Investor Presentation June 2014

Forward-Looking Statements As provided by the safe harbor provision under the Private Securities Litigation Reform Act of 1995, Viad cautions readers that, in addition to historical information contained herein, this press release includes certain information, assumptions and discussions that may constitute forward-looking statements. These forward-looking statements are not historical facts, but reflect current estimates, projections, expectations, or trends concerning future growth, operating cash flows, availability of short-term borrowings, consumer demand, new or renewal business, investment policies, productivity improvements, ongoing cost reduction efforts, efficiency, competitiveness, legal expenses, tax rates and other tax matters, foreign exchange rates, and the realization of restructuring cost savings. Actual results could differ materially from those discussed in the forward-looking statements. Viad’s businesses can be affected by a host of risks and uncertainties. Among other things, natural disasters, gains and losses of customers, consumer demand patterns, labor relations, purchasing decisions related to customer demand for exhibition and event services, existing and new competition, industry alliances, consolidation and growth patterns within the industries in which Viad competes, acquisitions, capital allocations, adverse developments in liabilities 2 associated with discontinued operations and any deterioration in the economy, may individually or in combination impact future results. In addition to factors mentioned elsewhere, economic, competitive, governmental, technological, capital marketplace and other factors, including terrorist activities or war, a pandemic health crisis and international conditions, could affect the forward-looking statements in this press release. Additional information concerning business and other risk factors that could cause actual results to materially differ from those in the forward-looking statements can be found in Viad’s annual and quarterly reports filed with the Securities and Exchange Commission. Information about Viad Corp obtained from sources other than the company may be out-of-date or incorrect. Please rely only on company press releases, SEC filings and other information provided by the company, keeping in mind that forward-looking statements speak only as of the date made. Viad undertakes no obligation to update any forward-looking statements, including prior forward-looking statements, to reflect events or circumstances arising after the date as of which the forward-looking statements were made.

Viad Overview 3

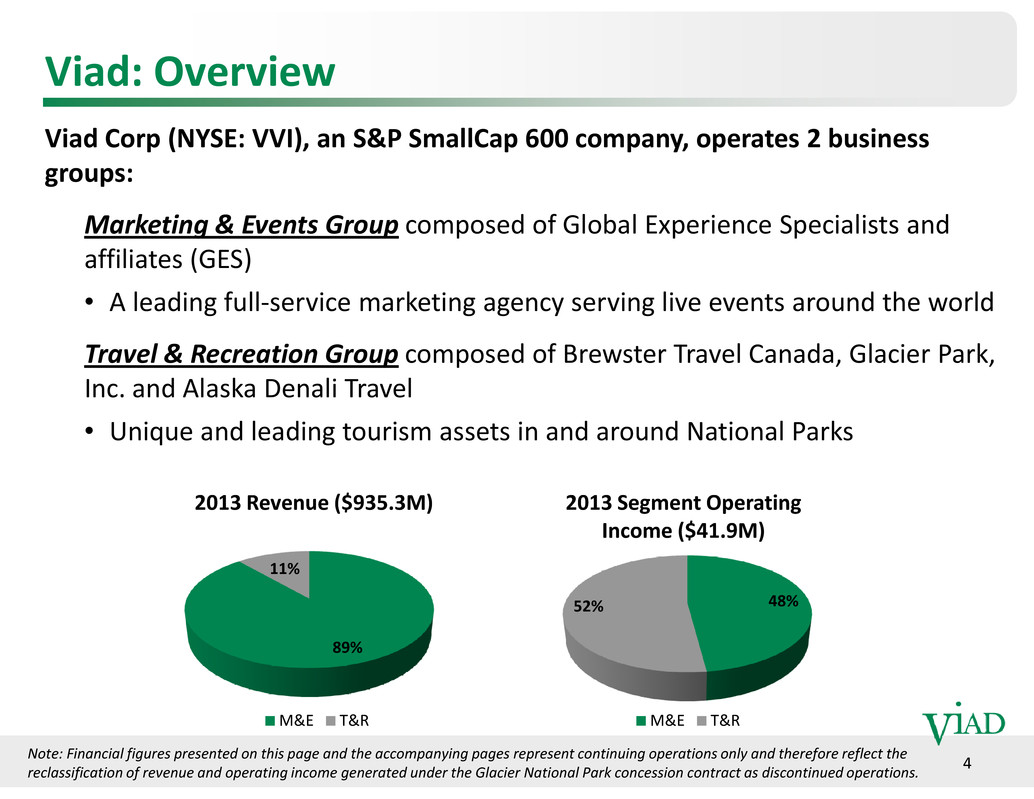

Viad: Overview Viad Corp (NYSE: VVI), an S&P SmallCap 600 company, operates 2 business groups: Marketing & Events Group composed of Global Experience Specialists and affiliates (GES) • A leading full-service marketing agency serving live events around the world Travel & Recreation Group composed of Brewster Travel Canada, Glacier Park, Inc. and Alaska Denali Travel 4 • Unique and leading tourism assets in and around National Parks 89% 11% 2013 Revenue ($935.3M) M&E T&R 48%52% 2013 Segment Operating Income ($41.9M) M&E T&R Note: Financial figures presented on this page and the accompanying pages represent continuing operations only and therefore reflect the reclassification of revenue and operating income generated under the Glacier National Park concession contract as discontinued operations.

Viad: Investment Highlights square4 Leading and defensible market positions square4 Recurring revenue streams square4 Balance sheet strength boxshadowdwn $47.3 million in cash (3/31/14) boxshadowdwn 0.5% debt-to-capital (3/31/14) square4 Board and Management focused on enhancing shareholder value 5 boxshadowdwn $0.10 per share quarterly dividend (increased 150% in 2012 from $0.04 per share) boxshadowdwn $81.3 million ($4.00 per share) return of capital through special dividends paid in Nov 2013 and Feb 2014 boxshadowdwn Share repurchase authorization of 1 million (with 20.4 million shares outstanding at 3/31/14) boxshadowdwn 448,436 shares have been repurchased as of 6/6/14

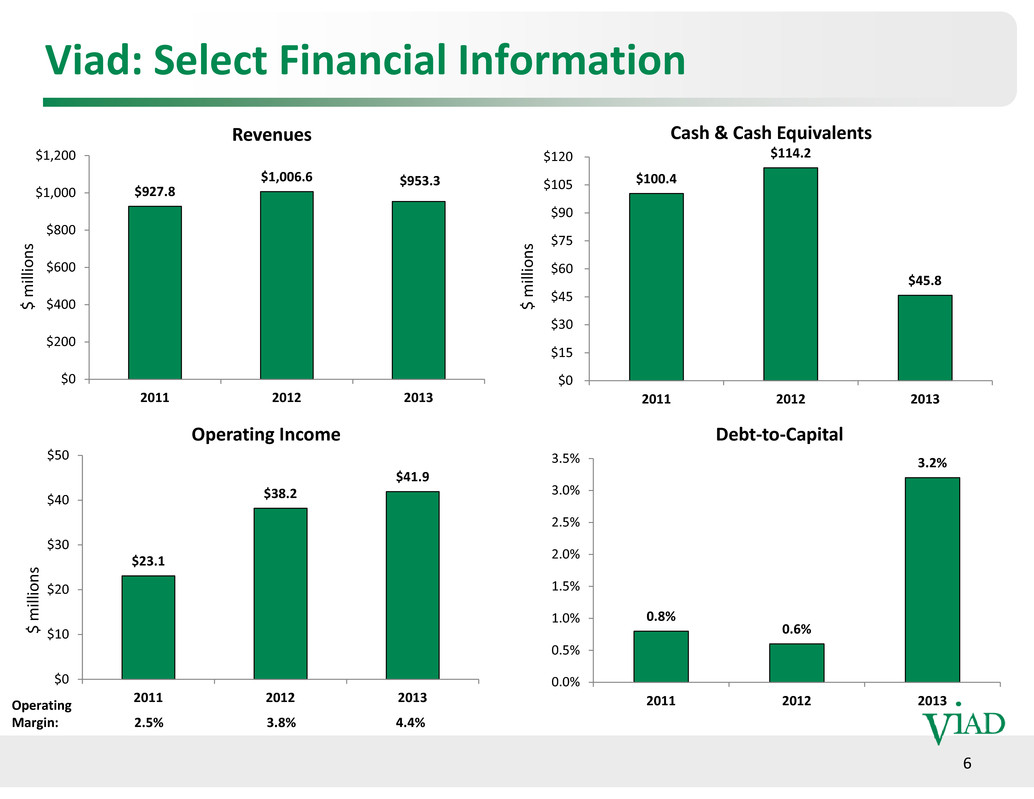

Viad: Select Financial Information Revenues $927.8 $1,006.6 $953.3 $0 $200 $400 $600 $800 $1,000 $1,200 2011 2012 2013 $ m i l l i o n s $ m i l l i o n s $100.4 $114.2 $45.8 $0 $15 $30 $45 $60 $75 $90 $105 $120 2011 2012 2013 Cash & Cash Equivalents 6 Operating Income $23.1 $38.2 $41.9 $0 $10 $20 $30 $40 $50 2011 2012 2013 $ m i l l i o n s Operating Margin: 2.5% 3.8% 4.4% 0.8% 0.6% 3.2% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 2011 2012 2013 Debt-to-Capital

Viad: Core Values INTEGRITY We lead by example, do the right thing and meet our commitments. INNOVATION We continuously look for new ways to create solutions to delight our clients, prospects and the markets we serve. LEADERSHIP Each one of us is an example for someone else. Be an energy provider through a positive attitude and drive to succeed. 7 TEAM ACHIEVEMENT We are committed to winning as a team and to delivering strong value for our customers and shareholders. ENVIRONMENT We respect our environment and conscientiously use our natural resources. TRUST and MUTUAL RESPECT We are able to accomplish more and move faster in an environment of trust. We earn trust through respect and accountability.

Marketing & Events Group Global Experience Specialists (GES)

Marketing & Events Group: Overview Global Experience Specialists (GES) – Specialists in the Art and Science of Engagement GES is a global leader in live event marketing that uniquely combines the art of high- impact creativity and service with the science of easy-to-use technology, strategy and worldwide logistics to help clients gain more awareness, more involvement and more value from their trade show programs and other live events. Award-Winning* Trusted by Top Brands* 9* Represent examples of awards and clients; not a complete list.

Marketing & Events Group: Global Leader GES holds leading positions in the U.S., U.K. and Canada Exhibition Contracting Markets GES U.S. CanadaU.K. 10 Source for Market Size/Share: GES estimates of Exhibition Contracting market. Note: GES 2013 Revenue shown above is total revenue before any intra-company eliminations; GES also derived $16M in revenue from its German operation in 2013. All Other GES All OtherGES All Other GES Official Services Contracting Market Share: ~30% ~55% ~45% GES 2013 Revenue: $629M $151M $67M

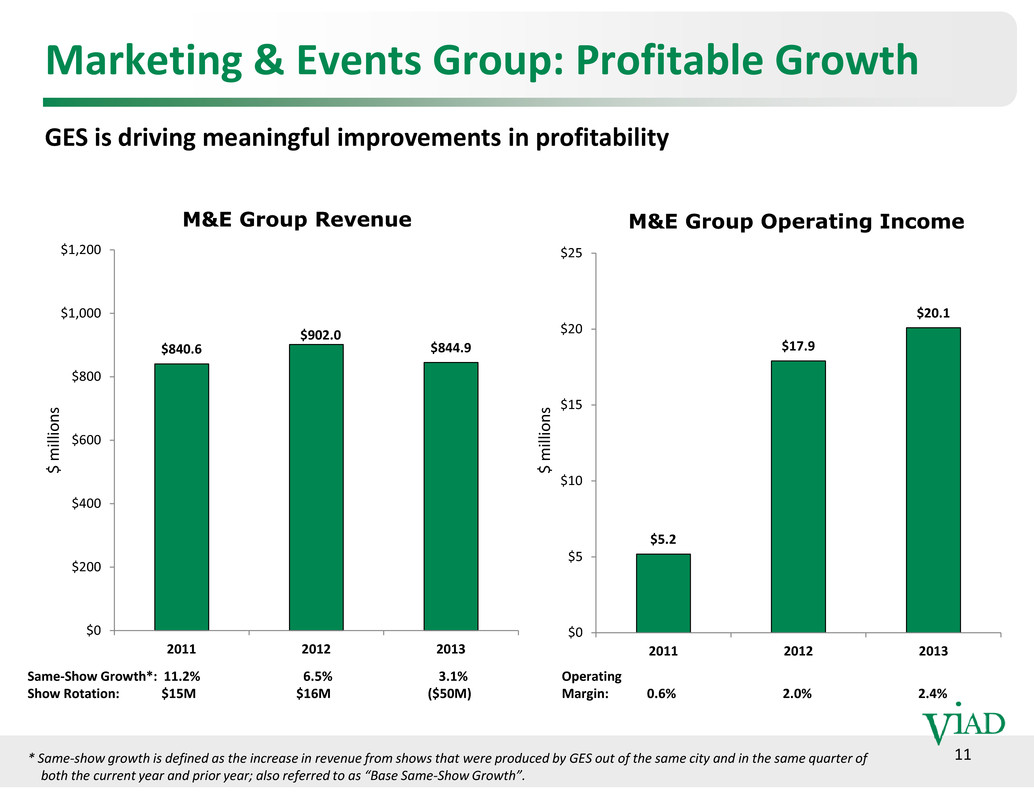

Marketing & Events Group: Profitable Growth GES is driving meaningful improvements in profitability $840.6 $902.0 $844.9 $800 $1,000 $1,200 M&E Group Revenue $17.9 $20.1 $15 $20 $25 M&E Group Operating Income 11* Same-show growth is defined as the increase in revenue from shows that were produced by GES out of the same city and in the same quarter of both the current year and prior year; also referred to as “Base Same-Show Growth”. $0 $200 $400 $600 2011 2012 2013 $5.2 $0 $5 $10 2011 2012 2013 Operating Margin: 0.6% 2.0% 2.4% Same-Show Growth*: 11.2% 6.5% 3.1% Show Rotation: $15M $16M ($50M) $ m i l l i o n s $ m i l l i o n s

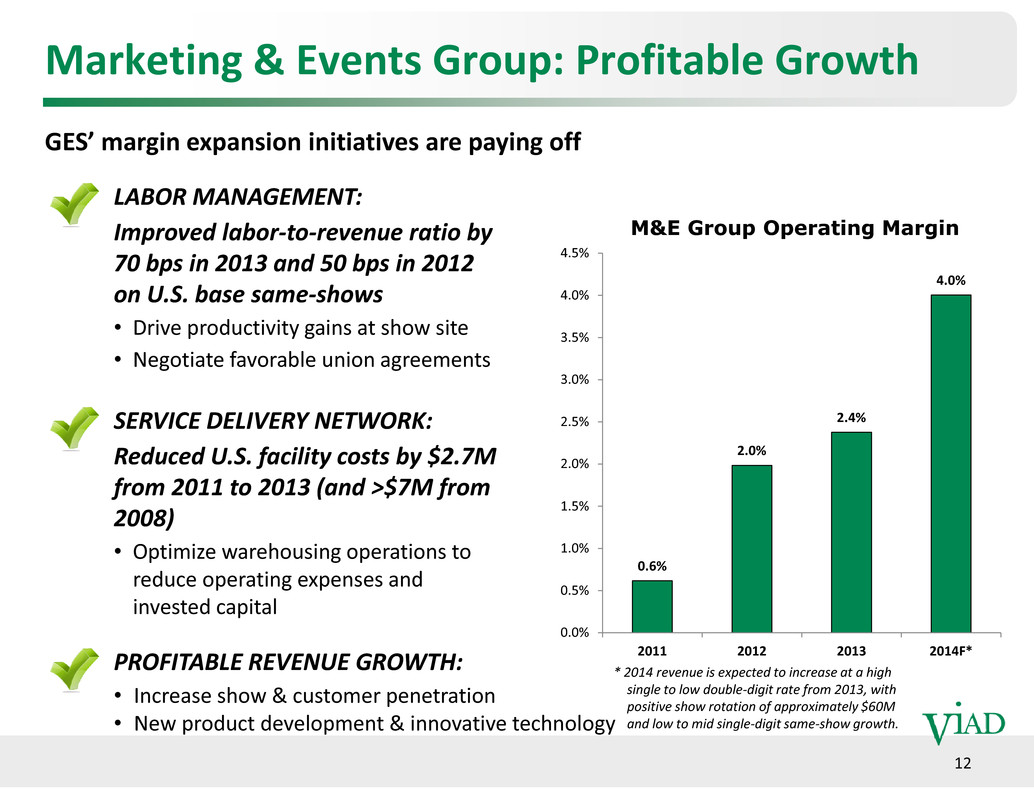

4.0% 3.0% 3.5% 4.0% 4.5% M&E Group Operating Margin Marketing & Events Group: Profitable Growth GES’ margin expansion initiatives are paying off LABOR MANAGEMENT: Improved labor-to-revenue ratio by 70 bps in 2013 and 50 bps in 2012 on U.S. base same-shows • Drive productivity gains at show site • Negotiate favorable union agreements 0.6% 2.0% 2.4% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 2011 2012 2013 2014F* 12 * 2014 revenue is expected to increase at a high single to low double-digit rate from 2013, with positive show rotation of approximately $60M and low to mid single-digit same-show growth. SERVICE DELIVERY NETWORK: Reduced U.S. facility costs by $2.7M from 2011 to 2013 (and >$7M from 2008) • Optimize warehousing operations to reduce operating expenses and invested capital PROFITABLE REVENUE GROWTH: • Increase show & customer penetration • New product development & innovative technology

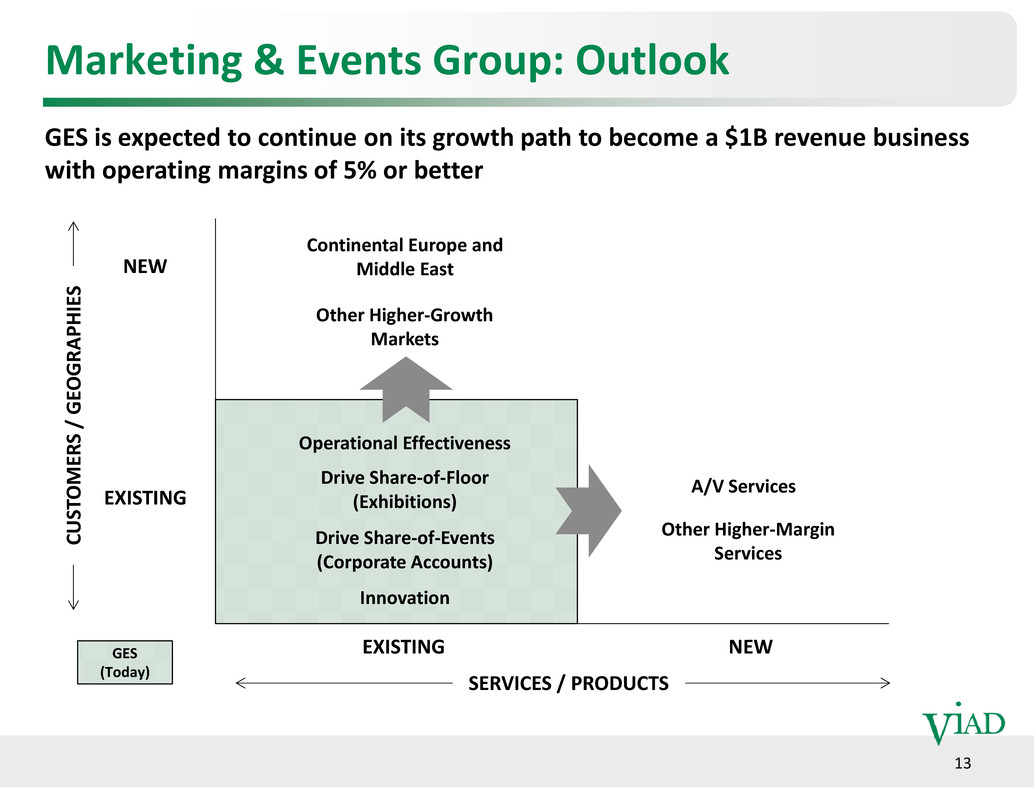

Marketing & Events Group: Outlook GES is expected to continue on its growth path to become a $1B revenue business with operating margins of 5% or better Other Higher-Growth Markets Continental Europe and Middle EastNEW C U S T O M E R S / G E O G R A P H I E S 13 Drive Share-of-Floor (Exhibitions) Drive Share-of-Events (Corporate Accounts) A/V Services Operational Effectiveness GES (Today) EXISTING EXISTING NEW SERVICES / PRODUCTS C U S T O M E R S / G E O G R A P H I E S Other Higher-Margin Services Innovation

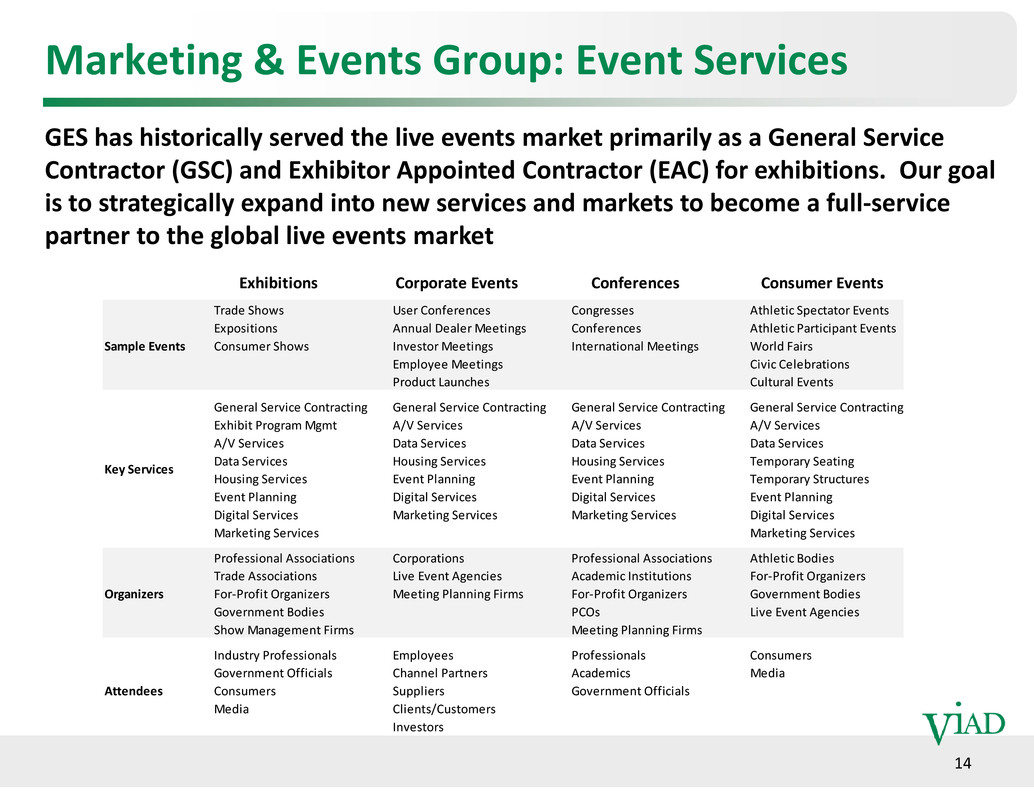

Marketing & Events Group: Event Services GES has historically served the live events market primarily as a General Service Contractor (GSC) and Exhibitor Appointed Contractor (EAC) for exhibitions. Our goal is to strategically expand into new services and markets to become a full-service partner to the global live events market Exhibitions Corporate Events Conferences Consumer Events Trade Shows User Conferences Congresses Athletic Spectator Events Expositions Annual Dealer Meetings Conferences Athletic Participant Events Sample Events Consumer Shows Investor Meetings International Meetings World Fairs Employee Meetings Civic Celebrations Product Launches Cultural Events General Service Contracting General Service Contracting General Service Contracting General Service Contracting 14 Exhibit Program Mgmt A/V Services A/V Services A/V Services A/V Services Data Services Data Services Data Services Data Services Housing Services Housing Services Temporary Seating Housing Services Event Planning Event Planning Temporary Structures Event Planning Digital Services Digital Services Event Planning Digital Services Marketing Services Marketing Services Digital Services Marketing Services Marketing Services Professional Associations Corporations Professional Associations Athletic Bodies Trade Associations Live Event Agencies Academic Institutions For-Profit Organizers Organizers For-Profit Organizers Meeting Planning Firms For-Profit Organizers Government Bodies Government Bodies PCOs Live Event Agencies Show Management Firms Meeting Planning Firms Industry Professionals Employees Professionals Consumers Government Officials Channel Partners Academics Media Attendees Consumers Suppliers Government Officials Media Clients/Customers Investors Key Services

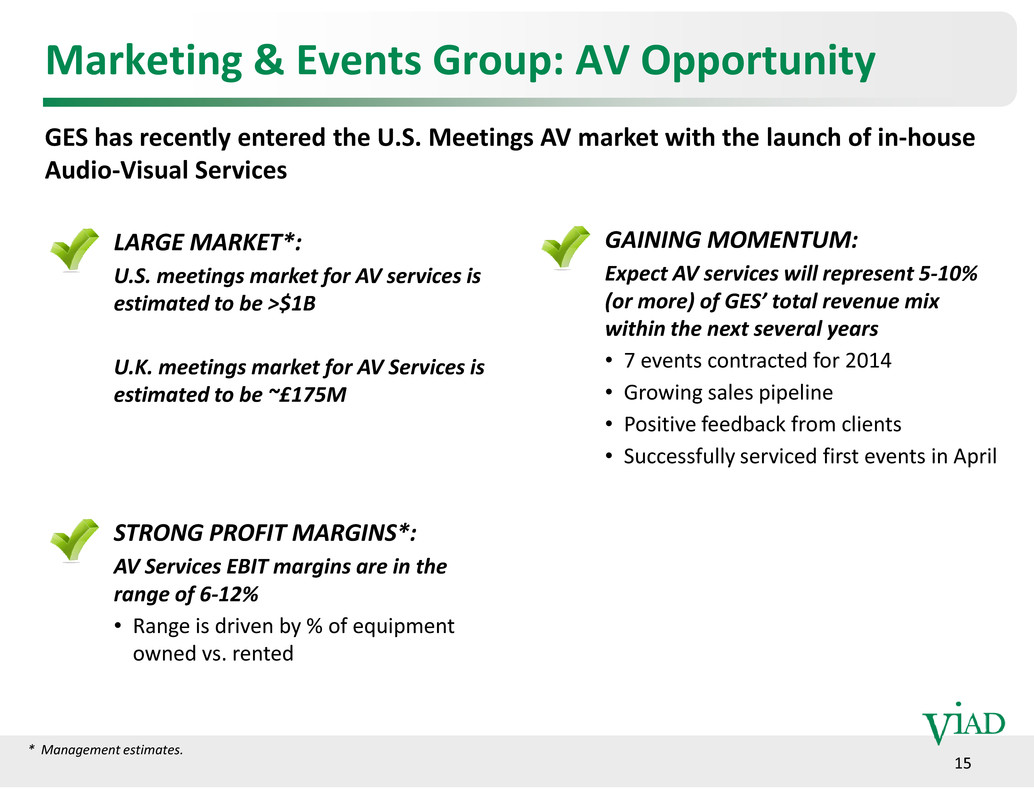

Marketing & Events Group: AV Opportunity GES has recently entered the U.S. Meetings AV market with the launch of in-house Audio-Visual Services LARGE MARKET*: U.S. meetings market for AV services is estimated to be >$1B U.K. meetings market for AV Services is estimated to be ~£175M GAINING MOMENTUM: Expect AV services will represent 5-10% (or more) of GES’ total revenue mix within the next several years • 7 events contracted for 2014 • Growing sales pipeline 15 STRONG PROFIT MARGINS*: AV Services EBIT margins are in the range of 6-12% • Range is driven by % of equipment owned vs. rented * Management estimates. • Positive feedback from clients • Successfully serviced first events in April

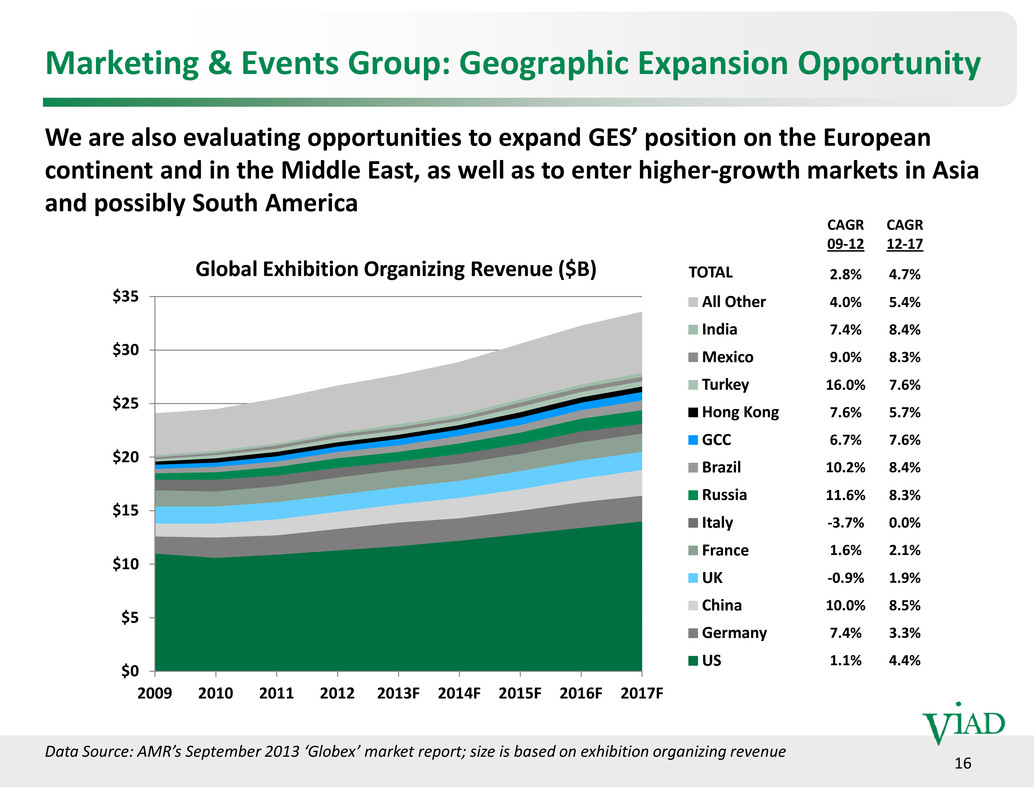

Marketing & Events Group: Geographic Expansion Opportunity CAGR CAGR 09-12 12-17 2.8% 4.7% 4.0% 5.4% 7.4% 8.4% 9.0% 8.3% 16.0% 7.6% We are also evaluating opportunities to expand GES’ position on the European continent and in the Middle East, as well as to enter higher-growth markets in Asia and possibly South America $25 $30 $35 All Other India Mexico Turkey TOTALGlobal Exhibition Organizing Revenue ($B) 16 7.6% 5.7% 6.7% 7.6% 10.2% 8.4% 11.6% 8.3% -3.7% 0.0% 1.6% 2.1% -0.9% 1.9% 10.0% 8.5% 7.4% 3.3% 1.1% 4.4% Data Source: AMR’s September 2013 ‘Globex’ market report; size is based on exhibition organizing revenue $0 $5 $10 $15 $20 2009 2010 2011 2012 2013F 2014F 2015F 2016F 2017F Hong Kong GCC Brazil Russia Italy France UK China Germany US

Travel & Recreation Group Brewster Travel Canada, Glacier Park and Alaska Denali Travel 17

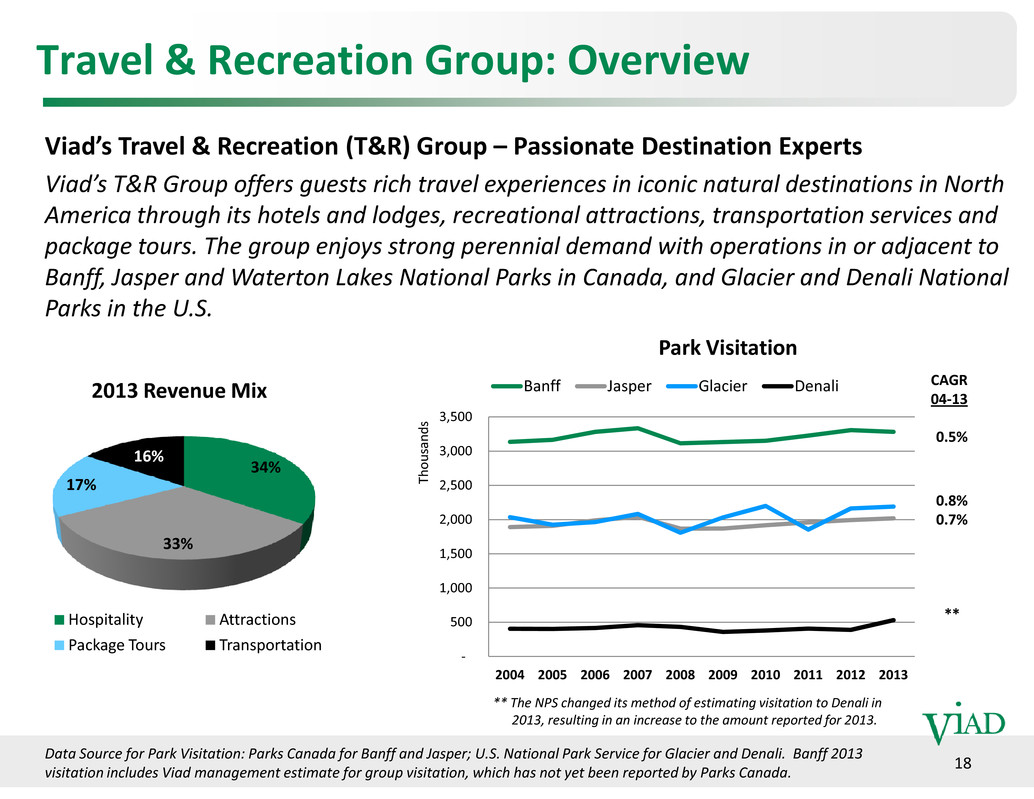

Travel & Recreation Group: Overview 2013 Revenue Mix Viad’s Travel & Recreation (T&R) Group – Passionate Destination Experts Viad’s T&R Group offers guests rich travel experiences in iconic natural destinations in North America through its hotels and lodges, recreational attractions, transportation services and package tours. The group enjoys strong perennial demand with operations in or adjacent to Banff, Jasper and Waterton Lakes National Parks in Canada, and Glacier and Denali National Parks in the U.S. Park Visitation Banff Jasper Glacier Denali CAGR 04-13 18 34% 33% 17% 16% Hospitality Attractions Package Tours Transportation - 500 1,000 1,500 2,000 2,500 3,000 3,500 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 T h o u s a n d s 0.5% 0.8% 0.7% ** Data Source for Park Visitation: Parks Canada for Banff and Jasper; U.S. National Park Service for Glacier and Denali. Banff 2013 visitation includes Viad management estimate for group visitation, which has not yet been reported by Parks Canada. ** The NPS changed its method of estimating visitation to Denali in 2013, resulting in an increase to the amount reported for 2013.

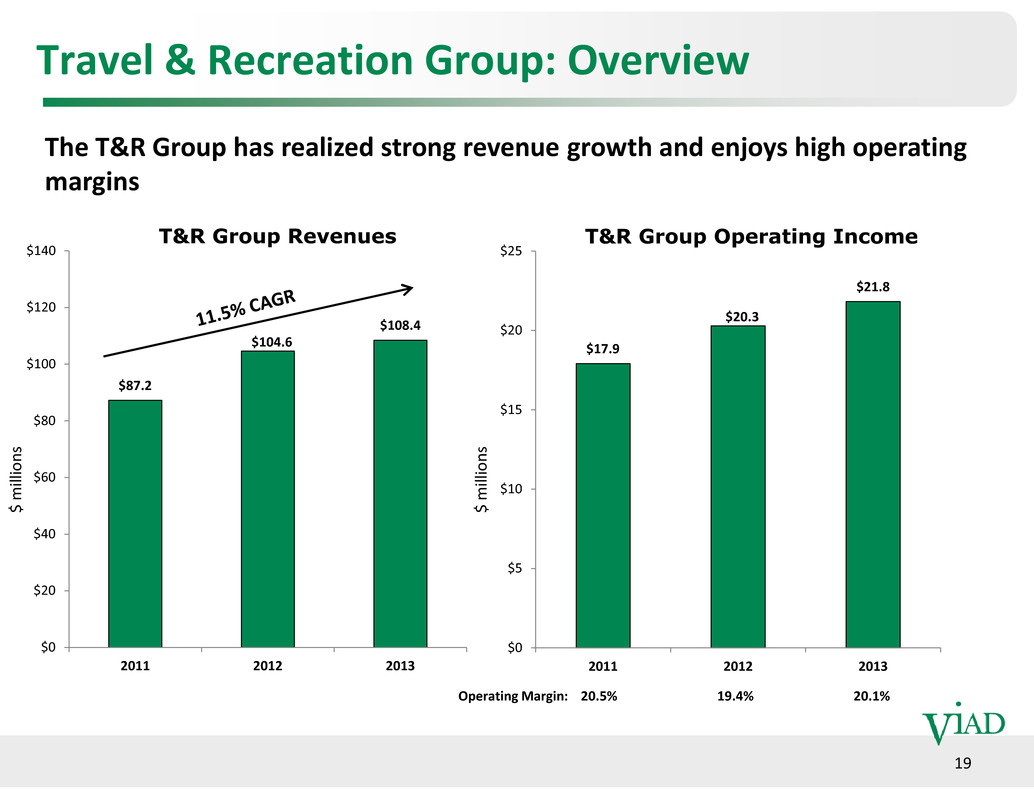

Travel & Recreation Group: Overview $87.2 $104.6 $108.4 $100 $120 $140 T&R Group Revenues The T&R Group has realized strong revenue growth and enjoys high operating margins $17.9 $20.3 $21.8 $20 $25 T&R Group Operating Income $0 $20 $40 $60 $80 2011 2012 2013 Operating Margin: 20.5% 19.4% 20.1% 19 $ m i l l i o n s $ m i l l i o n s $0 $5 $10 $15 2011 2012 2013

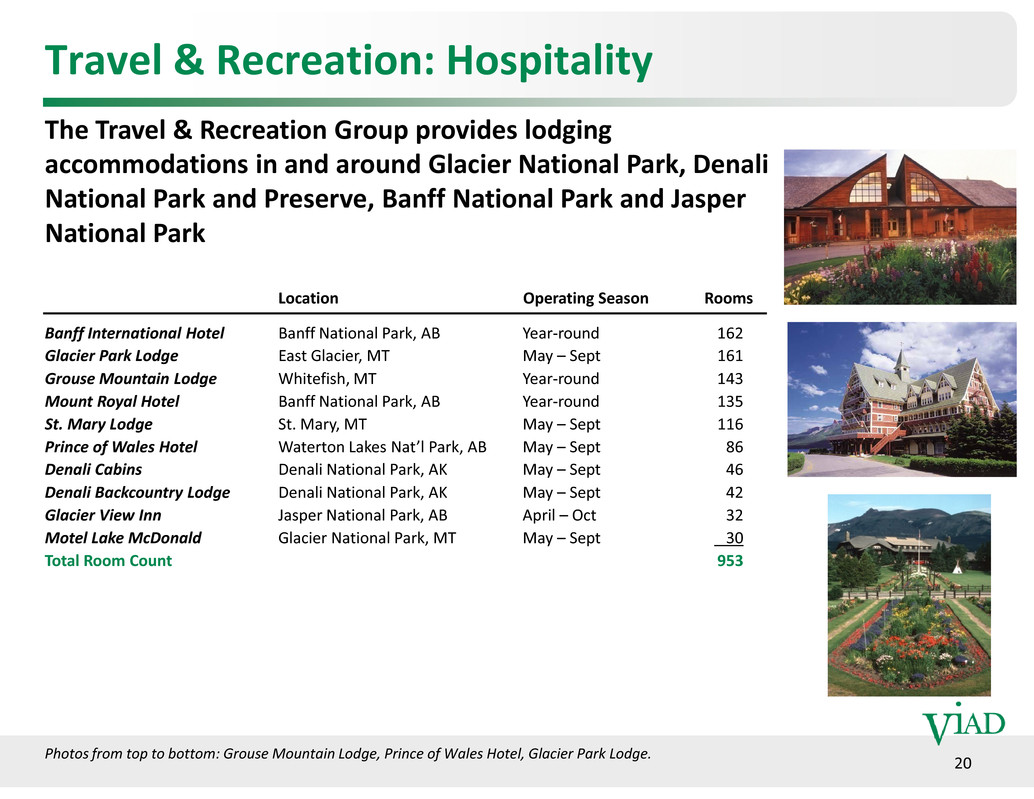

Travel & Recreation: Hospitality The Travel & Recreation Group provides lodging accommodations in and around Glacier National Park, Denali National Park and Preserve, Banff National Park and Jasper National Park Location Operating Season Rooms Banff International Hotel Banff National Park, AB Year-round 162 Glacier Park Lodge East Glacier, MT May – Sept 161 Grouse Mountain Lodge Whitefish, MT Year-round 143 Mount Royal Hotel Banff National Park, AB Year-round 135 20 St. Mary Lodge St. Mary, MT May – Sept 116 Prince of Wales Hotel Waterton Lakes Nat’l Park, AB May – Sept 86 Denali Cabins Denali National Park, AK May – Sept 46 Denali Backcountry Lodge Denali National Park, AK May – Sept 42 Glacier View Inn Jasper National Park, AB April – Oct 32 Motel Lake McDonald Glacier National Park, MT May – Sept 30 Total Room Count 953 Photos from top to bottom: Grouse Mountain Lodge, Prince of Wales Hotel, Glacier Park Lodge.

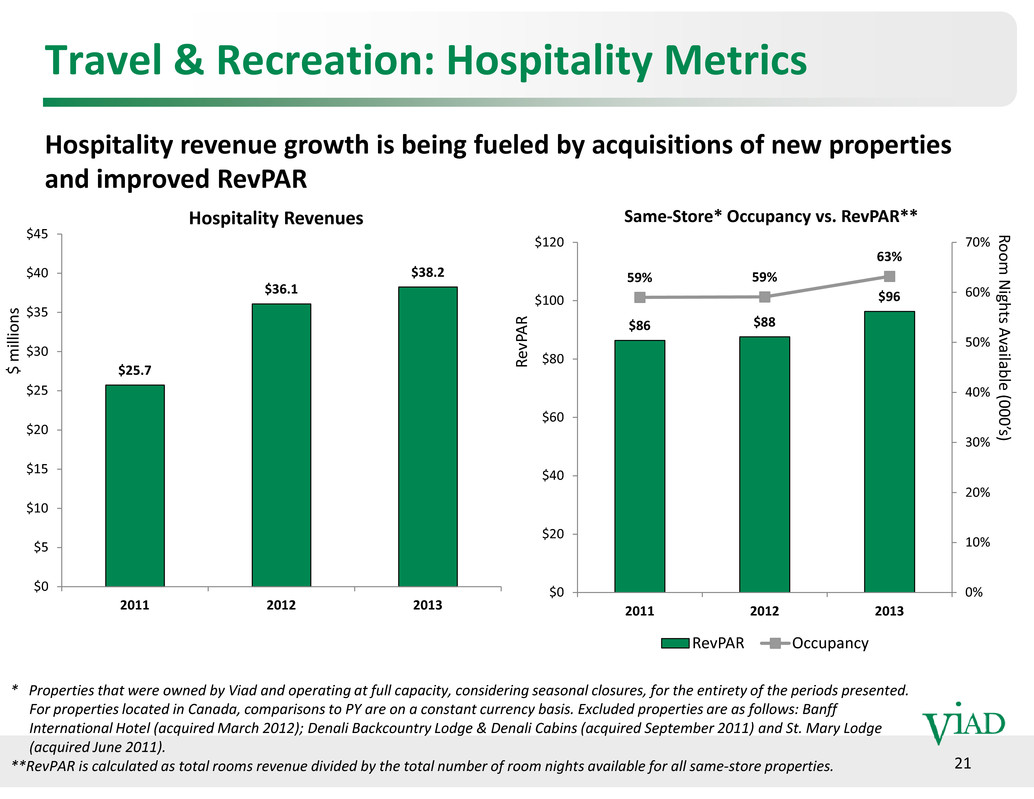

Travel & Recreation: Hospitality Metrics R e v P A R Room Nights Available (0 $ m i l l i o n s Hospitality revenue growth is being fueled by acquisitions of new properties and improved RevPAR Hospitality Revenues $25.7 $36.1 $38.2 $25 $30 $35 $40 $45 $86 $88 $96 59% 59% 63% 40% 50% 60% 70% $80 $100 $120 Same-Store* Occupancy vs. RevPAR** 21 e (000’s) * Properties that were owned by Viad and operating at full capacity, considering seasonal closures, for the entirety of the periods presented. For properties located in Canada, comparisons to PY are on a constant currency basis. Excluded properties are as follows: Banff International Hotel (acquired March 2012); Denali Backcountry Lodge & Denali Cabins (acquired September 2011) and St. Mary Lodge (acquired June 2011). **RevPAR is calculated as total rooms revenue divided by the total number of room nights available for all same-store properties. $0 $5 $10 $15 $20 2011 2012 2013 0% 10% 20% 30% $0 $20 $40 $60 2011 2012 2013 RevPAR Occupancy

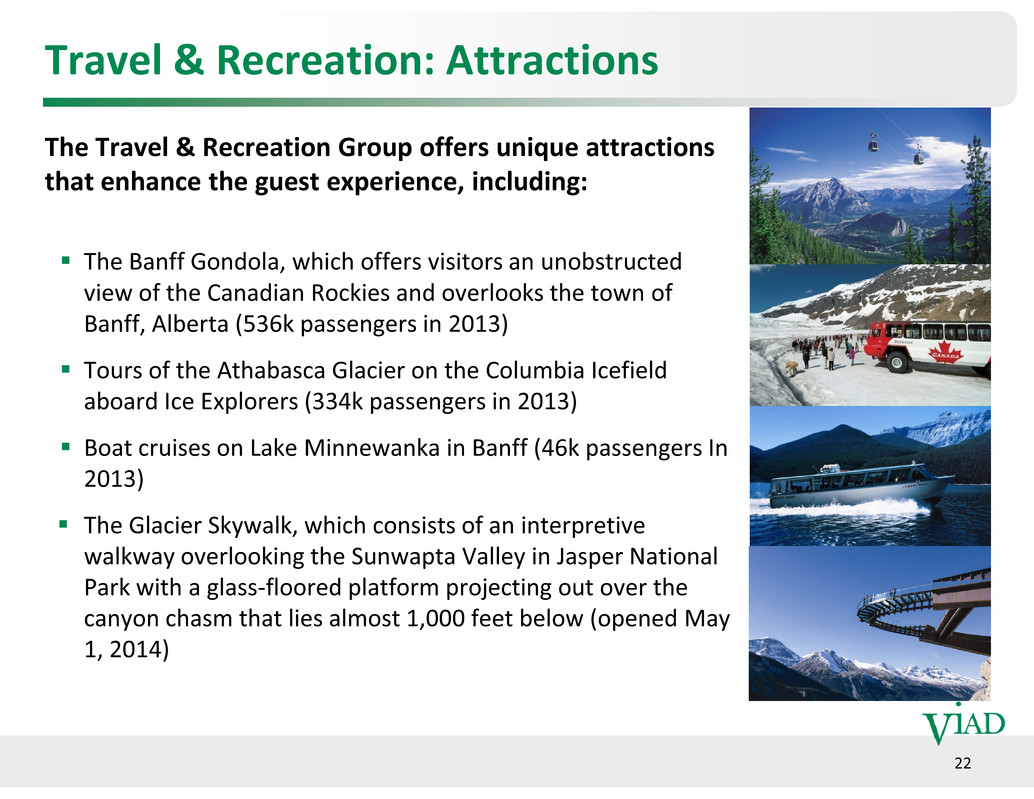

Travel & Recreation: Attractions The Travel & Recreation Group offers unique attractions that enhance the guest experience, including: square4 The Banff Gondola, which offers visitors an unobstructed view of the Canadian Rockies and overlooks the town of Banff, Alberta (536k passengers in 2013) square4 Tours of the Athabasca Glacier on the Columbia Icefield aboard Ice Explorers (334k passengers in 2013) 22 square4 Boat cruises on Lake Minnewanka in Banff (46k passengers In 2013) square4 The Glacier Skywalk, which consists of an interpretive walkway overlooking the Sunwapta Valley in Jasper National Park with a glass-floored platform projecting out over the canyon chasm that lies almost 1,000 feet below (opened May 1, 2014)

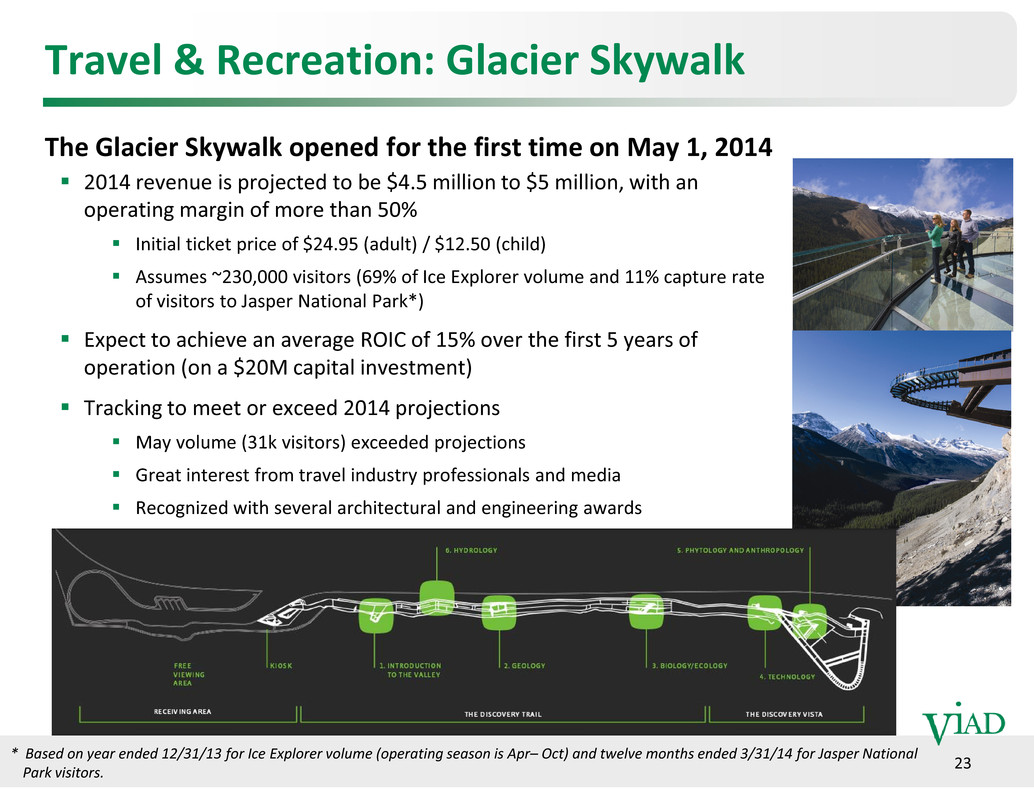

Travel & Recreation: Glacier Skywalk The Glacier Skywalk opened for the first time on May 1, 2014 square4 2014 revenue is projected to be $4.5 million to $5 million, with an operating margin of more than 50% square4 Initial ticket price of $24.95 (adult) / $12.50 (child) square4 Assumes ~230,000 visitors (69% of Ice Explorer volume and 11% capture rate of visitors to Jasper National Park*) square4 Expect to achieve an average ROIC of 15% over the first 5 years of operation (on a $20M capital investment) square4 Tracking to meet or exceed 2014 projections 23 square4 May volume (31k visitors) exceeded projections square4 Great interest from travel industry professionals and media square4 Recognized with several architectural and engineering awards * Based on year ended 12/31/13 for Ice Explorer volume (operating season is Apr– Oct) and twelve months ended 3/31/14 for Jasper National Park visitors.

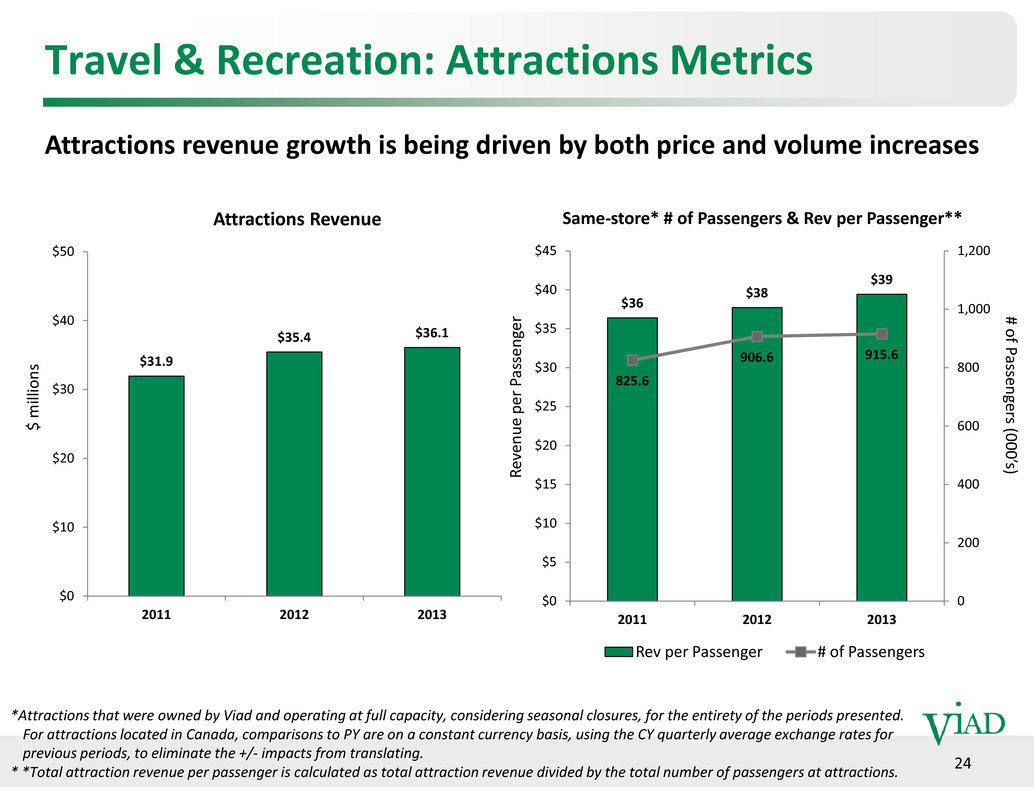

Travel & Recreation: Attractions Metrics Attractions Revenue Same-store* # of Passengers & Rev per Passenger** $ m i l l i o n s R e v e n u e p e r P a s s e n g e r # of Passenge Attractions revenue growth is being driven by both price and volume increases $31.9 $35.4 $36.1 $30 $40 $50 $36 $38 $39 825.6 906.6 915.6 800 1,000 1,200 $25 $30 $35 $40 $45 24 $ m i l l i o n s R e v e n u e p e r P a s s e n g e r ngers (000’s) *Attractions that were owned by Viad and operating at full capacity, considering seasonal closures, for the entirety of the periods presented. For attractions located in Canada, comparisons to PY are on a constant currency basis, using the CY quarterly average exchange rates for previous periods, to eliminate the +/- impacts from translating. * *Total attraction revenue per passenger is calculated as total attraction revenue divided by the total number of passengers at attractions. $0 $10 $20 2011 2012 2013 0 200 400 600 $0 $5 $10 $15 $20 2011 2012 2013 Rev per Passenger # of Passengers

Travel & Recreation: Transportation and Package Tours The Travel & Recreation Group provides ground transportation services to group tours and individual travelers, including: square4 Charter motorcoach services square4 Sightseeing square4 Airport shuttle and other scheduled services 25 The Travel & Recreation Group offers in-bound package tours throughout Canada and in Alaska square4 Drives traffic to our hotels, attractions and transportation services square4 Incorporates other tourism products/activities, including rail, skiing, sightseeing and hotels

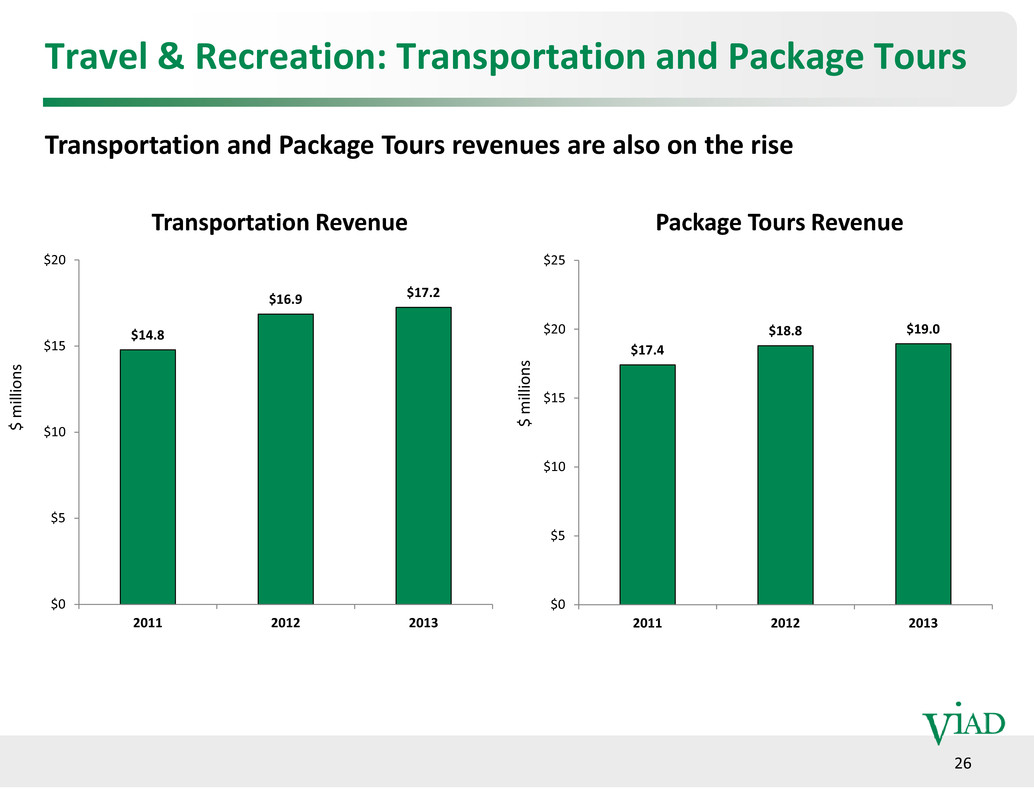

Travel & Recreation: Transportation and Package Tours Transportation Revenue $ m i l l i o n s Package Tours Revenue $ m i l l i o n s Transportation and Package Tours revenues are also on the rise $14.8 $16.9 $17.2 $15 $20 $17.4 $18.8 $19.0 $15 $20 $25 26 $ m i l l i o n s $ m i l l i o n s $0 $5 $10 2011 2012 2013 $0 $5 $10 2011 2012 2013

Travel & Recreation: Growth Initiatives square6 Refresh: boxshadowdwn Enhance visitor experience with upgraded facility amenities to maximize asset yield and strengthen customer advocacy square6 Buy: boxshadowdwn Acquire exclusive and unique tourism assets in iconic natural destinations in North America boxshadowdwn “Buy right” – location, asset, price We are building scale in this high-margin business through strategic initiatives to Refresh, Build and Buy assets square6 Build: boxshadowdwn Glacier Skywalk, a one-of-a-kind tourist attraction boxshadowdwn Expand existing lodging properties and terms boxshadowdwn Leverage economies of scale and scope boxshadowdwn Improve facility amenities to maximize asset yield and strengthen customer advocacy boxshadowdwn Apply professional management to increase efficiency / asset productivity 27

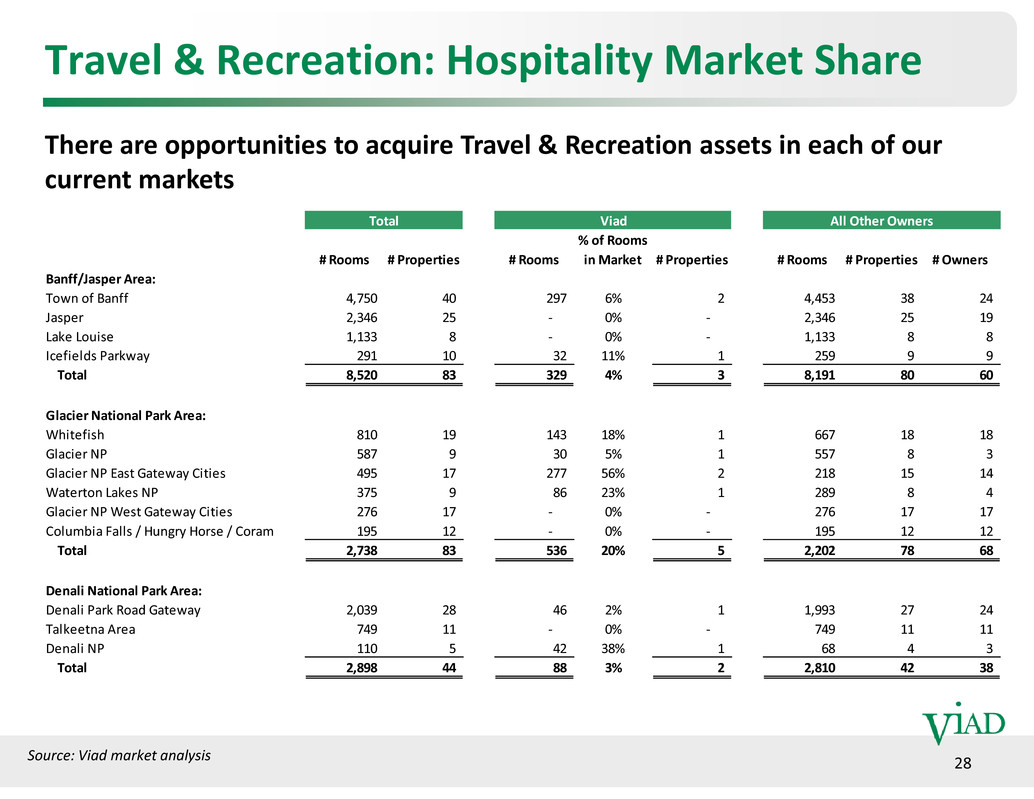

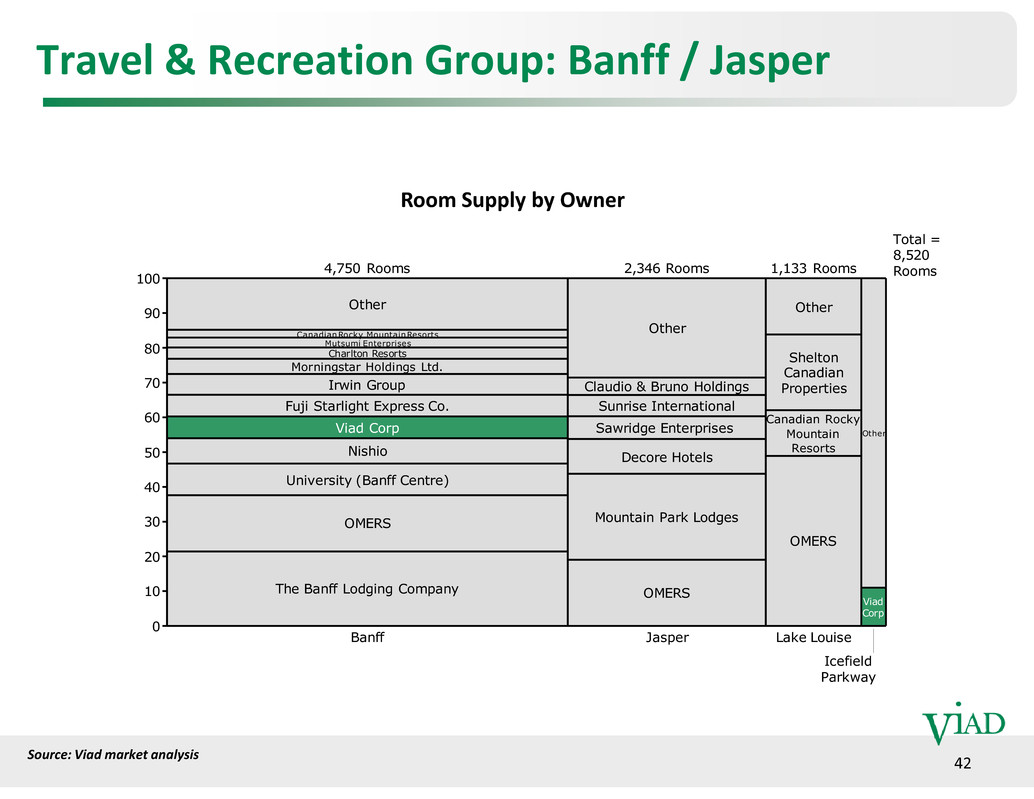

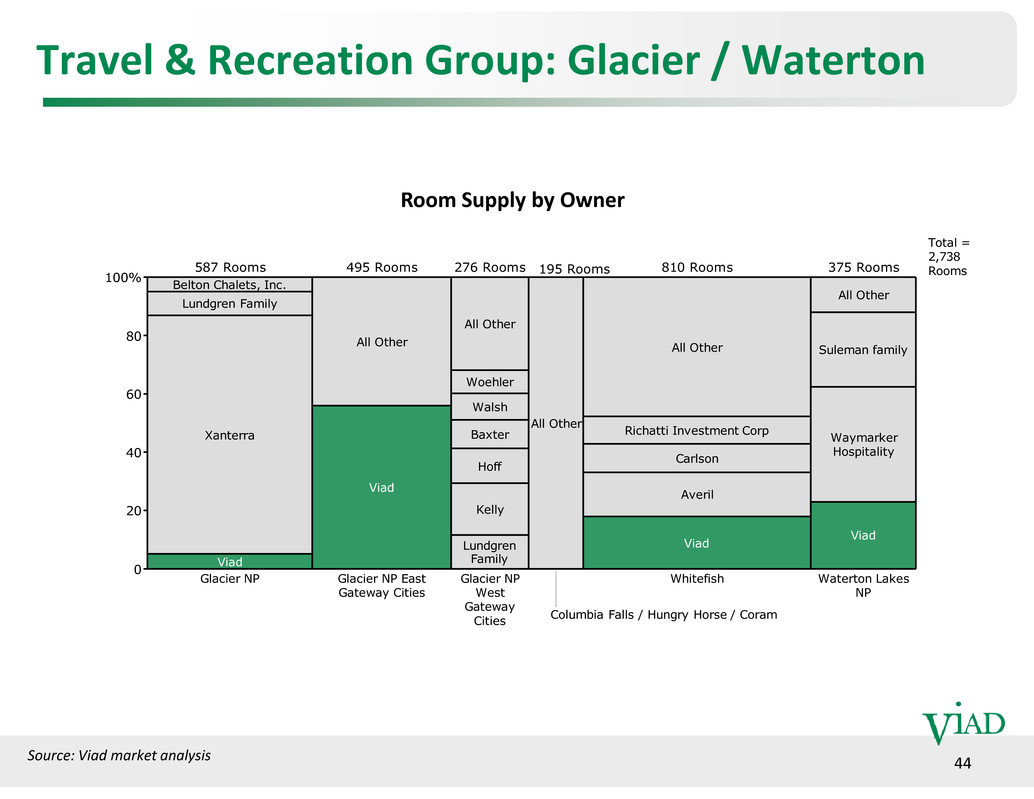

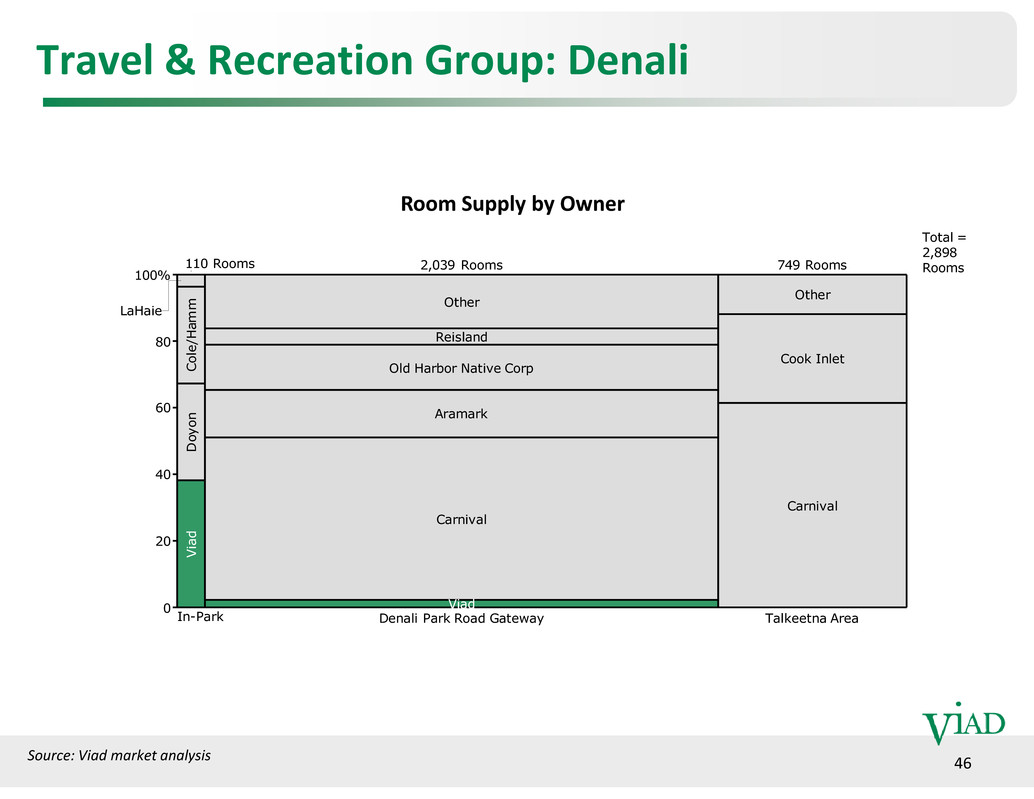

Travel & Recreation: Hospitality Market Share There are opportunities to acquire Travel & Recreation assets in each of our current markets Total Viad All Other Owners # Rooms # Properties # Rooms % of Rooms in Market # Properties # Rooms # Properties # Owners Banff/Jasper Area: Town of Banff 4,750 40 297 6% 2 4,453 38 24 Jasper 2,346 25 - 0% - 2,346 25 19 Lake Louise 1,133 8 - 0% - 1,133 8 8 Icefields Parkway 291 10 32 11% 1 259 9 9 Total 8,520 83 329 4% 3 8,191 80 60 28Source: Viad market analysis Glacier National Park Area: Whitefish 810 19 143 18% 1 667 18 18 Glacier NP 587 9 30 5% 1 557 8 3 Glacier NP East Gateway Cities 495 17 277 56% 2 218 15 14 Waterton Lakes NP 375 9 86 23% 1 289 8 4 Glacier NP West Gateway Cities 276 17 - 0% - 276 17 17 Columbia Falls / Hungry Horse / Coram 195 12 - 0% - 195 12 12 Total 2,738 83 536 20% 5 2,202 78 68 Denali National Park Area: Denali Park Road Gateway 2,039 28 46 2% 1 1,993 27 24 Talkeetna Area 749 11 - 0% - 749 11 11 Denali NP 110 5 42 38% 1 68 4 3 Total 2,898 44 88 3% 2 2,810 42 38

Summary

Viad Opportunity Summary square4 Two business units with leading and defensible market positions boxshadowdwn M&E Group is experiencing significant improvements in profits driven by margin initiatives and improved industry fundamentals boxshadowdwn T&R Group enjoys high margins with strong revenue growth fueled by Refresh- Build-Buy strategy square4 Balance sheet strength boxshadowdwn $47.3 million in cash (3/31/14) 30 boxshadowdwn 0.5% debt-to-capital (3/31/14) square4 Balanced approach to capital deployment focused on enhancing shareholder value square4 Investments in business (organic & acquisitions) square4 Dividends square4 Share repurchases

Appendix 31

Viad Summary Financial Data (000's) 2011 2012 2013 Revenue: M&E Group 840,550$ 902,040$ 844,904$ T&R Group 87,220 104,605 108,443 927,770$ 1,006,645$ 953,347$ Segment Operating Income: M&E Group 5,180$ 17,900$ 20,092$ T&R Group 17,909 20,290 21,819 23,089$ 38,190$ 41,911$ Cash Flow from Operations 34,736$ 69,186$ 6,055$ Capital Expenditures: 32 * Increased to $0.10 per share (from $0.04 per share) quarterly effective with August 2012 declaration (payable October 2012). ** Special dividends of $2.50 per share and $1.50 per share were paid in November 2013 and February 2014, respectively. M&E Group 17,327$ 12,438$ 12,610$ T&R Group 3,271 15,201 23,108 Corporate 940 36 401 21,538$ 27,675$ 36,119$ Dividends Paid: Regular Quarterly Dividends* 3,241$ 4,454$ 8,127$ Special Dividends** - - 50,787 3,241$ 4,454$ 58,914$ Cash & Cash Equivalents 100,376$ 114,171$ 45,821$ Debt 3,239$ 2,226$ 11,668$ Debt-to-Capital 0.8% 0.6% 3.2% Shares Outstanding 20,144 20,241 20,317

Marketing & Events Group: Summary GES is a leading global exhibition and trade show producer offering best-in-class event production, cutting-edge creative and design and service delivery square6 Exhibitions & Events boxshadowdwn Official Services Contractor boxshadowdwn Exhibitor Appointed Contractor Services Strengths square6 A leading market position square6 Global reach boxshadowdwn Leading positions in US, Canada, UK and UAE 33 square6 Other Marketing Services boxshadowdwn GES Entertainment (owned touring exhibitions, works for hire) boxshadowdwn Retail (holiday installations, kiosks, retail merchandizing units) square6 Clients include: boxshadowdwn Show organizers boxshadowdwn Corporate brand marketers boxshadowdwn Movie studios boxshadowdwn Retail shopping centers square6 Long-term contracts and strong backlog of business boxshadowdwn Typical contract length is 3 – 5 years boxshadowdwn Revenue backlog of $1 billion+ square6 Good customer and industry diversity boxshadowdwn Largest single show does not exceed 5% of GES’ annual revenue boxshadowdwn Shows span a broad range of industries, reducing exposure to any one industry

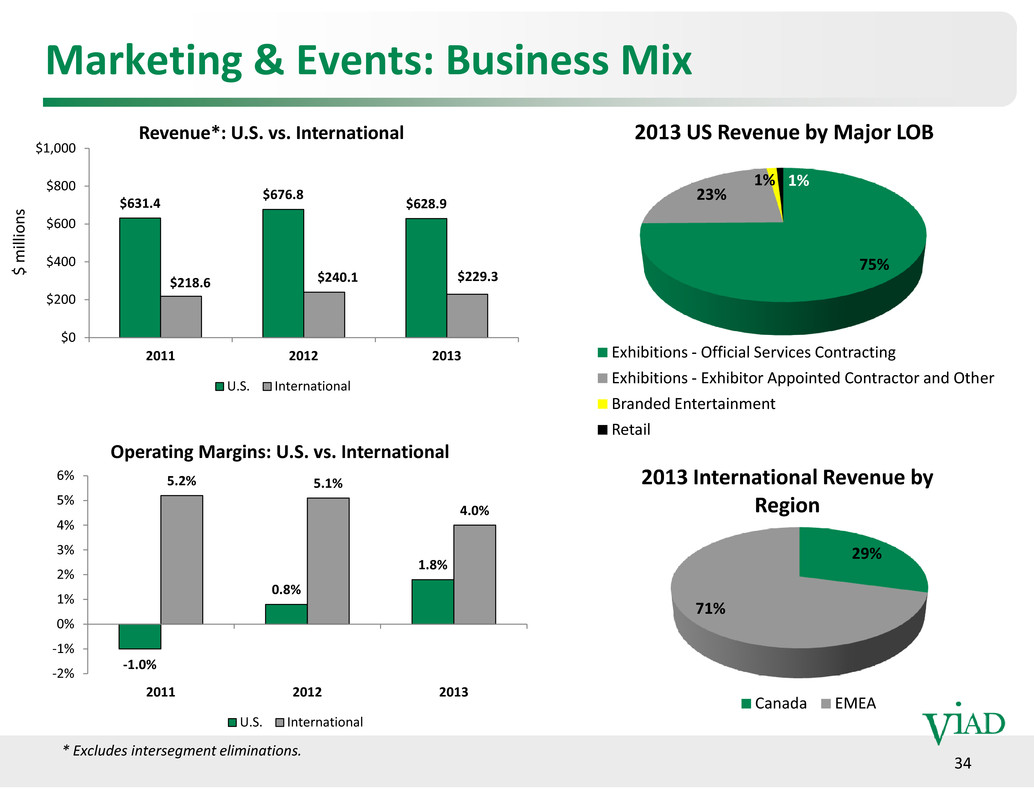

Marketing & Events: Business Mix 75% 23% 1% 1% 2013 US Revenue by Major LOB Exhibitions - Official Services Contracting Exhibitions - Exhibitor Appointed Contractor and Other Branded Entertainment Revenue*: U.S. vs. International $631.4 $676.8 $628.9 $218.6 $240.1 $229.3 $0 $200 $400 $600 $800 $1,000 2011 2012 2013 U.S. International $ m i l l i o n s 34 Retail 29% 71% 2013 International Revenue by Region Canada EMEA Operating Margins: U.S. vs. International -1.0% 0.8% 1.8% 5.2% 5.1% 4.0% -2% -1% 0% 1% 2% 3% 4% 5% 6% 2011 2012 2013 U.S. International * Excludes intersegment eliminations.

Marketing & Events: U.S. Business Model Exhibitor Discretionary: ~20% of M&E U.S. revenue square6 Installing & Dismantling square6 Logistics/Transportation square6 Exhibit Rental Show Organizer: ~20% of M&E U.S. revenue square6 Show Planning & Production square6 Look & Feel Design Layout & Floor Plan GES competes with other vendors to provide non- exclusive services to Exhibitors Exhibitor Exclusive:* ~35% of M&E U.S. revenue square6Material Handling (Drayage) square6Electrical Distribution square6Cleaning Official Services Contract with Show Organizer gives GES the exclusive right to provide services to Show Organizer and Exhibitors Program Exhibitors: ~23% of M&E U.S. revenue square6 Exhibit Construction square6 Exhibit Program Development & Design Brand Planningsquare6 Furnishings & Carpet square6 Graphics square6 Lighting square6 Storage & Refurbishing square6 ROI Analysis square6 Audio-Visual Services square6 Designs square6 Furnishings & Carpet square6 Signage square6 Show Traffic Analysis square6Audio-Visual Services *Exclusive services vary by show square6Plumbing square6Overhead Rigging square6Booth Rigging square6 square6 Integrated Marketing Campaigns square6 At-Event Activities square6 Audio-Visual Services 35

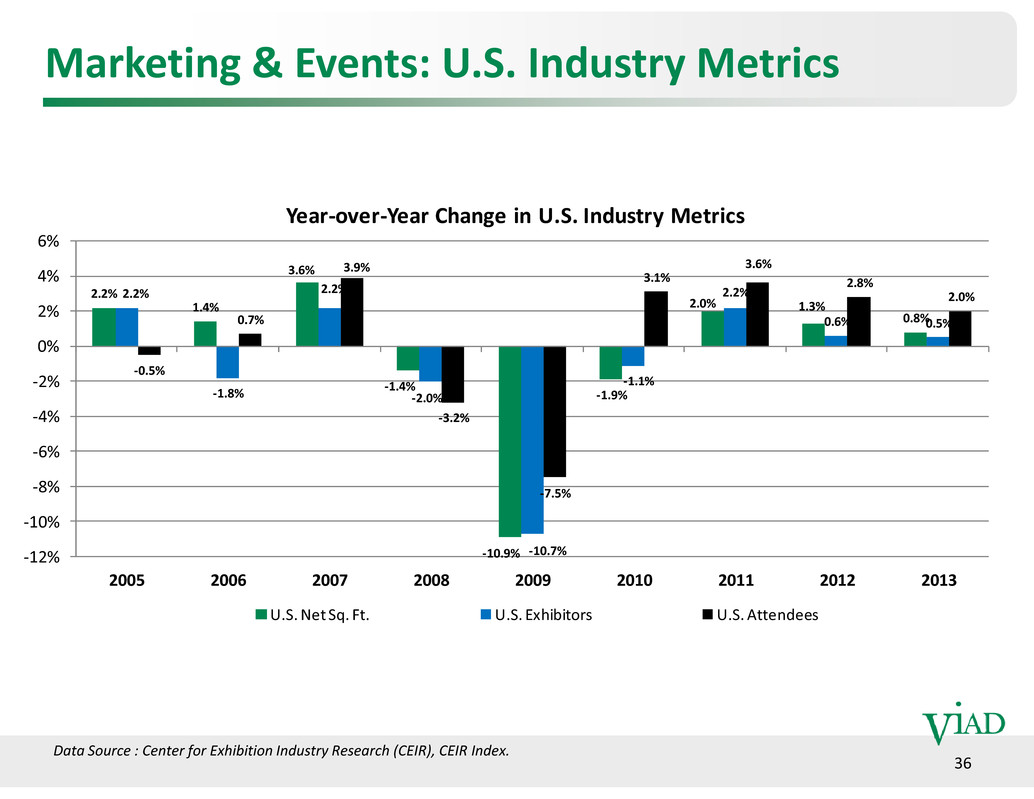

Marketing & Events: U.S. Industry Metrics 2.2% 1.4% 3.6% -1.4% -1.9% 2.0% 1.3% 0.8% 2.2% -1.8% 2.2% -2.0% -1.1% 2.2% 0.6% 0.5% -0.5% 0.7% 3.9% 3.1% 3.6% 2.8% 2.0% -2% 0% 2% 4% 6% Year-over-Year Change in U.S. Industry Metrics Data Source : Center for Exhibition Industry Research (CEIR), CEIR Index. 36 -10.9% -10.7% -3.2% -7.5% -12% -10% -8% -6% -4% 2005 2006 2007 2008 2009 2010 2011 2012 2013 U.S. Net Sq. Ft. U.S. Exhibitors U.S. Attendees

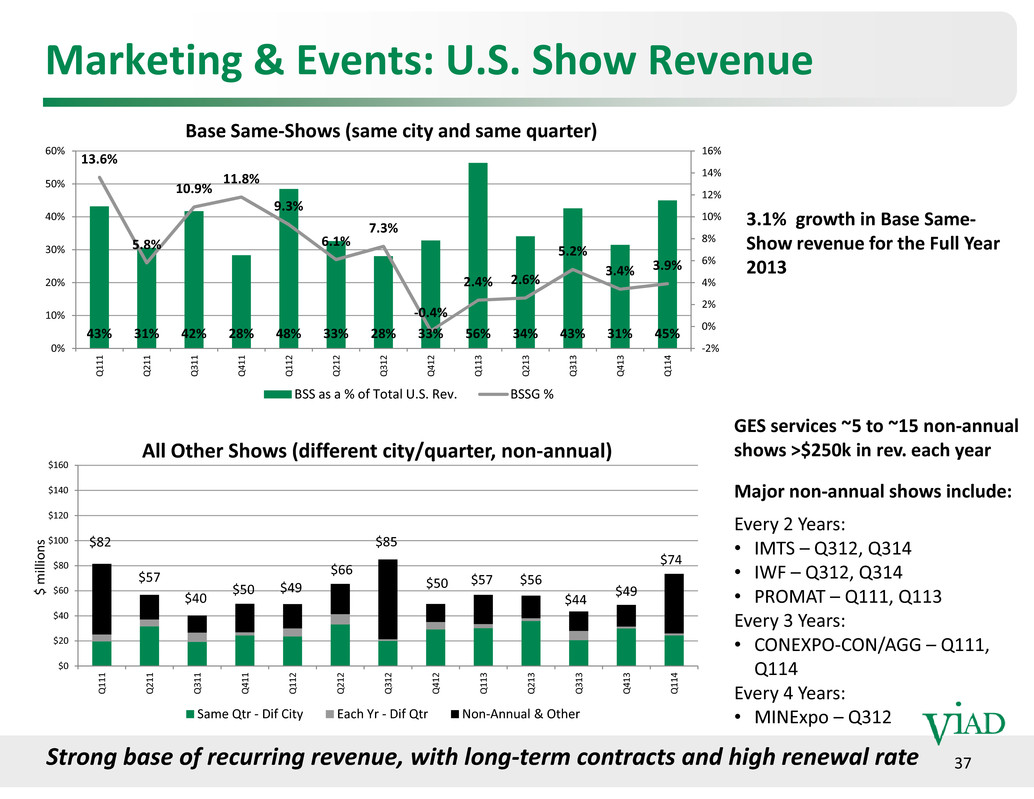

Marketing & Events: U.S. Show Revenue 3.1% growth in Base Same- Show revenue for the Full Year 2013 43% 31% 42% 28% 48% 33% 28% 33% 56% 34% 43% 31% 45% 13.6% 5.8% 10.9% 11.8% 9.3% 6.1% 7.3% -0.4% 2.4% 2.6% 5.2% 3.4% 3.9% -2% 0% 2% 4% 6% 8% 10% 12% 14% 16% 0% 10% 20% 30% 40% 50% 60% Q 1 1 1 Q 2 1 1 Q 3 1 1 Q 4 1 1 Q 1 1 2 Q 2 1 2 Q 3 1 2 Q 4 1 2 Q 1 1 3 Q 2 1 3 Q 3 1 3 Q 4 1 3 Q 1 1 4 Base Same-Shows (same city and same quarter) BSS as a % of Total U.S. Rev. BSSG % $82 $57 $40 $50 $49 $66 $85 $50 $57 $56 $44 $49 $74 $0 $20 $40 $60 $80 $100 $120 $140 $160 Q 1 1 1 Q 2 1 1 Q 3 1 1 Q 4 1 1 Q 1 1 2 Q 2 1 2 Q 3 1 2 Q 4 1 2 Q 1 1 3 Q 2 1 3 Q 3 1 3 Q 4 1 3 Q 1 1 4 All Other Shows (different city/quarter, non-annual) Same Qtr - Dif City Each Yr - Dif Qtr Non-Annual & Other 37 GES services ~5 to ~15 non-annual shows >$250k in rev. each year Major non-annual shows include: Every 2 Years: • IMTS – Q312, Q314 • IWF – Q312, Q314 • PROMAT – Q111, Q113 Every 3 Years: • CONEXPO-CON/AGG – Q111, Q114 Every 4 Years: • MINExpo – Q312 $ m i l l i o n s Strong base of recurring revenue, with long-term contracts and high renewal rate

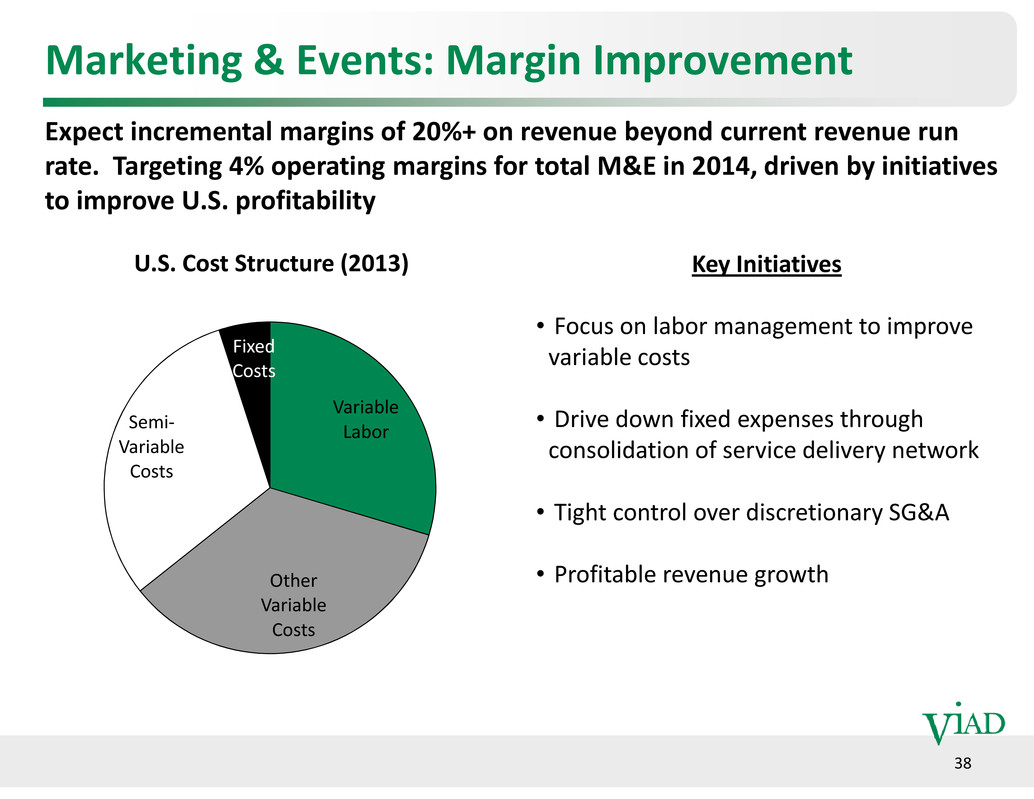

Marketing & Events: Margin Improvement Key Initiatives • Focus on labor management to improve variable costs Expect incremental margins of 20%+ on revenue beyond current revenue run rate. Targeting 4% operating margins for total M&E in 2014, driven by initiatives to improve U.S. profitability Variable Fixed Costs U.S. Cost Structure (2013) 38 • Drive down fixed expenses through consolidation of service delivery network • Tight control over discretionary SG&A • Profitable revenue growth Labor Other Variable Costs Semi- Variable Costs

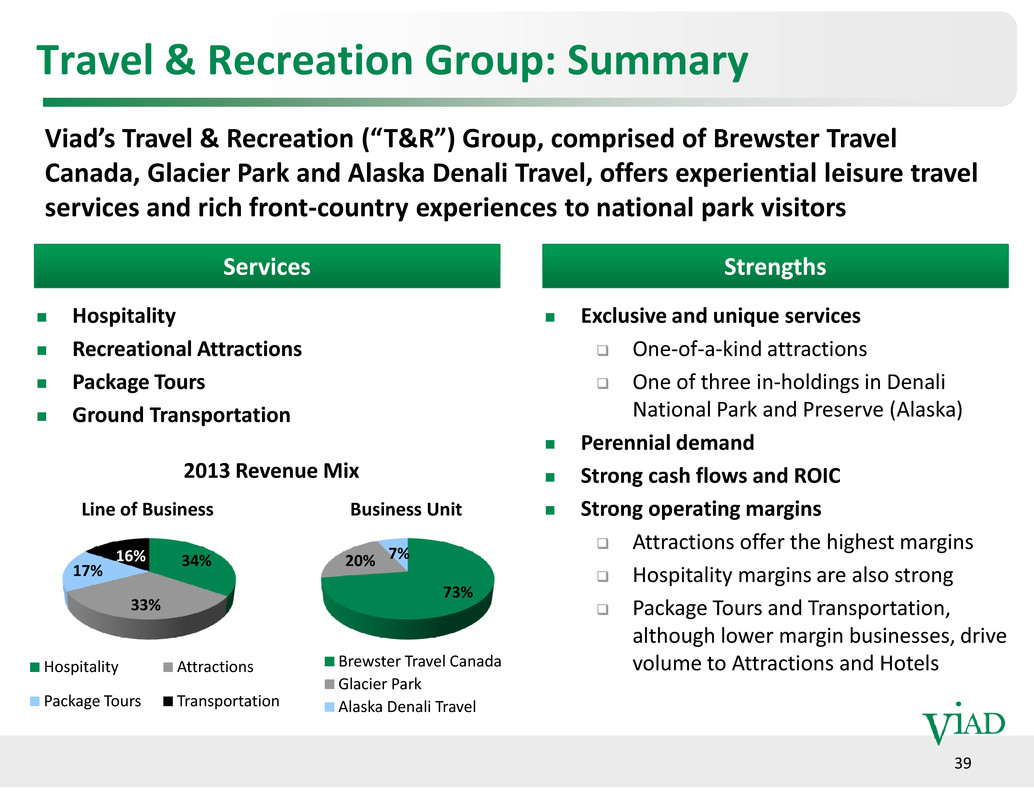

Viad’s Travel & Recreation (“T&R”) Group, comprised of Brewster Travel Canada, Glacier Park and Alaska Denali Travel, offers experiential leisure travel services and rich front-country experiences to national park visitors Travel & Recreation Group: Summary square6 Hospitality square6 Recreational Attractions square6 Package Tours Services Strengths square6 Exclusive and unique services boxshadowdwn One-of-a-kind attractions boxshadowdwn One of three in-holdings in Denali National Park and Preserve (Alaska) 39 square6 Ground Transportation square6 Perennial demand square6 Strong cash flows and ROIC square6 Strong operating margins boxshadowdwn Attractions offer the highest margins boxshadowdwn Hospitality margins are also strong boxshadowdwn Package Tours and Transportation, although lower margin businesses, drive volume to Attractions and Hotels 34% 33% 17% 16% Line of Business Hospitality Attractions Package Tours Transportation 73% 20% 7% Business Unit Brewster Travel Canada Glacier Park Alaska Denali Travel 2013 Revenue Mix

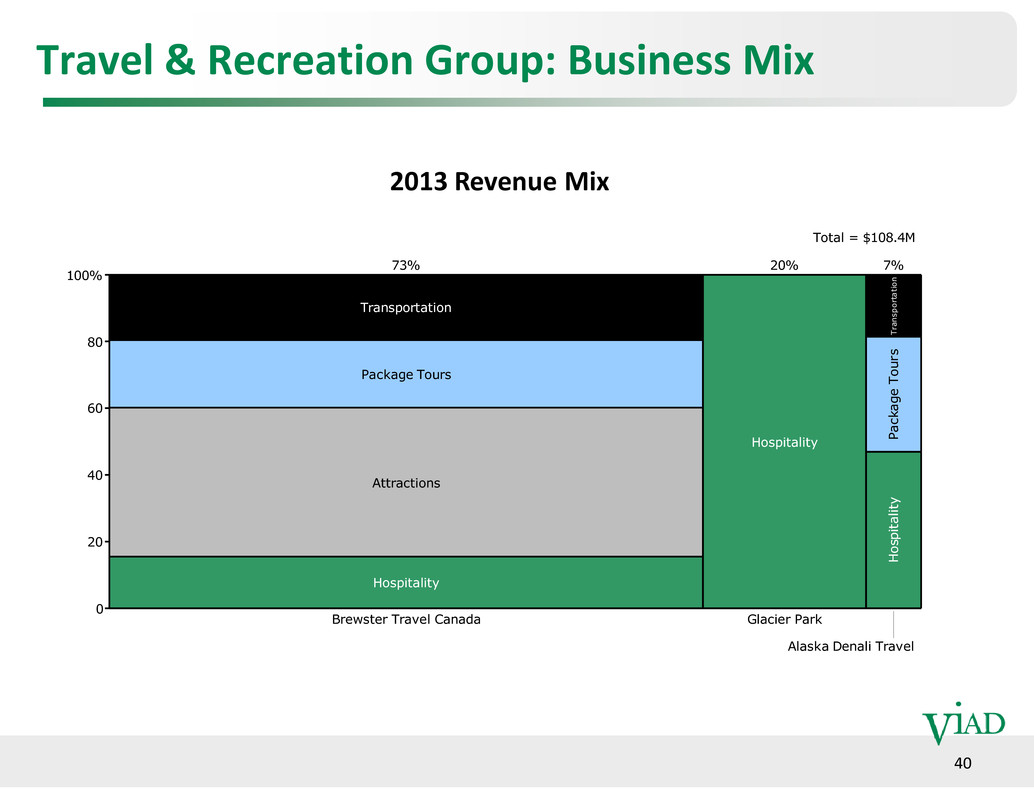

Travel & Recreation Group: Business Mix 80 100% Transportation Package Tours 73% 20% g e T o u r s T r a n s p o r t a t i o n 7% Total = $108.4M 2013 Revenue Mix 40 0 20 40 60 Brewster Travel Canada Attractions Hospitality Glacier Park Hospitality H o s p i t a l i t y P a c k a g Alaska Denali Travel

Travel & Recreation Group: Banff / Jasper and Glacier Skywalk 41

Travel & Recreation Group: Banff / Jasper 70 80 90 100 Other CanadianRocky MountainResorts Mutsumi Enterprises Charlton Resorts Morningstar Holdings Ltd. Irwin Group Fuji Starlight Express Co. 4,750 Rooms Other Claudio & Bruno Holdings Sunrise International 2,346 Rooms Other Shelton Canadian Properties 1,133 Rooms Total = 8,520 Rooms Room Supply by Owner 42 0 10 20 30 40 50 60 Banff Viad Corp Nishio University (Banff Centre) OMERS The Banff Lodging Company Jasper Sawridge Enterprises Decore Hotels Mountain Park Lodges OMERS Lake Louise Canadian Rocky Mountain Resorts OMERS Other Viad Corp Icefield Parkway Source: Viad market analysis

Travel & Recreation Group: Glacier / Waterton 43

Travel & Recreation Group: Glacier / Waterton Room Supply by Owner 60 80 100% Belton Chalets, Inc. Lundgren Family 587 Rooms All Other 495 Rooms All Other Woehler 276 Rooms All Other 810 Rooms All Other Suleman family 375 Rooms Total = 2,738 Rooms195 Rooms 44 0 20 40 Glacier NP Xanterra Viad Glacier NP East Gateway Cities Viad Glacier NP West Gateway Cities Walsh Baxter Hoff Kelly Lundgren Family All Other Whitefish Richatti Investment Corp Carlson Averil Viad Waterton Lakes NP Waymarker Hospitality Viad Columbia Falls / Hungry Horse / Coram Source: Viad market analysis

Travel & Recreation Group: Denali 45

80 100% C o l e / H a m m Other Reisland Old Harbor Native Corp 2,039 Rooms Other Cook Inlet 749 Rooms Total = 2,898 Rooms LaHaie 110 Rooms Travel & Recreation Group: Denali Room Supply by Owner 0 20 40 60 D o y o n V i a d Denali Park Road Gateway Aramark Carnival Viad Talkeetna Area Carnival In-Park 46Source: Viad market analysis