Exhibit 99(C)(2)

PROJECT STRATOSPHERE UPDATE August 22, 2019

DISCLAIMER The following pages contain material provided to the Special Committee of the Board of Directors (the “Special Committee”) of Stein Mart, Inc. (the “Company”) by PJ Solomon, L.P. and its affiliates, including, without limitation, PJ Solomon Securities, LLC (collectively, “PJ Solomon” or “Solomon”) in connection with Project Stratosphere. These materials were prepared on a confidential basis in connection with an oral presentation to the Special Committee and not with a view toward complying with the disclosure standards under state or federal securities laws or otherwise. The information contained in this presentation was based solely on publicly available information or information furnished to PJ Solomon by the Company. PJ Solomon has relied, without independent investigation or verification, on the accuracy, completeness and fair presentation of all such information and the conclusions contained herein are conditioned upon such information (whether written or oral) being accurate, complete and fairly presented in all respects. This presentation includes certain statements, estimates and projections provided by the Company with respect to the historical and anticipated future performance of the Company. Such statements, estimates and projections contain or are based on significant assumptions and subjective judgments made by the Company’s management. None of PJ Solomon, its affiliates or its or their respective employees, directors, officers, contractors, advisors, members, successors or agents makes any representation or warranty in respect of the accuracy, completeness or fair presentation of any information, projections or any conclusion contained herein. PJ Solomon, its affiliates and its and their respective employees, directors, officers, contractors, advisors, members, successors and agents shall have no liability with respect to any information, projections or matter contained herein, or any oral information provided herewith or data any of them generates. The information contained herein should not be assumed to have been updated at any time subsequent to date shown on the first page of the presentation and the delivery of the presentation does not constitute a representation by PJ Solomon that such information will be updated at any time after the date of the presentation. Neither PJ Solomon nor any of its affiliates is an advisor as to legal, tax, accounting or regulatory matters in any jurisdiction. The Company acknowledges that PJ Solomon is an affiliate of Natixis, a global full service commercial and investment bank.

PROCESS UPDATE SINCE LOI SUBMISSION Following the submission of its Letter of Intent (“LOI”, “Reaffirmed Proposal”) on July 24, the Special Committee, advised by PJ Solomon, analyzed and discussed the LOI and decided to grant Kingswood exclusivity conditioned upon (i) a higher price per share offer than the $1.10 per share price indicated (ii) further evidence that Kingswood’s $100M fundraising would be successful PJ Solomon spoke with M2O (Kingswood’s fund placement agent) and learned the fundraising was going well and targeting a mid-late August close Additionally, PJ Solomon negotiated with Kingswood and on July 30, Kingswood submitted an updated LOI (“Updated LOI”) increasing the purchase price to $1.15 per share Satisfying the Special Committee’s two conditions, Kingswood and Stratosphere executed an Exclusivity Agreement on July 31, which grants Kingswood exclusivity until 11:59pm August 31, 2019 (and terminates if Kingswood stops pursuing the transaction or signs a definitive agreement) On August 1, PJ Solomon sent a Foley-prepared draft of the Merger Agreement and Disclosure Schedules, Voting Agreement and Guarantee to Kingswood From August 6-8, Kingswood and its new Operating Partner [Third Party] traveled to Jacksonville to conduct on-site diligence, which included meetings with key management and a store visit Following the on-site diligence meetings, Kingswood hired several advisors including Goodwin Procter (Legal), Aon (Insurance & Benefits), Alix Partners (Operational) and A&G (Real Estate) ? These advisors have been active in the data room and are providing supplemental document requests Additionally, Kingswood has narrowed down its financing process to five ABL providers (RBC, PNC, Fifth Third, BAML, JPM) and two FILO / Term Loan providers (Great American, Pathlight) ? PJ Solomon (with the Special Committee’s permission) also granted Kingswood access to Wells Fargo and Gordon Brothers and is inviting them to defend their incumbent position as the current ABL / FILO provider

PROCESS UPDATE SINCE LOI SUBMISSION (CONT’D) On August 22, PJ Solomon spoke with Kingswood, who mentioned the diligence process has been going well so far. Michael Niegsch, the lead Partner on the deal, provided the following commentary: ? Currently, Kingswood’s main focus is developing a business plan with Alix Partners that anticipates potential savings and opportunities under its ownership ? Before signing a definitive agreement, Kingswood also plans to hire a third-party accounting advisor that would conduct a workpaper review, but anticipates it would be largely confirmatory in nature ? With respect to the Merger Agreement (and related transaction documents), Goodwin Procter (Kingswood’s legal advisor) has specialists reviewing the data room and the Merger Agreement to provide a fulsome markup next week ? The financing process has been going well, but Kingswood anticipates keeping the incumbent lenders (Wells Fargo and Gordon Brothers) based on their aggressive borrowing rates, lower closing / pre-payment fees and knowledge of the business ? Jay Stein is current on Kingswood’s progress and remains excited about the potential transaction ? Kingswood’s anticipates its inaugural $100M fundraising will close tomorrow (Friday, August 23)

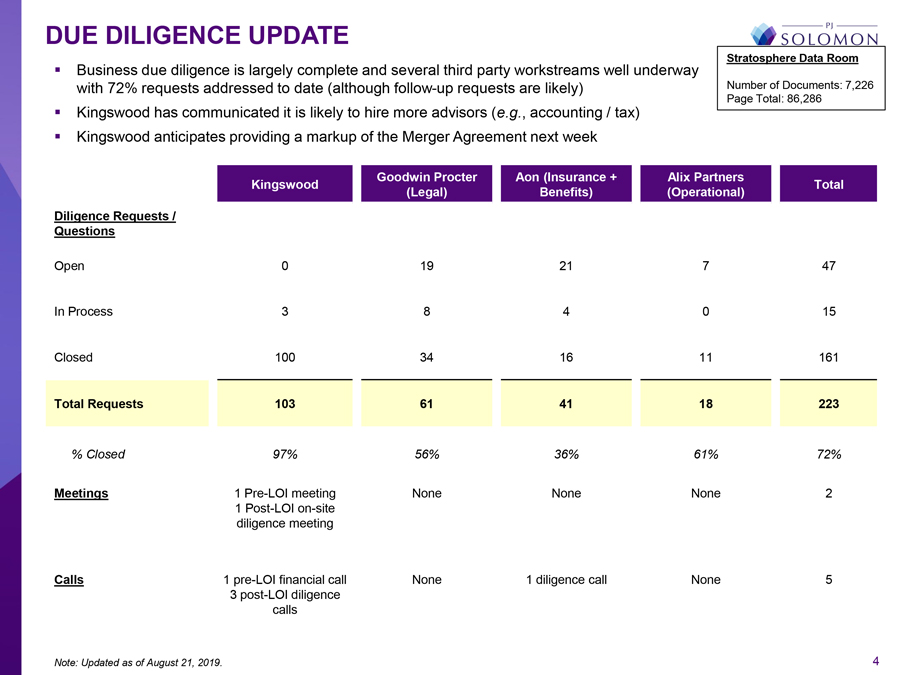

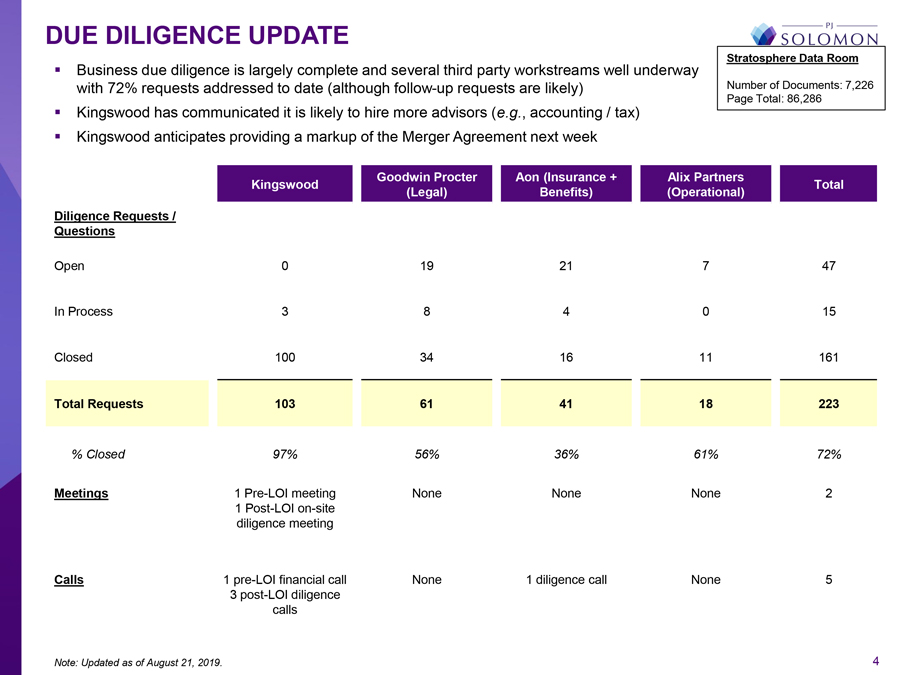

DUE DILIGENCE UPDATE Business due diligence is largely complete and several third party workstreams well underway with 72% requests addressed to date (although follow-up requests are likely) Kingswood has communicated it is likely to hire more advisors (e.g., accounting / tax) Kingswood anticipates providing a markup of the Merger Agreement next week Stratosphere Data Room Number of Documents: 7,226 Page Total: 86,286 Goodwin Procter Aon (Insurance + Alix Partners Kingswood Total (Legal) Benefits) (Operational) Diligence Requests / Questions Open 0 19 21 7 47 In Process 3 8 4 0 15 Closed 100 34 16 11 161 Total Requests 103 61 41 18 223 % Closed 97% 56% 36% 61% 72% Meetings 1 Pre-LOI meeting None None None 2 1 Post-LOI on-site diligence meeting Calls 1 pre-LOI financial call None 1 diligence call None 5 3 post-LOI diligence calls Note: Updated as of August 21, 2019.

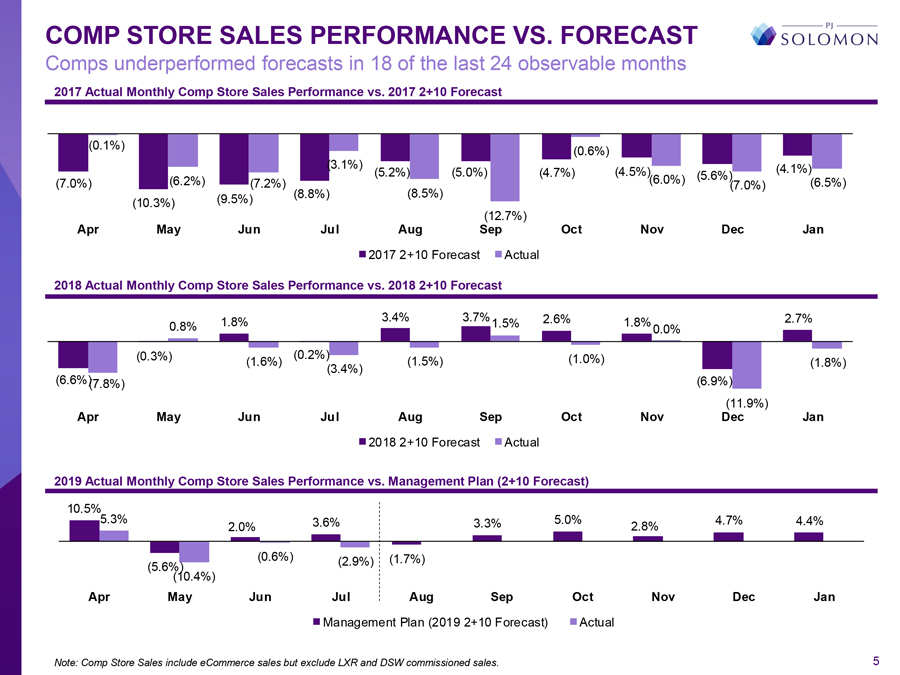

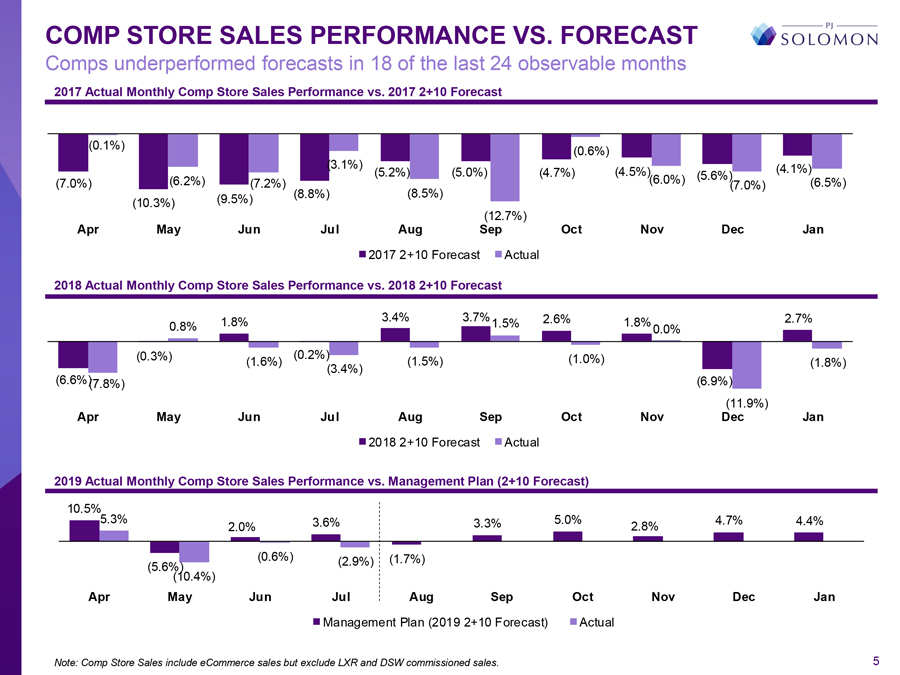

COMP STORE SALES PERFORMANCE VS. FORECAST Comps underperformed forecasts in 18 of the last 24 observable months 2017 Actual Monthly Comp Store Sales Performance vs. 2017 2+10 Forecast (0.1%) (0.6%) (3.1%) (5.2%) (5.0%) (4.7%) (4.5%) (5.6%) (4.1%) (7.0%) (6.2%) (7.2%) (6.0%) (7.0%) (6.5%) (8.8%) (8.5%) (10.3%) (9.5%) (12.7%) Apr May Jun Jul Aug Sep Oct Nov Dec Jan 2017 2+10 Forecast Actual 2018 Actual Monthly Comp Store Sales Performance vs. 2018 2+10 Forecast 1.8% 3.4% 3.7% 1.5% 2.6% 1.8% 2.7% 0.8% 0.0% (0.3%) (1.6%) (0.2%) (1.5%) (1.0%) (1.8%) (3.4%) (6.6%) (7.8%) (6.9%) (11.9%) Apr May Jun Jul Aug Sep Oct Nov Dec Jan 2018 2+10 Forecast Actual 2019 Actual Monthly Comp Store Sales Performance vs. Management Plan (2+10 Forecast) 10.5% 5.3% 2.0% 3.6% 3.3% 5.0% 2.8% 4.7% 4.4% (5.6%) (0.6%) (2.9%) (1.7%) (10.4%) Apr May Jun Jul Aug Sep Oct Nov Dec Jan Management Plan (2019 2+10 Forecast) Actual Note: Comp Store Sales include eCommerce sales but exclude LXR and DSW commissioned sales. 5