1 1 Fiscal 2022 First Quarter Results Ro ge r Pe r re a u l t President and CEO, UGI Corporation Te d J . J a s t r ze bs k i Chief Financial Officer, UGI Corporation Ro b e r t F. B e a rd Executive Vice President, Natural Gas, Global Engineering & Construction and Procurement 1

2 2 About This Presentation This presentation contains forward-looking statements, including estimates and projections, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on management’s beliefs and assumptions and can often be identified by terms and phrases that include believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” “intend,” “target,” “project,” “forecast,” or other similar words. Management believes that these are reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control; accordingly, there is no assurance that results will be realized. You should read UGI’s Annual Report on Form 10-K for a more extensive list of factors that could affect results. Among them are adverse weather conditions (including increasingly uncertain weather patterns due to climate change) and the seasonal nature of our business; cost volatility and availability of all energy products, including propane, natural gas, electricity and fuel oil as well as the availability of LPG cylinders; increased customer conservation measures; the impact of pending and future legal or regulatory proceedings, inquiries or investigations, liability for uninsured claims and for claims in excess of insurance coverage; domestic and international political, regulatory and economic conditions in the United States and in foreign countries, including the current conflicts in the Middle East and the withdrawal of the United Kingdom from the European Union, and foreign currency exchange rate fluctuations (particularly the euro); the timing of development of Marcellus and Utica Shale gas production; the availability, timing and success of our acquisitions, commercial initiatives and investments to grow our business; our ability to successfully integrate acquired businesses and achieve anticipated synergies; the interruption, disruption, failure, malfunction, or breach of our information technology systems, including due to cyberattack; the inability to complete pending or future energy infrastructure projects; our ability to achieve the operational benefits and cost efficiencies expected from the completion of pending and future transformation initiatives including the impact of customer disruptions resulting in potential customer loss due to the transformation activities; uncertainties related to a global pandemic, including the duration and/or impact of the COVID-19 pandemic; the impact of proposed or future tax legislation, including the potential reversal of existing tax legislation that is beneficial to us; and our ability to overcome supply chain issues that may result in delays or shortages in, as well as increased costs of, equipment, materials or other resources that are critical to our business operations.

3 3 First Quarter Summary Roger Perreault President and CEO, UGI Corporation

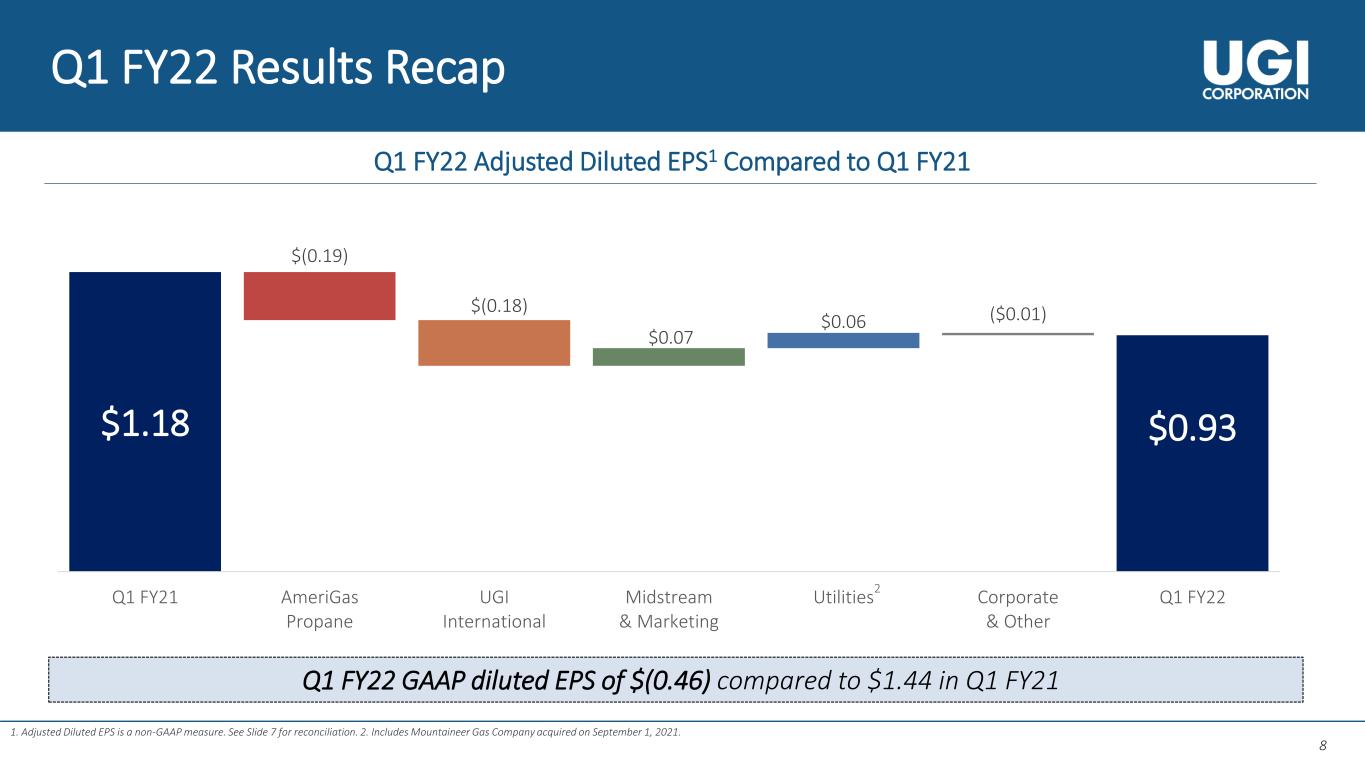

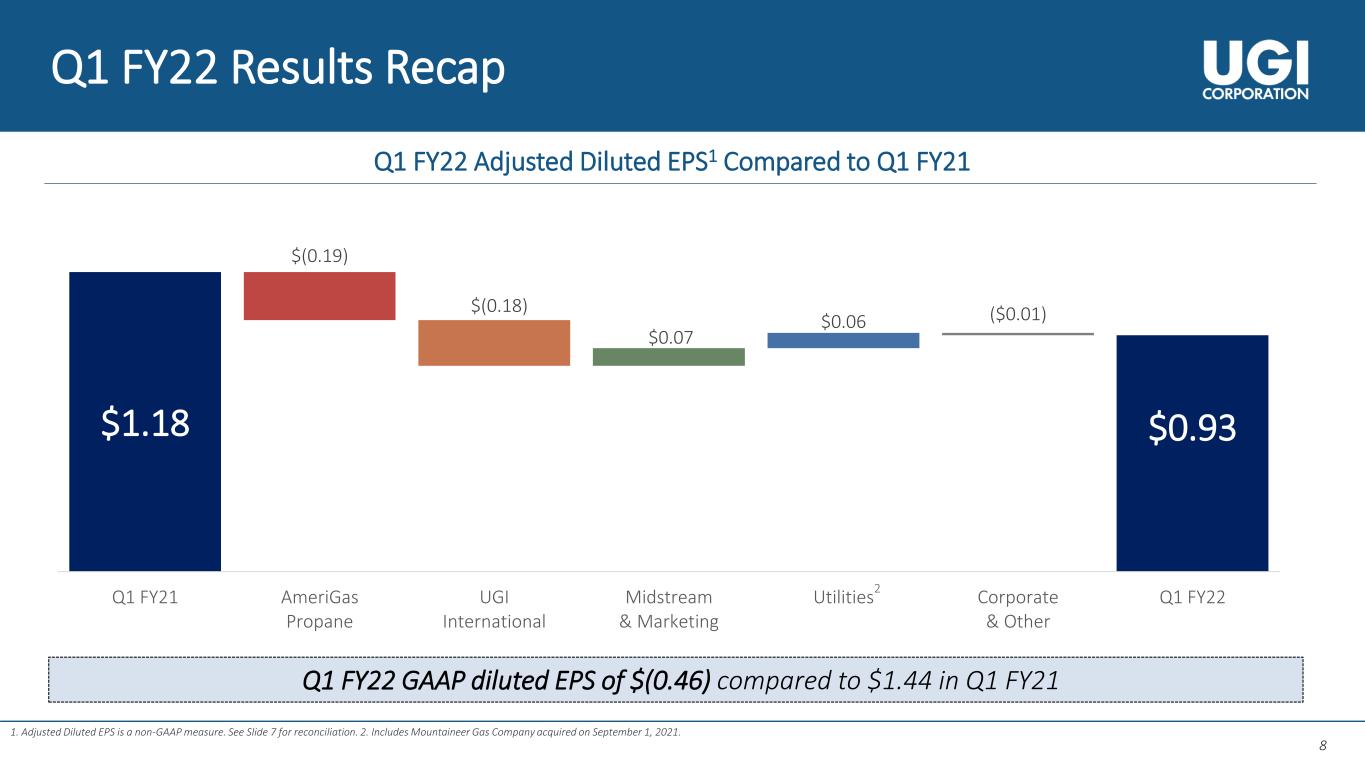

4 4 Q1 FY22 Financial Highlights Q1 FY22 Adjusted Diluted EPS1 $0.93 Adjusted diluted EPS1 of $0.93 in Q1 FY22 vs $1.18 in Q1 FY21 GAAP diluted EPS of ($0.46) vs. $1.44 in Q1 FY21 Results impacted by: record warm weather in the U.S. in December the effects of significant increases and volatility in commodity prices on LPG and energy marketing margins in Europe partially offset by incremental contribution from strategic investments in the natural gas businesses 1. Adjusted Diluted EPS is a non-GAAP measure. See Slide 7 for reconciliation. 6 – 10% Long-term EPS Growth Commitment

5 5 Key Highlights Received approval for JV with SHV Energy to advance the production and use of rDME1 Announced 15-year agreement with California-based Vertimass to produce renewable fuels in U.S. and Europe In December 2021, MSCI upgraded UGI Corporation’s ESG Rating to “AA” Utilities invested $110+ million of capital and adds 4,500+ customers Mountaineer delivered solid Q1 results and provides an avenue for growth AmeriGas benefitted from disciplined margin management efforts UGI Utilities filed a request with the PAPUC on January 28th Includes request to increase base rates by ~ $83 million and approve a weather normalization adjustment mechanism Acquired Stonehenge Appalachia for ~$190M on January 27th 47+ miles of pipeline and associated compression assets with gathering capacity of 130 million cu. ft. per day Immediately accretive to adjusted earnings 1. rDME stands for renewable dimethyl ether. Reliable Earnings Growth Renewables Rebalance

6 6 First Quarter Financial Review Ted J. Jastrzebski Chief Financial Officer, UGI Corporation

7 7 Q1 FY22 Adjusted Diluted Earnings per Share Q1 FY22 Q1 FY21 AmeriGas Propane $0.16 $0.35 UGI International 0.26 0.44 Midstream & Marketing 0.24 0.17 Utilities 0.29 0.23 Corporate & Other (a) (1.41) 0.25 (Loss) earnings per share – diluted (b) (0.46) 1.44 Net losses (gains) on commodity derivative instruments not associated with current-period transactions 1.37 (0.40) Unrealized (gains) losses on foreign currency derivative instruments (0.02) 0.07 Loss on extinguishment of debt 0.03 — Acquisition and integration expenses associated with the Mountaineer Acquisition — 0.01 Business transformation expenses 0.01 0.06 Total adjustments (a) 1.39 (0.26) Adjusted earnings per share – diluted (b) $0.93 $1.18 (a) Corporate & Other includes certain adjustments made to our reporting segments in arriving at net income attributable to UGI Corporation. These adjustments have been excluded from the segment results to align with the measure used by our Chief Operating Decision Maker in assessing segment performance and allocating resources. (b) The loss per share for the three months ended December 31, 2021, was determined excluding the effect of 6.49 million dilutive shares as the impact of such shares would have been antidilutive to the net loss for the period. Adjusted earnings per share for the three months ended December 31, 2021, was determined based upon fully diluted shares of 216.16 million.

8 8 Q1 FY22 Results Recap 1. Adjusted Diluted EPS is a non-GAAP measure. See Slide 7 for reconciliation. 2. Includes Mountaineer Gas Company acquired on September 1, 2021. Q1 FY22 GAAP diluted EPS of $(0.46) compared to $1.44 in Q1 FY21 Q1 FY22 Adjusted Diluted EPS1 Compared to Q1 FY21 $0.93 $(0.19) $(0.18) $1.18 $0.07 $0.06 ($0.01) Q1 FY21 AmeriGas Propane UGI International Midstream & Marketing Utilities Corporate & Other Q1 FY22 2

9 9 Financial Results – AmeriGas Propane (Dollars in Millions) Q1 FY21 Q1 FY22 Earnings Before Interest Expense & Income Taxes $141 Total Margin (34) Operating and Administrative Expenses (19) Depreciation and Amortization (1) Other Income and Expense, net (1) Earnings Before Interest Expense & Income Taxes $86 Item Primary Drivers Volume↓ Total retail gallons sold decreased 13% principally due to the warmer weather, the effect of higher commodity prices on customer usage, certain challenges associated with the implementation our new operating business model and the impact of COVID-19 on cylinder exchange and resale volumes Total Margin ↓ Attributable to the lower retail propane volumes partially offset by higher average propane selling prices Operating and Admin Expenses ↑ Largely due to higher general insurance, vehicle fuel, bad debt reserves, advertising expenses and telecommunications expenses, driven, in part, by the inflationary cost environment Weather versus normal 6.2% warmer than prior year Warmer (4.6%) (9.9%) Q1 FY22Q1 FY21

10 10 Item Primary Drivers Total Volume ↑ LPG retail gallons sold increased 6% largely attributable to the colder weather which positively impacted heating-related bulk volumes, favorable crop drying campaigns and recovery of certain autogas volumes negatively impacted by COVID-19 Total Margin ↓ Primarily reflects lower total margin from energy marketing business and lower average LPG unit margins that were impacted by significant increase and unprecedented volatility in commodity prices. Energy marketing margin was also impacted by increased commodity costs associated with higher-than-anticipated volumes purchased by certain customers through fixed price sales contracts Operating and Admin Expenses ↑ Primarily attributable to distribution and packaging costs associated with higher retail LPG volumes sold Other Income and Expense, net ↑ Primarily attributable to higher gains on sales of assets Financial Results – UGI International (Dollars in Millions) Q1 FY21 Q1 FY22 Earnings Before Interest Expense & Income Taxes $136 Total Margin (61) Operating and Administrative Expenses (4) Depreciation and Amortization 2 Realized FX Gains 3 Other Income and Expense, net 6 Earnings Before Interest Expense & Income Taxes $82 Weather versus normal 6.6% colder than prior year (14.7%) Warmer 5.0% Q1 FY21 Q1 FY22 (2.0%)

11 11 Item Primary Drivers Total Margin ↑ Largely reflecting higher margin from renewable energy marketing activities (including impact of increased sales volumes and average pricing related to environmental credits), and improved margins from capacity management and peaking contracts, partially offset by lower margin from natural gas marketing activities Operating and Admin Expenses ↓ Reflects, among other things, lower wages and benefits compared to the prior-year period Other Income and Expense, net ↑ Primarily relates to the absence of an adjustment to the contingent consideration related to the GHI acquisition Financial Results – Midstream & Marketing Weather versus normal 11.4% warmer than prior year Warmer (15.8%) Q1 FY21 Q1 FY22 (5.0%) (Dollars in Millions) Q1 FY21 Q1 FY22 Earnings Before Interest Expense & Income Taxes $59 Total Margin 18 Operating and Administrative Expenses 3 Depreciation and Amortization (1) Other Income and Expense, net 3 Earnings Before Interest Expense & Income Taxes $82

12 12 Item Primary Drivers Volume ↑ Gas Utility core market volumes increased largely due to incremental volumes attributable to Mountaineer Total Margin ↑ Largely reflects incremental margin attributable to Mountaineer, higher gas base rates (went into effect in FY2021), and a Distribution System Improvement Charge (effective April 1, 2021) Operating and Admin Expenses ↑ Principally related to incremental expenses attributable to Mountaineer Depreciation ↑ Principally related to incremental expenses attributable to Mountaineer Financial Results – Utilities (Dollars in Millions) Q1 FY21 Q1 FY221 Earnings Before Interest Expense & Income Taxes $78 Total Margin 46 Operating and Administrative Expenses (20) Depreciation (6) Earnings Before Interest Expense & Income Taxes $98 Weather versus normal 7.9% warmer than prior year Warmer (15.1%) Q1 FY21 Q1 FY22 (9.8%) 1. Includes Mountaineer Gas Company acquired on September 1, 2021.

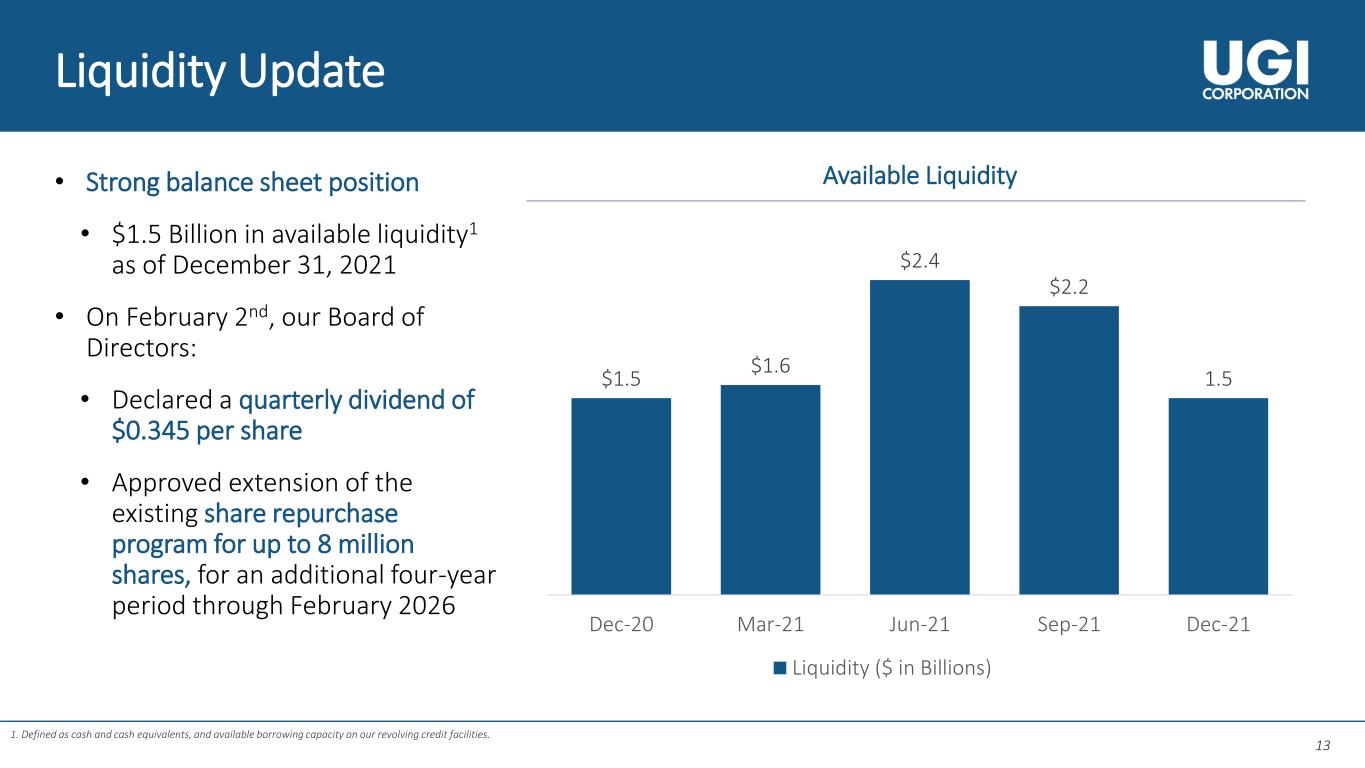

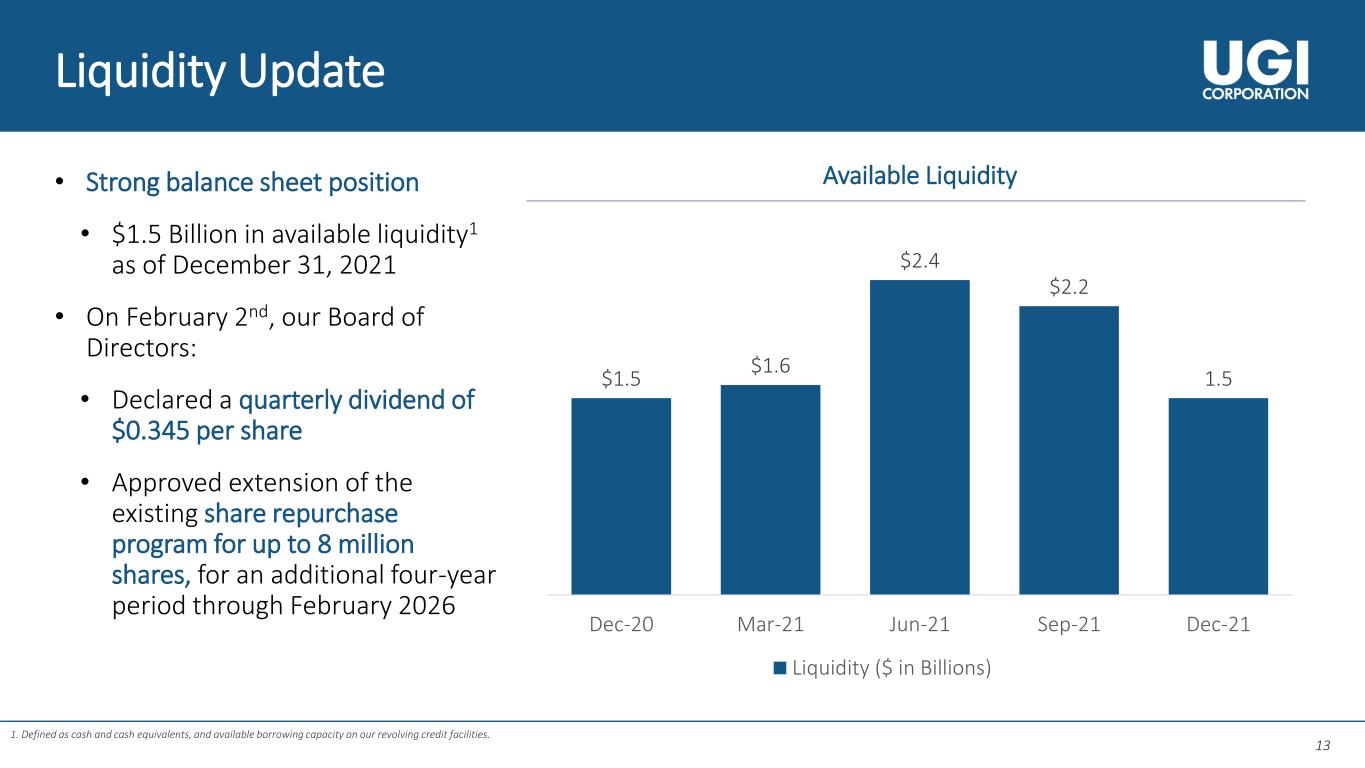

13 13 Liquidity Update • Strong balance sheet position • $1.5 Billion in available liquidity1 as of December 31, 2021 • On February 2nd, our Board of Directors: • Declared a quarterly dividend of $0.345 per share • Approved extension of the existing share repurchase program for up to 8 million shares, for an additional four-year period through February 2026 $1.5 $1.6 $2.4 $2.2 1.5 Dec-20 Mar-21 Jun-21 Sep-21 Dec-21 Available Liquidity Liquidity ($ in Billions) 1. Defined as cash and cash equivalents, and available borrowing capacity on our revolving credit facilities.

14 14 Conclusion Roger Perreault President and CEO, UGI Corporation

15 15 Conclusion SAFETY RESPECT INTEGRITY SUSTAINABILITY Long-term Dividend Growth Target 4% Long-term EPS Growth Target 6 - 10% Driving FY22 performance Our long-term commitments Focused Margin Management Disciplined Expense Management • Recovery of higher commodity cost • Control of operating expenses • Accelerating the Corporate Functions Transformation initiative Leveraging core competencies EXCELLENCE RELIABILITY Reliable Earnings Growth Renewables Rebalance

16 16 Q & A Q

17 17 Appendix

18 18 UGI Supplemental Footnotes • Management uses “adjusted net income attributable to UGI Corporation” and “adjusted diluted earnings per share,” both of which are non-GAAP financial measures, when evaluating UGI’s overall performance. Management believes that these non-GAAP measures provide meaningful information to investors about UGI’s performance because they eliminate gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions and other significant discrete items that can affect the comparison of period-over-period results. • Management does not designate its commodity and certain foreign currency derivative instruments as hedges under GAAP. Volatility in net income attributable to UGI can occur as a result of such gains and losses on commodity and certain foreign currency derivative instruments not associated with current-period transactions. These gains and losses result principally from recording changes in unrealized gains and losses on unsettled commodity and certain foreign currency derivative instruments and, to a much lesser extent, certain realized gains and losses on settled commodity derivative instruments that are not associated with current-period transactions. However, because these derivative instruments economically hedge anticipated future purchases or sales of energy commodities, or in the case of certain foreign currency derivatives, reduce volatility in anticipated future earnings associated with our foreign operations, we expect that such gains or losses will be largely offset by gains or losses on anticipated future energy commodity transactions or mitigate volatility in anticipated future earnings. • Non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures. • The table on slide 19 reconciles net income attributable to UGI Corporation, the most directly comparable GAAP measure, to adjusted net income attributable to UGI Corporation, and the table on slide 7 reconciles diluted earnings per share, the most comparable GAAP measure, to adjusted diluted earnings per share, to reflect the adjustments referred to above.

19 19 Q1 FY22 Adjusted Net Income (Dollars in Millions) Q1 FY22 Q1 FY21 AmeriGas Propane $34 $74 UGI International 57 92 Midstream & Marketing 51 35 Utilities 63 49 Corporate & Other (a) (302) 53 Net (loss) income attributable to UGI Corporation (97) 303 Net losses (gains) on commodity derivative instruments not associated with current-period transactions (net of tax of $(111) and $31, respectively) 292 (85) Unrealized (gains) losses on foreign currency derivative instruments (net of tax of $2 and $(5), respectively) (4) 15 Loss on extinguishment of debt (net of tax of $(3) and $0, respectively) 8 - Acquisition and integration expenses associated with the Mountaineer Acquisition (net of tax of $0 and $(1), respectively) 1 1 Business transformation expenses (net of tax of $(1) and $(4), respectively) 1 13 Total adjustments (a) (b) 298 (56) Adjusted net income attributable to UGI Corporation $201 $247 (a) Corporate & Other includes certain adjustments made to our reporting segments in arriving at net income attributable to UGI Corporation. These adjustments have been excluded from the segment results to align with the measure used by our Chief Operating Decision Maker in assessing segment performance and allocating resources. (b) Income taxes associated with pre-tax adjustments determined using statutory business unit tax rates.

20 20 Investor Relations: Tameka Morris 610-456-6297 morrista@ugicorp.com Arnab Mukherjee 610-768-7498 mukherjeea@ugicorp.com