UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-6563

CALVERT WORLD VALUES FUND, INC.

(Exact name of registrant as specified in charter)

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

William M. Tartikoff, Esq.

4550 Montgomery Avenue

Suite 1000N

Bethesda, Maryland 20814

(Name and Address of Agent for Service)

Registrant's telephone number, including area code: (301) 951-4800

Date of fiscal year end: September 30

Date of reporting period: Six months ended March 31, 2011

Item 1. Report to Stockholders.

INFORMATION REGARDING CALVERT OPERATING COMPANY

NAME CHANGES

Effective on April 30, 2011, the following Calvert operating companies will be renamed as indicated:

| | |

| Current Company Name | Company Name on 4/30/11 | Company Description |

| |

| Calvert Group, Ltd. | Calvert Investments, Inc. | Corporate parent of each |

| | | operating company listed |

| | | below |

| |

| Calvert Asset Management | Calvert Investment | Investment advisor to the |

| Company, Inc. | Management, Inc. | Calvert Funds |

| |

| Calvert Distributors, Inc. | Calvert Investment Distributors, | Principal underwriter |

| | Inc. | and distributor for the |

| | | Calvert Funds |

| |

| Calvert Administrative | Calvert Investment | Administrative services |

| Services Company | Administrative Services, Inc. | provider for the Calvert |

| | | Funds |

| |

| Calvert Shareholder | Calvert Investment Services, | Shareholder servicing |

| Services, Inc. | Inc. | provider for the Calvert |

| | | Funds |

Choose Planet-friendly E-delivery!

Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs.

Just go to www.calvert.com. If you already have an online account at Calvert, click on My Account, and select the documents you would like to receive via e-mail.

If you’re new to online account access, click on Login/Register to open an online account. Once you’re in, click on the E-delivery sign-up at the bottom of the Account Portfolio page and follow the quick, easy steps. Note: if your shares are not held directly at Calvert but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm.

Dear Shareholders:

The financial markets ended the six-month reporting period on a high note. The Federal Reserve’s announcement in the fall of 2010 of a second round of quantitative easing (QE2) initially buoyed the markets, which were further bolstered by the extension in December of the Bush-era tax cuts for all income levels. The resulting increase in U.S. consumer spending and confidence helped drive a year-end rally.

This calm lasted until new storms arrived in the beginning of 2011. Civil and political unrest in the Middle East and North Africa sent the price of energy soaring and heightened energy security concerns in many countries around the world. In March, the tragic earthquake and tsunami struck Japan. Our sympathies go out to the people of Japan who lost loved ones in this disaster. The earthquake—and its impact on the country’s nuclear reactors—roiled global financial markets. The cumulative effect of these events sparked a stock market sell-off before equities rebounded strongly in the final two weeks of the reporting period.

Markets Continue to Pick Up Steam

The stock market generally continued its upward momentum throughout the six-month period—with help from a strong fourth-quarter earnings season. Both U.S. growth- and value-oriented stocks reported significant gains across all capitalizations. In fact, the large-cap Russell 1000 Index and Standard & Poor’s 500 Index rose 18.13% and 17.31%, respectively, for the six-month period. Small- and mid-cap indices posted even higher returns as investors’ appetite for risk continued to strengthen.

However, continued uncertainty about the sovereign debt situation in some European countries as well as a drag from emerging markets tempered returns abroad, with the MSCI EAFE Index of international stocks returning 10.33% for the six-month period. Also, corporate bonds edged down slightly for the period, with the Barclays Capital U.S. Credit Index returning -0.98%. Money market returns remained flat, reflecting the Fed’s efforts to keep its target interest rate low.

Board Diversity and Company Competitiveness

At Calvert, we believe that companies with high standards of corporate governance, including diverse boards, are better positioned to compete in the global marketplace and to potentially outperform their peers. As a result, we continue to use our role as sustainable and responsible investors to encourage companies to clearly define diversity as inclusive of gender, ethnic, and racial backgrounds and to publicly commit to increasing diversity—on their boards and throughout their organizations.

We celebrated the first anniversary of the publication of the Women’s Empowerment Principles (WEP) and the 100th anniversary of International Women’s Day in March with a two-day event sponsored by the United Nations Women and the United Nations Global Compact. The WEP were established through collaboration between the United Nations

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 4 |

Women and the United Nations Global Compact in March 2010. Calvert continues to be an integral player in furthering the adoption of the WEP across the globe. In fact, more than 140 CEOs worldwide have signed a statement of support for the WEP, in part due to Calvert’s efforts.

Also, our October 2010 diversity report “Examining the Cracks in the Ceiling” has been making news by being cited in more than 40 articles from outlets such as The Washington Post, Forbes, and The New York Times. While we are pleased to see such strong media interest in this topic, we’re even more pleased that the report has led to Calvert having conversations with more than a dozen companies about their diversity scores and actions they can take to improve their overall diversity performance.

Opportunities and Challenges Ahead

Overall, we are encouraged by the market’s ability to move ahead despite the recent troubles in the Middle East and Japan, and we expect a slow, gradual economic recovery to continue throughout the remainder of the year. A low core inflation rate (which excludes food and energy prices) will likely facilitate economic growth, while continued debt reduction, lingering high unemployment, and a struggling housing market should limit gains. Energy prices will remain a challenge until we see more resolution of the issues in the Middle East and North Africa. Of course, more geopolitical crises, rising commodity prices, and inflation spikes could certainly dampen the markets.

In short, we are optimistic and believe the markets, the global economy, and your Calvert funds can successfully navigate through any temporary setbacks that may lie ahead.

Discuss Your Portfolio Allocations with Your Advisor

Given the market shifts we have experienced, your overall portfolio asset allocation and investment strategy may no longer match your needs. Therefore, we recommend reviewing these with your financial advisor to ensure that your target mix of U.S. and international stocks, bonds, and cash is well-diversified and appropriate given your financial goals, time horizon, and risk tolerance.

We encourage you to visit our website, www.calvert.com, for fund information and updates as well as market and economic commentary from Calvert professionals.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 5 |

As noted elsewhere in this report, the Calvert operating companies that provide services to the funds will change their names effective April 30, 2011. As part of the changes, Calvert Group, Ltd. will be known as Calvert Investments, Inc., and the funds’ advisor, Calvert Asset Management Company, Inc., will be known as Calvert Investment Management, Inc. As always, we appreciate your investing with Calvert.

Barbara J. Krumsiek

President and CEO

Calvert Investments, Inc.

April 2011

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 6 |

SRI

Update

from the Calvert Sustainability

Research Department

Responsible management of environmental, social, and governance (ESG) factors isn’t just “nice to do”—it’s essential to keeping our companies and our economy healthy and strong. Therefore, Calvert continues to work hard to ensure that you have a say in charting new paths to a more prosperous future.

Corporate & Board Diversity

The newly released version of the Calvert report, “Examining the Cracks in the Ceiling: A Survey of Corporate Diversity Practices of the S&P 100,” revealed that women are still significantly underrepresented on corporate boards (18%) and in C-level executive positions (8.4%)—despite comprising more than half the workforce.

Another disappointment was learning that 37% of the companies disclose no demographic data on employees—such as race, ethnicity and gender—which is necessary to evaluate a company’s progress. Only eight companies disclose full EEO-1 data, which is a full breakdown of the workforce by race and gender across employment categories.

As an investor, Calvert believes companies that combine competitive financial performance with fair and equitable working environments—where diversity is not only tolerated but embraced—are more likely to recognize gains in both the workplace and marketplace and be better positioned to generate long-term value for their shareholders.

Green Homebuilding

In October, Calvert released “A Green Recovery for America’s Homebuilders? A Survey of Sustainable Practices by the Homebuilding Industry.” This updated version of our 2008 report on America’s 10 largest publicly traded homebuilders shows they have started to improve their policies and practices related to the environment and resources, but much progress remains to be seen.

Out of 42 possible points, the average total sustainability score was just over six points, or 15%. All 10 homebuilders have made some effort to develop environmental policies or practices or offer environmental products. However, there is a big difference in the level of commitment to sustainability and the penetration of “green” homes in each company’s product mix.

In the homebuilder rankings, KB Home and Pulte remained in the top two spots, while Meritage Homes and Toll Brothers had the biggest improvements—each moving up five spots. DR Horton and Ryland Homes fell back four and three places, respectively.

Climate Change

Calvert has continued its corporate engagement and policy work in support of energy efficiency, alternative energy, and reductions in greenhouse gas emissions. We have also been ramping up our work on climate change adaptation. Leading scientists believe that even if we stop producing greenhouse gasses tomorrow, a certain amount of climate

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 7 |

change will still happen because of the carbon dioxide and other pollutants already in the atmosphere.

As a result, Calvert has been collaborating with Oxfam America to highlight the risks U.S. companies face from climate change as well as the opportunities for innovation and new business that corporate solutions could offer. In November 2010, we helped facilitate a high-level roundtable on Capitol Hill hosted by Oxfam for members of Congress, key congressional staff, and companies such as John Deere, Johnson Controls, and Starbucks to discuss these topics.

Calvert and Oxfam are now helping some of the attending companies form a business coalition to assist corporations and vulnerable communities in their adaptation to the effects of climate change. The new coalition would publish case studies and best practices as well as promote public policies related to climate change adaptation and resiliency.

On the shareholder advocacy front, Calvert has filed shareholder proposals with three companies asking them to clarify what they are doing to manage their risks related to climate change—two of these proposals have already been successfully withdrawn.

Overall Shareholder Advocacy Efforts

In all, Calvert has filed 35 resolutions to date in the 2011 proxy season and 22 have already been successfully withdrawn after the companies agreed to the terms of the resolution. In addition to the resolutions cited above, six focused on sustainability reporting, four on political contributions, and seven on climate principles.

Special Equities

A modest but important portion of certain funds is allocated to small private companies that are developing products or services that address important sustainability or environmental issues. For example, Calvert Equity Portfolio recently invested in the DBL Equity Fund-BAEF II, LP, which invests in private, mid- to late-stage growth companies—primarily in the clean tech, health care, information technology, and sustainability-oriented industries—ocated near low- and moderate-income communities in San Francisco and adjoining states. The Fund will assist its portfolio companies in creating and implementing their Second Bottom Line strategy in job creation, job quality, and environmental stewardship.

Calvert International Equity Fund invested in FINAE, S.A.P.I. de C.V. SOFOM ENR, a company that provides college loans to students from low- and middle-income families in Mexico. Students are selected by universities for their academic talent and financial need, and screened by FINAE for their repayment capacity.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 8 |

As of March 31, 2011, DBL Equity Fund –BAEF II, LP represented 0.02% of Calvert Equity Portfolio; FINAE represented 0.26% of Calvert International Equity Fund. All holdings are subject to change without notice.

As of March 31, 2011, the following companies represent the following percentages of net assets: KB Home represented 0.20% of Calvert Small Cap Fund; Pulte represented 0.03% of Calvert Social Index Fund; Meritage Homes represented 0% of all Calvert equity funds; DR Horton represented 0.04% of Calvert Social Index Fund; Ryland represented 0% of all Calvert equity funds; John Deere represented 1.53% of Calvert Balanced Portfolio and 0.52% of Calvert Social Index Fund; Johnson Controls represented 0.36% of Calvert Social Index Fund; Starbucks represented 0.35% of Calvert Social Index Fund, 2.01% of Calvert Equity Portfolio, and 1.65% of Calvert Enhanced Equity Portfolio; General Cable represented 1.74% of Calvert Capital Accumulation Fund and 0.03% of Calvert Social Index Fund; and WABCO Holdings represented 2.73% of Calvert Capital Accumulation Fund and 0.05% of Calvert Social Index Fund. All holdings are subject to change without notice.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 9 |

PORTFOLIO MANAGEMENT DISCUSSION

Natalie A. Trunow

Senior Vice President, Chief Investment Officer - Equities

Calvert Investment Management, Inc.

Performance

Calvert International Equity Fund Class A shares (at NAV) returned 6.04% for the six-month period ending March 31, 2011. The Fund underperformed its benchmark, the MSCI Europe Australasia Far East Investable Market Index (MSCI EAFE IMI), which returned 10.90% for the period, primarily due to an underweight to the Materials sector, plus stock selection in Materials and Financials.

Investment Climate

Large-cap benchmarks such as the Standard & Poor’s 500 Index and the Russell 1000 Index were trumped by the small-cap Russell 2000 Index for the period, with returns of 17.31%, 18.13%, and 25.48%, respectively. International benchmarks didn’t fare quite as well, as the MSCI EAFE and MSCI Emerging Markets Indices returned 10.33% and 9.61%, respectively.

Within the MSCI EAFE IMI Index, the Energy, Materials, and Industrials sectors were the top performers for the period, while Consumer Staples and Utilities lagged the

CALVERT INTERNATIONAL EQUITY FUND

MARCH 31, 2011

INVESTMENT PERFORMANCE

(TOTAL RETURN AT NAV*)

| | 6 Months | | 12 Months | |

| | ended | | ended | |

| | 3/31/11 | | 3/31/11 | |

| Class A | 6.04 | % | 7.36 | % |

| Class B | 5.32 | % | 6.01 | % |

| Class C | 5.54 | % | 6.42 | % |

| Class I | 6.44 | % | 8.20 | % |

| Class Y | 6.13 | % | 7.84 | % |

| MSCI EAFE Investable | | | |

| Market Index | 10.90 | % | 11.95 | % |

| Lipper International | | | | |

| Multi-Cap Core | | | | |

| Funds Average | 10.16 | % | 12.48 | % |

| |

| TEN LARGEST | | | % of | |

| STOCK HOLDINGS | | | Net Assets | |

| Canadian National Railway Co. | | 2.2 | % |

| BG Group plc | | | 2.2 | % |

| Pearson plc | | | 2.1 | % |

| Telefonica SA | | | 2.0 | % |

| Toyota Motor Corp. | | | 1.8 | % |

| BNP Paribas | | | 1.8 | % |

| SAP AG | | | 1.5 | % |

| ING Groep NV (CVA) | | 1.4 | % |

| Kingfisher plc | | | 1.3 | % |

| Canon, Inc. | | | 1.3 | % |

| Total | | | 17.6 | % |

*Investment performance/return at NAV does not reflect the deduction of the Fund’s maximum 4.75% front-end sales charge or any deferred sales charges.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 10 |

most. This dampened performance of portfolios that apply environmental, social, and governance (ESG) criteria, which are most restrictive in the Energy, Materials, and Industrials sectors. However, in the short term, we believe investor enthusiasm for the Energy sector may be momentum-driven, with the current dynamics already reflected in valuations. Therefore, we may see a reversal in Energy’s leadership in the coming months.

Investors worldwide became more focused on inflation as crude oil prices hit 20-month highs and food prices rose too, causing concerns about global economic growth—especially in emerging economies, which rely more on commodity inputs for fast economic growth. China fought inflation with a series of measures, fueling concerns about slowing economic growth in that country. The European sovereign debt crisis continued too, as the cost to insure against sovereign default in Europe hit record highs during early 2011. Austerity measures in response to historically high budget deficits and the sovereign debt crisis have thrown some of the eurozone economies into stagnation. The European Central Bank (ECB) raised the benchmark lending rate to 1.25% in early April.

The Financials sector remained under the regulatory microscope. Then, insurance and reinsurance industries faced record catastrophic losses in the wake of the earthquake and tsunami in Japan. The tragedy affected other industries as well, due to just-in-time manufacturing and low inventories in the personal computer supply chain. The residential real estate market also remained under stress, with 20% more homes potentially going into foreclosure this year.

On a more positive note, U.S. investors were optimistic about the two-year

| | |

| CALVERT |

| INTERNATIONAL |

| EQUITY FUND |

| MARCH 31, 2011 |

| | % OF TOTAL | |

| ECONOMIC SECTORS | INVESTMENTS | |

| Consumer Discretionary | 18.9 | % |

| Consumer Staples | 7.6 | % |

| Energy | 7.7 | % |

| Financials | 25.0 | % |

| Health Care | 6.7 | % |

| Industrials | 10.3 | % |

| Information Technology | 7.7 | % |

| Limited Partnership Interest | 0.8 | % |

| Materials | 4.8 | % |

| Telecommunication Services | 7.2 | % |

| Utilities | 2.8 | % |

| Venture Capital | 0.5 | % |

| Total | 100 | % |

extension of Bush-era income-tax cuts, a reduction in the payroll tax in 2011, and the Federal Reserve’s (Fed) plan to buy an additional $600 billion of Treasury securities under a new quantitative easing (QE2) program. The U.S. labor market seemed to turn upward as the economy accelerated into 2011. Consumer confidence also improved during the period, as consumers’ outlook on employment and the overall economy was at its highest level in seven years.

Portfolio Strategy

Stock selection was strongest in Energy with investments in natural gas company BG Group up 41% and oil sands company SunCor up 37%.1 The Fund had poor stock selection within the Financials and Materials sectors. Financials company Turkiye Garanti Bankasi was down 19%. Within Materials the lack of exposure to

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 11 |

mining companies was a loss driver.

Overall, sector allocation had a negative impact on Fund performance with the largest detractors the Fund’s underweights to Materials and Industrials.

Turning to country allocation, the Fund saw a positive effect from its exposure to Canada, while Turkey’s overweight and Australia’s underweight detracted. The effects of Japan’s earthquake and tsunami were both positive and negative. The Fund was underweight Japan relative to the benchmark but stock selection within Japan was detrimental.

Outlook

Our long-term outlook for equity markets continues to be positive. We are optimistic about improving prospects for economic recovery in the U.S. and are pleased to see consumers demonstrating the signs of recovery we were hoping for. However, some estimate that another 10% to 20% increase in the price of oil may start to impede U.S. and global gross domestic product (GDP) growth. High gasoline prices are already dampening consumer confidence, although it hasn’t been enough yet to offset the improving employment picture and stock market advances. We still see potential for more geopolitical crises and for spikes in commodity prices and inflation to be negative catalysts for equity markets. However, we continue to expect a slow, gradual economic recovery. We also believe the equity markets and global economy can successfully navigate any temporary setbacks.

One concern we have is the relative under-performance of emerging market stocks. If this continues, emerging market fund outflows may exacerbate that downward trend, especially given the relatively low liquidity in these markets. Also, equity valuations

CALVERT INTERNATIONAL EQUITY FUND

MARCH 31, 2011

AVERAGE ANNUAL TOTAL RETURNS

| Class A shares | (with max. load) | |

| One year | 2.29 | % |

| Five year | -4.46 | % |

| Ten year | 1.37 | % |

| |

| Class B shares | (with max. load) | |

| One year | 1.01 | % |

| Five year | -4.77 | % |

| Ten year | 0.67 | % |

| |

| Class c shares | (with max. load) | |

| One year | 5.42 | % |

| Five year | -4.36 | % |

| Ten year | 0.94 | % |

| |

| Class I shares | | |

| One year | 8.20 | % |

| Five year | -2.83 | % |

| Ten year | 2.65 | % |

| |

| Class Y shares* | | |

| One year | 7.84 | % |

| Five year | -3.32 | % |

| Ten year | 1.97 | % |

| * | Calvert International Equity Fund first offered Class Y Shares on October 31, 2008.

Performance prior to that date reflects the performance of Class A Shares at net asset value (NAV). Actual Class Y Share perfor- mance would have been different. |

| |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 12 |

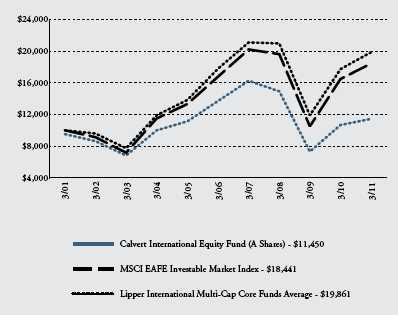

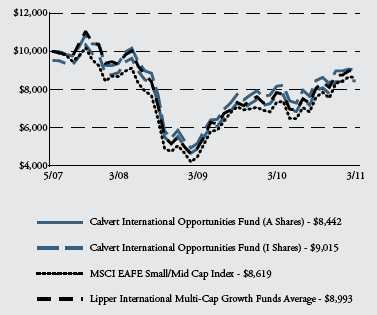

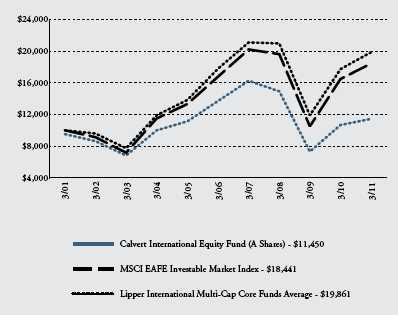

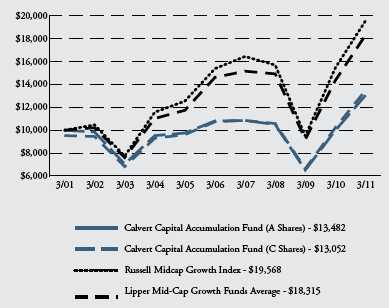

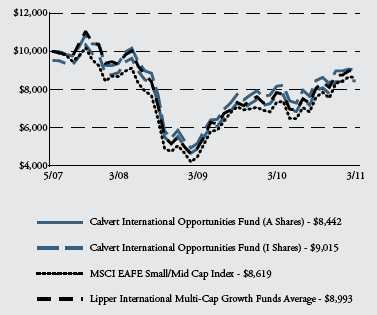

GROWTH OF $10,000

The graph below shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods. The results shown are for Classes A shares and reflect the deduction of the maximum front-end sales charge of 4.75%, and assume the reinvestment of dividends. The result is compared with benchmarks that include a broad based market index and a Lipper peer group average. Market indexes are unmanaged and their results do not reflect the effect of expenses or sales charges. The Lipper average reflects the deduction of the category’s average front-end sales charge. The value of an investment in a different share class would be different.

All performance data shown, including the graph above and the adjacent table, represents past performance, does not guarantee future results, assumes reinvestment of dividends and distributions and does not reflect the deduction of taxes that a shareholder would pay on the Fund’s/Portfolio’s distributions or the redemption of the Fund/Portfolio shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted; for current performance data visit www.calvert.com. The gross expense ratio from the current prospectus for Class A shares is 1.90%. This number may differ from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. Performance data quoted already reflects the deduction of the Fund’s/Portfolio’s operating expenses.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 13 |

have had a strong run-up in the last several months. Therefore, equity markets are likely to be vulnerable to a sell-off from negative news or further deterioration in geopolitical tensions once we’re past the earnings season.

April 2011

1 All returns shown for individual holdings reflect that part of the reporting period the holdings were held.

As of March 31, 2011, the following companies represented the following percentages of Fund net assets: BG Group 2.81%, SunCor 0.96%, and Turkiye Garanti Bankasi 0.40%. All holdings are subject to change at any time.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 14 |

SHAREHOLDER EXPENSE EXAMPLE

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2010 to March 31, 2011).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 15 |

| | | | | | |

| | | BEGINNING | | ENDING ACCOUNT | | EXPENSES PAID |

| | | ACCOUNT VALUE | | VALUE | | DURING PERIOD* |

| | | 10/1/10 | | 3/31/11 | | 10/1/10 - 3/31/11 |

| CLASS A | | | | | | |

| Actual | $ | 1,000.00 | $ | 1,062.00 | $ | 9.18 |

| Hypothetical | $ | 1,000.00 | $ | 1,016.03 | $ | 8.97 |

| (5% return per year before expenses) |

|

| | | | | | |

| CLASS B | | | | | | |

| Actual | $ | 1,000.00 | $ | 1,054.90 | $ | 15.22 |

| Hypothetical | $ | 1,000.00 | $ | 1,010.12 | $ | 14.88 |

| (5% return per year before expenses) |

|

| | | | | | |

| CLASS C | | | | | | |

| Actual | $ | 1,000.00 | $ | 1,056.20 | $ | 13.67 |

| Hypothetical | $ | 1,000.00 | $ | 1,011.63 | $ | 13.38 |

| (5% return per year before expenses) |

|

| | | | | | |

| CLASS I | | | | | | |

| Actual | $ | 1,000.00 | $ | 1,065.90 | $ | 5.46 |

| Hypothetical | $ | 1,000.00 | $ | 1,019.65 | $ | 5.34 |

| (5% return per year before expenses) |

|

| |

| cLass Y | | | | | | |

| Actual | $ | 1,000.00 | $ | 1,063.50 | $ | 7.15 |

| Hypothetical | $ | 1,000.00 | $ | 1,018.00 | $ | 6.99 |

| (5% return per year before expenses) |

|

* Expenses are equal to the Fund’s annualized expense ratio of 1.79%, 2.97%, 2.67%, 1.06% and 1.39% for Class A, Class B, Class C, Class I and Class Y, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 16 |

| | | |

| STATEMENT OF NET ASSETS |

| MARCH 31, 2011 |

| |

| |

| |

| EQUITY SECURITIES - 96.5% | SHARES | | VALUE |

| Australia - 1.2% | | | |

| Amcor Ltd. (ADR) | 6,013 | $ | 175,399 |

| Santos Ltd. | 190,373 | | 3,066,280 |

| Sims Metal Management Ltd. (ADR) | 63,229 | | 1,147,606 |

| | | | 4,389,285 |

| |

| Austria - 0.1% | | | |

| Erste Group Bank AG (ADR) | 10,957 | | 278,308 |

| Telekom Austria AG (ADR) | 552 | | 16,201 |

| Verbund AG (ADR) | 1,040 | | 9,183 |

| | | | 303,692 |

| |

| Belgium - 0.1% | | | |

| Ageas (ADR) | 4,301 | | 12,301 |

| Delhaize Group SA (ADR) | 4,372 | | 357,149 |

| | | | 369,450 |

| |

| Brazil - 2.4% | | | |

| Banco do Brasil SA | 78,600 | | 1,425,407 |

| BM&FBOVESPA SA | 243,793 | | 1,772,959 |

| Natura Cosmeticos SA | 94,099 | | 2,656,451 |

| Porto Seguro SA | 104,400 | | 1,768,351 |

| Tim Participacoes SA (ADR) | 35,300 | | 1,540,845 |

| | | | 9,164,013 |

| |

| Canada - 6.6% | | | |

| Canadian National Railway Co.: | | | |

| New York Exchange | 32,532 | | 2,448,684 |

| Toronto Exchange | 113,924 | | 8,575,366 |

| Cenovus Energy, Inc. | 45,200 | | 1,781,395 |

| EnCana Corp.: | | | |

| New York Exchange | 58,769 | | 2,029,294 |

| Toronto Exchange | 68,816 | | 2,374,357 |

| Loblaw Co.’s Ltd. | 62,500 | | 2,498,585 |

| Potash Corporation of Saskatchewan, Inc. | 32,601 | | 1,921,177 |

| Suncor Energy, Inc.: | | | |

| New York Exchange | 13,547 | | 607,447 |

| Toronto Exchange | 68,000 | | 3,042,437 |

| | | | 25,278,742 |

| |

| China - 1.1% | | | |

| China Merchants Bank Co. Ltd | 1,051,915 | | 2,915,447 |

| Mindray Medical International Ltd. (ADR)* | 55,700 | | 1,403,640 |

| | | | 4,319,087 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 17 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Denmark - 2.0% | | | |

| Danske Bank A/S (ADR)* | 28,999 | $ | 343,638 |

| H Lundbeck A/S (ADR) | 6,741 | | 155,852 |

| Novo Nordisk A/S, Series B | 37,322 | | 4,692,984 |

| Novozymes A/S (ADR) | 772 | | 119,119 |

| Vestas Wind Systems A/S* | 56,071 | | 2,434,090 |

| | | | 7,745,683 |

| |

| Finland - 0.1% | | | |

| Metso Oyj (ADR) | 868 | | 46,872 |

| Nokia Oyj (ADR) | 16,666 | | 141,827 |

| Sampo Oyj (ADR) | 13,165 | | 209,982 |

| | | | 398,681 |

| |

| France - 9.8% | | | |

| Air France-KLM (ADR)* | 5,263 | | 88,418 |

| Air Liquide SA | 21,862 | | 2,907,408 |

| Air Liquide SA (ADR) | 15,772 | | 419,220 |

| AXA SA (ADR) | 38,147 | | 798,798 |

| BNP Paribas | 92,435 | | 6,766,574 |

| BNP Paribas (ADR) | 16,432 | | 602,561 |

| Cap Gemini SA (ADR) | 416 | | 12,085 |

| Carrefour SA (ADR) | 56,867 | | 501,567 |

| Cie Generale d’Optique Essilor International SA (ADR) | 2,619 | | 97,296 |

| Credit Agricole SA (ADR) | 61,779 | | 507,206 |

| Danone (ADR) | 51,943 | | 682,012 |

| Dassault Systemes SA | 38,521 | | 2,963,028 |

| Groupe Danone | 47,866 | | 3,129,533 |

| L’Oreal SA (ADR) | 8,463 | | 197,611 |

| Publicis Groupe | 65,000 | | 3,648,655 |

| Rhodia SA | 64,395 | | 1,887,040 |

| Sanofi-Aventis SA | 47,723 | | 3,348,977 |

| Sanofi-Aventis SA (ADR) | 23,260 | | 819,217 |

| Schneider Electric SA (s) | 23,816 | | 4,073,941 |

| Schneider Electric SA (ADR) | 23,657 | | 406,664 |

| Suez Environnement Co. (ADR) | 3,302 | | 33,978 |

| Suez Environnement SA | 80,468 | | 1,666,382 |

| Valeo SA (ADR)* | 11,525 | | 337,913 |

| Veolia Environnement SA (ADR) | 40,490 | | 1,262,073 |

| | | | 37,158,157 |

| |

| Germany - 8.2% | | | |

| Adidas AG | 61,053 | | 3,849,694 |

| Aixtron SE (ADR) | 40,820 | | 1,791,182 |

| Allianz SE | 15,300 | | 2,149,101 |

| Allianz SE (ADR) | 135,181 | | 1,904,700 |

| Celesio AG (ADR) | 1,971 | | 9,559 |

| Commerzbank AG (ADR)* | 2,035 | | 15,914 |

| Continental AG* | 29,133 | | 2,630,986 |

| Continental AG (ADR)* | 123 | | 11,120 |

| Deutsche Bank AG | 41,826 | | 2,461,138 |

| Deutsche Post AG (ADR) | 15,724 | | 285,233 |

| Henkel AG & Co. KGaA | 35,166 | | 1,838,805 |

| K+S AG (ADR) | 3,053 | | 116,258 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 18 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Germany - Cont’d | | | |

| Merck KGaA (ADR) | 720 | $ | 21,600 |

| SAP AG | 92,848 | | 5,689,248 |

| SAP AG (ADR) | 32,385 | | 1,987,144 |

| SMA Solar Technology AG | 11,735 | | 1,472,077 |

| Volkswagen AG, Preferred | 27,142 | | 4,406,119 |

| Volkswagen AG (ADR), Preferred | 17,583 | | 573,030 |

| | | | 31,212,908 |

| |

| Greece - 0.2% | | | |

| National Bank of Greece SA (ADR)* | 421,208 | | 745,538 |

| |

| Hong Kong - 3.7% | | | |

| Bank of East Asia Ltd. (ADR) | 6,874 | | 29,146 |

| China Merchants Holdings International Co. Ltd. | 402,000 | | 1,700,980 |

| City Telecom HK Ltd. (ADR) | 99,920 | | 1,511,790 |

| Esprit Holdings Ltd. (ADR) | 114,548 | | 1,045,823 |

| Hang Lung Properties Ltd. | 515,989 | | 2,252,981 |

| Hang Lung Properties Ltd. (ADR) | 88,347 | | 1,962,187 |

| Hang Seng Bank Ltd. (ADR) | 2,321 | | 37,507 |

| Hengdeli Holdings Ltd. | 3,472,000 | | 1,830,800 |

| Hong Kong Exchanges and Clearing Ltd. | 152,646 | | 3,311,904 |

| Hong Kong Exchanges and Clearing Ltd. (ADR) | 7,090 | | 153,002 |

| Johnson Electric Holdings Ltd. (ADR) | 2,248 | | 13,398 |

| Li & Fung Ltd. (ADR) | 46,213 | | 240,307 |

| PCCW Ltd. (ADR) | 4,588 | | 19,270 |

| | | | 14,109,095 |

| |

| India - 0.4% | | | |

| Infosys Technologies Ltd. (ADR) | 19,935 | | 1,429,340 |

| |

| Indonesia - 0.5% | | | |

| Bank Mandiri Tbk PT | 2,479,000 | | 1,935,940 |

| |

| Ireland - 0.1% | | | |

| Experian plc (ADR) | 21,385 | | 263,249 |

| WPP plc (ADR) | 1,396 | | 86,217 |

| | | | 349,466 |

| |

| Israel - 0.6% | | | |

| Bezeq Israeli Telecommunication Corp Ltd. | 769,270 | | 2,282,103 |

| |

| Italy - 0.1% | | | |

| Intesa Sanpaolo SpA (ADR) | 22,862 | | 406,715 |

| Italcementi SpA (ADR) | 5,566 | | 56,439 |

| | | | 463,154 |

| |

| Japan - 14.4% | | | |

| Advantest Corp. (ADR) | 8,476 | | 152,314 |

| Aeon Co. Ltd. (ADR) | 6,165 | | 71,391 |

| Asahi Glass Co. Ltd. (ADR) | 51,260 | | 643,313 |

| Canon, Inc | 109,543 | | 4,790,935 |

| Canon, Inc. (ADR) | 50,554 | | 2,191,516 |

| Dai Nippon Printing Co. Ltd. (ADR) | 46,515 | | 569,809 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 19 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Japan - Cont’d | | | |

| Dai-ichi Life Insurance Co. Ltd. | 2,329 | $ | 3,531,346 |

| Daiwa House Industry Co. Ltd. (ADR) | 1,009 | | 123,562 |

| Denso Corp. (ADR) | 12,210 | | 200,854 |

| Eisai Co. Ltd. (ADR) | 533 | | 19,055 |

| Fanuc Ltd. | 15,395 | | 2,341,706 |

| Fujitsu Ltd. (ADR) | 21,293 | | 596,204 |

| Honda Motor Co. Ltd. (ADR) | 67,487 | | 2,531,437 |

| KDDI Corp. | 110 | | 684,427 |

| Konami Corp. (ADR) | 4,004 | | 73,914 |

| Kubota Corp. (ADR) | 12,924 | | 608,850 |

| Mitsui Fudosan Co. Ltd. | 102,256 | | 1,696,236 |

| Mizuho Financial Group, Inc. (ADR) | 396,411 | | 1,316,084 |

| MS&AD Insurance Group Holdings (ADR) | 71,066 | | 800,914 |

| Nippon Yusen KK (ADR) | 163,635 | | 1,286,171 |

| Nissan Motor Co. Ltd. (ADR)* | 99,869 | | 1,762,688 |

| Nitto Denko Corp. (ADR) | 15,636 | | 833,399 |

| Nomura Holdings, Inc. (ADR) | 283,127 | | 1,472,260 |

| NSK Ltd. (ADR) | 3,172 | | 54,749 |

| NTT DoCoMo, Inc | 1,607 | | 2,838,509 |

| ORIX Corp. (ADR) | 12,793 | | 595,770 |

| Panasonic Corp | 188,716 | | 2,412,245 |

| Panasonic Corp. (ADR) | 132,037 | | 1,662,346 |

| Sega Sammy Holdings, Inc. (ADR) | 12,316 | | 53,821 |

| Seiko Epson Corp. (ADR) | 18,925 | | 150,832 |

| Sekisui House Ltd. | 193,000 | | 1,818,775 |

| Sharp Corp. (ADR) | 50,097 | | 492,453 |

| Sony Corp. | 48,200 | | 1,551,345 |

| Sony Corp. (ADR) | 66,964 | | 2,131,464 |

| Sumitomo Mitsui Trust Holdings, Inc. (ADR) | 1,132 | | 7,811 |

| Sumitomo Trust & Banking Co. Ltd. (ADR) | 55,663 | | 301,137 |

| Tokyo Gas Co. Ltd. | 698,118 | | 3,205,084 |

| Toyota Motor Corp. | 167,282 | | 6,770,505 |

| Toyota Motor Corp. (ADR) | 31,583 | | 2,534,536 |

| | | | 54,879,767 |

| |

| Luxembourg - 0.7% | | | |

| SES SA (FDR) | 109,876 | | 2,832,539 |

| |

| Mexico - 0.5% | | | |

| America Movil SAB de CV (ADR), Series L | 25,043 | | 1,454,998 |

| FINAE, Series D, Preferred (b)(i)* | 1,910,937 | | 256,545 |

| | | | 1,711,543 |

| |

| Netherlands - 3.6% | | | |

| ASML Holding NV* | 5,168 | | 229,976 |

| BE Semiconductor Industries NV* | 7,522 | | 67,322 |

| Gemalto NV | 50,931 | | 2,507,107 |

| ING Groep NV (CVA)* | 422,915 | | 5,357,371 |

| Koninklijke Philips Electronics NV: | | | |

| Common* | 73,054 | | 2,337,144 |

| NY Shares* | 79,797 | | 2,567,069 |

| TNT NV (ADR) | 28,181 | | 721,152 |

| | | | 13,787,141 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 20 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Norway - 2.3% | | | |

| DnB NOR ASA | 188,167 | $ | 2,885,303 |

| Petroleum Geo-Services ASA* | 192,737 | | 3,087,735 |

| Yara International ASA | 40,150 | | 2,033,059 |

| Yara International ASA (ADR) | 16,024 | | 814,019 |

| | | | 8,820,116 |

| |

| Philippines - 0.7% | | | |

| Philippine Long Distance Telephone Co. (ADR) | 49,713 | | 2,659,646 |

| |

| Portugal - 0.2% | | | |

| Portugal Telecom SGPS SA (ADR) | 51,850 | | 603,016 |

| |

| Singapore - 0.8% | | | |

| City Developments Ltd. (ADR) | 986 | | 9,111 |

| Oversea-Chinese Banking Corp. Ltd. | 310,830 | | 2,362,920 |

| Singapore Telecommunications Ltd. (ADR) | 21,467 | | 517,569 |

| | | | 2,889,600 |

| |

| South Africa - 1.5% | | | |

| African Bank Investments Ltd. (ADR) | 340 | | 9,445 |

| Aspen Pharmacare Holdings Ltd.* | 179,954 | | 2,100,217 |

| Clicks Group Ltd.* | 379,200 | | 2,384,215 |

| MTN Group Ltd. (ADR) | 42,057 | | 853,757 |

| Nedbank Group Ltd. (ADR) | 7,205 | | 150,945 |

| Tiger Brands Ltd. (ADR) | 3,958 | | 103,185 |

| | | | 5,601,764 |

| |

| South Korea - 0.5% | | | |

| KT Corp. (ADR) | 97,100 | | 1,896,363 |

| |

| Spain - 2.6% | | | |

| Banco Bilbao Vizcaya Argentaria SA (ADR) | 73,588 | | 883,056 |

| Banco Santander SA (ADR) | 135,958 | | 1,593,428 |

| International Consolidated Airlines Group SA (ADR)* | 1,365 | | 24,911 |

| Telefonica SA | 301,828 | | 7,562,610 |

| | | | 10,064,005 |

| |

| Sweden - 2.3% | | | |

| Assa Abloy AB, Series B | 98,400 | | 2,828,907 |

| Atlas Copco AB (ADR) | 4,896 | | 130,429 |

| Hennes & Mauritz AB, B Shares | 101,754 | | 3,378,234 |

| Husqvarna AB, Series B | 275,200 | | 2,358,266 |

| SKF AB (ADR) | 1,361 | | 39,592 |

| Svenska Cellulosa AB (ADR) | 7,488 | | 121,605 |

| | | | 8,857,033 |

| |

| Switzerland - 5.4% | | | |

| Adecco SA (ADR) | 575 | | 19,032 |

| Credit Suisse Group AG | 108,430 | | 4,620,617 |

| Credit Suisse Group AG (ADR) | 63,021 | | 2,683,434 |

| Julius Baer Group Ltd | 42,873 | | 1,865,834 |

| Logitech International SA* | 119,234 | | 2,153,216 |

| Nobel Biocare Holding AG (ADR)* | 1,022 | | 10,506 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 21 |

| | | |

| EQUITY SECURITIES - CONT’D | SHARES | | VALUE |

| Switzerland - Cont’d | | | |

| Novartis AG | 77,612 | $ | 4,221,673 |

| Roche Holding AG (ADR) | 81,873 | | 2,943,334 |

| STMicroelectronics NV | 30,466 | | 378,388 |

| Swiss Reinsurance (ADR) | 8,622 | | 492,316 |

| Zurich Financial Services AG (ADR) | 35,996 | | 1,010,768 |

| | | | 20,399,118 |

| |

| Turkey - 0.4% | | | |

| Turkiye Garanti Bankasi AS | 322,700 | | 1,507,973 |

| |

| United Kingdom - 21.5% | | | |

| ARM Holdings plc | 163,700 | | 1,510,606 |

| Aviva plc (ADR) | 31,339 | | 442,507 |

| Barclays plc | 547,117 | | 2,437,003 |

| Barclays plc (ADR) | 40,096 | | 727,341 |

| BG Group plc | 344,368 | | 8,571,744 |

| BG Group plc (ADR) | 17,163 | | 2,143,659 |

| British Land Co. plc (ADR) | 1,136 | | 10,235 |

| BT Group plc (ADR) | 46,754 | | 1,406,360 |

| Bunzl plc (ADR) | 1,321 | | 80,515 |

| Cairn Energy plc* | 301,724 | | 2,237,589 |

| Capita Group plc | 216,239 | | 2,578,442 |

| Centrica plc | 545,604 | | 2,848,369 |

| Centrica plc (ADR) | 19,432 | | 410,598 |

| Compass Group plc | 322,548 | | 2,901,380 |

| GlaxoSmithKline plc | 122,492 | | 2,338,335 |

| HSBC Holdings plc | 326,228 | | 3,355,937 |

| HSBC Holdings plc (ADR) | 42,139 | | 2,182,800 |

| International Power plc (ADR) | 4,301 | | 215,910 |

| J Sainsbury plc (ADR) | 15,098 | | 324,003 |

| Johnson Matthey plc | 53,854 | | 1,607,555 |

| Johnson Matthey plc (ADR) | 291 | | 17,437 |

| Kingfisher plc | 1,216,487 | | 4,800,656 |

| Legal & General Group plc (ADR) | 1,274 | | 11,899 |

| Lloyds Banking Group plc (ADR)* | 263,495 | | 974,932 |

| Man Group plc (ADR) | 71,023 | | 284,092 |

| Old Mutual plc (ADR) | 1,880 | | 32,712 |

| Pearson plc | 455,949 | | 8,056,347 |

| Persimmon plc | 212,629 | | 1,518,508 |

| Prudential plc | 201,406 | | 2,283,595 |

| Prudential plc (ADR) | 102,558 | | 2,330,118 |

| Reckitt Benckiser Group plc | 82,117 | | 4,219,772 |

| Reckitt Benckiser Group plc (ADR) | 35,453 | | 368,002 |

| Sage Group plc (ADR) | 14,550 | | 261,464 |

| Scottish & Southern Energy plc (ADR) | 33,422 | | 684,148 |

| Smith & Nephew plc (ADR) | 27,389 | | 1,545,013 |

| Standard Chartered plc | 169,264 | | 4,392,474 |

| Tate & Lyle plc | 183,586 | | 1,701,477 |

| Tesco plc | 743,886 | | 4,548,476 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 22 |

| | | | |

| EQUITY SECURITIES - CONT’D | | SHARES | | VALUE |

| United Kingdom - Cont’d | | | | |

| Tesco plc (ADR) | | 85,163 | $ | 1,575,515 |

| Unilever plc (ADR) | | 78,317 | | 2,398,067 |

| United Utilities Group plc (ADR) | | 8,214 | | 156,477 |

| Vodafone Group plc (ADR) | | 46,585 | | 1,339,319 |

| | | | | 81,831,388 |

| |

| United States - 1.9% | | | | |

| Bristol-Myers Squibb Co. | | 49,992 | | 1,321,289 |

| Distributed Energy Systems Corp.* | | 308,138 | | 2,619 |

| Evergreen Solar, Inc.* | | 233 | | 314 |

| MeadWestvaco Corp. | | 82,974 | | 2,516,601 |

| Powerspan Corp.: | | | | |

| Series A, Convertible Preferred (b)(i)* | | 45,455 | | - |

| Series B, Convertible Preferred (b)(i)* | | 20,000 | | - |

| Series C, Convertible Preferred (b)(i)* | | 239,764 | | - |

| Series D, Convertible Preferred (b)(i)* | | 45,928 | | - |

| Series D, Preferred Warrants (strike price $3.44/share, | | | | |

| expires 12/31/12) (b)(i)* | | 2,347 | | - |

| Pricesmart, Inc. | | 40,500 | | 1,483,920 |

| RF Technology, Inc., Contingent Deferred Distribution (b)(i)* | | 365,374 | | 3,654 |

| Sealed Air Corp. | | 48,413 | | 1,290,691 |

| SmarThinking, Inc.: | | | | |

| Series 1-A, Convertible Preferred (b)(i)* | | 104,297 | | 387,429 |

| Series 1-B, Convertible Preferred (b)(i)* | | 163,588 | | 201,383 |

| Series 1-B, Preferred Warrants (strike price $0.01/share, expires | | | | |

| 5/31/15) (b)(i)* | | 11,920 | | 14,555 |

| Series 1-B, Preferred Warrants (strike price $1.53/share, expires | | | | |

| 6/1/15) (b)(i)* | | 32,726 | | - |

| | | | | 7,222,455 |

| |

| |

| Total Equity Securities (Cost $337,174,917) | | | | 367,217,801 |

| |

| | | PRINCIPAL | | |

| VENTURE CAPITAL DEBT OBLIGATIONS - 0.3% | | AMOUNT | | |

| FINAE: | | | | |

| Note I, 6.50%, 12/10/15 (b)(i) | $ | 250,000 | | 250,000 |

| Note II, 6.50%, 2/29/16 (b)(i) | | 500,000 | | 500,000 |

| Access Bank plc, 8.477%, 8/29/12 (b)(i) | | 375,000 | | 390,331 |

| Mayer Laboratories, Inc., 6.00%, 12/31/01 (b)(i)(w) | | 37,482 | | 9,371 |

| |

| Total Venture Capital Debt Obligations (Cost $1,162,482) | | | | 1,149,702 |

| |

| HIGH SOCIAL IMPACT INVESTMENTS - 1.2% | | | | |

| Calvert Social Investment Foundation Notes, 1.17%, 7/1/11 (b)(i)(r) | | 4,431,583 | | 4,395,864 |

| |

| Total High Social Impact Investments (Cost $4,431,583) | | | | 4,395,864 |

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 23 |

| | | | | | |

| | | | ADJUSTED | | | |

| VENTURE CAPITAL LIMITED PARTNERSHIP INTEREST - 0.8% | | BASIS | | VALUE | |

| Blackstone Cleantech Venture Partners (b)(i)* | $ | 49,396 | $ | 43,103 | |

| Balkan Financial Sector Equity Fund CV (b)(i)* | | 563,779 | | 518,796 | |

| China Environment Fund 2004 (b)(i)* | | - | | 182,455 | |

| Emerald Cleantech Fund I (b)(i)* | | 966,151 | | 611,417 | |

| gNet Defta Development Holdings LLC (a)(b)(i)* | | 400,000 | | 385,198 | |

| SEAF Central and Eastern European Growth Fund LLC (a)(b)(i)* | | 352,304 | | 526,370 | |

| SEAF India International Growth Fund (b)(i)* | | 394,032 | | 473,965 | |

| ShoreCap International LLC (b)(i)* | | - | | 216,289 | |

| Terra Capital (b)(i)* | | 469,590 | | 1 | |

| |

| Total Venture Capital Limited Partnership Interest | | | | | |

| (Cost $3,195,252) | | | | 2,957,594 | |

| |

| |

| |

| TOTAL INVESTMENTS (Cost $345,964,234) - 98.8% | | | | 375,720,961 | |

| Other assets and liabilities, net - 1.2% | | | | 4,589,265 | |

| NET ASSETS - 100% | | | $ | 380,310,226 | |

| |

| |

| |

| NET ASSETS CONSIST OF: | | | | | |

| Paid-in capital applicable to the following shares of common stock with | | | | | |

| 250,000,000 shares of $0.01 par value shares authorized: | | | | | |

| Class A: 17,388,324 shares outstanding | | | $ | 361,534,285 | |

| Class B: 486,798 shares outstanding | | | | 12,808,875 | |

| Class C: 1,709,858 shares outstanding | | | | 37,782,592 | |

| Class I: 5,812,141 shares outstanding | | | | 136,755,172 | |

| Class Y: 372,218 shares outstanding | | | | 5,143,787 | |

| Undistributed net investment income | | | | 30,651 | |

| Accumulated net realized gain (loss) on investments | | | | | |

| and foreign currency transactions | | | | (203,530,084 | ) |

| Net unrealized appreciation (depreciation) on investments, foreign | | | | | |

| currencies, and assets and liabilities denominated in foreign currencies | | | | 29,784,948 | |

| |

| NET ASSETS | | | $ | 380,310,226 | |

| |

| |

| NET ASSET VALUE PER SHARE | | | | | |

| Class A (based on net assets of $255,213,136) | | | $ | 14.68 | |

| Class B (based on net assets of $6,359,592) | | | $ | 13.06 | |

| Class C (based on net assets of $21,837,455) | | | $ | 12.77 | |

| Class I (based on net assets of $91,166,372) | | | $ | 15.69 | |

| Class Y (based on net assets of $5,733,671) | | | $ | 15.40 | |

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 24 |

| | | |

| RESTRICTED SECURITIES | ACQUISITION DATES | | COST |

| Access Bank plc, 8.477%, 8/29/12 | 8/29/07 | $ | 375,000 |

| Balkan Financial Sector Equity Fund CV LP | 1/12/06 - 9/24/10 | | 563,779 |

| Blackstone Cleantech Venture Partners LP | 7/29/10 - 1/28/11 | | 49,396 |

| Calvert Social Investment Foundation Notes, 1.17%, 7/1/11 | 7/1/08 | | 4,431,583 |

| China Environment Fund 2004 LP | 9/15/05 - 4/1/09 | | - |

| Emerald Cleantech Fund I LP | 7/19/01 - 3/29/11 | | 966,151 |

| FINAE: | | | |

| Series D, Preferred | 2/28/11 | | 252,398 |

| Note I, 6.50%, 12/10/15 | 12/10/10 | | 250,000 |

| Note II, 6.50%, 2/29/16 | 2/24/11 | | 500,000 |

| gNet Defta Development Holdings LLC, LP | 8/30/05 | | 400,000 |

| Mayer Laboratories, Inc., 6.00%, 12/31/01 | 12/31/96 | | 37,482 |

| Powerspan Corp.: | | | |

| Series A, Convertible Preferred | 8/20/97 | | 250,000 |

| Series B, Convertible Preferred | 10/5/99 | | 200,000 |

| Series C, Convertible Preferred | 12/21/04 - 6/12/08 | | 273,331 |

| Series D, Convertible Preferred | 6/20/08 | | 157,996 |

| Series D, Preferred Warrants | | | |

| (strike price $3.44/share, expires 12/31/12) | 12/5/07 - 6/20/08 | | - |

| RF Technology, Inc., Contingent Deferred Distribution | 7/17/06 | | 104,368 |

| SEAF Central and Eastern European Growth Fund LLC, LP | 8/10/00 - 3/25/11 | | 352,304 |

| SEAF India International Growth Fund LP | 3/22/05 - 5/24/10 | | 394,032 |

| ShoreCap International LLC, LP | 8/12/04 - 12/15/08 | | - |

| SmarThinking, Inc.: | | | |

| Series 1-A, Convertible Preferred | 4/22/03 - 5/27/05 | | 159,398 |

| Series 1-B, Convertible Preferred | 6/10/03 | | 250,000 |

| Series 1-B, Preferred Warrants | | | |

| (strike price $0.01/share, expires 5/31/15) | 5/27/05 | | - |

| Series 1-B, Preferred Warrants | | | |

| (strike price $1.53/share, expires 6/1/15) | 9/19/00 | | - |

| Terra Capital LP | 11/23/98 - 3/14/06 | | 469,590 |

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 25 |

| (a) | Affiliated company. |

| (b) | This security was valued by the Board of Directors. See Note A. |

| (i) | Restricted securities represent 2.5% of net assets of the Fund. |

| (r) | The coupon rate shown on floating or adjustable rate securities represents the rate at period end. |

| (s) | 23,816 shares of Schneider Electric SA have been soft segregated in order to cover outstanding commitments to certain limited partnerships investments within the Fund. There are no restrictions on the trading of this security. |

| (w) | Mayer Laboratories, Inc. is in default for principal and interest. Past due accrued interest as of March 31, 2011 totaled $1,184. |

| * | Non-income producing security. |

Abbreviations:

ADR: American Depositary Receipts

CVA: Certificaten Van Aandelen

FDR: Fiduciary Depositary Receipts

LLC: Limited Liability Corporation

LP: Limited Partnership

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 26 |

| | | |

| STATEMENT OF OPERATIONS |

| SIX MONTHS ENDED MARCH 31, 2011 |

| |

| |

| NET INVESTMENT INCOME | | | |

| Investment Income: | | | |

| Dividend income (net of foreign taxes withheld of $233,852) | $ | 3,115,220 | |

| Interest income | | 64,801 | |

| Total investment income | | 3,180,021 | |

| |

| Expenses: | | | |

| Investment advisory fee | | 1,382,156 | |

| Transfer agency fees and expenses | | 407,470 | |

| Administrative fees | | 562,676 | |

| Distribution Plan expenses: | | | |

| Class A | | 312,842 | |

| Class B | | 33,235 | |

| Class C | | 110,792 | |

| Directors’ fees and expenses | | 16,226 | |

| Custodian fees | | 144,176 | |

| Registration fees | | 33,891 | |

| Reports to shareholders | | 79,346 | |

| Professional fees | | 21,207 | |

| Miscellaneous | | 40,085 | |

| Total expenses | | 3,144,102 | |

| Reimbursement from Advisor: | | | |

| Class B | | (1,372 | ) |

| Class I | | (5,008 | ) |

| Class Y | | (4,316 | ) |

| Fees paid indirectly | | (1,864 | ) |

| Net expenses | | 3,131,542 | |

| |

| NET INVESTMENT INCOME | | 48,479 | |

| |

| REALIZED AND UNREALIZED GAIN (LOSS) | | | |

| Net realized gain (loss) on: | | | |

| Investments | | 6,806,855 | |

| Foreign currency transactions | | (234,226 | ) |

| | | 6,572,629 | |

| Change in unrealized appreciation (depreciation) on: | | | |

| Investments and foreign currencies | | 15,134,324 | |

| Assets and liabilities denominated in foreign currencies | | 53,567 | |

| | | 15,187,891 | |

| |

| NET REALIZED AND UNREALIZED GAIN (LOSS) | | 21,760,520 | |

| |

| INCREASE (DECREASE) IN NET ASSETS | | | |

| RESULTING FROM OPERATIONS | $ | 21,808,999 | |

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 27 |

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | |

| | | SIX MONTHS ENDED | | | YEAR ENDED | |

| | | MARCH

31, | | | SEPTEMBER 30, | |

| INCREASE (DECREASE) IN NET ASSETS | | 2011 | | | 2010 | |

| Operations: | | | | | | |

| Net investment income | $ | 48,479 | | $ | 2,088,917 | |

| Net realized gain (loss) | | 6,572,629 | | | 1,595,659 | |

| Change in unrealized appreciation (depreciation) | | 15,187,891 | | | (532,062 | ) |

| |

| INCREASE (DECREASE) IN NET ASSETS | | | | | | |

| RESULTING FROM OPERATIONS | | 21,808,999 | | | 3,152,514 | |

| |

| Distributions to shareholders from: | | | | | | |

| Net investment income: | | | | | | |

| Class A shares | | (655,710 | ) | | (1,877,571 | ) |

| Class I shares | | (542,675 | ) | | (1,650,864 | ) |

| Class Y shares | | (3,993 | ) | | (5,626 | ) |

| Total distributions | | (1,202,378 | ) | | (3,534,061 | ) |

| |

| Capital share transactions: | | | | | | |

| Shares sold: | | | | | | |

| Class A shares | | 22,229,166 | | | 37,402,286 | |

| Class B shares | | 49,297 | | | 269,456 | |

| Class C shares | | 825,701 | | | 2,587,664 | |

| Class I shares | | 5,832,831 | | | 13,046,519 | |

| Class Y shares | | 3,397,788 | | | 3,391,938 | |

| Reinvestment of distributions: | | | | | | |

| Class A shares | | 608,387 | | | 1,712,839 | |

| Class I shares | | 483,830 | | | 1,379,546 | |

| Class Y shares | | 419 | | | 2,622 | |

| Redemption fees: | | | | | | |

| Class A shares | | 492 | | | 1,376 | |

| Class B shares | | — | | | 6 | |

| Class C shares | | 166 | | | 59 | |

| Class Y shares | | 2 | | | 1,837 | |

| Shares redeemed: | | | | | | |

| Class A shares | | (26,804,130 | ) | | (64,598,217 | ) |

| Class B shares | | (894,672 | ) | | (2,328,107 | ) |

| Class C shares | | (2,130,616 | ) | | (4,676,204 | ) |

| Class I shares | | (6,585,645 | ) | | (35,107,420 | ) |

| Class Y shares | | (675,366 | ) | | (1,497,086 | ) |

| Total capital share transactions | | (3,662,350 | ) | | (48,410,886 | ) |

| |

| |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | 16,944,271 | | | (48,792,433 | ) |

| |

| |

| NET ASSETS | | | | | | |

| Beginning of period | | 363,365,955 | | | 412,158,388 | |

| End of period (including undistributed net investment | | | | | | |

| income of $30,651 and $1,184,550, respectively) | $ | 380,310,226 | | $ | 363,365,955 | |

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 28 |

stateMents of changes in net assets

| | | | |

| | SIX MONTHS ENDED | | YEAR ENDED | |

| | MARCH

31, | | SEPTEMBER 30, | |

| CAPITAL SHARE ACTIVITY | 2011 | | 2010 | |

| Shares sold: | | | | |

| Class A shares | 1,537,976 | | 2,802,787 | |

| Class B shares | 3,848 | | 22,231 | |

| Class C shares | 65,954 | | 220,010 | |

| Class I shares | 381,320 | | 924,635 | |

| Class Y shares | 224,949 | | 248,819 | |

| Reinvestment of distributions: | | | | |

| Class A shares | 42,634 | | 125,851 | |

| Class I shares | 31,789 | | 95,470 | |

| Class Y shares | 28 | | 185 | |

| Shares redeemed: | | | | |

| Class A shares | (1,861,502 | ) | (4,854,110 | ) |

| Class B shares | (69,591 | ) | (194,930 | ) |

| Class C shares | (169,203 | ) | (404,192 | ) |

| Class I shares | (430,343 | ) | (2,456,887 | ) |

| Class Y shares | (44,831 | ) | (105,845 | ) |

| Total capital share activity | (286,972 | ) | (3,575,976 | ) |

See notes to financial statements.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 29 |

NOTES TO FINANCIAL STATEMENTS

NOTE A — SIGNIFICANT ACCOUNTING POLICIES

General: The Calvert World Values International Equity Fund (the “Fund”), a series of Calvert World Values Fund, Inc., is registered under the Investment Company Act of 1940 as a diversified, open-end management investment company. The operation of each series is accounted for separately. The Fund offers five classes of shares of capital stock. Class A shares are sold with a maximum front-end sales charge of 4.75%. Class B shares are sold without a front-end sales charge. With certain exceptions, the Fund will impose a deferred sales charge at the time of redemption, depending on how long investors have owned the shares. Effective March 1, 2010, Class B shares are no longer offered for purchase, except through reinvestment of dividends and/or distributions and through certain exchanges. Class C shares are sold without a front-end sales charge. With certain exceptions, the Fund will impose a deferred sales charge on shares sold within one year of purchase. Class B and Class C shares have higher levels of expenses than Class A shares. Class I shares require a minimum account balance of $1,000,000. The $1 million minimum initial investment may be waived for certain institutional accounts, where it is believed to be in the best interest of the Fund and its shareholders. Class I shares have no front-end or deferred sales charge and have lower levels of expenses than Class A shares. Effective October 31, 2008, the Fund began to offer Class Y shares. Class Y shares are generally only available to wrap or similar fee-based programs offered by financial intermediaries that have entered into an agreement with the Fund’s Distributor to offer Class Y shares. Class Y shares have no front-end or deferred sales charge. Each class has different: (a) dividend rates, due to differences in Distribution Plan expenses and other class-specific expenses, (b) exchange privileges and (c) class-specific voting rights.

Security Valuation: Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Directors to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board of Directors. In determining fair value, the Board considers all relevant qualitative and quantitative information available. These factors are subject to change over time and are reviewed periodically. The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material.

At March 31, 2011, securities valued at $9,366,726 or 2.5% of net assets were fair valued in good faith under the direction of the Board of Directors.

The Fund utilizes various methods to measure the fair value of its investments. Generally Accepted Accounting Principles (GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below: Level 1 – quoted prices in active markets for identical securities Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 30 |

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an investment’s assigned level within the hierarchy during the period. Valuation techniques used to value the Fund’s investments by major category are as follows.

Equity securities, including restricted securities and venture capital securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Foreign securities are valued based on quotations from the principle market in which such securities are normally traded. If events occur after the close of the principle market in which foreign securities are traded, and before the close of business of the Fund, that are expected to materially affect the value of those securities, then they are valued at their fair value taking these events into account. The Fund has retained a third party fair value pricing service to quantitatively analyze the price movement of its holdings on foreign exchanges and to automatically fair value if the variation from the prior day’s closing price exceeds specified parameters. Such securities would be categorized as Level 2 in the hierarchy in these circumstances. Utilizing this technique may result in transfers between Level 1 and Level 2. For restricted securities and private placements where observable inputs are limited, assumptions about market activity and risk are used and are categorized as Level 3 in the hierarchy.

Venture capital securities for which market quotations are not readily available are fair valued by the Fund’s Board of Directors and are categorized as Level 3 in the hierarchy. Venture capital equity securities are generally valued at enterprise value, determined by an industry multiple times revenue, with discounts as appropriate based on assumptions of liquidation or exit risk, or to a recent round of equity financing. Venture capital limited partnership securities are generally valued at the enterprise value of the underlying investments held by the partnership based on reports from the general partner or other available information; the resulting figure is then multiplied by the capital percentage owned in the limited partnership. Venture capital debt securities are valued based on assumptions of credit and market risk. For venture capital securities denominated in foreign currency, the fair value is marked to the daily exchange rate.

Debt securities, including restricted securities, are valued based on evaluated prices received from independent pricing services or from dealers who make markets in such securities and are generally categorized as Level 2 in the hierarchy. Short-term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing matrices which consider similar factors that would be used by independent pricing services. These are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 31 |

The following is a summary of the inputs used to value the Fund’s net assets as of March 31, 2011:

| | | | | | | | | |

| | | VALUATION INPUTS | |

| InvestMents In securItIes | | LeveL 1 | LeveL 2 | | LeveL 3 | | | totaL | |

| Equity securities* | $ | 366,351,302 | — | | — | | $ | 366,351,302 | |

| Venture capital | | 2,933 | — | $ | 4,970,862 | | | 4,973,795 | |

| Other debt obligations | | — | — | | 4,395,864 | | | 4,395,864 | |

| TOTAL | $ | 366,354,235 | — | $ | 9,366,726 | ** | $ | 375,720,961 | |

| |

| * For further breakdown of equity securities by country, please refer to the Statement of Net Assets. | | | | |

| | | | | | | | | VENTURE | |

| | | | | | | | | CAPITAL | |

| Balance as of 9/30/10 | | | | | | | $ | 5,488,687 | |

| Accrued discounts/premiums | | | | | | | | - | |

| Realized gain (loss) | | | | | | | | 276 | |

| Change in unrealized appreciation (depreciation) | | | | | | (1,333,349 | ) |

| Purchases | | | | | | | | 1,084,307 | |

| Sales | | | | | | | | (269,059 | ) |

| Transfers in and/or out of Level 31 | | | | | | - | |

| Balance as of 3/31/11 | | | | | | | $ | 4,970,862 | |

| |

| | | | | | OTHER DEBT | | | | |

| | | | | | OBLIGATIONS | | | TOTAL | |

| Balance as of 9/30/10 | | | | $ | 4,532,706 | | $ | 10,021,393 | |

| Accrued discounts/premiums | | | | | - | | | - | |

| Realized gain (loss) | | | | | - | | | 276 | |

| Change in unrealized appreciation (depreciation) | | | 113,158 | | | (1,220,191 | ) |

| Purchases | | | | | - | | | 1,084,307 | |

| Sales | | | | | (250,000 | ) | | (519,059 | ) |

| Transfers in and/or out of Level 31 | | | - | | | - | |

| Balance as of 3/31/11 | | | | $ | 4,395,864 | | $ | 9,366,726 | |

1 The Fund’s policy is to recognize transfers into and transfers out of Level 3 as of the end of the reporting period.

For the six months ended March 31, 2011, total change in unrealized gain (loss) on Level 3 securities included in the change in net assets was ($1,220,191). Total unrealized gain (loss) for all securities (including Level 1 and Level 2) can be found on the accompanying Statement of Operations.

Repurchase Agreements: The Fund may enter into repurchase agreements with recognized financial institutions or registered broker/dealers and, in all instances, holds underlying securities with a value exceeding the total repurchase price, including accrued interest. Although risk is mitigated by the collateral, the Fund could experience a delay in recovering its value and a possible loss of income or value if the counterparty fails to perform in accordance with the terms of the agreement.

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 32 |

Restricted Securities: The Fund may invest in securities that are subject to legal or contractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities is included at the end of the Fund’s Statement of Net Assets.

Security Transactions and Net Investment Income: Security transactions are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date or, in the case of dividends on certain foreign securities, as soon as the Fund is informed of the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned. Investment income and realized and unrealized gains and losses are allocated to separate classes of shares based upon the relative net assets of each class. Expenses arising in connection with a class are charged directly to that class. Expenses common to the classes are allocated to each class in proportion to their relative net assets. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Foreign Currency Transactions: The Fund’s accounting records are maintained in U.S. dollars. For valuation of assets and liabilities on each date of net asset value determination, foreign denominations are converted into U.S. dollars using the current exchange rate. Security transactions, income and expenses are translated at the prevailing rate of exchange on the date of the event. The effect of changes in foreign exchange rates on securities and foreign currencies is included in the net realized and unrealized gain or loss on securities and foreign currencies.

Distributions to Shareholders: Distributions to shareholders are recorded by the Fund on ex-dividend date. Dividends from net investment income and distributions from net realized capital gains, if any, are paid at least annually. Distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles; accordingly, periodic reclassifications are made within the Fund’s capital accounts to reflect income and gains available for distribution under income tax regulations.

Estimates: The preparation of the financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reported period. Actual results could differ from those estimates.

Redemption Fees: The Fund charges a 2% redemption fee on redemptions, including exchanges, made within 30 days of purchase in the same Fund (within seven days for Class I shares). The redemption fee is paid to the Class of the Fund from which the redemption is made, and is accounted for as an addition to paid-in capital. The fee is

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 33 |

intended to discourage market-timers by ensuring that short-term trading costs are borne by the investors making the transactions and not the shareholders already in the Fund.

Expense Offset Arrangement: The Fund has an arrangement with its custodian bank whereby the custodian’s fees may be paid indirectly by credits earned on the Fund’s cash on deposit with the bank. These credits are used to reduce the Fund’s expenses. Such a deposit arrangement may be an alternative to overnight investments.

Federal Income Taxes: No provision for federal income or excise tax is required since the Fund intends to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable earnings.

Management has analyzed the Fund’s tax positions taken for all open federal income tax years and has concluded that no provision for federal income tax is required in the Fund’s financial statements. A Fund’s federal tax return is subject to examination by the Internal Revenue Service for a period of three years.

NOTE B — RELATED PARTY TRANSACTIONS

Calvert Asset Management Company, Inc. (the “Advisor”) is wholly-owned by Calvert Group, Ltd. (“Calvert”), which is indirectly wholly owned by UNIFI Mutual Holding Company. The Advisor provides investment advisory services and pays the salaries and fees of officers and Directors of the Fund who are employees of the Advisor or its affiliates. For its services, the Advisor receives a monthly fee based on the following annual rates of average daily net assets: .75% on the first $250 million, .725% on the next $250 million and .675% on the excess of $500 million. Under the terms of the agreement, $237,741 was payable at period end. In addition, $121,253 was payable at period end for operating expenses paid by the Advisor during March 2011.

The Advisor has contractually agreed to limit net annual fund operating expenses through January 31, 2012 for Class I and Class Y. The contractual expense cap is 1.10% and 1.39%, respectively. For the purposes of this expense limit, operating expenses do not include interest expense, brokerage commissions, taxes, and extraordinary expenses. This expense limitation does not limit any acquired fund fees and expenses. To the extent any expense offset credits are earned, the Advisor’s obligation under the contractual limitation may be reduced and the Advisor may benefit from the expense offset arrangement. The Advisor voluntarily reimbursed Class B shares for expenses of $1,372 for the six months ended March 31, 2011.

Calvert Administrative Services Company, an affiliate of the Advisor, provides administrative services to the Fund for an annual fee, payable monthly, of .35% for Classes A, B, C and Y, and .15% for Class I, based on their average daily net assets. Under the terms of the agreement, $96,905 was payable at period end.

Calvert Distributors, Inc., an affiliate of the Advisor, is the distributor and principal underwriter for the Fund. Distribution Plans, adopted by Class A, Class B and Class C shares, allow the Fund to pay the Distributor for expenses and services associated with distribution of shares. The expenses paid may not exceed .35%, 1.00% and 1.00% annually of average daily net assets of each Class A, Class B and Class C, respectively. The amount actually paid by the Fund is an annualized fee, payable monthly of .25%, 1.00%

| www. | calvert.com CALVERT INTERNATIONAL EQUITY FUND SEMI-ANNUAL REPORT (UNAUDITED) 34 |

and 1.00% of the Fund’s average daily net assets of Class A, Class B and Class C, respectively. Class I and Class Y shares do not have Distribution Plan expenses. Under the terms of agreement, $77,727 was payable at period end.

The Distributor received $19,241 as its portion of commissions charged on sales of the Fund’s Class A shares for the six months ended March 31, 2011.

Calvert Shareholder Services, Inc. (“CSSI”), an affiliate of the Advisor, is the shareholder servicing agent for the Fund. For its services, CSSI received a fee of $89,291 for the six months ended March 31, 2011. Under the terms of the agreement, $14,745 was payable at period end. Boston Financial Data Services, Inc. is the transfer and dividend disbursing agent.

The Fund invests in Community Investment Notes issued by the Calvert Social Investment Foundation (the “CSI Foundation”). The CSI Foundation is a 501(c)(3) non-profit organization that receives in-kind support from the Calvert Group, Ltd. and its subsidiaries. The Fund has received from the Securities and Exchange Commission an exemptive order permitting the Fund to make investments in these notes under certain conditions.