1 Fiscal Year 2016 Results FY17 Outlook John Walsh President & CEO, UGI Kirk Oliver Chief Financial Officer, UGI Jerry Sheridan President & CEO, AmeriGas

2 This presentation contains certain forward-looking statements that management believes to be reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control. You should read UGI’s Annual Report on Form 10-K and quarterly reports on Form 10-Q for a more extensive list of factors that could affect results. Among them are adverse weather conditions, cost volatility and availability of all energy products, including propane, natural gas, electricity and fuel oil, increased customer conservation measures, the impact of pending and future legal proceedings, domestic and international political, regulatory and economic conditions in the United States and in foreign countries, including the current conflicts in the Middle East and those involving Russia, and currency exchange rate fluctuations (particularly the euro), the timing of development of Marcellus Shale gas production, the timing and success of our acquisitions, commercial initiatives and investments to grow our business, and our ability to successfully integrate acquired businesses and achieve anticipated synergies. UGI undertakes no obligation to release revisions to its forward-looking statements to reflect events or circumstances occurring after today. In addition, this presentation uses certain non-GAAP financial measures. Please see the appendix for reconciliations of these measures to the most comparable GAAP financial measure. About This Presentation

3 2016 Fiscal Year Recap John Walsh President & CEO, UGI

4 FY16 Earnings Recap • Record earnings despite very warm weather • Significant contributions from growth initiatives • Marcellus infrastructure projects • Strong results from Finagaz $2.01 $2.05 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 FY-15 FY-16 Fiscal Year Weather AmeriGas UGI France Midstream & Marketing Gas Utility Adjusted EPS1 1 Adjusted Earnings Per Share is a non-GAAP measure. See Appendix for reconciliation. 2 Percent change in Heating Degree Days. VERSUS PRIOR YEAR2 12.5% Warmer 3.3% Warmer 20.5% Warmer 17.8% Warmer vs. Normal vs. Normal vs. Normal vs. Normal

5 -15.9% -13.6% -6.4% -13.9% -15.4% -15.0% -20.0% -10.0% 0.0% 10.0% Fiscal 2016 vs. Fiscal 2012 $1.25 $2.05 $- $0.50 $1.00 $1.50 $2.00 $2.50 FY12 FY16 …64% higher Adjusted EPS1 Comparable weather… Heating Degree Days versus Normal2 G AS U TIL IT IE S G AS U TIL IT IE S U G I FRANC E U G I FRANC E AM ERI G A S AM ERI G A S FY12 FY16 1 Adjusted Earnings Per Share is a non-GAAP measure. See Appendix for reconciliation. 2 Percent change in Heating Degree Days versus normal.

6 FY17 Guidance midpoint: • 16% CAGR over FY16 • 10% CAGR over FY13 Fiscal 2017 Guidance Key Drivers Organic Growth Strategic Investments Return to normal weather and volatility $1.00 $1.60 $2.20 $2.80 2013 2014 2015 FY16 FY17 Guidance $1.61 $2.02 $2.01 $2.05 $2.30 – $2.451 Adjusted Earnings Per Share1 1 Adjusted Earnings Per Share is a non-GAAP measure. See Appendix for reconciliation. Because we are unable to predict certain potentially material items affecting diluted earnings per share on a GAAP basis, principally mark-to-market gains and losses on commodity derivative instruments and Finagaz integration expenses, we cannot reconcile 2017 adjusted diluted earnings per share, a non-GAAP measure, to diluted earnings per share, the most directly comparable GAAP measure, in reliance on the “unreasonable efforts” exception set forth in SEC rules.

7 Midstream & Marketing Utility FY16 Key Accomplishments – Natural Gas • Successful $27 mm base rate case for UGI Gas • Executed a record amount of capital investment • Added ~16,000 new heating customers • Cast iron and bare steel infrastructure replacement programs are on track • Sunbury pipeline: Began construction; anticipate completion in FY17 • Manning LNG liquefaction: Began construction; anticipate completion in FY17 • PennEast pipeline: Received draft environmental impact statement in July; expect final environmental impact statement in February 2017

8 FY16 Key Accomplishments – Propane AmeriGas • Expanded all of our growth platforms • M&A • National Accounts • ACE • Agreements with major retailers that will add 1 million cylinders International • Earnings more than doubled on strength of Finagaz acquisition • Smaller acquisitions in Norway, U.K. and Austria • Finagaz integration on track

9 Financial Review Kirk Oliver Chief Financial Officer, UGI

10 FY16 Adjusted Earnings FY 2016 FY 2015 Net income attributable to UGI Corporation $364.7 $281.0 Net after-tax gains (losses) on commodity derivative instruments1,2 (29.9) 53.3 Integration and acquisition expenses associated with Finagaz 17.3 14.9 Loss on extinguishments of debt2,3 7.9 4.6 Adjusted net income attributable to UGI Corporation $360.0 $353.8 1 Includes impact of rounding. 2 Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates. 3 Loss on extinguishment of debt in the twelve months ended September 30, 2015 is included in interest expense on the Consolidated Statement of Income. FY 2016 FY 2015 UGI Corporation - Diluted Earnings Per Share (GAAP) $2.08 $1.60 Net after-tax gains (losses) on commodity derivative instruments1,2 (0.17) 0.30 Acquisition and integration expenses associated with Finagaz 0.10 0.08 Loss on extinguishments of debt2,3 0.04 0.03 Adjusted diluted earnings per share $2.05 $2.01

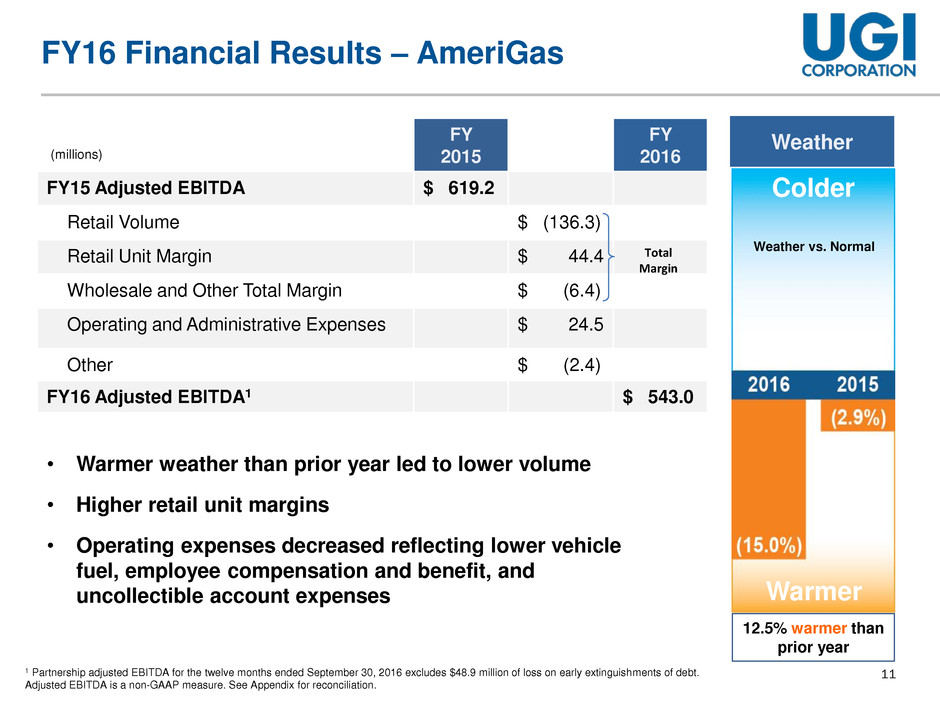

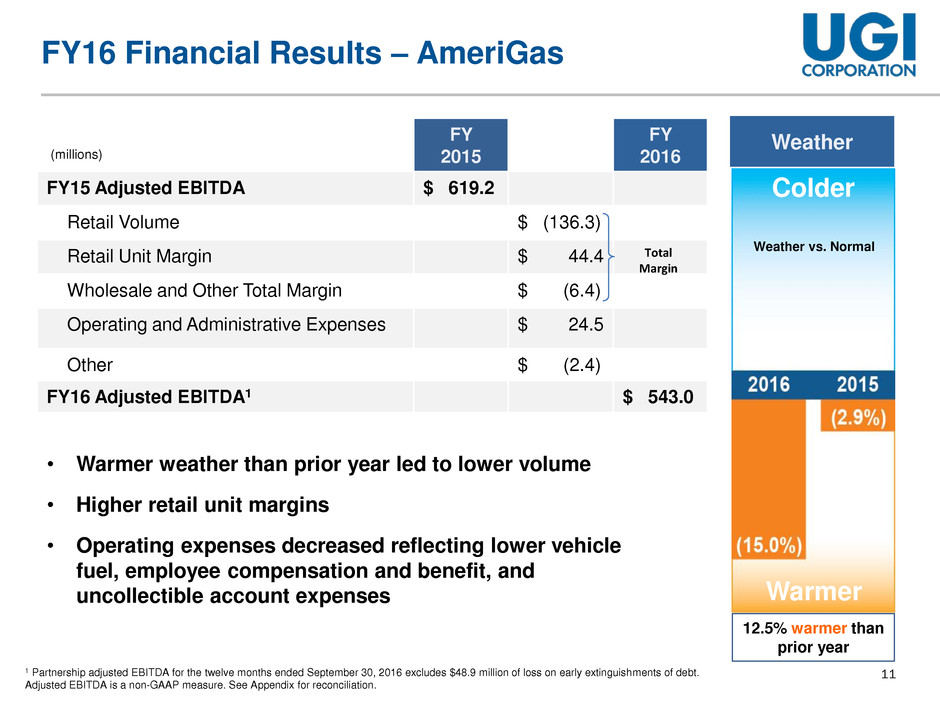

11 FY16 Financial Results – AmeriGas Weather vs. Normal 12.5% warmer than prior year FY 2015 FY 2016 FY15 Adjusted EBITDA $ 619.2 Retail Volume $ (136.3) Retail Unit Margin $ 44.4 Wholesale and Other Total Margin $ (6.4) Operating and Administrative Expenses $ 24.5 Other $ (2.4) FY16 Adjusted EBITDA1 $ 543.0 Total Margin 1 Partnership adjusted EBITDA for the twelve months ended September 30, 2016 excludes $48.9 million of loss on early extinguishments of debt. Adjusted EBITDA is a non-GAAP measure. See Appendix for reconciliation. (millions) • Warmer weather than prior year led to lower volume • Higher retail unit margins • Operating expenses decreased reflecting lower vehicle fuel, employee compensation and benefit, and uncollectible account expenses Colder Warmer Weather

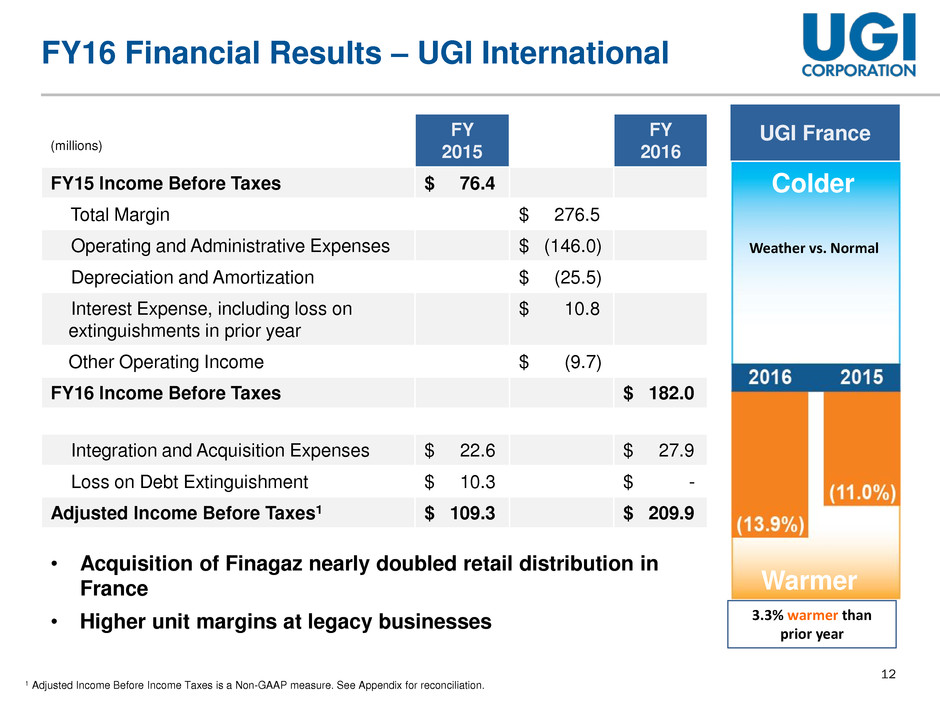

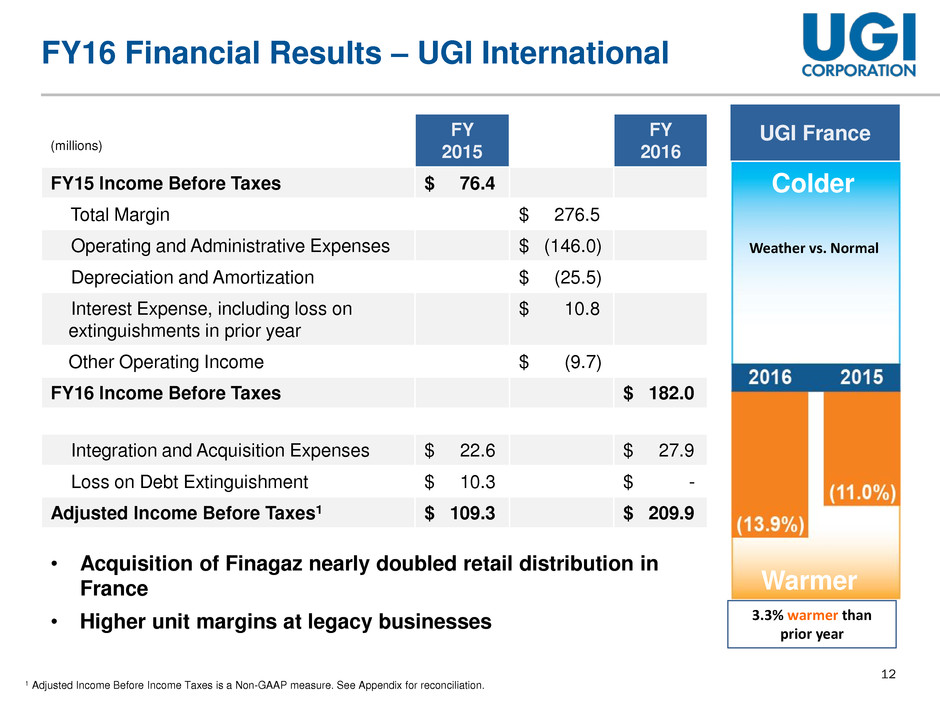

12 FY16 Financial Results – UGI International FY 2015 FY 2016 FY15 Income Before Taxes $ 76.4 Total Margin $ 276.5 Operating and Administrative Expenses $ (146.0) Depreciation and Amortization $ (25.5) Interest Expense, including loss on extinguishments in prior year $ 10.8 Other Operating Income $ (9.7) FY16 Income Before Taxes $ 182.0 (millions) UGI France Warmer Colder 3.3% warmer than prior year 1 Adjusted Income Before Income Taxes is a Non-GAAP measure. See Appendix for reconciliation. • Acquisition of Finagaz nearly doubled retail distribution in France • Higher unit margins at legacy businesses Integration and Acquisition Expenses $ 22.6 $ 27.9 Loss on Debt Extinguishment $ 10.3 $ - Adjusted Income Before Taxes1 $ 109.3 $ 209.9 Weather vs. Normal

13 FY16 Financial Results – Midstream & Marketing FY 2015 FY 2016 FY15 Income Before Taxes $ 180.5 Total Margin $ (44.6) Operating and Administrative Expenses $ 7.7 Depreciation and Amortization $ (2.6) Other $ 3.6 FY16 Income Before Taxes $ 144.6 Colder Weather vs. Normal Warmer 20.5% warmer than prior year • Lower prices for pipeline capacity due to locational basis differentials between Marcellus and non-Marcellus delivery points • Natural gas and retail power margins impacted by warmer weather • Higher margin in peaking and natural gas gathering • Lower margin in capacity management, natural gas and retail power, and electric generation (millions) Weather

14 FY16 Financial Results – Utilities FY 2015 FY 2016 FY15 Income Before Taxes $ 200.6 Total Margin $ (51.3) Operating and Administrative Expenses $ 25.6 Depreciation and Amortization $ (3.8) Interest Expense $ 3.5 Other Income and Expense, net $ (11.3) FY16 Income Before Taxes $ 163.3 (millions) • Lower core market throughput driven by significantly warmer weather than the prior year • Lower operating expenses • Lower other income Colder Warmer 17.8% warmer than prior year Weather vs. Normal Gas Utility

15 -$1200MM -$600MM $0MM $600MM $1200MM -20% -15% -10% -5% 0% 5% 10% 15% 20% FY06 FY08 FY10 FY12 FY14 FY16 Strong Cash Flow and Balance Sheet Weather vs. Normal Cash Flow From Operations • Strong and consistent cash flow despite fluctuations of weather • Strong balance sheet with capacity • No need to access the capital markets in the near term • Recent AmeriGas refinancing extends the maturity profile while reducing interest rates AmeriGas weather vs. Normal Utility weather vs. Normal Cash Flow from Operations $1.2B $0.6B $0

16 Fiscal Year Recap Jerry Sheridan President & CEO, AmeriGas

17 FY16 Adjusted EBITDA1 Retail volumes sold for FY16 decreased 10% to 1.07 billion gallons from 1.18 billion gallons in the prior year 2nd warmest year in 121 years $619 $543 $0 $100 $200 $300 $400 $500 $600 $700 FY15 FY16 1 Adjusted EBITDA is a non-GAAP measure. See appendix for reconciliation.

18 Growth Initiatives National Accounts Added 39 accounts and renewed 40 agreements AmeriGas Cylinder Exchange Added new business that represents sales of ~ 1 million cylinders M&A Closed six tuck-in acquisitions adding ~10 million gallons annually

19 Continuing to Deliver Value 12th consecutive annual distribution increase Outstanding total unitholder returns: Annualized Total Returns 1 Year 5 Year 10 Year 19.8% 8.8% 12.2% Looking ahead we expect adjusted EBITDA of $660 – $700 million in FY171 1 Because we are unable to predict certain potentially material items affecting net income on a GAAP basis, principally mark-to-market gains and losses on commodity derivative instruments, we cannot reconcile 2017 Adjusted EBITDA, a non-GAAP measure, to net income attribute to AmeriGas Partners, L.P., the most directly comparable GAAP measure, in reliance on the “unreasonable efforts” exception set forth in SEC rules. Adjustments that management can reasonably estimate are provided in the appendix.

20 Conclusion John Walsh President & CEO, UGI

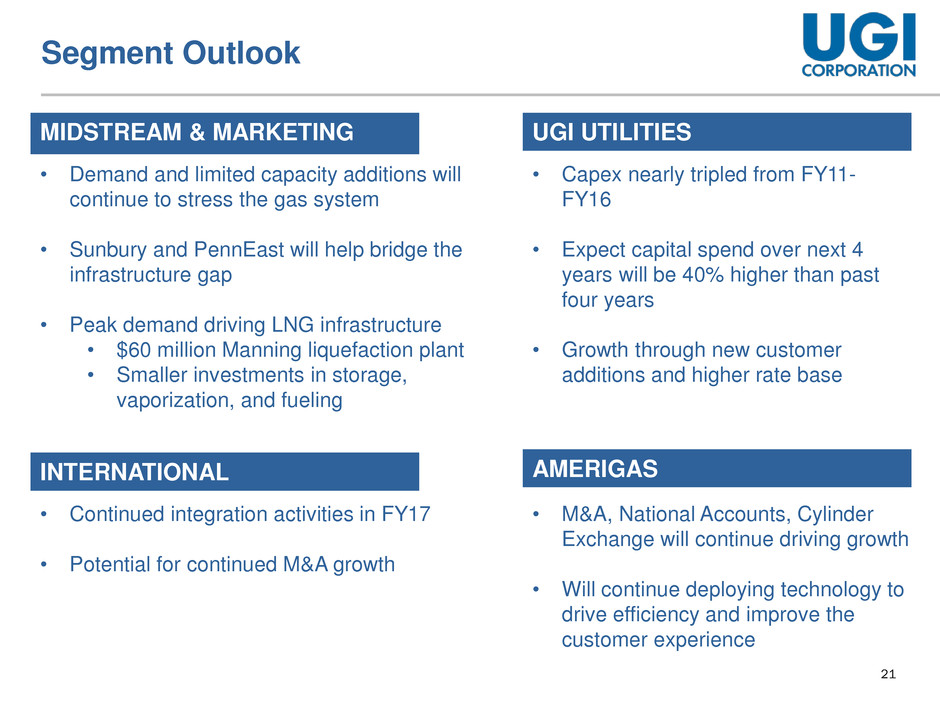

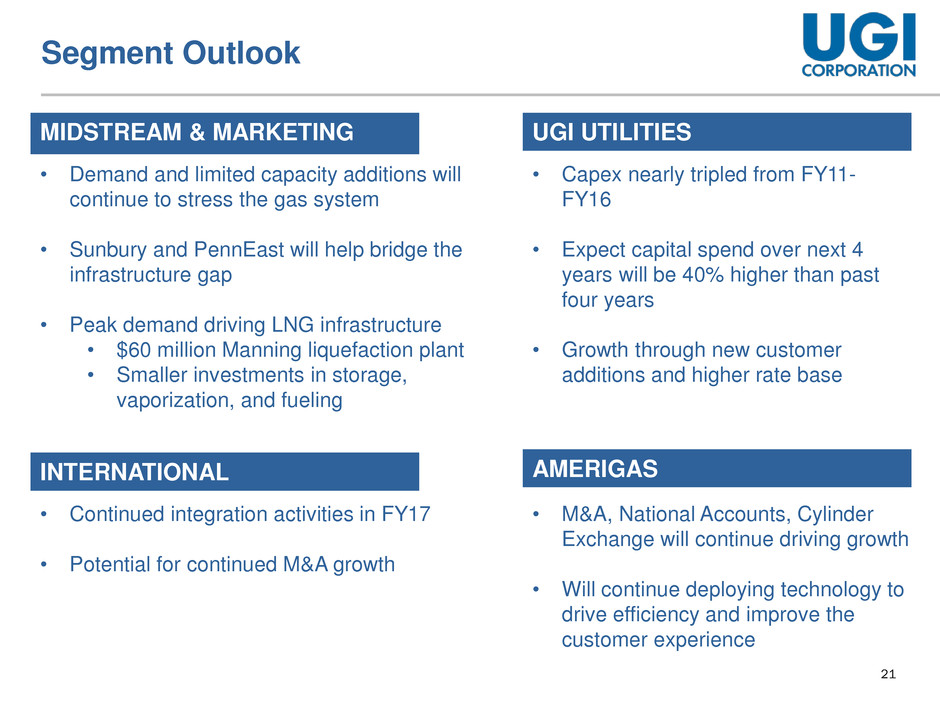

21 • Demand and limited capacity additions will continue to stress the gas system • Sunbury and PennEast will help bridge the infrastructure gap • Peak demand driving LNG infrastructure • $60 million Manning liquefaction plant • Smaller investments in storage, vaporization, and fueling • Capex nearly tripled from FY11- FY16 • Expect capital spend over next 4 years will be 40% higher than past four years • Growth through new customer additions and higher rate base MIDSTREAM & MARKETING UGI UTILITIES INTERNATIONAL AMERIGAS • Continued integration activities in FY17 • Potential for continued M&A growth • M&A, National Accounts, Cylinder Exchange will continue driving growth • Will continue deploying technology to drive efficiency and improve the customer experience MIDSTREAM & MARKETING Segment Outlook

22 Conclusion Outlook is very promising Several investments that came online in past 18 months will contribute to earnings Cash flow and balance sheet strength to fund active projects with additional capacity for investment UGI IS CONTINUING TO DELIVER

23 Appendix

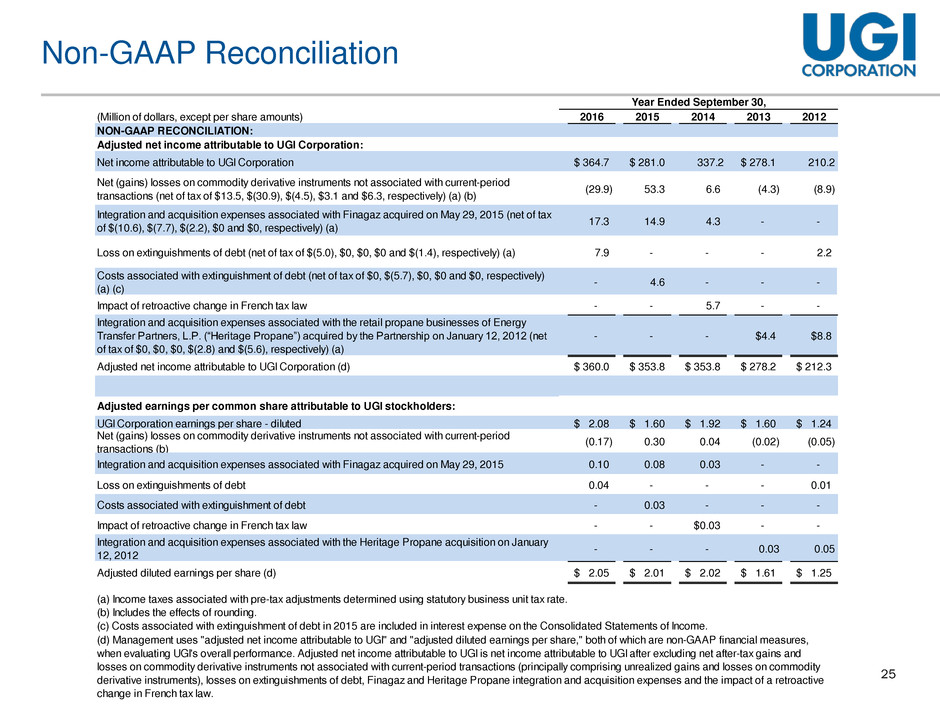

24 Management uses "adjusted net income attributable to UGI" and "adjusted diluted earnings per share“ (sometimes also referred to as “adjusted earnings per share”), both of which are non-GAAP financial measures, when evaluating UGI's overall performance. Adjusted net income attributable to UGI is net income attributable to UGI Corporation after excluding net after-tax gains and losses on commodity derivative instruments not associated with current period transactions, loss on extinguishment of debt, Finagaz integration and acquisition expenses and the retroactive impact of a change in French tax law. Volatility in net income at UGI can occur as a result of gains and losses on commodity derivative instruments not associated with current period transactions but included in earnings in accordance with U.S. generally accepted accounting principles ("GAAP"). Midstream & Marketing records gains and losses on commodity derivative instruments not associated with current-period transactions in cost of sales or revenues for all periods presented. Effective October 1, 2014, UGI International determined that on a prospective basis it would not elect cash flow hedge accounting for its commodity derivative transactions and also de-designated its then-existing commodity derivative instruments accounted for as cash flow hedges. Also effective October 1, 2014, AmeriGas Propane de-designated its remaining commodity derivative instruments accounted for as cash flow hedges. Previously, AmeriGas Propane had discontinued cash flow hedge accounting for all commodity derivative instruments entered into beginning April 1, 2014. Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures. Management believes that these non-GAAP measures provide meaningful information to investors about UGI’s performance because they eliminate the impact of (1) gains and losses on commodity derivative instruments not associated with current-period transactions and (2) other discrete items that can affect the comparison of period-over-period results. The following table reconciles net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and reconciles diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to above. UGI Supplemental Footnotes

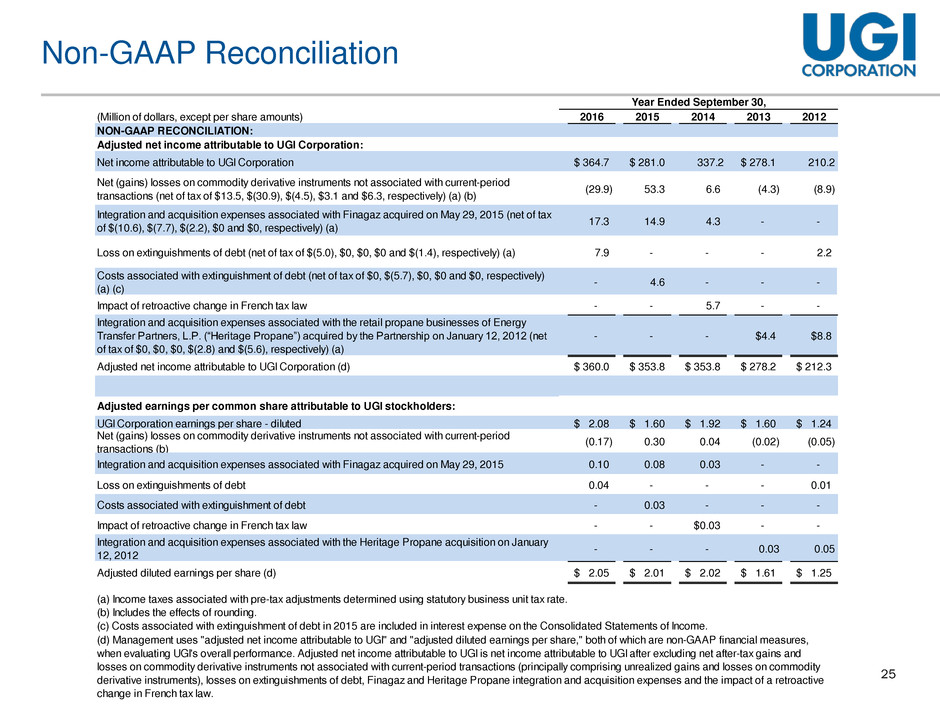

25 Non-GAAP Reconciliation (Million of dollars, except per share amounts) 2016 2015 2014 2013 2012 NON-GAAP RECONCILIATION: Adjusted net income attributable to UGI Corporation: Net income attributable to UGI Corporation 364.7$ 281.0$ 337.2 278.1$ 210.2 Net (gains) losses on commodity derivative instruments not associated with current-period transactions (net of tax of $13.5, $(30.9), $(4.5), $3.1 and $6.3, respectively) (a) (b) (29.9) 53.3 6.6 (4.3) (8.9) Integration and acquisition expenses associated with Finagaz acquired on May 29, 2015 (net of tax of $(10.6), $(7.7), $(2.2), $0 and $0, respectively) (a) 17.3 14.9 4.3 - - Loss on extinguishments of debt (net of tax of $(5.0), $0, $0, $0 and $(1.4), respectively) (a) 7.9 - - - 2.2 Costs associated with extinguishment of debt (net of tax of $0, $(5.7), $0, $0 and $0, respectively) (a) (c) - 4.6 - - - Impact of retroactive change in French tax law - - 5.7 - - Integration and acquisition expenses associated with the retail propane businesses of Energy Transfer Partners, L.P. (“Heritage Propane”) acquired by the Partnership on January 12, 2012 (net of tax of $0, $0, $0, $(2.8) and $(5.6), respectively) (a) - - - $4.4 $8.8 Adjusted net income attributable to UGI Corporation (d) 360.0$ 353.8$ 353.8$ 278.2$ 212.3$ Adjusted earnings per common share attributable to UGI stockholders: UGI Corporation earnings per share - diluted 2.08$ 1.60$ 1.92$ 1.60$ 1.24$ Net (gains) losses on commodity derivative instruments not associated with current-period transactions (b) (0.17) 0.30 0.04 (0.02) (0.05) Integration and acquisition expenses associated with Finagaz acquired on May 29, 2015 0.10 0.08 0.03 - - Loss on extinguishments of debt 0.04 - - - 0.01 Costs associated with extinguishment of debt - 0.03 - - - Impact of retroactive change in French tax law - - $0.03 - - Integration and acquisition expenses associated with the Heritage Propane acquisition on January 12, 2012 - - - 0.03 0.05 Adjusted diluted earnings per share (d) 2.05$ 2.01$ 2.02$ 1.61$ 1.25$ (d) Management uses "adjusted net income attributable to UGI" and "adjusted diluted earnings per share," both of which are non-GAAP financial measures, when evaluating UGI's overall performance. Adjusted net income attributable to UGI is net income attributable to UGI after excluding net after-tax gains and losses on commodity derivative instruments not associated with current-period transactions (principally comprising unrealized gains and losses on commodity derivative instruments), losses on extinguishments of debt, Finagaz and Heritage Propane integration and acquisition expenses and the impact of a retroactive change in French tax law. (c) Costs associated with extinguishment of debt in 2015 are included in interest expense on the Consolidated Statements of Income. (b) Includes the effects of rounding. (a) Income taxes associated with pre-tax adjustments determined using statutory business unit tax rate. Year Ended September 30,

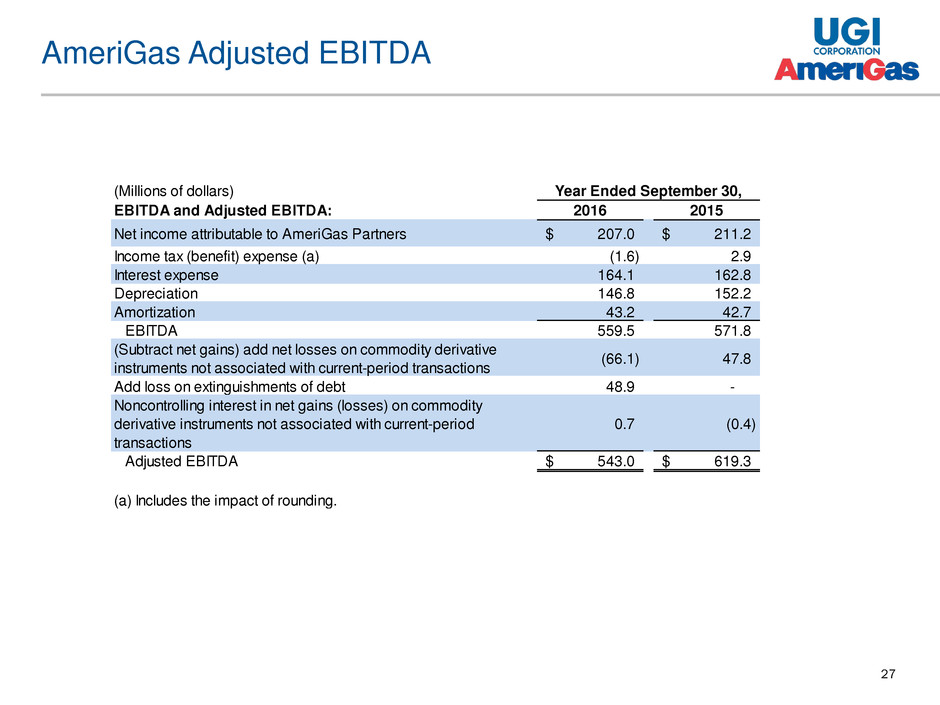

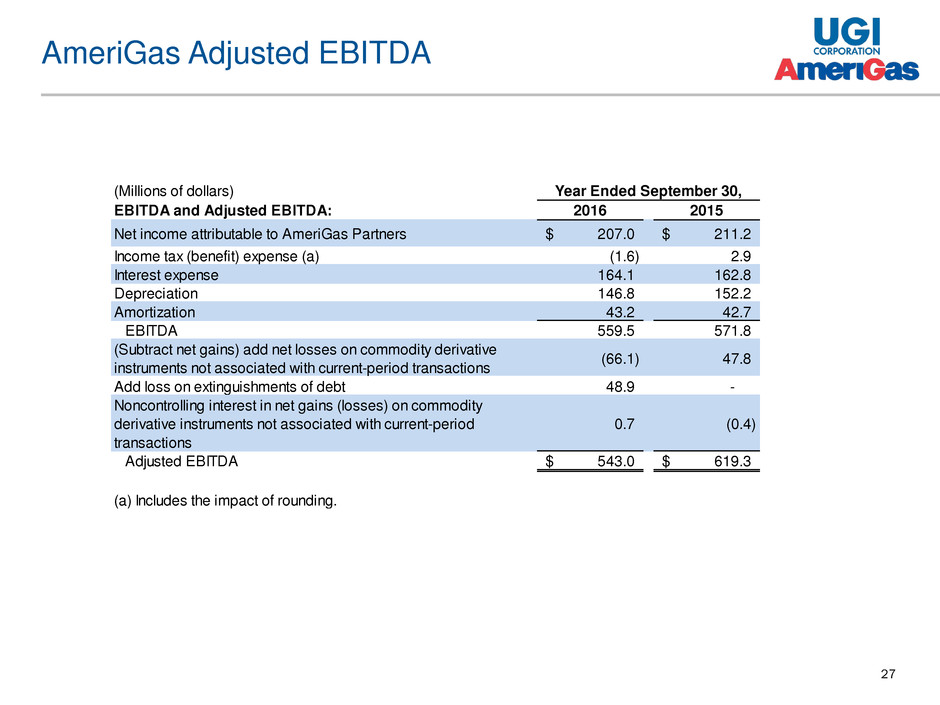

26 The enclosed supplemental information contains a reconciliation of earnings before interest expense, income taxes, depreciation and amortization ("EBITDA") and Adjusted EBITDA to Net Income. EBITDA and Adjusted EBITDA are not measures of performance or financial condition under accounting principles generally accepted in the United States ("GAAP"). Management believes EBITDA and Adjusted EBITDA are meaningful non-GAAP financial measures used by investors to compare the Partnership's operating performance with that of other companies within the propane industry. The Partnership's definitions of EBITDA and Adjusted EBITDA may be different from those used by other companies. EBITDA and Adjusted EBITDA should not be considered as alternatives to net income (loss) attributable to AmeriGas Partners, L.P. Management uses EBITDA to compare year-over-year profitability of the business without regard to capital structure as well as to compare the relative performance of the Partnership to that of other master limited partnerships without regard to their financing methods, capital structure, income taxes or historical cost basis. Management uses Adjusted EBITDA to exclude from AmeriGas Partners’ EBITDA gains and losses that competitors do not necessarily have to provide additional insight into the comparison of year-over-year profitability to that of other master limited partnerships. In view of the omission of interest, income taxes, depreciation and amortization from EBITDA and Adjusted EBITDA, management also assesses the profitability of the business by comparing net income attributable to AmeriGas Partners, L.P. for the relevant years. Management also uses EBITDA to assess the Partnership's profitability because its parent, UGI Corporation, uses the Partnership's EBITDA to assess the profitability of the Partnership, which is one of UGI Corporation’s business segments. UGI Corporation discloses the Partnership's EBITDA in its disclosures about its business segments as the profitability measure for its domestic propane segment. AmeriGas Supplemental Footnotes

27 AmeriGas Adjusted EBITDA (Millions of dollars) Year Ended September 30, EBITDA and Adjusted EBITDA: 2016 2015 Net income attributable to AmeriGas Partners 207.0$ 211.2$ Income tax (benefit) expense (a) (1.6) 2.9 Interest expense 164.1 162.8 Depreciation 146.8 152.2 Amortization 43.2 42.7 EBITDA 559.5 571.8 (Subtract net gains) add net losses on commodity derivative instruments not associated with current-period transactions (66.1) 47.8 A d loss on extinguishments of debt 48.9 - Noncontrolling interest in net gains (losses) on commodity derivative instruments not associated with current-period transactions 0.7 (0.4) Adjusted EBITDA 543.0$ 619.3$ (a) Includes the impact of rounding.

28 AmeriGas Adjusted EBITDA Guidance (Low End) (High End) Adjusted EBITDA (estimate) 660,000$ 700,000$ Interest expense (estimate) 160,000 159,000 Income tax expense (estimate) 3,000 3,000 Depreciation (estimate) 141,000 141,000 Amortization (estimate) 43,000 43,000 Forecast Fiscal Year Ending September 30, 2017 (Thousands)

29 Investor Relations: Will Ruthrauff 610-456-6571 ruthrauffw@ugicorp.com