Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

PRIMEDIA

Seizing The Targeted Media Opportunity

September, 2005

[LOGO]

Forward Looking Statements

This presentation contains forward-looking statements as that term is used under the Private Securities Litigation Act of 1995. These forward-looking statements are based on the current assumptions, expectations and projections of the Company’s management about future events. Although the assumptions, expectations and projections reflected in these forward-looking statements represent management’s best judgment at the time of this presentation, the Company can give no assurance that they will prove to be correct. Numerous factors, including those related to market conditions and those detailed from time-to-time in the Company’s filings with the Securities and Exchange Commission, may cause results of the Company to differ materially from those anticipated in these forward-looking statements. Many of the factors that will determine the Company’s future results are beyond the ability of the Company to control or predict. These forward-looking statements are subject to risks and uncertainties and, therefore, actual results may differ materially. The Company cautions you not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to revise or update any forward-looking statements, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. All references to “Company” and “PRIMEDIA” as used throughout this presentation refer to PRIMEDIA Inc. and its subsidiaries.

2

Targeted Media

A Significant Business Opportunity

“Mass advertising (and its dependent media) is in peril. Yet, the opportunity for advertisers and targeted media has never been brighter.”

—Bernstein Research, May, 2004

“In advertising, 2005 will be the year of the sharpshooter.”

—“Why Big Bucks Are Chasing Targeted Media”

BusinessWeek, January, 2005

3

Consumers Seek Content With Highest Relevance

Alabama Arkansas California Florida Georgia Great Plains Illinois Indiana Iowa Kentucky Louisiana Michigan Mid-Atlantic Minnesota Mississippi | [GRAPHIC] | Missouri New England New York North Carolina Ohio Oklahoma Pennsylvania Rocky Mountain South Carolina Tennessee Texas Virginia Washington-Oregon West Virginia Wisconsin |

30 State/Region-Specific Game & Fish Editions Outsell All Other

Outdoor Publications on Newsstand 2-to-1

4

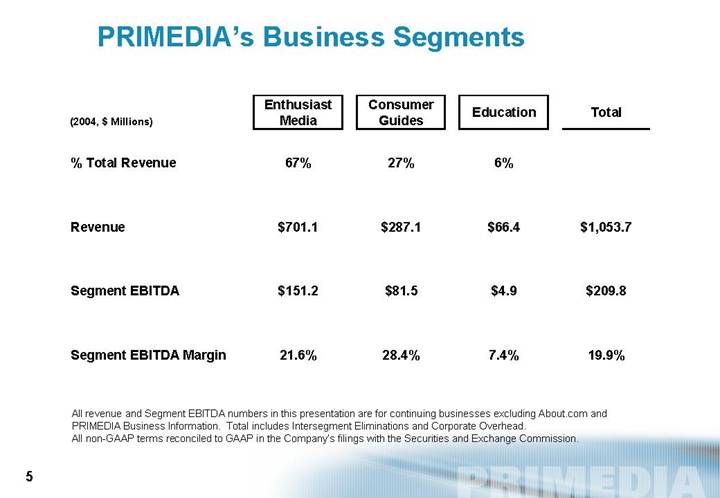

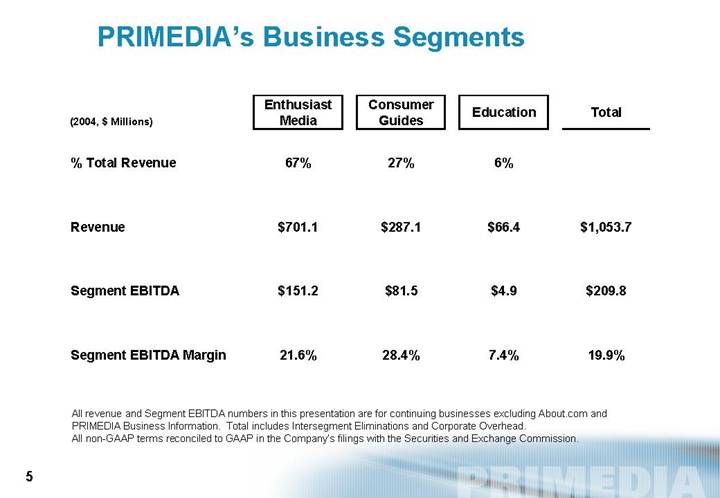

PRIMEDIA’s Business Segments

(2004, $ Millions) | | Enthusiast

Media | | Consumer

Guides | | Education | | Total | |

| | | | | | | | | |

% Total Revenue | | 67 | % | 27 | % | 6 | % | | |

| | | | | | | | | |

Revenue | | $ | 701.1 | | $ | 287.1 | | $ | 66.4 | | $ | 1,053.7 | |

| | | | | | | | | |

Segment EBITDA | | $ | 151.2 | | $ | 81.5 | | $ | 4.9 | | $ | 209.8 | |

| | | | | | | | | |

Segment EBITDA Margin | | 21.6 | % | 28.4 | % | 7.4 | % | 19.9 | % |

All revenue and Segment EBITDA numbers in this presentation are for continuing businesses excluding About.com and PRIMEDIA Business Information. Total includes Intersegment Eliminations and Corporate Overhead. All non-GAAP terms reconciled to GAAP in the Company’s filings with the Securities and Exchange Commission.

5

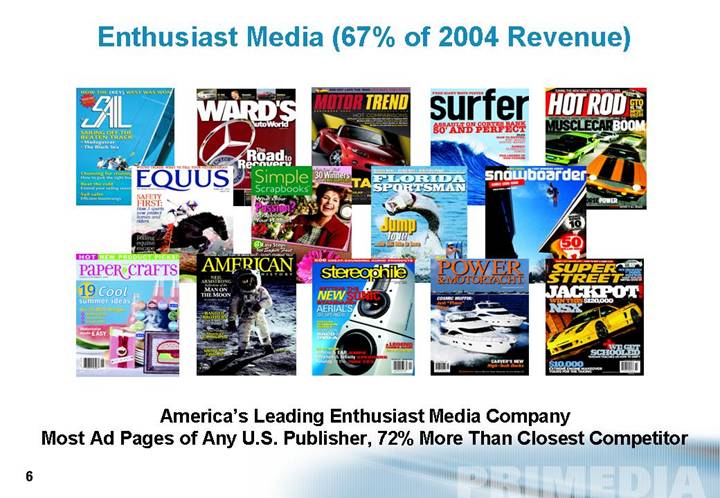

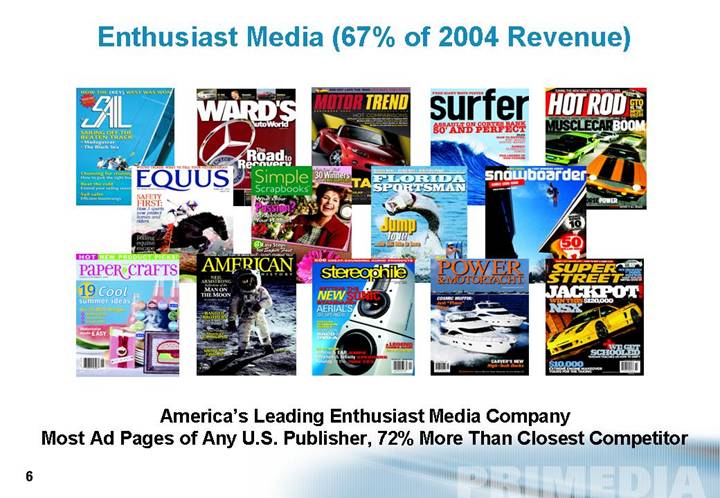

Enthusiast Media (67% of 2004 Revenue)

[GRAPHIC]

America’s Leading Enthusiast Media Company

Most Ad Pages of Any U.S. Publisher, 72% More Than Closest Competitor

6

Multi-Media Offering Maximizes Connection Between Advertisers, Enthusiasts and PRIMEDIA

[GRAPHIC] | [GRAPHIC] | [GRAPHIC] | [GRAPHIC] | [GRAPHIC] |

| | | | |

120+ | 115+ | 100+ | 10+ | 300+ |

Publications | Web sites | Events | TV

Programs | Branded

Products |

| | | | |

15+ Million

Avg. Monthly

Circulation | 10+ Million

Monthly Unique

Visitors | 2+ Million

Attendees | 89+ Million

Annual

Impressions | 100+

Licensees |

31+ Million Customer Database

7

Seizing the Targeted Media Opportunity

Example: $35 Billion Fishing Market

[GRAPHIC] | [GRAPHIC] | [GRAPHIC] | [GRAPHIC] |

| | | |

Publications,

Books, Videos,

Customer Database | Focused

Events | Television

Programming | Targeted

Web sites |

Targeted Message Surrounding Engaged Audience = High ROI

8

Improving Product Quality

Redesign Program Catalyst for Growth

Newsstand

Results From

Five Issues

Post-Redesign | | [GRAPHIC] | | [GRAPHIC] | |

| | | | | |

Ad Page Gains | | +25% | | +22% | |

| | | | | |

Copies Sold | | +17% | | +28% | |

6 Redesigns in 2004. 30 Planned for 2005.

9

Improving and Leveraging Online

[GRAPHIC] | Ad Revenue |

| |

| YTD Online Revenue Through 2Q05:

+17% |

| |

[GRAPHIC] | Subscriber Acquisition |

| |

[GRAPHIC] | E-Commerce |

10

Extending Brands To New Products

[GRAPHIC] | YTD Licensing Revenue Through

2Q05: +76% |

11

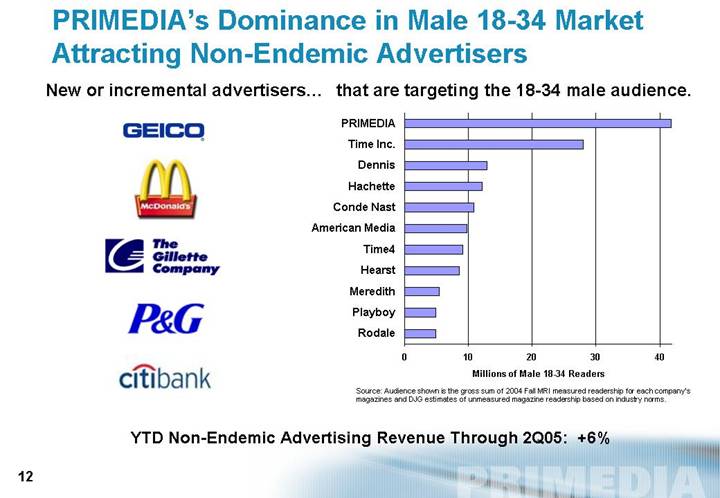

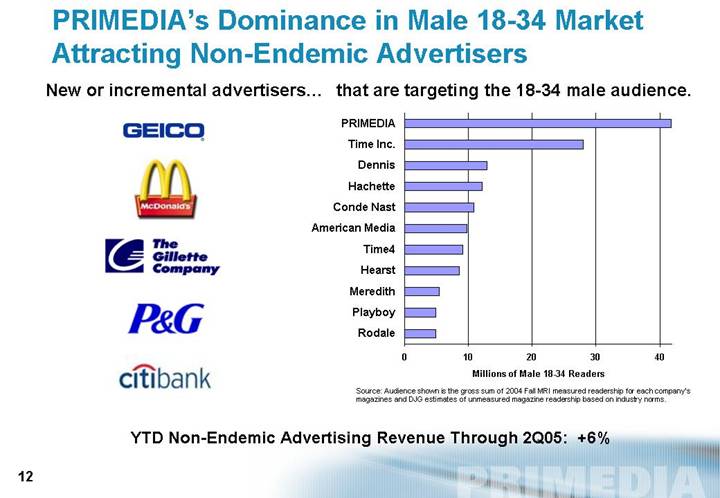

PRIMEDIA’s Dominance in Male 18-34 Market

Attracting Non-Endemic Advertisers

New or incremental advertisers… | that are targeting the 18-34 male audience. |

| |

[LOGO] | [CHART]

Millions of Male 18-34 Readers |

Source: Audience shown is the gross sum of 2004 Fall MRI measured readership for each company’s magazines and DJG estimates of unmeasured magazine readership based on industry norms. |

| | |

YTD Non-Endemic Advertising Revenue Through 2Q05: +6%

12

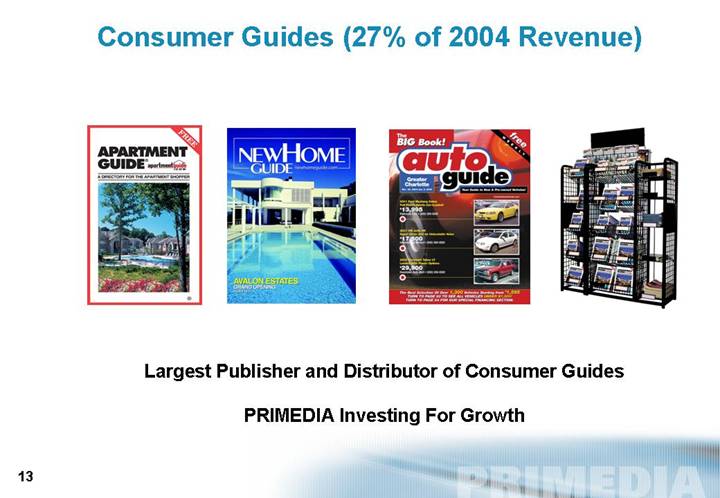

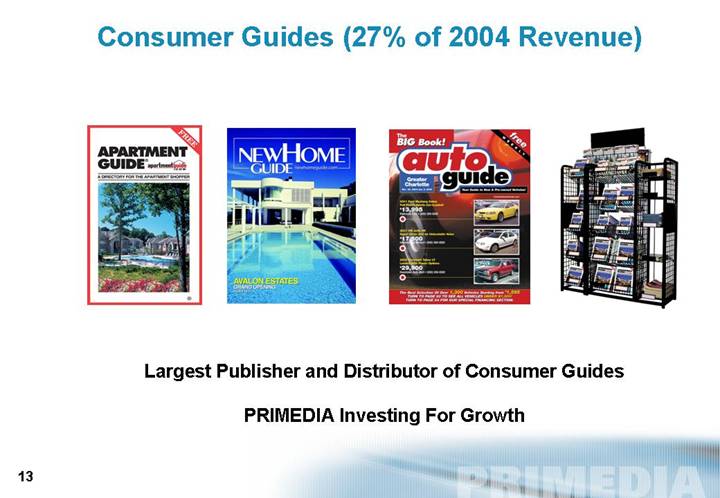

Consumer Guides (27% of 2004 Revenue)

[GRAPHIC]

Largest Publisher and Distributor of Consumer Guides

PRIMEDIA Investing For Growth

13

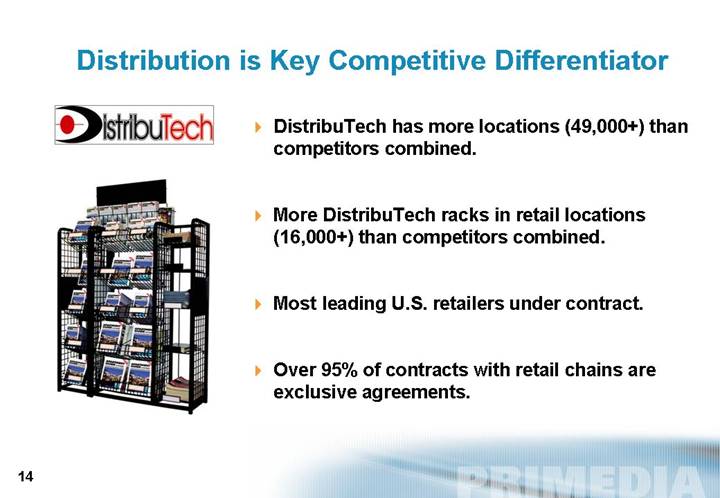

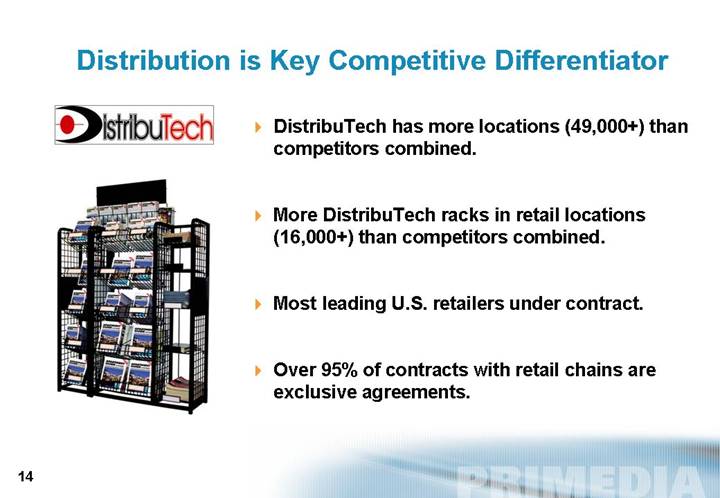

Distribution is Key Competitive Differentiator

[LOGO] | • | DistribuTech has more locations (49,000+) than competitors combined |

| | |

[GRAPHIC] | • | More DistribuTech racks in retail locations (16,000+) than competitors combined |

| |

• | Most Leading U.S. retailers under contract |

| |

• | Over 95% of contracts with retail chains are exclusive agreements |

14

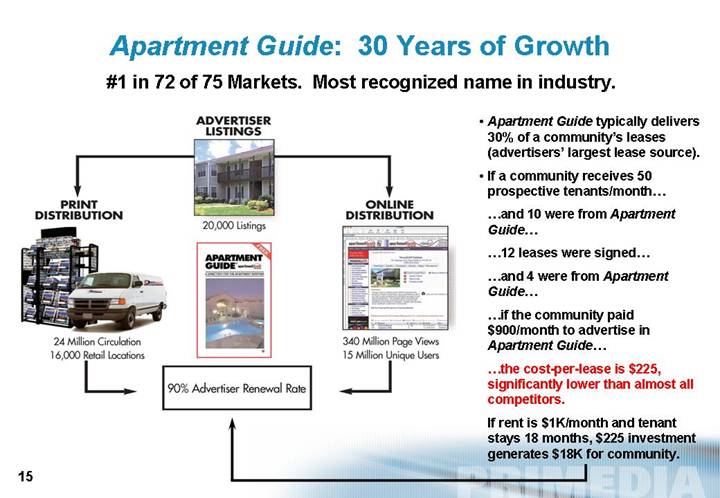

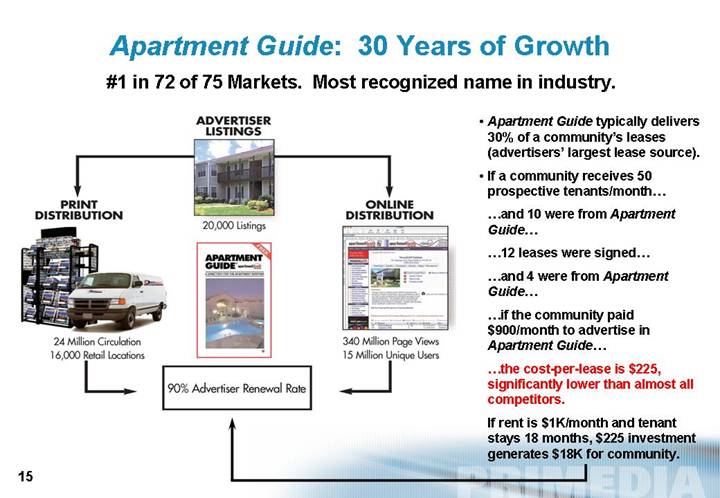

Apartment Guide: 30 Years of Growth

#1 in 72 of 75 Markets. Most recognized name in industry.

| | ADVERTISER

LISTINGS | | | • | Apartment Guide typically delivers 30% of a community’s leases (advertisers’ largest lease source). |

| | [GRAPHIC] | | | | |

PRINT

DISTRIBUTION | | 20,000 Listings | | ONLINE

DISTRIBUTION | • | If a community receives 50 prospective tenants/month... |

[GRAPHIC] | | [GRAPHIC] | | [GRAPHIC] | | ...and 10 were from Apartment Guide... |

24 Million Circulation | | | | 340 Million Page Views | | |

16,000 Retail Locations | | | | 15 Million unique Users | | ...12 leases were signed... |

| | 90% Advertiser Renewal Rate | | | | |

| | | | | | ...and 4 were from Apartment Guide... |

| | | | | | |

| | | | | | ...if the community paid $900/month to advertise in Apartment Guide... |

| | | | | | |

| | | | | | ...the cost-per-lease is $225, significantly lower than almost all competitors. |

| | | | | | |

| | | | | | If rent is $1K/month and tenant stays 18 months, $225 investment generates $18K for community. |

15

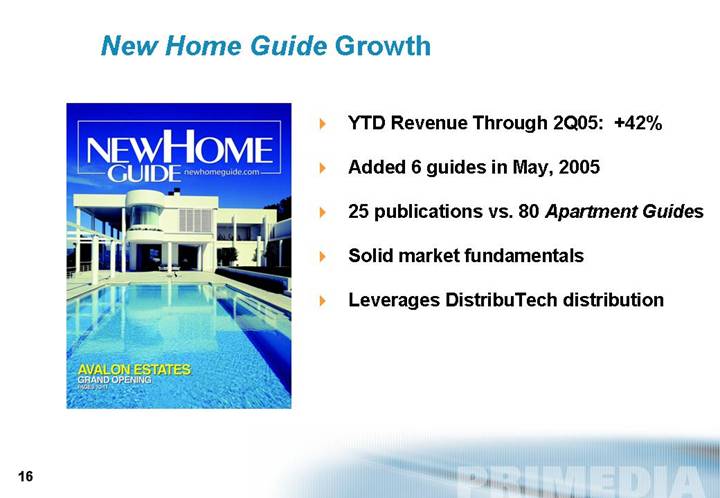

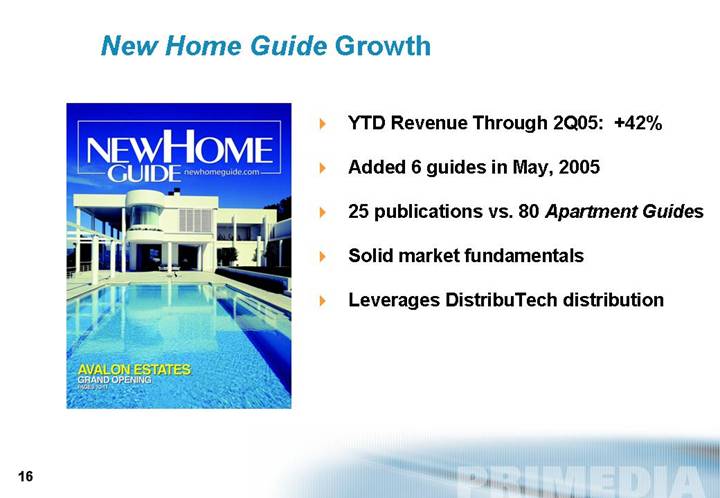

New Home Guide Growth

| • | YTD Revenue Through 2Q05: +42% |

| | |

| • | Added 6 guides in May, 2005 |

| | |

[GRAPHIC] | • | 25 publications vs. 80 Apartment Guides |

| | |

| • | Solid market fundamentals |

| | |

| • | Leverages DistribuTech distribution |

16

Auto Guide Growth

[GRAPHIC] | • | Established 2004. $13 million annualized revenue run rate as of June, 2005. |

| |

• | 13 publications |

| |

• | Scalable nationally |

| |

• | Enormous market |

| |

• | Weekly revenue stream |

| |

• | Leverages DistribuTech distribution |

17

30 Years of Consumer Guides Success

• DistribuTech provides unmatched competitive advantages for existing guides and launches.

• High advertiser renewal rates driven by provable leads.

• Industry-leading web sites.

• Efficient, automated processes maximize margins.

• All three PRIMEDIA-owned products address large markets.

• Investments expected to yield strong returns.

18

Education (6% of 2004 Revenue)

[LOGO]

• Add new advertising categories

[LOGO]

• Introducing digital platform

[LOGO]

• Maximizing strategic partnership with Mass General Hospital

19

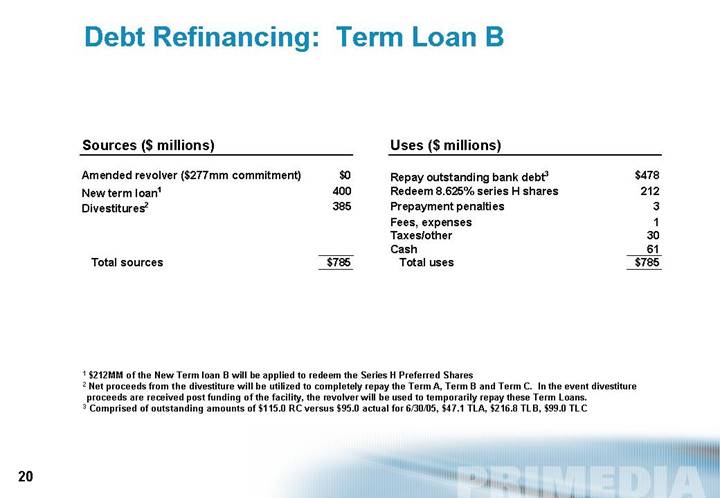

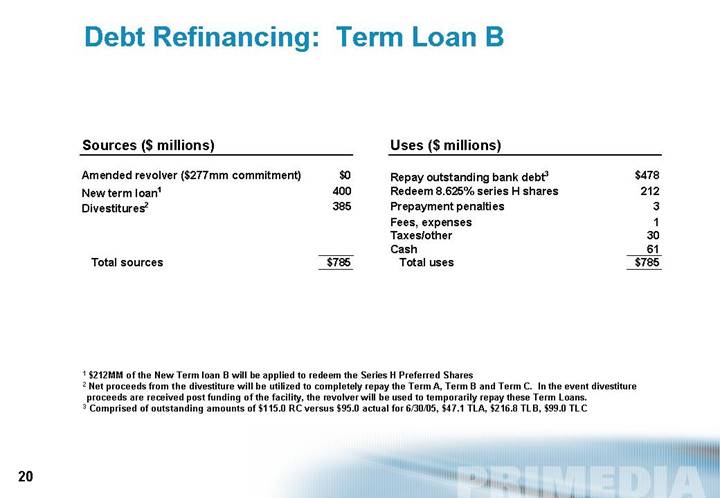

Debt Refinancing: Term Loan B

Sources ($ millions)

Amended revolver ($277mm commitment) | | $ | 0 | |

New term loan (1) | | 400 | |

Divestitures (2) | | 385 | |

| | | |

Total sources | | $ | 785 | |

Uses ($ millions)

Repay outstanding bank debt(3) | | $ | 478 | |

Redeem 8.625% series H shares | | 212 | |

Prepayment penalties | | 3 | |

Fees, expenses | | 1 | |

Taxes/other | | 30 | |

Cash | | 61 | |

Total uses | | $ | 785 | |

(1) $212MM of the New Term loan B will be applied to redeem the Series H Preferred Shares

(2) Net proceeds from the divestiture will be utilized to completely repay the Term A, Term B and Term C. In the event divestiture proceeds are received post funding of the facility, the revolver will be used to temporarily repay these Term Loans.

(3) Comprised of outstanding amounts of $115.0 RC versus $95.0 actual for 6/30/05, $47.1 TLA, $216.8 TLB, $99.0 TLC

20

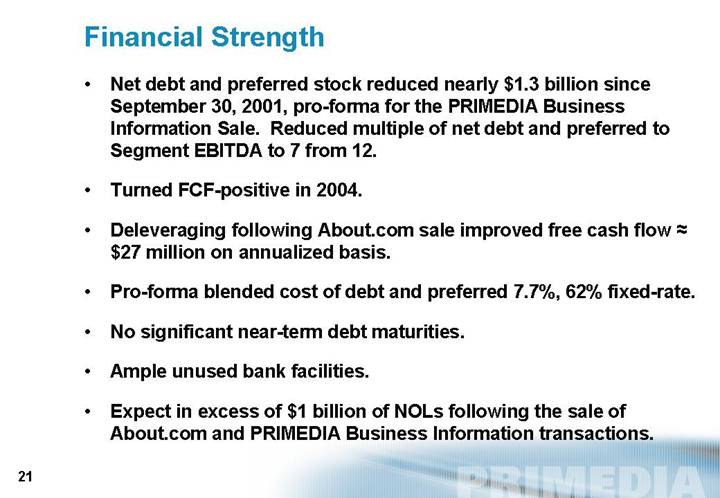

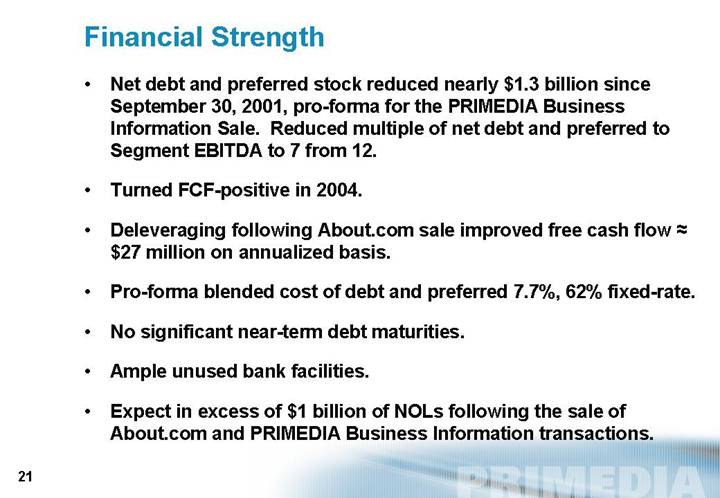

Financial Strength

• Net debt and preferred stock reduced nearly $1.3 billion since September 30, 2001, pro-forma for the PRIMEDIA Business Information Sale. Reduced multiple of net debt and preferred to Segment EBITDA to 7 from 12.

• Turned FCF-positive in 2004.

• Deleveraging following About.com sale improved free cash flow ≈ $27 million on annualized basis.

• Pro-forma blended cost of debt and preferred 7.7%, 62% fixed-rate.

• No significant near-term debt maturities.

• Ample unused bank facilities.

• Expect in excess of $1 billion of NOLs following the sale of About.com and PRIMEDIA Business Information transactions.

21

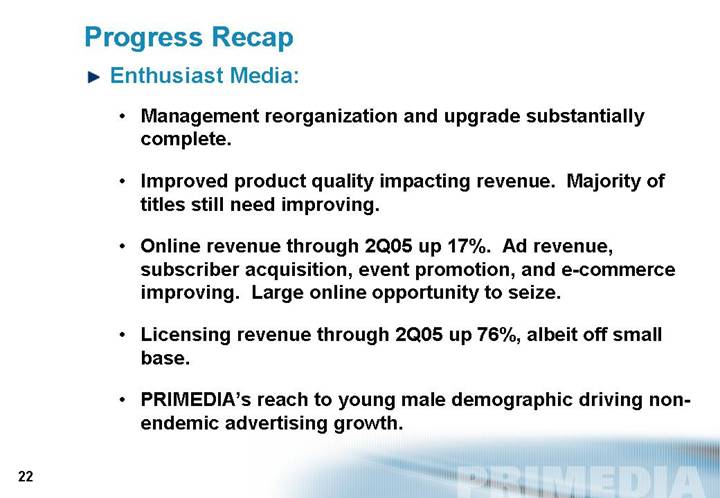

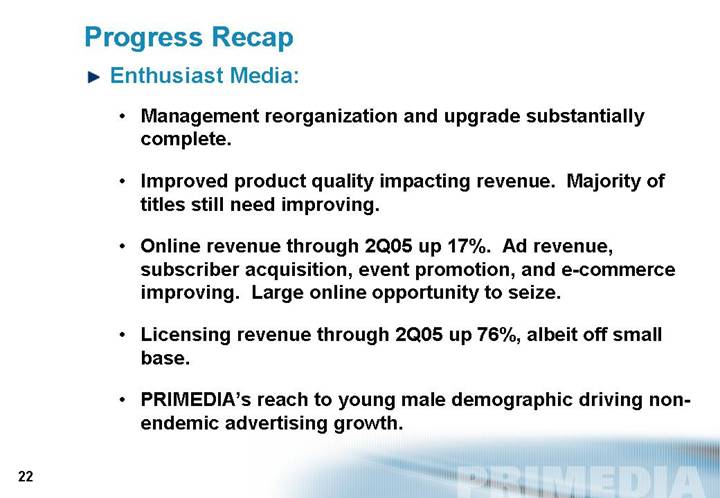

Progress Recap

• Enthusiast Media:

• Management reorganization and upgrade substantially complete.

• Improved product quality impacting revenue. Majority of titles still need improving.

• Online revenue through 2Q05 up 17%. Ad revenue, subscriber acquisition, event promotion, and e-commerce improving. Large online opportunity to seize.

• Licensing revenue through 2Q05 up 76%, albeit off small base.

• PRIMEDIA’s reach to young male demographic driving non-endemic advertising growth.

22

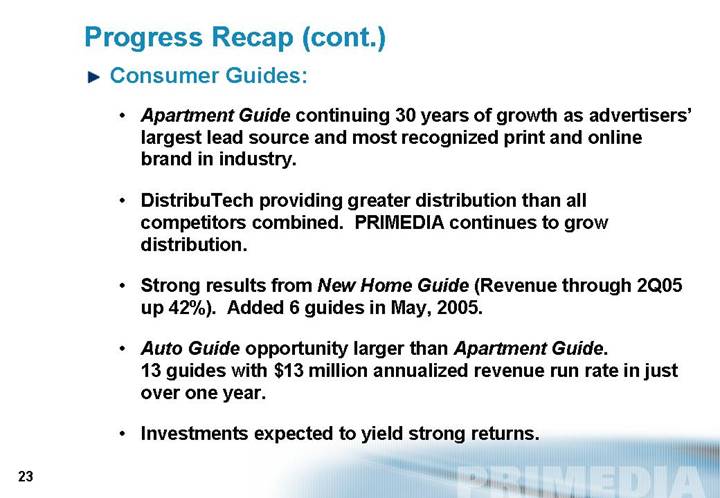

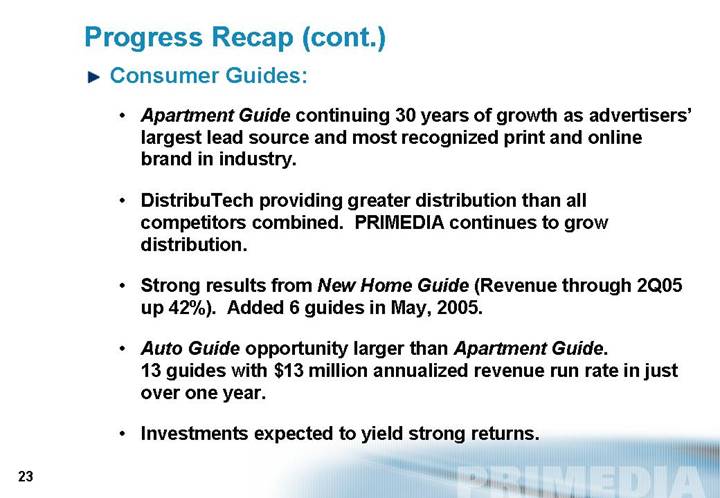

• Consumer Guides:

• Apartment Guide continuing 30 years of growth as advertisers’ largest lead source and most recognized print and online brand in industry.

• DistribuTech providing greater distribution than all competitors combined. PRIMEDIA continues to grow distribution.

• Strong results from New Home Guide (Revenue through 2Q05 up 42%). Added 6 guides in May, 2005.

• Auto Guide opportunity larger than Apartment Guide.

13 guides with $13 million annualized revenue run rate in just over one year.

• Investments expected to yield strong returns.

23

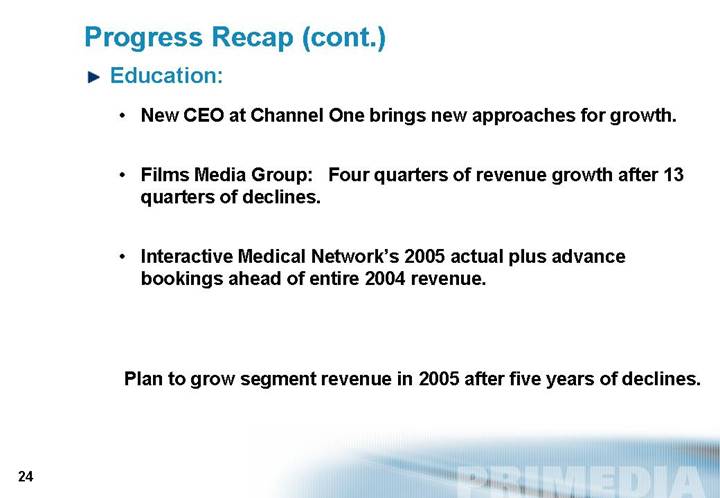

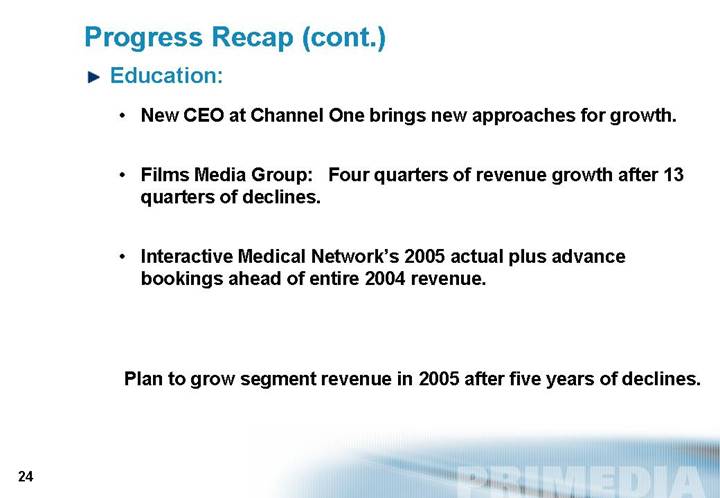

• Education:

• New CEO at Channel One brings new approaches for growth.

• Films Media Group: Four quarters of revenue growth after 13 quarters of declines.

• Interactive Medical Network’s 2005 actual plus advance bookings ahead of entire 2004 revenue.

Plan to grow segment revenue in 2005 after five years of declines.

24

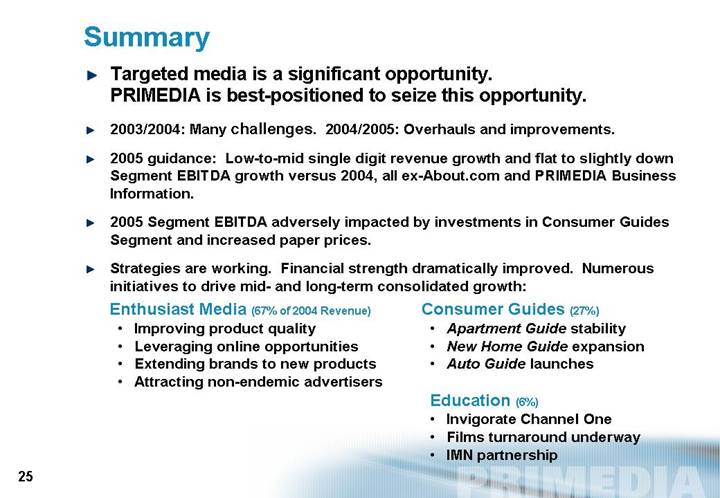

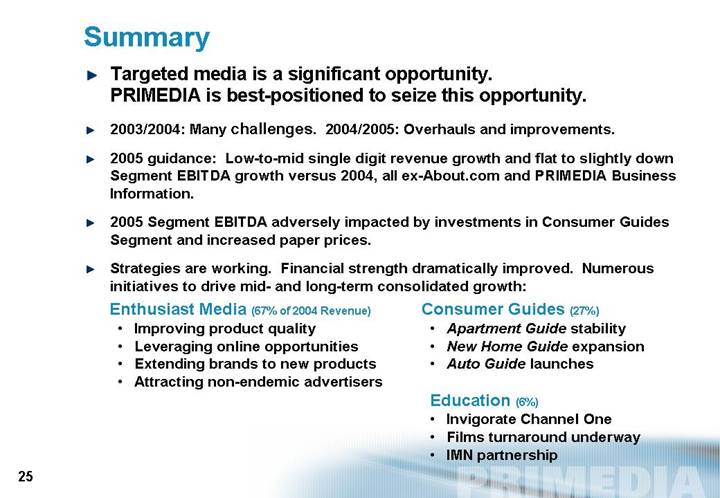

Summary

• Targeted media is a significant opportunity.

PRIMEDIA is best-positioned to seize this opportunity.

• 2003/2004: Many challenges. 2004/2005: Overhauls and improvements.

• 2005 guidance: Low-to-mid single digit revenue growth and flat to slightly down Segment EBITDA growth versus 2004, all ex-About.com and PRIMEDIA Business Information.

• 2005 Segment EBITDA adversely impacted by investments in Consumer Guides Segment and increased paper prices.

• Strategies are working. Financial strength dramatically improved. Numerous initiatives to drive mid- and long-term consolidated growth:

Enthusiast Media (67% of 2004 Revenue)

• Improving product quality

• Leveraging online opportunities

• Extending brands to new products

• Attracting non-endemic advertisers

Consumer Guides (27%)

• Apartment Guide stability

• New Home Guide expansion

• Auto Guide launches

Education (6%)

• Invigorate Channel One

• Films turnaround underway

• IMN partnership

25