FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of October, 2014

Commission File Number 1-11080

THE ICA CORPORATION

(Translation of registrant's name into English)

Blvd. Manuel Avila Camacho 36

Col. Lomas de Chapultepec

Del. Miguel Hidalgo

11000 Mexico City

Mexico

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F.....x.... Form 40-F.........

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ...... No...x...

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ________

Empresas ICA Announces Unaudited

Third Quarter 2014 Results

October 24, 2014, Mexico City — Empresas ICA, S.A.B. de C.V. (BMV and NYSE: ICA),the largest infrastructure and construction company in Mexico, announced today its unaudited results for the third quarter of 2014, which have been prepared in accordance with International Financial Reporting Standards.

The results of the third quarter of 2013 havebeen restated in accordance with IFRS 5, “Non-current Assets Held for Sale and Discontinued Operations,” as a result of the strategic partnership for social infrastructure projects announced on January 22, 2014 between ICA and CGL.

Summary for the third quarter

The results of the third quarter of 2014 show significant increases in revenues, operating income and Adjusted EBITDA. Revenues increased 13% to Ps. 8,752 million as compared to 3Q13, principally as the result of growth in the Concessions and Airports segments. Operating Income was Ps. 1,112 million, an increase of 75%, and Adjusted EBITDA reached Ps. 1,501 million, an increase of 51% as compared to 3Q13. As a result of this performance, the Adjusted EBITDA margin reached 17.2%. Backlog rose as a result of the award of the Monterrey VI aqueduct project, among others.

During the first nine months of 2014, ICA delivered sustained growth in revenues, margins, and backlog. The Construction segment showed a clear recovery as a result of the favorable performance of the works contracted as well as the results of Facchina Construction Group (FCG). The Concessions segment delivered strong increases in performance indicators as a result of the high rates of growth associated with putting projects into operation. The Airports segment contributed to the improvement in results with increases in both aeronautical and non-aeronautical revenues.

Construction backlog grew 11% to Ps. 34,134 million, as compared to December 31, 2013, reversing the decreasing trend of the first two quarters.

For more information, please contact: Ana Paulina Rubio ana.rubio@ica.mx Elena Garcia elena.garcia@ica.mx relacion.inversionistas@ica.mx +(5255) 5272 9991 x 3608 | Gabriel de la Concha gabriel.delaconcha@ica.mx Corporate Finance Director and Treasurer Victor Bravo victor.bravo@ica.mx Chief Financial Officer In the US: Daniel Wilson, Zemi Communications +(1212) 689 9560 dbmwilson@zemi.com |

Backlog of non-consolidated subsidiaries and joint ventures also rose 128% to Ps. 25,216 million. Long-term contracts for mining and other services were Ps. 4,551 million.

The traffic volumes for the concessioned highways rose 21% as a result of the increase in most of the operating projects.

The Construction segment contributed 72% of consolidated revenues and 30% of Adjusted EBITDA in 3Q14.

Concessions contributed 15% of revenues and 36% of Adjusted EBITDA.

Airports contributed 13% of revenues and 34% of Adjusted EBITDA.

As of September 30, 2014, Concessions participated in 18 projects: ten highways, five water projects, two social infrastructure projects, and a port. Of these, nine were in operation, and nine were in the construction phase.

Consolidated net loss was Ps. 519 million in 3Q14, and the loss of the controlling interest was Ps. 769 million, or Ps. 1.28 per share or US$ 0.39 per ADS. The loss principally resulted from the exchange loss included in the comprehensive financing cost.

| ICA 3Q14 Results | www.ir.ica.mx | 2 of 25 |

Construction

Construction revenues were Ps. 6,133 million in 3Q14, 2% above the level of the prior year period. FCG contracts, the Mitla-Tehuantepec highway, and the Barranca Larga – Ventanilla highway made the largest contributions to revenues. For the first nine months of 2014, revenues increased 15% compared to the same period the previous year.

Operating income for the quarter was Ps. 349 million. Adjusted EBITDA was Ps. 458 million, with an Adjusted EBITDA margin of 7.5%. Operating income for the first nine months of 2014 increased 48% compared to the prior year period, as a result of a significant reduction in expenses.

Construction debt decreased by Ps. 2,095 million from December 31, 2013, to Ps. 6,312 million as of September 30, 2014, which represents a reduction of 25%.

| ICA 3Q14 Results | www.ir.ica.mx | 3 of 25 |

Construction Backlog

Construction backlog was Ps. 34,134 million as of September 30, 2014, equivalent to 20 months work at the average rate for the 2014. Backlog was above the levels at the end of 2013.

New contracts and net contract increases were Ps. 10,716 million, including the Monterrey VI aqueduct, the Churubusco-Xochiaca water tunnel, and the tunneling contract for the Mexico City – Toluca train.

Projects outside of Mexico were 18% of backlog, in line with the initiative to increase geographic diversification.

Contracted Mining and Other Services

As of September 30, 2014, ICA also had Ps. 4,551 million in long-term mining and other services contracts, principally in San Martín Contratistas Generales.

Concessions

| ICA 3Q14 Results | www.ir.ica.mx | 4 of 25 |

The portfolio of concessioned projects continues to strengthen with the start of operations of the Nuevo Necaxa - Tihuatlan highway and opening the new Tintal – Playa del Carmen segment of the Mayab tollroad. In addition, the ramp-up in operations of the recently completed highways is generating high rates of traffic growth.

Concessions revenues increased 47% to Ps 1,254 million, as compared to 3Q13. The operating concessions were the principal contributors to the growth in revenues.

Adjusted EBITDA increased 151% to Ps. 543 million, with an Adjusted EBITDA margin of 43.3%. For the first nine months of 2014, the margin was 48.3%.

Debt was Ps. 15,714 million as of September 30, 2014, an increase of 11% as compared to December 31, 2013, as a result of disbursements for projects under construction; 73% of the total debt is associated with projects in operation, and 27% with projects under construction.

The segment’s cash balances increased to Ps. 2,635 million as of September 30, 2014 from Ps. 2,164 million at December 31, 2013.

Average Daily Traffic Volumes (ADTV) on consolidated highways increased 21% in 3Q14 and 57% in the first nine months of 2014, principally because of increased traffic on the Rio de Los Remedios-Ecatepec (+30%) and Rio Verde-Ciudad Valles (+24%). In addition, traffic for the Acapulco Tunnel rose 12%, and the La Piedad Bypass increased 13%.

| ICA 3Q14 Results | www.ir.ica.mx | 5 of 25 |

Operating Concessions Information

| ICA 3Q14 Results | www.ir.ica.mx | 6 of 25 |

Airports

Terminal passenger traffic increased 9% to 3.9 million in 3Q14; domestic traffic and international traffic each increased 9%. Sixteen new domestic routes and two international routes opened in 3Q14, as a result of the combined efforts of OMA and the airlines to develop new routes.

Total revenues rose 24% to Ps. 1,065 million. Aeronautical revenues rose 13% principally as a result of traffic growth; while non-aeronautical revenues rose 8% as a result of commercial and diversification initiatives.

Adjusted EBITDA increased 20% to Ps. 512 million in 3Q14, with an Adjusted EBITDA margin of 48.1%, and increased 18% in the first nine months of 2014 to Ps. 1,375 million.

Debt was Ps. 4,844 million as of September 30, 2014, an increase of Ps. 1,741 million as compared to December 31, 2013. The increase in debt reflects the placement in 2Q14 of Ps. 3,000 million in notes due 2021; the proceeds were used to prepay Ps. 1,300 million in OMA notes due 2016 and to finance investment commitments included in OMA’s Master Development Plan and strategic investments.

The Airports segment includes Grupo Aeroportuario del Centro Norte (known as OMA), Aeroinvest, and Servicios de Tecnología Aeroportuaria (SETA). The earnings report of GACN, which is the operating company in the Airports segment, can be found athttp://ir.oma.aero. Those results differ from the ones presented here as a result of consolidation effects.

| ICA 3Q14 Results | www.ir.ica.mx | 7 of 25 |

Consolidated Results for the Third Quarter and First Nine Months of 2014

Revenues increased 13% to Ps. 8,752 million in 3Q14. In the first nine months of 2014, revenues grew 18%, with strong growth in all three principal business segments.

Cost of sales increased 6% in 3Q14 and 15% in the first nine months of 2014, as a result of the change in the composition of revenues generated by each segment. Cost of sales includes interest expense on financed projects in Concessions during the construction phase.

Selling, general, and administrative expenses were Ps. 899 million in 3Q14, equivalent to 10% of revenues. In the first nine months of 2014, SG&A decreased 9% as compared to the same period of 2013, as a result of cost reduction initiatives.

Other income (loss) was a loss of Ps. 57 million in 3Q14.

Operating income increased 75% to Ps. 1,112 million in 3Q14, principally because of the increase in traffic on operating concessions and the continued growth of Airports aeronautical and non-aeronautical revenues. For the first nine months of 2014, operating income increased 45% to Ps. 3,354 million, with an operating margin of 13%.

Adjusted EBITDA increased 51% to Ps. 1,501 million in 3Q14, principally because of the strong increases in Concessions and Airports. The Adjusted EBITDA margin reached 17.2% in 3Q14. For the first nine months of the year, Adjusted EBITDA increased 33% to Ps. 4,627 million with an EBITDA margin of 17.9%.

Comprehensive financing cost was Ps. 2,021 million in 3Q14, principally because of interest expense of Ps. 1,395 million and an exchange loss of Ps. 486 million. Interest expense includes the cost of early termination of derivatives related to the La Piedad Bypass and the Rio Verde – Ciudad Valles highway project financings. For the first nine months of the year, the comprehensive financing cost reached Ps. 4,279 million.

| ICA 3Q14 Results | www.ir.ica.mx | 8 of 25 |

Share of earnings of affiliated companies and joint ventures increased to Ps. 135 million from Ps. 120 million in 3Q13 and to Ps. 332 million in the first nine months of 2014. The annexes to this report include supplementary information on the performance of affiliated companies and joint ventures.

Discontinued operations include the after-tax operating results of the social infrastructure projects.

Consolidated net loss was Ps. 519 million in 3Q14 and Ps. 260 million in the first nine months of 2014.

Net loss of the controlling interest was Ps. 769 million in 3Q14. The loss was Ps. 1.28 per share and US$ 0.39 per ADS. The net loss of the controlling interest was Ps. 942 million, or Ps. 1.54 per share and US$ 0.46 per ADS.

Investments

During 3Q14, ICA investments totaled approximately Ps. 3,052 million. It is important to note that the investments in Concessions and other projects are expected to generate revenues from the operation of the assets upon completion of construction and start of operations.

ICA participates across the entire cycle of developing infrastructure projects: including formulation, engineering, structuring and financing, construction, operation, and management as part of a portfolio of assets. This is a dynamic process that implies monetizing assets that are in the operating stage, while arranging new projects under development.

Debt

Total debt was Ps. 47,710 million as of September 30, 2014, a 20% increase as compared to December 31, 2013, principally because of the effect of depreciation of the peso against the U.S. dollar on foreign-currency denominated debt.

As part of the capital recycling process for mature assets, the concessionaires for the Rio Verde – Ciudad Valles and La Piedad Bypass placed Notes (Certificados Bursátiles) for Ps. 3,800 million, in order to take advantage of the 15-year increase in the term of the La Piedad concession and a rate increase authorized for Rio Verde – Ciudad Valles. The proceeds were used to repay existing project debt.

Total cash and cash equivalents as of September 30, 2014 was Ps. 7,247 million, an increase of Ps. 2,072 million compared to December 31, 2013. Restricted cash was Ps. 2,533 million. Net debt was Ps. 40,463 million as of September 30, 2014.

| ICA 3Q14 Results | www.ir.ica.mx | 9 of 25 |

Construction accounted for 13% of total debt, and consisted principally of short-term working capital credit lines required to carry out the work program. The source of payment of these obligations is client payments.

Concessions accounted for 33% of total debt. Such debt consisted principally of structured project finance credit facilities. This debt is expected to be gradually amortized as resources are generated from project operation.

Corporate and other debt represented 44% of total debt, and consisted principally of the three U.S. dollar-denominated notes issued by the parent company. The source of payment for these debts are dividend payments from ICA subsidiaries, fees, and other cash generated by operating companies and paid to the parent.

Airports accounted for 10% of total debt.

35% of debt as of September 30, 2014 was bank debt, and 65% was securities debt. Short-term debt represented 12% of the total, compared to 25% as of December 31, 2013. 51% of debt was denominated in foreign currency, principally U.S. dollars compared to the same period the previous year.

ICA’s policy is to contract financing for projects in the same currency as the source of repayment. In addition, the Company uses financial derivatives to reduce exchange and interest rate risks. ICA expects to be active in the capital markets to finance or refinance infrastructure projects that generate value for the Company.

Conference Call Invitation

ICA’s conference call will be held on Monday, October 27, at 11:00 am Eastern Time (9:00 am Mexico City time). To participate, please dial toll-free(855) 826-6151 from the U.S. or+1 (559) 549-9841 internationally. The conference ID is17748544. The conference call will beWebcast live through streaming audio and available on ICA’s website at http://ir.ica.mx.

| ICA 3Q14 Results | www.ir.ica.mx | 10 of 25 |

A replay will be available until November 3, 2014 by calling toll-free(855) 859-2056 from the U.S. or+1 (404) 537-3406 internationally, again using conference ID17748544.

| ICA 3Q14 Results | www.ir.ica.mx | 11 of 25 |

Consolidated Financial Statements

| ICA 3Q14 Results | www.ir.ica.mx | 12 of 25 |

| ICA 3Q14 Results | www.ir.ica.mx | 13 of 25 |

| ICA 3Q14 Results | www.ir.ica.mx | 14 of 25 |

| ICA 3Q14 Results | www.ir.ica.mx | 15 of 25 |

| ICA 3Q14 Results | www.ir.ica.mx | 16 of 25 |

Annexes: Complementary Information

Construction Backlog

Restated 2013 Results

FCG Consolidation

| ICA 3Q14 Results | www.ir.ica.mx | 17 of 25 |

Concessions Portfolio

| ICA 3Q14 Results | www.ir.ica.mx | 18 of 25 |

Non-Consolidated Affiliates and Joint Ventures

Construction

This includes the results of ICA Fluor (ICA’s share 51%), Grupo Rodio Kronsa (50%), and the construction companies for the Nuevo Necaxa-Tihuatlán highway (60%), the El Realito aqueduct (51%), and the Atotonilco WTP (50%), among others.

Non-Consolidated Backlog

Non-consolidated backlog reached Ps. 25,216 million as of September 30, 2014.

| ICA 3Q14 Results | www.ir.ica.mx | 19 of 25 |

Non-consolidated construction affiliates reported new contracts and net contract additions of Ps. 11,367 million in 3Q14, including pipeline maintenance on the Caño Limon oil pipeline in Colombia, the Acapulco Scenic Bypass, and Line 3 of the Santiago Metro in Chile.

| ICA 3Q14 Results | www.ir.ica.mx | 20 of 25 |

Concessions

Includes principally the concessions for the Nuevo Necaxa-Tihuatlán highway (with ICA holding a 50% interest), the Mitla-Tehuantepec highway (60%), the El Realito aqueduct (51%), the Querétaro Aqueduct II (43%), the Lázaro Cárdenas Port operator (5%), and Proactiva Medio Ambiente (49%).

Corporate and Other

Includes principally Actica (ICA’s interest in the company is 50%) and Los Portales in Peru (50%).

| ICA 3Q14 Results | www.ir.ica.mx | 21 of 25 |

Notes and Disclaimer

The unaudited condensed consolidated financial statements of Empresas ICA, S.A.B. de C.V. and subsidiaries have been prepared in accordance with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB) and presented in accordance with IAS 34 “Intermediate Financial Reporting”. These financial statements include all the adjustments, including those of a normal and recurring nature, required for an adequate presentation of the results of operations. Results for interim reporting periods may not be indicative of full year results. As a result, the reading and analysis of these interim financial statements should be done in conjunction with the financial statements for the year ended December 31, 2013, which were also prepared under IFRS.

Unaudited financials: Financial statements are unaudited statements.

Prior period comparisons: Unless stated otherwise, comparisons of operating or financial results are made with respect to the comparable prior-year period, or balances as of December 31, 2013.

Percentage changes:Are calculated based on actual amounts.

Adjusted EBITDA: Adjusted EBITDA is not a financial measure computed under IFRS and should not be considered an indicator of financial performance or free cash flow. We define Adjusted EBITDA as net income of controlling interest plus (i) net income of non-controlling interest, (ii) discontinued operations, (iii) income taxes, (iv) share in net income of affiliates, (v) net comprehensive financing cost, (vi) depreciation and amortization, and (vii) net interest expense included in cost of sales. Our management believes that Adjusted EBITDA provides a useful measure of its performance, supplemental to net income and operating income, because it excludes the effects of financing decisions, non-controlling shareholdings, and other non-operating items. The calculation of Adjusted EBITDA is also provided as a result of requests from the financial community and is widely used by investors in order to calculate ratios and to make estimates of the total value of our company in comparison to other companies. Financial ratios calculated on the base of Adjusted EBITDA are also widely used by credit providers in order to gauge the debt servicing capacity of companies and are relevant measures under one or more of our or our subsidiaries’ financing agreements.

Exchange rate: Amounts in U.S. dollars (US$) are converted at an exchange rate of Ps. 13.3015 per U.S. dollar as of September 30, 2014, Ps. 13.0652 as of December 31, 2013, and Ps. 12.9530 as of September 30, 2013.

Financial Derivative Instruments:ICA enters into financial derivative contracts in the subsidiaries where projects are located solely in order to reduce the uncertainty on the returns on projects. The instruments entered into are established on a notional amount. Interest rate derivatives are used in order to fix maximum financial costs. Exchange rate derivatives are entered into in order to reduce the exchange risk on projects that incur labor and materials costs in a currency different from the currency of the financing of the project, as well as to convert foreign debt into domestic currencies. ICA enters into its financings in the same currency as the source of repayment. ICA has a policy of not entering into derivatives for speculative purposes.

| ICA 3Q14 Results | www.ir.ica.mx | 22 of 25 |

From an accounting perspective, there are two classifications for derivative instruments. “Hedging financial instruments” must meet the specific requirements established in IFRS. Other derivative financial instruments that do not meet IFRS requirements for hedge accounting treatment are designated as trading derivatives.

ICA values all derivatives at fair value. Fair value is based on market prices for derivatives traded in recognized markets; if no active market exists, fair value is based on other recognized valuation methodologies in the financial sector, validated by third party experts, and supported by sufficient, reliable, and verifiable information.

Fair value is recognized in the balance sheet as an asset or liability, in accordance with the rights or obligations derived from the contracts executed and in accordance with accounting norms. For hedging derivatives, changes in fair value are recorded temporarily in other comprehensive income within stockholders’ equity, and are subsequently reclassified to results at the same time that they are affected by the item being hedged. For trading derivatives, the fluctuation in fair value is recognized in results of the period as part of Comprehensive Financing Cost.

Glossary

ADTV:Average Daily Traffic Volume is the number of vehicles that travel the entire length of a highway.

CGL:a wholly-owned subsidiary of the Hunt Companies, Inc., a U.S. developer, investor and manager of real estate assets.

Concessions Revenuesare composed of the following:

Operating revenue from concessions: includes tolls and fee payments from the government for the availability of PPP roads and or tariffs based on traffic volume, according to the type of concession.

Operations and maintenance: revenue from the provision of services for operating and maintaining highways for non-consolidated affiliates.

Financial income: is equal to the financial cost that is capitalized in value of the financial asset constructed.

Construction: the revenue recognized by the concessionaire for costs that are not attributable to the construction company.

| ICA 3Q14 Results | www.ir.ica.mx | 23 of 25 |

FCG:Facchina Construction Group is a heavy civil construction company, with its main markets in the Washington, D.C. metropolitan area and Florida.

PPP:Public-Private Partnership is a legal mechanism that enables a private sector company to provide services to the federal, state, or municipal government clients through fixed term licenses, generally from 20 to 40 years, to finance, construct, establish, operate, and maintain a public means of transportation or communication. The client’s payment consists of a fixed payment for the availability of the highway together with a minimum shadow tariff based on traffic volume.

SPC:Services Provider Contract. 22-year contract for the provision of services to the Ministry of Government, including the construction and operation of social infrastructure.

Analyst coverage

In compliance with the regulations of the Mexican Stock Exchange, the following is the list of analysts that cover ICA’s securities:

| Actinver - Ramón Ortiz Reyes | HSBC - Alexandre Falcao |

| BBVA Bancomer - Francisco Chávez | Intercam - Enrique Mendoza |

| Banorte-Ixe - José Itzamna Espitia | Invex - Ana Hernández |

| Barclays - Pablo Monsiváis | ITAU - Roberto Barba |

| Bank of America Merrill Lynch – Carlos | Monex - Roberto Solano |

Peyrelongue | Morgan Stanley - Nikolaj Lippmann |

| Citi - Dan McGoey | Santander - Toe Matsumura |

| Deutsche Bank - Esteban Polidura | UBS - Marimar Torreblanca |

| GBM - Javier Gayol | Vector - Jorge Plácido |

| ICA 3Q14 Results | www.ir.ica.mx | 24 of 25 |

This report contains projections or other forward-looking statements related to ICA that reflect ICA’s current expectations or beliefs concerning future events. Such forward-looking statements are subject to various risks and uncertainties and may differ materially from actual results or events due to important factors such as changes in general economic, business or political or other conditions in Mexico, Latin America or elsewhere, changes in capital markets in general that may affect policies or attitudes towards lending to Mexico or Mexican companies, changes in tax and other laws affecting ICA’s businesses, increased costs, unanticipated increases in financing and other costs or the inability to obtain additional debt or equity financing on attractive terms and other factors set forth in ICA’s most recent filing on Form 20-F and in any filing or submission ICA has made with the SEC subsequent to its most recent filing on Form 20-F. All forward-looking statements are based on information available to ICA on the date hereof, and ICA assumes no obligation to update such statements.

Empresas ICA, S.A.B. de C.V. is Mexico's largest infrastructure company. ICA carries out large-scale civil and industrial construction projects and operates a portfolio of long-term assets, including airports, toll roads, water systems, and real estate. Founded in 1947, ICA is listed on the Mexican and New York Stock Exchanges.

| ICA 3Q14 Results | www.ir.ica.mx | 25 of 25 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: October 24, 2014 | Empresas ICA, S.A.B. de C.V. /s/ Gabriel de la Concha Guerrero Name: Gabriel de la Concha Guerrero

Title: Chief Investment Officer |

Exhibit 99.1

(Translation) File 151.112.32

NATIONAL BANKING AND SECURITIES COMMISSION

LIC. RAFAEL COLADO IBARRECHE

Chief Supervisor of Issuers

LIC. ANDREA FABIOLA TINOCO H.

Chief Supervisor for Compliance with Stock Market Supervision

Mexico City, October 24th, 2014

RE: 151-2/76211/2009

RODRIGO A. QUINTANA KAWAGE, acting in my capacity as legal representative of Empresas ICA S.A.B. de C.V. (ICA or “the Issuer”) with an address for notifications located at Blvd. Manuel Ávila Camacho No. 36, 15th floor, Col. Lomas de Chapultepec, 11000, Mexico City, Federal District, and being duly registered before the National Banking and Securities Commission (CNBV) respectfully appear and state the following:

On January 20, 2009 I was notified of Order No. 151-2/76211/2009, File 151.112.32 which requested that ICA disclose qualitative and quantitative information regarding ICA’s exposure to financial derivative instruments, whether to increase profitability or to hedge risks, in order to provide investors information that would allow them to understand ICA’s operations with financial derivative instruments.

Based on the foregoing requirement, we state the following:

I. Qualitative and Quantitative Information

i) ICA only contracts hedging instruments in order to reduce the uncertainty on the return on its projects. It is the policy to contract financial instruments at the level of the project in order to mitigate the risks resulting from interest rates and exchange rate fluctuations. From an accounting perspective, the derivative instruments may be classified as hedging instruments or trading instruments, although in all cases the objective is to mitigate risks to which ICA is exposed in its projects. Interest rate hedges are established based on a notional value with the objective to cap maximum financial costs.

Exchange rate hedges are contracted to ensure that the project will have sufficient resources for labor costs and inputs that are incurred in currencies different from those provided by the financing of the project, which is in the same currency as the source of repayment. ICA contracts all derivatives in the subsidiaries where the projects are located.

The contracting of financial derivatives is linked to the financing of projects, as a result of which it is often the case that the counterparty is the same institution that is providing the financing or one of its. These derivatives are non exchange traded (OTC) derivatives.

Our internal control policies state that the contracting of credits (tied to the financing of projects) and the risks inherent in the projects require collaborative analysis by representatives from the Finance, Law, Administration, and Operations areas, prior to any approval. This analysis also includes the use of derivatives to hedge the risks of the financing. Once this analysis has been concluded and documented, the responsibility for contracting derivatives belongs to the Finance area, in accordance with internal control policy.

The hedging instruments are contracted to fix the variable interest rates of the loans. The changes between the fair value of these instruments and the primary positions are compensated at an inverse correlation within a range between 80% and 125%. These instruments are classified as highly effective.

The decision to contract derivative financial instruments is linked to the amount and level of financing for the project. The levels of authorization do not expressly contemplate requiring the authorization of the Corporate Practices or Audit Committees. With respect to approval authorization levels, ICA has documented policies, of which the most important are the following:

| § | The Chief Executive Officer, the Vice President for Finance and Administration, and/or the responsible Finance officer have limits on their authorities to act, whether in terms of amounts or for unusual or non-recurring operations. |

| § | The Chief Executive Officer has the authority to establish limits on the approval authorities of other Officers in terms of amounts or kind of operation. |

| § | In the event that a higher level of authorization is required, the Board of Directors will make the approval, after considering the opinion of the Chief Executive Officer and/or the applicable Committees. |

The derivatives that are contracted do not have margin calls, in accordance with what is negotiated with each counterparty. For those projects that require collateral, the policy is that any required deposits to be made or standby letters of credit be provided at the time of contracting the derivative. This collateral will only be payable in the event of non-compliance.

In accordance with the standards of the International Swaps and Derivatives Association (ISDA), it is agreed that counterparties may act as valuation or calculation agents, in order to determine fair value and required payments.

While there is no formal risk committee, as previously stated various areas participate in the evaluation, administration, and monitoring of project risks (both financial and operational). As regards risk administration, there are documented processes that require the periodic review of risks.

ii) ICA uses the valuations of counterparties (valuation agents) and a price provider authorized by the CNBV in order to calculate the fair value of derivative positions for accounting purposes. The valuations are made using formal, documented methodologies. The calculated values are based on fair value measurements techniques recognized in the financial sector and supported by sufficient, reliable and verifiable information. The data used for the calculations comes from reliable and verifiable sources that reflect market prices.

Fair value is recognized in the balance sheet as an asset or liability, in accordance with the rights or obligations derived from the contracts executed and in accordance with accounting norms. Changes in fair value are recorded in the balance sheet. In addition to the valuations that are received, the pricing provider carries out tests of effectiveness for the derivatives that qualify as hedging instruments from an accounting perspective.

When the transactions comply with all hedging requirements, the Company designates the derivatives as hedging financial instrument at the beginning of the relationship. For fair value hedges, the fluctuation in the fair value of both the derivatives and the open risk position is recognized in results of the period in which it takes place. For cash flow hedges, the effective portions is temporarily recognized in comprehensive income within stockholder’s equity and is subsequently reclassifies to results at the same time that they are affected by the item being hedge; the ineffective portion is recognized immediately in results of the period.

As previously mentioned, occasionally derivatives contracted as hedges do not qualify for accounting treatment as hedging instruments, and are classified as trading derivatives for accounting purposes. In these cases, the fluctuation in fair value on these derivatives is recognized in the results of the period.

iii) ICA has a policy of contracting derivatives instruments at the project level and not contracting instruments that have margin call or additional credit requirements beyond those authorized by the responsible committees at the time of approval. At September 30, 2014 there has been no default on the contracts.

iv) Based on the interest rate and exchange rate projections recently issued by Banco de México, and assuming these rates are maintained, the Issuer does not expect to suffer any material adverse impact from its derivative positions on its results of operations for the fourth quarter of 2014 as a result of additional changes in the peso or changes in interest rates since September 30, 2014.

In accordance with your request for this section, we set forth below the derivatives that matured during the quarter.

| company | instrument | type | | notional | | strike level | to | date

closing | Term |

| | | | | (thousand) | currency | from |

| EMICA | Compra acciones | forward sintético | Cobertura | 368,224,062.52 | MXN | Variable | 23.63 | 20-nov-13 | 0.60 | AÑOS |

The following were the effects of derivative transactions as of September 25, 2014:

derivative

mxp thousand | fair value | income statement | Stockholders' equity |

ICA (Túnel Río Compañía)

(FX swap EUR) | 624 | (207) | (207) |

ICASAL

(TIIE swap) | - | - | 162,150 |

LIPSA

(TIIE swap) | - | 59 | 62,603 |

ICA

(FX Option) | (10,809) | (11) | - |

ICA

(FX Swap) | 7,773 | - | (526) |

ICA

(FX Swap) | (15,242) | (851) | (7,275) |

ICA

(FX Swap) | - | - | - |

ICA

(Swap) | - | - | - |

ICA

(Fwd) | - | - | (583) |

EMICA

(FX Swap) | (36,361) | - | - |

CICASA

(Swap Collar) | 1,021 | - | - |

EMICA

(Forward) | 44,016 | - | 29,287 |

EMICA

(Swap) | 185,716 | - | 54,068 |

EMICA

(CCS) | 24,320 | - | 3,759 |

CICASA

(CCS) | (2,538) | - | 1,135 |

CICASA

(CCS) | - | - | 17,061 |

PIADISA

(CCS) | (730) | - | 78,645 |

ICAPRIN

(CCS) | (393) | - | 42,348 |

AEROINVEST

(Swap) | (14,424) | 2,623 | - |

AQSA

(Swap) | (194,325) | (6,291) | 50,696 |

AEROINVEST

(Option) | 83,589 | - | 39,816 |

ICAPLAN

(Call Spread) | 283,372 | 283,372 | - |

ICAPLAN

(ZERO COST EQUITY COLLAR) | (15,311) | (15,311) | - |

ICAPLAN

(CCS) | 4,858 | - | 4,858 |

| TOTAL | 345,156 | 263,382 | 537,836 |

v) Table 1 presents the information requested regarding all material instruments that the Issuer currently has outstanding through project companies, including subsidiaries and affiliates.

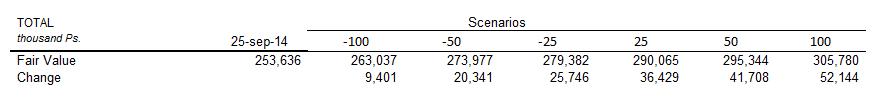

II. SENSITIVITY ANALYSIS

The derivatives instruments identified in the table above as hedging derivatives were excluded from the sensitivity analysis because they do not show any ineffectiveness.

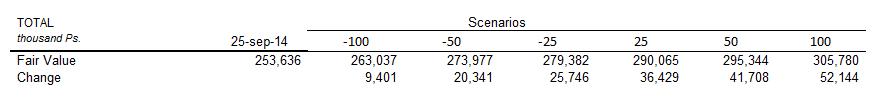

Sensitivity analysis was developed considering three scenarios: a) 25 bp reduction in interest rates; b) 50 bp reduction in interest rates; and c) 100 bp reduction in interest rates.

In conclusion, on aggregating the potential losses under the different scenarios described above for the position analyzed, the following results obtain:

Compared to balance sheet concepts and revenues, one can appreciate that under no scenario, is the effect more than 5% of assets, liabilities, or shareholders’ equity as of September 30, 2014, as shown below. The threshold of 3% of revenues is not exceeded under any scenario as well.

In virtue of the foregoing, the undersigned respectfully submits to the National Banking and Securities Commission:

FIRST. I have responded on time and in the appropriate manner, and with the authorities granted to me.

SECOND. I have delivered the information required in your Order No. 151-2/76211/2009.

Mexico City, October 24, 2014

________________________________________

Empresas ICA, S.A.B. de C.V.

By: Rodrigo A. Quintana Kawage

Position: Legal Representative