UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the registrant x

Filed by a Party other than the registrant ¨

Check the appropriate box:

¨ Preliminary proxy statement.

¨ Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)).

x Definitive proxy statement.

¨ Definitive additional materials.

¨ Soliciting material pursuant to § 240.14a-11(c) of § 240.14a-12.

THERMOENERGY CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of filing fee (check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price of other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount Previously Paid: __________

(2) Form, Schedule or Registration Statement No.: __________

(3) Filing Party: __________

(4) Date Filed: __________

NOTICE OF SPECIAL MEETING

IN LIEU OF THE 2010 ANNUAL MEETING OF SHAREHOLDERS

Notice is hereby given that a Special Meeting in lieu of the 2010 Annual Meeting of Shareholders of ThermoEnergy Corporation will be held Thursday, November 18, 2010 at 10:00 a.m., local time, at the offices of Nixon Peabody LLP, 100 Summer Street, Boston, Massachusetts, for these purposes:

| 1. | To elect three directors to serve on our Board of Directors, to serve until the 2011 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified; |

| 2. | To approve amendments to the 2008 Incentive Stock Plan; |

| 3. | To ratify the appointment of CCR LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2010; and |

| 4. | To consider and act upon such other business as may be properly presented to the meeting or any postponement or adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this notice. The Board of Directors has fixed the close of business on October 13, 2010, as the record date for the determination of the shareholders entitled to notice of, and to vote at, the meeting or any postponement or adjournment.

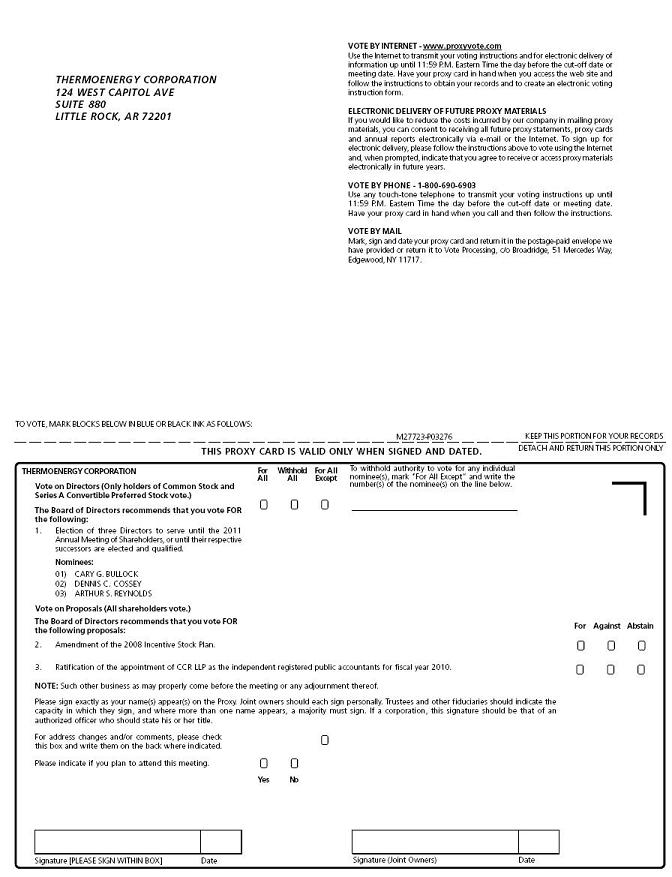

A Proxy Card, ThermoEnergy’s Proxy Statement and our Annual Report on Form 10-K/A for the fiscal year ended December 31, 2009 are enclosed with this Notice of Special Meeting in lieu of the 2010 Annual Meeting of Shareholders. Our Board of Directors recommends that you vote FOR election of the nominees for director named in the Proxy Statement, FOR approval of the amendments to our 2008 Incentive Stock Plan, and FOR ratification of the appointment of CCR LLP as independent registered public accountants for the fiscal year ending December 31, 2010.

All shareholders are cordially invited to attend the meeting in person. However, to assure your representation at the meeting, you are urged to mark, sign, date and return the enclosed Proxy Card as promptly as possible in the postage prepaid envelope provided for that purpose. Any shareholder attending the meeting may vote in person even if he or she returned a proxy.

| | By order of the Board of Directors, |

| | |

| | |

| | Cary G. Bullock President and Chief Executive Officer |

October 20, 2010

Little Rock, Arkansas

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING IN LIEU OF THE 2010 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON NOVEMBER 18, 2010:

This Proxy Statement and the accompanying Annual Report are available via the Internet at http://thermoenergy.ir.stockpr.com and at www.proxyvote.com

Table of Contents

| Questions and Answers about Voting and the Special Meeting | 1 |

| Proposal I – Election of Directors | 4 |

| Nominees | 4 |

| Directors who are not Nominees for Election at the Special Meeting | 5 |

| Committees of the Board of Directors | 7 |

| Shareholder Communications | 8 |

| Code of Ethics | 8 |

| Board Determination of Independence | 8 |

| Attendance at Annual Meeting and at Board and Committee Meetings | 8 |

| Compensation of the Board | 9 |

| Security Ownership by Certain Beneficial Owners, Directors and Executive Officers | 10 |

| Section 16(a) Beneficial Ownership Reporting Compliance | 12 |

| Executive Officers | 13 |

| Executive Compensation | |

| Summary Compensation Table | 13 |

| Outstanding Equity Awards at December 31, 2009 | 14 |

| Equity Compensation Plan Information | 15 |

| Employment Contracts and Agreements | 15 |

| Certain Relationships and Related Transactions | 17 |

| Audit Committee Report | 21 |

| Proposal II – Approval of Amendments to 2008 Incentive Stock Plan | 23 |

| Proposal III – Ratification of Appointment of Independent Registered Public Accounting Firm | 31 |

| Other Matters | 33 |

| Information Incorporated by Reference to Annual Report on Form 10-K/A | 33 |

| Audit Committee Charter | Annex A |

| 2008 Incentive Stock Plan, as amended | Annex B |

THERMOENERGY CORPORATION

124 W. Capitol Avenue, Suite 880

Little Rock, Arkansas 72201

Telephone 501.376.6477

Facsimile 501.375.5249

October 20, 2010

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT VOTING AND THE SPECIAL MEETING IN LIEU OF THE 2010 ANNUAL MEETING

| Q: | Why did I receive this proxy statement? |

| | A: | The Board of Directors of ThermoEnergy Corporation is soliciting your proxy to vote at the Special Meeting of Shareholders because you were a shareholder of ThermoEnergy as of the close of business on October 13, 2010, the record date, and are therefore entitled to vote at the meeting. |

This Proxy Statement and Proxy Card, along with the Annual Report on Form 10-K/A for the fiscal year ended December 31, 2009, are being mailed to shareholders as of the record date beginning on or about October 20, 2009. The Proxy Statement summarizes the information you need to know to vote at the meeting. You do not need to attend the meeting to vote your shares.

| | A: | ● Election of three directors: Cary G. Bullock, Dennis C. Cossey and Arthur S. Reynolds, each of whom is an incumbent director, have been nominated to serve until the 2011 Annual Meeting of Shareholders, or until their respective successors are elected or appointed. |

● Approval of amendments to the ThermoEnergy Corporation 2008 Incentive Stock Plan, including an amendment to increase the number of shares of our Common Stock available for issuance under such Plan to 20,000,000.

● Ratification of the appointment of CCR LLP as ThermoEnergy’s independent registered public accounting firm for the fiscal year ending December 31, 2010.

The Board of Directors recommends a vote FOR election of the nominees to the Board of Directors. FOR approval of the amendment of our 2008 Incentive Stock Plan, and FOR ratification of the appointment of CCR LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2010.

Q: What is the voting requirement to elect the directors? What is the voting requirement to approve the amendment of the 2008 Incentive Stock Plan and to ratify the appointment of CCR LLP as independent registered public accountants?

| | A: | For the election of directors, the nominees must receive the affirmative vote of a plurality of the votes cast by the holders of the Common Stock and Series A Convertible Preferred Stock, voting together as a single class. The proposals to approve the amendments to our 2008 Incentive Stock Plan and to ratify the appointment of CCR LLP as independent registered public accountants require the affirmative vote of a majority of the votes cast by the holders of the Common Stock, Series A Convertible Preferred Stock and Series B Convertible Preferred Stock, voting together as a single class. The voting requirements given in this answer assume that a quorum is present. |

| Q: | How many votes do I have? |

| | A: | You are entitled to one vote for each share of ThermoEnergy’s Common Stock or Series A Convertible Preferred Stock that you hold and ten votes for each share of ThermoEnergy’s Series B Convertible Preferred Stock that you hold. Shareholders do not have cumulative voting rights. Holders of ThermoEnergy’s Series B Convertible Preferred Stock are not entitled to vote in the election of directors at the Special Meeting in lieu of the 2010 Annual Meeting of Shareholders. |

| | A: | You may vote using any of the following methods: |

| | (1) | Complete, sign and date the Proxy Card you receive and return it in the prepaid envelope; or |

| | (2) | Attend the Special Meeting of Shareholders to vote in person. |

If you return your signed Proxy Card but do not indicate your voting preferences, the persons named in the Proxy Card will vote FOR the election of the nominees for director, FOR approval of the amendments to our 2008 Incentive Stock Plan, and FOR ratification of CCR LLP as our independent registered public accountants for 2010.

| Q: | What can I do if I change my mind after I vote my shares? |

| | A: | You may revoke your proxy at any time before it is voted at the Special Meeting of Shareholders by: |

| | (1) | Sending written notice of revocation to the Secretary of ThermoEnergy; |

| | (2) | Submitting a new paper ballot, after the date of the revoked proxy; or |

| | (3) | Attending the Special Meeting of Shareholders and voting in person. |

You may also be represented by another person at the meeting by executing a proper proxy designating that person.

| Q: | What constitutes a quorum? |

| | A: | As of the record date, 53,488,090 shares of Common Stock, 208,334 shares of Series A Convertible Preferred Stock and 5,912,956 shares of Series B Convertible Preferred Stock were outstanding. Except as otherwise required by law or the Certificate of Incorporation, the holders of the Common Stock, the holders of the Series A Convertible Preferred Stock and the holders of the Series B Convertible Preferred Stock vote together as a single class, with each share of Common Stock and each share of Series A Convertible Preferred Stock entitling the holder thereof to one vote and each share of Series B Convertible Preferred Stock entitling the holder thereof to ten votes. The holders of a majority in voting power of the outstanding shares of Common Stock, Series A Convertible Preferred Stock and Series B Convertible Preferred Stock (or 56,412,993 votes), present in person or represented by proxy, constitute a quorum for the purpose of the meeting. If you submit a properly executed proxy, then you will be considered part of the quorum. If you are present or represented by proxy at the meeting, you will count toward a quorum. |

| Q: | Who can attend the Annual Meeting of Shareholders? |

| | A: | All shareholders as of the record date may attend the Special Meeting of Shareholders. |

| Q: | Are there any shareholders that own more than 5% of ThermoEnergy’s outstanding Common Stock? |

| | A: | As of October 13, 2010, David Gelbaum, Dennis C. Cossey, J. Winder Hughes III, Elise C. Roenigk, the Estate of P.L. Montesi, Security Management LLC, The Quercus Trust, Robert S. Trump, The Focus Fund, Empire Capital Management, Spencer Trask Specialty Group, LLC and Kevin B. Kimberlin each beneficially owned more than 5% of our outstanding Common Stock. |

| Q: | When are shareholder proposals due for the 2011 Annual Meeting of Shareholders? |

| | A: | In order to be considered for inclusion in next year’s proxy statement, shareholder proposals must be submitted in writing by December 31, 2010, to Cary G. Bullock, President and Chief Executive Officer, ThermoEnergy Corporation, 10 New Bond Street, Worcester, Massachusetts 01606. |

If you notify us after March 1, 2011 of an intent to present a proposal at our 2011 Annual Meeting of Shareholders, we will have the right to exercise discretionary voting authority with respect to your proposal, if presented at the meeting, without including information regarding it in our proxy materials.

| Q: | What happens if the nominees for director are unable to serve as directors? |

| | A: | If a nominee becomes unavailable for election, which we do not expect, votes will be cast for the substitute nominee or nominees who may be designated by the Nominating Committee of the Board of Directors. |

| Q: | Who will be responsible for soliciting proxies? |

| | A: | We have neither hired nor paid for assistance in the distribution of proxy materials and solicitation of votes. Employees, officers and directors of ThermoEnergy may solicit proxies, but will not be separately compensated for such solicitation. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to the owners of Common Stock. |

PROPOSAL I

ELECTION OF DIRECTORS

Unless otherwise directed in the proxy, the persons named in the enclosed proxy card, or their substitute, will vote the proxy FOR the election of Cary G. Bullock, Dennis C. Cossey, and Arthur S. Reynolds to the Board of Directors.

Pursuant to our Certificate of Incorporation, as amended, the number of directors constituting the Board of Directors has been set at seven. Four members of the Board of Directors are elected by the holders of our Series B Convertible Preferred Stock and three members of the Board of Directors are elected by the holders of our Common Stock and our Series A Convertible Preferred Stock (voting together as a single class). All directors serve one-year terms. At the Special Meeting of Shareholders, three directors are to be elected by the holders of our Common Stock and our Series A Convertible Preferred Stock. Cary G. Bullock, Dennis C. Cossey, and Arthur S. Reynolds currently serve on the Board of Directors and are being nominated for another term, expiring at the 2011 Annual Meeting of Shareholders.

Nominees

Cary G. Bullock, age 64, was appointed as our President and Chief Executive Officer and was elected to our Board of Directors on January 27, 2010. Mr. Bullock also serves as Chief Executive Officer and a member of the Board of Directors of our subsidiary, ThermoEnergy Power Systems LLC, as a member of the Board of Managers of Babcock-Thermo Carbon Capture LLC, our joint venture with Babcock Power, Inc., and as a member of the Board of Directors of our subsidiary, CASTion Corporation. Prior to becoming our President and CEO, Mr. Bullock had been employed by GreenFuel Technologies Corporation, serving as Chief Executive Officer from February 2005 through July 2007 and as Vice President for Business Development from July 2007 through January 2009; he was a member of the Board of Directors of GreenFuel Technologies Corporation from February 2005 through August 2009. In May 2009, GreenFuel Technologies ceased business operations and made an assignment of its assets to a trustee for the benefit of its creditors. From February 2009 through January 2010, Mr. Bullock served a variety of clients as an independent consultant and business advisor. Prior to joining GreenFuel Technologies, Mr. Bullock was Chairman and Chief Executive Officer of Excelergy Corporation, Vice President of KENETECH Management Services and President of its affiliate, KENETECH Energy Management, Inc., Chairman and Chief Executive Officer of Econoler/USA Inc., Vice President of Engineering and Operations and Principal Engineer of Xenergy Inc., Director of Special Engineering and a Senior Engineer at ECRM, Inc. and a Senior Engineer at Sylvania Electronics Systems. Mr. Bullock received an A.B. from Amherst College and an S.B. and an S.M. from Massachusetts Institute of Technology. Having worked as a senior executive in several early stage energy companies, Mr. Bullock brings to the Board extensive industry and strategic experience.

Dennis C. Cossey, age 64, has served as a director of the Company since 1988 and as Chairman of our Board of Directors since 1990. Since March 1, 2010, he has held the title “Executive Chairman.” Mr. Cossey was our Chief Executive Officer from 1988 through January 27, 2010. Mr. Cossey also serves as a member of the Boards of Directors of our subsidiaries, CASTion Corporation and ThermoEnergy Power Systems LLC. Prior to joining the Company, Mr. Cossey served in executive and marketing positions at a number of companies, including IBM and Peter Kiewit Sons. Mr. Cossey is a member of several industry professional groups including the US Naval Institute, the New York Academy of Sciences, the National Safety Council, the American Chemical Society, the Asia Pacific Water Council, the International Power Producers Forum and the Association of Energy Engineers. Mr. Cossey has testified before Congress on various environmental issues. Mr. Cossey brings to the Board deep experience in the management of publicly-financed research and operating projects and in the development and maintenance of government relationships on the federal, state and municipal levels.

Arthur S. Reynolds, age 66, has been a director of the Company since October 2008. He also serves as a member of the Board of Directors of our subsidiary, CASTion Corporation. From August 3, 2009 through November 16, 2009, Mr. Reynolds served as our interim Chief Financial Officer, and except during that period, has been Chairman of the Audit Committee of the Board of Directors. Since July 30, 2010, Mr. Reynolds has been a director and the acting Chief Executive Officer and President of Clean Power Technologies, Inc. He is the founder of Rexon Limited of London and New York where, since 1999, he has served as managing director. Mr. Reynolds was founder and, from 1997 to 1999, managing partner of London-based Value Management & Research (UK) Limited. Mr. Reynolds was the founder and, from 1982 to 1997, served as managing director of Ferghana Financial Services Limited. Prior thereto, Mr. Reynolds held executive positions at Merrill Lynch International Bank Limited, Banque de la Société Financière Européene, J.P. Morgan & Company and Mobil Corporation. Mr. Reynolds is a director of Apogee Technology, Inc. Mr. Reynolds holds an A.B. from Columbia University, a M.A. from Cambridge University, and an M.B.A. in Finance from New York University. Mr. Reynolds brings to the Board extensive financial and executive experience across multiple sectors, with special strength in the international arena.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR ELECTION OF THE NOMINEES.

Directors who are not Nominees for Election at the Special Meeting

The following members of the Board of Directors have been elected by the holders of our Series B Convertible Preferred Stock, are not candidates for election at the Special Meeting of Shareholders, and will continue to serve as directors following the Special Meeting:

David Anthony, age 49, has been a director of the Company since October 2009. Mr. Anthony also serves as a member of the Board of Managers of Babcock-Thermo Carbon Capture LLC, our joint venture with Babcock Power, Inc., and as a member of the Board of Directors of our subsidiary, CASTion Corporation. Since 2003, he has been Managing Director of 21 Ventures, LLC, a VC management firm providing seed, growth and bridge capital for technology ventures. Mr. Anthony sits on numerous boards, including: Axion Power International, Inc.; Clean Power Technologies Inc.; Solar EnerTech Corp.; Energy Focus, Inc.; Advanced Hydro, Inc.; Advanced Telemetry, LLC; Aero Farm Systems LLC; Applied Solar LLC; BioPetroClean, Inc.; Expansion Media, LLC; ETV Motors, Ltd.; Graphene Energy, Inc.; Gravity Power, LLC; GreenRay, Inc.; Lightwave Power, Inc.; Magenn Power, Inc.; ReGen Power Systems LLC; Safe Hydrogen, LLC; Variable Wind Solutions Ltd.; Agent Video Intelligence Ltd.; and Command Speech Ltd. Prior to 21 Ventures, Mr. Anthony launched Notorious Entertainment, a developer of multimedia brands. Mr. Anthony received a B.A. in Economics from George Washington University and an M.B.A. from Dartmouth College. Mr. Anthony brings to the Board extensive public company corporate governance and venture capital experience.

J. Winder Hughes III, age 52, has been a director of the Company since July 2009 (except for the period from January 27, 2010 to February 5, 2010). Mr. Hughes also serves as a member of the Board of Managers of Babcock-Thermo Carbon Capture LLC, our joint venture with Babcock Power, Inc., and as a member of the Board of Directors of our subsidiary, CASTion Corporation. Since 1995, Mr. Hughes has served as the managing partner of Hughes Capital Investors, LLC, which manages private assets and raises money for small public companies. He formed the Focus Fund, LP in 2000 (with Hughes Capital as the fund manager), which is a highly-concentrated equity partnership that focuses on publicly-traded emerging growth companies. From November 2007 to November 2009, Mr. Hughes was a director of Viking Systems, Inc, a manufacturer of surgical tools. From 1983 to 1995, Mr. Hughes was an investment executive, first with Kidder Peabody & Co. and subsequently with Prudential Securities. Mr. Hughes holds a B.A. in Economics from the University of North Carolina at Chapel Hill. Mr. Hughes brings to the Board significant experience with capital raising, corporate restructuring, and managing strategic business relationships.

Shawn R. Hughes, age 50, has been a director of the Company since October 2009. He previously served as a member of our Board of Directors from September 2008 until January 2009. Mr. Hughes also serves as a member of the Board of Directors of our subsidiary, CASTion Corporation. He served as President and Chief Operating Officer of the Company from January 1, 2008 to January 27, 2010. From June 15, 2007 through December 31, 2007, he was employed by us to assist the Chief Executive Officer in administering corporate affairs and overseeing all of our business operating functions. From November 2006 to May 2007, Mr. Hughes served as President and Chief Operating Officer of Mortgage Contract Services. From 2001 to 2006, Mr. Hughes served as Chief Executive Officer of Fortress Technologies. Mr. Hughes holds a B.S.B.A. from Slippery Rock University and an M.B.A. from Florida State University. Mr. Hughes brings to the Board extensive experience in executive management and strategic planning.

Pursuant to our Certificate of Incorporation, as amended, the holders of our Series B Convertible Preferred Stock are entitled to elect four members of our Board of Directors (the “Series B Directors”), which Series B Directors are subject to removal only by a vote of the holders of not less than 66⅔% of the then-outstanding shares of Series B Convertible Preferred Stock voting as a separate class; any vacancy created by the resignation or removal of a Series B Director may be filled either by (i) the vote or consent of the holders of a majority of the then-outstanding shares of Series B Convertible Preferred Stock or (ii) the unanimous vote or consent of the remaining Series B Directors. The holders of our Common Stock, voting together with the holders of our Series A Preferred Stock, are entitled to elect three members of our Board of Directors (the “Common Stock Directors”), which Common Stock Directors are subject to removal only by a vote of the holders of a majority of the then-outstanding shares of Common Stock (taken together as a single class with the then-outstanding shares of Series A Preferred Stock); any vacancy created by the resignation or removal of a Common Stock Director may be filled either by (i) the vote or consent of the holders of a majority of the then-outstanding shares of Common Stock and Series A Preferred Stock (voting or consenting together as a single class) or (ii) the unanimous vote or consent of the remaining Common Stock Directors. The holders of our Series B Convertible Preferred Stock are parties to a Voting Agreement dated as of November 19, 2009, pursuant to which they have agreed to vote all of their shares of Series B Convertible Preferred Stock for the election to our Board of Directors of three persons designated by The Quercus Trust and one person designated by Robert S. Trump. The Series B Directors are David Anthony and J. Winder Hughes III (both of whom are designees of The Quercus Trust) and Shawn R. Hughes (who is the designee of Robert S. Trump); one Series B Directorship is vacant. The Common Stock Directors are Cary G. Bullock, Dennis C. Cossey and Arthur S. Reynolds. All directors serve terms of one year.

The Executive Employment Agreement of our President and Chief Executive Officer, Cary G. Bullock, provides that, during the term of his employment, Mr. Bullock will be elected to serve on our Board of Directors.

None of our directors or executive officers is related by blood or marriage to any other director or executive officer.

Committees of the Board of Directors

Compensation and Benefits Committee. The Compensation and Benefits Committee consists of Mr. Anthony, as Chairman, Mr. Shawn Hughes, and Mr. Winder Hughes. This committee makes recommendations to the Board of Directors on compensation generally, executive officer salaries, bonus awards, stock option grants, special awards and supplemental compensation. The Compensation and Benefits Committee consults generally with management on matters concerning executive compensation and other compensation issues where Board of Directors or shareholder action is contemplated. The Board has determined that all of the members of the Compensation and Benefits Committee are independent.

Audit Committee. The Audit Committee consists of Mr. Reynolds, as Chairman, Mr. Winder Hughes, and Mr. Anthony. This committee oversees the Company’s financial reporting process and internal controls. The Audit Committee is governed by a written charter approved by the Board of Directors. The charter sets out the Audit Committee’s membership requirements and responsibilities. A copy of the Audit Committee charter is attached hereto as Appendix A. As part of its duties, the Audit Committee consults with management and the Company’s independent registered public accounting firm during the year on matters related to the annual audit, internal controls, the published financial statements and the accounting principles and auditing procedures being applied. The Audit Committee selects the Company’s registered public accounting firm, reviews the independent registered public accounting firm’s audit fees, discusses relationships with the auditor, and reviews and approves in advance non-audit services to ensure no compromise of independence. The Board has determined that Messrs. Anthony and Hughes are “independent directors” and that all of the members are audit committee financial experts (as defined in Item 407(d)(5)(ii) of Regulation S-K). Mr. Reynolds is not considered independent due to his service as interim Chief Financial Officer during the period August 3, 2009 through November 16, 2009 but, because of Mr. Reynolds’s prior service as an independent member of the Audit Committee, the extraordinary circumstances under which he agreed to serve as interim Chief Financial Officer, and the brief period of such service, the Board of Directors has determined that Mr. Reynolds will be able to exercise independent judgment as a member of the Audit Committee and that his service as Chairman of the Audit Committee is in the best interests of the Company and its shareholders.

Nominating Committee. The directors elected by the holders of our Common Stock and our Series A Convertible Preferred Stock (Messrs. Bullock, Cossey, and Reynolds) serve as the Nominating Committee, with Mr. Cossey serving as Chairman. The Nominating Committee identifies the individuals to be nominated for election to the Board of Directors by the holders of our Common Stock and our Series A Convertible Preferred Stock. In considering candidates, the Nominating Committee seeks to assure that the Board of Directors will include persons with a variety of skills and experience, including at least one director with expertise in the areas of science and technology in which the Company operates and at least one director who qualifies as an audit committee financial expert. The Nominating Committee does not have a charter. The Nominating Committee will consider director candidates recommended by the shareholders if a nominating shareholder complies with the following requirements. If a shareholder wishes to recommend a candidate to the Nominating Committee for consideration as a candidate for election to the Board of Directors, the shareholder must submit in writing to the Nominating Committee the nominee’s name and a brief resume setting forth the nominee’s business and educational background and qualifications for service, and a notarized consent signed by the recommended candidate stating the recommended candidate’s willingness to be nominated and to serve. This information must be delivered to the Chairman of the Nominating Committee at the following address: ThermoEnergy Corporation, 124 W. Capitol Avenue, Suite 880, Little Rock, Arkansas 72201, and must be received no later than December 31 in any year to be considered as a potential director nominee at the Annual Meeting of Shareholders for the following year. The Nominating Committee may request additional information if it determines a potential candidate may be an appropriate nominee.

Shareholder Communications

We do not have a formal policy for shareholder communications to the Board of Directors. The small size of our Board of Directors and the simple administrative structure of ThermoEnergy permits shareholders to have easy access to ThermoEnergy’s management and its directors for any communications, including those pertaining to director nominations as set forth above. Shareholder inquiries, suggestions and other communications may be directed to Investor Relations at ThermoEnergy Corporation, 124 W. Capitol Avenue, Suite 880, Little Rock, Arkansas 72201.

Code of Ethics

A copy of our Code of Business Conduct and Ethics, including additional provisions which apply to the chief executive officer and senior financial officers, may be obtained free of charge by making a written request to Investor Relations, ThermoEnergy Corporation, 124 W. Capitol Avenue, Suite 880, Little Rock, Arkansas 72201.

Board Determination of Independence

Our securities are not listed on a national securities exchange or on an inter-dealer quotation system which has requirements that a majority of the board of directors be independent. In determining which directors and which members of committees are “independent,” our Board of Directors has voluntarily adopted the independence standards set forth in the Marketplace Rules of the Nasdaq Stock Market. Our Board of Directors has determined that, in accordance with these standards, two of our current Directors, David Anthony and J. Winder Hughes III are “independent directors.” Further, six persons who served as members of our Board of Directors for a portion of the fiscal ended December 31, 2009 (Joseph P. Bartlett, David Gelbaum, David Fields, Paul A. Loeffler, Louis J. Ortmann and Martin A. Roenigk) were “independent directors.” Although Shawn R. Hughes and Arthur S. Reynolds do not satisfy the independence standards that we have adopted because each of them, during part or all of the fiscal year ended December 31, 2009, served as an executive officer, our Board of Directors believes that neither Mr. Hughes nor Mr. Reynolds currently has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In determining the independence of our directors, the Board of Directors considered all transactions in which we and any director had any interest, including those discussed under “Certain Relationships and Related Transactions” below.

Attendance at the Annual Meeting and at Board and Committee Meetings

Although we do not have a requirement that all members of the Board of Directors attend the Annual Meeting of Shareholders, such attendance is strongly encouraged. Six of the seven directors then in office attended the 2009 Annual Meeting of Shareholders. During the fiscal year ended December 31, 2009, the Board of Directors held 17 meetings and every director attended at least 75% of those meetings. During 2009, the Audit Committee held 9 meetings and the Compensation and Benefits Committee held 4 meetings, and all members of those committees attended at least 75% of the meetings of their respective committees. The Nominating Committee did not hold any meetings during the fiscal year ended December 31, 2009.

Compensation of the Board

Directors do not receive cash compensation for serving on the Board or its committees. Non-employee directors are awarded annual grants of non-qualified stock options. All directors are reimbursed for their reasonable expenses incurred in attending board meetings. We maintain directors and officers liability insurance.

The following table shows compensation for the fiscal year ended December 31, 2009 to our directors who were not also named executive officers:

Director Compensation (1)

| | | Fees Earned or | | | Option Awards | | | | |

| Name | | Paid in Cash | | | ($) (2) | | | Total ($) | |

| Paul A. Loeffler | | none | | | none | | | $ | 0 | |

| Louis J. Ortmann | | none | | | none | | | $ | 0 | |

| Martin A. Roenigk | | none | | | none | | | $ | 0 | |

| David Gelbaum | | none | | | $ | 9,192 | (3) | | $ | 9,192 | |

| David Anthony | | none | | | $ | 9,192 | (4) | | $ | 9,192 | |

| J. Winder Hughes III | | $ | 60,000 | (5) | | $ | 17,920 | (6) | | $ | 77,920 | |

| David A. Field | | none | | | $ | 7,457 | (7) | | $ | 7,457 | |

| Joseph P. Bartlett | | none | | | $ | 9,192 | (8) | | $ | 9,192 | |

| (1) | Certain columnar information required by Item 402(m) of Regulation S-K has been omitted for categories where there was no compensation awarded to, or paid to, the named executive officers required to be reported in such columns during 2009. |

| (2) | The amounts in the column “Options Award” reflect the dollar amount recognized for financial statement reporting purposes in accordance with ASC Topics 505 and 718. Assumptions used in the calculation of these amounts are included in Note 9 and Note 10 to the Company’s consolidated financial statements for the fiscal year ended December 31, 2009. The amounts shown exclude the impact of any forfeitures related to service-based vesting conditions. The actual amount realized by the director will likely vary based on a number of factors, including the Company’s performance, stock price fluctuations and applicable vesting. |

| (3) | An option to purchase 30,000 shares of Common Stock at an exercise price of $0.37 per share was granted to Mr. Gelbaum on October 15, 2009; this option expired when Mr. Gelbaum resigned from our Board of Directors. |

| (4) | An option to purchase 30,000 shares of Common Stock at an exercise price of $0.37 per share was granted to Mr. Anthony on October 15, 2009; this option expires on October 15, 2019 (subject to Mr. Anthony’s continued service on our Board of Directors through the date of our 2010 Annual Meeting). |

| (5) | We paid Mr. Hughes a fee for certain consulting services prior to his election to our Board of Directors. |

| (6) | An option to purchase 30,000 shares of Common Stock at an exercise price of $0.33 per share was granted to Mr. Hughes on July 28, 2009; this option expires on July 28, 2019. An option to purchase an additional 30,000 shares of Common Stock at an exercise price of $0.39 per share was granted to Mr. Hughes on December 15, 2009; this option expires on December 15, 2019 (subject to Mr. Hughes’s continued service on our Board of Directors through the date of our 2010 Annual Meeting). |

| (7) | An option to purchase 30,000 shares of Common Stock at an exercise price of $0.299 per share was awarded to Mr. Field on December 28, 2009; this option expired when Mr. Field resigned from our Board of Directors. |

| (8) | An option to purchase 30,000 shares of Common Stock at an exercise price of $0.37 per share was granted to Mr. Bartlett on October 15, 2009; this option expired when Mr. Bartlett resigned from our Board of Directors. |

Security Ownership by Certain Beneficial Owners, Directors and Executive Officers

The following table sets forth certain information as of October 13, 2010 with respect to beneficial ownership of our Common Stock by each shareholder known by the Company to be the beneficial owner of more than 5% of our Common Stock and by each of our directors and executive officers and by all of the directors, nominees for election as director, and executive officers as a group.

| Beneficial Owners | | Amount and Nature of Beneficial Ownership (1) | | | Percent of Class (2) | |

| | | | | | | |

| Directors and Officers | | | | | | |

| | | | | | | |

| David Anthony | | | | | | |

| 2105 Natalie Lane | | | | | | |

| Birmingham, Alabama 35244 | | | 30,000 | (3) | | | * | |

| | | | | | | | | |

| Cary G. Bullock | | | | | | | | |

| 10 New Bond Street | | | | | | | | |

| Worcester, Massachusetts 01606 | | | 0 | | | | * | |

| | | | | | | | | |

| Dennis C. Cossey | | | | | | | | |

| 124 West Capitol Avenue, Suite 880 | | | | | | | | |

| Little Rock, Arkansas 72201 | | | 2,941,050 | (4) | | | 5.3 | % |

| | | | | | | | | |

| David W. Delasanta | | | | | | | | |

| 10 New Bond Street | | | | | | | | |

| Worcester, Massachusetts 01606 | | | 212,500 | (3) | | | * | |

| | | | | | | | | |

| J. Winder Hughes III | | | | | | | | |

| PO Box 389 | | | | | | | | |

| Ponte Vedra, Florida 32004 | | | 10,516,098 | (5) | | | 17.3 | % |

| | | | | | | | | |

| Shawn R. Hughes | | | | | | | | |

| 717 South Edison Avenue | | | | | | | | |

| Tampa, Florida 33606 | | | 952,500 | (6) | | | 1.8 | % |

| | | | | | | | | |

| Teodor Klowan, Jr. | | | | | | | | |

| 10 New Bond Street | | | | | | | | |

| Worcester, Massachusetts 01606 | | | 1,019,925 | (3) | | | 1.9 | % |

| | | | | | | | | |

| Arthur S. Reynolds | | | | | | | | |

| 230 Park Avenue, Suite 1000 | | | | | | | | |

| New York, New York 10169 | | | 751,103 | (7) | | | 1.4 | % |

| | | | | | | | | |

| All executive officers and directors as a group (8 persons) | | | 16,393,176 | (8) | | | 25.1 | % |

| | | | | | | | | |

| Other 5% Beneficial Owners | | | | | | | | |

| | | | | | | | | |

| David Gelbaum and Monica Chavez Gelbaum | | | | | | | | |

| Quercus Trust | | | | | | | | |

| 1835 Newport Blvd. | | | | | | | | |

| A109-PMC 467 | | | | | | | | |

| Costa Mesa, California 92627 | | | 53,810,887 | (9) | | | 53.8 | % |

| Security Investors, LLC | | | | | | |

| One Security Benefit Place | | | | | | |

| Topeka, Kansas 66636 | | | 57,774,484 | (10) | | | 53.7 | % |

| | | | | | | | | |

| Robert S. Trump | | | | | | | | |

89 10th Street | | | | | | | | |

| Garden City, New York 11530 | | | 30,747,785 | (11) | | | 39.2 | % |

| | | | | | | | | |

| Elise C. Roenigk | | | | | | | | |

| PO Box 230 | | | | | | | | |

| Eureka Springs, Arkansas 72632 | | | 5,685,954 | (12) | | | 9.7 | % |

| | | | | | | | | |

| The Focus Fund | | | | | | | | |

| PO Box 389 | | | | | | | | |

| Ponte Vedra, Florida 32004 | | | 10,486,097 | (13) | | | 17.3 | % |

| | | | | | | | | |

| Empire Capital Management and Affiliates | | | | | | | | |

| One Gorham Island, Suite 201 | | | | | | | | |

| Westport, Connecticut 06880 | | | 29,747,917 | (14) | | | 37.1 | % |

| | | | | | | | | |

Kevin B. Kimberlin Spencer Trask Specialty Group | | | | | | | | |

| 535 Madison Avenue | | | | | | | | |

| New York, NY 10022 | | | 9,164,029 | (15) | | | 15.5 | % |

| | | | | | | | | |

| * Less than 1% | | | | | | | | |

| (1) | Includes shares as to which the identified person or entity directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise, has or shares voting power and/or investment power, as these terms are defined in Rule 13d-3(a) of the Exchange Act. Shares of Common Stock underlying options to purchase shares of Common Stock and securities convertible into shares of Common Stock, which were exercisable or convertible on, or become exercisable or convertible within 60 days after, October 13, 2010 are deemed to be outstanding with respect to a person or entity for the purpose of computing the outstanding shares of Common Stock owned by the particular person and by the group, but are not deemed outstanding for any other purpose. |

| (2) | Based on 53,488,090 shares of Common Stock issued and outstanding on October 13, 2010 plus, with respect to each individual or entity (but not with respect to other individuals or entities), the number of shares of Common Stock underlying options to purchase shares of Common Stock and securities convertible into shares of Common Stock, held by such individual or entity which were exercisable or convertible on, or which become exercisable or convertible within 60 days after, October 13, 2010. |

| (3) | All shares are issuable upon exercise of options. |

| (4) | Includes 1,547,500 shares issuable upon exercise of options. |

| (5) | Includes 10,486,097 shares owned by, or issuable to The Focus Fund. Mr. Hughes is the Managing Director of The Focus Fund and may be deemed to be the beneficial owner of the securities held by such fund; he disclaims beneficial ownership of such securities except to the extent of his pecuniary interest therein. Also includes 30,000 shares issuable upon exercise of options. |

| (6) | Includes 850,000 shares issuable upon exercise of options and warrants. |

| (7) | Includes 570,000 shares issuable upon exercise of options and warrants. Also includes 181,103 shares issuable upon the exercise of warrants held by Christine Reynolds, Mr. Reynolds’s wife. Mr. Reynolds disclaims beneficial ownership of the shares issuable to Mrs. Reynolds. |

| (8) | Includes shares issuable upon exercise of options and warrants, conversion of shares of Series B Convertible Preferred Stock, and conversion of convertible debt, as detailed in notes (3) through (7) above. |

| (9) | This beneficial ownership information is based on information contained in Amendment No. 8 to the Statement on Schedule 13D filed by The Quercus Trust and Mr. and Mrs. Gelbaum as its trustees on August 13, 2010. Includes 19,586,210 shares issuable upon conversion of shares of Series B Convertible Preferred Stock, 22,720,000 shares issuable upon the exercise of warrants and 4,083,333 shares issuable upon conversion of convertible debt. |

| (10) | This beneficial ownership information is based on information contained in Amendment No. 3 to the Statement on Schedule 13G filed by Security Investors, LLC on September 10, 2010. Includes 20,833,340 shares issuable upon conversion of shares of Series B Convertible Preferred Stock and 33,333,344 shares issuable upon the exercise of warrants. |

| (11) | Includes 9,366,670 shares issuable upon conversion of shares of Series B Convertible Preferred Stock, 11,711,104 shares issuable upon the exercise of warrants and 3,846,554 shares issuable upon conversion of convertible debt. |

| (12) | Includes 30,000 shares issuable the exercise of options, 1,500,000 shares issuable upon the exercise of warrants, and 3,486,365 shares issuable upon conversion of convertible debt. |

| (13) | Includes 2,977,490 shares issuable upon conversion of shares of Series B Convertible Preferred Stock, 4,000,000 shares issuable upon the exercise of warrants, and 108,607 shares issuable upon conversion of convertible debt. |

| (14) | This beneficial ownership information is based on information contained in Amendment No. 4 to the Statement on Schedule 13G filed by the group consisting of Empire Capital Management LLC and its affiliates on August 16, 2010. Includes 9,263,409 shares issuable upon conversion of outstanding shares of Series B Convertible Preferred Stock and 17,480,937 shares of Common Stock issuable upon the exercise of warrants. |

| (15) | This beneficial ownership information is based on information contained in Amendment No. 1 to the Statement on Schedule 13D filed by Mr. Kimberlin on July 22, 2008. Includes 50,000 shares issuable upon the exercise of warrants and 5,460,228 shares issuable upon conversion of convertible debt. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended requires our executive officers and directors and persons who own more than 10% of our Common Stock to file reports of ownership and changes in ownership with the SEC. Such executive officers, directors and shareholders are also required by SEC rules to furnish us with copies of all Section 16(a) forms they file. Based on information supplied to us and filings made with the SEC, during the fiscal year ended December 31, 2009 the following executive officers and directors failed to make Section 16(a) filings on a timely basis:

| Director or Officer | | Number of Delinquent Filings | | Number of Transactions |

| Dennis C. Cossey | | 1 | | 1 |

| Alexander G. Fassbender | | 1 | | 1 |

| J. Winder Hughes III | | 3 | | 3 |

| Shawn R. Hughes | | 2 | | 3 |

| Teodor Klowan, Jr. | | 2 | | 1 |

| Andrew T. Melton | | 1 | | 1 |

| Arthur S. Reynolds | | 5 | | 5 |

EXECUTIVE OFFICERS

Set forth below is information regarding our Executive Officers who are not also members of our Board of Directors:

Teodor Klowan, Jr., age 42, was appointed as our Executive Vice President, Secretary and Treasurer on November 2, 2009 and became our Chief Financial Officer on November 16, 2009. He also serves as Clerk and Treasurer of our subsidiary, CASTion Corporation. Mr. Klowan has been a certified public accountant since 1991. From November 2007 through February 2009 he was Chief Financial Officer and from May 2006 to November 2007 he was Vice President, Corporate Controller and Chief Accounting Officer of Nestor, Inc., a publicly held automated speed and red light technology company. On June 3, 2009, a receiver was appointed by the Rhode Island Superior Court for the business and assets of Nestor, Inc. Mr. Klowan was Corporate Controller of MatrixOne, Inc. in 2005 and Corporate Controller and Chief Accounting Officer at Helix Technology Corporation from 1999 to 2004. He was Assistant Corporate Controller of Waters Corporation from 1996 to 1999. Prior to 1996, Mr. Klowan worked in management and staff positions at Banyan Systems, Inc. and Ernst & Young. Mr. Klowan holds a B.A. in Accounting from Bryant University and an M.B.A. in International Finance from Clark University.

David W. Delasanta, age 60, was appointed as our Executive Vice President for Business Development and Marketing on September 1, 2010. Since December 2008, he has been President of our subsidiary, CASTion Corporation. Mr. Delasanta was our Senior Vice President of Marketing from January 2008 to December 2008. Before joining ThermoEnergy as a consultant in July 2007, Mr. Delasanta had over 30 years of experience in the environmental and energy fields. From March 1997 to April 2007, he was Regional Vice-President, Business Development for Shaw Group, a major environmental and energy engineering firm. From 1994 to 1997, he was Regional Director of Government Business Development for ICF Kaiser Engineers. Prior to 1994, he served in various management, sales and marketing positions at RESNA Industries, Air & Water Technologies, ACUREX, and SynGas Systems, and as a consultant with DHR, a Washington DC consulting company where, among other things, he managed the technical support contract for the Department of Energy’s National Energy Plan for coal gasification. Mr. Delasanta holds a B.S. in Physics from Providence College, a M.S. in Environmental Engineering from Washington University in St. Louis and an M.B.A. from San Jose State University.

Executive Compensation

Summary Compensation Table

The table set forth below summarizes the compensation earned by our named executive officers in 2009 and 2008.

Executive Compensation (1)

Name and Principal Position | | Year | | Salary ($) | | | Option Awards ($) (2) | | | All Other Compensation ($) (3) | | | Total ($) | |

| | | | | | | | | | | | | | | |

| Dennis C. Cossey | | 2009 | | $ | 228,750 | | | $ | 0 | | | $ | 41,944 | | | $ | 270,694 | |

| Chairman and CEO | | 2008 | | $ | 295,000 | | | $ | 774,093 | | | $ | 24,653 | | | $ | 1,093,746 | |

| | | | | | | | | | | | | | | | | | | |

| Andrew T. Melton | | 2009 | | $ | 79,166 | | | $ | 0 | | | $ | 31,933 | | | $ | 111,099 | |

Executive Vice President and CFO (4) | | 2008 | | $ | 250,000 | | | $ | 83,159 | | | $ | 24,466 | | | $ | 357,635 | |

| | | | | | | | | | | | | | | | | | | |

| Alexander G. Fassbender | | | | | | | | | | | | | | | | | | |

| Executive Vice President and | | 2009 | | $ | 232,500 | | | $ | 0 | | | $ | 23,184 | | | $ | 255,684 | |

| Chief Technology Officer | | 2008 | | $ | 295,000 | | | $ | 437,372 | | | $ | 109,000 | | | $ | 841,372 | |

| | | | | | | | | | | | | | | | | | | |

| Shawn R. Hughes | | 2009 | | $ | 229,167 | | | $ | 143,000 | | | $ | 39,833 | | | $ | 412,000 | |

| President and Chief Operating Officer | | 2008 | | $ | 275,000 | | | $ | 76,600 | | | $ | 12,000 | | | $ | 363,300 | |

| | | | | | | | | | | | | | | | | | | |

| Arthur S. Reynolds | | 2009 | | $ | 105,000 | | | $ | 138,856 | | | $ | 0 | | | $ | 243,856 | |

Interim CFO (5) | | 2008 | | | n/a | | | | n/a | | | | n/a | | | | n/a | |

| | (1) | Certain columnar information required by Item 402(m) of Regulation S-K has been omitted for categories where there was no compensation awarded to, or paid to, the named executive officers required to be reported in such columns during 2009 or 2008. |

| | (2) | The amounts in the column “Options Award” reflect the dollar amount recognized for financial statement reporting purposes in accordance with ASC Topics 505 and 718. Assumptions used in the calculation of these amounts are included in Note 9 and Note 10 to the Company’s consolidated financial statements for the fiscal year ended December 31, 2009. |

| | (3) | The amounts in the column “All Other Compensation” reflect the following items: automobile expenses, medical and insurance reimbursement, temporary living expenses, moving relocation expense reimbursement and salary to executive officers’ spouses. |

| | (4) | Mr. Melton’s employment as Executive Vice President and Chief Financial Officer terminated on August 3, 2009. |

| | (5) | Mr. Reynolds served as interim Chief Financial Officer from August 3, 2009 through November 16, 2009. The information for 2008 does not reflect compensation paid to Mr. Reynolds during that year in his capacity as a member of the Board of Directors. |

Outstanding Equity Awards at December 31, 2009

The following table summarizes information concerning outstanding equity awards held by the named executive officers at December 31, 2009. No named executive officer exercised options in the fiscal year ended December 31, 2009.

| | | Stock Option Awards |

| | | Securities | | Securities | | | | |

| | | Underlying | | Underlying | | | | |

| | | Unexercised | | Unexercised | | Option | | Option |

| | | Options (#) | | Options (#) | | Exercise | | Expiration |

| Name | | Exercisable | | Unexercisable | | Price ($) | | Date |

| | | | | | | | | |

| Dennis C. Cossey | | | 250,000 | | none | | $ | 1.22 | | 6/10/2010 |

| | | | 560,000 | | none | | $ | 1.29 | | 9/15/2010 |

| | | | 150,000 | | none | | $ | 0.94 | | 1/20/2011 |

| | | | 350,000 | | none | | $ | 1.11 | | 1/02/2011 |

| | | | 797,500 | | none | | $ | 1.75 | | 6/30/2018 |

| | | | 250,000 | | none | | $ | 1.50 | | 2/27/2019 |

| | | | | | | | | | | |

| Andrew T. Melton | | | 150,000 | | none | | $ | 1.22 | | 6/10/2010 |

| | | | 40,000 | | none | | $ | 0.90 | | 9/15/2010 |

| | | | 150,000 | | none | | $ | 0.94 | | 1/20/2011 |

| | | | 350,000 | | none | | $ | 1.11 | | 1/02/2011 |

| | | | 7,500 | | none | | $ | 1.75 | | 6/30/2018 |

| | | | 250,000 | | none | | $ | 1.50 | | 2/27/2019 |

| | | | | | | | | | | |

| Alexander G. Fassbender | | | 250,000 | | none | | $ | 1.22 | | 6/10/2010 |

| | | | 440,000 | | none | | $ | 1.29 | | 9/15/2010 |

| | | | 150,000 | | none | | $ | 0.94 | | 1/20/2011 |

| | | | 350,000 | | none | | $ | 1.11 | | 1/02/2011 |

| | | | 412,500 | | none | | $ | 1.75 | | 6/30/2018 |

| | | | 250,000 | | none | | $ | 1.50 | | 2/27/2019 |

| | | | | | | | | | | |

| Shawn R. Hughes | | | 250,000 | | none | | $ | 1.50 | | 2/27/2019 |

| | | | 600,000 | | none | | $ | 0.24 | | 9/16/2019 |

| | | | | | | | | | | |

| Arthur S. Reynolds | | | 48,232 | | none | | $ | 0.31 | | 07/31/2014 |

| | | | 45,455 | | none | | $ | 0.33 | | 08/31/2014 |

| | | | 40,541 | | none | | $ | 0.37 | | 09/30/2014 |

| | | | 46,875 | | none | | $ | 0.32 | | 10/31/2014 |

| | | | 500,000 | | none | | $ | 0.50 | | 11/30/2014 |

| | | | 30,000 | | none | | $ | 1.24 | | 10/03/2018 |

| | | | 40,000 | | none | | $ | 1.24 | | 06/30/2019 |

| | | none | | 30,000 | | $ | 0.39 | | 12/15/2019 |

Equity Compensation Plan Information

The following table sets forth the securities that are authorized for issuance under our equity compensation plans as of December 31, 2009:

| Plan Category | | (A) Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | (B) Weighted-average exercise price of outstanding options, warrants and rights | | | (C) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column A) | |

| | | | | | | | | | |

| Equity Compensation plans approved by security holders | | | | | | | | | |

| | | | | | | | | | |

| 2008 Incentive Stock Plan | | | 2,540,000 | | | $ | 0.85 | | | | 7,460,000 | |

| | | | | | | | | | | | | |

| Equity Compensation plans not approved by security holders | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Stock options | | | 8,663,800 | | | $ | 1.43 | | | | 0 | |

| | | | | | | | | | | | | |

| Warrants | | | 781,103 | | | $ | 0.26 | | | | 0 | |

| | | | | | | | | | | | | |

| Total | | | 11,984,903 | | | $ | 1.12 | | | | 7,460,000 | |

Employment Contracts and Agreements

We have written employment agreements with each of our senior executives. Set forth below are descriptions of the agreements with each of our current executive officers and with each person who was an executive officer on December 31, 2009.

Dennis C. Cossey. Our Executive Employment Agreement with our Executive Chairman, Dennis C. Cossey, provides for an annual base salary of $150,000, with eligibility for performance bonuses, from time to time, in accordance with incentive compensation arrangements to be established by the Compensation and Benefits Committee of our Board of Directors. Mr. Cossey’s employment is terminable by either party upon 30 days’ written notice; provided that we may terminate Mr. Cossey’s employment immediately for “Cause” (as such term is defined in the Executive Employment Agreement) and Mr. Cossey may terminate his employment immediately for “Good Reason” (as such term is defined in the Executive Employment Agreement) or with 60 days’ written notice upon his “Retirement” (as such term is defined in the Executive Employment Agreement). If Mr. Cossey’s employment is terminated for any reason other than (i) by us for Cause or (ii) voluntarily by Mr. Cossey without Good Reason, Mr. Cossey will be entitled to receive severance payments of $12,500 per month for twelve months following the termination of his employment, and we will keep in force for such twelve-month period all health insurance benefits afforded to Mr. Cossey and his family at the time of termination. Mr. Cossey’s Executive Employment Agreement contains other conventional terms, including covenants relating to the confidentiality and non-use of our proprietary information, and a provision prohibiting Mr. Cossey, for a period of one year following the termination of his employment, from competing against us or soliciting our customers or employees. Mr. Cossey’s Executive Employment Agreement supersedes Mr. Cossey’s Employment Agreement dated as of September 14, 2005 which provided, among other things, for a contract term of five years (extended, each month for an additional month), with a beginning base compensation of $200,000 (in 2005) for Mr. Cossey and minimum annual 15% increases in compensation. The prior employment agreement also provided that Mr. Cossey would be eligible for discretionary incentive compensation of up to 100% of his base salary, as determined by the Compensation and Benefits Committee. The prior employment agreement also entitled Mr. Cossey to periodic performance-based compensation upon the occurrence of certain unusual, but significant, events, including but not limited to the acquisition of new technology, the execution of new contracts in excess of 20% of existing revenues and other events as determined by the Compensation and Benefits Committee. In addition, the prior employment agreement provided that, upon a change in control of the Company, Mr. Cossey would have been entitled to receive a lump sum payment of five years’ base compensation from the date of such change of control, as well as an immediate vesting of all unvested stock options and/or restricted stock grants.

Cary G. Bullock. On January 27, 2010, we entered into an Executive Employment Agreement with our President and Chief Executive Officer, Cary G. Bullock, pursuant to which we agreed to pay him a base salary of $200,000, with eligibility for performance bonuses, from time to time, in accordance with incentive compensation arrangements to be established by the Compensation and Benefits Committee of our Board of Directors. Mr. Bullock’s employment is terminable by either party upon 30 days’ written notice; provided that we may terminate Mr. Bullock’s employment immediately for “Cause” (as such term is defined in the Executive Employment Agreement) and Mr. Bullock may terminate his employment immediately for “Good Reason” (as such term is defined in the Executive Employment Agreement). If Mr. Bullock’s employment is terminated for any reason other than (i) by us for Cause or (ii) voluntarily by Mr. Bullock without Good Reason, Mr. Bullock will be entitled to receive severance payments of $16,667 per month for six months following the termination of his employment, and we will keep in force for such six-month period all health insurance benefits afforded to Mr. Bullock and his family at the time of termination. Mr. Bullock’s Executive Employment Agreement contains other conventional terms, including covenants relating to the confidentiality and non-use of our proprietary information, and a provision prohibiting Mr. Bullock, for a period of six months or one year following the termination of his employment (depending on the circumstances of termination), from competing against us or soliciting our customers or employees.

Teodor Klowan, Jr. On November 2, 2009 we entered into an Executive Employment Agreement with our Executive Vice President and Chief Financial Officer, Teodor Klowan, Jr., pursuant to which we agreed to pay him an annual base salary of $175,000, with eligibility for performance bonuses, from time to time, in accordance with incentive compensation arrangements to be established by the Compensation and Benefits Committee of our Board of Directors. Mr. Klowan’s employment is terminable by either party upon 30 days’ written notice; provided that we may terminate Mr. Klowan’s employment immediately for “Cause” (as such term is defined in the Executive Employment Agreement) and Mr. Klowan may terminate his employment immediately for “Good Reason” (as such term is defined in the Executive Employment Agreement). If Mr. Klowan’s employment is terminated for any reason other than (i) by us for Cause or (ii) voluntarily by Mr. Klowan without Good Reason, Mr. Klowan will be entitled to receive severance payments of $14,583 per month for six months following the termination of his employment, and we will keep in force for such six-month period all health insurance benefits afforded to Mr. Klowan and his family at the time of termination. Mr. Klowan’s Executive Employment Agreement contains other conventional terms, including covenants relating to the confidentiality and non-use of our proprietary information and a provision prohibiting Mr. Klowan, for a period of one year following the termination of his employment, from competing against us or soliciting our customers or employees.

Alexander G. Fassbender. Our employment agreement with Alexander G. Fassbender, who was our Executive Vice President and Chief Technology Officer until March 3, 2010, provided for a continuous three-year term (subject to our right to terminate the annual extensions upon 60 days’ written notice), with a beginning base compensation of $135,000 (in 1998) with 15% annual increases, capped at $250,000, after which annual increases will be determined on the basis of changes in the consumer price index. Mr. Fassbender was also eligible for discretionary incentive compensation of up to 50% of his base salary, as determined by the Compensation and Benefits Committee of our Board of Directors. Upon the termination of his employment following a change in control of the Company, Mr. Fassbender was entitled to a lump sum payment equal to 2.99 years’ base compensation in effect on the date of such change of control. The employment agreement also contained certain restrictive covenants protecting trade secrets and prohibiting Mr. Fassbender from competing with us or soliciting our customers or employees for a period of one year after the termination of his employment. We are currently engaged in litigation with Mr. Fassbender regarding the termination of his employment.

Shawn R. Hughes. On September 16, 2009 we entered into an Executive Employment Agreement with Shawn R. Hughes, who was, until January 27, 2010, our President and Chief Operating Officer. The agreement provided that term of Mr. Hughes’s employment expired on the earlier of (i) the date on which the Company had appointed both a new Chief Executive Officer as successor to Dennis C. Cossey and a new Chief Financial Officer as successor to Arthur S. Reynolds or (ii) March 31, 2010 (in either case, the “Termination Date”); provided, however, that the Termination Date was extended until February 28, 2010 to permit Mr. Hughes to assist in the transition of authority to Cary G. Bullock, our new President and CEO. Mr. Hughes’s Executive Employment Agreement provided for a base salary of $150,000 per annum, with an entitlement to a bonus, upon completion of a certain contract involving our subsidiary, CASTion Corporation, in an amount equal to 10% of CASTion’s gross profits on such contract. Pursuant to the agreement, we are obligated to make severance payments in the amount of $20,834 per month to Mr. Hughes during the period from March 1, 2010 through February 28, 2011. The agreement also contained certain restrictive covenants protecting trade secrets and prohibiting Mr. Hughes from competing with us or soliciting our customers or employees for a period of one year after the termination of his employment.

Certain Relationships and Related Transactions

Certain Relationships and Related Transactions

We are a party to a license agreement with Alexander G. Fassbender, who until March 3, 2010 was our Executive Vice President and Chief Technology Officer, under which Mr. Fassbender has granted to us an exclusive license in the patents and patent applications for ThermoFuel and Enhanced Biogas Production in the United States and certain foreign countries. We are required to pay to Mr. Fassbender a royalty of 1% of net sales after the cumulative sales of all licensed products exceed $20,000,000. In December 2007, Mr. Fassbender waived certain termination rights under the license agreement, agreed that we can assign or transfer the license without his consent in connection with a merger or a sale of all or a portion of our business and assets, and agreed that he would not transfer his interest in the license agreement without our consent.

We are members, along with Mr. Fassbender and Mr. Fassbender’s ex-wife, of a limited liability company, ThermoEnergy Power Systems, LLC (“TEPS”), which owns the ZEBS technology and which is a 50% member of Babcock-Thermo Carbon Capture, LLC, our joint venture with Babcock Power. We hold an 85% ownership interest in TEPS and Mr. Fassbender and his ex-wife each own a 7.5% membership interest. The Operating Agreement of TEPS provides, among other things, that the interests of Mr. Fassbender and his ex-wife cannot be diluted and that Mr. Fassbender will not be obligated to make capital contributions to TEPS other than his initial contribution of intellectual property.

The Company and Rexon Limited, a company controlled by Arthur S. Reynolds, a member of our Board of Directors, entered into a consulting agreement on August 21, 2009, pursuant to which Mr. Reynolds provided services as our interim Chief Financial Officer. Under the Consulting Agreement, the Company paid Rexon a retainer of $15,000 per month, reimbursed Rexon for all reasonable and customary expenses incurred by it in connection with Mr. Reynolds’s services, and issued to Rexon warrants, on the first business day of each month, commencing on August 1, 2009 and continuing through November 1, 2009, for the purchase of that number of shares of Common Stock determined by dividing (i) $15,000 by (ii) the market price per share of the Common Stock on such date. The consulting agreement with Rexon terminated on November 16, 2009 upon the appointment of Teodor Klowan, Jr. as our Chief Financial Officer; under the consulting agreement, we are obligated to continue payment of the $15,000 monthly retainer to Rexon for six months following termination. Pursuant to the consulting agreement, upon the successful consummation of our Series B Preferred Stock financing, we paid Rexon a success fee of $30,000 in cash, issued to Mr. Reynolds a five-year warrant for the purchase of up to 500,000 shares of our Common Stock at an exercise price of $0.50 per share, and agreed to pay Mr. Reynolds an additional amount of $53,000, payable in five roughly equal monthly installments commencing in June 2010.

Our Board of Directors has adopted a policy whereby all transactions between us and any of our affiliates, officers, directors, principal shareholders and any affiliates of the foregoing must be approved in advance by the disinterested members of the Board of Directors based on a determination that the terms of such transactions are no less favorable to us than would prevail in arm’s-length transactions with independent third parties.

Compensation Discussion and Analysis

Philosophy and Objectives

The objective of our executive compensation program is to attract, retain and motivate the talented and dedicated executives who are critical to our goals of continued growth, innovation, increasing profitability and, ultimately, maximizing shareholder value. We provide these executives with what we believe to be a competitive total compensation package consisting primarily of base salary and long-term equity incentive compensation. Our executive compensation program aims to provide a risk-balanced compensation package which is competitive in our market sector and, more importantly, relevant to the individual executive.

Our policy for allocating between long-term and currently-paid compensation is to ensure adequate base compensation to attract and retain personnel, while providing incentives to maximize long-term value for our Company and our shareholders. Accordingly, (i) we provide cash compensation in the form of base salary to meet competitive cash compensation norms and (ii) we provide non-cash compensation, primarily in the form of stock option awards, to encourage superior performance against long-term strategic goals. Although on occasion we grant cash bonuses, we do not maintain a formal short-term incentive plan, as our strategic philosophy is to focus on long-term goals. The Compensation and Benefits Committee of our Board of Directors believes this compensation structure focuses our executives’ attention primarily on long-term stock price appreciation, rather than short-term results, and yet enables us to recruit and retain talented executives by ensuring that their annual cash compensation in the form of base salary is competitive with the annual cash compensation paid by other similarly situated companies.

Executive Compensation Process

We have employment agreements with all of our executive officers. These agreements provide for payment of base compensation at a rate negotiated at the time of the agreement, with eligibility for cash bonuses from time to time upon achievement of certain performance goals to be established through discussions with the Compensation and Benefits Committee of our Board of Directors (in the case of our Chief Executive Officer) or with such Committee and our Chief Executive Officer (in the case of the other executive officers). The employment agreements with our Chief Executive Officer and our Chief Financial Officer, both of whom have been recently hired, also provide for an initial grant of stock options, with provision for future grants of stock options at the discretion of the Compensation and Benefits Committee of our Board of Directors.

In negotiating the employment agreements of our executive officers and establishing their base compensation, the ad hoc Executive Search Committee (which had primary responsibility for recruitment of our Chief Executive Officer and our Chief Financial Officer), the Compensation and Benefits Committee and management considered the practices of comparable companies of similar size, geographic location and market focus. We did not utilize any standard executive compensation index or engage the services of a compensation consultant in setting executive compensation, although management, the ad hoc Executive Search Committee and the Compensation and Benefits Committee analyzed publicly available compensation data.

In determining each component of each executive’s compensation, numerous factors particular to the executive are considered, including:

| | • | The individual’s particular background, including prior relevant work experience; |

| | • | The market demand for individuals with the executive’s specific expertise and experience; |

| | • | The individual’s role with us; and |

| | • | Comparison to other executives within our Company. |

Elements of Compensation

Executive compensation consists of the following elements:

Base Salary. Base salary is established based on the factors discussed above. Our general compensation philosophy, as described above, is to offer a competitive package of base salary plus long-term, equity-based incentive compensation. Because we place emphasis on the long-term equity-based portion of our compensation package, we believe that the cash portion of our executive’s compensation is below the average of the range of annual cash compensation (base salary plus annual non-equity incentive compensation) for executives in similar positions with similar responsibilities at comparable companies.

Bonuses. Cash bonuses and non-equity incentive compensation are generally not a regular or important element of our executive compensation strategy, and we focus instead on stock-based awards designed to reward long-term performance.

Stock Option and Stock-Based Awards. We believe that long-term performance is best stimulated through an ownership culture that encourages such performance through the use of stock-based awards. The ThermoEnergy Corporation 2008 Incentive Stock Plan was established to provide certain of our employees, including our executive officers, with incentives to help align those employees’ interests with the interests of shareholders and with our long-term success. Our Board of Directors believes that the use of stock options and other stock-based awards offers the best approach to achieving our long-term compensation goals. While the 2008 Incentive Stock Plan provides for a variety of stock-based awards, to date we have relied exclusively on stock options to provide equity incentive compensation. We believe that stock options most effectively focus the attention of our executives and management on long-term performance and stock price appreciation. Stock options granted to our executive officers have an exercise price equal to the fair market value of our common stock on the grant date. Our stock options typically vest 25% on the first anniversary of grant and thereafter in equal quarterly installments over an additional three-year period, and generally expire ten years after the date of grant. Stock option grants to our executive officers are made in connection with the commencement of employment, in conjunction with an annual review of total compensation and, occasionally, to meet special retention or performance objectives. Proposals to grant stock options to our executive officers are made by our CEO to the Compensation and Benefits Committee. The Compensation and Benefits Committee considers the estimated Black-Scholes valuation of each proposed stock option grant in determining the number of shares subject to each option grant. In light of the significance we place on equity-based incentive compensation, in January 2010 our Board of Directors amended the 2008 Incentive Plan (subject to shareholder approval) to increase the number of shares of our common stock available for grant under such Plan from 10,000,000 to 20,000,000.

We have not adopted stock ownership guidelines.

Other Compensation. Our executive officers are not eligible to participate in, and do not have any accrued benefits under, any Company-sponsored defined benefit pension plan. They are eligible to, and in some cases do, participate in defined contributions plans, such as a 401(k) plan, on the same terms as other employees. In addition, consistent with our compensation philosophy, we intend to continue to maintain our current benefits and perquisites for our executive officers; however, the Compensation and Benefits Committee in its discretion may revise, amend or add to the officer’s executive benefits and perquisites if it deems it advisable. We believe these benefits and perquisites are currently lower than median competitive levels for comparable companies. Finally, all of our executives are eligible to participate in our other employee benefit plans, including medical, dental, life and disability insurance.

Tax Implications

Section 162(m) of the Internal Revenue Code of 1986, as amended, limits the deductibility on our tax return of compensation of over $1,000,000 to certain of our executive officers unless, in general, the compensation is paid pursuant to a plan which is performance-related, non-discretionary and has been approved by our shareholders. We periodically review the potential consequences of Section 162(m) and may structure the performance-based portion of our executive compensation to comply with the exemptions available under Section 162(m). We believe that options granted under our 2008 Incentive Stock Plan will generally qualify as performance-based compensation under Section 162(m). However, we may authorize compensation payments that do not comply with these exemptions when we believe that such payments are appropriate and in the best interest of the shareholders, after taking into consideration changing business conditions or the officer’s performance.

Audit Committee Report

The Audit Committee reviews the financial reporting process of ThermoEnergy Corporation (the “Company”) on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls. The Company’s independent registered public accountants are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Audit Committee monitors these processes.