UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-06563

CALVERT WORLD VALUES FUND, INC.

(Exact Name of Registrant as Specified in Charter)

1825 Connecticut Avenue NW, Suite 400, Washington, DC 20009

(Address of Principal Executive Offices)

Deidre E. Walsh

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(202) 238-2200

(Registrant’s Telephone Number)

September 30

Date of Fiscal Year End

September 30, 2022

Date of Reporting Period

Item 1. Reports to Stockholders

Calvert

Mid-Cap Fund

Annual Report

September 30, 2022

Commodity Futures Trading Commission Registration. The Commodity Futures Trading Commission (“CFTC”) has adopted regulations that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The adviser has claimed an exclusion from the definition of “commodity pool operator” under the Commodity Exchange Act with respect to its management of the Fund and the other funds it manages. Accordingly, neither the Fund nor the adviser is subject to CFTC regulation.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing, investors should consider carefully the investment objective, risks, and charges and expenses of a mutual fund. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial intermediary. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-368-2745.

Choose Planet-friendly E-delivery!

Sign up now for on-line statements, prospectuses, and fund reports. In less than five minutes you can help reduce paper mail and lower fund costs.

Just go to www.calvert.com. If you already have an online account with the Calvert funds, click on Login to access your Account and select the documents you would like to receive via e-mail.

If you’re new to online account access, click on Login, then Register to create your user name and password. Once you’re in, click on the E-delivery sign-up on the Account Portfolio page and follow the quick, easy steps.

Note: If your shares are not held directly with the Calvert funds but through a brokerage firm, you must contact your broker for electronic delivery options available through their firm.

Annual Report September 30, 2022

Calvert

Mid-Cap Fund

Calvert

Mid-Cap Fund

September 30, 2022

Management's Discussion of Fund Performance†

Economic and Market Conditions

The 12-month period starting October 1, 2021, was dominated by the ongoing effects of one black swan event — the COVID-19 pandemic — and new fallout from another — Russia’s unprovoked invasion of Ukraine.

In the opening months of the period, stock investors as well as consumers appeared to be taking a “glass is half full” approach. Despite the appearance of a new and more contagious COVID-19 variant, the highest inflation readings in nearly four decades, and the U.S. Federal Reserve’s (the Fed’s) announcement that it would begin tapering bond purchases that had supported economic growth, major U.S. equity indexes repeatedly closed at new all-time highs during the final quarter of 2021. As consumers rushed to spend money saved during the early months of the pandemic, Mastercard, Inc. reported its highest retail sales on record during the 2021 holiday season.

But as the new year began, investors appeared to reevaluate the twin threats of inflation and interest rate hikes, and stock performance turned negative. In February, Russia’s invasion of Ukraine sent shock waves through U.S. and global markets, exacerbating inflationary pressures on energy and food costs.

As the Fed’s outlook on inflation worsened from “transitory” to “persistent,” the central bank admitted it might have been late in initiating rate hikes to address the problem. Investors began to expect that the Fed would raise interest rates at every 2022 policy meeting and, in turn, worried that aggressive rate hikes could tip the U.S. economy into recession. At its June, July, and September meetings, the Fed hiked the federal funds rate 0.75% each time — its first moves of that magnitude since 1994. Higher interest rates, inflation, and recessionary worries drove stock prices down, with rate-sensitive technology stocks — which had been star performers early in the pandemic — suffering some of the worst declines.

For the period as a whole, the blue-chip Dow Jones Industrial Average® returned -13.40%; the S&P 500® Index, a broad measure of U.S. stocks, lost 15.47%; and the technology-laden Nasdaq Composite Index fell 26.25%.

Fund Performance

For the 12-month period ended September 30, 2022, Calvert Mid-Cap Fund (the Fund) returned -22.06% for Class A shares at net asset value (NAV), underperforming its benchmark, the Russell Midcap® Index (the Index), which returned -19.39%.

Security selections in the industrials, energy, and health care sectors detracted from returns relative to the Index during the period. An underweight exposure to the energy sector — the top-performing sector within the Index during the period — also detracted from relative performance.

Bill.com Holdings, Inc. (Bill.com), a provider of cloud-based software for automating the back-office financial operations of small- and mid-size businesses, detracted from Fund performance relative to the Index. Bill.com’s share price fell as rising interest rates weighed on highly valued growth stocks. By period-end, the stock was sold from the Fund.

Teleflex Inc. (Teleflex) manufactures single-use medical devices for hospitals and health care providers. Teleflex’s share price fell after the company did not improve its 2022 outlook, raising investor concerns that a strong U.S. dollar might hinder earnings growth for the remainder of the year.

The share price of Bath & Body Works, LLC, a retailer of personal care and home products, fell on investor concerns about the company’s transition to a new CEO, elevated freight costs, and the possible impact of inflation on consumer spending. By period-end, the stock was sold from the Fund.

On the up side, security selections in the financials and information technology sectors contributed to relative performance. Overweight exposures to the industrials and consumer staples sectors were also beneficial during the period.

Baker Hughes Co. (Baker), a global provider of technology for energy producers, contributed to performance relative to the Index. Its share price benefited from the rapid rise in oil prices during the period, leading investors to expect Baker’s customers to spend more for its services. By period-end, the stock was sold from the Fund.

The share price of Assurant, Inc., a provider of consumer electronics and homeowners insurance, rose after the company reported strong 2021 returns. Earnings growth, driven by mobile device trade-ins, exceeded market expectations. By period-end, the stock was sold from the Fund.

Xcel Energy, Inc., a Minnesota-based electric and natural gas utility, benefited from investment demand for noncyclical stocks in a volatile market environment. Utilities and energy were the only two sectors to have positive returns during the period. By period-end, the stock was sold from the Fund.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the redemption of Fund shares. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to www.calvert.com.

Calvert

Mid-Cap Fund

September 30, 2022

Performance

Portfolio Manager(s) Michael D. McLean, CFA and J. Griffith Noble, CFA, each of Calvert Research and Management

| % Average Annual Total Returns1,2 | Class

Inception Date | Performance

Inception Date | One Year | Five Years | Ten Years |

| Class A at NAV | 10/31/1994 | 10/31/1994 | (22.06)% | 4.12% | 6.70% |

| Class A with 5.25% Maximum Sales Charge | — | — | (26.16) | 3.01 | 6.13 |

| Class C at NAV | 10/31/1994 | 10/31/1994 | (22.63) | 3.35 | 6.06 |

| Class C with 1% Maximum Deferred Sales Charge | — | — | (23.27) | 3.35 | 6.06 |

| Class I at NAV | 06/03/2003 | 10/31/1994 | (21.87) | 4.42 | 7.14 |

|

| Russell Midcap® Index | — | — | (19.39)% | 6.48% | 10.29% |

| % Total Annual Operating Expense Ratios3 | Class A | Class C | Class I |

| Gross | 1.22% | 1.98% | 0.97% |

| Net | 1.18 | 1.93 | 0.93 |

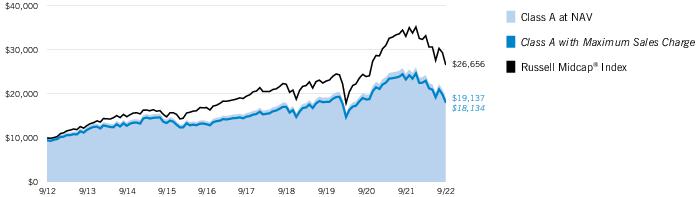

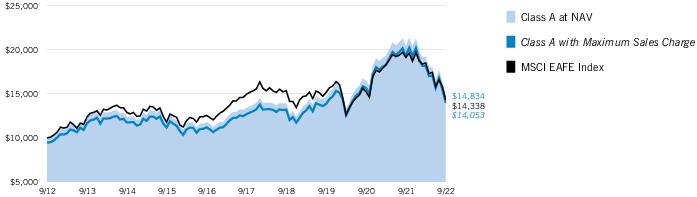

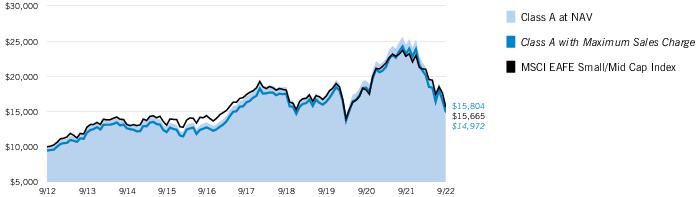

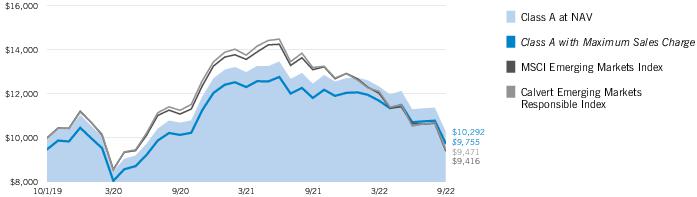

Growth of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in Class A of the Fund for the period indicated. For comparison, the same investment is shown in the indicated index.

| Growth of Investment | Amount Invested | Period Beginning | At NAV | With Maximum Sales Charge |

| Class C | $10,000 | 09/30/2012 | $18,008 | N.A. |

| Class I, at minimum investment | $1,000,000 | 09/30/2012 | $1,993,088 | N.A. |

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or offering price (as applicable) with all distributions reinvested. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the redemption of Fund shares. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Performance for periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end, please refer to www.calvert.com.

Calvert

Mid-Cap Fund

September 30, 2022

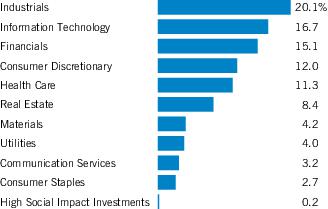

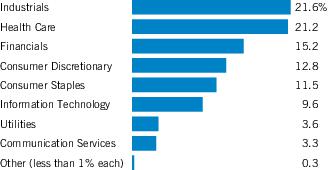

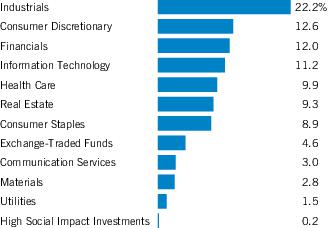

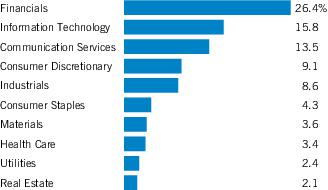

| Sector Allocation (% of net assets)1 |

| Top 10 Holdings (% of net assets)1 | |

| Sysco Corp. | 2.7% |

| Synopsys, Inc. | 2.7 |

| Nordson Corp. | 2.6 |

| Teleflex, Inc. | 2.6 |

| Graco, Inc. | 2.5 |

| Tyler Technologies, Inc. | 2.4 |

| Equity LifeStyle Properties, Inc. | 2.4 |

| Fair Isaac Corp. | 2.4 |

| Microchip Technology, Inc. | 2.4 |

| VeriSign, Inc. | 2.4 |

| Total | 25.1% |

Footnotes:

| 1 | Excludes cash and cash equivalents. |

Calvert

Mid-Cap Fund

September 30, 2022

Endnotes and Additional Disclosures

| † | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Calvert and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Calvert fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| | |

| 1 | Russell Midcap® Index is an unmanaged index of U.S. mid-cap stocks. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

| 2 | Total Returns at NAV do not include applicable sales charges. If sales charges were deducted, the returns would be lower. Total Returns shown with maximum sales charge reflect the stated maximum sales charge. Unless otherwise stated, performance does not reflect the deduction of taxes on Fund distributions or redemptions of Fund shares.Effective November 5, 2020, Class C shares automatically convert to Class A shares eight years after purchase. The average annual total returns listed for Class C reflect conversion to Class A shares after eight years. Prior to November 5, 2020, Class C shares automatically converted to Class A shares ten years after purchase.Calvert Research and Management became the investment adviser to the Fund on December 31, 2016. Performance reflected prior to such date is that of the Fund’s former investment adviser. |

| 3 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 1/31/23. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. Performance reflects expenses waived and/or reimbursed, if applicable. Without such waivers and/or reimbursements, performance would have been lower. |

| | Fund profile subject to change due to active management. |

| | Additional Information |

| | S&P 500® Index is an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. Dow Jones Industrial Average® is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. S&P Dow Jones Indices are a product of S&P Dow Jones Indices LLC (“S&P DJI”) and have been licensed for use. S&P® and S&P 500® are registered trademarks of S&P DJI; Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); S&P DJI, Dow Jones and their respective affiliates do not sponsor, endorse, sell or promote the Fund, will not have any liability with respect thereto and do not have any liability for any errors, omissions, or interruptions of the S&P Dow Jones Indices. Nasdaq Composite Index is a market capitalization-weighted index of all domestic and international securities listed on Nasdaq. Source: Nasdaq, Inc. The information is provided by Nasdaq (with its affiliates, are referred to as the “Corporations”) and Nasdaq’s third party licensors on an “as is” basis and the Corporations make no guarantees and bear no liability of any kind with respect to the information or the Fund. |

Calvert

Mid-Cap Fund

September 30, 2022

Example

As a Fund shareholder, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2022 to September 30, 2022).

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if applicable). Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | Beginning

Account Value

(4/1/22) | Ending

Account Value

(9/30/22) | Expenses Paid

During Period*

(4/1/22 – 9/30/22) | Annualized

Expense

Ratio |

| Actual | | | | |

| Class A | $1,000.00 | $ 789.00 | $5.29 ** | 1.18% |

| Class C | $1,000.00 | $ 785.70 | $8.64 ** | 1.93% |

| Class I | $1,000.00 | $ 789.90 | $4.17 ** | 0.93% |

| Hypothetical | | | | |

| (5% return per year before expenses) | | | | |

| Class A | $1,000.00 | $1,019.15 | $5.97 ** | 1.18% |

| Class C | $1,000.00 | $1,015.39 | $9.75 ** | 1.93% |

| Class I | $1,000.00 | $1,020.41 | $4.71 ** | 0.93% |

| * | Expenses are equal to the Fund's annualized expense ratio for the indicated Class, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on March 31, 2022. |

| ** | Absent a waiver and/or reimbursement of expenses by an affiliate, expenses would be higher. |

Calvert

Mid-Cap Fund

September 30, 2022

| Security | Shares | Value |

| Auto Components — 3.8% | |

| Aptiv PLC(1) | | 54,950 | $ 4,297,640 |

| Dorman Products, Inc.(1) | | 58,418 | 4,797,286 |

| | | | $ 9,094,926 |

| Banks — 5.0% | |

| Commerce Bancshares, Inc. | | 60,425 | $ 3,997,718 |

| First Republic Bank | | 27,040 | 3,530,072 |

| M&T Bank Corp. | | 24,925 | 4,394,776 |

| | | | $ 11,922,566 |

| Building Products — 1.7% | |

| Trex Co., Inc.(1) | | 93,356 | $ 4,102,063 |

| | | | $ 4,102,063 |

| Capital Markets — 6.3% | |

| LPL Financial Holdings, Inc. | | 17,422 | $ 3,806,358 |

| MarketAxess Holdings, Inc. | | 14,980 | 3,332,900 |

| Raymond James Financial, Inc. | | 50,087 | 4,949,597 |

| Tradeweb Markets, Inc., Class A | | 54,947 | 3,100,110 |

| | | | $ 15,188,965 |

| Chemicals — 2.1% | |

| Quaker Chemical Corp. | | 35,390 | $ 5,109,608 |

| | | | $ 5,109,608 |

| Commercial Services & Supplies — 3.0% | |

| Copart, Inc.(1) | | 23,941 | $ 2,547,322 |

| Rentokil Initial PLC ADR(2) | | 179,368 | 4,719,172 |

| | | | $ 7,266,494 |

| Communications Equipment — 3.1% | |

| F5, Inc.(1) | | 25,025 | $ 3,621,868 |

| Motorola Solutions, Inc. | | 17,273 | 3,868,634 |

| | | | $ 7,490,502 |

| Containers & Packaging — 2.0% | |

| AptarGroup, Inc. | | 51,730 | $ 4,915,902 |

| | | | $ 4,915,902 |

| Distributors — 1.0% | |

| Pool Corp. | | 7,556 | $ 2,404,395 |

| | | | $ 2,404,395 |

| Electric Utilities — 2.0% | |

| Alliant Energy Corp. | | 92,486 | $ 4,900,833 |

| | | | $ 4,900,833 |

| Security | Shares | Value |

| Electrical Equipment — 3.0% | |

| AMETEK, Inc. | | 41,593 | $ 4,717,062 |

| Generac Holdings, Inc.(1) | | 14,529 | 2,588,196 |

| | | | $ 7,305,258 |

| Electronic Equipment, Instruments & Components — 1.4% | |

| TE Connectivity, Ltd. | | 29,626 | $ 3,269,525 |

| | | | $ 3,269,525 |

| Entertainment — 2.3% | |

| Electronic Arts, Inc. | | 47,775 | $ 5,528,045 |

| | | | $ 5,528,045 |

| Equity Real Estate Investment Trusts (REITs) — 8.4% | |

| Equity LifeStyle Properties, Inc. | | 91,628 | $ 5,757,903 |

| Lamar Advertising Co., Class A | | 58,759 | 4,847,030 |

| Mid-America Apartment Communities, Inc. | | 30,857 | 4,784,995 |

| Rexford Industrial Realty, Inc. | | 91,025 | 4,733,300 |

| | | | $ 20,123,228 |

| Food & Staples Retailing — 2.7% | |

| Sysco Corp. | | 93,339 | $ 6,600,001 |

| | | | $ 6,600,001 |

| Health Care Equipment & Supplies — 5.9% | |

| Cooper Cos., Inc. (The) | | 20,794 | $ 5,487,537 |

| IDEXX Laboratories, Inc.(1) | | 7,461 | 2,430,794 |

| Teleflex, Inc. | | 30,962 | 6,237,604 |

| | | | $ 14,155,935 |

| Health Care Providers & Services — 1.5% | |

| R1 RCM, Inc.(1) | | 194,636 | $ 3,606,605 |

| | | | $ 3,606,605 |

| Hotels, Restaurants & Leisure — 1.0% | |

| Wyndham Hotels & Resorts, Inc. | | 38,496 | $ 2,361,730 |

| | | | $ 2,361,730 |

| Insurance — 3.8% | |

| RLI Corp. | | 47,059 | $ 4,817,900 |

| Ryan Specialty Holdings, Inc.(1) | | 105,577 | 4,288,538 |

| | | | $ 9,106,438 |

| Interactive Media & Services — 0.9% | |

| CarGurus, Inc.(1) | | 147,939 | $ 2,096,296 |

| | | | $ 2,096,296 |

7

See Notes to Financial Statements.

Calvert

Mid-Cap Fund

September 30, 2022

Schedule of Investments — continued

| Security | Shares | Value |

| IT Services — 2.4% | |

| VeriSign, Inc.(1) | | 32,524 | $ 5,649,419 |

| | | | $ 5,649,419 |

| Life Sciences Tools & Services — 1.8% | |

| Waters Corp.(1) | | 16,223 | $ 4,372,585 |

| | | | $ 4,372,585 |

| Machinery — 7.2% | |

| Graco, Inc. | | 99,578 | $ 5,969,701 |

| Nordson Corp. | | 29,495 | 6,260,904 |

| Westinghouse Air Brake Technologies Corp. | | 62,773 | 5,106,583 |

| | | | $ 17,337,188 |

| Multiline Retail — 2.2% | |

| Dollar General Corp. | | 21,712 | $ 5,207,840 |

| | | | $ 5,207,840 |

| Multi-Utilities — 2.0% | |

| CMS Energy Corp. | | 80,944 | $ 4,714,179 |

| | | | $ 4,714,179 |

| Pharmaceuticals — 2.1% | |

| Royalty Pharma PLC, Class A | | 125,092 | $ 5,026,197 |

| | | | $ 5,026,197 |

| Road & Rail — 1.6% | |

| Landstar System, Inc. | | 27,139 | $ 3,918,057 |

| | | | $ 3,918,057 |

| Semiconductors & Semiconductor Equipment — 2.4% | |

| Microchip Technology, Inc. | | 92,725 | $ 5,659,007 |

| | | | $ 5,659,007 |

| Software — 7.5% | |

| Fair Isaac Corp.(1) | | 13,877 | $ 5,717,463 |

| Synopsys, Inc.(1) | | 21,475 | 6,560,827 |

| Tyler Technologies, Inc.(1) | | 16,855 | 5,857,113 |

| | | | $ 18,135,403 |

| Specialty Retail — 4.1% | |

| Five Below, Inc.(1) | | 21,570 | $ 2,969,542 |

| Floor & Decor Holdings, Inc., Class A(1) | | 37,226 | 2,615,499 |

| O'Reilly Automotive, Inc.(1) | | 4,178 | 2,938,596 |

| RH (1)(2) | | 5,231 | 1,287,192 |

| | | | $ 9,810,829 |

| Trading Companies & Distributors — 3.5% | |

| Core & Main, Inc., Class A(1) | | 181,659 | $ 4,130,926 |

| Security | Shares | Value |

| Trading Companies & Distributors (continued) | |

| United Rentals, Inc.(1) | | 15,946 | $ 4,307,333 |

| | | | $ 8,438,259 |

Total Common Stocks

(identified cost $247,857,629) | | | $234,818,278 |

| High Social Impact Investments — 0.2% |

| Security | Principal

Amount

(000's omitted) | Value |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/23(3)(4) | $ | 360 | $ 334,354 |

Total High Social Impact Investments

(identified cost $360,000) | | | $ 334,354 |

| Short-Term Investments — 4.1% | | | |

| Affiliated Fund — 2.2% |

| Security | Shares | Value |

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio, Institutional Class, 2.80%(5) | | 5,423,426 | $ 5,423,426 |

Total Affiliated Fund

(identified cost $5,423,426) | | | $ 5,423,426 |

| Securities Lending Collateral — 1.9% |

| Security | Shares | Value |

| State Street Navigator Securities Lending Government Money Market Portfolio, 3.07%(6) | | 4,485,280 | $ 4,485,280 |

Total Securities Lending Collateral

(identified cost $4,485,280) | | | $ 4,485,280 |

Total Short-Term Investments

(identified cost $9,908,706) | | | $ 9,908,706 |

Total Investments — 102.0%

(identified cost $258,126,335) | | | $245,061,338 |

| Other Assets, Less Liabilities — (2.0)% | | | $ (4,762,537) |

| Net Assets — 100.0% | | | $ 240,298,801 |

| The percentage shown for each investment category in the Schedule of Investments is based on net assets. |

| (1) | Non-income producing security. |

| (2) | All or a portion of this security was on loan at September 30, 2022. The aggregate market value of securities on loan at September 30, 2022 was $4,765,352. |

| (3) | May be deemed to be an affiliated company (see Note 7). |

8

See Notes to Financial Statements.

Calvert

Mid-Cap Fund

September 30, 2022

Schedule of Investments — continued

| (4) | Restricted security. Total market value of restricted securities amounts to $334,354, which represents 0.2% of the net assets of the Fund as of September 30, 2022. |

| (5) | May be deemed to be an affiliated investment company. The rate shown is the annualized seven-day yield as of September 30, 2022. |

| (6) | Represents investment of cash collateral received in connection with securities lending. |

Restricted Securities

| Description | Acquisition Date | Cost |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/23 | 12/14/20 | $360,000 |

| Abbreviations: |

| ADR | – American Depositary Receipt |

9

See Notes to Financial Statements.

Calvert

Mid-Cap Fund

September 30, 2022

Statement of Assets and Liabilities

| | September 30, 2022 |

| Assets | |

Investments in securities of unaffiliated issuers, at value (identified cost $252,342,909) - including

$4,765,352 of securities on loan | $ 239,303,558 |

| Investments in securities of affiliated issuers, at value (identified cost $5,783,426) | 5,757,780 |

| Receivable for capital shares sold | 209,479 |

| Dividends receivable | 96,916 |

| Dividends and interest receivable - affiliated | 10,926 |

| Securities lending income receivable | 15,021 |

| Receivable from affiliate | 2,171 |

| Directors' deferred compensation plan | 144,417 |

| Total assets | $245,540,268 |

| Liabilities | |

| Payable for capital shares redeemed | $ 301,707 |

| Deposits for securities loaned | 4,485,280 |

| Payable to affiliates: | |

| Investment advisory fee | 137,791 |

| Administrative fee | 25,523 |

| Distribution and service fees | 34,937 |

| Sub-transfer agency fee | 11,900 |

| Directors' deferred compensation plan | 144,417 |

| Accrued expenses | 99,912 |

| Total liabilities | $ 5,241,467 |

| Net Assets | $240,298,801 |

| Sources of Net Assets | |

| Paid-in capital | $ 256,490,219 |

| Accumulated loss | (16,191,418) |

| Net Assets | $240,298,801 |

| Class A Shares | |

| Net Assets | $ 138,646,241 |

| Shares Outstanding | 4,828,533 |

Net Asset Value and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | $ 28.71 |

Maximum Offering Price Per Share

(100 ÷ 94.75 of net asset value per share) | $ 30.30 |

| Class C Shares | |

| Net Assets | $ 4,611,511 |

| Shares Outstanding | 261,959 |

Net Asset Value and Offering Price Per Share*

(net assets ÷ shares of beneficial interest outstanding) | $ 17.60 |

10

See Notes to Financial Statements.

Calvert

Mid-Cap Fund

September 30, 2022

Statement of Assets and Liabilities — continued

| | September 30, 2022 |

| Class I Shares | |

| Net Assets | $ 97,041,049 |

| Shares Outstanding | 2,745,789 |

Net Asset Value, Offering Price and Redemption Price Per Share

(net assets ÷ shares of beneficial interest outstanding) | $ 35.34 |

| On sales of $50,000 or more, the offering price of Class A shares is reduced. |

| * | Redemption price per share is equal to the net asset value less any applicable contingent deferred sales charge. |

11

See Notes to Financial Statements.

Calvert

Mid-Cap Fund

September 30, 2022

| | Year Ended |

| | September 30, 2022 |

| Investment Income | |

| Dividend income (net of foreign taxes withheld of $662) | $ 3,309,168 |

| Dividend income - affiliated issuers | 19,408 |

| Interest income - affiliated issuers | 5,400 |

| Securities lending income, net | 29,122 |

| Total investment income | $ 3,363,098 |

| Expenses | |

| Investment advisory fee | $ 1,953,735 |

| Administrative fee | 360,689 |

| Distribution and service fees: | |

| Class A | 429,902 |

| Class C | 62,915 |

| Directors' fees and expenses | 13,250 |

| Custodian fees | 6,705 |

| Transfer agency fees and expenses | 376,455 |

| Accounting fees | 68,961 |

| Professional fees | 37,180 |

| Registration fees | 64,816 |

| Reports to shareholders | 29,756 |

| Miscellaneous | 18,705 |

| Total expenses | $ 3,423,069 |

| Waiver and/or reimbursement of expenses by affiliate | $ (135,219) |

| Net expenses | $ 3,287,850 |

| Net investment income | $ 75,248 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss): | |

| Investment securities | $ 2,440,767 |

| Investment securities - affiliated issuers | (777) |

| Foreign currency transactions | (5,244) |

| Net realized gain | $ 2,434,746 |

| Change in unrealized appreciation (depreciation): | |

| Investment securities | $ (72,510,082) |

| Investment securities - affiliated issuers | (20,023) |

| Net change in unrealized appreciation (depreciation) | $(72,530,105) |

| Net realized and unrealized loss | $(70,095,359) |

| Net decrease in net assets from operations | $(70,020,111) |

12

See Notes to Financial Statements.

Calvert

Mid-Cap Fund

September 30, 2022

Statements of Changes in Net Assets

| | Year Ended September 30, |

| | 2022 | 2021 |

| Increase (Decrease) in Net Assets | | |

| From operations: | | |

| Net investment income (loss) | $ 75,248 | $ (688,234) |

| Net realized gain | 2,434,746 | 40,068,200 |

| Net change in unrealized appreciation (depreciation) | (72,530,105) | 18,161,340 |

| Net increase (decrease) in net assets from operations | $ (70,020,111) | $ 57,541,306 |

| Distributions to shareholders: | | |

| Class A | $ (22,683,407) | $ (1,449,640) |

| Class C | (1,286,728) | (106,024) |

| Class I | (14,188,529) | (801,809) |

| Total distributions to shareholders | $ (38,158,664) | $ (2,357,473) |

| Capital share transactions: | | |

| Class A | $ 17,137,117 | $ 352,323 |

| Class C | (149,927) | (3,016,708) |

| Class I | 17,639,759 | 27,105,326 |

| Net increase in net assets from capital share transactions | $ 34,626,949 | $ 24,440,941 |

| Net increase (decrease) in net assets | $ (73,551,826) | $ 79,624,774 |

| Net Assets | | |

| At beginning of year | $ 313,850,627 | $ 234,225,853 |

| At end of year | $240,298,801 | $313,850,627 |

13

See Notes to Financial Statements.

Calvert

Mid-Cap Fund

September 30, 2022

| | Class A |

| | Year Ended September 30, |

| | 2022 | 2021 | 2020 | 2019 | 2018 |

| Net asset value — Beginning of year | $ 41.79 | $ 33.96 | $ 34.69 | $ 34.84 | $ 33.40 |

| Income (Loss) From Operations | | | | | |

| Net investment income (loss)(1) | $ (0.02) | $ (0.12) | $ 0.05 | $ 0.09 | $ 0.07 |

| Net realized and unrealized gain (loss) | (7.90) | 8.28 | 1.07 | 1.85 | 4.59 |

| Total income (loss) from operations | $ (7.92) | $ 8.16 | $ 1.12 | $ 1.94 | $ 4.66 |

| Less Distributions | | | | | |

| From net investment income | $ — | $ (0.00)(2) | $ (0.03) | $ (0.08) | $ (0.04) |

| From net realized gain | (5.16) | (0.33) | (1.82) | (2.01) | (3.18) |

| Total distributions | $ (5.16) | $ (0.33) | $ (1.85) | $ (2.09) | $ (3.22) |

| Net asset value — End of year | $ 28.71 | $ 41.79 | $ 33.96 | $ 34.69 | $ 34.84 |

| Total Return(3) | (22.06)% | 24.13% | 3.20% | 6.56% | 15.04% |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of year (000’s omitted) | $138,646 | $183,991 | $149,112 | $158,005 | $157,046 |

| Ratios (as a percentage of average daily net assets):(4) | | | | | |

| Total expenses | 1.23% | 1.22% | 1.26% | 1.30% | 1.28% |

| Net expenses | 1.18% (5) | 1.18% | 1.18% | 1.19% | 1.21% |

| Net investment income (loss) | (0.07)% | (0.30)% | 0.15% | 0.27% | 0.22% |

| Portfolio Turnover | 109% | 79% | 70% | 83% | 62% |

| (1) | Computed using average shares outstanding. |

| (2) | Amount is less than $(0.005). |

| (3) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (4) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (5) | Includes a reduction by the investment adviser of a portion of its advisory fee due to the Fund’s investment in the Liquidity Fund (equal to less than 0.005% of average daily net assets for the year ended September 30, 2022). |

14

See Notes to Financial Statements.

Calvert

Mid-Cap Fund

September 30, 2022

Financial Highlights — continued

| | Class C |

| | Year Ended September 30, |

| | 2022 | 2021 | 2020 | 2019 | 2018 |

| Net asset value — Beginning of year | $ 27.53 | $ 22.64 | $ 23.83 | $ 24.65 | $ 24.55 |

| Income (Loss) From Operations | | | | | |

| Net investment loss(1) | $ (0.18) | $ (0.28) | $ (0.14) | $ (0.11) | $ (0.12) |

| Net realized and unrealized gain (loss) | (4.78) | 5.50 | 0.73 | 1.23 | 3.27 |

| Total income (loss) from operations | $ (4.96) | $ 5.22 | $ 0.59 | $ 1.12 | $ 3.15 |

| Less Distributions | | | | | |

| From net realized gain | $ (4.97) | $ (0.33) | $ (1.78) | $ (1.94) | $ (3.05) |

| Total distributions | $ (4.97) | $ (0.33) | $ (1.78) | $ (1.94) | $ (3.05) |

| Net asset value — End of year | $ 17.60 | $27.53 | $22.64 | $ 23.83 | $ 24.65 |

| Total Return(2) | (22.63)% | 23.20% | 2.40% | 5.77% | 14.20% |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of year (000’s omitted) | $ 4,612 | $ 7,469 | $ 8,787 | $14,535 | $17,043 |

| Ratios (as a percentage of average daily net assets):(3) | | | | | |

| Total expenses | 1.98% | 1.98% | 2.01% | 2.05% | 2.03% |

| Net expenses | 1.93% (4) | 1.93% | 1.93% | 1.94% | 1.96% |

| Net investment loss | (0.82)% | (1.05)% | (0.62)% | (0.49)% | (0.53)% |

| Portfolio Turnover | 109% | 79% | 70% | 83% | 62% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (3) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (4) | Includes a reduction by the investment adviser of a portion of its advisory fee due to the Fund’s investment in the Liquidity Fund (equal to less than 0.005% of average daily net assets for the year ended September 30, 2022). |

15

See Notes to Financial Statements.

Calvert

Mid-Cap Fund

September 30, 2022

Financial Highlights — continued

| | Class I |

| | Year Ended September 30, |

| | 2022 | 2021 | 2020 | 2019 | 2018 |

| Net asset value — Beginning of year | $ 50.28 | $ 40.77 | $ 41.25 | $ 40.97 | $ 38.70 |

| Income (Loss) From Operations | | | | | |

| Net investment income (loss)(1) | $ 0.09 | $ (0.03) | $ 0.16 | $ 0.21 | $ 0.23 |

| Net realized and unrealized gain (loss) | (9.77) | 9.95 | 1.27 | 2.24 | 5.37 |

| Total income (loss) from operations | $ (9.68) | $ 9.92 | $ 1.43 | $ 2.45 | $ 5.60 |

| Less Distributions | | | | | |

| From net investment income | $ (0.08) | $ (0.08) | $ (0.09) | $ (0.16) | $ (0.15) |

| From net realized gain | (5.18) | (0.33) | (1.82) | (2.01) | (3.18) |

| Total distributions | $ (5.26) | $ (0.41) | $ (1.91) | $ (2.17) | $ (3.33) |

| Net asset value — End of year | $ 35.34 | $ 50.28 | $ 40.77 | $ 41.25 | $ 40.97 |

| Total Return(2) | (21.87)% | 24.45% | 3.45% | 6.85% | 15.48% |

| Ratios/Supplemental Data | | | | | |

| Net assets, end of year (000’s omitted) | $97,041 | $122,391 | $76,327 | $46,533 | $93,198 |

| Ratios (as a percentage of average daily net assets):(3) | | | | | |

| Total expenses | 0.98% | 0.97% | 1.01% | 1.05% | 1.03% |

| Net expenses | 0.93% (4) | 0.93% | 0.93% | 0.91% | 0.86% |

| Net investment income (loss) | 0.20% | (0.06)% | 0.40% | 0.54% | 0.59% |

| Portfolio Turnover | 109% | 79% | 70% | 83% | 62% |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of sales charges, if any. |

| (3) | Total expenses do not reflect amounts reimbursed and/or waived by the adviser and certain of its affiliates, if applicable. Net expenses are net of all reductions and represent the net expenses paid by the Fund. |

| (4) | Includes a reduction by the investment adviser of a portion of its advisory fee due to the Fund’s investment in the Liquidity Fund (equal to less than 0.005% of average daily net assets for the year ended September 30, 2022). |

16

See Notes to Financial Statements.

Calvert

Mid-Cap Fund

September 30, 2022

Notes to Financial Statements

1 Significant Accounting Policies

Calvert Mid-Cap Fund (the Fund) is a diversified series of Calvert World Values Fund, Inc. (the Corporation). The Corporation is a Maryland corporation registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company. The investment objective of the Fund is to seek to provide long-term capital appreciation by investing primarily in mid-cap stocks.

The Fund offers three classes of shares. Class A shares are generally sold subject to a sales charge imposed at time of purchase. A contingent deferred sales charge of 1.00% (0.80% prior to April 29, 2022) may apply to certain redemptions of Class A shares for accounts for which no sales charge was paid, if redeemed within 12 months of purchase. Class C shares are sold without a front-end sales charge, and with certain exceptions, are charged a contingent deferred sales charge of 1% on shares redeemed within 12 months of purchase. Class C shares are only available for purchase through a financial intermediary. Effective November 5, 2020, Class C shares automatically convert to Class A shares eight years after their purchase as described in the Fund’s prospectus. Class I shares are sold at net asset value, are not subject to a sales charge and are sold only to certain eligible investors. Each class represents a pro rata interest in the Fund, but votes separately on class-specific matters and is subject to different expenses.

The Fund applies the accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (ASC 946). Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements.

A Investment Valuation— Net asset value per share is determined every business day as of the close of the regular session of the New York Stock Exchange (generally 4:00 p.m. Eastern time). The Fund uses independent pricing services approved by the Board of Directors (the Board) to value its investments wherever possible. Investments for which market quotations are not available or deemed not reliable are fair valued in good faith under the direction of the Board.

U.S. generally accepted accounting principles (U.S. GAAP) establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

Level 1 - quoted prices in active markets for identical securities

Level 2 - other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Valuation techniques used to value the Fund’s investments by major category are as follows:

Equity Securities. Equity securities (including warrants and rights) listed on a U.S. securities exchange generally are valued at the last sale or closing price as reported by an independent pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. Equity securities listed on the NASDAQ National Market System are valued at the NASDAQ official closing price and are categorized as Level 1 in the hierarchy. Unlisted or listed securities for which closing sales prices or closing quotations are not available are valued at the mean between the latest available bid and ask prices and are categorized as Level 2 in the hierarchy.

Debt Securities. Debt securities are generally valued based on valuations provided by third party pricing services, as derived from such services’ pricing models. Inputs to the models may include, but are not limited to, reported trades, executable bid and ask prices, broker/dealer quotations, prices or yields of securities with similar characteristics, interest rates, anticipated prepayments, benchmark curves or information pertaining to the issuer, as well as industry and economic events. Accordingly, debt securities are generally categorized as Level 2 in the hierarchy. Short-term debt securities with a remaining maturity at time of purchase of more than sixty days are valued based on valuations provided by a third party pricing service. Such securities are generally categorized as Level 2 in the hierarchy. Short-term debt securities of sufficient credit quality purchased with remaining maturities of sixty days or less for which a valuation from a third party pricing service is not readily available may be valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

Other Securities. Investments in management investment companies (including money market funds) that do not trade on an exchange are valued at the net asset value as of the close of each business day and are categorized as Level 1 in the hierarchy.

Fair Valuation. In connection with Rule 2a-5 of the 1940 Act, which became effective September 8, 2022, the Board has designated the Fund’s investment adviser as its valuation designee. Investments for which valuations or market quotations are not readily available or are deemed unreliable are valued by the investment adviser, as valuation designee, at fair value using methods that most fairly reflect the security’s “fair value”, which is the amount that the Fund might reasonably expect to receive for the security upon its current sale in the ordinary course. Each such determination is based on a consideration of relevant factors, which are likely to vary from one pricing context to another. These factors may include, but are not limited to, the type of security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies or entities, quotations or relevant information obtained from broker/dealers or other market participants, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company’s or entity’s financial statements, and an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold.

Calvert

Mid-Cap Fund

September 30, 2022

Notes to Financial Statements — continued

The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized. Further, due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed, and the differences could be material.

The following table summarizes the market value of the Fund's holdings as of September 30, 2022, based on the inputs used to value them:

| Asset Description | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | $ 234,818,278(1) | $ — | $ — | $ 234,818,278 |

| High Social Impact Investments | — | 334,354 | — | 334,354 |

| Short-Term Investments: | | | | |

| Affiliated Fund | 5,423,426 | — | — | 5,423,426 |

| Securities Lending Collateral | 4,485,280 | — | — | 4,485,280 |

| Total Investments | $244,726,984 | $334,354 | $ — | $245,061,338 |

| (1) | The level classification by major category of investments is the same as the category presentation in the Schedule of Investments. |

B Investment Transactions and Income— Investment transactions for financial statement purposes are accounted for on trade date. Realized gains and losses are recorded on an identified cost basis and may include proceeds from litigation. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities or, in the case of dividends on certain foreign securities, as soon as the Fund is informed of the ex-dividend date. Non-cash dividends are recorded at the fair value of the securities received. Withholding taxes on foreign dividends, if any, have been provided for in accordance with the Fund's understanding of the applicable country’s tax rules and rates. Distributions received that represent a return of capital are recorded as a reduction of cost of investments. Distributions received that represent a capital gain are recorded as a realized gain. Interest income, which includes amortization of premium and accretion of discount on debt securities, is accrued as earned.

C Share Class Accounting— Realized and unrealized gains and losses and net investment income and losses, other than class-specific expenses, are allocated daily to each class of shares based upon the relative net assets of each class to the total net assets of the Fund. Expenses arising in connection with a specific class are charged directly to that class.

D Foreign Currency Transactions— The Fund’s accounting records are maintained in U.S. dollars. For valuation of assets and liabilities on each date of net asset value determination, foreign denominations are converted into U.S. dollars using the current exchange rate. Security transactions, income and expenses are translated at the prevailing rate of exchange on the date of the event. Recognized gains or losses on investment transactions attributable to changes in foreign currency exchange rates are recorded for financial statement purposes as net realized gains and losses on investments. That portion of unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.

E Restricted Securities— The Fund may invest in securities that are subject to legal or contractual restrictions on resale. Generally, these securities may only be sold publicly upon registration under the Securities Act of 1933 or in transactions exempt from such registration. Information regarding restricted securities (excluding Rule 144A securities) is included at the end of the Schedule of Investments.

F Distributions to Shareholders— Distributions to shareholders are recorded by the Fund on ex-dividend date. Distributions from net investment income and distributions from net realized capital gains, if any, are paid at least annually. Distributions are declared separately for each class of shares. Distributions are determined in accordance with income tax regulations, which may differ from U.S. GAAP; accordingly, periodic reclassifications are made within the Fund's capital accounts to reflect income and gains available for distribution under income tax regulations.

G Estimates— The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

H Indemnifications— The Corporation’s By-Laws provide for indemnification for Directors or officers of the Corporation and certain other parties, to the fullest extent permitted by Maryland law and the 1940 Act, provided certain conditions are met. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

I Federal Income Taxes— No provision for federal income or excise tax is required since the Fund intends to continue to qualify as a regulated investment company under the Internal Revenue Code and to distribute substantially all of its taxable earnings.

Management has analyzed the Fund's tax positions taken for all open federal income tax years and has concluded that no provision for federal income tax is required in the Fund's financial statements. A Fund's federal tax return is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

Calvert

Mid-Cap Fund

September 30, 2022

Notes to Financial Statements — continued

2 Related Party Transactions

The investment advisory fee is earned by Calvert Research and Management (CRM), an indirect, wholly-owned subsidiary of Morgan Stanley, as compensation for investment advisory services rendered to the Fund. The investment advisory fee is computed at the annual rate of 0.65% of the Fund's average daily net assets and is payable monthly. For the year ended September 30, 2022, the investment advisory fee amounted to $1,953,735.

Effective April 26, 2022, the Fund may invest in a money market fund, the Institutional Class of the Morgan Stanley Institutional Liquidity Funds - Government Portfolio (the “Liquidity Fund”), an open-end management investment company managed by Morgan Stanley Investment Management Inc., a wholly-owned subsidiary of Morgan Stanley. The investment advisory fee paid by the Fund is reduced by an amount equal to its pro-rata share of the advisory and administration fees paid by the Fund due to its investment in the Liquidity Fund. For the year ended September 30, 2022, the investment advisory fee paid was reduced by $1,882 relating to the Fund’s investment in the Liquidity Fund. Prior to April 26, 2022, the Fund may have invested its cash in Calvert Cash Reserves Fund, LLC (Cash Reserves Fund), an affiliated investment company managed by CRM. CRM did not receive a fee for advisory services provided to Cash Reserves Fund.

CRM has agreed to reimburse the Fund’s operating expenses to the extent that total annual operating expenses (relating to ordinary operating expenses only and excluding expenses such as brokerage commissions, acquired fund fees and expenses of unaffiliated funds, borrowing costs, taxes or litigation expenses) exceed 1.18%, 1.93% and 0.93% for Class A, Class C and Class I, respectively, of such class's average daily net assets. The expense reimbursement agreement with CRM may be changed or terminated after January 31, 2023. For the year ended September 30, 2022, CRM waived or reimbursed expenses of $133,337.

The administrative fee is earned by CRM as compensation for administrative services rendered to the Fund. The fee is computed at an annual rate of 0.12% of the Fund’s average daily net assets attributable to Class A, Class C and Class I and is payable monthly. For the year ended September 30, 2022, CRM was paid administrative fees of $360,689.

The Fund has in effect a distribution plan for Class A shares (Class A Plan) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Class A Plan, the Fund pays Eaton Vance Distributors, Inc. (EVD), an affiliate of CRM and the Fund’s principal underwriter, a distribution and service fee of 0.25% per annum of its average daily net assets attributable to Class A shares for distribution services and facilities provided to the Fund by EVD, as well as for personal services and/or the maintenance of shareholder accounts. The Fund also has in effect a distribution plan for Class C shares (Class C Plan) pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Class C Plan, the Fund pays EVD amounts equal to 0.75% per annum of its average daily net assets attributable to Class C shares for providing ongoing distribution services and facilities to the Fund. In addition, pursuant to the Class C Plan, the Fund also makes payments of service fees to EVD, financial intermediaries and other persons in amounts equal to 0.25% per annum of its average daily net assets attributable to that class. Service fees paid or accrued are for personal services and/or the maintenance of shareholder accounts. Distribution and service fees paid or accrued for the year ended September 30, 2022 amounted to $429,902 and $62,915 for Class A shares and Class C shares, respectively.

The Fund was informed that EVD received $20,841 as its portion of the sales charge on sales of Class A shares for the year ended September 30, 2022. The Fund was also informed that EVD received less than $100 and $267 of contingent deferred sales charges paid by Class A and Class C shareholders, respectively, for the same period.

Eaton Vance Management (EVM), an affiliate of CRM, provides sub-transfer agency and related services to the Fund pursuant to a Sub-Transfer Agency Support Services Agreement. For the year ended September 30, 2022, sub-transfer agency fees and expenses incurred to EVM amounted to $65,421 and are included in transfer agency fees and expenses on the Statement of Operations.

Each Director of the Fund who is not an employee of CRM or its affiliates receives an annual fee of $214,000 ($154,000 prior to January 1, 2022), plus an annual Committee fee ranging from $8,500 to $16,500 depending on the Committee. The Board chair receives an additional $30,000 annual fee, Committee chairs receive an additional $6,000 annual fee and the special equities liaison receives an additional $2,500 annual fee. Eligible Directors may participate in a Deferred Compensation Plan (the Plan). Amounts deferred under the Plan are treated as though equal dollar amounts had been invested in shares of the Fund or other Calvert funds selected by the Directors. The Fund purchases shares of the funds selected equal to the dollar amounts deferred under the Plan, resulting in an asset equal to the deferred compensation liability. Obligations of the Plan are paid solely from the Fund's assets. Directors’ fees are allocated to each of the Calvert funds served. Salaries and fees of officers and Directors of the Fund who are employees of CRM or its affiliates are paid by CRM.

3 Investment Activity

During the year ended September 30, 2022, the cost of purchases and proceeds from sales of investments, other than short-term securities, were $322,507,785 and $324,110,541, respectively.

Calvert

Mid-Cap Fund

September 30, 2022

Notes to Financial Statements — continued

4 Distributions to Shareholders and Income Tax Information

The tax character of distributions declared for the years ended September 30, 2022 and September 30, 2021 was as follows:

| | Year Ended September 30, |

| | 2022 | 2021 |

| Ordinary income | $ 4,740,634 | $ 165,389 |

| Long-term capital gains | $33,418,030 | $2,192,084 |

During the year ended September 30, 2022, accumulated loss was increased by $1,457 and paid-in capital was increased by $1,457 due to differences between book and tax accounting. These reclassifications had no effect on the net assets or net asset value per share of the Fund.

As of September 30, 2022, the components of distributable earnings (accumulated loss) on a tax basis were as follows:

| Post October capital losses | $ (3,048,302) |

| Late year ordinary losses | (29,021) |

| Net unrealized depreciation | (13,114,095) |

| Accumulated loss | $(16,191,418) |

At September 30, 2022, the Fund had a late year ordinary loss of $29,021 which it has elected to defer to the following taxable year pursuant to income tax regulations. Late year ordinary losses represent certain specified losses realized in that portion of a taxable year after October 31 that are treated as ordinary for tax purposes plus ordinary losses attributable to that portion of a taxable year after December 31.

Additionally, at September 30, 2022, the Fund had a net capital loss of $3,048,302 attributable to security transactions incurred after October 31, 2021 that it has elected to defer. This net capital loss is treated as arising on the first day of the Fund's taxable year ending September 30, 2023.

The cost and unrealized appreciation (depreciation) of investments of the Fund at September 30, 2022, as determined on a federal income tax basis, were as follows:

| Aggregate cost | $258,175,433 |

| Gross unrealized appreciation | $ 8,856,589 |

| Gross unrealized depreciation | (21,970,684) |

| Net unrealized depreciation | $ (13,114,095) |

5 Securities Lending

To generate additional income, the Fund may lend its securities pursuant to a securities lending agency agreement with State Street Bank and Trust Company (SSBT), the securities lending agent. Security loans are subject to termination by the Fund at any time and, therefore, are not considered illiquid investments. The Fund requires that the loan be continuously collateralized by either cash or securities in an amount at least equal to the market value of the securities on loan. The market value of securities loaned is determined daily and any additional required collateral is delivered to the Fund on the next business day. Cash collateral is generally invested in a money market fund registered under the 1940 Act that is managed by an affiliate of SSBT. Any gain or loss in the market price of the loaned securities that might occur and any interest earned or dividends declared during the term of the loan would accrue to the account of the Fund. Income earned on the investment of collateral, net of broker rebates and other expenses incurred by the securities lending agent, is split between the Fund and the securities lending agent based on agreed upon contractual terms. Non-cash collateral, if any, is held by the lending agent on behalf of the Fund and cannot be sold or re-pledged by the Fund; accordingly, such collateral is not reflected in the Statement of Assets and Liabilities.

The risks associated with lending portfolio securities include, but are not limited to, possible delays in receiving additional collateral or in the recovery of the loaned securities, possible loss of rights to the collateral should the borrower fail financially, as well as risk of loss in the value of the collateral or the value of the investments made with the collateral. The securities lending agent shall indemnify the Fund in the case of default of any securities borrower.

Calvert

Mid-Cap Fund

September 30, 2022

Notes to Financial Statements — continued

At September 30, 2022, the total value of securities on loan was $4,765,352 and the total value of collateral received was $4,853,948, comprised of cash of $4,485,280 and U.S. government and/or agencies securities of $368,668.

The following table provides a breakdown of securities lending transactions accounted for as secured borrowings, the obligations by class of collateral pledged, and the remaining contractual maturity of those transactions as of September 30, 2022.

| | Remaining Contractual Maturity of the Transactions |

| | Overnight and

Continuous | <30 days | 30 to 90 days | >90 days | Total |

| Common Stocks | $4,485,280 | $ — | $ — | $ — | $4,485,280 |

The carrying amount of the liability for deposits for securities loaned at September 30, 2022 approximated its fair value. If measured at fair value, such liability would have been considered as Level 2 in the fair value hierarchy (see Note 1A) at September 30, 2022.

6 Line of Credit

The Fund participates with other portfolios and funds managed by EVM and its affiliates, including CRM, in an $800 million unsecured line of credit with a group of banks, which is in effect through October 25, 2022. Borrowings are made by the Fund solely for temporary purposes related to redemptions and other short-term cash needs. Interest is charged to the Fund based on its borrowings at an amount above either the Secured Overnight Financing Rate (SOFR) or Federal Funds rate. In addition, a fee computed at an annual rate of 0.15% on the daily unused portion of the line of credit is allocated among the participating portfolios and funds at the end of each quarter. In connection with the renewal of the agreement in October 2021, an arrangement fee of $150,000 was incurred that was allocated to the participating portfolios and funds. Because the line of credit is not available exclusively to the Fund, it may be unable to borrow some or all of its requested amounts at any particular time.

The Fund had no borrowings outstanding pursuant to its line of credit at September 30, 2022. The Fund did not have any significant borrowings or allocated fees during the year ended September 30, 2022. Effective October 25, 2022, the Fund renewed its line of credit agreement, which expires October 24, 2023. In connection with the renewal, the borrowing limit was decreased to $725 million.

7 Affiliated Companies and Funds

The Fund has invested a portion of its assets in notes (the Notes) issued by Calvert Impact Capital, Inc. (CIC) pursuant to exemptive relief granted by the U.S. Securities and Exchange Commission (the SEC). There are certain potential points of affiliation between the Fund and CIC. CRM has licensed use of the Calvert name to CIC and provides other types of support. CRM’s President and Chief Executive Officer (and the only director/trustee on the Fund Board that is an “interested person” of the Fund) serves on the CIC Board. In addition, another director/trustee on the Fund Board serves as a director emeritus on the CIC Board.

At September 30, 2022, the value of the Fund’s investment in the Notes and affiliated funds was $5,757,780, which represents 2.4% of the Fund’s net assets. Transactions in the Notes and affiliated funds by the Fund for the year ended September 30, 2022 were as follows:

| Name | Value,

beginning

of period | Purchases | Sales

proceeds | Net

realized

gain

(loss) | Change in

unrealized

appreciation

(depreciation) | Value,

end of

period | Interest/

Dividend

income | Principal amount/

Units/Shares,

end of period |

| High Social Impact Investments | | | | | | | | |

| Calvert Impact Capital, Inc., Community Investment Notes, 1.50%, 12/15/23(1) | $ 353,819 | $ — | $ — | $ — | $ (19,465) | $ 334,354 | $ 5,400 | $ 360,000 |

| Short-Term Investments | | | | | | |

| Cash Reserves Fund | 5,583,915 | 26,366,998 | (31,949,578) | (777) | (558) | — | 1,031 | — |

| Liquidity Fund | — | 38,745,254 | (33,321,828) | — | — | 5,423,426 | 18,377 | 5,423,426 |

| Total | | | | $(777) | $(20,023) | $5,757,780 | $24,808 | |

Calvert

Mid-Cap Fund

September 30, 2022

Notes to Financial Statements — continued

8 Capital Shares

The Corporation may issue its shares in one or more series (such as the Fund). The authorized shares of the Fund consist of 75,000,000 common shares, $0.01 par value, for each Class.

Transactions in capital shares for the years ended September 30, 2022 and September 30, 2021 were as follows:

| | Year Ended

September 30, 2022 | | Year Ended

September 30, 2021 |

| | Shares | Amount | | Shares | Amount |

| Class A | | | | | |

| Shares sold | 347,775 | $ 12,598,312 | | 375,750 | $ 15,160,623 |

| Reinvestment of distributions | 569,411 | 21,853,997 | | 36,990 | 1,395,999 |

| Shares redeemed | (511,755) | (18,074,158) | | (465,944) | (18,704,612) |

| Converted from Class C | 20,522 | 758,966 | | 65,033 | 2,500,313 |

| Net increase | 425,953 | $ 17,137,117 | | 11,829 | $ 352,323 |

| Class C | | | | | |

| Shares sold | 18,402 | $ 425,732 | | 39,443 | $ 1,049,807 |

| Reinvestment of distributions | 53,032 | 1,255,259 | | 4,145 | 103,674 |

| Shares redeemed | (47,986) | (1,071,952) | | (62,534) | (1,669,876) |

| Converted to Class A | (32,755) | (758,966) | | (97,920) | (2,500,313) |

| Net decrease | (9,307) | $ (149,927) | | (116,866) | $ (3,016,708) |

| Class I | | | | | |

| Shares sold | 1,148,431 | $ 52,061,444 | | 1,050,276 | $ 50,894,880 |

| Reinvestment of distributions | 296,205 | 13,963,127 | | 17,429 | 789,688 |

| Shares redeemed | (1,133,056) | (48,384,812) | | (505,501) | (24,579,242) |

| Net increase | 311,580 | $ 17,639,759 | | 562,204 | $ 27,105,326 |

9 Risks and Uncertainties

Pandemic Risk

An outbreak of respiratory disease caused by a novel coronavirus was first detected in China in late 2019 and subsequently spread internationally. This coronavirus has resulted in closing borders, enhanced health screenings, changes to healthcare service preparation and delivery, quarantines, cancellations, disruptions to supply chains and customer activity, as well as general concern and uncertainty. Health crises caused by outbreaks of disease, such as the coronavirus outbreak, may exacerbate other pre-existing political, social and economic risks and disrupt normal market conditions and operations. The impact of this outbreak has negatively affected the worldwide economy, as well as the economies of individual countries and industries, and could continue to affect the market in significant and unforeseen ways. Other epidemics and pandemics that may arise in the future may have similar effects. Any such impact could adversely affect the Fund's performance, or the performance of the securities in which the Fund invests.

Calvert

Mid-Cap Fund

September 30, 2022

Report of Independent Registered Public Accounting Firm

To the Board of Directors of Calvert World Values Fund, Inc. and Shareholders of Calvert Mid-Cap Fund:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of Calvert Mid-Cap Fund (the "Fund") (one of the funds constituting Calvert World Values Fund, Inc.), including the schedule of investments, as of September 30, 2022, the related statement of operations for the year then ended, the statements of changes in net assets and the financial highlights for each of the two years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of September 30, 2022, and the results of its operations for the year then ended, and the changes in its net assets and the financial highlights for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. The financial highlights for the years ended September 30, 2020, 2019, and 2018 were audited by other auditors whose report, dated November 20, 2020, expressed an unqualified opinion on those financial highlights.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund's financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of September 30, 2022, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/ Deloitte & Touche LLP

Boston, Massachusetts

November 22, 2022

We have served as the auditor of one or more Calvert investment companies since 2021.

Calvert

Mid-Cap Fund

September 30, 2022

Federal Tax Information (Unaudited)

The Form 1099-DIV you receive in February 2023 will show the tax status of all distributions paid to your account in calendar year 2022. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals, the dividends received deduction for corporations and capital gains dividends.

Qualified Dividend Income. For the fiscal year ended September 30, 2022, the Fund designates approximately $2,601,665, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund's dividend distribution that qualifies under tax law. For the Fund's fiscal 2022 ordinary income dividends, 38.53% qualifies for the corporate dividends received deduction.

Capital Gains Dividends. The Fund hereby designates as a capital gain dividend with respect to the taxable year ended September 30, 2022, $4,726,203 or, if subsequently determined to be different, the net capital gain of such year.

Calvert

Mid-Cap Fund

September 30, 2022

Board of Directors' Contract Approval

Overview of the Contract Review Process

The Investment Company Act of 1940, as amended, provides, in substance, that each investment advisory agreement between a fund and its investment adviser will continue in effect from year to year only if its continuation is approved at least annually by the fund’s board of directors, including by a vote of a majority of the directors who are not “interested persons” of the fund (“Independent Directors”), cast in person at a meeting called for the purpose of considering such approval.

At a video conference meeting of the Boards of Trustees/Directors (each a “Board”) of the registered investment companies advised by Calvert Research and Management (“CRM” or the “Adviser”) (the “Calvert Funds”) held on June 14, 2022, the Board, including a majority of the Independent Directors, voted to approve continuation of existing investment advisory and investment sub-advisory agreements for the Calvert Funds for an additional one-year period. The meeting was held by video conference due to circumstances related to current or potential effects of COVID-19 pursuant to temporary exemptive relief issued by the Securities and Exchange Commission.

In evaluating the investment advisory and investment sub-advisory agreements for the Calvert Funds, the Board considered a variety of information relating to the Calvert Funds and various service providers, including the Adviser. The Independent Directors reviewed a report prepared by the Adviser regarding various services provided to the Calvert Funds by the Adviser and its affiliates. Such report included, among other data, information regarding the Adviser’s personnel and the Adviser’s revenue and cost of providing services to the Calvert Funds, and a separate report prepared by an independent data provider, which compared each fund’s investment performance, fees and expenses to those of comparable funds as identified by such independent data provider (“comparable funds”).

The Independent Directors were separately represented by independent legal counsel with respect to their consideration of the continuation of the investment advisory and investment sub-advisory agreements for the Calvert Funds. Prior to voting, the Independent Directors reviewed the proposed continuation of the Calvert Funds’ investment advisory and investment sub-advisory agreements with management and also met in private sessions with their counsel at which time no representatives of management were present.

The information that the Board considered included, among other things, the following (for funds that invest through one or more affiliated underlying fund(s), references to “each fund” in this section may include information that was considered at the underlying fund-level):

Information about Fees, Performance and Expenses

| • | A report from an independent data provider comparing the advisory and related fees paid by each fund with fees paid by comparable funds; |

| • | A report from an independent data provider comparing each fund’s total expense ratio and its components to comparable funds; |

| • | A report from an independent data provider comparing the investment performance of each fund to the investment performance of comparable funds over various time periods; |

| • | Data regarding investment performance in comparison to benchmark indices; |

| • | For each fund, comparative information concerning the fees charged and the services provided by the Adviser in managing other accounts (including mutual funds, other collective investment funds and institutional accounts) using investment strategies and techniques similar to those used in managing such fund; |

| • | Profitability analyses for the Adviser with respect to each fund; |

Information about Portfolio Management and Trading

| • | Descriptions of the investment management services provided to each fund, including investment strategies and processes it employs; |