INVESTOR PRESENTATION JUNE 2021 Exhibit 99.1

Forward-looking statements This presentation contains a number of forward-looking statements. Words, and variations of words, such as “will,” “may,” “expect,” “would,” “could,” “might,” “intend,” “plan,” “believe,” “estimate,” “anticipate,” “deliver,” “seek,” “aim,” “potential,” “target,” “outlook,” and similar expressions are intended to identify our forward-looking statements. Similarly, statements that describe our business strategy, outlook, objectives, plans, initiatives, intentions or goals also are forward looking statements. These forward-looking statements are not historical facts and are subject to a host of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those in the forward-looking statements. Important factors that could cause actual results to differ materially from those described in our forward-looking statements include, but are not limited to, the following: the impact of the COVID-19 pandemic on our financial condition, liquidity, and cash flow; our ability to anticipate and adjust for the impact of the COVID-19 pandemic on our businesses; general economic uncertainty in key global markets and a worsening of global economic conditions; travel industry disruptions; our ability to successfully integrate and achieve established financial and strategic goals from acquisitions; our dependence on large exhibition event clients; the importance of key members of our account teams to our business relationships; the competitive nature of the industries in which we operate; unanticipated delays and cost overruns of our capital projects, and our ability to achieve established financial and strategic goals for such projects; seasonality of our businesses; transportation disruptions and increases in transportation costs; natural disasters, weather conditions, and other catastrophic events; our multi-employer pension plan funding obligations; our exposure to labor cost increases and work stoppages related to unionized employees; liabilities relating to prior and discontinued operations; adverse effects of show rotation on our periodic results and operating margins; our exposure to currency exchange rate fluctuations; our exposure to cybersecurity attacks and threats; compliance with laws governing the storage, collection, handling, and transfer of personal data and our exposure to legal claims and fines for data breaches or improper handling of such data; and changes affecting the London Inter-bank Offered Rate (“LIBOR”) and the Canadian Dollar Offered Rate (“CDOR”). For a more complete discussion of the risks and uncertainties that may affect our business or financial results, please see Item 1A, “Risk Factors,” of our most recent annual report on Form 10-K filed with the SEC. We disclaim and do not undertake any obligation to update or revise any forward-looking statement in this presentation except as required by applicable law or regulation. 2

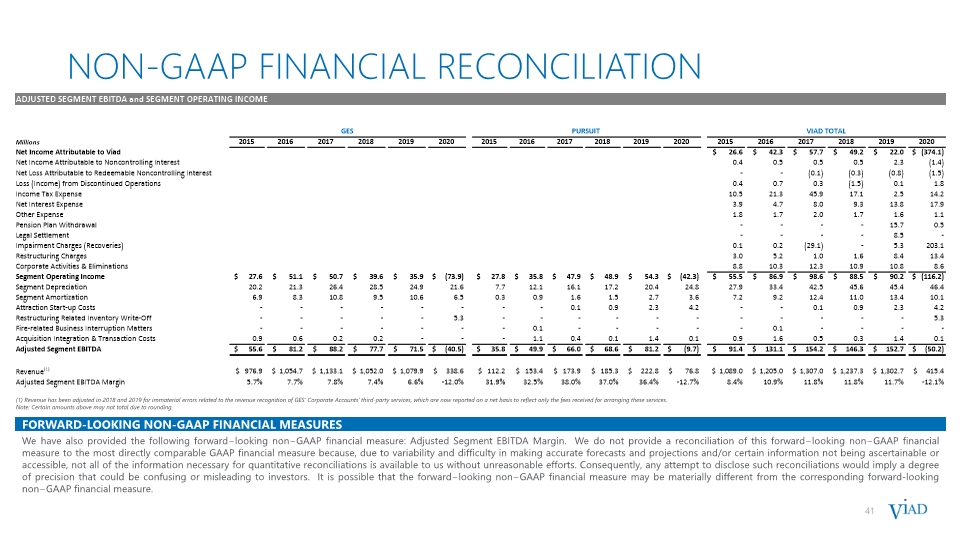

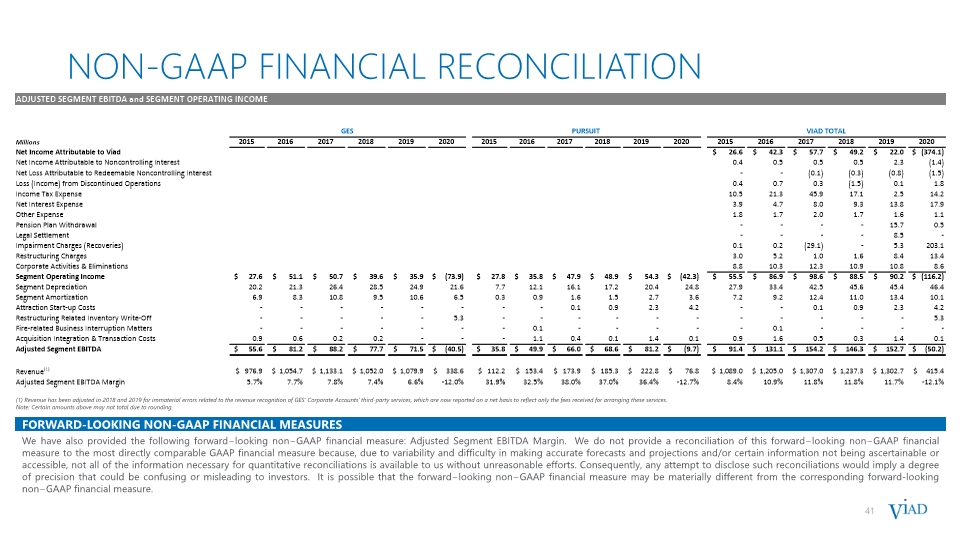

NON-GAAP FINANCIAL MEASURES This document includes the presentation of “Adjusted Segment EBITDA”, which is supplemental to results presented under accounting principles generally accepted in the United States of America (“GAAP”) and may not be comparable to similarly titled measures presented by other companies. This non-GAAP measure should be considered in addition to, but not as a substitute for, other similar measures reported in accordance with GAAP. The use of this non-GAAP financial measure is limited, compared to the GAAP measure of net income attributable to Viad, because it does not consider a variety of items affecting Viad’s consolidated financial performance as explained below. Because this non-GAAP measure does not consider all items affecting Viad’s consolidated financial performance, a user of Viad’s financial information should consider net income attributable to Viad as an important measure of financial performance because it provides a more complete measure of the Company’s performance. Adjusted Segment EBITDA is defined by management as net income attributable to Viad before income (loss) from discontinued operations, corporate activities, interest expense and interest income, income taxes, segment depreciation and amortization, segment acquisition-related costs, attraction start-up costs, restructuring charges, impairment losses, and the reduction/increase for income/loss attributable to non-redeemable and redeemable non-controlling interests. Adjusted Segment EBITDA is considered a useful operating metric, in addition to net income attributable to Viad, as potential variations arising from non-recurring integration costs, non-cash amortization and depreciation, and non-operational expenses/income are eliminated, thus resulting in an additional measure considered to be indicative of Viad’s segment performance. Management believes that the presentation of Adjusted Segment EBITDA provides useful information to investors regarding Viad’s results of operations for trending, analyzing and benchmarking the performance and value of Viad’s business. 3

Leading and defensible market positions Delivered strong growth from 2015 - 2019 Strong liquidity and financial flexibility Opportunity to continue investing for growth 5 INVESTMENT HIGHLIGHTS High-quality businesses with leading market positions in experiential leisure travel and experiential B2B events Track-record of creating significant shareholder value through strategic execution Strong liquidity position and financial flexibility to endure pandemic and resume growth Capitalizing on pandemic disruption to strengthen leading market positions Experienced management team positioning company for post-COVID-19 success Significantly scale Pursuit Improve GES margin profile

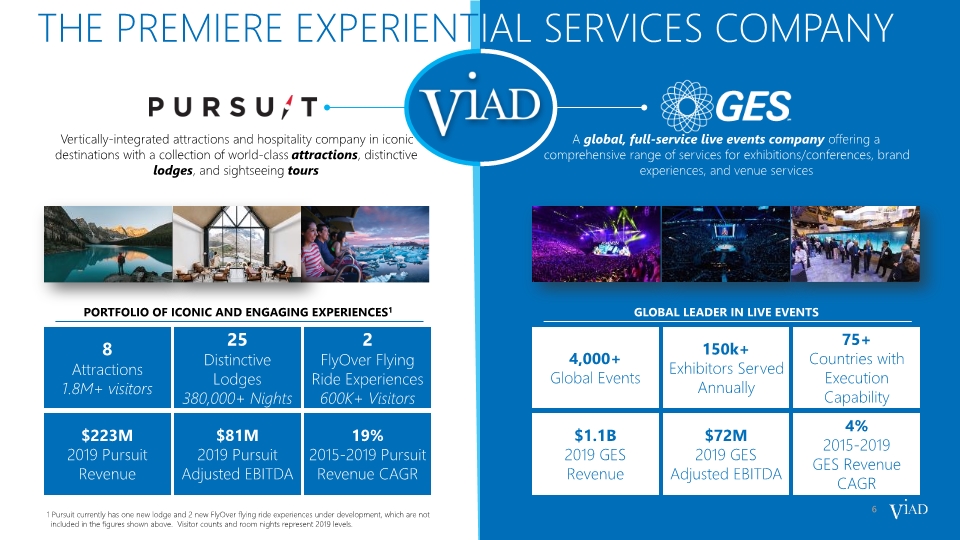

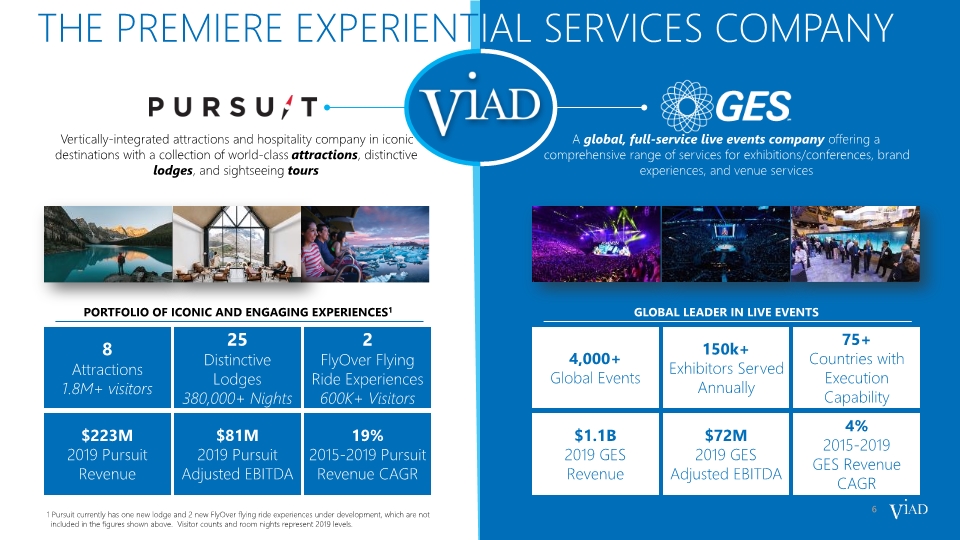

6 Vertically-integrated attractions and hospitality company in iconic destinations with a collection of world-class attractions, distinctive lodges, and sightseeing tours A global, full-service live events company offering a comprehensive range of services for exhibitions/conferences, brand experiences, and venue services GLOBAL LEADER IN LIVE EVENTS 2 FlyOver Flying Ride Experiences 600K+ Visitors 25 Distinctive Lodges 380,000+ Nights 8 Attractions 1.8M+ visitors 4,000+ Global Events 75+ Countries with Execution Capability 150k+ Exhibitors Served Annually the Premiere experiential services company 6 19% 2015-2019 Pursuit Revenue CAGR $81M 2019 Pursuit Adjusted EBITDA $223M 2019 Pursuit Revenue $1.1B 2019 GES Revenue 4% 2015-2019 GES Revenue CAGR $72M 2019 GES Adjusted EBITDA PORTFOLIO OF ICONIC AND ENGAGING EXPERIENCES1 1 Pursuit currently has one new lodge and 2 new FlyOver flying ride experiences under development, which are not included in the figures shown above. Visitor counts and room nights represent 2019 levels.

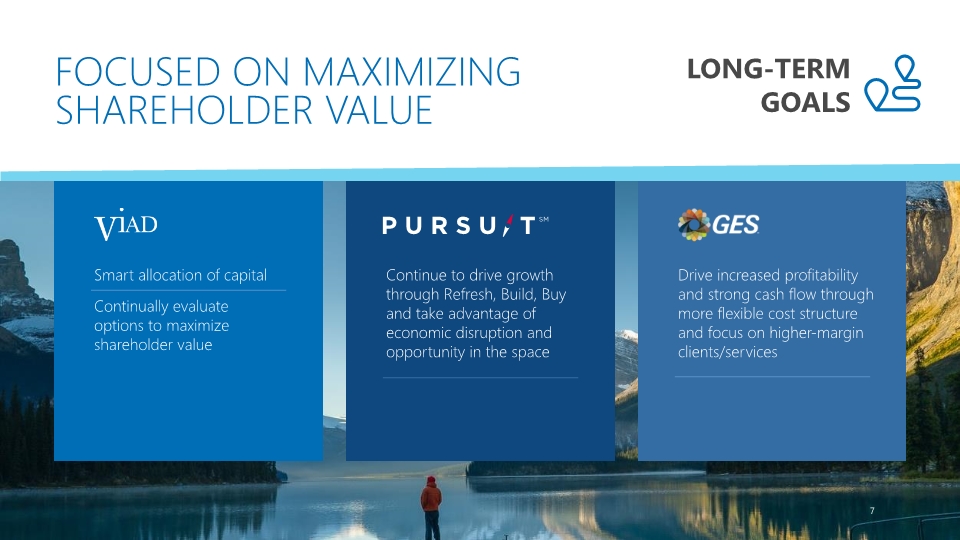

FOCUSED ON MAXIMIZING SHAREHOLDER VALUE Smart allocation of capital Continually evaluate options to maximize shareholder value Continue to drive growth through Refresh, Build, Buy and take advantage of economic disruption and opportunity in the space LONG-TERM GOALS Drive increased profitability and strong cash flow through more flexible cost structure and focus on higher-margin clients/services 7

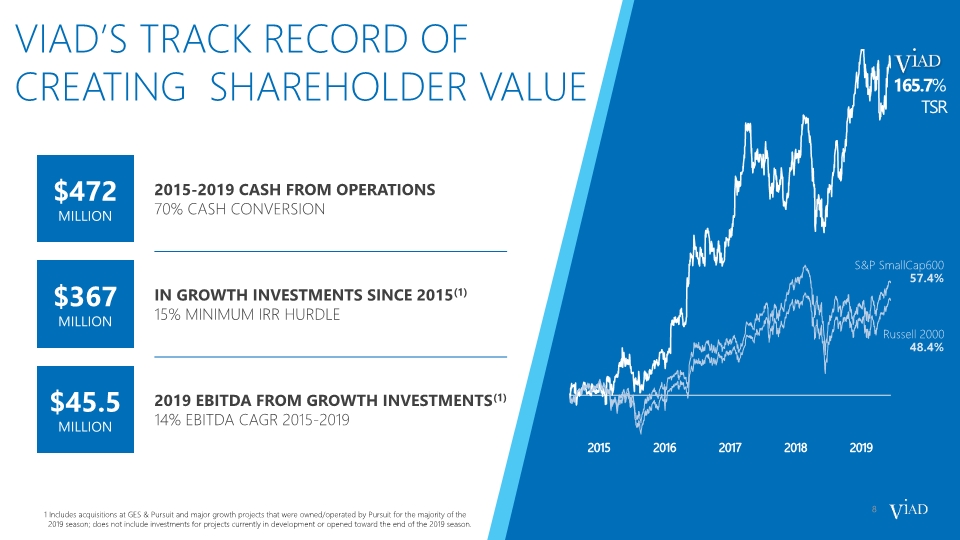

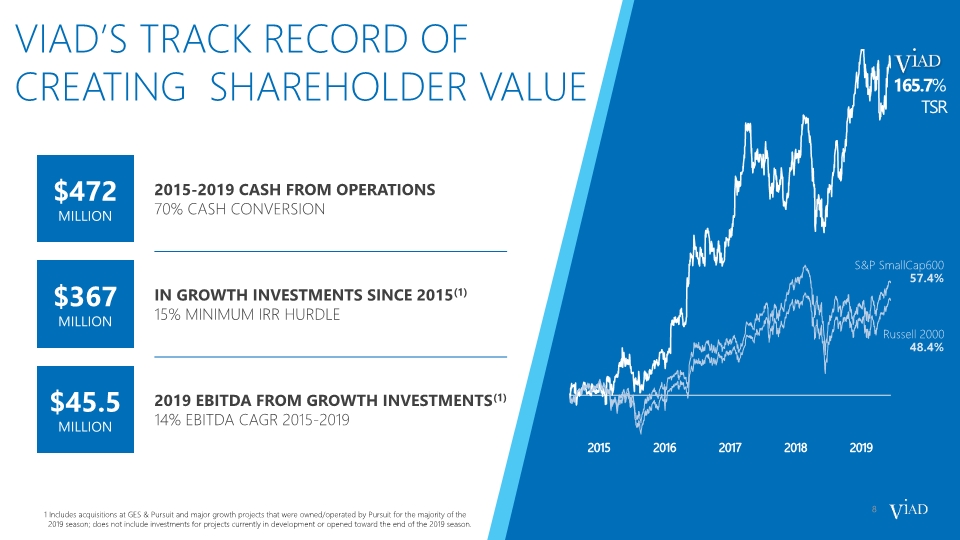

165.7% TSR S&P SmallCap600 57.4% Russell 2000 48.4% Viad’S TRACK RECORD OF CREATING shareholder value 2015-2019 CASH FROM OPERATIONS 70% CASH CONVERSION IN GROWTH INVESTMENTS SINCE 2015(1) 15% MINIMUM IRR HURDLE $472 MILLION $367 MILLION 8 1 Includes acquisitions at GES & Pursuit and major growth projects that were owned/operated by Pursuit for the majority of the 2019 season; does not include investments for projects currently in development or opened toward the end of the 2019 season. 2019 EBITDA FROM GROWTH INVESTMENTS(1) 14% EBITDA CAGR 2015-2019 $45.5 MILLION

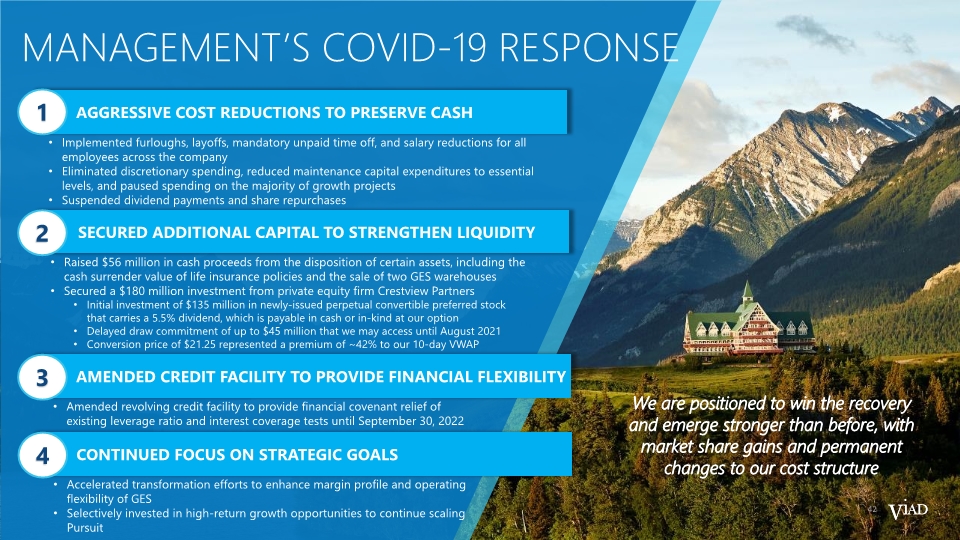

covid-19 IMPACT The COVID-19 pandemic caused a halt to in-person exhibitions, conferences and corporate events, and a significant slow-down in leisure travel We took swift and significant actions to reduce costs, bolster liquidity and provide financial flexibility to ensure our business endured the effects of the pandemic while also funding select Pursuit growth investments Leisure travel and in-person events are beginning to recover as vaccination rates increase, pandemic-related restrictions lessen, and people feel more comfortable traveling and gathering We are positioned to win the recovery and emerge stronger than before, with market share gains and permanent changes to our cost structure 9 14% CAGR from 2015-19 EBITDA expected to return to near 2019 levels by 2022 and surpass 2019 levels by 2023 + Substantial recovery in leisure travel by 2022 + New experiences opened at Pursuit + Recovery of in-person events beginning 2H’21 Adjusted Segment EBITDA ($M)

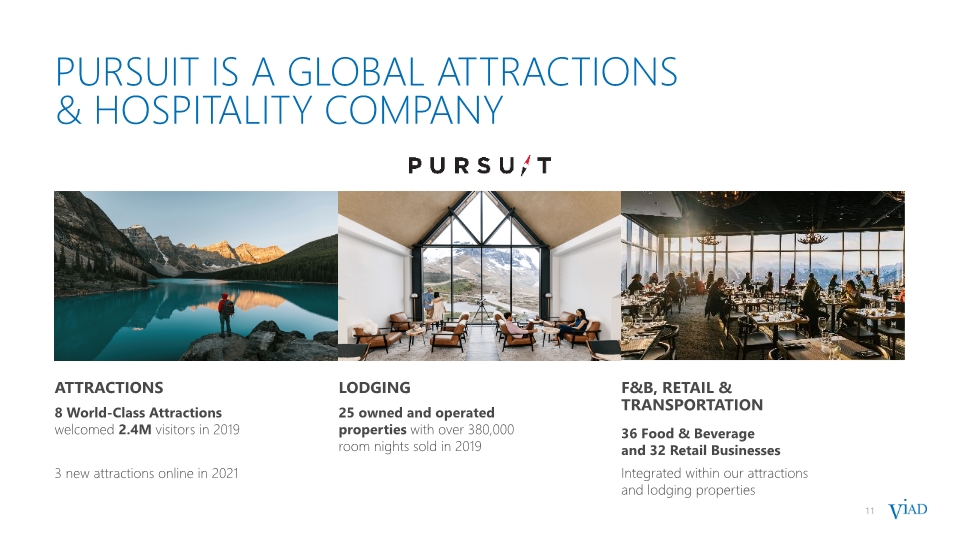

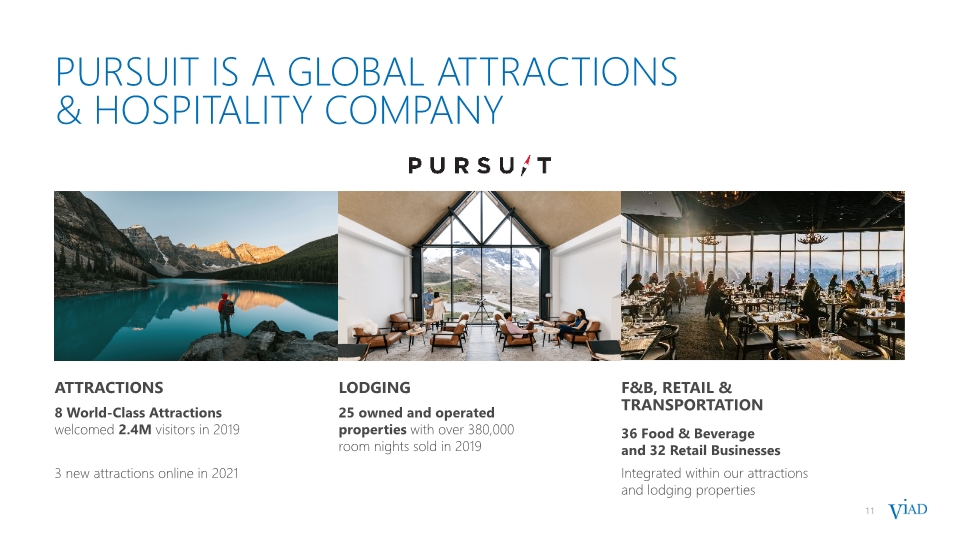

11 ATTRACTIONS LODGING F&B, RETAIL & TRANSPORTATION 8 World-Class Attractions welcomed 2.4M visitors in 2019 3 new attractions online in 2021 25 owned and operated properties with over 380,000 room nights sold in 2019 36 Food & Beverage and 32 Retail Businesses Integrated within our attractions and lodging properties PURSUIT IS A global ATTRACTIONS & HOSPITALITY company

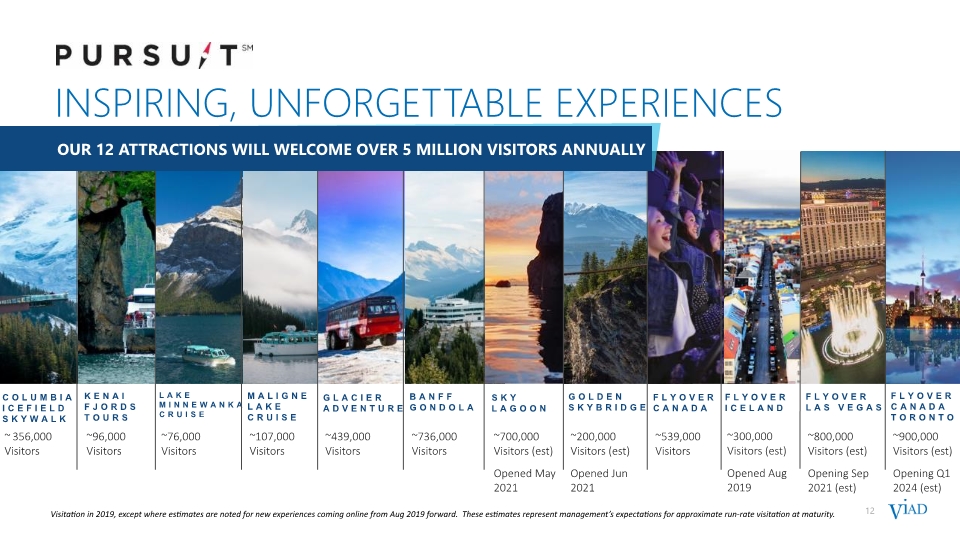

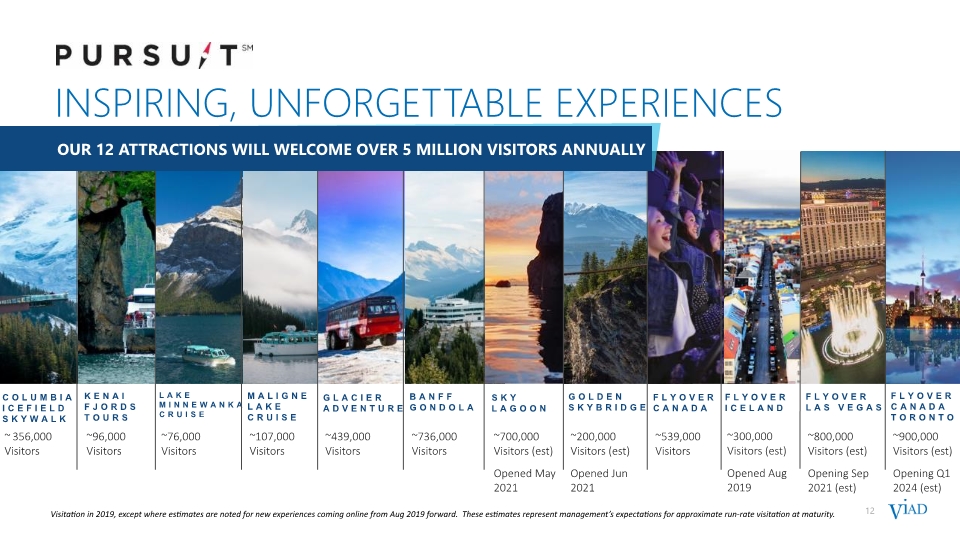

12 Visitation in 2019, except where estimates are noted for new experiences coming online from Aug 2019 forward. These estimates represent management’s expectations for approximate run-rate visitation at maturity. Lake Minnewanka CRUISE Kenai FJORDS TOURS Columbia ICEFIELD Skywalk Maligne Lake CRUISE GLACIER ADVENTURE BANFF GONDOLA FLYOVER LAS VEGAS FLYOVER CANADA TORONTO SKY LAGOON ~76,000 Visitors ~96,000 Visitors ~356,000 Visitors ~ 107,000 Visitors ~439,000 Visitors ~736,000 Visitors ~800,000 Visitors (est) Opening Sep 2021 (est) ~900,000 Visitors (est) Opening Q1 2024 (est) ~700,000 Visitors (est) Opened May 2021 INSPIRING, UNFORGETTABLE EXPERIENCES FlyOver Canada GOLDEN SKYBRIDGE ~539,000 Visitors ~200,000 Visitors (est) Opened Jun 2021 FlyOver iceland ~300,000 Visitors (est) Opened Aug 2019

13 INSPIRING, UNFORGETTABLE EXPERIENCES 1. Marmot Lodge currently has 107 guest rooms, 29 of which are expected to be converted to staff accommodation when the 78 Connaught property comes online. * Denotes a property that operates seasonally (generally closed from October - April)

Banff National Park Jasper National Park ~6.5M Visitors Denali National Park Kenai Fjords National Park ~1M Visitors Glacier National Park Waterton Lakes National Park ~3.5M Visitors Vancouver British Columbia ~11M Visitors Reykjavik Iceland ~2M Visitors Market visitation statistic sources: Tourism Vancouver (2019); Parks Canada (2019); U.S. National Park Service (2019); Icelandic Tourist Board (2019); Las Vegas Convention and Visitors Authority (Las Vegas 2019) 14 Pursuit operates in ICONIC Global Locations Las vegas ~40M Visitors

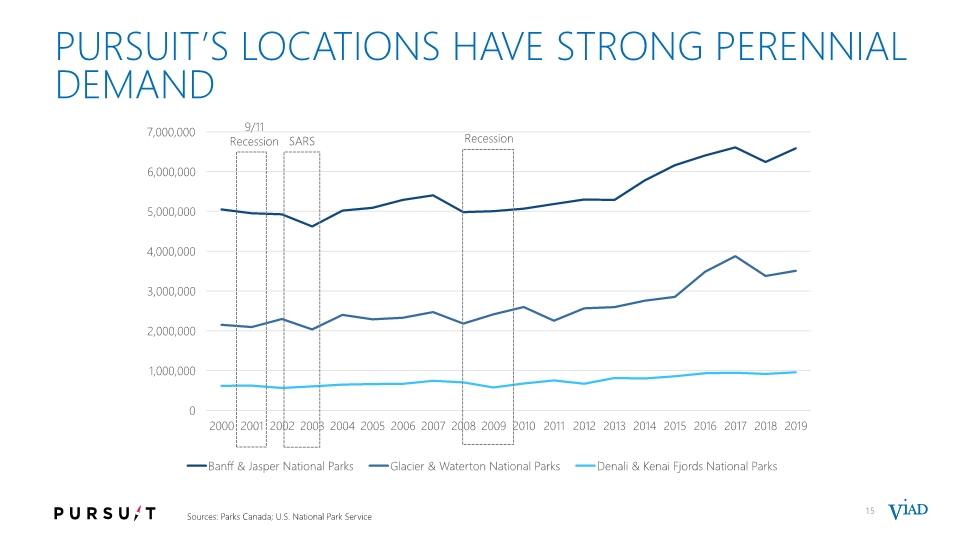

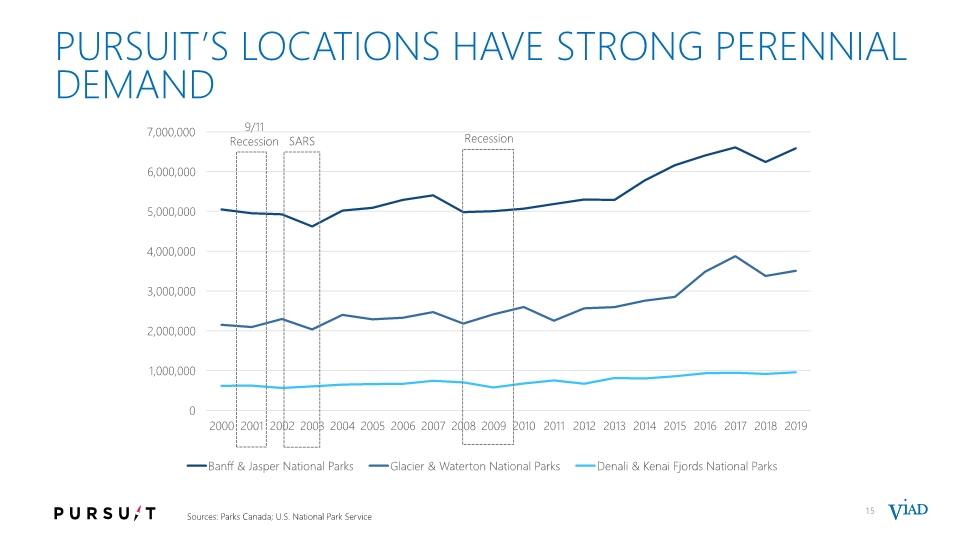

Pursuit’s locations have strong perennial demand Recession SARS 9/11 Recession 15 Sources: Parks Canada; U.S. National Park Service

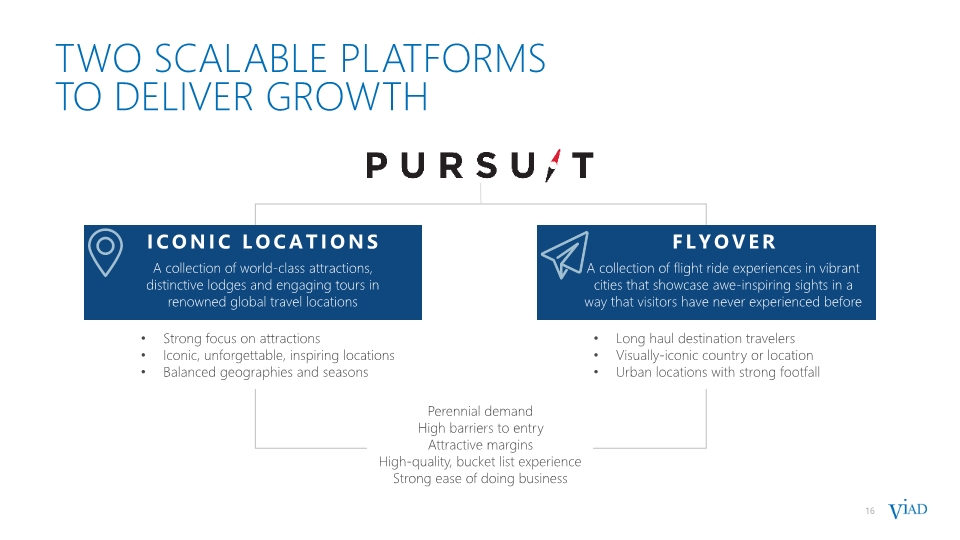

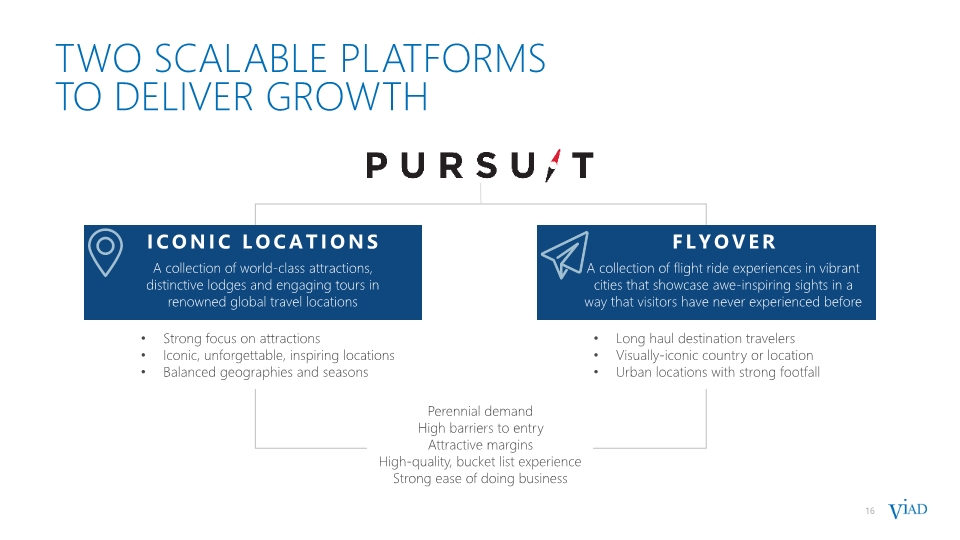

16 TWO SCALABLE PLATFORMS TO DELIVER GROWTH ICONIC LOCATIONS A collection of world-class attractions, distinctive lodges and engaging tours in renowned global travel locations FLYOVER A collection of flight ride experiences in vibrant cities that showcase awe-inspiring sights in a way that visitors have never experienced before Strong focus on attractions Iconic, unforgettable, inspiring locations Balanced geographies and seasons Long haul destination travelers Visually-iconic country or location Urban locations with strong footfall Perennial demand High barriers to entry Attractive margins High-quality, bucket list experience Strong ease of doing business

17 Pursuit has a compelling and proven GROWTH strategy REFRESH To optimize guest experience, market position and maximize returns BUILD To create new guest experiences and revenue streams with economies of scale and scope BUY Strategic assets that drive guest experience, economies of scale and scope, improving financial performance Banff gondola Investment: $22M EBITDA: $11M Glacier skywalk Investment: $20M EBITDA: $7M Alaska collection Investment: $60M EBITDA: $10M Note: 2019 EBITDA (incremental for Banff Gondola as compared to trailing twelve months prior to renovation)

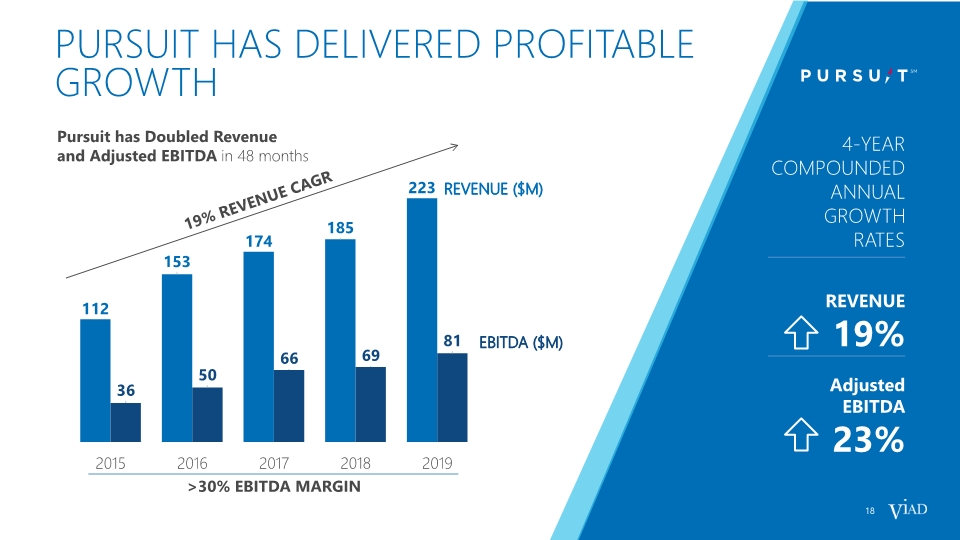

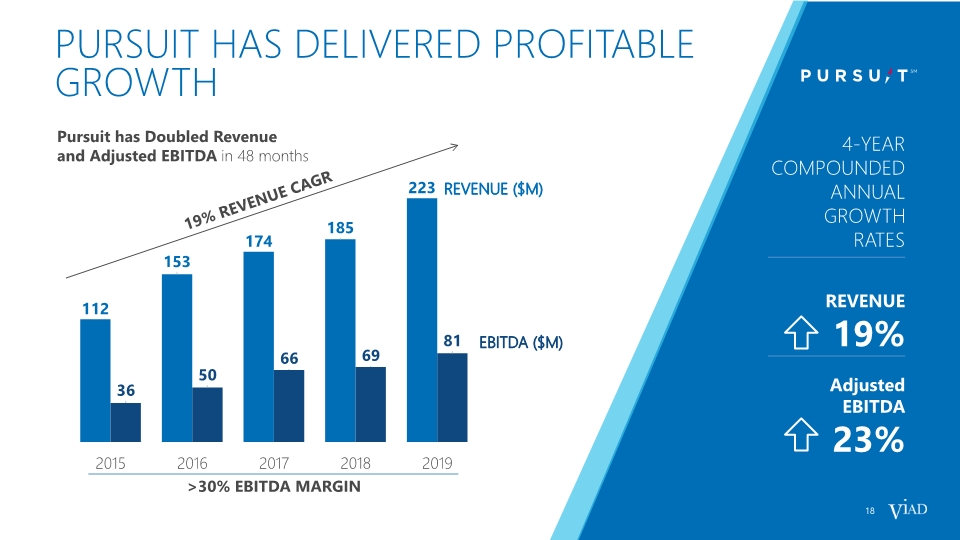

4-YEAR COMPOUNDED ANNUAL GROWTH RATES REVENUE 19% Adjusted EBITDA 23% pursuit has delivered profitable growth Pursuit has Doubled Revenue and Adjusted EBITDA in 48 months 19% Revenue CAGR 18 REVENUE ($M) EBITDA ($M) >30% EBITDA MARGIN

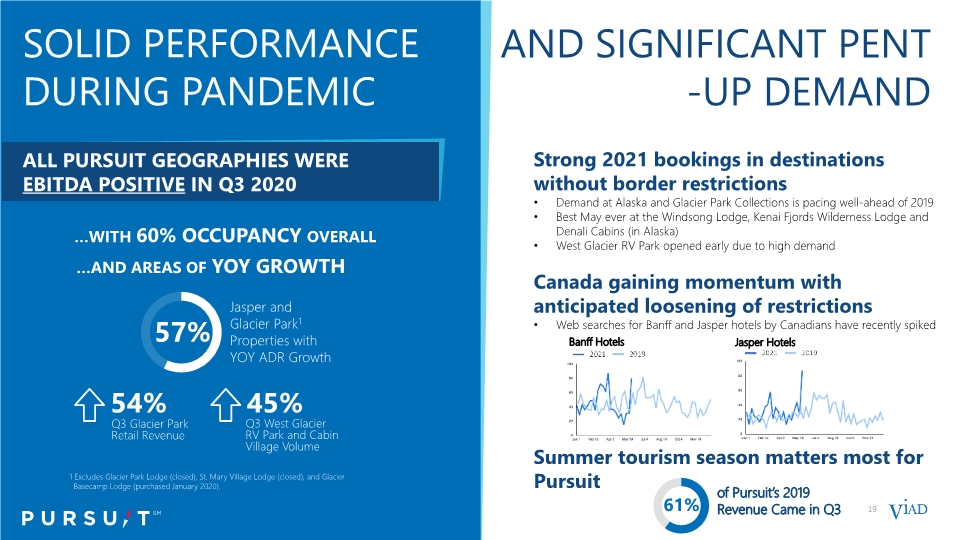

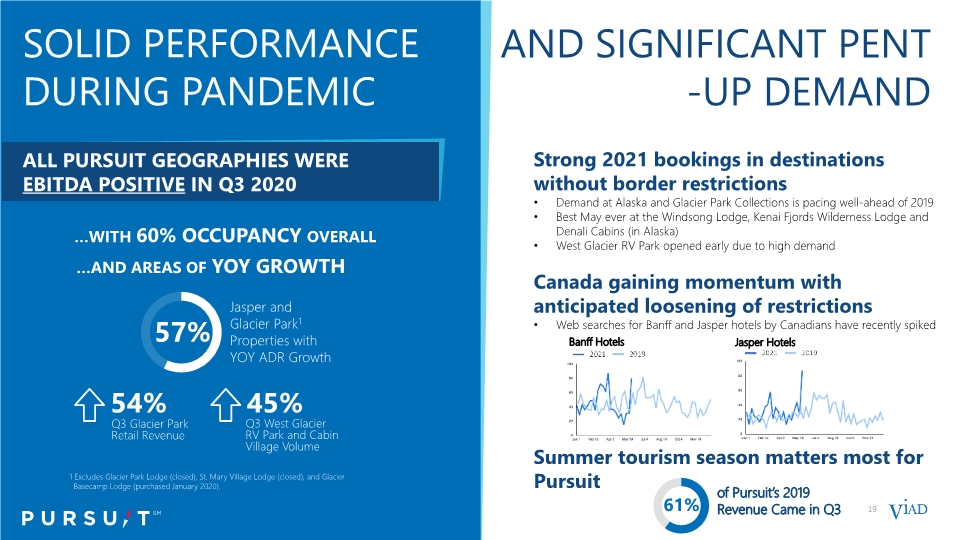

Strong 2021 bookings in destinations without border restrictions Demand at Alaska and Glacier Park Collections is pacing well-ahead of 2019 Best May ever at the Windsong Lodge, Kenai Fjords Wilderness Lodge and Denali Cabins (in Alaska) West Glacier RV Park opened early due to high demand Canada gaining momentum with anticipated loosening of restrictions Web searches for Banff and Jasper hotels by Canadians have recently spiked Summer tourism season matters most for Pursuit Solid performance during pandemic 19 ALL PURSUIT GEOGRAPHIES WERE EBITDA POSITIVE IN Q3 2020 of Pursuit’s 2019 Revenue Came in Q3 61% 54% Q3 Glacier Park Retail Revenue 45% Q3 West Glacier RV Park and Cabin Village Volume …AND AREAS OF YOY GROWTH …WITH 60% OCCUPANCY OVERALL Jasper and Glacier Park1 Properties with YOY ADR Growth 57% 1 Excludes Glacier Park Lodge (closed), St. Mary Village Lodge (closed), and Glacier Basecamp Lodge (purchased January 2020). and significant PENT-UP DEMANd Banff Hotels Jasper Hotels

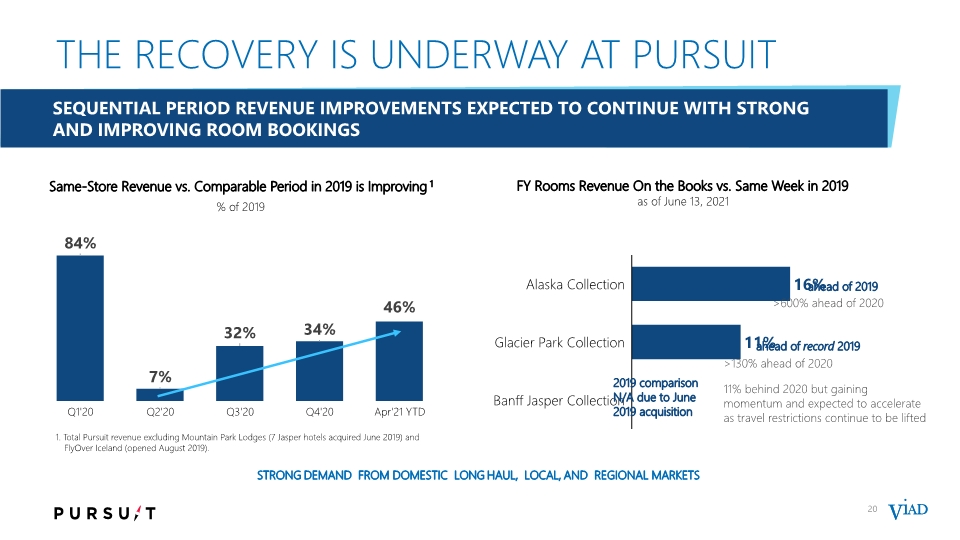

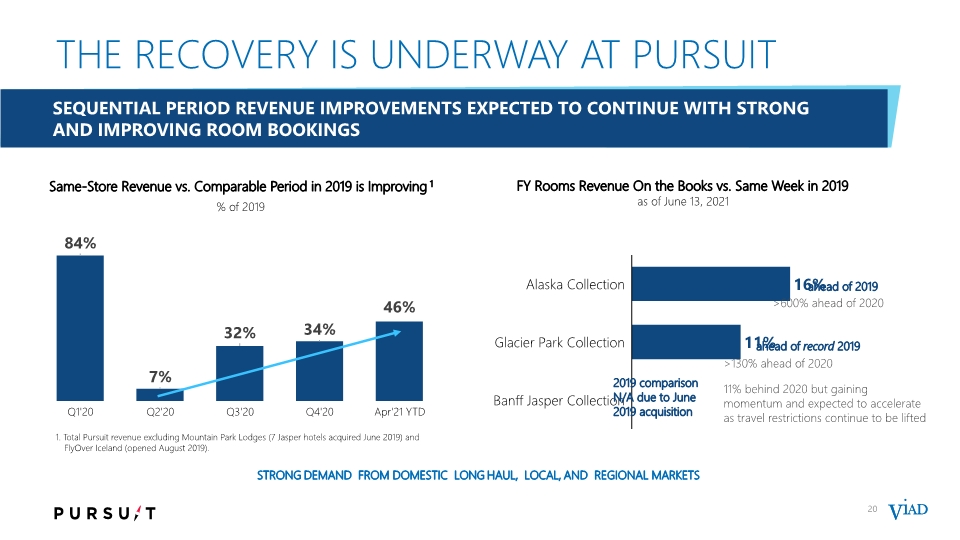

SEQUENTIAL PERIOD REVENUE IMPROVEMENTS EXPECTED TO CONTINUE WITH STRONG AND IMPROVING ROOM BOOKINGS STRONG DEMAND FROM DOMESTIC LONG HAUL, LOCAL, AND REGIONAL MARKETS 20 Same-Store Revenue vs. Comparable Period in 2019 is Improving1 % of 2019 The recovery is underway at pursuit FY Rooms Revenue On the Books vs. Same Week in 2019 as of June 13, 2021 11% behind 2020 but gaining momentum and expected to accelerate as travel restrictions continue to be lifted >600% ahead of 2020 >130% ahead of 2020 ahead of 2019 ahead of record 2019 2019 comparison N/A due to June 2019 acquisition 1. Total Pursuit revenue excluding Mountain Park Lodges (7 Jasper hotels acquired June 2019) and FlyOver Iceland (opened August 2019).

21 WHY WE WILL BE SUCCESSFUL Our MISSION is to connect guests and staff to iconic places through unforgettable inspiring experiences. We believe that collecting memories is far more important than collecting things. Since the beginning of time, human beings share a passion for exploration and the search for remarkable experiences. That hasn’t changed.

23 EXHIBITIONS/CONFERENCES BRAND EXPERIENCES VENUE SERVICES 3,600 exhibitions, #1 and #2 market share in the UK, US, respectively. 2,900 unique live and virtual experiences - partnering with leading brands incl. 4 of top 5 pharma companies. In-house AV, lighting, electrical, rigging and power service provider for 35+ leading convention centers and hotels a Global Live Events Company Note: 2019 amounts

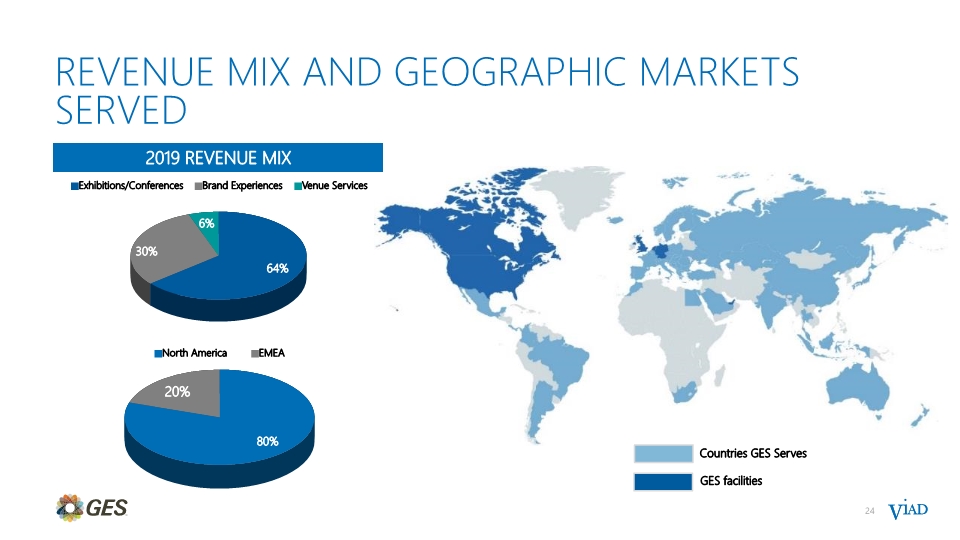

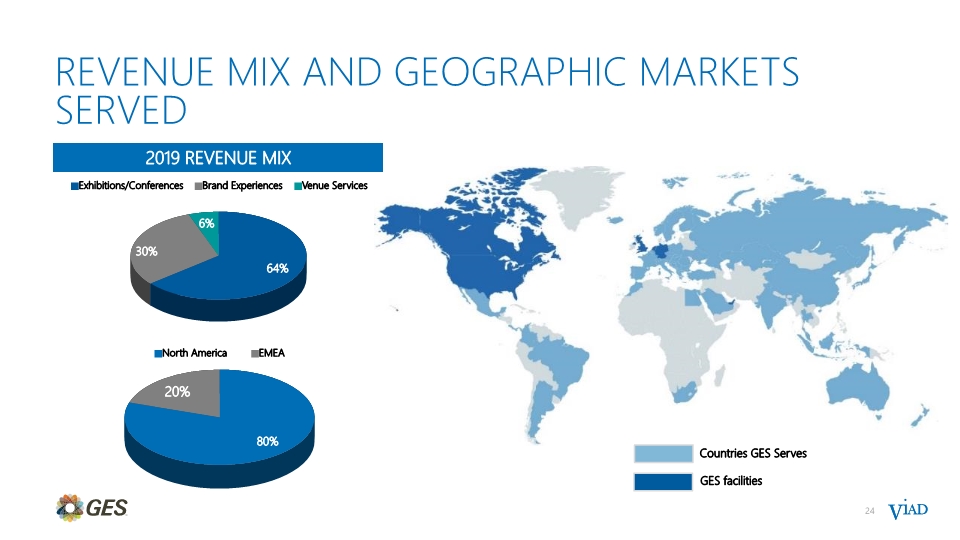

Revenue mix and Geographic Markets Served 24

2019 Global Tradeshow Market $34.4B Source: PwC Global Entertainment & Media Outlook 2020-2024 Global Tradeshow Market Growth 2016-2019 4.3% annually The Exhibition and Conference market was over $34B in 2019 with low-single digit growth from 2016 THE US exhibition and conference market is the largest worldwide ~$2.5B Total Addressable Market for GES Exhibitions and conferences 25 25

#1 AND #2 MARKET SHARE IN UK AND US RESPECTIVELY 26 2019 GES Exhibition/Conference Revenue 2019 GES Market Share of Largest Tradeshows 75% 25% Exhibitions and Conferences GES is a global leader in the $2.5 billion addressable market within Exhibition and Conference industry North America/UK GES clients analyzed against TSNN Top 250 Tradeshow List and The UK Events Report 2020

Brand Experiences 27 2019 Global Digital & Alternative Marketing (%) Source: PQ Media’s Global Advertising & Marketing Spend Forecast, 2020-2024 Experiential marketing is forecasted to grow by 7% annually from 2021 to 2024 Experiential Marketing is a large, fast-growing segment of the corporate marketer’s budget Experiential Marketing – 35% $340B $39B $45B 2019 Experiential Marketing Categories ($,000) $38B

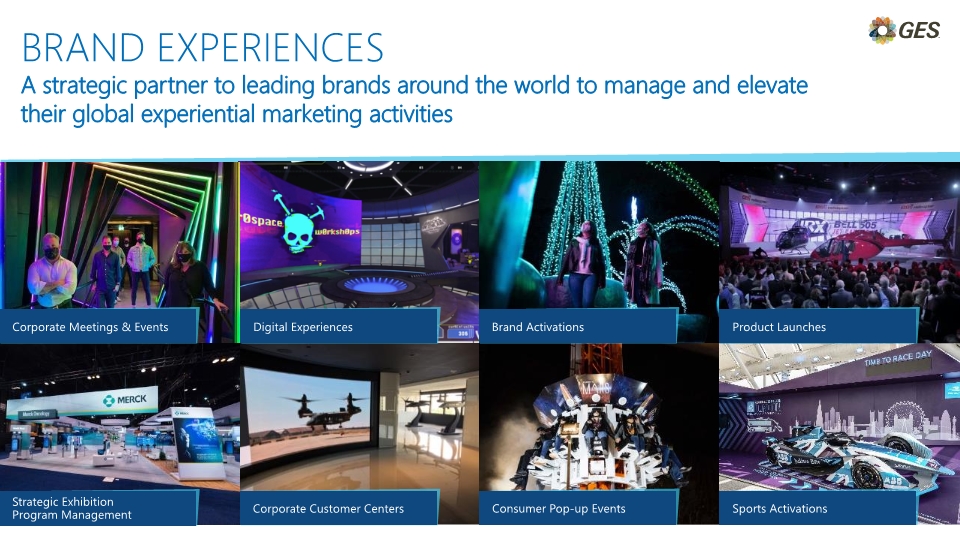

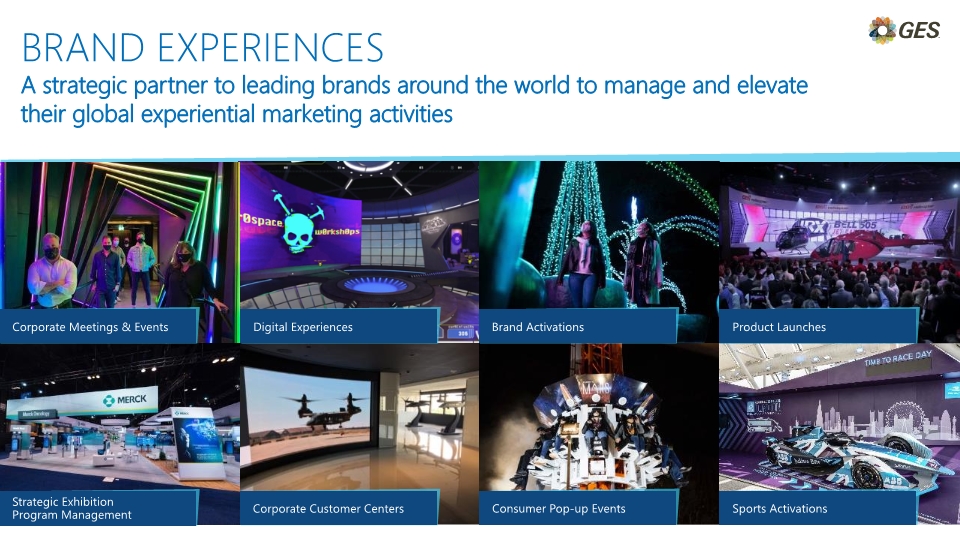

A strategic partner to leading brands around the world to manage and elevate their global experiential marketing activities 28 Brand Experiences

29 Audio Visual Services Electrical or Power Services Rigging Services The Venue Services market was $9B in 2019 "For the past 14 years we have been partners with ON Site. It's good to know you have a trusted partner with you in the trenches, because sometimes Audio Visual services make the difference in closing a piece of business.“ Mercedes Miller, Georgia International Convention Center Venue SERVICES A strategic partner providing in-house services to leading hotel and convention centers for the last 35 years

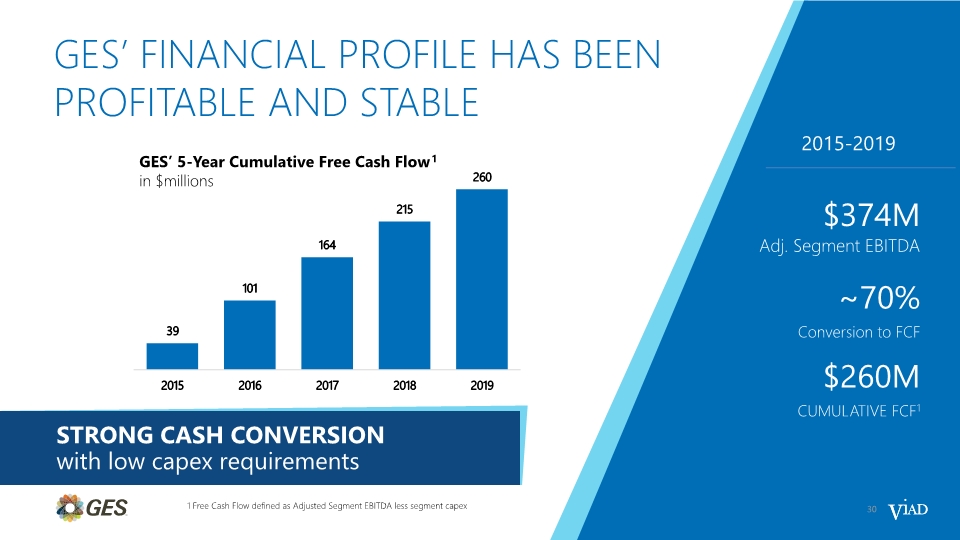

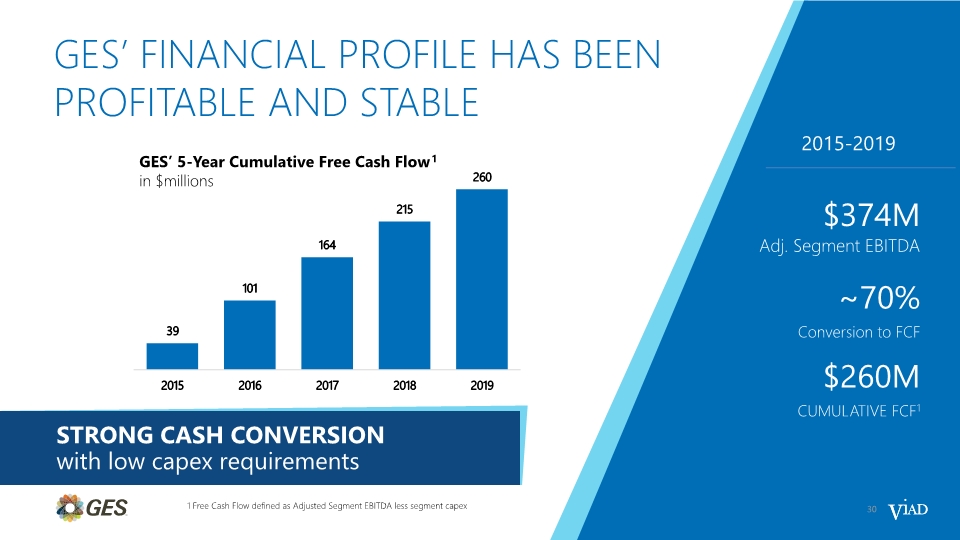

Ges’ financial profile has been profitable and stable 2015-2019 $260M CUMULATIVE FCF1 $374M Adj. Segment EBITDA ~70% Conversion to FCF STRONG CASH CONVERSION with low capex requirements GES’ 5-Year Cumulative Free Cash Flow1 in $millions 30 1 Free Cash Flow defined as Adjusted Segment EBITDA less segment capex

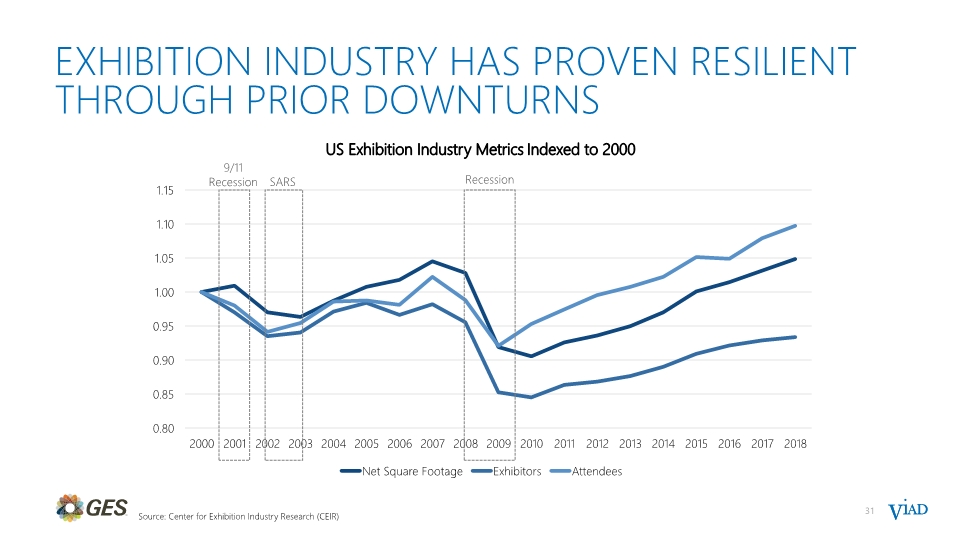

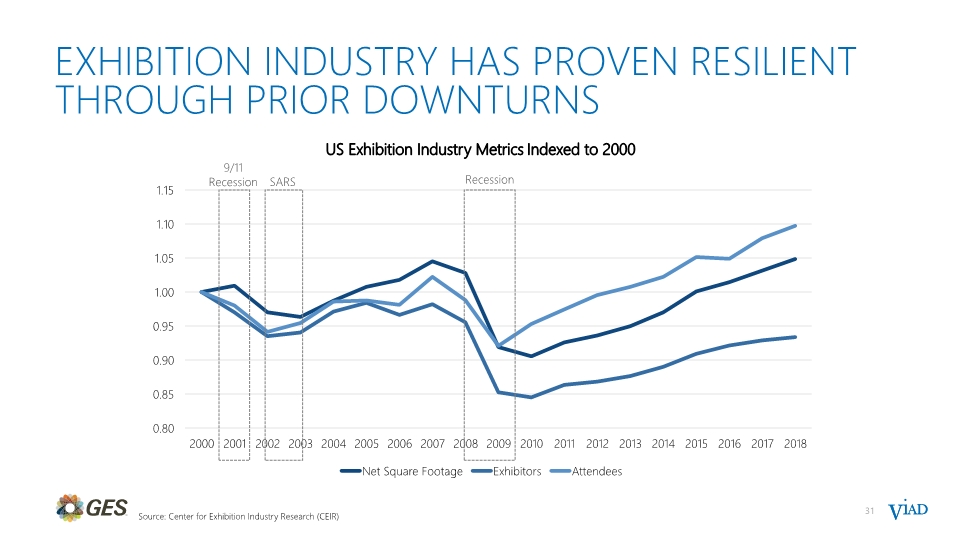

EXHIBITION INDUSTRY has proven resilient through prior downturns Recession SARS 9/11 Recession Source: Center for Exhibition Industry Research (CEIR) 31

Impact of CV19 on GES Revenue ($,000) Pandemic offered opportunity to accelerate transformation - creating a stronger GES Quick and thoughtful response with a vision for the future of live events

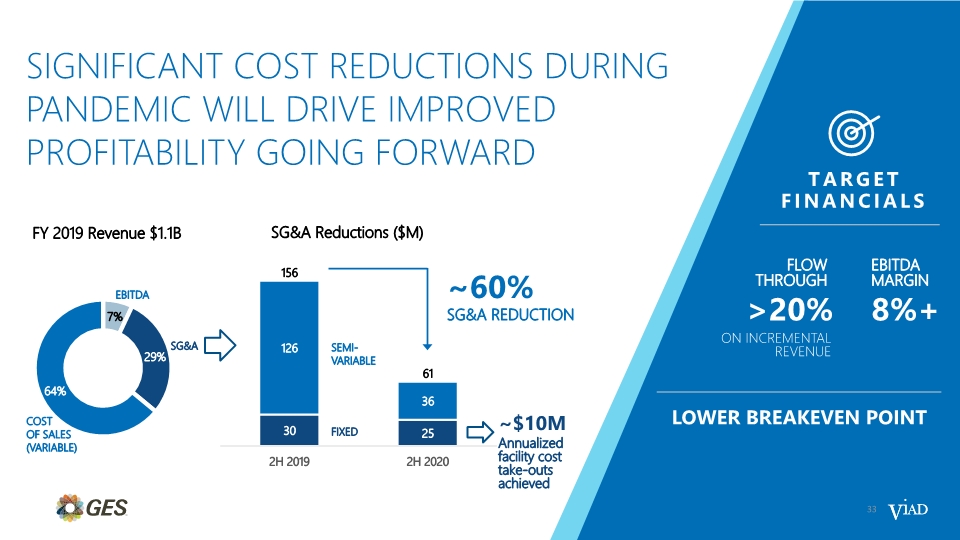

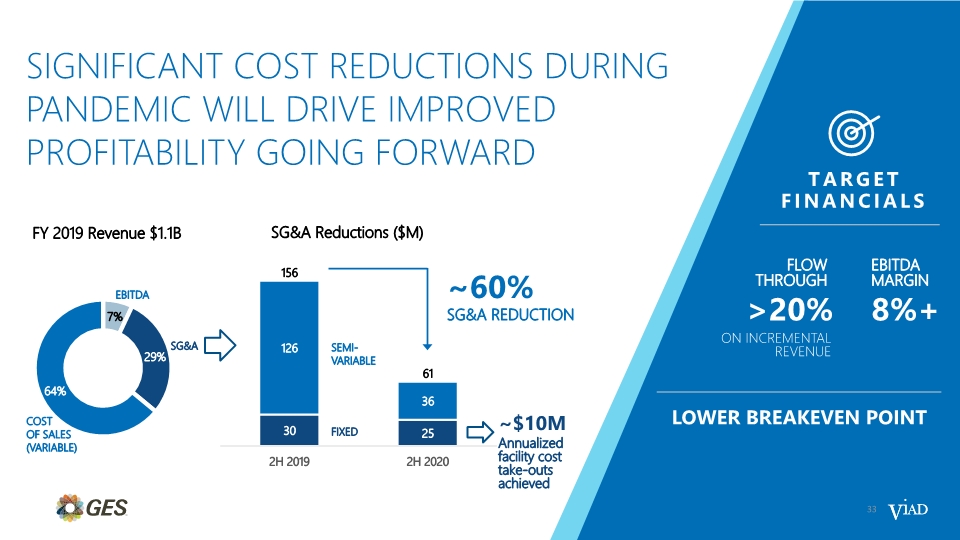

SIGNiFICANT COST REDUCTIONS DURING PANDEMIC WILL DRIVE IMPROVED PROFITABILITY GOING FORWARD EBITDA COST OF SALES (VARIABLE) SEMI-VARIABLE FIXED ~60% SG&A REDUCTION SG&A ~$10M Annualized facility cost take-outs achieved 33 Target financials >20% ON INCREMENTAL REVENUE FLOW THROUGH 8%+ EBITDA MARGIN LOWER BREAKEVEN POINT

The return of live events Live Events will continue to be a powerful driver for companies to transact business, build stronger relationships, network and generate business growth. Virtual event technology will continue to play a role in delivering content to a wider cast of attendees. “Ninety percent of my company’s sales leads came from live events. So to say this has had an impact on our bottom line is an understatement.” — Marketing Manager Source: Exhibitor Insight Report, March 2021 , Event Outlook Report; Bizzabo Of corporate exhibition managers say virtual exhibits generate fewer (or “far fewer”) sales leads than comparable live activations, likewise for digital events. 96% 95% Of exhibit marketers agree that in-person will be back. The majority of event marketers are looking for technology that supports both in-person and virtual events. Anticipate their budget allocations will rebound (at least in part) once trade shows and live events resume 91% 34

35 Return of in-person events to be further supported by states reopening Source: NY Times (as of June 14, 2021).

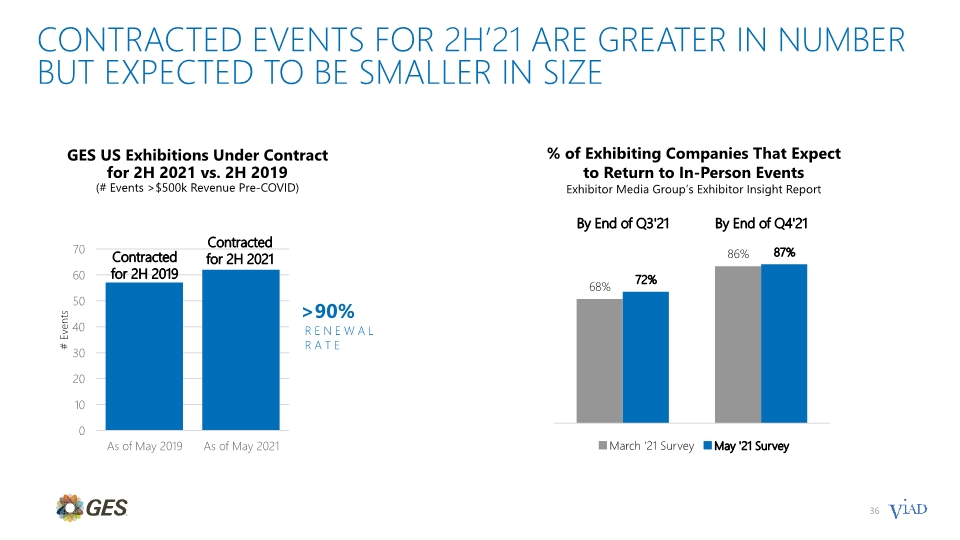

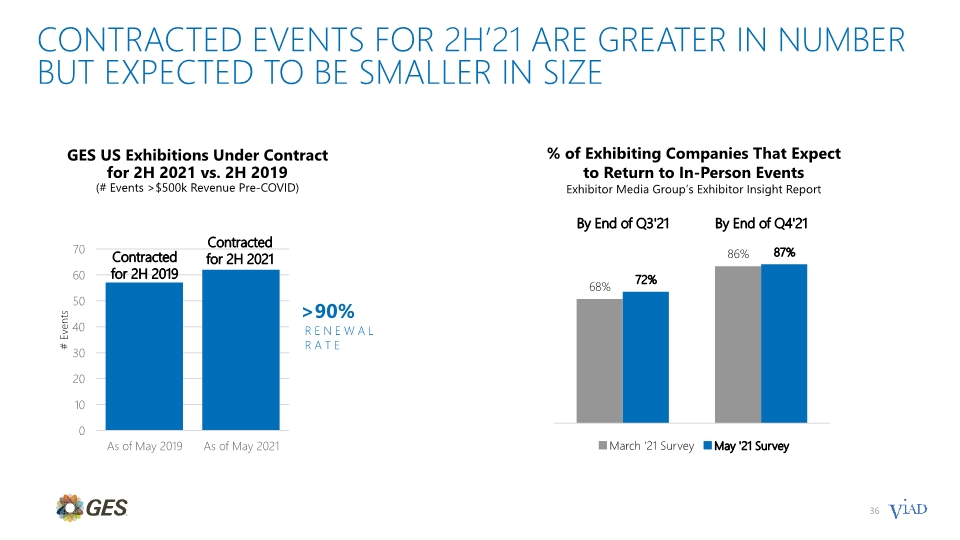

36 % of Exhibiting Companies That Expect to Return to In-Person Events Exhibitor Media Group’s Exhibitor Insight Report contracted events for 2h’21 are GREATER IN NUMBER BUT EXPECTED TO BE SMALLER IN SIZE Contracted for 2H 2019 Contracted for 2H 2021 RENEWAL RATE GES US Exhibitions Under Contract for 2H 2021 vs. 2H 2019 (# Events >$500k Revenue Pre-COVID) >90% # Events

37 WHY WE WILL BE SUCCESSFUL Our MISSION is to create the most meaningful and memorable experiences for marketers, organizers and attendees. We believe that virtual events cannot replace the rich connections created through in-person interactions. From transacting business to building brand loyalty, live events provide a powerful and cost-effective means to drive business growth. That hasn’t changed.

Investment Opportunity Summary

Clear path to accelerate growth and significantly enhance shareholder returns 53% 47% 39 CREATING EXTRAORDINARY EXPERIENCES & STRONG RETURNS Proven Success Executing Growth Strategy and Driving Strong Returns Experienced Management Team Focused on Shareholder Value Strong Liquidity Position and Financial Flexibility to Sustain and Invest Capitalizing on Pandemic Disruption to Strengthen Leading Market Positions

Appendix

(1) Revenue has been adjusted in 2018 and 2019 for immaterial errors related to the revenue recognition of GES’ Corporate Accounts’ third-party services, which are now reported on a net basis to reflect only the fees received for arranging these services. Note: Certain amounts above may not total due to rounding. FORWARD-LOOKING NON-GAAP FINANCIAL MEASURES We have also provided the following forward−looking non−GAAP financial measure: Adjusted Segment EBITDA Margin. We do not provide a reconciliation of this forward−looking non−GAAP financial measure to the most directly comparable GAAP financial measure because, due to variability and difficulty in making accurate forecasts and projections and/or certain information not being ascertainable or accessible, not all of the information necessary for quantitative reconciliations is available to us without unreasonable efforts. Consequently, any attempt to disclose such reconciliations would imply a degree of precision that could be confusing or misleading to investors. It is possible that the forward−looking non−GAAP financial measure may be materially different from the corresponding forward-looking non−GAAP financial measure. NON-GAAP FINANCIAL RECONCILIATION 41

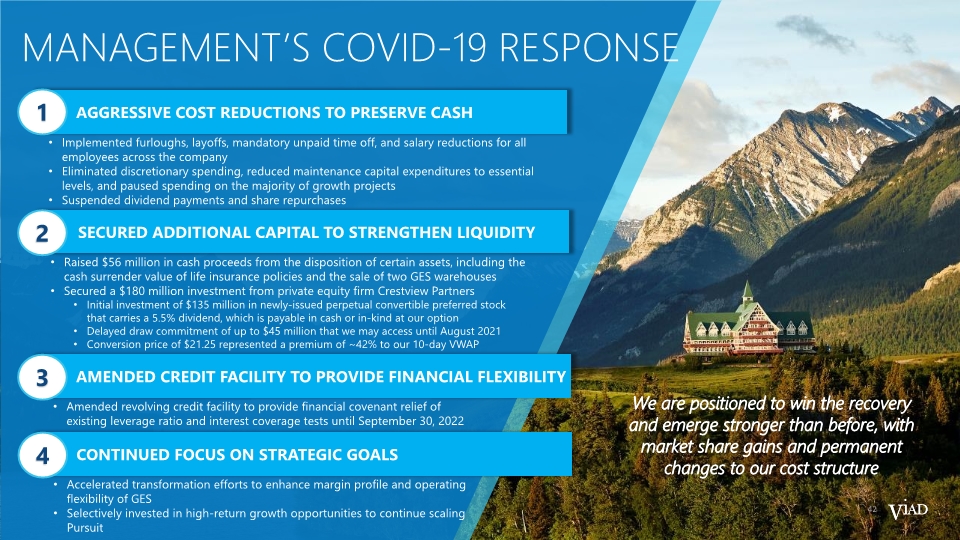

42 MANAGEMENT’S COVID-19 RESPONSE We are positioned to win the recovery and emerge stronger than before, with market share gains and permanent changes to our cost structure

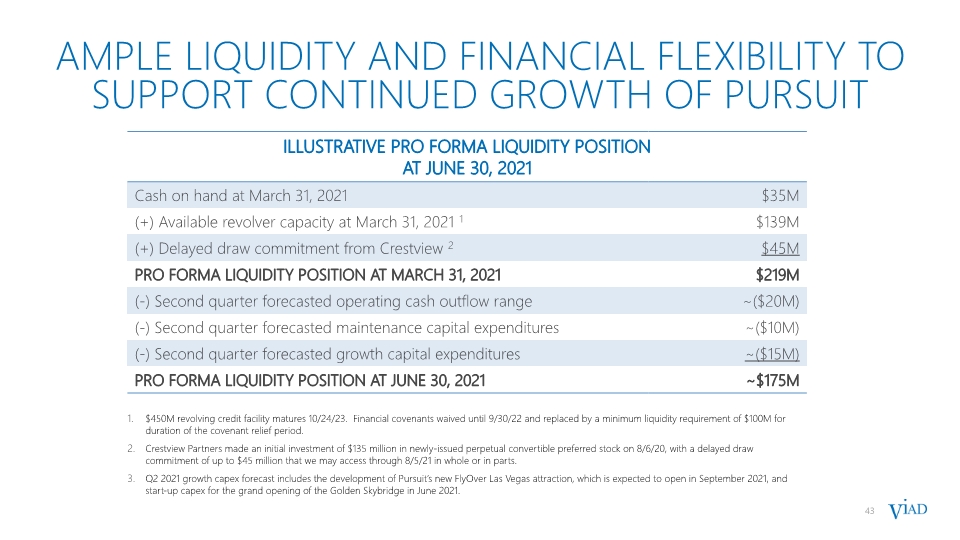

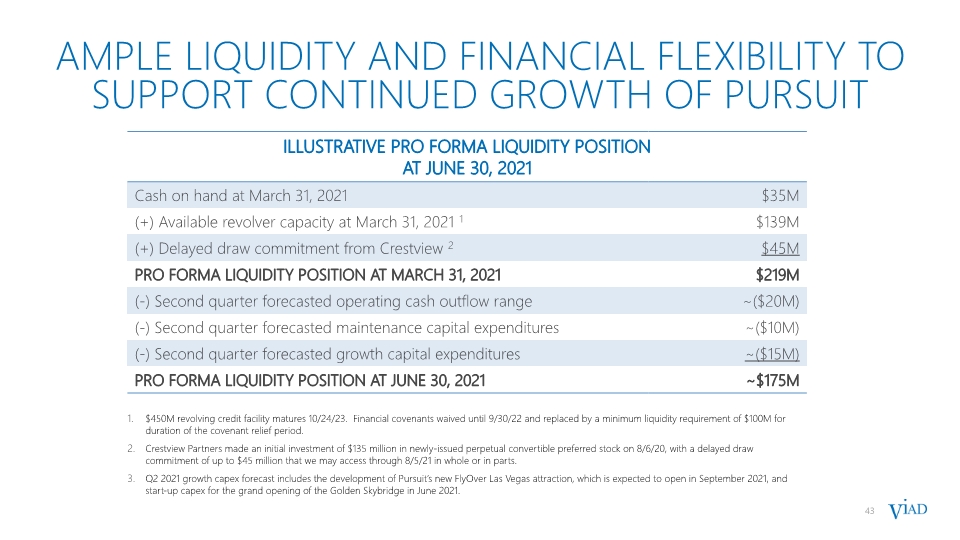

43 Ample liquidity and FINANCIAL FLEXIBILITY to support continued growth of pursuit $450M revolving credit facility matures 10/24/23. Financial covenants waived until 9/30/22 and replaced by a minimum liquidity requirement of $100M for duration of the covenant relief period. Crestview Partners made an initial investment of $135 million in newly-issued perpetual convertible preferred stock on 8/6/20, with a delayed draw commitment of up to $45 million that we may access through 8/5/21 in whole or in parts. Q2 2021 growth capex forecast includes the development of Pursuit’s new FlyOver Las Vegas attraction, which is expected to open in September 2021, and start-up capex for the grand opening of the Golden Skybridge in June 2021.

Steve Moster - President & Chief Executive Officer Has served as President and CEO of Viad since 2014 and as President of GES from 2010 to 2019 Joined Viad in 2004 as GES Vice President of Exhibition Furnishings and his career evolved to various sales and leadership roles within GES company, including Executive Vice President - Products and Services, where he led double-digit revenue growth Holds a Bachelor of Engineering from Vanderbilt University and an MBA from the Tuck School of Business OUR EXPERIENCED EXECUTIVE MANAGEMENT TEAM 44 Ellen Ingersoll - Chief Financial Officer Has served as CFO of Viad since July 2002 During her tenure, the Company successfully divested MoneyGram International in 2004 and acquired and integrated more than 15 businesses Holds a B.S. from Arizona State University and is a CPA David Barry - President - Pursuit Joined Viad in 2015 and through the repositioning of the Viad Travel and Recreation Group created Pursuit in 2016 Prior to joining the Company, he served as the President and CEO of a financial services and tech company following a three decade career in hospitality, the ski industry and aviation Experience includes being CEO of the world’s largest heli-skiing company (CMH) and Chief Operating Officer of Intrawest USA (ski resorts, lodging, hospitality)

OUR EXPERIENCED EXECUTIVE MANAGEMENT TEAM 45 Derek Linde - General Counsel and Secretary Has served as General Counsel and Secretary of Viad since April 2018 Previously served as Deputy General Counsel & Assistant Secretary at Illinois Tool Works Inc., and was a partner at Winston & Strawn LLP, where he focused on merger and acquisition transactions, private equity, securities/capital markets, corporate governance, SEC filings Received his J.D. from the Vanderbilt University School of Law and a B.A. from the University of Missouri-Columbia Leslie Striedel - Chief Accounting Officer Has served as Chief Accounting Officer of Viad Corp since 2014 Previously served as Vice President of Finance and Administration or similar positions at Colt Defense LLC, and held various roles within finance and accounting in both public and private environments Received her B.S. from the University of Vermont and is a CPA

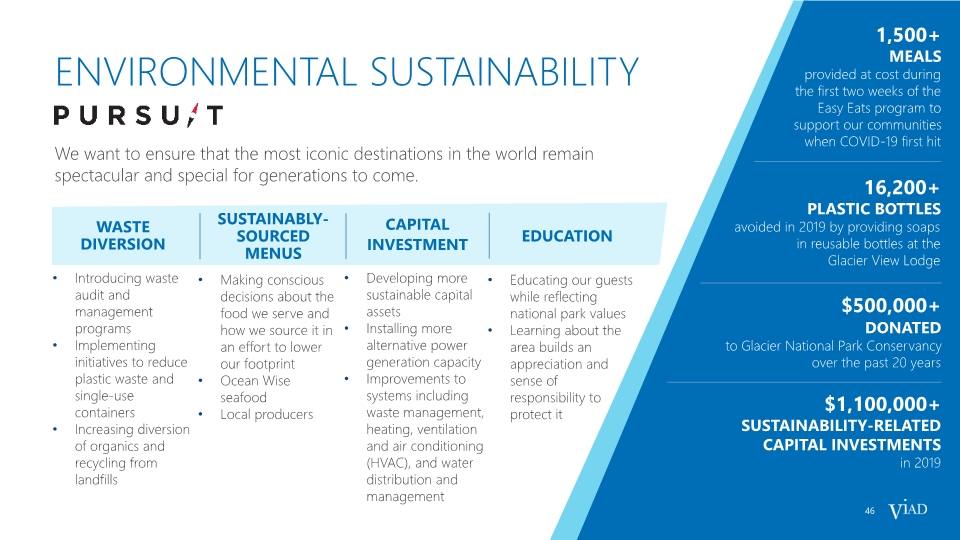

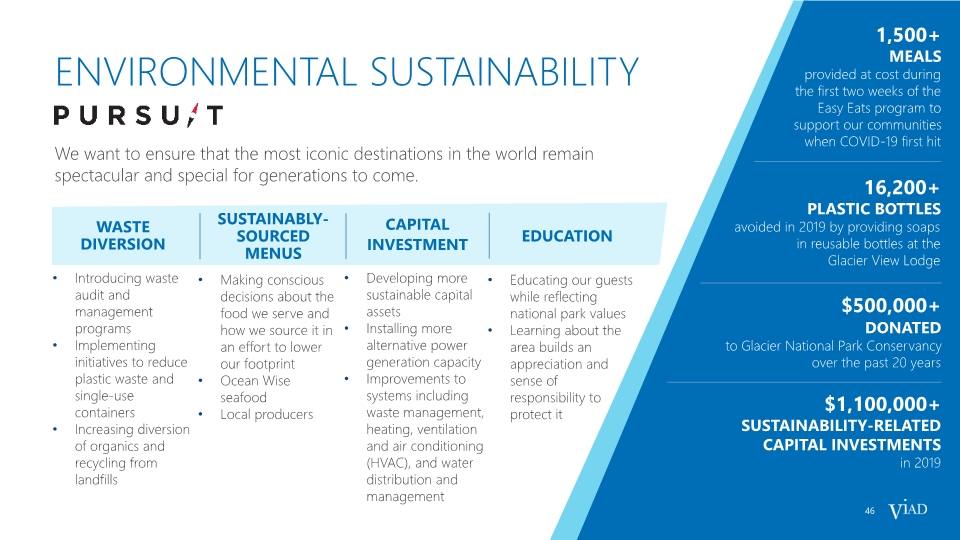

ENVIRONMENTAL SUSTAINABILITY 1,500+ MEALS provided at cost during the first two weeks of the Easy Eats program to support our communities when COVID-19 first hit 46 WASTE DIVERSION Introducing waste audit and management programs Implementing initiatives to reduce plastic waste and single-use containers Increasing diversion of organics and recycling from landfills SUSTAINABLY-SOURCED MENUS Making conscious decisions about the food we serve and how we source it in an effort to lower our footprint Ocean Wise seafood Local producers CAPITAL INVESTMENT Developing more sustainable capital assets Installing more alternative power generation capacity Improvements to systems including waste management, heating, ventilation and air conditioning (HVAC), and water distribution and management EDUCATION Educating our guests while reflecting national park values Learning about the area builds an appreciation and sense of responsibility to protect it We want to ensure that the most iconic destinations in the world remain spectacular and special for generations to come. 16,200+ PLASTIC BOTTLES avoided in 2019 by providing soaps in reusable bottles at the Glacier View Lodge $1,100,000+ SUSTAINABILITY-RELATED CAPITAL INVESTMENTS in 2019 $500,000+ DONATED to Glacier National Park Conservancy over the past 20 years

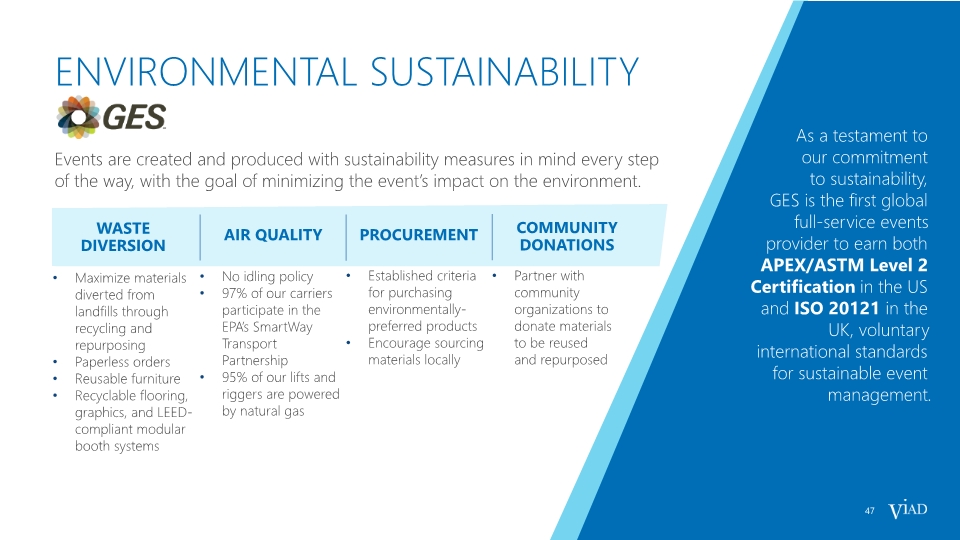

ENVIRONMENTAL SUSTAINABILITY As a testament to our commitment to sustainability, GES is the first global full-service events provider to earn both APEX/ASTM Level 2 Certification in the US and ISO 20121 in the UK, voluntary international standards for sustainable event management. 47 Events are created and produced with sustainability measures in mind every step of the way, with the goal of minimizing the event’s impact on the environment. Maximize materials diverted from landfills through recycling and repurposing Paperless orders Reusable furniture Recyclable flooring, graphics, and LEED-compliant modular booth systems No idling policy 97% of our carriers participate in the EPA’s SmartWay Transport Partnership 95% of our lifts and riggers are powered by natural gas Established criteria for purchasing environmentally-preferred products Encourage sourcing materials locally Partner with community organizations to donate materials to be reused and repurposed WASTE DIVERSION AIR QUALITY PROCUREMENT COMMUNITY DONATIONS

SOCIAL RESPONSIBiLITY 48 We believe that maintaining a culture of high ethical and legal standards provides Viad with a distinct advantage in recruiting and retaining top talent, driving the best value for our customers and attracting shareholders. Being Always Honest is at the very core of our corporate identity and guides everything we do. -Steve Moster Our success is built on a foundation of integrity, ethical behavior, corporate and social responsibility, and compliance, which are reinforced every day in our businesses through our Always Honest Compliance and Ethics Program. Provide a safe and healthy work environment Follow all written safety information and policies to prevent harm to our employees, the communities in which we work, and our reputation Value and respect diversity and promote inclusivity in the workplace Provide equal opportunities for all of our employment activities, including hiring, training, promoting, and compensating Treat our customers with honesty and integrity, honor their trust, and deliver world-class products, services, and support Ensure that those doing business with us and on our behalf uphold our standards of integrity in all that they do for us Treat our employees fairly and in accordance with the law FAIR LABOR PRACTICES WORKPLACE SAFETY DIVERSITY BUSINESS RELATIONSHIPS

49 Safety promise Pursuit's Safety Promise is our commitment to the safety and well-being of our guests and staff. Through this program, we will ensure that everyone feels safe when visiting our experiences and that these places can continue to make a positive impact.

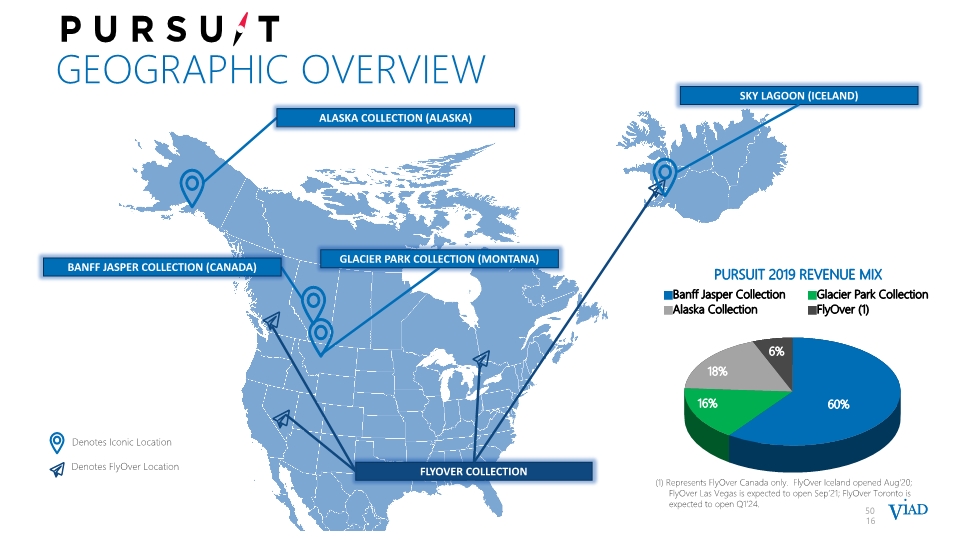

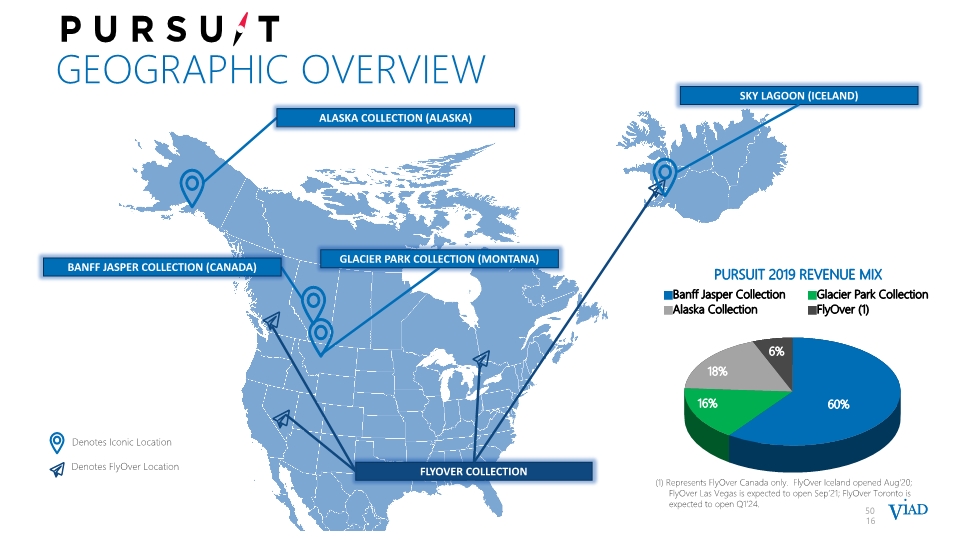

FLYOVER COLLECTION Pursuit 2019 Revenue Mix 50 SKY LAGOON (ICELAND) GLACIER PARK COLLECTION (MONTANA) ALASKA COLLECTION (ALASKA) BANFF JASPER COLLECTION (CANADA) Geographic overview Denotes Iconic Location Denotes FlyOver Location (1) Represents FlyOver Canada only. FlyOver Iceland opened Aug'20; FlyOver Las Vegas is expected to open Sep’21; FlyOver Toronto is expected to open Q1’24. 16

New experiences will ACCELERATE growth 2021 2022 2023 & Beyond 2022 FULL YEAR Sky Lagoon Golden Skybridge FlyOver Las Vegas 2022 (Est) 78 Connaught Drive Hotel Jasper, AB, Canada early 2024 (EST) FlyOver Canada Toronto opens Toronto, ON September 2021 (EST) FlyOver Las Vegas opens Las Vegas, NV MAY 2021 Sky Lagoon opens Reykjavik, Iceland ONGOING New Refresh, Build, Buy Investments Worldwide 51 BUSINESS RETURNS AND NEW GROWTH FROM INVESTMENTS AND CONTINUED CORPORATE DEVELOPMENT FOCUS ONGOING, NEVER-ENDING FOCUS ON SAME-STORE ORGANIC GROWTH AND IMPROVING THE GUEST EXPERIENCE jUNE 2021 Golden Skybridge opens Golden, BC, Canada 2023 FULL YEAR 78 Connaught Drive Hotel

WE’RE JUST GETTING STARTED Our entrepreneurial hospitality-oriented culture, combined with two scalable growth platforms, provides significant growth opportunities

SUCCESS STORIES: BUILD, BUY. 82 Attraction Net Promoter Score Sky Bistro #1 Restaurant in Banff on TripAdvisor ~$11M EBITDA INCREASE SINCE REFRESH1 53 1 2019 as compared to trailing twelve months prior to renovation

SUCCESS STORIES: BUILD, BUY. REVPAR INCREASE from $98 in 2016 to $157 in 2019 60% Improved Net Promotor Score 77 points from -7 to 70 in 2 years 54 #2 hOTEL in Banff

IN DEVELOPMENT: REFRESH, Opened Aug 2019 3 New attractions in world class tourism cities Expected opening Sept 2021 Expected opening in 2024 REYKJAVIK LAS VEGAS TORONTO #2 TripAdvisor Ranking for FlyOver Iceland BUY. 55

IN DEVELOPMENT: REFRESH, BUY. IDEAL LOCATION Closest geothermal lagoon to Reykjavik OPERATING PARTNER in this venture 56 Opened May 2021

SUCCESS STORIES: REFRESH, BUILD, 7 Experiences in Iconic Locations Sightseeing Boat Tours Lodging Properties F&B and Retail 57

SUCCESS STORIES: REFRESH, BUILD, Ownership Interest 60% Market Share of the Jasper Area Bed Base 31% 58

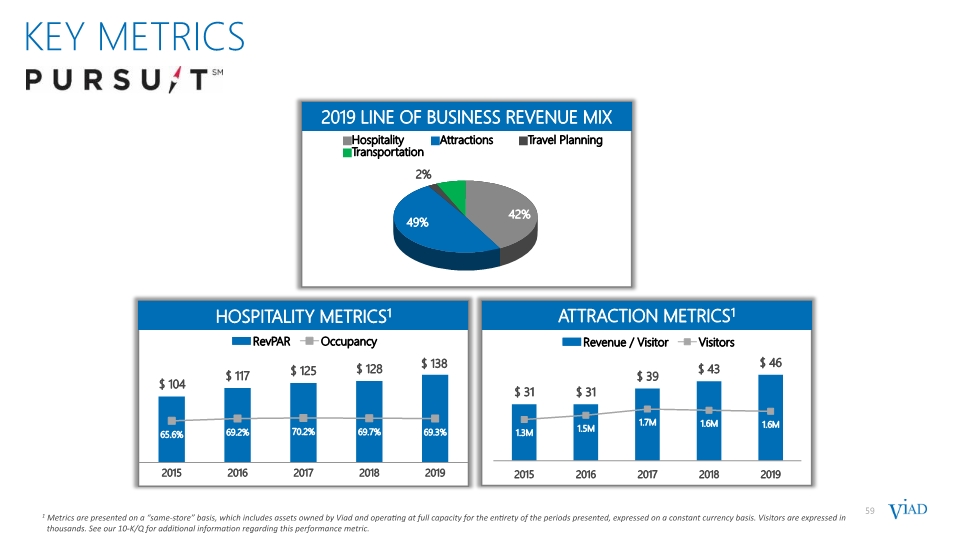

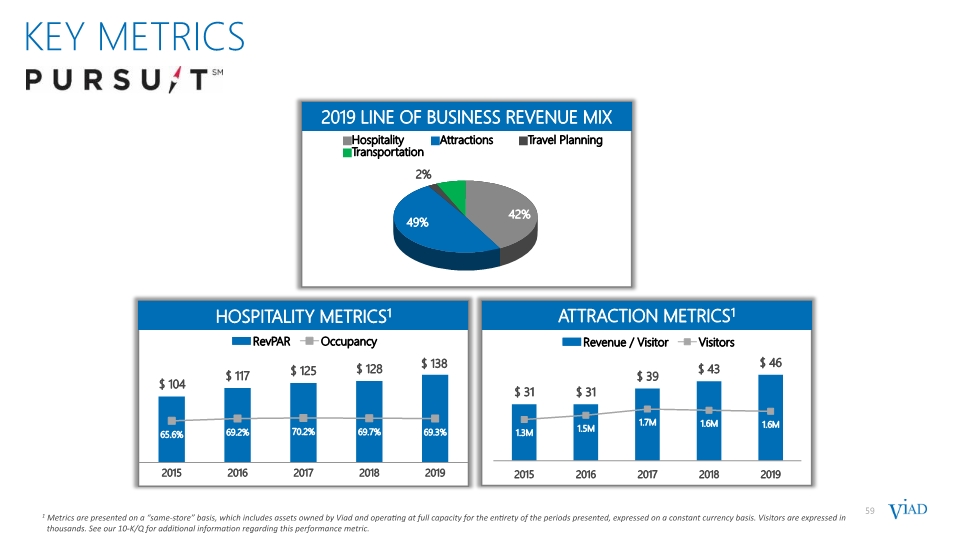

HOSPITALITY METRICS1 2019 LINE OF BUSINESS REVENUE MIX KEY METRICS 59 1 Metrics are presented on a “same-store” basis, which includes assets owned by Viad and operating at full capacity for the entirety of the periods presented, expressed on a constant currency basis. Visitors are expressed in thousands. See our 10-K/Q for additional information regarding this performance metric. ATTRACTION METRICS1

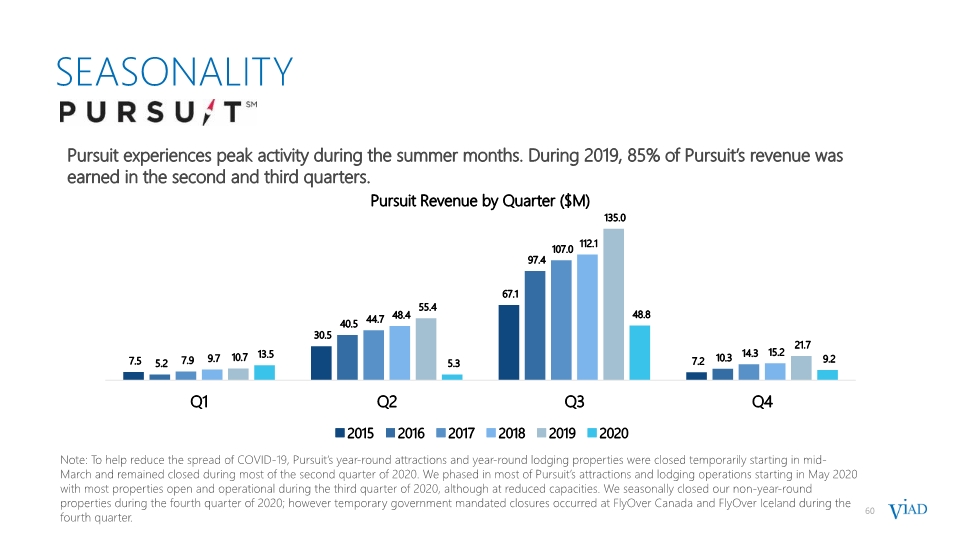

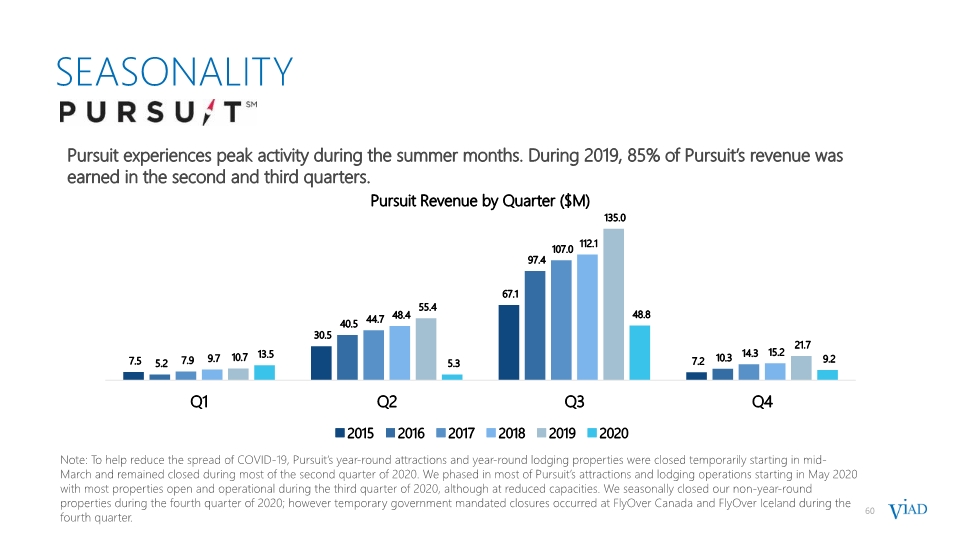

60 Seasonality Pursuit experiences peak activity during the summer months. During 2019, 85% of Pursuit’s revenue was earned in the second and third quarters. Note: To help reduce the spread of COVID-19, Pursuit’s year-round attractions and year-round lodging properties were closed temporarily starting in mid-March and remained closed during most of the second quarter of 2020. We phased in most of Pursuit’s attractions and lodging operations starting in May 2020 with most properties open and operational during the third quarter of 2020, although at reduced capacities. We seasonally closed our non-year-round properties during the fourth quarter of 2020; however temporary government mandated closures occurred at FlyOver Canada and FlyOver Iceland during the fourth quarter.

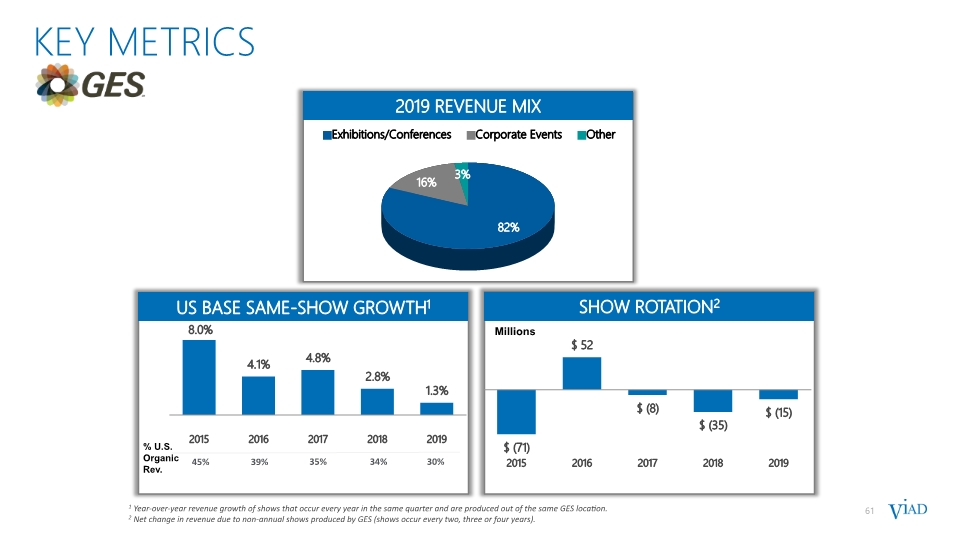

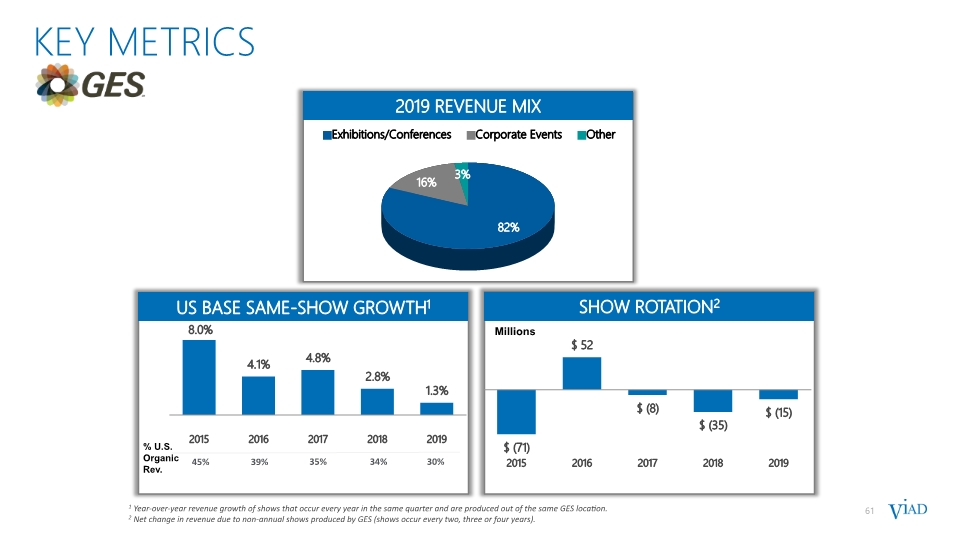

US BASE SAME-SHOW GROWTH1 SHOW ROTATION2 45% 39% 35% 34% 1 Year-over-year revenue growth of shows that occur every year in the same quarter and are produced out of the same GES location. 2 Net change in revenue due to non-annual shows produced by GES (shows occur every two, three or four years). 61 30% 2019 REVENUE MIX KEY METRICS

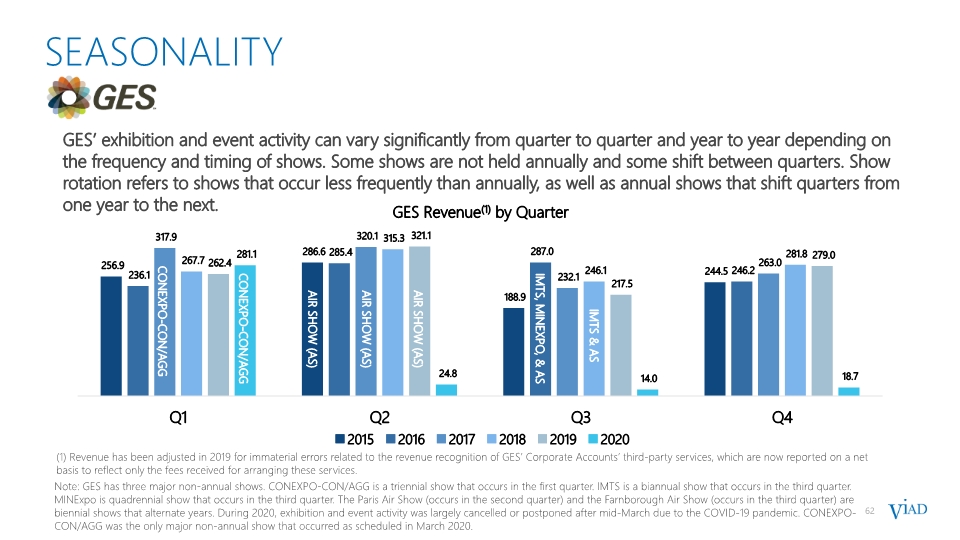

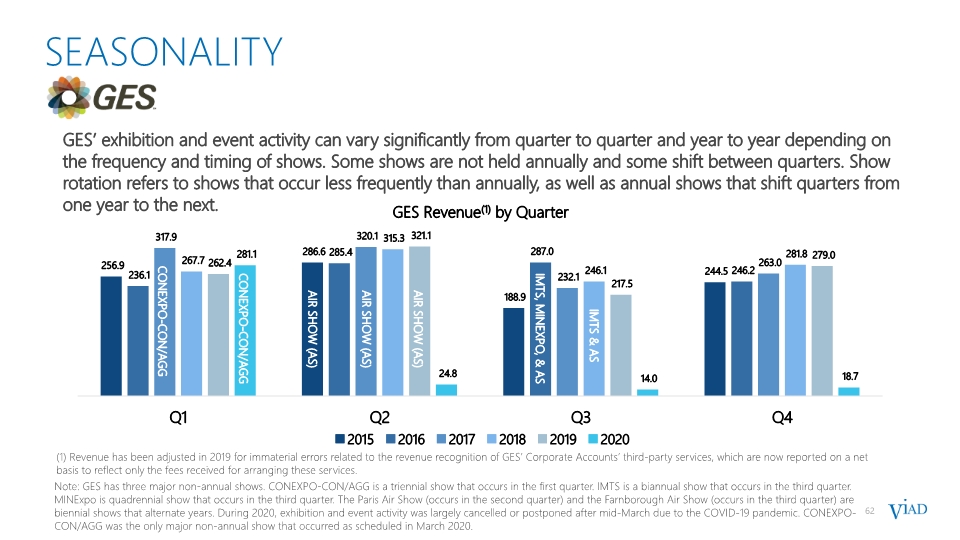

62 Seasonality GES’ exhibition and event activity can vary significantly from quarter to quarter and year to year depending on the frequency and timing of shows. Some shows are not held annually and some shift between quarters. Show rotation refers to shows that occur less frequently than annually, as well as annual shows that shift quarters from one year to the next. CONEXPO-CON/AGG IMTS, MINEXPO, & AS IMTS & AS AIR SHOW (AS) AIR SHOW (AS) Note: GES has three major non-annual shows. CONEXPO-CON/AGG is a triennial show that occurs in the first quarter. IMTS is a biannual show that occurs in the third quarter. MINExpo is quadrennial show that occurs in the third quarter. The Paris Air Show (occurs in the second quarter) and the Farnborough Air Show (occurs in the third quarter) are biennial shows that alternate years. During 2020, exhibition and event activity was largely cancelled or postponed after mid-March due to the COVID-19 pandemic. CONEXPO-CON/AGG was the only major non-annual show that occurred as scheduled in March 2020. CONEXPO-CON/AGG AIR SHOW (AS) (1) Revenue has been adjusted in 2019 for immaterial errors related to the revenue recognition of GES’ Corporate Accounts’ third-party services, which are now reported on a net basis to reflect only the fees received for arranging these services.