Filed Pursuant to Rule 424(b)(3)

Registration No. 333-175115

| | |

| PROSPECTUS | |  |

CLEAR CHANNEL COMMUNICATIONS, INC.

Exchange Offer for

$1,750,000,000 9.0% Priority Guarantee Notes due 2021

We are offering to exchange up to $1,750,000,000 aggregate principal amount of our new 9.0% Priority Guarantee Notes due 2021, which will be registered under the Securities Act of 1933, as amended (the “Securities Act”), for up to $1,750,000,000 aggregate principal amount of our outstanding 9.0% Priority Guarantee Notes due 2021 (the “exchange offer”). We issued $1,000,000,000 aggregate principal amount of our outstanding 9.0% Priority Guarantee Notes due 2021 on February 23, 2011 and $750,000,000 aggregate principal amount of outstanding 9.0% Priority Guarantee Notes due 2021 on June 14, 2011. We refer to the outstanding 9.0% Priority Guarantee Notes due 2021 as the “outstanding notes” and we refer to the new 9.0% Priority Guarantee Notes due 2021 as the “exchange notes.” We sometimes refer to the outstanding notes and the exchange notes collectively as the “notes.”

Material Terms of the Exchange Offer

| | • | | The exchange offer will expire at 5:00 p.m., New York City time, on August 4, 2011, unless extended. |

| | • | | We will exchange all outstanding notes that are validly tendered and not withdrawn prior to the expiration or termination of the exchange offer. You may withdraw your tender of outstanding notes at any time before the expiration of the exchange offer. |

| | • | | The terms of the exchange notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the transfer restrictions and registration rights relating to the outstanding notes will not apply to the exchange notes. |

| | • | | The exchange of outstanding notes for exchange notes should not be a taxable event for U.S. federal income tax purposes, but you should see the discussion under the caption “Certain United States Federal Income Tax Considerations” for more information. |

| | • | | We will not receive any proceeds from the exchange offer. |

| | • | | We issued the outstanding notes in transactions not requiring registration under the Securities Act and, as a result, their transfer is restricted. We are making the exchange offer to satisfy your registration rights as a holder of the outstanding notes. |

We are not asking you for a proxy and you are not requested to send us a proxy.

For a discussion of certain factors that you should consider before participating in this exchange offer, see “Risk Factors” beginning on page 19 of this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the exchange notes to be distributed in the exchange offer, nor have any of these organizations determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We have filed a registration statement on Form S-4 to register with the SEC the exchange notes to be issued in exchange for the outstanding notes. This prospectus is part of that registration statement.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, starting on the expiration date (as defined herein) and ending on the close of business 180 days after the expiration date, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

THEDATEOFTHISPROSPECTUSIS JULY 7, 2011.

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. You should assume that the information contained in this prospectus is accurate as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since then. We are not making an offer to sell the exchange notes offered by this prospectus in any jurisdiction where the offer or sale is not permitted.

TABLE OF CONTENTS

i

BASIS OF PRESENTATION

The financial statements and related footnotes included in this prospectus are those of Clear Channel Capital I, LLC (“Clear Channel Capital”), the direct parent of Clear Channel Communications, Inc. (“Clear Channel”), which is a guarantor of the notes. The financial statements included in this prospectus contain certain footnote disclosures regarding the financial information of Clear Channel and Clear Channel’s domestic wholly-owned subsidiaries that guarantee certain of Clear Channel’s outstanding indebtedness. Clear Channel Capital does not have any operations of its own, and, as a result, the financial statements of Clear Channel Capital reflect the financial condition and results of Clear Channel. All other data and information in this prospectus are that of Clear Channel and its subsidiaries, unless otherwise indicated.

Clear Channel Capital and Clear Channel are indirect wholly-owned subsidiaries of CC Media Holdings, Inc. (“CCMH”), which was formed in May 2007 by private equity funds managed by Bain Capital Partners, LLC (“Bain Capital”) and Thomas H. Lee Partners, L.P. (“THL,” and together with Bain Capital, the “Sponsors”) for the purpose of acquiring the business of Clear Channel. On November 16, 2006, Clear Channel entered into a merger agreement with BT Triple Crown Merger Co. Inc., an entity formed by private equity funds sponsored by the Sponsors (“Merger Sub”), to effect the acquisition of Clear Channel by CCMH (the “Merger Agreement”). Clear Channel held a special meeting of its shareholders on July 24, 2008, at which time the proposed merger of Merger Sub into Clear Channel (the “Merger”) was approved, and the Merger was completed on July 30, 2008.

CCMH accounted for its acquisition of Clear Channel as a purchase business combination in conformity with Statement of Financial Accounting Standards No. 141,Business Combinations, and Emerging Issues Task Force Issue 88-16,Basis in Leveraged Buyout Transactions.

Clear Channel Capital’s consolidated statements of operations and statements of cash flows included in this prospectus are presented for two periods: post-Merger and pre-Merger. The Merger resulted in a new basis of accounting beginning on July 31, 2008 and the financial reporting periods are presented as follows.

| | • | | Each of the periods beginning on and after July 31, 2008 reflects our post-Merger period. Subsequent to the acquisition, Clear Channel became an indirect, wholly-owned subsidiary of CCMH, and Clear Channel Capital’s business became that of Clear Channel and its subsidiaries. |

| | • | | The period from January 1 through July 30, 2008 and the years ended December 31, 2006 and 2007 reflect our pre-Merger period. The consolidated financial statements for all pre-Merger periods were prepared using the historical basis of accounting for Clear Channel. |

As a result of the Merger and the associated purchase accounting, the consolidated financial statements of the post-Merger periods are not comparable to periods preceding the Merger. We have also presented in this prospectus our results from 2008 on a basis that combines the pre-Merger and post-Merger periods for 2008. We believe that the presentation of 2008 on a combined basis is more meaningful as it allows the results of operations to be compared to the full year periods in 2009 and 2010. This combined financial information is for informational purposes only, is not being presented on a pro forma basis and should not be considered indicative of actual results that would have been achieved had the Merger not been completed during 2008 or been completed at the beginning of 2008. In particular, it does not reflect the full year effect of depreciation and amortization expense associated with valuations of property, plant and equipment and definite-lived intangible assets that were adjusted in the Merger, interest expense related to debt issued in conjunction with the Merger, issuance costs with respect to this indebtedness, the fair value adjustment to Clear Channel’s existing indebtedness or the related tax effects of these items. The combined financial information should be read in conjunction with the information contained in “Selected Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements of Clear Channel Capital and the accompanying notes appearing elsewhere in this prospectus.

ii

FORWARD-LOOKING STATEMENTS

This prospectus contains certain statements that are, or may be deemed to be, “forward-looking statements.” These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Actual outcomes and results may differ materially from those expressed in, or implied by, our forward-looking statements. Words such as “expects,” “anticipates,” “believes,” “estimates” and other similar expressions or future or conditional verbs such as “will,” “should,” “would” and “could” are intended to identify such forward-looking statements. Readers should not rely solely on the forward-looking statements and should consider all uncertainties and risks throughout this prospectus, including those set forth under “Risk Factors.” The statements are representative only as of the date they are made, and we undertake no obligation to update any forward-looking statement.

All forward-looking statements, by their nature, are subject to risks and uncertainties. Our actual future results may differ materially from those set forth in our forward-looking statements. We face risks that are inherent in the businesses and the market places in which we operate. While management believes these forward-looking statements are accurate and reasonable, uncertainties, risks and factors, including those described below and under “Risk Factors,” could cause actual results to differ materially from those reflected in the forward-looking statements.

Factors that may cause the actual outcome and results to differ materially from those expressed in, or implied by, these forward-looking statements include, but are not necessarily limited to:

| | • | | the impact of our substantial indebtedness, including the effect of our leverage on our financial position and earnings; |

| | • | | the need to allocate significant amounts of our cash flow to make payments on our indebtedness, which in turn could reduce our financial flexibility and ability to fund other activities; |

| | • | | risks associated with a global economic downturn and its impact on capital markets; |

| | • | | other general economic and political conditions in the United States and in other countries in which we currently do business, including those resulting from recessions, political events and acts or threats of terrorism or military conflicts; |

| | • | | the impact of the geopolitical environment; |

| | • | | industry conditions, including competition; |

| | • | | legislative or regulatory requirements; |

| | • | | fluctuations in operating costs; |

| | • | | technological changes and innovations; |

| | • | | changes in labor conditions; |

| | • | | capital expenditure requirements; |

| | • | | fluctuations in exchange rates and currency values; |

| | • | | the outcome of pending and future litigation; |

| | • | | changes in interest rates; |

| | • | | taxes and tax disputes; |

| | • | | shifts in population and other demographics; |

iii

| | • | | access to capital markets and borrowed indebtedness; |

| | • | | the risk that we may not be able to integrate the operations of acquired companies successfully; |

| | • | | the risk that our cost savings initiatives may not be entirely successful or that any cost savings achieved from those initiatives may not persist; and |

| | • | | the other factors described in this prospectus under the heading “Risk Factors.” |

Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations and also could cause actual results to differ materially from those included, contemplated or implied by the forward-looking statements made in this prospectus, and the reader should not consider the above list of factors to be a complete set of all potential risks or uncertainties.

iv

INDUSTRY AND MARKET DATA

Market and industry data throughout this prospectus was obtained from a combination of our own internal company surveys, the good faith estimates of management, various trade associations and publications, Arbitron Inc. (“Arbitron”) and Nielsen Media Research, Inc. (“Nielsen”) rankings, comScore, Inc., the Veronis Suhler Stevenson Industry Forecast, SNL Kagan, the Radio Advertising Bureau, Media Dynamics, Ando Media, Omniture, BIA Financial Network Inc., eMarketer, the Outdoor Advertising Association of America and Universal McCann. While we believe our internal surveys, third-party information, estimates of management and data from trade associations are reliable, we have not verified this data with any independent sources. Accordingly, we do not make any representations as to the accuracy or completeness of that data.

As of March 31, 2011, entities affiliated with THL beneficially owned approximately 15.5% of the outstanding shares of capital stock of The Nielsen Company B.V., an affiliate of Nielsen, and officers of THL are members of the governing bodies of Nielsen Finance LLC, The Nielsen Company B.V. and Nielsen Finance Co., each of which are affiliates of Nielsen. As of March 31, 2011, entities affiliated with David C. Abrams, a member of the board of directors of CCMH, beneficially owned approximately 11.2% of the outstanding shares of capital stock of Arbitron. Information provided by Arbitron or Nielsen is contained in reports that are available to all of the clients of Arbitron or Nielsen, as applicable, and were not commissioned by or prepared for THL, Bain Capital or Mr. Abrams.

TRADEMARKS AND TRADE NAMES

This prospectus includes trademarks, such as “Clear Channel,” which are protected under applicable intellectual property laws and are the property of Clear Channel or its subsidiaries. This prospectus also contains trademarks, service marks, trade names and copyrights, of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the® or™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

v

SUMMARY

This summary highlights key information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether or not to participate in the exchange offer. You should read this entire prospectus, including the information set forth under “Risk Factors” and the financial statements and related notes, before participating in the exchange offer.

Unless otherwise indicated or required by the context, as used in this prospectus, the terms the “Company,” “we,” “our” and “us” refer to Clear Channel Communications, Inc. and all of its subsidiaries that are consolidated under GAAP, and the term “Clear Channel” refers to Clear Channel Communications, Inc. and not to any of its subsidiaries. Clear Channel Communications, Inc., the issuer of the notes, is a direct, wholly-owned subsidiary of Clear Channel Capital I, LLC, one of the guarantors of the notes. All references in this prospectus to “Clear Channel Capital” refer to Clear Channel Capital I, LLC and not to any of its subsidiaries.

As an indirect, wholly-owned subsidiary of CCMH, the compensation of our officers and directors is governed by the policies and practices of CCMH. Accordingly, the information contained in the sections titled “Compensation Discussion and Analysis,” “Executive Compensation,” “Relationship of Compensation Policies and Programs to Risk Management,” “Director Compensation” and “Security Ownership of Certain Beneficial Owners and Management” relates to the executive compensation, security ownership, director compensation and other arrangements between CCMH and our officers and directors and all references therein to the “Company,” “we,” “our” and “us” refer to CCMH.

Overview

We are the largest radio company and one of the largest outdoor media companies in the world (based on revenues) with leading market positions in each of our operating segments: Radio Broadcasting, Americas Outdoor Advertising and International Outdoor Advertising.

| | • | | Radio Broadcasting.We are the largest radio broadcaster in the United States (based on revenues). As of December 31, 2010, we owned 892 domestic radio stations, servicing approximately 150 U.S. markets, including 47 of the top 50 markets and 89 of the top 100 markets. Our portfolio of stations offers a broad assortment of programming formats, including adult contemporary, country, contemporary hit radio, rock, urban and oldies, among others, to a total weekly listening base of almost 120 million individuals based on Arbitron National Regional Database figures for the Spring 2010 ratings period. In addition to our radio broadcasting business, we operate Premiere Radio Networks, a national radio network that produces, distributes or represents approximately 90 syndicated radio programs, serves nearly 5,800 radio station affiliates and has over 213 million weekly listeners. Some of our more popular syndicated programs include Rush Limbaugh, Jim Rome, Steve Harvey, Ryan Seacrest and Delilah. For the year ended December 31, 2010, our Radio Broadcasting segment represented approximately 49% of our revenue. |

| | • | | Americas Outdoor Advertising.We are the largest outdoor advertising company in the Americas (based on revenue), which includes the United States, Canada and Latin America. Approximately 89% of our 2010 revenue in our Americas Outdoor Advertising segment was derived from the United States. We own or operate approximately 188,000 displays in our Americas segment and have operations in 49 of the 50 largest markets in the United States, including all of the 20 largest markets. Our Americas outdoor assets consist of billboards, street furniture and transit displays, airport displays, mall displays, and wallscapes and other spectaculars, which we own or operate under lease management agreements. Our Americas outdoor advertising business is focused on urban markets with dense populations. For the year ended December 31, 2010, our Americas Outdoor Advertising segment represented approximately 22% of our revenue. |

1

| | • | | International Outdoor Advertising.Our International Outdoor Advertising business segment includes our operations in Asia, Australia and Europe, with approximately 37% of our 2010 revenue in this segment derived from France and the United Kingdom. As of December 31, 2010, we owned or operated approximately 634,000 displays in 29 countries. Our International outdoor assets consist of street furniture and transit displays, billboards, mall displays, Smartbike schemes, wallscapes and other spectaculars, which we own or operate under lease agreements. Our International business is focused on urban markets with dense populations. For the year ended December 31, 2010, our International Outdoor Advertising segment represented approximately 25% of our revenue. |

| | • | | Other.Our other (“Other”) category includes our media representation business, Katz Media Group, Inc. (“Katz Media”), a full-service media representation firm that sells national spot advertising time for clients in the radio and television industries throughout the United States. As of December 31, 2010, Katz Media represented approximately 3,900 radio stations, approximately one-fifth of which were owned by us, as well as approximately 900 digital properties. Katz Media also represents approximately 600 television and digital multicast stations. Katz Media generates revenue primarily through contractual commissions realized from the sale of national spot and online advertising. National spot advertising is commercial airtime sold to advertisers on behalf of radio and television stations. Katz Media represents its media clients pursuant to media representation contracts, which typically have terms of up to ten years in length. For the year ended December 31, 2010, our Other category represented approximately 4% of our revenue. |

For the year ended December 31, 2010, we generated consolidated net revenues of $5,866 million, operating income of $865 million and consolidated net loss of $463 million.

Our Strengths

Leading Positions in the U.S. Radio Broadcasting and Global Outdoor Market. We are a market leader in both the radio and outdoor media industries.

| | • | | We own the number one or number two ranked radio station clusters in eight of the top 10 and in 20 of the top 25 markets in the United States. With a total weekly listening base of almost 120 million individuals based on Arbitron National Regional Database figures for the Spring 2010 ratings period, our portfolio of 892 stations generated twice the revenue as our next largest radio broadcasting competitor in 2010. |

| | • | | In the United States outdoor market, we believe we hold the number one market share in seven of the top 10 markets and are either number one or number two in 16 of the top 20 markets. Internationally, we believe we hold leading positions in France, the United Kingdom, Spain, Italy, Sweden, Belgium and Norway. In addition, we hold positions in several countries where we have experienced strong growth, including Australia, China and Turkey. |

Global Scale in Radio Broadcasting and Outdoor Advertising.Based on revenues, we are the largest radio and one of the largest outdoor media companies in the world. As of December 31, 2010, we owned 892 domestic radio stations servicing approximately 150 U.S. markets, including 47 of the top 50 markets and 89 of the top 100 markets. We also operate more than 822,000 outdoor advertising displays worldwide, in what we believe are premier real estate locations. We believe that our scale provides us with the flexibility and resources to introduce new products and solutions in a cost effective manner.

| | • | | Our scale has enabled cost-effective investment in new technologies, such as digital billboards, HD radio and streaming technology, which we believe will continue to support future growth. Digital billboards, for example, enable us to transition from selling space on a display to a single advertiser |

2

| | to selling time on that display to multiple advertisers, creating new revenue opportunities from both new and existing clients. We have enjoyed significantly higher revenue per digital billboard than the revenue per vinyl billboard with modest capital costs. |

| | • | | Our large distribution platform in our Radio Broadcasting segment allows us to attract top talent and more effectively utilize programming, sharing the best and most compelling talent and programming across many stations throughout the United States. |

| | • | | With more than 3,500 sales people in local markets across the globe, we believe we have one of the media industry’s largest local-based sales forces. Our scale has facilitated cost-effective investment in systems that allow us to maximize yield management and systems that improve the ability of our local salespeople to increase revenue. Additionally, our scale has allowed us to implement initiatives that we believe differentiate us from the rest of the radio and outdoor industries and position us to outperform our competitors across our markets. |

Diversification Across Business Lines, Geographies, Markets and Format.Approximately half of our revenue is generated by our Radio Broadcasting segment, with the remaining half generated by our Americas Outdoor Advertising and International Outdoor Advertising segments, as well as other support services and initiatives. We offer advertisers a diverse platform of media assets across geographies, outdoor products and radio programming formats. Due to our multiple business units, we are not dependent upon any single source of revenue.

Strong Collection of Unique Assets.Through acquisitions and organic growth, we have aggregated a unique portfolio of assets. We believe the combination of our assets cannot be replicated.

| | • | | Ownership and operation of radio broadcast stations is governed by the Federal Communications Commission’s (“FCC”) licensing process, which limits the number of radio licenses available in any market. Any party seeking to acquire or transfer radio licenses must go through a detailed review process with the FCC. Over several decades, we have aggregated multiple licenses in local market clusters across the United States. A cluster of multiple radio stations in a market allows us to provide listeners with more diverse programming and advertisers with a more efficient means to reach those listeners. In addition, we are able to increase our efficiency by operating in clusters, which allows us to eliminate duplicative operating expenses and realize economies of scale. |

| | • | | The domestic outdoor industry is regulated by the federal government as well as state and municipal governments. Statutes and regulations govern the construction, repair, maintenance, lighting, height, size, spacing and placement and permitting of outdoor advertising structures. Due to these regulations, it has become increasingly difficult to develop new outdoor advertising locations. Further, for many of our existing billboards, a competitor or landlord could not obtain a permit for replacement under existing laws and regulations due to their non-conforming status. |

Attractive Businesses with High Margins and Low Capital Expenditure Requirements.Our global scale has enabled us to make productive and cost effective investments across our portfolio. As a result of our strong margins and low capital expenditure requirements, we have been able to convert a significant portion of our operating income into cash flow that can be utilized for debt service.

| | • | | We have strong operating margins, driven by our significant scale and leading market share in both radio broadcasting and outdoor advertising. For the year ended December 31, 2010, our consolidated operating margin (before corporate expenses) was 33%, with strong operating margins in our Radio Broadcasting (38%) and Americas Outdoor Advertising (37%) segments. |

| | • | | In addition, both radio broadcasting and outdoor media are low capital intensity businesses. For the year ended December 31, 2010, our total capital expenditures were 4% of total revenue. |

3

Highly Effective Advertising Medium.We believe both radio broadcasting and outdoor advertising offer compelling value propositions to advertisers and valuable access to consumers when they are out of the home and therefore closer to purchase decisions. We also believe both the radio broadcasting and outdoor advertising industries are well positioned to benefit from the fragmentation of audiences of other media as they are able to reach mass audiences on a local market basis.

| | • | | Radio broadcasting and outdoor media offer compelling value propositions to advertisers by providing the number two and number one most cost effective media advertising outlets, respectively, as measured by cost per thousand persons reached. |

| | • | | Both radio broadcasting and outdoor media reach potential consumers outside of the home, a valuable position as it is closer to the purchase decision. Today, consumers spend a significant portion of their day out-of-home, while out-of-home media (radio and outdoor) currently garner a disproportionately smaller share of media spending than in-home media. We believe this discrepancy represents an opportunity for growth. |

| | • | | Additionally, radio programming reaches 93% of all consumers in the United States in a given week, with the average consumer listening for almost two hours per day. On a weekly basis, this represents nearly 240 million unique listeners. |

| | • | | According to Nielsen, consumers in the United States listen to a significant amount of radio per day. In 2008, broadcast radio captured 109 minutes of user consumption per day, which compares favorably to the Internet at 77 minutes, newspapers at 41 minutes and magazines at 22 minutes. |

| | • | | According to Arbitron, in 2009, 98% of U.S. residents traveled in a car each month, with an average of 224 miles traveled per week. The captive in-car audience is protected from media fragmentation and is subject to increasing out-of-home advertiser exposure as time and distance of commutes increase. |

Significant Operating Leverage with Flexibility to Manage Cost Base As Necessary.We benefit from significant operating leverage, which leads to operating margin increases in a growth environment. Conversely, we have demonstrated our flexibility to effectively manage our cost base in a low growth or recessionary environment.

| | • | | In 2010, both gross domestic product and advertising revenue returned to growth in many of our markets, including in the United States, allowing us to realize the benefits of our significant operating leverage. |

| | • | | By many accounts, the “Great Recession” was the worst economic downturn since the Great Depression. During this time, we demonstrated our flexibility to manage our cost base, announcing a cost savings initiative in January 2009. This initiative included significant cost savings derived from the renegotiation of lease agreements, display takedowns, workforce reductions and the elimination of overlapping functions. |

Our Strategy

Radio

Our radio broadcasting strategy centers on providing effective programming, offering a wide range of services, and contributing to the local communities in which we operate. We believe that by serving the needs of local communities, we will be able to grow listenership and deliver target audiences to advertisers. Our radio broadcasting strategy also focuses on consistently improving the ongoing operations of our stations through effective programming, promotion, marketing, distribution, sales, and cost management.

4

Drive Local and National Advertising.We intend to drive growth in our radio business through effective programming, new and better solutions for large national advertisers and agencies, key relationships with advertisers and improvement of our national sales team. We seek to maximize revenue by closely managing on-air inventory of advertising time and adjusting prices to local market conditions. We operate price and yield information systems, which provide detailed inventory information. These systems enable our station managers and sales directors to adjust commercial inventory and pricing based on local market demand, as well as to manage and monitor different commercial durations (60 second, 30 second, 15 second and five second) in order to provide more effective advertising for our customers at what we believe are optimal prices given market conditions.

Continue to Enhance the Radio Listener Experience.We will continue to focus on enhancing the radio listener experience by offering a wide variety of compelling content. Our investments in radio programming over time have created a collection of leading on-air talent. For example, our Premiere Radio Network offers more than 90 syndicated radio programs and services for nearly 5,800 radio station affiliates across the United States. Our distribution platform allows us to attract top talent and more effectively utilize programming, sharing the best and most compelling content across many stations.

Deliver Content via New Distribution Technologies.We are continually expanding content choices for our listeners, including utilization of new distribution technologies such as HD radio, streaming audio, mobile and other distribution channels. Some examples of these initiatives are as follows:

| | • | | HD Radio.HD radio enables crystal clear reception, data services and new applications. Further, HD radio allows for many more stations, providing greater variety of content which we believe will enable advertisers to target consumers more effectively. The capabilities of HD radio will potentially permit us to participate in commercial download services. |

| | • | | Streaming Audio.We provide streaming audio via the Internet, mobile and other digital platforms and, accordingly, have increased listener reach and developed new listener applications as well as new advertising capabilities. We estimate that more than twelve million people visit Clear Channel Radio Online each month, with more than 750 stations streaming online. We rank among the top streaming networks in the U.S. with regards to Average Active Sessions (“AAS”), Session Starts (“SS”) and Average Time Spent Listening (“ATSL”) according to Ando Media. AAS and SS measure the level of activity while ATSL measures the ability to keep the audience engaged. |

| | • | | Mobile.We have pioneered mobile applications such as the iheartradio smart phone application, which allows listeners to use their smart phones to interact directly with stations, find titles/artists, request songs and download station wallpapers. iheartradio is often in the top ten for free music application downloads on both Blackberry and iPhone. |

Americas Outdoor Advertising

We seek to capitalize on our Americas outdoor network and diversified product mix to maximize revenue. In addition, by sharing best practices among our business segments, we believe we can quickly and effectively replicate our successes in other markets in which we operate. Our outdoor strategy also focuses on leveraging our diversified product mix and long-standing presence in many of our existing markets, which provides us with the platform to launch new products and test new initiatives in a reliable and cost-effective manner.

Drive Overall Outdoor Media Spending. Given the attractive industry fundamentals of outdoor media and our depth and breadth of relationships with both local and national advertisers, we believe we can drive outdoor advertising’s share of total media spending, which represented only 4% of total dollars spent on advertising in the United States in 2010, by utilizing our dedicated national sales team to highlight the value of

5

outdoor advertising relative to other media. We have made and continue to make significant investments in research tools that enable our clients to better understand how our displays can successfully reach their target audiences and promote their advertising campaigns. Also, we are working closely with clients, advertising agencies and other diversified media companies to develop more sophisticated systems that will provide improved audience metrics for outdoor advertising. For example, we have implemented the EYES ON audience measurement system which: (1) separately reports audiences for each of the nearly 400,000 units of inventory across the industry in the United States, (2) reports those audiences using the same demographics available and used by other media permitting reach and frequency measures, (3) provides the same audience measures across more than 200 markets, and (4) reports which advertisement is most likely to be seen. We believe that measurement systems such as EYES ON will further enhance the attractiveness of outdoor advertising for both existing clients and new advertisers and further foster outdoor media spending growth.

Continue to Deploy Digital Billboards. Digital outdoor advertising provides significant advantages over traditional outdoor media. Our electronic displays are linked through centralized computer systems to instantaneously and simultaneously change advertising copy on a large number of displays, allowing us to sell more slots to advertisers. The ability to change copy by time of day and quickly change messaging based on advertisers’ needs creates additional flexibility for our customers. The advantages of digital allow us to penetrate new accounts and categories of advertisers as well as serve a broader set of needs for existing advertisers. We expect this trend to continue as we increase our quantity of digital inventory. As of March 31, 2011, we had deployed approximately 650 digital displays in 36 markets in the United States.

International Outdoor Advertising

Similar to our Americas outdoor advertising, we believe International outdoor advertising has attractive industry fundamentals including a broad audience reach and a highly cost effective media for advertisers as measured by cost per thousand persons reached compared to other traditional media. Our International strategy focuses on our competitive strengths to position the Company through the following strategies:

Promote Overall Outdoor Media Spending. Our strategy is to drive growth in outdoor advertising’s share of total media spending and leverage such growth with our international scale and local reach. We are focusing on developing and implementing better and improved outdoor audience delivery measurement systems to provide advertisers with tools to determine how effectively their message is reaching the desired audience.

Capitalize on Product and Geographic Opportunities. We are also focused on growing our business internationally by working closely with our advertising customers and agencies in meeting their needs, and through new product offerings, optimization of our current display portfolio and selective investments targeting promising growth markets. We have continued to innovate and introduce new products in international markets based on local demands. Our core business is our street furniture business and that is where we plan to focus much of our investment. We plan to continue to evaluate municipal contracts that may come up for bid and will make prudent investments where we believe we can receive attractive returns. We will also continue to invest in markets such as China, Turkey and Poland, where we believe there is high growth potential.

6

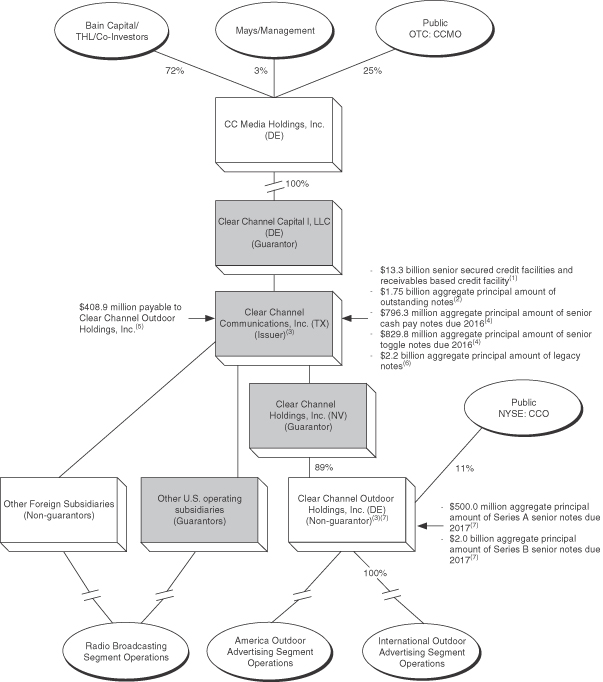

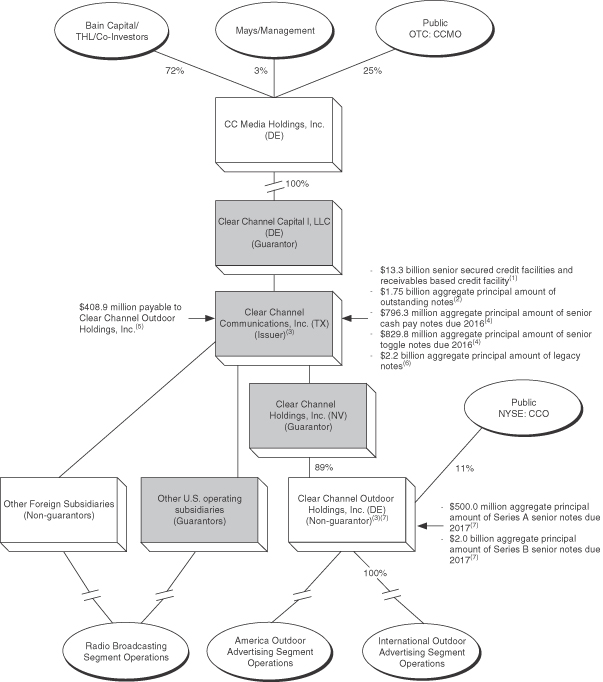

Corporate Structure

The following chart summarizes our corporate structure and principal indebtedness as of March 31, 2011, after giving effect to the issuance of $750 million aggregate principal amount of the outstanding notes in June 2011 and the voluntary paydown of our receivables based credit facility we made on June 8, 2011, but without giving effect to the application of any proceeds of the issuance of outstanding notes in June 2011, including the anticipated repayment at maturity of our legacy notes due in March 2012.

7

| (1) | Our senior secured credit facilities and receivables based credit facility are guaranteed on a senior secured basis by Clear Channel Capital and by our material wholly-owned domestic restricted subsidiaries. As of March 31, 2011, our senior secured credit facilities consisted of a $1,928 million revolving credit facility, including a letter of credit sub-facility and a swingline loan sub-facility, of which $1,780.5 million was outstanding, a $1,087.1 million term loan A, an $8,735.9 million term loan B, a $670.9 million term loan C—asset sale facility and $976.8 million of delayed draw term loans. Our receivables based credit facility provides for a revolving credit commitment of $625.0 million, subject to a borrowing base. As of March 31, 2011, after giving effect to the voluntary paydown of this facility using cash on hand on June 8, 2011, we had no outstanding borrowings under our receivables based credit facility and $625.0 million available for borrowing thereunder. The amount available under the term loan A facility and the receivables based credit facility are subject to adjustment as described under “Description of Other Indebtedness.” |

| (2) | The $1,000 million aggregate principal amount of outstanding notes issued in February 2011 and the $750 million aggregate principal amount of outstanding notes issued in June 2011 have identical terms and are treated as a single class of notes under the indenture governing the notes. The outstanding notes are, and the exchange notes offered hereby will be, guaranteed on a senior basis by Clear Channel Capital and by our wholly-owned domestic restricted subsidiaries. Our foreign subsidiaries and CCOH and its subsidiaries have not guaranteed any of our obligations under the outstanding notes and will not guarantee any of our obligations under the exchange notes offered hereby. As of March 31, 2011, our non-guarantor subsidiaries held approximately 47.4% of our assets and had $2,561 million in outstanding indebtedness, excluding intercompany obligations. During the three months ended March 31, 2011, our non-guarantor subsidiaries generated 49.7% of our revenue and 9.9% of our operating income. |

| (3) | As of March 31, 2011, we had $66.9 million of other indebtedness, consisting of $38.6 million of indebtedness at our International Outdoor Advertising segment, $22.2 million of indebtedness at our Americas Outdoor Advertising segment and $6.1 million of indebtedness at certain of our other subsidiaries. |

| (4) | The senior cash pay notes due 2016 and senior toggle notes due 2016 are guaranteed on a senior basis by Clear Channel Capital and by our wholly-owned domestic restricted subsidiaries that guarantee our senior secured credit facilities, except that those guarantees by our subsidiaries are subordinated to each such guarantor’s guarantee of such facilities and to the notes. For a description of the senior cash pay notes due 2016 and the senior toggle notes due 2016, see “Description of Other Indebtedness.” |

| (5) | As part of the day-to-day cash management services we provide to Clear Channel Outdoor Holdings, Inc. (“CCOH”), we maintain accounts that represent amounts payable to or due from CCOH, and the net amount is recorded as “Due from/to Clear Channel Communications” on CCOH’s consolidated balance sheet. |

| (6) | As of March 31, 2011, we had $2,218.6 million aggregate principal amount of legacy notes outstanding, all of which had been issued prior to the Merger. Our legacy notes bore interest at fixed rates ranging from 4.4% to 7.25%, have maturities through 2027 and contain provisions, including limitations on certain liens and sale and leaseback transactions, customary for investment grade debt securities. The legacy notes are not guaranteed by Clear Channel Capital or any of our subsidiaries. For a description of the material terms of the legacy notes, see “Description of Other Indebtedness.” On May 15, 2011, we repaid at maturity $250 million in aggregate principal amount of our legacy notes, of which $109.8 million was held by one of our subsidiaries. |

| (7) | CCOH became a publicly traded company on November 11, 2005 through an initial public offering in which CCOH sold 35 million shares, or 10%, of its common stock. Prior to CCOH’s public offering, it was an indirect wholly-owned subsidiary of Clear Channel. The senior notes (the “CCWH Notes”) were issued by Clear Channel Worldwide Holdings, Inc. (“CCWH”), an indirect wholly-owned subsidiary of CCOH, and are guaranteed by CCOH and certain of its subsidiaries but not by Clear Channel Capital or any of its wholly-owned subsidiaries. For a description of the material terms of the CCWH Notes, including limits on CCOH’s ability to pay dividends, see “Risk Factors—Risks Related to the Notes—Because we derive a substantial portion of operating income from our subsidiaries, our ability to repay our debt, including the notes, depends upon the performance of our subsidiaries and their ability to dividend or distribute funds to us” and “Description of Other Indebtedness.” |

8

Equity Sponsors

Bain Capital, LLC

Bain Capital, LLC is a global private investment firm whose affiliates, including Bain Capital, manage several pools of capital, including private equity, venture capital, public equity, high-yield assets and mezzanine capital, with approximately $65 billion in assets under management. Bain Capital has a team of approximately 375 professionals dedicated to investing and to supporting its portfolio companies. Since its inception in 1984, funds sponsored by Bain Capital have made private equity investments and add-on acquisitions in more than 300 companies in a variety of industries around the world. Headquartered in Boston, Bain Capital has offices in New York, Chicago, London, Munich, Hong Kong, Shanghai, Tokyo and Mumbai.

Thomas H. Lee Partners, L.P.

Thomas H. Lee Partners, L.P. is one of the world’s oldest and most experienced private equity firms. THL invests in growth-oriented companies across three broad sectors: Business & Financial Services, Consumer & Healthcare and Media & Information Services. THL’s investment and operating professionals partner with portfolio company management teams to identify and implement business model improvements that accelerate sustainable revenue and profit growth. The firm focuses on global businesses headquartered primarily in North America. Since the firm’s founding in 1974, THL has acquired more than 100 portfolio companies and has completed over 200 add-on acquisitions, representing a combined value of more than $125 billion. The firm’s two most recent private equity funds comprise more than $14 billion of aggregate committed capital.

Corporate Information

Clear Channel is a Texas corporation. Clear Channel was incorporated in 1974 and its principal executive offices are located at 200 East Basse Road, San Antonio, Texas 78209 (telephone: 210-822-2828). Our website is http://www.clearchannel.com. The information on our website is not deemed to be part of this prospectus, and you should not rely on it in connection with your decision whether to participate in the exchange offer.

9

Exchange Offer

On February 23, 2011, we completed a private offering of $1,000,000,000 aggregate principal amount of 9.0% Priority Guarantee Notes due 2021 and on June 14, 2011 we completed a private offering of $750,000,000 aggregate principal amount of 9.0% Priority Guarantee Notes due 2021. With respect to each private offering, we entered into an exchange and registration rights agreement with the initial purchasers in which we agreed, among other things, to file the registration statement of which this prospectus is a part. The following is a summary of the exchange offer. For more information, please see “Exchange Offer.” Unless the context otherwise requires, we use the term “notes” in this prospectus to collectively refer to the outstanding notes and the exchange notes.

The Initial Offerings of Outstanding Notes | We sold $1,000,000,000 aggregate principal amount of outstanding notes on February 23, 2011 to Goldman, Sachs & Co., Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC, Deutsche Bank Securities Inc., Morgan Stanley & Co. LLC, RBS Securities Inc. and Wells Fargo Securities, LLC. We refer to these parties in this prospectus collectively as the “initial purchasers.” |

| | We sold $750,000,000 aggregate principal amount of outstanding notes on June 14, 2011 to the initial purchasers. |

| | The issuances of outstanding notes have identical terms and are treated as a single class of notes. |

| | The initial purchasers subsequently resold the outstanding notes (i) to qualified institutional buyers pursuant to Rule 144A under the Securities Act and (ii) outside the United States to non-U.S. persons in offshore transactions in reliance on Regulation S under the Securities Act. |

Exchange and Registration Rights Agreements | Simultaneously with the initial sales of the outstanding notes, we entered into two registration rights agreements, one with respect to each issuance of outstanding notes, pursuant to which we have agreed, among other things, to use commercially reasonable efforts to file with the SEC and cause to become effective a registration statement relating to an offer to exchange the outstanding notes for an issue of SEC-registered notes with terms identical to the outstanding notes. The exchange offer is intended to satisfy your rights under the applicable registration rights agreement. After the exchange offer is completed, you will no longer be entitled to any exchange or registration rights with respect to your outstanding notes. |

The Exchange Offer | We are offering to exchange the exchange notes, which have been registered under the Securities Act, for your outstanding notes, which were issued in the applicable private offering. In order to be exchanged, an outstanding note must be properly tendered and accepted. All outstanding notes that are validly tendered and not validly withdrawn will be exchanged. We will issue exchange notes |

10

| | promptly after the expiration of the exchange offer. |

Resales | Based on interpretations by the staff of the SEC set forth in no-action letters issued to unrelated parties, we believe that the exchange notes issued in the exchange offer may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act provided that: |

| | • | | the exchange notes are being acquired in the ordinary course of your business; |

| | • | | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the exchange notes issued to you in the exchange offer; and |

| | • | | you are not an affiliate of ours. |

| | If any of these conditions are not satisfied and you transfer any exchange notes issued to you in the exchange offer without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from registration of your exchange notes from these requirements, you may incur liability under the Securities Act. We will not assume, nor will we indemnify you against, any such liability. |

| | Each broker-dealer that is issued exchange notes in the exchange offer for its own account in exchange for outstanding notes that were acquired by that broker-dealer as a result of market-making or other trading activities, must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the exchange notes. A broker-dealer may use this prospectus for an offer to resell, resale or other retransfer of the exchange notes issued to it in the exchange offer. |

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time,August 4, 2011, unless we decide to extend the expiration date. |

Conditions to the Exchange Offer | The exchange offer is not subject to any condition, other than that the exchange offer does not violate applicable law or any applicable interpretation of the staff of the SEC. |

Procedures for Tendering Outstanding Notes | If you wish to tender your outstanding notes for exchange in the exchange offer, you must transmit to the exchange agent on or before the expiration date either: |

| | • | | an original or a facsimile of a properly completed and duly executed copy of the letter of transmittal, which accompanies this prospectus, together with your outstanding notes and any other documentation required by the letter of transmittal, at the address provided on the cover page of the letter of transmittal; or |

11

| | • | | if the outstanding notes you own are held of record by The Depository Trust Company, or “DTC,” in book-entry form and you are making delivery by book-entry transfer, a computer-generated message transmitted by means of the Automated Tender Offer Program System of DTC, or “ATOP,” in which you acknowledge and agree to be bound by the terms of the letter of transmittal and which, when received by the exchange agent, forms a part of a confirmation of book-entry transfer. As part of the book-entry transfer, DTC will facilitate the exchange of your notes and update your account to reflect the issuance of the exchange notes to you. ATOP allows you to electronically transmit your acceptance of the exchange offer to DTC instead of physically completing and delivering a letter of transmittal to the notes exchange agent. |

| | In addition, you must deliver to the exchange agent on or before the expiration date: |

| | • | | a timely confirmation of book-entry transfer of your outstanding notes into the account of the notes exchange agent at DTC if you are effecting delivery of book-entry transfer, or |

| | • | | if necessary, the documents required for compliance with the guaranteed delivery procedures. |

Special Procedures for Beneficial Owners | If you are the beneficial owner of book-entry interests and your name does not appear on a security position listing of DTC as the holder of the book-entry interests or if you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender the book-entry interest or outstanding notes in the exchange offer, you should contact the person in whose name your book-entry interests or outstanding notes are registered promptly and instruct that person to tender on your behalf. |

Withdrawal Rights | You may withdraw the tender of your outstanding notes from the exchange offer at any time prior to 5:00 p.m., New York City time, on August 4, 2011. |

U.S. Federal Income Tax Consequences | We believe that the exchange of outstanding notes should not be a taxable event for United States federal income tax purposes. |

Use of Proceeds; Fees and Expenses | We will not receive any proceeds from the issuance of exchange notes pursuant to the exchange offer. We will pay all of our expenses incident to the exchange offer. |

Exchange Agent | Deutsche Bank Trust Company Americas, the collateral agent under the indenture governing the notes, is serving as the exchange agent in connection with the exchange offer. |

12

Exchange Notes

The form and terms of the exchange notes are the same as the form and terms of the outstanding notes, except that the exchange notes will be registered under the Securities Act. As a result, the exchange notes will not bear legends restricting their transfer and will not contain the registration rights and liquidated damage provisions contained in the outstanding notes.

Issuer | Clear Channel Communications, Inc., a Texas corporation. |

Notes Offered | $1,750,000,000 aggregate principal amount of 9.0% priority guarantee notes due March 1, 2021. |

Interest | The exchange notes will bear interest at a rate of 9.0% per annum. |

| | Interest on the exchange notes will be payable by Clear Channel Communications, Inc. semi-annually in arrears on March 1 and September 1 of each year, commencing on September 1, 2011. See “Description of the Exchange Notes—Principal, Maturity and Interest.” |

Ranking | The exchange notes: |

| | • | | will be our senior obligations; |

| | • | | will rank equally in right of payment with all of our existing and future indebtedness that is not by its terms expressly subordinated in right of payment to the exchange notes; |

| | • | | will rank senior in right of payment to all of our existing and future indebtedness that is by its terms expressly subordinated in right of payment to the exchange notes; |

| | • | | will be effectively subordinated in right of payment to all of our existing and future indebtedness that is secured by assets that are not part of the collateral securing the exchange notes, to the extent of such assets; and |

| | • | | will be structurally subordinated in right of payment to all existing and future indebtedness and other liabilities of any subsidiary of ours that is not a guarantor of the exchange notes. |

| | As of March 31, 2011, after giving effect to the issuance in June 2011 of $750 million aggregate principal amount of the outstanding notes and the voluntary paydown we made on June 8, 2011 using cash on hand of all amounts outstanding under our receivables based credit facility, of which $320.7 million was outstanding as of March 31, 2011, we would have had approximately $20,787 million of total indebtedness outstanding. As of March 31, 2011, our non-guarantor subsidiaries held approximately 47.4% of our consolidated assets and had $2,561 million in outstanding indebtedness, excluding |

13

| | intercompany obligations. During the three months ended March 31, 2011, our non-guarantor subsidiaries generated 49.7% of our revenue and 9.9% of our operating income. |

Guarantors | The exchange notes will be fully and unconditionally guaranteed on a senior basis by Clear Channel Capital and each of our existing and future wholly-owned domestic restricted subsidiaries. CCOH, which is not a wholly-owned subsidiary of ours, and its subsidiaries will not guarantee the notes. The guarantee of the notes by Clear Channel Capital will rank equally in right of payment to all existing and future indebtedness of Clear Channel Capital that is not expressly subordinated in right of payment to such guarantee, including Clear Channel Capital’s guarantee of the senior cash pay notes due 2016 and the senior toggle notes due 2016. Each subsidiary guarantee: |

| | • | | will rank senior in right of payment to all existing and future indebtedness of the applicable subsidiary guarantor that is by its terms expressly subordinated in right of payment to such subsidiary guarantee, including such subsidiary guarantor’s guarantee of the senior cash pay notes due 2016 and the senior toggle notes due 2016; |

| | • | | will rank equally in right of payment with all existing and future indebtedness of the applicable subsidiary guarantor that is not by its terms expressly subordinated in right of payment to such subsidiary guarantee; and |

| | • | | will be effectively subordinated in right of payment to all existing and future indebtedness of the applicable subsidiary guarantor that is secured by assets that are not part of the collateral securing such subsidiary guarantee, to the extent of such assets. |

| | Each guarantee will be structurally subordinated in right of payment to all existing and future indebtedness and other liabilities of any subsidiary of the applicable guarantor that is not also a guarantor of the exchange notes. |

Security | Initially, our obligations under the exchange notes and the guarantors’ obligations under the guarantees will be secured, subject to prior liens permitted by the indenture governing the legacy notes, by (1) a lien on (a) our capital stock and (b) certain property and related assets that do not constitute “principal property” (as defined in the indenture governing the legacy notes), in each case equal in priority to the liens securing the obligations under our senior secured credit facilities (collectively, “certain collateral securing our senior secured credit facilities”) and (2) a lien on the accounts receivable and related assets securing our receivables based credit facility junior in priority to the lien securing our obligations under such receivables based credit facility (the “receivables-based collateral” and, together with certain collateral securing our senior secured credit facilities, the “collateral”). The collateral will also include (x) 100% of the capital |

14

| | stock of our wholly-owned domestic restricted subsidiaries and intercompany loans between the issuer and its restricted subsidiaries or between any restricted subsidiaries and (y) our assets that constitute “principal property” under the indenture governing the legacy notes if (A) the aggregate amount of legacy notes outstanding is $500 million or less, (B) the indenture governing the legacy notes has been amended or otherwise modified to remove or limit the applicability of the negative pledge covenant set forth in the indenture governing the legacy notes, (C) any legacy notes are secured or become required to be secured by a lien on any collateral with respect to the springing lien or (D) our senior secured credit facilities are secured by a lien on the assets described in this sentence (other than certain liens securing our senior secured credit facilities permitted under the indenture governing the legacy notes in effect on the issue date). See “Description of the Exchange Notes—Security.” The value of the collateral at any time will depend on market and other economic conditions, including the availability of suitable buyers for the collateral. See “Risk Factors—Risks Related to the Notes.” |

Intercreditor Agreements | The notes are subject to (i) an intercreditor agreement that establishes the relative priority of the liens securing our senior secured credit facilities and the notes and (ii) an intercreditor agreement that establishes the relative rights of the lenders under our senior secured credit facilities, our receivables based credit facility and the notes in the collateral securing our receivables based credit facility. See “Description of the Exchange Notes—Intercreditor Agreements.” |

Optional Redemption | The notes are redeemable, in whole or in part, at any time on or after March 1, 2016, at the redemption prices specified under “Description of the Exchange Notes—Optional Redemption.” At any time prior to March 1, 2014, we may redeem up to 40% of the aggregate principal amount of the notes with the net cash proceeds from certain equity offerings at a price equal to 109.000% of the principal amount thereof, together with accrued and unpaid interest, if any, to the redemption date. In addition, at any time prior to March 1, 2016, we may redeem the exchange notes, in whole or in part, at a price equal to 100% of the principal amount of the notes plus a “make-whole” premium, together with accrued and unpaid interest, if any, to the redemption date. |

Mandatory Repurchase Offers | If we or our restricted subsidiaries engage in asset sales or sales of collateral under certain circumstances and do not use the proceeds for certain specified purposes, we must use all or a portion of such proceeds to offer to repurchase the notes at 100% of their principal amount, plus accrued and unpaid interest, if any, to the date of purchase. |

| | Additionally, upon the occurrence of a change of control, we must offer to purchase the notes at 101% of their principal amount, plus |

15

| | accrued and unpaid interest, if any, thereon. For more details, you should read “Description of the Exchange Notes—Repurchase of the Option of Holders—Change of Control.” |

Certain Covenants | The indenture governing the exchange notes contains covenants that limit, among other things, our ability and the ability of the restricted subsidiaries to: |

| | • | | incur additional indebtedness or issue certain preferred stock; |

| | • | | pay dividends on, or make distributions in respect of, their capital stock or repurchase their capital stock; |

| | • | | make certain investments or other restricted payments; |

| | • | | create liens or use assets as security in other transactions; |

| | • | | merge, consolidate or transfer or dispose of substantially all of their assets; |

| | • | | engage in transactions with affiliates; and |

| | • | | designate subsidiaries as unrestricted subsidiaries. |

| | The covenants are subject to a number of important limitations and exceptions. See “Description of the Exchange Notes.” |

Risk Factors | In evaluating whether to participate in the exchange offer, you should carefully consider, along with the other information set forth in this prospectus, the specific factors set forth under “Risk Factors.” |

16

Summary Historical Consolidated Financial Data

The following table sets forth summary historical consolidated financial data as of the dates and for the periods indicated. The summary historical consolidated financial data for the years ended December 31, 2010, 2009 and 2008, and as of December 31, 2010 and 2009, is derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary historical consolidated financial data for the three months ended March 31, 2011 and 2010 and as of March 31, 2011 is derived from our unaudited consolidated financial statements included elsewhere in this prospectus. In the opinion of management, the interim financial data reflects all adjustments (consisting only of normal and recurring adjustments) necessary for a fair presentation of the results for the interim periods. Historical results are not necessarily indicative of the results to be expected for future periods and the interim results are not necessarily indicative of the results that may be expected for the full year.

The summary historical consolidated financial data should be read in conjunction with “Risk Factors,” “Selected Historical Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto appearing elsewhere in this prospectus. The amounts in the tables may not add due to rounding.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Three Months Ended

March 31, | |

| (Dollars in millions) | | 2010

Post-Merger | | | 2009

Post-Merger | | | 2008

Combined

(1) | | | 2011

Post-Merger | | | 2010

Post-Merger | |

Results of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Revenue | | $ | 5,866 | | | $ | 5,552 | | | $ | 6,689 | | | $ | 1,321 | | | $ | 1,264 | |

Operating Expenses: | | | | | | | | | | | | | | | | | | | | |

Direct operating expenses(2) | | | 2,442 | | | | 2,583 | | | | 2,904 | | | | 596 | | | | 598 | |

Selling, general and administrative expenses(2) | | | 1,510 | | | | 1,467 | | | | 1,829 | | | | 361 | | | | 349 | |

Corporate expenses(2) | | | 284 | | | | 254 | | | | 228 | | | | 52 | | | | 65 | |

Depreciation and amortization | | | 733 | | | | 765 | | | | 697 | | | | 184 | | | | 181 | |

Merger expenses | | | — | | | | — | | | | 156 | | | | — | | | | — | |

Impairment charges(3) | | | 15 | | | | 4,119 | | | | 5,269 | | | | — | | | | — | |

Other operating income (expense)—net | | | (17 | ) | | | (51 | ) | | | 28 | | | | 17 | | | | 4 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | | 865 | | | | (3,687 | ) | | | (4,366 | ) | | | 145 | | | | 75 | |

Interest expense | | | 1,533 | | | | 1,501 | | | | 929 | | | | 370 | | | | 386 | |

Loss on marketable securities | | | (6 | ) | | | (13 | ) | | | (82 | ) | | | — | | | | — | |

Equity in earnings (loss) of nonconsolidated affiliates | | | 5 | | | | (21 | ) | | | 100 | | | | 3 | | | | 2 | |

Other income (expense)—net | | | 46 | | | | 680 | | | | 126 | | | | (2 | ) | | | 58 | |

| | | | | | | | | | | | | | | | | | | | |

Loss before income taxes | | | (623 | ) | | | (4,542 | ) | | | (5,151 | ) | | | (224 | ) | | | (251 | ) |

Income tax benefit | | | 160 | | | | 493 | | | | 524 | | | | 93 | | | | 71 | |

| | | | | | | | | | | | | | | | | | | | |

Loss before discontinued operations | | | (463 | ) | | | (4,049 | ) | | | (4,627 | ) | | | (131 | ) | | | (180 | ) |

Income from discontinued operations, net | | | — | | | | — | | | | 638 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Consolidated net loss | | | (463 | ) | | | (4,049 | ) | | | (3,989 | ) | | | (131 | ) | | | (180 | ) |

Amount attributable to noncontrolling interest | | | 16 | | | | (15 | ) | | | 17 | | | | 1 | | | | (5 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net loss attributable to the Company | | $ | (479 | ) | | $ | (4,034 | ) | | $ | (4,006 | ) | | $ | (132 | ) | | $ | (175 | ) |

| | | | | | | | | | | | | | | | | | | | |

17

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Three Months Ended

March 31, | |

| (Dollars in millions) | | 2010

Post-Merger | | | 2009

Post-Merger | | | 2008

Combined

(1) | | | 2011

Post-Merger | | | 2010

Post-Merger | |

Cash Flow Data: | | | | | | | | | | | | | | | | | | | | |

Capital expenditures(4) | | $ | 241 | | | $ | 224 | | | $ | 430 | | | $ | 64 | | | $ | 55 | |

Net cash flows provided by (used for) operating activities | | | 582 | | | | 181 | | | | 1,281 | | | | (125 | ) | | | 30 | |

Net cash flows used for investing activities | | | (240 | ) | | | (142 | ) | | | (18,128 | ) | | | (33 | ) | | | (72 | ) |

Net cash flows provided by (used for) financing activities | | | (305 | ) | | | 1,605 | | | | 15,908 | | | | (252 | ) | | | (360 | ) |

Net cash flows provided by discontinued operations | | | — | | | | — | | | | 1,033 | | | | — | | | | — | |

Other Financial Data (total debt at end of period): | | | | | | | | | | | | | | | | | | | | |

Total debt | | | 20,607 | | | | 20,702 | | | | 19,504 | | | | 20,404 | | | | 20,377 | |

Balance Sheet Data (at end of period): | | | | | | | | | | | | | | | | | | | | |

Current assets | | $ | 3,603 | | | $ | 3,659 | | | $ | 2,067 | | | $ | 3,143 | | | $ | 3,168 | |

Property, plant and equipment –net | | | 3,146 | | | | 3,332 | | | | 3,548 | | | | 3,118 | | | | 3,260 | |

Total assets | | | 17,460 | | | | 18,047 | | | | 21,125 | | | | 16,939 | | | | 17,400 | |

Current liabilities | | | 2,099 | | | | 1,544 | | | | 1,846 | | | | 1,498 | | | | 1,889 | |

Long-term debt, net of current maturities | | | 19,740 | | | | 20,303 | | | | 18,941 | | | | 20,000 | | | | 19,577 | |

Member’s/shareholders’ deficit | | | (7,205 | ) | | | (6,845 | ) | | | (2,916 | ) | | | (7,280 | ) | | | (7,055 | ) |

| (1) | We have presented our 2008 financial results on a combined basis because we believe that this allows for a more meaningful comparison to the other full year periods. We have presented a reconciliation showing our combination of the post-Merger and pre-Merger periods in footnote 1 under “Selected Historical Consolidated Financial Data.” See also “Basis of Presentation.” |

| (2) | Includes non-cash compensation expense. |

| (3) | As a result of the global economic downturn that adversely affected advertising revenue across our businesses during 2008 and 2009, we performed an interim impairment test as of December 31, 2008 and again as of June 30, 2009 on our indefinite-lived permits and goodwill. In addition, we performed our annual impairment test in the fourth quarter of 2009. The impairment tests resulted in our recognizing non-cash impairment charges of $5.3 billion in 2008 and $4.1 billion in 2009. We also recorded impairment charges of $15.4 million in the fourth quarter of 2010. |

| (4) | Capital expenditures include additions to our property, plant and equipment and do not include any proceeds from disposal of assets, nor any expenditures for acquisitions of operating (revenue-producing) assets. |

18

RISK FACTORS

An investment in the notes is subject to a number of risks. You should carefully consider the following risk factors as well as the other information and data included in this prospectus before participating in the exchange offer. Any of the following risks related to our business could materially and adversely affect our business, cash flows, financial condition or results of operations. In such a case, you may lose all or part of your original investment in your notes.

Risk Factors Related to the Exchange Offer

Because there is no public market for the exchange notes, you may not be able to resell your exchange notes.

The exchange notes will be registered under the Securities Act, but will constitute a new issue of securities with no established trading market, and there can be no assurance as to:

| | • | | the liquidity of any trading market that may develop; |

| | • | | the ability of holders to sell their exchange notes; or |

| | • | | the price at which the holders would be able to sell their exchange notes. |

If a trading market were to develop, the exchange notes might trade at higher or lower prices than their principal amount or purchase price, depending on many factors, including prevailing interest rates, the market for similar securities and our financial performance.

Your outstanding notes will not be accepted for exchange if you fail to follow the exchange offer procedures and, as a result, your outstanding notes will continue to be subject to existing transfer restrictions and you may not be able to sell your outstanding notes.

We will not accept your outstanding notes for exchange if you do not follow the exchange offer procedures. We will issue exchange notes as part of the exchange offer only after a timely receipt of your outstanding notes and all other required documents. Therefore, if you want to tender your outstanding notes, please allow sufficient time to ensure timely delivery. If we do not receive your outstanding notes and other required documents by the expiration date of the exchange offer, we will not accept your outstanding notes for exchange. We are under no duty to give notification of defects or irregularities with respect to the tenders of outstanding notes for exchange. If there are defects or irregularities with respect to your tender of outstanding notes, we may not accept your outstanding notes for exchange. For more information, see “Exchange Offer.”

In addition, any holder of outstanding notes who tenders in the exchange offer for the purpose of participating in a distribution of the exchange notes may be deemed to have received restricted securities, and if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction. For a description of these requirements, see “Exchange Offer.”

If you do not exchange your outstanding notes, your outstanding notes will continue to be subject to the existing transfer restrictions and you may not be able to sell your outstanding notes.

We did not register the outstanding notes, nor do we intend to do so following the exchange offer. Outstanding notes that are not tendered will therefore continue to be subject to the existing transfer restrictions and may be transferred only in limited circumstances under the securities laws. If you do not exchange your outstanding notes, you will lose your right to have your outstanding notes registered under the federal securities laws. As a result, if you hold outstanding notes after the exchange offer, you may not be able to sell your outstanding notes.

19

Risks Related to Our Business

Our results have been in the past, and could be in the future, adversely affected by deteriorations in economic conditions.

The risks associated with our businesses become more acute in periods of a slowing economy or recession, which may be accompanied by a decrease in advertising. Expenditures by advertisers tend to be cyclical, reflecting economic conditions and budgeting and buying patterns. The recent global economic downturn resulted in a decline in advertising and marketing by our customers, which resulted in a decline in advertising revenues across our businesses. This reduction in advertising revenues had an adverse effect on our revenue, profit margins, cash flow and liquidity. Although we believe that global economic conditions are improving, if they do not continue to improve or if they deteriorate again, global economic conditions may once again adversely impact our revenue, profit margins, cash flow and liquidity. Furthermore, because a significant portion of our revenue is derived from local advertisers, our ability to generate revenues in specific markets is directly affected by local and regional conditions, and regional economic declines also may adversely impact our results. In addition, even in the absence of a downturn in general economic conditions, an individual business sector or market may experience a downturn, causing it to reduce its advertising expenditures, which may also adversely impact our results.

Our consolidated revenue increased $313.8 million during 2010 compared to 2009. However, primarily as a result of the recent global economic downturn, our consolidated revenue decreased $1.14 billion during 2009 compared to 2008. This decrease in 2009 was experienced by each of our Radio, Americas Outdoor Advertising and International Outdoor Advertising segments.