SCHEDULE 14A

Proxy Statement Pursuant to Section 14(A)

of the Securities Exchange Act of 1934

Filed by the Registrant / X /

Filed by a Party other than the Registrant / /

Check the appropriate box:

/ / Preliminary Proxy Statement.

/ / Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e) (2)).

/ X / Definitive Proxy Statement.

/ / Definitive Additional Materials.

/ / Soliciting Material Pursuant to § 240.14a-12.

the calvert fund

calvert impact fund, inc.

calvert management series

calvert responsible index series, inc.

calvert social investment fund

calvert world values fund, inc.

calvert variable series, inc.

calvert variable products, inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

/ X / No fee required.

/ / Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction |

computed pursuant to Exchange Act Rule 0-11 (set forth the

amount on which the filing fee is calculated and state how it

was determined):

| (4) | Proposed maximum aggregate value of transaction: |

/ / Fee paid previously with preliminary materials.

/ / Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement

number, or the form or schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Calvert Funds

1825 Connecticut Avenue NW, Suite 400

Washington, DC 20009

December 30, 2020

Dear Shareholder:

We cordially invite you to attend the joint special meeting of shareholders of the funds listed in Appendix A of the attached Proxy Statement (each, a “Fund” and, collectively, the “Funds”) scheduled to be held at the principal office of the Funds, 1825 Connecticut Avenue NW, Suite 400, Washington, DC 20009, on February 19, 2021 at 11:30 a.m. Eastern Time (the “Meeting”). The Meeting is being held to approve matters important to your Fund(s) relating to Morgan Stanley’s proposed acquisition of Eaton Vance Corp. (“EVC”) and its affiliates. EVC is the parent company of Calvert Research and Management (“CRM”). CRM serves as investment adviser to each Fund.

On October 7, 2020, EVC entered into a definitive agreement with Morgan Stanley, a leading global financial services firm providing a wide range of investment banking, securities, wealth management, and investment management services, pursuant to which Morgan Stanley will acquire EVC (the “Transaction”), subject to the completion or waiver of various conditions (the “Closing”). The Closing may be deemed to cause each Fund’s current investment advisory agreement with CRM and, with respect to certain Funds, each such Fund’s current investment sub-advisory agreement between CRM and Eaton Vance Advisers International Ltd., Atlanta Capital Management Company, LLC, Hermes Investment Management Limited, or Ameritas Investment Partners, Inc. (each a “Sub-Adviser”) to terminate in accordance with applicable law. In order to help ensure that each Fund’s investment program continues uninterrupted after the Closing, we are asking shareholders of each Fund to approve a new investment advisory agreement and, as applicable, a new investment sub-advisory agreement. Each Fund’s Board of Trustees or Board of Directors, as applicable (each, a “Board,” and collectively, the “Boards”), has approved its new agreement(s). It is important to note that the investment advisory fee rate(s) of the Funds under the new agreements will not change as a result of the Transaction, that the Transaction is not expected to result in any change in the investment objective(s) or investment strategies of the Funds or to the Funds’ commitment to responsible investing, if applicable, and that the portfolio managers for the Funds are expected to continue in such roles upon consummation of the Transaction.

As more fully described in the enclosed Proxy Statement, the purpose of the Meeting is to seek your vote on the following proposals relating to the Transaction: (i) the approval of a new investment advisory agreement with CRM and (ii) for certain Funds, the approval of a new investment sub-advisory agreement with the applicable Sub-Adviser.

The Boards have carefully considered each of these proposals and, as described more fully in the enclosed Proxy Statement, unanimously recommend that shareholders vote FOR each proposal. In particular, the Boards believe that approving the new investment advisory agreements with CRM and, as applicable, the new investment sub-advisory agreements with the Sub-Advisers, is in the best interests of the Funds.

We hope that you will be able to attend the Meeting. Whether or not you plan to attend, and regardless of the number of shares you own, it is important that your shares be represented. We urge you to mark, sign, date, and mail the enclosed proxy card/voting instruction form in the postage-paid envelope provided or to record your voting instructions by telephone or via the internet as soon as possible to ensure that your shares are represented at the Meeting.

Your vote is important to us. We appreciate your consideration of these important proposals. If you have questions about the proposals, please call our proxy information line at 877-225-6862 or contact your financial intermediary.

Sincerely yours,

/s/ John H. Streur

John H. Streur

President and Chief Executive Officer

Calvert Research and Management

*******

Table of Contents

| Notice of Joint Special Meeting of Shareholders | 1 |

| Important Information for Owners of Variable Annuity or Life Insurance Contracts Invested in |

| Certain Funds | 3 |

| Proxy Statement | 4 |

| General Information | 4 |

| Questions and Answers | 5 |

| Proposal 1 | 8 |

| Proposal 2 | 10 |

| Further Information About Voting and the Joint Special Meeting | 14 |

| Information for Insurance Underlying Funds | 15 |

| Additional Meeting Information | 16 |

| Appendix A – Funds in this Proxy Statement | A-1 |

| Appendix B – Investment Advisory Agreements: Compensation | B-1 |

| Appendix C – Investment Sub-Advisory Agreements: Compensation | C-1 |

| Appendix D – Expense Reimbursement Arrangements | D-1 |

| Appendix E – Number of Shares Outstanding as of the Record Date | E-1 |

| Appendix F – Form of New CRM Investment Advisory Agreement | F-1 |

| Appendix G – Investment Advisory Agreements: Dates and Approvals | G-1 |

| Appendix H – Board Considerations | H-1 |

| Appendix I – Form of New EVAIL and Atlanta Capital Investment Sub-Advisory Agreements | I-1 |

| Appendix J – Form of New Hermes Investment Sub-Advisory Agreement | J-1 |

| Appendix K – Form of New AIP Investment Sub-Advisory Agreement | K-1 |

| Appendix L – Investment Sub-Advisory Agreements: Dates and Approvals | L-1 |

| Appendix M – Payments to CRM, the Sub-Advisers, or Affiliates | M-1 |

| Appendix N – Fund Directors/Trustees and Officers | N-1 |

| Appendix O – 5% Ownership | O-1 |

| Appendix P – Ownership of Fund Management | P-1 |

| Appendix Q – Affiliated Brokerage Commissions | Q-1 |

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

To be held on February 19, 2021

the calvert fund calvert impact fund, inc. calvert management series calvert responsible index series, inc. calvert social investment fund calvert world values fund, inc. calvert variable series, inc. calvert variable products, inc. |

The separate series of each trust and corporation listed above, as set forth on Appendix A to the enclosed Proxy Statement, are collectively referred to herein as the “Funds” and, each individually, a “Fund.”

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING OF THE FUNDS SCHEDULED TO BE HELD ON FEBRUARY 19, 2021: The notice of joint special meeting of shareholders, Proxy Statement, and the forms of proxy card/voting instruction form are available at https://www.proxy-direct.com/cal-31802.

To the shareholders of each Fund:

The joint special meeting of shareholders of your Fund(s) will be held on February 19, 2021 at 11:30 a.m., Eastern Time, at the principal office of the Funds, 1825 Connecticut Avenue NW, Suite 400, Washington, DC 20009 (the “Meeting”), to consider the following proposals (each, a “Proposal”), as more fully described in the accompanying Proxy Statement.

Proposals:

| 1. | Approval of a new investment advisory agreement for each Fund with Calvert Research and Management to continue to serve as the Fund’s investment adviser |

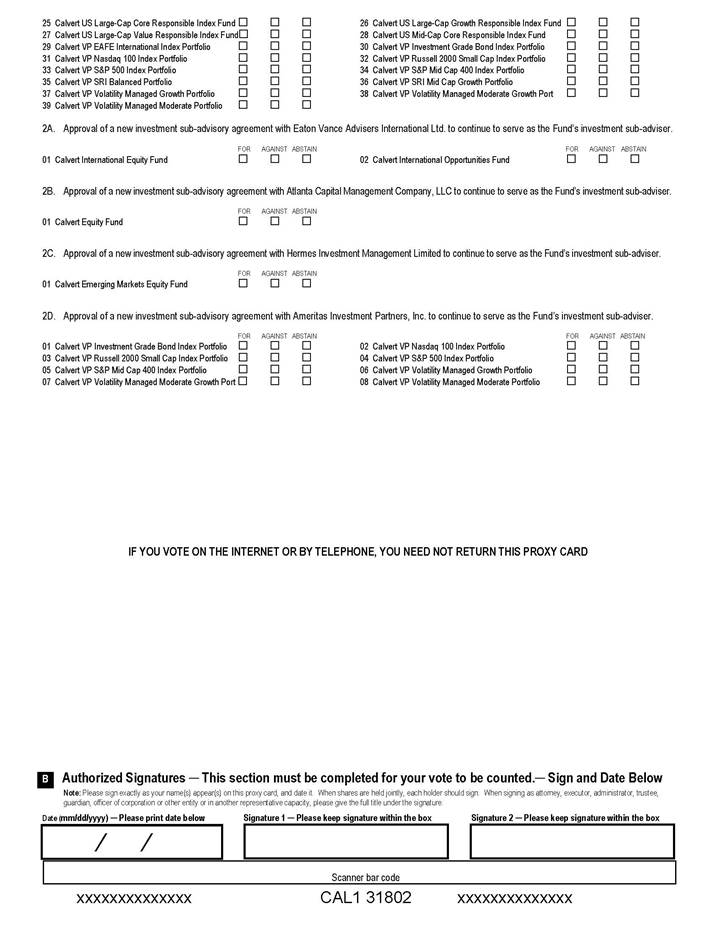

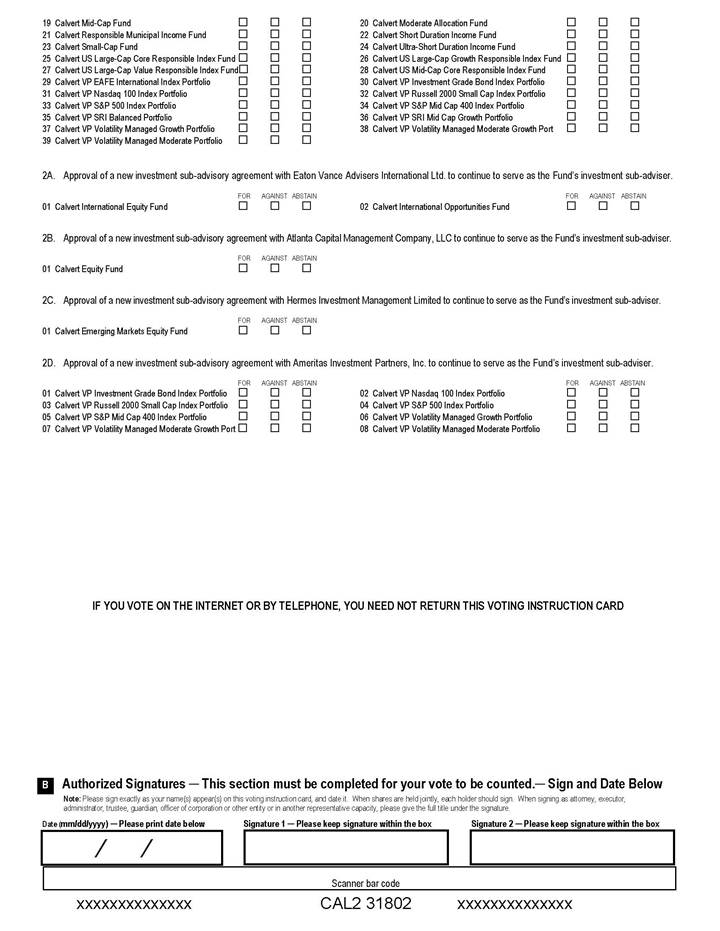

| 2. | Approval of a new investment sub-advisory agreement for each Fund listed below |

| 2A. | (Calvert International Equity Fund and Calvert International Opportunities Fund, each a series of Calvert World Values Fund, Inc.) Approval of a new investment sub-advisory agreement with Eaton Vance Advisers International Ltd. to continue to serve as the Fund’s investment sub-adviser |

| 2B. | (Calvert Equity Fund, a series of Calvert Social Investment Fund) Approval of a new investment sub-advisory agreement with Atlanta Capital Management Company, LLC to continue to serve as the Fund’s investment sub-adviser |

| 2C. | (Calvert Emerging Markets Equity Fund, a series of Calvert World Values Fund, Inc.) Approval of a new investment sub-advisory agreement with Hermes Investment Management Limited to continue to serve as the Fund’s investment sub-adviser |

| 2D. | (Calvert VP S&P 500 Index Portfolio, Calvert VP S&P MidCap 400 Index Portfolio, Calvert VP Russell 2000 Small Cap Index Portfolio, Calvert VP Nasdaq 100 Index Portfolio, Calvert VP Investment Grade Bond Index Portfolio, Calvert VP Volatility Managed Moderate Portfolio, Calvert VP Volatility Managed Moderate Growth Portfolio, and Calvert VP Volatility Managed Growth Portfolio, each a series of Calvert Variable Products, Inc.) Approval of a new investment sub-advisory agreement with Ameritas Investment Partners, Inc. to continue to serve as the Fund’s investment sub-adviser |

Shareholders at the Meeting also may consider and act upon such other matters as may properly come before the Meeting and any adjournments and postponements thereof. Holders of record of shares of the Funds at the close of business on December 22, 2020 who have voting power with respect to such shares are entitled to vote at the Meeting and at any adjournments or postponements thereof. As part of our effort to maintain a safe and healthy environment at the Meeting, the Funds and the Funds’ Boards of Trustees or Board of Directors, as applicable (each a “Board” and, collectively, the “Boards”), are closely monitoring statements issued by the Centers for Disease Control and Prevention (cdc.gov) and local authorities regarding the novel coronavirus disease, COVID-19. For that reason, the Boards reserve the right to reconsider the date, time, and/or means of convening the Meeting for one or more Funds. Subject to any restrictions imposed by applicable law, the Boards may choose to conduct the Meeting of one or more Funds solely by means of remote communications, or may hold a “hybrid” meeting where some participants attend in person and others attend by means of remote communications. If the Boards choose to change the date, time, and/or means of convening the Meeting for a Fund, the Fund will publicly announce the decision to do so in advance, and details on how to participate will be filed with the U.S. Securities and Exchange Commission as additional proxy material.

This notice and the related proxy materials first are being mailed to shareholders on or about January 4, 2021. This proxy is being solicited on behalf of each Fund’s Board.

By Order of the Board,

/s/ Maureen A. Gemma

Maureen A. Gemma

Secretary

We urge you to mark, sign, date, and mail the enclosed proxy card/voting instruction form in the postage-paid envelope provided or to record your voting instructions by telephone or via the internet so that your shares are represented at the Meeting.

December 30, 2020

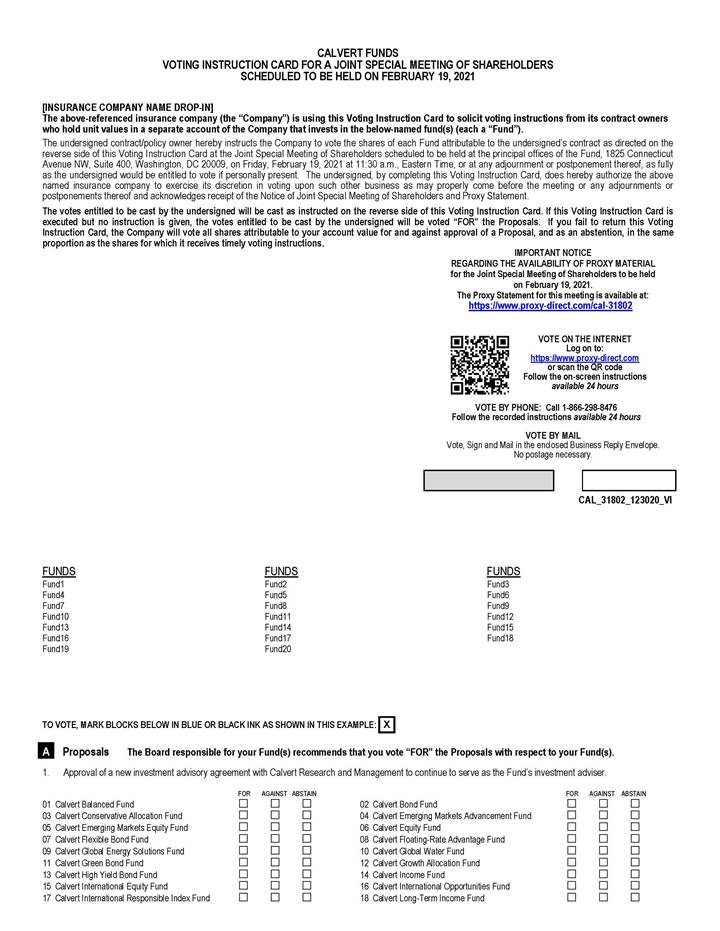

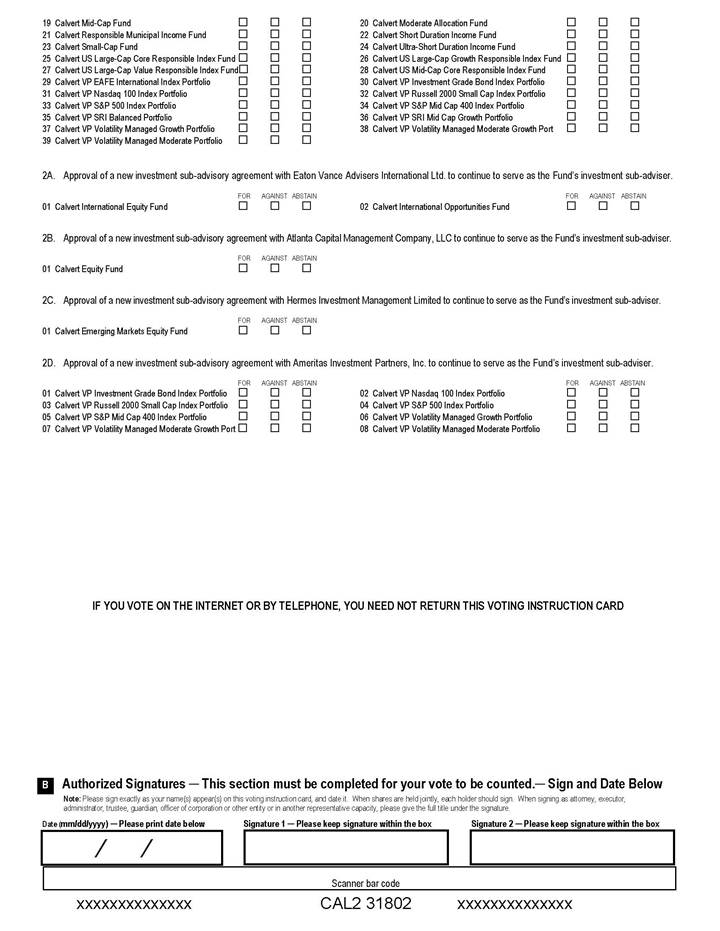

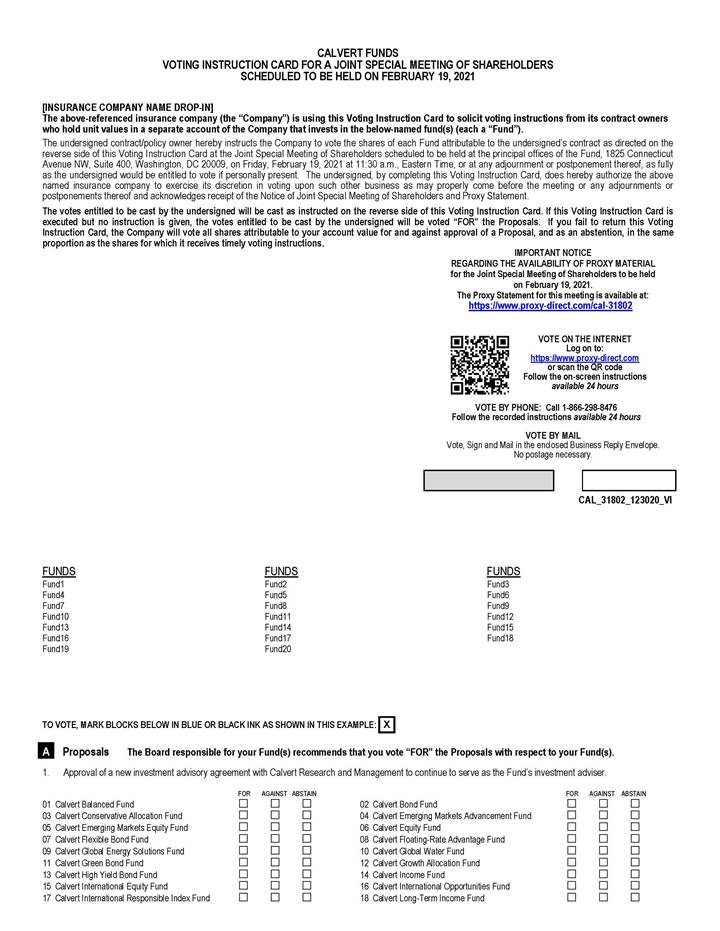

Important Information for Owners of Variable Annuity or Life Insurance Contracts Invested in Certain Funds

Shares of certain Funds are available to variable life insurance policies and variable annuity contracts (each a “Contract”) offered by the separate accounts or sub-accounts of certain life insurance companies (“Participating Insurance Companies”) and certain qualified plans. Shares of each Fund that is a series of Calvert Variable Products, Inc. or Calvert Variable Series, Inc. are offered exclusively to such Contracts. The Participating Insurance Companies own shares of these Funds (each an “Insurance Underlying Fund”) as depositors for the owners of their respective Contracts (each a “Contract Owner”). Thus, individual Contract Owners are not the “shareholders” of an Insurance Underlying Fund. Rather, the Participating Insurance Companies and their separate accounts are the shareholders. To the extent required to be consistent with the interpretations of voting requirements by the staff of the U.S. Securities and Exchange Commission, each Participating Insurance Company will offer to Contract Owners the opportunity to instruct it as to how it should vote shares of an Insurance Underlying Fund held by it and the separate accounts on the proposals. The Proxy Statement is, therefore, furnished to Contract Owners entitled to give voting instructions with regard to the Insurance Underlying Fund. All persons entitled to direct the voting of shares of an Insurance Underlying Fund, whether or not they are shareholders, are described as voting for purposes of the Proxy Statement.

This document contains a Proxy Statement, Notice of a Joint Special Meeting of Shareholders, and a proxy card/voting instruction form. This document explains what you should know before voting on the proposals described herein. You can use your voting instruction form to instruct your insurance company how to vote on your behalf on these important issues relating to your investment in an Insurance Underlying Fund. If you complete and sign the voting instruction form (or instruct your insurance company by telephone or through the internet how to vote on your behalf), your insurance company will vote the shares corresponding to your insurance contract exactly as you indicate. If you simply sign the voting instruction form, your insurance company will vote the shares corresponding to your insurance contract in accordance with the Boards’ recommendation on each Proposal applicable to your Insurance Underlying Fund. If you do not return your voting instruction form or record your voting instructions by telephone or through the internet, your insurance company will vote your shares in the same proportion as shares for which instructions have been received.

We urge you to review the Proxy Statement carefully and either fill out your voting instruction form and return it by mail or record your voting instructions by telephone or through the internet. Your prompt return of the enclosed voting instruction form (or providing voting instructions by telephone or through the internet) may save the necessity and expense of further solicitations.

If you have any questions, please call Computershare Fund Services (“Computershare”), your Insurance Underlying Fund’s proxy solicitor, at the special toll-free number we have set up for you, 877-225-6862, or contact your insurance company.

PROXY STATEMENT

For the Joint Special Meeting of Shareholders

To be held on February 19, 2021

the calvert fund

calvert impact fund, inc.

calvert management series

calvert responsible index series, inc.

calvert social investment fund

calvert world values fund, inc.

calvert variable series, inc.

calvert variable products, inc.

The separate series of each trust and corporation listed above are collectively referred to herein as the “Funds” and, each individually, a “Fund.”

**********

General Information

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Boards of Trustees or Boards of Directors, as applicable (each, a “Board” and, collectively, the “Boards”), of your Fund(s) at a meeting to be held jointly at the principal office of the Funds, 1825 Connecticut Avenue NW, Suite 400, Washington, DC 20009, on February 19, 2021 at 11:30 a.m. (Eastern Time), and at any and all adjournments or postponements thereof (the “Meeting”), at which shareholders of each Fund will be asked to approve a new investment advisory agreement with Calvert Research and Management (“CRM”) and shareholders of certain Funds will also be asked to approve a new investment sub-advisory agreement (each, a “Proposal” and, collectively, the “Proposals”).

This Proxy Statement, along with the enclosed Notice of Joint Special Meeting of Shareholders and the accompanying proxy card/voting instruction form, is being mailed to shareholders beginning on or about January 4, 2021. It explains what you should know before voting on the Proposals described herein. Please read it carefully and keep it for future reference.

CRM provides investment advisory services to the Funds pursuant to an investment advisory agreement. In addition, certain Funds have investment sub-advisory relationships with Eaton Vance Advisers International Ltd. (“EVAIL”), Atlanta Capital Management Company, LLC (“Atlanta Capital”), Hermes Investment Management Limited (“Hermes”), or Ameritas Investment Partners, Inc. (“AIP”) (each a “Sub-Adviser” and, collectively, the “Sub-Advisers”). Each of EVAIL and Atlanta Capital is an affiliate of CRM. For the purposes of this Proxy Statement, the term “investment sub-advisory agreement” is, unless otherwise noted, used to refer to agreements with any of the Sub-Advisers.

Calvert Conservative Allocation Fund, Calvert Moderate Allocation Fund, and Calvert Growth Allocation Fund (each, an “Allocation Fund”) may invest in other Funds (“Underlying Funds”) in a fund-of-funds structure. When a shareholder of an Allocation Fund votes on Proposal 1 for that Allocation Fund, that vote will also constitute instructions for the Allocation Fund to vote in the same manner on each proposal for the Underlying Fund(s) in which it invests. Accordingly, for each applicable proposal brought before the Meeting, each Allocation Fund will vote its interests in the Underlying Fund(s) in the same proportion as the vote received by the Allocation Fund from its shareholders on its Proposal 1 and will vote interests in the Underlying Fund(s) for which no vote has been received with respect to its Proposal 1 in the same proportion as the interests for which it received votes. Because of this practice, a small number of shareholders could determine how an Allocation Fund votes with respect to an Underlying Fund if other shareholders fail to vote. Because each Underlying Fund has shareholders in addition to an Allocation Fund, it is possible that Proposal 1 may be approved by an Underlying Fund even if it is not approved by such Allocation Fund's shareholders.

It is important to note that implementation of the proposed investment advisory agreements and proposed investment sub-advisory agreements with respect to the Funds is subject to the closing of the Transaction (as defined below). Should the Transaction not be completed, none of the proposed agreements would be implemented regardless of how shareholders vote. Shareholders are not entitled to any appraisal rights or similar rights of dissenters in connection with any Proposal to be considered at the Meeting.

Questions and Answers

Q: Why am I being asked to vote?

A: On October 7, 2020, Eaton Vance Corp. (“EVC”), the ultimate parent company of CRM, entered into a definitive agreement and plan of merger (the “Merger Agreement”) with Morgan Stanley pursuant to which Morgan Stanley will acquire EVC and its affiliates, including CRM (the “Transaction”). The closing of the Transaction is subject to the completion or waiver of various conditions, and is expected to close in the second quarter of 2021 (the “Closing”).

The Transaction is relevant to your Fund(s) because CRM serves as investment adviser to your Fund. In addition, certain Funds have investment sub-advisory relationships with EVAIL or Atlanta Capital, each of which is a subsidiary of EVC. Upon the Closing, each of CRM, EVAIL, and Atlanta Capital will become an indirect wholly-owned subsidiary of Morgan Stanley.

Upon the Closing, each Fund’s investment advisory agreement with CRM and, if applicable, investment sub-advisory agreement with its Sub-Adviser, may be deemed to automatically terminate. This is because the Investment Company Act of 1940, as amended (the “1940 Act”), which regulates investment companies such as the Funds, requires investment advisory and investment sub-advisory agreements to terminate automatically in the event of an assignment of the agreement.

Each Fund’s Board unanimously recommends that you approve a new investment advisory agreement with CRM and, if applicable, a new investment sub-advisory agreement with the applicable Sub-Adviser, to ensure that these entities will serve as the Fund’s investment adviser and, if applicable, investment sub-adviser after the Closing. In connection with the Transaction, CRM proposed, and each Fund’s Board approved, certain updates to the provisions of its current investment advisory agreement with CRM and, if applicable, current investment sub-advisory agreement for each Fund. This Proxy Statement describes the Transaction, the new investment advisory agreement, and, if applicable, the new investment sub-advisory agreement for each Fund.

Q: How will the Transaction affect CRM and the Sub-Advisers?

A: Following the Closing, CRM is expected to operate as an indirect wholly-owned subsidiary of Morgan Stanley and is expected to retain its existing portfolio management and other key personnel who provide services to the Funds. Further, EVAIL and Atlanta Capital are each expected to (i) operate as an indirect wholly-owned subsidiary of Morgan Stanley and (ii) maintain their respective portfolio management and other key personnel who currently provide services to the Funds. The Transaction is not expected to affect Hermes or AIP.

Q: How will the Transaction potentially benefit my Fund?

A: It is expected that the Transaction will deliver long-term financial benefits for the Funds. The combined business of EVC and Morgan Stanley will offer a unique public and private market investment solution set to clients in the industry and is expected to have the resources to bring deep capital markets and value-added service excellence to EVC and its affiliates’ relationships. Approval of the new investment advisory and investment sub-advisory agreements will provide continuity of the investment program you selected through your investment in the Fund(s) and help to ensure that each Fund’s operations continue uninterrupted after the Closing.

Q: How does the proposed investment advisory agreement and proposed investment sub-advisory agreement, as applicable, differ from my Fund’s current investment advisory agreement and, as applicable, current investment sub-advisory agreement?

A: While certain provisions have been updated, the proposed investment advisory agreements with CRM are substantially similar to the current investment advisory agreements with CRM, and the proposed investment sub-advisory agreements with each Sub-Adviser are substantially similar to the current investment sub-advisory agreements with such Sub-Adviser. The services that your Fund(s) will receive under the new investment advisory agreement and, if applicable, new investment sub-advisory agreement are expected to be substantially similar to those it receives under the current investment advisory agreement and, if applicable, current investment sub-advisory agreement.

The material differences between (i) the provisions of the proposed investment advisory agreement and each Fund’s current investment advisory agreement and (ii) if applicable, the provisions of the proposed investment sub-advisory agreement and a Fund’s current investment sub-advisory agreement, are described in more detail within this Proxy Statement.

Q: Will my Fund’s contractual advisory and sub-advisory fee rates increase?

A: No. As shown in Appendix B, the investment advisory fee rates proposed for the Funds will remain the same as under their existing agreements. No Sub-Adviser will receive increased investment sub-advisory fees as a result of the Transaction, as shown in Appendix C. CRM has contractually agreed to reimburse certain Funds’ expenses for a specified period and will continue to do so following the Transaction, as set forth in Appendix D.

Q: Will the new investment advisory agreement and the new investment sub-advisory agreement result in any changes in the portfolio management, investment objective(s), or investment strategy of my Fund?

A: No. The new agreements are not expected to result in any changes to any Fund’s investment objective(s) or investment strategy. Further, the portfolio managers for each Fund are expected to continue in such roles after the Closing. Importantly, the Funds will, where applicable, continue to be managed in accordance with their responsible investing mandates.

Q: Will one Proposal pass if the other Proposal is not approved?

A: The Proposals are subject to the Closing. If the Closing does not occur, the Proposals will be deemed null and the Boards will consider whether other actions are warranted. Proposal 1 is not contingent on the approval of Proposal 2. Proposal 2, with respect to a particular Fund, is contingent upon approval of Proposal 1 by shareholders of that Fund. If the shareholders of a given Fund do not approve Proposal 1, Proposal 2 will be deemed null with respect to that Fund and the Board of that Fund will then consider whether other actions, if any, are warranted.

Q: Will the Transaction be completed if the Proposal(s) are not approved?

A: The Closing may take place even if shareholders of a Fund(s) do not approve the Proposal(s). If this should happen, the Board(s) of such Fund(s) would consider what additional actions to take, which could include continuing to solicit approval of a new investment advisory or new investment sub-advisory agreement. In addition, CRM could (and expects to) propose that the Board of each Fund approve an interim investment advisory agreement and, as applicable, an interim investment sub-advisory agreement to permit continuity of management while the proxy solicitation continues. The terms of the interim investment advisory and sub-advisory agreements would be identical to those of the current agreements except for term, termination, and escrow provisions required by applicable law.

Q: How does the Board recommend that shareholders of each Fund vote or submit voting instructions on the Proposals?

A: Each Board unanimously recommends that you vote FOR each Proposal applicable to your Fund(s).

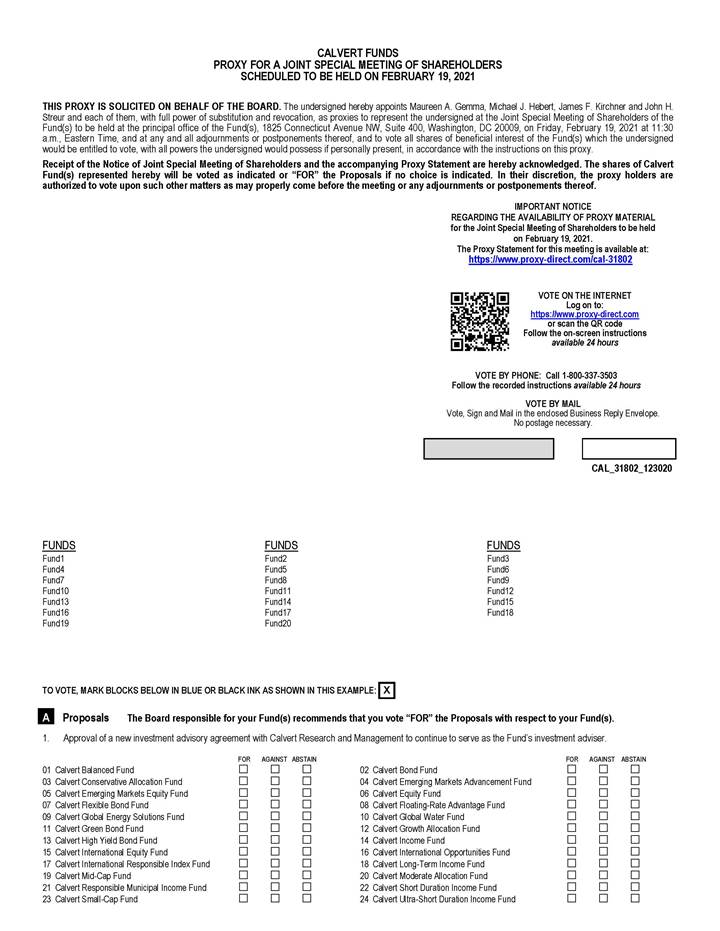

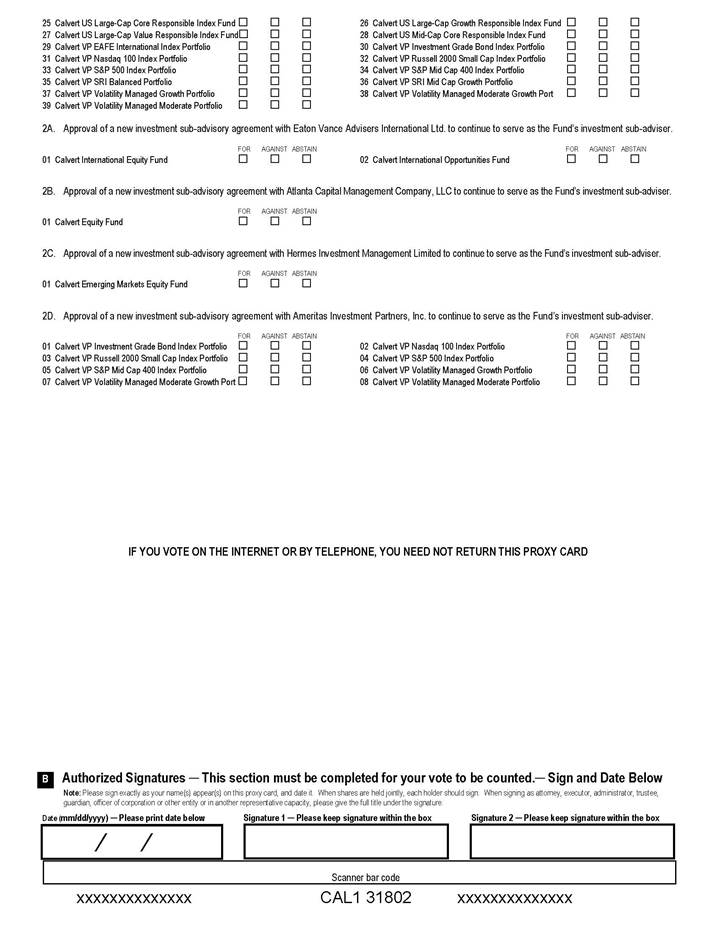

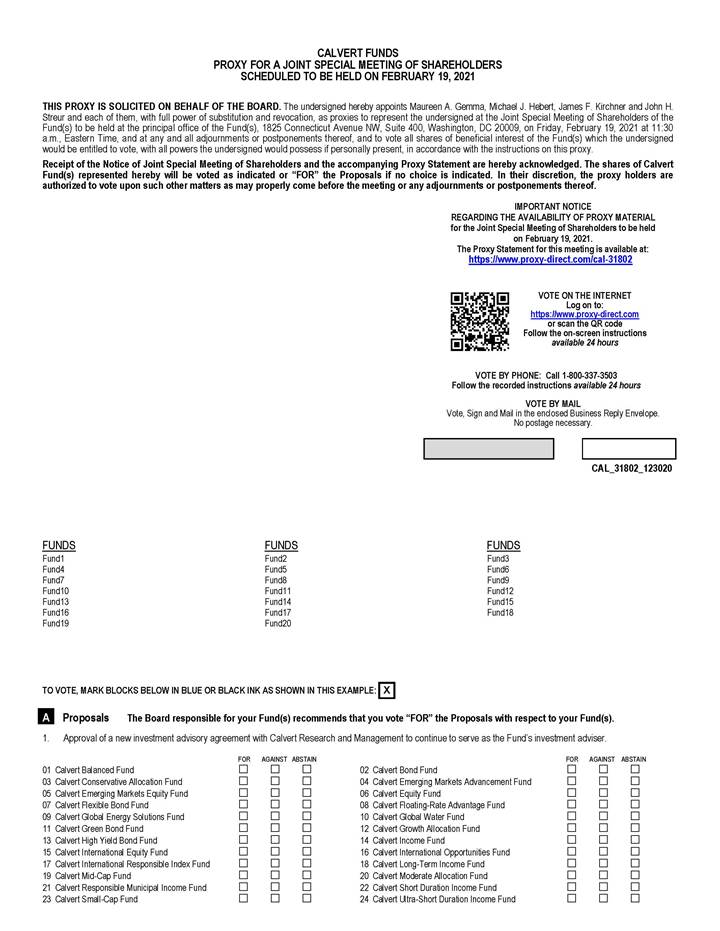

Q: Who is asking for my vote and/or voting instructions?

A: The enclosed proxy card/voting instruction form is solicited by each Fund’s Board for use at the Meeting of each Fund to be held on February 19, 2021 and, if your Fund’s/Funds’ Meeting is adjourned or postponed, at any later meetings held, as permitted by such Fund’s/Funds’ organizational documents, for the purposes stated in the Notice of Joint Special Meeting provided herewith. The Notice of Joint Special Meeting, the proxy card/voting instruction form, and this Proxy Statement are expected to be mailed to shareholders beginning on or about January 4, 2021.

Q: Who is eligible to vote?

A: Shareholders of record of each Fund at the close of business on December 22, 2020 (the “Record Date”) who have voting power with respect to such shares are entitled to be present and to vote and, as applicable, give instruction at the Meeting. Such Record Date shall apply to any adjourned or postponed meeting unless the Board fixes a new record date.

The number of voting securities of each Fund outstanding and entitled to vote on the Record Date is shown in Appendix E. Each whole share held by a shareholder having voting power with respect to such share is entitled to one vote, with fractional shares voting proportionately. Shares represented by your duly executed proxy card(s) will be voted in accordance with your instructions. If you sign the proxy card, but do not fill in a vote, your shares will be voted in accordance with the Board’s recommendation. If any other business is brought before your Fund’s Meeting, your shares will be voted at the discretion of the persons designated on the proxy card.

Q: I am the owner of a variable life insurance policy or a variable annuity contract offered by my insurance company. I am not a shareholder of the Funds. Why am I being asked to vote on proposals for Fund shareholders?

A: You have previously directed your insurance company to invest certain proceeds relating to your variable life insurance policy and/or variable annuity contract (each a “Contract”) in certain Funds whose shares are available as an investment vehicle for Contracts. Although you receive the gains, losses, and income from this investment, your insurance company holds on your behalf any shares corresponding to your investment in these Funds. Thus, you are not the “shareholder” of the Funds; rather, your insurance company is the shareholder. However, you have the right to instruct your insurance company on how to vote the Fund shares corresponding to your investment through your Contract. It is your insurance company, as the shareholder, that will actually vote the shares that correspond to your investment (likely by executing a proxy card) once it receives instructions from you and other owners of Contracts.

This Proxy Statement is, therefore, used to solicit voting instructions from you and other owners of Contracts. All persons entitled to direct the voting of shares of a Fund, whether or not they are shareholders, are described as voting for purposes of this Proxy Statement.

Q: How do I vote my shares?

A: You may vote your shares in one of four ways:

| · | By telephone: Call the toll-free number printed on the enclosed proxy card(s) and follow the directions. |

| · | By internet: Access the website address printed on the enclosed proxy card(s) and follow the directions on the website. |

| · | By mail: Complete, sign, and date the proxy card(s) you received and return in the self-addressed, postage-paid envelope. |

| · | At the Meeting: Vote your shares at the Meeting scheduled to be held at the principal office of the Funds, 1825 Connecticut Avenue NW, Suite 400, Washington, DC 20009, on February 19, 2021 at 11:30 a.m. Eastern Time. |

Q: Is my Fund paying for the Transaction or this proxy solicitation?

A: No. The Funds will not bear any portion of the costs associated with the Transaction. All costs of this Proxy Statement and the Meeting, including proxy solicitation costs, legal fees, and the costs of printing and mailing this Proxy Statement, will be borne by EVC.

Proposal 1

APPROVAL OF A NEW INVESTMENT ADVISORY AGREEMENT

Each Board has unanimously approved, and recommends that shareholders of each Fund approve, a new investment advisory agreement between the Fund and CRM.

| Proposal 1: | Approval of a New Investment Advisory Agreement with CRM |

It is proposed that CRM continue to serve as investment adviser to each Fund pursuant to a new investment advisory agreement between each such Fund and CRM.

The form of the proposed investment advisory agreement with CRM is attached as Appendix F. You should refer to Appendix F for the complete text of the form of the proposed investment advisory agreement for each Fund.

Comparison of Proposed New Investment Advisory Agreements with Current Investment Advisory Agreements

In connection with the approval of new investment advisory agreements, CRM proposed, and each Board approved, certain changes to the provisions of the current investment advisory agreements for those Funds in order to standardize, clarify, and modernize the terms of the agreements. The Boards believe that this standardization will benefit shareholders by making the administration of the Funds’ investment advisory agreements more efficient.

The terms of the proposed investment advisory agreements, and material differences between the proposed investment advisory agreements and the current investment advisory agreements, are described generally below. Differences in language, stylistic changes, and changes to provisions that would not result in a change to a reasonable substantive interpretation of an agreement are not included in the below description; however, the complete text of the form of the proposed investment advisory agreement with CRM is attached as Appendix F. The date of each Fund’s current investment advisory agreement, the date on which it was last approved by shareholders, and the date on which its continuance was last approved by the relevant Board is set forth in Appendix G.

Fees. No Fund will experience increased advisory fee rates as a result of the Transaction. The contractual advisory fee rates for each Fund under the proposed investment advisory agreements with CRM will be the same as the contractual rate of fees currently payable to CRM under the current investment advisory agreements. The fee schedules to the current and proposed investment advisory agreements for each Fund are described in Appendix B.

Investment Advisory Services. The current and proposed investment advisory agreements contain the same terms relating to the retention of CRM to act as investment adviser for, and to manage the investment and reinvestment of the assets of, each Fund. In pursuit of the foregoing, CRM shall furnish continuously an investment program and shall determine from time to time what securities and other investments shall be acquired, disposed of, or exchanged and what portion of a Fund’s assets shall be held uninvested, subject always to the applicable restrictions of the relevant Fund’s organizational documents and registration statement, including, where applicable, responsible investment criteria.

Best Execution. The proposed investment advisory agreements provide that CRM shall use its best efforts to seek to execute security transactions at prices that are advantageous to the Fund and describe considerations for CRM’s selection of brokers and dealers, including soft dollar considerations, which are subject to policies and procedures adopted by the Board. This concept is included in the current investment advisory agreements for the Funds through adherence to the policies and procedures adopted by the Board and federal securities laws. While no change in practice is expected, this provision was updated in the proposed investment advisory agreements to more closely reflect statutory requirements relating to the payment of brokerage commission rates for investment transactions.

While the current investment advisory agreements for the Funds provide that CRM shall place purchase and sale orders either directly with the issuer or with brokers or dealers, the proposed investment advisory agreements provide that CRM may also place such orders with futures commission merchants, or other market participants selected by CRM. The language in the proposed investment advisory agreements reflects the different types of investments in which a Fund may transact.

Limitation of Liability. Both the current and proposed investment advisory agreements provide that, in the absence of willful misfeasance, bad faith, gross negligence, or reckless disregard of duties, CRM shall not be subject to liability to a Fund or to any shareholder of the Fund for any act or omission in connection with rendering services under the agreement or for any losses that may be sustained in the acquisition, holding, or disposition of any security or other investment.

Non-Exclusive Services. The proposed investment advisory agreements clarify that the services of CRM to a Fund are not exclusive and contemplate that CRM may provide investment advice to other funds and accounts that may differ from or conflict with the advice provided to the Fund.

Amendments. The proposed investment advisory agreements clarify that the agreements may be amended by a writing signed by both parties so long as the amendment is approved in a manner consistent with the requirements of the 1940 Act.

Governing Law and Legal Requirements. Both the current and proposed investment advisory agreements are governed by the laws of the Commonwealth of Massachusetts. The proposed investment advisory agreements refer to certain requirements under the 1940 Act and provide that these requirements will be deemed to reflect the effect of any modification or interpretation by any applicable order, rule, regulation, or interpretive release of the U.S. Securities and Exchange Commission (“SEC”) or guidance issued by the staff thereof.

Description of the Transaction

The Merger Agreement was unanimously approved by the Board of Directors of each of Morgan Stanley and EVC. The Closing is subject to the completion or waiver of customary closing conditions and is expected to close in the second quarter of 2021. Upon the Closing, CRM, EVAIL, and Atlanta Capital will become indirect wholly-owned subsidiaries of Morgan Stanley.

Board Considerations

At a meeting held on December 8, 2020, the Board of each Fund, including a majority of the Trustees or Directors who are not “interested persons” of CRM or the Fund (the “Independent Board Members”), voted to approve a new investment advisory agreement between the Fund and CRM. Prior to and during meetings leading up to the meeting held on December 8, 2020, each Board reviewed and discussed information furnished by CRM and Morgan Stanley, as requested by the Independent Board Members, that the Board considered reasonably necessary to evaluate the terms of the new investment advisory agreement and to form its recommendation. Such information included, among other things, the terms and anticipated impacts of the Transaction on the Funds and their shareholders. In addition to considering information furnished specifically to evaluate the impact of the Transaction on the Funds and their respective shareholders, each Board also considered information furnished for prior meetings of the Boards, including information provided in connection with the annual contract review process for the Funds, which most recently culminated in March 2020. The Board of each Fund, including the Independent Board Members, concluded that the new investment advisory agreement, including the fees payable thereunder, was fair and reasonable, and it voted to approve the new investment advisory agreement and to recommend that shareholders do so as well. Each Board’s considerations are described in more detail in Appendix H.

Required Vote and Related Matters

Required Vote. Approval of each Fund’s proposed investment advisory agreement requires the affirmative vote of “a majority of the outstanding voting securities” of the Fund, defined in the 1940 Act as the lesser of: (i) 67% or more of the voting securities of the Fund present or represented by proxy at the Meeting if the holders of more than 50% of outstanding voting securities are present or represented by proxy, or (ii) more than 50% of the outstanding voting securities of the Fund (“1940 Act Majority”), provided the applicable quorum, as described below under “Further Information About Voting and the Joint Special Meeting – Quorum and Methods of Tabulation,” has been satisfied.

Variable Contract Voting. Shares of certain Funds are available as investment vehicles for variable life insurance policies and variable annuity contracts (each a “Contract”) offered by the separate accounts or sub-accounts of certain life insurance companies (“Participating Insurance Companies”). Shares of each Fund that is a series of Calvert Variable Products, Inc. or Calvert Variable Series, Inc. are offered exclusively to such Contracts. The Participating Insurance Companies are the shareholders of record of these Funds (each an “Insurance Underlying Fund”). Each

Participating Insurance Company will vote shares of the applicable Insurance Underlying Fund held by it in accordance with voting instructions received from the variable life insurance policy and variable annuity contract owners (collectively, the “Contract Owners”) for whose accounts the shares are held. Accordingly, with respect to the Insurance Underlying Funds, this Proxy Statement is also intended to be used by each Participating Insurance Company in obtaining these voting instructions from Contract Owners.

Allocation Funds. The Allocation Funds invest in Underlying Funds in a fund-of-funds structure. When a shareholder of an Allocation Fund votes on Proposal 1 for that Allocation Fund, that vote will also constitute instructions for the Allocation Fund to vote in the same manner on each proposal for the Underlying Fund(s) in which it invests. Accordingly, for each applicable proposal brought before the Meeting, each Allocation Fund will vote its interests in the Underlying Fund(s) in the same proportion as the vote received by the Allocation Fund from its shareholders on its Proposal 1 and will vote interests in the Underlying Fund(s) for which no vote has been received with respect to its Proposal 1 in the same proportion as the interests for which it received votes. Because of this practice, a small number of shareholders could determine how an Allocation Fund votes with respect to an Underlying Fund if other shareholders fail to vote. Because each Underlying Fund has shareholders in addition to an Allocation Fund, it is possible that Proposal 1 may be approved by an Underlying Fund even if it is not approved by such Allocation Fund's shareholders.

Conditions. This Proposal 1 is subject to the Closing. If the Closing does not occur, Proposal 1 will be deemed null and the Boards will consider whether other actions are warranted. Assuming the Transaction is completed, Proposal 1 will pass for a particular Fund if the requisite shareholder vote is obtained for that Fund. With respect to each Fund, Proposal 1 is not contingent on the approval of Proposal 2 and, further, Proposal 1 is not contingent upon the approval of Proposal 1 by any other Fund.

Please note that even if shareholders of your Fund(s) approve Proposal 1, it is possible that such Fund’s new investment advisory agreement will not take effect. This is because the Closing is subject to the completion or waiver of certain conditions. One of these conditions is that advisory clients of EVC’s investment adviser subsidiaries, which would include the Funds and other advisory clients, representing a specified percentage of EVC revenue as of September 30, 2020, consent to the continuation of their advisory relationships after the Closing, as more fully described in the Merger Agreement that EVC filed with the SEC on October 8, 2020 on Form 8-K, Exhibit 2.1.

On the other hand, the Closing may take place even if shareholders of a Fund do not approve Proposal 1. If this should happen, the Board of such Fund would consider what additional actions to take, which could include continuing to solicit approval of a new investment advisory agreement. In addition, CRM could (and expects to) propose that the Board of each Fund approve an interim investment advisory agreement to permit continuity of management while the proxy solicitation continues. The terms of the interim investment advisory agreement would be identical to those of the current agreement except for term, termination, and escrow provisions required by applicable law.

BOARD RECOMMENDATION

Each Fund’s Board, including a majority of the Independent Board Members, believes that the approval of the new investment advisory agreement is in the best interests of the Fund. Accordingly, each Fund’s Board unanimously recommends that shareholders vote FOR the new investment advisory agreement as described in Proposal 1.

Proposal 2

APPROVAL OF A NEW INVESTMENT SUB-ADVISORY AGREEMENT

The Boards unanimously approved, and recommend that shareholders of each Fund noted below (collectively, the “Sub-Advised Funds”) approve, a new investment sub-advisory agreement between CRM and the applicable Sub-Adviser. As described in more detail below, CRM has retained, and intends to continue to retain, EVAIL, Atlanta Capital, Hermes, and AIP, as applicable, to furnish investment advisory services to the Sub-Advised Funds.

| Proposal 2A: | Approval of a new investment sub-advisory agreement with EVAIL (Calvert International Equity Fund and Calvert International Opportunities Fund, each a series of Calvert World Values Fund, Inc.) (the “EVAIL Sub-Advised Funds”) |

It is proposed that EVAIL, an affiliate of CRM, continue to serve as investment sub-adviser to each EVAIL Sub-Advised Fund pursuant to a new investment sub-advisory agreement.

| Proposal 2B: | Approval of a new investment sub-advisory agreement with Atlanta Capital (Calvert Equity Fund, a series of Calvert Social Investment Fund) (the “Atlanta Capital Sub-Advised Fund”) |

It is proposed that Atlanta Capital, an affiliate of CRM, continue to serve as investment sub-adviser to the Atlanta Capital Sub-Advised Fund pursuant to a new investment sub-advisory agreement.

| Proposal 2C: | Approval of a new investment sub-advisory agreement with Hermes (Calvert Emerging Markets Equity Fund, a series of Calvert World Values Fund, Inc.) (the “Hermes Sub-Advised Fund”) |

It is proposed that Hermes continue to serve as investment sub-adviser to the Hermes Sub-Advised Fund pursuant to a new investment sub-advisory agreement.

| Proposal 2D: | Approval of a new investment sub-advisory agreement with AIP (Calvert VP S&P 500 Index Portfolio, Calvert VP S&P MidCap 400 Index Portfolio, Calvert VP Russell 2000 Small Cap Index Portfolio, Calvert VP Nasdaq 100 Index Portfolio, Calvert VP Investment Grade Bond Index Portfolio, Calvert VP Volatility Managed Moderate Portfolio, Calvert VP Volatility Managed Moderate Growth Portfolio, and Calvert VP Volatility Managed Growth Portfolio, each a series of Calvert Variable Products, Inc.) (the “AIP Sub-Advised Funds”) |

It is proposed that AIP continue to serve as investment sub-adviser to each AIP Sub-Advised Fund pursuant to a new investment sub-advisory agreement.

Each Sub-Adviser currently serves as an investment sub-adviser to the respective Sub-Advised Fund(s). Each of EVAIL and Atlanta Capital is an indirect, wholly-owned subsidiary of EVC. The termination of each Sub-Advised Fund’s investment advisory agreement with CRM would result in the automatic termination of the Sub-Advised Funds’ current investment sub-advisory agreements. In order to ensure that each Sub-Advised Fund retains the benefit of the sub-advisory services provided by the relevant Sub-Adviser, CRM intends to enter into new investment sub-advisory agreements with the Sub-Advisers, as applicable, that will be substantively similar to the current investment sub-advisory agreements with respect to the Sub-Advised Funds. In connection with the approval of new investment sub-advisory agreements, CRM proposed, and each Board approved, certain changes to the provisions of the current agreements in order to standardize, clarify, and modernize the current agreements. The Boards believe that this standardization will benefit shareholders by making the administration of the Funds’ investment sub-advisory agreements more efficient. A general description of the differences between the existing and proposed investment sub-advisory agreements appears below. The Board of each Sub-Advised Fund has unanimously approved these new investment sub-advisory agreements.

The form of the proposed investment sub-advisory agreement between CRM and EVAIL and CRM and Atlanta Capital is attached as Appendix I. The form of the proposed investment sub-advisory agreement between CRM and Hermes is attached as Appendix J. The form of the proposed investment sub-advisory agreements between CRM and AIP is attached as Appendix K. You should refer to the applicable Appendix for the complete text of the form of the proposed investment sub-advisory agreement for your Fund. The date of each Fund’s current investment sub-advisory agreement, the date on which it was last approved by shareholders, and the date on which its continuance was last approved by the relevant Board is set forth in Appendix L.

Comparison of Proposed New Investment Sub-Advisory Agreements with Current Investment Sub-Advisory Agreements with each Sub-Adviser

In connection with the approval of new investment sub-advisory agreements, CRM proposed, and the Boards approved, certain changes to the provisions of the current investment sub-advisory agreements with each Sub-Adviser. The terms of the proposed investment sub-advisory agreements with each Sub-Adviser, and material differences between the proposed investment sub-advisory agreements and the current investment sub-advisory agreements, are described generally below. Differences in language, stylistic changes, and changes to provisions that would not result in a change to a reasonable substantive interpretation of an agreement are not included in the below description; however, the complete text of the form of the proposed investment sub-advisory agreements with each Sub-Adviser is attached.

Fees. No Sub-Adviser will receive increased investment sub-advisory fees as a result of the Transaction. There is no change in the rate of the fees that CRM will pay to a Sub-Adviser under the proposed investment sub-advisory agreements, as compared to the rate of fees that CRM currently pays to the Sub-Adviser under the current investment sub-advisory agreements. Both the current and proposed investment sub-advisory agreements provide that CRM is solely responsible for the payment of the compensation to the Sub-Adviser pursuant to the agreements. The current and proposed fee schedules for investment sub-advisory services for each Sub-Advised Fund are described in Appendix C.

Investment Advisory Services. The current and proposed investment sub-advisory agreements for each Sub-Adviser contain similar terms relating to the appointment of the Sub-Adviser to act as investment sub-adviser for, and to manage the investment and reinvestment of the designated assets of, the Fund.

Best Execution. The current and proposed investment sub-advisory agreements with each Sub-Adviser provide that the Sub-Adviser shall follow the Fund’s policies and procedures with respect to best execution of securities transactions. The proposed investment sub-advisory agreements with EVAIL and Atlanta Capital further describe considerations for the Sub-Adviser’s selection of brokers and dealers, including soft dollar considerations, which are subject to policies and procedures adopted by the Board. While no change in practice is expected, this provision was updated in the proposed investment sub-advisory agreements with EVAIL and Atlanta Capital to more closely reflect statutory requirements relating to the payment of brokerage commission rates for investment transactions and align the language across agreements.

While the current investment sub-advisory agreements with EVAIL and Atlanta Capital provide that the Sub-Adviser shall place purchase and sale orders either directly with the issuer or with brokers or dealers, the proposed investment sub-advisory agreements provide that the Sub-Adviser may also place such orders with futures commission merchants or other market participants selected by the Sub-Adviser. The language in the proposed investment sub-advisory agreements reflect the different types of investments in which a Fund may transact.

Limitation of Liability. No changes are being proposed with respect to the liability of the Sub-Advisers under the proposed investment sub-advisory agreements.

The current and proposed investment sub-advisory agreements with EVAIL and Atlanta Capital provide that, in the absence of willful misfeasance, bad faith, gross negligence, or reckless disregard of duties, the Sub-Adviser shall not be subject to liability to CRM, the Fund, or any shareholder of the Fund for any act or omission in connection with rendering services under the agreement.

The current and proposed investment sub-advisory agreements with Hermes and AIP provide that, except as may otherwise be required by the 1940 Act or other applicable law, the Sub-Adviser shall not be subject to liability for any act or omission in connection with rendering services under the agreement in the absence of willful misfeasance, bad faith, gross negligence, or breach of its obligations under the agreement. In addition, these agreements provide that the Fund shall not be subject to liability for any losses of the Sub-Adviser in connection with the services provided under the agreement unless the loss was a result of (i) actions taken or failed to be taken by the Fund or CRM; (ii) the willful misfeasance, bad faith, or gross negligence of CRM or any breach or reckless disregard of CRM’s obligations; (iii) the breach of CRM’s obligations or duties under the agreement or the investment advisory agreement; or (iv) statements or omissions that result in registration statement liability unless the statement or omission was made in reliance upon information furnished by the Sub-Adviser. These agreements also provide for indemnification by each party in certain circumstances that exclude the other party’s willful misfeasance, bad faith, gross negligence, or reckless disregard of duties under the agreement.

Exclusivity. The current and proposed investment sub-advisory agreement with Hermes limits the investment advisory services that the Sub-Adviser may provide to registered investment companies that have substantially similar strategies to those of the Fund and which employ a responsible investing mandate or social screens. There are no restrictions on the investment advisory services EVAIL, Atlanta Capital, and AIP may provide to others under their current or proposed investment sub-advisory agreements. The current and proposed investment sub-advisory agreements with EVAIL and Atlanta Capital specifically provide that the services of the Sub-Adviser to the Fund are not exclusive and the proposed investment sub-advisory agreements with EVAIL and Atlanta Capital contemplate that the Sub-Adviser may provide investment advice to other funds and accounts that may differ from or conflict with the advice provided to the Fund.

Responsible Investing. The current and proposed investment sub-advisory agreements for each Sub-Adviser provide that the Sub-Adviser will provide a continuous investment program for the portfolio of the Fund’s assets allocated to the Sub-Adviser in accordance with the Fund’s investment objective and policies set forth in the Fund’s prospectus. In the case of the investment sub-advisory agreements with each of EVAIL, Atlanta Capital, and Hermes, the Sub-Adviser also agrees to buy only securities determined by CRM to meet certain responsible investment criteria and to sell securities when notified they no longer meet such criteria.

Amendments. The proposed investment sub-advisory agreements with each Sub-Adviser clarify that the agreements may be amended by a writing so long as the amendment is approved in a manner consistent with the requirements of the 1940 Act.

Governing Law; Interpretation of Terms. The current and proposed investment sub-advisory agreements for each Sub-Adviser are governed by the laws of the Commonwealth of Massachusetts. The proposed investment sub-advisory agreements for each Sub-Adviser provide that certain terms used in the agreements have the meanings specified in the 1940 Act and any requirement of the 1940 Act reflected in the agreement will be deemed to reflect the effect of any modification or interpretation by any applicable order, rule, regulation, or interpretive release of the SEC or guidance issued by the staff thereof.

Proposals 2A, 2B, 2C, and 2D:

Board Considerations

At a meeting held on December 8, 2020, the Board of each Sub-Advised Fund, including a majority of the Independent Board Members, voted to approve a new investment sub-advisory agreement between CRM and the applicable Sub-Adviser. Prior to and during meetings leading up to the meeting held on December 8, 2020, each Board reviewed and discussed information furnished by CRM, the Sub-Advisers, and Morgan Stanley, as requested by the Independent Board Members, that the Board considered reasonably necessary to evaluate the terms of the new investment sub-advisory agreement and to form its recommendation. Such information included, among other things, the terms and anticipated impacts of the Transaction on the Funds and their shareholders. In addition to considering information furnished specifically to evaluate the impact of the Transaction on the Funds and their respective shareholders, each Board also considered information furnished for prior meetings of the Boards, including information provided in connection with the annual contract review process for the Sub-Advised Funds, which most recently culminated in March 2020. The Board of each Sub-Advised Fund, including the Independent Board Members, concluded that the new investment sub-advisory agreement, including the fees payable thereunder, was fair and reasonable, and it voted to approve the new investment sub-advisory agreement and to recommend that shareholders do so as well. Each Board’s considerations are described in more detail in Appendix H.

Required Vote and Related Matters

Required Vote. Approval of a Fund’s proposed investment sub-advisory agreement requires the affirmative vote of a 1940 Act Majority of the voting securities of the Fund, provided the applicable quorum, as described below under “Further Information About Voting and the Joint Special Meeting – Quorum and Methods of Tabulation,” has been satisfied.

Variable Contract Voting. Shares of certain Funds are available as investment vehicles for Contracts offered by the separate accounts or sub-accounts of Participating Insurance Companies. Shares of each Fund that is a series of Calvert Variable Products, Inc. or Calvert Variable Series, Inc. are offered exclusively to such Contracts. The Participating Insurance Companies are the shareholders of record of these Insurance Underlying Funds. Each Participating Insurance Company will vote shares of the Insurance Underlying Fund held by it in accordance with voting instructions received from the Contract Owners for whose accounts the shares are held. Accordingly, with respect to the Insurance Underlying Funds, this Proxy Statement is also intended to be used by each Participating Insurance Company in obtaining these voting instructions from Contract Owners.

Allocation Funds. The Allocation Funds invest in Underlying Funds in a fund-of-funds structure. When a shareholder of an Allocation Fund votes on Proposal 1 for that Allocation Fund, that vote will also constitute instructions for the Allocation Fund to vote in the same manner on each proposal (Proposal 1 and, as applicable, Proposal 2) for the Underlying Fund(s) in which it invests. Accordingly, for each applicable proposal brought before the Meeting, each Allocation Fund will vote its interests in the Underlying Fund(s) in the same proportion as the vote received by the Allocation Fund from its shareholders on its Proposal 1 and will vote interests in the Underlying Fund(s) for which

no vote has been received with respect to its Proposal 1 in the same proportion as the interests for which it received votes. Because of this practice, a small number of shareholders could determine how an Allocation Fund votes with respect to an Underlying Fund if other shareholders fail to vote. Because each Underlying Fund has shareholders in addition to an Allocation Fund, it is possible that Proposal 1 and, as applicable, Proposal 2 may be approved by an Underlying Fund even if it is not approved by such Allocation Fund's shareholders.

Conditions. This Proposal 2 is subject to the Closing and, with respect to a particular Fund, its shareholders’ approval of Proposal 1, which seeks approval of a new investment advisory agreement between each Fund and CRM. If the shareholders of a given Fund do not approve Proposal 1, or if the Transaction is not completed, this Proposal 2 will be deemed null with respect to that Fund. If this should happen, the Board of such Fund will consider whether other actions, if any, are warranted.

Please note that even if shareholders of a Fund approve Proposal 2, it is possible that such Fund’s new investment sub-advisory agreement will not take effect. This is because the Closing is subject to the completion or waiver of certain conditions. One of these conditions is that advisory clients of EVC’s investment adviser subsidiaries, which would include the Funds and other advisory clients, representing a specified percentage of EVC revenue as of September 30, 2020, consent to the continuation of their advisory relationships after the Closing, as more fully described in the Merger Agreement that EVC filed with the SEC on October 8, 2020 on Form 8-K, Exhibit 2.1.

On the other hand, the Closing may take place even if shareholders of your Fund(s) do not approve Proposal 2. If this should happen, the Board(s) of such Fund(s) would consider what additional actions to take, which could include continuing to solicit approval of a new investment sub-advisory agreement. In addition, CRM could (and expects to) propose that the Board of each Fund approve an interim investment sub-advisory agreement to permit continuity of management while the proxy solicitation continues. The terms of an interim investment sub-advisory agreement would be identical to those of the current investment sub-advisory agreement except for term, termination, and escrow provisions required by applicable law.

BOARD RECOMMENDATION

The Board of each Fund listed above believes that the new investment sub-advisory agreement is in the best interests of such Fund. Accordingly, each Fund’s Board unanimously recommends that shareholders vote FOR the approval of the new investment sub-advisory agreement as set forth in Proposal 2.

Further Information About Voting and the Joint Special Meeting

Required Vote. Approval of each Proposal requires the affirmative vote of a 1940 Act Majority.

Quorum and Methods of Tabulation. With respect to the Funds that are series of The Calvert Fund, Calvert Management Series, and Calvert Social Investment Fund, a quorum with respect to the Meeting of a Fund requires the presence, in person or by proxy, of one-fourth (1/4) of the total number of the outstanding shares of the Fund entitled to vote. With respect to the Funds that are series of Calvert Impact Fund, Inc., Calvert Responsible Index Series, Inc., Calvert World Values Fund, Inc., Calvert Variable Series, Inc., and Calvert Variable Products, Inc., a quorum with respect to the Meeting of a Fund requires the presence, in person or by proxy, of one-third (1/3) of the total number of the outstanding shares of the Fund entitled to vote.

All shares that are voted and votes to abstain will be counted towards establishing a quorum, as will broker non-votes (if any). Broker non-votes are shares for which a broker returns a proxy but for which (i) the beneficial owner has not voted and (ii) the broker holding the shares does not have discretionary authority to vote on the particular proposal. Accordingly, abstentions and broker non-votes (if any), which will be treated as shares that are present at the Meeting but which have not been voted, will assist a Fund in obtaining a quorum. With respect to each Proposal, abstentions and broker non-votes, if any, have the effect of a negative vote on the Proposal. Please note that broker non-votes are not expected with respect to any Proposal because brokers are required to receive instructions from the beneficial owners or persons entitled to vote in order to submit proxies.

With respect to Fund shares held in CRM individual retirement accounts, undirected shares will be voted by CRM or an affiliate in the same proportion as shares of that Fund for which instructions were received.

Adjournment. In the event that a quorum is not present at the Meeting, or if a quorum is present at the Meeting but sufficient votes by the shareholders of a Fund in favor of a Proposal have not been received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies to the extent permitted by applicable law. Any such adjournment will require the affirmative vote of the holders of a majority of the shares of that Fund that are entitled to vote and present in person or by proxy at the session of the Meeting to be adjourned. Unless a proxy is limited in this regard, the persons named as proxies will vote in favor of such adjournment those proxies which they are entitled to vote in favor of the Proposal for which further solicitation of proxies is to be made. They will vote against any such adjournment those proxies required to be voted against such Proposal. The costs of any such additional solicitation and of any adjourned session will be borne by EVC.

Other business. The Boards know of no matters other than those described in this Proxy Statement to be brought before the Meeting. If, however, any other matters properly come before the Meeting, proxies will be voted on such matters in accordance with the judgment of the persons named in the enclosed form of proxy.

Revocation of proxies. An executed proxy delivered to a Fund is revocable by the person giving it, prior to its exercise, by a signed writing filed with the Fund’s Secretary, by executing and delivering a later dated proxy, or by voting at the Meeting. If you hold Fund shares entitled to vote through an intermediary (such as a broker, bank, adviser or custodian), please consult with the intermediary regarding your ability to revoke voting instructions after they have been provided.

Information for Insurance Underlying Funds

Voting Process. With respect to the Insurance Underlying Funds (which include, but are not limited to, the Funds that are series of Calvert Variable Series, Inc. and Calvert Variable Products, Inc.) as of the Record Date, the Participating Insurance Companies were shareholders of record of each Insurance Underlying Fund. Each Participating Insurance Company will vote shares of the Insurance Underlying Fund or Funds held by it in accordance with voting instructions received from the Contract Owners for whose accounts the shares are held. Accordingly, with respect to the Insurance Underlying Funds, this Proxy Statement is also intended to be used by each Participating Insurance Company in obtaining these voting instructions from Contract Owners. In the event that a Contract Owner gives no instructions, the relevant Participating Insurance Company will vote the shares of the appropriate Insurance Underlying Fund attributable to the Contract Owner in the same proportion as shares of that Insurance Underlying Fund for which it has received instructions. One effect of this system of proportional voting is that, if only a small number of Contract Owners provide voting instructions, this small number of Contract Owners may determine the outcome of a vote for an Insurance Underlying Fund.

Contract Owner Instructions. Each Contract Owner is entitled to instruct his or her Participating Insurance Company as to how to vote its shares of an Insurance Underlying Fund and can do so by marking voting instructions on the voting instruction form enclosed with this Proxy Statement and then signing, dating, and mailing the form in the postage-paid envelope provided. If a voting instruction form is not marked to indicate voting instructions, but is signed, dated, and returned, it will be treated as an instruction to vote the shares in favor of the Proposal(s). Each Participating Insurance Company will vote the shares for which it receives timely voting instructions from Contract Owners in accordance with those instructions and will vote those shares for which it receives no timely voting instructions for and against approval of a Proposal, and as an abstention, in the same proportion as the shares for which it receives voting instructions. Shares attributable to accounts retained by each Participating Insurance Company will be voted in the same proportion as votes cast by Contract Owners. Accordingly, there are not expected to be any “broker non-votes.”

Contract Owners have the opportunity to submit their voting instructions via the internet by using a program provided by a third-party vendor hired by CRM or by automated telephone service. To use the internet, please access the internet address listed on your voting instruction form and follow the instructions on the internet site. To record your voting instructions via automated telephone service, use the toll-free number listed on your proxy card. The internet and telephone voting procedures are designed to authenticate Contract Owners’ identities, to allow Contract Owners to give their voting instructions and to confirm that their instructions have been recorded properly. Contract Owners voting via the internet should understand that there may be costs associated with electronic access, such as usage charges from internet access providers and telephone companies, that must be borne by the Contract Owners.

Revocation of voting instructions. The giving of voting instructions will not affect your right to vote in person should you decide to attend the Meeting. Any Contract Owner giving voting instructions to a Participating Insurance Company has the power to revoke such instructions by mail by providing superseding instructions. All properly executed voting instruction forms received in time for the Meeting will be voted as specified on such forms.

Additional Meeting Information

Identification. If you are a record holder of Fund shares entitled to vote and plan to attend the Meeting in person, you must show a valid photo identification (such as a driver’s license) to gain admission to the Meeting. Please call 877-225-6862 for information on how to obtain directions to be able to attend the Meeting and vote in person. If you hold Fund shares entitled to vote through an intermediary and plan to attend the Meeting in person, you will be required to show a valid photo identification and authority to vote your shares (referred to as a “legal proxy”) to gain admission to the Meeting. You must contact your intermediary to obtain a legal proxy for your shares.

Date for receipt of shareholders’ proposals for subsequent meetings of shareholders. Your Fund does not regularly hold annual shareholder meetings, but may from time to time schedule special meetings. In accordance with the regulations of the SEC, in order to be eligible for inclusion in a Fund’s proxy statement for such a meeting, a shareholder proposal must be received a reasonable time before the fund prints and mails its proxy statement. A shareholder proposal intended to be presented at a future special meeting of shareholders of a Fund must be received at the principal offices of the Fund, c/o the Secretary of the Fund, 1825 Connecticut Avenue NW, Suite 400, Washington, DC 20009, at a reasonable time before the Fund begins to print and mail its proxy materials. Timely submission of a proposal does not, however, necessarily guarantee that such proposal will be included in a Fund’s proxy statement.

Proxy Solicitation and Tabulation. The expense of preparing, printing, and mailing this Proxy Statement and enclosures and the costs of soliciting proxies on behalf of the Boards will be borne by EVC and not by the Funds. Proxies will be solicited by mail and may be solicited in person or by telephone or facsimile by officers of a Fund, by personnel of its administrator, CRM, by the transfer agent, DST Asset Manager Solutions, Inc., by broker-dealer firms, or by a professional solicitation organization. EVC has retained Computershare Fund Services (“Computershare”), to assist in the solicitation of proxies. A written proxy may be delivered to a Fund or its transfer agent prior to the Meeting by facsimile machine, graphic communication equipment or similar electronic transmission. EVC will reimburse banks, broker-dealer firms, and other persons holding shares registered in their names or in the names of their nominees, for their expenses incurred in sending proxy material to and obtaining proxies from the beneficial owners of such shares. Total estimated proxy solicitation costs are approximately $11,000,000. Estimated costs assume a moderate level of solicitation activity. If a greater solicitation effort is required, the solicitation costs would be higher.

Telephonic or Internet Voting. Shareholders may choose to give their proxy votes by telephone using an automated telephonic voting system or through the internet rather than return their proxy cards. Please see the proxy card for details. A Fund may arrange for CRM, its affiliates or agents to contact shareholders who have not returned their proxy cards and offer to have votes recorded by telephone. If a Fund records votes over the internet or by telephone, it will use procedures designed to authenticate shareholders’ identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded.

In addition to soliciting proxies by mail, Board members of your Fund and employees of CRM and Eaton Vance Distributors, Inc. (“EVD”), the Funds’ principal underwriter, may solicit proxies in person or by telephone. Your Fund also may arrange to have a proxy solicitation firm call you to record your voting instructions by telephone. The procedures for voting proxies by telephone are designed to authenticate shareholders’ identities, to allow them to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. Shareholders would be called at the telephone number CRM has in its records for their accounts, and would be asked for identifying information. The shareholders would then be given an opportunity to authorize the proxies to vote their shares at the Meeting in accordance with their instructions. To ensure that the shareholders’ instructions have been recorded correctly, they will also receive a confirmation of their instructions in the mail. A special toll-free number will be available in case the information contained in the confirmation is incorrect.

Convening the Meeting. As part of our effort to maintain a safe and healthy environment at the Meeting, the Funds and the Boards are closely monitoring statements issued by the Centers for Disease Control and Prevention (cdc.gov) and local authorities regarding the novel coronavirus disease, COVID-19. For that reason, the Board of each Fund reserves the right to reconsider the date, time, and/or means of convening the Meeting for that Fund. Subject to any restrictions imposed by applicable law, the Board(s) may choose to conduct the Meeting of one or more Funds solely by means of remote communications, or may hold a “hybrid” meeting where some participants attend in person and others attend by means of remote communications. If the Board chooses to change the date, time, and/or means of convening the Meeting for a Fund, the Fund will publicly announce the decision to do so in advance, and details on how to participate will be filed with the SEC as additional proxy material. Attendees are also encouraged to review guidance from public health authorities on this issue.

Duplicate mailings. As permitted by SEC rules, CRM’s policy is to send a single copy of this Proxy Statement to shareholders who share the same last name and address, unless a shareholder previously has requested otherwise. Separate proxy cards will be included with this Proxy Statement for each account registered at that address. If you would prefer to receive your own copy of this Proxy Statement, please call our proxy information line at 877-225-6862.

Financial information. Each Fund has previously sent its Annual Report and Semiannual Report to its shareholders. Each Fund will furnish without charge a copy of the Fund’s most recent Annual Report and the most recent Semiannual Report to any shareholder upon request. Shareholders desiring to obtain a copy of such reports should (i) access them on CRM’s website at www.calvert.com; (ii) write to the Funds’ principal underwriter at Eaton Vance Distributors, Inc., Two International Place, Boston, MA 02110; or (iii) call 1-800-368-2745 Monday through Friday between 9:00 a.m. – 5:30 p.m. (Eastern Time).