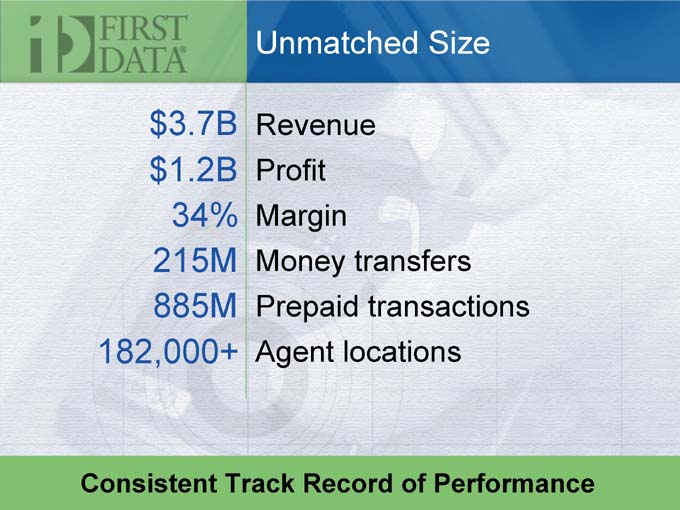

Unmatched Size

$3.7B Revenue $1.2B Profit 34% Margin 215M Money transfers 885M Prepaid transactions 182,000+ Agent locations

Consistent Track Record of Performance

Winning in the Marketplace

• Well-positioned in a huge market

• Expand and diversify distribution

• Build the brand and enhance the consumer experience

• Leverage channels and diversify product offerings

Ultimate Focus on Shareholder Return

Well-Positioned in a Huge Market

• Estimated Remittance Market = $151B

• Face value of international transactions up 21%

Year over year

Source: Celent Communications, 2002

Huge Market Opportunity

Well-Positioned in a Huge Market

Europe

Asia Pacific Middle East

Africa

Americas

182,000 Locations Across the Globe

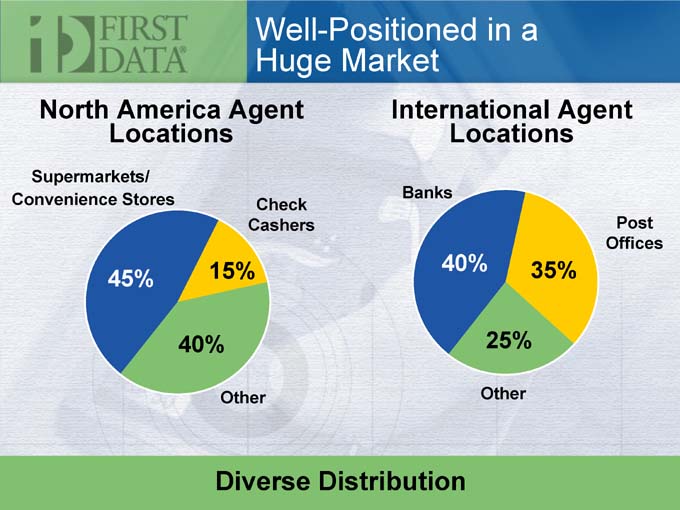

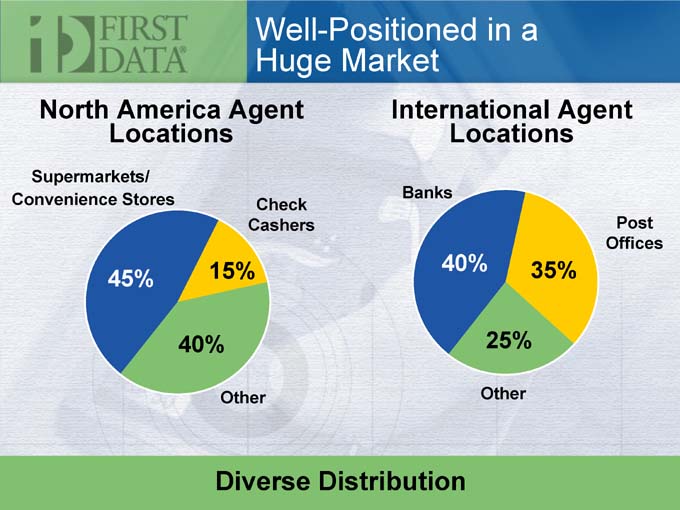

Well-Positioned in a Huge Market

North America Agent Locations International Agent Locations

Supermarkets/ Convenience Stores

Check Cashers

15%

Banks

40%

Post Offices

45%

35%

40%

Other

25%

Other

Diverse Distribution

Well-Positioned in a Huge Market

Hungarian Post Hungary

France

Europe

Turkey

Poland

India

United States

Argentina

Africa

Names Customers Know & Trust

Consumer-to-Consumer Strategy

• C2C growth strategy is clear

– Aggressively expand and diversify distribution

– Develop corridors and build brand awareness

– Drive agent productivity and market strength

Simple Strategy—Dynamic Results

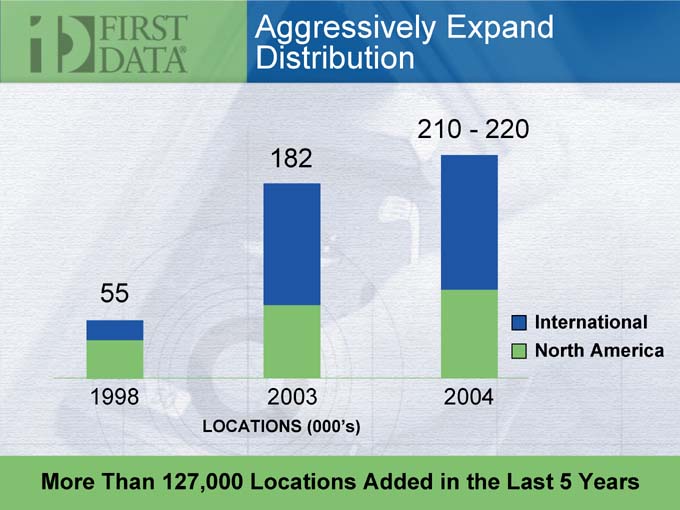

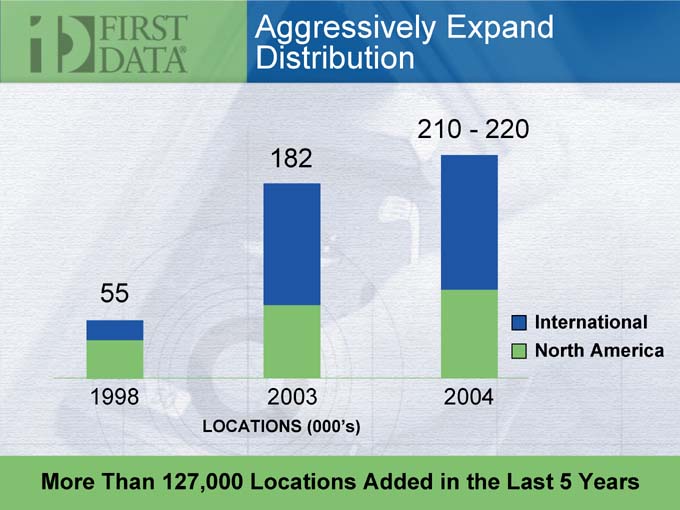

Aggressively Expand Distribution

182

210—220

International North America

55

1998

2003

LOCATIONS (000’s)

2004

More Than 127,000 Locations Added in the Last 5 Years

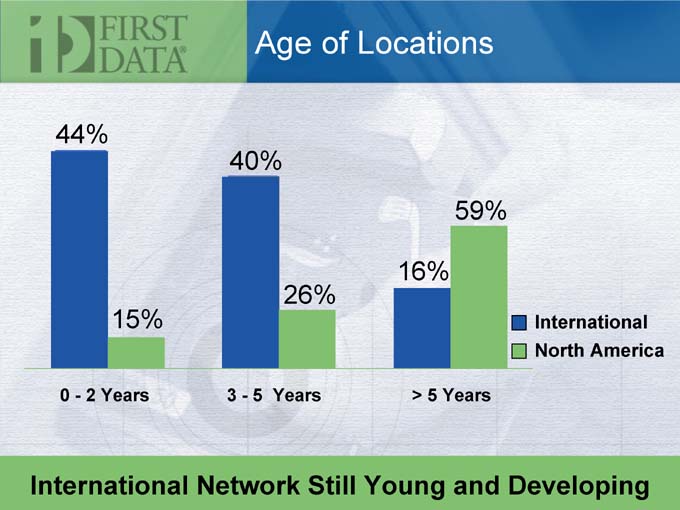

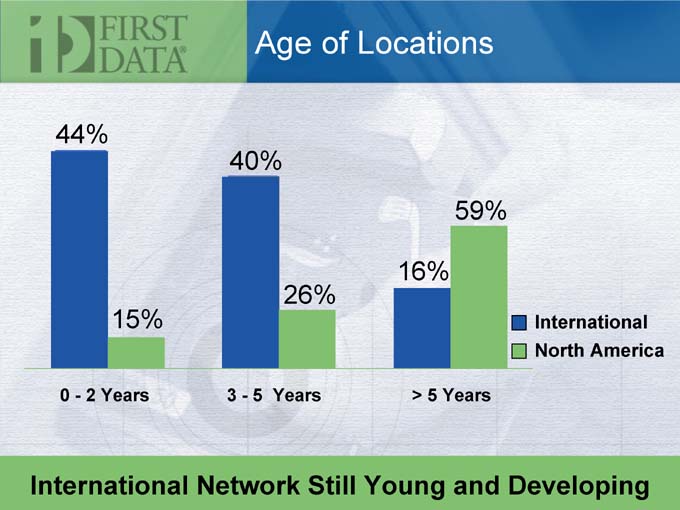

Age of Locations

40%

44%

59%

16%

26%

15%

International North America

0—2 Years 3—5 Years > 5 Years

International Network Still Young and Developing

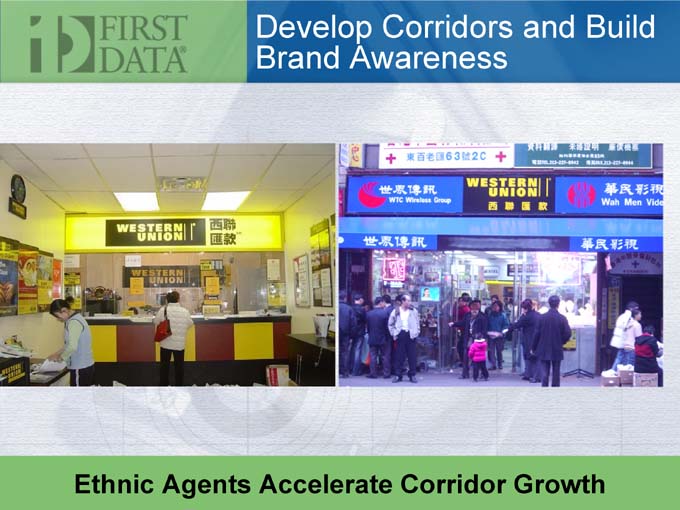

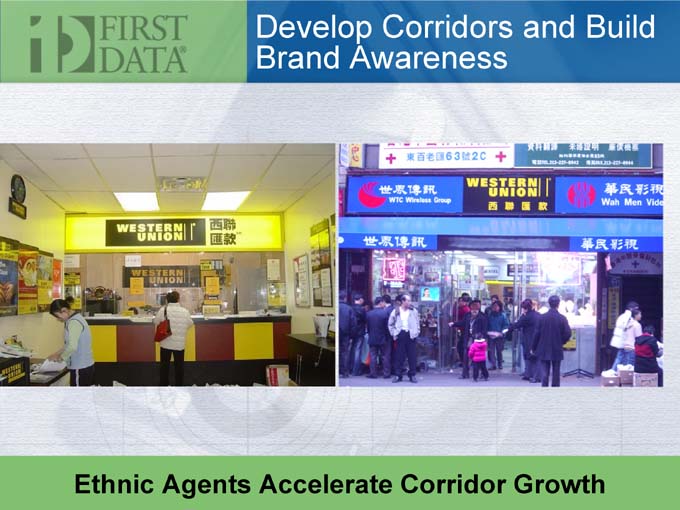

Develop Corridors and Build Brand Awareness

International / Ethnic Locations in the U.S. / Canada

15%

60%

Locations Transactions

Ethnic Agents Positively Impacting International Growth

Develop Corridors and Build Brand Awareness

Ethnic Agents Accelerate Corridor Growth

Develop Corridors and Build Brand Awareness

Transactions

232% CAGR

2000 2001 2002 2003

China Strategy On Track

• Revenue nearly triples

• Building corridors

– 15,000 locations in U.S. sending to China

• Marketing campaigns in place

• Raising brand awareness

Corridor Development Drives Transactions

Agent Productivity and Market Strength

• Solid performance continues

• C2C growth trends in high teens

• International business strong

• Increased productivity from send agents added in 2003

Increased Productivity in New Send Agents

Agent Productivity and Market Strength

Direct to Bank Account

Direct Connect

ATM

Home Delivery

Agent Locations

Loyalty Programs

Western Union.com

Telephone Money Transfer

Single Source Provider of End-to-End Payment Solutions

Building a Global Brand

• Significant investment

• Brand awareness > > > drives transactions

– Media (TV, radio, print)

– Local marketing events

– Loyalty programs

– Signage

[GRAPHIC]

Loyalty Card Programs

• Build relationships

• Improve retention and frequency

• Enhance compliance

• Drive revenue

Customer Loyalty Improves Profitability

Leverage & Diversify Product Offerings

Consumer Money Transfer

Bill Payments

Prepaid Services

Many More Services To Meet Customer Needs

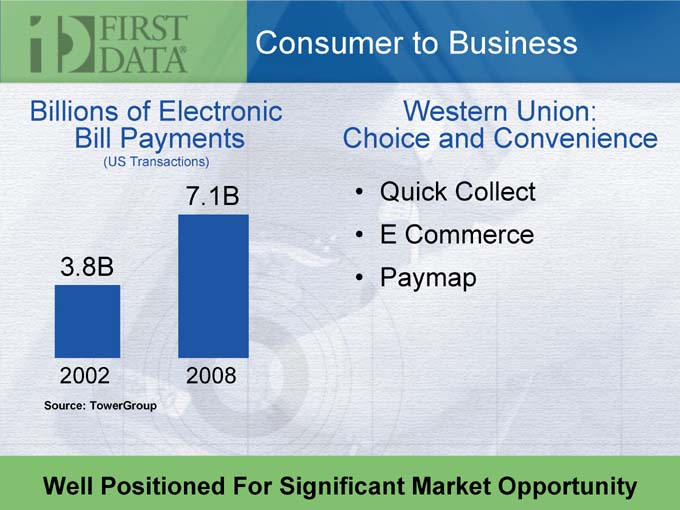

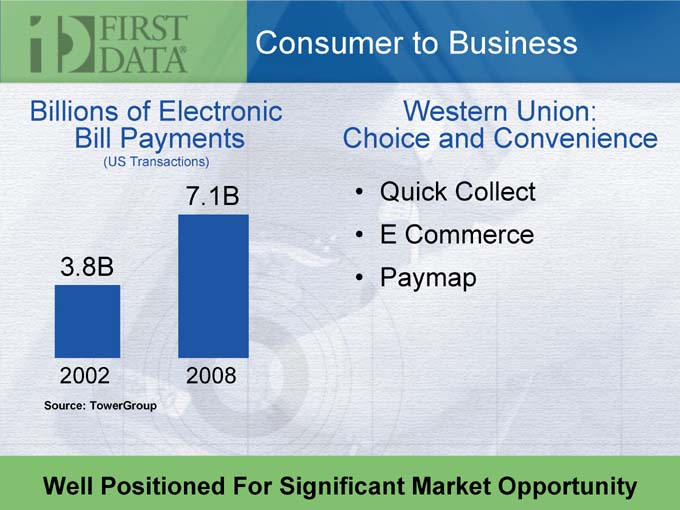

Consumer to Business

Billions of Electronic Bill Payments

(US Transactions)

7.1B

3.8B

2002

Source: TowerGroup

Western Union: Choice and Convenience

• Quick Collect

• E Commerce

• Paymap

2008

Well Positioned For Significant Market Opportunity

Prepaid Services

$125B Prepaid wireless market

$42B U.S. gift card sales market

$17B In gift card sales during the 2003

holiday season

Source: Baskerville Strategic Research, Bain & Co., National Retail Federation

Fast Growing—Big Market Opportunity

Why

Western Union Wins

• Huge global growth opportunities

• Unmatched distribution network

• Strong brand

• Diverse product offerings

Ultimate Focus on Shareholder Return

Charlie Fote

Card Issuing / eONE / International Discussion

Card Issuing Services Update

• New leadership

• 70 million account pipeline

• Contract update

Emerging Payments Update

• B2B

• Government Contracts

• Encorus

First Data International

Around the World Update

First Data International: Key Initiatives

• Innovate new products & enter new geographies

• Grow existing customers through superior service

• Leverage existing platforms and capabilities

• Expand VisionPLUS® solutions and merchant services opportunities

Europe

Building on Existing Leadership Position

• Won new card issuing relationships

• Extended existing card issuing relationships

• Launched new products

Europe

Building on Existing Leadership Position

• Led EMV smart card migration

• Integrated TeleCash and Active

• Growth in merchant business

• Converted Deutsche Postbank alliance

Latin America & Canada

Enabling Commerce Through Complete Offerings

• Strong transaction growth

• Launched ScotiaPOS merchant services alliance in Mexico

• Formed PROCESA processing company in Panama

• Expanded client relationships

Australia, New Zealand & South Asia

Significant, Diverse Market Opportunity

• Announced Cashcard Australia acquisition

• Converted Westpac to VisionPLUS

• Implemented DCC product at Commonwealth Bank

• Executing market entry strategy in S. Asia

China & North Asia

Investment for the Long Term

• China Everbright Bank running on Shanghai data center

• Expanding VisionPLUS opportunities

– Processing pipeline

– Additional software sales

– Ongoing professional services

Japan

Building Relationships for the Long Term

• Restructured ongoing partnership

– Nihon Card Processing Co., Ltd. (NICAP)

• Responding to interest on merchant capability

Why First Data Wins

• Participating in the high-growth payment market

• Successfully identifying & integrating acquisitions

• Finding creative entry points into new markets

• Leveraging First Data’s strengths

• Strong cash flow

Ultimate Focus on Shareholder Return

Leveraging First Data’s Strengths

• Reputation

• Management expertise

• Superior product offerings

• Distribution channels

• Strong Balance sheet

Ultimate Focus on Shareholder Return

Why First Data is a Good Investment

• #1 in the markets we serve

• Leveraging infrastructure

• Leveraging distribution

• Record of flawless execution

• Leading edge products

• Highly predictable recurring revenue

Ultimate Focus on Shareholder Return

Questions & Answers

Appendix

Cautionary Information Regarding Forward-Looking Statements

Statements in this press release regarding First Data Corporation’s business which are not historical facts, including the revenue and earnings projections, are “forward-looking statements.” All forward-looking statements are inherently uncertain as they are based on various expectations and assumptions concerning future events and they are subject to numerous known and unknown risks and uncertainties which could cause actual events or results to differ materially from those projected. Important factors upon which the Company’s forward-looking statements are premised include: (a) no unanticipated developments that delay or negatively impact the integration of Concord EFS, Inc. according to the Company’s integration plans, including its plans to integrate IT systems, eliminate duplicative overhead and costs, and retain customers and critical employees; (b) receipt of Concord shareholder approval without any unexpected delay and no material deterioration in Concord’s business prior to closing; (c) the divestiture of NYCE Corporation within the time period allowed in the Company’s agreement with the Department of Justice on terms reasonable to the Company; (d) continued growth at rates approximating recent levels for card-based payment transactions, consumer money transfer transactions and other product markets; (e) successful conversions under service contracts with major clients; (f) renewal of material contracts in the Company’s business units consistent with past experience; (g) timely, successful and cost-effective implementation of processing systems to provide new products, improved functionality and increased efficiencies; (h) successful and timely integration of significant businesses and technologies acquired by the Company and realization of anticipated synergies; (i) continuing development and maintenance of appropriate business continuity plans for the Company’s processing systems based on the needs and risks relative to each such system; (j) absence of consolidation among client financial institutions or other client groups which has a significant impact on FDC client relationships and no material loss of business from significant customers of the Company; (k) achieving planned revenue growth throughout the Company, including in the merchant alliance program which involves several joint ventures not under the sole control of the Company and each of which acts independently of the others, and successful management of pricing pressures through cost efficiencies and other cost management initiatives; (l) successfully managing the credit and fraud risks in the Company’s business units and the merchant alliances, particularly in the context of the developing e-commerce markets; (m) anticipation of and response to technological changes, particularly with respect to e-commerce; (n) attracting and retaining qualified key employees; (o) no unanticipated changes in laws, regulations, credit card association rules or other industry standards affecting FDC’s businesses which require significant product redevelopment efforts, reduce the market for or value of its products or render products obsolete; (p) continuation of the existing interest rate environment so as to avoid increases in agent fees related to Payment Services’ products and increases in interest on the Company’s borrowings; (q) absence of significant changes in foreign exchange spreads on retail money transfer transactions, particularly in high-volume corridors, without a corresponding increase in volume or consumer fees; (r) continued political stability in countries in which Western Union has material operations; (s) implementation of Western Union agent agreements with governmental entities according to schedule and no interruption of relations with countries in which Western Union has or is implementing material agent agreements; (t) no unanticipated developments relating to previously disclosed lawsuits, investigations or similar matters; (u) no catastrophic events that could impact the Company’s or its major customer’s operating facilities, communication systems and technology or that has a material negative impact on current economic conditions or levels of consumer spending; (v) no material breach of security of any of our systems; and (w) successfully managing the potential both for patent protection and patent liability in the context of rapidly developing legal framework for expansive software

patent protection.

Not a Proxy Solicitation

This communication is not a solicitation of a proxy from any security holder of Concord EFS, Inc. First Data Corporation has filed a proxy statement/prospectus with the Securities and Exchange Commission (SEC) concerning the planned merger of Concord EFS, Inc. with a subsidiary of First Data Corporation. WE URGE INVESTORS TO READ THE DEFINITIVE VERSION OF THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors will be able to obtain the documents free of charge at the SEC’s website, www.sec.gov. In addition, documents filed with the SEC by First Data Corporation will be available free of charge from First Data Investor Relations, 6200 S. Quebec St., Suite 340, Greenwood Village, CO, 80111. Documents filed with the SEC by Concord EFS, Inc. will be available free of charge from Concord Investor Relations, 2525 Horizon Lake Drive, Suite 120, Memphis, TN, 38133.

First Data, its directors and executive officers and other members of its management and employees, may be deemed to be participants in the solicitation of proxies in connection with the planned merger. Information about the directors and executive officers of First Data and their ownership of First Data stock is set forth in the proxy statement for First Data’s 2003 annual meeting of stockholders. Investors may obtain additional information regarding the interests of the participants by reading the proxy statement/prospectus.

February 3, 2004