November 19, 2013 Fourth Quarter 2013 Earnings Conference Call November 19, 2013

November 19, 2013 2 This presentation contains certain forward-looking statements that management believes to be reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control. You should read UGI’s Annual Report on Form 10-K for a more extensive list of factors that could affect results. Among them are adverse weather conditions, cost volatility and availability of all energy products, including propane, natural gas, electricity and fuel oil, increased customer conservation measures, the impact of pending and future legal proceedings, domestic and international political, regulatory and economic conditions including currency exchange rate fluctuations (particularly the euro), the timing of development of Marcellus Shale gas production, the timing and success of our commercial initiatives and investments to grow our business, and our ability to successfully integrate acquired businesses and achieve anticipated synergies. UGI undertakes no obligation to release revisions to its forward-looking statements to reflect events or circumstances occurring after today. About This Presentation

November 19, 2013 John Walsh President & CEO, UGI Kirk Oliver Chief Financial Officer, UGI Jerry Sheridan President & CEO, AmeriGas

November 19, 2013 4 Fiscal 2013 EPS Fiscal 2014 EPS Guidance: $2.60 - $2.70 $1.76 $2.39 $1.00 $1.20 $1.40 $1.60 $1.80 $2.00 $2.20 $2.40 $2.60 2 0 1 2 2 0 1 3 GAAP EPS 35% increase in EPS, fully diluted

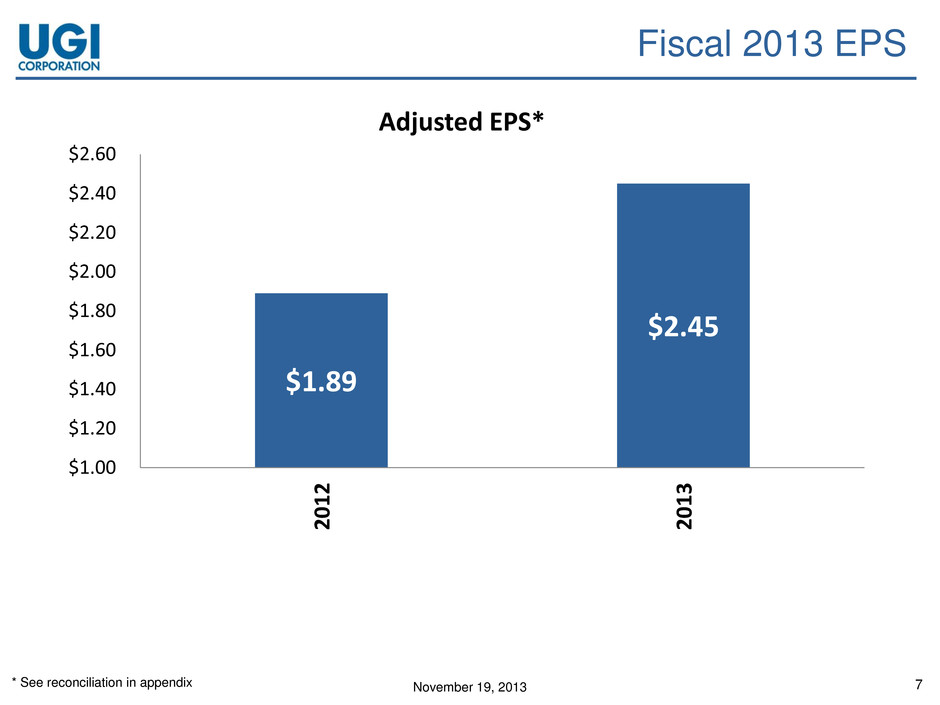

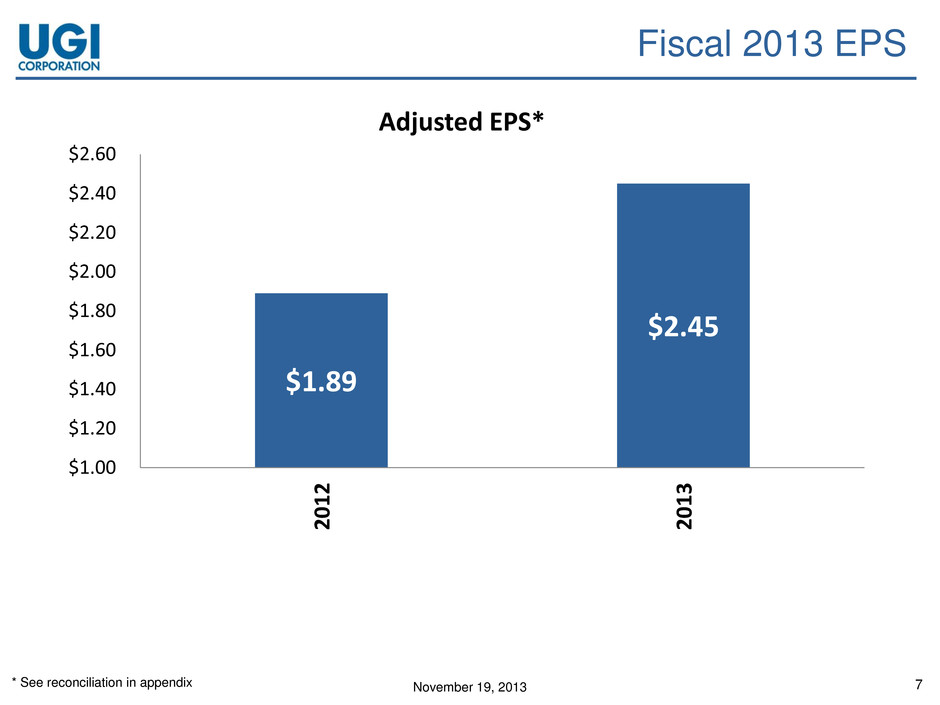

November 19, 2013 5 Fiscal 2013 EPS Fiscal 2014 EPS Guidance: $2.60 - $2.70 $1.90 $2.45 $1.00 $1.20 $1.40 $1.60 $1.80 $2.00 $2.20 $2.40 $2.60 2 0 1 2 2 0 1 3 Adjusted EPS* * See reconciliation in appendix

November 19, 2013 6 Weather vs Normal -4.9% -18.6% 3.7% -7.1% 0.9% -6.4% -0.5% -16.3% -20% -10% 0% 10% 20% FY2013 FY2012 AmeriGas Antargaz Flaga Utility (W A R M E R ) COL D E R (W A R M E R )

November 19, 2013 7 Fiscal 2013 EPS $1.89 $2.45 $1.00 $1.20 $1.40 $1.60 $1.80 $2.00 $2.20 $2.40 $2.60 2 0 1 2 2 0 1 3 Adjusted EPS* * See reconciliation in appendix

November 19, 2013 8 AmeriGas VOLUME Full-year impact of Heritage Colder weather ACE and National Accounts MARGIN Higher unit margins OPEX Full-year impact of Heritage Synergies Lower transition expenses than prior-year period Total Margin 392.0 231.5 46.7 26.4 (49.2) (33.7) $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 2 0 1 2 V o lu m e U n it Mar gi n s A nc ill ar y sa les/ serv ic e s O p ex & O th e r D & A 2 0 1 3 Operating Income, $ MM 170.3 * Opex includes all operating expenses, net of miscellaneous income. Total Margin represents total revenues less total cost of sales.

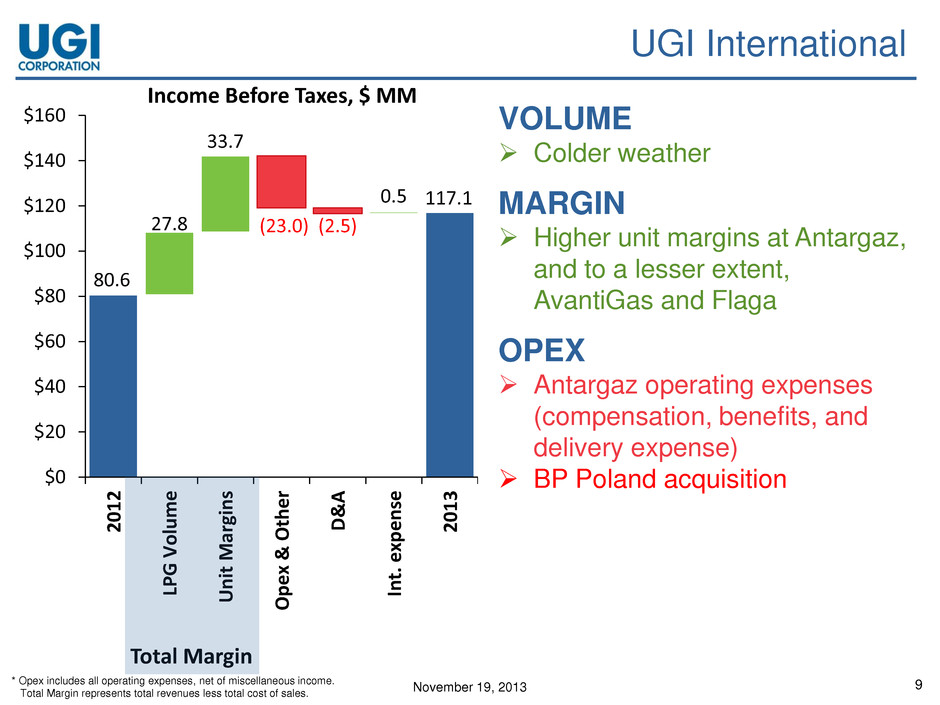

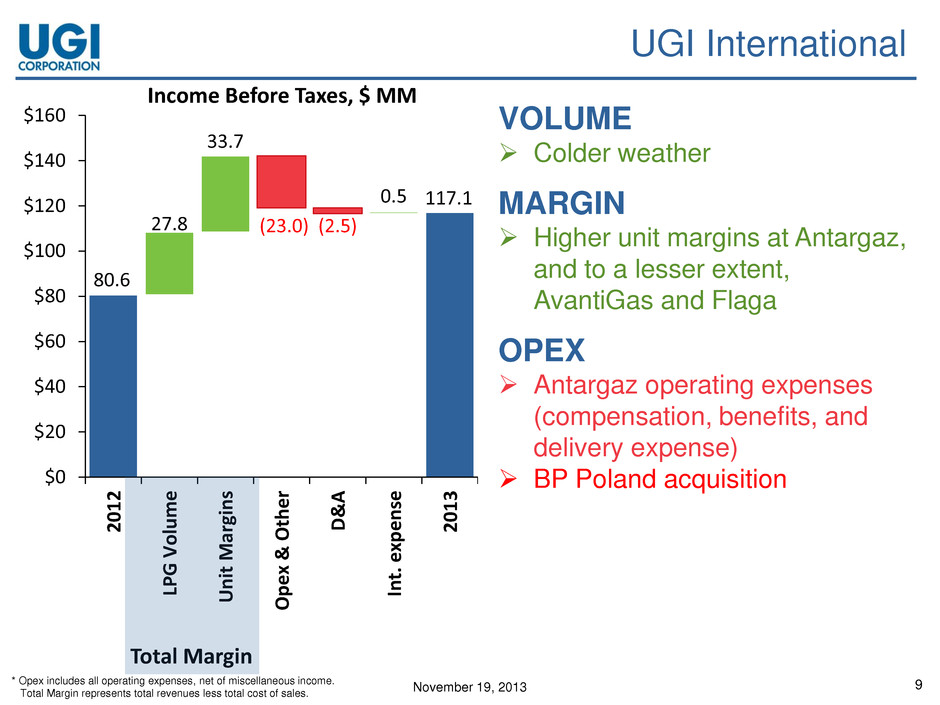

November 19, 2013 9 UGI International VOLUME Colder weather MARGIN Higher unit margins at Antargaz, and to a lesser extent, AvantiGas and Flaga OPEX Antargaz operating expenses (compensation, benefits, and delivery expense) BP Poland acquisition 27.8 33.7 (23.0) (2.5) 0.5 $0 $20 $40 $60 $80 $100 $120 $140 $160 2 0 1 2 LPG V o lu m e U n it Mar gi n s O p ex & O th e r D & A In t. ex p e n se 2 0 1 3 Income Before Taxes, $ MM Total Margin * Opex includes all operating expenses, net of miscellaneous income. Total Margin represents total revenues less total cost of sales. 117.1 80.6

November 19, 2013 10 Gas Utility MARGIN Colder weather than prior-year period Conversions from heating oil OPEX Higher pension and benefits and distribution expense Total Margin 132.1 161.0 38.1 10.8 (20.0) (2.7) 2.7 $0 $40 $80 $120 $160 $200 $240 2 0 1 2 C o re Ma rket M argi n Ot h er Mar gi n O p ex & O th e r D & A Int. ex p e n se 2 0 1 3 Income Before Taxes, $ MM * Opex includes all operating expenses, net of miscellaneous income. Total Margin represents total revenues less total cost of sales.

November 19, 2013 11 Midstream & Marketing MARGIN Higher electric generation total margin Lower power marketing margins Higher peaking, capacity management, and gas marketing margin Opex Higher operating expenses and depreciation associated with midstream assets 57.6 5.5 15.6 15.7 (3.0) (4.9) 1.6 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 2 0 1 2 M ar ketin g Ge n erati o n M id st re am/ot h e r O p ex & O th e r D & A In t. Ex p e n se 2 0 1 3 Income Before Taxes, $ MM 88.5 Total Margin * Total Margin represents total revenues less total cost of sales.

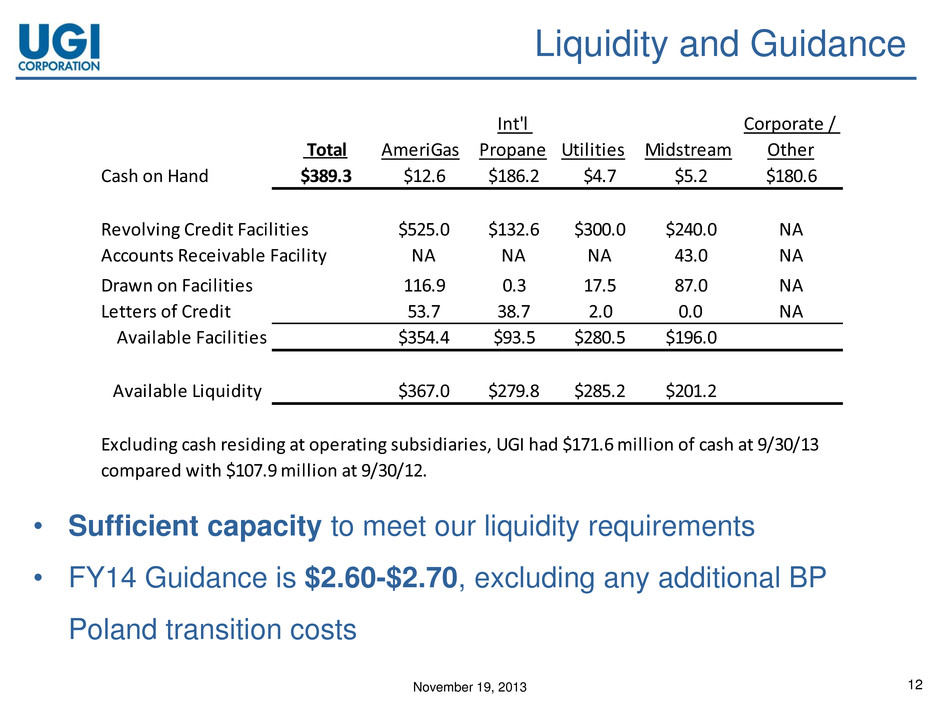

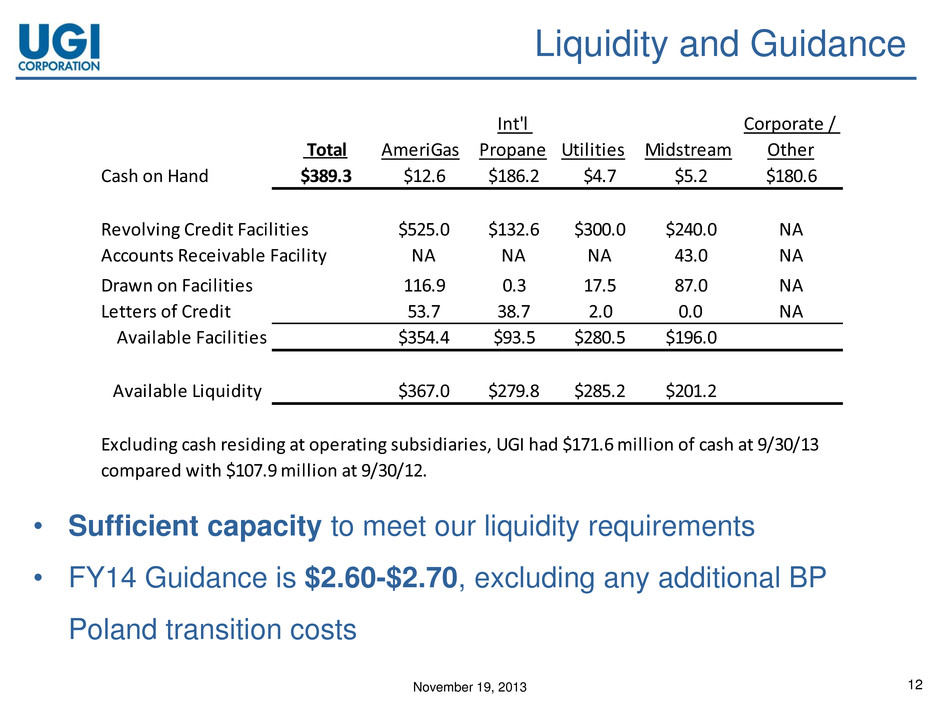

November 19, 2013 12 Liquidity and Guidance • Sufficient capacity to meet our liquidity requirements • FY14 Guidance is $2.60-$2.70, excluding any additional BP Poland transition costs Total AmeriGas Int'l Propane Utilities Midstream Corporate / Other Cash on Hand $389.3 $12.6 $186.2 $4.7 $5.2 $180.6 Revolving Credit Facilities $525.0 $132.6 $300.0 $240.0 NA Accounts Receivable Facility NA NA NA 43.0 NA Drawn on Facilities 116.9 0.3 17.5 87.0 NA Letters of Credit 53.7 38.7 2.0 0.0 NA Available Facilities $354.4 $93.5 $280.5 $196.0 Available Liquidity $367.0 $279.8 $285.2 $201.2 Excluding cash residing at operating subsidiaries, UGI had $171.6 million of cash at 9/30/13 compared with $107.9 million at 9/30/12.

November 19, 2013 Jerry Sheridan CEO of AmeriGas

November 19, 2013 14 Q4 Adjusted EBITDA $34.1 $46.5 $20 $30 $40 $50 2 0 1 2 2 0 1 3 Adjusted EBITDA*, $ Millions * See appendix for Adjusted EBITDA reconciliation

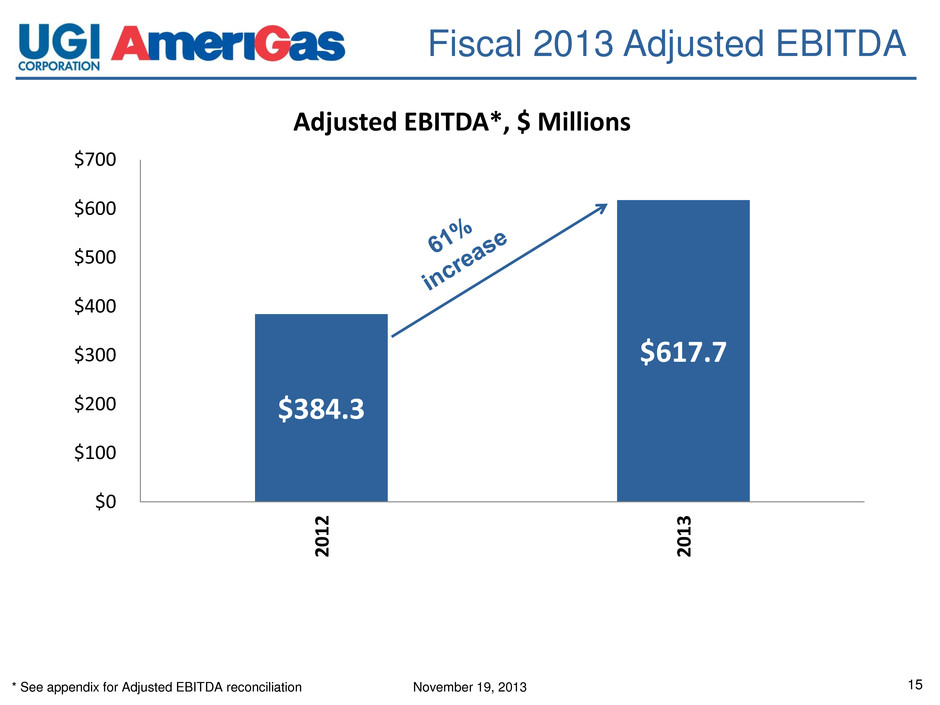

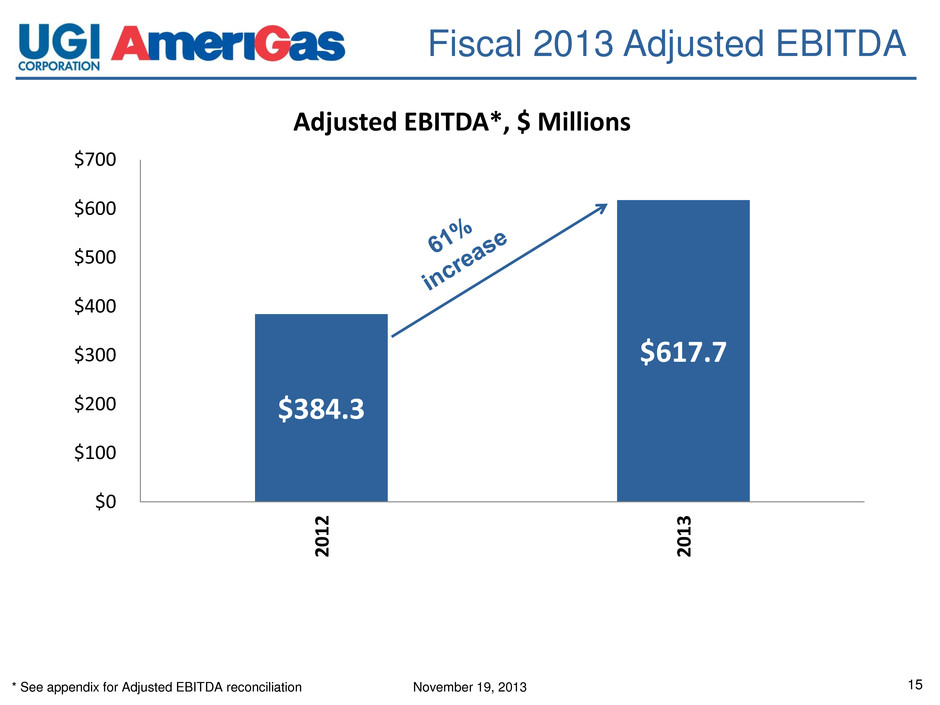

November 19, 2013 15 Fiscal 2013 Adjusted EBITDA $384.3 $617.7 $0 $100 $200 $300 $400 $500 $600 $700 2 0 1 2 2 0 1 3 Adjusted EBITDA*, $ Millions * See appendix for Adjusted EBITDA reconciliation

November 19, 2013 16 Operational Update Operations • Volume increased 1% versus last year’s fourth quarter despite weather that was 6% warmer than normal • Continued decrease in operating expenses: $9.4 MM decrease from Q4 of fiscal 2012 due to Heritage synergies (excluding Heritage transition expenses) Growth Initiatives • AmeriGas Cylinder Exchange (ACE): Volume growth of 6% from the prior-year quarter, 2,800 new outlets added • National Accounts: Volume increased over 30% from the prior-year quarter • Acquisitions: Closed one acquisition, adding an annualized 4.3 MM gallons

November 19, 2013 17 Guidance & Heritage Update • FY14 Guidance $645 MM - $675 MM • Achieved all major milestones set at the beginning of the Heritage Propane integration

November 19, 2013 John Walsh President & CEO

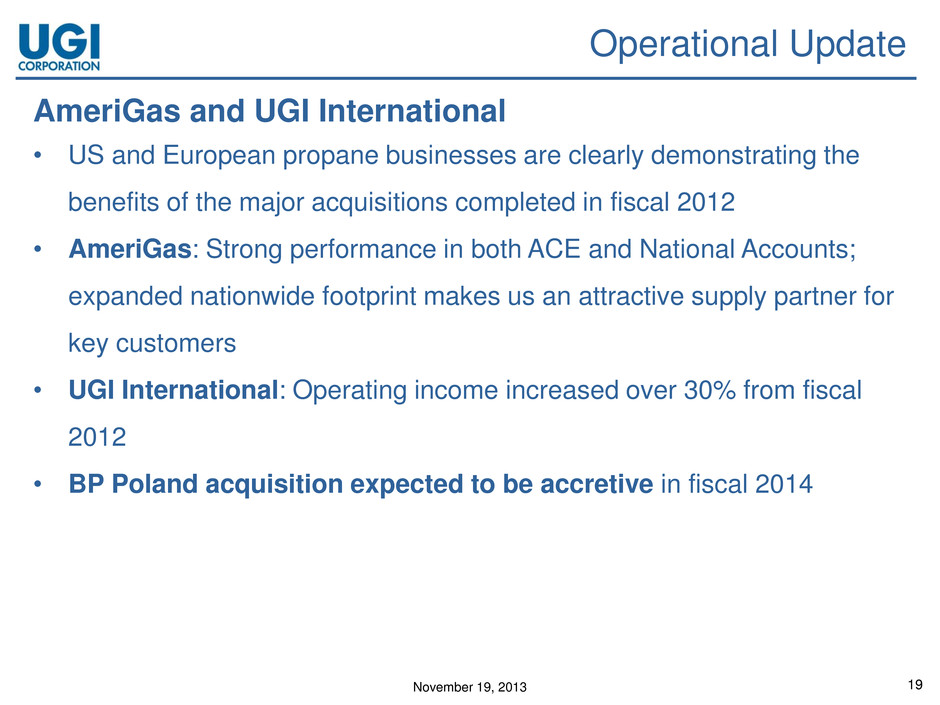

November 19, 2013 19 Operational Update AmeriGas and UGI International • US and European propane businesses are clearly demonstrating the benefits of the major acquisitions completed in fiscal 2012 • AmeriGas: Strong performance in both ACE and National Accounts; expanded nationwide footprint makes us an attractive supply partner for key customers • UGI International: Operating income increased over 30% from fiscal 2012 • BP Poland acquisition expected to be accretive in fiscal 2014

November 19, 2013 20 Operational Update Gas Utility • Productive year for infrastructure replacement: fiscal 2013 infrastructure capex was approximately 30% above fiscal 2012 level • Strong demand for natural gas: UGI Utilities connected almost 17,000 residential, commercial, and industrial customers in fiscal 2013 Midstream & Marketing • Auburn II pipeline achieved mechanical completion and is subscribed to near-capacity levels for this phase under firm contracts • Project provides critical new gas distribution infrastructure in northeast PA

November 19, 2013 Q&A

November 19, 2013 Appendix

November 19, 2013 23 UGI Supplemental Information: Footnotes Adjusted EPS is not a measure of performance or financial condition under accounting principles generally accepted in the United States ("GAAP"). Adjusted EPS is calculated by excluding the effect of non-recurring items from the calculation of reported EPS. Management believes Adjusted EPS is a meaningful non-GAAP financial measure that provides an additional means of analyzing the Company’s performance excluding the effect of non-recurring items. The Company's definition of Adjusted EPS may be different from that used by other companies. Adjusted EPS should not be considered a substitute for financial information presented in accordance with GAAP.

November 19, 2013 24 Adjusted EPS to GAAP EPS Reconciliation (millions of dollars) 2013 2012 GAAP Net Income 275.8$ 199.4$ Adjustments: Loss on early extinguishment of debt at AmeriGas (2.2) Acquisition and transition costs - Heritage and Shell LPG (13.3) Acquisition and transition costs - BP Poland (3.2) Valuation adjustment - renewable energy partnership (3.7) Adjusted Net Income 282.7$ 214.9$ GAAP EPS $2.39 $1.76 Adjusted EPS $2.45 $1.90 Diluted Shares Outstanding 115.5 113.4

November 19, 2013 25 AmeriGas Supplemental Information: Footnotes The enclosed supplemental information contains a reconciliation of earnings before interest expense, income taxes, depreciation and amortization ("EBITDA") and Adjusted EBITDA to Net Income. EBITDA and Adjusted EBITDA are not measures of performance or financial condition under accounting principles generally accepted in the United States ("GAAP"). Management believes EBITDA and Adjusted EBITDA are meaningful non-GAAP financial measures used by investors to compare the Partnership's operating performance with that of other companies within the propane industry. The Partnership's definitions of EBITDA and Adjusted EBITDA may be different from those used by other companies. EBITDA and Adjusted EBITDA should not be considered as alternatives to net income (loss) attributable to AmeriGas Partners, L.P. Management uses EBITDA to compare year-over-year profitability of the business without regard to capital structure as well as to compare the relative performance of the Partnership to that of other master limited partnerships without regard to their financing methods, capital structure, income taxes or historical cost basis. Management uses Adjusted EBITDA to exclude from AmeriGas Partners’ EBITDA gains and losses that competitors do not necessarily have to provide additional insight into the comparison of year-over-year profitability to that of other master limited partnerships. In view of the omission of interest, income taxes, depreciation and amortization from EBITDA and Adjusted EBITDA, management also assesses the profitability of the business by comparing net income attributable to AmeriGas Partners, L.P. for the relevant years. Management also uses EBITDA to assess the Partnership's profitability because its parent, UGI Corporation, uses the Partnership's EBITDA to assess the profitability of the Partnership, which is one of UGI Corporation’s industry segments. UGI Corporation discloses the Partnership's EBITDA in its disclosures about its industry segments as the profitability measure for its domestic propane segment.

November 19, 2013 26 AmeriGas Partners EBITDA Reconciliation 2013 2012 2013 2012 Net (loss) income attributable to AmeriGas Partners, L.P. (54,056)$ (76,003)$ 221,222$ 11,025$ Income tax expense 1,155 925 1,671 1,931 Interest xpense 41,213 39,210 165,432 142,641 Depreciation 41,638 39,632 159,306 134,225 Amortization 10,740 10,996 43,565 34,898 EBITDA 40,690$ 14,760$ 591,196$ 324,720$ Heritage Propane acquisition and transition expense 5,793 19,295 26,539 46,187 Loss on extinguishments of debt - - - 13,349 Adjusted EBITDA 46,483$ 34,055$ 617,735$ 384,256$ September 30, Three Months Ended Twelve Months Ended September 30,

November 19, 2013 Investor Relations: 610-337-1000 Simon Bowman (x3645) bowmans@ugicorp.com