SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Focus Enhancements, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

FOCUS ENHANCEMENTS, INC.

1370 Dell Avenue

Campbell, California 95008

(408) 866-8300

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JULY 30, 2004

To Our Stockholders:

The Annual Meeting of Stockholders of Focus Enhancements, Inc., a Delaware corporation (“Focus”) will be held at 1370 Dell Ave., Campbell, CA 95008 on July 30, 2004 at 2:00 p.m., local time.

At our meeting, we will ask you to vote on the following matters:

1. Election of Directors. You will have the opportunity to elect two (2) members of the Board of Directors for terms of three years. The following persons are current members of the Board of Directors and they are our nominees for re-election:

| | | | |

Name

| | Age

| | Term to Expire

|

N. William Jasper, Jr. | | 56 | | 2007 |

Carl E. Berg | | 66 | | 2007 |

2.Approval of the Focus 2004 Stock Incentive Plan. You will be asked to adopt the Focus Enhancements, Inc. 2004 Stock Incentive Plan.

3. Appointment of Independent Registered Public Accounting Firm.You will be asked to ratify the selection of Deloitte & Touche, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2004.

4. Other Business.If other business is properly raised at the meeting or if we need to adjourn the meeting, you will vote on these matters too.

If you were a stockholder as of the close of business on June 11, 2004, you are entitled to vote at this meeting.

We cordially invite all stockholders to attend the meeting in person. To assure your representation at the meeting, however, you are urged to mark, sign, date and return the enclosed proxy card as soon as possible in the enclosed postage-prepaid envelope.

Whether or not you expect to attend the annual meeting, please complete, sign, date and promptly mail your proxy in the envelope provided. You may revoke your proxy at any time prior to the annual meeting, and, if you attend the annual meeting, you may revoke your proxy and vote your shares in person.

|

| BY ORDER OF THE BOARD OF DIRECTORS |

|

| |

Gary L. Williams, Secretary June , 2004 |

Focus Enhancements, Inc.

1370 Dell Avenue

Campbell, California 95008

PROXY STATEMENT

For the

Annual Meeting of Stockholders

to be held on July 30, 2004

GENERAL INFORMATION

This proxy statement contains information about Focus’ Annual Meeting of Stockholders to be held at 1370 Dell Ave., Campbell, CA on Friday, July 30, 2004 at 2:00 p.m. local time and at any postponements or adjournments of the meeting.

Why did you send me this proxy statement?

We sent you this proxy statement and the enclosed proxy card because our Board of Directors is soliciting your votes for use at Focus’ annual meeting of stockholders.

This proxy statement summarizes information that you need to know in order to cast an informed vote. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

We will begin sending this proxy statement, notice of annual meeting and the enclosed proxy card on or about June , 2004 to all stockholders entitled to vote. The record date for those entitled to vote is June 11, 2004. On June 11, 2004, there were 53,163,548 shares of our common stock and 2,744 shares of Series B Preferred Stock and 417 shares of Series C Preferred Stock outstanding.

Our Annual Report for the fiscal year ended December 31, 2003 on Form 10-K and Quarterly Report for the period ending March 31, 2004 on Form 10-Q, as filed previously filed with the Securities and Exchange Commission (the “SEC”), accompany this proxy statement.

What constitutes a quorum?

To establish a quorum at the annual meeting, a majority of the shares of our common stock and Series B and Series C Preferred Stock voting as a single class outstanding on the record date must be present either in person or by proxy. Focus will count abstentions and broker non-votes for purposes of establishing the presence of a quorum at the meeting.

What vote is required for each proposal?

| | • | Proposal 1: Election of Directors. The two nominees for director who receive the most votes cast by holders of our common stock and Series B and Series C Preferred Stock, voting as a single class at the annual meeting, will be elected. |

| | • | Proposal 2: Approval of the 2004 Stock Incentive Plan.The affirmative vote of a majority of the votes cast at the Focus annual meeting date is required to adopt the 2004 Stock Incentive Plan. |

1

| | • | Proposal 3: Ratification of Independent Registered Public Accounting Firm. Law does not currently require stockholder ratification of the selection of Deloitte & Touche, LLP as Focus’ independent registered public accounting firm. However, we are submitting the selection of Deloitte & Touche, LLP to you for ratification as a matter of good corporate practice. If you fail to ratify the selection by a majority vote of the present and voting shares, we will reconsider whether to retain Deloitte & Touche, LLP. Even if the selection is ratified, we may, in our discretion, direct the appointment of different independent registered public accounting firms at any time during the year if we determine that such a change would be in the best interests of Focus and its stockholders. |

| | • | Voting Shares Held by Brokers, Banks and Other Nominees. If you hold your shares in a broker, bank or other nominee account, you are a “beneficial owner” of our common stock. In order to vote your shares, you must give voting instructions to your bank, broker or other intermediary who is the “nominee holder” of your shares. We ask brokers, banks and other nominee holders to obtain voting instructions from the beneficial owners of shares that are registered in the nominee’s name. Proxies that are transmitted by nominee holders on behalf of beneficial owners will count toward a quorum and will be voted as instructed by the nominee holders. |

| | • | Effect of an Abstention and Broker Non-Votes. A shareholder who abstains from voting on any or all proposals will be included in the number of shareholders present at the meeting for the purpose of determining the presence of a quorum. Abstentions and broker non-votes will not be counted either in favor of or against the election of the nominees or other proposals. If a broker indicates on the enclosed proxy card or its substitute that it does not have discretionary authority to vote on a particular matter as to certain shares (“broker non-votes”), those shares will be considered as represented for purposes of determining a quorum, but will not be considered as entitled to vote with respect to that matter. Under applicable rules, brokers will not have discretionary authority with respect to Proposal No. 2, involving the proposed adoption of the 2004 Stock Incentive Plan. |

What are the recommendations of the board of directors?

The Board of Directors of Focus has unanimously approved all of the proposals we are submitting to you:

| | • | Election of the named nominees for director; |

| | • | Adoption of the 2004 Stock Incentive Plan; and |

| | • | Appointment of Deloitte & Touche, LLP as our independent registered public accounting firm. |

The Board of Directors recommends a vote “FOR” the nominees for director, “FOR” the 2004 Stock Incentive Plan, and “FOR” ratification of Deloitte & Touche, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2004.

How many votes do I have?

Each share of our common stock that you own entitles you to one (1) vote on each proposal. Each share of Series B Preferred Stock and each share of Series C Preferred Stock that you own entitles you to one thousand (1,000) votes on each proposal. The proxy card indicates the number of shares of our common stock and/or Series B and Series C Preferred Stock that you own.

How many shares of stock are outstanding?

As of June 11, 2004, there were 53,163,548 shares of our common stock outstanding and 2,744 shares of Series B Preferred Stock and 417 shares of Series C Preferred Stock outstanding. For the purposes of this meeting, the 3,161 aggregate shares of preferred stock will be entitled to cast 3,161,000 votes for each proposal to be considered.

2

How do I vote by proxy?

Whether you plan to attend the meeting or not, we urge you to complete, sign and date the enclosed proxy card and to return it promptly in the envelope provided. Returning the proxy card will not affect your right to vote in person at the meeting.

If you properly fill in your proxy card and send it to us in time to vote, your “proxy” (one of the individuals named on your proxy card) will vote your shares as you have directed on each proposal. If you sign the proxy card but do not make specific choices, your proxy will vote your shares as recommended by the Board of Directors as follows:

| | • | “FOR” the election of the nominees for director; |

| | • | “FOR” the adoption of the 2004 Stock Incentive Plan; |

| | • | “FOR” ratification of Deloitte & Touche, LLP as Focus’ independent registered public accounting firm; and |

| | • | At the discretion of the proxy holder as to any other matter that may properly come before the meeting. At the time this proxy statement went to press, we knew of no other matters that needed to be acted on at the meeting other than those discussed in this proxy statement. |

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised if:

| | • | You file either a written revocation of your proxy, or a duly executed proxy bearing a later date, with the Corporate Secretary of Focus prior to the meeting; or |

| | • | You attend the meeting and vote in person. |

Presence at the meeting will not revoke your proxy unless and until you present proper documentation and vote in person. However, if your shares are held in the name of your broker, bank or other nominee, and you wish to vote in person, you must bring an account statement and a letter of authorization from your nominee so that you can vote your shares.

How will Focus executive officers and directors vote?

On the record date of June 11, 2004, our executive officers and directors, including their affiliates, had voting power with respect to an aggregate of 5,849,789 shares of our common stock or approximately 10.4% of the shares of our common stock, which includes 2,744 shares of Series B Preferred Stock and 417 shares of Series C Preferred Stock converted into 3,161,000 shares of our common stock for the purposes of voting at this meeting. We currently expect that such officers and directors will vote all of their shares in favor of each of the nominees for director and in favor of each of the proposals.

What are the costs of solicitation of proxies?

We will bear the cost of solicitation of proxies from our stockholders and the cost of printing and mailing this document. In addition to solicitation by mail, Focus directors, officers and employees may solicit proxies from stockholders by telephone, in person or through other means. These persons will not receive additional compensation, but they will be reimbursed for the reasonable out-of-pocket expenses they incur in connection with this solicitation. We also will make arrangements with brokerage firms, fiduciaries and other custodians who hold shares of record to forward solicitation materials to the beneficial owner of these shares. We will reimburse these brokerage firms, fiduciaries and other custodians for their reasonable out-of-pocket expenses in connection with this solicitation. In addition, we may pay for and utilize the services of individuals or companies we do not regularly employ in connection with the solicitation of proxies.

3

Will there be any other matters considered at the annual meeting?

We are unaware of any matter to be presented at the annual meeting other than the proposals discussed in this proxy statement. If other matters are properly presented at the annual meeting, then the persons named in the proxy will have authority to vote all properly executed proxies in accordance with their judgment on any such matter, including any proposal to adjourn or postpone the meeting. If you vote against any proposal (other than a proposal regarding the election of directors or ratification of registered public accounting firms), your proxy will not vote in favor of any proposal to adjourn or postpone the meeting if such postponement or adjournment is for the purpose of soliciting additional proxies to approve the proposal that you voted against.

Can I view a list of stockholders?

The names of stockholders of record entitled to vote at the annual meeting will be available to stockholders entitled to vote at the annual meeting, for ten days prior to the annual meeting for any purpose germane to the annual meeting, between the hours of 9:00 a.m. and 5:00 p.m., at our principal executive offices at 1370 Dell Avenue, Campbell, California 95008, by contacting the Secretary of the Company at our principal executive offices.

EXECUTIVE OFFICERS AND DIRECTORS

Who are our executive officers and directors?

The following table sets forth certain information regarding our executive officers and directors as of December 31, 2003.

| | | | |

Name (1)

| | Age

| | Position

|

| N. William Jasper, Jr. | | 56 | | Chairman of the Board |

| | |

| Brett A. Moyer | | 45 | | Director, President and Chief Executive Officer |

| | |

| Carl E. Berg | | 66 | | Director |

| | |

| William B. Coldrick | | 61 | | Vice Chairman of the Board |

| | |

| Michael L. D’Addio | | 59 | | Director |

| | |

| Tommy Eng | | 45 | | Director |

| | |

| Timothy E. Mahoney | | 47 | | Director |

| | |

| Jeffrey A. Burt | | 50 | | Vice President of Operations |

| | |

| Thomas M. Hamilton | | 54 | | Executive Vice President and General Manager of the Focus Semiconductor Group |

| | |

| Gary L. Williams | | 37 | | Secretary, Vice President of Finance and Chief Financial Officer |

What is the background of our executive officers and directors?

Directors

N. William Jasper, Jr. has served as Chairman of the Board of Directors since December 20, 2002. Mr. Jasper became a member of our Board of Directors on March 6, 2001, in connection with the Videonics acquisition. Mr. Jasper served as a member of the Videonics Board of Directors since August 1993. Mr. Jasper has been the President and Chief Executive Officer of Dolby Laboratories, Inc., a private signal processing technology company located in San Francisco, California since 1983. Mr. Jasper’s term expires at the annual meeting in 2004 at which time he will be nominated for re-election.

4

Brett A. Moyer joined us in May 1997. On September 30, 2002 he assumed the role as President and Chief Executive Officer and became a member of our Board of Directors. From May 1997 to September 29, 2002, Mr. Moyer served as our Executive Vice President and Chief Operating Officer. From February 1986 to April 1997, Mr. Moyer worked at Zenith Electronics Corporation, Glenview, IL, where he was most recently the Vice President and General Manager of Zenith’s Commercial Products Division. Mr. Moyer has also served as Vice President of Sales Planning and Operations at Zenith where he was responsible for forecasting, customer service, distribution, MIS, and regional credit operations. Mr. Moyer has a Bachelor of Arts in Economics from Beloit College in Wisconsin and a Masters of International Management with a concentration in finance and accounting from The American Graduate School of International Management (Thunderbird). Mr. Moyer’s term expires in 2005.

Carl E. Berg, a co-founder of Videonics, served on Videonics’ Board of Directors since June 1987. In connection with the Videonics acquisition, Mr. Berg became one of our directors on March 6, 2001. Mr. Berg is currently Chief Executive Officer and a director for Mission West Properties, a real estate investment company located in Cupertino, CA. Mr. Berg is also a member of the Board of Directors of Valence Technology, Inc., and Monolithic System Technology Inc. Mr. Berg’s term expires at the annual meeting in 2004, at which time he will be nominated for re-election. See also “Certain Relationships and Related Parties.”

William B. Coldrick has served as our Director since January 1993 and Executive Vice President from July 1994 to May 1995. Mr. Coldrick is currently a principal of Enterprise Development Partners, a consulting firm serving emerging growth companies that he founded in April 1998. From July 1996 to April 1998, Mr. Coldrick was Group Vice President and General Manager of Worldwide Field Operations for the Computer Systems Division of Unisys Corp. From 1982 to 1992, Mr. Coldrick served with Apple Computer Inc. in several senior executive positions including Senior Vice President of Apple USA from 1990 to 1992. Prior to joining Apple Computer Inc. Mr. Coldrick held several sales and marketing management positions with Honeywell Inc. from 1968 to 1982. Mr. Coldrick holds a Bachelor of Science degree in Marketing from Iona College in New Rochelle, New York. Mr. Coldrick also serves on the Board of Directors of AESP, a computer hardware company located in North Miami, Florida. Mr. Coldrick’s term expires in 2006.

Michael L. D’Addio joined us on January 16, 2001, in connection with the acquisition of Videonics Inc., and served as our President, Chief Executive Officer and Director. On September 30, 2002 Mr. D’Addio voluntarily resigned as President and Chief Executive Officer. Mr. D’Addio is currently President and Chief Executive Officer of Coaxsys, Inc., a new network technology company located in Los Gatos, California. Mr. D’Addio was a co-founder of Videonics, and had served as Chief Executive Officer and Chairman of the Board of Directors since Videonics’ inception in July 1986. In addition Mr. D’Addio served as Videonics’ President from July 1986 until November 1997. From May 1979 through November 1985 he served as President, Chief Executive Officer and Chairman of the Board of Directors of Corvus Systems, a manufacturer of small computers and networking systems. Mr. D’Addio holds an A.B. degree in Mathematics from Northeastern University. Mr. D’Addio’s term expires in 2006.

Tommy Eng has served as our Director since January 2004. Mr. Eng is the Vice Chairman and founder of Tera Systems, a private electronic design automation (EDA) company. Mr. Eng’s career includes various management and engineering positions of increasing responsibilities. Prior to founding Tera Systems in 1996, he was the General Manager of the Advanced IC Design Automation and Design Consultation division of Mentor Graphics. Previous to Mentor Graphics, Mr. Eng was the General Manager of the IC Design Services and EDA Software division of Silicon Compiler Systems. Mr. Eng also has held various technical staff positions at ATT Bell Laboratories developing microprocessors, network switches, and IC design tools. Mr. Eng holds an M.S. in Electrical Engineering from the University of California, Berkeley. Mr. Eng’s term expires in 2005.

Timothy E. Mahoney has served as our Director since March 1997. He has more than 20 years of experience in the computing industry. Mr. Mahoney founded Union Atlantic LC, in 1994, a consulting company for emerging technology companies and in 1999 became Chairman and COO of vFinance, Inc., the parent company of Union Atlantic, LC and vFinance Investments, Inc. He earned a BA in computer science and business from West Virginia University and an M.B.A. from George Washington University. Mr. Mahoney’s term expires at the annual meeting in 2004. In order to meet the NASDAQ requirements that our Board of Directors be composed of at least a majority of independent directors, Mr. Mahoney has agreed not to seek re-election at this meeting. See also “Certain Relationships and Related Parties.”

5

Non-Director Executive Officers

Jeffrey A. Burt joined us to serve as our Vice President of Operations on January 16, 2001 in connection with the acquisition of Videonics, Inc. Mr. Burt was Vice President of Operations of Videonics since April 1992. From August 1991 to March 1992, Mr. Burt served Videonics as its Materials Manager. Prior to that time, from October 1990 until July 1991, Mr. Burt acted as a consultant to Videonics in the area of materials management. From May 1989 to October 1990, Mr. Burt served as the Director of Manufacturing of On Command Video. Mr. Burt holds a B.A. degree in Economics from the University of Wisconsin at Whitewater.

Thomas M. Hamilton joined us in September 1996 and in July 2001 assumed the role of Executive Vice President and General Manager of the Focus Semiconductor Group. From September 1996 to July 2001, Mr. Hamilton served as Vice President of Engineering and our Chief Technical Officer. From 1992 to 1996, Mr. Hamilton was President, Chief Executive Officer and Co-Founder of TView, Inc., a company acquired by us. From 1985 to 1990, Mr. Hamilton was Vice President of Engineering of TSSI. From 1973 to 1985, Mr. Hamilton held a variety of engineering and marketing management positions at Tektronix, Inc. Mr. Hamilton has a B.S. in Mathematics from Oregon State University.

Gary L. Williams joined us as our Secretary, Vice President of Finance & CFO on January 16, 2001 in connection with the acquisition of Videonics Inc. Mr. Williams had served Videonics as its Vice President of Finance, Chief Financial Officer and Secretary since February 1999. From February 1995 to January 1999, Mr. Williams served as Videonics’ Controller. From July 1994 to January 1995, he served as Controller for Western Micro Technology, a publicly traded company in the electronics distribution business. From January 1990 to June 1994, Mr. Williams worked in public accounting for Coopers & Lybrand LLP. Mr. Williams is a Certified Public Accountant and has a Bachelors Degree in Business Administration, with an emphasis in Accounting from San Diego State University.

What are the responsibilities of our board of directors and committees?

Our business, property and affairs are managed by or, are under the direction of, the Board of Directors pursuant to the General Corporation Law of the State of Delaware and our bylaws. Members of the Board of Directors are kept informed of the company’s business through discussions with the Chairman, with the President and Chief Executive Officer, and with key members of management, by reviewing materials provided to them and by participating in meetings of the Board of Directors and its committees. During the fiscal year ended December 31, 2003, the Board of Directors held a total of five meetings. All of the persons who were directors of Focus during the fiscal year ended December 31, 2003 attended at least seventy-five percent (75%) of the aggregate of (a) the total number of Board meetings and (b) the total number of meetings held by all committees of the Board on which they served during the fiscal year. In addition, the Board of Directors took action by unanimous written consent once in 2003.

The Board also has two committees: a Compensation Committee and an Audit Committee.

Compensation Committee

The Compensation Committee’s responsibilities are to make determinations with respect to salaries and bonuses payable to executive officers and to administer stock option plans. The Compensation Committee is currently comprised of Messrs. Coldrick and Mahoney. We expect to appoint a third independent member in accordance with Nasdaq rules. This committee met one time during the fiscal year ended December 31, 2003. See also “Report of Compensation Committee on Executive Compensation.”

Audit Committee

The Audit Committee of the board is composed of three members and operates under a written charter adopted by the board of directors. The responsibilities of the Audit Committee are contained in the Report of Audit Committee below. The Audit Committee currently consists of Messrs. Berg, Coldrick, and Jasper. All three members are “independent,” as defined by the Nasdaq current listing standards. The Board has determined that Mr. Jasper qualifies as an audit committee financial expert as defined in Item 401(h)(1) of Regulation S-K and therefore meets the Nasdaq listing requirements for having related financial expertise. During the fiscal year ended December 31, 2003, this committee held five formal meetings. See also “Report of the Audit Committee”.

6

How does the Board select nominees for the Board?

The Board of Directors considers candidates for Board membership suggested by its members and other Board members, as well as management and shareholders. A shareholder who wishes to recommend a prospective nominee for the Board should notify the Corporate Secretary in writing with whatever supporting material the shareholder considers appropriate.

Once the Board has identified a prospective nominee, it considers such relevant factors, as it deems appropriate, including the current composition of the Board, the balance of management and independent directors, the need for Audit Committee expertise and the evaluations of other prospective nominees. In connection with this evaluation, the Board determines whether to interview the prospective nominee, and if warranted, one or more independent members of the Board and others as appropriate, interview prospective nominees in person or by telephone. After completing this evaluation and interview, the majority of the independent members make a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board determines the nominees after considering the recommendation and report of such independent members.

How can shareholders nominate directors?

The procedures for nominating directors, other than by the Board of Directors itself, are set forth in Section 7.1. of our bylaws. Generally, stockholders can nominate persons for election to the Board by giving notice not later than the close of business on the 60th day nor earlier than the close of business on the 90th day prior to the first anniversary of the preceding year’s annual meeting and must include such information as required in the bylaws. In the event next year’s annual meeting is more than 30 days before or more than 60 days after the anniversary date, to be timely, stockholder nominees must be delivered not earlier than the close of business on the later of the 90th day prior to such annual meeting and not later than the close of business on the later of the 60th day prior to such annual meeting or the close of business on the 10th day following the day on which public announcement of the date of such meeting is first made by Focus. With regard to this year’s annual meeting, Focus announced the date and time of the meeting on June 8, 2004.

Executive Sessions of the Board of Directors

We have adopted a policy whereby our independent directors will meet regularly in executive sessions at least twice a year in conjunction with regularly scheduled meetings of the Board of Directors. Independent directors include all directors who are independent as determined by the Board of Directors. The independent directors presently consist of all current Directors except Messrs. D’Addio, Mahoney and Moyer.

Independence of Directors

Nasdaq requires that a majority of the Board of Directors be “independent” directors as defined in Nasdaq Rule 4200. We reviewed the independence of the Board of Directors and considered any transaction between each director or any member of his or her family and us. As a result of this review, the Board of Directors has determined that each of the members of the Board of Directors is independent under the Nasdaq definition of “independence” for the Board except for Messrs. D’Addio, Mahoney and Moyer, who are not considered independent because of their current or past employment as executive officers of Focus or due to their business relationships with Focus.

How do shareholders communicate with the Board?

Shareholders and other parties interested in communicating directly with members of our Board of Directors individually or as a group may do so by writing to Chairman of the Board, Focus Enhancements, Inc., 1370 Dell Avenue, Campbell, California 95008. All communications will be compiled by the Secretary and submitted to the Board or the individual directors on a periodic basis. No irrelevant or inappropriate communications, such as advertisements, solicitations and hostile communications, will be forwarded to directors. Concerns relating to accounting, internal controls or auditing matters are handled in accordance with procedures established by the Audit Committee with respect to such matters.

Does Focus have a Policy on Attending Annual Meetings?

We encourage, but do not require, all incumbent directors and director nominees to attend our annual meetings of stockholders. At our Annual Meeting of Stockholders on December 19, 2003, one of the seven directors then in office was in attendance.

Does Focus have a Code of Ethics?

We have adopted a Code of Conduct, which is applicable to of our directors and employees, including the principal executive officer, the principal financial officer and the principal accounting officer. The Code of Conduct is posted on our website. We intend to file amendments to or waivers from our Code of Conduct (to the extent applicable to our chief executive officer, principal financial officer or principal accounting officer) on a Form 8-K with the SEC.

7

REPORT OF AUDIT COMMITTEE

The following Report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Focus filings under the Securities Act of 1933 or under the Securities Exchange Act of 1934, as amended, except to the extent we specifically incorporate this Report of the Audit Committee by reference.

The Audit Committee of the Board of Directors is responsible for providing independent, objective oversight of Focus’ accounting functions and internal controls. In addition, the Audit Committee reviews the quarterly and financial statements of Focus and any significant accounting issues affecting such statements. Furthermore, the committee reviews the scope of the audit, and discusses any other audit-related matters, with our independent registered public accounting firm.

The Audit Committee acts under a written charter first adopted and approved by the Board of Directors on June 1, 2000 and subsequently amended. A copy of the amended Audit Committee Charter is attached to this Proxy Statement as Appendix B.

The responsibilities of the Audit Committee include recommending to the Board of Directors an accounting firm to be engaged as Focus’ independent registered public accounting firm. Additionally, and as appropriate, the Audit Committee reviews and evaluates the independent registered public accounting firm’s performance, and discusses and consults with Focus’ management and the independent registered public accounting firm regarding the following:

| • | The plan for, and the independent registered public accounting firm’s report on, each audit of Focus’ financial statements; |

| • | Focus’ financial disclosure documents, including all financial statements and reports filed with the SEC or sent to stockholders; |

| • | Changes in Focus’ accounting practices, principles, controls or methodologies, or in Focus’ financial statements; |

| • | Significant developments in accounting rules; and |

| • | The adequacy of Focus’ internal accounting controls and financial accounting and auditing personnel. |

In connection with these responsibilities, the members of the Board of Directors met with management and the independent registered public accounting firm to review and discuss the financial statements for the fiscal year ended December 31, 2003. They also discussed with the independent registered public accounting firm the matters required by Statement on Auditing Standards No. 61 (Communication with Audit Committees) and Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and they discussed with the independent registered public accounting firm that firm’s independence and satisfied itself as to the independent registered public accounting firm’s independence.

Based upon the Board of Directors’ discussions with management and the independent registered public accounting firm, and their review of the representations of management and the independent registered public accounting firm, they recommended that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003, to be filed with the SEC.

Management is responsible for Focus’ financial reporting process including its system of internal controls, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. Focus’ independent registered public accounting firm is responsible for auditing those financial statements. Our responsibility is to monitor and review these processes. It is not our duty or our responsibility to conduct auditing or accounting reviews or procedures. We are not employees of Focus and we may not be, and we may not represent ourselves to be or to serve as, accountants or auditors by profession or experts in the fields of accounting or auditing. Therefore, we have relied, without independent verification, on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and on the representations of the independent registered public accounting firm included in their report on Focus’ financial statements. Our oversight does not provide us with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, our considerations and discussions with management and the independent registered public accounting firm do not assure that Focus’ financial statements are presented in accordance with generally accepted accounting principles, that the audit of our company’s financial statement has been carried out in accordance with generally accepted auditing standards or that our company’s independent registered public accounting firm are in fact “independent.”

|

THE AUDIT COMMITTEE N. WILLIAM JASPER JR., CHAIR |

8

SECTION 16(A) BENEFICIAL OWNERSHIP

REPORTING COMPLIANCE

Did our directors and officers comply with their section 16(a) beneficial ownership reporting compliance requirements in 2003?

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than ten percent (10%) of our equity securities, to file reports of ownership and reports of changes in ownership of our common stock with the SEC. The SEC requires officers, directors and greater than ten percent (10%) stockholders to furnish us with copies of all Section 16(a) forms they file.

To our best knowledge, based solely on a review of the copies of such forms and certifications furnished to us, we believe that all of our current directors have complied with the Section 16(a) filing requirements during the fiscal year ended December 31, 2003.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

Who owns more than 5% of our common stock and Series B and Series C Preferred Stock, and what is the beneficial ownership of our common stock and Series B and Series C Preferred Stock of our executive officers and directors?

The following table sets forth information, as of June 11, 2004, regarding the shares of our common stock beneficially owned by those stockholders of Focus known to management to beneficially own more than five percent (5%) of our common stock, each of our directors, nominees, and named executive officers, as well as all directors and executive officers as a group. Except as noted, we believe each person has sole voting and investment power with respect to the shares shown subject to applicable community property laws.

“Beneficial ownership” is a technical term broadly defined by the SEC to mean more than ownership in the usual sense. For example, you beneficially own our common stock not only if you hold it directly, but also indirectly, if you, through a relationship, contract or understanding, have, or share, the power to vote the stock, to sell the stock or have the right to acquire the stock. The percentage of beneficial ownership presented in the table below is based on 53,163,548 shares of our common stock, 2,744 shares of Series B Preferred Stock and 417 shares of Series C Preferred Stock, in aggregate converted into 3,161,000 shares of our common stock, 4,157,556 shares issuable pursuant to options that are immediately exercisable within 60 days of June 11, 2004, the record date.

| | | | | |

Name

| | Number of Shares Beneficially

Owned

| | Percentage of Beneficial

Ownership (1)

| |

Brett A. Moyer(2) | | 570,032 | | * | |

Carl E. Berg(3) | | 5,460,576 | | 9.0 | % |

William B. Coldrick(4) | | 224,036 | | * | |

Michael L. D’Addio(5) | | 946,044 | | 1.6 | % |

Tommy Eng(6) | | 11,111 | | * | |

N. William Jasper, Jr.(7) | | 174,762 | | * | |

Timothy E. Mahoney(8) | | 31,668 | | * | |

Jeffrey A. Burt(9) | | 128,161 | | * | |

Thomas M. Hamilton(10) | | 357,507 | | * | |

Gary L. Williams(11) | | 230,661 | | * | |

All executive officers and directors as a group (12 persons)(12) | | 8,142,890 | | 13.4 | % |

| * | Less than 1% of the outstanding common stock. |

9

| (1) | Unless otherwise indicated, each person possesses sole voting and investment power with respect to the shares. |

| (2) | Includes 40,100 shares of common stock held directly by Mr. Moyer. Includes 529,932 shares issuable pursuant to outstanding stock options that are exercisable at June 11, 2004, or within 60 days thereafter. |

| (3) | Includes 2,173,193 shares of common stock held directly by Mr. Berg. Includes 3,161 shares of preferred stock held directly by Mr. Berg that are convertible into 3,161,000 shares of our common stock. Includes 126,383 shares issuable pursuant to outstanding stock options that are exercisable at June 11, 2004, or within 60 days thereafter. |

| (4) | Includes 7,369 shares of common stock held directly or indirectly by Mr. Coldrick. Includes 216,667 shares issuable pursuant to outstanding stock options that are exercisable at June 11, 2004, or within 60 days thereafter. |

| (5) | Includes 419,932 shares of common stock held directly or indirectly by Mr. D’Addio. Includes 526,112 shares issuable pursuant to outstanding stock options that are exercisable at June 11, 2004, or within 60 days thereafter. |

| (6) | Includes 11,111 shares issuable pursuant to outstanding stock options that are exercisable at June 11, 2004, or within 60 days thereafter. |

| (7) | Includes 29,000 shares of common stock held directly or indirectly by Mr. Jasper. Includes 145,762 shares issuable pursuant to outstanding stock options that are exercisable at June 11, 2004, or within 60 days thereafter. |

| (8) | Includes 13,195 shares of common stock held directly or indirectly by Mr. Mahoney. Includes 18,473 shares issuable pursuant to outstanding stock options that are exercisable at June 11, 2004, or within 60 days thereafter. |

| (9) | Includes 128,161 shares issuable pursuant to outstanding stock options that are exercisable at June 11, 2004, or within 60 days thereafter. |

| (10) | Includes 6,000 shares of common stock held directly by Mr. Hamilton. Includes 351,507 shares issuable pursuant to outstanding stock options that are exercisable at June 11, 2004, or within 60 days thereafter. |

| (11) | Includes 230,661 shares issuable pursuant to outstanding stock options that are exercisable at June 11, 2004, or within 60 days thereafter. |

| (12) | Includes 2,293,101 shares issuable pursuant to options to purchase common stock exercisable at June 11, 2004, or within 60 days thereafter. Includes stock ownership of two officers who joined us upon the acquisition of substantially all the assets of Visual Circuits Corporation on May 28, 2004. |

EXECUTIVE AND DIRECTOR COMPENSATION

How do we compensate our directors?

Non-employee directors are reimbursed for out of pocket expenses incurred in attending the meetings. No director who is an employee receives separate compensation for services rendered as a director, however, directors are eligible to participate in our stock option plans. During the year ended December 31, 2003, we granted 25,000 options to each non-employee director. These options vest over a three-year period.

10

How do we compensate our executive officers?

The following table sets forth certain information concerning the executive compensation our Chief Executive Officer and four (4) other most highly compensated executive officers whose cash salary and bonus exceeded $100,000 (the “Named Executive Officers”) for the fiscal years ended December 31, 2003, 2002, and 2001.

Summary Compensation Table

| | | | | | | | | | | | | | | |

| | | Annual Compensation(1)(2)

| | | Long-Term Compensation Options(3)

| | Other

Compensation

| |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus($)

| | | |

Brett A. Moyer(4) | | 2003 | | $ | 206,847 | | $ | 25,241 | | | 202,239 | | $ | 10,008 | (8) |

President & Chief Executive | | 2002 | | $ | 164,673 | | $ | 7,846 | (5) | | 350,000 | | $ | 64,510 | (6) |

Officer | | 2001 | | $ | 155,000 | | $ | 91,133 | (5) | | — | | | — | |

| | | | | |

Thomas M. Hamilton | | 2003 | | $ | 163,077 | | $ | 34,789 | | | 36,567 | | | — | |

Executive Vice President and | | 2002 | | $ | 156,154 | | $ | 12,500 | | | 95,000 | | | — | |

General Manager, | | 2001 | | $ | 140,000 | | | — | | | — | | | — | |

Semiconductor Group | | | | | | | | | | | | | | | |

| | | | | |

Jeffrey A. Burt | | 2003 | | $ | 168,172 | | $ | 10,000 | | | 26,119 | | $ | 400 | (7) |

Vice President of Operations | | 2002 | | $ | 161,826 | | | — | | | 25,000 | | $ | 400 | (7) |

| | | 2001 | | $ | 158,654 | | | — | | | — | | $ | 400 | (7) |

| | | | | |

Gary L. Williams | | 2003 | | $ | 167,885 | | $ | 19,200 | | | 36,567 | | $ | 400 | (7) |

Secretary, Vice President of | | 2002 | | $ | 152,135 | | $ | 11,666 | | | 25,000 | | $ | 400 | (7) |

Finance and Chief Financial | | 2001 | | $ | 144,231 | | | — | | | — | | $ | 400 | (7) |

Officer | | | | | | | | | | | | | | | |

| (1) | Includes salary and bonus payments earned by the named officers in the year indicated, for services rendered in such year, which were paid in the following year. |

| (2) | Excludes perquisites and other personal benefits, the aggregate annual amount of which for each officer was less than the lesser of $50,000 or 10% of the total salary and bonus reported. |

| (3) | Long-term compensation table reflects the grant of non-qualified and incentive stock options granted to the named persons in each of the periods indicated. |

| (4) | Mr. Moyer assumed the role of President and Chief Executive Officer on September 30, 2002. |

| (5) | Includes compensation based on sales commissions. |

| (6) | Relocation expenses paid by the Company for Mr. Moyer’s move from Massachusetts to California. |

| (7) | Company discretionary 401(k) contribution. |

| (8) | Remaining relocation expenses paid by the Company for Mr. Moyer’s move ($9,608) and Company 401(k) contribution ($400). |

Stock Option Plans

We maintain various qualified and non-qualified stock option plans for our employees, officers and directors. The purpose of our stock option plans is to provide incentives to employees, directors and consultants who are in positions to make significant contributions to us. As of June 11, 2004, options to purchase 420,943 shares of common stock remained available for grant under the plans. We are seeking approval of a new stock incentive plan at this meeting. See “Proposal 2: Approval of the 2004 Stock Incentive Plan”.

11

OPTION/SAR GRANTS IN 2003

The following tables sets forth as to the Chief Executive Officer and the Named Executive Officers, certain information with respect to options to purchase shares of our common stock as of and for the year ended December 31, 2003.

| | | | | | | | | | | | | | | | |

| | | Number of

Securities

Underlying

Options/

SARs

Granted (#)

| | % of Total

Options/

SARs

Granted to

Employees in 2003(1)

| | | Exercise

Or Base

Price ($/per Share)

| | | | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for Option Term

|

Name

| | | | | Exp. Date

| | 5%

| | 10%

|

Brett A. Moyer | | 150,000 | | 15.2 | % | | $ | 0.75 | | 3/31/13 | | $ | 31,082 | | $ | 68,682 |

Brett A. Moyer | | 52,239 | | 5.3 | % | | $ | 1.57 | | 7/22/13 | | $ | 51,579 | | $ | 130,711 |

Jeffrey A. Burt | | 26,119 | | 2.6 | % | | $ | 1.57 | | 7/22/13 | | $ | 25,789 | | $ | 65,354 |

Thomas M. Hamilton | | 36,567 | | 3.7 | % | | $ | 1.57 | | 7/22/13 | | $ | 36,105 | | $ | 91,497 |

Gary L. Williams | | 36,567 | | 3.7 | % | | $ | 1.57 | | 7/22/13 | | $ | 36,105 | | $ | 91,497 |

| (1) | Focus granted options to purchase a total of 989,558 shares of common stock to employees and directors in 2003. |

The following table sets forth information concerning options exercised during fiscal year 2003 and the value of unexercised options as of December 31, 2003 held by the executives named in the Summary Compensation Table above.

Aggregated Option/SAR Exercises in 2003 and Fiscal Year-End Option/SAR Values

| | | | | | | | | | | | | | | |

| | | Shares Acquired

on

Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options/SARs at Year-End

| | Value of Unexercised In-the-Money Options/SARs at Year-End(1)

|

| | | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Brett A. Moyer | | 179,999 | | $ | 148,625 | | 410,314 | | 351,295 | | $ | 525,096 | | $ | 385,070 |

Jeffrey A. Burt | | 97,875 | | $ | 147,954 | | 104,277 | | 49,067 | | $ | 126,756 | | $ | 47,961 |

Thomas M. Hamilton | | 41,666 | | $ | 43,379 | | 322,302 | | 84,265 | | $ | 394,422 | | $ | 72,725 |

Gary L. Williams | | 25,000 | | $ | 44,500 | | 210,989 | | 49,606 | | $ | 283,012 | | $ | 39,826 |

| (1) | Value is based on the difference between option exercise price and the closing price as quoted on The Nasdaq SmallCap Market at the close of trading on December 31, 2003 ($2.17) multiplied by the number of shares underlying the option. |

Repricing of Stock Options/Additional Option Plans

On September 1, 1998, we repriced all employee and director options under all plans to $1.22 per share for those options priced in excess of this value. This price represented the closing market price of our common stock on September 1, 1998.

12

Existing Equity Compensation Plan Information

| | | | | | | |

At June 11, 2004 Plan Category

| | (a) Number of securities to be issued upon exercise of

outstanding options

| | (b) Weighted-average

exercise price of

outstanding options

| | (c) Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

|

Equity compensation plans approved by security holders(1) | | 5,287,012 | | $ | 1.09 | | 420,943 |

| (1) | Focus does not maintain any equity compensation plans that were not submitted to, and approved by, its shareholders. |

Employment Agreements

Brett Moyer is party to an employment contract with us effective September 30, 2002. Pursuant to this employment contract, Mr. Moyer serves as our Chief Executive Officer and President. In addition, in connection with the employment agreement, Mr. Moyer was granted a total of 500,000 options to purchase shares of common stock at prices of $0.75 and $1.15 per share, the then fair market values. The options vest over a three-year period at 2.77% per month. Under the employment contract, these options accelerate, so as to be immediately exercisable if Mr. Moyer is terminated without cause during the term of the contract. The employment contract provides for incentive bonuses of up to $110,000 as determined by our Board of Directors and employee benefits, including health and disability insurance, in accordance with our policies. The initial term of the agreement is for two years and would terminate on August 6, 2004. Mr. Moyer’s contract will automatically renew for an additional one-year period unless terminated by either party 30 days prior to the end of the initial term.

Thomas Hamilton is party to an employment contract with us effective October 17, 1996, as amended to date, which renews automatically after December 31, 1998, for one-year terms, subject to certain termination provisions. This employment contract requires the acceleration of vesting of all options held by Mr. Hamilton so as to be immediately exercisable if Mr. Hamilton is terminated without cause during the term of the contract. The employment contract provides for bonuses as determined by our Board of Directors and employee benefits, including health and disability insurance, in accordance with Focus’ policies.

Gary Williams is party to an employment contract with us effective May 28, 2004. Pursuant to this employment contract, Mr. Williams serves as our Vice President of Finance and Chief Financial Officer. The initial term of the agreement is for one year and would terminate on May 27, 2005. Mr. Williams’ contract will automatically renew for an additional one-year period unless terminated by either party 90 days prior to the end of the initial term. This employment contract requires payment of 12 months of salary and the acceleration of vesting of all options held by Mr. Williams so as to be immediately exercisable if Mr. Williams is terminated either without cause or in the event of a change in control as defined in the employment agreement during the term of the contract. The employment contract provides for bonuses as determined by our Board of Directors and employee benefits, including health and disability insurance, in accordance with Focus’ policies.

Mr. Burt has entered into a Key Employee Agreement to provide for the acceleration of option vesting under certain circumstances upon a change in control as defined in those respective agreements.

Each of these agreements provide for certain cash payments in the event of a change of control of Focus.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee has ever been an officer or employee of Focus or of any of our subsidiaries or affiliates. None of our executive officers has served on the board of directors or on the Compensation Committee of any other publicly traded company.

13

Notwithstanding anything to the contrary set forth in any of our previous or future filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 (the “Exchange Act”) that might incorporate this Proxy Statement or future filings with the SEC, in whole or in part, the following report and the Stock Performance Graph that follows shall not be deemed to constitute soliciting material and should not be deemed to be incorporated by reference into any such filing.

REPORT OF COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

Membership and Role of the Committee on Compensation

The Compensation Committee consists of the following non-employee members of our Board of Directors: Messrs. Coldrick and Mahoney. We expect to appoint a third independent member in accordance with Nasdaq rules. The Compensation Committee reviews and determines our executive compensation objectives and policies, administers our stock plans, grants stock options, and monitors and oversees the career development of our executive management pool. The Compensation Committee helps us to attract, develop and retain talented executive personnel in a competitive market.

Executive Compensation Program

Objectives

The objectives of our executive compensation program are to:

| | • | Attract and retain highly talented and productive executives; |

| | • | Provide incentives for superior performance; and |

| | • | Align the interests of executive officers with our stockholders’ interests by basing a significant portion of compensation upon our revenues, profits before taxes, stock price and other measures of performance. |

Components

Our executive compensation program generally combines the following three components: base salary; annual bonus; and long-term incentive compensation, which historically has consisted of stock option grants.

Base salary. The Compensation Committee annually reviews the salaries of our executives. When setting base salary levels, in a manner consistent with the objectives outlined above, the Compensation Committee considers (a) competitive market conditions for executive compensation, (b) our performance and (c) the individual’s performance.

The measures of individual performance considered in setting fiscal year 2003 salaries included, to the extent applicable to an individual executive officer, a number of quantitative and qualitative factors, such as the Company’s historical and recent financial performance in the principal area of responsibility of the executive, the individual’s progress toward non-financial goals within his area of responsibility, individual performance, experience and level of responsibility and other contributions made to our success. The Compensation Committee has not found it practicable, nor has it attempted, to assign relative weights to the specific factors used in determining base salary levels, and the specific factors used may vary among individual executives. As is typical for most corporations, payment of base salary is not conditioned upon the achievement of any specific, pre-determined performance targets.

Annual bonus. Our cash bonus program seeks to motivate executives to work effectively to achieve our financial performance objectives and to reward them when objectives are met. The executive bonus payments for Messrs. Moyer, D’Addio, Hamilton and Williams were based upon the Company’s performance and the Company’s attainment of certain strategic goals including new customer acquisition, revenue growth and cash management.

Long-term incentive compensation. We believe that option grants (1) align executive interests with stockholder interests by creating a direct link between compensation and stockholder return, (2) give executives a significant, long-term interest in our success and (3) help retain key executives in a competitive market for executive talent. We do, however, monitor general corporate and industry trends and practices and may in the future, for

14

competitive or other reasons, use other equity incentive vehicles in place of, or in combination with, stock options. For fiscal year 2004 to date, we have continued our stock option program, granting an aggregate of 123,165 options to the named executive officers.

Our stock option plans authorize the Compensation Committee to grant stock options to directors, executives and employees. Option grants are made from time to time to executives whose contributions have or will have a significant impact on our long-term performance. Generally, options granted to executives vest in equal annual installments over a period of three years and expire five to ten years from the date of grant.

Compensation of the Chief Executive Officer. The Chief Executive Officer’s compensation plan for fiscal years 2001 through 2003 consisted primarily of base salary, a bonuses, and option grants. In determining the compensation paid to Brett A. Moyer, who served as our President and Chief Executive officer beginning September 30, 2002, the Committee utilized each of the components described above for executive officers. In this regard, the Committee established Mr. Moyer’s salary level for 2003 based on its evaluation of not only our financial performance, but also on the Committee’s evaluation of Mr. Moyer’s potential strategic and leadership abilities in planning for and leading us during fiscal 2004. The Committee granted options to Mr. Moyer in 2003 as a motivation for future performance. While the compensation for Mr. Moyer was based on our performance, it was not tied to specific performance objectives.

|

| Submitted by: |

|

| |

| William B. Coldrick |

| Timothy E. Mahoney |

15

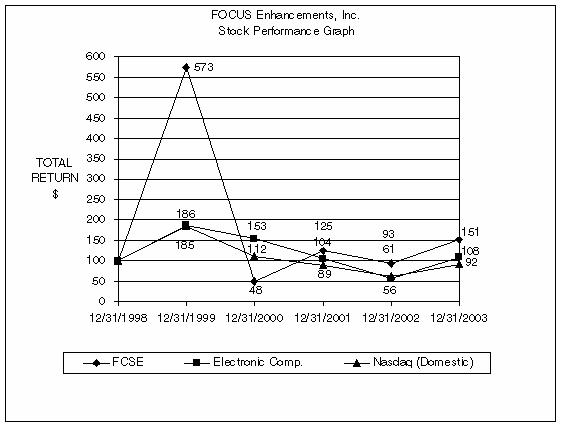

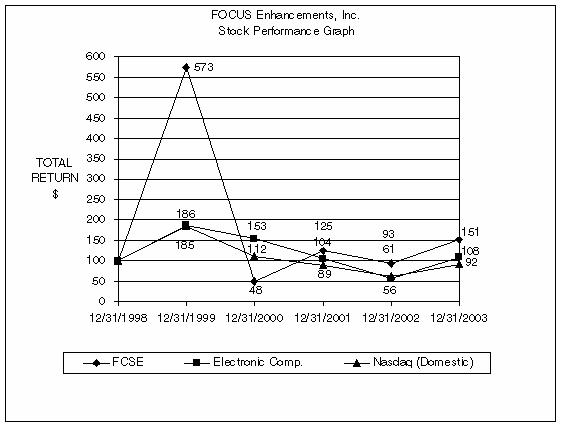

COMPANY STOCK PRICE PERFORMANCE GRAPH

The graph below compares the five-year cumulative total stockholder return on our common stock with the cumulative total return on the Nasdaq US Market Index and the Nasdaq Electronic Components Index for the last five fiscal years ended December 31, 2003, assuming an investment of $100 at the beginning of that five-year period and the reinvestment of any dividends. No dividends were declared or paid by Focus during the five-year period.

The comparisons in the graph below are based upon historical data and are not indicative of, nor intended to forecast, future performance of our common stock.

CERTAIN RELATIONSHIPS

What relationships exist between Focus and its directors and officers and entities with which any director or officer is affiliated? What is the nature of those relationships?

vFinance.com, Inc.

Timothy Mahoney, who is a Focus director, is the Chairman and COO of vFinance, Inc., the parent of vFinance Capital L.C. and a partner of Union Atlantic L.C. For the year ended December 31, 2001, the Company issued to vFinance Capital L.C. 243,833 shares of its common stock in lieu of investment banking fees in connection with the acquisition of Videonics in January 2001, and 79,444 shares of our common stock were issued to vFinance, Inc. for payment under and settlement for the termination of a Management and Financial Consulting Agreement between Focus and Union Atlantic L.C. and vFinance Capital L.C. In addition, vFinance and its affiliates were issued 47,055 shares of common stock pursuant to a price protection provision. Had vFinance, Inc. or any of its affiliates publicly sold its shares of common stock in the market at a price below $1.03, Focus would have been required to issue to vFinance, Inc. additional unregistered shares to make up any shortfalls between the market price at the time the shares were sold and $1.03. At December 31, 2002, the price protection provision had expired and the Company was under no further obligations to vFinance. Consequently, vFinance, Inc. returned the 47,055 shares of common stock in the first quarter of 2003.

16

In addition, pursuant to an agreement dated December 27, 2001, vFinance received a warrant to purchase 25,000 shares of the Company’s common stock at a per share exercise price of $1.54 per share. For such compensation, vFinance provided the Company with non-exclusive financial advisory services for a period of 12 months.

During the quarter ended March 31, 2002, in connection with its efforts to find investors in the private placement completed on January 11, 2002, vFinance Investments Inc. received from us $275,000 in cash and a warrant to purchase 123,690 shares of our common stock at $1.36 per share.

During the quarter ended December 31, 2002, in connection with its efforts to find investors in the private placement completed on November 25, 2002, vFinance Investments Inc. received from us $70,000 in cash and warrants to purchase 40,000 shares of our common stock at $1.20 per share.

In February 2003, the Company engaged vFinance Investments, Inc. to assist the Company with the preparation of a strategic business plan. In connection with the preparation of the business plan, the Company incurred consulting expenses of $50,000 during 2003.

In connection with its efforts to find investors for the Company in the private placement completed on July 2, 2003, vFinance Investments Inc. received $137,500 and out-of-pocket expenses, including legal fees, of $27,500. All such cash payments to vFinance Investments Inc., were recorded as reductions of the proceeds received from the private placements.

The Company also engaged vFinance Investments Inc., from July 1, 2003 to May 31, 2004, to act as the Company’s exclusive financial advisor, for the purpose of merger and acquisition services. In connection with the acquisitions of COMO Computer & Motion in February 2004 and Visual Circuits Corporation in May 2004 the Company incurred aggregate consulting expenses of $279,000 and issued 110,000 shares.

Carl Berg

Carl Berg, a Focus director and stockholder and previous director and stockholder of Videonics Inc., had a $1,035,000 loan outstanding to Videonics Inc., which we assumed on January 16, 2001 in connection with the merger. This unsecured loan accrued interest at 8% per year, and was due on January 16, 2002. Accrued interest was payable at maturity. On May 7, 2001, Focus and Mr. Berg agreed to the conversion of $1,035,000 of the outstanding principal balance and all accrued interest into 1,012 shares of Series B Preferred Stock.

Additionally, Carl Berg loaned us $2,362,494 on October 26, 2000, to collateralize a $2,362,494 bond posted in connection with the CRA Systems, Inc. litigation. The promissory note had a term of three years and bears interest at a rate of prime plus 1% (5.00% at December 31, 2003). Interest earned on the restricted collateral deposit was payable to Mr. Berg. The interest payable by us to Mr. Berg was reduced by the amount of interest earned on the restricted collateral deposit. The principal amount of the note was originally due on October 26, 2003, but was amended on November 25, 2003, to provide for an extension of the maturity date to January 25, 2005, with interest to be paid quarterly. Under certain circumstances, including at the election of Mr. Berg and Focus, the promissory note and any accrued and unpaid interest is convertible into shares of the Focus common stock at a conversion price of $1.25, which represented the average closing bid and ask price of our common stock on the day preceding the agreement. The promissory note is secured by a security agreement in favor of Mr. Berg granting him a first priority security interest, over substantially all of our assets. On May 7, 2001, $46,000 of outstanding interest due under the note was converted into 38 shares of Series B Preferred Stock. In February 2002, in connection with the settlement of the CRA Systems Inc. case, the bond was liquidated and excess proceeds of $145,000 were used to pay down a portion of this note. Prior to the conversion on March 19, 2004 of Mr. Berg’s principal and accrued interest into common and preferred stock, we had unpaid principal and accrued interest due under the note totaling approximately $2,509,000.

On February 28, 2001,Carl Berg agreed to loan us $2.0 million to support our working capital needs, bearing interest at a rate of prime plus 1%. The principal amount of the note will be due at the end of its term, with interest to be paid quarterly. On April 24, 2001, the note was amended to provide that under certain circumstances,

17

including at the election of Mr. Berg and Focus, the promissory note and any accrued and unpaid interest is convertible into shares of the Company’s preferred stock at a conversion price of $1,190 per share which represented 1,000 (each share of preferred is convertible into 1,000 shares of common) multiplied by 125% of the trailing 30-day average of the Company’s common stock ending April 23, 2001. The promissory note is secured by a security agreement in favor of Mr. Berg granting him a security interest in first priority over substantially all of our assets. On May 7, 2001, Focus and Mr. Berg agreed to the conversion of $1,000,000 of the outstanding principal balance and $16,000 of accrued interest into 854 shares of Series B Preferred Stock. On November 25, 2003, the note was amended to provide for an extension of the maturity date for the remaining principal balance of $1,000,000, from the maturity date of October 26, 2003 to January 25, 2005. Prior to the conversion on March 19, 2004 of Mr. Berg’s principal and accrued interest into common and preferred stock, we had principal and accrued interest due under the note totaling approximately $1,160,000.

On June 29, 2001,we issued a convertible promissory note to Mr. Berg in the amount up to $650,000 to support the Company’s working capital needs. The promissory note had an original due date of January 3, 2003 which was extended to January 25, 2005 and bears interest at a rate of prime plus 1%. The principal amount of the note will be due at the end of its term, with interest to be paid quarterly. The note provides that at the election of Mr. Berg and Focus, the promissory note and any accrued and unpaid interest is convertible into shares of the Company’s Series C Preferred Stock at a conversion price of $1,560 per share which represented 1,000 (each share of preferred is convertible into 1,000 shares of common) multiplied by 125% of the trailing 30-day average of Focus’ common stock ending June 28, 2001. The promissory note is secured by a security agreement in favor of Mr. Berg granting him a security interest in first priority over substantially all of our assets. Prior to the conversion on March 19, 2004 of Mr. Berg’s principal and accrued interest into common and preferred stock, we had principal and accrued interest due under the note totaling approximately $744,000.

Additionally, in December 2002, Mr. Berg provided Samsung Semiconductor Inc., the Company’s contracted ASIC manufacturer, with a personal guarantee to secure the Company’s working capital requirements for ASIC purchase order fulfillment. Mr. Berg agreed to provide the personal guarantee on the Company’s behalf without additional cost or collateral, as Mr. Berg maintains a secured priority interest in substantially all the Company’s assets. At May 31, 2004, the Company owed Samsung $129,000, under net 30 terms.

At December 31, 2003, the Company owed Carl Berg approximately $4.4 million in principal and accrued interest on the various aforementioned notes. In September 2003, Mr. Berg agreed to convert such debt and accrued interest into preferred and common stock on conversion terms agreed to more than two years ago. On March 19, 2004, Mr. Berg converted his approximately $4.4 million of principal and accrued interest into common and preferred stock. This conversion resulted in the issuance of 2,173,193 shares of common stock and 840 shares of Series B preferred stock and 417 shares of Series C preferred stock, which are convertible into an additional 840,000 and 417,000 shares of common stock, respectively.

All material affiliate transactions and loans between Focus and its officers, directors, principal stockholders or other affiliates are made or entered into on terms that are no less favorable to such individuals than would be obtained from, or given to, unaffiliated third parties and are approved by a majority of the board of directors who do not have an interest in the transactions and who have access, at Focus’ expense to Focus’ or independent legal counsel.

18

DISCUSSION OF PROPOSALS RECOMMENDED BY THE BOARD OF DIRECTORS

PROPOSAL 1:

ELECTION OF DIRECTORS

Our Bylaws provide that the number of directors of Focus shall be determined by resolution of the Board of Directors but in no event shall be less than three. The number of directors is currently set at seven (7). We are currently seeking to add one more independent board member.

The Board of Directors recommends the election as directors the nominees listed below, to hold office for the terms indicated and until their successors are elected and qualified or until their earlier death, resignation or removal. Messrs. Berg and Jasper are being nominated for three-year terms. The person named as “Proxy” in the enclosed form of proxy statement will vote the shares represented by all valid returned proxies in accordance with the specifications of the stockholders returning such proxies. If at the time of the Annual Meeting of Stockholders that the nominee named below should be unable to serve, which event is not expected to occur, the discretionary authority provided in the proxy statement will be exercised to vote for such substitute nominee or nominees, if any, as shall be designated by the Board of Directors.

Our full Board of Directors acts as the nominating committee. A shareholder who desires to propose an individual for consideration by the Board of Directors as a nominee for director should submit a proposal in writing to the Secretary of Focus in accordance with Section 7.A. of Focus’ Bylaws. See “How can shareholders nominate directors?” Nominations for this year’s meeting were due June 18, 2004, ten days from the date of the announcement of our annual meeting.

The following sets forth the name and age as of June 11, 2004 of the nominee for director and the term he has been nominated to serve:

| | | | |

Name

| | Age

| | Term to Expire

|

Carl E. Berg | | 66 | | 2007 |

N. William Jasper, Jr. | | 56 | | 2007 |

There is no family relationship between any director or executive officer of Focus. For a complete discussion of the background of the nominee for director, see “What is the background of our executive officers and directors?” on page 4.

The following directors are continuing in office pursuant to their terms as indicated and are not up for election this year:

| | | | |

Name

| | Age

| | Term to Expire

|

Tommy Eng | | 45 | | 2005 |

William B. Coldrick | | 61 | | 2006 |

Michael L. D’Addio | | 59 | | 2006 |

Brett A. Moyer | | 46 | | 2006 |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE NOMINEES FOR DIRECTOR.

19

PROPOSAL 2:

APPROVAL OF THE 2004 STOCK INCENTIVE PLAN

Proposed Plan

On May 27, 2004, our Board of Directors adopted, subject to shareholder approval, the 2004 Stock Incentive Plan. Pursuant to the incentive plan, 2,452,000 shares will be available for issuance under the plan and awards can be made by granting options or issuing restricted stock. The incentive plan is subject to the approval by the affirmative vote of holders of a majority of the votes cast at the meeting.

A copy of the 2004 Stock Incentive Plan is attached as Appendix A.

Our Board of Directors believes that the proposed plan is in the best interests of Focus and our shareholders for the reasons stated below. Therefore, the Board unanimously recommends a vote “for” approval of the 2004 Stock Incentive Plan.

Reasons for the Proposed Plan

Additional Shares. The primary purpose of the proposed plan is to ensure that Focus will have a sufficient reserve of common stock available under the Plan to provide eligible employees, officers and directors of Focus with continuing opportunity to acquire a proprietary interest in Focus and to align their interests with Focus shareholders. The incentive plan will permit the continuation of option awards as well as restricted stock awards (discussed later), which provide long-term incentives to the Plan’s participants. Without this new plan, we only have approximately 421,000 shares remaining under our existing plans, which we estimate to be depleted during 2004. We believe stock incentives help us compete for, motivate and retain executives and other key employees. Furthermore, the value of any award is dependent solely on appreciation in the market value of our common stock, which in turn generates value for stockholders.

Furthermore, since our shareholders approved an amendment to our 2002 Non-Qualified Stock Option Plan in December 2003, we have been involved in the following two acquisitions:

| | • | Visual Circuits Corporation.On January 27, 2004, we agreed to acquire certain assets and assume certain liabilities of Visual Circuits. The transaction was completed on May 28, 2004. |

| | • | COMO Computer & Motion.In February 2004, we entered into an agreement to purchase all the outstanding stock of COMO Computer & Motion GmbH (“COMO”), a corporation, located in Kiel, Germany from its two shareholders. The transaction was completed on February 27, 2004. |

These acquisitions have increased our employee base by 29 people. In addition, we have added an aggregate of six employees related to compliance and our investment in Ultra Wideband technology.

Stock Awards. We believe that the ability to issue restricted stock as well as options pursuant to the plan will provide us with added flexibility in compensating our employees. In addition, such restricted stock could be used to compensate our board of directors.

Recently, there has been a trend towards granting restricted stock. Some have argued that one advantage of restricted stock is it is better at motivating employees to think and act like owners. When a restricted stock award vests, the employee who received the restricted stock becomes an owner of the company and has a vested interest in such grant.

Furthermore, because of the cost of restricted stock awards, companies will often grant a lower number of awards compared to options, thereby decreasing dilution to existing shareholders.

Finally, anticipated changes in the manner in which companies are required to account for stock options may also make it more desirable for public companies to issue restricted stock rather than options. Currently, the Financial Accounting Standards Board (FASB) does not require companies to account for options as an expense, but allows companies the choice of either including the amount of the option expense in their financial statements or disclosing the option expense amount in the notes to their financial statements. We currently include the amount of option expense as a pro forma disclosure in the notes to our financial statements. However, FASB has indicated that

20

it will require companies to account for stock options as a compensation expense that must be subtracted from earnings. This change in accounting treatment could have a significant effect on our earnings. FASB’s proposal does have significant opposition in Congress and it is difficult to predict when, if ever, such proposal will be adopted. A number of companies have determined to expense options when granted and/or eliminate options and make future awards in restricted stock. Having the ability to issue restricted stock pursuant to the plan will provide us with the ability to remain competitive in attracting talented employees.

Possible Dilutive Effects of the Option Plan

The common stock to be issued upon the exercise of options awarded under the plan may either be authorized but unissued shares of our common stock or shares of our common stock purchased in the open market. In that Focus shareholders do not have preemptive rights, to the extent that we fund the plan, in whole or in part, with authorized but unissued shares, the interests of current shareholders will be diluted upon exercise of such options.

Description of the 2004 Stock Incentive Plan

General. The purpose of the plan is to promote the interests of Focus by providing an inducement to obtain and retain the services of qualified persons.

The plan is administered by the Board of Directors of Focus. The Board of Directors, subject to the provisions of the plan, has the power to interpret the plan, to determine all questions there under, and to adopt and amend any rules and regulations for the administration of the plan as it may deem desirable.