Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File number:811-06563

Calvert World Values Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

1825 Connecticut Avenue NW, Suite 400, Washington, DC 20009

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Service)

(202)238-2200

(Registrant’s telephone number)

September 30

Date of Fiscal Year End

March 31, 2020

Date of Reporting Period

Table of Contents

| Item 1. | Report to Stockholders. |

Table of Contents

Table of Contents

Table of Contents

Table of Contents

| % Average Annual Total Returns1,2 | Class Inception Date | Performance Inception Date | Six Months | One Year | Five Years | Ten Years |

| Class A at NAV | 10/31/1994 | 10/31/1994 | (18.95)% | (12.98)% | 0.14% | 7.87% |

| Class A with 4.75% Maximum Sales Charge | — | — | (22.80) | (17.11) | (0.83) | 7.35 |

| Class C at NAV | 10/31/1994 | 10/31/1994 | (19.31) | (13.66) | (0.63) | 7.04 |

| Class C with 1% Maximum Sales Charge | — | — | (20.06) | (14.46) | (0.63) | 7.04 |

| Class I at NAV | 06/03/2003 | 10/31/1994 | (18.85) | (12.76) | 0.52 | 8.44 |

| ·· | ||||||

| Russell Midcap® Index | — | — | (21.92)% | (18.31)% | 1.85% | 8.76% |

| % Total Annual Operating Expense Ratios3 | Class A | Class C | Class I |

| Gross | 1.30% | 2.05% | 1.05% |

| Net | 1.18 | 1.93 | 0.93 |

Table of Contents

| Top 10 Holdings (% of net assets)* | |

| Centene Corp. | 2.6% |

| Xcel Energy, Inc. | 2.6 |

| Dollar General Corp. | 2.3 |

| CMS Energy Corp. | 2.3 |

| Electronic Arts, Inc. | 2.2 |

| Sempra Energy | 2.2 |

| Black Knight, Inc. | 2.2 |

| Extra Space Storage, Inc. | 2.2 |

| Agilent Technologies, Inc. | 1.9 |

| Cognizant Technology Solutions Corp., Class A | 1.9 |

| Total | 22.4% |

| * | Excludes cash and cash equivalents. |

Table of Contents

| 1 | Russell Midcap® Index is an unmanaged index of U.S. mid-cap stocks. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares.Calvert Research and Management became the investment adviser to the Fund on December 31, 2016. Performance reflected prior to such date is that of the Fund’s former investment adviser. |

| 3 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 1/31/21. Without the reimbursement, performance would have been lower. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report.Fund profile subject to change due to active management. |

Table of Contents

| Beginning Account Value (10/1/19) | Ending Account Value (3/31/20) | Expenses Paid During Period* (10/1/19 – 3/31/20) | Annualized Expense Ratio | |

| Actual | ||||

| Class A | $1,000.00 | $810.50 | $5.34** | 1.18% |

| Class C | $1,000.00 | $806.90 | $8.72** | 1.93% |

| Class I | $1,000.00 | $811.50 | $4.21** | 0.93% |

| Hypothetical | ||||

| (5% return per year before expenses) | ||||

| Class A | $1,000.00 | $1,019.10 | $5.96** | 1.18% |

| Class C | $1,000.00 | $1,015.35 | $9.72** | 1.93% |

| Class I | $1,000.00 | $1,020.35 | $4.70** | 0.93% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on September 30, 2019. |

| ** | Absent a waiver and/or reimbursement of expenses by an affiliate, expenses would be higher. |

Table of Contents

| Common Stocks — 97.7% |

| Security | Shares | Value |

| Aerospace & Defense — 1.2% | ||

| Hexcel Corp. | 57,714 | $ 2,146,384 |

| $ 2,146,384 | ||

| Auto Components — 0.7% | ||

| Aptiv PLC | 23,676 | $ 1,165,806 |

| $ 1,165,806 | ||

| Banks — 1.1% | ||

| First Republic Bank | 14,360 | $ 1,181,541 |

| Zions Bancorp NA | 26,363 | 705,474 |

| $1,887,015 | ||

| Beverages — 1.5% | ||

| Coca-Cola European Partners PLC | 71,729 | $2,691,989 |

| $2,691,989 | ||

| Biotechnology — 1.5% | ||

| Emergent BioSolutions, Inc.(1) | 45,695 | $2,643,913 |

| $2,643,913 | ||

| Building Products — 2.0% | ||

| Fortune Brands Home & Security, Inc. | 44,458 | $1,922,809 |

| Trex Co., Inc.(1)(2) | 21,158 | 1,695,602 |

| $3,618,411 | ||

| Capital Markets — 3.7% | ||

| Cboe Global Markets, Inc. | 25,049 | $2,235,623 |

| Northern Trust Corp. | 29,369 | 2,216,185 |

| Tradeweb Markets, Inc., Class A | 49,505 | 2,081,190 |

| $6,532,998 | ||

| Commercial Services & Supplies — 2.2% | ||

| Republic Services, Inc. | 27,676 | $2,077,361 |

| Tetra Tech, Inc. | 25,989 | 1,835,343 |

| $3,912,704 | ||

| Communications Equipment — 1.6% | ||

| Motorola Solutions, Inc. | 21,765 | $2,893,004 |

| $2,893,004 | ||

| Consumer Finance — 0.3% | ||

| Discover Financial Services | 15,939 | $568,544 |

| $568,544 | ||

| Security | Shares | Value |

| Containers & Packaging — 4.4% | ||

| AptarGroup, Inc. | 24,817 | $ 2,470,284 |

| Ball Corp. | 48,824 | 3,156,960 |

| Packaging Corp. of America | 25,534 | 2,217,117 |

| $ 7,844,361 | ||

| Diversified Consumer Services — 2.4% | ||

| Service Corp. International | 46,591 | $ 1,822,174 |

| ServiceMaster Global Holdings, Inc.(1) | 93,291 | 2,518,857 |

| $ 4,341,031 | ||

| Electric Utilities — 2.6% | ||

| Xcel Energy, Inc. | 77,818 | $4,692,425 |

| $4,692,425 | ||

| Electrical Equipment — 1.7% | ||

| AMETEK, Inc. | 42,453 | $3,057,465 |

| $3,057,465 | ||

| Electronic Equipment, Instruments & Components — 2.2% | ||

| CDW Corp. | 22,429 | $2,091,953 |

| Zebra Technologies Corp., Class A(1) | 10,514 | 1,930,370 |

| $4,022,323 | ||

| Entertainment — 2.2% | ||

| Electronic Arts, Inc.(1) | 39,579 | $3,964,628 |

| $3,964,628 | ||

| Equity Real Estate Investment Trusts (REITs) — 8.3% | ||

| AvalonBay Communities, Inc. | 21,488 | $3,162,389 |

| Extra Space Storage, Inc. | 40,709 | 3,898,294 |

| Lamar Advertising Co., Class A | 39,933 | 2,047,764 |

| Mid-America Apartment Communities, Inc. | 31,502 | 3,245,651 |

| National Retail Properties, Inc. | 79,924 | 2,572,754 |

| $14,926,852 | ||

| Food & Staples Retailing — 0.7% | ||

| Performance Food Group Co.(1) | 48,762 | $1,205,397 |

| $1,205,397 | ||

| Food Products — 2.0% | ||

| Lamb Weston Holdings, Inc. | 27,560 | $1,573,676 |

| Nomad Foods, Ltd.(1) | 111,421 | 2,067,974 |

| $3,641,650 | ||

| Health Care Equipment & Supplies — 3.3% | ||

| Cooper Cos., Inc. (The) | 7,379 | $2,034,169 |

Table of Contents

| Security | Shares | Value |

| Health Care Equipment & Supplies (continued) | ||

| Haemonetics Corp.(1) | 11,312 | $ 1,127,354 |

| Teleflex, Inc. | 9,168 | 2,684,940 |

| $ 5,846,463 | ||

| Health Care Providers & Services — 5.8% | ||

| Amedisys, Inc.(1) | 8,945 | $ 1,641,765 |

| Centene Corp.(1) | 79,453 | 4,720,303 |

| Chemed Corp. | 5,365 | 2,324,118 |

| LHC Group, Inc.(1) | 12,063 | 1,691,233 |

| $10,377,419 | ||

| Independent Power and Renewable Electricity Producers — 0.8% | ||

| NextEra Energy Partners, L.P. | 35,267 | $1,516,481 |

| $1,516,481 | ||

| Insurance — 7.0% | ||

| Alleghany Corp. | 3,329 | $1,838,773 |

| Allstate Corp. (The) | 23,210 | 2,129,054 |

| American Financial Group, Inc. | 25,312 | 1,773,865 |

| Assurant, Inc. | 29,498 | 3,070,447 |

| First American Financial Corp. | 36,971 | 1,567,940 |

| RLI Corp. | 24,382 | 2,143,909 |

| $12,523,988 | ||

| Interactive Media & Services — 0.8% | ||

| IAC/InterActiveCorp.(1) | 7,590 | $1,360,356 |

| $1,360,356 | ||

| IT Services — 8.9% | ||

| Amdocs, Ltd. | 43,015 | $2,364,535 |

| Black Knight, Inc.(1) | 67,350 | 3,910,341 |

| Broadridge Financial Solutions, Inc. | 30,922 | 2,932,333 |

| Cognizant Technology Solutions Corp., Class A | 71,487 | 3,322,001 |

| CSG Systems International, Inc. | 53,638 | 2,244,750 |

| WEX, Inc.(1) | 10,480 | 1,095,684 |

| $15,869,644 | ||

| Life Sciences Tools & Services — 1.9% | ||

| Agilent Technologies, Inc. | 47,366 | $3,392,353 |

| $3,392,353 | ||

| Machinery — 3.8% | ||

| Fortive Corp. | 40,439 | $2,231,829 |

| Stanley Black & Decker, Inc. | 26,101 | 2,610,100 |

| Xylem, Inc. | 31,402 | 2,045,212 |

| $6,887,141 | ||

| Security | Shares | Value |

| Metals & Mining — 0.6% | ||

| Steel Dynamics, Inc. | 50,662 | $ 1,141,921 |

| $ 1,141,921 | ||

| Multiline Retail — 2.3% | ||

| Dollar General Corp. | 27,436 | $ 4,143,110 |

| $ 4,143,110 | ||

| Multi-Utilities — 4.5% | ||

| CMS Energy Corp. | 69,733 | $ 4,096,814 |

| Sempra Energy | 34,864 | 3,939,283 |

| $8,036,097 | ||

| Pharmaceuticals — 1.1% | ||

| Jazz Pharmaceuticals PLC(1) | 19,045 | $1,899,548 |

| $1,899,548 | ||

| Professional Services — 2.7% | ||

| IHS Markit, Ltd. | 50,236 | $3,014,160 |

| Verisk Analytics, Inc. | 13,581 | 1,892,920 |

| $4,907,080 | ||

| Semiconductors & Semiconductor Equipment — 3.4% | ||

| Analog Devices, Inc. | 22,834 | $2,047,068 |

| NXP Semiconductors NV | 20,678 | 1,714,826 |

| Skyworks Solutions, Inc. | 26,597 | 2,377,240 |

| $6,139,134 | ||

| Software — 5.1% | ||

| ACI Worldwide, Inc.(1) | 70,740 | $1,708,371 |

| ANSYS, Inc.(1) | 10,457 | 2,430,939 |

| Bill.com Holdings, Inc.(1) | 22,031 | 753,460 |

| CDK Global, Inc. | 60,269 | 1,979,837 |

| Everbridge, Inc.(1)(2) | 9,634 | 1,024,672 |

| RealPage, Inc.(1) | 21,577 | 1,142,070 |

| $9,039,349 | ||

| Specialty Retail — 3.4% | ||

| Best Buy Co., Inc. | 38,640 | $2,202,480 |

| National Vision Holdings, Inc.(1) | 105,513 | 2,049,063 |

| Ross Stores, Inc. | 20,924 | 1,819,760 |

| $6,071,303 | ||

| Total Common Stocks (identified cost $188,133,108) | $174,908,287 | |

Table of Contents

| High Social Impact Investments — 0.7% |

| Security | Principal Amount (000's omitted) | Value |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/20(3)(4) | $ 697 | $ 671,675 |

| ImpactAssets, Inc., Global Sustainable Agriculture Notes, 3.48%, 11/3/20(4)(5) | 309 | 302,820 |

| ImpactAssets, Inc., Microfinance Plus Notes, 1.20%, 11/3/20(4)(5) | 398 | 386,956 |

| Total High Social Impact Investments (identified cost $1,403,903) | $ 1,361,451 | |

| Total Investments — 98.4% (identified cost $189,537,011) | $176,269,738 | |

| Other Assets, Less Liabilities — 1.6% | $ 2,781,272 | |

| Net Assets — 100.0% | $179,051,010 |

| The percentage shown for each investment category in the Schedule of Investments is based on net assets. | ||

| (1) | Non-income producing security. | |

| (2) | All or a portion of this security was on loan at March 31, 2020. The aggregate market value of securities on loan at March 31, 2020 was $1,970,571. | |

| (3) | Affiliated company (see Note 7). | |

| (4) | Restricted security. Total market value of restricted securities amounts to $1,361,451, which represents 0.7% of the net assets of the Fund as of March 31, 2020. | |

| (5) | Notes carry an interest rate that varies by period and is contingent on the performance of the underlying portfolio of loans to borrowers. The coupon rate shown represents the rate in effect at March 31, 2020. | |

| Description | Acquisition Dates | Cost |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/20 | 12/13/19 | $696,903 |

| ImpactAssets, Inc., Global Sustainable Agriculture Notes, 3.48%, 11/3/20 | 11/13/15 | 309,000 |

| ImpactAssets, Inc., Microfinance Plus Notes, 1.20%, 11/3/20 | 11/13/15 | 398,000 |

Table of Contents

| March 31, 2020 | |

| Assets | |

| Investments in securities of unaffiliated issuers, at value (identified cost $188,840,108) - including $1,970,571 of securities on loan | $175,598,063 |

| Investments in securities of affiliated issuers, at value (identified cost $696,903) | 671,675 |

| Cash | 2,833,581 |

| Receivable for capital shares sold | 508,269 |

| Dividends and interest receivable | 262,316 |

| Interest receivable - affiliated | 3,049 |

| Securities lending income receivable | 99 |

| Receivable from affiliate | 26,635 |

| Directors' deferred compensation plan | 150,367 |

| Total assets | $180,054,054 |

| Liabilities | |

| Payable for investments purchased | $220,418 |

| Payable for capital shares redeemed | 334,799 |

| Payable to affiliates: | |

| Investment advisory fee | 102,786 |

| Administrative fee | 18,976 |

| Distribution and service fees | 34,558 |

| Sub-transfer agency fee | 5,440 |

| Directors' deferred compensation plan | 150,367 |

| Accrued expenses | 135,700 |

| Total liabilities | $1,003,044 |

| Net Assets | $179,051,010 |

| Sources of Net Assets | |

| Paid-in capital | $189,567,414 |

| Accumulated loss | (10,516,404) |

| Total | $179,051,010 |

| Class A Shares | |

| Net Assets | $121,294,455 |

| Shares Outstanding | 4,548,742 |

| Net Asset Value and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) | $26.67 |

| Maximum Offering Price Per Share (100 ÷ 95.25 of net asset value per share) | $28.00 |

| Class C Shares | |

| Net Assets | $7,711,174 |

| Shares Outstanding | 432,163 |

| Net Asset Value and Offering Price Per Share* (net assets ÷ shares of beneficial interest outstanding) | $17.84 |

Table of Contents

| March 31, 2020 | |

| Class I Shares | |

| Net Assets | $50,045,381 |

| Shares Outstanding | 1,565,126 |

| Net Asset Value, Offering Price and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) | $31.98 |

| On sales of $50,000 or more, the offering price of Class A shares is reduced. | |

| * | Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge. |

Table of Contents

| Six Months Ended | |

| March 31, 2020 | |

| Investment Income | |

| Dividend income (net of foreign taxes withheld of $5,547) | $1,507,177 |

| Interest income | 8,879 |

| Interest income - affiliated issuers | 10,689 |

| Securities lending income, net | 1,728 |

| Total investment income | $1,528,473 |

| Expenses | |

| Investment advisory fee | $715,398 |

| Administrative fee | 132,074 |

| Distribution and service fees: | |

| Class A | 194,773 |

| Class C | 66,240 |

| Directors' fees and expenses | 5,981 |

| Custodian fees | 284 |

| Transfer agency fees and expenses | 156,455 |

| Accounting fees | 23,098 |

| Professional fees | 20,663 |

| Registration fees | 40,808 |

| Reports to shareholders | 17,020 |

| Miscellaneous | 16,931 |

| Total expenses | $1,389,725 |

| Waiver and/or reimbursement of expenses by affiliate | $(101,385) |

| Reimbursement of expenses - other | (3,135) |

| Net expenses | $1,285,205 |

| Net investment income | $243,268 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss): | |

| Investment securities - unaffiliated issuers | $4,522,564 |

| Foreign currency transactions | (565) |

| Net realized gain | $4,521,999 |

| Change in unrealized appreciation (depreciation): | |

| Investment securities - unaffiliated issuers | $(45,456,437) |

| Investment securities - affiliated issuers | (11,371) |

| Foreign currency | 4 |

| Net change in unrealized appreciation (depreciation) | $(45,467,804) |

| Net realized and unrealized loss | $(40,945,805) |

| Net decrease in net assets from operations | $(40,702,537) |

Table of Contents

| Six Months Ended March 31, 2020 (Unaudited) | Year Ended September 30, 2019 | |

| Increase (Decrease) in Net Assets | ||

| From operations: | ||

| Net investment income | $243,268 | $707,838 |

| Net realized gain | 4,521,999 | 12,080,437 |

| Net change in unrealized appreciation (depreciation) | (45,467,804) | (1,504,174) |

| Net increase (decrease) in net assets from operations | $(40,702,537) | $11,284,101 |

| Distributions to shareholders: | ||

| Class A | $(8,276,383) | $(9,307,133) |

| Class C | (1,104,384) | (1,293,432) |

| Class I | (2,242,939) | (4,175,285) |

| Total distributions to shareholders | $(11,623,706) | $(14,775,850) |

| Capital share transactions: | ||

| Class A | $153,166 | $882,077 |

| Class C | (4,151,519) | (2,030,602) |

| Class I | 16,302,195 | (43,573,385) |

| Net increase (decrease) in net assets from capital share transactions | $12,303,842 | $(44,721,910) |

| Net decrease in net assets | $(40,022,401) | $(48,213,659) |

| Net Assets | ||

| At beginning of period | $219,073,411 | $267,287,070 |

| At end of period | $179,051,010 | $219,073,411 |

Table of Contents

| Class A | ||||||

| Six Months Ended March 31, 2020 (Unaudited) | Year Ended September 30, | |||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||

| Net asset value — Beginning of period | $34.69 | $34.84 | $33.40 | $29.68 | $33.41 | $36.99 |

| Income (Loss) From Operations | ||||||

| Net investment income (loss)(1) | $0.04 | $0.09 | $0.07 | $0.20 | $0.02(2) | $(0.16) |

| Net realized and unrealized gain (loss) | (6.21) | 1.85 | 4.59 | 3.68 | (0.67) | 1.91 |

| Total income (loss) from operations | $(6.17) | $1.94 | $4.66 | $3.88 | $(0.65) | $1.75 |

| Less Distributions | ||||||

| From net investment income | $(0.03) | $(0.08) | $(0.04) | $(0.15) | $— | $— |

| From net realized gain | (1.82) | (2.01) | (3.18) | (0.01) | (3.08) | (5.33) |

| Total distributions | $(1.85) | $(2.09) | $(3.22) | $(0.16) | $(3.08) | $(5.33) |

| Net asset value — End of period | $26.67 | $34.69 | $34.84 | $33.40 | $29.68 | $33.41 |

| Total Return(3) | (18.95)%(4) | 6.56% | 15.04% | 13.11% | (2.08)% | 4.90% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $121,294 | $158,005 | $157,046 | $159,951 | $192,402 | $223,328 |

| Ratios (as a percentage of average daily net assets):(5) | ||||||

| Total expenses | 1.28%(6) | 1.30% | 1.28% | 1.34% | 1.37% | 1.41% |

| Net expenses | 1.18%(6) | 1.19% | 1.21% | 1.21% | 1.31% | 1.41% |

| Net investment income (loss) | 0.21%(6) | 0.27% | 0.22% | 0.64% | 0.07%(2) | (0.43)% |

| Portfolio Turnover | 41%(4) | 83% | 62% | 162% | 199% | 74% |

| (1) | Computed using average shares outstanding. |

| (2) | Amount includes a non-recurring refund for overbilling of prior years' custody out-of-pocket fees. This amounted to $0.001 per share and 0% of average net assets. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (4) | Not annualized. |

| (5) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (6) | Annualized. |

Table of Contents

| Class C | ||||||

| Six Months Ended March 31, 2020 (Unaudited) | Year Ended September 30, | |||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||

| Net asset value — Beginning of period | $23.83 | $24.65 | $24.55 | $21.87 | $25.62 | $29.76 |

| Income (Loss) From Operations | ||||||

| Net investment loss(1) | $(0.07) | $(0.11) | $(0.12) | $(0.03) | $(0.16)(2) | $(0.34) |

| Net realized and unrealized gain (loss) | (4.14) | 1.23 | 3.27 | 2.72 | (0.51) | 1.53 |

| Total income (loss) from operations | $(4.21) | $1.12 | $3.15 | $2.69 | $(0.67) | $1.19 |

| Less Distributions | ||||||

| From net realized gain | $(1.78) | $(1.94) | $(3.05) | $(0.01) | $(3.08) | $(5.33) |

| Total distributions | $(1.78) | $(1.94) | $(3.05) | $(0.01) | $(3.08) | $(5.33) |

| Net asset value — End of period | $17.84 | $23.83 | $24.65 | $24.55 | $21.87 | $25.62 |

| Total Return(3) | (19.31)%(4) | 5.77% | 14.20% | 12.29% | (2.87)% | 4.09% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $7,711 | $14,535 | $17,043 | $18,146 | $22,885 | $29,837 |

| Ratios (as a percentage of average daily net assets):(5) | ||||||

| Total expenses | 2.03%(6) | 2.05% | 2.03% | 2.18% | 2.16% | 2.21% |

| Net expenses | 1.93%(6) | 1.94% | 1.96% | 1.96% | 2.09% | 2.21% |

| Net investment loss | (0.58)%(6) | (0.49)% | (0.53)% | (0.12)% | (0.72)%(2) | (1.23)% |

| Portfolio Turnover | 41%(4) | 83% | 62% | 162% | 199% | 74% |

| (1) | Computed using average shares outstanding. |

| (2) | Amount includes a non-recurring refund for overbilling of prior years' custody out-of-pocket fees. This amounted to $0.001 per share and 0% of average net assets. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (4) | Not annualized. |

| (5) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (6) | Annualized. |

Table of Contents

| Class I | ||||||

| Six Months Ended March 31, 2020 (Unaudited) | Year Ended September 30, | |||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||

| Net asset value — Beginning of period | $41.25 | $40.97 | $38.70 | $34.38 | $38.05 | $41.19 |

| Income (Loss) From Operations | ||||||

| Net investment income(1) | $0.09 | $0.21 | $0.23 | $0.41 | $0.19(2) | $0.06 |

| Net realized and unrealized gain (loss) | (7.45) | 2.24 | 5.37 | 4.22 | (0.78) | 2.13 |

| Total income (loss) from operations | $(7.36) | $2.45 | $5.60 | $4.63 | $(0.59) | $2.19 |

| Less Distributions | ||||||

| From net investment income | $(0.09) | $(0.16) | $(0.15) | $(0.30) | $— | $— |

| From net realized gain | (1.82) | (2.01) | (3.18) | (0.01) | (3.08) | (5.33) |

| Total distributions | $(1.91) | $(2.17) | $(3.33) | $(0.31) | $(3.08) | $(5.33) |

| Net asset value — End of period | $31.98 | $41.25 | $40.97 | $38.70 | $34.38 | $38.05 |

| Total Return(3) | (18.85)%(4) | 6.85% | 15.48% | 13.53% | (1.64)% | 5.53% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $50,045 | $46,533 | $93,198 | $68,748 | $166,759 | $236,228 |

| Ratios (as a percentage of average daily net assets):(5) | ||||||

| Total expenses | 1.03%(6) | 1.05% | 1.03% | 0.88% | 0.86% | 0.83% |

| Net expenses | 0.93%(6) | 0.91% | 0.86% | 0.86% | 0.84% | 0.83% |

| Net investment income | 0.46%(6) | 0.54% | 0.59% | 1.14% | 0.55%(2) | 0.14% |

| Portfolio Turnover | 41%(4) | 83% | 62% | 162% | 199% | 74% |

| (1) | Computed using average shares outstanding. |

| (2) | Amount includes a non-recurring refund for overbilling of prior years' custody out-of-pocket fees. This amounted to $0.001 per share and 0% of average net assets. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (4) | Not annualized. |

| (5) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (6) | Annualized. |

Table of Contents

Table of Contents

| Asset Description | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | $174,908,287(1) | $ — | $— | $174,908,287 |

| High Social Impact Investments | — | 1,361,451 | — | 1,361,451 |

| Total Investments | $174,908,287 | $1,361,451 | $ — | $176,269,738 |

| (1) | The level classification by major category of investments is the same as the category presentation in the Schedule of Investments. |

Table of Contents

Table of Contents

| Aggregate cost | $190,361,991 |

| Gross unrealized appreciation | $8,698,842 |

| Gross unrealized depreciation | (22,791,095) |

| Net unrealized depreciation | $(14,092,253) |

Table of Contents

| Name of issuer | Value, beginning of period | Purchases | Sales proceeds | Net realized gain (loss) | Change in unrealized appreciation (depreciation) | Value, end of period | Interest income | Capital gain distributions received | Principal amount, end of period |

| High Social Impact Investments | |||||||||

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/19(1) | $2,605,631 | $ — | $(2,619,488) | $ — | $13,857 | $ — | $7,640 | $ — | $— |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/20(1) | — | 696,903 | — | — | (25,228) | 671,675 | 3,049 | — | 696,903 |

| Totals | $ — | $(11,371) | $671,675 | $10,689 | $ — |

| (1) | Restricted security. |

| Six Months Ended March 31, 2020 (Unaudited) | Year Ended September 30, 2019 | ||||

| Shares | Amount | Shares | Amount | ||

| Class A | |||||

| Shares sold | 167,622 | $5,622,609 | 336,722 | $10,998,087 | |

| Reinvestment of distributions | 233,552 | 7,959,447 | 299,488 | 8,942,725 | |

| Shares redeemed | (414,513) | (13,680,822) | (742,143) | (23,719,620) | |

| Converted from Class C | 7,867 | 251,932 | 152,429 | 4,660,885 | |

| Net increase (decrease) | (5,472) | $153,166 | 46,496 | $882,077 | |

| Class C | |||||

| Shares sold | 60,854 | $1,406,221 | 220,887 | $4,577,767 | |

| Reinvestment of distributions | 30,825 | 704,666 | 59,723 | 1,232,088 | |

| Shares redeemed | (257,889) | (6,010,474) | (141,161) | (3,179,572) | |

| Converted to Class A | (11,662) | (251,932) | (220,894) | (4,660,885) | |

| Net decrease | (177,872) | $(4,151,519) | (81,445) | $(2,030,602) | |

| Class I | |||||

| Shares sold | 673,112 | $25,086,790 | 1,227,687 | $47,437,976 | |

| Reinvestment of distributions | 51,752 | 2,113,537 | 96,198 | 3,408,286 | |

| Shares redeemed | (287,767) | (10,898,132) | (2,470,818) | (94,419,647) | |

| Net increase (decrease) | 437,097 | $16,302,195 | (1,146,933) | $(43,573,385) | |

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

| Officers |

| Hope L. Brown Chief Compliance Officer |

| Maureen A. Gemma Vice President, Secretary and Chief Legal Officer |

| James F. Kirchner Treasurer |

| Directors |

| Alice Gresham Bullock Chairperson |

| Richard L. Baird, Jr. |

| Cari M. Dominguez |

| John G. Guffey, Jr. |

| Miles D. Harper, III |

| Joy V. Jones |

| John H. Streur* |

| Anthony A. Williams |

| *Interested Director and President |

Table of Contents

| • | At the time of opening an account, Eaton Vance generally requires you to provide us with certain information such as name, address, social security number, tax status, account numbers, and account balances. This information is necessary for us to both open an account for you and to allow us to satisfy legal requirements such as applicable anti-money laundering reviews and know-your-customer requirements. |

| • | On an ongoing basis, in the normal course of servicing your account, Eaton Vance may share your information with unaffiliated third parties that perform various services for Eaton Vance and/or your account. These third parties include transfer agents, custodians, broker/dealers and our professional advisers, including auditors, accountants, and legal counsel. Eaton Vance may additionally share your personal information with our affiliates. |

| • | We believe our Privacy Program is reasonably designed to protect the confidentiality of your personal information and to prevent unauthorized access to that information. |

| • | We reserve the right to change our Privacy Program at any time upon proper notification to you. You may want to review our Privacy Program periodically for changes by accessing the link on our homepage: www.eatonvance.com. |

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

| % Average Annual Total Returns1,2 | Class Inception Date | Performance Inception Date | Six Months | One Year | Five Years | Since Inception |

| Class A at NAV | 10/29/2012 | 10/29/2012 | (15.17)% | (15.96)% | 1.50% | 3.43% |

| Class A with 4.75% Maximum Sales Charge | — | — | (19.20) | (19.96) | 0.51 | 2.75 |

| Class C at NAV | 10/29/2012 | 10/29/2012 | (15.56) | (16.57) | 0.72 | 2.57 |

| Class C with 1% Maximum Sales Charge | — | — | (16.40) | (17.41) | 0.72 | 2.57 |

| Class I at NAV | 10/29/2012 | 10/29/2012 | (15.11) | (15.73) | 1.81 | 3.77 |

| Class R6 at NAV | 02/01/2018 | 10/29/2012 | (15.07) | (15.69) | 1.81 | 3.77 |

| ·· | ||||||

| MSCI Emerging Markets Index | — | — | (14.55)% | (17.69)% | (0.37)% | 0.28% |

| % Total Annual Operating Expense Ratios3 | Class A | Class C | Class I | Class R6 |

| Gross | 1.37% | 2.12% | 1.12% | 1.05% |

| Net | 1.24 | 1.99 | 0.99 | 0.92 |

Table of Contents

| Top 10 Holdings (% of net assets)* | |

| Alibaba Group Holding, Ltd. ADR | 9.3% |

| Samsung Electronics Co., Ltd. | 7.6 |

| Taiwan Semiconductor Manufacturing Co., Ltd. ADR | 5.8 |

| Prosus NV | 5.0 |

| Tencent Holdings, Ltd. | 5.0 |

| NARI Technology Co., Ltd., Class A | 3.8 |

| AIA Group, Ltd. | 3.0 |

| Delta Electronics, Inc. | 3.0 |

| Techtronic Industries Co., Ltd. | 2.9 |

| Yandex NV, Class A | 2.5 |

| Total | 47.9% |

| * | Excludes cash and cash equivalents. |

Table of Contents

| 1 | MSCI Emerging Markets Index is an unmanaged index of emerging markets common stocks. MSCI indexes are net of foreign withholding taxes. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares.Performance prior to the inception date of a class may be linked to the performance of an older class of the Fund. This linked performance is adjusted for any applicable sales charge, but is not adjusted for class expense differences. If adjusted for such differences, the performance would be different. The performance of Class R6 is linked to Class I. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. Performance presented in the Financial Highlights included in the financial statements is not linked.Calvert Research and Management became the investment adviser to the Fund on December 31, 2016. Performance reflected prior to such date is that of the Fund’s former investment adviser. |

| 3 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 1/31/21. Without the reimbursement, performance would have been lower. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. |

Table of Contents

| Beginning Account Value (10/1/19) | Ending Account Value (3/31/20) | Expenses Paid During Period* (10/1/19 – 3/31/20) | Annualized Expense Ratio | |

| Actual | ||||

| Class A | $1,000.00 | $848.30 | $5.73** | 1.24% |

| Class C | $1,000.00 | $844.40 | $9.18** | 1.99% |

| Class I | $1,000.00 | $848.90 | $4.58** | 0.99% |

| Class R6 | $1,000.00 | $849.30 | $4.25** | 0.92% |

| Hypothetical | ||||

| (5% return per year before expenses) | ||||

| Class A | $1,000.00 | $1,018.80 | $6.26** | 1.24% |

| Class C | $1,000.00 | $1,015.05 | $10.02** | 1.99% |

| Class I | $1,000.00 | $1,020.05 | $5.00** | 0.99% |

| Class R6 | $1,000.00 | $1,020.40 | $4.65** | 0.92% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on September 30, 2019. |

| ** | Absent a waiver and/or reimbursement of expenses by an affiliate, expenses would be higher. |

Table of Contents

| Common Stocks — 97.7% |

| Security | Shares | Value |

| Brazil — 4.9% | ||

| BB Seguridade Participacoes SA | 5,594,967 | $ 26,757,555 |

| Duratex SA | 7,531,441 | 13,552,274 |

| Hapvida Participacoes e Investimentos SA(1) | 2,523,231 | 20,589,480 |

| Itau Unibanco Holding SA, PFC Shares | 5,565,971 | 24,733,602 |

| Notre Dame Intermedica Participacoes SA | 2,056,276 | 17,792,223 |

| $ 103,425,134 | ||

| China — 30.1% | ||

| Aier Eye Hospital Group Co., Ltd., Class A | 5,224,259 | $ 28,667,572 |

| Alibaba Group Holding, Ltd. ADR(2) | 1,011,274 | 196,672,568 |

| Autohome, Inc. ADR(2)(3) | 375,061 | 26,636,832 |

| Baozun, Inc. ADR(2)(3) | 1,509,209 | 42,167,299 |

| China Communications Services Corp., Ltd., Class H | 56,120,000 | 40,353,253 |

| China Mengniu Dairy Co., Ltd.(2) | 14,186,310 | 48,924,569 |

| Gree Electric Appliances, Inc. of Zhuhai, Class A | 3,979,786 | 28,984,725 |

| NARI Technology Co., Ltd., Class A | 29,235,024 | 80,247,443 |

| Shenzhen International Holdings, Ltd. | 21,211,373 | 38,469,019 |

| Tencent Holdings, Ltd. | 2,160,596 | 106,793,062 |

| $637,916,342 | ||

| Egypt — 1.4% | ||

| Commercial International Bank Egypt SAE | 7,806,374 | $28,817,712 |

| $28,817,712 | ||

| Hong Kong — 6.9% | ||

| AIA Group, Ltd. | 7,184,034 | $64,330,392 |

| Samsonite International SA(1) | 21,423,226 | 20,059,202 |

| Techtronic Industries Co., Ltd. | 9,710,290 | 61,659,403 |

| $146,048,997 | ||

| Hungary — 1.6% | ||

| Richter Gedeon Nyrt | 1,850,443 | $34,897,593 |

| $34,897,593 | ||

| India — 9.4% | ||

| Bharat Forge, Ltd. | 4,514,504 | $13,965,663 |

| Container Corp. of India, Ltd. | 3,400,134 | 14,796,409 |

| HCL Technologies, Ltd. | 3,849,553 | 22,032,570 |

| HDFC Bank, Ltd. ADR | 1,006,618 | 38,714,528 |

| Hero MotoCorp, Ltd. | 1,064,796 | 22,226,138 |

| ICICI Bank, Ltd. | 5,701,779 | 24,554,438 |

| Motherson Sumi Systems, Ltd. | 16,901,669 | 13,506,400 |

| Power Grid Corp. of India, Ltd. | 3,961,772 | 8,306,583 |

| SBI Life Insurance Co., Ltd.(1) | 2,267,103 | 19,543,336 |

| Security | Shares | Value |

| India (continued) | ||

| Tech Mahindra, Ltd. | 2,930,258 | $ 21,692,254 |

| $ 199,338,319 | ||

| Indonesia — 2.1% | ||

| Bank Rakyat Indonesia Persero Tbk PT | 239,723,796 | $ 43,966,567 |

| $ 43,966,567 | ||

| Mexico — 1.2% | ||

| Wal-Mart de Mexico SAB de CV | 10,677,884 | $ 25,157,000 |

| $ 25,157,000 | ||

| Peru — 1.6% | ||

| Credicorp, Ltd. | 234,761 | $33,587,256 |

| $33,587,256 | ||

| Russia — 3.6% | ||

| Mail.ru Group, Ltd. GDR(2) | 1,470,759 | $23,639,992 |

| Yandex NV, Class A(2) | 1,571,595 | 53,512,810 |

| $77,152,802 | ||

| South Africa — 6.5% | ||

| Prosus NV(2) | 1,539,053 | $106,900,131 |

| Shoprite Holdings, Ltd. | 4,297,707 | 30,158,799 |

| $137,058,930 | ||

| South Korea — 13.3% | ||

| KB Financial Group, Inc. | 1,499,412 | $42,169,486 |

| LG Household & Health Care, Ltd. | 28,615 | 26,210,987 |

| NCSoft Corp. | 99,802 | 53,264,759 |

| Samsung Electronics Co., Ltd. | 4,153,138 | 161,480,182 |

| $283,125,414 | ||

| Taiwan — 14.0% | ||

| Accton Technology Corp. | 7,323,000 | $39,182,348 |

| Advantech Co., Ltd. | 3,064,983 | 25,254,439 |

| Chipbond Technology Corp. | 14,961,000 | 24,227,323 |

| Delta Electronics, Inc. | 16,062,000 | 63,570,413 |

| LandMark Optoelectronics Corp. | 2,621,900 | 22,297,024 |

| Taiwan Semiconductor Manufacturing Co., Ltd. ADR | 2,583,549 | 123,467,807 |

| $297,999,354 | ||

| Turkey — 1.1% | ||

| BIM Birlesik Magazalar AS | 3,209,406 | $24,369,402 |

| $24,369,402 | ||

Table of Contents

| Security | Shares | Value |

| United Arab Emirates — 0.0% | ||

| NMC Health PLC(4) | 2,704,917 | $ — |

| $ — | ||

| Total Common Stocks (identified cost $2,408,955,720) | $2,072,860,822 | |

| High Social Impact Investments — 0.3% |

| Security | Principal Amount (000's omitted) | Value |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/20(5)(6) | $ 7,467 | $ 7,196,569 |

| ImpactAssets, Inc., Global Sustainable Agriculture Notes, 3.48%, 11/3/20(6)(7) | 43 | 42,140 |

| ImpactAssets, Inc., Microfinance Plus Notes, 1.20%, 11/3/20(6)(7) | 56 | 54,446 |

| Total High Social Impact Investments (identified cost $7,565,870) | $ 7,293,155 |

| Short-Term Investments — 1.9% |

| Security | Shares | Value |

| State Street Navigator Securities Lending Government Money Market Portfolio, 0.24%(8) | 40,714,661 | $ 40,714,661 |

| Total Short-Term Investments (identified cost $40,714,661) | $ 40,714,661 | |

| Total Investments — 99.9% (identified cost $2,457,236,251) | $2,120,868,638 | |

| Other Assets, Less Liabilities — 0.1% | $ 1,168,390 | |

| Net Assets — 100.0% | $2,122,037,028 |

| The percentage shown for each investment category in the Schedule of Investments is based on net assets. | ||

| (1) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. Total market value of Rule 144A securities amounts to $60,192,018, which represents 2.8% of the net assets of the Fund as of March 31, 2020. | |

| (2) | Non-income producing security. | |

| (3) | All or a portion of this security was on loan at March 31, 2020. The aggregate market value of securities on loan at March 31, 2020 was $42,083,443. |

| (4) | For fair value measurement disclosure purposes, security is categorized as Level 3 (see Note 1A). |

| (5) | Affiliated company (see Note 7). |

| (6) | Restricted security. Total market value of restricted securities amounts to $7,293,155, which represents 0.3% of the net assets of the Fund as of March 31, 2020. |

| (7) | Notes carry an interest rate that varies by period and is contingent on the performance of the underlying portfolio of loans to borrowers. The coupon rate shown represents the rate in effect at March 31, 2020. |

| (8) | Represents investment of cash collateral received in connection with securities lending. |

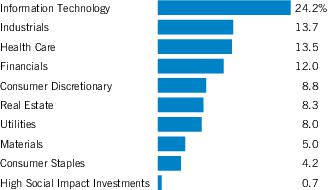

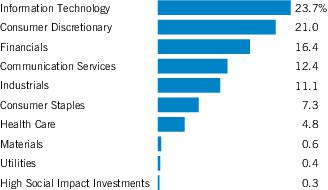

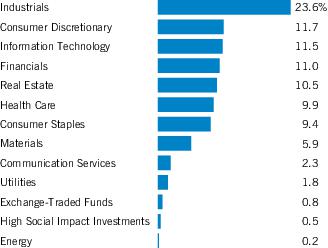

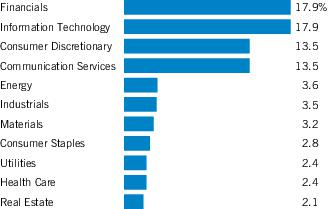

| Economic Sectors | % of Net Assets |

| Information Technology | 23.7% |

| Consumer Discretionary | 21.0 |

| Financials | 16.4 |

| Communication Services | 12.4 |

| Industrials | 11.1 |

| Consumer Staples | 7.3 |

| Health Care | 4.8 |

| Materials | 0.6 |

| Utilities | 0.4 |

| High Social Impact Investments | 0.3 |

| Total | 98.0% |

Table of Contents

| Description | Acquisition Dates | Cost |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/20 | 12/13/19 | $7,466,870 |

| ImpactAssets, Inc., Global Sustainable Agriculture Notes, 3.48%, 11/3/20 | 11/13/15 | 43,000 |

| ImpactAssets, Inc., Microfinance Plus Notes, 1.20%, 11/3/20 | 11/13/15 | 56,000 |

| Abbreviations: | |

| ADR | – American Depositary Receipt |

| GDR | – Global Depositary Receipt |

| PFC Shares | – Preference Shares |

Table of Contents

| March 31, 2020 | |

| Assets | |

| Investments in securities of unaffiliated issuers, at value (identified cost $2,449,769,381) - including $42,083,443 of securities on loan | $2,113,672,069 |

| Investments in securities of affiliated issuers, at value (identified cost $7,466,870) | 7,196,569 |

| Cash | 10,426,164 |

| Cash denominated in foreign currency, at value (cost $6,741,623) | 6,745,636 |

| Receivable for investments sold | 15,281,733 |

| Receivable for capital shares sold | 18,120,533 |

| Dividends and interest receivable | 5,912,457 |

| Interest receivable - affiliated | 32,668 |

| Securities lending income receivable | 70,037 |

| Directors' deferred compensation plan | 659,726 |

| Total assets | $2,178,117,592 |

| Liabilities | |

| Payable for investments purchased | $4,384,230 |

| Payable for capital shares redeemed | 5,999,013 |

| Payable for foreign capital gain taxes | 1,174,111 |

| Deposits for securities loaned | 40,714,661 |

| Payable to affiliates: | |

| Investment advisory fee | 1,456,898 |

| Administrative fee | 233,104 |

| Distribution and service fees | 52,295 |

| Sub-transfer agency fee | 6,265 |

| Directors' deferred compensation plan | 659,726 |

| Other | 283,980 |

| Accrued expenses | 1,116,281 |

| Total liabilities | $56,080,564 |

| Net Assets | $2,122,037,028 |

| Sources of Net Assets | |

| Paid-in capital | $2,553,438,216 |

| Accumulated loss | (431,401,188) |

| Total | $2,122,037,028 |

| Class A Shares | |

| Net Assets | $140,441,587 |

| Shares Outstanding | 10,367,238 |

| Net Asset Value and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) | $13.55 |

| Maximum Offering Price Per Share (100 ÷ 95.25 of net asset value per share) | $14.23 |

| Class C Shares | |

| Net Assets | $24,841,382 |

| Shares Outstanding | 1,883,355 |

| Net Asset Value and Offering Price Per Share* (net assets ÷ shares of beneficial interest outstanding) | $13.19 |

Table of Contents

| March 31, 2020 | |

| Class I Shares | |

| Net Assets | $1,739,326,952 |

| Shares Outstanding | 127,240,387 |

| Net Asset Value, Offering Price and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) | $13.67 |

| Class R6 Shares | |

| Net Assets | $217,427,107 |

| Shares Outstanding | 15,940,917 |

| Net Asset Value, Offering Price and Redemption Price Per Share (net assets ÷ shares of beneficial interest outstanding) | $13.64 |

| On sales of $50,000 or more, the offering price of Class A shares is reduced. | |

| * | Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge. |

Table of Contents

| Six Months Ended | |

| March 31, 2020 | |

| Investment Income | |

| Dividend income (net of foreign taxes withheld of $2,513,946) | $19,653,300 |

| Interest income - unaffiliated issuers | 637 |

| Interest income - affiliated issuers | 38,501 |

| Securities lending income, net | 1,064,700 |

| Total investment income | $20,757,138 |

| Expenses | |

| Investment advisory fee | $9,310,190 |

| Administrative fee | 1,489,630 |

| Distribution and service fees: | |

| Class A | 179,567 |

| Class C | 154,081 |

| Directors' fees and expenses | 68,843 |

| Custodian fees | 9,301 |

| Transfer agency fees and expenses | 898,508 |

| Accounting fees | 71,578 |

| Professional fees | 87,570 |

| Registration fees | 178,022 |

| Reports to shareholders | 147,669 |

| Miscellaneous | 92,469 |

| Total expenses | $12,687,428 |

| Waiver and/or reimbursement of expenses by affiliate | $(114,348) |

| Reimbursement of expenses - other | (35,450) |

| Net expenses | $12,537,630 |

| Net investment income | $8,219,508 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss): | |

| Investment securities - unaffiliated issuers | $(59,292,498) |

| Foreign currency transactions | (1,051,380) |

| Net realized loss | $(60,343,878) |

| Change in unrealized appreciation (depreciation): | |

| Investment securities - unaffiliated issuers (including net increase in payable for foreign capital gains taxes of $177,189) | $(367,513,164) |

| Investment securities - affiliated issuers | (259,721) |

| Foreign currency | (567,286) |

| Net change in unrealized appreciation (depreciation) | $(368,340,171) |

| Net realized and unrealized loss | $(428,684,049) |

| Net decrease in net assets from operations | $(420,464,541) |

Table of Contents

| Six Months Ended March 31, 2020 (Unaudited) | Year Ended September 30, 2019 | |

| Increase (Decrease) in Net Assets | ||

| From operations: | ||

| Net investment income | $8,219,508 | $22,716,547 |

| Net realized loss | (60,343,878) | (24,321,645) |

| Net change in unrealized appreciation (depreciation) | (368,340,171) | 84,061,839 |

| Net increase (decrease) in net assets from operations | $(420,464,541) | $82,456,741 |

| Distributions to shareholders: | ||

| Class A | $(673,897) | $(830,950) |

| Class C | — | (100,965) |

| Class I | (14,521,439) | (12,937,246) |

| Class R6 | (1,960,798) | (549,482) |

| Total distributions to shareholders | $(17,156,134) | $(14,418,643) |

| Capital share transactions: | ||

| Class A | $33,434,954 | $(24,807,970) |

| Class C | 915,581 | 3,743,762 |

| Class I | 288,411,838 | 742,127,821 |

| Class R6 | 39,956,132 | 205,025,396 |

| Net increase in net assets from capital share transactions | $362,718,505 | $926,089,009 |

| Net increase (decrease) in net assets | $(74,902,170) | $994,127,107 |

| Net Assets | ||

| At beginning of period | $2,196,939,198 | $1,202,812,091 |

| At end of period | $2,122,037,028 | $2,196,939,198 |

Table of Contents

| Class A | ||||||

| Six Months Ended March 31, 2020 (Unaudited) | Year Ended September 30, | |||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||

| Net asset value — Beginning of period | $16.05 | $15.55 | $16.33 | $12.94 | $10.90 | $13.15 |

| Income (Loss) From Operations | ||||||

| Net investment income(1) | $0.03 | $0.17 | $0.19 | $0.10 | $0.08(2) | $0.11 |

| Net realized and unrealized gain (loss) | (2.45) | 0.45 | (0.94) | 3.36 | 2.06 | (1.92) |

| Total income (loss) from operations | $(2.42) | $0.62 | $(0.75) | $3.46 | $2.14 | $(1.81) |

| Less Distributions | ||||||

| From net investment income | $(0.08) | $(0.12) | $(0.03) | $(0.07) | $(0.10) | $(0.03) |

| From net realized gain | — | — | — | — | — | (0.41) |

| Total distributions | $(0.08) | $(0.12) | $(0.03) | $(0.07) | $(0.10) | $(0.44) |

| Net asset value — End of period | $13.55 | $16.05 | $15.55 | $16.33 | $12.94 | $10.90 |

| Total Return(3) | (15.17)%(4) | 4.02% | (4.62)% | 26.89% | 19.75% | (14.18)% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $140,442 | $132,066 | $155,735 | $62,432 | $39,343 | $23,569 |

| Ratios (as a percentage of average daily net assets):(5) | ||||||

| Total expenses | 1.25%(6) | 1.41% | 1.56% | 1.80% | 1.95% | 2.18% |

| Net expenses | 1.24%(6) | 1.25% | 1.27% | 1.27% | 1.47% | 1.75% |

| Net investment income | 0.40%(6) | 1.06% | 1.15% | 0.73% | 0.66%(2) | 0.84% |

| Portfolio Turnover | 18%(4) | 32% | 27% | 36% | 32% | 66% |

| (1) | Computed using average shares outstanding. |

| (2) | Amount includes a non-recurring refund for overbilling of prior years' custody out-of-pocket fees. This amounted to $0.003 per share and 0.003% of average net assets. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (4) | Not annualized. |

| (5) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (6) | Annualized. |

Table of Contents

| Class C | ||||||

| Six Months Ended March 31, 2020 (Unaudited) | Year Ended September 30, | |||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||

| Net asset value — Beginning of period | $15.62 | $15.18 | $16.04 | $12.76 | $10.74 | $13.05 |

| Income (Loss) From Operations | ||||||

| Net investment income (loss)(1) | $(0.03) | $0.05 | $0.10 | $0.01 | $—(2) | $(0.03) |

| Net realized and unrealized gain (loss) | (2.40) | 0.45 | (0.96) | 3.29 | 2.03 | (1.87) |

| Total income (loss) from operations | $(2.43) | $0.50 | $(0.86) | $3.30 | $2.03 | $(1.90) |

| Less Distributions | ||||||

| From net investment income | $— | $(0.06) | $— | $(0.02) | $(0.01) | $— |

| From net realized gain | — | — | — | — | — | (0.41) |

| Total distributions | $— | $(0.06) | $— | $(0.02) | $(0.01) | $(0.41) |

| Net asset value — End of period | $13.19 | $15.62 | $15.18 | $16.04 | $12.76 | $10.74 |

| Total Return(3) | (15.56)%(4) | 3.33% | (5.36)% | 25.88% | 18.94% | (14.98)% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $24,841 | $28,794 | $24,286 | $4,627 | $994 | $566 |

| Ratios (as a percentage of average daily net assets):(5) | ||||||

| Total expenses | 2.00%(6) | 2.16% | 2.31% | 3.69% | 4.44% | 5.00% |

| Net expenses | 1.99%(6) | 2.00% | 2.02% | 2.02% | 2.21% | 2.70% |

| Net investment income (loss) | (0.34)%(6) | 0.35% | 0.60% | 0.08% | 0.02%(2) | (0.23)% |

| Portfolio Turnover | 18%(4) | 32% | 27% | 36% | 32% | 66% |

| (1) | Computed using average shares outstanding. |

| (2) | Amount includes a non-recurring refund for overbilling of prior years' custody out-of-pocket fees. This amounted to $0.003 per share and 0.003% of average net assets. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (4) | Not annualized. |

| (5) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (6) | Annualized. |

Table of Contents

| Class I | ||||||

| Six Months Ended March 31, 2020 (Unaudited) | Year Ended September 30, | |||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||

| Net asset value — Beginning of period | $16.22 | $15.73 | $16.48 | $13.06 | $10.99 | $13.26 |

| Income (Loss) From Operations | ||||||

| Net investment income(1) | $0.06 | $0.22 | $0.29 | $0.17 | $0.12(2) | $0.14 |

| Net realized and unrealized gain (loss) | (2.49) | 0.45 | (0.99) | 3.35 | 2.09 | (1.93) |

| Total income (loss) from operations | $(2.43) | $0.67 | $(0.70) | $3.52 | $2.21 | $(1.79) |

| Less Distributions | ||||||

| From net investment income | $(0.12) | $(0.18) | $(0.05) | $(0.10) | $(0.14) | $(0.07) |

| From net realized gain | — | — | — | — | — | (0.41) |

| Total distributions | $(0.12) | $(0.18) | $— | $(0.10) | $(0.14) | $(0.48) |

| Net asset value — End of period | $13.67 | $16.22 | $15.73 | $16.48 | $13.06 | $10.99 |

| Total Return(3) | (15.11)%(4) | 4.36% | (4.30)% | 27.27% | 20.31% | (13.92)% |

| Ratios/Supplemental Data | ||||||

| Net assets, end of period (000’s omitted) | $1,739,327 | $1,817,479 | $1,012,574 | $126,398 | $58,259 | $39,101 |

| Ratios (as a percentage of average daily net assets):(5) | ||||||

| Total expenses | 1.00%(6) | 1.15% | 1.32% | 1.32% | 1.41% | 1.48% |

| Net expenses | 0.99%(6) | 0.97% | 0.92% | 0.92% | 1.12% | 1.40% |

| Net investment income | 0.69%(6) | 1.41% | 1.71% | 1.20% | 1.06%(2) | 1.12% |

| Portfolio Turnover | 18%(4) | 32% | 27% | 36% | 32% | 66% |

| (1) | Computed using average shares outstanding. |

| (2) | Amount includes a non-recurring refund for overbilling of prior years' custody out-of-pocket fees. This amounted to $0.003 per share and 0.003% of average net assets. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (4) | Not annualized. |

| (5) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (6) | Annualized. |

Table of Contents

| Class R6 | |||

| Six Months Ended March 31, 2020 (Unaudited) | Year Ended September 30, 2019 | Period Ended September 30, 2018(1) | |

| Net asset value — Beginning of period | $16.19 | $15.72 | $18.65 |

| Income (Loss) From Operations | |||

| Net investment income(2) | $0.06 | $0.27 | $0.26 |

| Net realized and unrealized gain (loss) | (2.47) | 0.40 | (3.19) |

| Total income (loss) from operations | $(2.41) | $0.67 | $(2.93) |

| Less Distributions | |||

| From net investment income | $(0.14) | $(0.20) | $— |

| Total distributions | $(0.14) | $(0.20) | $— |

| Net asset value — End of period | $13.64 | $16.19 | $15.72 |

| Total Return(3) | (15.07)%(4) | 4.35% | (15.71)%(4) |

| Ratios/Supplemental Data | |||

| Net assets, end of period (000’s omitted) | $217,427 | $218,601 | $10,217 |

| Ratios (as a percentage of average daily net assets):(5) | |||

| Total expenses | 0.93%(6) | 1.06% | 1.24%(6) |

| Net expenses | 0.92%(6) | 0.92% | 0.92%(6) |

| Net investment income | 0.74%(6) | 1.67% | 2.48%(6) |

| Portfolio Turnover | 18%(4) | 32% | 27%(7) |

| (1) | From February 1, 2018 inception. |

| (2) | Computed using average shares outstanding. |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (4) | Not annualized. |

| (5) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (6) | Annualized. |

| (7) | For the year ended September 30, 2018. |

Table of Contents

Table of Contents

| Asset Description | Level 1 | Level 2 | Level 3(1) | Total |

| Common Stocks | ||||

| Brazil | $103,425,134 | $— | $— | $103,425,134 |

| China | 265,476,699 | 372,439,643 | — | 637,916,342 |

| Egypt | — | 28,817,712 | — | 28,817,712 |

| Hong Kong | — | 146,048,997 | — | 146,048,997 |

| Hungary | — | 34,897,593 | — | 34,897,593 |

| India | 38,714,528 | 160,623,791 | — | 199,338,319 |

| Indonesia | — | 43,966,567 | — | 43,966,567 |

| Mexico | 25,157,000 | — | — | 25,157,000 |

| Peru | 33,587,256 | — | — | 33,587,256 |

| Russia | 53,512,810 | 23,639,992 | — | 77,152,802 |

| South Africa | — | 137,058,930 | — | 137,058,930 |

| South Korea | — | 283,125,414 | — | 283,125,414 |

| Taiwan | 123,467,807 | 174,531,547 | — | 297,999,354 |

| Turkey | — | 24,369,402 | — | 24,369,402 |

| United Arab Emirates | — | — | — | — |

| Total Common Stocks | $643,341,234 | $1,429,519,588(2) | $— | $2,072,860,822 |

| High Social Impact Investments | $— | $7,293,155 | $— | $7,293,155 |

| Short-Term Investments | 40,714,661 | — | — | 40,714,661 |

| Total Investments | $684,055,895 | $1,436,812,743 | $ — | $2,120,868,638 |

| (1) | None of the unobservable inputs for Level 3 assets, individually or collectively, had a material impact on the Fund. |

| (2) | Includes foreign equity securities whose values were adjusted to reflect market trading of comparable securities or other correlated instruments that occurred after the close of trading in their applicable foreign markets. |

Table of Contents

Table of Contents

Table of Contents

| Aggregate cost | $2,475,205,214 |

| Gross unrealized appreciation | $93,423,643 |

| Gross unrealized depreciation | (447,760,219) |

| Net unrealized depreciation | $(354,336,576) |

| Remaining Contractual Maturity of the Transactions | |||||

| Overnight and Continuous | <30 days | 30 to 90 days | >90 days | Total | |

| Securities Lending Transactions | |||||

| Common Stocks | $40,714,661 | $ — | $ — | $ — | $40,714,661 |

Table of Contents

| Name of issuer | Value, beginning of period | Purchases | Sales proceeds | Net realized gain (loss) | Change in unrealized appreciation (depreciation) | Value, end of period | Interest income | Capital gain distributions received | Principal amount, end of period |

| High Social Impact Investments | |||||||||

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/19(1) | $1,989,420 | $ — | $(2,000,000) | $ — | $10,580 | $ — | $5,833 | $ — | $— |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/20(1) | — | 7,466,870 | — | — | (270,301) | 7,196,569 | 32,668 | — | 7,466,870 |

| Totals | $ — | $(259,721) | $7,196,569 | $38,501 | $ — |

| (1) | Restricted security. |

| Six Months Ended March 31, 2020 (Unaudited) | Year Ended September 30, 2019 | ||||

| Shares | Amount | Shares | Amount | ||

| Class A | |||||

| Shares sold | 3,525,520 | $55,743,033 | 5,131,302 | $80,055,643 | |

| Reinvestment of distributions | 36,614 | 607,428 | 49,242 | 739,118 | |

| Shares redeemed | (1,422,423) | (22,941,123) | (6,985,125) | (105,845,381) | |

| Converted from Class C | 1,524 | 25,616 | 15,904 | 242,650 | |

| Net increase (decrease) | 2,141,235 | $33,434,954 | (1,788,677) | $(24,807,970) | |

Table of Contents

| Six Months Ended March 31, 2020 (Unaudited) | Year Ended September 30, 2019 | ||||

| Shares | Amount | Shares | Amount | ||

| Class C | |||||

| Shares sold | 261,165 | $4,299,716 | 684,007 | $10,374,888 | |

| Reinvestment of distributions | — | — | 6,731 | 98,943 | |

| Shares redeemed | (220,138) | (3,358,519) | (429,880) | (6,487,419) | |

| Converted to Class A | (1,568) | (25,616) | (16,277) | (242,650) | |

| Net increase | 39,459 | $915,581 | 244,581 | $3,743,762 | |

| Class I | |||||

| Shares sold | 42,919,240 | $710,181,159 | 91,075,131 | $1,420,261,887 | |

| Reinvestment of distributions | 822,269 | 13,756,564 | 817,003 | 12,369,427 | |

| Shares redeemed | (28,552,744) | (435,525,885) | (44,204,094) | (690,503,493) | |

| Net increase | 15,188,765 | $288,411,838 | 47,688,040 | $742,127,821 | |

| Class R6 | |||||

| Shares sold | 4,714,959 | $78,265,826 | 16,658,520 | $266,753,381 | |

| Reinvestment of distributions | 110,978 | 1,852,220 | 36,389 | 549,482 | |

| Shares redeemed | (2,386,059) | (40,161,914) | (3,843,934) | (62,277,467) | |

| Net increase | 2,439,878 | $39,956,132 | 12,850,975 | $205,025,396 | |

Table of Contents

Table of Contents

Table of Contents

Table of Contents

| Officers |

| Hope L. Brown Chief Compliance Officer |

| Maureen A. Gemma Vice President, Secretary and Chief Legal Officer |

| James F. Kirchner Treasurer |

| Directors |

| Alice Gresham Bullock Chairperson |

| Richard L. Baird, Jr. |

| Cari M. Dominguez |

| John G. Guffey, Jr. |

| Miles D. Harper, III |

| Joy V. Jones |

| John H. Streur* |

| Anthony A. Williams |

| *Interested Director and President |

Table of Contents

| • | At the time of opening an account, Eaton Vance generally requires you to provide us with certain information such as name, address, social security number, tax status, account numbers, and account balances. This information is necessary for us to both open an account for you and to allow us to satisfy legal requirements such as applicable anti-money laundering reviews and know-your-customer requirements. |

| • | On an ongoing basis, in the normal course of servicing your account, Eaton Vance may share your information with unaffiliated third parties that perform various services for Eaton Vance and/or your account. These third parties include transfer agents, custodians, broker/dealers and our professional advisers, including auditors, accountants, and legal counsel. Eaton Vance may additionally share your personal information with our affiliates. |

| • | We believe our Privacy Program is reasonably designed to protect the confidentiality of your personal information and to prevent unauthorized access to that information. |

| • | We reserve the right to change our Privacy Program at any time upon proper notification to you. You may want to review our Privacy Program periodically for changes by accessing the link on our homepage: www.eatonvance.com. |

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

Table of Contents

| % Average Annual Total Returns1,2 | Class Inception Date | Performance Inception Date | Six Months | One Year | Five Years | Ten Years |

| Class A at NAV | 07/02/1992 | 07/02/1992 | (9.36)% | (4.20)% | 1.03% | 2.85% |

| Class A with 4.75% Maximum Sales Charge | — | — | (13.68) | (8.76) | 0.05 | 2.35 |

| Class C at NAV | 03/01/1994 | 07/02/1992 | (9.73) | (4.95) | 0.26 | 2.00 |

| Class C with 1% Maximum Sales Charge | — | — | (10.63) | (5.90) | 0.26 | 2.00 |

| Class I at NAV | 02/26/1999 | 07/02/1992 | (9.28) | (3.99) | 1.38 | 3.39 |

| Class R6 at NAV | 03/07/2019 | 07/02/1992 | (9.26) | (3.93) | 1.40 | 3.40 |

| ·· | ||||||

| MSCI EAFE Index | — | — | (16.52)% | (14.38)% | (0.62)% | 2.71% |

| % Total Annual Operating Expense Ratios3 | Class A | Class C | Class I | Class R6 |

| Gross | 1.40% | 2.15% | 1.14% | 1.10% |

| Net | 1.15 | 1.90 | 0.90 | 0.86 |

Table of Contents

| Top 10 Holdings (% of net assets) | |

| Nestle SA | 4.9% |

| AIA Group, Ltd. | 3.5 |

| Sanofi | 3.0 |

| Novo Nordisk A/S, Class B | 3.0 |

| Kao Corp. | 3.0 |

| Unilever PLC | 2.9 |

| CSL, Ltd. | 2.6 |

| DCC PLC | 2.6 |

| Lonza Group AG | 2.6 |

| Pan Pacific International Holdings Corp. | 2.6 |

| Total | 30.7% |

Table of Contents

| 1 | MSCI EAFE Index is an unmanaged index of equities in the developed markets, excluding the U.S. and Canada. MSCI indexes are net of foreign withholding taxes. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares.Performance prior to the inception date of a class may be linked to the performance of an older class of the Fund. This linked performance is adjusted for any applicable sales charge, but is not adjusted for class expense differences. If adjusted for such differences, the performance would be different. The performance of Class R6 is linked to Class I. Performance presented in the Financial Highlights included in the financial statements is not linked.Calvert Research and Management became the investment adviser to the Fund on December 31, 2016. Performance reflected prior to such date is that of the Fund’s former investment adviser. |

| 3 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 1/31/21. Without the reimbursement, performance would have been lower. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. |

| Fund profile subject to change due to active management. |

Table of Contents

| Beginning Account Value (10/1/19) | Ending Account Value (3/31/20) | Expenses Paid During Period* (10/1/19 – 3/31/20) | Annualized Expense Ratio | |

| Actual | ||||

| Class A | $1,000.00 | $906.40 | $5.43** | 1.14% |

| Class C | $1,000.00 | $902.70 | $8.99** | 1.89% |

| Class I | $1,000.00 | $907.20 | $4.24** | 0.89% |

| Class R6 | $1,000.00 | $907.40 | $4.05** | 0.85% |

| Hypothetical | ||||

| (5% return per year before expenses) | ||||

| Class A | $1,000.00 | $1,019.30 | $5.76** | 1.14% |

| Class C | $1,000.00 | $1,015.55 | $9.52** | 1.89% |

| Class I | $1,000.00 | $1,020.55 | $4.50** | 0.89% |

| Class R6 | $1,000.00 | $1,020.75 | $4.29** | 0.85% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on September 30, 2019. |

| ** | Absent a waiver and/or reimbursement of expenses by affiliates, expenses would be higher. |

Table of Contents

| Common Stocks — 97.4% |

| Security | Shares | Value |

| Australia — 2.6% | ||

| CSL, Ltd. | 46,070 | $ 8,351,181 |

| $ 8,351,181 | ||

| Belgium — 1.1% | ||

| KBC Groep NV | 77,220 | $ 3,503,869 |

| $ 3,503,869 | ||

| Canada — 1.1% | ||

| CAE, Inc. | 273,268 | $ 3,454,443 |

| $ 3,454,443 | ||

| Denmark — 6.5% | ||

| Chr. Hansen Holding A/S | 72,525 | $5,351,817 |

| Coloplast A/S, Class B | 38,395 | 5,568,285 |

| Novo Nordisk A/S, Class B | 159,330 | 9,514,557 |

| $20,434,659 | ||

| France — 8.6% | ||

| Dassault Systemes SE | 34,040 | $4,969,534 |

| LVMH Moet Hennessy Louis Vuitton SE | 19,852 | 7,280,742 |

| Sanofi | 110,783 | 9,591,015 |

| Schneider Electric SE | 60,993 | 5,155,302 |

| $26,996,593 | ||

| Germany — 2.9% | ||

| adidas AG | 26,347 | $5,849,752 |

| Infineon Technologies AG | 220,034 | 3,176,355 |

| $9,026,107 | ||

| Hong Kong — 3.5% | ||

| AIA Group, Ltd. | 1,214,441 | $10,874,874 |

| $10,874,874 | ||

| India — 1.4% | ||

| HDFC Bank, Ltd. | 379,246 | $4,302,132 |

| $4,302,132 | ||

| Ireland — 4.4% | ||

| DCC PLC | 132,149 | $8,252,854 |

| Kerry Group PLC, Class A | 47,772 | 5,576,248 |

| $13,829,102 | ||

| Japan — 16.2% | ||

| Kao Corp. | 114,441 | $9,323,306 |

| Security | Shares | Value |

| Japan (continued) | ||

| Keyence Corp. | 21,077 | $ 6,776,517 |

| ORIX Corp. | 466,200 | 5,562,075 |

| Pan Pacific International Holdings Corp. | 429,600 | 8,135,470 |

| Recruit Holdings Co., Ltd. | 185,507 | 4,791,881 |

| Santen Pharmaceutical Co., Ltd. | 386,692 | 6,636,312 |

| SMC Corp. | 13,800 | 5,785,562 |

| Yamaha Corp. | 105,400 | 4,084,821 |

| $ 51,095,944 | ||

| Netherlands — 2.4% | ||

| ASML Holding NV | 28,915 | $7,622,415 |

| $7,622,415 | ||

| New Zealand — 1.3% | ||

| Fisher & Paykel Healthcare Corp., Ltd. | 233,520 | $4,245,036 |

| $4,245,036 | ||

| Singapore — 1.9% | ||

| DBS Group Holdings, Ltd. | 464,528 | $6,061,231 |

| $6,061,231 | ||

| South Africa — 1.7% | ||

| Naspers, Ltd., Class N | 37,942 | $5,392,104 |

| $5,392,104 | ||

| Spain — 7.7% | ||

| Amadeus IT Group SA | 151,011 | $7,107,913 |

| Banco Santander SA | 1,966,783 | 4,678,622 |

| Iberdrola SA | 651,252 | 6,369,899 |

| Industria de Diseno Textil SA | 233,005 | 6,038,000 |

| $24,194,434 | ||

| Sweden — 7.7% | ||

| Assa Abloy AB, Class B | 292,031 | $5,451,839 |

| Indutrade AB | 220,156 | 5,956,259 |

| Sandvik AB | 423,406 | 5,955,920 |

| Tele2 AB, Class B | 522,329 | 6,959,008 |

| $24,323,026 | ||

| Switzerland — 10.9% | ||

| Lonza Group AG | 20,055 | $8,249,098 |

| Nestle SA | 150,022 | 15,357,420 |

| Sika AG | 28,522 | 4,683,676 |

| Straumann Holding AG | 8,206 | 5,999,438 |

| $34,289,632 | ||

Table of Contents

| Security | Shares | Value |

| Taiwan — 1.6% | ||

| Taiwan Semiconductor Manufacturing Co., Ltd. ADR | 108,783 | $ 5,198,739 |

| $ 5,198,739 | ||

| United Kingdom — 10.8% | ||

| Abcam PLC | 377,805 | $ 5,329,367 |

| Compass Group PLC | 369,600 | 5,758,406 |

| Halma PLC | 172,713 | 4,056,348 |

| London Stock Exchange Group PLC | 63,698 | 5,698,156 |

| Melrose Industries PLC | 3,676,339 | 4,085,272 |

| Unilever PLC | 179,554 | 9,054,943 |

| $33,982,492 | ||

| United States — 3.1% | ||

| Visa, Inc., Class A | 29,927 | $4,821,838 |

| Xylem, Inc. | 75,842 | 4,939,590 |

| $9,761,428 | ||

| Total Common Stocks (identified cost $313,717,178) | $306,939,441 | |

| High Social Impact Investments — 0.4% |

| Security | Principal Amount (000's omitted) | Value |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/20(1)(2) | $ 880 | $ 848,483 |

| ImpactAssets, Inc., Global Sustainable Agriculture Notes, 3.48%, 11/3/20(2)(3) | 220 | 215,600 |

| ImpactAssets, Inc., Microfinance Plus Notes, 1.20%, 11/3/20(2)(3) | 283 | 275,147 |

| Total High Social Impact Investments (identified cost $1,383,352) | $ 1,339,230 |

| Preferred Stocks — 0.0%(4) |

| Security | Shares | Value |

| Venture Capital — 0.0%(4) | ||

| Bioceptive, Inc.: | ||

| Series A(2)(5)(6) | 582,574 | $ — |

| Series B(2)(5)(6) | 40,523 | — |

| FINAE, Series D(2)(5)(6) | 2,597,442 | 100,733 |

| Total Preferred Stocks (identified cost $491,304) | $ 100,733 | |

| Venture Capital Debt Obligations — 0.0% |

| Security | Principal Amount (000's omitted) | Value |

| Windhorse International-Spring Health Water, Ltd., 1.00%, 4/15/20(2)(7) | $ 70 | $ — |

| Total Venture Capital Debt Obligations (identified cost $70,000) | $ — |

| Venture Capital Limited Partnership Interests — 0.4% |

| Security | Value | |

| Africa Renewable Energy Fund L.P.(2)(5)(6) | $ 891,264 | |

| Blackstone Clean Technology Partners L.P.(2)(5)(6) | 4,165 | |

| Emerald Sustainability Fund I L.P.(2)(5)(6) | 43,132 | |

| gNet Defta Development Holding LLC(1)(2)(5)(6) | 195,700 | |

| SEAF India International Growth Fund L.P.(2)(5)(6) | 550 | |

| Total Venture Capital Limited Partnership Interests (identified cost $2,067,964) | $ 1,134,811 | |

| Total Investments — 98.2% (identified cost $317,729,798) | $309,514,215 | |

| Other Assets, Less Liabilities — 1.8% | $ 5,649,500 | |

| Net Assets — 100.0% | $315,163,715 |

| The percentage shown for each investment category in the Schedule of Investments is based on net assets. | ||

| (1) | Affiliated company (see Note 7). | |

| (2) | Restricted security. Total market value of restricted securities amounts to $2,574,774, which represents 0.8% of the net assets of the Fund as of March 31, 2020. | |

| (3) | Notes carry an interest rate that varies by period and is contingent on the performance of the underlying portfolio of loans to borrowers. The coupon rate shown represents the rate in effect at March 31, 2020. | |

| (4) | Amount is less than 0.05%. | |

| (5) | For fair value measurement disclosure purposes, security is categorized as Level 3 (see Note 1A). | |

| (6) | Non-income producing security. | |

| (7) | Security defaulted as to principal and interest in March 2013. It was restructured at a 9% rate maturing on April 15, 2020 with 1% to be paid annually and the remaining interest due at maturity. As of March 31, 2020, security is in default with respect to its annual 1% interest payment. | |

Table of Contents

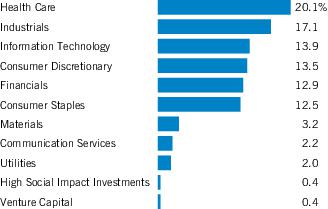

| Economic Sectors | % of Net Assets |

| Health Care | 20.1% |

| Industrials | 17.1 |

| Information Technology | 13.9 |

| Consumer Discretionary | 13.5 |

| Financials | 12.9 |

| Consumer Staples | 12.5 |

| Materials | 3.2 |

| Communication Services | 2.2 |

| Utilities | 2.0 |

| High Social Impact Investments | 0.4 |

| Venture Capital | 0.4 |

| Total | 98.2% |

| Description | Acquisition Dates | Cost |

| Africa Renewable Energy Fund L.P. | 4/17/14-5/13/19 | $986,557 |

| Bioceptive, Inc., Series A | 10/26/12-12/18/13 | 252,445 |

| Bioceptive, Inc., Series B | 1/7/16 | 16,250 |

| Blackstone Clean Technology Partners L.P. | 7/29/10-6/25/15 | 77,081 |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/20 | 12/13/19 | 880,352 |

| Emerald Sustainability Fund I L.P. | 7/19/01-5/17/11 | 393,935 |

| FINAE, Series D | 2/28/11-11/16/15 | 222,609 |

| gNet Defta Development Holding LLC | 8/30/05 | 400,000 |

| ImpactAssets, Inc., Global Sustainable Agriculture Notes, 3.48%, 11/3/20 | 11/13/15 | 220,000 |

| ImpactAssets, Inc., Microfinance Plus Notes, 1.20%, 11/3/20 | 11/13/15 | 283,000 |

| SEAF India International Growth Fund L.P. | 3/22/05-5/24/10 | 210,391 |

| Windhorse International-Spring Health Water, Ltd., 1.00%, 4/15/20 | 2/12/14 | 70,000 |

| Abbreviations: | |

| ADR | – American Depositary Receipt |

Table of Contents

| March 31, 2020 | |

| Assets | |

| Investments in securities of unaffiliated issuers, at value (identified cost $316,449,446) | $308,470,032 |

| Investments in securities of affiliated issuers, at value (identified cost $1,280,352) | 1,044,183 |

| Cash | 19,054,624 |

| Cash denominated in foreign currency, at value (cost $103,898) | 104,081 |

| Receivable for capital shares sold | 2,600,068 |

| Dividends and interest receivable | 366,050 |

| Interest receivable - affiliated | 3,852 |

| Securities lending income receivable | 238 |

| Tax reclaims receivable | 400,175 |

| Receivable from affiliates | 61,215 |

| Directors' deferred compensation plan | 109,547 |

| Total assets | $332,214,065 |

| Liabilities | |

| Payable for investments purchased | $16,160,065 |

| Payable for capital shares redeemed | 387,133 |

| Payable to affiliates: | |

| Investment advisory fee | 168,682 |

| Administrative fee | 29,866 |

| Distribution and service fees | 27,104 |

| Sub-transfer agency fee | 5,451 |

| Directors' fees and expenses | 425 |

| Directors' deferred compensation plan | 109,547 |

| Accrued expenses | 162,077 |

| Total liabilities | $17,050,350 |

| Commitments and contingent liabilities (Note 10) | |

| Net Assets | $315,163,715 |

| Sources of Net Assets | |

| Paid-in capital | $341,108,871 |

| Accumulated loss | (25,945,156) |

| Total | $315,163,715 |

| Class A Shares | |

| Net Assets | $104,408,586 |

| Shares Outstanding | 6,408,667 |