Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-K

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 29, 2007

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission file number 001-31410

COTT CORPORATION

(Exact name of registrant as specified in its charter)

| CANADA | NONE | |

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) | |

6525 VISCOUNT ROAD MISSISSAUGA, ONTARIO | L4V 1H6 | |

5519 WEST IDLEWILD AVENUE TAMPA, FLORIDA, UNITED STATES | 33634 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (905) 672-1900

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

COMMON SHARES WITHOUT NOMINAL OR PAR VALUE | NEW YORK STOCK EXCHANGE |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this form 10-K or any amendment to this form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-12 of the Act). Yes ¨ No x

The aggregate market value of the common equity held by non-affiliates of the registrant as of June 30, 2007 (based on the closing sale price of $14.39 for the registrant’s common stock as reported on the New York Stock Exchange on June 29, 2007) was $1,025,396,286.

(Reference is made to the last paragraph of Part II, Item 5 for a statement of assumptions upon which the calculation is made.)

The number of shares outstanding of the registrant’s common stock as of February 19, 2008 was 71,871,330.

Table of Contents

| 3 | ||||

ITEM 1. | 3 | |||

ITEM 1A. | 8 | |||

ITEM 1B. | 14 | |||

ITEM 2. | 14 | |||

ITEM 3. | 15 | |||

ITEM 4. | 15 | |||

SUPPLEMENTAL ITEM PART I. EXECUTIVE OFFICERS OF COTT CORPORATION | 16 | |||

| 18 | ||||

ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY AND RELATED SHAREOWNER MATTERS | 18 | ||

ITEM 6. | 20 | |||

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 22 | ||

| 22 | ||||

| 24 | ||||

| 29 | ||||

| 30 | ||||

| 32 | ||||

| 35 | ||||

ITEM 7A. | 41 | |||

ITEM 8. | 43 | |||

ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 43 | ||

ITEM 9A. | 43 | |||

ITEM 9B. | 46 | |||

| 47 | ||||

ITEM 10. | 47 | |||

ITEM 11. | 47 | |||

ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREOWNER MATTERS | 47 | ||

ITEM 13. | 47 | |||

ITEM 14. | 47 | |||

| 48 | ||||

ITEM 15. | 48 | |||

| F - 1 | ||||

| F - 2 | ||||

| F - 3 | ||||

| F - 5 | ||||

| F - 6 | ||||

| F - 7 | ||||

| F - 8 | ||||

| F - 9 | ||||

| SCH -1 | ||||

Table of Contents

Our consolidated financial statements are prepared in accordance with United States (“U.S.”) generally accepted accounting principles (“GAAP”) in U.S. dollars. Unless otherwise indicated, all amounts in this report are in U.S. dollars and U.S. GAAP.

Any reference to 2007, 2006 and 2005 corresponds to our fiscal years ended December 29, 2007, December 30, 2006, and December 31, 2005, respectively.

Documents incorporated by reference

Portions of our definitive proxy statement for the 2008 Annual Meeting of Shareowners, to be filed within 120 days of December 29, 2007, are incorporated by reference in Part III.

Such proxy statement, except for the parts therein which have been specifically incorporated by reference, shall not be deemed “filed” for the purposes of this report on Form 10-K.

Forward-looking statements

In addition to historical information, this report and the reports and documents incorporated by reference in this report contain statements relating to future events and our future results. These statements are “forward-looking” within the meaning of the Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation and include, but are not limited to, statements that relate to projections of sales, earnings, earnings per share, cash flows, capital expenditures or other financial items, discussions of estimated future revenue enhancements and cost savings. These statements also relate to our business strategy, goals and expectations concerning our market position, future operations, margins, profitability, liquidity and capital resources. Generally, words such as “anticipate”, “believe”, “continue”, “could”, endeavor, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”, “project”, “should” and similar terms and phrases are used to identify forward-looking statements in this report and in the documents incorporated in this report by reference. These forward-looking statements are made as of the date of this report.

Although we believe the assumptions underlying these forward-looking statements are reasonable, any of these assumptions could prove to be inaccurate and, as a result, the forward-looking statements based on those assumptions could be incorrect. Our operations involve risks and uncertainties, many of which are outside of our control, and any one or any combination of these risks and uncertainties could also affect whether the forward-looking statements ultimately prove to be correct.

The following are some of the factors that could affect our financial performance, including but not limited to sales, earnings and cash flows, or could cause actual results to differ materially from estimates contained in or underlying the forward-looking statements:

| • | the continued decline of the North American carbonated soft drink (“CSD”) business (including the ability to manage fixed costs related to such business); |

| • | changes in consumer tastes and preferences for existing products, and market acceptance of new product offerings that appeal to such changing tastes; |

| • | our ability to successfully execute the previously announced water bottling initiatives in the United States, maintain plant efficiencies, lower logistics costs, and other costs; |

| • | fluctuations in the cost and availability of beverage ingredients and packaging supplies, and our ability to maintain favorable arrangements and relationships with our suppliers; |

| • | our ability to pass on increased costs to our customers and the impact those increased prices could have on our volumes; |

| • | our ability to grow our business outside of North America, including new geographic areas; |

1

Table of Contents

| • | our ability to expand our business to new channels and customers; |

| • | our ability to retain existing senior management; |

| • | loss of or a reduction in business with key customers, particularly Wal-Mart, and the commitment of our customers to their own Cott-supplied beverage programs; |

| • | increases in competitor consolidations and marketplace competitive activities, particularly among manufacturers of branded beverage products; |

| • | our ability to identify acquisition and alliance candidates and to integrate into our operations the businesses and product lines that we acquire or become allied with; |

| • | our ability to secure and implement additional hot-filled and aseptic production capacity to support New Age type beverage growth through our purchase of manufacturing assets, acquisitions or third party manufacturing arrangements; |

| • | our ability to continue to obtain financing; |

| • | increase in interest rates; |

| • | unseasonably cold or wet weather, which could reduce demand for our beverages; |

| • | our ability to protect the intellectual property inherent in new and existing products; |

| • | adverse rulings, judgments or settlements in our existing litigation and regulatory reviews, and the possibility that additional litigation or regulatory reviews will be brought against us; |

| • | product recalls or changes in or increased enforcement of the laws and regulations that affect our business; |

| • | currency fluctuations that adversely affect the exchange between the U.S. dollar and the pound sterling, the euro, the Canadian dollar, the Mexican peso and other currencies; |

| • | changes in tax laws and interpretations of tax laws; |

| • | interruption in transportation systems, labor strikes, work stoppages and other interruptions or difficulties in the employment of labor or transportation in our markets; and |

| • | changes in general economic and business conditions. |

Many of these factors are described in greater detail in this report and in other filings that we make with the U.S. Securities and Exchange Commission (“SEC”) and Canadian securities regulatory authorities. We undertake no obligation to update any information contained in this report or to publicly release the results of any revisions to forward-looking statements to reflect events or circumstances of which we may become aware of after the date of this report. Undue reliance should not be placed on forward-looking statements.

All future written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing.

2

Table of Contents

| ITEM 1. | BUSINESS |

Our Company

We operate our business in North America through our indirect wholly owned subsidiary Cott Beverages Inc., in the United States and through Cott Corporation in Canada. We operate our International business (as defined below) through several subsidiaries including our indirect wholly owned subsidiary Cott Beverages Ltd. in the United Kingdom (“U.K.”) and Europe, and in Mexico through an indirect 90% owned subsidiary, Cott Embotelladores de Mexico, S.A. de C.V. References throughout this report to North America or our North American business mean, unless otherwise indicated, Canada and the United States. References throughout this report to International mean, unless otherwise indicated, U.K., Europe, Mexico and Asia as well as our Royal Crown International business.

We incorporated in 1955 and are governed by the Canada Business Corporations Act. Our registered Canadian office is located at 333 Avro Avenue, Pointe-Claire, Quebec, Canada H9R 5W3 and our principal executive offices are located at 6525 Viscount Road, Mississauga, Ontario, Canada L4V 1H6 and 5519 W. Idlewild Avenue, Tampa, Florida, United States 33634.

Principal markets and products

We are one of the world’s largest non-alcoholic beverage companies and the world’s largest retailer brand soft drink provider. Based on industry information, we estimate that we produce (either directly or through third party manufacturers with whom we have co-packing agreements) approximately 67% of all retailer brand carbonated soft drinks (“CSDs”) sold in North America. We produce directly approximately 65% of retailer brand CSD’s sold in the U.K. In addition to carbonated soft drinks, our product lines include clear, still and sparkling flavored waters, juice-based products, bottled water, energy drinks and ready-to-drink teas. As of the year ended December 29, 2007, approximately 93% of all of the beverages we sell in North America and the U.K. (measured in 8-ounce equivalent cases) are under customer controlled retailer brands, and the remainder are sold under brand names that we either own or license from others. Eight-ounce equivalent cases is a standard industry measure equaling 24 8-ounce servings (192 U.S. fluid ounces), and does not equate to physical cases. Sales of carbonated soft drinks, including concentrate, sparkling flavored waters and energy drinks, represented approximately 86% of our sales volume in 8-ounce equivalent cases. Sales of bottled water represented approximately 7% of our sales volume in 8-ounce equivalent cases. The balance of approximately 7% was composed of sales of ready-to-drink teas, still flavored waters and other non-carbonated beverages.

In recent years, we expanded our business through acquisitions and growth with key customers. We believe that opportunities exist to increase sales of beverages in our markets by leveraging existing customer relationships, obtaining new customers, exploring new channels of distribution and introducing new products.

Liquidity

We are currently in the process of negotiating a new asset based lending credit facility (“ABL”) that will be secured by substantially all of our assets, including accounts receivable, inventory and property plant and equipment. The proposed new ABL facility would likely be a five year revolving senior secured credit facility of up to $250 million and we are endeavoring to close the facility by the end of the fiscal quarter ending March 29, 2008.

For a discussion of our liquidity, please refer to “Liquidity and capital resources” in Management’s Discussion and Analysis on page 35.

North American realignment and cost reduction activities

In September 2005, we announced our plan to realign the management of our Canadian and U.S. businesses to a North American basis, rationalize product offerings, eliminate underperforming assets and increase focus on high potential customer accounts. In conjunction with the North American realignment plan, we closed several plants and warehouses in 2006.

3

Table of Contents

In 2006, we announced the realignment of the management of our U.K. and Europe business, our Mexican business, our Royal Crown International business and our business in Asia into a combined International business, to focus on cohesive customer management, channel development, sales and marketing. We also announced the closure of several plants and warehouses in North America.

In fiscal year 2007, we completed the closure of certain North American plants and warehouses, decided to dispose of one our water production facilities in Canada and decided to dispose of certain hot-filled production assets at one of our co-packers.

Financial information about segments

For financial information about segments and geographic areas, see note 9 to the consolidated financial statements of this Annual Report on Form 10-K.

Manufacturing and distribution

Approximately 94% of our beverages produced in North America were manufactured in facilities that we, or third party manufacturers with whom we have long-term co-packing agreements, either own or lease. We manufacture virtually all of our U.K. and Mexican beverages in facilities that we either own or lease. We rely on third parties to produce and distribute products in areas or markets where we do not have our own production facilities, such as continental Europe, or when additional production capacity is required.

Our products are either picked up by customers at our facilities or delivered by us, a common carrier, or third party distributors to the customer’s distribution centers or to retail locations.

Subject to the terms and conditions of the applicable policies, we are insured against product liability claims and product recalls that could result from the injury, illness or death of consumers using our products, contamination of our products, or damage to or mislabeling of our products. We believe that our insurance coverage is adequate. Our insurance advisors are comfortable with our deductibles given our operational risk profile, our claims history and our financial stability.

Ingredients and packaging supplies

In addition to water, the principal raw materials required to produce our products are polyethylene terephthalate (“PET”) bottles, PET caps and preforms, aluminum cans and ends, labels, cartons and trays, concentrates and sweeteners.

We generally enter into annual supply arrangements rather than long-term contracts with our suppliers, which mean that our suppliers are obligated to continue to supply us with materials for one-year periods, at the end of which we must either renegotiate the contracts with our incumbent suppliers or find alternative sources.

With respect to some of our key packaging supplies, such as aluminum cans and ends, and some of our key ingredients, such as artificial sweeteners, we have entered into long-term supply agreements, the terms of which range from 1 to 5 years. Crown Cork & Seal USA, Inc. (“CCS”) supplies aluminum cans and ends under a contract that expires on December 31, 2011. The contract provides that CCS will supply our entire aluminum cans and ends requirements worldwide, subject to certain exceptions. The contract contains a pricing mechanism for certain materials, standard representations, warranties, indemnities, termination events (including termination events related to bankruptcy or insolvency of either party), and a cap on aluminum prices, which expired in December 2006. In 2007, the market price paid for aluminum increased significantly to reflect increased worldwide demand. We entered into a supply agreement to mitigate the impact of aluminum market fluctuations on pricing by minimizing price increases on our business into the fourth quarter of 2008.

4

Table of Contents

We rely upon our ongoing relationships with key suppliers to support our operations. We believe that we will be able to either renegotiate contracts with these suppliers when they expire or find alternative sources for supply.

We believe there is adequate supply of the ingredients and packaging materials used to produce or package our products.

The majority of our ingredient and packaging supply contracts allow our suppliers to alter the prices they charge us based on changes in the costs of the underlying commodities. Aluminum for cans, resin for PET bottles, preforms and caps, and corn for high fructose corn syrup (“HFCS”) are examples of these underlying commodities. In addition, the contracts for certain of our ingredients and packaging materials permit our suppliers to increase the costs they charge us based on increases in their cost of converting the underlying commodities into the materials we purchase. In certain cases those increases are subject to negotiated limits. Changes in the prices we pay for ingredients and packaging materials occur at times that vary by product and supplier, but take place principally on a semi-annual or annual basis.

PET resin prices have increased significantly in recent years but decreased slightly in 2007 as compared with 2006 levels. We are currently working with PET resin suppliers to manage pricing in 2008 but at this point in time, because PET resin is not a traded commodity, no fixed price mechanism has been implemented. However, we are aggressively seeking to obtain price protection for PET resin.

HFCS has a history of volatile price changes. We expect HFCS market prices will continue to increase as a result of growing demand for corn-related products. Therefore, we have locked in the price for the majority of our requirements for our North American business into the third quarter of 2008.

Generally, we bear the risk of increases in the costs of the ingredients and packaging materials used to produce our products, including the underlying costs of the commodities that comprise them and, to some extent, the costs of converting those commodities into finished products. We do not use derivatives to manage this risk.

Trade secrets, copyrights, trademarks and licenses

We sell the majority of our beverages under retailer brands to customers who own the trademarks associated with those products. We also own registrations, or applications to register, various trademarks that are important to our worldwide business, includingCott® andOrient Emporium Tea Co.™ in the U.S., Canada and the U.K.,Stars & Stripes®,Vess®,Vintage®,So Clear®,Top Pop®, andCity Club® in the U.S.,Red Rain® andRed Rave™ in the U.S. and Canada,Red Rooster®,Ben Shaw’s® and the H2 family of brands in the U.K.,Stars & Stripes®andVintage® in Mexico, andRC® in more than 100 countries outside of North America. Moreover, we are licensed to use certain trademarks, includingCarters® in the U.K.,Jarritos®in Mexico, andRC® in certain regions of Canada. The licenses to which we are a party are of varying terms, including some which are perpetual. Trademark ownership is generally of indefinite duration when marks are properly maintained in commercial use.

Our success depends in part on our intellectual property, which includes trade secrets in the form of concentrate formulas for our beverages and trademarks for the names of the beverages we sell. To protect this intellectual property, we rely principally on registration of trademarks, contractual responsibilities and restrictions in agreements (such as indemnification, nondisclosure and confidentiality agreements) with employees, consultants and customers, and on the common law and statutory protections afforded to trademarks, copyrights, trade secrets and proprietary “know-how.” We also closely monitor the use of our trademarks and vigorously pursue any party that infringes on our trademarks, using all available legal remedies.

5

Table of Contents

Seasonality of sales

Sales of our beverages are seasonal, with the highest sales volumes generally occurring in the second and third fiscal quarters, which correspond to the warmer months of the year in our major markets.

Customers

A significant portion of our revenue is concentrated in a small number of customers. Our customers include many large national and regional grocery, mass-merchandise, drugstore, wholesale and convenience store chains in our core markets of North America and International. For the year ended December 29, 2007, sales to Wal-Mart Stores, Inc. and its affiliates (collectively, “Wal-Mart”) accounted for approximately 39% of total revenue, 46% of our North American business and 22% of our International business. Wal-Mart was the only customer that accounted for more than 10% of our total revenue in that period. For the same period, our top ten customers accounted for approximately 64% of total revenue. We expect that sales of our products to a limited number of customers will continue to account for a high percentage of revenue for the foreseeable future. The loss of Wal-Mart, or customers which in the aggregate represent a significant portion of our revenue, or a decline in sales to these customers, would have a material adverse effect on our operating results and cash flows.

Competition

Generally, carbonated soft drinks compete against all forms of liquid beverages, including bottled and flavored water, teas, coffees and juice-based beverages, for consumers’ shopping preferences.

The carbonated soft drink category is highly competitive in each region in which we compete and competition for incremental volume is intense. The brands owned by the three major national soft drink companies, Coca-Cola, Pepsi and Cadbury Schweppes, control approximately 84% of the aggregate take-home volume of carbonated soft drink sales in the combined North American, U.K. and Mexican markets. Those companies have significant financial resources and spend heavily on promotional programs. They also have direct store delivery systems which enable their personnel to visit retailers frequently to sell new items, stock shelves and build displays.

In addition, we face competition in the U.S., U.K. and Mexico from regional soft drink manufacturers who sell aggressively priced brands and, in many cases, also supply retailer brand products. A few larger U.S. retailers also self-manufacture products for their own needs and consistently approach other retailers seeking additional business.

The competitive pressures in our industry are significant. However, we seek to differentiate ourselves by offering our customers efficient distribution methods, high-quality products, category management strategies, packaging and marketing strategies and superior service.

Government regulation and environmental matters

The conduct of our business, and the production, distribution, sale, labeling, safety, transportation and use of many of our products are subject to various federal, state, provincial, local and foreign laws and regulations.

As a producer of beverages, we must comply with various federal, state, provincial, local and foreign laws relating to production, packaging, quality, labeling and distribution. We are also subject to various federal, state, provincial, local and foreign environmental laws and workplace regulations.

Our operations are also subject to extensive regulations administered by various environmental regulatory authorities, including the U.S. Environmental Protection Agency, which pertain to the discharge of materials into the environment and the handling and disposition of wastes. Failure to comply with these regulations can have serious consequences, including civil and administrative penalties.

6

Table of Contents

We do not expect to make any material expenditures in connection with environmental remediation and compliance. However, as discussed below, changes in how the Ontario Ministry of the Environment enforces the Ontario Environmental Protection Act could result in us having to make material expenditures for environmental compliance.

The Ontario Environmental Protection Act (“EPA”)

EPA regulations provide that a minimum percentage of a bottler’s soft drink sales within specified areas in Ontario must be made in refillable containers. The penalty for non-compliance is a fine, which ranges from $50,000 per day beginning upon which the offense first occurs or continues until the first conviction to $100,000 per day for each subsequent conviction, although such fines may be increased to equal the amount of monetary benefit acquired by the offender as a result of the commission of the offense.

We, and we believe other industry participants, are currently not in compliance with the requirements of the EPA. To comply with these requirements we, and we believe many other industry participants, would have to significantly increase sales in refillable containers to a minimum refillable sales ratio of 30%. We are not in compliance with these regulations and do not expect to be in the foreseeable future. Ontario is not enforcing the EPA at this time, despite the fact that it is still in effect and not amended, but if it chooses to enforce it in the future, we could incur fines for non-compliance and the possible prohibition of sales of soft drinks in non-refillable containers in Ontario. We estimate that approximately 4% of our sales would be affected by the possible limitation of sales of soft drinks in non-refillable containers in Ontario if the Ontario Ministry of the Environment initiated an action to enforce the provisions of the EPA against us. Moreover, the Ontario Ministry of the Environment released a report in 1997 stating that these EPA regulations are “outdated and unworkable.” However, despite the “unworkable” nature of the EPA regulations, they have not yet been revoked.

We believe that the magnitude of the potential fines that we could incur if the Ontario Ministry of the Environment chose to enforce these regulations is such that the costs to us of non-compliance could be, although are not contemplated to be, significant. However, our management believes that such enforcement is very remote and, in any event, these regulations are expected to be revoked in the future given the regulatory activity in this area as described below.

In December of 2003, the Ontario Ministry of the Environment approved the Blue Box Program, which included provisions regarding industry responsibility for 50% of the net cost of the Program. Generally, the company that owns the intellectual property rights to the brand of a product, or is the licensee of those rights, and that manufactures, packages or distributes a product for sale in Ontario or causes such manufacturing, packaging or distributing of a product in Ontario, will be liable for the costs under the Program. We generally do not own the intellectual property rights to the brands of our products. Rather, we generally manufacture, package and distribute products for and on behalf of Ontario-based third party customers who are the brand owners, and we do not believe that any costs for which we might be ultimately responsible would have a material adverse effect on our results of operations; however, we cannot guarantee this outcome.

Employees

As of December 29, 2007, we had approximately 2,996 employees, of whom an estimated 1,881 were located in North America and 1,115 were located in International. We have entered into numerous collective bargaining agreements that we believe contain terms that are typical in the beverage industry. As these agreements expire, we believe they can be renegotiated on terms satisfactory to us. We consider our relations with employees to be good.

Availability of information and other matters

Our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of

7

Table of Contents

1934, as amended, are available free of charge from our website at http://www.cott.com, when such reports are available on the Securities and Exchange Commission’s website, http://www.sec.gov. The information found on our website is not part of this or any other report that we file with, or furnish to, the Securities and Exchange Commission or to Canadian securities regulators.

Our chief executive officer is required by the rules of the New York Stock Exchange (the “NYSE”) to certify annually to the NYSE that he is not aware of any violation by us of our corporate governance listing standards. Our chief executive officer made such certification to the NYSE as of May 28, 2007.

We are responsible for establishing and maintaining adequate internal control over financial reporting as required by the U.S. Securities and Exchange Commission. See Management’s Report on Internal Control over Financial Reporting on page F-2.

| ITEM 1A. | RISK FACTORS |

We face a number of risks and uncertainties, including the following:

We may be unable to compete successfully in the highly competitive beverage category.

The markets for our products are extremely competitive. In comparison to the major national brand beverage manufacturers, we are a relatively small participant in the industry. We face competition from the national brand beverage manufacturers in all of our markets and from other retailer brand beverage manufacturers in the U.S. and the U.K. If our competitors reduce their selling prices or increase the frequency of their promotional activities in our core markets or if our customers do not allocate adequate shelf space for the beverages we supply, we could experience a decline in our volumes or be forced to reduce pricing or increase capital and other expenditures, any of which could adversely affect our profitability.

There is a current trend in the North American beverage market of a significant consumer shift away from carbonated soft drinks. To address these trends and the increasing price competition in the beverage market resulting from them, we have instituted a significant cost reduction program to position our company as the low cost provider of retailer brand soft drinks. We have also developed several new initiatives, such as the U.S. water bottling project, new product initiatives and increasing our hot-fill aseptic capacity. If we are unable to achieve the objectives of these programs, our business may be negatively impacted.

Because a small number of customers account for a significant percentage of our sales, the loss of or reduction in sales to any significant customer could have a material adverse effect on our results of operations and financial condition.

A significant portion of our revenue is concentrated in a small number of customers. Our customers include many large national and regional grocery, mass-merchandise, drugstore, wholesale and convenience store chains in our core markets of North America and International. Sales to Wal-Mart, our top customer in 2007 and 2006, accounted for 39% and 38%, respectively of our total revenue, and sales to the top ten customers in 2007 and 2006 were 64% and 60%, respectively in each year. We expect that sales of our products to a limited number of customers will continue to account for a high percentage of our revenue in the foreseeable future. The loss of any significant customer, or customers which in the aggregate represent a significant portion of our revenue, or a material reduction in the amount of business we undertake with such customer or any other customer, could have a material adverse effect on our operating results and cash flows. Furthermore, we could be adversely affected if a significant customer reacted unfavorably to any pricing of our products or decided to de-emphasize or reduce their product offerings in the categories that we supply them with. At December 29, 2007, we had $105.1 million of customer relationships recorded as an intangible asset. The permanent loss of any customer included in the intangible asset would result in impairment in the value of the intangible asset.

8

Table of Contents

If we cannot reach agreement with our largest customer regarding the merchandising of our products, our sales may be materially adversely affected.

As previously disclosed, we are currently discussing with Wal-Mart future plans for merchandising of carbonated soft drinks manufactured by us. If the result of these discussions is a reduction in shelf space without adjustments to product placement and mix, product merchandising, and additional promotions it is likely that we would experience a significant decrease in sales volume. Even if such adjustments are put in place, there can be no assurance that a positive effect on sales would materialize. A significant decline in sales volume of carbonated soft drinks sold at Wal-Mart could have a material adverse impact on our sales and gross profit.

If we breach the covenants and conditions set out in our senior secured credit facilities or securitization facility, the lenders could terminate the facilities or we would have to renegotiate these agreements and may incur higher fees and interest costs.

Our senior secured credit facilities allow for revolving credit borrowings of up to $225.0 million provided we are in compliance with the covenants and conditions of the agreement. Our securitization facility allows for borrowings of up to $75.0 million, depending on eligible receivables balances and calculations of reserves. These facilities contain cross default provisions. If we are in default under one facility, default may be triggered under the other facility. As of December 29, 2007, total borrowings under these facilities were $135.3 million. If we breach the covenants and such non-compliance is not waived by the lenders, or an event occurs that would have a material adverse effect on us, we would be required to renegotiate the agreements and would expect to incur higher fees and interest rates, provided the lenders wish to renegotiate. The lenders could choose to terminate the facilities, in which case we believe we could replace them. We could however incur higher fees and interest expense which would negatively impact our financial condition and results of operations. Effective December 20, 2007, we entered into a letter amendment to our senior secured credit facilities. The amendment adjusted the maximum total leverage ratio that is required to be maintained under the credit facilities for the fiscal quarter ending December 29, 2007 from 3.00 to 1.00 to 4.00 to 1.00, and excluded specific asset additions from the calculation of the fixed charge covenant. A conforming change was made to align the covenants in our securitization facility. Our financial covenants are calculated and determined at the end of each quarter. After giving effect to the amendment, we are in compliance with our covenants as of December 29, 2007.

We are currently in the process of negotiating a new asset based credit lending facility (“ABL”) that will be secured by substantially all of our assets, including accounts receivable, inventory and property plant and equipment. The proposed new ABL facility would likely be a five year revolving senior secured credit facility of up to $250 million and we are endeavoring to close the facility by the end of the fiscal quarter ending March 29, 2008.

We were in compliance with all our amended covenants of our existing senior secured credit facility as of December 29, 2007. We expect that we may not maintain compliance with the total leverage ratio and the fixed charge ratio financial covenant set forth in our senior secured credit facilities at the end of the first quarter of 2008. Absent refinancing this facility through the use of an ABL facility or some other facility, we would endeavor to reach agreement with our lenders on new covenants. There can be no assurance that we will be able to. If we are not able to obtain the ABL financing and our current lenders do not agree to amend our covenants on terms acceptable to us, we would seek to obtain new facilities and we may incur additional fees and higher interest costs. A covenant default in our senior secured credit facilities would permit our senior secured lenders to demand or accelerate payment. A demand or acceleration of payment of our senior secured credit facilities would

9

Table of Contents

result in a default of our 8% senior subordinated notes due in 2011 and in such event, the trustee or the holders of at least 25% of principal amount of the then outstanding notes, may declare the notes due and payable. If the notes are declared due and payable, they would be classified as a current liability.

The events of default in the 8% senior subordinated notes due in 2011 related to other indebtedness arise only if there is a failure to pay principal, interest or premiums of such other indebtedness after the expiration of any applicable grace period, or there has been an acceleration in payment of such other indebtedness, in each case, in excess of a threshold amount. As at December 29, 2007, these conditions of default did not exist with respect to any other indebtedness. If we are in default and our lenders do not agree to amend the covenant on terms that are acceptable to us, our lenders could terminate our facilities and we would endeavor to replace them. Should our credit facilities and 2011 notes become currently due, we may have to incur additional fees and higher interest costs to replace them.

The 8% senior subordinated notes include covenants that limit new borrowings with certain exceptions, including borrowings based on receivables and inventory, unless certain conditions are met.

Our ingredients and packaging supplies are subject to price increases and we may be unable to effectively pass rising costs on to our customers.

We bear the risk of increasing prices on the ingredients and packaging in our products. The majority of our ingredient and packaging supply contracts allow our suppliers to alter the prices they charge us based on changes in the costs of the underlying commodities that are used to produce them. Aluminum for cans and ends, resin for PET bottles, preforms and caps and high fructose corn syrup for sweeteners are examples of these underlying commodities. In addition, the contracts for certain of our ingredients and packaging materials permit our suppliers to increase the costs they charge us based on increases in their cost of converting those underlying commodities into the materials that we purchase. In certain cases those increases are subject to negotiated limits and, in other cases, they are not. These changes in the prices that we pay for ingredients and packaging materials occur at times that vary by product and supplier, but are principally on a semi-annual and annual basis.

In 2006, most aluminum buyers, including ourselves, were protected by price caps keeping the price paid below world prices. However, the cap on aluminum pricing in our contract expired in December 2006, and in 2007 the price paid for aluminum increased significantly to reflect increased worldwide demand. We are at risk with respect to rising aluminum prices. Simultaneously, because PET resin is not a traded commodity, no fixed price mechanism has been implemented, and we are accordingly also at risk with respect to rising PET prices. HFCS has a history of volatile price changes. We typically purchase HFCS requirements for North America under 12 month contracts and have locked in the majority of our requirements into the third quarter of 2008.

Accordingly, we bear the risk of fluctuations in the costs of these ingredients and packaging materials, including the underlying costs of the commodities that comprise them and, to some extent, the costs of converting those commodities into finished products. We do not use derivatives to manage this risk. If the cost of these ingredients or packaging materials increases, we may be unable to pass these costs along to our customers through adjustments to the prices we charge. If we cannot pass on these increases to our customers on a timely basis, they could have a material adverse effect on our results of operations. If we are able to pass these costs on to our customers through price increases, the impact those increased prices could have on our volumes is uncertain.

If we are unable to maintain relationships with our raw material suppliers, we may incur higher supply costs or be unable to deliver products to our customers.

In addition to water, the principal raw materials required to produce our products are PET bottles, caps and preforms, aluminum cans and ends, labels, cartons and trays, concentrates and sweeteners.

10

Table of Contents

We typically enter into annual supply arrangements rather than long-term contracts with our suppliers, which means that our suppliers are obligated to continue to supply us with materials for one-year periods, at the end of which we must either renegotiate the contracts with our incumbent suppliers or find alternative sources for supply. With respect to some of our key packaging supplies, such as aluminum cans and ends, and some of our key ingredients, such as artificial sweeteners, we have entered into long-term supply agreements, the terms of which range from 1 to 5 years, and therefore we are assured of a supply of those key packaging supplies and ingredients for a longer period of time. CCS supplies aluminum cans and ends under a contract expiring on December 31, 2011. The contract provides that CCS will supply our entire aluminum can and end requirements worldwide, subject to certain exceptions. This contract included a cap on aluminum prices, which expired in December 2006. In 2007, the price paid for aluminum increased significantly to reflect world pricing. As with our annual supply contracts, we must either renegotiate these long-term supply agreements with the incumbent suppliers when they expire or find alternative sources for supply.

We rely upon our ongoing relationships with our key suppliers to support our operations. We believe that we will be able to either renegotiate contracts with these suppliers when they expire or, alternatively, if we are unable to renegotiate contracts with our key suppliers, we believe that we could replace them. We could, however, incur higher ingredient and packaging supply costs in renegotiating contracts with existing suppliers or replacing those suppliers, or we could experience temporary dislocations in our ability to deliver products to our customers, either of which could have a material adverse effect on our results of operations.

In addition, the supply of specific ingredients and packaging materials could be adversely affected by economic factors such as industry consolidation, energy shortages, governmental controls, labor disputes, natural disasters, acts of war or terrorism and other factors.

We identified material weaknesses in our internal controls over financial reporting. Failure to remediate the material weaknesses could negatively impact our business.

We concluded that material weaknesses existed in our internal controls over financial reporting as of December 30, 2006 and December 29, 2007. In response to the identified material weaknesses, and with oversight from our Audit Committee, we are focused on improving our internal controls over financial reporting and remedying the identified material weaknesses. We intend to expand and strengthen our accounting and control staff, implement policy and process changes to the financial close and tax processes and reduce segregation of duties deficiencies over access to financial information systems, but we cannot assure you that we will be able to do so on a timely basis or at all.

If we fail to remediate these material weaknesses, or if our internal controls over financial reporting required under Section 404 of the Sarbanes-Oxley Act are inadequate in the future, it could negatively impact our business and the price of our common stock.

If we fail to manage our expanding operations successfully, our business and financial results may be materially and adversely affected.

Our success depends, in part, on our ability to manage our expanding operations, including new acquisitions. In recent years, we have grown our business and beverage offerings primarily through the acquisition of other companies, new product lines and growth with key customers. A part of our strategy is to expand our business in new channels and markets and with new beverage offerings, including through acquisitions and alliances. To succeed with this strategy, we must identify appropriate acquisition or strategic alliance candidates. The success of this strategy also depends on our ability to manage and integrate acquisitions and alliances at a pace consistent with the growth of our business. If attractive acquisition opportunities are not available, we may not continue to acquire businesses and product lines. Furthermore, the businesses or product lines that we acquire or align with may not be integrated successfully into our business or prove profitable. A key element of our strategy is the expansion of our business outside North America. In addition to the foregoing

11

Table of Contents

factors, our ability to expand our business in foreign countries is also dependent on, and may be limited by, our ability to comply with the laws of the various jurisdictions in which we may operate, as well as changes in local government regulations and policies in such jurisdictions.

We could be liable for injury, illness or death caused by consumption of our products.

We may be liable to our customers and/or consumers if the consumption of any of our products causes injury, illness or death. We also may be required to recall some of our products if they become contaminated or are damaged or mislabeled. A significant unfavorable product liability judgment or a widespread product recall could have a material adverse effect on our results of operations or cash flows.

Our success depends, in part, on our intellectual property, which we may be unable to protect.

We possess certain intellectual property that is important to our business. This intellectual property includes trade secrets, in the form of the concentrate formulas for most of the beverages that we produce, and trademarks for the names of the beverages that we sell. While we own certain of the trademarks used to identify our beverages, other trademarks are used through license from third parties or by permission from our retailer brand customers. Our success depends, in part, on our ability to protect our intellectual property.

To protect this intellectual property, we rely principally on registration of trademarks, contractual responsibilities and restrictions in agreements (such as indemnification, nondisclosure and confidentiality agreements) with employees, consultants and customers, and on common law and statutory protections afforded to trademarks, trade secrets and proprietary “know-how.” In addition, we vigorously protect our intellectual property against infringements using any and all legal remedies available. Notwithstanding our efforts, we may not be successful in protecting our intellectual property for a number of reasons, including:

| • | our competitors may independently develop intellectual property that is similar to or better than ours; |

| • | employees, consultants or customers may not abide by their contractual agreements and the cost of enforcing those agreements may be prohibitive, or those agreements may prove to be unenforceable or more limited than anticipated; |

| • | foreign intellectual property laws may not adequately protect our intellectual property rights; and |

| • | our intellectual property rights may be successfully challenged, invalidated or circumvented. |

If we are unable to protect our intellectual property, it would weaken our competitive position and we could face significant expense to protect or enforce our intellectual property rights. At December 29, 2007, we had $80.4 million of rights and $16.3 million of trademarks recorded as intangible assets.

Others may allege that we infringe on their intellectual property rights, which could result in the diversion of attention and resources from our business operations.

Occasionally, third parties may assert that we are, or may be, infringing on or misappropriating their intellectual property rights. In these cases, we intend to defend against claims or negotiate licenses when we consider these actions appropriate. Intellectual property cases are uncertain and involve complex legal and factual questions. If we become involved in this type of litigation, it could consume significant resources and divert our attention from business operations.

If we are found to infringe on the intellectual property rights of others, we could incur significant damages, be enjoined from continuing to manufacture, market or use the affected product, or be required to obtain a license to continue manufacturing or using the affected product. A license could be very expensive to obtain or may not be available at all. Similarly, changing products or processes to avoid infringing the rights of others may be costly or impracticable.

12

Table of Contents

Our geographic diversity subjects us to the risk of currency fluctuations.

We are exposed to changes in foreign currency exchange rates, including those between the U.S. dollar and the pound sterling, the euro, the Canadian dollar, the Mexican peso and other currencies. Our operations outside of the U.S. accounted for approximately 40% of our 2007 sales. Accordingly, currency fluctuations in respect of our outstanding non-U.S. dollar denominated net asset balances may affect our reported results and competitive position.

A portion of our indebtedness is variable rate debt, and changes in interest rates could adversely affect us by causing us to incur higher interest costs with respect to such variable rate debt.

Our credit and securitization facilities subject us to interest rate risk. We have a secured revolving credit facility, under which we borrow from time to time for various purposes, including to fund our day-to-day operations and to finance acquisitions. The maximum amount that we may borrow under these facilities is $225.0 million. We obtain funding under the securitization facility for our day-to-day operations. The maximum amount that we may borrow under this facility is $75.0 million, subject to limitations based on eligible receivables and various reserves required in the facility.

The interest rate applicable to our revolving credit facility is variable, meaning that the rate at which we pay interest on amounts borrowed under the facility fluctuates with changes in interest rates and our leverage. The interest rate applicable to our securitization facility is also variable, based on the cost of borrowing of Park Avenue Receivables Company, LLC and certain other financial institutions, as required.

Accordingly, with respect to any amounts from time to time outstanding under these facilities, we are exposed to changes in interest rates. We do not currently use derivative instruments to hedge interest rate exposure. If we are unable to refinance our indebtedness on terms that are favorable to us or otherwise adequately manage our debt structure in response to changes in the market, our interest expense could increase, which would negatively impact our financial condition and results of operations.

Changes in the legal and regulatory environment in the jurisdictions in which we operate could increase our costs or reduce our revenues.

As a producer of beverages, we must comply with various federal, state, provincial, local and foreign laws relating to production, packaging, quality, labeling and distribution, including, in the U.S., those of the federal Food, Drug and Cosmetic Act, the Fair Packaging and Labeling Act, the Federal Trade Commission Act, the Nutrition Labeling and Education Act and California Proposition 65. We are also subject to various federal, state, provincial, local and foreign environmental laws and workplace regulations. These laws and regulations include, in the U.S., the Occupational Safety and Health Act, the Unfair Labor Standards Act, the Clean Air Act, the Clean Water Act, the Comprehensive Environmental Response, Compensation, and Liability Act, the Resource Conservation and Recovery Act, the Federal Motor Carrier Safety Act, laws governing equal employment opportunity, customs and foreign trade laws and regulations, laws relating to the maintenance of fuel storage tanks, laws relating to water consumption and treatment, and various other federal statutes and regulations. These laws and regulations may change as a result of political, economic, or social events. Such regulatory changes may include changes in food and drug laws, laws related to advertising, accounting standards, taxation requirements, competition laws and environmental laws, including laws relating to the regulation of water rights and treatment. Changes in laws, regulations or government policy and related interpretations may alter the environment in which we do business, which may impact our results or increase our costs or liabilities.

We are not in compliance with the requirements of the Ontario Environmental Protection Act (“EPA”) and, if the Ontario government seeks to enforce those requirements or implements modifications to them, we could be adversely affected.

Certain regulations under the EPA provide that a minimum percentage of a bottler’s soft drink sales within specified areas in Ontario must be made in refillable containers. The penalty for non-compliance is a fine of

13

Table of Contents

$50,000 per day beginning when the first offense occurs and continuing until the first conviction, and then increasing to $100,000 per day for each subsequent conviction. These fines may be increased to equal the amount of monetary benefit acquired by the offender as a result of the commission of the offense. We, and we believe other industry participants, are currently not in compliance with the requirements of the EPA. Ontario is not enforcing the EPA at this time, but if it chose to enforce the EPA in the future, we could incur fines for non-compliance and the possible prohibition of sales of soft drinks in non-refillable containers in Ontario.

We estimate that approximately 4% of our sales would be affected by the possible limitation on sales of soft drinks in non-refillable containers in Ontario if the Ontario Ministry of the Environment initiated an action to enforce the provisions of the EPA against us.

In April 2003, the Ontario Ministry of the Environment proposed to revoke these regulations in favor of new mechanisms under the Ontario Waste Diversion Act to enhance diversion from disposal of carbonated soft drink containers. On December 22, 2003, the Ontario provincial government approved the implementation of the Blue Box Program plan under the Ministry of Environment Waste Diversion Act. The Program requires those parties who are brand owners or licensees of rights to brands which are manufactured, packaged or distributed for sale in Ontario to contribute to the net cost of the Blue Box Program. We generally manufacture, package and distribute products for and on behalf of third party customers. Therefore, we do not believe that we will be responsible for direct costs of the Program. However, our customers may attempt to pass these costs, or a portion of them, on to us. We do not believe that the costs for which we may ultimately be responsible under this Program will have a material adverse effect on our results of operations; however, we cannot guarantee this outcome. The Blue Box Program does not revoke any of the regulations mentioned above under the EPA regarding refillable containers, although the industry anticipates that they will be reversed in the future.

Adverse weather conditions could reduce the demand for our products.

The sales of our products are influenced to some extent by weather conditions in the markets in which we operate. Unusually cold or rainy weather during the summer months may reduce the demand for our products and contribute to lower revenues, which could negatively impact our profitability.

Increase in the cost of energy could affect our profitability.

Our beverage and concentrate manufacturing facilities use a significant amount of electricity, natural gas and other energy sources to operate. An increase in the price of fuel and other energy sources would increase our operating costs, which could negatively impact our profitability.

Global or regional catastrophic events could impact our operations and financial results.

Our business can be affected by large-scale terrorist acts, especially those directed against the United States or other major industrialized countries, major natural disasters, or widespread outbreaks of infectious diseases such as avian influenza or severe acute respiratory. Such events could impair our ability to manage our business around the world, could disrupt our supply of raw materials, and could impact production, transportation and delivery of products. In addition, such events could cause disruption of regional or global economic activity, which can affect consumers’ purchasing power in the affected areas and, therefore, reduce demand for our products.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

As of the end of 2007, we operated 15 beverage production facilities in North America, 11 of which we owned and four of which we leased. We also operate a global concentrate manufacturing facility in Columbus, Georgia, which we own. Internationally, we operate 6 beverage production facilities, five of which we own and one of which we lease.

14

Table of Contents

Total square footage of our beverage production facilities is approximately 2,294,776 square feet in the U.S. 877,050 square feet in Canada; 871,218 in the U.K.; and 240,446 square feet in Mexico. This square footage does not include separate offsite warehouses. Lease terms for non-owned beverage production facilities expire between 2008 and 2019.

The beverage production facilities and square footage amounts noted above do not include the owned facilities that are listed as held for sale, which includes Elizabethtown, Kentucky and Revelstoke, British Columbia, or leased facilities in Columbus, Ohio and Wyomissing, Pennsylvania. All of these properties were closed as of December 29, 2007, except for the Revelstoke, British Columbia facility, which we expect to dispose of by the end of March 2008.

| ITEM 3. | LEGAL PROCEEDINGS |

In January 2005, we were named as one of many defendants in The Consumers’ Association of Canada and Bruce Cran v. Coca-Cola Bottling Ltd. et al., a class action suit alleging the unauthorized use by the defendants of container deposits and the imposition of recycling fees on consumers. On June 2, 2006, the British Columbia Supreme Court granted the summary trial application, which resulted in the dismissal of the plaintiffs’ action against us and the other defendants. On June 26, 2006, the plaintiffs appealed the dismissal of the action to the British Columbia Court of Appeals which was denied, and an appeal to the Supreme Court of Canada was rejected on December 20, 2007. In February 2005, similar class action claims were filed in a number of other Canadian provinces. Claims filed in Quebec have since been discontinued, but is unclear how the dismissal of the British Columbia case will impact the other cases.

We are subject to various claims and legal proceedings with respect to matters such as governmental regulations, income taxes, and other actions arising out of the normal course of business. Management believes that the resolution of these matters will not have a material adverse effect on our financial position or results from operations.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of shareowners during the fourth quarter of 2007.

15

Table of Contents

SUPPLEMENTAL ITEM PART I. EXECUTIVE OFFICERS OF COTT CORPORATION

The following is a list of names and ages of all of our executive officers as of March 1, 2008, and the positions and offices that each of them holds. Our officers do not serve for a set term.

Office | Age | Period served as officer | ||||

Brent D. Willis | Chief Executive Officer | 48 | 2006 to present | |||

Juan Figuereo | Chief Financial Officer | 52 | 2007 to present | |||

Richard Dobry | President, North America | 51 | 2006 to present | |||

Abilio Gonzalez | Chief People Officer | 47 | 2006 to present | |||

Matthew A. Kane, Jr. | Vice President, General Counsel and Secretary | 49 | 2007 to present | |||

Gregory Leiter | Senior Vice President, Controller and Assistant Secretary | 50 | 2007 to present | |||

William Reis | Senior Vice President, Chief Procurement Officer | 52 | 2007 to present |

| • | Brent D. Willis was appointed Chief Executive Officer on May 15, 2006. Prior to joining Cott, he was Zone President for the Asia Pacific region of InBev, the world’s largest brewer by volume from August 2004 to May 2006. From September 2003 to August 2004, he served as Chief Commercial Officer of InBev and, prior to September 2003, he was Chief Marketing and Sales Officer of InBev. Prior to InBev, he was President of the North Latin American division at the Coca-Cola Company and held various general management roles at Kraft Foods and the U.S. Army. |

| • | Juan Figuereo was appointed Chief Financial Officer on March 26, 2007. Prior to joining Cott, he served as Vice President, Mergers and Acquisitions for Wal-Mart International from July 2003 to March 2007. Prior to July 2003, he spent 15 years with PepsiCo in a variety of international finance and general management roles, first within the Pepsi-Cola organization and then in the Frito Lay business. He held Chief Financial Officer roles for Frito-Lay in Southern Europe, and for Pepsi-Cola Latin America, as well as a stint as seconded CFO of the largest Pepsi bottler in Brazil. |

| • | Richard Dobry was appointed President, North America on June 29, 2007. He was previously Cott’s Chief Manufacturing and Supply Chain Officer, a position he held since October 2006. Prior to joining Cott, he was President, Americas Supply for Diageo, plc, a premium alcoholic beverage business, from April 2004 to October 2006. Prior to April 2004, he was Senior Vice President, Supply Chain at Tropicana Products, Inc. the juice beverages subsidiary of PepsiCo. |

| • | Abilio Gonzalez was appointed Chief People Office on July 27, 2006. Prior to joining Cott, he was General Manager, Global Talent Acquisition and Engagement and Microsoft Business Division at Microsoft Corporation. Prior to that, he served from September 2003 to November 2004 as General Manager, HR Microsoft Productivity and Business Solutions for Microsoft. Prior to September 2003, he was Corporate Vice President, Human Resources of Panamco LLC, a Latin American beverage manufacturer. |

| • | Matthew A. Kane was appointed as Vice President, General Counsel and Secretary of Cott Corporation on September 17, 2007. Prior to joining Cott, he served as Vice President of Law of Cott Beverages, Inc., a wholly-owned U.S. subsidiary of the Company, from April, 2004 until his appointment. From January 2003 to April 2004, he was Chief Counsel, Sales of PepsiCo Beverages and Foods. From 1993 to 2003, he served as Associate General Counsel of Tropicana Products Inc. |

| • | Gregory Leiter was appointed Vice President, Corporate Controller and Assistant Secretary on December 5, 2007 and appointed to Senior Vice President, Controller and Assistant Secretary on February 7, 2008. Prior to joining Cott, he served from October 2006 to October 2007 as Practice Manager—Governance, Risk & Compliance with the international software firm SAP America. From January 2003 to September 2006, he held two positions with Graham Packaging Company, an |

16

Table of Contents

international manufacturer of custom blow-molded plastic containers. From February 2006 to September 2006, he served as Vice President—Global Business Process and from January 2003 to February 2006, he served as Director of Internal Audit. |

| • | William Reis was appointed Senior Vice President, Chief Procurement Officer on March 26, 2007. Prior to joining Cott, he served from February 2004 to February 2007 as Senior Vice President and Chief Procurement Officer for Revlon. From February 2001 to February 2004, he served as Vice President of Global Procurement for Goldman Sachs. |

17

Table of Contents

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY AND RELATED SHAREOWNER MATTERS |

Our common shares are listed on the Toronto Stock Exchange (the “TSX”) under the ticker symbol “BCB,” and on the New York Stock Exchange (the “NYSE”) under the ticker symbol “COT.”

The tables below show the high and low reported per share sales prices of common shares on the TSX (in Canadian dollars) and the NYSE (in U.S. dollars) for the indicated periods of the years ended December 29, 2007 and December 30, 2006.

Toronto Stock Exchange (C$)

| 2007 | 2006 | |||||||

| High | Low | High | Low | |||||

January 1—March 31 | 17.80 | 15.23 | 16.95 | 13.02 | ||||

April 1—June 30 | 19.70 | 14.57 | 17.40 | 14.37 | ||||

July 1—September 30 | 16.63 | 7.98 | 20.15 | 13.76 | ||||

October 1—December 31 | 8.19 | 5.14 | 19.75 | 15.10 | ||||

New York Stock Exchange (U.S.$)

| 2007 | 2006 | |||||||

| High | Low | High | Low | |||||

January 1—March 31 | 15.22 | 13.17 | 14.62 | 11.31 | ||||

April 1—June 30 | 17.33 | 12.64 | 15.73 | 12.68 | ||||

July 1—September 30 | 16.12 | 7.39 | 18.03 | 12.16 | ||||

October 1—December 31 | 8.36 | 5.40 | 17.32 | 13.21 | ||||

As of February 29, 2008, we had 693 shareowners of record. This number was determined from records maintained by our transfer agent and it does not include beneficial owners of securities whose securities are held in the names of various dealers or clearing agencies. The closing sale price of our common shares on February 19, 2008 was C$5.46 on the TSX and $5.38 on the NYSE.

We have not paid cash dividends since June 1998. There are certain restrictions on the payment of dividends under our senior secured credit facility and the indenture governing the 8% senior subordinated notes maturing in 2011. The most restrictive is the quarterly limitation on dividends based on the prior quarter’s earnings. The senior secured credit facility and the indenture governing the 8% senior subordinated notes due 2011 are discussed in Management’s Discussion and Analysis on page 22.

If we were to pay dividends to shareowners that are U.S. residents, those dividends would generally be subject to Canadian withholding tax. Under current Canadian tax law, dividends paid by a Canadian corporation to a nonresident shareowner are generally subject to Canadian withholding tax at a 25% rate. Under the current tax treaty between Canada and the U.S., U.S. residents are eligible for a reduction in this withholding tax rate to 15% (and to 5% for a company shareowner who is the beneficial owner of at least 10% of our voting stock). Accordingly, under current tax law, our U.S. resident shareowners would generally be subject to a Canadian withholding tax at a 15% rate on dividends paid by us, provided that they had complied with applicable procedural requirements to claim the benefit of the reduced rate under the tax treaty. Current amendments to the treaty have been proposed, which if enacted, would place additional restrictions on the ability of U.S. residents to claim these reduced rate benefits. U.S. resident shareowners should consult their tax advisors to determine if they satisfy the applicable requirements.

18

Table of Contents

Calculation of aggregate market value of non-affiliate shares

For purposes of calculating the aggregate market value of common shares held by non-affiliates as shown on the cover page of this report, it was assumed that all of the outstanding shares were held by non-affiliates except for outstanding shares held or controlled by our directors and executive officers. This should not be deemed to constitute an admission that any of these persons are, in fact, affiliates of us, or that there are not other persons who may be deemed to be affiliates. For further information concerning shareholdings of officers, directors and principal stockholders see Item 12, “Security Ownership of Certain Beneficial Owners and Management and Related Shareowner Matters” on page 47.

Shareowner return performance graph

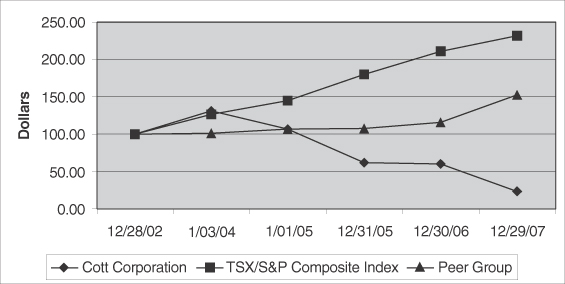

The following graph shows changes over our past five fiscal years in the value of C$100, assuming reinvestment of dividends, invested in: (i) our common shares; (ii) the Toronto Stock Exchange’s S&P/TSX Composite Index; and (iii) a peer group of publicly traded companies in the bottling industry comprised of Coca-Cola Enterprises Inc., Coca-Cola Bottling Co. Consolidated, National Beverage Corp., Pepsi Bottling Group Inc. and PepsiAmericas Inc. The closing price of Cott’s common shares as of December 29, 2007 on the Toronto Stock Exchange was C$6.58 and on the New York Stock Exchange was $6.72. The following tables are in Canadian dollars.

Date | December 28, 2002 | January 3, 2004 | January 1, 2005 | December 31, 2005 | December 30, 2006 | December 29, 2007 | ||||||

Cott Common Shares | 100.00 | 131.33 | 106.99 | 62.11 | 60.17 | 23.72 | ||||||

TSX/S&P Composite Index | 100.00 | 126.72 | 145.07 | 180.08 | 211.16 | 231.92 | ||||||

Peer Group | 100.00 | 101.25 | 107.10 | 107.85 | 115.90 | 152.60 |

19

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

The following selected financial data reflects the results of operations. This information should be read in conjunction with, and is qualified by reference to “Management’s discussion and analysis of financial condition and results of operations” and the consolidated financial statements and notes thereto included elsewhere in this report. The financial information presented may not be indicative of future performance.

(In millions of U.S. dollars, except per share amounts) | December 29, 20071 | December 30, 20062 | December 31, 20053 | January 1, 20054 | January 3, 20045 | |||||||||||||||

| (52 weeks) | (52 weeks) | (52 weeks) | (52 weeks) | (53 weeks) | ||||||||||||||||

Revenue | $ | 1,776.4 | $ | 1,771.8 | $ | 1,755.3 | $ | 1,646.3 | $ | 1,417.8 | ||||||||||

Cost of sales | 1,578.0 | 1,554.9 | 1,505.8 | 1,362.6 | 1,141.0 | |||||||||||||||

Gross Profit | 198.4 | 216.9 | 249.5 | 283.7 | 276.8 | |||||||||||||||

Selling, general and administrative expenses | 161.9 | 176.1 | 138.6 | 138.1 | 126.1 | |||||||||||||||

Loss (gain) on disposal of property, plant and equipment | 0.2 | — | 1.5 | (0.3 | ) | (0.1 | ) | |||||||||||||

Restructuring, asset and goodwill impairments and other charges | ||||||||||||||||||||

Restructuring | 24.3 | 20.5 | 3.2 | — | — | |||||||||||||||

Asset impairments | 10.7 | 15.4 | 27.6 | 0.9 | 1.8 | |||||||||||||||

Goodwill impairments | 55.8 | — | 5.9 | — | — | |||||||||||||||

Other | — | 2.6 | 0.8 | — | — | |||||||||||||||

Operating (loss) income | (54.5 | ) | 2.3 | 71.9 | 145.0 | 149.0 | ||||||||||||||

Other (income) expense, net | (4.7 | ) | 0.1 | (0.7 | ) | 0.2 | 0.6 | |||||||||||||

Interest expense, net | 32.8 | 32.2 | 28.8 | 26.0 | 27.5 | |||||||||||||||

Minority interest | 2.7 | 3.8 | 4.5 | 4.0 | 3.2 | |||||||||||||||

(Loss) income before income taxes | (85.3 | ) | (33.8 | ) | 39.3 | 114.8 | 117.7 | |||||||||||||

Income tax (benefit) expense | (13.9 | ) | (16.3 | ) | 14.7 | 35.8 | 40.1 | |||||||||||||

Equity loss | — | — | — | 0.7 | 0.2 | |||||||||||||||

Net (loss) income | $ | (71.4 | ) | $ | (17.5 | ) | $ | 24.6 | $ | 78.3 | $ | 77.4 | ||||||||

(Loss) Income per common share—basic | ||||||||||||||||||||

Basic | $ | (0.99 | ) | $ | (0.24 | ) | $ | 0.34 | $ | 1.10 | $ | 1.12 | ||||||||

Diluted | (0.99 | ) | (0.24 | ) | 0.34 | 1.09 | 1.09 | |||||||||||||

Total assets | $ | 1,148.9 | $ | 1,140.7 | $ | 1,179.1 | $ | 1,030.3 | $ | 908.8 | ||||||||||

Short-term borrowings | 137.0 | 107.7 | 157.9 | 71.4 | 78.1 | |||||||||||||||

Current maturities of long-term debt | 2.4 | 2.0 | 0.8 | 0.8 | 3.3 | |||||||||||||||

Long-term debt | 269.0 | 275.2 | 272.3 | 272.5 | 275.7 | |||||||||||||||

Shareowners’ equity | 432.2 | 488.7 | 481.9 | 457.3 | 345.1 | |||||||||||||||

Cash dividends paid | — | — | — | — | — | |||||||||||||||

Under the 1986 Common Share Option Plan, as amended, we have reserved 14 million shares for issuance.

1 | During the year we acquired 100% of the business assets of El Riego, a Mexican water bottler, for $2.2 million. We also recorded asset and goodwill impairment charges and restructuring charges of $90.8 million, which includes a $55.8 million write-down for goodwill impairments. Effective January 1, 2007, we adopted Financial Accounting Standards Board (“FASB”) Interpretation No. 48, “Accounting for Uncertainty for Income Taxes” and recorded a $8.8 million charge to our shareowners equity as of December 29, 2007. |

2 | There were no acquisitions in the year ended December 30, 2006 and we recorded asset impairment charges of $15.4 million. During the year we adopted Statement of Financial Accounting Standards (“SFAS”) No. 123R, “Share-Based Payments”, using the modified prospective approach and therefore have not restated results for prior periods. This change resulted in the recognition of $11.4 million in share-based compensation expense, $8.4 million net of tax or $0.12 per basic and diluted share. |

20

Table of Contents

3 | During the year we acquired 100% of the shares of Macaw (Holdings) Limited, the parent company of Macaw (Soft Drinks) Limited. We also recorded asset impairment charges of $27.6 million and goodwill impairment charges of $5.9 million. |

4 | During the year we acquired certain of the assets of The Cardinal Companies of Elizabethtown, LLC and certain of the assets of Metro Beverage Co. |

5 | During the year we acquired the retailer brand business of Quality Beverage Brands, L.L.C. |

21

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

We are one of the world’s largest non-alcoholic beverage companies and the world’s largest retailer brand soft drink company.

Our objective of creating sustainable long-term growth in revenue and profitability is predicated on success across three key strategic priorities: 1) being the lowest cost producer; 2) becoming the retailers’ best partner; and 3) building and sustaining a product innovation pipeline.

Energy drinks and non-carbonated beverages, including bottled water, nutrient enhanced waters, sports drinks and ready-to-drink teas, continue to show strong growth.