THIRD quarter 2024 EARNINGS CALL NOVEMBER 7, 2024 Exhibit 99.2

Forward-looking statements This presentation contains a number of forward-looking statements. Words, and variations of words, such as “will,” “can,” “may,” “expect,” “would,” “could,” “might,” “intend,” “plan,” “believe,” “estimate,” “anticipate,” “deliver,” “seek,” “aim,” “potential,” “target,” “outlook,” and similar expressions are intended to identify our forward-looking statements. Such forward-looking statements include those that address activities, events or developments that Viad or its management believes or anticipates may occur in the future, including all statements regarding the expected timing of the closing of the GES transaction, the use of proceeds of the transaction, potential benefits of the transaction, expectations concerning Pursuit’s opportunities and performance as a standalone public company, and the expected Chief Executive Officer transition in connection with the closing of the GES transaction. Similarly, statements that describe our go-forward business strategy, objectives, plans, intentions, or goals also are forward-looking statements. These forward-looking statements are not historical facts and are subject to a host of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those in the forward-looking statements. Important factors that could cause actual results to differ materially from those described in our forward-looking statements include, but are not limited to, the following: the pending sale of our GES business may not be completed in the timeframe or on the terms we anticipate (or at all); we may not realize the full strategic, financial, operational and other benefits that are expected to result from the pending sale of our GES business; general economic uncertainty in key global markets and a worsening of global economic conditions; travel industry disruptions; the impact of our overall level of indebtedness, as well as our financial covenants, on our operational and financial flexibility; seasonality of our businesses; unanticipated delays and cost overruns of our capital projects, and our ability to achieve established financial and strategic goals for such projects; the importance of key members of our account teams to our business relationships; our ability to manage our business and continue our growth if we lose any of our key personnel; the competitive nature of the industries in which we operate; our dependence on large exhibition event clients; adverse effects of show rotation on our periodic results and operating margins; transportation disruptions and increases in transportation costs; natural disasters, weather conditions, accidents, and other catastrophic events; our exposure to labor cost increases and work stoppages related to unionized employees; our multi-employer pension plan funding obligations; our ability to successfully integrate and achieve established financial and strategic goals from acquisitions; our exposure to cybersecurity attacks and threats; our exposure to currency exchange rate fluctuations; liabilities relating to prior and discontinued operations; sufficiency and cost of insurance coverage; and compliance with laws governing the storage, collection, handling, and transfer of personal data and our exposure to legal claims and fines for data breaches or improper handling of such data. For a more complete discussion of the risks and uncertainties that may affect our business or financial results, please see Item 1A, “Risk Factors,” of our most recent annual report on Form 10-K filed with the SEC. We disclaim and do not undertake any obligation to update or revise any forward-looking statement in this presentation except as required by applicable law or regulation.

NON-GAAP FINANCIAL MEASURES This document includes the presentation of “Adjusted EBITDA”, which is supplemental to results presented under accounting principles generally accepted in the United States of America (“GAAP”) and may not be comparable to similarly titled measures presented by other companies. This non-GAAP measure should be considered in addition to, but not as a substitute for, other similar measures reported in accordance with GAAP. The use of this non-GAAP financial measure is limited, compared to the GAAP measure of net income attributable to Viad, because it does not consider a variety of items affecting Viad’s consolidated financial performance as explained below. Because this non-GAAP measure does not consider all items affecting Viad’s consolidated financial performance, a user of Viad’s financial information should consider net income attributable to Viad as an important measure of financial performance because it provides a more complete measure of the Company’s performance. Adjusted EBITDA is defined by management as net income attributable to Viad before income (loss) from discontinued operations, interest expense and interest income, income taxes, depreciation and amortization, transaction-related costs, attraction start-up costs, restructuring charges, impairment losses, the reduction/increase for income/loss attributable to non-redeemable and redeemable non-controlling interests, and gains or losses from sales of businesses. Adjusted EBITDA is considered a useful operating metric, in addition to net income attributable to Viad, as potential variations arising from non-recurring integration costs, non-cash amortization and depreciation, and non-operational expenses/income are eliminated, thus resulting in an additional measure considered to be indicative of Viad’s consolidated and segment performance. Management believes that the presentation of Adjusted EBITDA provides useful information to investors regarding Viad’s results of operations for trending, analyzing and benchmarking the performance and value of Viad’s business. Adjusted EBITDA margin is defined by management as Adjusted EBITDA divided by revenue. Please see the slide titled "Non-GAAP Financial Reconciliation" for reconciliations of these non-GAAP financial measures to their most directly comparable GAAP financial measures. Forward-Looking Non-GAAP Measures The company has not quantitatively reconciled its guidance for adjusted EBITDA to its respective most comparable GAAP measure because certain reconciling items that impact this metric including, provision for income taxes, interest expense, restructuring or impairment charges, transaction-related costs, and attraction start-up costs have not occurred, are out of the company’s control, or cannot be reasonably predicted. Accordingly, reconciliations to the nearest GAAP financial measure are not available without unreasonable effort. Please note that the unavailable reconciling items could significantly impact the company’s results as reported under GAAP.

Q3’24 Earnings Call HIGHLIGHTS Strong third quarter performance at both Pursuit and GES 1 Pursuit completes tuck-in acquisition in Glacier National Park for $15.9 million 2 Sale of GES for $535 million is on track to close on December 31, 2024 3

FINANCIAL PERFORMANCE & OUTLOOK

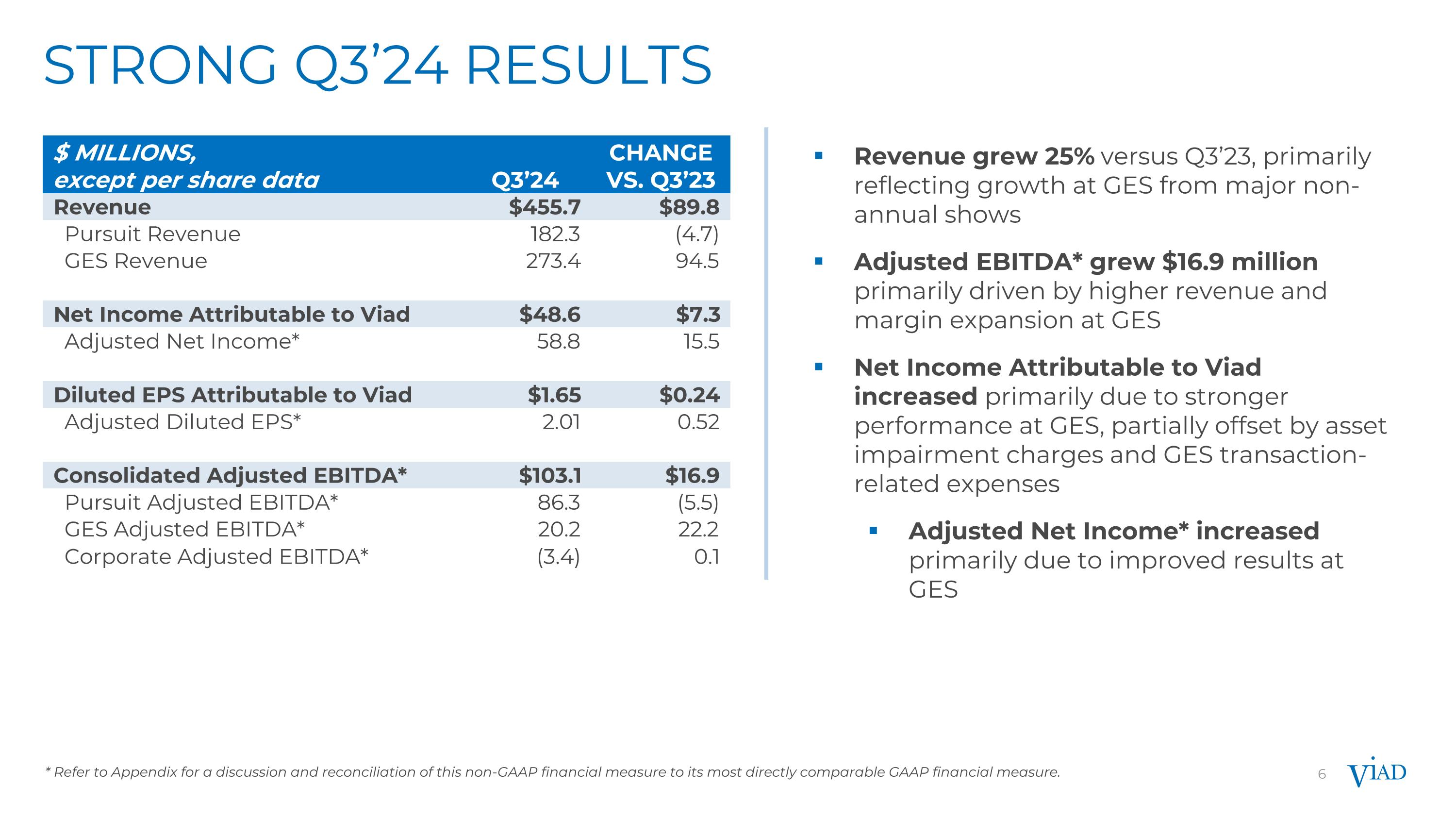

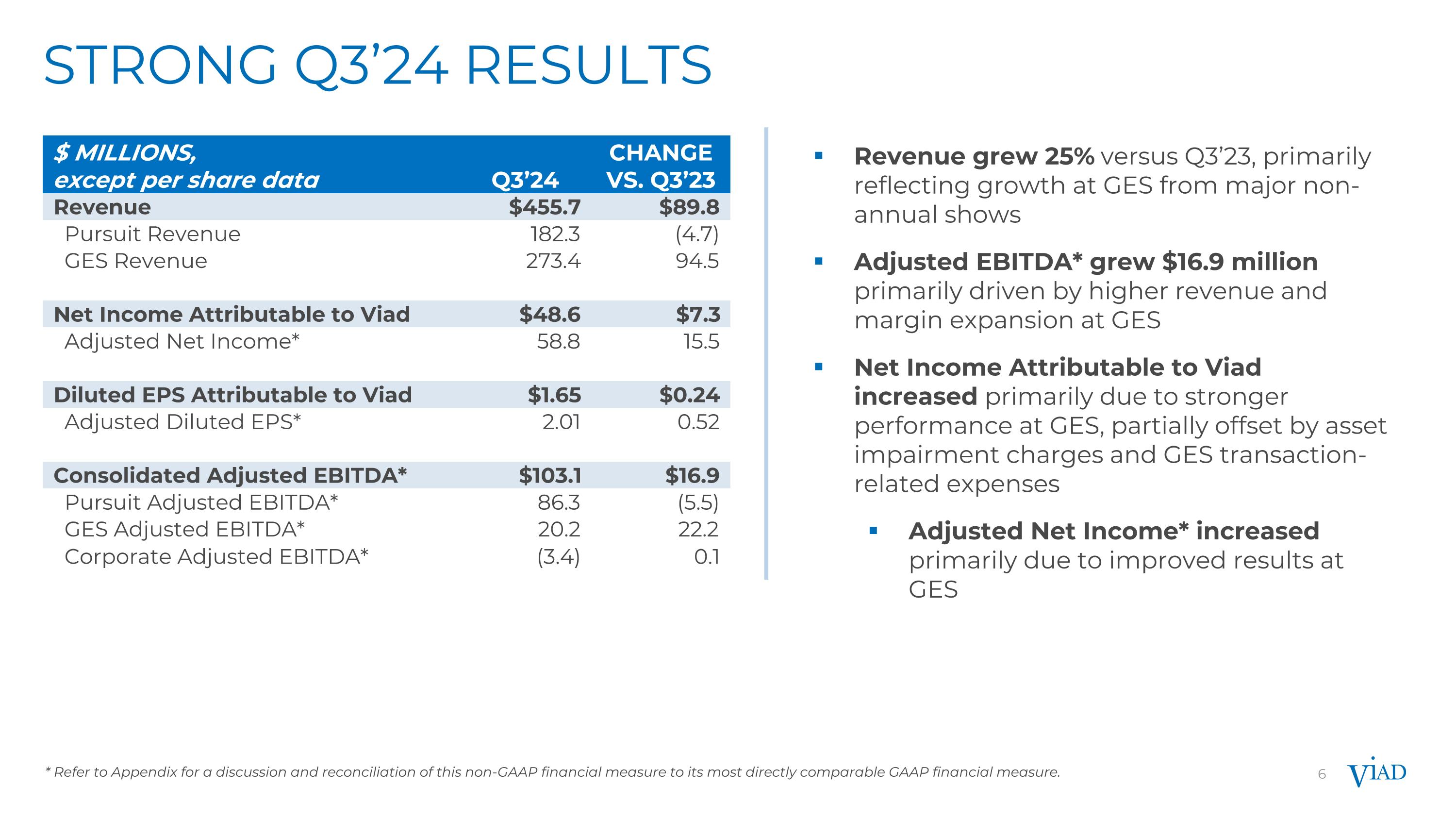

6 STRONG Q3’24 RESULTS Revenue grew 25% versus Q3’23, primarily reflecting growth at GES from major non-annual shows Adjusted EBITDA* grew $16.9 million primarily driven by higher revenue and margin expansion at GES Net Income Attributable to Viad increased primarily due to stronger performance at GES, partially offset by asset impairment charges and GES transaction-related expenses Adjusted Net Income* increased primarily due to improved results at GES * Refer to Appendix for a discussion and reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure. $ MILLIONS, except per share data Q3’24 CHANGE VS. Q3’23 Revenue $455.7 $89.8 Pursuit Revenue 182.3 (4.7) GES Revenue 273.4 94.5 Net Income Attributable to Viad $48.6 $7.3 Adjusted Net Income* 58.8 15.5 Diluted EPS Attributable to Viad $1.65 $0.24 Adjusted Diluted EPS* 2.01 0.52 Consolidated Adjusted EBITDA* $103.1 $16.9 Pursuit Adjusted EBITDA* 86.3 (5.5) GES Adjusted EBITDA* 20.2 22.2 Corporate Adjusted EBITDA* (3.4) 0.1

7 PURSUIT Q3’24 YEAR-OVER-YEAR RESULTS * Refer to Appendix for a discussion and reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure. ** Same-Store metrics include only attractions and lodging properties that Pursuit operated at full capacity, considering seasonal closures, for the entirety of the 2024 and 2023 periods presented. Attractions and lodging properties located in Jasper National Park that were temporarily closed during Q3’24 due the Jasper wildfire are excluded. For experiences located outside the United States, financial metric comparisons to the prior year are expressed on a constant U.S. dollar basis. Note: Amounts may not add as presented due to rounding Excluding our Jasper properties, revenue increased 13% year-over-year Same-store attractions ticket revenue grew 16% primarily driven by higher effective ticket prices Same-store room revenue grew 9% with growth in ADR and strong occupancy Total Revenue decreased 2.5% year-over-year primarily due to the temporary closures and disruption caused by the Jasper wildfire Adjusted EBITDA decreased $5.5 million primarily due to lower revenue, combined with a year-over-year increase in certain general and operating costs PURSUIT ($ MILLIONS) Q3’24 CHANGE VS. Q3’23 Revenue: Excluding Jasper: Ticket Revenue $61.7 $10.4 Room Revenue 33.3 2.5 Food & Beverage 22.5 1.5 Retail Operations 21.7 1.1 Transportation and Other 9.5 1.8 Total Excluding Jasper $148.7 $17.2 Jasper Lodges & Attractions 33.6 (21.9) Total Revenue $182.3 $(4.7) Adjusted EBITDA* $86.3 $(5.5) Adjusted EBITDA Margin 47.4% (1.7)% Metrics: Attraction Visitors (000’s) 1,624.4 -3% Same-Store Attraction ETP** $51 14% Same-Store Hospitality RevPAR** $265 9%

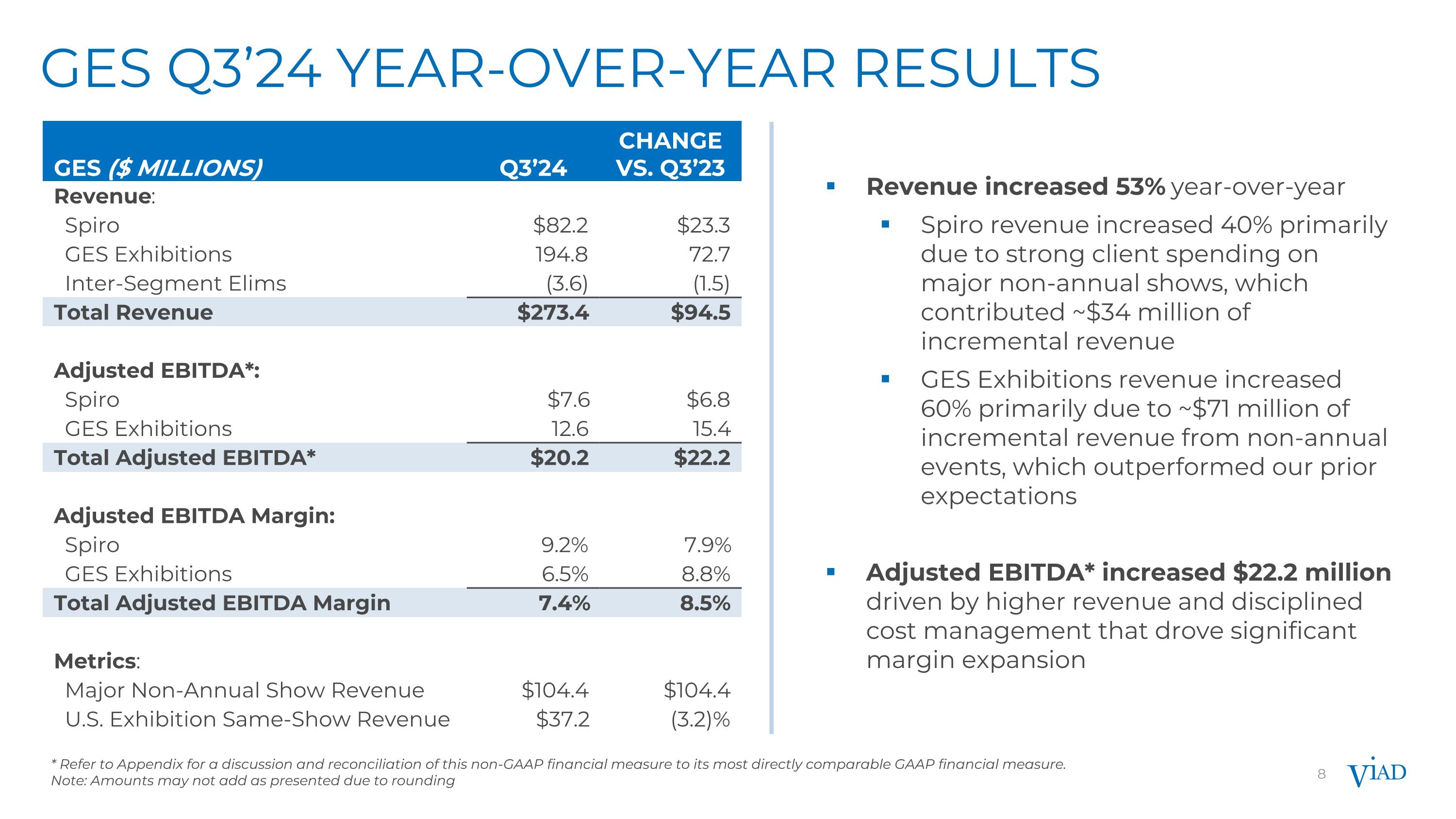

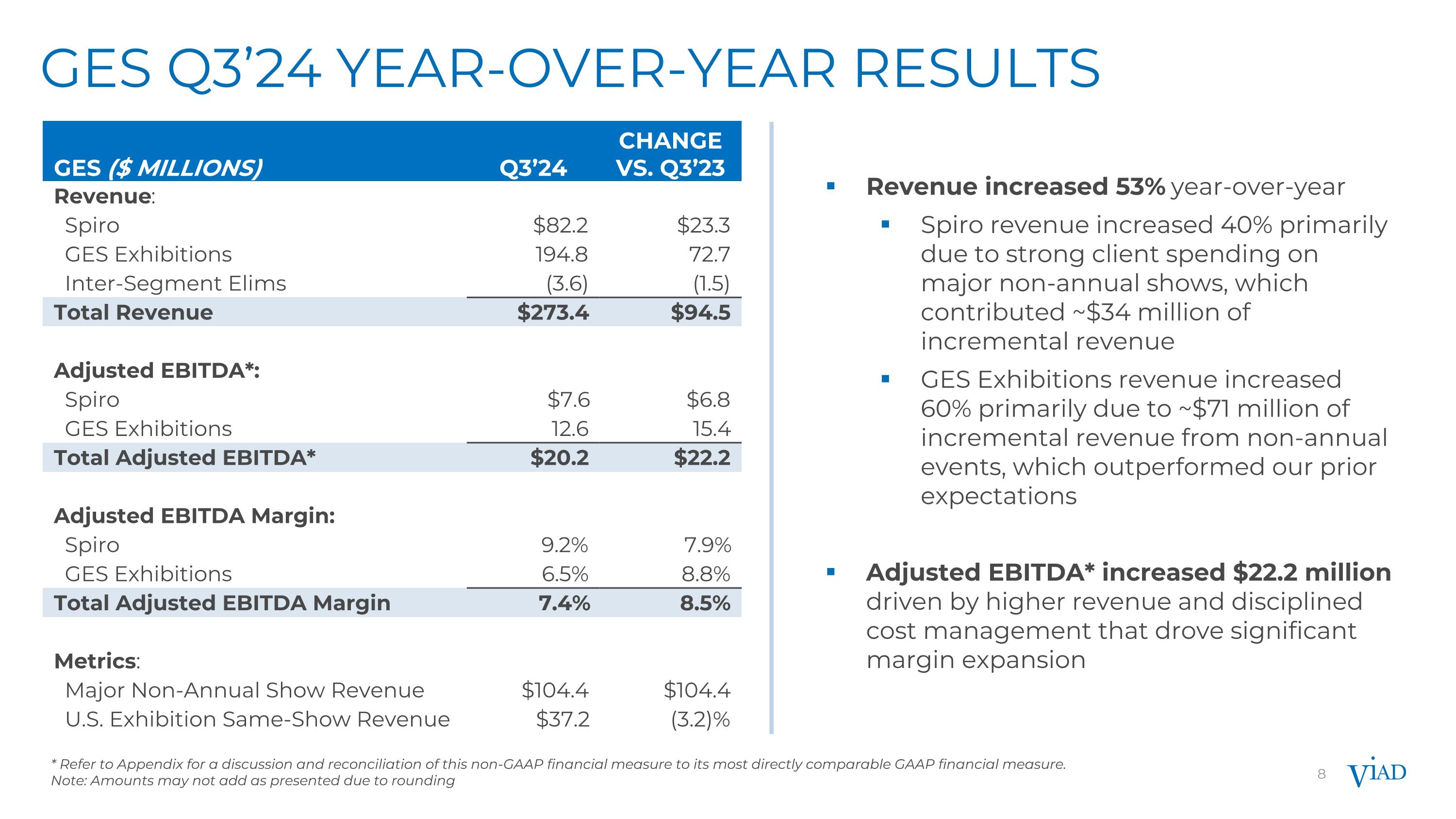

8 GES Q3’24 YEAR-OVER-YEAR RESULTS Revenue increased 53% year-over-year Spiro revenue increased 40% primarily due to strong client spending on major non-annual shows, which contributed ~$34 million of incremental revenue GES Exhibitions revenue increased 60% primarily due to ~$71 million of incremental revenue from non-annual events, which outperformed our prior expectations Adjusted EBITDA* increased $22.2 million driven by higher revenue and disciplined cost management that drove significant margin expansion GES ($ MILLIONS) Q3’24 CHANGE VS. Q3’23 Revenue: Spiro $82.2 $23.3 GES Exhibitions 194.8 72.7 Inter-Segment Elims (3.6) (1.5) Total Revenue $273.4 $94.5 Adjusted EBITDA*: Spiro $7.6 $6.8 GES Exhibitions 12.6 15.4 Total Adjusted EBITDA* $20.2 $22.2 Adjusted EBITDA Margin: Spiro 9.2% 7.9% GES Exhibitions 6.5% 8.8% Total Adjusted EBITDA Margin 7.4% 8.5% Metrics: Major Non-Annual Show Revenue $104.4 $104.4 U.S. Exhibition Same-Show Revenue $37.2 (3.2)% * Refer to Appendix for a discussion and reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure. Note: Amounts may not add as presented due to rounding

9 Cash Flow and Balance Sheet highlights *Capacity available on revolving credit facility is equal to $170M facility size less outstanding balance and letters of credit. Q3 Cash Flow Items $110M cash from operations $15M capex $94M net debt payments

FINANCIAL OUTLOOK – Q4’24 & FY’24 $ MILLIONS Q4’24 GUIDANCE FY’24 GUIDANCE Pursuit: Revenue Adjusted EBITDA $40 to $45 $(12) to $(7) Up low-single digits $87 to $92 GES: Revenue Adjusted EBITDA $200 to $215 $6 to $11 Up low-double digits $90 to $95 Consolidated: Revenue Adjusted EBITDA* Cash from Operations Capital Expenditures Effective Tax Rate $240 to $260 $(9) to $0 $(43) to $(33) $12 to $17 (includes ~$3 for growth) 1% to 2% Up high-single to low-double digits $163 to $172 $90 to $100 $65 to $70 (includes ~$20 for growth) 35% to 36% *Viad Consolidated Adjusted EBITDA represents segments less corporate.

PURSUIT’s REVENUE GROWTH REVENUE ($M) +4% Q3’23 YTD 4% YTD revenue growth despite Jasper wildfire impact 14% growth excluding Jasper properties for Q3’24 Jasper revenue decreased ~$22 million in Q3’24 due to fire disruption Key Drivers: Increased visitation with strong demand for iconic locations and unforgettable, inspiring experiences Improvements to guest experience Growth in effective ticket prices and ADR FlyOver Chicago opened March 1 Q3’24 YTD FY’23 FY’24 Est. ~361 - 366

PURSUIT’s Q3 YTD attraction PERFORMANCE TICKET REVENUE ($M) +12% 2023F 2024P 12% YTD ticket revenue growth with meaningful improvement in effective ticket prices and additional visitors Up 21% when removing Jasper attractions for Q3 Continued demand for our one-of-a-kind experiences and effective dynamic pricing strategy Sky Lagoon expansion (completed August 22nd) added capacity for coveted higher tier experience Stand-out performance from the Banff Gondola VISITORS (K) SAME-STORE ETP +5% +13% Note: Same-Store metrics include only attractions properties that Pursuit operated at full capacity, considering seasonal closures, for the entirety of the 2024 and 2023 periods presented. Attractions that were temporarily closed during Q3’24 due the Jasper wildfire are excluded for the third quarter of both periods presented. For experiences located outside the United States, financial metric comparisons to the prior year are expressed on a constant U.S. dollar basis. Banff Gondola Banff NP, Canada Jasper Q3 -33% All Other +21%

PURSUIT’s Q3 YTD HOSPITALITY PERFORMANCE ROOM REVENUE ($M) 2023F 2024P 8% YTD same-store RevPAR growth with strong increase in ADR All geographies outside of Jasper delivered growth in room revenue Perennial demand for our renowned experiential travel destinations and compression in the market SAME-STORE ADR SAME-STORE OCCUPANCY SAME-STORE REVPAR Note: Same-Store metrics include only lodging properties that Pursuit operated at full capacity, considering seasonal closures, for the entirety of the 2024 and 2023 periods presented. Lodging properties that were temporarily closed due the Jasper wildfire are excluded. For experiences located outside the United States, financial metric comparisons to the prior year are expressed on a constant U.S. dollar basis. Prince of Wales Hotel Waterton Lakes NP, Canada +8% +8% Jasper Q3 -26% All Other +8%

PURSUIT’s Adjusted EbitdA ADJUSTED EBITDA* ($M) Solid Adjusted EBITDA performance despite Jasper wildfire impact Expect strong growth in 2025 Adjusted EBITDA in excess of $100M including estimated run-rate stand-alone public company costs of $12M to $13M Key Drivers: Higher attraction visitation with strong throughput Revenue management to optimize price/volume Prudent labor and expense management Q3’23 YTD Q3’24 YTD FY’23 FY’24 Est. * Refer to Appendix for a discussion and reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure. ~87-92 FY’25 Est.

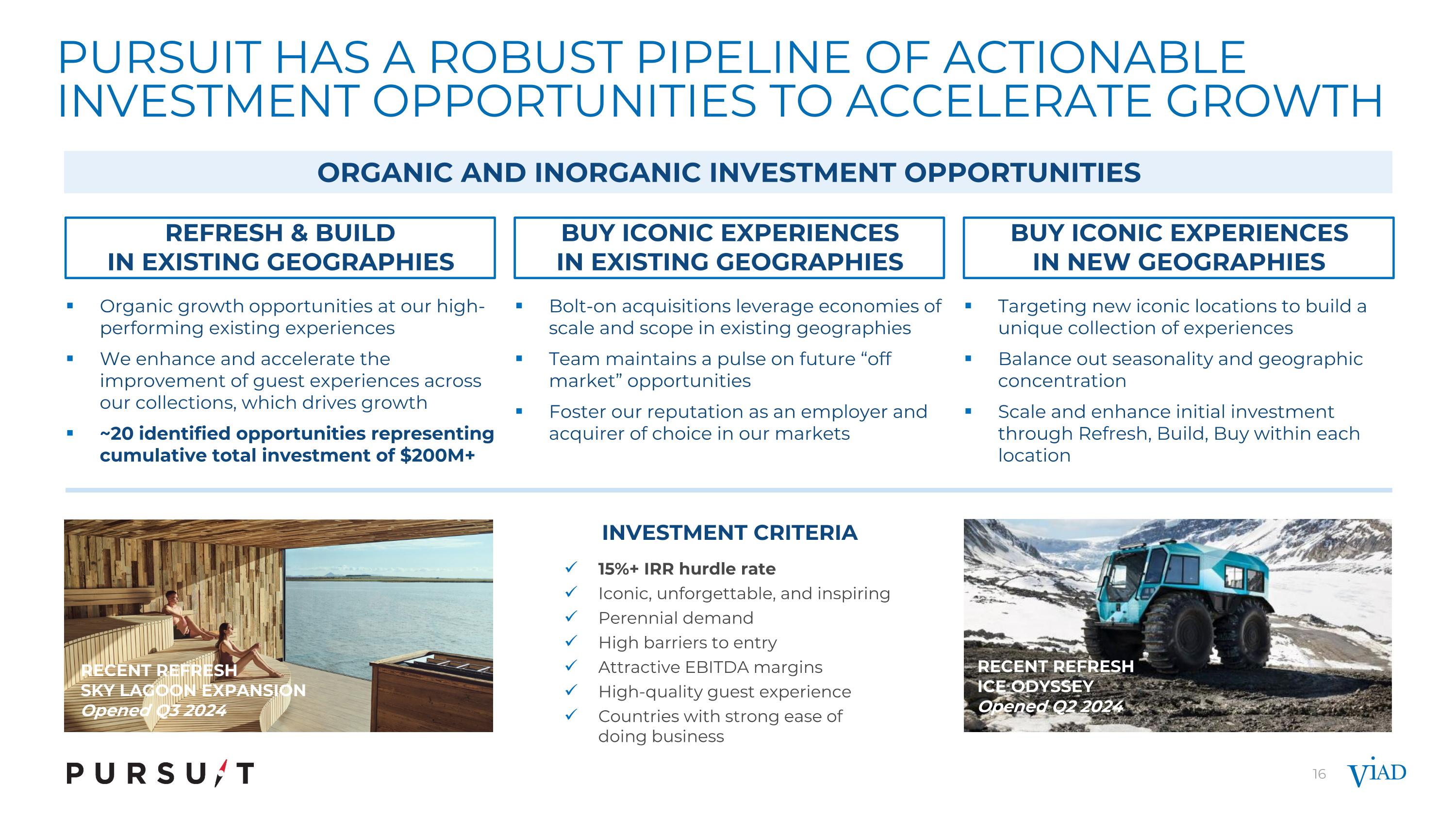

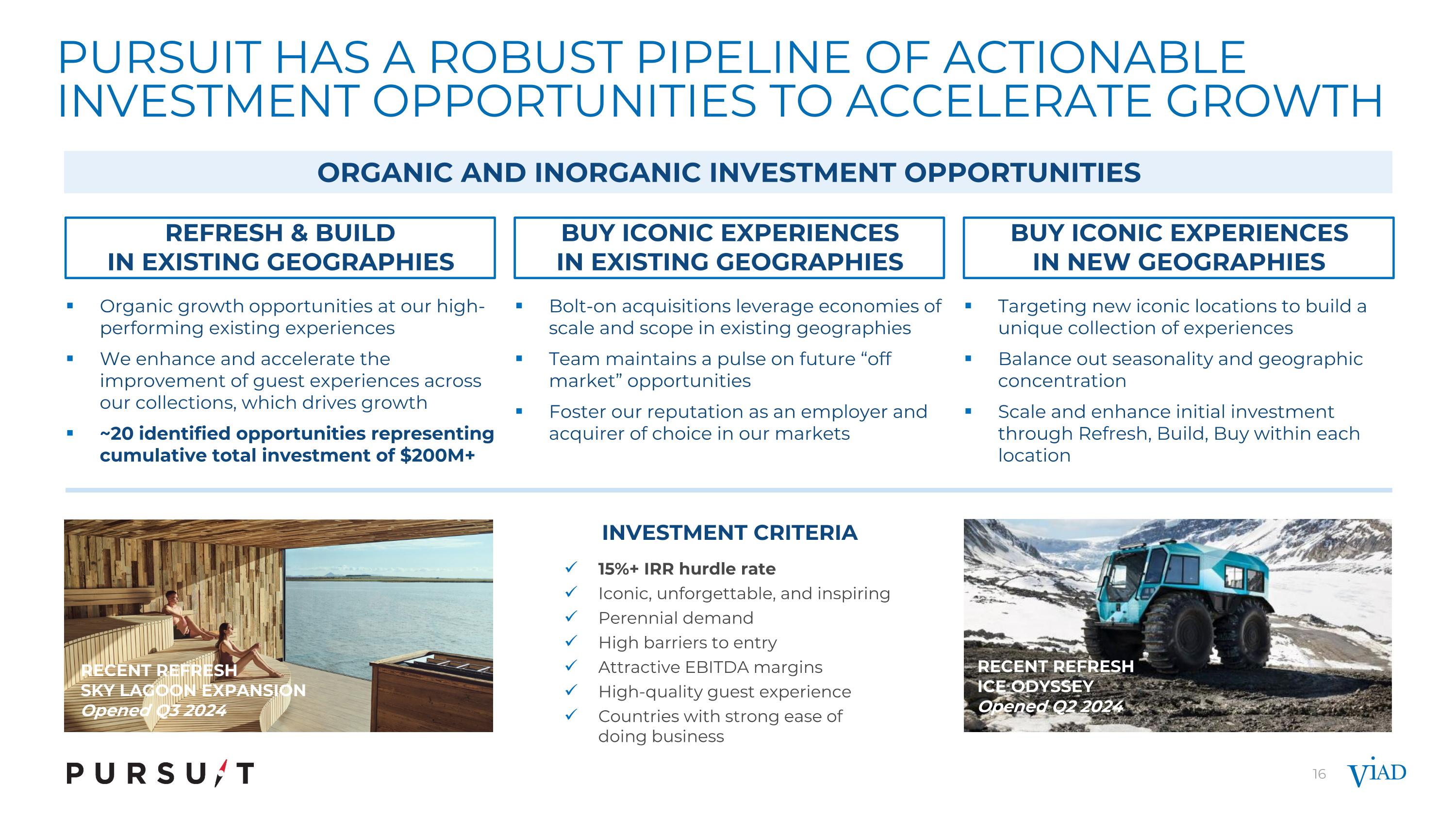

PURSUIT has a ROBUST pipeline of ACTIONABLE investment opportunities to accelerate growth INVESTMENT CRITERIA 15%+ IRR hurdle rate Iconic, unforgettable, and inspiring Perennial demand High barriers to entry Attractive EBITDA margins High-quality guest experience Countries with strong ease of doing business BUY ICONIC EXPERIENCES IN NEW GEOGRAPHIES Targeting new iconic locations to build a unique collection of experiences Balance out seasonality and geographic concentration Scale and enhance initial investment through Refresh, Build, Buy within each location BUY ICONIC EXPERIENCES IN EXISTING GEOGRAPHIES Bolt-on acquisitions leverage economies of scale and scope in existing geographies Team maintains a pulse on future “off market” opportunities Foster our reputation as an employer and acquirer of choice in our markets REFRESH & BUILD IN EXISTING GEOGRAPHIES RECENT REFRESH SKY LAGOON EXPANSION Opened Q3 2024 Organic growth opportunities at our high-performing existing experiences We enhance and accelerate the improvement of guest experiences across our collections, which drives growth ~20 identified opportunities representing cumulative total investment of $200M+ organic and inorganic investment opportunities RECENT REFRESH ICE ODYSSEY Opened Q2 2024

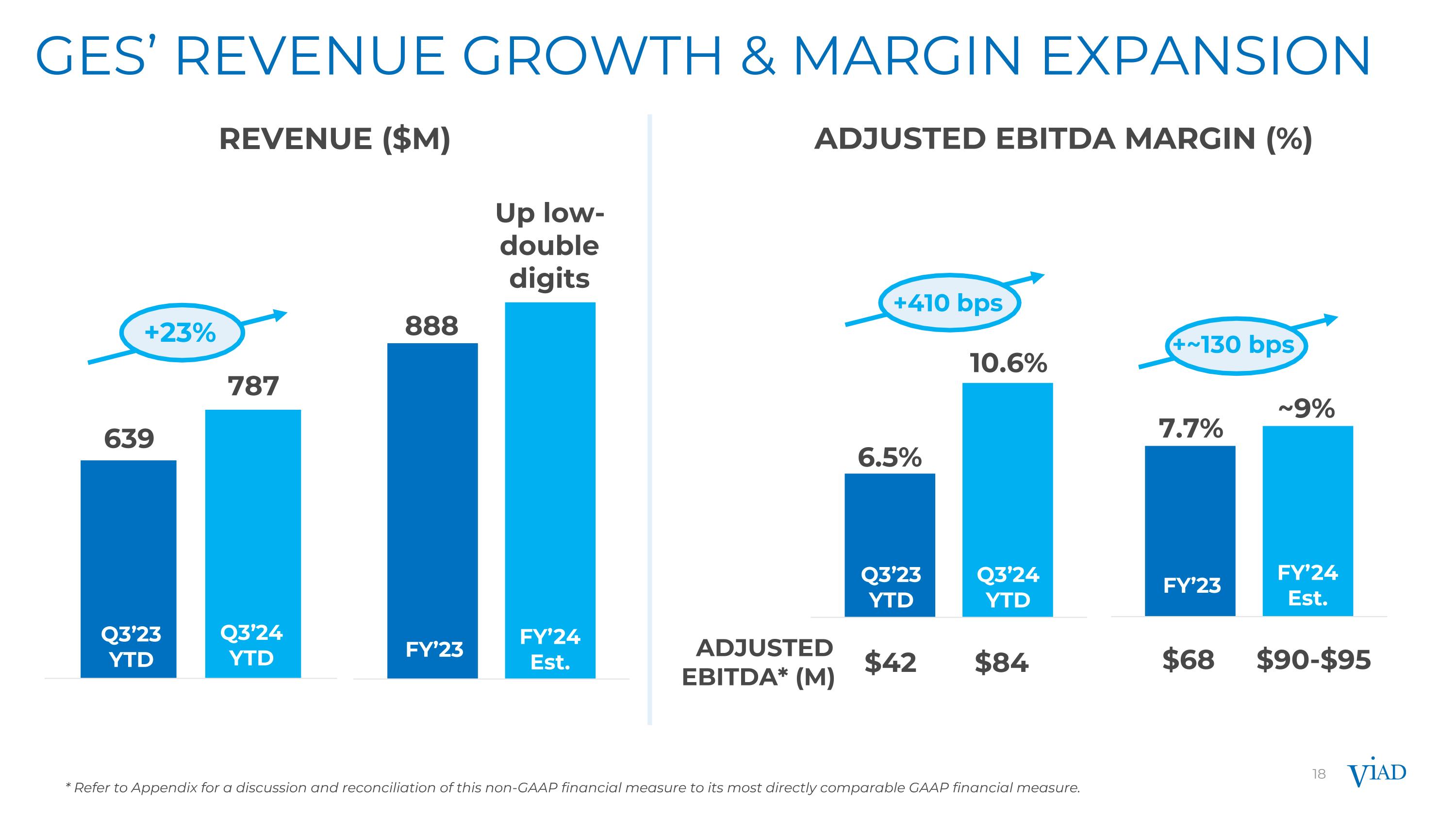

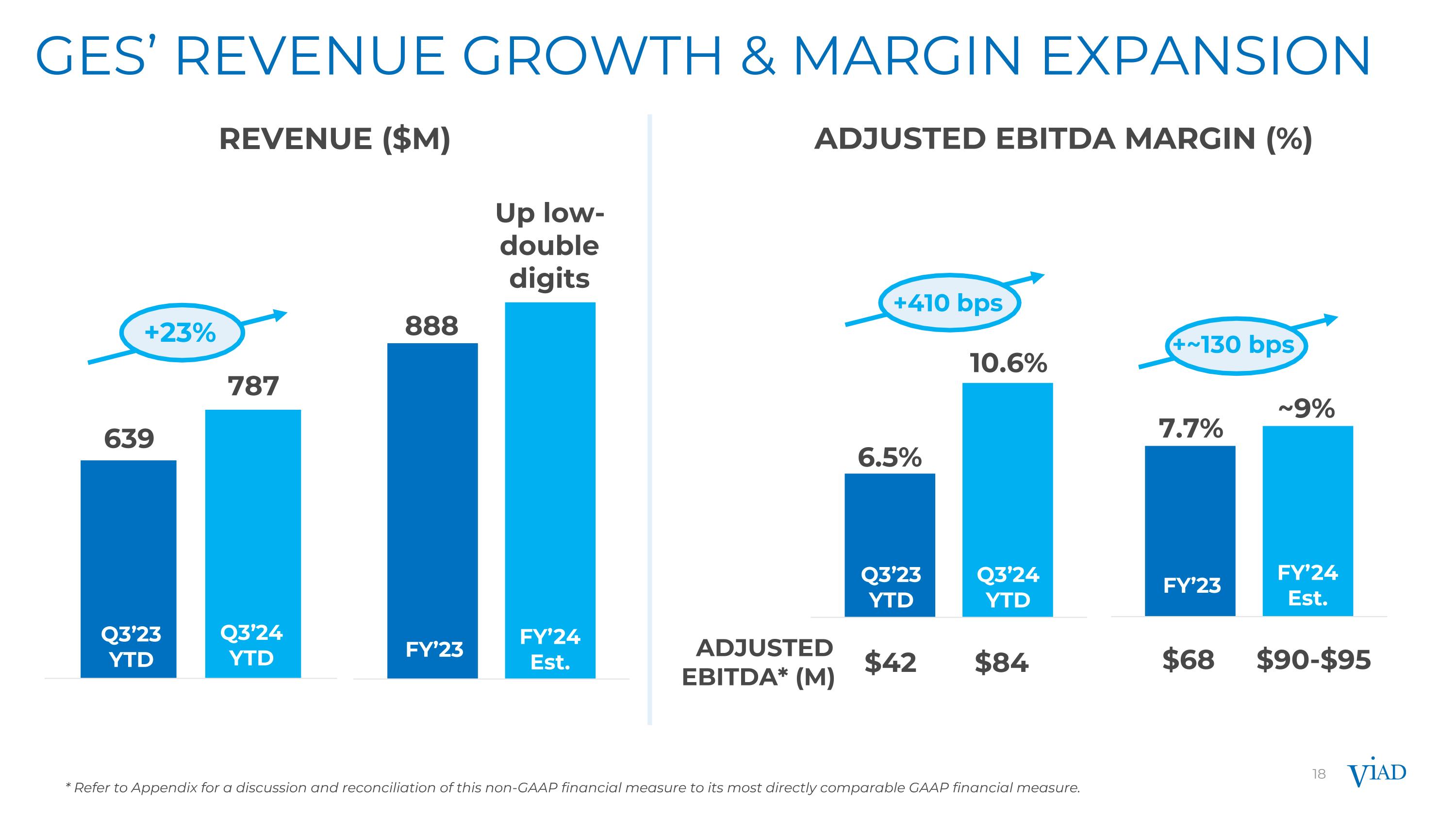

GES’ REVENUE GROWTH & MARGIN EXPANSION Q3’23 YTD Q3’24 YTD FY’23 FY’24 Est. REVENUE ($M) +23% Up low-double digits ADJUSTED EBITDA MARGIN (%) ADJUSTED EBITDA* (M) Q3’23 YTD Q3’24 YTD +~130 bps FY’23 FY’24 Est. +410 bps $42 $84 $68 $90-$95 * Refer to Appendix for a discussion and reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure.

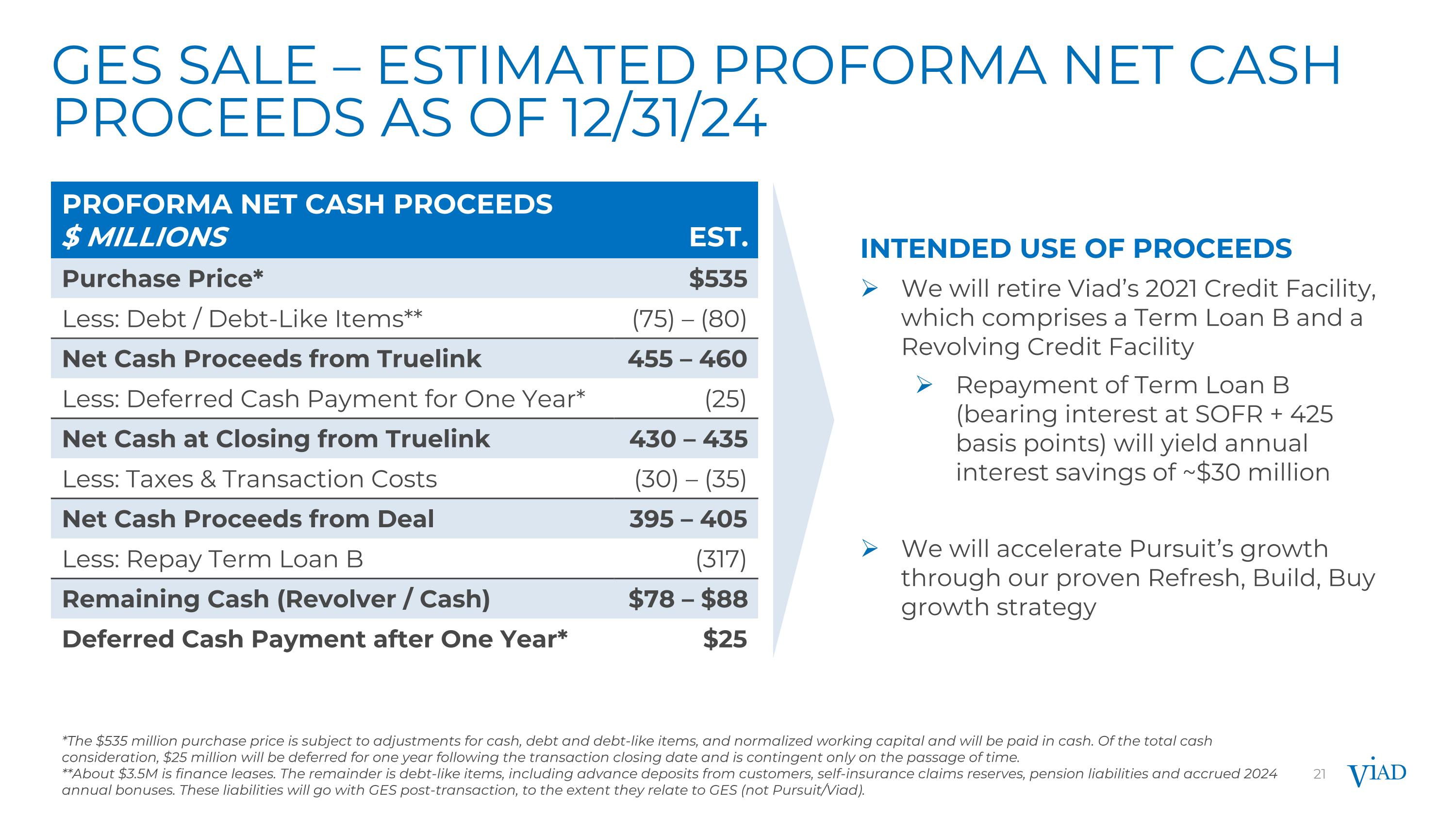

Sale of GES Business to TrueLink for $535M�Expected to Close on December 31, 2024 Both businesses to gain execution flexibility and better allocate growth capital Pursuit becomes a standalone, pure-play attractions and hospitality company with new capital and balance sheet capacity to accelerate REFRESH, BUILD, BUY growth strategy Eliminates Viad’s higher cost debt and establishes balance sheet optimized for enhanced growth, with low leverage, an excess cash position and new undrawn revolver for opportunistic M&A Follows Board’s thorough evaluation of paths to maximize shareholder value and robust transaction process All cash offer of $535M, subject to transaction-related adjustments for cash, debt and debt-like items, and working capital, inclusive of $25M deferred for one year Net proceeds will be used to fully retire Viad’s existing Term Loan B and revolver, and to fund near-term growth initiatives for Pursuit Transaction benefits TRANSACTION DETAILS VIAD TO CHANGE CORPORATE NAME AND RELAUNCH AS PURSUIT (NYSE: PRSU) FOLLOWING CLOSE

APPENDIX

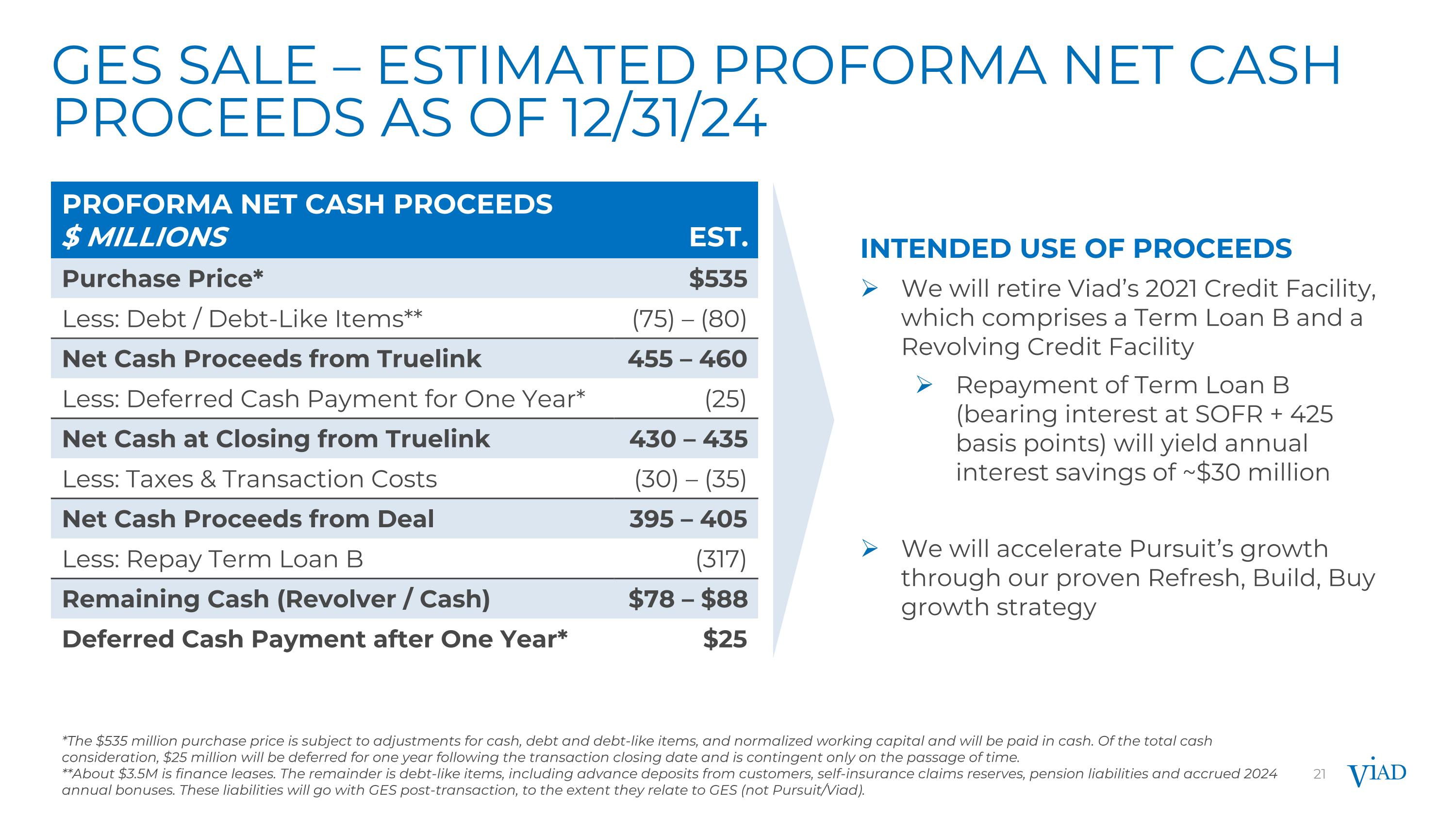

21 GES SALE – ESTIMATED proforma net cash proceeds AS OF 12/31/24 PROFORMA NET CASH PROCEEDS $ MILLIONS EST. Purchase Price* $535 Less: Debt / Debt-Like Items** (75) – (80) Net Cash Proceeds from Truelink 455 – 460 Less: Deferred Cash Payment for One Year* (25) Net Cash at Closing from Truelink 430 – 435 Less: Taxes & Transaction Costs (30) – (35) Net Cash Proceeds from Deal 395 – 405 Less: Repay Term Loan B (317) Remaining Cash (Revolver / Cash) $78 – $88 Deferred Cash Payment after One Year* $25 INTENDED USE OF PROCEEDS We will retire Viad’s 2021 Credit Facility, which comprises a Term Loan B and a Revolving Credit Facility Repayment of Term Loan B (bearing interest at SOFR + 425 basis points) will yield annual interest savings of ~$30 million We will accelerate Pursuit’s growth through our proven Refresh, Build, Buy growth strategy *The $535 million purchase price is subject to adjustments for cash, debt and debt-like items, and normalized working capital and will be paid in cash. Of the total cash consideration, $25 million will be deferred for one year following the transaction closing date and is contingent only on the passage of time. **About $3.5M is finance leases. The remainder is debt-like items, including advance deposits from customers, self-insurance claims reserves, pension liabilities and accrued 2024 annual bonuses. These liabilities will go with GES post-transaction, to the extent they relate to GES (not Pursuit/Viad).

FORWARD-LOOKING NON-GAAP FINANCIAL MEASURES We have also provided forward−looking guidance for Adjusted EBITDA, a non−GAAP financial measure. We do not provide a reconciliation of the forward−looking guidance of Adjusted EBITDA, a non−GAAP financial measure, to the most directly comparable GAAP financial measure because, due to variability and difficulty in making accurate forecasts and projections and/or certain information not being ascertainable or accessible, not all of the information necessary for quantitative reconciliations is available to us without unreasonable efforts. Consequently, any attempt to disclose such reconciliations would imply a degree of precision that could be confusing or misleading to investors. It is possible that the forward−looking non−GAAP financial measure may be materially different from the corresponding forward-looking GAAP financial measure. NON-GAAP FINANCIAL RECONCILIATION Includes costs primarily related to the development of Pursuit's new FlyOver attraction in Chicago. Includes non-capitalizable fees and expenses related to Viad’s shelf registration in 2024 and Viad’s credit facility refinancing efforts in 2023. Remeasurement of finance lease obligation represents the non-cash foreign exchange loss/(gain) included within Cost of Services related to the periodic remeasurement of the Sky Lagoon finance lease obligation. Corporate Adjusted EBITDA is calculated as Corporate activities expense before depreciation, transaction-related costs and other non-recurring costs included within Corporate activities expense.

NON-GAAP FINANCIAL RECONCILIATION Remeasurement of finance lease obligation attributable to Viad represents the non-cash foreign exchange loss/(gain) included within Cost of Services related to the periodic remeasurement of the Sky Lagoon finance lease obligation that is attributed to Viad’s 51% interest in Sky Lagoon.

24 Pursuit key performance metrics * Same-Store metrics include only attractions and lodging properties that Pursuit operated at full capacity, considering seasonal closures, for the entirety of the 2024 and 2023 periods presented. Attractions and lodging properties that were temporarily closed due the Jasper wildfire are excluded. For experiences located outside the United States, financial metric comparisons to the prior year are expressed on a constant U.S. dollar basis.

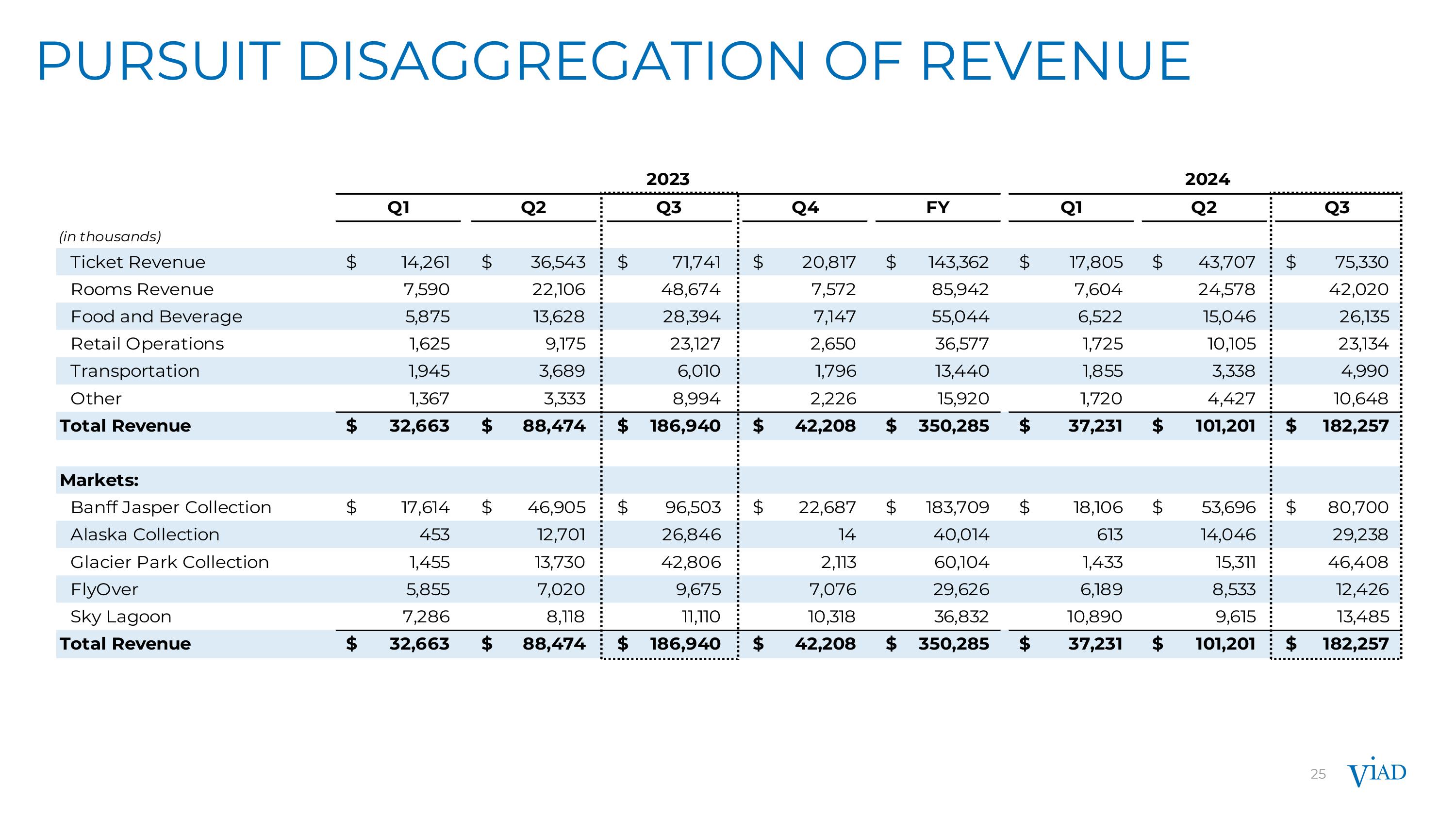

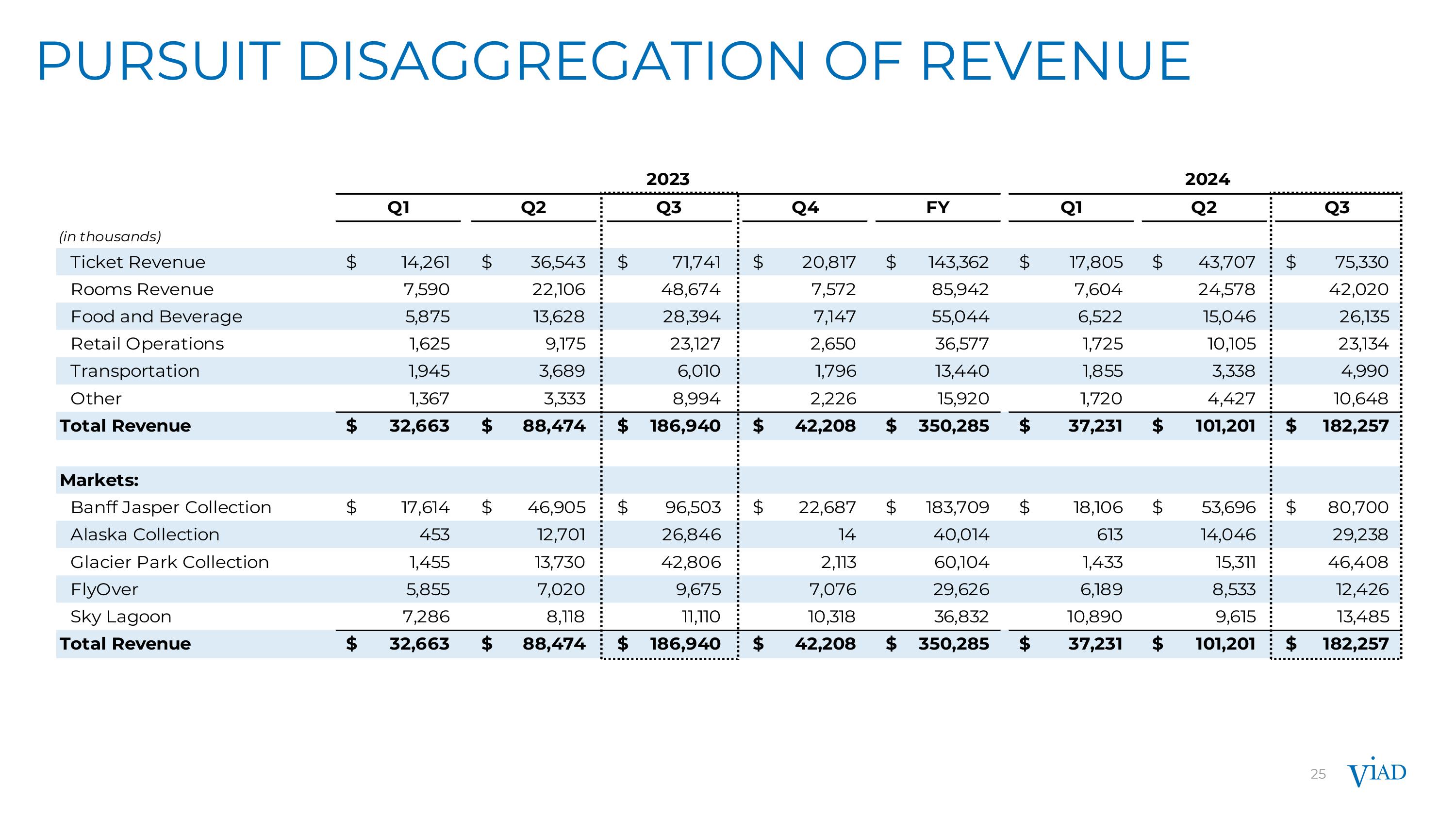

25 Pursuit disaggregation of revenue