Exhibit 99.1

SUMMARY

This summary highlights selected information appearing elsewhere in this offering memorandum. As a result, it is not complete and does not contain all of the information that you should consider before purchasing the notes. You should read the following summary in conjunction with the more detailed information contained in this offering memorandum and the documents incorporated by reference. As used in this offering memorandum, unless the context otherwise requires or as is otherwise indicated, the words “we,” “us,” “our,” “Cott,” “the Company” and words of similar import refer to Cott Corporation, Cott Beverages Inc. and their subsidiaries on a consolidated basis.

Our Company

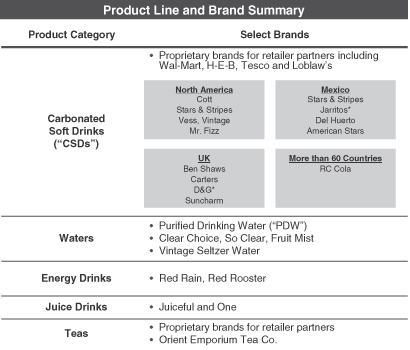

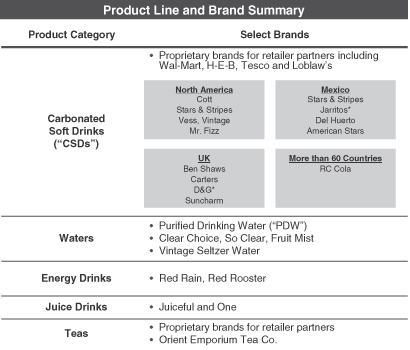

Cott is one of the world’s largest non-alcoholic beverage companies and the world’s largest retailer brand soft drink provider. We have a diversified product line, which, in addition to carbonated soft drinks (“CSDs”), includes clear, still and sparkling flavored waters, juice-based products, bottled water, energy drinks and ready-to-drink teas. In 2008, CSDs, concentrate, bottled water and all other products represented 59.0%, 2.1%, 6.7% and 32.2%, as a percentage of revenue respectively. For the twelve month period ended September 26, 2009, we generated revenue of $1.58 billion and Adjusted EBITDA of $152.4 million. A reconciliation of Adjusted EBITDA to net income is provided on page 14.

Retailer brand products have become an attractive alternative to branded products for consumers as a result of manufacturers improving product quality while maintaining a strong value proposition. In the U.S., we have experienced stronger volume growth than the overall beverage category year-to-date as consumers are increasingly looking for value during difficult economic conditions. Market trends have historically shown that demand for private label goods continues after recovery from economic downturns. Therefore, we believe that some of the private label market share gains may be long-lasting, and as a result of our leadership in this category, we believe that we are well-positioned to benefit from any growth in the overall retailer brand segment of the non-alcoholic beverage industry.

We have five operating segments—North America (which includes the U.S. reporting unit and Canada reporting unit), United Kingdom (“U.K.”) (which includes our United Kingdom reporting unit and our Continental European reporting unit), Mexico, Royal Crown International (“RCI”) and All Other (which includes our Asia reporting unit and our international corporate expenses). In 2008, our North America, U.K., Mexico and RCI operating segments represented 71.5%, 23.4%, 3.8% and 1.3%, as a percentage of revenue, respectively.

Our North America operating segment is primarily dedicated to the development, marketing, selling, production and distribution of CSDs, sparkling flavored waters and purified drinking water. While we also produce energy drinks and other non-carbonated products, these are a small portion of our overall product mix in North America. Based on industry information compiled from Nielsen, we estimate that as of December 27, 2008, we produced (either directly or through third party manufacturers with whom we have co-packing agreements) approximately 67% of all retailer brand CSDs sold in the United States. Our customer base consists primarily of large retailers including grocery stores and mass merchandisers, although we also serve customers in the dollar convenience and drug channels. Generally, product distribution is handled by our customers or through third parties. This method of distribution avoids the costly and capital-intensive functions of direct store delivery and merchandizing, and allows us to focus on our core capabilities of providing low-cost manufacturing and supply chain expertise.

Our U.K. operating segment has broad product manufacturing capabilities, including CSD, energy and aseptic drink production, which enables us to produce non-preserved juices, waters, sports drinks and other non-carbonated beverage products. While we are the number one supplier of retailer brand CSDs in the U.K. as of the end of 2008, CSDs represent a smaller portion of our overall product mix in the U.K. as compared to North

1

America. In 2008, CSDs accounted for approximately 42.4% of our U.K. revenues. We rank among the top five bottlers (by annual volume of cases produced) of energy drinks in the U.K. as of the end of 2008, including company-owned brands, retailer brands and co-manufactured brands.

In Mexico we are also the number one supplier of retailer brand CSDs as of the end of 2008. We produce CSDs and spring water (flavored and still) primarily for large retail customers. We are also pursuing a growth opportunity in direct store delivery to small retailers and convenience stores, which constitute the largest food and beverage distribution channel in Mexico.

Our RCI concentrate business sells CSD and other beverage concentrates to beverage bottlers in over 50 countries around the world. These customers can either buy RC Cola branded concentrate for bottling, sale and distribution under the RC Cola brand or buy concentrates for other own-label or private label CSDs.

Competitive Strengths

We believe that our competitive strengths will enable us to maintain our position as one of the world’s leading retailer brand soft drink providers and capitalize on future opportunities to drive sustainable and profitable growth in the long-run.

Leading Producer of Retailer Brand Beverages with Diverse Product Portfolio

We are one of the world’s largest private label non-alcoholic beverage manufacturers. We currently have the number one private label market share in the U.S., Canada, the United Kingdom and Mexico. Our leadership position is evidenced by our production of approximately 67% and 64% of all private label CSDs in the United States and the United Kingdom in 2008, respectively.

Our product portfolio ranges from traditional CSDs to categories such as clear, still and sparkling flavored waters, juice-based products, bottled water, energy drinks and ready-to-drink teas. Our proven ability to innovate and evolve our portfolio to meet changing consumer demand will position us well to continue to serve our retailer customers and their consumers. Since the beginning of 2009, we have launched more than 100 new product SKUs, including new flavor profiles based on successful new product launches by the national brands, new package types and new product category introductions for our retailer partners.

We market or supply over 200 retailer, licensed and Company-owned brands in our four core geographic segments. We sell CSDs concentrates and non-carbonated concentrates in over 50 countries. We believe that our leadership position, our broad portfolio offering and our existing infrastructure will enable us to continue to further penetrate the private label market, whether it is winning contracts from competitors or supplying customers who currently self-manufacture.

2

Cott offers products under trademarks which it owns or which it licenses on an exclusive basis, including:

Extensive, Flexible Manufacturing Capabilities

Our leading position in the private label market is supported by our extensive manufacturing network and flexible production capabilities. Our manufacturing footprint encompasses 20 strategically located bottling facilities, including nine in the U.S., five in Canada, four in the United Kingdom and two in Mexico, as well as a vertically-integrated concentrate facility in Columbus, Georgia.

In North America, we are the only dedicated private label CSD producer with a nation-wide manufacturing footprint. Manufacturing flexibility is one of our core competencies and is critical to private label leadership, as our products will typically feature customized packaging, design and graphics for our key retailer customers. Our ability to produce multiple SKUs and packages on our production lines and manage complexities through quick-line changeover processes differentiates us from our competition.

| (1) | Locations represent Company-owned and -leased facilities. |

3

High Customer Service Level and Strong Customer Integration

Private label leadership requires a high level of coordination with our retailer partners in areas such as supply chain, product development and customer service. In addition to managing increased product manufacturing complexity with efficiency, we have a proven track record of maintaining high service levels across our customer base. Since the beginning of 2009, we have averaged on-time and in-full order fulfillment rates of higher than 97%. We also partner closely with customers on supply chain planning and execution to minimize freight costs, reduce working capital requirements and increase in-store product availability. We work as a team with our retailer customers on new product development and packaging designs. Our role includes providing market expertise as well as knowledge of CSD category trends that may present opportunities for our retailer customers. A high level of customer integration and partnership coupled with a nationwide manufacturing footprint is critical for the development of successful private label programs.

Strategic Importance to Blue-Chip Retailers

We have longstanding partnerships with many of the world’s leading retailers in the grocery, mass merchandise and drugstore channels, enabling retailers to build their private label programs with high-quality, affordable beverages. We are the sole supplier for a majority of our clients due to our competitive advantages, including:

| | • | | Private label expertise |

| | • | | Vertically integrated, low cost production platform |

| | • | | CSD category insights and marketing expertise |

| | • | | Supply chain and quality consistency |

| | • | | Product innovation and differentiation |

For 2008, our top ten customers accounted for 61% of total revenue. Wal-Mart was the only customer that accounted for more than 10% of the Company’s total revenue for the period. We have established long-standing relationships with our top 10 customers. As a result of our high product quality and service, coupled with a national footprint, we believe we will continue to play a meaningful role in helping our customers develop store brand strategies to build loyalty with consumers.

Strong Management Team with Significant Operating Experience

We have in place a strong executive team with extensive industry experience to build on our strengths and to implement our business strategy. Our management team has a proven track record of successful management with positive operating results, both with us and in previous leadership roles in the consumer goods and beverage industries.

Our management team is led by Jerry Fowden, our Chief Executive Officer. Mr. Fowden has extensive experience in the beverage industry, including leadership positions at AB InBev (formerly known as InBev), Hero Group AG, and Pepsico. The management team has been augmented by the addition of Neal Cravens, our Chief Financial Officer. Mr. Cravens has held senior finance positions in both public and private companies, including approximately 20 years at Seagram Company, Ltd.

Our businesses are led by executives with extensive experience in the consumer goods and beverage industries. Throughout the organization, we benefit from employees’ prior experience in other global beverage bottling companies, including leaders of our manufacturing plants who have worked at bottling companies of national brands.

4

Business Strategy

Our primary goal is to enhance our position as the market leader and preferred supplier of retailer brand soft drinks in the markets where we operate. Continued leadership in our core markets will enable us to sustain and grow profitability as we drive for increased private label penetration and share growth within the CSD category. We believe that the following strategies will help us to achieve our goal.

Strengthen Customer Relationships

Customer relationships are important for any business, but at Cott, where our products bear our customers’ brand names, we must forge close partnerships with our customers and make their success our top priority. We will continue to provide our retailer partners with high quality products and great service at an attractive value that will help them provide quality value-oriented products to their consumers.

We will continue to focus on our high customer service levels as well as core private label innovations through the introduction of new packs, flavors and varieties of CSDs. We believe our focus on our customers will enable us to leverage our existing relationships and to develop new ones in existing and new markets. As a fast follower of innovative products, our goal is to identify new products which are succeeding in the marketplace and develop similar products of high quality for our retail partners to offer their customers at a better value.

Continue to Lower Operating Costs

As a retailer brand producer, we understand that our long-term success will be closely tied to our ability to remain a low-cost supplier. Effective management of commodity costs is a focus of our management team, including entering into contract commitments with suppliers of key raw materials such as aluminum and high fructose corn syrup (“HFCS”). Our 2008 refocus plan included cost reductions, such as lower headcount in our headquarters office and reduced operating costs through improved manufacturing efficiencies. While our refocus plan has laid an important foundation for the Company, we will continue to look for additional ways to reduce our cost structure. In addition to the cost reductions we have achieved in 2009, we have identified and are pursuing further cost reductions which we believe will begin to show results in 2010 and 2011, including cost reductions in information technology.

Control Capital Expenditures and Rigorously Manage Working Capital

Consistent with our status as a low-cost supplier, we will focus on leveraging our existing manufacturing capacity and maintaining an efficient supply chain. We are committed to both reducing and carefully prioritizing our capital investments. We will focus on expenditures that provide the best financial returns for Cott and for our retailer partners, while maintaining safety, efficiency and superior product quality. Our production facilities operate according to the highest standards of safety and product quality. We perform regular third-party audits of our facilities and are subject to consistent quality audits on behalf of our customers. Maintaining this high performance standard in our manufacturing facilities will be the primary use of capital expenditures in the future. However, we will continue to review growth and other opportunities, while remaining mindful of our total capital expenditure targets.

In 2009, while our capital expenditures have been primarily devoted to maintenance on existing manufacturing facilities, we have also invested in additional capabilities such as expanded can production capability in the United Kingdom and other investments in the U.S. to improve the competitiveness and consumer appeal of certain packaging configurations.

5

Improve Cash Flow and Cash Management

We believe that strong financial position and maximum flexibility will enable us to capitalize on opportunities in the marketplace. As such, teams have been put in place in all business units to review and improve the effectiveness of our cash management processes. Cash flow should naturally improve as we reduce costs and optimize our capital expenditures. We will strive to reduce working capital by collecting our receivables sooner, diligently managing our payables, and taking other actions designed to improve cash flow and strengthen our balance sheet.

Pursue Select Acquisitions

We believe that opportunities exist for us to expand geographically, reduce fixed manufacturing costs and broaden our product portfolio. We intend to evaluate and pursue strategic opportunities that would enhance our industry position and strengthen our business.

Recent Developments

Ratings Upgrades.

On July 28, 2009, S&P upgraded our corporate family rating to B- from CCC+, and on September 3, 2009, Moody’s upgraded our corporate family rating to B3 from Caa1. A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

Appointment of Neal Cravens as Chief Financial Officer.

On August 20, 2009, we announced the appointment of Neal Cravens as CFO, effective September 8, 2009.

Equity Offering.

On August 11, 2009, we announced the completion of the public offering of 9,435,000 of our common shares at a price of $5.30 per share (the “Equity Offering”). We received net proceeds from the Equity Offering of approximately $47.4 million, after deducting fees and expenses. As a result of the Equity Offering, the previously announced amendment to our senior secured asset-based lending credit facility (our “ABL Facility”) on July 22, 2009 is now fully effective. We used a portion of the net proceeds of the Equity Offering to repay all outstanding indebtedness under our ABL Facility that was required to be repaid by the amendment to our ABL Facility. The remainder of the net proceeds of the Equity Offering was used to repurchase a portion of our 8.0% senior subordinated notes due 2011 that had a fair value of $20.7 million in the aggregate.

Concurrent Debt Tender Offer and Consent Solicitation.

On the date of this offering memorandum, we commenced an offer to purchase for cash all of our outstanding 8.0% senior subordinated notes due 2011 at a price of $1,005 per $1,000 of principal amount, plus accrued and unpaid interest. Approximately $248.3 million in aggregate principal amount of our 8.0% senior subordinated notes due 2011 are currently outstanding. The tender offer is subject to the closing of the issuance of the notes offered in this offering memorandum. We intend to fund the repurchase of our 8.0% senior subordinated notes with the cash proceeds from this offering, together with cash on hand and ABL Facility borrowings. We reserve the right to modify the terms of the tender offer. We intend to redeem or repurchase any notes not tendered in the tender offer. There is no assurance as to when and the manner in which we will repurchase or redeem such notes. Barclays Capital Inc. is acting as dealer manager in connection with the tender offer. The initial purchasers of the notes offered hereby and/or their affiliates may hold our 8.0% senior subordinated notes, and therefore may receive a portion of the proceeds from this offering.

Corporate Information

Cott Corporation was incorporated in 1955 and is governed by the Canada Business Corporations Act. Cott Beverages Inc. was incorporated in 1991 as a Georgia corporation. Our registered Canadian office is located at 333 Avro Avenue, Pointe-Claire, Quebec, Canada H9R 5W3 and our principal executive offices are located at 5519 W. Idlewild Avenue, Tampa, Florida, United States 33634 and 6525 Viscount Road, Mississauga, Ontario, Canada L4V 1H6. Our telephone number is (813) 313-1800.

6