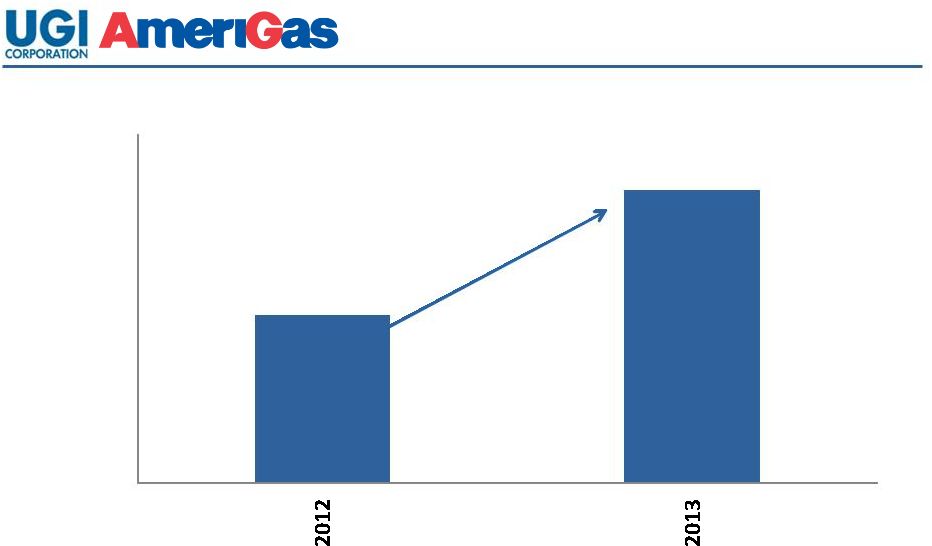

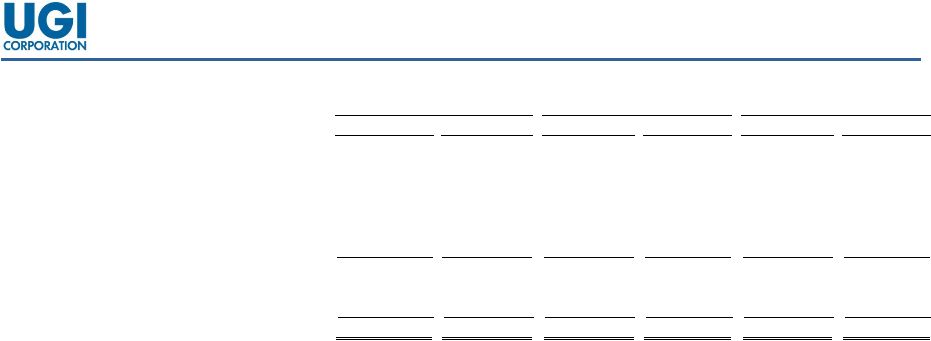

May 1, 2013 23 AmeriGas Propane EBITDA Reconciliation (1) Adjusted EBITDA is a non-GAAP financial measure. Management believes the presentation of this measure provides useful information to investors to more effectively evaluate the year-over-year results of operations of the Partnership. Management uses Adjusted EBITDA to exclude from AmeriGas Partners' EBITDA gains and losses that competitors do not necessarily have to provide additional insight into the comparison of year-over-year profitability to that of other master limited partnerships. This measure is not comparable to measures used by other entities and should only be considered in conjunction with net income attributable to AmeriGas Partners, L.P. for the relevant periods. 2013 2012 2013 2012 2013 2012 Net income attributable to AmeriGas Partners, L.P. 221,820 $ 133,885 $ 318,485 $ 176,410 $ 153,100 $ 122,063 $ Income tax (benefit) expense (52) 764 575 1,214 1,292 1,256 Interest expense 41,776 45,045 82,972 61,578 164,035 93,374 Depreciation 37,607 35,351 75,930 56,282 153,873 98,841 Amortization 11,022 9,441 22,050 12,698 44,250 18,978 EBITDA 312,173 $ 224,486 $ 500,012 $ 308,182 $ 516,550 $ 334,512 $ Heritage Propane acquisition and transition expense 5,396 8,138 10,884 11,855 45,216 11,855 Loss (gain) on extinguishments of debt - 13,379 - 13,379 (30) 32,695 Adjusted EBITDA (1) 317,569 $ 246,003 $ 510,896 $ 333,416 $ 561,736 $ 379,062 $ March 31, Twelve Months Ended March 31, Three Months Ended Six Months Ended March 31, |