Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Primedia similar filings

- 29 Mar 07 Regulation FD Disclosure

- 6 Mar 07 Regulation FD Disclosure

- 27 Feb 07 Results of Operations and Financial Condition

- 22 Feb 07 Regulation FD Disclosure

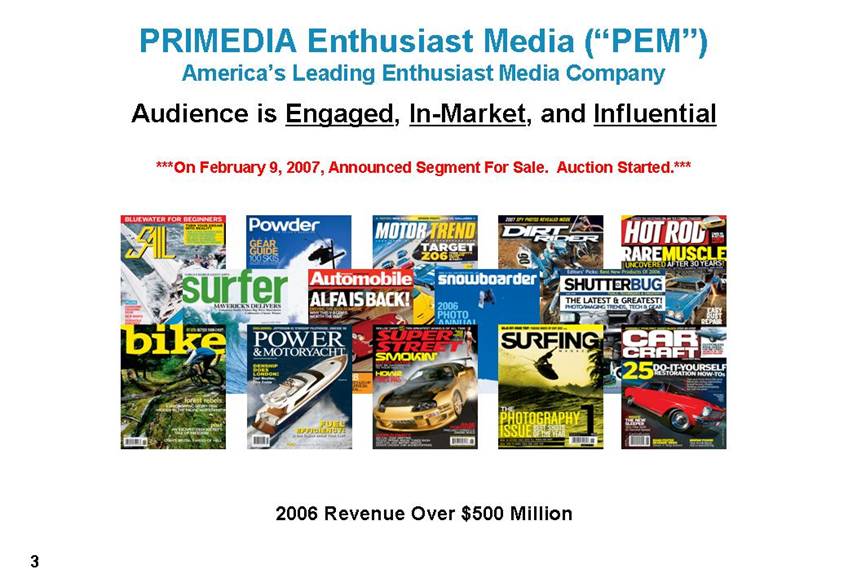

- 9 Feb 07 PRIMEDIA Announces Intention to Sell Enthusiast Media Segment

- 6 Feb 07 Completion of Acquisition or Disposition of Assets

- 31 Jan 07 PRIMEDIA Completes Sale of Hunting, Shooting and Fishing Titles

Filing view

External links