Searchable text section of graphics shown above

PRIMEDIA

March, 2006

[LOGO]

Forward Looking Statements

This presentation contains forward-looking statements as that term is used under the Private Securities Litigation Act of 1995. These forward-looking statements are based on the current assumptions, expectations and projections of the Company’s management about future events. Although the assumptions, expectations and projections reflected in these forward-looking statements represent management’s best judgment at the time of this presentation, the Company can give no assurance that they will prove to be correct. Numerous factors, including those related to market conditions and those detailed from time-to-time in the Company’s filings with the Securities and Exchange Commission, may cause results of the Company to differ materially from those anticipated in these forward-looking statements. Many of the factors that will determine the Company’s future results are beyond the ability of the Company to control or predict. These forward-looking statements are subject to risks and uncertainties and, therefore, actual results may differ materially. The Company cautions you not to place undue reliance on these forward-looking statements. The Company undertakes no obligation to revise or update any forward-looking statements, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. All references to “Company” and “PRIMEDIA” as used throughout this presentation refer to PRIMEDIA Inc. and its subsidiaries.

2

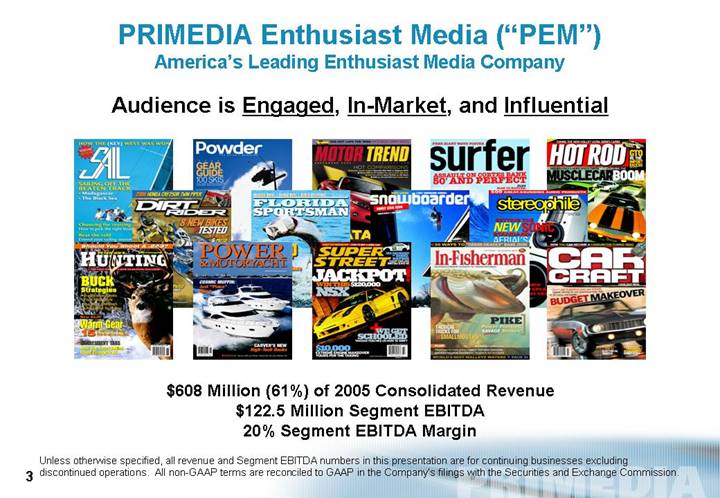

PRIMEDIA Enthusiast Media (“PEM”)

America’s Leading Enthusiast Media Company

Audience is Engaged, In-Market, and Influential

[GRAPHIC]

$608 Million (61%) of 2005 Consolidated Revenue

$122.5 Million Segment EBITDA

20% Segment EBITDA Margin

Unless otherwise specified, all revenue and Segment EBITDA numbers in this presentation are for continuing businesses excluding discontinued operations. All non-GAAP terms are reconciled to GAAP in the Company’s filings with the Securities and Exchange Commission.

3

PEM’s Key Differentiator:

Audience is Engaged, In-Market, and Influential

ADVERTISER: “I want to break through in a unique way that hooks into their passion... I want engagement.”

—Andy Markowitz, Kraft Foods, December, 2005

MEDIA BUYER: “A marketer can buy multiple pages in PRIMEDIA’s Stereophile for what it would spend for a single page in a national newsmagazine, all the while reaching technophiles in a highly targeted environment. “When a consumer electronics company comes in with $200,000 to spend, they’re not going to buy a big book. They’re going to buy smaller books that hopefully will reach influencers in the category.”

—Mike McHale, Group Media Director, Optimedia, November, 2005

ANALYST: “Mass advertising (and its dependent media) is in peril. Yet, the opportunity for advertisers and targeted media has never been brighter.”

—Bernstein Research, May, 2004

4

PEM Surrounds Engaged, In-Market, Influential Audience With Print and Non-Print Media

90+ Targeted Publications With

13+ Million Avg. Monthly Circ.

29+ Million Customer List

600+ Branded Products

90+ Targeted Events With

2+ Million Attendees

11 Targeted TV Programs With

89+ Million Annual Impressions

100+ Targeted Web Sites With

15+ Million Monthly Unique Visitors

Example: $35 Billion Fishing Market

[GRAPHIC]

5

PEM Strategy #1:

Improve Product Quality

[GRAPHIC]

“Before”

October, 2003

[GRAPHIC]

“After”

April, 2005

• Improved product quality increases newsstand sales, subscription renewal rates, and endemic and non-endemic advertising.

• Serves as the foundation for line extensions and non-print growth: Internet, video, licensing, and merchandise.

6

2006 Product Quality Improvement Plan

• Implement 25 meaningful product redesigns by September.

• Upgrade editorial and art talent.

• Launch aggressive advertising programs with redesigns.

• Institute tracking and discipline to ensure improvements are maintained after implementation.

• Continually improve testing of cover art, cover line, content, and table of contents.

7

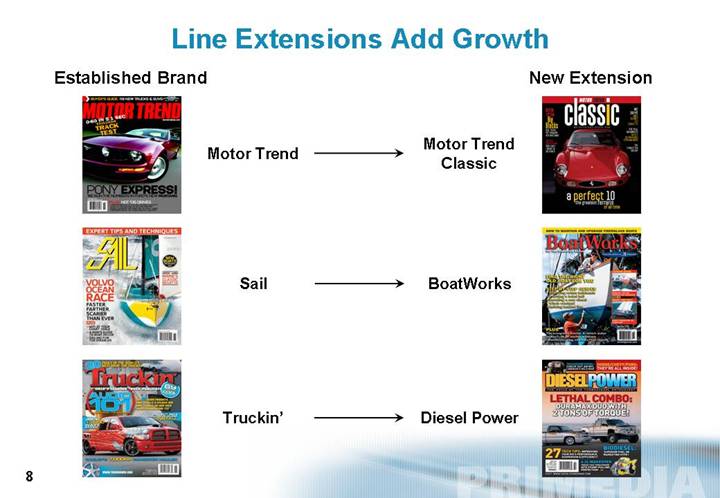

Line Extensions Add Growth

Established Brand | | | | New Extension |

| | | | |

[GRAPHIC] | Motor Trend |

| Motor Trend

Classic | [GRAPHIC] |

| | | | |

[GRAPHIC] | Sail |

| BoatWorks | [GRAPHIC] |

| | | | |

[GRAPHIC] | Truckin’ |

| Diesel Power | [GRAPHIC] |

8

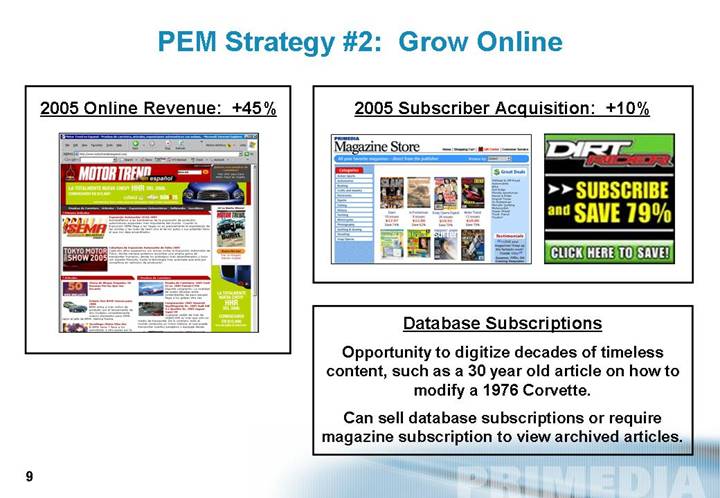

PEM Strategy #2: Grow Online

2005 Online Revenue: +45%

[GRAPHIC]

2005 Subscriber Acquisition: +10%

[GRAPHIC]

Database Subscriptions

Opportunity to digitize decades of timeless content, such as a 30 year old article on how to modify a 1976 Corvette.

Can sell database subscriptions or require magazine subscription to view archived articles.

9

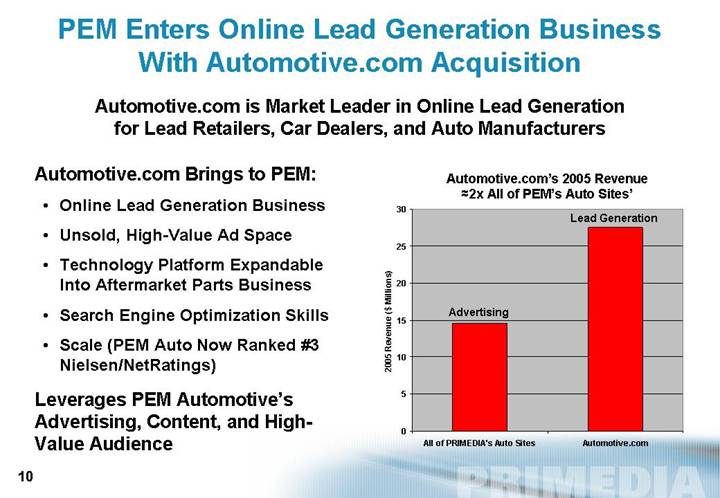

PEM Enters Online Lead Generation Business With Automotive.com Acquisition

Automotive.com is Market Leader in Online Lead Generation for Lead Retailers, Car Dealers, and Auto Manufacturers

Automotive.com Brings to PEM:

• Online Lead Generation Business

• Unsold, High-Value Ad Space

• Technology Platform Expandable Into Aftermarket Parts Business

• Search Engine Optimization Skills

• Scale (PEM Auto Now Ranked #3 Nielsen/NetRatings)

Leverages PEM Automotive’s Advertising, Content, and High-Value Audience

Automotive.com’s 2005 Revenue

»2x All of PEM’s Auto Sites’

[CHART]

10

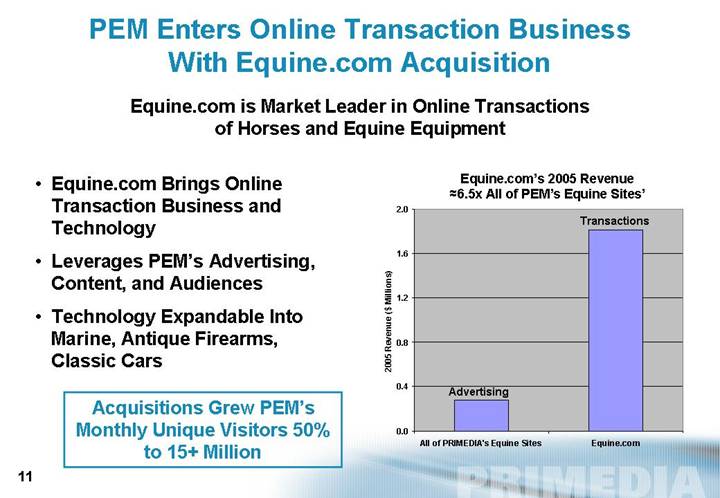

PEM Enters Online Transaction Business With Equine.com Acquisition

Equine.com is Market Leader in Online Transactions of Horses and Equine Equipment

• Equine.com Brings Online Transaction Business and Technology

• Leverages PEM’s Advertising, Content, and Audiences

• Technology Expandable Into Marine, Antique Firearms, Classic Cars

Acquisitions Grew PEM’s Monthly Unique Visitors 50% to 15+ Million

Equine.com’s 2005 Revenue

»6.5x All of PEM’s Equine Sites’

[CHART]

11

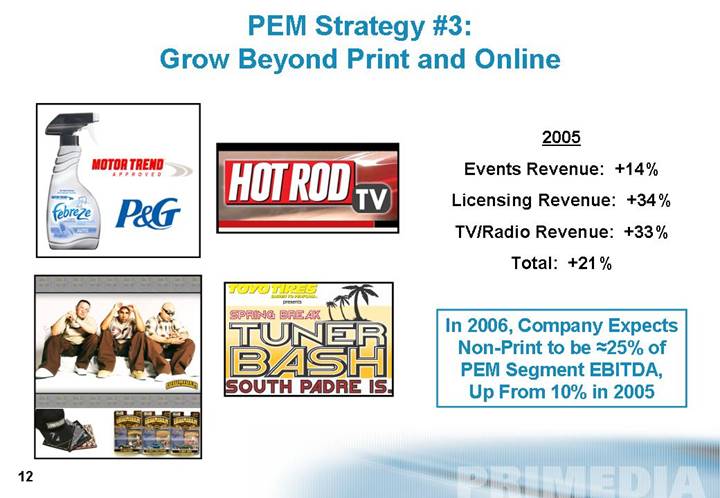

PEM Strategy #3:

Grow Beyond Print and Online

[LOGO]

[GRAPHIC]

2005

Events Revenue: +14%

Licensing Revenue: +34%

TV/Radio Revenue: +33%

Total: +21%

In 2006, Company Expects Non-Print to be »25% of PEM Segment EBITDA, Up From 10% in 2005

12

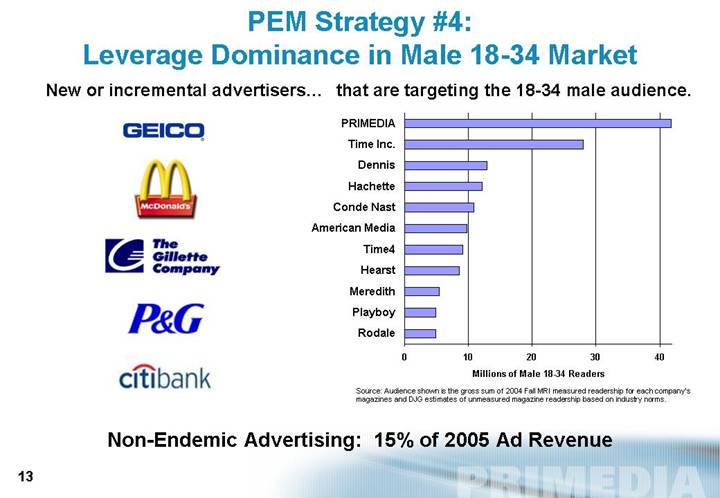

PEM Strategy #4:

Leverage Dominance in Male 18-34 Market

New or incremental advertisers… that are targeting the 18-34 male audience.

[LOGO]

[CHART]

Millions of Male 18-34 Readers

Source: Audience shown is the gross sum of 2004 Fall MRI measured readership for each company’s magazines and DJG estimates of unmeasured magazine readership based on industry norms.

Non-Endemic Advertising: 15% of 2005 Ad Revenue

13

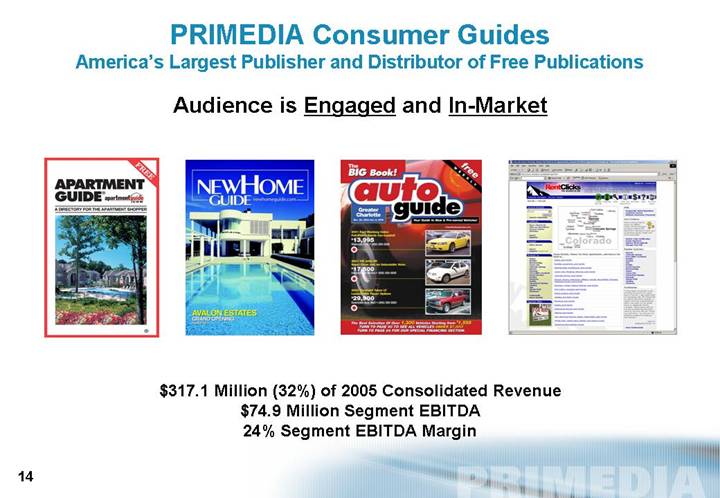

PRIMEDIA Consumer Guides

America’s Largest Publisher and Distributor of Free Publications

Audience is Engaged and In-Market

[GRAPHIC]

$317.1 Million (32%) of 2005 Consolidated Revenue

$74.9 Million Segment EBITDA

24% Segment EBITDA Margin

14

Distribution is Key Competitive Differentiator

[LOGO]

[GRAPHIC]

• Sole, exclusive distributor of free publications in leading retail chains, with more racks in retail locations (16,000+) than all competitors combined.

Example: In Dallas, DistribuTech is exclusive distributor in:

• Top three supermarkets: Kroger, Alberston’s, Tom Thumb;

• Top drugstore: Eckerd;

• Top video store: Blockbuster; and

• Top convenience store: 7-Eleven

• DistribuTech has more total locations (50,000+) than all competitors combined.

15

Apartment Guide

#1 In Almost All Markets. Most recognized name in industry.

| 20,000 Advertisers | |

| | |

| [GRAPHIC] | |

| | |

Print Distribution | | Online Distribution |

| | |

[GRAPHIC] | [GRAPHIC] | [GRAPHIC] |

| | |

16,000 | | 340 Mil. Page Views |

Retail Locations | | 15 Mil. Uniques |

| | |

| 90% Advertiser | |

| Renewal Rate | |

• Apartment Guide typically delivers 30% of a community’s leases (advertisers’ largest lease source).

• If a community receives 50 prospective tenants/month…

…and 10 were from Apartment Guide…

…12 leases were signed…

…and 4 were from Apartment Guide…

…if the community paid $900/month to advertise in Apartment Guide…

…the cost-per-lease is $225, significantly lower than almost all competitors.

If rent is $1K/month and tenant stays 18 months, $225 investment generates $18K for community.

16

New Home Guide Growth

[GRAPHIC]

• Leverages DistribuTech distribution.

• 2005 Revenue: +60%.

• 31 publications vs. 79 Apartment Guides.

• Solid market fundamentals.

17

Auto Guide Growth

[GRAPHIC]

• Leverages DistribuTech distribution.

• Established 2004. $14 million annualized quarterly revenue run rate as of 4Q05.

• 14 publications.

• Scalable nationally.

• Market larger than Apartment Guide.

• Weekly revenue stream.

18

RentClicks Opportunity

[GRAPHIC]

• In business just three years, RentClicks is largest online marketplace for small unit rental properties—the largest segment of the rental market.

• Addresses market not served by Apartment Guide.

• Even as market leader, RentClicks’ market penetration is less than 2%, representing a significant opportunity.

19

31 Years of Consumer Guides Success

• Industry-leading print and Web Sites.

• DistribuTech provides high barriers to entry for competitors and eases Auto Guide and New Home Guide expansion.

• High advertiser renewal rates driven by demonstrable ROI.

• All four Guide products address large markets.

20

PRIMEDIA Education

$65.9 Million (7%) of 2005 Consolidated Revenue

$7 Million Segment EBITDA, 11% Segment EBITDA Margin

[LOGO]

• Targeted audience, highly engaged.

• Expand beyond the traditional advertiser.

[LOGO]

• Introducing digital platform.

• First year of revenue growth after three years of declines.

[LOGO]

• Maximizing strategic partnership with Mass General Hospital.

• Grown revenue and Segment EBITDA every quarter in 2005.

21

Financial Strength

• Net debt and preferred stock reduced by $1.25 billion since September 30, 2001.

• Reduced multiple of net debt and preferred to Segment EBITDA (including discontinued operations not yet sold or shut down) to 7.5x from 12x since September 30, 2001.

• Pro-forma blended cost of debt 7.9%; 53% of debt carrying a fixed-rate.

• All preferred stock redeemed.

• Net debt of $1.46 billion. Nearest significant maturity not until 2010.

• Ample unused bank facilities.

• More than $1 billion of NOLs.

22

Summary

• PRIMEDIA’s offering of highly engaged, in-market audiences distinguishes PRIMEDIA to advertisers and marketers.

• Executing Enthusiast Media Segment’s four primary growth strategies.

• Consumer Guides Segment provides significant growth opportunities for years to come.

• Financial condition dramatically strengthened since 2001.

• Guiding for growth in 2006 to be better than in 2005:

• Mid single digit percentage revenue growth in 2006, up from low single digit growth in 2005.

• Low-to-mid single digit percentage Segment EBITDA growth in 2006, up from high single digit decline in 2005.

23

Appendix

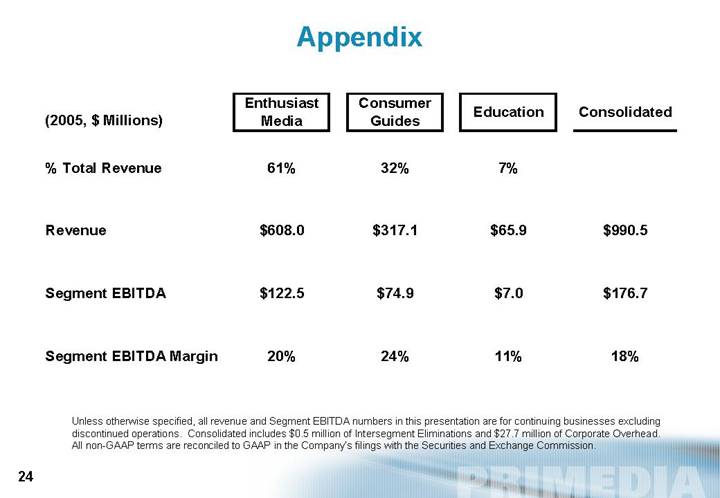

| | Enthusiast | | Consumer | | | | | |

(2005, $ Millions) | | Media | | Guides | | Education | | Consolidated | |

| | | | | | | | | |

% Total Revenue | | 61 | % | 32 | % | 7 | % | | |

| | | | | | | | | |

Revenue | | $ | 608.0 | | $ | 317.1 | | $ | 65.9 | | $ | 990.5 | |

| | | | | | | | | |

Segment EBITDA | | $ | 122.5 | | $ | 74.9 | | $ | 7.0 | | $ | 176.7 | |

| | | | | | | | | |

Segment EBITDA Margin | | 20 | % | 24 | % | 11 | % | 18 | % |

Unless otherwise specified, all revenue and Segment EBITDA numbers in this presentation are for continuing businesses excluding discontinued operations. Consolidated includes $0.5 million of Intersegment Eliminations and $27.7 million of Corporate Overhead. All non-GAAP terms are reconciled to GAAP in the Company’s filings with the Securities and Exchange Commission.

24